1. Introduction

The objective of this paper is to provide empirical evidence regarding the relationship between religion and real earnings management in the context of EU member states. Hofstede (1980, 2001) pioneeringly examined the bond between social and cultural dimensions. As a critical part of the culture, religion could be paid particular attention to. Previous literature has confirmed that religion could impact company activities (Kanagaretnam et al., 2015). In this context in the past few decades, real earnings management has become one of the most provocative topics in accounting literature. Researchers have investigated the determinants of business ethics that could mitigate accrual-based earnings management in companies (Elias, 2002; McGuire et al., 2012; Mukhibad and Nurkhin, 2019). However, there is little research examining this theme in Europe. In addition, Du et al. (2015) call for a research focus on the asymmetric influence of different religions on earnings management.

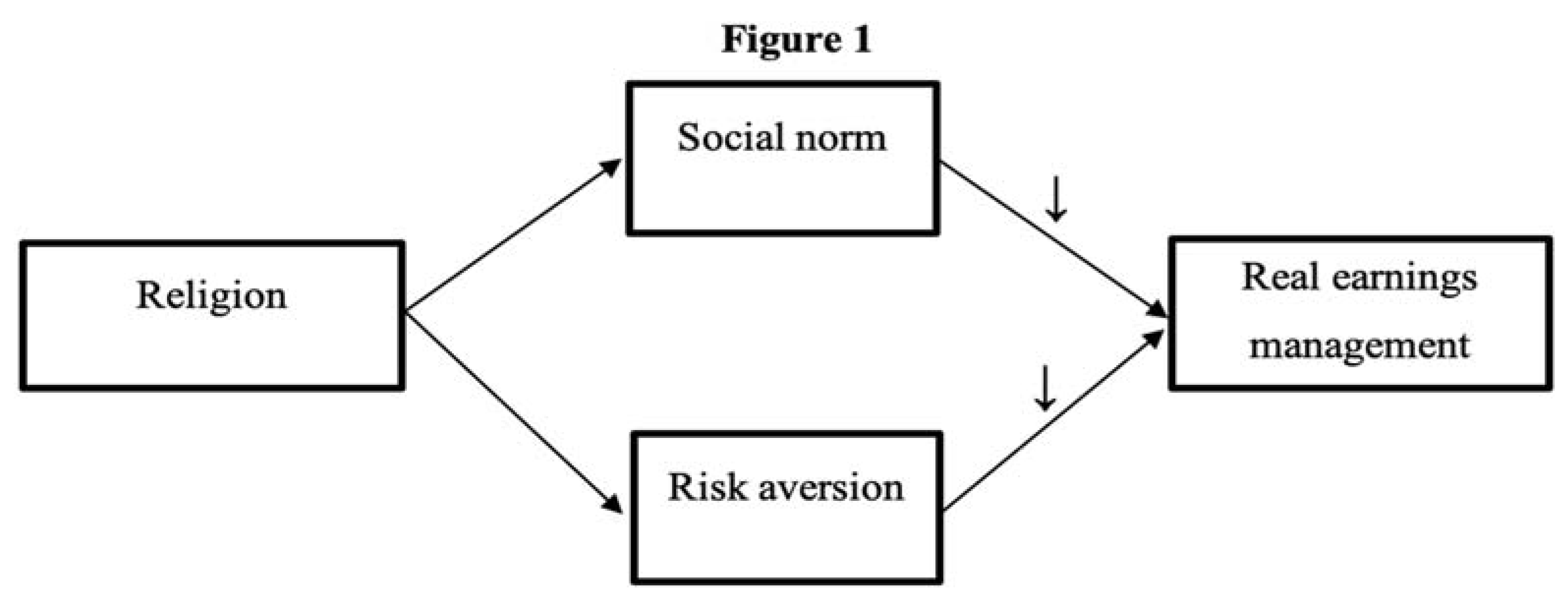

Researchers have studied the association between religion and Corporate Social Responsibility (CSR), accounting irregularity, the cost of equity, equity structure, auditor going-concern opinions and other themes (Brammer et al., 2007; McGuire et al., 2012; El Ghoul et al., 2012; Baxamusa and Jalal, 2013; Omer et al., 2018). Two mechanisms can be highlighted through which religion may influence firms’ activities and characteristics. The first works through the effect of social norms; religiosity is an example of such mean. Individuals are inclined to behave in ways that follow the common norms of adhering groups (Kohlberg 1984). Therefore, religion could help regulate the behaviors of its adherents and thus shape up common rules in a local society. McGuire et al. (2012) indicate that religious social norms work as an external monitoring mechanism and could mitigate financial reporting irregularities of local firms as being unethical. The second one works through risk aversion. Considering that an important reason for the existence of religion is that people expect certainty in life, it could be induced that religious people have a lower risk tolerance than non-religious people. Accounting and finance studies link religion and corporates with this risk aversion trait. Relevant research indicates that firms located in areas with higher religiosity are less prone to engage in inappropriate activities such as tax avoidance, and high risky investments (Grullon et al., 2010; Kumar et al., 2011; Dyreng et al., 2012; Baxamusa and Jalal, 2016).

Earnings management originates from the discretion and flexibility of managers when making operating decisions. Compensation incentives can drive managers in earnings manipulation. After the introduction of the Sarbanes-Oxley Act, accrual earnings management decreased sharply and real earnings management increased severely (Gunny, 2010). This implies that identifying and measuring real earnings management in current capital markets could help upgrade regulatory policies and protect shareholders’ interests. When researchers associate religion and earnings management, they provide different, or even contradicting results. For instance, using a cross-country dataset, Callen et al. (2011) find that there is no significant association between religion and earnings management. Grullon et al. (2010) and Dyreng et al. (2012) on the other hand indicate that religious social norms can affect managers’ choices of earnings management. By studying the sample of American firms, McGuire et al. (2012) find the degree of religiosity is negative associated with accrual-based earnings management, while there is a positive association between religiosity and real earnings management. Other related studies examining a similar question mainly test the religious effect on accrual earnings management. Their results indicate that religion could mitigate firms’ manipulation activities on earnings. Nevertheless, very few studies focus on real earnings management. Therefore, we argue it would be necessary to further examine the association between religion and real earnings management (Cohen et al, 2008).

To bridge this gap, our paper uses religious data of EU member states collected from the Pew Research Center’s Religion & Public Life Project and from WRDS (Compustat Global dataset). The total number of observations is 20,038 from 2010 to 2020. Including firm-specific and country-specific control variables, such as the leverage ratio of firms and national GDP, four models are developed to test the potential relationship between religion and real earnings management. Our results indicate that the degree of religiosity in a country can mitigate firms’ real earnings management indeed, unaffected by proxies used. We find a positive and significant association between Islam and real earnings management, compared to a negative association with Christianity.

In our view our paper contributes in three ways to existing literature1. Firstly, we enrich the corporate governance literature through our probing in real earnings management and we provide further empirical evidence on the effect of religion on corporate activities. Secondly, this paper extends the existing literature by testing a European firm sample, considering that other similar investigations focus on U.S. and China. Thirdly, we distinguish between the different effects of religions on real earnings management. Specifically, test results of model 3 and model 4 indicate that Christianity and Islam have potentially opposite effects on real earnings management. Future research may further study competitive impacts of religions on accrual and non-accrual earnings management and/or the influence of CEOs’ beliefs on earnings management (Du et al., 2015).

The remainder of this paper is structured as follow. In the next section the literature regarding religion in Europe and earnings management, including real earnings management, is discussed. Four hypotheses are formulated and our expectations on the test results are provided. Then, our research approach is discussed, including our sample selection, data processing, and regression models. Our results are presented and discussed then and we close with our conclusions.

