Submitted:

04 May 2023

Posted:

05 May 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Literature Review

2.1. Halal Tourism Concept

2.2. Financial Literacy and Marketing Communication

2.3. Islamic Financial Inclusion and Business Performance

2.4. Previous Studies and Hypothesis Development

3. Method

3.1. Information

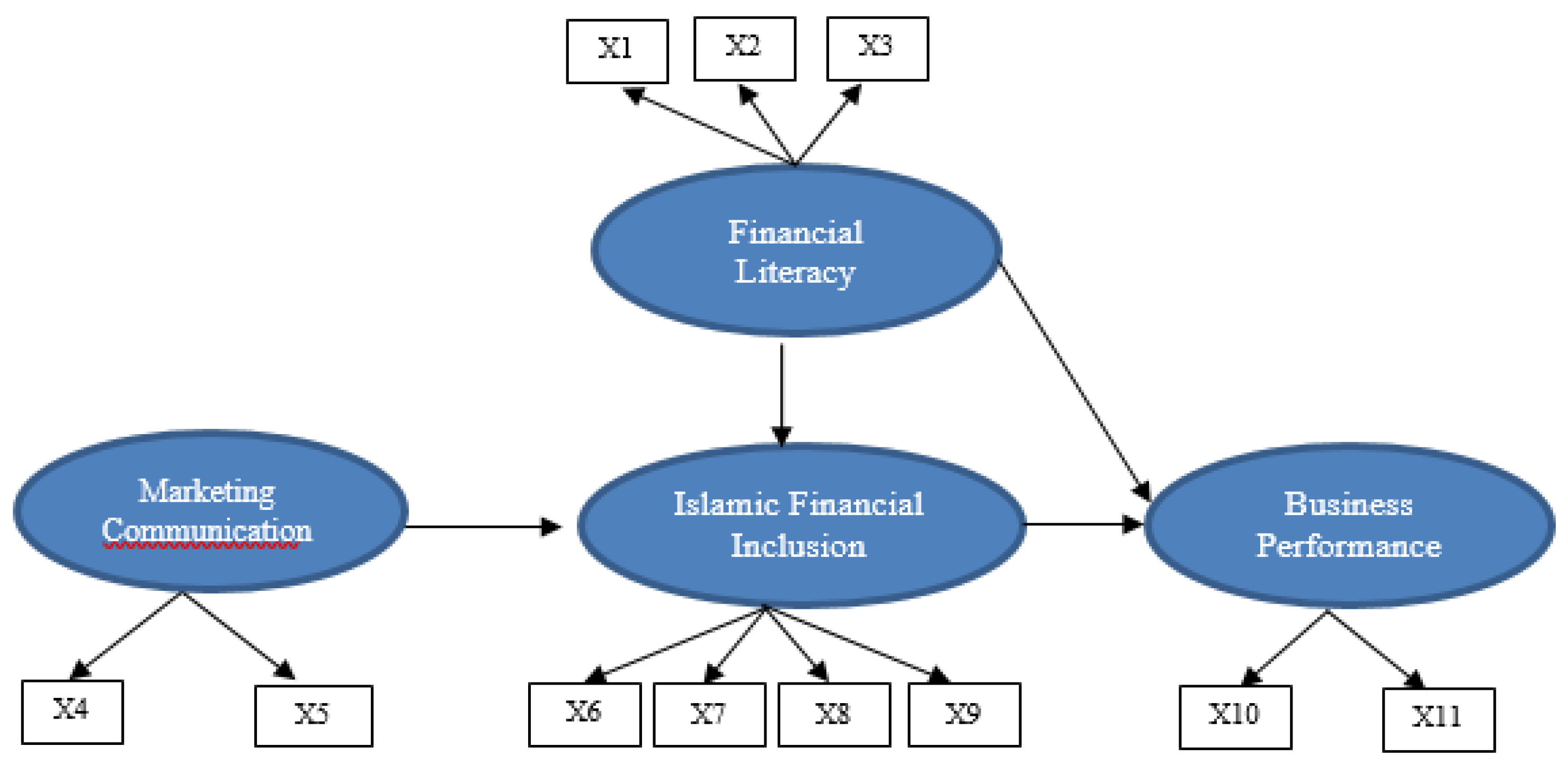

3.2. Empirical Model

3.3. Information

| No | The goodness of Fit Model Category | Criteria |

| 1 | Chi-Square | Small is better |

| 2 | Probability | > 0.05 |

| 3 | Goodness of Fit Index (GFI) | > 0.90 |

| 4 | Average of Goodness of Fit Index (AGFI) | Usually below of GFI |

| 5 | Root Mean Square Errors of Approximation (RSMEA) | < 0.08 |

4. Results

4.1. Respondent Profile

4.2. SEM Evaluation

4.2.1. Descriptive Statistic

| No | Descriptions | Total | Percentage |

| 1 | Gender | ||

|

87 65 |

57.24 42.76 |

|

| 2 | Education | ||

|

27 44 81 |

17.76 28.95 53.29 |

|

| 3 | Age | ||

|

51 44 53 4 |

33.55 28.95 34.87 02.63 |

|

