Submitted:

25 June 2023

Posted:

26 June 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Materials and Methods

2.1. The GAS Model

2.1.1. Reparameterisation of the Time-Varying Parameter

2.2. The True Parameter Recovery Measure

2.3. Simulation Design

2.3.1. Aim of the Simulation Study

2.3.2. State the Research Questions

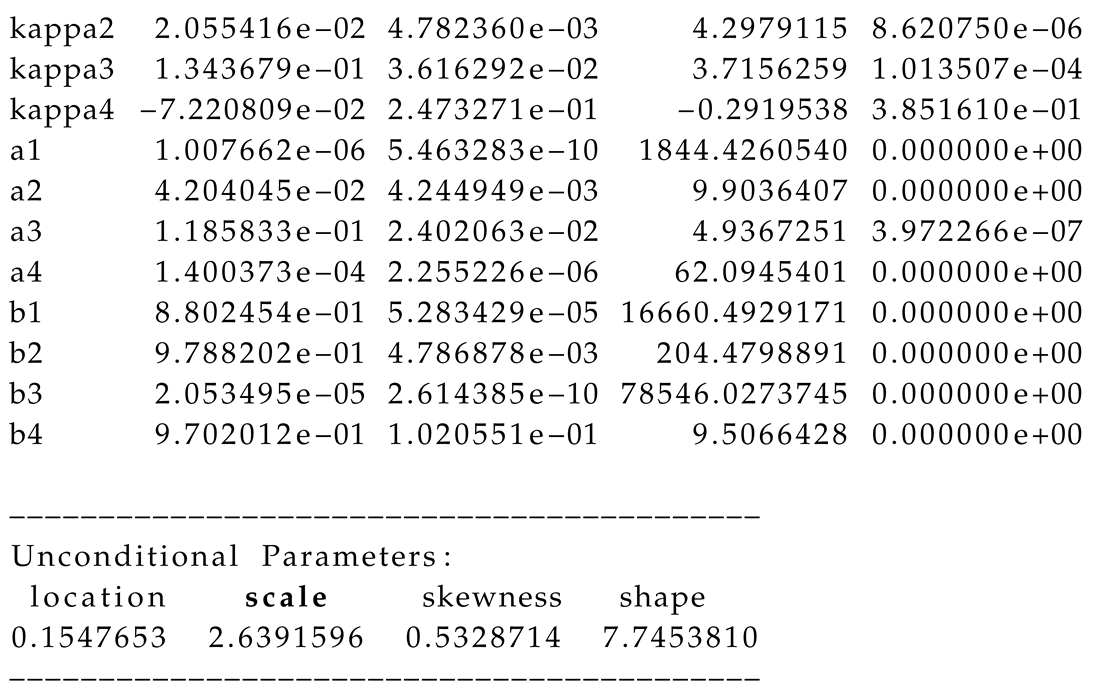

2.3.3. Method of Implementation

- Write the code: Carrying out a proper simulation experiment that mirrors real-life situation can be very demanding and computationally intensive, hence readable computer code with the right syntax must be ensued. MCS code must be well organised to avoid difficulties during debugging. It is always safer to start with small coding practices, get familiar with them and ensure they run properly with necessary debugging of errors before embarking on more intensive and complex ones. Code must be efficiently and flexibly written and well arranged for easy readability.

- Set the seed: Simulation code will generate different sequence of random numbers each time it is run unless a seed is set [34]. A set seed initialises the random number generator [32] and ensures reproducibility, where the same result is obtained for different runs of the simulation process [35]. The seed needs to be set only once, for each simulation, at the start of the simulation session [6,32], and it is better to use the same seed values throughout the process [6]. The seed is essentially used for reproducibility. Samuel et al. [4] used the GARCH model to show that as the sample size N increases, the arrangement (or pattern) of the seed values generally does not influence the efficiency and consistency of an estimator. This however may depend on the quality of the model used.

-

Next, simulated observations are generated using the true sampling distribution or the true model given some sets of (or different sets of) fixed parameters. Generation of simulated datasets through the GAS model is carried out using the R package "GAS". Random data generation involving this package can be implemented using either of two approaches [5,16]. The first approach is to carry out the data generating simulation directly on a fitted object "fit" (or uGASFit) using the UniGASSim (univariate GAS simulation) function for the simulated random data. The second approach uses the function UniGASSim with "fit = null". This latter approach involves full specification of a GAS model that includes selection of the conditional error distribution of the time series process, and specifying the static parameter = (, , ) that controls the time variation in , as described in Section 2.1.The simulation or data generating process can be run once or replicated multiple times. However, data generation through the GAS process is generally designed to run only once. In their study through autoregressive process, Samuel et al. [4] showed that the outcomes of MCS experiments using the GARCH model are the same for datasets simulated with the same seed value, regardless of whether the simulation or data generating process is run once or replicated multiple times. Hence, the outcome of a single run is the same as the average of multiple runs or replicates. Their findings further revealed that in any multiple generated (simulated) datasets in the family GARCH model, each simulated series is distinct in randomness and shape, and it is different from every other series in the datasets.

- The generated (simulated) data are analysed and the estimates from them are assessed using classic methods through meta-statistics to derive relevant information about the estimators. Meta-statistics (see [27]) are performance measures or metrics for evaluating the modelling outcomes by judging the closeness between an estimate and the true parameter. A few of the frequently used meta-statistical summaries, as described below, include the bias, root mean square error (RMSE), standard error (SE) and relative efficiency (RE). For more meta-statistics, see [6,27,37].

2.4. Discussion and Summary

3. Results: Simulation and Empirical

3.1. Practical Illustrations of the Simulation Design: Application to Bond Return Series

3.2. The Background

3.3. Aim of the Simulation Study

3.4. Research Questions

- 1.

