Submitted:

03 May 2023

Posted:

04 May 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

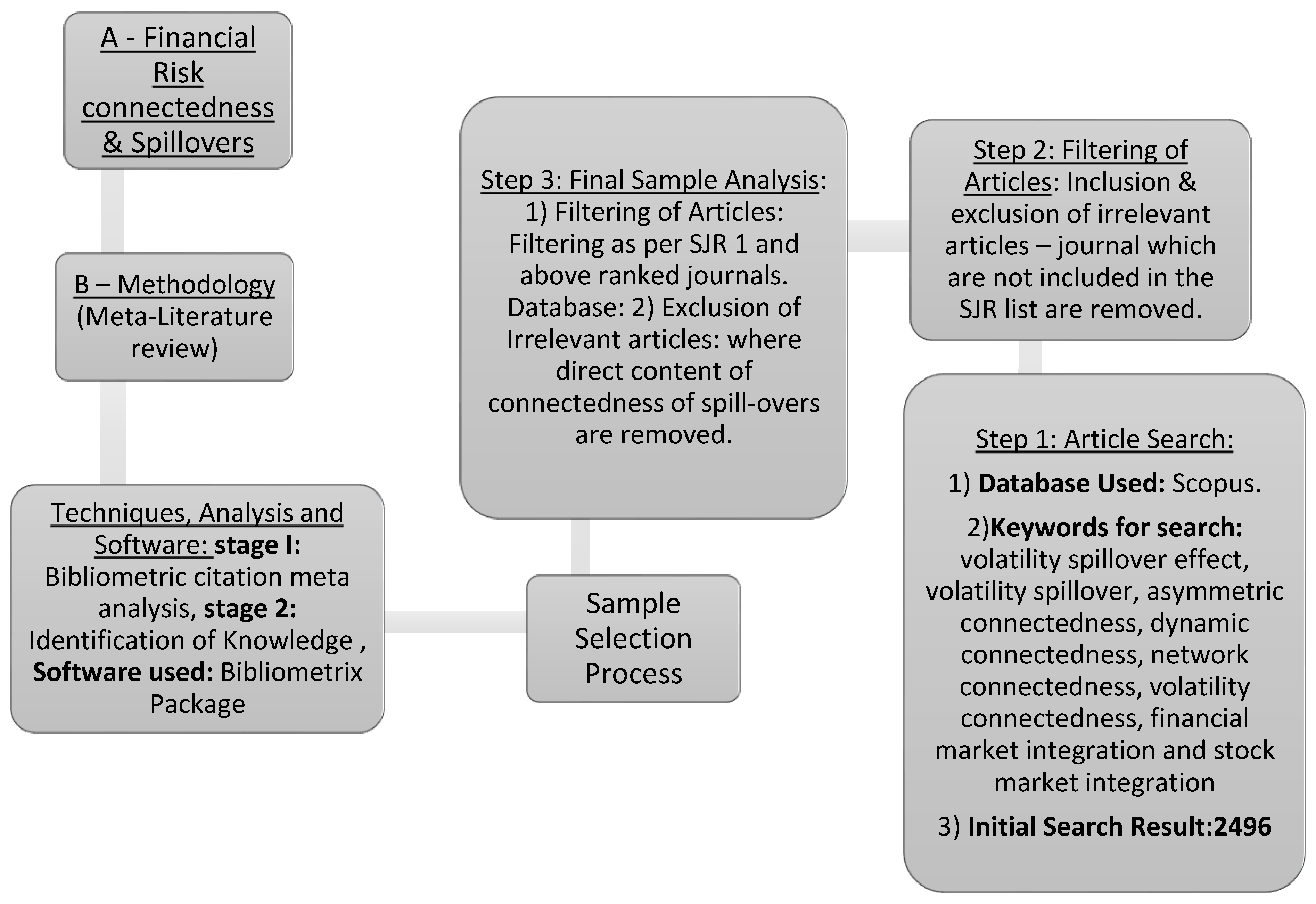

2. Methodology

2.1. Data Collection & Sample selection process

2.2. Data Analysis & Visualization

2.2.1. Meta-literature review

2.2.2. Co-citation analysis:

2.2.3. Co-authorship analysis:

2.2.4. Co-word analysis:

2.2.5. Word trend and thematic analysis:

2.2.6. Content analysis:

3. Identification of significant aspects of Connectedness and Spillover literature

3.1. Most studied countries

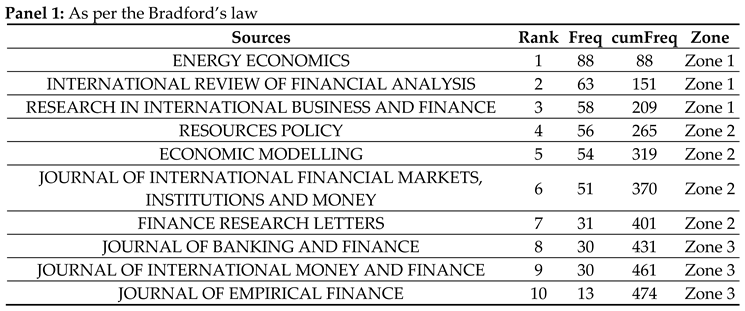

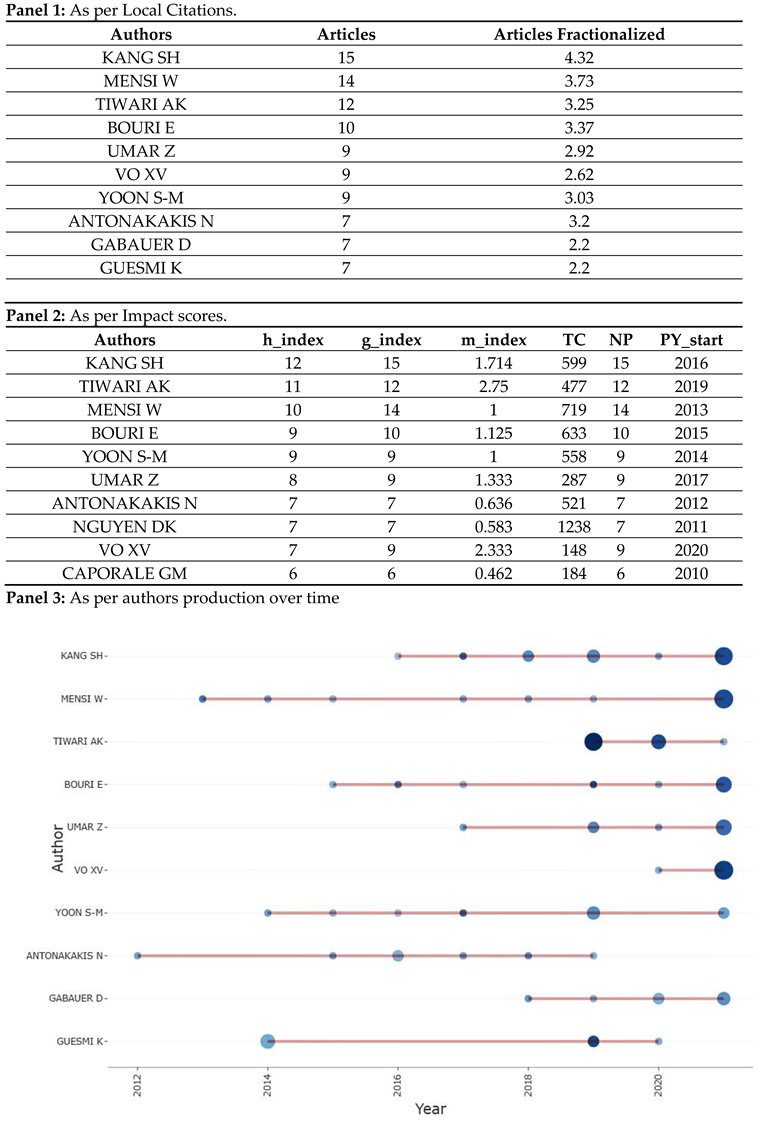

3.2. Most influential journal

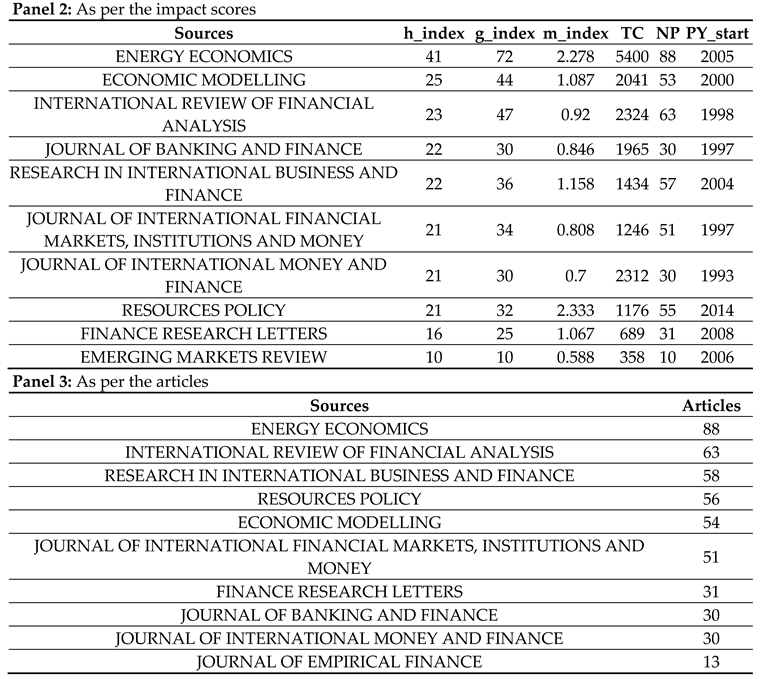

3.3. Influential authors and articles

4. Citation analysis and visualization

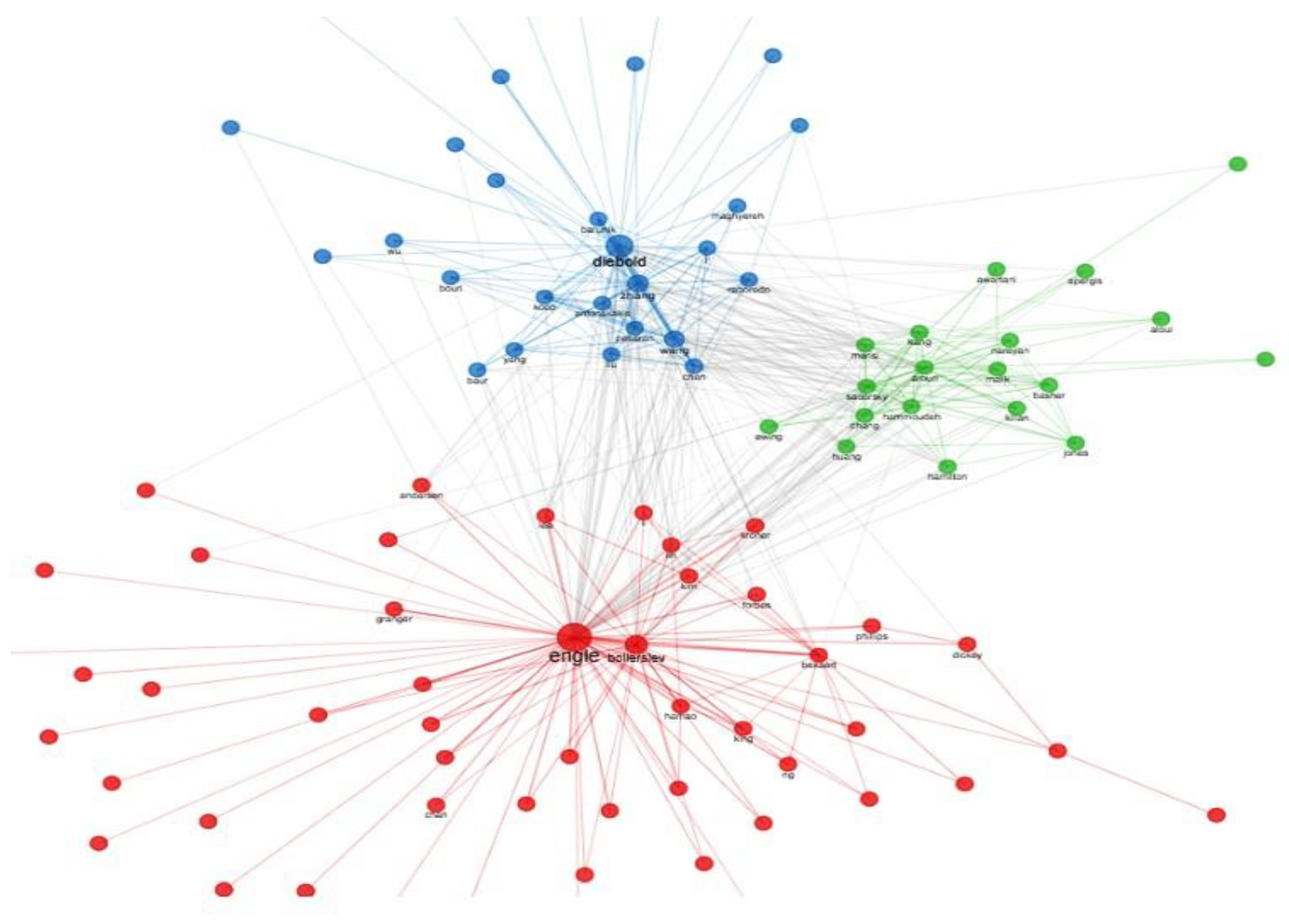

4.1. Co-citation mapping

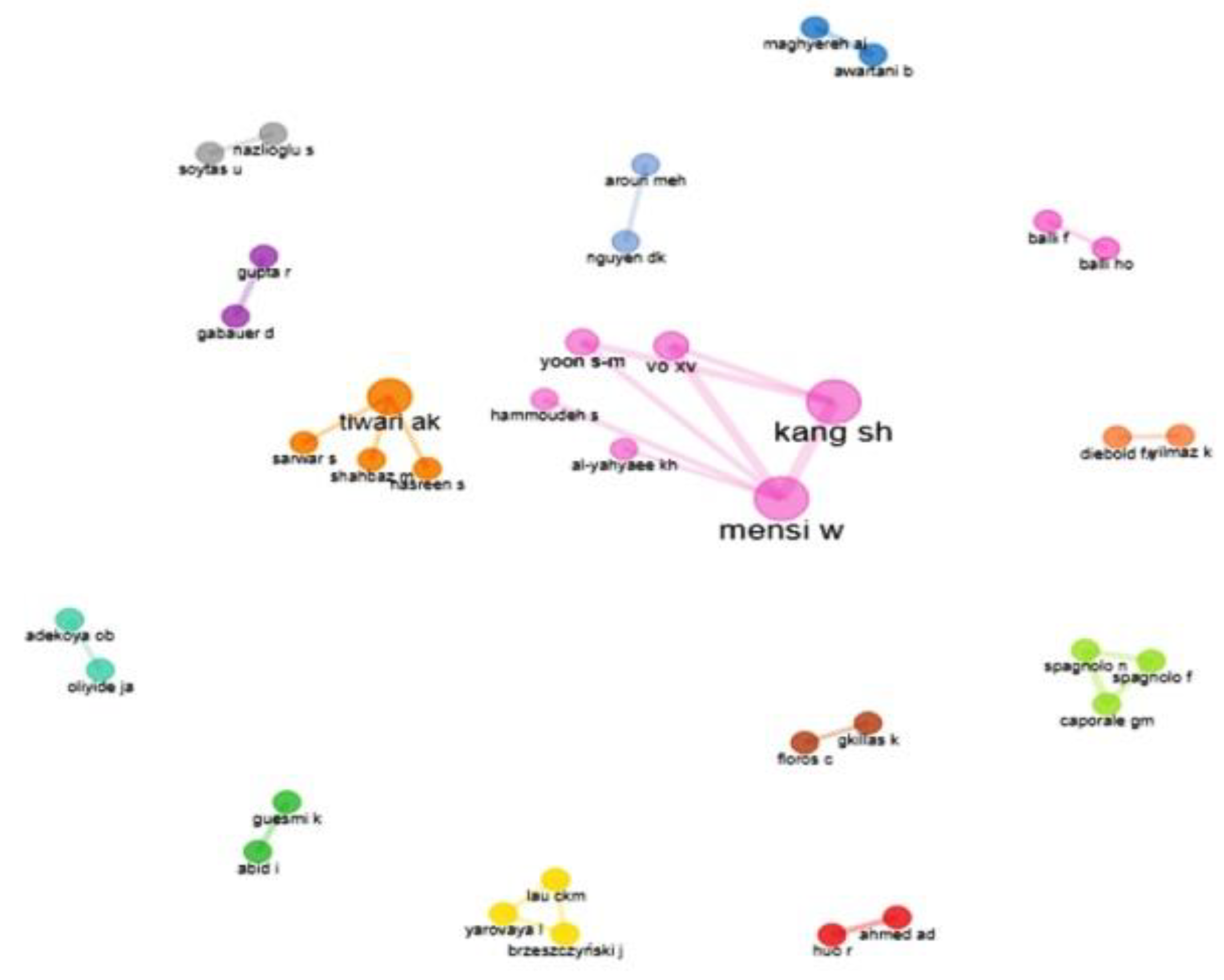

4.2. Co-authorship visualization:

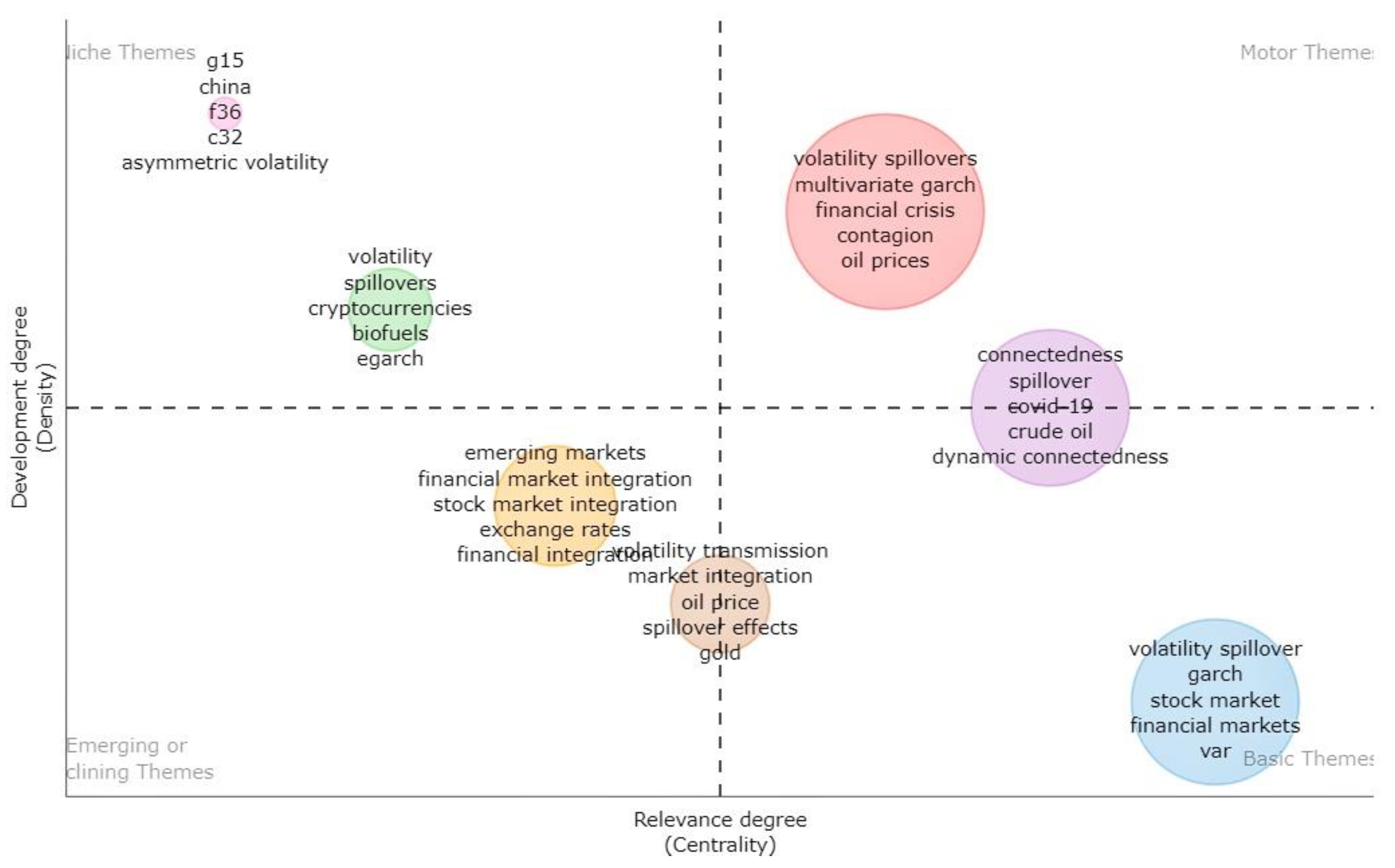

4.3. Co-word and Thematic analysis

5. Content Analysis of the four clusters:

5.1. Asymmetries in market connectedness:

5.2. Macro factors impact on market connectedness and spillovers:

5.3. Role of Oil in the Market spillovers and hedging:

5.4. Dynamic Cross-markets connectedness and spillover:

6. Discussions & Future Directions:

6.1. Asymmetries in the market connectedness and spillover:

6.2. Macro factor influence on the market connectedness and spillover:

6.3. Role of Oil in market spillovers and hedging portfolios:

6.4. Dynamic Cross market connectedness and spillovers:

7. Conclusions

Appendix

| Authors (Year) | Type of paper (empirical or qualitative) | Title of Study | Objective/research question | Methods (technique/sample of study/data questions | Main Findings |

|---|---|---|---|---|---|

|

Empirical | Volatility spillovers in east Asian financial markets: A mem-based approach | Volatility spillover during Asian Currency Crisis | MEM-GARCH | Hong Kong was a major transmitter and build-up of volatility transmission during the currency crises in 1997 but few in the 9/11 attack. |

|

Empirical | Bear squeezes, volatility spillovers and speculative attacks in the hyperinflation 1920s foreign exchange | Co-movements between exchange rates during 1920 and their behaviour to present exchange rate connectedness | QMLE and Robust Wald test for causality, 7 Country 162 Weekly exchange rates | Even though there is a significant relationship during events, there is no clear evidence of transmission between exchange rates. |

|

Empirical | On the global financial market integration "swoosh" and the trilemma | Analyzing the pattern in Financial Market Integration | Factor Model and CAPM 17 country's 1554 monthly equity portfolio of 1885-2014 | There is no significant regional cointegration, but the cointegration among countries follows a swoosh pattern as opposed to the previous findings. |

|