| 4 | Business Type | ||

|

29 85 12 6 20 |

19.08 55.92 07.89 03.95 13.16 |

|

| 5 | Business Sales Per Years | ||

|

104 35 13 |

68.42 23.03 08.55 |

|

| 6 | Number of Employees | ||

|

127 19 6 |

83.55 12.50 03.95 |

| Variabel | Mean | St.Dev | Min | Max | Skewness & Curtosis | |

| Chi-Square | P-Value | |||||

| X1 | 3.339 | 0.709 | 1.340 | 5.074 | 0.662 | 0.718 |

| X2 | 3.289 | 0.657 | 20001 | 5.169 | 0.081 | 0.961 |

| X3 | 3.250 | 0.702 | 1983 | 5.034 | 0.086 | 0.958 |

| X4 | 2,947 | 0.744 | 0.994 | 5.018 | 0.360 | 0.835 |

| X5 | 3.151 | 0.735 | 0.912 | 5.204 | 0.117 | 0.943 |

| X6 | 3.645 | 0.694 | 1.476 | 5.185 | 2,797 | 0.247 |

| X7 | 3.566 | 0.851 | 1.012 | 4.977 | 0.284 | 0.868 |

| X8 | 3.395 | 0.862 | 1.399 | 5.154 | 0.085 | 0.958 |

| X9 | 3.395 | 0.870 | 1.252 | 5.118 | 0.181 | 0.914 |

| X10 | 3,599 | 0.730 | 1.366 | 5.083 | 0.534 | 0.766 |

| X11 | 3.447 | 0.717 | 1.414 | 5.022 | 0.584 | 0.747 |

| Variables | Financial Inclusion | Business Performan | Financial Literacy | Marketing Comm |

