1. Introduction-Research Questions

An analysis relating to corruption on a global level is carried out below. Corruption impacts almost all the factors of economics, politics, and society. The corrupt countries are generally poor countries, without democratic and economic freedom, and affected by the curse of natural resources. However, corruption is not just a fact that concerns poor and developing countries. Corruption also concerns many countries that have high levels of pro-capita income, and which also have legal systems oriented to the “

Rule of Law”. For example, the recent Qatargate scandal [

1] that has shocked the European Parliament is a classic case of corruption that takes place in an area of the world characterized by high per capita GDP and presence of “

Rule of Law”. However, obviously corruption is not only present in Europe. Corruption also abounds in Anglo -Saxon countries where, however, it often takes a strange form: lobbyism. In fact, from a technical point of view, the lobbyist can be considered as a corruptor or a person who uses money to make sure that the policy maker makes laws in his favor. For example, if the Qatargate had happened in the USA there would have been no scandal. The Qatar lobbyists would in fact have regularly recorded at the congress as lobbyists and would have carried out their work of corruption towards the senators and the US deputies. To have an idea of how similar lobbyism it is to corruption, and it is not assimilable to corruption only for legislative reasons, for example, look at the US health system as reported by Anna Case and Angus Deaton [

2].

Corruption is obviously not a new fact in the history of regimes, states, and legal systems. For example, in the book of Robinson and Acemoglu [

3]. There are many examples of how corrupt regimes have decreed the end of states, nations, and empires even once powerful and rich. The corruption of the ruling class is a characteristic of rent-seeking or of that complex of activities that an elite of power puts in place to subtract resources from the population, the state, and the market.

There are also new and imaginative forms of activities that in some way can be understood as forms of corruption of states. This is the case, for example, of those countries, such as Ireland and Luxembourg, which allow for fiscal domiciliation by agreeing a favorable taxation. In this case it is as if the government deliberately renounced part of the tax revenues to acquire unpleasant counterparts deriving from the presence of large multinational companies in the national territory. A condition that can generate dangerous imitative effects in what is the tax competition that pushes European states to sell off its tax system in exchange for the domiciliation of multinational companies [

4].

How can corruption be reduced? Certainly, there are sociological and cultural elements that must be taken into consideration. First, corruption must be taken seriously as a real economic system. Corrupt countries and communities have developed corruption as a social norm implicit in public and private contracts. And in this context, corruption operates as a “grundnorm” implicit in the regulation of economic exchanges. It is therefore necessary to understand what the economic need is, or the structure of incentives, that is shaped through corruption. And then it is necessary to act with the formation of human capital and social capital. Particular attention must be paid to the share capital. In fact, corrupt countries are also countries that have little trust in the state, in politics, in policy makers. It is important to intervene socially by creating the conditions for greater participation of the population in democratic and legislative processes. Strengthening parties, associations, trade unions and offering citizens paths of active participation in institutional politics and local government can help create that social capital which can lead to a culture of legality and respect for the rules.

Another element that can reduce corruption is technology. The use of IT and e-government tools can broke the connection among entrepreneurs, public officials, bankers and corrupt politicians, creating the conditions for an objective, impartial and anonymous evaluation of the economic relations between the public sector and the private sector. Unfortunately, this solution is difficult to implement in corrupt countries which are also countries with low levels of digitization.

It is also necessary to create international rules against corruption. Indeed, it is known that corrupt politicians are very good at winning elections in democratic or pseudo-democratic countries. A limitation on the number of parliamentary mandates imposed by international organizations could reduce the presence of corrupt politicians in the institutions at national level. However, corruption often also affects the police, the judiciary, and the legal system. In this case, the fight against corruption can be very difficult at the country level and requires the joint intervention of endogenous and exogenous forces that are able to defuse the incentives for corruption by bringing the economy back to the path of economic growth.

The article proceeds as follows: the second paragraph contains a synthesis of the methodology used, the third paragraph shows a brief analysis and discussion of the scientific literature, the fourth paragraph contains the econometric models and results, the fifth paragraph contains the cluster analysis, the sixth paragraph offers the analysis with Machin Learning algorithms for prediction, the seventh paragraph indicates the limitations, implications and future developments of the research, the eighth paragraph concludes.

2. Methodology for the Investigation of the Dataset and Catch the Determinants of Control of Corruption

To investigate the dataset of the World Bank entitled Esg-Environmental, Social and Governance we have chosen to use an approach consisting of three essential elements or: panel of regression, clusterization and algorithms of machine learning. The reasons for this choice are identified below or:

Panel Data Regressions: the regression panel data were carried out to investigate the relationships of the variable in question with the other variables in the database of the World Bank dataset. In particular, the following regression models were made: Panel Data with Random Effects, Panel Data with Fixed Effects, WLS, and Poled OLS. The configuration of the model that presents significant variables was therefore chosen. The analysis suggests what are the relationships between the variables, that is, what are the variables connected positively and which negatively with respect to the value of the variable investigated;

