1. Introduction

In an era marked by rapid technological advancements, economic fluctuations, and global competition, businesses are constantly grappling with uncertainty and complexity [

1,

2,

3]. These challenges demand not only operational excellence but also strategic adaptability to remain competitive and thrive in the marketplace[

4,

5]. Organizations must now evolve at an accelerated pace to meet the ever-changing needs of their customers and stakeholders, while also addressing emerging threats and opportunities[

6,

7]. This growing demand for adaptability and resilience has led to the emergence of enterprise agility [

8] a critical factor for success in today’s volatile business landscape[

9].

In today’s fast-paced business landscape, the criticality of swiftly adapting and seizing emerging opportunities for the success of any organization is recognized. The importance of enterprise agility in driving growth and delivering value for clients and ecosystems is acknowledged by TCS[

10,

11,

12]. Since 2014, agile transformation has been actively pursued by the organization on a global scale, both internally and externally, in order to foster innovation and resilience in an increasingly dynamic environment[

13,

14,

15].

Agile organizations demonstrate the capacity to navigate change effectively, capitalizing on new possibilities while minimizing the adverse effects of disruptions[

16,

17]. This approach necessitates a proactive, adaptable mindset [

10,

11,

18] and an openness to experimentation, learning from setbacks [

19,

20], and innovation and entrepreneurship [

21]. Companies that fail to embrace agility risk falling behind their competition and losing market share[

22,

23,

24].

As a global enterprise, TCS confronts distinct challenges in managing the complexity and diversity inherent in our operations[

15,

25]. We have discovered that cultivating agility is a crucial ingredient in achieving sustainable growth and generating value for our clients and stakeholders[

15].

This paper delves into TCS’s approach to gauging and enhancing our enterprise agility, incorporating statistical analysis and continuous improvement methodologies[

11,

26,

27]. We will present a real-world challenge we encountered, the measures we employed to overcome it, and the outcomes we attained. Additionally, we will provide valuable insights and recommendations for organizations aiming to implement a comparable system for assessing and optimizing their enterprise agility.

The structure of this paper is organized as follows: In

Section 2, the Enterprise Agile transformation process is detailed. The context for measuring agility is established in

Section 3. The specific challenges encountered in Latin America are explored in

Section 4. The agile transformation implemented by the cognitive business operation is illustrated in

Section 5. The results and statistical validation are presented in

Section 6. The discussion of the obtained results can be found in

Section 7 and

Section 8. Finally, a summary of the conclusions is provided in

Section 9, along with proposed future directions.

2. Enterprise Agility

In 2017, with the goal of staying relevant to our clients and anticipating the disruption curve, TCS decided to become Enterprise Agile by 2020 [

28]. This involved a large-scale cultural transformation to absorb agile throughout the entire organization and reinvent the flow of value across our entire organization [

29]. This transformation has impacted half a million people worldwide and has been orchestrated in the following three areas:

Considering our role as agile coaches[

30], we are aligned and committed to our organizational purpose: "Helping our clients create the future" and their Enterprise Agile Vision [

31]. This is because we know that agility is a fundamental pillar in the era of Business 4.0™

1, as it facilitates the development of a culture of inspiration, transparency, and autonomy in teams, areas, business units, and companies[

14]. This is reflected in highly collaborative teams that constantly generate virtuous circles of innovation, customer satisfaction, and value growth, both at a personal and business level[

14,

15,

30].

3. Need to Measure Agility

The measurement of enterprise agility is essential for any company that wants to improve its responsiveness to market changes and customer needs[

14]. However, starting an organizational agility measurement system that supports agile governance and helps track progress and evolution towards future state goals can be a challenging task for many companies[

16].

To do this, and in accordance with its Enterprise Agile Vision, TCS has designed an index called

AgilityDebt™, which is a proprietary way for TCS to measure the debt that an organization has that restricts its agility. It was built thanks to TCS’s vast experience leading more than 300 agile transformations worldwide[

31].

This index is very simple to understand by everyone in the organization, it has a simple and unique range between 0 and 1, the lower, the better, as this represents a low debt, reflecting a high level of agility in the organization.

In an organization,

AgilityDebt™ can scale both horizontally and vertically, as it contains different views ranging from the most granular level of a project to an aggregate level by client, business vertical, or country, and then scaling back up to a regional and global level within TCS. Additionally, this tool can scale horizontally, as it is not only for IT services, but also applies to all service units that TCS provides to its clients, such as CBO

2(Cognitive Business Operations), Consulting, or Enterprise Solutions, to name a few.

Currently, this index has become a great governance tool for C-level executives who need to lead organizational change in large and complex organizations[

23], as the calculation of

AgilityDebt™ can be easily customized for our client’s organizations. The calculation of

AgilityDebt™ is carried out by means of a carefully sequenced polynomial, dependent on its factors, which is fed by variables that are continuously monitored thanks to the data recorded in TCS information systems. To measure

AgilityDebt™ in the IT world, as a guiding example, we can mention the following factors:

People’s training in agile and their levels of competence,

Leveraging agile practitioners,

The agile maturity of projects/services,

Customer satisfaction, and

Business outcomes created by our delivery.

In the CBO world, as a guiding example, we can mention the following factors to execute the AgilityDebt™ measurement:

People’s training in agile and their levels of competence,

The agile maturity of projects/services,

Operational performance, and

Customer satisfaction.

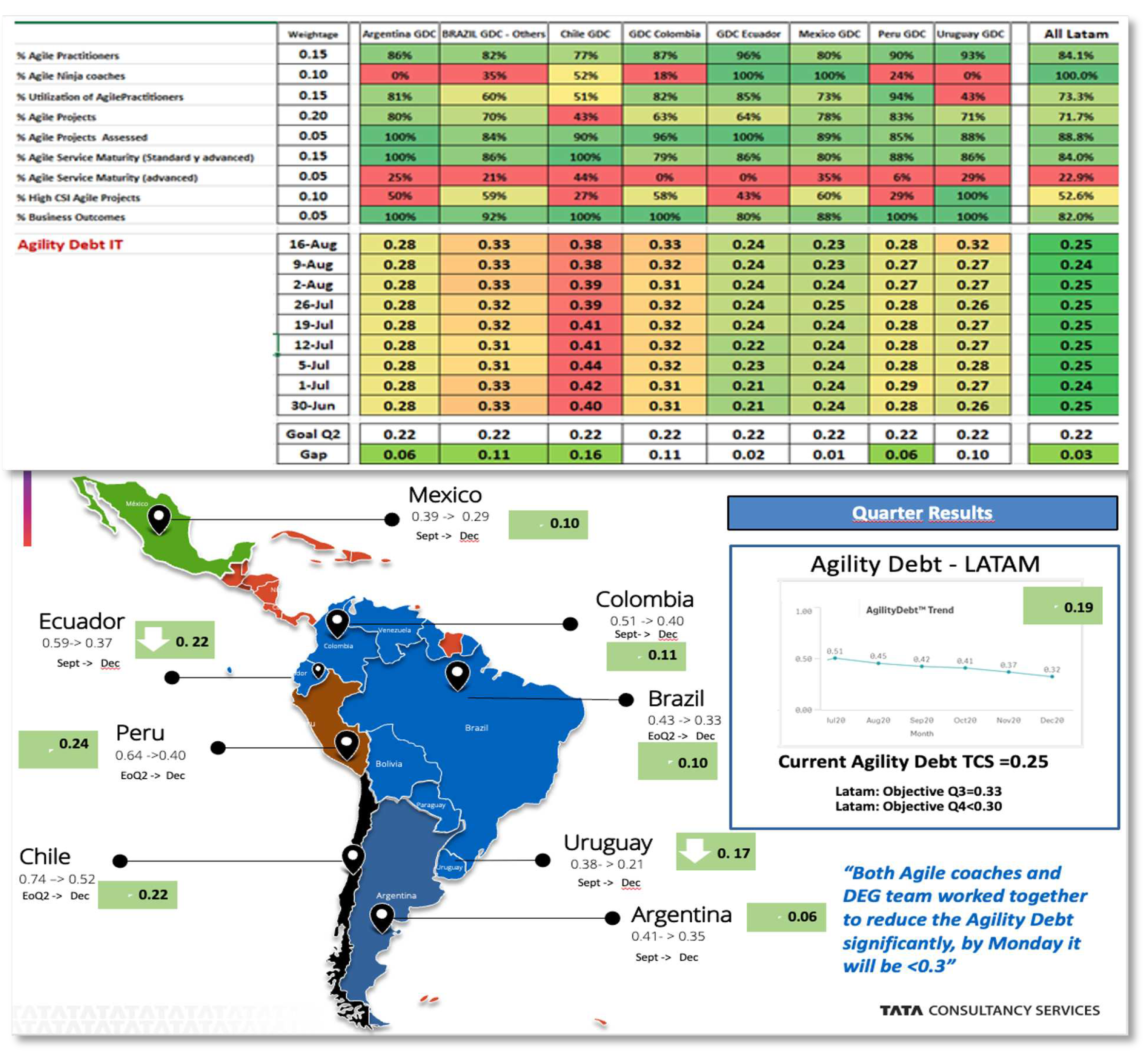

As an example,

Figure 1 shows a dashboard with

AgilityDebt™ values by country and global Latam, including a view of the performance of each factor in the polynomial equation. This dashboard is evaluated weekly and monthly with the leaders and C-Levels of TCS Latam.