| Financial Inclusion | 1.00 | |||

| Business Perform | 0.90 | 1.00 | ||

| Financial Literacy | 0.78 | 0.78 | 1.00 | |

| Marketing Comm | 0.64 | 0.63 | 0.79 | 1.00 |

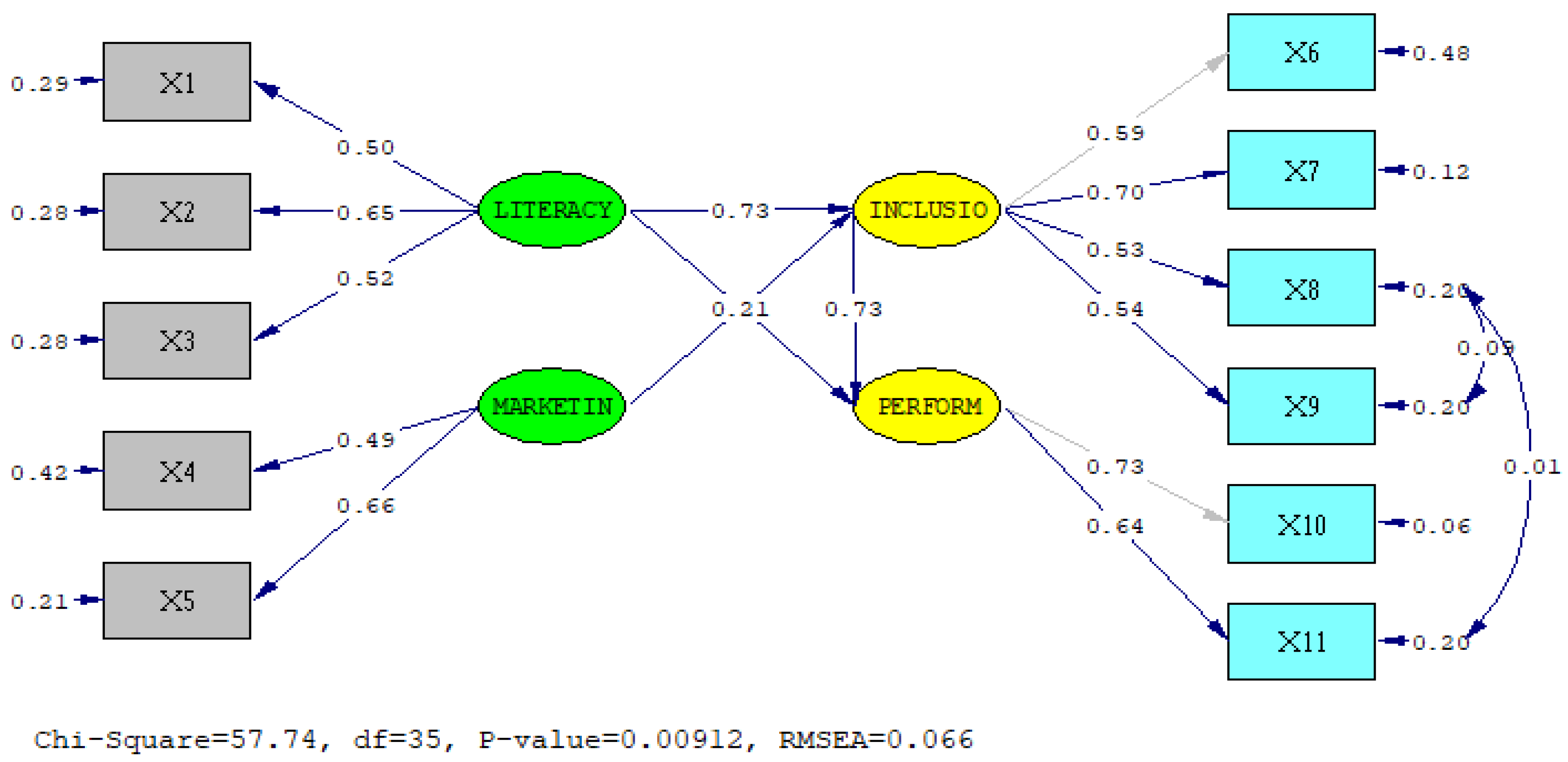

| Variables | Loading Factor | Cronbach Alpha | Composite Alpha | Variance Explained |