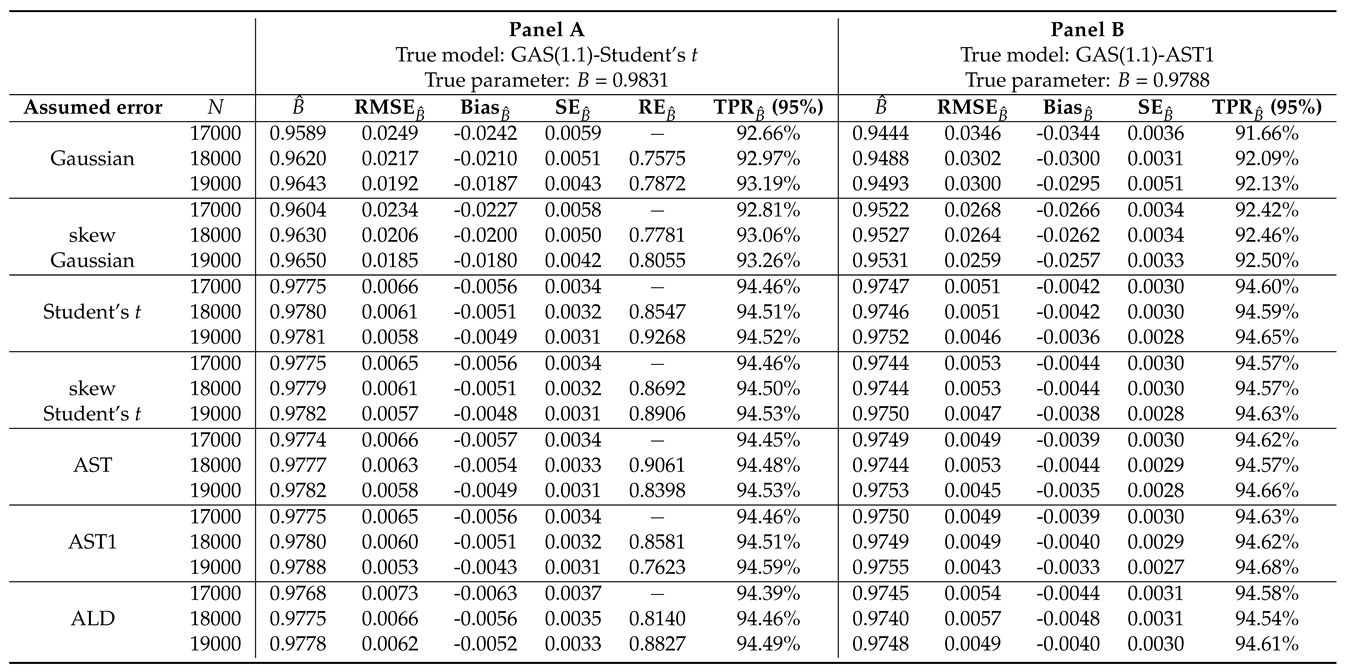

- Which among the assumed error distributions is the most suitable from the GAS simulation process to estimate volatility?

- 2.

- What type (i.e., strong, weak or inconsistence) of consistency, in terms of RMSE and SE, does the volatility persistence estimator of the GAS process exhibit?

- 3.

- How does the estimator of the most suitable assumed error distribution compare to the estimator of contending assumed error distributions with regards to bias, and efficiency (or precision) in terms of RMSE, SE and RE?

- 4.

- How is the performance of the MCS estimator in recovering the true parameter B?

