3.1. Hypotheses and phases

In our study, we aimed to identify/argue the relationship between disruptive technology and financial innovations and to suggest some principles for the realization of financial innovation by firms; such principles would also be of theoretical/conceptual interest in that they would become a starting point for other similar studies. Most studies [

31,

37] on financial innovation through the use of disruptive technologies refer either to firms in high-tech sectors of the manufacturing industry (Pharmaceuticals, ITC, etc.) or to firms in more knowledge intensive services (KIS) sectors. There are few studies that propose financial evaluation by technologies from both a country and a firm perspective and that, in addition, propose a synthetic analysis of the factors/principles that explain the innovative capacity of an entity (whether it is a firm in the manufacturing industry or KIS). Another important aspect to achieve the aim of our research is the identification of a unified classification of innovation types/categories. In the sense invoked, according to the Oslo Manual under the auspices of the OECD[

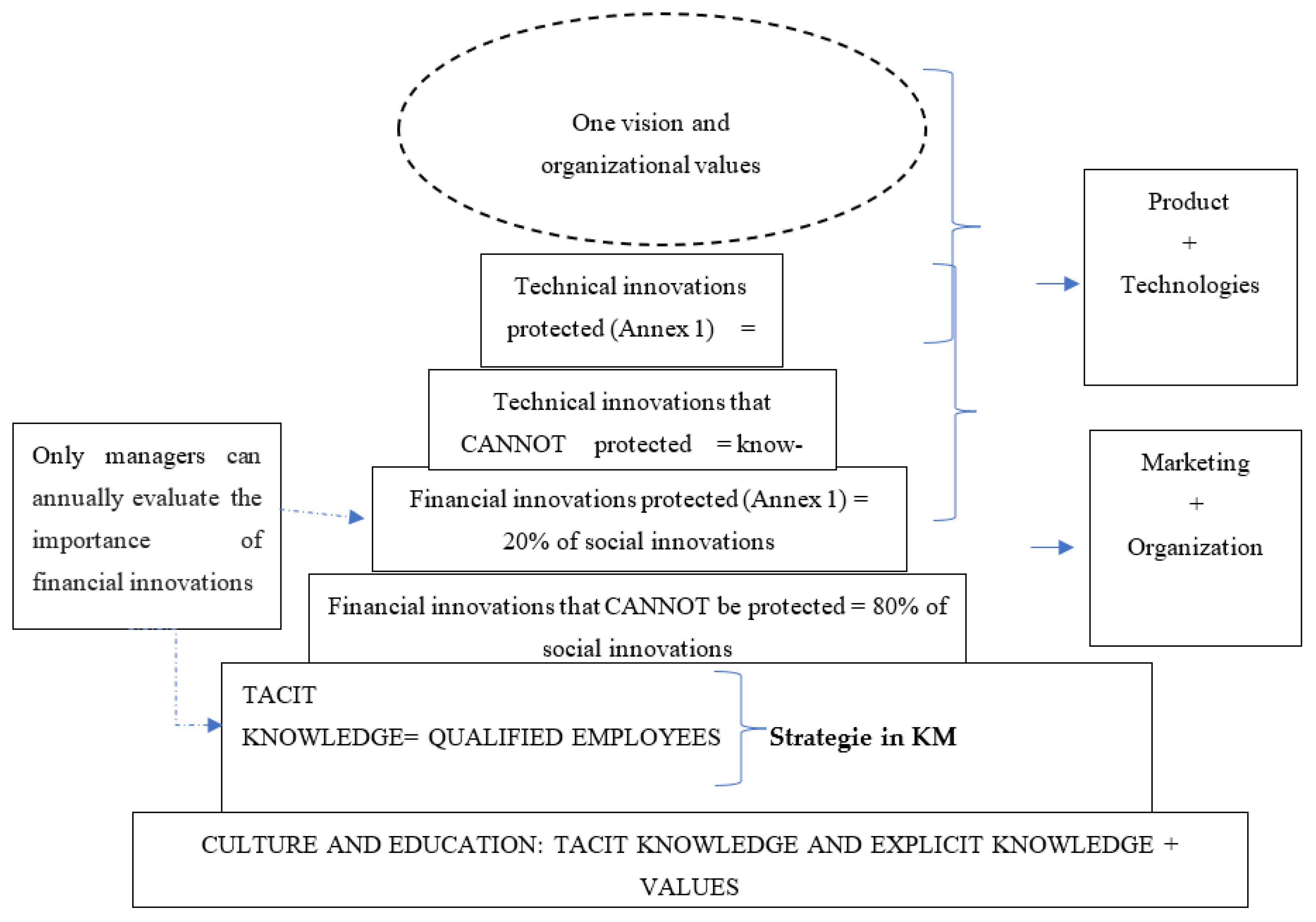

38] and the European Commission, there are four types/categories of innovations: product innovations, process innovations, marketing innovations and organisational innovations (OECD, 2005). As we will show later (point 5.2 in section 5 of the study), financial innovation at the level of any firm refers in particular to marketing innovations and organisational innovations (even if it is not possible to clearly delimit/dissociate between the 4 types of innovations mentioned, the way in which protection can be obtained for an element of novelty in the firm and the industry sector in which the firm is located).

At the basis of our study we state the following research hypotheses:

H1: There is no statistical, correlation and/or direct association between technical and social innovative capacity at the MNC level;

H2: Financial innovative capacity, with or without the help of disruptive technologies, at the firm level accounts for about 80% of the social innovations that are made by such entities;

H3: Countries that have a good international competitive position, i.e. are part of the group of innovative countries, have a number of MNCs and/or SMEs that are each significant in terms of resources allocated to R&D and technical, social and financial innovation results.

In order to achieve this proposed objective, we have proceeded through several steps specific to such research:

We have listed a number of 3-4 hypotheses on which the whole study would be based;

We have selected the GCI (Global Competitiveness Index) ranking [

39,

40] for the period 2009-2019 in an attempt to get a first picture of the competitiveness/innovative capacity of the world's major countries. This first picture based on the GCI gives us, at the same time, elements of interest for our study on the innovative capacity existing in the firms of these countries (since some sub-pillars such as: social capital, cooperation in labour employer relation, university industry collaboration in R

$D, extent of staff training give us important information for innovation in firms).

We selected the GII (Global Innovation Index) ranking [

41,

42] for the period 2010-2020 to see which of the world's major countries have an innovative capacity above the average of the entire group of countries analysed by this annual ranking. Even the choice of this ranking was determined by the fact that some of the sub-indexes (e.g. gross expenditure on R&D, global R&D companies; ICT access, ICT use, GERD performed by business enterprise, etc.) also provide valuable information on the innovative capacity of firms in these countries. The inclusion in our study of GCI and GII at slightly postponed times has been foreseen for informal comparisons that can be formulated already at this stage of the study (year 2010 vs. 2009, respectively year 2020 vs. 2019), in order to connect these comparisons later with the microeconomic perspective on innovative, technical and/or other capacities in the main countries of the world.

