1. Introduction

Across the world, ecologically responsible investments are growing in popularity as more individuals worry about the future of the earth and seek methods to invest in businesses that support sustainable practices. The clean energy sector, which focuses on renewable energy sources including solar, wind, hydropower, geothermal, and biomass, is one of the most well-liked and rapidly expanding investment sectors [

3].

Although there are still significant amounts of oil, gas, and coal under the soil, their extraction becomes more challenging and expensive. Countries that extensively rely on fossil fuels for their electricity production are more susceptible because of supply interruptions and price volatility [

4].

Elie et al. [

2] also argue that the risks connected with greenhouse gas emissions and the necessity to decrease reliance on fossil fuels are what are driving the rising demand for clean energy.

Investment prospects in the clean energy sector are developing quickly as governments all over the world raise their renewable energy and greenhouse gas emission objectives. The solar and wind energy have seen notable advances in clean energy technologies at the same time. These technologies are a feasible substitute for fossil fuels because they are becoming more affordable and effective. The economic advantages of clean energy, particularly in terms of job creation and local economic growth, are also being increasingly recognized [

5,

6,

7].

Climate change, the limited availability of fossil fuels, improvements in clean energy technology, and the erratic nature of oil prices are just a few of the causes that have led to the widespread acceptance of clean energy as a viable substitute for dirty energy (such as crude oil). As part of the 2015 Paris Climate Accord, several nations made the commitment to transition to climate resilient economies. Because of the increased interest among investors and policymakers as a result of the 2015 Paris Climate Accord, development in renewable energy initiatives have prospered [

8,

9].

As a result of the COVID-19 pandemic and the ongoing conflict between Russia and Ukraine, the price of energy has recently been severely impacted globally, causing several behavioral changes. The energy sector experienced a period of stagnation following the initial COVID-19 pandemic as several health and safety precautions were implemented to stop the virus’s spread. According to various studies, this led to a significant drop in energy consumption [

10,

11,

12].

The decline in energy demand resulted in lower prices and forced a reduction in production levels [

13]. Tensions between Saudi Arabia and Russia, the two largest oil producers, increased during this time. Saudi Arabia advised oil-producing nations to cut back on production as prices continued to drop to stabilize the market. Russia disagreed, which led to conflict between the two nations and had a negative effect on the economy of the sector. Energy supply has fallen behind demand as post-pandemic economic activity picks back up in 2021, which has resulted in increased prices and market volatility overall. The relationship between economic activity and energy use is unequivocally demonstrated [

14].

At the start of the Russia-Ukraine conflict in 2022, the pandemic-related energy problem has become worse. As a result of the conflict, Russia cut off the energy supply to European countries. Because of the numerous effects that threats and geopolitical events have on the volatility of energy prices, this factor not only contributed to the energy crisis in the European region but also to the instability of the global energy market [

15].

Although there is a substantial body of academic research on price efficiency in the stock, bond, credit, exchange rate, commodity, and cryptocurrency markets [

16,

17], there is still a lot of room for further development of studies into the clean energy stock markets.

Understanding the efficiency of clean energy stock markets has important implications for various energy topics. First, it is argued that clean energy stock markets can affect energy consumption and many economic sectors. Second, given the strong link between market efficiency and the validity of price information, clean energy stock markets can influence dirty energy markets, such as crude oil.

This paper aims to examine the efficiency in the Clean Energy Fuels Index, S&P Global Clean Energy Index, iShares Global Clean Energy ETF, iShares Global Energy (SWX) ETF, crude oil (BRENT), gold (DOW JONES), and natural gas (DOW JONES) between January 1, 2018, and March 9, 2023, which covers periods of low volatility and financial instability (2020 and 2022 events).

Based on the literature consulted, we expect to find asymmetric multifractality in the US, European, and global clean energy stock indices. Moreover, the efficiency levels of the European and global indices may be more efficient, while for the US index may show some signs of (in) efficiency.

The structure of the article is described as follows: In Part 2, a review of pertinent studies on the efficiency of clean energy stock markets is presented. In

Section 3, the methods and data used to address research issues are described. In

Section 4, the data analysis and conclusion interpretations are provided.

Section 5 makes recommendations based on the information provided.

2. Literature Review

One of the distinguishing characteristics of an efficient market is how quickly new information is incorporated into stock prices. In such a market, new information is rapidly and completely reflected in pricing, and there is no potential to gain an edge by leveraging already-public information. Because of this, the market is always adjusting to new information, and stock values fluctuate as a result [

18,

19,

20].

EMH (Efficiency Market Hypothesis) also makes the premise that market players are rational and act in their own best interests, in addition to presuming that information available on the market is free of charge. This implies that you won’t let emotions or other illogical circumstances affect your judgment; instead, you’ll base your choices on all the information at your disposal. Recent research, however, has refuted this notion by demonstrating that psychological aspects, such as emotions, may have a big impact on financial decisions [

21,

22,

23].

The EMH is nevertheless a widely recognized theory in finance, and many investors utilize it as the foundation for their investing strategies despite these obstacles. Yet, it’s vital to keep in mind that no theory is foolproof and that a variety of variables, such as political developments, economic conditions, and societal trends, can have an impact on financial markets.

As a result, it’s crucial to approach investing cautiously and to weigh all the facts before making any decisions [

24,

25,

26].

2.1. The Particularity of Clean Energy Stocks

Portfolio managers’ interest in clean energy stocks has recently risen because of the additional advantages of investing in these companies. It’s noteworthy to note that several recent studies indicate investing in clean energy stocks may carry less risk than doing so in the U.S. aggregated stock market index [

27].

According to additional research, renewable energy stock indices can act as a hedge and safe haven for the crude oil and gold markets [

2]. The same authors contend that government subsidies that stabilize the cash flows of green businesses make clean energy assets attractive investment opportunities. Clean energy reserves have characteristics of both the general stock market and energy products, and include companies involved in clean energy and related products and services. There is less opportunity for speculative activity in the clean energy market now that professional investors are participants. The interactions of market players using various informational time frames and interpretations may have an impact on the value of clean energy stocks.

Uddin et. al [

28] investigated the relationship between clean energy stock returns (ER) and aggregate share returns, changes in crude oil and gold prices, and exchange rates. Using a cross-quantilogram approach, the study concludes that the relationship between ER stock returns and changes in oil prices and the aggregate share index is not symmetrical between quants and is more significant with a higher number of lags. Furthermore, the study shows that the positive influence of exchange rates and gold returns on ER stock returns is only observed during extreme market conditions.

Shahzad et al. [

29] investigated the market efficiency of clean energy stock indices in the U.S., Europe, and globally. They found that the three markets exhibit a multifractal asymmetry after analyzing the data using the asymmetric MF-DFA (Multifractal Detrended Fluctuation Analysis), with the U.S. market exhibiting this asymmetry because of long-range and fat-tailed correlation. Moreover, they discover that while the American market is less efficient during the rising trend, the European and international markets are more efficient. The American market has nonetheless become comparatively more efficient over time.

Yao et al. [

29] have complementary examined and focused on China’s clean energy stock indices and analyzed their multifractal scale behavior and market efficiency using the A-MFDFA (Asymmetric and Multifractal Detrended Fluctuation Analysis) and the A-MFDCCA (Asymmetric Cross-correlation and Multifractal Detrended Analysis). The results show that the clean energy stock market is far from efficient and presents considerable asymmetries in both upward and downward fluctuations. Furthermore, the cross-correlation between crude oil price trends and low-carbon indices has significant multifractal characteristics. To limit risks, the study advises investors to undertake a hedging operation and pay attention to the counterparty market’s long-term effects.

Wan et al. [

30] investigated whether green recovery plans may affect the performance of clean energy and fossil fuel enterprises as well as the COVID-19 pandemic’s effects on financial markets and the energy stock market. According to the findings, fossil fuel corporations will be more negatively impacted by the pandemic than clean energy companies.

Also, due to investor interest, clean energy firms perform adequately during the pandemic, whereas fossil fuel companies do not. According to the study, green recovery programs can have a favorable impact on financial markets and promote the implementation of green measures.

Moreover, Thai [

9], utilizing quantile-on-quantile regression and Granger’s causality methods, examined the connections between green bonds and other traditional assets such as Bitcoin, the S&P 500, the Clean Energy Index, the GSCI Commodities Index, and CBOE volatility. The findings show that other assets strengthen green bonds, and this effect is stronger in larger quantiles. The study recommends that policymakers think about tightening the eligibility requirements for green bond programs or restricting the use of green bonds for refinancing to promote renewable energy and energy efficiency. The author advises market players to raise funds to match the whole amount of investment required.