3.5. Method of Implementation

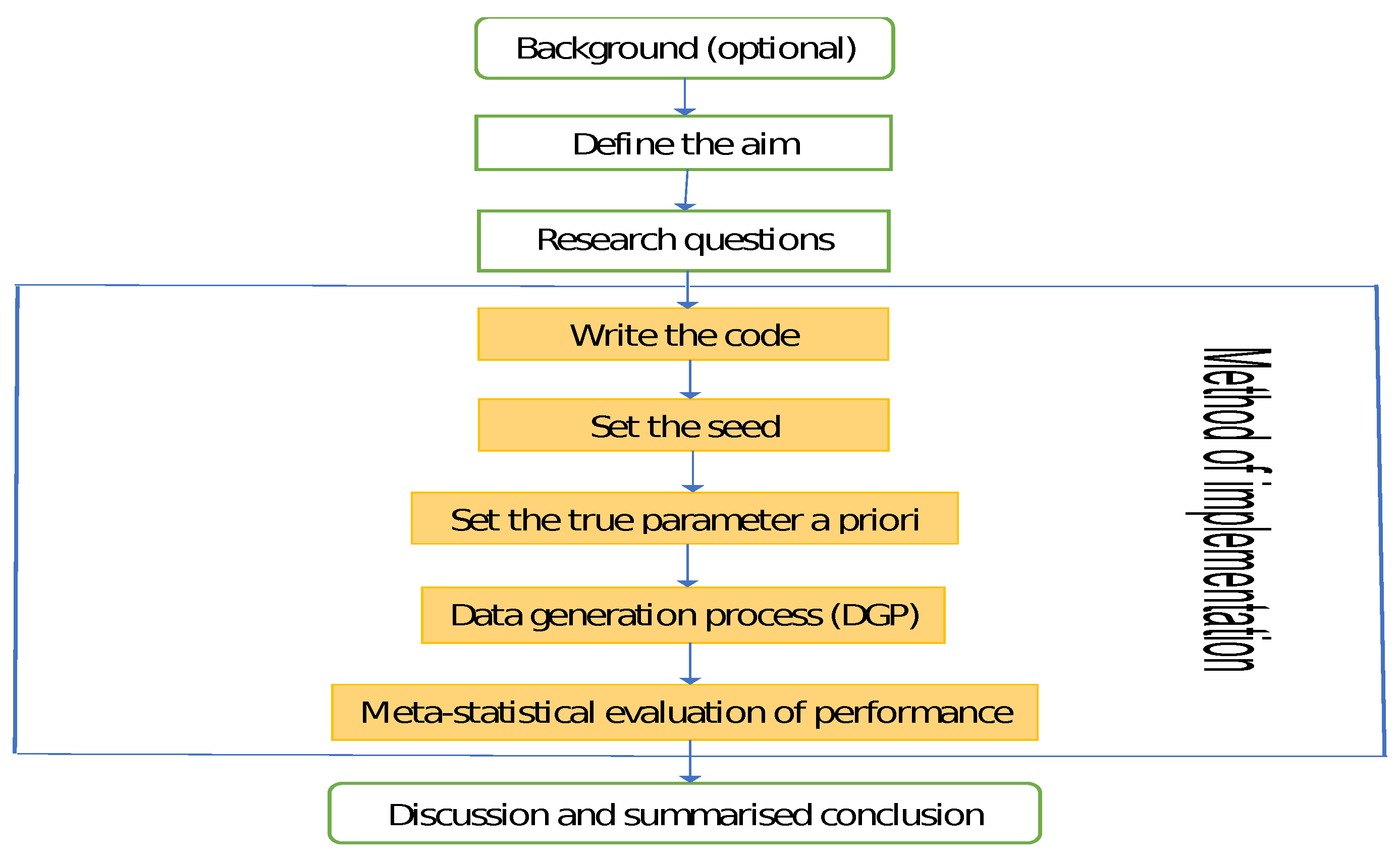

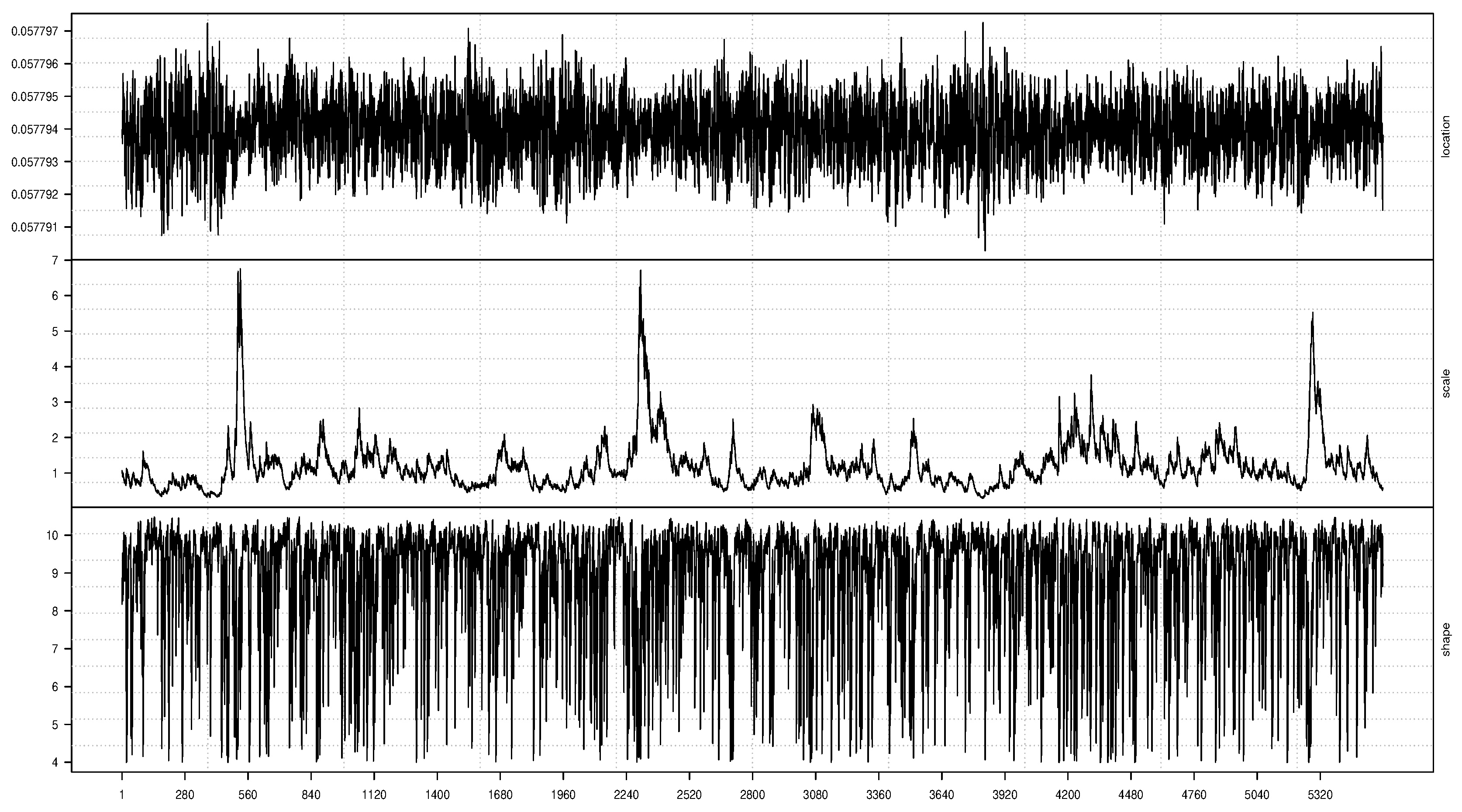

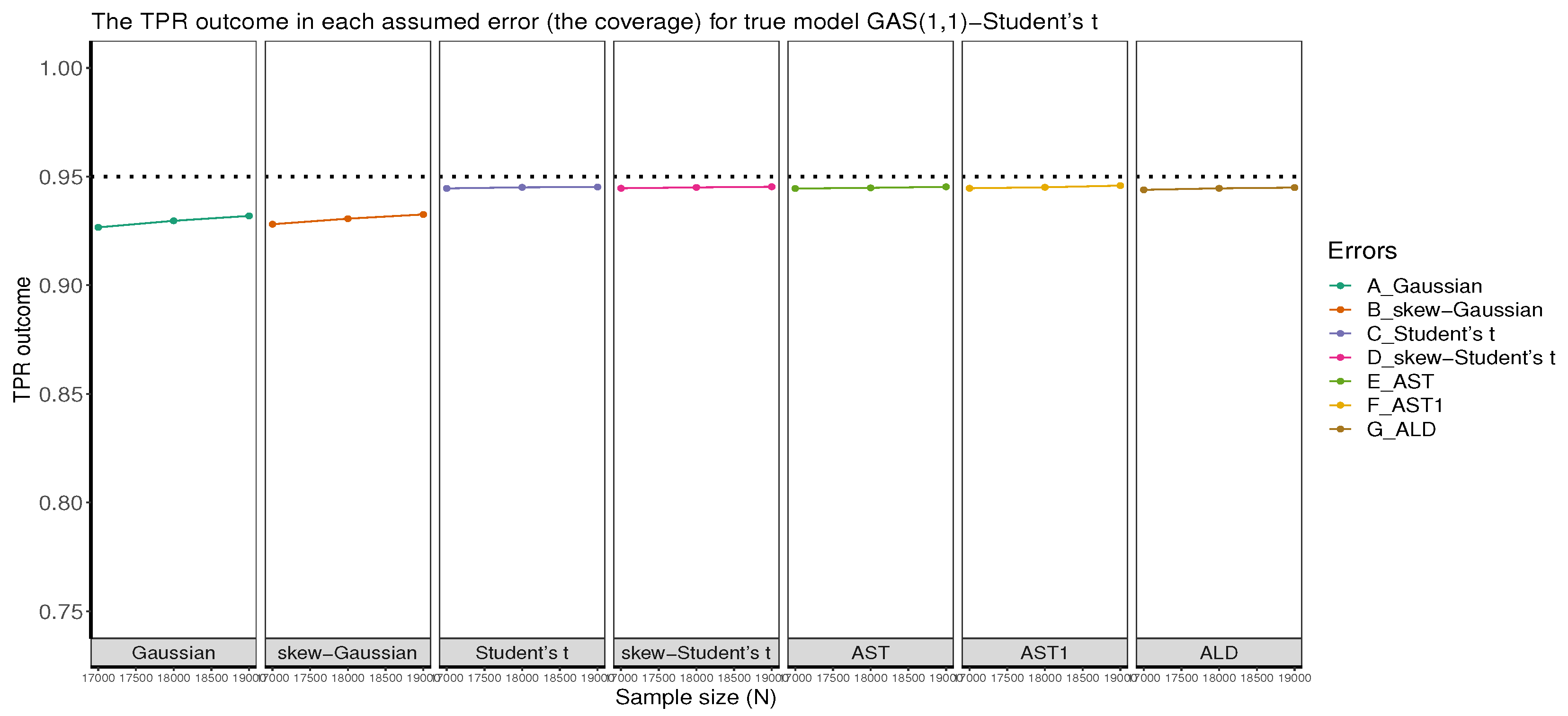

3.5.1. Method of Implementation with the Student’s t Error