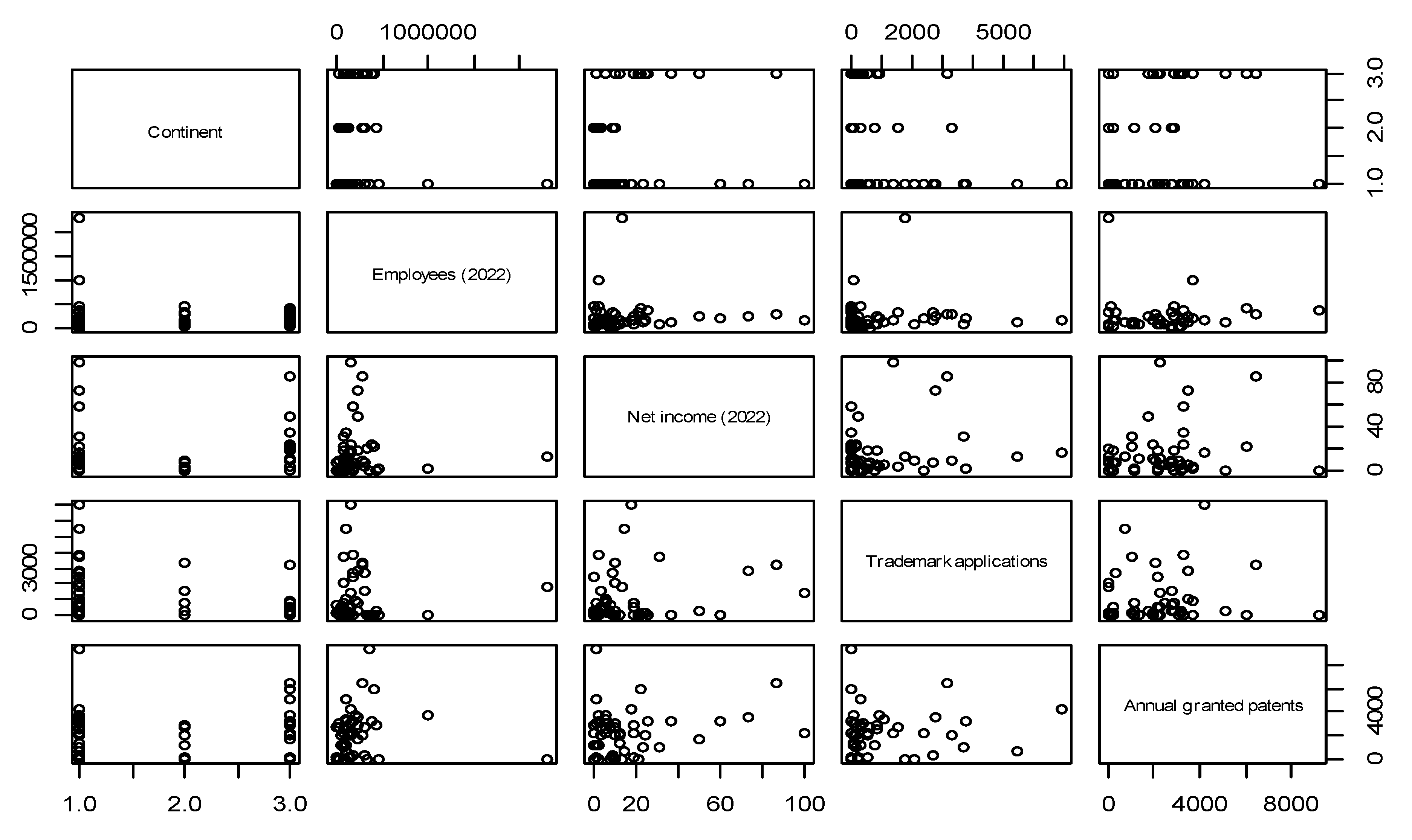

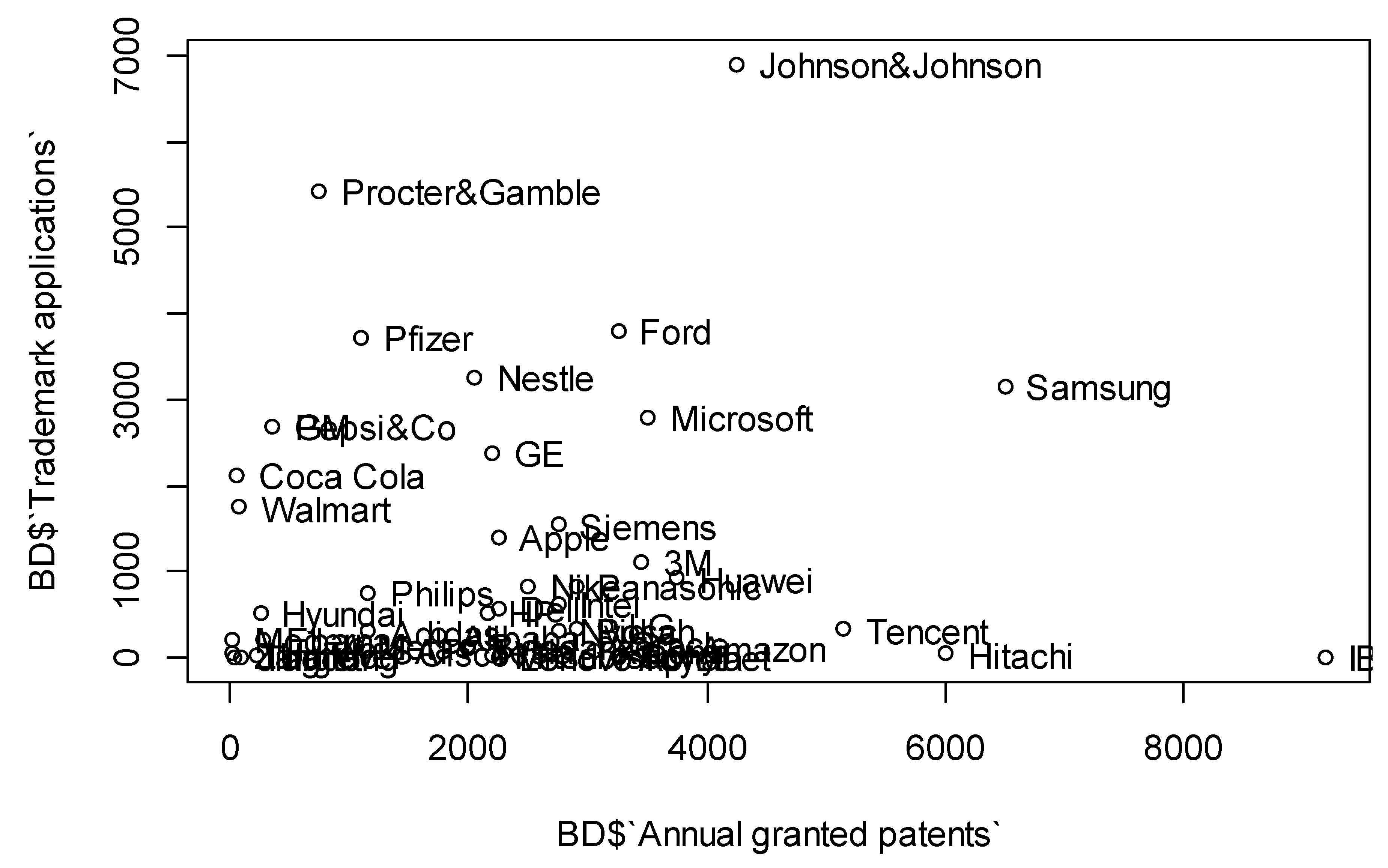

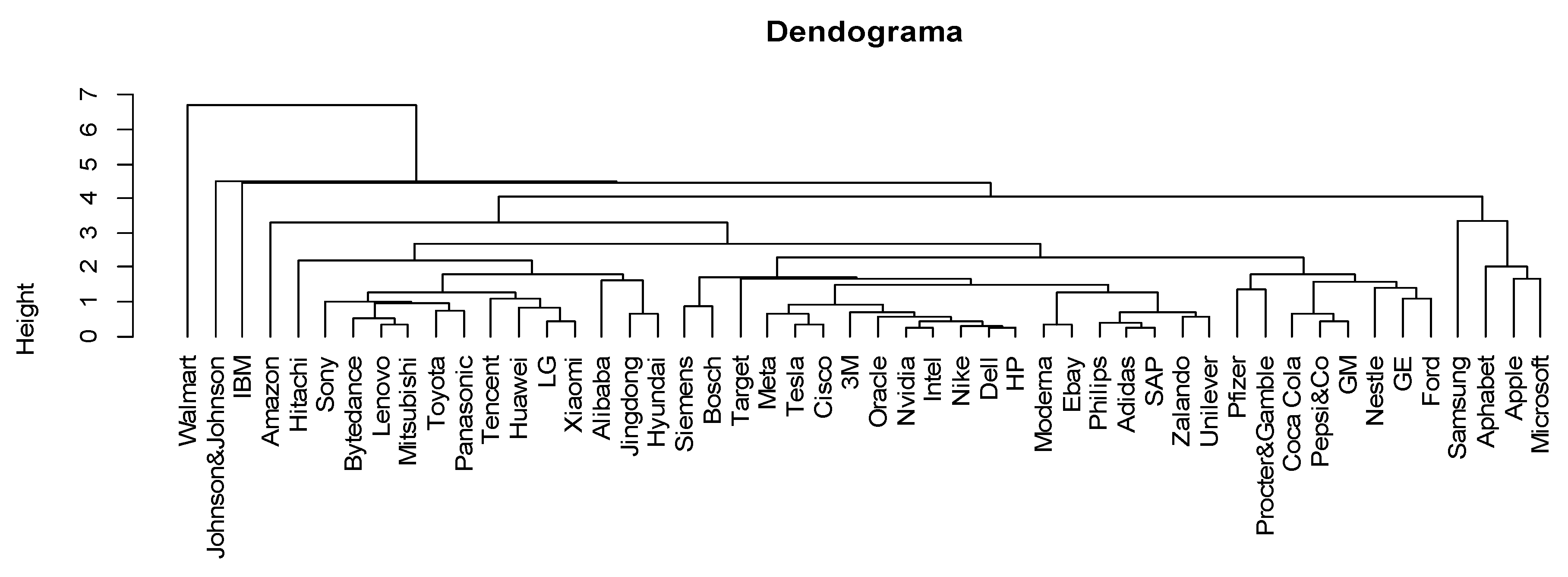

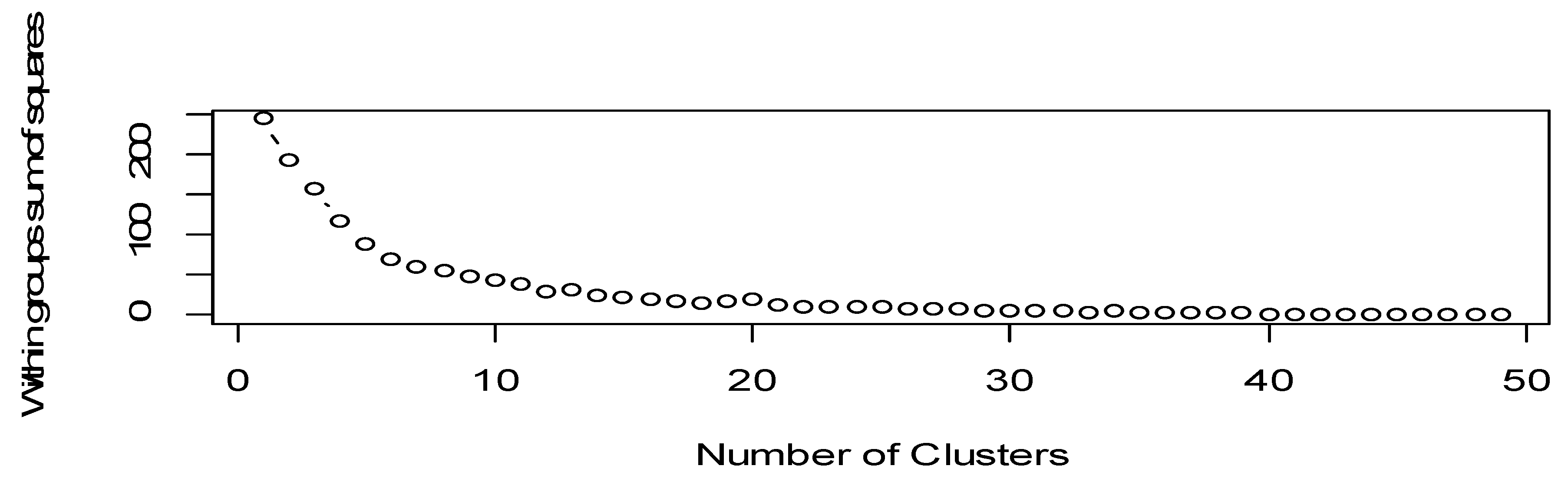

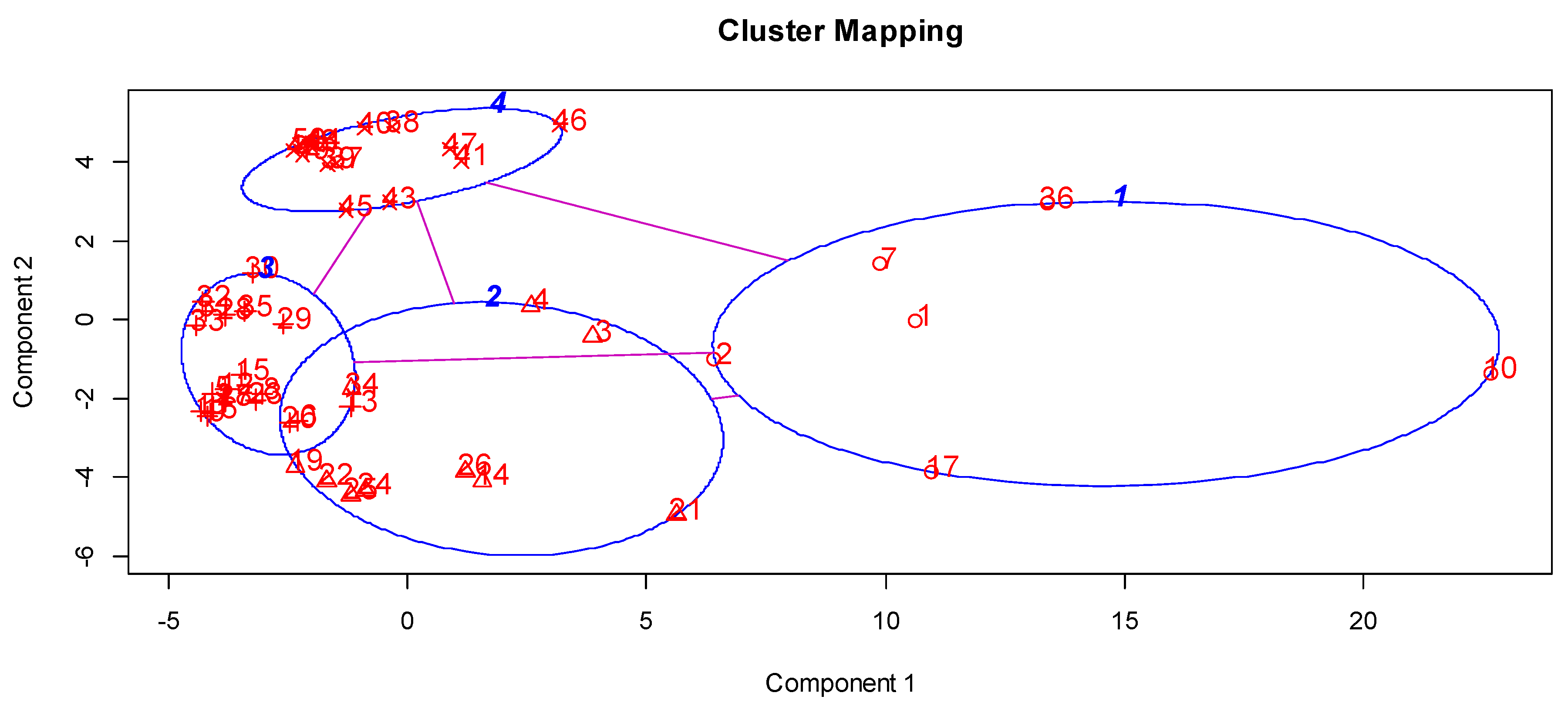

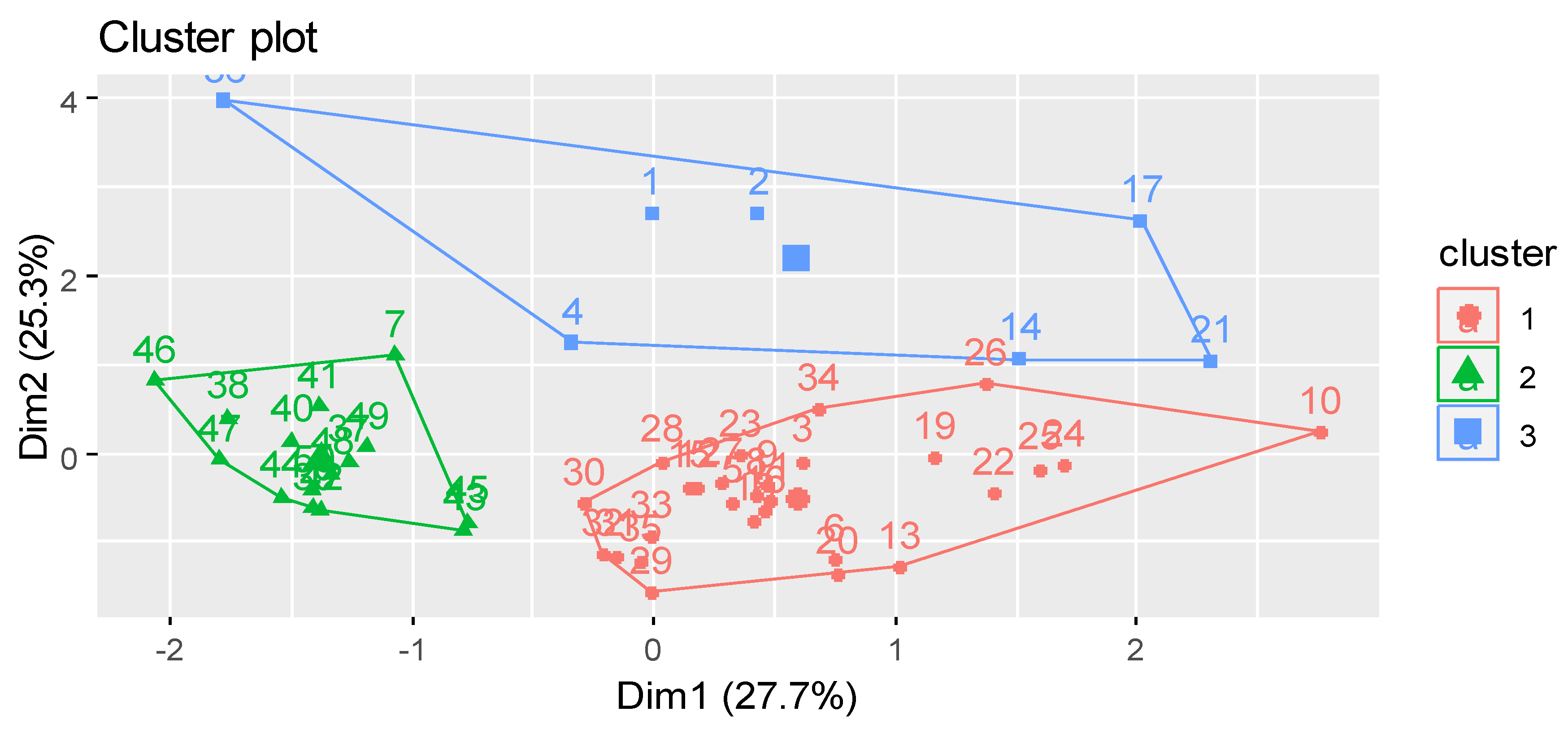

We have chosen the study provided by BCG (Boston Consulting Group) for the period 2004-2022 and which highlights 50 of the most innovative companies in the world (27-USA; 15-Asia; 8-Europe) and for which, based on the Annual Report of each organization, we have highlighted in Annex 1 technical and social innovative capacity together with some information on size, financial performance, etc.The data on the 50 MNCs in the BCG study were then statistically ordered by different tools trying to identify association relationships between companies, sectors in which they are located and countries of affiliation.