Kanamura [

5] used in his empirical research the S&P Global Clean Energy Index (GCE), Wilderhill Clean Energy Index (ECO), S&P/TSX Renewable Energy and Clean Technology Index (TXCT), S&P 500, WTI crude oil prices, and Henry Hub (HH) natural gas prices to examine the correlation between them. The findings demonstrate that while the S&P 500 and energy prices have a positive but declining correlation, clean energy indices have positive and increasing correlations with crude oil or natural gas prices. For TXCT, correlations with WTI are generally positive and decrease as WTI increases, but correlations with HH are mostly positive and increase as HH decreases. Considering the results of GCE and ECO, it could imply that TXCT is still evolving as a clean energy index and is not yet fully operational.

Gustafsson et al. [

31], underline the necessity of knowing the connections between energy metals and the clean energy stock markets. The findings point to statistically significant non-linear correlations between the studied markets. Except for cobalt, all energy metals exhibit a strong positive correlation with clean energy stock indices, and these correlations persist throughout periods of extreme volatility. The results support past studies on the hedging properties of precious metals, showing that gold and silver act as hedges for select clean energy stock indices.

3. Material and Methods

The daily price indices were obtained from the Thomson Reuters/Eikon platform, namely the Clean Energy Fuels Index, the S&P Global Clean Energy Index, the iShares Global Clean Energy ETF, the iShares Global Energy (SWX) ETF, crude oil (BRENT), gold (DOW JONES), and natural gas (DOW JONES).

The sample data spans the period from January 1, 2018 through March 9, 2023, which includes times of low volatility and financial instability (2020 and 2022 events).

The investigation was divided into stages, with the first analyzing the statistical properties of the studied series and estimating parameters such as the mean, standard deviation, asymmetry coefficients, and kurtosis, as well as applying the Jarque and Bera [

32] test to infer the data series’ normality. To determine the stationarity of the time series, conventional panel unit root tests were applied, namely, the Levin et al. [

33] and for validation the Dickey and Fuller [

34] and Perron and Philips [

35] tests, with Fisher’s transformation.

Considering that the period under consideration includes times of volatility in financial markets caused by events in 2020 and 2022, the Clemente et al. [

36] test was employed to infer the existence of unit roots in the observable time series components while taking structural breakdowns into consideration.

In a second stage, to answer the research question, we first applied the Brock and De Lima [

37] test to identify nonlinear serial dependency in the time series under examination. To infer autocorrelation between series returns, the ratio of variances was examined using the Lo et al. [

38] methodology. The premise of this test is that, in a non-autocorrelated process, the variance of the increases rises linearly with the observation range, i.e., the variance of the differences must be q times that of the first difference. The model consists of determining if the variance ratio for different ranges evaluated over time is equal to one. To confirm the autocorrelation’s plausibility, the results of the variance ratio must be statistically distinct from 1.

The ratio of variance is given by:

When , the series follows a random walk process; however, when , the series reveals the presence of positive correlation, and when , the series exhibits negative correlations.

The Detrended Fluctuation Analysis (DFA) approach, which allows for the investigation of temporal dependency in non-stable dataseries, was used to validate the reliability of the results produced. The calculated DFA coefficient can be interpreted as follows:

Table 1.

Detrended Fluctuation Analysis (DFA).

Table 1.

Detrended Fluctuation Analysis (DFA).