2. Literature Review and Hypotheses Development

2.1. Religion and Religiosity

2.1.1. Religion in Europe

Even though the trail of religion can be traced back to primitive society, the concept of “religion” emerged in the 16th and 17th centuries. Developing with the process of human history, religion has become a social-cultural system, which contains a wide range of factors that closely relate to human society, such as moral standards, worldviews, texts, and organization. Around the world, religious people take account of about 84% of the total population. The majority of them are affiliated with Christianity, Islam, Hinduism, and Buddhism. In Europe, the three major religious trends involve Christianity (including the Catholic Church, Protestantism, and Orthodoxy), Islam, and unaffiliated.

Christianity is based on the teachings of Jesus of Nazareth, and confessions and salvation are amongst its main cores. Till now, Christianity is the largest and most influential religion in Europe. Islam is a typical monotheistic religion, which regards the Quran as its primary sacred scripture. Except from geography, recent migration prompts the concentration of Muslims in the Southeastern part of Europe as well as the formation of Muslim communities in Western Europe. For unaffiliated groups, many social surveys such as the Eurobarometer have indicated the ratio of non-believers to be increasing across European countries. Bruce (2002) sums up that: "...individualism, diversity, and egalitarianism in the context of liberal democracy undermine the authority of religious beliefs." The spread of secularization facilitates changes in religious populations to some extent.

2.1.2. Social Norm

Social norm theory can explain the influence of religion on the behaviors of individuals and organizations. According to this theory, individuals incline to behave in ways that abide by the common norms of their adhering groups (Kohlberg, 1984). Since social norms are the informal rules that stem from the interactions among groups and societies, local religious norms reflect a significant part of social norms. Stavrova et al. (2013) argues religiosity being an example of such a social norm.

Religion has two basic traits: cultural attributes and institutional ones (Stark and Finke, 2000). The former provide the general compliance outline for humans, to

pursue values, while the latter fill the outline with many concrete details and form implicit informal and normative mechanisms. On the one hand, religions resort to doctrines, ethics, and morality to shape up people’s individual values and beliefs. For example, both Christianity and Islam promote trust in interpersonal relationships and condemn fraud. Thus, religions help to form traditional informal standards and regulate the behaviors of people who live in a particular locality. Consequently, it can be predicted that whether managers are religious or not, they would be affected by religious social norms in local geographic areas where they live or work because these norms are environmental elements that have existed for a long time and even been rooted in the local culture (Kohlberg 1984; Cialdini and Goldstein 2004).

The influence of religion on human behavior and economic activities can be traced to Adam Smith’s “The Wealth of Nations”. Guiso et al. (2003) find that religious people trust the government and the legal system more, are less willing to break the law, and are more likely to believe that market outcomes are fair. Choi (2010) predicts that religious affiliation can influence individual switching tendencies through religious doctrines and then studies the impact that religion exerts on consumers switching behavior. McGuire et al. (2012) indicate religious social norms work as an external monitoring mechanism that can mitigate the accounting manipulation of firms in a local geographic area. In this paper, the religious social norms are mainly associated with business ethics appealed by religiosity. Specifically, if managers misreport or manipulate the financial results, such decisions will be considered unethical. Dyreng et al. (2012) list two traits of religious individuals: honesty and risk aversion. By investigating whether religion is associated with accrual choices managers make when disclosing financial information, they find that companies located in a higher level of religious adherence are less likely to restate annual financial results and this has a potential relationship with reminders of moral codes of conduct in these localities. Ma et al. (2020) hold that ethical norms related to religiosity could drive companies to focus on long-term firm value and to be conscious of shareholder interests. In this case firms’ adoption of accounting conservatism is positively associated with the level of religiosity in the geographic areas within which they are based and function.

2.1.3. Risk Aversion

Risk aversion is another path that many accounting and finance scholars have followed. Christianity, the largest religion in Europe, guides its followers to believe in and accept the death and resurrection of Jesus, and with confessions and living a Christian life, sinful people can be reconciled with God and thus offered salvation. Believing that humans will

experience divine judgment at the ending of their lives and then receive salvation or damnation, Christians are less likely to do things that will or might break Christian rules and disciplines, considering potential religious punishment. Islamism also constrains its adherents’ daily behaviors. Following the guidance of the Quran and Allah, adherents practice the Five Pillars of Islam in every aspect of their life and society. In financial affairs because of the promotion of fairness, Shari ah regards interest as a form of exploitation, and Islamic banks are prohibited from receiving interest in any business transaction. Usury is strictly forbidden in Islam, which represents disproportionate risk-taking among participants. Prior research has shown that both implicit and explicit moral ethics and behavioral norms brought by religion increase the tendency of uncertainty avoidance in society (Miller and Hoffmann, 1995), and that makes religious persons to entertain lower risk tolerance than non-religious people. Besides, the expectation of certainty is an important reason for people to believe in religion. It is reasonable to link risk aversion to local religiosity.

Prior research has connected organizations, individuals, and religion with risk aversion, and religious traditions can lead to decision makers’ cognitive bias toward risk aversion. Hilary and Hui (2009) directly study how religiosity influences organizational behavior and finds that US companies located in a higher religious county exhibit lower risk exposure measured by a lower variance in ROA and equity returns. According to the findings of Grullon et al. (2010), religiosity has a substantial deterrent impact on inappropriate conduct by local headquartered firm managers. Kumar et al. (2011) investigate the influence of religion-induced gambling norms on market outcomes. This paper distinguishes between different attitudes of the Protestant and Catholic church on gambling. Protestants are more likely to view gambling as a sinful activity, while the Roman Catholic Church does not react that severely and maintains a tolerant attitude to some extent. The results again can be juxtaposed to reflect the effects of risk aversion from religion in capital markets. Dyreng et al. (2012) find companies in religiously conservative regions to be less likely to partake in tax avoidance and to be more open about negative news in voluntary disclosures. Adhikari and Agrawal (2016) use four methods to measure bank risks in different American counties and reveal that banks surrounded by a higher level of local religiosity take less risk. For example, these banks hold safer assets and provide fewer risk incentives to their employees and executives. Baxamusa and Jalal (2016) study CEO’s religious affiliations and three sets of decisions in companies (capital structure, diversification, and investments), and argue that CEOs with different religious affiliations demonstrate different risk appetites when making decisions (e.g. R&D investment). Aibibula et al. (2017) also find a negative association between the religious belief of entrepreneurs and R&D investments due to risk aversion.

Another branch of the literature represented by Miller (2000) concludes that Western religious adherents are more risk-averse than Eastern religious adherents. This difference can explain to some extent the mixed findings in previous studies about religious influence and believers’ tendencies in risk.

2.2. Earnings Management

2.2.1. Background Information on Earnings Management

The study of earnings management emerged in the 1980s. The extensive use of earnings management in financial statement disclosures has increasingly drawn the attention of regulators and academics. Although there may be a lack of agreement on the exact definition of earnings management it cannot be neglected that earnings management has been one of the most provocative topics in accounting research. Taking the position of accounting policymakers, Healy and Wahlen (1999) define earnings management as “managers’ use of judgment in financial reporting and in structuring transactions to alter financial reports to either mislead some stakeholders about the underlying economic performance of a firm or to affect contractual outcomes that depend on reported accounting numbers”.

There are many motivations that can lead to earnings management. Demand for financing with a relatively low cost of capital is one of the primary drivers. As a result, companies may adopt aggressive accounting policies that lead to frequent accounting restatements (Richardson et al, 2003). In addition, according to contracting theory, compensation plan incentives can drive managers to manipulate earnings and increase private gains. Although stock options could align management interests with shareholders’ and reduce agency costs, they could also incentivize managers to take improper actions in increasing earnings numbers (Christopoulos et al., 2014; Dobbin and Jung, 2010) . Marrakchi et al. (2001) indicate the association between short-term stock options held by non-executive committee members and income-increasing earnings management. A further motivation involves “beating benchmarks’’ by avoiding losses and surpassing analyst forecasts (Burgstahler and Dichev, 1997). Amongst additional motivations are included the: maintenance of firm reputation; smoothing earnings; avoidance of lawsuits, and others (Graham et al., 2005; Bartov et al., 2002).