In the fifth part of the research, we have recurred to our own analysis in which we "cross-reference" (mix) the main data provided by the international literature, the GCI study and the GII study, including the BCG study in an attempt to suggest our own way of assessing financial innovations as part of the social innovations that are carried out by firms. Also at this stage, in the final part of the research we have outlined a number of "n" principles that can be considered for strategic thinking on social innovation at firm level in different countries of the world. The same principles for financial/social innovation are also of interest from a theoretical perspective as they provide a "common denominator" for future studies that aim to argue the relationship between disruptive technologies and innovative capacity at the firm/country level.

3.2. Implications of GCI for financial innovation in firms

By "implications of the GCI for financial innovation" we mean that this ranking provides some useful, although partial, information for understanding and subsequently assessing (section 5 of the study, Main Findings) innovative capacity at the firm level. Our assessment focuses on MNCs, as the realities of the last 3 decades in the global economy lead to the conclusion that this category of organisations in particular have become the main vectors for technical and social innovation. As argued by [

43] medium and large firms have become essential for R&D&innovation, job creation, exports, revenues, productivity and other critical indicators for competition in different markets. At the same time, our assessment, reasoning and conclusions may also include, where appropriate, firms in the SME category (in high-tech sectors such as IT, telecommunications, etc. firms with a significant number of employees can quickly become highly innovative).