| X1 | 0.50 | 0.926 | 46.430 | |

| X2 | 0.66 | 0.919 | 44.906 | |

| X3 | 0.52 | 0.921 | 45.070 | |

| X4 | 0.50 | 0.927 | 46.912 | |

| X5 | 0.65 | 0.922 | 9.26 | 45.127 |

| X6 | 0.60 | 0.928 | 47.209 | |

| X7 | 0.70 | 0.917 | 42.490 | |

| X8 | 0.53 | 0.924 | 44.197 | |

| X9 | 0.54 | 0.915 | 41.992 | |

| X10 | 0.73 | 0.917 | 43.834 | |

| X11 | 0.64 | 0.921 | 44.877 |

| Categoty | Criteria | Result | Remarks |

| Chi-Square | Small is better | 56.42 | FIT |

| Profitabiliy | >0.05 | 0.01 | Marginal FIT |

| GFI | >0.90 | 0.94 | FIT |

| AGFI | Below GFI | 0.88 | FIT |

| RSMEA | <0.08 | 0.06 | FIT |

4.2.2. Correlation Matrix of Laten Variables

4.2.3. Structural Model evaluation

5. Discussions

6. Conclusion and Recommendations

6.1. Conclusion

6.2. Recommendations

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Global Economic Impact & Trend 2020. World Travel and Tourism Council. 2020. Retrived from : Global Economic Impact Trends 2020.pdf (wttc.org).

- Travel and Tourism Economic Impact on 2022. World Travel and Tourism Council. 2022. Retrived from : EIR2022-Global Trends.pdf (wttc.org).

- BPS. (2020). The Number of Tourist Visits to Indonesia in December 2019 Reached 1.38 Visits. Retrived from: https://www.bps.go.id/pressrelease/2020/02/03/1711/sum-kunjungan-wisman-ke-indonesia-desember-2019-menreach-1-38-juta-kunjungan-.html. 20 December.

- Mardianto, M. F. F., Cahyono, E. F., Syarifah, L., & Andriani, P. (2019). Prediction of the Number of Foreign Tourist Arrival in Indonesia Halal Tourism Entrance using Simultaneously Fourier Series Estimator. KnE Social Sciences, 1093–1104-1093–1104.

- Zaki, I., Hamida, G., & Cahyono, E. F. (2020). POTENTIALS OF IMPLEMENTATION OF SHARIA PRINCIPLES IN THE TOURISM SECTOR OF BATU CITY, EAST JAVA. Amwaluna: Jurnal Ekonomi dan Keuangan Syariah, 4(1), 96-111.

- Global Muslim Travel Index. (2019). Mastercard-Crescentating (GMTI). Bukit Merah Central : Crescentrating Company. C: Central.

- Antara. Indoesian Named as the Wolrd’s Best Halal Tourist Destination. 2019. Retrived from Indonesia named as the world's best halal tourist destination - ANTARA News.

- Pikiran Rakyat. (2017). Ekonomi Kreatif Intangible Sulit Akses Perbankan. https://www.pikiran-rakyat.com/ekonomi/pr-01286464/ekonomi-kreatif-intangible-sulit-akses-perbankan-410021. Access date : th, 2020. 11 August.

- Camara, N. and Tuesta, D. (2017). Measuring Financial Inclusion: A Multidimensional Index . Bank of Morocco – CEMLA –IFC Satellite Seminar of The ISI World Statistics Congress on Financial Inclusion. Morocco : Marrakech.

- Abubakar, H.A. (2015), "Entrepreneurship development and financial literacy in Africa", World Journal of Entrepreneurship, Management and Sustainable Development, Vol. 11 No. 4, pp. 281-294. [CrossRef]

- BADULESCU D, GIURGIU A, ISTUDOR N, BADULESCU A. Rural tourism development and financing in Romania: A supply-side analysis. Agric. Econ. - Czech. 2015, 61, 72-8. [CrossRef]

- Alinea. Kontribusi Sektor Pariwisata Terhadap PDB Tahun 2017 – 2021. 2022. Retrived from Kontribusi sektor pariwisata terhadap PDB 2017-2021 - Grafik Alinea ID.

- Ali, M.M., Devi, A., Furqani, H. and Hamzah, H. (2020), "Islamic financial inclusion determinants in Indonesia: an ANP approach", International Journal of Islamic and Middle Eastern Finance and Management, Vol. 13 No. 4, pp. 727-747. [CrossRef]

- JANAH, M. (2021). MINAT USAHA MIKRO KECIL MENENGAH PASAR BAWAH UNTUK MELAKUKAN PEMBIAYAAN BERBASIS KONVENSIONAL DAN BERBASIS SYARIAH (Doctoral dissertation, Universitas Islam Negeri Sultan Syarif Kasim Riau).