4. The Latin American Challenge

4.1. Getting Started in IT

At TCS Latam, where we currently have over 27,000 employees and more than 800 IT and CBO projects, we set ourselves the challenge over three years ago of continuously improving[

11] our enterprise agility with the

AgilityDebt™ instrument, with the mission of collectively making an impact this asset within the organization[

32], in order to:

Promote agility with leaders and sponsors,

Energize the agile cultural change,

Improve our delivery, and

Positively impact the growth of our clients.

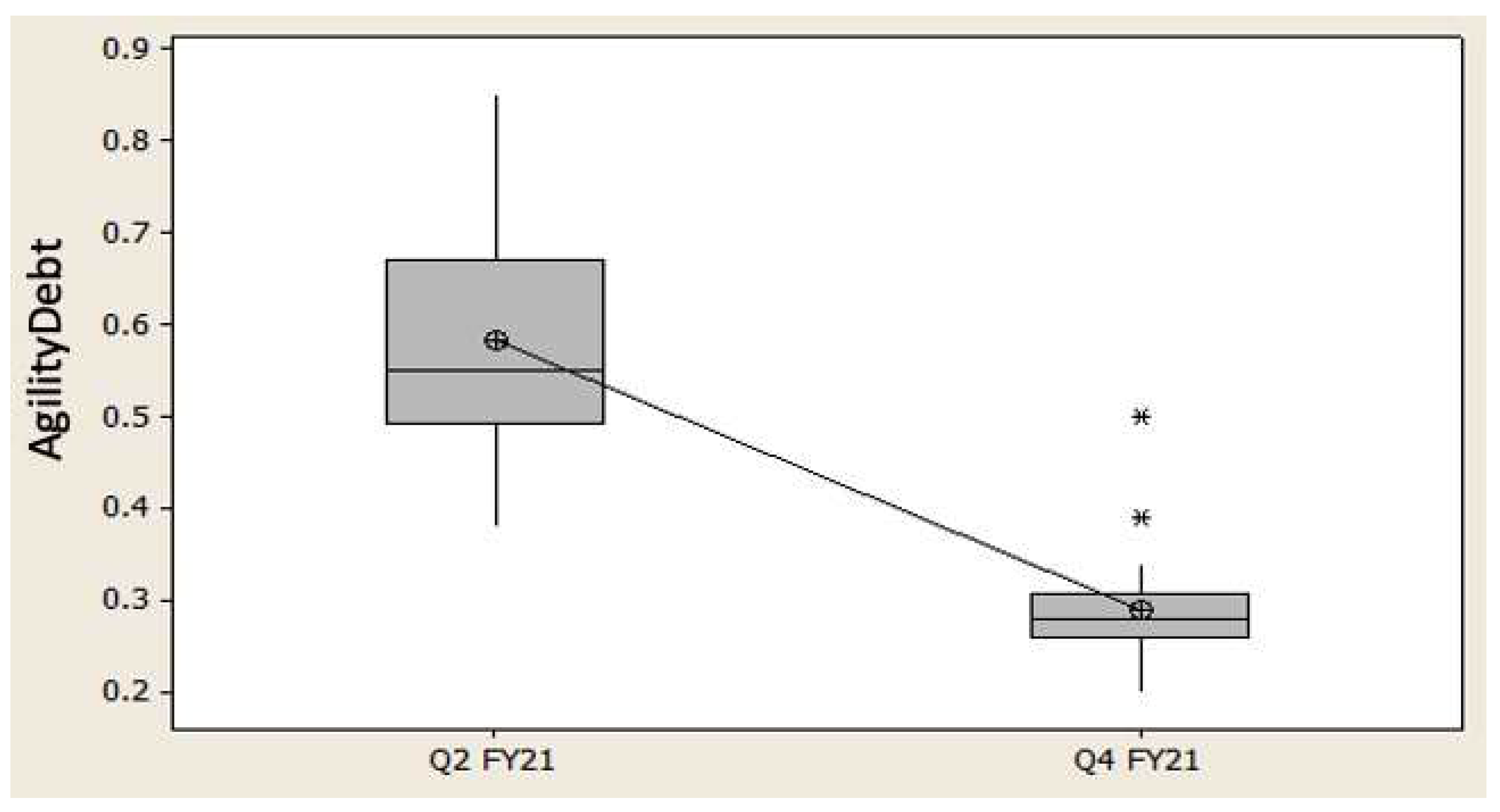

In 2020 we started measuring

AgilityDebt™. First, we did it for the IT world, where we successfully managed to reduce debt from 0.58 for the second quarter of the fiscal year 2021 (Q2-FY21) to 0.29 for the fourth quarter of the fiscal year 2021 (Q4-FY21).

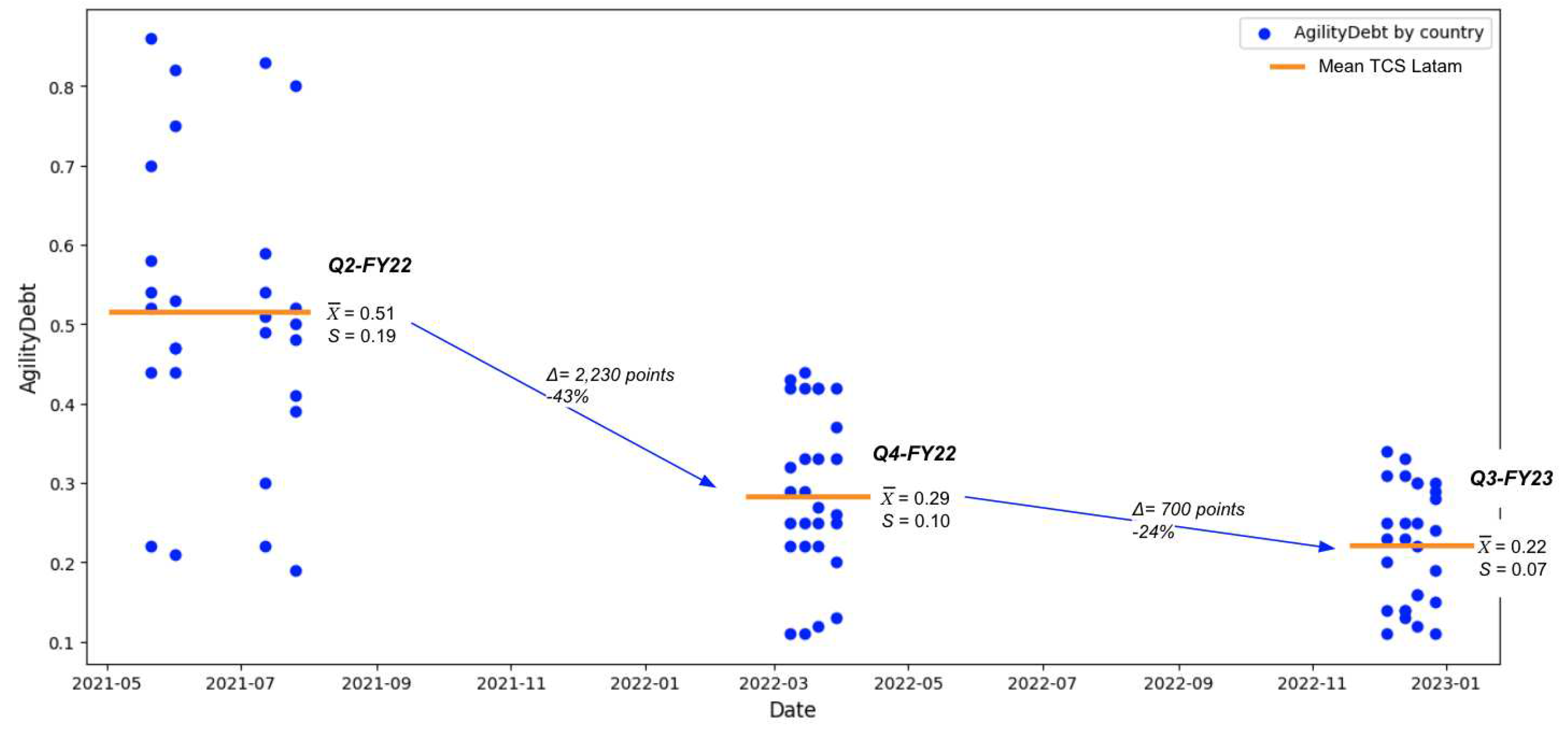

Figure 2 shows a graph where this reduction can be observed.