Based on this ranking (GCI) we conducted a comparative analysis at the time of 2009 and respectively 2019, trying to identify what are the main correlations and significant associations between the different sub-pillars of the ranking, as well as the extent to which these sub-pillars support the understanding of technical and social innovative activity at the firm level (from a microeconomic analysis perspective). As is well known, the GCI ranking is based on 12 main pillars (Institution, Infrastructure, ICT adoption, Macroeconomic stability, Product market, Business dynamism, Innovation capability, etc. ); countries are grouped by main ranking and by sub-pillars, based on a "score" expressed on a scale of 0-100 (relative position of countries). In our analysis we have selected a number of 7 variables that should show us, cumulatively, the innovative capacity at country level (social_capital, health_primary_education, higher_education_training,extent_of_staff_training, cooperation_in_labour_employer_relations, state_of_cluster_development, university_industry_collaboration_in_RD). A second selection condition was given by the need to "cover" most of the 12 main pillars with the 7 variables and which refer, at the same time, directly or indirectly, to R&D and innovation activity in firms. A total of 24 main countries of the world have been selected (countries that are in the top positions in the ranking both at the time of 2009 and at the time of 2019; Switzerland, USA, Japan, Singapore, South Korea, Germany, Denmark, France, Netherlands, UK, etc.; countries that are important in the global economy but have a more prudent/modest position in the ranking; countries such as Argentina, Brazil, China, India, Mexico, South Africa, etc.).

We present below the correlation matrix in SPSS for 2009 (

Table 1) and for 2019 (

Table 2). In the first half of the tables are the pairwise correlations between the 7 variables included in the analysis for the two years (sub-pillars). In the second half of the table are the significance coefficients calculated for the correlation coefficients obtained (having different values in 2019 vs 2009).

In both tables we have used some unitary underlining, respectively:

- -

In each table, we have marked in bold the significant correlations between the 7 variables (this means statistically significant correlations; some sub-pillars help us to further understand the factors explaining the innovative capacity of the companies in the BCG ranking);

- -

We have marked in bold and italics in each table the sig. coefficients of significance greater than 0.05 between the 7 variables, which indicate that there are no statistically significant correlations.

Taking into account the previous mentions, some conclusions of interest for our study can be drawn (which will then be correlated with the information shown by the GII ranking and the situation of the 50 companies in the BCG ranking):

The situation of insignificant correlations between the 7 variables has changed significantly during the decade under analysis, i.e. in 2009 there were five correlations of this type, and in 2019 there were only two correlations of this type:

- ✓

At the time of 2009 the realities of the following variables were insignificant:

- -

Social capital variable and Cooperation in_labour_employer_relations, State_of_cluster_development, University_industry_collaboration_in_R&D;

- -

health_primary_education if extent_of_staff_training, State_of_cluster_development;

- -

higher_education_training if State_of_cluster_development;

- -

extent_of_staff_training and State_of_cluster_development;

- -

State_of_cluster_development and Univeristy_industry_collaboration_in_R&D.

- ✓

At the time of 2009 a smaller number of the following variables were insignificant:

- -

health_life_expectancy and extent_of_staff_training;

- -

cooperation_in_labour_employer_relation, respectively Multistakeholder_collaboration.

In addition, it is easy to notice that the association between variables recording insignificant correlations is completely different at the two moments of analysis (this means that different pillars of the GCI component advanced/evolved differently from one country to another and led to changes in position at both pillar and ranking level in 2019 vs 2009).

- b.

The situation of significant correlations between the 7 variables has changed significantly during the decade under analysis, i.e. in 2009 there were three correlations of this type, and in 2019 there were four correlations of this type:

- ✓

At the time of 2009, there were significant differences between the following variables:

- -

health primary_education si higher_education_training (0.748);

- -

extent_of_staff_training if Cooperation_in_labour_employer_relations (0.791);

- -

extent_of_staff_training if Univeristy_industry_collaboration_in_R&D (0,800).

- ✓

At the time of 2019 there were significant realities between the following variables:

- -

extent_of_staff_training if Cooperation_in_labour_employer_relations (0.799);

- -

extent_of_staff_training if Multistakeholder_collaboration (0.932);

- -

Cooperation_in_labour_employer_relation if Multistakeholder_collaboration (0.738);

- -

State_of_cluster_development if Multistakeholder_collaboration (0.735).

In the following, we summarize in

Table 1 and 2 the "Correlation Matrix" for previously reported issues at the time of 2009 and 2019 respectively.

From the data presented in

Table 1 and

Table 2, it is easy to see that the association between variables with significant correlations has changed significantly during the decade under analysis, 2019 vs. 2009. At the time of 2019, there were four statistically significant correlations between the seven variables compared to only three such correlations at the beginning of the period. These statistical correlation changes between the different variables/factors about which the GCI provides information derive from changes in overall ranking and/or ranking of the plilars in the competitive position component. Such changes in terms of the ranking provided by the GCI for the world's leading countries will then be analysed "cross-referenced" with the main conclusions provided by the GII ranking (including performing an informal analysis, by main influencing factors, of some deductible aspects for the year 2020 vs 2019 and 2010 vs 2009 respectively) and the main conclusions provided by the BCG ranking for the 50 MNCs considered to be the most innovative in the world.

Next, based on the information provided by the same GCI ranking we calculate and present synthetically the KMO and the Bartlett sphericity test (

Table 3 and

Table 4), as well as the Initial Eigenvalues associated to each factor before extraction, after extraction and after rotation (

Table 5 and Table 6).

Table 3 and

Table 4 present two indicators relevant to our study, namely the KMO (Kaiser-Meyer-Olkin) and the Bartlett sphericity test. The KMO varies between 0 and 1. A value close to 0 indicates that the sum of partial correlations is relatively high compared to the sum of correlations and factor analysis is not indicated while a value close to 1 indicates that factor analysis should produce distinct and reliable factors. A value above 0.5 is considered acceptable (

http://cda.psych.uiuc.edu/psychometrika_highly_cited_articles/kaiser_1974.pdf). In this case the value is 0.627, so an acceptable value.

Bartlett's test of sphericity is highly significant, the sig value is less than 0.01, which means that the correlation matrix R is not an identical matrix. There are links between variables that could be included in our analysis based on the GCI ranking.

In the following table, applying the same tests based on data provided by the GCI at the time of 2019 leads to slightly higher values than at the time of 2009.

Table 5 and Table 6 centralize the Initial Eigenvalues associated with each factor before extraction, after extraction and after rotation. Before extraction, 7 factors were identified corresponding to the 7 variables included in the analysis. The initial values associated to each factor also show the weight of the explained variants. For example, at the time of 2009, the first factor explains 53.86% of the total variance and the second factor 17.623%. It can be seen that the first two factors together explain 71.48% of the total variance. After extraction, at the same time 2009 only 2 factors remained as can be seen in

Table 5 (SPSS extracts only factors that have values above 1). It can be seen that for the extracted factors the values are identical to those before extraction. In the last part of the table are the eigenvalues after rotation. Before and after rotation the first factor and the second factor keep their values.