| Exponent |

Type of Signal |

|

long-range anti-persistent |

|

≃ 0.5 |

uncorrelated, white noise |

|

> 0.5 |

long-range persistent |

4. Results

4.1. Descriptive Statistics

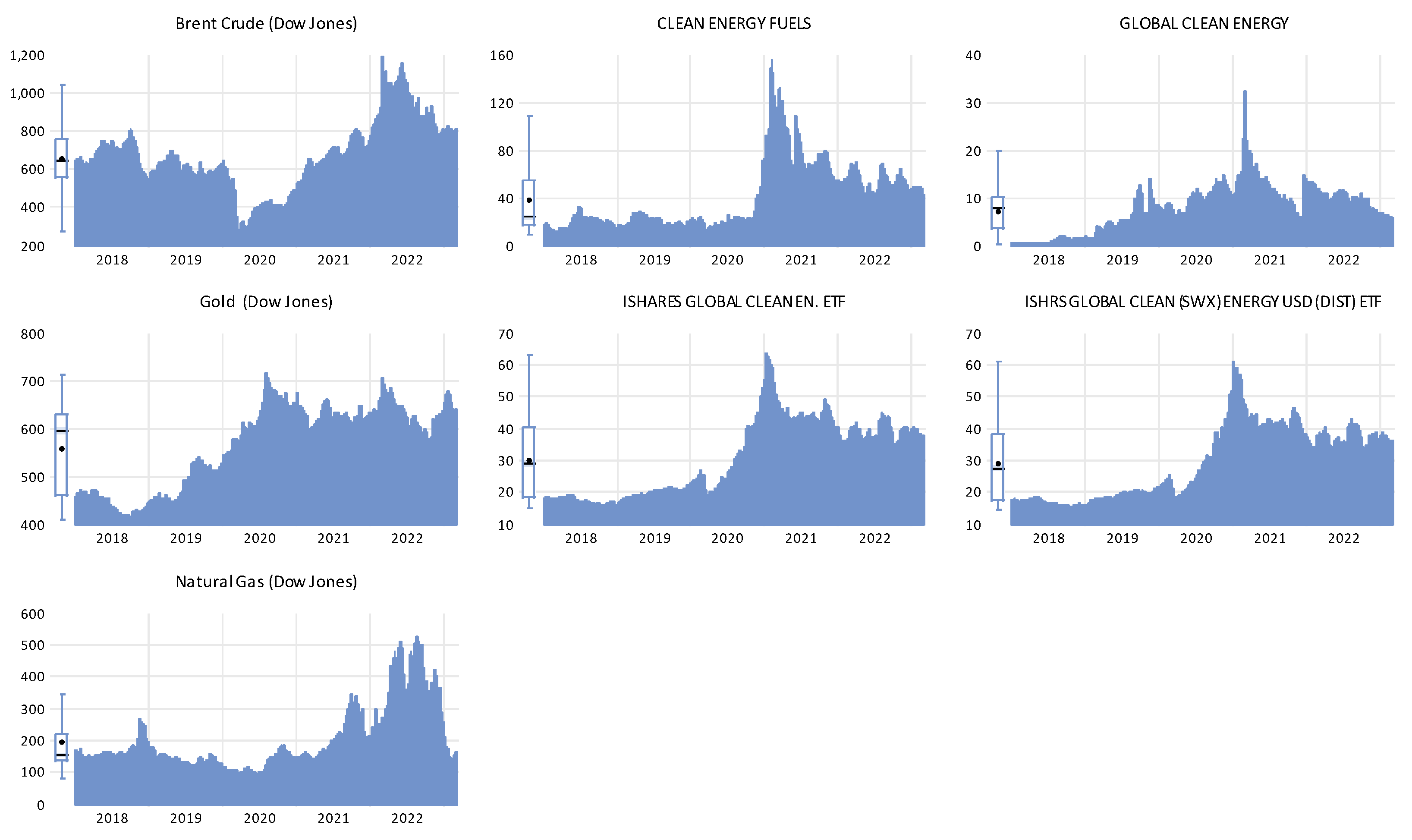

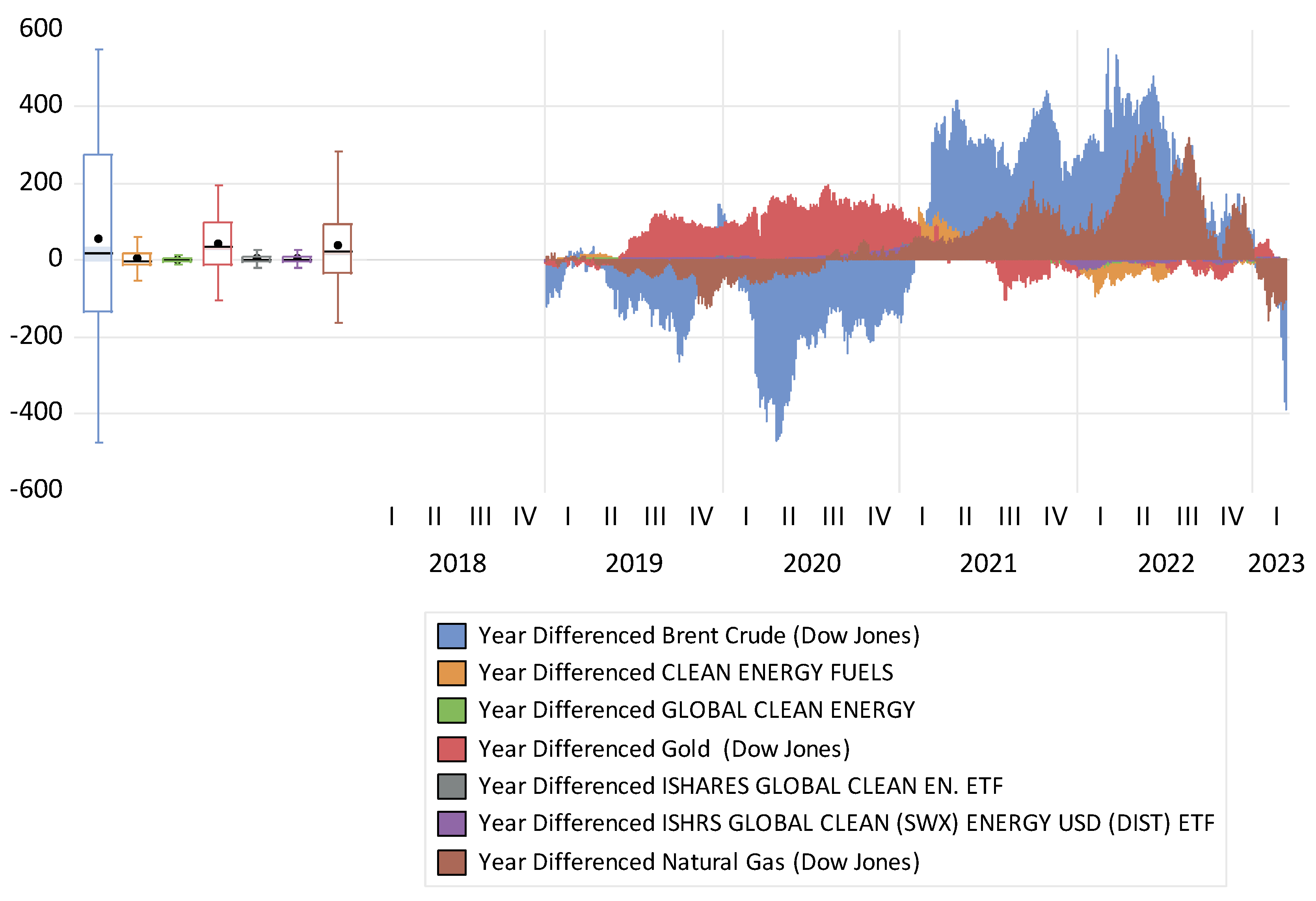

Figure 1 shows the price movements of the seven financial markets over the course of the sample period. During the first wave of the COVID-19 pandemic, there was inevitably a decline in global demand for energy sources due to the implementation of limitations by world governments to prevent the virus’s spread, including the confinement of the population and the blocking of productive and commercial activity (oil, natural gas, and clean energies). Crude Oil has seen a dramatic reduction in price as supply has greatly exceeded demand on a massive scale (see

Figure 2).

The COVID-19 pandemic had a significant influence on the financial markets under study, causing drops in the first and second quarters of 2020, except for the gold market, which saw a price increase. This trend may be driven by an increase in the demand for safe-haven assets, which has been driven by the climate of uncertainty created by COVID-19 (see

Figure 2).

During the last year of 2022, with the start of the war in Ukraine and, as a result, a reduction in natural gas supply, the price of natural gas increase rapidly. Because of the looming scarcity of energy resources, the world’s economies have begun to increase their investments in clean energy.

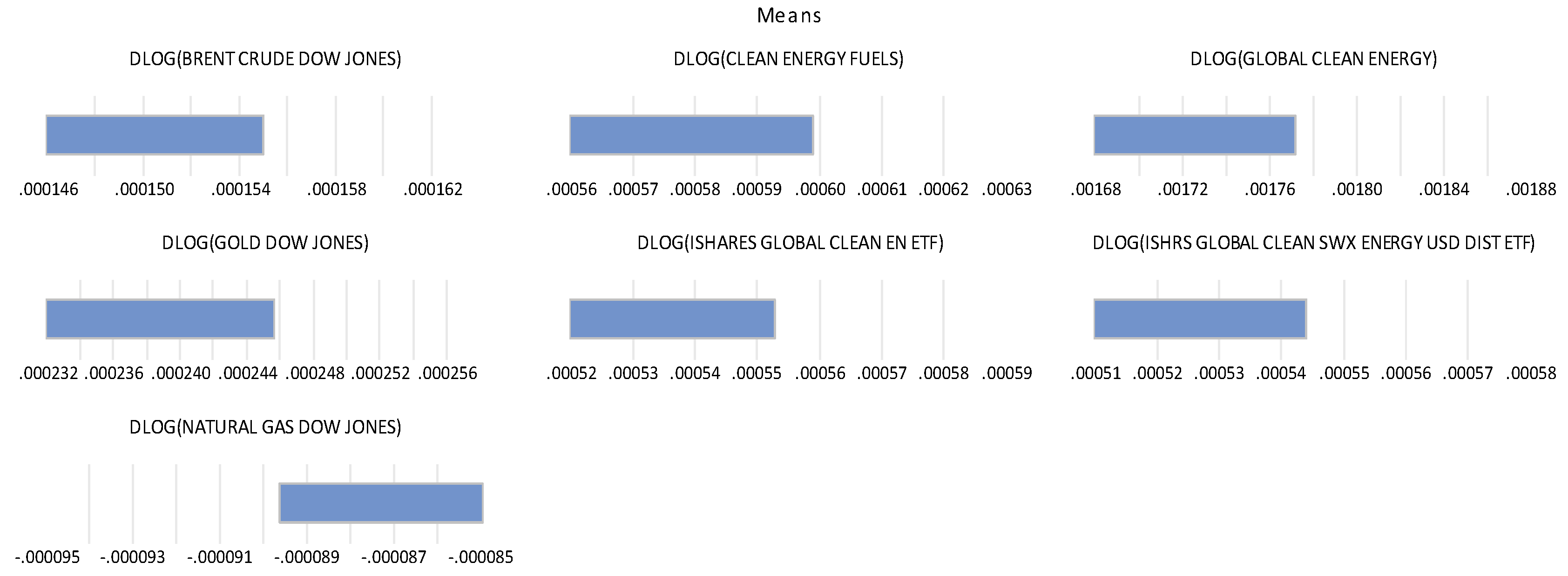

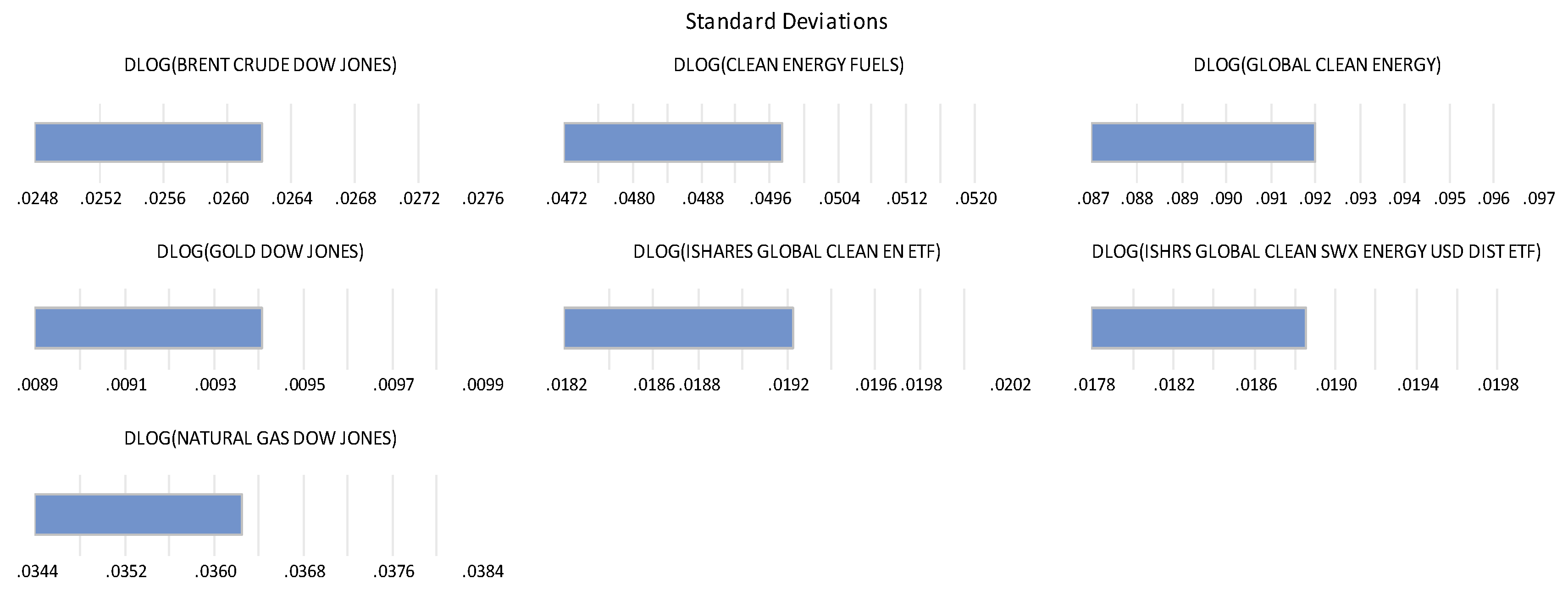

Prior to presenting and analyzing the empirical findings on the serial dependency and efficiency of the financial markets under examination, we give a summary of the descriptive daily return data, as well as the stationarity results, of the following price indices: Clean Energy Fuels I, S&P Global Clean Energy Index, iShares Global Clean Energy ETF, iShares Global Energy (SWX) ETF, crude oil (BRENT), gold (DOW JONES), and natural gas (DOW JONES).