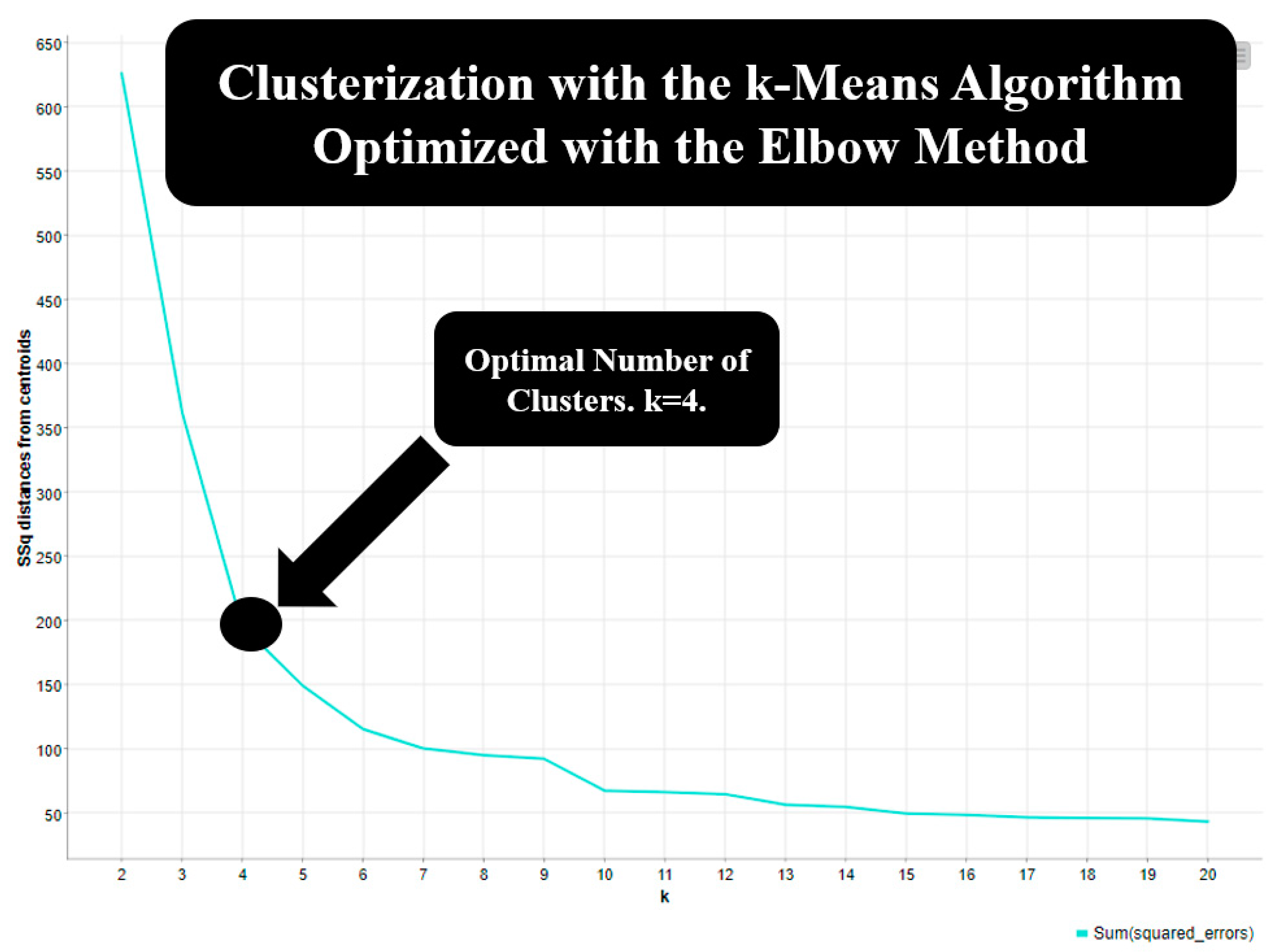

Clusterization: a clusterization with the K-means algorithm was later carried out. To effectively use the K-means algorithm, it is necessary to specify the optimal number of K, or the Clusters. To identify the optimal number of clusters, the Elbow method was chosen, or a graphic method that allows you to identify the optimal number of clusters. Clusterization is necessary to verify the presence of groupings within the analyzed dataset. The groupings highlight what are the geographical, institutional, political, and economic characteristics of the countries based on the level of corruption.

Machine Learning Algorithms for Prediction: Machine Learning algorithms are then presented for the prediction of the future value of the variable analyzed. The algorithms used were trained with 70% of the available data and the remaining 30% of the data was used for the test. The choice of the most performing algorithms took place through the analysis of the following statistical indicators namely: R-Squared, Mae, MSE, RMSE.

The joint use of these three methods allows us to describe what are the major determinants of corruption in the context of the ESG dataset of the World Bank, how the countries by corruption level are grouping, and what are the prospects of the countries in terms of growth or reduction of corruption.

3. Literature Review, Synthesis of the Main Findings in terms of Control of Corruption and Critical Discussion of Relevant Features

A brief analysis of the scientific literature relating to the theme of corruption in various areas is presented below. The analysis of literature has no exhaustive character and simply aims to introduce the theme of the fight against corruption from a scientific point of view. In this regard, it is necessary to underline that the negative effects of corruption expand from the private to public sphere. Corruption not only reduces the ability of the countries to grow from the point of view of the gross domestic product. Corruption also prevents investments in relevant sectors such as health, education, and non-profit. Finally, corruption prevents companies and banks from performing effectively by reducing the possibility of producing goods and services at the country level.

Corruption and food security. [

1] find a positive relationship between food security and control of corruption in a Sub-Saharan Countries in the period 1996-2015. The ability of corruption to reduce food security is very serious especially in the Saharan countries which are among the poorest on the African continent. Obviously, corruption leads to an unequal distribution of resources and makes Foreign Direct Investments-FDI difficult. It follows that the efficiency of international aid is also reduced to a context characterized by corruption. However, it is very difficult for corruption to sub-Saharan countries to disappear without adequate public and private investments in the formation of human capital and in the creation of democratic institutions subject to the Rule of Law.

Corruption and environment. [

2] show the positive effect that corruption control has in creating a connection between E-Participation and Environmental Performance. The control of corruption improves the efficiency of Protected Area-PA with positive effects on environmental sustainability and biodiversity [

3]. The spread of corruption prevents countries from performing effectively in terms of environmental protection. In this sense, phenomena of pollution of the territory are possible, depletion of natural resources, poaching, and other forms of violence against nature and animals that can reduce environmental heritage at the country level. Obviously, this violence against the territory perpetrated thanks to corruption increases in those countries that are equipped with natural resources such as oil. Corruption therefore threatens nature and biodiversity by creating the conditions for the deprivation of natural resources, for the reduction of biodiversity and for the pollution of the territories also protected by special rules.

Corruption and international affairs. [

4] verify the presence of a positive relationship between Chinese local aid in Africa and the increase in local corruption even in the absence of local economic development. [

5] show a strong relationship between corruption and international business concluding that only a reinforcement of international law can reduce corruption in international affairs. The relationship between corruption and international affairs is not a necessity, as showed in [

6] where the authors find a positive relationship between control of corruption and Foreign Direct Investments in BRICS country. [

7] suggests that in some Western Balkan Countries such as Montenegro, Serbia and Macedonia, the diffusion of corruption is due to ability of corrupted politicians to win elections. [

8] considers the failure of anticorruption policies in Asian countries, specifically in Hong Kong, India, the Philippines, Singapore, Taiwan. The author sustains that the major reason for the failure of anti-corruption policy is the presence of corrupt political leaders and their ability to control corrupted police. However, the intervention of international global institutions such as IMF-International Monetary Fund improves corruption even imposing neoliberalist and market-oriented reforms in developing countries [

9]. Corruption returns the efficiency of international cooperation and foreign direct investments-ideas. Corruption concerns not only poor developing countries. Corruption also concerns evolved countries such as Singapore and Hong Kong. To solve the problem of corruption in business and international affairs it is necessary to build international institutions that act on a supranational level and that are therefore free from those national political pressures that can cause a growth of corruption also in the tendentially democratic and liberal countries.