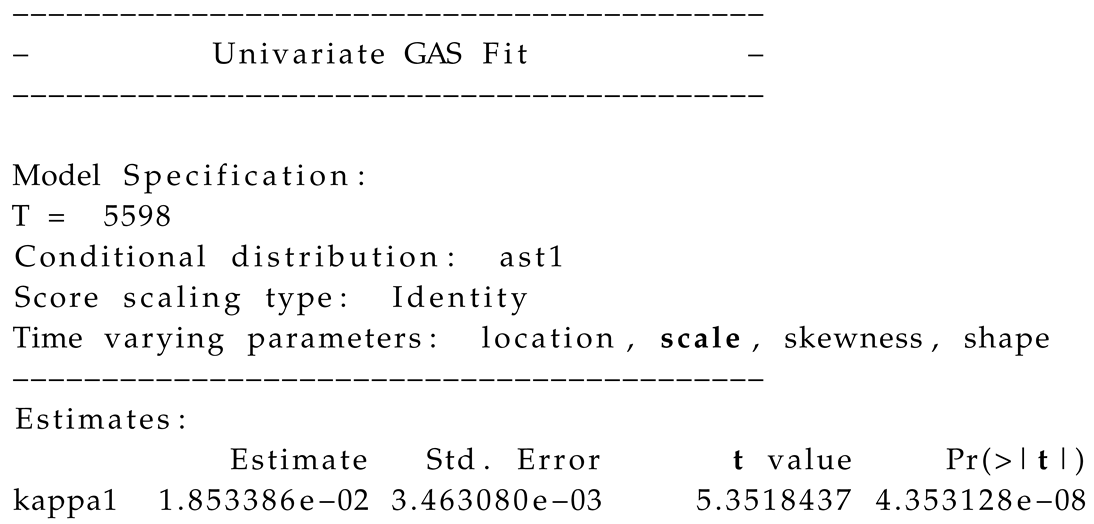

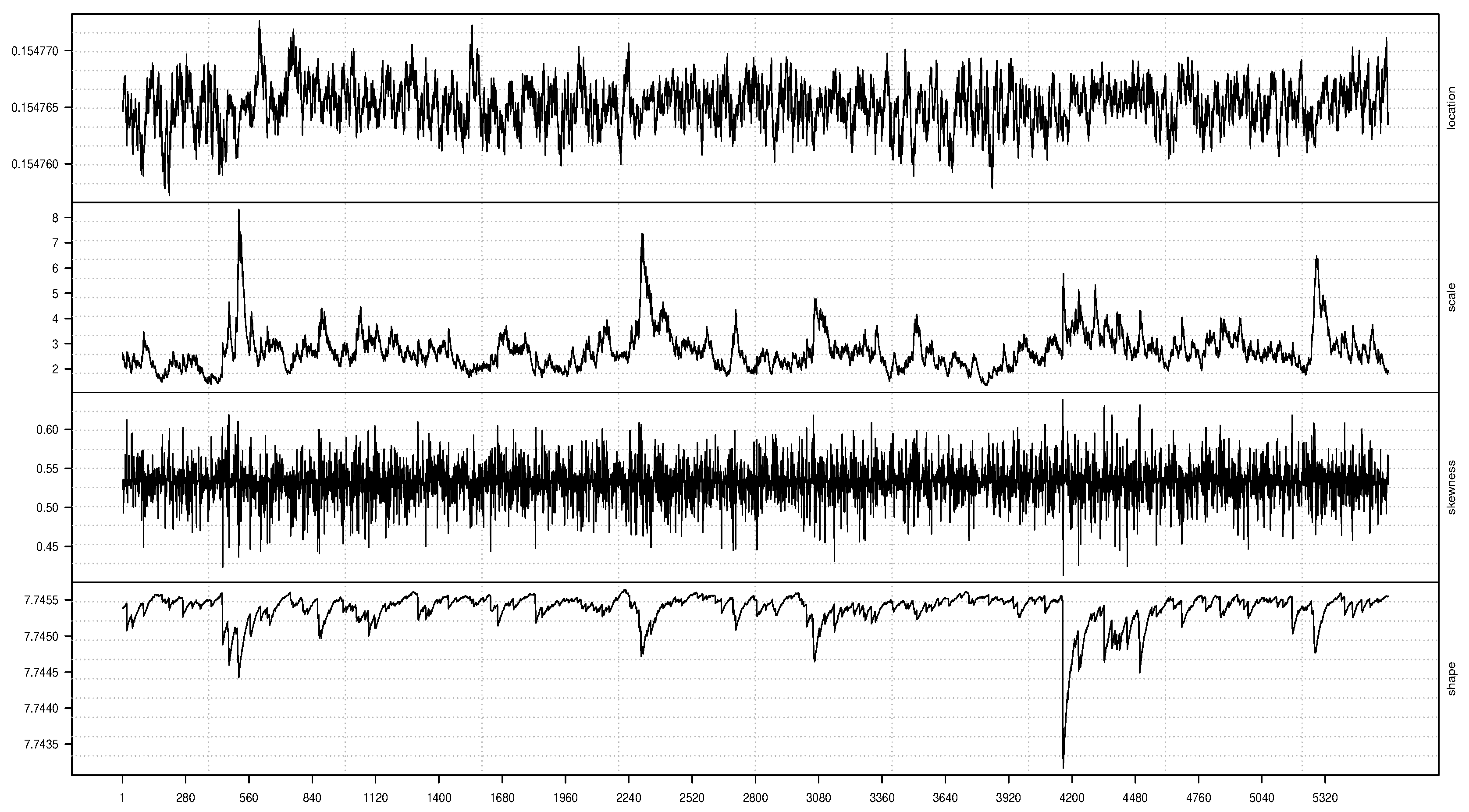

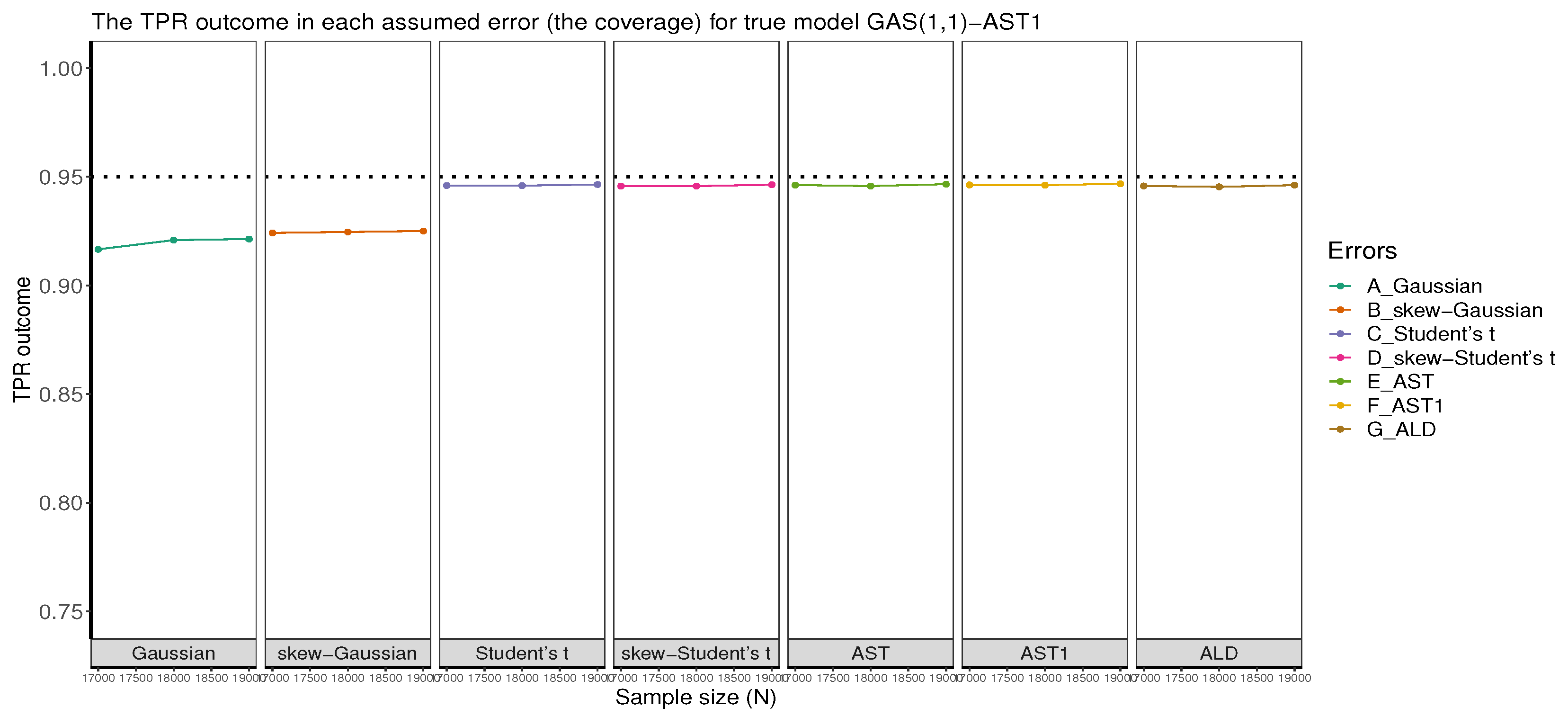

3.5.2. Method of Implementation with AST1

3.6. Empirical Study

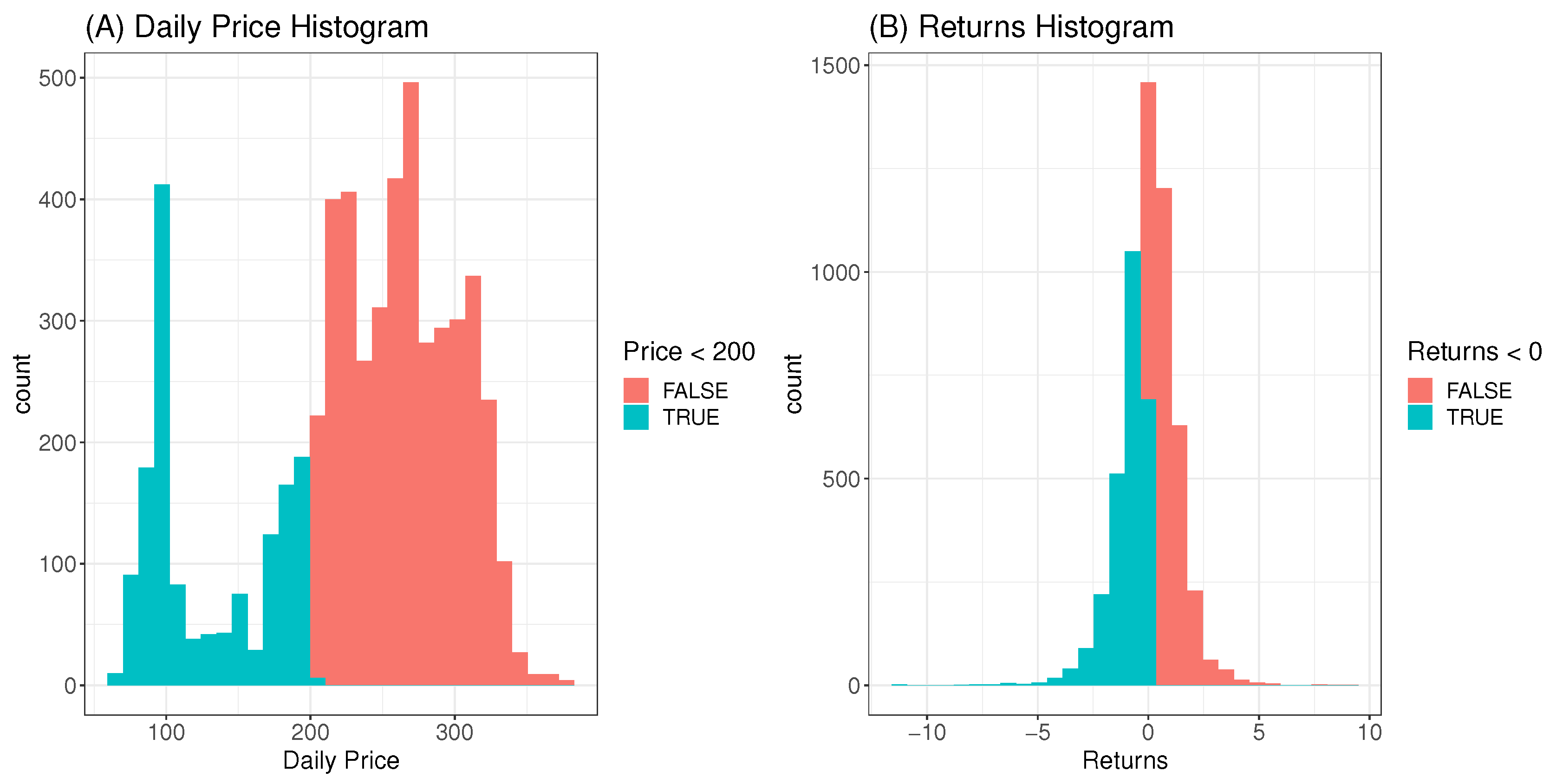