Table 2 summarizes the descriptive data of the price indices examined, revealing that all except natural gas had positive average daily returns.

As shown in

Figure 3, the Global Clean Energy Index had the greatest average daily return (0.001771) during the research period; nevertheless, natural gas had a negative average daily return (-0,0000896).

Figure 4 shows the risk indicator (standard deviation) for the markets under investigation, revealing that the Global Clean Energy Index has the highest standard deviation (0.091985), and the gold market has the lowest. (0.009404).

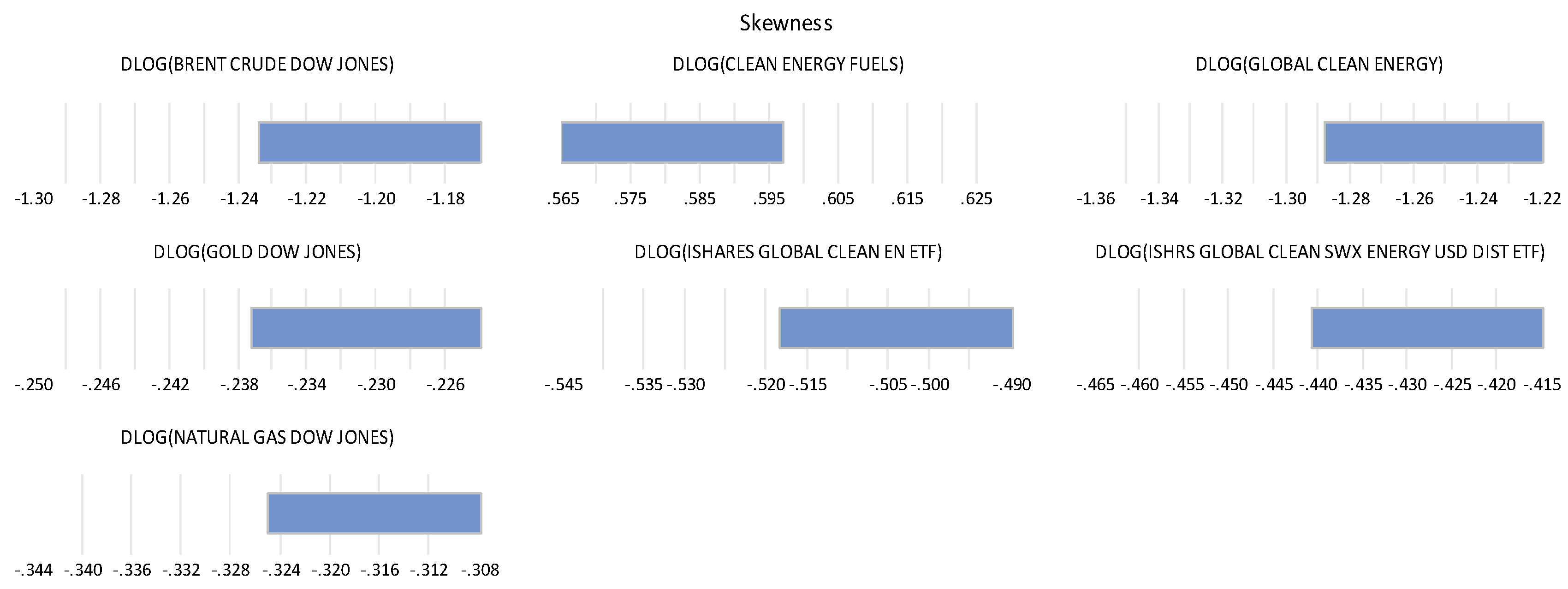

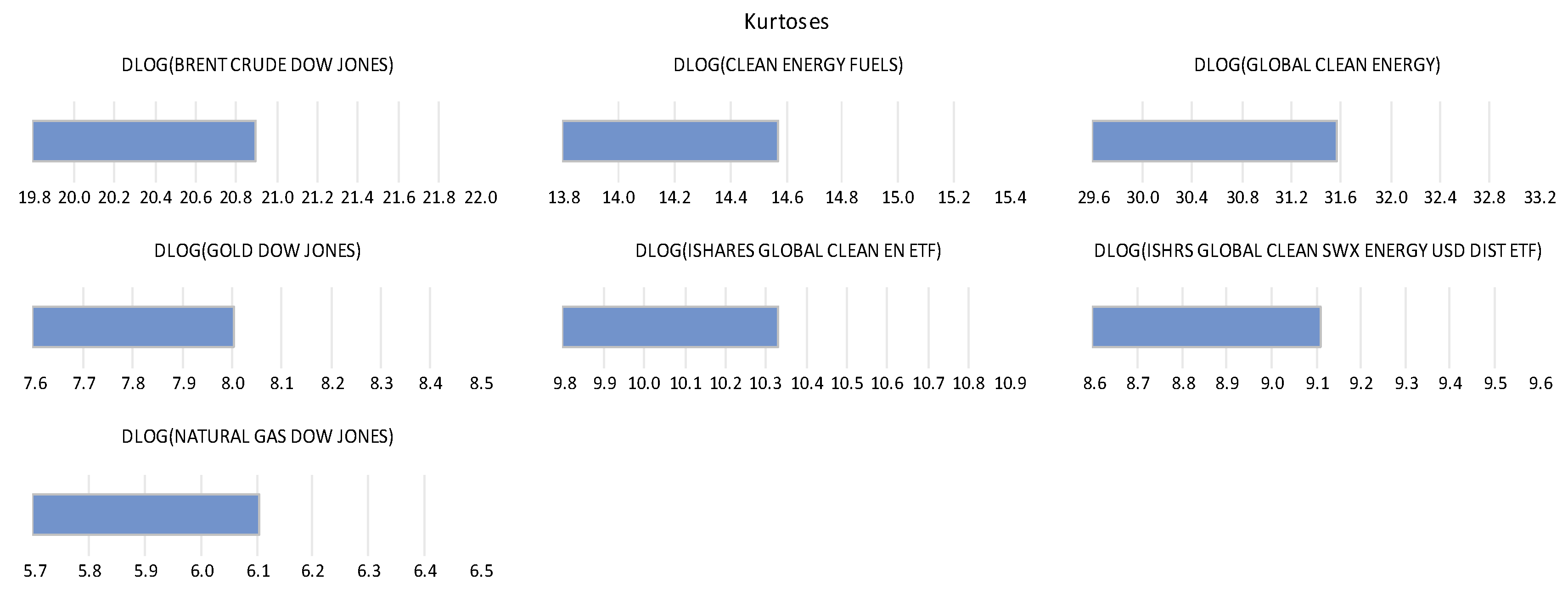

The data series are leptokurtic and asymmetrical, as indicated by the kurtosis values and asymmetry coefficients provided in

Figure 5 and

Figure 6, suggesting that they do not follow to the requisites of a normal distribution. The conclusion of the Jarque and Bera test, which leads to the rejection of the null hypothesis (at a level of significance of 1%), supports this evidence.

4.2. Diagnostic

4.2.1. Time Series Stationarity

The assessment of time series stationarity is essential for the ARMA approach used in the BDS test. Conventional unit root tests and an additional unit root test that takes the impact of structural breakdowns into account were used to evaluate the stationarity of the time series under consideration.

The critical value of the Levin et al. [

33] test indicates that the presence of autoregressive unit roots in time series is rejected. The results of Dickey et al. [

34] and Phillips et al. [

35] tests confirm the idea that the series are stationary at first differences.

The results of the unit root test are shown in

Table 3.