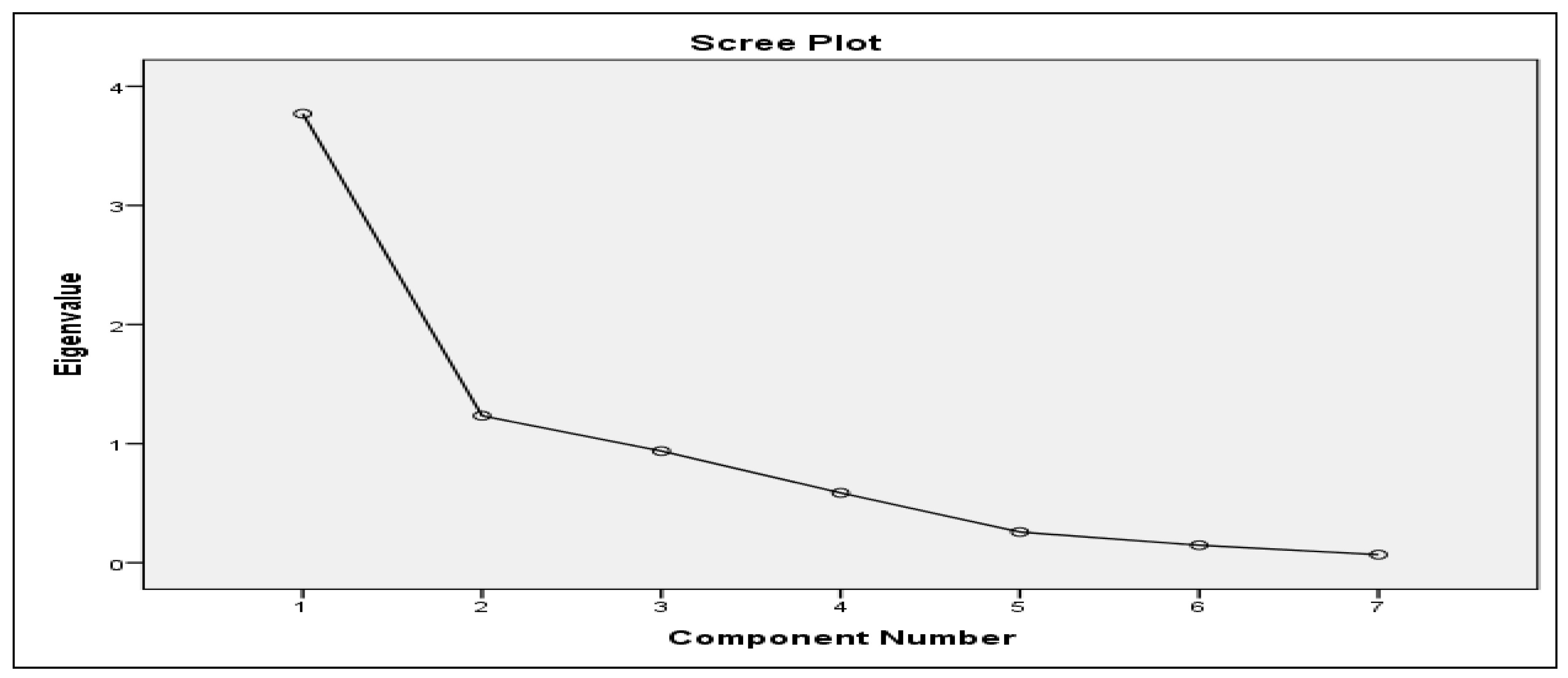

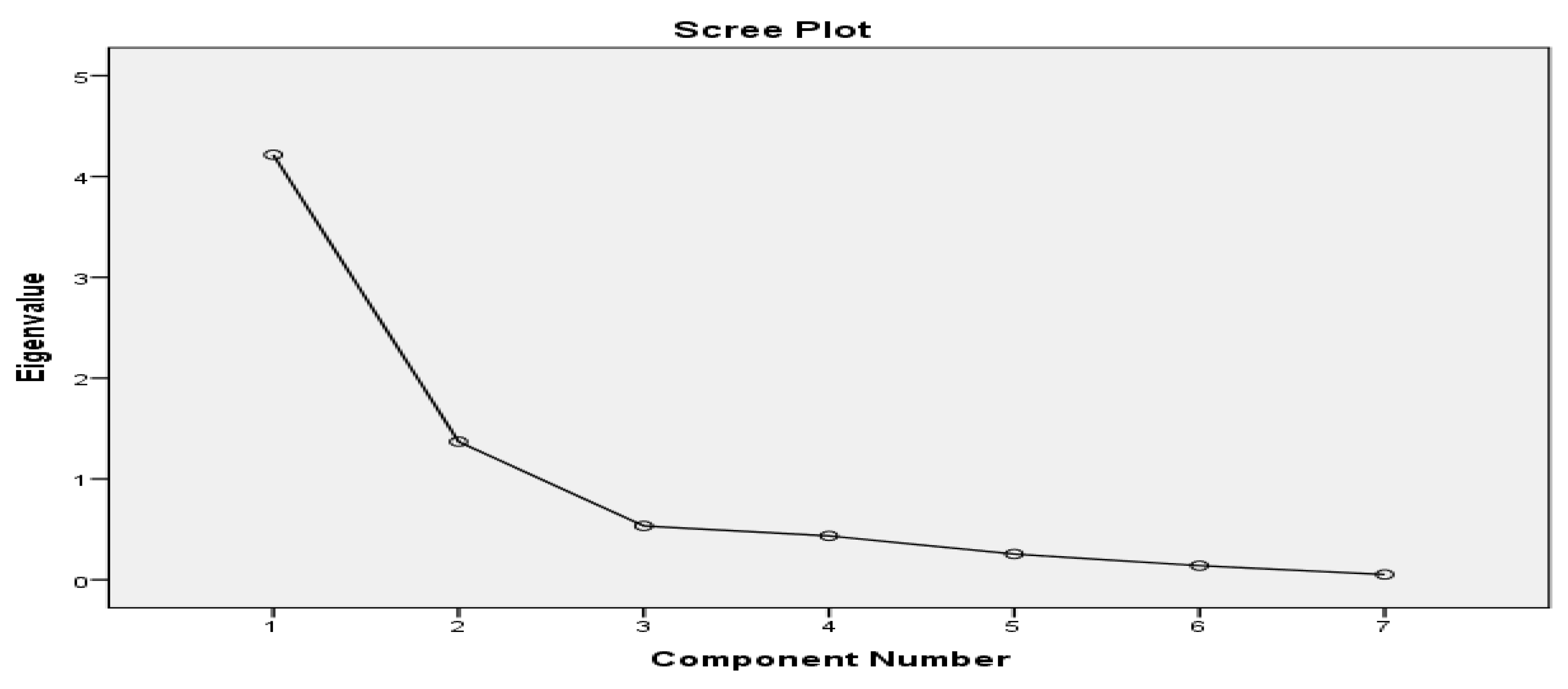

A more synthetic version of the analysis on the 7 variables at the time 2019 vs 2009 can be obtained by plotting the Scree plot for the year 2009 (

Figure 1) and 2019 (

Figure 2).