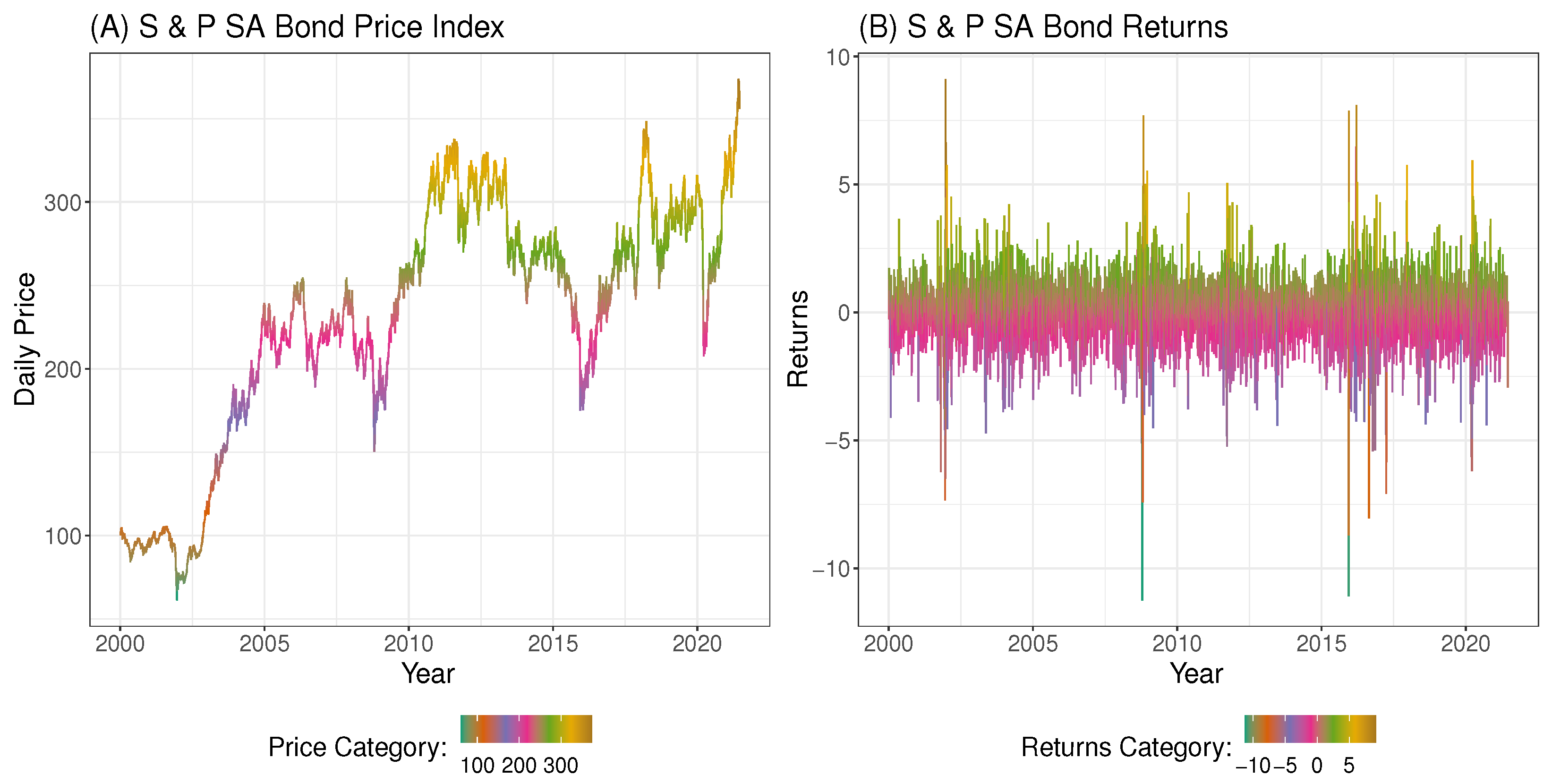

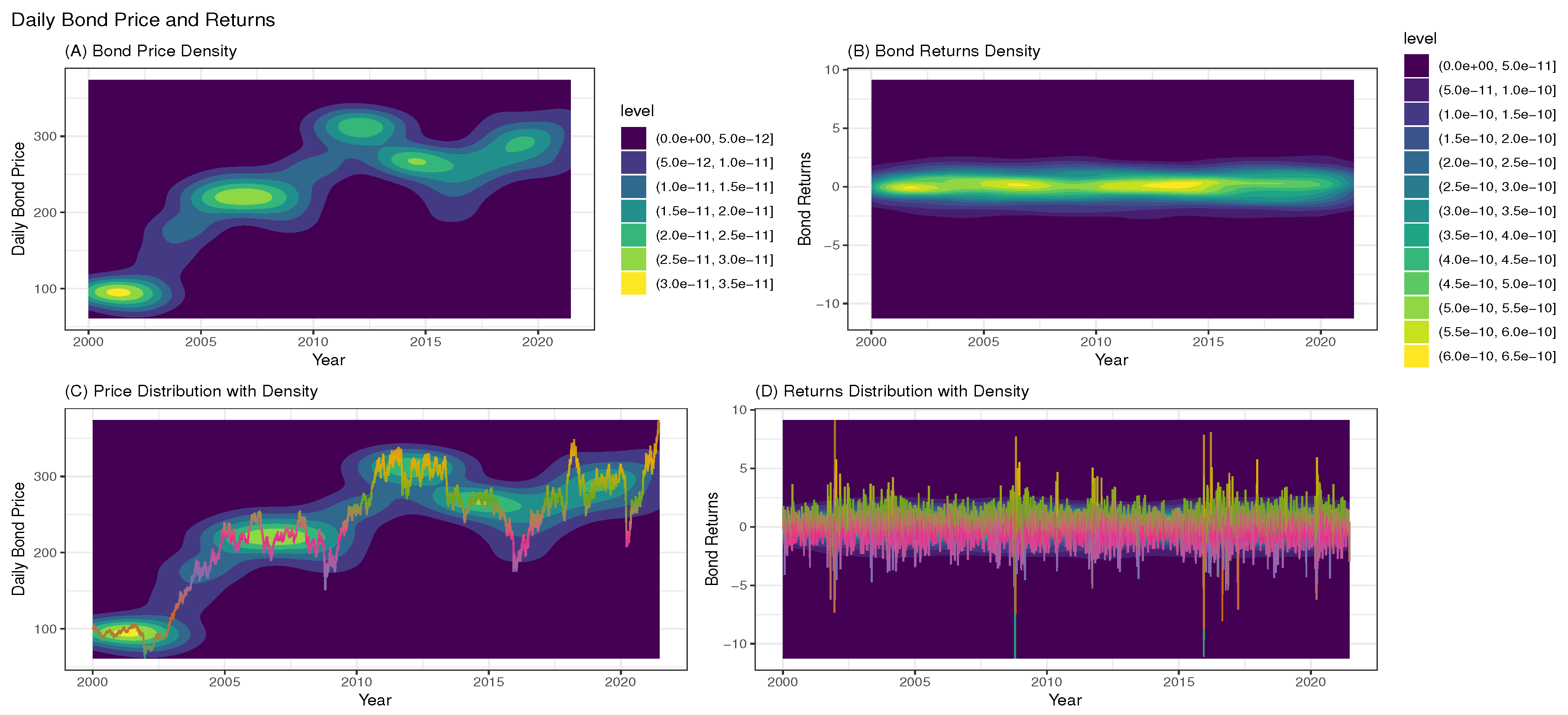

3.6.1. Exploratory Data Analysis

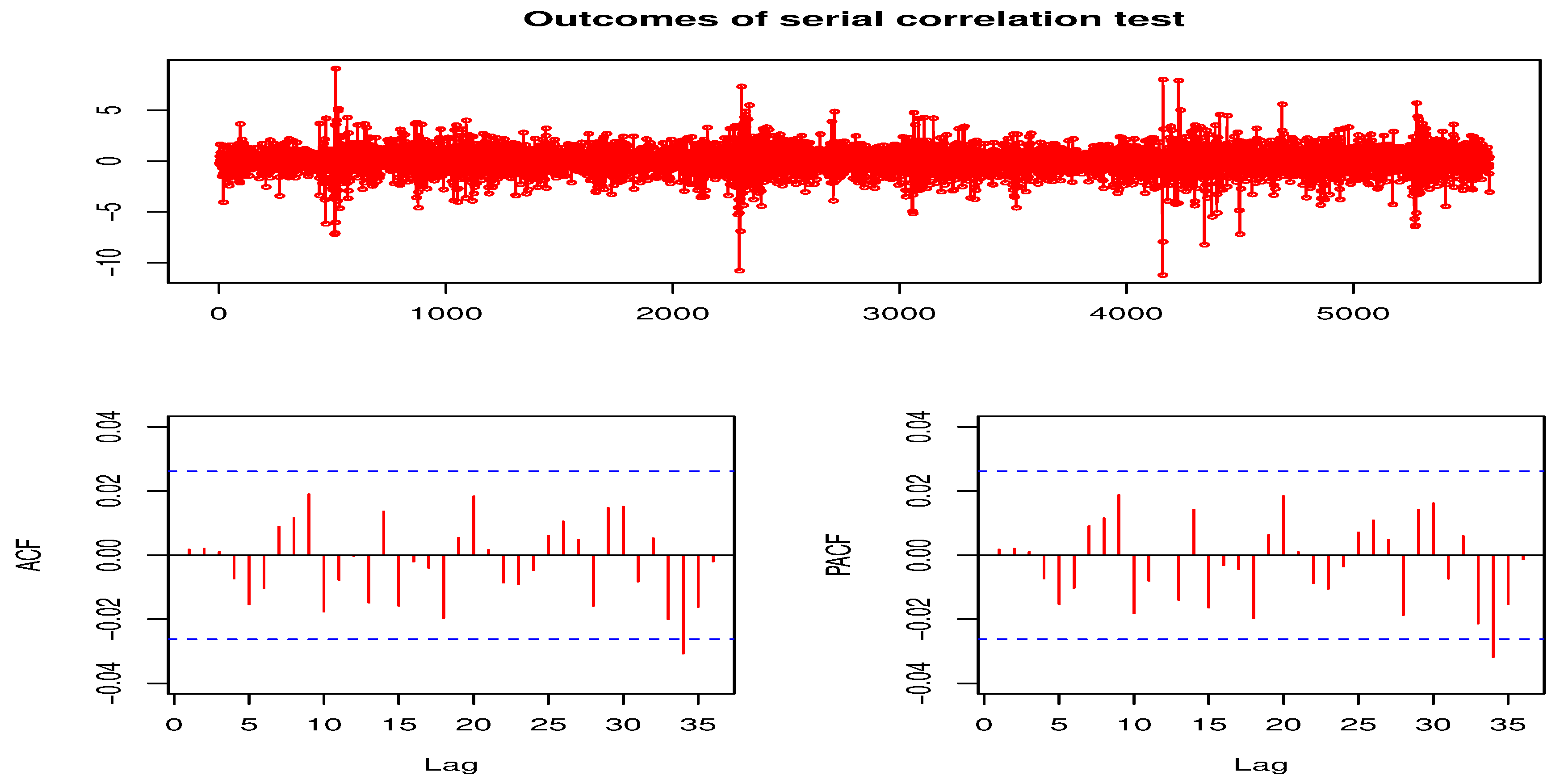

3.6.2. Tests for Autocorrelation and Heteroscedasticity

3.6.3. Selection of the Most Appropriate Error Assumption

4. Discussion and Summarised Conclusion

5. Concluding Remarks

5.1. Limitations in the Study

5.2. Future Research Interest

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| MCS | Monte Carlo simulation |