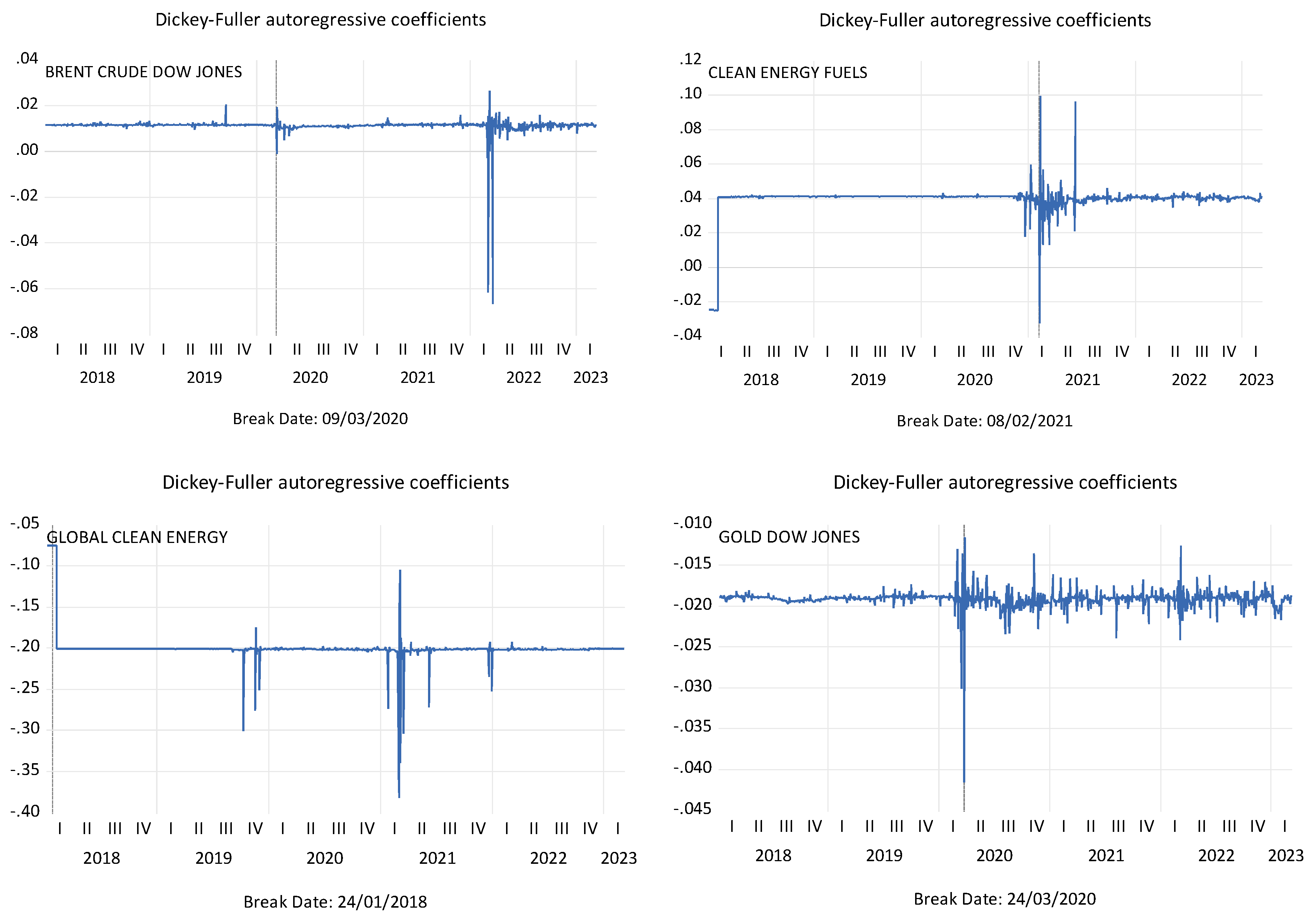

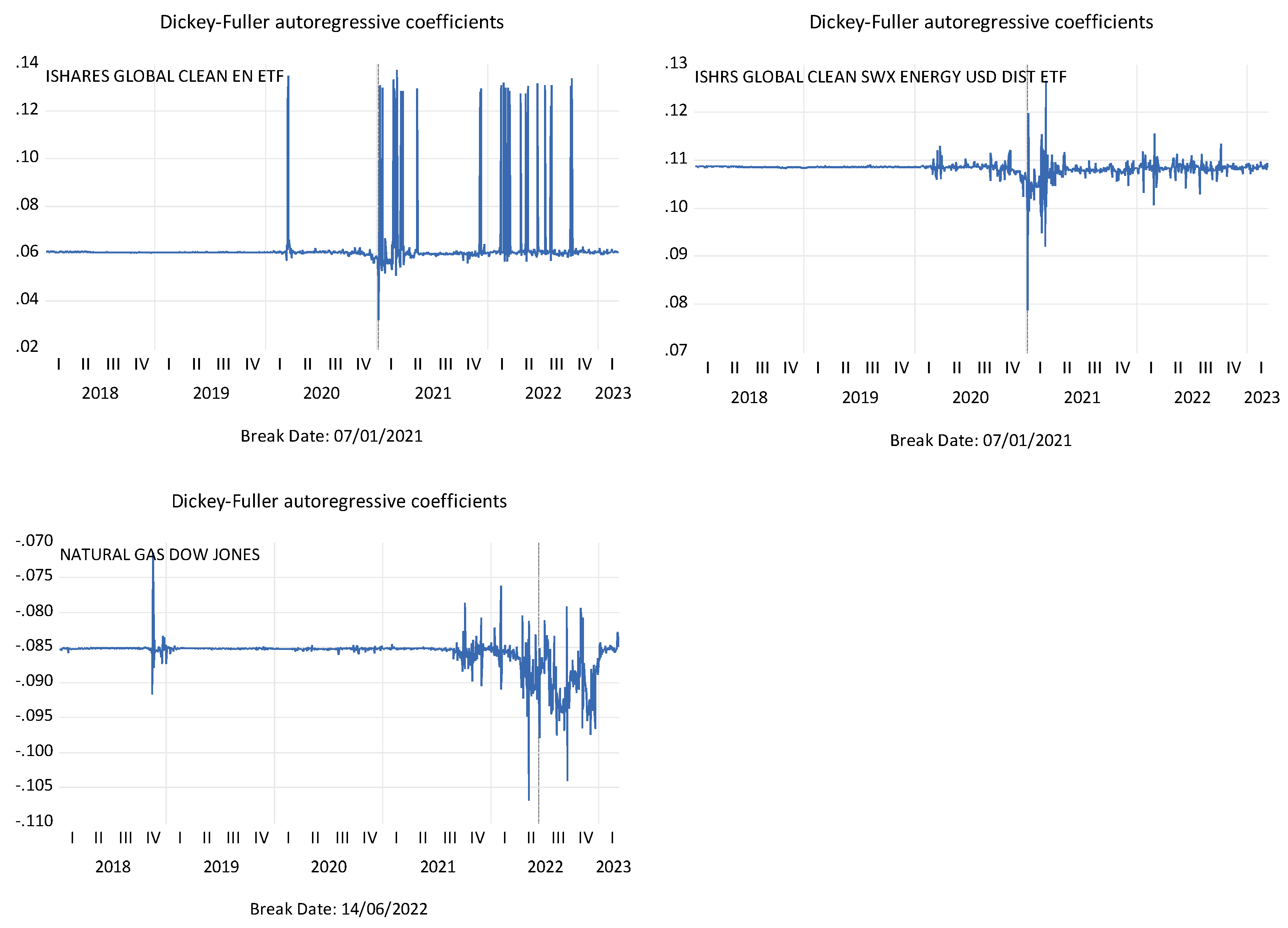

The study by Clemente et al. [

36] was also necessary since it enabled the confirmation of unit roots while taking into account the potential for structural breakdowns in the time series and identifying the moment of their occurrence. This is due to the fact that the financial markets are now unstable and frequently subject to shocks brought on by the events of 2020 and 2022. All markets exhibit transitional imbalances, as illustrated in

Figure 7, with the markets for dirty energy (crude oil and natural gas) and gold being particularly vulnerable to the shocks of the events of 2020 and 2022. In 2021, the clean energy markets exhibit volatility. The volatility of clean energy markets in 2021 may be attributed to leveraged investments in the industry.

4.2.2. Serial Dependence

To test the serial dependence was applied the Brock et al. [

37] Test. The test’s null hypothesis assumes that the residual serial is independently and identically distributed. (i.i.d.). With the exception of the gold market in its second dimension, where the null hypothesis is only rejected at a degree of significance of 5%, the findings imply rejection of the null hypothesis at a level of significance of 1% for all time series in all dimensions (see

Table 4). Because the serial residues are not i.i.d., it is possible that the price indices under study either have linear returns or have a significant nonlinear component.