- Trianto, B., Rahmayati, R., Yuliaty, T., & Sabiu, T. T. (2021). Determinant factor of Islamic financial inclusiveness at MSMEs: Evidence from Pekanbaru, Indonesia. Jurnal Ekonomi & Keuangan Islam, 7(2), 105–122. [CrossRef]

- Hoque, M.E., Nik Hashim, N.M.H. and Azmi, M.H.B. (2018), "Moderating effects of marketing communication and financial consideration on customer attitude and intention to purchase Islamic banking products: A conceptual framework", Journal of Islamic Marketing, Vol. 9 No. 4, pp. 799-822. [CrossRef]

- Devi, A., & Firmansyah, I. (2019). DEVELOPING HALAL TRAVEL AND HALAL TOURISM TO PROMOTE ECONOMIC GROWTH: A CONFIRMATORY ANALYSIS. Journal of Islamic Monetary Economics and Finance, 5(1), 193-214. [CrossRef]

- Zamani-Farahani, H. and Henderson, JC (20 10 ). Islamic Tourism and Managing Tourism Development in Islamic Societies: The Case of Iran and Saudi Arabia. International Journal of Tourism Research, 12, 79-89. [CrossRef]

- Jaelani, A. (2017). Halal Tourism Industry in Indonesia: Pontential and Prospects. Munich Personal RePEc , 76235.

- Chianeh, R.H., Kian, B. and Azgoomi, S.K.R. (2019), "Islamic and Halal Tourism in Iran", Experiencing Persian Heritage (Bridging Tourism Theory and Practice, Vol. 10), Emerald Publishing Limited, Bingley, pp. 295-307. [CrossRef]

- Mohsin, A., Ramli, N., & Alkhulayfi, B. A. (2016). Halal tourism: Emerging opportunities. Tourism Management Perspectives, 19, 137–143. [CrossRef]

- Battour, M., & Ismail, M. N. (2016). Halal tourism: Concepts, practises, challenges and future. Tourism Management Perspectives, 19, 150–154. https://doi.org/10.1016/j.tmp.2015.12.008Rahman, R. F. (2021). PENGARUH BRAND IMAGE BANK SYARIAH TERHADAP MINAT PINJAMAN MODAL UMKM (Studi Kasus Pada Bank Kal-Sel Syariah Kota Banjarmasin) (Doctoral dissertation, Universitas Islam Kalimantan MAB). [CrossRef]

- El-Gohary, H. (2016). Halal tourism, is it really Halal? Tourism Management Perspectives, 19, 124–130. [CrossRef]

- Din, K. H. (1989). Islam and tourism. Annals of Tourism Research, 16(4), 542–563. [CrossRef]

- Republika. (2019). People Still Misunderstand the Definition of Halal Tourism. Retrieved https://www.republika.co.id/berita/gaya-Life/travelling/19/03/25/pox1lw459- Masyarakat-masih-salah-paham-pengertian-wisata-halal.

- Wuryasti. F. (2013). Halal Tourism, a New Concept of Tourism Activities in Indonesia. Retrieved from https://travel.detik.com/travel-news/d-2399509/wisata-halal-concept-baru-activity-wisata-di-indonesia.

- Jafari, J.Y., & Scott, N. (2014). Muslim world and its tourisms. Annals of Tourism Research, 44, 1-19. [CrossRef]

- Carboni, M., Parelli, C . and Sistu, G. (2014). Is Islamic Tourism a Viable Option for Tunisian Tourism ? Insight from Djerba. Tourism Management Perspectives, Vol.11, pp.1-9. 1–9.

- Bogan, E. and Sarusik, M. (2018). Halal Tourism : Conceptual and Practical Challenges. Journal of Islamic Marketing.

- Khan, F. and Callanan, M. (2017). The “Halilification” of Tourism. Journal of Islamic Marketing, Vol.8, No.4, pp.558 0 577. .4.