Corruption in post-communist countries and transition economies. [

10] show the presence of corruption in post-communist countries. Corruption in post-communist countries is due to series of motivations i.e.: communist institutions, lack of efficiency in transaction to democratic liberalism and capitalism, and economic underdevelopment that preceded the instauration of the communist regime. Obviously, the transition from a communist economy to a market economy involves difficulties and adjustment periods. However, in many ex-communist countries, such as Eastern European countries, corruption was not introduced by the communist institutions. Corruption pre-existing to communism. This condition highlights the role of corruption as the previous social rule. Corruption persists in the transition from autocratic regimes to democratic-liberal regimes. In these cases, the elimination of corruption requires a long phase of adjustment guided by the investment in human capital and in the efficiency of the government in producing goods and services for the population.

| Synthesis of the Literatures by Macro-Themes |

| Main Themes |

Main Propositions |

References |

| Corruption and Food Security |

There is a negative relationship between corruption and food security. |

[1] |

| Corruption and Environment |

Control of corruption can improve the environmental performance. Control of corruption increases the efficiency of Protected Areas-PA. |

[2,3] |

| Corruption and International Affairs |

Corruption impacts either the Chinese financial aid in Africa either the international business. But studies also show that in BRICS countries the reduction of corruption improve Foreign Direct Investments-FDI. But corruption is also due to the presence of corrupted politicians that knows how to win democratic elections. Many Asian countries also have failed to fight against corruption due to the dominance of corrupted politicians in formally democratic elections. Neoliberal reforms proposed by IMF can improve corruption. |

[4,5,6,7,8,9] |

| Corruption and Post-communist Countries and Transition Economies |

Post-communist countries are characterized by the presence of corruption either due to pre-regimes socio-economic conditions either to the specific characteristics of communist institutions. |

[10] |

| Corruption, Good Governance and Rule of Law |

Countries that have higher quality of rule of law are also better in fight against corruption. E-government and IT can reduce corruption. Better informed citizens can discriminate corrupted politicians. Control of corruption improves tax obedience. The fight against corruption improves tax revenues. Corruption reduces the efficiency of democracies. The increase in youth population reduces corruption at country level. Some countries, such as Bulgaria and Hungary still have higher level of corruption even if they are part of high productive and well governed areas and institutions. Countries that have higher level of public debt also have higher levels of corruption. |

[11,12,13,14,15,16,17,18,19,20] |

| Corruption and Economic Growth |

There is a positive relationship between control of corruption and economic growth. Corruption reduces economic growth, especially in autocracies. Corruption is negatively associated to GDP growth and FDI-Foreign Direct Investments. An increase in GDP per capita promotes corruption in natural resources rich countries. |

[21,22,23,24,25] |

| Corruption and Health Systems |

Corruption impedes the implementation of universal health systems. |

[26] |

| Corruption, banking, and firm performance |

There is a negative relationship between corruption and corporate social responsibility ad firm level in China. Corporate corruption worsens SMEs financial conditions in low-income per capita countries. Islamic banking is strengthened by the reduction of corruption. The fight against corruption promotes a better banking regulation. A widespread corruption drives firms to strongly prefer cash. Corruption can promote some industrial sector, i.e., construction and reduce the resources for others, i.e. non-profit. |

[27,28,29,30,31,32]. |

Corruption and good governance and rule of law. [

11] shows that the positive relationship between the fight against corruption and the high level of cognitive ability at country level holds only for countries that have high quality of rule of law. The implementation of e-government can reduce the orientation toward corruption in middle-high per capita income countries [

12]. Furthermore, if citizens have greater cognitive abilities, then they have better probabilities to discriminate corrupted politicians. The fight against corruption is also a function of the investment in human capital at country level [

13]. Furthermore, control of corruption and rule of law have a positive effect on tax obedience [

14]. The reduction of corruption drives government towards better fiscal outcomes and tax revenues compatible with Sustainable Development Goals [

15]. On an institutionalist point of view, corruption reduce the efficiency of democracies [

16]. Show the presence of a positive relationship between corruption and a large share of young population at country level. Specifically, the authors find that the probability to improve corruption decrease when the young population exceed 19% of the total population [

17]. The fight against corruption relevant not only for developing countries, but also for advanced countries and economic areas. For example, even if generally European Countries show low level of corruption, there are exception. Hungary and Bulgaria have higher level of corruption and European Union Member States have tried, with scarce results, to reduce corruption. The case of Hungary and Bulgaria show that corruption as implicit social norm has deep cultural connections with the individual and collective behaviors at country level. It can be difficult to introduce incentives that promote anti-corrupt behaviors if corruption is intended as an implicit social norm in public and private bargaining [

18]. The implementation of IT methods in governmental practices can reduce corruption [

19]. Countries that have higher levels of corruption also have higher levels of public debt [

20]. Corruption reduces the ability of governments to operate effectively in the production of goods and services. Corruption is produced by the political class. However, it is very difficult to eradicate corruption in government. In fact, corrupt politicians have a special ability to win elections in formally democratic countries with low per capita incomes. The introduction of legislation limiting the number of parliamentary mandates and government posts could reduce the impact of corrupt politicians in the institutions of newly industrialized countries.

Corruption and economic growth. [

21] find a positive relationship between control of corruption and economic growth in the context of the complexity index. Control of corruption can promote economic growth also in low and middle-income countries if there is also an investment in human capital [

22]. Corruption reduces economic growth especially in autocracies [

23]. Corruption not only reduces Gdp growth but also negatively affect Foreign Direct Investments-FDI [

24]. The increase in income per capita is positively associated with corruption in country that have natural resources, even if the diffusion of economic and political freedom tends to reduce the degree of corruption [

25]. Corruption prevents economic growth as it offers wrong incentives for the population. In fact, in a corrupt country the population will not be encouraged to study or work. The population will try to use the corruption system to acquire the necessary social positions and economic resources. Corruption therefore prevents meritocracy. The lack of meritocracy reduces individual and collective effort and distorts incentives to produce added value at an economic and social level.