5. Results

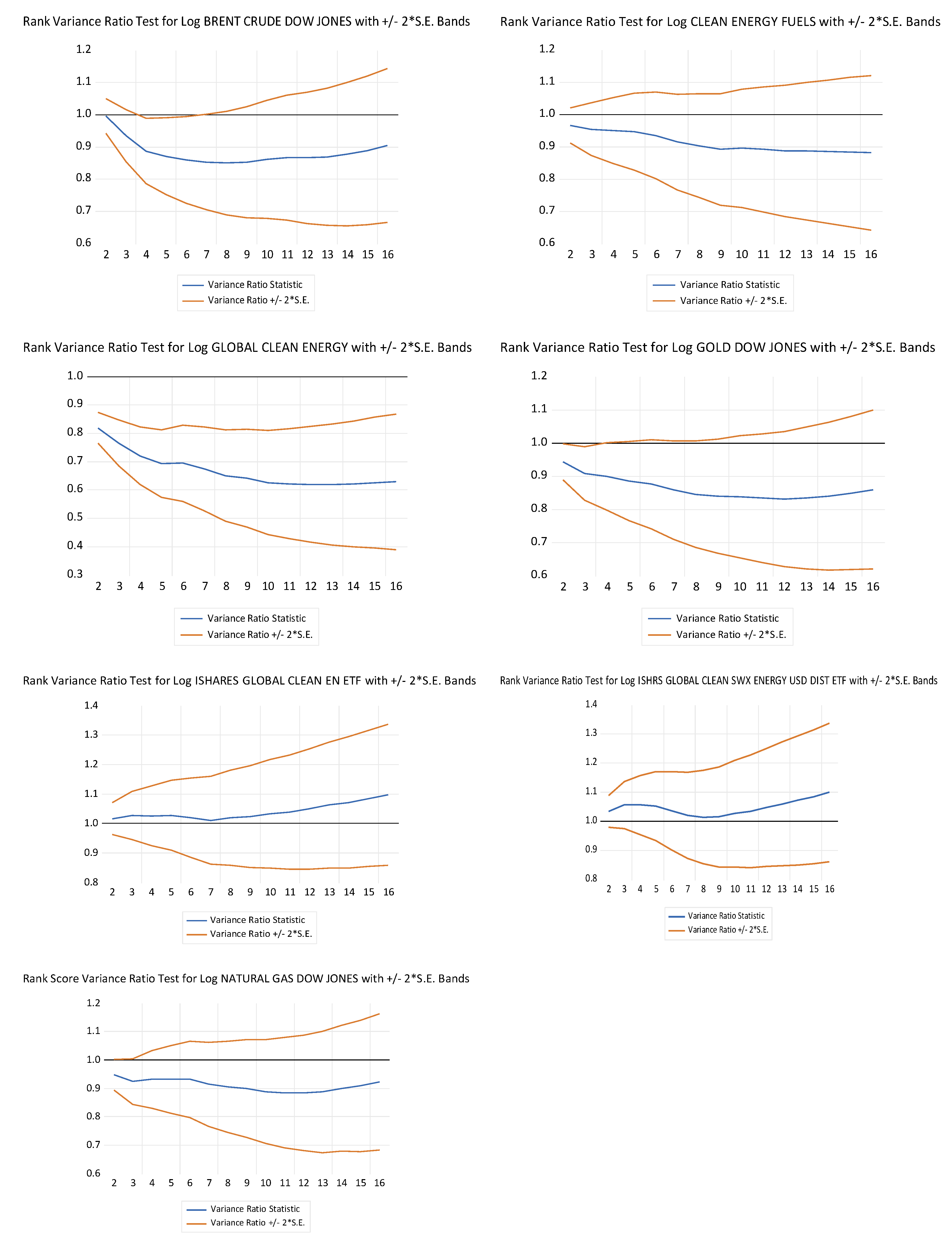

To examine whether the returns from the data series under study are autocorrelated over time, we applied the methodology proposed by Lo and Mackinlay [

38].

The data were computed for the 2 to 16 lags in each case. The findings demonstrate that all stock indices reject the random walk hypothesis (see

Figure 8). We may deduce from the variance ratio values that the returns of crude oil market, the Clean Energy Fuels Index, the Global Clean Energy Index, the gold market, and the natural gas market are negatively autocorrelated over time because they all displayed values below the unit. As the EFTs’ variance ratio values are smaller than those of the unit, their returns are positively autocorrelated over time.

The DFA exponents for the time series were calculated in order to verify the validity of the previously obtained results (see

Table 5). We split the sample into two subperiods to test the predictability of time series returns: Tranquil subperiod from January 1, 2018, to December 31, 2019, and Stress subperiod from January 1, 2020, to March 9, 2023. All markets exhibit predictability and a long memory during the tranquil subperiod, refuting the random walk hyphotesis, except for the iShares Global Clean Energy ETF, which is exhibiting indications of equilibrium. (0.50). The crude oil market (0.52), the Clean Energy Fuels Index (0.61), the natural gas market (0.55), the iShares Global Energy (SWX) EFT (0.51), the Global Clean Energy (0.46), and the gold market (0.46) have all demonstrated indications of persistence in their returns. The random walk hypothesis was rejected in the Stress subperiod by all markets, including the iShares Global Clean Energy ETF, which corrected against the Tranquil subperiod and is presently displaying signs of persistence (0,50 to 0,59).

6. Discussion

The returns of the crude oil market, the Clean Energy Fuels Index, Global Clean Energy Index, the gold market, and the natural gas market are negatively autocorrelated, which implies that series returns present a reverse average. Reverse average trading implies that, despite significant fluctuations, the price of an asset returns to its average levels. This approach requires the investor to first determine the average value of a financial instrument, sell when the value exceeds the average, and buy when the value declines. On the other hand, positive autocorrelation signals may be detected in the returns of the EFTs, which implies that if the market is "up" today, it is more likely to stay that way tomorrow.

The DFA coefficients demonstrated that during the Tranquil subperiod, the series returns are independent and identically distributed (i.i.d.). Due to the consistent rejection of the random walk hypothesis across all markets over the Stress subperiod, we did not see any discernible changes in the predictability of the series returns.

These results challenge the notion of an efficient market, allowing investors to consider methods for forecasting future returns based on their prior observations. For investors who use arbitrage strategies to create projections, the series returns autocorrelation looks to be crucial evidence. This could make it possible to increase profits without taking on additional risks. However, some caution should be exercised because the assets’ prices may increase above their actual market value and reduce the profitability of trading.

However, these findings do not suggest that it is economically viable to draw conclusions about whether these possibilities result in profitable commercial opportunities or inefficient market results.

7. Conclusions

Despite rising public knowledge and interest in renewable energy, clean energy firms still have a tiny market valuation compared to the traditional energy industry. This is partially because the clean energy sector is still seen as a new and unproven area, which may give investors a sense of uncertainty and risk. Nonetheless, the clean energy sector is anticipated to expand quickly in the next years as more nations and people throughout the world realize how important it is to switch to greener energy sources. This expansion is anticipated to be fueled by a mix of financial government incentives, developments in clean energy technologies, and rising consumer demand for environmentally friendly and sustainable goods and services. Moreover, more environmental, social, and governance (ESG) expenditures are anticipated to accelerate the growth of the clean energy industries.

This paper examine the efficiency in the Clean Energy Fuels Index, the S&P Global Clean Energy Index, the iShares Global Clean Energy ETF, the iShares Global Energy (SWX) ETF, the crude oil market (BRENT), the gold market (DOW JONES), and the natural gas market (DOW JONES). We conclude that understading the efficiency of clean energy markets is important for several reasons. First, as the world turns toward renewable energy consumption, it is important to understand how the clean energy stock market is working. This knowledge can help investors make informed decisions about where to invest their money, which can have a significant impact on the development and growth of clean energy technologies. Second, understanding the efficiency of clean energy stock markets can help policymakers design more effective policies to promote the growth of clean-energy industries. Finally, understanding the efficiency of clean energy markets can provide a broader insight into the functioning of markets and the factors that influence efficiency.

Author Contributions

The three authors, Rui Dias, Nicole Horta and Mariana Chambino contributed equally to this work. All authors have read and agreed to the published version of the manuscript.

Funding

This paper is financed by Instituto Politécnico de Setúbal.

Acknowledgments

This work would not have been possible without the financial support of the Instituto Politécnico de Setúbal.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Dutta, A.; Bouri, E.; Das, D.; Roubaud, D. Assessment and Optimization of Clean Energy Equity Risks and Commodity Price Volatility Indices: Implications for Sustainability. J Clean Prod 2020, 243, 118669. [CrossRef]

- Elie, B.; Naji, J.; Dutta, A.; Uddin, G.S. Gold and Crude Oil as Safe-Haven Assets for Clean Energy Stock Indices: Blended Copulas Approach. Energy 2019, 178. [CrossRef]

- Dutta, A.; Bouri, E.; Das, D.; Roubaud, D. Assessment and Optimization of Clean Energy Equity Risks and Commodity Price Volatility Indices: Implications for Sustainability. J Clean Prod 2020, 243, 118669. [CrossRef]

- Dincer, I.; Zamfirescu, C. Sustainability Dimensions of Energy. In Comprehensive Energy Systems; 2018; Vol. 1–5.