2.2.2. Measurement of Earnings Management

Earnings manipulation can be achieved through two main means: 1) accrual-based earnings management and 2) real earnings management. In the former managers use their discretion in applying accounting policies or making accounting estimations to adjust companies’ financial disclosures. Accrual-based earnings management is easily achieved in looser regulatory environments and/or where incomplete accounting reporting standards are in effect (e.g. Dechow et al., 1995; Jones, 1991). Real earnings management emerged much later as a research focus and is regarded as an alternative to accrual-based exploitations. It involves manipulations in real firm activities and management of earning in this case is more variant and undetectable (e.g Dechow and Sloan, 1991; Gunny, 2010; Roychowdhurry 2006). Previous research has examined three forms of real earnings management: the reduction of discretionary costs such as research and development (R&D) expenditures and training costs; the expansion of production in order to reduce unit costs and; the acceleration of sales or the selling of assets of the company.

For the measurement of accrual-based earnings management, the Jones and modified Jones models have been used widely (Jones, 1991; Dechow et al. 1995), whereas for the measurement of real earnings management, two estimations are often applied in the literature: the aggregation of abnormal discretionary expenses and abnormal production costs and; the aggregation of abnormal cash flows and abnormal discretionary expenses. Since Roychowdhury (2006) built up an approach to measure real earnings management with abnormal cash flows, abnormal production costs, and abnormal discretionary expenses, many other studies have employed the same model to derive real earnings management data. As managers regard real earnings management as a more ethical and less risky option (Bruns and Merchant, 1990; Graham et al., 2005) in this paper we chose real earnings management as our primary dependent variable based on the Roychowdhury (2006) approach.

2.2.3. Prior Research on Real Earnings Management

Gunny (2010) shows that before the Sarbanes-Oxley Act, firm management mainly used accrual manipulations, but after the Act this behavior totally changed, with accrual earnings management dropping sharply while real earnings management rose drastically. This implies that external legal factors could have significantly influenced the choices of earnings management in a company. Leuz et al (2003) use firm-level data of 31 countries and find that outside investor rights and legal enforcement can negatively influence the intensity of earnings management. Following the Hofstede (1980) proxies, Guan et al (2006) provide evidence for the negative relation between earnings management and uncertainty avoidance. Callen et al. (2011) research culture and earnings management and find that the cultural metrics of individualism are significantly negatively related to earnings management. Business ethics is another channel that may restrict earnings management. By investigating Islamic banks, Quttainah et al. (2013) show a negative relation between Islamic banks and earnings management, probably due to the religious-based system of business ethics.

Internal corporate governance could also impact managers’ real earnings manipulations. Bushee (1998) finds that institutional investors would exert a restrictive effect on the intensity of real earnings management in firms. Cheng (2004) shows that the compensation committee could detect real earnings management and make related adjustments to react, such as adjusting compensation payoffs. Garcia Osma (2008) indicate the proportion of independent directors in the board of directors to be positively related to earnings management.

Presented in financial statement disclosures, real earnings management can be captured through changes in certain accounting items. For example a firm’s R&D capitalization policy is manipulable to some extent, since the management can decide the moment of R&D expenditure capitalization (Skordoulis et al., 2020; Prencipe et al., 2008). By using such discretion, the management can, therefore “create” significant economic benefits in financial statements (Chambers et al., 2002). Markarian et al. (2008) study Italian family firms and find that these firms smooth their earnings by capitalizing their R&D expenditures. Focusing on French companies as samples, Cazavan-Jeny et al. (2011) found that small and highly indebted companies are more likely to use R&D capitalization policies to manage their earnings.

2.3. Religion and Earnings Management

As discussed, religion works on individuals and organizations through social norms and risk aversion. As a result firms located in regions with a high level of religiosity present characteristics, such as an unwillingness to break rules and a conservatism in investment decisions and could be reluctant to engage in accrual-based and/or real earnings’ manipulations.

Prior studies have explored the association between religion/religiosity and earnings management with different associations for accrual-based and real earnings manipulations. Callen et al. (2011) use a cross-country data set to investigate whether culture and religion can reduce the management of earnings. Their results provide evidence that after controlling for the influence of different cultural characteristics (Hofstede 1980, 2001), religious affiliations and the degree of religiosity have no significant relationship with earnings manipulations. McGuire et al. (2012) take U.S. firms as their study focus to investigate the impact of religion on financial reporting irregularities and the methods managers would choose to do so. In their findings, there is a negative association between religiosity and abnormal accruals, a proxy for accruals management, and a positive relation between religiosity and measures of real earnings manipulations. Grullon et al. (2010) and Dyreng et al. (2012) test the link between religion and earnings management, and their findings also indicate that religious social norms can influence managers’ methods of earnings management. Du et al. (2015) adopt geographic measures of religious variables to examine how religion influences firms’ earnings manipulations in the Chinese market. Their results indicate a significant negative association existing due to the curbing of unethical corporate behaviors. In addition regulatory intensity variables are tested and the results suggest religion acting as an informal regulatory mechanism. Kanagaretnam et al. (2015) employ a country-level measure of religiosity to study religion and banks from an international sample. The tests employed show the aggregate measure of religiosity to be negatively related to income-increasing earnings management and less opportunistic behavior.

Following this review of the literature we formulate our first hypothesis as:

H1: Firms headquartered in EU countries with a strong religious atmosphere are less likely to engage in real earnings management.

In this hypothesis, our estimation of real earnings management follows the seminal work of Roychowdhury (2006).

2.4. Religion and R&D Investment

Research has also confirmed that managers exercise discretion and manage earnings in a variety of ways, ranging from cutting expenditures or carrying out special transactions (so-called real earnings management) to manipulating accounting earnings.

Reducing investment in research and development (R&D) is a typical method of real earnings management so that current performance meets desired thresholds (Dechow and Sloan, 1991; Wang and D’Souza, 2006; Prencipe et al, 2008; Garcia Osma, 2008). According to the imprinting theory (Marquis and Tilcsik, 2013), cultural factors in an area can form a distinct “imprint” that continually affects the local economy and business activities.

Choi (2020) investigate the linkage between national culture and R&D investment. By using data for 12,362 firms from 40 countries, the author finds that in cultures with more individualistic, less masculine, and more indulgent features, firms tend to make more R&D investments.

Yan et al. (2021) use a nationwide survey with Chinese private firms to examine the effect of the Confucian culture on corporate R&D. Their findings indicate that firms headquartered in provinces with stronger Confucian culture are more likely to invest in corporate R&D and increase related expenditures. Du (2021) examines whether adherents of all religions in China are risk-averse and whether followers of different religions show equally risk-averse appetites. The findings of this study also suggest that religions can significantly and negatively affect corporate R&D and Western religious beliefs have a more pronounced negative influence. Following this logic we predict that there is a similar association between religions and corporate R&D expenditure in Europe.

Thus, our remaining hypotheses are formulated as follow:

H2: Firms headquartered in EU countries with a strong religious atmosphere are less likely to engage in R&D investment.

Whereby we specifically use R&D expenditure as a proxy for real earnings management.

H3: The prevalence of Christianity in a country can negatively affect firms’ real earnings management.

H4: The prevalence of Islam in a country can negatively affect firms’ real earnings management.

In hypotheses 3 and 4 we aim to study whether different religions in EU countries have different influences on firms.