As a result of the positive experience in the IT world, in 2021 we took on the challenge of scaling continuous improvement horizontally, now bringing good agility improvement practices to the world of CBO services.

4.2. Escalating to CBO

In this document, we want to explain in detail the challenge of improving enterprise agility in CBO, including the methodology and results obtained.

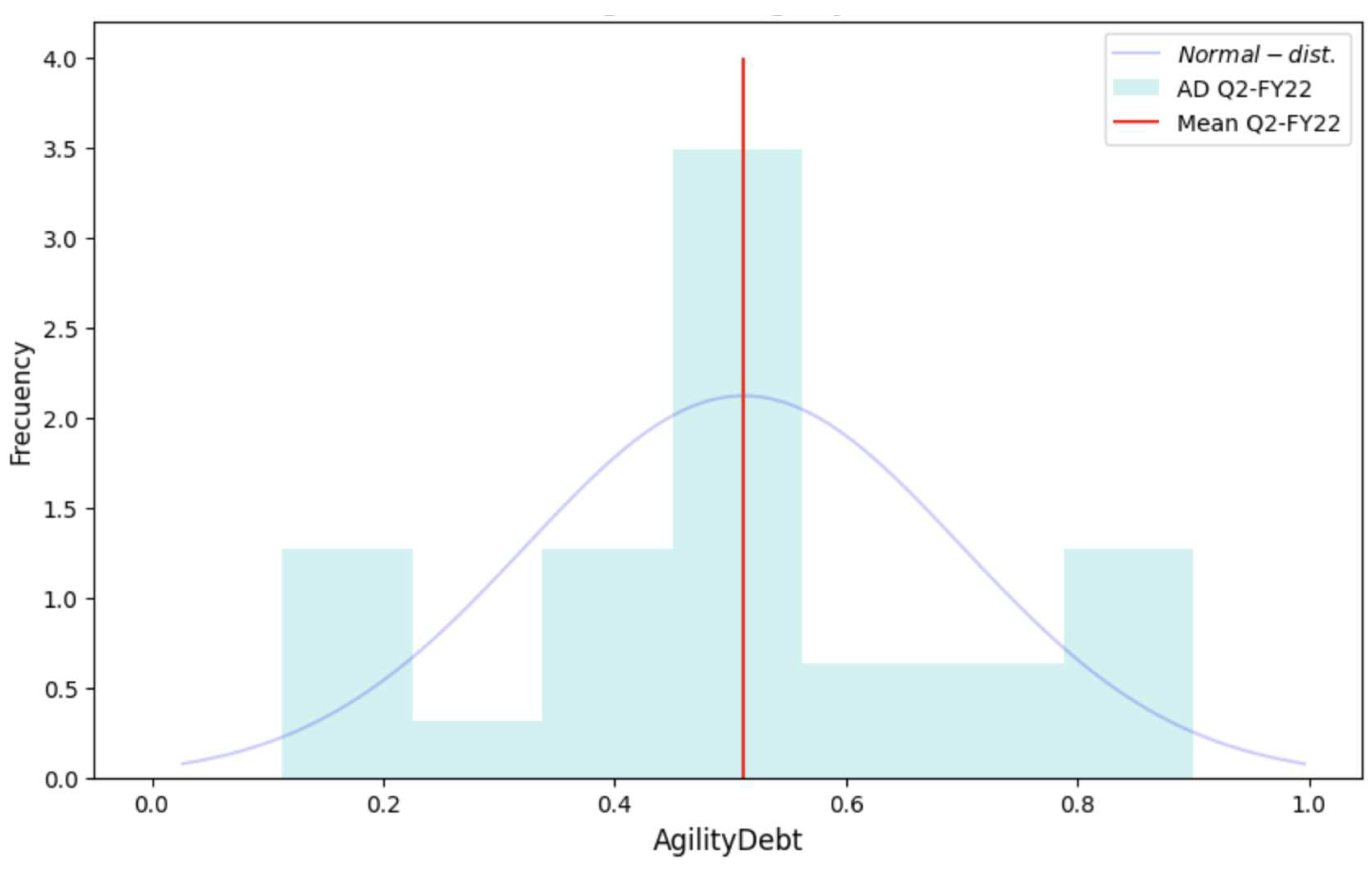

For CBO, we apply a process similar to the IT case, which involves weekly monitoring of the metric in all TCS Latam countries. After having enough data points, we conduct an initial analysis to calculate the mean and dispersion at the regional level, that is, considering all Latin American countries where TCS operates with CBO services.

This analysis yields a baseline for the second quarter of the fiscal year 2022 (Q2-FY22) of 0.51 on average and 0.19 in terms of dispersion (standard deviation), as shown in

Figure 3. As previously explained, the scale of this index ranges from 0 to 1, where 0 represents low debt and high agility, and 1 represents high debt and low agility. In this sense, having a score of 0.51 represents a medium or regular agility, and as our Agile Enterprise Vision inspires us to the Zero-For-Tomorrow (0-4-2), which means achieving zero agile debt and consequently enabling high enterprise agility, we decide to create an improvement team [

11,

26] with the aim of significantly reducing CBO

AgilityDebt™ in the organization

Table 1.

Sample statistics Q2-FY22.

Table 1.

Sample statistics Q2-FY22.

| Statistic |

Value Q2-FY22 |

| Size |

28 |

| Mean |

0.51 |

| Std. dev. |

0.19 |

| Variance |

0.04 |

5. Agile Transformation Journey at CBO

Next target condition: 30% reduction in 6 months

The improvement begins with people and a well-connected team with the agile transformation vision. This team was made up of change agents and agile facilitators[

33] who voluntarily decided to be part of this journey[

22].

The team began by analyzing and diagnosing the current situation, which allowed us to identify certain patterns and causes that explained the high[

26]

AgilityDebt™ in CBO. Later, we applied prioritization mechanisms[

34,

35] that allowed us to establish the initial version of our agile debt improvement backlog. In front of this backlog, the transformation team co-created different hypotheses and their respective actionable items to implement.

Our project had a limited budget of six months, therefore the objective of reducing the AgilityDebt™ by at least 30% had to be achieved in the fourth quarter of the fiscal year 2022 (Q4-FY22).

The actionable items devised by the transformation team were related to:

The transformation team conducted weekly tracking of the actionable items and their results[

32], which allowed us to adapt the improvement backlog and the board where the project’s progress in reducing the debt was visualized[

13,

38]. Monthly, the organization’s leaders reviewed the progress and provided feedback[

22,

36] to continue reducing the

AgilityDebt™. The TCS Latam agile community played a crucial role in socializing agility and seeking new change agents[

37]. Thanks to this, we were able to add new facilitators, scrum masters, and agile coaches to this transformation initiative[

30,

32].

6. Results and Statistical Validation

6.1. Methods and Tools

We used statistical analysis to objectively demonstrate that the change or improvement exhibited in the

AgilityDebt™ after the actions implemented by the transformation team corresponds to a statistically significant finding and is not something that results from the randomness of the data and its sampling error[

39].