From

Figure 1 and

Figure 2 it can be deduced that the main points of inference occur in variables 2 and 3 which means that education, employee training and R&D investment are the main factors explaining innovative capacity at country level. This preliminary conclusion has significance for the objective of our research, and we will then analyse whether or not various elements related to education, training and R&D are reflected in the methodology applied by BCG to establish the ranking of the 50 globally innovative companies.

The next step the authors used is to analyze the variables that were assigned in the first factor to see if there is some common theme. It can be seen that between the variable State_of_cluster_development2009, which has the highest loadings distributed in component 2 and the variable Cooperation_in_labour_employer_relations2009 there is a certain relationship. Therefore, the variables allocated to the first component at the time of 2009 seem to fall under the same theme, namely education. All of them are related to the same aspect, as follows: higher_education_training2009,Univeristy_industry_collaboration_in_RD2009,extent_of_staff_training2009, Cooperation_in_labour_employer_relations2009, healt_primary_education2009, social_capital2009 .

Table 11 shows the matrix of rotated components, for the year 2009, then in

Table 12 the same data for the year 2019.

Factor loadings less than 0.5 have been removed from the table. We can see that there are two components and most of the variables are distributed in the first component, except for 2 variables: Cooperation_in_labour_employer_relations and State_of_cluster_development which have been distributed in the second component. The variables have been presented in the table in the order in which they were entered. A descending sort by load size places the variable higher_education_training first, followed by Univeristy_industry_collaboration_in_RD.

Factor loadings less than 0.4 have been removed from the table. We can see that there are two components and 4 variables (extent_of_staff_training2019, Cooperation_in_labour_employer_relation2019, State_of_cluster_development2019, Multistakeholder_collaboration2019) are distributed in the first and 3 variables (social_capital2019, healt_life_expectancy2019, mean_years_of_schooling2019) are distributed in the 2nd component.

The Multistakeholder_collaboration2019 variable is ranked first by the upload size. Therefore, it can be inferred that, although there have been some changes on the variables/factors explaining the innovative capacity of countries in 2019 vs 2009, education, staff training and collaboration with various categories of stakeholders remain essential for innovative capacity at country level. Finally, the last stage of the authors' analysis of the importance of the variables/factors on which the GCI ranking is based is presented at the time of 2019, as shown in

Table 13.

It can be seen that there have been some changes in 2019 in the distribution of variables by components compared to 2009; however, the conclusion remains that social capital, education, staff training, R&D activity and collaboration with various categories of stakeholders remain the main factors conditioning the innovative capacity of countries. As we will see later (evaluation based on the 50 Top BCG ranking[

44]), employee education, investment in R&D, firms' orientation towards open networks for innovation, staff training, organisational culture and/or social capital, collaboration between management and employees/trade unions, etc. are the main factors determining innovative capacity at firm level. It is, however, extremely difficult to argue which would be the "common factors" that simultaneously explain innovative capacity at firm and country level.

Next we conduct an analysis based on the Global Innovation Index (GII) to further assess innovative capacity at the country level and the theoretical/hypothetical relationship between such rankings vs. innovative capacity at the firm level. Later (section 5 of the study, Main findings), when we perform an in-depth analysis based on the BCG survey of the 50 most innovative companies internationally, we will try to "disentangle/separate" social/financial innovation from overall firm-level innovative capacity. Also in the above sense, based on the information provided by the GCI and GII we will then try to "cross-check" the results we arrive at on financial innovativeness as part of social innovation, both at firm and country level.

3.3. Implications of GII for financial innovation in firms

In order to understand and assess financial innovative capacity at the firm level (BCG Innovation Study), we further recurre to an assessment of innovative capacity (technical and social) at the level of major countries of the world. For this purpose we will use the data provided by the GII ranking.

We use a data set of Global Innovation Index (GII), sub-indexes and components for 2010, and 2020; in the following table we summarize the main variables selected for analysis. In our study, we have chosen to assess the relationship between GII and firm-level innovative capacity at 2020 vs. 2010 in order to have a broader picture (4 years if GII and GCI are cumulated) of the factors/variables determining technical, social and other types of innovation at country/firm level.

In order to determine the paternity of evolution, i.e. the central tendency and the variability of the components, we used a quantitative analysis using descriptive statistics. In the first step, we identified global patterns of evolution for all countries included in the index calculation. In the second step, we selected countries that scored above the world average on the GII and determined the central tendency and variability for these groups of countries. For the group of countries that scored above the world average, we performed a correlation analysis.

Table 15 summarises descriptive statistics for the GII and selected components in 2010, both for all countries included in the index calculation and for the group of countries scoring above the world average.

Overall, the trend in innovation performance (GII) in 2010 remains somewhat constant, with a relatively normal distribution of values. The best performers are countries such as Switzerland, Sweden, Singapore, Hong Kong (SAR), China, Finland, Denmark, United States of America, Canada, Netherlands, United Kingdom, Iceland, Germany, Ireland, Israel, New Zealand, Korea, Rep, Luxembourg, Norway, Austria, Japan, Australia, France, Estonia, Belgium, Hungary, Qatar, etc. , while the lowest performers are associated with countries such as Senegal, Swaziland, Venezuela, Cameroon, Tanzania, Pakistan, Uganda, Mali, Malawi, Rwanda, Nicaragua, Cambodia, Bolivia, Madagascar, Zambia, Syrian Arab Republic, Tajikistan, Cote d'Ivoire, Benin, Zimbabwe, Burkina Faso, Ethiopia, Niger, Yemen, Sudan, Algeria, etc.a. As we will see later (section 5, BCG ranking starting point study), there are several European countries such as Sweden, Estonia, Belgium, Hungary, France, Finland, Denmark, etc. that are in good positions in the GII vs GCI ranking, but do not have large/representative MNCs to include companies from these countries in the BCG ranking. How can this situation be explained? Also in the sense mentioned, there are countries such as Qatar, Canada, New Zealand etc. that do not have representative companies in the top tier of innovation category that is summarised by the BCG study.

Among the selected components, the best scores were obtained in the Infrastructure pillar on components such as ICT access, Creative outputs (ICTs and business model creation, ICTs and organisational model creation). As regards Business sophistication, notable performances were obtained GERD performed by business enterprises, GERD financed by business enterprise), but the importance of inter-firm cooperation through strategic alliances or joint ventures in innovation was rather low. The central trend towards the Human capital and research pillar is also rather moderate, with a dispersed distribution of values across the board. The central tendency towards high-tech exports as a means of knowledge diffusion is also low, with a dispersed distribution of values.

In the group of countries performing above the world average in innovation, the central trend is relatively constant, but with a more dispersed distribution of variables. In this group, there is a noticeable trend towards a much stronger focus on infrastructure (through components such as ICT access, ICT use), Business sophistication (GERD performed by business, GERD financed by business enterprise), Creative outputs (ICTs and business model creation, ICTs and organisational model creation). Also noteworthy is the increasing trend of knowledge diffusion, through high-tech exports and ICT services exports. However, the trend towards attracting external sources for research and development (GERD financed by abroad) is less pronounced than the worldwide trend.

Table 16 illustrates the correlation matrix for the group of countries scoring above the world average in the GII, highlighting a number of significant influences that various components/variables have on innovation.