Figure 1 summarizes the paths through which religion can affect real earnings management. According to social norm theory and risk aversion theory, religion is expected to be negatively associated with real earnings management. In addition

Table 1 summarizes key articles scrutinized in our review.

3. Research Method

3.1. Data and Sample Selection

Our paper focuses on the period from 2010 to 2020 due to availability and completeness of religious data in the Pew Research database. Listed entities in all EU member states participate in our examination sample for three reasons. First, the historical interaction between these countries with similar culture and traditions if these were to be contrasted with Asian or American countries. In this manner the possibility that a significant relationship between religion and real earnings management from unobservable cultural factors could be mitigated/reduced due to the similar cultural setting. In addition, the major religions are more easily identifiable in this setting further aiding the examination of their possible influence on business activities. Second, firms in EU member states report financial disclosures in accordance with IFRS further facilitating the proxying of our dependent variables and reduce noise in our empirical testing. Third, overall development of EU countries is relatively high and monitoring institutions are reasonably well functioning, thus real (non-accrual based) earnings management could be more prevalent than accrual-based earnings management.

Data are collected from Compustat, Pew Research Center’s Religion & Public Life Project, Eurostat, and the World Justice Project of Law Index. Firm data were collected from the Compustat Global in WRDS. Initially we derive firms’ real earnings management data. Following Roychowdhury (2006), we first eliminate firms with SIC codes between 4400 and 5000 and SIC codes between 6000 and 6500, which involve regulated industries and banks & financial institutions and we delete “inactive” firms. Detailing of REM models employed and related proxies follows in the next section.

Data relating with religion are collected from the Pew Research Center’s Religion & Public Life Project. We mainly collect three categories of religious groups: Christians, Muslims, and unaffiliated. The first two categories are used to compare the effect of different religions on firms’ real earnings management since Christianity and Islam are the two main religions in Europe. The last category “unaffiliated” is used to derive the proportion of the religious population, which is calculated as “one minus the unaffiliated percentage”. All figures on the Pew Research website are already expressed as percentages.

Firm-level data used for the control variables are obtained from Compustat Global. In addition to eliminating firms with missing observations and those of the particular industries mentioned earlier, we winsorize our data at the first and ninety-nineth percentiles to prevent for the possible influencing of outliers.

Values for country-level variables are downloaded from Eurostat and the World Justice Project. Datasets are merged by country codes while screening out unavailable and missing values. A more detailed discussion on our data collection process can also be seen in the following section.

Table 2 describes how our final firm-year observations are derived.

3.2. Variables

3.2.1. Measuring the Effect of Religion

REL is our main independent variable representing the degree of religiosity in the EU countries where our sample companies are headquartered. Existing literature mainly uses four methods to measure religious traditions. First drawing from questionnaire or interview data. Guiso et al. (2003) and Callen et al. (2011) for example tie data from the World Value Survey on the belief in heaven, religious affiliations, church attendance, and other categories to estimate the effect of religious traditions. McGuire et al. (2012) measure religiosity by using a database of more than 610,000 interviews from different countries conducted by the Gallup organization. Second, the ratio of the number of religious believers to the total population in the area where a firm is headquartered as a proxy of religiosity. Hilary and Hui (2009) and Dyreng et al. (2012) follow this method and calculate the level of religious adherence in the county of a US firm’s HQ. Third, by focusing on the proportions of the religious population for different religions researchers can study then the influence of cultural differences (mainly religious differences) on economic and business activities. For example Baxamusa and Jalal (2016) and Adhikari and Agrawal (2015) utilize this approach. The fourth method involves the utilization of geographic factors. In this case, researchers use the number of religious sites, such as churches and temples, in a certain area to construct an instrumental variable. Articles that adopt this approach focus on the Chinese context since information regarding religious population data in China are not available usually.

In our paper we chose the demographic approach to proxy for our main independent variable; whereby the degree of religiosity in a country is measured as the percentage of religious affiliation in the total population. By taking time factors into account, we collect data from 2010 to 2020, matching our financial sample. Then in order to construct the religious adherence for our sample years we follow the existing literature (Hilary and Hui, 2009; and Dyreng et al., 2012) and use the two years’ figures to linearly interpolate the degree of religiosity for every year in the decade. We hand collect religious data from the Pew Research Center’s Religion & Public Life Project for that same period.

To test hypotheses 3 and 4, we also collect the proportion of Christian adherents and Muslims out of the total population for each EU member state participating in our sample in order to proxy for Christianity and Islam the data for Christianity and Islam are processed in the same manner as and for the same period as REL.

3.2.2. Measuring Real Earnings Management

As mentioned earlier we follow Roychowdhury’s (2006) seminal work to derive real earnings management data. In this context real activities manipulation is defined as departures from normal operational practices, used to mislead the perceptions of financial information users that management has achieved the expected operating goals. Roychowdhury (2006) finds evidence to support that companies can beat expected earnings through three methods: improving production to report the lower cost of goods sold; manipulating sales mainly through lenient credit terms; and reducing discretionary expenditures. These three manipulation methods can cause abnormal deviations in operating cash flows and could reflect the extent of real earnings management. The measurement model of real earnings management is developed in three parts as described by the following formulae:

where

CFOt is cash flow from operations in year t,

TAt-1 is the total assets at the end of year

t-1,

ΔSalest is the changes of sales revenue between year

t-1 and year

t and in each fiscal year, abnormal cash flow from operations equals the actual

CFO minus the “normal”

CFO.

where

PRODt is the sum of the cost of goods sold (

COGS) and changes of inventory in year t. This model combines the measures of COGS and inventory.

where

DISEXPt is discretionary expenses in year t, which is measured as selling and administrative expenses.

After running the above three models abnormal

CFO, abnormal production costs, and abnormal expenses for every firm and year can be derived. The degree of real earnings management can be obtained then as:

where

REMt is real earnings management in year t.

When the company carries out upward real earnings management, it will reduce the cost of the unit product by expanding production. This will lead to an increased book value of inventory. In other words, this method will increase abnormal production costs. By increasing price discounts and providing more lenient credit items, the company can accelerate and/or generate sales which can increase profits, but at the same time, it will bring a reduction in operating cash flows (net reduction of abnormal operating cash flow). When profits are increased by reducing R&D expenditures, advertising expenditures, and administrative expenses, discretionary expenses will also decrease. Therefore, the three parts of REM have different coefficient signs.

3.2.3. Measuring R&D Expenditure

The variable R&D proxies another aspect of real earnings management and is used in testing hypothesis 2. According to prior research (e.g. Brown et al., 2013; Choi, 2020; Yan et al., 2021) corporate R&D investment can be proxied by: the number and quality of patents that a firm obtains every year; the increase in intangible assets of a firm; a dummy variable that equals 1 if the firm has R&D expenditures, and 0 otherwise; the natural logarithm of the amount of related expenditures in a firm-year period; the amount of R&D expenditures divided by firm’s current-year sales revenue. We take R&D expenditure as a percentage of revenue in our regression examination and use the other measures in robustness testing.

3.2.4. Control Variables and Others

In each empirical specification, we control for factors that could relate to innate business characteristics and/or determinants of dependent variables that could correlate with our variable of interest. We separate these control factors, into two groups: firm-specific and country-specific.

At firm level, we include firm size (SIZE). Due to the difference in enterprise-scale, the opportunity of earnings manipulating activities can vary in companies. SIZE is measured as the natural logarithm of total asset at the end of the year.

Leverage (LEV) can also influence earnings management (Kalantonis et al., 2021) . LEV is total liabilities scaled by total assets.

Return on assets (ROA), is included in our model as a proxy for risk exposure (Hilary and Hui, 2009).

LOSS is a dummy we include to proxy for profit/loss making.