Corruption in health systems. [

26] shows that corruption is one of the main obstacles to the implementation of universal health systems. Health systems are undergoing clientele pressure that through corruption can distort the quality and quantity of health services offered to the population. Corruption in the health system can operate both in the models centered on the public offer of health services and on private models. The costs of health services, drugs, health machinery are growing artificially. In this context only people who have medium high income or qualified personal relationships can have access to adequate health care. The idea of the universal health service, be it public, private, or mixed, is an idea that derives from the movements of the welfare state of the 900 and which however struggles to establish itself in highly corrupt countries. The population of corrupt countries can suffer from inadequate and insufficient health care.

Corruption, banking, and firm performance. There is a negative relationship between corruption and corporate social responsibility ad firm level in China [

27]. Corruption at corporate level reduces the ability of SMEs to growth in low-income countries [

28]. The fight against corruption improves banking efficiency in Islamic countries [

29]. Control of corruption enhances governments in promoting a better capital regulation in the banking sector having a positive impact in macro-economic and financial stability [

30]. The fact that firms tend to prefer cash is a signal of a widespread corruption [

31]. Corruption can distort the distribution of resources and incentives among economic sectors. For example, in USA the increase in corruption has created a shift of investment towards the construction sector reducing the flow of resources towards non-profit and educational system [

32].

Corruption prevents companies from producing efficiently. The distortions introduced by corruption are evident. Companies in ordinary conditions should focus on the production of competitive goods and services in terms of price or quality. In countries characterized by corruption on the contrary, companies can spend many resources in making public relations, in paying bribes to politicians, and in guaranteeing market power through pressure on competitors and suppliers. Firms subtract economic resources from production to allocate them to clientelism and corruption. The result is an entrepreneurial system unable to produce goods and services, with low productivity and low competitiveness.

4. The Econometric Model for the Estimation of the Value of Control of Corruption

We have estimated the following formula:

Where

and

We found that Control of Corruption is positively associated to:

Government Effectiveness: considers the government's ability in producing public services, quality of civil service, degree of independence from political pressure, quality of formulation and implementation of the policies and credibility of the government. The analysis provides a score that varies from -2.5 to +2.5. There is a positive relationship between the government's ability to control the corruption and the effectiveness of the government. This relationship can be easily understood considering that the possibility of states to produce qualitatively high services for the population depends significantly on the ability to reduce corruption. In fact, corruption can prevent the realization of public works and significantly reduce the effectiveness and efficiency of the provision of services towards the population. In fact, considering the top ten of the countries by the value of the Government Effectiveness it is possible to note that they coincide with those of the most performing cluster as indicated in paragraph 4 or: Singapore with a value equal to 2.32, Switzerland with an amount equal to 2.01, Finland with a value of 1.94, Norway with a value of 1.93, Denmark with an amount equal to 1.88, the Netherlands with a value of 1.84, Luxembourg with 1.83, Andorra with 1, 82 Unit, Liechtenstein with a 1.81, and Sweden with a value equal to 1.71 units. We can also consider both the effectiveness of the government and the ability to combat corruption as elements of that type of enlightened government that inspired by democratic laws on the one hand recognizes the rights and freedoms of citizens and on the other hand protects the property of natural and legal persons.

Political Stability and Absence of Violence/Terrorism: is a variable that measures perception about the probability of political instability or manifestation of politically motivated violence also through terrorism. The indicator varies from an amount of -2.5 up to a value of 2.5. There is a positive relationship between political stability and the absence of terrorism and the ability to fight corruption. Certainly, in fact, countries that have high ability to fight corruption are also able to guarantee political stability and to combat terrorism. Obviously, it must be considered that the indicator brings together two elements that probably should be distinguished or the political stability and the absence of terrorism. In fact, while on the one hand it is certainly true that countries that can fight corruption also have a good ability to guarantee political stability, on the other hand it is not exactly true that the high ability countries to fight corruption are also to fight terrorism. In fact, terrorism, for its own characteristics, is very difficult to predict. And, the countries of Northern Europe, such as Norway, or Anglo-Saxon countries, such as UK and USA, also having high levels of political stability, are unable to guarantee the absence of terrorism or terrorist violence. Furthermore, it must also be considered that above all the USA are often crossed by a tension of racial social violence that reduce the ability of guarantee the stability of government.

School enrollment, primary (% gross): is an indicator that considers primary education that provides children with basic skills in reading, writing and mathematics together with a basic understanding of subjects such as history, geography, natural sciences, social sciences, art and the music. There is a positive relationship between the government's ability to fight corruption and the education system's ability to provide education and training for children. This relationship can be understood considering the sociological scenario in which the economic policies against corruption and the economic policies of primary education are implemented. In fact, countries that have a vision of enlightened government that guarantees rights to its citizens and fights corruption also have attention towards education and especially primary education.

| Estimation of the Value of Control of Corruption. Source: Eurostat |

| |

|

Pooled OLS |

Fixed Effects |

Random Effects |

WLS |

Average |

| |

|

Coefficient |

P-Value |

Coefficient |

P-Value |

Coefficient |

P-Value |

Coefficient |

P-Value |

| |

Constant |

-0,0059428 |

|

-0,0204129 |

|

0,0311085 |

|

-0,0324549 |

*** |

-0,006925525 |

| A6 |

Agriculture, forestry, and fishing, value added (% of GDP) |

-0,0020579 |

* |

-0,0124109 |

*** |

-0,00681574 |

*** |

-0,00785992 |

*** |

-0,007286103 |

| A24 |

GDP growth (annual %) |

0,0036255 |

*** |

-0,0047215 |

*** |

0,00291442 |

*** |

-0,00296939 |

*** |

-0,000287743 |

| A25 |

GHG net emissions/removals by LUCF (Mt of CO2 equivalent) |

0,070035 |

*** |

-0,382405 |

*** |

0,0542848 |

*** |

-0,364013 |

*** |

-0,15552455 |

| A27 |

Government Effectiveness: Estimate |

0,465544 |

*** |

0,59781 |

*** |

0,485724 |

*** |

0,636079 |

*** |

0,54628925 |

| A47 |

Political Stability and Absence of Violence/Terrorism: Estimate |

0,0521247 |

*** |

0,135428 |

*** |

0,0667375 |

*** |

0,139837 |

*** |

0,0985318 |

| A54 |

Ratio of female to male labor force participation rate (%) (modeled ILO estimate) |