In 2010, in the group of countries scoring above the world average, innovation performance is positively and significantly associated with

gross expenditure on R&D, infrastructure (ICT access, ICT use) and business sophistication. Also, a significant influence has been had by the creation of business and organisational models through the use of ICT, which are positively associated with R&D financed and carried out by firms and with access to ICT (which predominantly means common social innovations of which some may later prove to be disruptive in society). An insignificant influence was exerted by R&D financed by abroad. As regards joint ventures and strategic alliances, there is a positive association with the use of ICT and R&D activity carried out within firms, positively influencing overall innovation performance. Thus, based on the 2010 GII data, it is quite clear that some factors/variables related to the innovative capacity of an entity (

gross expenditure on R&D, with infrastructure (ICT access, ICT use) and with business sophistication, business model, alliances and open innovation in R&D activity, etc.) are simultaneously found at the level of countries and/or firms that are considered to be innovative. However, it is extremely difficult to quantify and argue to what extent the existing technical or social innovative capacity in firms conditions/determines the same innovative capacity in countries A, B, C, etc. This is because, according to the Forbes rankings for both 2010 and more recently in 2022 [

45], at the time of 2022 there were at least 2000 important/significant companies globally, yet the vast majority of them are far from making the BCG ranking, even if they also have quite good achievements on technical and social innovations. During the last decade we analysed (2010-2020) there have been major changes in the number of companies and countries of origin that are included in the various international rankings (Forbes 2022; Fortune 2022; etc.). However, the dominance of US innovative capacity at country and firm level remains; more recently China and companies originating from this country have improved their international competitive capacity. In a few cases we find companies that have a turnover of USD 2-10 billion or more (Gold Fields-South Africa; Grifols-Spain; Cencosud-Chile; Dexus-Australia; Ayala Corporation-Philippines; Fertiglobe-United Arab Emirates, etc.), have a good position in Forbes 2022 and come from countries that do not have an above average position in the GCI and GII. Simply put, the world's leading developed countries with relatively high GDP per capita dominate R&D activity (funding by firms as well as by government) and perform better annually in terms of number of patents, social innovations, financial innovations, etc..

Table 17 summarises descriptive statistics for the GII and selected components in 2020, both for all countries included in the index calculation and for the group of countries scoring above the world average.

The trend for the Global Innovation Index in 2020 remains somewhat constant, close to the trend recorded in 2010 in terms of value distribution. The best performers are Switzerland, Sweden, United States of America (the), United Kingdom (the), Netherlands (the), Denmark, Finland, Singapore, Germany, Republic of Korea, Hong Kong, China, France, Israel, China, Ireland, Japan, Canada, Luxembourg, Austria, Norway, Iceland, Belgium, Australia, Estonia, Czech Republic, New Zealand, Malta, Cyprus, Italy, Spain, Portugal, while the lowest performances are associated with countries such as Bolivia, Guatemala, Ghana, Pakistan, Tajikistan, Cambodia, Malawi, Côte d'Ivoire, Lao People's Democratic Republic, Uganda, Bangladesh, Madagascar, Nigeria, Burkina Faso, Cameroon, Zimbabwe, Algeria, Zambia, Mali, Mozambique, Togo, Benin, Ethiopia, Niger, Myanmar, Guinea, Yemen, etc.a. Of the selected components, the best scores were obtained in the

Infrastructure pillar (on components such as ICT access, ICT use),

Business sophistication (GERD financed by business enterprise),

Creative outputs (ICTs and business model creation, ICTs and organisational model creation), while the central trend towards the

Human capital and research pillar is still rather moderate, with a dispersed distribution of values across all situations. Also notable is the central trend of increasing high-tech exports, as a means of knowledge diffusion, but still with a dispersed distribution of values; this time among the leaders are Malaysia, Vietnam, the Philippines, the Republic of Korea, China and Singapore, together with the Czech Republic, France, Germany, etc. Together with other conclusions that can be drawn, it follows that the GCI and GII rankings are still largely dominated by the developed countries of the world by 2020. In a few cases we will find in 2020 companies that are globally significant ([

41,

42]) but come from countries that are well below the average GII ranking. Therefore, we see that there is a certain conditionality/correlation between existing technical and social capacity at firm/company level vs. innovative capacity and/or competitive position at country level. In the next part of the study (section 5) we address the same topic, but from the microeconomic perspective of analysing financial innovations as part of social innovations at the firm/country level.

In the group of countries performing above the world average in GII, the central trend is relatively constant, but with a more dispersed distribution of variables. In this group, there is a perceptible trend towards a much stronger focus on infrastructure (through components such as ICT access, ICT use), Business sophistication (GERD financed by business enterprise), Creative outputs (ICTs and business model creation, ICTs and organisational model creation); at the same time, the central trend towards the Human capital and research pillar, although still moderate and rather spread, is more consistent than the global trend. The orientation towards attracting external sources for research and development (GERD financed by abroad) should also be highlighted, with Israel, the Czech Republic, Austria, Iceland, Belgium, Sweden, Finland, etc. leading the way. Japan, Malaysia, China, Thailand, India, etc. have shown less interest in this direction. Last but not least, mobile app creation is showing a more consistent, albeit still dispersed, upward trend than the global trend.

In 2020, the innovation performance of the 53 countries scoring above the world average was positively and significantly associated mainly with resources invested in R&D activity, infrastructure, R&D activity carried out by firms and especially the creation of new organisational models under the impact of ICT. (United States of America , Sweden, Finland, Netherlands , Estonia, United Kingdom, Denmark, Germany, Switzerland, Norway, Israel, Canada, Iceland, Singapore, Luxembourg, Belgium). The creation of these new organisational models is positively and significantly associated with ICT use, cooperation through joint ventures and strategic alliances, and R&D activities carried out by firms. The conclusions that can be drawn from the GCI and GII rankings over the last 10 years largely confirm Porter's concept of "The five forces" shaping competition at the level of industrial sectors and/or countries [

46].

In contrast to 2010, the role of strategic alliances, but especially R&D financed by abroad, has increased. High-tech and medium-tech production is mainly supported by in-house R&D, and high-tech exports are positively associated with R&D financed by firms. Moreover, in 2020, the role, albeit still modest, of mobile technologies is being felt, which is positively associated with cooperation through JVs and strategic alliances.

Up to this point, our assessments have predominantly focused on the macro-economic perspective of country/firm level innovation processes through the use of disruptive technologies. In the following sections of the study we aim to focus the analysis on the same topic from a microeconomic perspective, i.e. with reference to the realities in different categories of firms (especially MNCs). In the innovative sense, we then aim to "intersect" the two perspectives of analysis in order to reach some clearer conclusions on the role/importance of disruptive/digital technologies in the case of financial innovations made by firms.

New entrant

New entrant  Returned. Source: BCG Most Innovative Companies (MIC) Report 2022; the full version of the ranking and our assessment can be found in Appendix 1. Note: Industry classification based on Capital IQ; some companies play across industries. 1Facebook became Meta in 2021; in previous BCG Most Innovative Companies reports, it appeared under the name Facebook.

Returned. Source: BCG Most Innovative Companies (MIC) Report 2022; the full version of the ranking and our assessment can be found in Appendix 1. Note: Industry classification based on Capital IQ; some companies play across industries. 1Facebook became Meta in 2021; in previous BCG Most Innovative Companies reports, it appeared under the name Facebook.