- Kanamura, T. A Model of Price Correlations between Clean Energy Indices and Energy Commodities. Journal of Sustainable Finance and Investment 2022, 12. [CrossRef]

- Karim, S.; Naeem, M.A. Do Global Factors Drive the Interconnectedness among Green, Islamic and Conventional Financial Markets? International Journal of Managerial Finance 2022, 18. [CrossRef]

- Lu, X.; Liu, K.; Lai, K.K.; Cui, H. Transmission between EU Allowance Prices and Clean Energy Index. In Proceedings of the Procedia Computer Science; 2021; Vol. 199.

- Fuentes, F.; Herrera, R. Dynamics of Connectedness in Clean Energy Stocks. Energies (Basel) 2020, 13. [CrossRef]

- Thai, H.N. Quantile Dependence between Green Bonds, Stocks, Bitcoin, Commodities and Clean Energy. Econ Comput Econ Cybern Stud Res 2021, 55. [CrossRef]

- Benlagha, N.; Karim, S.; Naeem, M.A.; Lucey, B.M.; Vigne, S.A. Risk Connectedness between Energy and Stock Markets: Evidence from Oil Importing and Exporting Countries. Energy Econ 2022, 115, 106348. [CrossRef]

- Gong, X.; Liu, Y.; Wang, X. Dynamic Volatility Spillovers across Oil and Natural Gas Futures Markets Based on a Time-Varying Spillover Method. International Review of Financial Analysis 2021, 76, 101790. [CrossRef]

- Lee, Y.; Yoon, S.M. Dynamic Spillover and Hedging among Carbon, Biofuel and Oil. Energies (Basel) 2020, 13. [CrossRef]

- Mensi, W.; Rehman, M.U.; Vo, X.V. Dynamic Frequency Relationships and Volatility Spillovers in Natural Gas, Crude Oil, Gas Oil, Gasoline, and Heating Oil Markets: Implications for Portfolio Management. Resources Policy 2021, 73, 102172. [CrossRef]

- Mensi, W.; Rehman, M.U.; Maitra, D.; Al-Yahyaee, K.H.; Vo, X.V. Oil, Natural Gas and BRICS Stock Markets: Evidence of Systemic Risks and Co-Movements in the Time-Frequency Domain. Resources Policy 2021, 72, 102062. [CrossRef]

- Qin, Y.; Hong, K.; Chen, J.; Zhang, Z. Asymmetric Effects of Geopolitical Risks on Energy Returns and Volatility under Different Market Conditions. Energy Econ 2020, 90, 104851. [CrossRef]

- Kristjanpoller, W.; Bouri, E. Asymmetric Multifractal Cross-Correlations between the Main World Currencies and the Main Cryptocurrencies. Physica A: Statistical Mechanics and its Applications 2019, 523, 1057–1071. [CrossRef]

- Shahzad, S.J.H.; Nor, S.M.; Mensi, W.; Kumar, R.R. Examining the Efficiency and Interdependence of US Credit and Stock Markets through MF-DFA and MF-DXA Approaches. Physica A: Statistical Mechanics and its Applications 2017, 471, 351–363. [CrossRef]

- Dias, R.T.; Pardal, P.; Santos, H.; Vasco, C. Testing the Random Walk Hypothesis for Real Exchange Rates. 2021, 304–322. [CrossRef]

- Dias, R.; Santos, H. Stock Market Efficiency in Africa: Evidence From Random Walk Hypothesis. 6th LIMEN Conference Proceedings (part of LIMEN conference collection) 2020, 6, 25–37. [CrossRef]

- Dias, R.; Heliodoro, P.; Teixeira, N.; Godinho, T. Testing the Weak Form of Efficient Market Hypothesis: Empirical Evidence from Equity Markets. International Journal of Accounting, Finance and Risk Management 2020, 5, 40. [CrossRef]

- Pardal, P., Dias, R., Teixeira, N. & Horta, N. The Effects of Russia ’ s 2022 Invasion of Ukraine on Global Markets : An Analysis of Particular Capital and Foreign Exchange Markets. 2022. [CrossRef]

- Dias, R.; Pereira, J.M.; Carvalho, L.C. Are African Stock Markets Efficient? A Comparative Analysis Between Six African Markets, the UK, Japan and the USA in the Period of the Pandemic. Naše gospodarstvo/Our economy 2022, 68, 35–51. [CrossRef]

- Teixeira, N.; Dias, R.; Pardal, P.; Horta, N. Financial Integration and Comovements Between Capital Markets and Oil Markets : An Approach During the Russian. 2022. [CrossRef]

- Dias, R.; Pardal, P.; Teixeira, N.; Horta, N. Tail Risk and Return Predictability for Europe ’ s Capital Markets : An Approach in Periods of The. 2022. [CrossRef]

- Guedes, E.F.; Santos, R.P.C.; Figueredo, L.H.R.; Da Silva, P.A.; Dias, R.M.T.S.; Zebende, G.F. Efficiency and Long-Range Correlation in G-20 Stock Indices: A Sliding Windows Approach. Fluctuation and Noise Letters 2022. [CrossRef]

- Zebende, G.F.; Santos Dias, R.M.T.; de Aguiar, L.C. Stock Market Efficiency: An Intraday Case of Study about the G-20 Group. Heliyon 2022, 8, e08808. [CrossRef]

- Uddin, G.S.; Rahman, M.L.; Hedström, A.; Ahmed, A. Cross-Quantilogram-Based Correlation and Dependence between Renewable Energy Stock and Other Asset Classes. Energy Econ 2019, 80, 743–759. [CrossRef]

- Uddin, G.S.; Rahman, M.L.; Hedström, A.; Ahmed, A. Cross-Quantilogram-Based Correlation and Dependence between Renewable Energy Stock and Other Asset Classes. Energy Econ 2019, 80, 743–759. [CrossRef]

- Shahzad, S.J.H.; Bouri, E.; Kayani, G.M.; Nasir, R.M.; Kristoufek, L. Are Clean Energy Stocks Efficient? Asymmetric Multifractal Scaling Behaviour. Physica A: Statistical Mechanics and its Applications 2020, 550. [CrossRef]

- Wan, D.; Xue, R.; Linnenluecke, M.; Tian, J.; Shan, Y. The Impact of Investor Attention during COVID-19 on Investment in Clean Energy versus Fossil Fuel Firms. Financ Res Lett 2021. [CrossRef]

- Gustafsson, R.; Dutta, A.; Bouri, E. Are Energy Metals Hedges or Safe Havens for Clean Energy Stock Returns? Energy 2022, 244. [CrossRef]

- Jarque, C.M.; Bera, A.K. Efficient Tests for Normality, Homoscedasticity and Serial Independence of Regression Residuals. Econ Lett 1980, 6, 255–259. [CrossRef]

- Levin, A.; Lin, C.F.; Chu, C.S.J. Unit Root Tests in Panel Data: Asymptotic and Finite-Sample Properties. J Econom 2002, 108, 1–24. [CrossRef]

- Dickey, D.; Fuller, W. Likelihood Ratio Statistics for Autoregressive Time Series with a Unit Root. Econometrica 1981, 49, 1057–1072. [CrossRef]

- Perron, P.; Phillips, P.C.B. Testing for a Unit Root in a Time Series Regression. Biometrika 1988, 2, 335–346. [CrossRef]

- Clemente, J.; Montañés, A.; Reyes, M. Testing for a Unit Root in Variables with a Double Change in the Mean. Econ Lett 1998, 59, 175–182. [CrossRef]

- Brock, W.A.; de Lima, P.J.F. 11 Nonlinear Time Series, Complexity Theory, and Finance. Handbook of Statistics 1996, 14, 317–361.

- Lo, A.W.; MacKinlay, A.C. Stock Market Prices Do Not Follow Random Walks: Evidence from a Simple Specification Test. Review of Financial Studies 1988. [CrossRef]

Figure 1.

Evolution in levels of the financial markets under study during the period from March 1, 2018, to March 9, 2023.

Figure 1.

Evolution in levels of the financial markets under study during the period from March 1, 2018, to March 9, 2023.

Figure 2.

Evolution in first differences of the financial markets under study during the period from March 1, 2018, to March 9, 2023.

Figure 2.

Evolution in first differences of the financial markets under study during the period from March 1, 2018, to March 9, 2023.

Figure 3.

Means Plot of the financial markets under study during the period from March 1, 2018, to March 9, 2023.

Figure 3.

Means Plot of the financial markets under study during the period from March 1, 2018, to March 9, 2023.

Figure 4.

Standard Deviations Plot of the financial markets under study during the period from March 1, 2018, to March 9, 2023.

Figure 4.

Standard Deviations Plot of the financial markets under study during the period from March 1, 2018, to March 9, 2023.

Figure 5.

Skewness Plot of the financial markets under study during the period from March 1, 2018, to March 9, 2023.