-0,0006505 |

*** |

0,000635711 |

* |

-0,00044924 |

** |

0,00034609 |

** |

-0,000029492 |

| A60 |

School enrollment, primary (% gross) |

0,0002244 |

** |

0,00119453 |

*** |

0,00024819 |

** |

0,000726612 |

*** |

0,000598435 |

| A63 |

Strength of legal rights index (0=weak to 12=strong) |

-0,0004274 |

*** |

-0,00073973 |

*** |

-0,00047837 |

*** |

-0,00083395 |

*** |

-0,000619861 |

We also found that Control of Corruption is negatively associated to:

Ratio of female to male labor force participation rate: It is an indicator that is calculated dividing the participation rate of the female workforce for the participation rate of the male workforce multiplied by 100. It is therefore an indicator that considers female participation in the labor market compared to the male participation rate. There is a negative relationship between the female participation rate at work and the corruption control rate. This relationship may seem paradoxical as women's participation in the labor market is generally considered a conquest of western medium-high per capita housing countries which are also those who have the highest levels of corruption control. This relationship may appear against factual, however, take the ranking for countries with a high level of women's participation in the workforce in percentage of the male workforce, it is noted that they are low-income income countries characterized by corruption. For example, if you consider the top ten of the countries for percentage of female work at male work, the following ranking is obtained or Burundi with 102.53%, Sierra Leone 100.62%, Rwanda with 100.33%, Guinea with 99.29 % and Mozambique with 98.66%. It should be noted that in Burundi the participation rate of women in the market has exceeded the corresponding male participation rate. Furthermore, it is possible to note that the same countries have very low values in terms of corruption control or: Burundi -1.28, Sierra Leone, -1.02, Rwanda 0.3, Guinea with -0.94, Mozambique with -0.77. It follows that contrary to what is supported in the western world and what is proclaimed by feminists, in reality the countries where women participate more in the labor market are poor and corrupt countries. The first western country in the ranking of women's participation in the labor market is Sweden in 27th place where about 89 women every 100 men work.

GDP growth: is a variable that considers the percentage GDP growth rate at constant prices. There is a negative relationship between the value of the GDP growth rate and the value of corruption control at the country level. This relationship can be easily understood considering that the countries that have the highest levels of corruption control are western countries with high per capita income. Notoriously the growth rate of high-income countries high tends to be quite reduced. On the contrary, the countries that have a reduced value of pro-capita income have high GDP growth rates. It follows that countries that grow more in terms of GDP have more corrupt governments of countries that grow less. For example, the five countries that have had greater economic growth in 2020 in terms of GDP are in order: Guyana with +43.47%, fear-lilies with +31.91%, Ireland with +6.18%, Ethiopia with 6.05% and American Samoa with 5.06%. The same countries have had very reduced levels of evaluation in terms of fighting corruption with an exception of course of Ireland which instead had a high evaluation of 1.47%. However, it must be considered that Ireland is an exception above all because it has based its amazing economic growth on aggressive tax policies that have favored the domiciliation of foreign companies above all operating in the Information Community Technology-ICT sector. Therefore, having made the exception of Ireland, it is confirmed that the countries that have greater economic growth in terms of GDP are also those who have a reduced ability to control corruption. With this obviously we do not want to say that creating corruption is a strategy for the growth of GDP. Instead, we want to emphasize that the countries that grow a lot in terms of GDP, with due exceptions, are also those that start from low-income levels and that tend to have a reduced ability to control corruption.

Strength of legal rights index: It is an indicator that considers the ability of a country to protect the rights of mutuals and financiers through a special regulatory-legislative structure. It is an index that therefore measures the presence of laws that can easily allow the exercise of the loan activity. The indicator varies from 0 to 12. 12 is the maximum level in which the laws are believed to be able to allow the spread of credit activity to the population. There is a negative relationship between the ability to control corruption and the ability to defend creditors with special laws. This negative relationship is not so much of a theoretical nature. Ideally there is no contradiction between fighting corruption and guaranteeing a regulatory structure that is in favor of the credit and banking system. However, the relationship becomes negative for strictly metric reasons. For example, if we take the top ten of the countries for the ability to guarantee creditors, it is possible to verify that there are five countries with negative corruption control values or Azerbaijan, Montenegro, Kenya, Malawi, Tajikistan. In addition, there are three others who have corruption control values close to zero or Colombia, Jordan, Rwanda. It follows that in the top ten of the countries that have the best regulation in favor of creditors there are 8 countries that have a value of the control of negative corruption or close to zero. With this obviously one does not mean that to have greater control of corruption, the effectiveness of the rules that protect creditors must be reduced. But it is also true that many countries that have good performances in the fight against corruption also have low levels of protection of creditors. For example, the United Kingdom has a value of 7 out of 12, and France of 4 out of 12.

Agriculture, forestry, and fishing, value added: is a variable that considers the impact of agriculture, silviculture, and percentage fishing of GDP. There is a negative relationship between the value of GDP produced by agriculture as a percentage of total GDP and the ability to fight corruption. This negative relationship does not only have a metric sense, but it also has a theoretical dimension. In fact, the countries that have the greatest ability to fight against corruption are the high-income countries that are such precisely because they have a percentage value of GDP produced by reduced agriculture especially if compared with that deriving from services and industry. It follows that if obviously a country has a value of agriculture very high in percentage of GDP means that it is a medium-low-income country, an African country, or a country of southern Asia, that is, those geographical areas that have the greatest difficulties in fighting against the spread of corruption on government level. For example, if we consider the countries that have the greatest presence of agriculture, silviculture, and fishing worldwide we note that in first place there is Sierra Leone with a value of 59.48%, followed by Chad with a value of 46.83%, Liberia with 41.05%, Niger with 38.37%and Syrian Arab Republic with 36.63%. The same countries also have bad values in terms of corruption control. In particular, the Sierra Leone has a value of the corruption control equal to an amount of -1.02, followed by the Chad with an amount of -1.48 units, by Liberia with a value of -1.43 units, from Nigeria with a value of -0.63 units and from Syria Arab Republic with a value of -1.73 units. With this we do not want to say that agriculture creates corruption in the exercise of government activity. On the contrary, we want to highlight that the countries that have significant percentages of GDP from agriculture have generally little ability to fight against corruption, also because they are low-income income countries.