- Etzkowitz, H. and Leydesdorff, L . (1995). Triple Helix - University Industry Government Relations: A Laboratory for Knowledge Based Economy . Development. EASST Review 14 .

- Bisnis. (2016). Minister of Tourism Emphasizes Penta Helix Collaboration. Here’s the explanation. https://ekonomi.bisnis.com/read/20160725/12/568877/menteri-pariwisata-tekankan-kolaborasi-penta-helix.-begini-pencepatan . Access Date: 1 st November 2020. 20 November.

- OECD INFE. ( 2011 ). Measuring Financial Literacy: Questionaire and Guidance Notes For Conducting an Internationally Comparable Survey of Financial Literacy. International Network on Financial Education, Paris.

- OJK. (2017). Indonesian Financial Literacy National Strategy (Revisit). Available at : https://www.ojk.go.id/id/berita-dan-activities/publikasi/Documents/Pages/Strategi-Nasional-Literasi-Keuangan-Indonesia-(Revisit-2017)-/SNLKI%20( Revisit%202017)-new.pdf. Access date, 28 June 2020.

- Pond, C. (2008 ). Financial Capability Strategy. OECD-US Treasury International Conference on Financial Education. Taking Financial Literacy to the Next Level : Important Challenges and Promising Solutions . Volume I. US Treasury Department and OECD.

- Van Rooij, M., Lusardi, A. and Alessie, R. (2007). Financial Literacy and Stock Market Participation. Available at : https://www.dartmouth.edu/~alusardi/Papers/Literacy_StockMarket.pdf . Access date : 29 June 2020. 29 June.

- Lusardi, A. and Mitchell, OS (2014). The Economic Importance of Financial Literacy: Theory and Evidence. Journal of Economic Literature , 52(1), 5-44.

- Bongomin, GOC, Munene, JC, Ntayi, JM and Malinga, CA (2018). Nexus between financial Literacy and financial inclusion . Examining the moderating role of cognition from a developing country perspective. International journal of bank marketing.

- Bongomin, GOC, Ntayi, JM and Malinga, CA (2020). Analyzing the relationship between financial Literacy and financial inclusion by microfinance in developing countries: social network theoretical approach. International Journal of Sociology and Social Policy.

- Bongomin, GOC, Ntayi, JM, Munene, JC and Malinga, CA (2017). The Relationship Between Access to Finance and Growth of SMEs in Developing Economies : Financial Literacy as a Moderator. Review of International Business and Strategy, Vol. 27, No.4, pp.520 – 538.

- Walsh, S., Gilmore, A. and Carson, D. (2004). Managing and Implementing Simultaneous Transaction and Relationship Marketing. International Journal of Bank Marketing , Vol. 22 , No. 7, pp. 468-83. 7.

- Eisingerich, AB and Bell, SJ (2006). Relationship Marketing in the Financial Services Industry: The Importance of Customer Education, Participation and Problem Management for Customer Loyalty. Journal of Financial Services Marketing , Vol. 10 No. 4, pp. 86-97.

- Laverin, A. and Liljander, V. (2006). Does Relationship Marketing Improve Customer Relationship Satisfaction and Loyalty?. International Journal of Bank Marketing , Vol.24, No.4, pp. 232 – 251. .4.

- El-Deeb, MS, Halim, YT and Kamel, EM (2021). The pillars determining financial inclusion of SMEs in Egypt: Service awareness , access and usage metrics and macroeconomic policies. Future Business Journal, 7(32).

- Rangarajan, C. (2008). Report of The Committee on Financial Inclusion.

- Puspitasasi, S., Mahri, AJW and Utami, SA (2020). Sharia Financial Inclusion Index in Indonesia 2015 – 2018. Amwaluna : Journal of Islamic Economics and Finance, Vol.4, No.1.

- Kalunda, E. (2013). Financial Inclusion Impact on Small-Scale Tea Farmers in Pain County, Kenya. Proceedings of the 6th International Business and Social Sciences Research Conference , 3 – 4 January. Dubai: UAE. U: Dubai.