Empirical | Oil price fluctuation, volatility spillover and the Ghanaian equity market: Implication for portfolio management and hedging effectiveness | Hedging and portfolio diversification during oil shocks in west Africa and Nigeria stocks | VAR-GARHC, VAR-AGARCH &DCC-GARCH,574 weekly Ghana stock, oil from 2000-2010 | There is significant volatility spillover between oil and the two stock markets, and the information shocks intensified the spillovers and predictability. |

|

Empirical | Evolution of international stock and bond market integration: Influence of the European Monetary Union | EMU influence on stock-bond integration | EGARCH, PCA&GLS, the eurozone and non-eurozone total of seven countries of 1994-2003. | The introduction of EMU impacted the eurozone stock-bond co-movement but not the non-euro countries; it led to a flight to quality phenomena. |

|

Empirical | Dependence Structure between Oil Prices, Exchange Rates, and Interest Rates | What is the co-movement nature of the oil, exchange rate and U.S. interest rate | TGARCH and Asymmetric ARCH, APRCH and Copula, weekly data 1998-2017 | There is a negative relationship between oil and the U.S. interest rate; Oil fluctuations are transported to the Exchange rate of oil exporting countries. |

|

Empirical | Exogenous shocks and the spillover effects between uncertainty and oil price | Examining the information spillover between oil and stock pre- and post-GFC | Bi-variable EGARCH, VIX, ted spread, S&P 500 index and gold future oil price as exogenous shocks, daily data of 2004-2014 | There was no information transmission between the oil and stock pre crises, but it became significant after the crises, and the exogenous shocks intensified the transmission. |

|

Empirical | Analyzing the time-frequency connectedness among oil, gold prices and BRICS geopolitical risks | Examining the interaction between Oil, BRICS, Gold and Geopolitical risk index. | Asymmetric Frequency Index, 2000-2019, Gold, Geopolitical risk index, BRICS risk index and Oil price. | There is a clear presence of spillover among the variables. |

|

Empirical | Asymmetric volatility connectedness on the forex market | Do Asymmetries exist in the volatility of the Currency market, and if they do, what is their uniformity | BK (2016) &DY (2012) &SAM | GFC triggers good volatility spillover, and JPY is the receiver mainly, and macro variables play their Role in monetary policies and bank interventions. |

|

Empirical | Oil volatility shocks and the stock markets of oil-importing MENA economies: A tale from the financial crisis | AVS between oil and MENA countries (Jordan and Lebanon Stock markets) | L.M. test & ARMAX-GARCH | Oil volatility impacts Jordan's stock post-GFC, whereas oil volatility does not predict Lebanon's volatility. There is a heterogeneity in the comparison between Tunisia and Morocco (small & heavy oil importing countries). |