Variation in audit firms can achieve different external supervision of financial reports. In the case of a “Big4” firm investors are more likely to believe that the financial statements are fairly stated and that the company is less likely to engage in earnings manipulation. These firm-level variables are usually included in the extant literature on religious factors and earnings management (Dyreng et al., 2012; McGuire et al., 2012); Baxamusa and Jalal, 2013; Du et al., 2015). In addition research focusing on firms’ R&D expenditure also considers these variables as control (dummy) factors (Choi, 2020)).

In cross-country research, Gross Domestic Product (GDP) is an unavoidable variable since it is associated closely with the overall development of a given society. Callen et al. (2011) and Choi (2020) for example include GDP as a country-level variable.

The Law index (LAW) can reflect the degree of regulatory force and can proxy for the level of overall monitoring of formal regulatory institutions in a country. From the World Justice Project, we collect law index data in EU member states for each year in our testing period. A law index score reflects an overall grade measured in a hundred-mark system.

Finally, we include industry (two-digit SIC code) and year fixed effects to absorb potential unobservable influences.

Table 3 shows the proxies for all variables:

3.3. Empirical Model

Hypotheses 1 to 4 are tested with OLS regressions with fixed effect estimates and robust standard errors. Our regression models are following:

Model 1

where REL is the tested independent variable. The rest are the control variables discussed earlier. “𝜀” represents random noise. Model 1 is used to test hypothesis 1. In light of our literature review we predict coefficient

β1 to describe a negative association.

Model 2

In this model, we use R&D expenditure as the dependent variable to proxy for firms’ real earnings management. By running this model, we can test whether the religious atmosphere in a country can influence the R&D expenditure of companies, thus testing hypothesis 2. Considering the characteristics of R&D activities, the coefficient

β1 is predicted negative.

Model 3

where Christianity is the independent variable. This model is used to test hypothesis 3. Consistent with the main variable of interest in hypothesis 1, the coefficient estimate for

Christianity is expected negative.

Model 4

where Islam is the independent variable. According to prior research, a negative

β1 is expected. Model 3 and model 4 are used to compare the effect of different religions (Christianity and Islam) on real earnings management. From the regression results, hypotheses 3 and 4 can be tested.

4. Results

4.1. Descriptive Statistics

Table 4 provides the descriptive statistics of the dependent and independent variables of the above four models. There are 20,761 observations in the sample from 2010 to 2020. The two dependent variables are

REM and

R&D. The mean value of

REM is 0.0247 and the standard deviation is 0.819.

R&D has a mean value of 3.920 with a standard deviation of 130.8.

R&D has a large range of values.

REM ranges from -77 to 40, and

R&D from a minimal -1 to 8108. Comparing this to the sample (2000 - 2010) in Ipino and Parbonetti (2017), the average value of REM is -0.056, which indicates the objective of real earnings management in firms to have shifted from a downward manipulation of earnings (from -0.056 to 0.025).

The three independent variables are

REL, Christianity, Islam. From

Table 4, the degree of religiosity in EU countries has a mean of 0.801 with a standard deviation of 0.112. This implies that 80% of people in EU counties are religiously affiliated indicating a strong influence of religion. Among EU countries, it can be seen that the minimal value of religiosity is 0.216 and the maximal 0.99. When the two main religions are selected separately Christianity has a larger influence than Islam in European countries. The mean of

Christianity is 0.746 with a standard deviation of 0.137. Whereas the mean of Islam is 0.05 with a standard deviation of 0.0289. This shows that demographically, although the proportion of Muslim population is much smaller than that of Christians, the variation is stable and small across EU countries. At minimum and maximum levels, there are 21.6% and 99% of people respectively believing in Christianity, while for Islam, these figures are at only 1% (min) and 14.2% (max). According to these numbers, some countries are statistically fully religious since 99% of the population have such beliefs; in some others the majority of the population are non- religious.

When it comes to control variables, with the exception of dummies, there are 5 variables depicted in

Table 4. Firm size (

SIZE) is transformed using a natural logarithm, with a minimum value at -6.2, implying that the level of total assets of some companies is quite small. The mean of

LEV is 0.53 with a standard deviation of 0.32, and the mean of

ROA is -0.04 with a standarddeviation of 0.25. For country-specific variables,

GDP variable has a mean value of 13.41 and a standard deviation of 1.13. Law index (

LAW) presents a large difference across countries. The mean is 0.75, the minimum 0.53, and the maximum 0.9.

4.1. Analysis of Correlation

Table 5 presents Pearson correlation results among REL and other variables for each of the four models. This summarized examination is to ensure that there is no higher correlation within the independent variables. If the absolute value of a coefficient in the matrix is

0.8 or higher, multicollinearity is present and could decrease the t-statistic leading to insignificant associations. It is clear that in

Table 5, no variable has an absolute value of coefficient above 0.8, indicating no- multicollinearity issues.

Consistent with our earlier expectations the table shows a negative correlation between the degree of religiosity and the two dependent variables – REM and R&D –that proxy for real earnings management. The low correlation between REM and R&D suggests that these two proxies capture different dimensions of real earnings manipulation in corporates. All independent variables, except for Islam, are negatively and significantly correlated with REM. The coefficient of Islam and REM is positive, which is opposite to our earlier prediction. For R&D, the coefficient sign is consistent with our expectations, and the significance is at 0.01 indicating a strong relationship.

4.3. Hypotheses Testing

Hypothesis 1 predicts that religion is negatively associated with real earnings management, and Hypothesis 2 foretells that religion is negatively associated with R&D investment. Both hypotheses concern the effect of the degree of religiosity on firms’ earnings manipulation.

Table 6 presents the multivariate regression results of hypotheses 1 and 2.

We perform a fixed effect OLS-regression with robust standard errors for each model. The number of observations for model 1 amounts to 20,038, and in model 2 there are 19,501 data points. REM and R&D are used as proxies for real earnings management activities. The adjusted R2 for model 1 and model 2 is the same at 0.00644. This indicates that the independent variables only explain a small part; 0.6% percent, of the variance in the response variables, REM and R&D. Both models show significant F-statistics.

Based on the theory, hypothesis 1 expects that the degree of religiosity negatively affects

REM. Therefore, a negative coefficient for the variable

REL is expected. The first result column in

Table 6 is for Model 1. In this column,

REL has a negative coefficient of -0.3, which is significant at 1% level or above (p-value < 0.01with t = -4.42). This result implies that an increase in the degree of religiosity will decrease firms’ earnings manipulation. More specifically, this coefficient estimate suggests that when

REL increases by one unit, real earnings management decreases by 0.3 units. Therefore, the test result strongly supports this hypothesis, which suggests that religion can mitigate real earnings management to some extent. The results contradict prior studies, such as Callen et al. (2011) (indicating no relationship) and McGuire et al. (2012) (indicating a positive relationship). Our results indicate religion as part of social norms to influence firms’ choice with regards to earnings manipulation. A possible reason is that our paper takes a different geographic sample from that of the former two mentioned studies.

The second column is for hypothesis 2. Based on risk aversion theory, hypothesis 2 predicts that the level of R&D investment is negatively associated with the degree of religiosity in the country where the firm is located. According to the test result, Model 2 finds a negative coefficient of -19.131, significant at 0.05 (p-value<0.05 with t = -2.20). This means that with one unit increase in REL, R&D decreases more than 19 units. This outcome denotes that religion negatively affects R&D expenditure. In other words, if a company is headquartered in a higher religious area, it is thereby less likely to engage in R&D investments. Considering that R&D activities are usually high-risk and highly-uncertain, model 2 indicates compliance with the risk aversion theory.