- Ajide, FM (2019). Financial Inclusion in Africa : Does it Promote Entrepreneurship ?. Journal of Financial Economic Policy.

- Neely, A. , Gregory, MJ and Platts, K. (1995). Performance measurement system design: a literature review and research agenda . International Journal of Operations & Production Management , Vol. 15 No. 4, pp. 80-116. 4.

- Kaplan , RS and Norton, DP (1996). Linking the balanced scorecard to strategy (reprinted from the balanced scorecard). California Management Review , Vol. 39 No. 1, pp. 53-79.

- Trianto, B., Barus, E.E. and Sabiu, T.T. (2021). Relationship between Islamic financial Literacy, Islamic financial inlusion and business performance : Evidence from culinary cluster of creative economy.

- Sanistasya, P.A, Rahardjo, K. and Iqbal, M. (2019). The Effect of Financial Literacy and Financial Inclusion on Small Entreprises Performance in Kaliimantan. Jurnal Economia, Vol15, No.1, 48 – 59.

- Sherril,. GW, Kennedy, H., Cheese, J. And Rushton, A. (1990). Maximizing Marketing Effectiveness. Management Decisions, Vol.8, Iss 2. Emerald Backfiles 2007.

- Cheese, J., Day, A. and Wills, G. (1988). Handbook of Marketing and Selling Bank Services. International Journal of Bank Marketing, Vol.6, Iss 3, pp.3 – 186. Emerald Backfiles 2007. 2007; 3.

- Payne, A. and Frow, P. (2017). Relationship Marketing : Looking Backwards Towards Future. Journal of Services Marketing , 31/1, 11 – 15.

- Wahyuni, S. (2012). Moslem Community Behavior in The Conduct of Islamic Bank: The Moderation Role of Knowledge and Pricing. International Conference on Asia Pacific Business Innovation and Technology Management. Procedia : Social and Behavioral Science 59 : 290-298. [CrossRef]

- Hair, J. F., Hult, G. T. M., Ringle, C. M., and Sarstedt, M. (2014). A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM). 2nd Ed. Thousand Oaks, CA: Sage.

- Hair, J.F., Black, W., Babin, B., Anderson, R., & Tatham, R. (2006). Multivariate Data Analysis (6th ed.). Upper Saddle River, NJ : Pearson Prentice Hall.

- Raji, RA, Rashid, S. and Ihhak, S. (2019). The Mediating Effect of Brand Image on The Relationship between Social Media Advertisemnet, Sales Promotion Content and Behavioral Intention. Journal of Research in Interactive Marketing , Vol. 13, No. 3, pp.302 – 330.

- Manisha. (2017). Marketing Communication as a pivotal strategy for banking sector – A study literarute. International journal of Engineering Research & Technology.

- Tantisaowaphap, K. (2001). Measuring effectivenees of integrated marketing communications program in services business. Thesis, Mass communication industrial techno,ogy : consumer behaviour. Bangkok : Chulalongkorn University.

- Mehta, S. (2001). Personal selling – a strategy for promoting banking marketing. State Bank of Indian, Monthly review.

| Variables | Financial Inclusion | Business Performan | Financial Literacy | Marketing Comm |

| Financial Inclusion | 1.00 | |||

| Business Perform | 0.90 | 1.00 | ||

| Financial Literacy | 0.78 | 0.78 | 1.00 | |

| Marketing Comm | 0.64 | 0.63 | 0.79 | 1.00 |

| Relationships | Path Coefficients | ||

| Estimate | SE | CR | |

| Marketing Communication on Financial Inclusion | 0.06 | 0.18 | 0.36 |

| Financial Literacy on Financial Inclusion | 0.73 | 0.19 | 3.83* |

| Financial Literacy on Business Performance | 0.21 | 0.11 | 1.90 |

| Financial Inclusion on Business Performance | 0.73 | 0.13 | 5.67* |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).