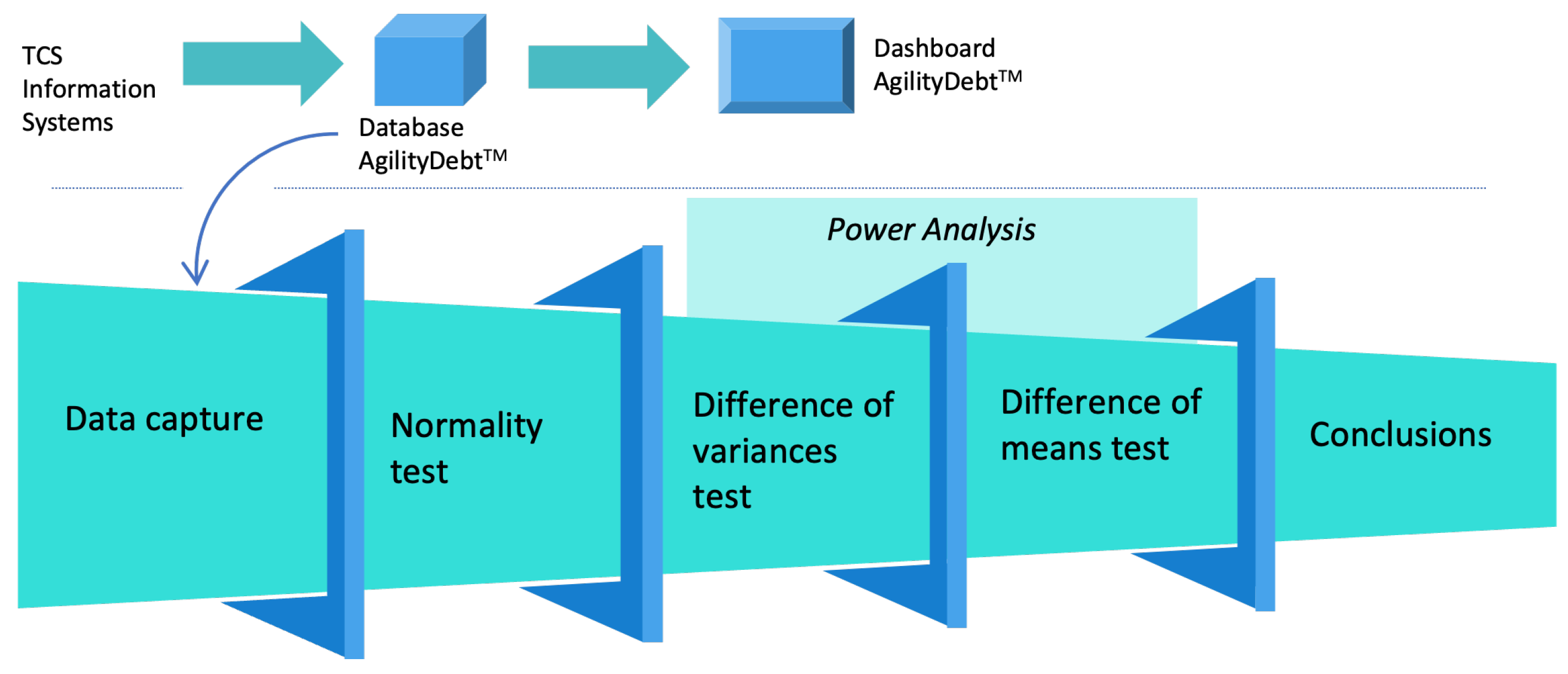

For this purpose, the method employed to carry out the data analysis consisted of the following steps:

- 1.

Dataset capture (pre and post): Samples are extracted and their statistics are calculated (mean, standard deviation, variance, and size), along with graphs to improve data interpretation [

39] (see

Figure 5).

- 2.

Normality test of the samples: A normality test is performed on both samples with the aim of ensuring that the normality assumption is met[

40], and to perform future parametric tests of difference of variances and tests of difference of means.

- 3.

-

Fisher’s F-test for variance difference: If normality exists in step number 2, this test is performed to:

- (a)

Evaluate if there are statistically significant differences in the variability of the samples[

41,

42].

- (b)

Determine if the future test of difference of means to be executed in step number 4 will assume equality of variances or not.

- 4.

Student’s

T-test for mean difference: If normality exists in step number 2, this test is performed to determine if there are statistically significant differences in the means of the samples[

43].

- 5.

Power test: If there are statistically significant differences in both the variance difference test and the mean difference test, a power test is performed to evaluate the size of the effect[

44,

45] obtained and the probability that the effect is true.

- 6.

Conclusions: Based on the results of the previous steps, we conclude whether the improvement obtained in

AgilityDebt™ has substantial significance from a practical point of view for our organization[

39].

The analysis of data provides scientific tools to systematically and efficiently evaluate the study samples[

46]. We use the Python ecosystem tools to perform statistical analysis.

6.2. Data Capture

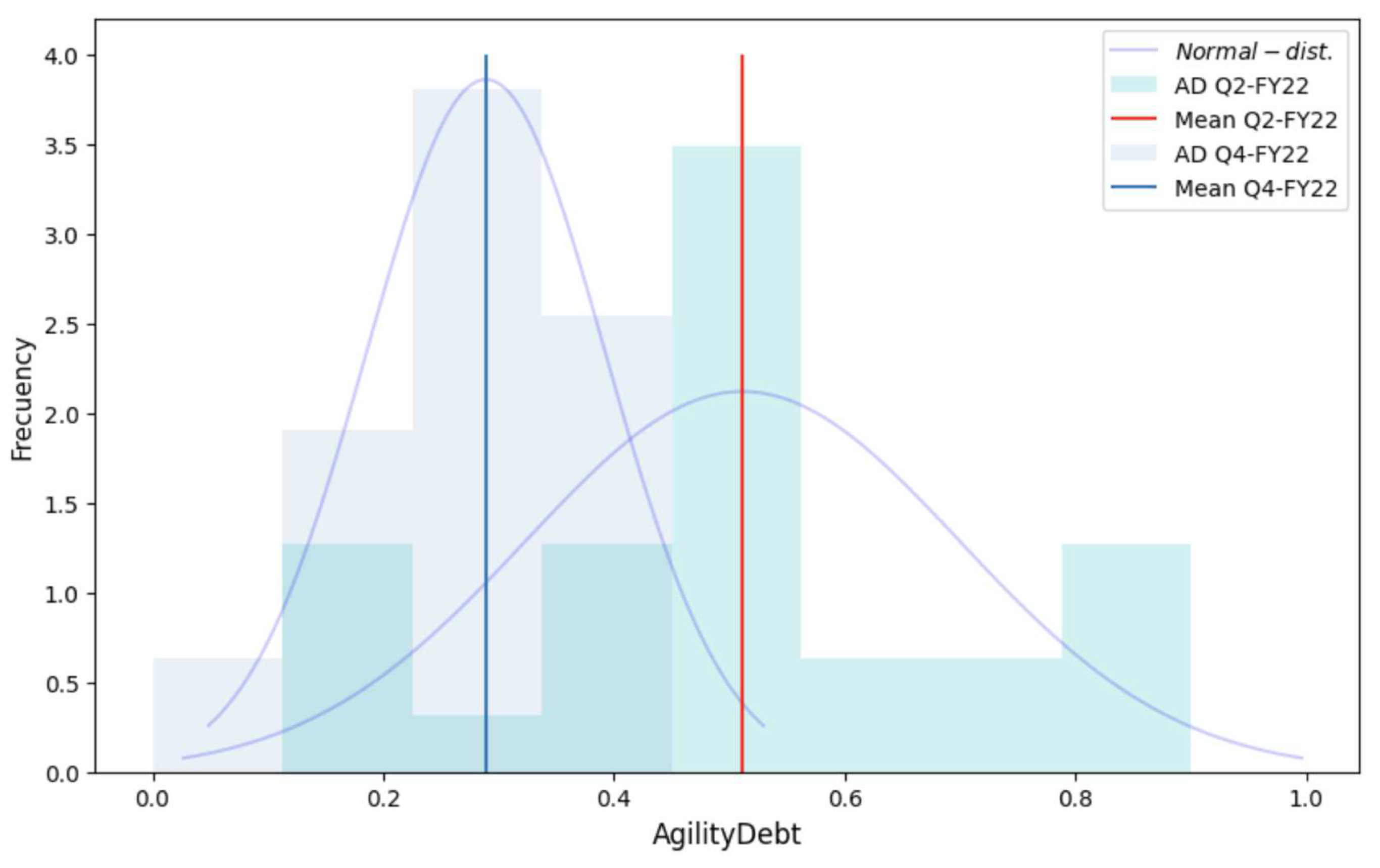

At the end of the fourth quarter of fiscal year 2022 (Q4-FY22), we extract a new sample of data points from TCS Latam countries with CBO services, yielding a result of 0.29 for the mean and 0.10 for the standard deviation. Although we meet our established target of reducing AgilityDebt™ by 2,230 basis points, we need to perform a statistical analysis to verify the significance of this reduction.

Figure 5 shows a visualization with histograms and main statistics of both evaluated samples, remember that in our case these samples were:

Table 2.

Sample statistics Q2-FY22 and Q4-FY22.

Table 2.