Table 7 depicts the regression results for hypotheses 3 and 4. Models 3 and 4 are aimed at testing whether Christianity and Islam have a significant effect on real earnings management and if do, how this impact works. As discussed earlier, Christianity and Islam are the two main religions in European countries and have been long integrated into people’s life. Therefore, it is unavoidable to investigate these two religions if a study plans to focus on European religions and religious influence. As it can be seen in

Table 7, the number of observations included in the two regression models is 20,038.

Hypothesis 3 expects that Christianity can negatively influence earnings manipulation. In Column (1) of

Table 7, the coefficient of

Christianity is -0.264. The negative sign of the main variable of interest (

Christianity) indicates that companies are less likely to manage earnings if their countries have a higher Christians ratio. Besides, this coefficient estimate is negative and significant (at 1 % for

Christianity-REM tests and a t-value of -4.07), indicating strong support for hypothesis 3.

Column (2) of

Table 7 displays the result for hypothesis 4. This hypothesis predicts that Islam negatively affects real earnings manipulation. Therefore, a negative coefficient for

Islam is expected, which has the same sign as

Christianity in hypothesis 3. In Column (2), after controlling year and industry fixed effects, the coefficient estimate of

Islam is 0.857, with a p-value < 1%. This implies that Islam beliefs in a country can positively affect real earnings management of firms, and such impact is significant. Thus, the result rejects hypothesis 4, which suggests that at least in EU countries, Islamic culture does not help to mitigate activities of real earnings management. This positive result also contradicts the finding of Quttainah et al. (2013). Quttainah et al. (2013) studied earnings management in Islamic banks and found that Islamic banks are less prone to earnings management because important determinants, such as the Shari’ah Supervisory Board and the Auditing Organization for Islamic Financial Institutions, play a role in the operation of banks. The possible explanations for the opposite results between can be explained first because Quttainah et al. (2013) selected organizations in the financial industry to construct a test sample, while this paper contains all industries except for regulated industries such as banks & financial institutions. Second, although the two studies use cross-country data, country selections are different. Specifically, Quttainah et al. (2013) focus on Islamic banks in traditionally Islamic countries, such as Iran and Turkey with mature Muslim communities and cultures. While this paper aims to study EU countries, where the proportion of Muslims being much smaller than that of Christians. Therefore, even if a firm is a “religious” firm, in EU countries is more likely to be a typical “Christian” firm rather than an “Islamic” firm. In all, the positive and significant coefficient indicates that hypothesis 4 should be rejected.

4.4. Robustness Testing

To strengthen the reliability of our results we undertook the following robustness tests:

Firstly, we winsorized at the top and bottom 5% of the control variables to eliminate the adverse effect of extreme values. The new results are consistent with the previous ones. Results are depicted in

Table 8, panel A.

Secondly, we used the religious data collected from the European Values website to replace the independent

REL variable and then we tested again our hypotheses. The result shows that

REL is still negatively and significantly associated with REM, while REL does not show significant influence on firms’ R&D expenditure. Results are portrayed in

Table 8, panel B.

Lastly, we separated all observations in two groups through the

BIG4 variable, and then tested the group results. Effects are consistent again with the results in section 4.3.

REL is significantly and negatively associated with

REM, independent of the accounting firms that the local companies choose (“Big4” or others). The results are shown in

Table 8, panel C. To sum up, robustness testing findings suggest reliability of our results.

Table 8.

Robustness Testing - Panel A.

Table 8.

Robustness Testing - Panel A.

| |

(1) |

(2) |

(3) |

(4) |

| |

model 1 |

model 2 |

model 3 |

model 4 |

| VARIABLES |

REM |

R&D |

REM |

REM |

| REL |

-0.291*** |

-18.198** |

|

|

| |

(-4.38) |

(-2.13) |

|

|

| Christianity |

|

|

-0.256*** |

|

| |

|

|

(-4.04) |

|

| Islam |

|

|

|

0.836*** |

| |

|

|

|

(3.30) |

| SIZE |

-0.001 |

0.612 |

-0.001 |

-0.000 |

| |

(-0.20) |

(1.39) |

(-0.28) |

(-0.14) |

| LEV |

0.086** |

-17.446*** |

0.086** |

0.086** |

| |

(2.25) |

(-3.35) |

(2.26) |

(2.26) |

| ROA |

-0.467*** |

-76.966*** |

-0.465*** |

-0.471*** |

| |

(-7.98) |

(-3.56) |

(-8.00) |

(-8.04) |

| LOSS |

-0.044* |

-4.741* |

-0.045* |

-0.045* |

| |

(-1.77) |

(-1.69) |

(-1.79) |

(-1.79) |

| BIG4 |

0.009 |

-1.000 |

0.009 |

0.013 |

| |

(0.86) |

(-0.37) |

(0.92) |

(1.24) |

| GDP |

0.007** |

-1.575** |

0.006 |

0.010*** |

| |

(2.03) |

(-2.36) |

(1.48) |

(2.72) |

| LAW |

-0.213*** |

9.678 |

-0.203*** |

-0.035 |

| |

(-3.75) |

(0.92) |

(-3.76) |

(-0.61) |

| Constant |

0.210** |

30.589** |

0.180* |

-0.239*** |

| |

(2.14) |

(2.08) |

(1.84) |

(-5.18) |

| Observations |

20,036 |

19,500 |

20,036 |

20,036 |

| R-squared |

0.012 |

0.008 |

0.012 |

0.012 |

| adj_R2 |

0.00675 |

0.00675 |

0.00675 |

0.00675 |

| F |

1.675 |

1.675 |

1.675 |

1.675 |

| Robust t-statistics in parentheses |

|

|

|

| *** p<0.01, ** p<0.05, * p<0.1 |

|

|

|

Table 8.

Robustness Testing - Panel B.

Table 8.

Robustness Testing - Panel B.

| |

(1) |

(2) |

| |

test1 |

test2 |

| VARIABLES |

REM |

R&D |

| REL |

-0.003* |

-0.090 |

| |

(-1.65) |

(-0.65) |

| SIZE |

-0.004 |

0.735** |

| |

(-1.59) |

(2.28) |

| LEV |

0.051* |

-15.692*** |

| |

(1.71) |

(-3.60) |

| ROA |

-0.243*** |

-42.679*** |

| |

(-7.78) |

(-3.12) |

| LOSS |

-0.021 |

-0.880 |

| |

(-0.95) |

(-0.44) |

| BIG4 |

0.011 |

-2.032 |

| |

(1.01) |

(-0.86) |

| GDP |

0.011*** |

-0.868* |

| |

(3.02) |

(-1.72) |

| LAW |

-0.187* |

15.726 |

| |

(-1.83) |

(1.25) |

| Constant |

-0.067 |

3.011 |

| |

(-0.89) |

(0.67) |

| Observations |

18,831 |

18,318 |

| R-squared |

0.008 |

0.008 |

| adj_R2 |

0.00701 |

0.00701 |

| F |

2.579 |

2.579 |

| Robust t-statistics in parentheses |

|

| *** p<0.01, ** p<0.05, * p<0.1 |

|

Table 8.

Robustness Testing – Panel C.

Table 8.

Robustness Testing – Panel C.

| (1) |

(2) |

| |

BIG4 = 0 |

BIG4 = 1 |

| VARIABLES |

REM |

REM |

| REL |

-0.312** |

-0.148*** |

| |

(0.146) |

(0.0517) |

| SIZE |

0.000208 |

-0.0113*** |

| |

(0.00521) |

(0.00225) |

| LEV |

0.116*** |

0.0538** |

| |

(0.0393) |

(0.0212) |

| ROA |

-0.393*** |

-0.532*** |

| |

(0.0824) |

(0.0465) |

| LOSS |

-0.0616** |

-0.0375*** |

| |

(0.0283) |

(0.0142) |

| GDP |

0.0144 |

-0.00672 |

| |

(0.0112) |

(0.00426) |

| LAW |

-0.164 |

-0.220*** |

| |

(0.164) |

(0.0601) |

| Constant |

0.159 |

0.448*** |

| |

(0.288) |

(0.107) |

| Observations |

11,149 |

9,610 |

| R-squared |

0.005 |

0.032 |

| Standard errors in parentheses |

|

| *** p<0.01, ** p<0.05, * p<0.1 |

|

5. Conclusions

Hilary and Hui (2009) document that a higher level of religiosity could lead to more conservative investment of local companies. This paper focuses on the effects of religious factors on real earnings management. In particular we examine whether there is a negative association between the degree of religiosity in a country and the real earnings management behavior of companies in this country. In addition we examine whether different religions such as Christianity and Islam, have a different effect on firms’ (non-accrual) earnings manipulation.