| GAS | Generalized Autoregressive Score |

| UniGASSim | Univariate GAS simulation |

| UniGASSpec | Univariate GAS specification |

| SD | Score Driven |

| DCS | Dynamic Conditional Score |

| SV | Stochastic volatility |

| GARCH | Generalised Autoregressive Conditional Heteroscedasticity |

| AST1 | Asymmetric Student’s t with one tail decay parameter |

| AST | Asymmetric Student’s t with two tail decay parameters |

| ALD | Asymmetric Laplace distribution |

| TPR | True Parameter Recovery |

| S&P | Standard & Poor |

| ARMA | Autoregressive Moving Average |

| ARIMA | Autoregressive Integrated Moving Average |

| MLE | Maximum likelihood estimation |

| DGP | Data generation process |

| RMSE | Root mean square error |

| MSE | Mean square error |

| RE | Relative efficiency |

| SE | Standard error |

| Unconditional shape parameter or degree of freedom | |

| NaN | Not a Number |

| EDA | Exploratory Data Analysis |

| Quantile-Quantile | |

| LM | Lagrange Multiplier |

| PQ | Portmanteau-Q |

| AIC | Akaike information criterion |

| BIC | Bayesian information criterion |

| p-value | Probability value |

| SA | South Africa |

| ACF | Autocorrelation function |

| PACF | Partial autocorrelation function |

| WLB | Weighted Ljung-Box |

Appendix A. The Empirical Outputs of GAS(1,1)-AST1 Model

| 1 | That is, the inverse of the mapping function in is represented by the UniUnmapParameters() function in the GAS simulation code (see [5]) |

| 2 | The ACF and PACF diagrams were plotted using the auto.arima() function in R forecast package developed by Hyndman and Khandakar [33]. |

References

- Satchell, S.; Knight, J. Forecasting volatility in the financial markets; Elsevier, 2011.

- Diebold, F.X.; Lopez, J.A., Modeling volatility dynamics. In Macroeconometrics: Developments, Tensions, and Prospects; Hoover, K.D., Ed.; Springer Netherlands: Dordrecht, 1995; pp. 427–472. [CrossRef]

- Bollerslev, T. Generalized autoregressive conditional heteroskedastic. Journal of Econometrics 1986, 31, 307–327. [Google Scholar] [CrossRef]

- Samuel, T.; Chimedza, C.; Sigauke, C. Framework for simulation study involving volatility estimation: The GARCH approach. Preprints.org 2023, 2023060598 2023, pp. 1–28. [CrossRef]

- Ardia, D.; Boudt, K.; Catania, L. Generalized autoregressive score models in R: The GAS package. Journal of Statistical Software 2019, 88, 1–28. [Google Scholar] [CrossRef]

- Morris, T.P.; White, I.R.; Crowther, M.J. Using simulation studies to evaluate statistical methods. Statistics in Medicine 2019, 38, 2074–2102. [Google Scholar] [CrossRef]

- Johansen, A. , Monte Carlo methods. In International Encyclopedia of Education; Peterson, P.; Baker, E.; MCGaw, B., Eds.; Elsevier Academic Press, 2010; pp. 296–303.

- Giovanni, R. , Essential Monte Carlo analysis. In Elements of Numerical Mathematical Economics with Excel; Romer, B., Ed.; Elsevier Academic Press, 2020; pp. 763–795. [CrossRef]

- Kenton, W. Monte Carlo simulation, 2021.

- Agarwal, K. The Monte Carlo simulation: Understanding the basics, 2022.

- Kwiatkowski, R. Monte Carlo simulation — a practical guide, 2022.

- Datastream. Thomson reuters datastream. [Online]. Available at: Subscription Service (Accessed: June 2021), 2021.

- Harvey, A.C. Dynamic models for volatility and heavy tails: With applications to financial and economic time series; Cambridge University Press: New York, USA, 2013; pp. 1–261. [Google Scholar] [CrossRef]

- Creal, D.; Koopman, S.J.; Lucas, A. Generalized autoregressive score models with applications. Journal of Applied Econometrics 2013, 28, 777–795. [Google Scholar] [CrossRef]

- Ardia, D.; Boudt, K.; Catania, L. Downside risk evaluation with the R package GAS. The R Journal 2018, 10, 410–421. [Google Scholar] [CrossRef]

- Catania, L.; Ardia, D.; Boudt, K. Generalized autoregressive score models. Package ‘GAS’ Version 0.3.3, 2020. [CrossRef]

- Gammoudi, I.; Nani, A.; El Ghourabi, M. Generalized quasi maximum likelihood estimation for generalized autoregressive score models: Simulations and real applications. Communications in Statistics: Simulation and Computation 2021, 50, 3338–3363. [Google Scholar] [CrossRef]

- Taylor, S.J. Modelling financial time series, second ed.; Wiley: Chichester, UK, 1986; pp. 1–268. [Google Scholar]

- Ardia, D.; Boudt, K.; Catania, L. Value-at-Risk prediction in R with the GAS package. The R Journal 2016, pp. 1–10, [1611.06010].

- Opschoor, A.; Janus, P.; Lucas, A.; Van Dijk, D. New heavy models for fat-tailed realized covariances and returns. Journal of Business and Economic Statistics 2018, 36, 643–657. [Google Scholar] [CrossRef]

- Buccheri, G.; Bormetti, G.; Corsi, F.; Lillo, F. A score-driven conditional correlation model for noisy and asynchronous data: An application to high-frequency covariance dynamics. Journal of Business and Economic Statistics 2021, 39, 920–936. [Google Scholar] [CrossRef]

- Koopman, S.J.; Lucas, A.; Zamojski, M. Dynamic term structure models with score driven time varying parameters: estimation and forecasting. NBP Working Paper No. 258.

- Blasques, F.; Gorgi, P.; Koopman, S.J. Accelerating GARCH and score-driven models: Optimality, estimation and forecasting. Estimation and Forecasting 2017, pp. 1–37. [CrossRef]

- Creal, D.; Koopman, S.J.; Lucas, A. Generalized autoregressive score models. Aenorm 2012, 20, 37–41. [Google Scholar]

- Kim, S.Y.; Huh, D.; Zhou, Z.; Mun, E.Y. A comparison of Bayesian to maximum likelihood estimation for latent growth models in the presence of a binary outcome. International Journal of Behavioral Development 2020, 44, 447–457. [Google Scholar] [CrossRef]

- Hallgren, K.A. Conducting simulation studies in the R programming environment. Tutorials in Quantitative Methods for Psychology 2013, 9, 43–60. [Google Scholar] [CrossRef] [PubMed]

- Chalmers, R.P.; Adkins, M.C. Writing effective and reliable Monte Carlo simulations with the SimDesign package. The Quantitative Methods for Psychology 2020, 16, 248–280. [Google Scholar] [CrossRef]

- Wickham, H.; Averick, M.; Bryan, J.; Chang, W.; McGowan, L.; François, R.; Grolemund, G.; Hayes, A.; Henry, L.; Hester, J.; et al. Welcome to the Tidyverse. Journal of Open Source Software 2019, 4, 1–6. [Google Scholar] [CrossRef]

- Pedersen, T.L. patchwork: The composer of plots, 2020.

- Qiu, D. aTSA: Alternative time series analysis, 2015.

- Ghalanos, A. Introduction to the rugarch package. (Version 1.3-8), 2018.