GHG net emissions/removals by LUCF: refer to changes in the atmospheric levels of all greenhouse gases attributable to forest change activities and soil use, including but not limited to (1) emissions and removals of CO2 from decreases or biomass increases due to forestry stock management, registration, flow wood collection, etc.; (2) conversion of existing forests and natural meadows in other terrestrial uses; (3) Removal of CO2 from the abandonment of previously managed lands (for example cultivated land and pastures); and (4) CO2 emissions and removals in the soil associated with change and management of soil use. There is a negative relationship between this variable and the ability to control corruption. This negative relationship can be understood considering that while the western countries, which also pollute, have signed protocols for the reduction of emissions, emissions continue to be very significant in some low-income countries that have also medium or low levels of corruption control. It therefore derives that for the medium -low-income countries that are also without institutions capable of controlling corruption, the question of choosing among economic growth, pollution, and ethics in public affairs is placed. Obviously often low-income countries prefer to pollute to grow, and this pollution is certainly facilitated by the presence of institutions without the ability to effectively control corruption in public offices.

| Average Value of the Variables for the Estimation of the Value of Control of Corruption |

| Label |

Variables |

Average Value |

Positive or Negative |

| A27 |

Government Effectiveness: Estimate |

0,5462893 |

Positive |

| A47 |

Political Stability and Absence of Violence/Terrorism: Estimate |

0,0985318 |

| A60 |

School enrollment, primary (% gross) |

0,0005984 |

| A54 |

Ratio of female to male labor force participation rate (%) (modeled ILO estimate) |

-0,0000295 |

Negative |

| A24 |

GDP growth (annual %) |

-0,0002877 |

| A63 |

Strength of legal rights index (0=weak to 12=strong) |

-0,0006199 |

| A6 |

Agriculture, forestry, and fishing, value added (% of GDP) |

-0,0072861 |

| A25 |

GHG net emissions/removals by LUCF (Mt of CO2 equivalent) |

-0,1555246 |

5. Clusterization with the k-Means Algorithm optimized with the Elbow Method

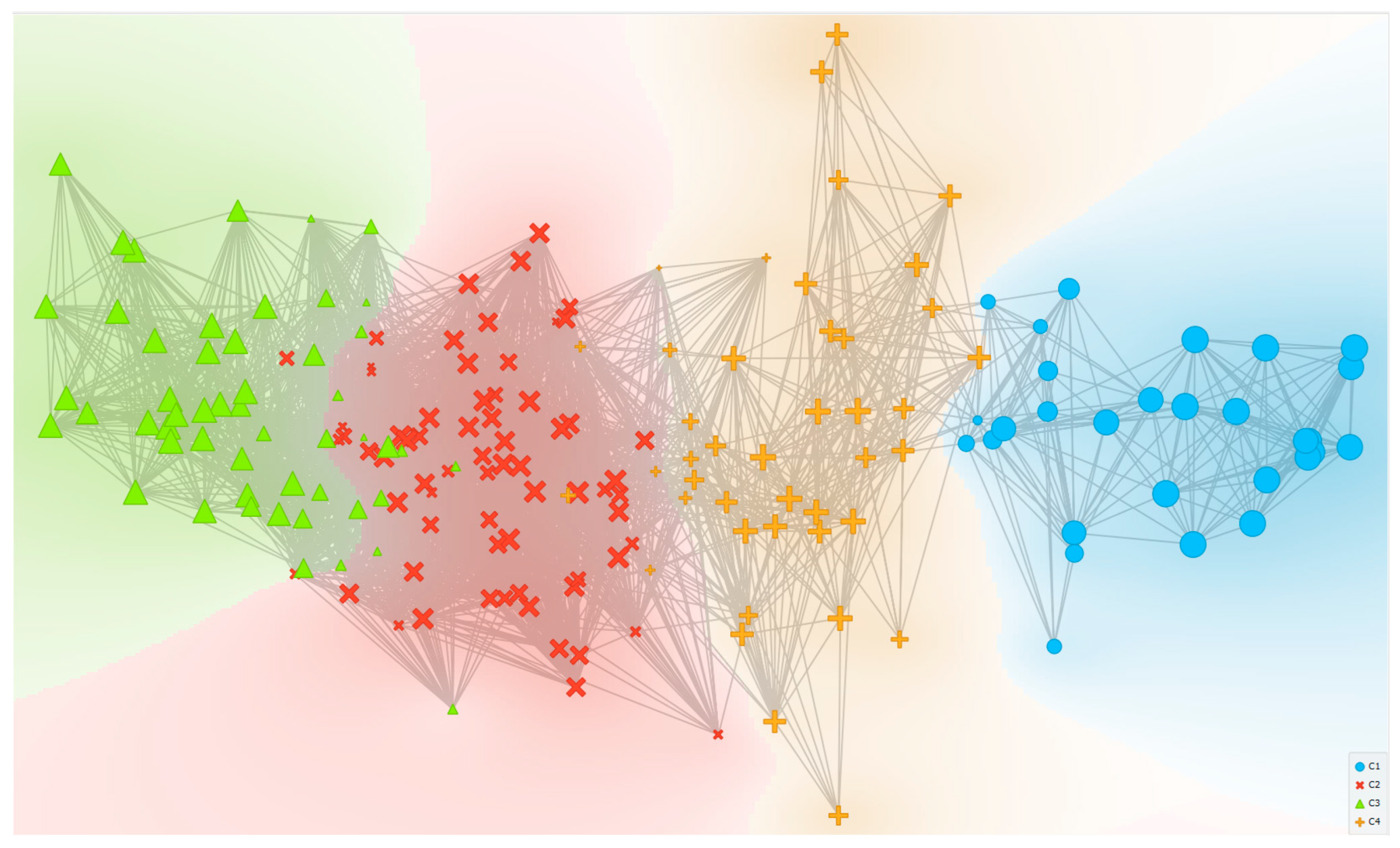

Below is an analysis with the K-means algorithm optimized using the Elbow method. For the cluster analysis we use a dataset from World Bank in the period 2011-2021. Specifically, four different Clusters represented are identified or:

Cluster 1: Andorra, Australia, Austria, The Bahamas, Barbados, Belgium, Bhutan, Canada, Chile, Denmark, Estonia, Finland, France, Germany, Iceland, Island, Japan, Liechtenstein, Luxembourg, Netherlands, New Zealand, Norway, Singapore, Sweden, Switzerland, United Arab Emirates, United Kingdom, United States, Uruguay;

Cluster 2: Kazakhstan, Albania, Algeria, Argentina, Armenia, Belarus, Belize, Benin, Bolivia, Bosnia and Herzegovina, Brazil, Bulgaria, Burkina Faso, China, Colombia, Cote d’Ivoire, Djibouti, Ecuador, Egypt Arab Rep, El Salvador, Eswatini, Ethiopia, The Gambia, Ghana, Greece, Guyana, India, Indonesia, Jamaica, Kuwait, Lesotho, Liberia, Malawi, Maldives, Mali, Marshall Islands, Moldova, Mongolia, Montenegro, Morocco, Mozambique, Nauru, Nepal, Niger, North Macedonia, Palau, Panama, Peru, Philippines, Romania, Sao Tome and Principe, Senegal, Serbia, Sierra Leone, Solomon Islands, South Africa, Sri Lanka, Suriname, Tanzania, Thailand, Timor-Leste, Tonga, Trinidad and Tobago, Tunisia, Turkey, Tuvalu, Vietnam, Zambia;

Cluster 3: Afghanistan, Angola, Azerbaijan, Bangladesh, Burundi, Cambodia, Cameroon, Central African Republic, Chad, Comoros, Congo Dem. Rep., Congo Rep., Dominican Republic, Equatorial Guinea, Eritrea, Gabon, Guatemala, Guinea, Guinea-Bissau, Haiti, Honduras, Iran Islamic Rep., Iraq, Kenya, Korea Dem. People's Rep., Kyrgyz Republic, Lao PDR, Lebanon, Libya, Madagascar, Mauritania, Mexico, Myanmar, Nicaragua, Nigeria, Pakistan, Papua New Guinea, Paraguay, Russian Federation, Somalia, South Sudan, Sudan, Syrian Arab Republic, Tajikistan, Togo, Turkmenistan, Uganda, Ukraine, Uzbekistan, Venezuela RB, Yemen Rep, Zimbabwe;

Cluster 4: Antigua and Barbuda, Bahrain, Botswana, Brunei Darussalam, Cabo Verde, Costa Rica, Croatia, Cuba, Cyprus, Czechia, Dominica, Fiji, Georgia, Grenada, Hungary, Israel, Italy, Jordan, Kiribati, Korea Rep., Latvia, Lithuania, Malaysia, Malta, Mauritius, Micronesia Fed Sts, Namibia, Oman, Poland, Portugal, Qatar, Rwanda, Samoa, Saudi Arabia, Seychelles, Slovak Republic, Slovenia, Spain, St Kitts and Nevis, St Lucia, St Vincent and the Grenadines, Vanuatu.

From the point of view of the median, it is possible to check the following system of the Clusters or: C1 = 1,64912> C4 = 0.552678> C2 = -0.37155> C3 = -1.15803.

Figure 1.

The Elbow Method to find the optimal number of clusters with the implementation of the k-Means algorithm.

Figure 1.

The Elbow Method to find the optimal number of clusters with the implementation of the k-Means algorithm.

From a strictly geographical point of view, it is possible to verify that the countries that have the greatest capacity to fight government corruption and therefore create institutions that are freer from the point of view of deliberation are essentially the countries with medium-high per capita income. Most countries are European, to which are added the countries of Anglo-Saxon culture or United Kingdom, Canada, Australia, New Zealand, and the United States. Furthermore, some countries that are tax havens or are highly evolved from a financial point of view, such as Andorra, The Bahamas, Barbados, Liechtenstein, Luxembourg, Switzerland, Singapore, are also part of the countries that have a greater capacity to control government corruption. There are also two Latin American countries, namely Chile and Uruguay. The only country present in the Middle East is UAE. It must be considered that the fight against corruption can be considered as an essential prerequisite of the rule of law which is necessary to increase trade, industry, and finance. In fact, the possibility of creating a trading system depends on the effectiveness of the legal system. If the State can guarantee impartiality in the application of the laws and to be in some way independent with respect to the pressures exerted by the power groups then it is highly probable that productive organizations will be implemented in that economy, the industry, and productivity. If, on the other hand, there is corruption, then the trust of entrepreneurs and traders is reduced. In fact, the investor will be afraid that his investment will be confiscated or that his competitor, bribing a state official, could cause the company to close or create the political-institutional or social-regulatory conditions for bankruptcy. This is certainly the case, for example, of tax havens, in fact no private investor would place their financial funds in tax havens if they were not legally secure. And certainly, one of the strengths of Switzerland, Singapore, Liechtenstein, Luxembourg is guaranteeing an absolute defense of the private property rights of both individuals and companies. For example, the same new rich Chinese and Indians, as well as the Russians, deposit their funds within European or Anglo-Saxon countries as they have the utmost certainty of being guaranteed by the rule of law and of being able to make the generational transition that probably at home, they would not be able to achieve due to the interference of a corrupt political power.

It follows therefore that the fight against corruption that is carried out with great effectiveness in the identified countries is a very powerful tool for accumulating resources from abroad and for guaranteeing economic growth supported by the development of markets and financial institutions. It is also possible to consider the control exercised over corruption as a component of the Rule of Law or the “Dominion of the law”, the ability to control the application and execution of legal contracts. This element is therefore an essential prerequisite for the development of a capitalist system that is integrated at an international level and can also guarantee the inflow of foreign capital.

However, it must be considered that among the countries that have the greatest ability to control corruption there is also the USA. This condition should make you think. In fact, the ability to control corruption is defined by the World Bank as an ability to be independent of the pressures of lobbies and economic, financial, and industrial powers. It is known that in the USA there is a large system of lobbying in Congress which operates as a distortive tool against the normal constituencies of US parliamentarians. However, the financial resources that are invested in lobbying are not considered as a cause of government corruption. On the contrary, lobbying is considered as a tool capable of minimizing corruptive tensions by bringing them back to the normal functioning of democratic institutions. It follows therefore that by control of corruption we do not mean the total lack of lobbying attempts, but rather the lack of regulatory institutions and practices that can lead the pressures of industrial and financial groups back to democratic decision-making processes.