Sample statistics Q2-FY22 and Q4-FY22.

| Statistic |

Value Q2-FY22 |

Value Q4-FY22 |

| Size |

28 |

28 |

| Mean |

0.51 |

0.29 |

| Std. dev. |

0.19 |

0.10 |

| Variance |

0.04 |

0.01 |

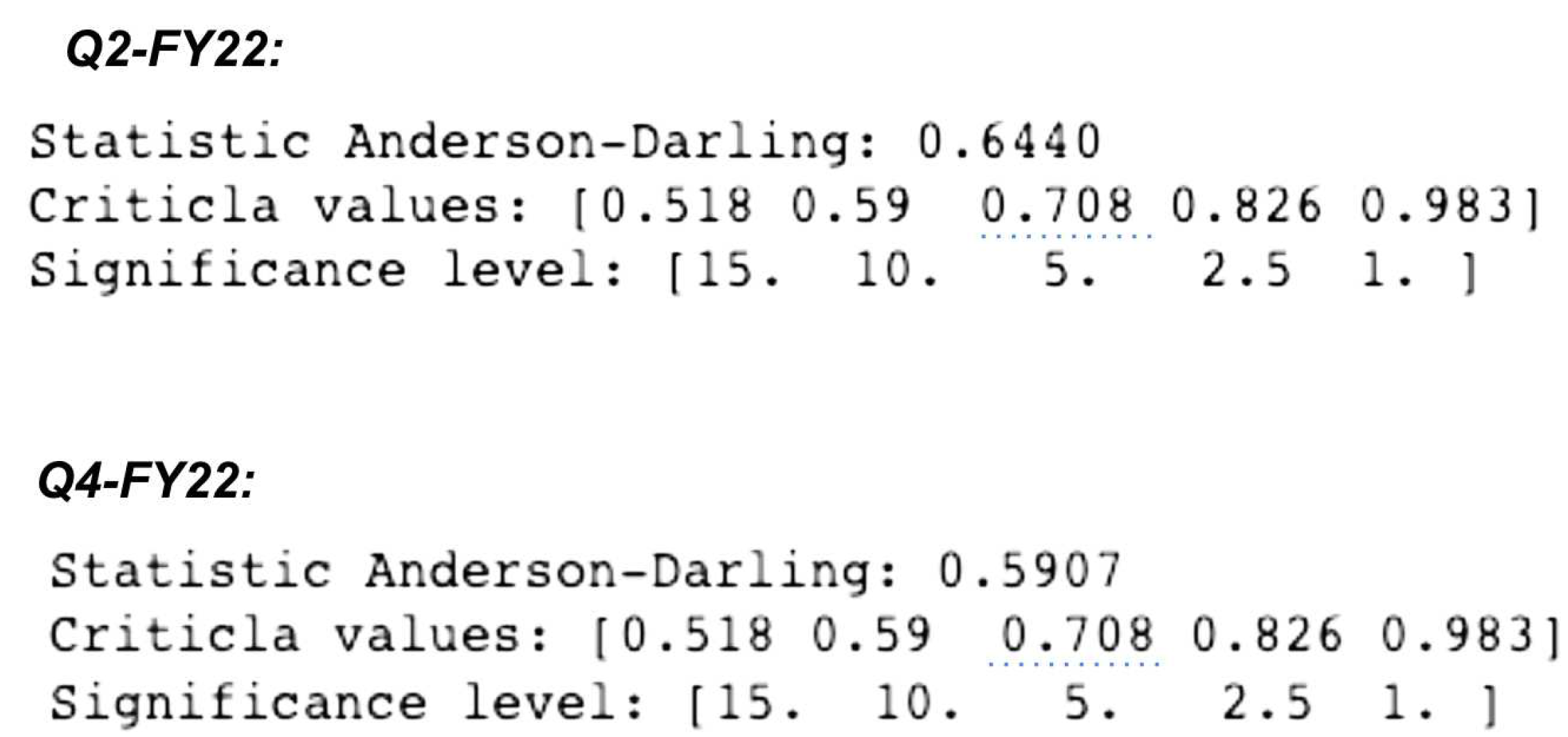

6.3. Normality Test

After capturing both datasets (Q2-FY22 and Q4-FY22) and performing a descriptive analysis of them, the first thing we did was to evaluate the normality of the data in both datasets. We conducted a normality test using the Anderson-Darling test [

40], where we formulated the following hypothesis:

The data follows a normal distribution.

The data does not follow a normal distribution.

The results obtained in this test are presented in

Figure 6.

Conclusion: Both samples, at a significance level of 0.05, show that they follow a normal distribution because the Anderson-Darling test statistics of both samples (0.644 for Q2-FY22 and 0.5907 for Q4-FY22) were lower than the critical value of 0.708 for a significance level of 0.05. Thus, we do not reject the null hypothesis .

This result validated the future execution of a Student’s T-test for the difference in means of two independent samples, and the execution of a Fisher’s F-test for the difference in variances of two independent samples.

6.4. Difference of Variances Test (Fisher’s F-Test)

Before conducting the mean difference test, it is necessary to evaluate whether the variances of both samples are equal or not, which is done through a Fisher’s

F test [

41,

42]. Running the test shows that the variances differ significantly and that we significantly reduce variability in the Q4-FY22 quarter compared to the Q2-FY22 quarter.

The Fisher’s method involves taking the ratio of the larger population variance,

, to the smaller population variance,

, and then looking up the ratio on an

F distribution curve [

41,

42,

47].

In this test, the null hypothesis states that the ratio is equal to 1:

and the alternative hypothesis states that the ratio is greater than 1:

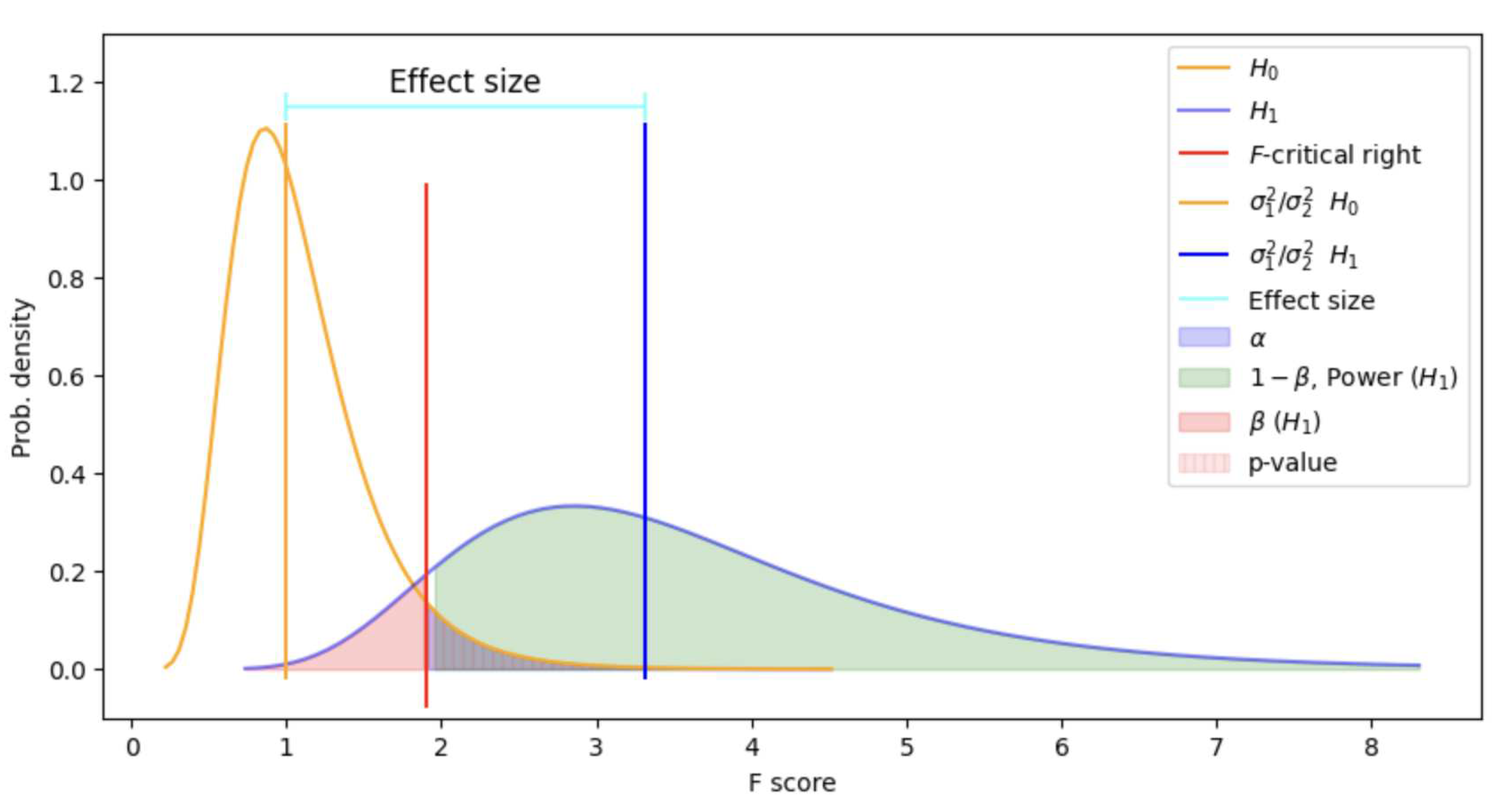

Figure 7.