- Ghalanos, A. rugarch: Univariate GARCH models. R package version 1.4-7, 2022.

- Hyndman, R.J.; Khandakar, Y. Automatic time series forecasting: The forecast package for R. Journal of Statistical Software 2008, 27, 1–22. [Google Scholar] [CrossRef]

- Danielsson, J. Financial risk forecasting: the theory and practice of forecasting market risk with implementation in R and Matlab; John Wiley ∖& Sons: Chichester, West Sussex, 2011; pp. 1–274. [Google Scholar]

- Foote, W.G. Financial engineering analytics: A practice manual using R, 2018.

- Mooney, C.Z. Monte Carlo simulation, first ed.; Vol. 116, SAGE Publications: Thousand Oaks, CA, 1997. [Google Scholar]

- Sigal, M.J.; Chalmers, P.R. Play it again: Teaching statistics with Monte Carlo simulation. Journal of Statistics Education 2016, 24, 136–156. [Google Scholar] [CrossRef]

- Feng, L.; Shi, Y. A simulation study on the distributions of disturbances in the GARCH model. Cogent Economics and Finance 2017, 5, 1355503. [Google Scholar] [CrossRef]

- Harwell, M. A strategy for using bias and RMSE as outcomes in Monte Carlo studies in statistics. Journal of Modern Applied Statistical Methods 2018, 17, 1–16. [Google Scholar] [CrossRef]

- Chalmers, P. Introduction to Monte Carlo simulations with applications in R using the SimDesign package 2019. pp. 1–46.

- Yuan, K.H.; Tong, X.; Zhang, Z. Bias and efficiency for SEM with missing data and auxiliary variables: Two-stage robust method versus two-stage ML. Structural Equation Modeling: A Multidisciplinary Journal 2015, 22, 178–192. [Google Scholar] [CrossRef]

- Wang, C.; Gerlach, R.; Chen, Q. A semi-parametric realized joint value-at-risk and expected shortfall regression framework. arXiv preprint arXiv:1807.02422, arXiv:1807.02422 2018, pp. 1–39, [1807.02422].

- Gilli, M.; Maringer, D.; Schumann, E. , Generating random numbers. In Numerical Methods and Optimization in Finance; Janco, C., Ed.; Academic Press, 2019; pp. 103–132. [CrossRef]

- Davidian, M. Simulation studies in statistics, 2016.

- Bollerslev, T. Conditionally heteroskedasticity time series model for speculative prices and rates of returns. The Review of Economic and Statistics 1987, 69, 542–547. [Google Scholar] [CrossRef]

- Creal, D.; Koopman, S.J.; Lucas, A. A dynamic multivariate heavy-tailed model for time-varying volatilities and correlations. Journal of Business and Economic Statistics 2011, 29, 552–563. [Google Scholar] [CrossRef]

- Li, Q. Three essays on stock market volatility. Doctor of philosophy thesis, Utah State University, 2008.

- Lin, C.H.; Shen, S.S. Can the student-t distribution provide accurate value at risk? Journal of Risk Finance 2006, 7, 292–300. [Google Scholar] [CrossRef]

- Duda, M.; Schmidt, H. Evaluation of various approaches to value at risk. PhD thesis, Lund University, 2009.

- Hentschel, L. All in the family nesting symmetric and asymmetric GARCH models. Journal of Financial Economics 1995, 39, 71–104. [Google Scholar] [CrossRef]

- Blasques, F.; Koopman, S.J.; Lucas, A. Stationarity and ergodicity of univariate generalized autoregressive score. Electronic Journal of Statistics 2014, 8, 1088–1112. [Google Scholar] [CrossRef]

- Su, J.J. On the oversized problem of Dickey-Fuller-type tests with GARCH errors. Communications in Statistics: Simulation and Computation 2011, 40, 1364–1372. [Google Scholar] [CrossRef]

- Silvennoinen, A.; Teräsvirta, T. Testing constancy of unconditional variance in volatility models by misspecification and specification tests. Studies in Nonlinear Dynamics and Econometrics 2016, 20, 347–364. [Google Scholar] [CrossRef]

- Weismer, J. History as guide : Lessons from the 2002-2003 SARS Outbreak, 2020.

- Jo, H.; Lee, C.; Munguia, A.; Nguyen, C. Unethical misuse of derivatives and market volatility around the global financial crisis. Journal of Academic and Business Ethics 2009, 2, 1–11. [Google Scholar]

- Amadeo, K. The stock market crash of 2008, 2022.

- Heracleous, M.S. Sample kurtosis, GARCH-t and the degrees of freedom issue. EUR Working Papers 2007, pp. 1–22.

- Fisher, T.J.; Gallagher, C.M. New weighted portmanteau statistics for time series goodness of fit testing. Journal of the American Statistical Association 2012, 107, 777–787. [Google Scholar] [CrossRef]

- Engle, R.F. Autoregressive conditional heteroscedacity with estimates of variance of United Kingdom inflation. Econometrica 1982, 50, 987–1008. [Google Scholar] [CrossRef]

- Mandelbrot, B. The variation of certain speculative prices. The Journal of Business 1963, 36, 394–419. [Google Scholar] [CrossRef]

|

| ARMA(1,1) | ARMA(2,2) | |||||

| Normal | Student’s t | Normal | Student’s t | |||

| Test on standardized | WLB(9) | 2.2258 | 3.2100 | WLB(19) | 6.2949 | 10.3830 |

| residuals | p-value(9) | (0.9728) | (0.8563) | p-value(19) | (0.9573) | (0.4060) |

| Test on standardized | WLB(9) | 6.5740 | 7.4880 | WLB(19) | 6.4740 | 7.5450 |

| squared residuals | p-value(9) | (0.2376) | (0.1617) | p-value(19) | (0.2473) | (0.1577) |

| ARMA(1,1) model | ARMA(2,2) model | |||||||

| PQ test | LM test | PQ test | LM test | |||||

| Lag order | PQ | P-value | LM | P-value | PQ | P-value | LM | P-value |

| 4 | 904 | 0 | 4729 | 0 | 888 | 0 | 4658 | 0 |

| 8 | 1127 | 0 | 2196 | 0 | 1104 | 0 | 2184 | 0 |

| 12 | 1400 | 0 | 1361 | 0 | 1377 | 0 | 1354 | 0 |

| 16 | 1517 | 0 | 1015 | 0 | 1497 | 0 | 1010 | 0 |

| 20 | 1575 | 0 | 807 | 0 | 1556 | 0 | 803 | 0 |

| 24 | 1624 | 0 | 666 | 0 | 1602 | 0 | 663 | 0 |

| Normal | skew-Normal | Student t | skew-Student t | AST | AST1 | ALD | |

|---|---|---|---|---|---|---|---|

| 0.9804* | 0.9819* | 0.9790* | 0.9804* | 0.9788* | 0.9790* | 0.9784* | |

| AIC | 17936.36 | 17900.84 | 17682.49 | 17672.13 | 17668.28 | 17666.39 | 17910.63 |

| BIC | 17962.88 | 17933.99 | 17715.64 | 17711.91 | 17714.69 | 17706.17 | 17943.78 |

| Normal | skew-Normal | Student t | skew-Student t | AST | AST1 | ALD | |

| 0.9805* | 0.9819* | 0.9831* | 0.9818* | 0.9807* | 0.9818* | 0.9784* | |

| AIC | 17915.19 | 17904.84 | 17666.31 | 17672.84 | 17664.18 | 17650.89 | 17914.63 |

| BIC | 17954.97 | 17951.25 | 17725.98 | 17739.14 | 17737.11 | 17717.19 | 17961.04 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).