|

Empirical | Volatility transmission from commodity markets to sovereign CDS spreads in emerging and frontier countries | AVS from Commodity to Sovereign CDS, sector-wise, country-wise analysis | L.M. test & AR-GARCH | 10 out of 17 emergings, four frontier markets are affected by commodity price volatility, whereas the energy and precious metals sectors are large contributors. |

|

Empirical | Extreme spillovers across Asian-Pacific currencies: A quantile-based analysis | AVS between Asian Currency markets | Quantile based VAR | Return spillovers vary between periods of appreciation and depreciation and extreme events. |

|

Empirical | Spillovers in higher moments and jumps across U.S. stock and strategic commodity markets | AVS in the Higher moment and jumps between | TVP-VAR, GIRF & GFEVD | U.S. (RV&RK), Oil (R.S. & jumps) main transmitter, and Gold is the primary receiver. |

|

Empirical | Does feedback trading drive returns of cross-listed shares? | Analyze feedback and information volatility spillover among cross-listed shares, whether the same market segmentation information gives volatility of the same stock and how exogenous shocks affect the price discovery | Feedback Model- VAR, VECM, VAR-MV-GARCH | Cross-listed shares have long-run co-movements and bi-directional causations; a dynamic exists between volatility and liquidity. |

|

Empirical | Realized volatility connectedness among Bitcoin exchange markets | To determine the integration degree of the crypto market | Realized Volatility, FEVD, D.Y. Connectedness | Coinbase is the most influential exchange, although not in the top 3 in trading volume, and Binance is the no1 in terms of trading volume but not influential. |

|

Empirical | Dynamic connectedness and integration in cryptocurrency markets | Return Connectedness and Volatility spillover between six Cryptocurrencies | FEVD, D.Y. Connectedness | The largest net Transmitter is Bitcoin and Receivers are Ethereum and Dash. A negative Return is more potent than a positive, Dynamically, Bitcoin moved from net transmitter to net receiver, and Trading volume might be a significant determinant given that return and trading volume have linkages. |

|

Empirical | Macro factors and the realized volatility of commodities: A dynamic network analysis | Analyzing Macro Factors' impact on Commodity volatilities | Realized Volatility, FEVD, D.Y. Connectedness | Gold is the net information transmitter, . Gold and Crude Oil show significant time-varying characteristics over macro information; Gold influenced mainly from the sentiment index and volatility index and Crude Oil for default spread and volatility index. |

|

Empirical | Housing market spillovers through the lens of transaction volume: A new spillover index approach | Analyzing the determinants and the pattern of housing information transmission | Directed Cycle Graph (DAG) and Spillover index. Eight Chinese provinces' daily housing index, from Nov 2009 to Feb 2018 | Hierarchy in the cities is the primary determinant and propounds different dynamic information transmissions. The Usage of High and low-frequency results in different daily fluctuations housing sector. |

|

Empirical | Analyzing and forecasting volatility spillovers, asymmetries and hedging in major oil markets | Crude oil price volatility | CCC, VARMA–GARCH, VARMA–AGARCH | Conditional correlation forecasts exhibited both upward trend and downward trends, and optimal portfolio weights suggest holding the light sweet grade category in a more significant proportion than theheavier and less sweet-grade category |

|

Empirical | Dynamic connectedness of oil price shocks and exchange rates | different sources of oil price shocks are connected to the exchange rates of major oil-dependent countries | ARMA, VAR, SVAR | Oil price shocks resulting from changes in demand and risk significantly contribute to variations in exchange rates, while supply shocks have virtually no impact. |

|

Empirical | Dynamic spillover effects among crude oil, precious metal, and agricultural commodity futures markets | spillover effects among six commodity futures markets | multivariate DECO-GARCH, Spillover Index | Hedging strategies depend on market conditions, with a higher value for the hedge ratios during episodes of financial turmoil. |

|

Empirical | Dynamic spillovers among major energy and cereal commodity prices | examining the impacts of three types of OPEC news announcements on the volatility spillovers and persistence | VAR-BEKK-GARCH, VAR-DCC-GARCH | Empirical models are flexible enough to capture the dynamic structure of the return interactions, volatility spillovers, and conditional correlations. |

|

Empirical | Exploring the time-frequency connectedness and network among crude oil and agriculture commodities V1 | frequency domain connectedness between oil and agriculture commodity prices | frequency domain spillover method, D.Y. Spillover Index | vegetable oil prices are net volatility transmitters at any frequency band. |

|

Empirical | Dynamic spillovers between Shanghai and London nonferrous metal futures markets | examines the dynamic return and volatility spillovers between the Shanghai Futures Exchange (SFE) and the London Metal Exchange (LME) | new spillover index of Diebold and Yilmaz | LME nonferrous metal futures have a more significant impact on SFE nonferrous metal futures. |

|

Empirical | Volatility spillovers between oil and equity markets and portfolio risk implications in the U.S. and vulnerable E.U. countries | frequency dynamics of volatility spillovers between Brent crude oil and stock markets in the U.S., Europe, Asia, GIPSI, Ireland, Portugal, Spain and Italy | Methods by Diebold and Yilmaz, and Barunik and Krehlik, AR (1)-FIGARCH | Spillover effect between the oil and the stock markets is conidered time-varying, crisis-sensitive, and frequency-dependent. |

|

Empirical | Return and volatility transmission between world oil prices and stock markets of the GCC countries | return links and volatility transmission between oil and stock markets in the Gulf Cooperation Council (GCC) countries | VAR-GARCH, GCC-GARCH | Oil stock return and volatility linkages could compare their causality across GCC countries and other oil-exporting and oil-importing countries. |

|

Empirical | Risk spillovers and hedging effectiveness between significant commodities and Islamic and conventional GCC banks | dynamic risk spillovers and hedging effectiveness between two important commodity markets (Oil and Gold) | DECO-FIGARCH, spillover index of Diebold and Yilmaz | Gold offers the best hedging effectiveness for UAE, Qatar and Saudi Arabia, which are major oil exporters, while oil provides the highest hedging effectiveness for Bahrain, which is a minor oil producer. |

|

Empirical | Correlations and volatility spillovers between oil prices and the stock prices of clean energy and technology companies | analyze the volatility spillovers between oil prices and the stock prices of clean energy companies and technology companies | MGARCH, BEKK | Stock prices of clean energy companies correlate reasonably highly with the stock prices of technology companies. Portfolio of clean energy stocksand oil futures can be built, and oil futures can be used to hedge aninvestment in clean energy stock prices. |