Figure 5.

Skewness Plot of the financial markets under study during the period from March 1, 2018, to March 9, 2023.

Figure 6.

Kurtoses Plot of the financial markets under study during the period from March 1, 2018, to March 9, 2023.

Figure 6.

Kurtoses Plot of the financial markets under study during the period from March 1, 2018, to March 9, 2023.

Figure 7.

Unit Root Test, with structural breaks, applied to the financial markets under study during the period from March 1, 2018, to March 9, 2023.

Figure 7.

Unit Root Test, with structural breaks, applied to the financial markets under study during the period from March 1, 2018, to March 9, 2023.

Figure 8.

Results of Rank Variance Ratio Test applied to the financial markets under study during the period from March 1, 2018, to March 9, 2023.

Figure 8.

Results of Rank Variance Ratio Test applied to the financial markets under study during the period from March 1, 2018, to March 9, 2023.

Table 2.

Descriptive Statistics of the financial markets under study during the period from March 1, 2018, to March 9, 2023.

Table 2.

Descriptive Statistics of the financial markets under study during the period from March 1, 2018, to March 9, 2023.

| |

BRENT CRUDE OIL |

CLEAN ENERGY FUELS |

GLOBAL CLEAN ENERGY |

GOLD |

ISHARES |

ISHRS |

NATURAL GAS |

| Mean |

0.000155 |

0.000598 |

0.001771 |

0.000245 |

0.000553 |

0.000544 |

-8.96E-05 |

| Std. Dev. |

0.026217 |

0.049719 |

0.091985 |

0.009404 |

0.019220 |

0.018850 |

0.036237 |

| Skewness |

-1.234521 |

0.597367 |

-1.288416 |

-0.237269 |

-0.518329 |

-0.440643 |

-0.325035 |

| Kurtosis |

20.91207 |

14.58143 |

31.59122 |

8.009203 |

10.33827 |

9.116044 |

6.109057 |

| Probability Jarque-Bera |

0.000000*** |

0.000000*** |

0.000000*** |

0.000000*** |

0.000000*** |

0.000000*** |

0.000000*** |

| Observations |

1354 |

1354 |

1354 |

1354 |

1354 |

1354 |

1354 |

Table 3.

Painel Unit root Tests applied to the financial markets under study during the period from March 1, 2018, to March 9, 2023.

Table 3.

Painel Unit root Tests applied to the financial markets under study during the period from March 1, 2018, to March 9, 2023.

| Group unit root test: Summary |

|

| |

|

|

Cross- |

|

| Method |

Statistic |

Prob.** |

sections |

Obs |

| Null: Unit root (assumes common unit root process) |

| Levin. Lin & Chu t* |

-173.944 |

0.0000 |

7 |

9470 |

| Breitung t-stat |

-92.8583 |

0.0000 |

7 |

9463 |

| |

|

|

|

|

| Null: Unit root (assumes individual unit root process) |

| Im. Pesaran and Shin W-stat |

-115.814 |

0.0000 |

7 |

9470 |

| ADF - Fisher Chi-square |

1843.74 |

0.0000 |

7 |

9470 |

| PP - Fisher Chi-square |

1843.74 |

0.0000 |

7 |

9471 |

Table 4.

Results of the BDS Test applied to the financial markets under study during the period from March 1, 2018, to March 9, 2023.

Table 4.

Results of the BDS Test applied to the financial markets under study during the period from March 1, 2018, to March 9, 2023.

| BDS Test for BRENT CRUDE DOW JONES |

|

| Dimension |

BDS Statistic |

Std. Error |

z-Statistic |

Prob. |

| 2 |

0.016876 |

0.002599 |

6.492842 |

0.0000 |

| 3 |

0.036247 |

0.004129 |

8.778088 |

0.0000 |

| 4 |

0.051300 |

0.004917 |

10.43424 |

0.0000 |

| 5 |

0.059954 |

0.005124 |

11.70030 |

0.0000 |

| 6 |

0.063392 |

0.004942 |

12.82805 |

0.0000 |

| BDS Test for CLEAN ENERGY FUELS |

|

| Dimension |

BDS Statistic |

Std. Error |

z-Statistic |

Prob. |

| 2 |

0.020259 |

0.002572 |

7.877258 |

0.0000 |

| 3 |

0.038072 |

0.004080 |

9.330183 |

0.0000 |

| 4 |

0.048559 |

0.004852 |

10.00868 |

0.0000 |

| 5 |

0.052180 |

0.005050 |

10.33347 |

0.0000 |

| 6 |

0.052027 |

0.004863 |

10.69846 |

0.0000 |

| BDS Test for GLOBAL CLEAN ENERGY |

|

| Dimension |

BDS Statistic |

Std. Error |

z-Statistic |

Prob. |

| 2 |

0.022778 |

0.002952 |

7.716667 |

0.0000 |

| 3 |

0.039843 |

0.004700 |

8.476748 |

0.0000 |

| 4 |

0.047173 |

0.005610 |

8.408223 |

0.0000 |

| 5 |

0.048214 |

0.005862 |

8.224290 |

0.0000 |

| 6 |

0.047695 |

0.005669 |

8.413907 |

0.0000 |

| BDS Test for GOLD DOW JONES |

|

| Dimension |

BDS Statistic |

Std. Error |

z-Statistic |

Prob. |

| 2 |

0.005789 |

0.002664 |

2.173212 |

0.0298 |

| 3 |

0.016060 |

0.004242 |

3.786072 |

0.0002 |

| 4 |

0.023335 |

0.005062 |

4.609951 |

0.0000 |

| 5 |

0.026482 |

0.005288 |

5.008143 |

0.0000 |

| 6 |

0.026392 |

0.005111 |

5.163640 |

0.0000 |

| DBS Test for ISHARES GLOBAL CLEAN EN ETF |

| Dimension |

BDS Statistic |

Std. Error |

z-Statistic |

Prob. |

| 2 |

0.018124 |

0.002587 |

7.005582 |

0.0000 |

| 3 |

0.040525 |

0.004105 |

9.872918 |

0.0000 |

| 4 |

0.056914 |

0.004881 |

11.66085 |

0.0000 |

| 5 |

0.070098 |

0.005080 |

13.79832 |

0.0000 |

| 6 |

0.076621 |

0.004893 |

15.66015 |

0.0000 |

| BDS Test for ISHARES GLOBAL CLEAN SWX ENERGY USD DIST ETF |

| Dimension |

BDS Statistic |

Std. Error |

z-Statistic |

Prob. |

| 2 |

0.023454 |

0.002629 |

8.920287 |

0.0000 |

| 3 |

0.046955 |

0.004177 |

11.24106 |

0.0000 |

| 4 |

0.063969 |

0.004973 |

12.86232 |

0.0000 |

| 5 |

0.078078 |

0.005183 |

15.06335 |

0.0000 |

| 6 |

0.084883 |

0.004999 |

16.98125 |

0.0000 |

| BDS Test for NATURAL GAS DOW JONES |

|

| Dimension |

BDS Statistic |

Std. Error |

z-Statistic |

Prob. |

| 2 |

0.023727 |

0.002609 |

9.093599 |

0.0000 |

| 3 |

0.046691 |

0.004145 |

11.26397 |

0.0000 |

| 4 |

0.066183 |

0.004935 |

13.41045 |

0.0000 |

| 5 |

0.082197 |

0.005143 |

15.98124 |

0.0000 |

| 6 |

0.092390 |

0.004960 |

18.62734 |

0.0000 |

Table 5.

DFA results. The hypotheses are

Table 5.

DFA results. The hypotheses are

| Mercado |

Expoente DFA (Tranquilo) |

Expoente DFA (Stress) |

| CRUDE OIL (BRENT) |

0.52≌ 0.0206 (= 0.97)

|

0.56*** ≌ 0.0029 ( = 0.97) |

| CLEAN ENERGY FUELS |

0.61*** ≌ 0.0010 ( = 0.97) |

0.54** ≌ 0.0014 ( = 0.98) |

| GLOBAL CLEAN ENERGY |

0.46** ≌ 0.0019 ( = 0.98) |

0.44** ≌ 0.0012 ( = 0.98) |

| GOLD (DJ) |

0.46≌0.0248 (= 0.97)

|

0.44** ≌ 0.0064 ( = 0.98) |

| ISHARES GLOBAL CLEAN ENERGY EFT |

0.50≌0.0082 (= 0.98)

|

0.59*** ≌ 0.0023 ( = 0.99) |

| ISHARES Global Energy (SWX) EFT |

0.51≌0.0106 (= 0.98)

|

0.58*** ≌ 0.0019 ( = 0.99) |

| NATURAL GAS (DJ) |

0.55** ≌ 0.0027 ( = 0.97) |

≌0.0136(= 0.98)

|

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).