Difference of variances test (Fisher’sF-test). This graph allows visualizing the hypothesis testing of variance difference and the associated statistical power analysis, which represents the effect produced.

Figure 7.

Difference of variances test (Fisher’sF-test). This graph allows visualizing the hypothesis testing of variance difference and the associated statistical power analysis, which represents the effect produced.

Table 3.

F-Test results .

Table 3.

F-Test results .

| F-test |

3.31 |

| F-critical |

1.90 |

| p-value |

0.0014 |

| Power |

0.9217 |

| Beta |

0.0783 |

| Effect (rate std. dev) |

1.8204 |

Conclusion: For this one-tailed test, since the p-value of 0.0014 is less than the pre-established alpha (

) of 0.05, or since the

F statistic of the test equal to 3.31 falls outside the non-rejection zone (0.00 to 1.90), we proceed to reject the

, therefore, we conclude that the variance of the Q2-FY22 period is statistically higher than the variance of the Q4-FY22 period. Then, upon evaluating the power of

[

46], we see that the exhibited power of 0.92 is greater than the threshold of 0.80 and the relative effect size of 1.8204 is also highly relevant, so we conclude that in practical terms the variance of the Q4-FY22 period is significantly lower than that of the Q2-FY22 period, meaning that there is a significant and relevant reduction in the variability of the

AgilityDebt™ data in CBO.

6.5. Difference of Means Test (Student’s T-Test)

Once we complete the variance difference test, we proceeded to carry out the expected test of difference of means (applying different variances). The

T-test of Student can be utilized in cases where at least one of the sample sizes is small (less than 30 units), the samples are independent, the populations have normal distribution, and the variances of both populations are equal. [

43,

47]. If the latter requirement is not met (equality of variances), as is the case in our study since the variances are not equal, we apply the

T-test of Student with an adjustment in the equation to calculate the degrees of freedom, without calculating the pooled variance [

48]. In this case, we use the sample variances to calculate the standard deviation of the difference of the sample means.

In this test, the hypotheses are formulated as follows:

The null hypothesis states that the difference is equal to 0:

and the alternative hypothesis states that the difference is less than 0:

This is because we want to test whether the reduction exhibited in AgilityDebt™ from Q4-FY22 compared to Q2-FY22 was actually less than zero, and not just due to chance.

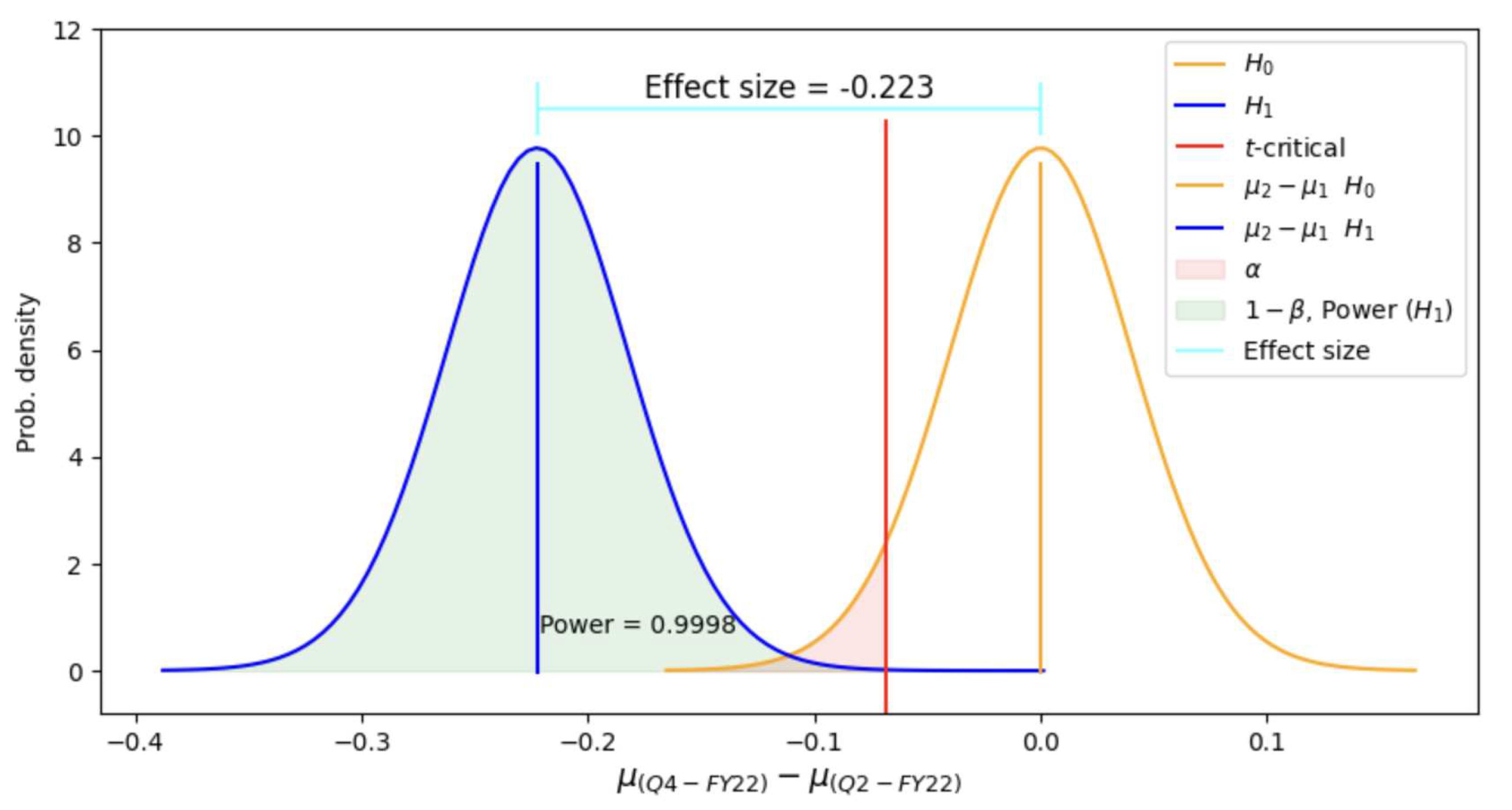

Figure 8.

Difference of means test (Student’sT-test). This graph allows visualizing the hypothesis testing of mean difference and the associated statistical power analysis, which represents the effect produced.

Figure 8.

Difference of means test (Student’sT-test). This graph allows visualizing the hypothesis testing of mean difference and the associated statistical power analysis, which represents the effect produced.

Table 4.

T-Test results .

Table 4.

T-Test results .

| T-test |

-5.48 |

| T-critical |

-1.68 |

| p-value |

0.0000 |

| Power |

0.9998 |

| Beta |

0.0002 |

| Effect size |

-0.2230 |

Conclusion: Since the T test statistic of -5.48 was less than the critical T equal to -1.68, or the p-value was less than the preset alpha () of 0.05, the is rejected, concluding that the average of Q4-FY22 is statistically lower than the average of Q2-FY22.

As the

is rejected, we proceed to calculate the effect size and power of the test [

44,

45].

From the power analysis, we conclude that the effect [

46] produced by the

AgilityDebt™ improvement project, which reduced the indicator by 2,230 basis points, is highly significant. Additionally, the reduction exhibits statistical power of almost 100%. Therefore, the improvement is not due to random chance, but is real and highly relevant.

6.6. Analysis Conclusions

In conclusion, the analysis conducted in this research demonstrates a highly significant improvement in TCS Latam’s AgilityDebt™ CBO. The average reduction in the indicator is not only statistically significant but also relevant, with a 43% decrease, equivalent to a reduction of 2,230 basis points between Q2-FY22 and Q4-FY22. This impressive result surpasses the initial goal of a 30% reduction. Additionally, the analysis reveals a marked improvement in consistency among the countries reporting the debt indicator within the Latam region. This is evidenced by a significant decrease in variance between Q2-FY22 and Q4-FY22, translating to a substantial 45% reduction in terms of standard deviation.

7. Continuous Improvement

The path to improve

AgilityDebt™ does not end here. TCS Latam continues to apply the same improvement framework to further reduce and control this parameter. By the end of the third quarter of fiscal year 2023 (Q3-FY23), the indicator continues to decrease, reaching 0.22 (see

Figure 9). This reduction is statistically significant in both mean and variance, and in its substantive relevance for the organization.