A significant body of the accounting literature has studied earnings management and its association with other topics (Elias, 2002; Leuz, 2003; Roychowdhury, 2006; Garcia Osma, 2008; Ipino and Parbonetti, 2017). It is not surprising to find that prior research has talked about the impact of religion (as an external factor) on firms’ behaviors for manipulating earnings (Dyreng et al., 2012; McGuire et al., 2012; Quttainah et al., 2013; Du et al., 2015). However, these studies mainly focus on accrual-based earnings management, which is easily captured from annual financial and audit reports. Only a few articles pay enough attention to real earnings management which is more concealed. Considering the limited discussion about religious factors and real earnings management, this paper helps to fill this research gap by examining how religiosity in European Union member states affects the EU based firms’ real earnings management. Based on social norm and risk aversion theories, four hypotheses are put forward, all predicting a negative relationship between Religiosity and REM.

In order to answer our research question a dataset from Compustat and the Pew Research database is examined. The main sample consists of 20,761 observations of 3,090 firms headquartered in EU from 2010 to 2020. The regression models consider religiosity (the Christian and Muslim ratios of the local populations) as independent variables, with these variables been obtained from the Pew Research database. Real earnings management related figures and R&D expenditures were derived from the Compustat database and are used as dependent variables in the four models. Furthermore, all regression models consider firm size, leverage, return on assets, loss, and the type of audit firms as firm-level control variables, additionally including GDP and the law index as country-level control variables.

We test four hypotheses. Hypotheses one and two expect the degree of overall religiosity to have a negative effect on both REM and R&D (as an alternative proxy for real earnings management). The results of model 1 and model 2 indicate a negative and significant association between religiosity for both proxies thus accepting both hypotheses. Hypotheses three and four put particular emphasis on the different of types of religions and their effects on firms’ real earnings manipulations. Both hypotheses anticipate a negative association between Christianity and Islam and real earnings management. Model 3 indicates a negative and significant association between Christianity and real earnings management, while model 4 indicates that Islam has a positive and significant impact on real earnings management. Therefore, hypothesis three is accepted but hypothesis four is rejected. In addition, the coefficient of Christianity in model 3 is -0.26, whose absolute value is smaller than that of Islam in model 4, which is -0.86. This difference in coefficients may reveal that the influence of Islam on firms’ operating activities is larger than the influence of Christianity, even though Christianity has much more advantages of adherent numbers in EU member states. Our robustness testing supports our main findings. We also find evidence that the effect of religion on real earnings management is stronger among firms with low levels of external monitoring providing evidence for the role of a “cultural institution” where activities of formal institutions are absent or lagging behind.

This paper has some limitations and potential future research avenues. First, we proxy for religious factors using demographics only. Potential statistical errors could drive our findings. Besides, this method of analysis could not capture the complete workings of religion and omit significant characteristics of its effects. Future research could focus on the construction of a more unbiased and complete proxy to evaluate such types of cultural level attributes. Second, our control variables are not incorporating important information due to an absence of related data. For instance, executive factors may also impact the paper results since religious beliefs of CEOs could influence the design of corporate policies (Cai et al. 2019), and ownership concentration ina firm could also influence earnings manipulation (Callen et al. 2015). Future researchers could add more control variables in their regression. Third, our sample only includes data from EU member states. Other European countries (e.g. Britain) are not included in our examination and this could have an impact on our output. Future studies could extend the scope to all European countries to obtain a more reliable result. Last, we do not pay much attention to external regulation that could affect the association between religion and real earnings manipulation. The consideration of relevant moderating effects is another possible future path.

References

- Adhikari, B. K. , & Agrawal, A. . (2016). Does local religiosity matter for bank risk-taking? Journal of Corporate Finance, 272-293.

- Aibibula, H., Wang, G., & Zhang, C. (2017). Religious Belief and Firm R&D Investment. Technology and Investment, 8(2), 142-150.

- Bartov, E., Givoly, D., & Hayn, C. (2002). The rewards to meeting or beating earnings expectations. Journal of accounting and economics, 33(2), 173-204.

- Baxamusa, M., & Jalal, A. (2016). CEO’s religious affiliation and managerial conservatism. Financial Management, 45(1), 67-104.

- Brammer, S., Williams, G., & Zinkin, J. (2007). Religion and attitudes to corporate social responsibility in a large cross-country sample. Journal of business ethics, 71(3), 229-243.

- Bruns, W., & Merchant, K. (1990). The dangerous morality of managing earnings. Management accounting, 72(2), 22-25. 2.

- Burgstahler, D., & Dichev, I. (1997). Earnings management to avoid earnings decreases and losses. Journal of accounting and economics, 24(1), 99-126. 1.

- Bushee, B. J. (1998). The influence of institutional investors on myopic R&D investment behavior. Accounting review, 305-333.

- Callen, J. L., Morel, M., & Richardson, G. (2011). Do culture and religion mitigate earnings management? Evidence from a cross-country analysis. International Journal of Disclosure and Governance, 8(2), 103-121.

- Cazavan-Jeny, A., Jeanjean, T., & Joos, P. (2011). Accounting choice and future performance: The case of R&D accounting in France. Journal of accounting and public policy, 30(2), 145-165.

- Chambers, D., Jennings, R., & Thompson, R. B. (2002). Excess returns to R&D-intensive firms. Review of Accounting Studies, 7(2), 133-158.

- Choi, K. (2020). National culture and R&D investments. The European Journal of Finance, 26(6), 500–531.

- Choi, Y. (2010). Religion, religiosity, and South Korean consumer switching behaviors. Journal of Consumer Behaviour, 9(3), 157-171.

- Christopoulos, A. G., Papathanasiou, S., Kalantonis, P., Chouliaras, A., & Katsikidis, S. (2014). An Investigation of cointegration and casualty relationships between the PIIGS’stock markets. Stock Markets European Research Studies, 17(2), 109 – 123. Cohen, D. A., Dey, A., & Lys, T. Z. (2008). Real and accrual-based earnings management in the pre-and post-Sarbanes-Oxley periods. The accounting review, 83(3), 757-787.

- Dechow, P. M., & Sloan, R. G. (1991). Executive incentives and the horizon problem: An empirical investigation. Journal of accounting and Economics, 14(1), 51-89.

- Dechow, P. M., Sloan, R. G., & Sweeney, A. P. (1995). Detecting earnings management. Accounting review, 193-225.

- Dobbin, F., & Jung, J. (2010). The misapplication of Mr. Michael Jensen: How agency theory brought down the economy and why it might again. In Markets on trial: The economic sociology of the US financial crisis: Part B. Emerald Group Publishing Limited.

- Du, X. (2021). Religious Entrepreneurs and Corporate R&D Investment. In On Informal Institutions and Accounting Behavior (pp. 207-259). Springer, Singapore.

- Du, X. , Jian, W., Lai, S., Du, Y., & Pei, H. (2015). Does religion mitigate earnings management?

- Evidence from China. Journal of Business Ethics, 131(3), 699-749.