|

Empirical | Stock market integration of emerging Asian economies: Patterns and causes | patterns and causes of stock market integration of selected emerging Asian nations against the U.S., Australia, China, and India | GARCH-DCC, EGARCH | Monthly correlations were least influenced; six Asian markets were relatively more correlated with the Chinese stock market than those of India, Australia, or the U.S.. |

|

Empirical | Structural breaks, dynamic correlations, asymmetric volatility transmission, and hedging strategies for petroleum prices and USD exchange rate | Influence of structural changes on the asymmetry of volatility spillovers, asset allocation and portfolio diversification between the USD/euro exchange market and each of six major spot petroleum markets, including WTI, Europe Brent, kerosene, gasoline and propane. | Bivariate DCC-EGARCH Model | Volatility spillovers from the petroleum prices to the dollar/euro exchange rate have implications for import inflation and the general price level; portfolio strategies are sensitive to the petroleum-currency nexus. |

|

Empirical | The directional volatility connectedness between crude oil and equity markets: new evidence from implied volatility indexes | directional connectedness between oil and equities in eleven major stock exchanges | VAR, KPSS H-Step | The study exploited newly introduced implied volatility indices and directional connectedness measures to study the risk transfer between the oil market and a group of global equity markets. |

|

Empirical | Volatility spillovers for spot, futures, and ETF prices in agriculture and energy | relationship and the interactions on price and volatility, and on the covolatility spillover effects for agricultural and energy industries | Full BEKK and DCC, | Volatility spillovers exist for all four financial assets in three different markets, though there are some differences in the quantitative results. |

References

- Acedo, F. J., & Casillas, J. C. (2005). Current paradigms in the international management field: An author co-citation analysis. International Business Review, 14(5), 619–639. [CrossRef]

- Alon, I., Anderson, J., Munim, Z. H., & Ho, A. (2018). A review of the internationalization of Chinese enterprises. Asia Pacific Journal of Management, 35(3), 573–605. [CrossRef]

- Apriliyanti, I. D., & Alon, I. (2017). Bibliometric analysis of absorptive capacity. International Business Review, 26(5), 896–907. [CrossRef]

- Aria, M., & Cuccurullo, C. (2017). bibliometrix: An R-tool for comprehensive science mapping analysis. Journal of Informetrics, 11(4), 959–975. [CrossRef]

- Aria, M., Misuraca, M., & Spano, M. (2020). Mapping the Evolution of Social Research and Data Science on 30 Years of Social Indicators Research. Social Indicators Research, 149(3), 803–831. [CrossRef]

- Bajaj, V., Kumar, P., & Singh, V. K. Linkage dynamics of sovereign credit risk and financial markets: A bibliometric analysis. Research in International Business and Finance 2022, 59, 101566. [CrossRef]

- Balcilar, M., Demirer, R., Gupta, R., & Wohar, M. E. (2020). The effect of global and regional stock market shocks on safe haven assets. Structural Change and Economic Dynamics, 54, 297–308. [CrossRef]

- Baruník, J., Kočenda, E., & Vácha, L. (2016a). Asymmetric connectedness on the U.S. stock market: Bad and good volatility spillovers. Journal of Financial Markets, 27, 55–78. [CrossRef]

- Baruník, J., Kočenda, E., & Vácha, L. (2016b). Asymmetric connectedness on the U.S. stock market: Bad and good volatility spillovers. Journal of Financial Markets, 27, 55–78. [CrossRef]

- Baruník, J., Kočenda, E., & Vácha, L. (2017). Asymmetric volatility connectedness on the forex market. Journal of International Money and Finance, 77, 39–56. [CrossRef]

- Baruník, J., & Křehlík, T. (2018a). Measuring the frequency dynamics of financial connectedness and systemic risk. Journal of Financial Econometrics, 16(2), 271–296. [CrossRef]

- Baruník, J., & Křehlík, T. (2018b). Measuring the frequency dynamics of financial connectedness and systemic risk. Journal of Financial Econometrics, 16(2), 271–296. [CrossRef]

- BenSaïda, A. (2019). Good and bad volatility spillovers: An asymmetric connectedness. Journal of Financial Markets, 43, 78–95. [CrossRef]

- Bouri, E. (2015). Oil volatility shocks and the stock markets of oil-importing MENA economies: A tale from the financial crisis. Energy Economics, 51, 590–598. [CrossRef]

- Bouri, E., de Boyrie, M. E., & Pavlova, I. (2017). Volatility transmission from commodity markets to sovereign CDS spreads in emerging and frontier countries. International Review of Financial Analysis, 49, 155–165. [CrossRef]

- Bouri, E., Lucey, B., Saeed, T., & Vo, X. V. (2020). Extreme spillovers across Asian-Pacific currencies: A quantile-based analysis. International Review of Financial Analysis, 72, 101605. [CrossRef]

- Brown, G. Why Are U. S. Stocks More Volatile ? ABSTRACT; LXVII; 2012. [Google Scholar]

- Chang, C. L., McAleer, M., & Tansuchat, R. (2010). Analyzing and forecasting volatility spillovers, asymmetries and hedging in major oil markets. Energy Economics, 32(6), 1445–1455. [CrossRef]

- Chang, E. C., Cheng, J. W., & Pinegar, J. M. (1999). Does futures trading increase stock market volatility? the case of the Nikkei stock index futures markets. Journal of Banking and Finance, 23(5), 727–753. [CrossRef]

- Cobo, M. J., López-Herrera, A. G., Herrera-Viedma, E., & Herrera, F. (2011). An approach for detecting, quantifying, and visualizing the evolution of a research field: A practical application to the Fuzzy Sets Theory field. Journal of Informetrics, 5(1), 146–166. [CrossRef]

- Ederington, L. H., & Guan, W. (2010). How asymmetric is U.S. stock market volatility? Journal of Financial Markets, 13(2), 225–248. [CrossRef]

- Engle, R. F., Ito, T., & Wenlong, L. Metor Shower? Heteroskedastic Intra-Daily Volatility in the Foreign Exchange Market. Econometrica 1990, 58, 525–542.