Today we see an empowered agile movement that has created different learning communities[

37] within TCS, an agile competence enriched with new change agents such as Scrum Masters[

33], Agile Champions, and Agile Coaches[

30], and certainly, better-equipped projects with disruptive practices and tools are delivering better outcomes for clients. It is important to mention that as of the third quarter of fiscal year 2023 (Q3-FY23), the IT

AgilityDebt™ is also at a mean of 0.22.

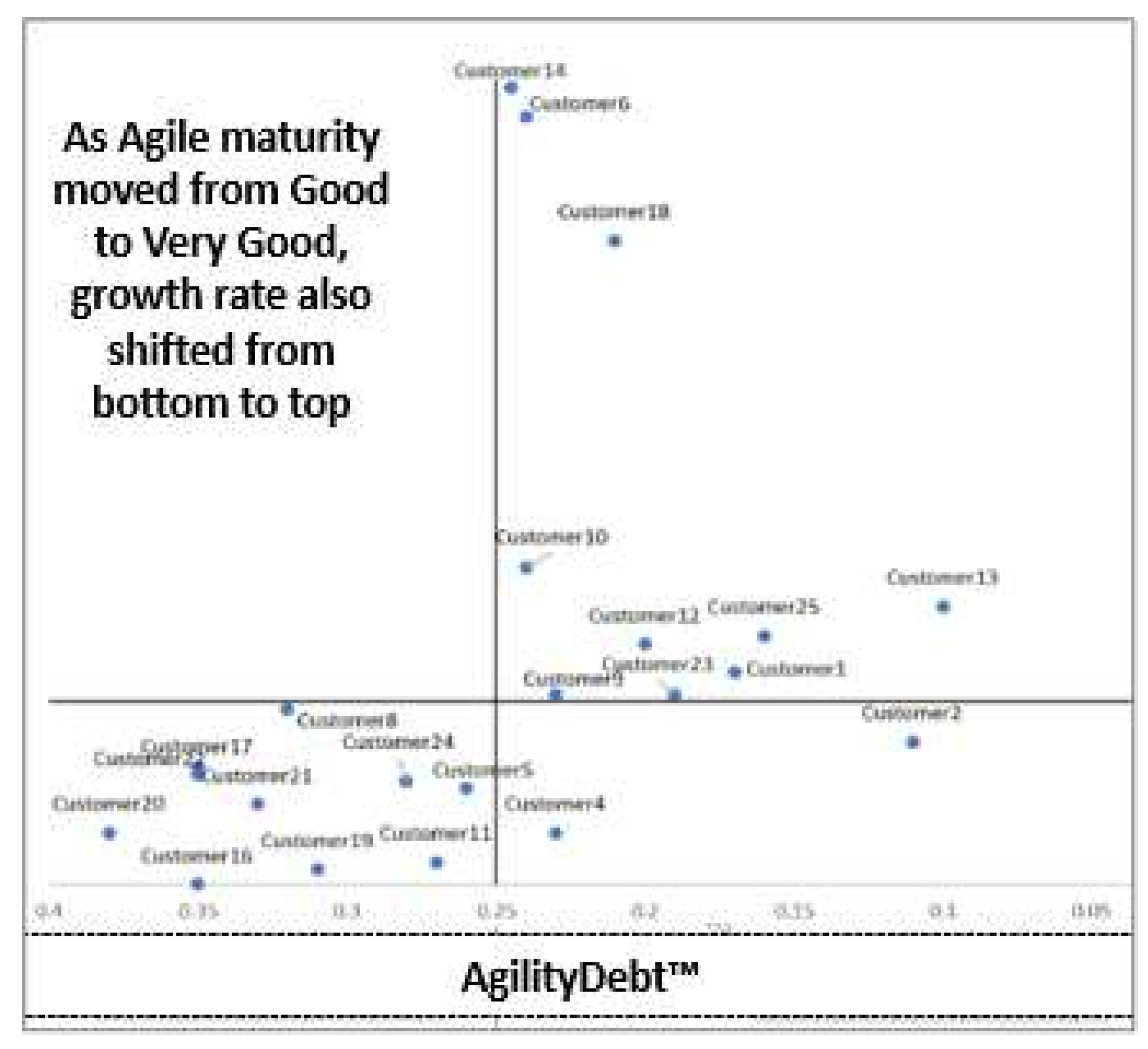

In

Figure 10, the correlation between the level of AgilityDebt™ calculated by TCS clients and the commercial growth rate they have exhibited can be appreciated.

This study is key to demonstrating the value of

AgilityDebt™ and its direct impact on business outcomes. The ’TCS Agile Initiative Network’ team leads the agile practice for all of TCS worldwide and carries out the analysis globally, [

31].

Our work, demonstrate that enterprise agility is fundamental to business success and can be achieved through an agile, collaborative, and transparent approach[

19,

33].

8. Recommendations to Start an Enterprise Agility Measurement System

Implementing a system for measuring enterprise agility may seem like a complex task, especially if the organization has no previous experience in this field. However, there are some key recommendations that can help guide the process and ensure its success:

Define the purpose and objectives of the measurement system: The first step in implementing a system for measuring enterprise agility is to define its purpose and objectives. Why do we want to measure enterprise agility? What results do we expect to obtain? Which areas of the organization do we want to improve? What matters to measure in this transformation? These questions should be answered before starting to collect data, and ideally, it should be a co-created process that connects with the organization’s vision and purpose[

49].

Identify the key dimensions of enterprise agility: To measure organizational agility effectively, it is important to identify the key dimensions that must be measured. These may include the ability to experiment and adapt to change[

13], the speed of decision-making, project maturity, the ability to learn and continuously improve, collaboration, and transparency in communication, among others[

14].

Select appropriate metrics and measurement tools: Once the key dimensions have been identified, it is necessary to select appropriate metrics and measurement tools for each of them. Metrics may include response time to changes, product delivery time, the number of production errors, customer satisfaction, the number of agile practitioners, among others. Measurement tools may vary from surveys and interviews for perception metrics to real-time database reading for operational metrics. It is ideal to incorporate data analysis tools[

50].

Establish a system for data collection and analysis: The next step is to establish a system for data collection and analysis. This may involve real-time data capture and processing through a polynomial that calculates a global metric, which can scale both vertically and horizontally. Here, exploratory data analysis is essential to visualize information and help identify patterns and insights, create timely alerts[

50], and most importantly, define research questions and continuous improvement hypotheses. It is important to ensure that the data collection and analysis system is reliable and consistent to ensure the accuracy of the results.

Establish a feedback and continuous improvement process: Finally, it is important to establish a feedback and continuous improvement process[

11,

18] to ensure that the enterprise agility measurement system is working effectively. This may involve reviewing and adjusting metrics and measurement tools, reviewing the results obtained, and implementing improvements[

34] to address the areas for improvement identified.

By following these steps, an organization can measure and improve its enterprise agility effectively, reliably, and consistently. Lastly, it is important to remember that all of the above requires a highly connected human team with the organizational transformational purpose[

49], without this connection, there will be no essential inspiration, momentum, and energy to energize the organization[

19].

9. Conclusions

The need to measure agility is essential for any organization that wishes to improve its response to environmental changes and the growing complexity of its customers and stakeholders. However, the challenge is not insignificant and faces problems at both methodological and cultural levels.

The history of the agile transformation in TCS Latam is an interesting and valuable case study, which shows how the implementation of concrete measures and continuous improvement can lead to significant results in enterprise agility. The use of the

AgilityDebt™ index as a measurement tool and the focus on agile mindset, socialization of agile culture, and the formation of collaborative teams[

32] have been key factors in the success of this initiative[

14].

The active participation of leaders and the agile community has been crucial in ensuring the sustainability of the results[

36]. This case has demonstrated that agility is not merely an abstract goal but can be measured and improved in a tangible way, with clear benefits for teams, clients, and the organization as a whole. Overall, this case study offers valuable insights into how an organization can leverage agile practices and principles to enhance its agility, foster innovation, and create value for its stakeholders[

19].

In methodological terms, our work applied, among other tests, the Fisher-Snedecor power analysis test for variance inequality. To the best of our knowledge, this type of test represents a novel implementation in this type of organizational metric calculation and process. This kind of test assumes normality in the data; as future work, we aim to create a new workflow considering non-parametric tests to address data with other distributions.

Based on these encouraging results, several next steps are recommended to navigate toward an agile culture and strategy: First, investigate the key factors contributing to the observed improvements in the agility debt indicator and identify best practices that can be shared across the organization to sustain and further enhance performance. Second, develop a continuous improvement plan to periodically assess and adjust the AgilityDebt™ strategy, ensuring it remains relevant and effective in addressing new challenges that may arise in the dynamic business environment. Third, expand the scope of the research to include a broader range of performance metrics and a more comprehensive analysis of the impact of the AgilityDebt™ on overall business performance, including customer satisfaction and financial outcomes. Fourth, strengthen communication and collaboration between organization teams to ensure the successful implementation of identified best practices and to foster a culture of continuous improvement throughout the organization. Finally, conduct regular reviews and update the AgilityDebt™ strategy as needed, based on the evolving business landscape and the lessons learned from ongoing performance monitoring and analysis.