- Dyreng, S. D., Mayew, W. J., & Williams, C. D. (2012). Religious social norms and corporate financial reporting. Journal of Business Finance & Accounting, 39(7-8), 845-875.

- El Ghoul, S., Guedhami, O., Ni, Y., Pittman, J., & Saadi, S. (2012). Does religion matter to equity pricing?. Journal of Business Ethics, 111(4), 491-518.

- Elias, R. Z. (2002). Determinants of earnings management ethics among accountants. Journal of Business Ethics, 40(1), 33-45.

- Garcia Osma, B. (2008). Board independence and real earnings management: The case of R&D expenditure. Corporate Governance: An International Review, Forthcoming.

- Graham, J. R., Harvey, C. R., & Rajgopal, S. (2005). The economic implications of corporate financial reporting. Journal of accounting and economics, 40(1-3), 3-73.

- Grullon, G., Kanatas, G., & Weston, J. (2010). Religion and corporate (mis) behavior. Working paper, Rice University.

- Guan, L., He, D., & Yang, D. (2006). Auditing, integral approach to quarterly reporting, and cosmetic earnings management. Managerial auditing journal.

- Guiso, L., Sapienza, P., & Zingales, L. (2003). People’s opium? Religion and economic attitudes. Journal of monetary economics, 50(1), 225-282.

- Gunny, K. A. (2010). The relation between earnings management using real activities manipulation and future performance: Evidence from meeting earnings benchmarks. Contemporary accounting research, 27(3), 855-888.

- Healy, P. M., & Wahlen, J. M. (1999). A review of the earnings management literature and its implications for standard setting. Accounting horizons, 13(4), 365-383.

- Hilary, G., & Hui, K. W. (2009). Does religion matter in corporate decision making in America?. Journal of financial economics, 93(3), 455-473. Jiang, F., Jiang, Z., Kim, K. A., & Zhang, M. (2015). Family-firm risk-taking does religion matter. Journal of Corporate Finance, 33, 260-278.

- Hofstede, G. (1980). Culture and organizations. International studies of management & organization, 10(4), 15-41.

- Hofstede, G. (2001). Culture’s recent consequences: Using dimension scores in theory and research. International Journal of cross cultural management, 1(1), 11-17.

- Ipino, E., & Parbonetti, A. (2017). Mandatory IFRS adoption: the trade-off between accrual- based and real earnings management. Accounting and Business Research, 47(1), 91-121.

- Jones, J. J. (1991). Earnings management during import relief investigations. Journal of accounting research, 29(2), 193-228.

- Kalantonis, P., Kallandranis, C., & Sotiropoulos, M. (2021). Leverage and firm performance: new evidence on the role of economic sentiment using accounting information. Journal of Capital Markets Studies.

- Kanagaretnam, K., Lobo, G., & Wang, C. (2015). Religiosity and Earnings Management International Evidence from the Banking Industry. Journal of Business Ethics, 132(2), 277–296.

- Kohlberg, L. (1984). Essays on moral development/2 The psychology of moral development. Harper & Row.

- Kumar, A., Page, J. K., & Spalt, O. G. (2011). Religious beliefs, gambling attitudes, and financial market outcomes. Journal of financial economics, 102(3), 671-708. 3.

- Leuz, C., Nanda, D., & Wysocki, P. D. (2003). Earnings management and investor protection: an international comparison. Journal of financial economics, 69(3), 505-527.

- Ma, L., Zhang, M., Gao, J., & Ye, T. (2020). The effect of religion on accounting conservatism. European Accounting Review, 29(2), 383-407. 2.

- Markarian, G., Pozza, L., & Prencipe, A. (2008). Capitalization of R&D costs and earnings management: Evidence from Italian listed companies. The International Journal of Accounting, 43(3), 246-267.

- Marquis, C. , & András Tilcsik. (2013). Imprinting: toward a multilevel theory. The Academy of Management Annals, 7(1), 195-245.

- Marrakchi Chtourou, S., Bedard, J., & Courteau, L. (2001). Corporate governance and earnings management. Available at SSRN 275053.

- McGuire, S. T., Omer, T. C., & Sharp, N. Y. (2012). The impact of religion on financial reporting irregularities. The Accounting Review, 87(2), 645-673.

- Miller, A. S., & Hoffmann, J. P. (1995). Risk and religion: An explanation of gender differences in religiosity. Journal for the scientific study of religion, 63-75.

- Mukhibad, H., & Nurkhin, A. (2019). Islamic Business Ethics Disclosure and Earnings Management–Evidence from Islamic Banks in Indonesia. Journal of Islamic Finance (ISSN: 2289-2109 e-ISSN: 2289-2117), 8(2), 31-42.

- Noussair, C. N., Trautmann, S. T., Van de Kuilen, G., & Vellekoop, N. (2013). Risk aversion and religion. Journal of Risk and Uncertainty, 47(2), 165-183.

- Omer, T. C., Sharp, N. Y., & Wang, D. (2018). The impact of religion on the going concern reporting decisions of local audit offices. Journal of Business Ethics, 149(4), 811-831.

- Prencipe, A., Markarian, G., & Pozza, L. (2008). Earnings management in family firms: Evidence from R&D cost capitalization in Italy. Family Business Review, 21(1), 71-88.

- Quttainah, M., Song, L., & Wu, Q. (2013). Do Islamic Banks Employ Less Earnings Management. Journal of International Financial Management & Accounting, 24(3), 203– 233.

- Richardson, S. A., Tuna, A., & Wysocki, P. D. (2003). Accounting for taste: Board member preferences and corporate policy choices. MIT Sloan School of Management Working Paper. Available at SSRN 405101, 2003 - papers.ssrn.com.

- Roychowdhurry, S. (2006). Earnings management through real activities manipulation. Journal of Accounting & Economics 42(3), 335-370.

- Skordoulis, M., Ntanos, S., Kyriakopoulos, G. L., Arabatzis, G., Galatsidas, S., & Chalikias, M. (2020). Environmental innovation, open innovation dynamics and competitive advantage of medium and large.sized firms. Journal of Open Innovation: Technology, Market, and Complexity, 6(4), 195.

- Stark, R., & Finke, R. (2000). Acts of faith: Explaining the human side of religion. Univ of California Press.

- Stavrova, O., Fetchenhauer, D., & Schlösser, T. (2013). Why are religious people happy? The effect of the social norm of religiosity across countries. Social science research, 42(1), 90- 105.

- Wang, S., & D’Souza, J. (2006). Earnings management: The effect of accounting flexibility on R&D investment choices. Johnson School Research Paper Series, (33-06).

- Yan, Y., Xu, X., & Lai, J. (2021). Does Confucian culture influence corporate R&D investment? Evidence from Chinese private firms. Finance Research Letters, 40, 101719.

| 1. |

As mentioned earlier there is no consensus in the literature on the existence of a link between religion and real earnings management. Differences in the findings could be driven from the distinctive samples used. A sorting of the related literature indicates the majority of the studies to concentrate either on companies in America or in China; whereas cross-country samples usually contain countries all over the world (Kanagaternam et al., 2015). Our review of the related literature is in support of Kanagaretnam et al. (2015) indicating that there is little research in examining how EU listed entities behave in this context. Our primary contribution therefore is to document that differences in religiosity between countries are related to differences in real (non-accrual) earnings management and we extend prior research on the examination of this relation to the international setting by examining a more homogenous (i.e. EU) reporting setting. Additionally our study can be viewed as identifying softer dimensions such as religion, in addition to previously identified international institutional factors, that influence financial reporting behavior. Overall, our findings support the growing awareness among researchers studying international financial markets that informal institutions such as religion which is a major source of morality and ethical behavior matter in financial reporting and financial decisions, even when those decisions are made by sophisticated professional managers. |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).