- Fetscherin, M., & Heinrich, D. (2015). Consumer brand relationships research: A bibliometric citation meta-analysis. Journal of Business Research, 68(2), 380–390. [CrossRef]

- Forbes, K. J., & Rigobon, R. (2002). No contagion, only interdependence: Measuring stock market comovements. Journal of Finance, 57(5), 2223–2261. [CrossRef]

- Hu, M., Zhang, D., Ji, Q., & Wei, L. (2020). Macro factors and the realized volatility of commodities : A dynamic network analysis. Resources Policy, 68(July), 101813. [CrossRef]

- Ji, Q., Bouri, E., Keung, C., Lau, M., & Roubaud, D. Dynamic connectedness and integration in cryptocurrency markets. International Review of Financial Analysis. [CrossRef]

- Ji, Q., Bouri, E., Kristoufek, L., & Lucey, B. (2019). Realised volatility connectedness among Bitcoin exchange markets. Finance Research Letters, 101391. [CrossRef]

- Kang, S. H., McIver, R., & Yoon, S. M. (2017). Dynamic spillover effects among crude oil, precious metal, and agricultural commodity futures markets. Energy Economics, 62, 19–32. [CrossRef]

- Kim, J. M., & Jung, H. (2018). Dependence Structure between Oil Prices, Exchange Rates, and Interest Rates. Energy Journal, 39(2), 233–258. [CrossRef]

- Kim, S., Moshirian, F., & Wu, E. (2006). Evolution of international stock and bond market integration : Influence of the European Monetary Union. 30, 1507–1534. [CrossRef]

- Kumar, S., Pradhan, A. K., Tiwari, A. K., & Kang, S. H. Correlations and volatility spillovers between oil, natural gas, and stock prices in India. Resources Policy 2019, 62, 282–291. [CrossRef]

- Li, H., & Majerowska, E. Testing stock market linkages for Poland and Hungary : A multivariate GARCH approach. Research in International Business and finance 2008, 22, 247–266. [CrossRef]

- Li, L., Yin, L., & Zhou, Y. (2016). Exogenous shocks and the spillover effects between uncertainty and oil price. Energy Economics, 54, 224–234. [CrossRef]

- Li, Y., Huang, J., Gao, W., & Zhang, H. (2021). Analyzing the time-frequency connectedness among oil, gold prices and BRICS geopolitical risks ☆. Resources Policy, 73, 102134. [CrossRef]

- Liu, C., & Yang, H. (2016). Systemic risk in carry-trade portfolios. Finance Research Letters. [CrossRef]

- Liu, L. (2013a). International stock market interdependence: Are developing markets the same as developed markets? Journal of International Financial Markets, Institutions and Money, 26(1), 226–238. [CrossRef]

- Liu, L. (2013b). Journal of International Financial Markets, Institutions & Money International stock market interdependence : Are developing markets the same as developed markets ? “Journal of International Financial Markets, Institutions & Money,” 26, 226–238. [CrossRef]

- Liu, L., Chen, C., & Wan, J. (2013). Is world oil market “ one great pool ” ?: An example from China ’ s and international oil markets. Economic Modelling, 35, 364–373. [CrossRef]

- Maghyereh, A. I., Awartani, B., & Bouri, E. (2016). The directional volatility connectedness between crude oil and equity markets : New evidence from implied volatility indexes. Energy Economics, 57, 78–93. [CrossRef]

- Maghyereh, A. I., Awartani, B., & Tziogkidis, P. (2017). PT CR. [CrossRef]

- Malik, F., & Umar, Z. (2019). Dynamic connectedness of oil price shocks and exchange rates. Energy Economics, 84(xxxx), 104501. [CrossRef]

- Mensi, W., Hammoudeh, S., Nguyen, D. K., & Yoon, S. M. Dynamic spillovers among major energy and cereal commodity prices. Energy Economics 2014, 43, 225–243. [CrossRef]

- Mensi, W., Hammoudeh, S., Vinh, X., & Hoon, S. (2021). Journal of International Financial Markets, Volatility spillovers between oil and equity markets and portfolio risk implications in the US and vulnerable EU countries. Journal of International Financial Markets, Institutions & Money, 75(October), 101457. [CrossRef]

- Mensi, W., Hammoudeh, S., & Yoon, S. (2014). AC NU. Energy Economics. [CrossRef]

- Mokni, K., Hammoudeh, S., Ajmi, A. N., & Youssef, M. (2020). Does economic policy uncertainty drive the dynamic connectedness between oil price shocks and gold price? Resources Policy, 69(July), 101819. [CrossRef]

- Narayan, S., Sriananthakumar, S., & Islam, S. Z. (2014). Stock market integration of emerging Asian economies : Patterns and causes. Economic Modelling, 39, 19–31. [CrossRef]

- Patel, R., Goodell, J. W., Oriani, M. E., Paltrinieri, A., & Yarovaya, L. A bibliometric review of financial market integration literature. International Review of Financial Analysis 2022, 80, 102035. [CrossRef]

- Sanchez-Nunez, P., Cobo, M. J., Heras-Pedrosa, C. D. Las, Pelaez, J. I., & Herrera-Viedma, E. (2020). Opinion Mining, Sentiment Analysis and Emotion Understanding in Advertising: A Bibliometric Analysis. IEEE Access, 8(July), 134563–134576. [CrossRef]

- Snyder, H. (2019). Literature review as a research methodology: An overview and guidelines. Journal of Business Research, 104(July), 333–339. [CrossRef]

- Vieira, E. S., & Gomes, J. A. N. F. (2009). A comparison of Scopus and Web of science for a typical university. Scientometrics, 81(2), 587–600. [CrossRef]

- Wang, Z., Li, Y., & He, F. (2020). Asymmetric volatility spillovers between economic policy uncertainty and stock markets: Evidence from China. Research in International Business and Finance, 53(March). [CrossRef]

- Wu, F. (2019). ur l P re of. International Review of Financial Analysis, 101416. [CrossRef]

- Xu, X., Chen, X., Jia, F., Brown, S., Gong, Y., & Xu, Y. International Journal of Production Economics Supply chain fi nance : A systematic literature review and bibliometric analysis. Intern. Journal of Production Economics 2018, 204, 160–173. [CrossRef]

- Yarovaya, L., Brzeszczyński, J., & Lau, C. K. M. (2016). Intra- and inter-regional return and volatility spillovers across emerging and developed markets: Evidence from stock indices and stock index futures. International Review of Financial Analysis, 43, 96–114. [CrossRef]