Are you looking to enhance your organization’s agile maturity and achieve replicable and scalable positive impacts? To achieve your goals, it’s essential to have the right tools and strategies in place. Analyzing data and utilizing agile assets can provide valuable insights that will inform your decision-making process. Furthermore, working with an experienced team of agile coaches can help ensure a successful transformation journey.

Acknowledgments

We appreciate the opportunity, support, comments, suggestions, and complementary material shared to strengthen this article from Vaidiyanathan Sathyamurthy (Director of Delivery Excellence for TCS Latam), Jorge Abad Londoño (Head Agility for TCS Latam), Mohammed Musthafa Soukath Ali (Head - TCS Strategic Initiative), and Durba Biswas (Agile Coach - Agile Initiative Network).

Conflicts of Interest

The authors declare no conflict of interest.

References

- An, I.; Initiative, C. Digital Vortex, 2015.

- Porter, M.E. Competitive strategy: Creating and sustaining superior performance. The free, New York.

- Chesbrough, H.W. Open innovation: The new imperative for creating and profiting from technology; Harvard Business Press, 2003.

- Drucker, P.F. What makes an effective executive. In Harvard Business Review; 2004; volume: 82.

- Barney, J.B.; Peteraf, M.A. Comment on Hashai and Buckley: Transactions costs, capabilities, and corporate advantage considerations in theories of the multinational enterprise. Glob. Strategy J. 2014, 4, 70–73. [Google Scholar] [CrossRef]

- Christensen, C.M. The innovator’s dilemma: When new technologies cause great firms to fail; Harvard Business Review Press: 2013.

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Schwaber, K.; Beedle, M. Agile software development with scrum. Series in agile software development; Vol. 1, Prentice Hall Upper Saddle River, 2002.

- Aghina, W.; Handscomb, C.; Ludolph, J.; Rona, D.; West, D. Enterprise agility: Buzz or business impact. McKinsey & Company.

- Fowler, M.; Highsmith, J. The agile manifesto. SOftware Dev. 2001, 9, 28–35. [Google Scholar]

- Womack, J.P.; Jones, D.T. Lean Thinking: Banish Waste and Create Wealth in Your Corporation, 2nd ed.; Simon and Schuster: USA, 2003. [Google Scholar]

- TCS. TCS COIN™. TCS 2018, 1, 2–4. [Google Scholar]

- Takeuchi, H.; Nonaka, I. The new new product development game. Harv. Bus. Rev. 1986, 64, 137–146. [Google Scholar]

- Denning, S. The age of agile: How smart companies are transforming the way work gets done, 1st ed.; Amacom, 2018.

- TCS. Winning in a Business 4.0 world. TCS 2019, 1, 4–52. [Google Scholar]

- Abad, J.H.; Salazar, L.; Jimenez, A.; Moraga, R.A. Nuevas Aguas, Nuevos Navíos, Nuevos Navegantes: Business Agility con notas sobre Transformación Digital, 1st ed.; Amazon Digital Services LLC, 2022.

- Kotter, J.P. Leading change: Why transformation efforts fail. In Museum management and marketing; Routledge: 2007; pp. 20–29.

- Liker, J.K. The Toyota Way: 14 Management Principles from the World’s Greatest Manufacturer, 1st ed.; McGraw-Hill: USA, 2004. [Google Scholar]

- Hamel, G. The Future of Management, 1st ed.; Harvard Business Press, 2007.

- Edmondson, A.C. Strategies for learning from failure. Harv. Bus. Rev. 2011, 89, 48–55. [Google Scholar]

- Silva, D.S.; Ghezzi, A.; Aguiar, R.B.d.; Cortimiglia, M.N.; ten Caten, C.S. Lean Startup, Agile Methodologies and Customer Development for business model innovation: A systematic review and research agenda. Int. J. Entrep. Behav. Res. 2020, 26, 595–628. [Google Scholar] [CrossRef]

- Mundra, S. Enterprise Agility: Being Agile in a Changing World, 1st ed.; Packt Publishing, 2018.

- Tarba, S.Y.; Frynas, J.G.; Liu, Y.; Wood, G.; Sarala, R.M.; Fainshmidt, S. Strategic agility in international business. J. World Bus. 2023, 58. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. Absorptive capacity: A review, reconceptualization, and extension. Acad. Manag. Rev. 2002, 27, 185–203. [Google Scholar] [CrossRef]

- Ghoshal, S.; Bartlett, C.A. Creation, adoption and diffusion of innovations by subsidiaries of multinational corporations. J. Int. Bus. Stud. 1988, 19, 365–388. [Google Scholar] [CrossRef]

- Harry, M.J. Six Sigma: A Breakthrough Strategy for Profitability. Qual. Prog. 1998, 31, 60–64. [Google Scholar]

- Jarrar, Y.F.; Zairi, M. Best practice transfer for future competitiveness: a study of best practices. Total Qual. Manag. 2000, 11, 734–740. [Google Scholar] [CrossRef]

- Anjum, M.F.; Veermanju, K. Company Analysis: Tata Consultancy Services.

- TCS. Agile as a way of life: The TCS story. TCS 2022, 1, 1. [Google Scholar]

- Soukath, M.M. The Road to Agile Coaching: A Life Changing Leadership Role, 1st ed.; Amazon Digital Services LLC, 2020.

- TCS. Here’s the TCS agile transformation story. TCS 2022, 1, 1. [Google Scholar]

- Kotter, J.P. Leading Change: Why Transformation Efforts Fail. Harv. Bus. Rev. 1995, 73, 59–67. [Google Scholar]

- Schwaber, K.; Sutherland, J. The Scrum Guide The Definitive Guide to Scrum: The Rules of the Game, 6th ed.; scrumguides.org, 2020.

- Lockwood, T. Design Thinking: Integrating Innovation, Customer Experience, and Brand Value, 1st ed.; Allworth Press, 2009.

- Gray, D.; Brown, S. ;.; Macanufo, J. Gamestorming: A playbook for innovators, rulebreakers, and changemakers, 1st ed.; O’Reilly Media, Inc., 2010. [Google Scholar]

- Deming, W.E. Out of the Crisis, 1st ed.; MIT press, 1982.

- Wenger, E. Communities of Practice: Learning, Meaning, and Identity, 1st ed.; Cambridge University Press, 1998.

- Anderson, D.J. Kanban: Successful Evolutionary Change for Your Technology Business, 1st ed.; Blue Hole Press, 2010.

- Cumming, G. Introduction to the New Statistics: Estimation, Open Science, and Beyond, 1st ed.; Routledge, 2016.

- Anderson, T.W.; Darling, D.A. A test of goodness of fit. J. Am. Stat. Assoc. 1954, 49, 765–769. [Google Scholar] [CrossRef]

- Fisher, R.A. Statistical Methods for Research Workers, 1st ed.; Oliver and Boyd, 1925.

- Snedecor, G.W.; Cochran, W.G. Statistical Methods, 8th ed.; Iowa State University Press, 1989.

- Student. The Probable Error of a Mean. Biometrika 1908, 6, 1–25. [Google Scholar] [CrossRef]

- Cohen, J. Statistical Power Analysis for the Behavioral Sciences, 2nd ed.; Lawrence Erlbaum Associates, 1988.

- Cohen, J. Statistical Power Analysis. Curr. Dir. Psychol. Sci. 1992, 1, 98–101. [Google Scholar] [CrossRef]

- Ellis, P.D. The Essential Guide to Effect Sizes: An Introduction to Statistical Power, Meta-Analysis and the Interpretation of Research Results, 1st ed.; Cambridge University Press, 2010.

- Neyman, J.; Pearson, E.S. On the Problem of the Most Efficient Tests of Statistical Hypotheses. Philosophical Transactions of the Royal Society of London. Series A, Containing Papers of a Mathematical or Physical Character 1933, 231, 289–337. [Google Scholar] [CrossRef]

- Welch, B.L. The Generalization of `Student’s’ Problem When Several Different Population Variances Are Involved. Biometrika 1947, 34, 28–35. [Google Scholar] [CrossRef] [PubMed]

- Satell, G. Cascades: How to Create a Movement that Drives Transformational Change, 1st ed.; McGraw-Hill, 2019.

- Provost, F.; Fawcett, T. Data Science for Business: What You Need to Know about Data Mining and Data-Analytic Thinking, 1st ed.; O’Reilly Media, 2013.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).