- Zamore, S., Ohene Djan, K., Alon, I., & Hobdari, B. (2018). Credit Risk Research: Review and Agenda. Emerging Markets Finance and Trade, 54(4), 811–835. [CrossRef]

| Description | Results |

|---|---|

| Timespan | 1991:2021 |

| Sources (Journals, Books, etc) | 66 |

| Documents | 594 |

| Annual Growth Rate % | 16.14 |

| Document Average Age | 7.41 |

| Average citations per doc | 42.79 |

| References | 23501 |

| DOCUMENT CONTENTS | |

| Keywords Plus (ID) | 1073 |

| Author's Keywords (DE) | 1428 |

| AUTHORS | |

| Authors | 1104 |

| Authors of single-authored docs | 85 |

| AUTHORS COLLABORATION | |

| Single-authored docs | 87 |

| Co-Authors per Doc | 2.63 |

| International co-authorships % | 37.21 |

| DOCUMENT TYPES | |

| article | 585 |

| conference paper | 2 |

| erratum | 2 |

| review | 5 |

| Country | TC | Average Article Citations |

|---|---|---|

| USA | 4483 | 75.98 |

| CHINA | 2579 | 31.07 |

| UNITED KINGDOM | 1604 | 34.13 |

| AUSTRALIA | 1427 | 43.24 |

| FRANCE | 1151 | 46.04 |

| CZECH REPUBLIC | 828 | 118.29 |

| GREECE | 824 | 45.78 |

| KOREA | 769 | 36.62 |

| SPAIN | 725 | 31.52 |

| JAPAN | 591 | 59.1 |

| Document | DOI | Year | Local Citations |

|---|---|---|---|

| DIEBOLD FX, 2009, ECON J | 10.1111/j.1468-0297.2008. 02208.x | 2009 | 125 |

| EL HEDI AROURI M, 2011, J INT MONEY FINANC | 10.1016/j.jimonfin.2011.07.008 | 2011 | 44 |

| BARUNÍK J, 2018, J FINANC ECONOM | 10.1093/jjfinec/nby001 | 2018 | 41 |

| SADORSKY P, 2012, ENERGY ECON | 10.1016/j.eneco.2011.03.006 | 2012 | 38 |

| MENSI W, 2013, ECON MODEL | 10.1016/j.econmod.2013.01.023 | 2013 | 35 |

| AROURI MEH, 2012, ENERGY ECON | 10.1016/j.eneco.2011.08.009 | 2012 | 31 |

| NG A, 2000, J INT MONEY FINANC | 10.1016/S0261-5606(00)00006-1 | 2000 | 30 |

| DU X, 2011, ENERGY ECON | 10.1016/j.eneco.2010.12.015 | 2011 | 30 |

| HONG Y, 2001, J ECONOM | 10.1016/S0304-4076(01)00043-4 | 2001 | 30 |

| BAELE L, 2005, J FINANC QUANT ANAL | 10.1017/s0022109000002350 | 2005 | 29 |

| Research Stream Clusters | Question | Research Questions |

|---|---|---|

| Asymmetries in market connectedness | 1 | What are the variables that pose a geopolitical risk to the markets? |

| 2 | How does information dissemination happen between Frontier and Emerging markets and developed markets? | |

| 3 | Do the asymmetries in the currency market propounds into the large oil-importing small countries? | |

| 4 | How do the asymmetries differ when high-frequency data are used from different markets? | |

| 5 | How do the asymmetries differ in economic integration and financial integration? | |

| 6 | Can asymmetry in connectedness be quantified? | |

| 7 | How does the country-specific asymmetry differ among the sectors? | |

| 8 | Do structural breaks in volatility play a significant role in asymmetry prediction? | |

| 9 | Does volatility asymmetry follow a mean reverting process? | |

| 10 | Does the US contribute most of the asymmetry to the world market? | |

| 11 | Does the EMU have an impact on the Asian markets? | |

| 12 | Do Social and cultural factors play any role in volatility asymmetry fluctuations? | |

| 13 | Do political and policy tie-ups between countries direct market connectedness? | |

| 14 | Are there any potential benefits from good volatility spillovers? | |

| 15 | Is there a Bilateral Spillover between Asia and US and EMU? Moreover, how much net good and bad contribution happens between them during the tranquil and contagion period? | |

| 16 | What are the major determinants of the volatility asymmetries in developed and emerging markets? | |

| Macro Factors influence on market connectedness and spillovers | 17 | Does the market size indicate the level of integration? |

| 18 | How to derive the EPU index between the Frontier and Emerging markets? How do their economic conditions behave about this index? | |

| 19 | Does the technologically advanced stock market dominate international markets? | |

| 20 | Country-specific determinants of the connectedness and spillovers? | |

| 21 | How do Dollar currency and exchange rates trigger the connectedness among specific Asian countries? | |

| 22 | What is the role of information capacity in the volatility spillovers in country-level sectors? | |

| 23 | Does international economic integration trigger financial integration among the countries? | |

| 24 | What is the degree of impact of oil volatility fluctuation in the macroeconomic variables in oil-importing countries? | |

| 25 | What is the long-run behaviour between emerging and developed nations' economic and financial integration? | |

| 26 | Does EDC affect specific Asian markets? Why is there not much political or terrorism spillover from the US and EU to the East Asian markets? | |

| 27 | Does good economic performance from a country or firm shield them from bad volatility spillovers? | |

| Role of oil in the spillovers and hedging | 28 | Do the Asian markets have the upper hand in the Oil futures as a hedging tool? |

| 29 | What is the degree of connectedness between the large oil-importing and exporting EU and Asian countries? | |

| 30 | What is the impact of green alternatives and green energy products on oil price fluctuations? | |

| 31 | What is the role of oil in connecting the commodity and financial markets in specific EU and Asian Countries? | |

| 32 | What is the degree of change in geopolitical risk from oil among different countries? | |

| 33 | Does the Oil-Gold nexus pose an effective hedging tool for emerging countries? | |

| 34 | What is the spillover effect of oil on the Safe haven assets? | |

| 35 | Are high natural gas-using countries well-off from oil spillovers? | |

| 36 | What are the substantial hedging values for oil futures and exchange rates for the Asian sub-countries? | |

| 37 | What is the optimal international diversification for Oil futures in the tranquil and event period? | |

| 38 | What is the directional spillover of oil to the Asian Sub-countries during the Crises? | |

| 39 | Does oil integrate the financial markets across countries during Crises? | |

| Dynamic cross-market connectedness and spillover | 40 | How do the dynamic spillover changes differ in the high-frequency data? |

| 41 | Do structural changes pose a constraint in the dynamic analysis? | |

| 42 | What is the level of integration among firms? | |

| 43 | What are the changes in dynamics in the Short and Long-run? | |

| 44 | What is the intensity of short- and long-run connectedness and directional spillovers between commodity, stock and bond markets? | |

| 45 | Does connectedness shift when the market's foreign investors percentage is high? | |

| 46 | What is the time-varying changes in feedback trading of cross-listed shares? | |

| 47 | Do market openness and information capacity transform the directional spillover in Developed and emerging markets? |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).