Figure 2.

The structure of clusters.

Figure 2.

The structure of clusters.

Finally, it must be considered that only a part of the European countries is part of the cluster with the greatest control over corruption. This condition therefore creates a significant gap. In fact, the ability to attract foreign capital and financial and productive investments is closely connected to the presence of regulations that can protect against government corruption. The result is therefore a sign of the difference between Central-Northern Europe, with high levels of ability to fight corruption, and Southern and Eastern Europe with low ability to fight corruption.

Furthermore, some considerations on the countries of cluster 3 which are the countries that have a reduced capacity to control corruption. These are countries with low-middle per capita income.

Specifically, these are countries belonging to the African continent, Asia, and South America. In this cluster it is also possible to find Russia together with other countries having an anti-democratic political regime such as Iran, Syria, Libya, Afghanistan, and North Korea. Evidently there is a very significant relationship between the ability to limit corruption to government level and the possibility of introducing those institutional reforms that can generate economic growth through the activation of markets and representative democracy based on the principles of liberalism. It is still possible to note that many of the countries that have difficulty controlling corruption are also countries with remarkable equipment of natural resources and of oil as happens for example for Iran, Iraq, and Venezuela. In these cases, it is very likely that corruption is precisely a product of the presence of raw materials that ideally gives to countries an international bargaining "power" with the possibility of acting in determining the price of oil. That is, it is that "malediction of raw materials" that continues to characterize many countries by preventing them from growing and accessing advanced forms of economic growth and development.

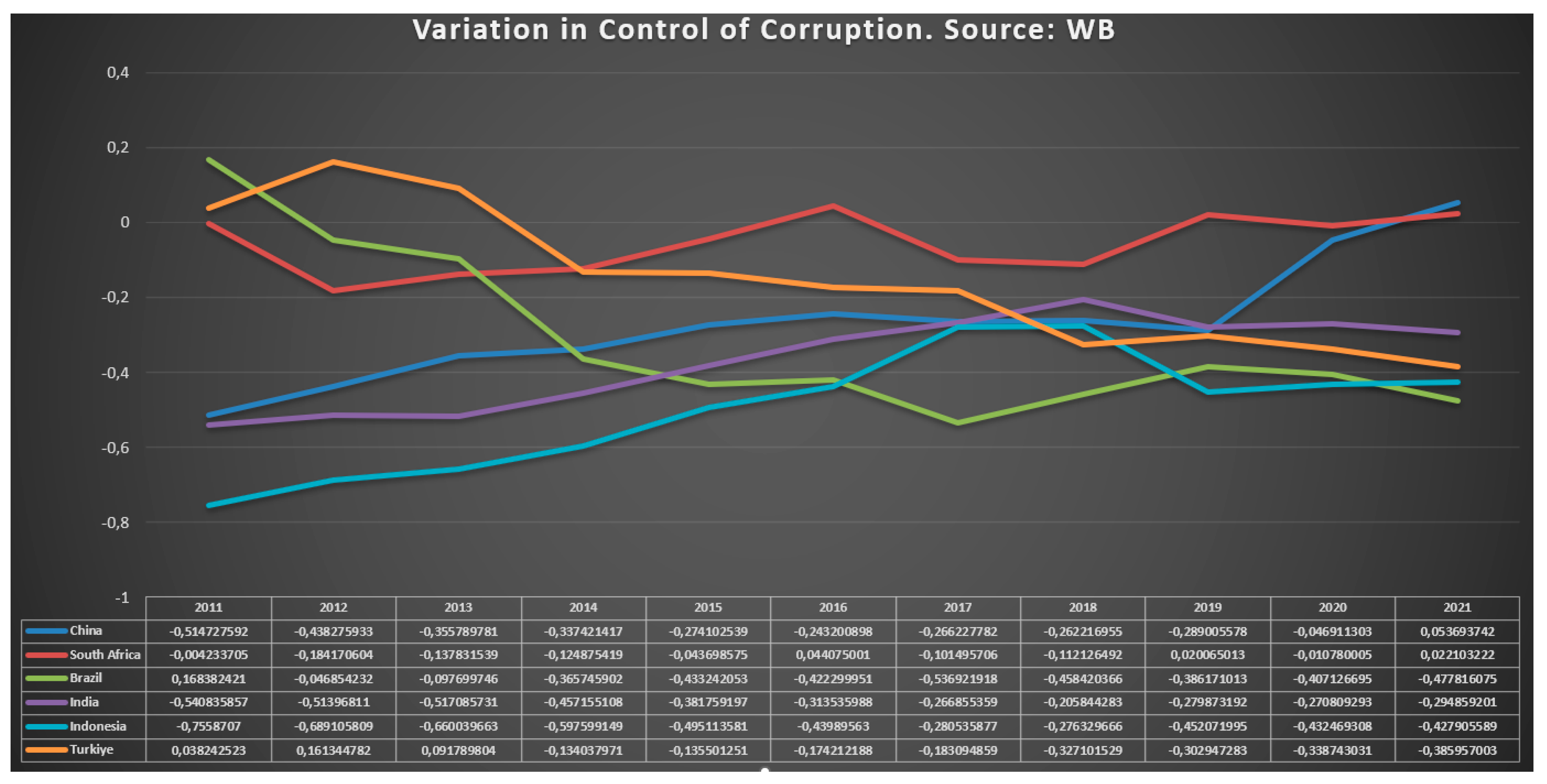

Figure 3.

Variation in the level of control of corruption for China, South Africa, Brazil, India, Indonesia, and Turkey. While on the one hand the Asian Countries have improved the level of control of corruption, on the other hand Brazil and Turkey have worsened their condition in terms of control of corruption.

Figure 3.

Variation in the level of control of corruption for China, South Africa, Brazil, India, Indonesia, and Turkey. While on the one hand the Asian Countries have improved the level of control of corruption, on the other hand Brazil and Turkey have worsened their condition in terms of control of corruption.

Finally, it is necessary to make some considerations on the countries of the Cluster 2 which are the countries of the penultimate Clusters. The median value of the ability to control corruption in this cluster is negative and equal to -0.37155. This cluster is relevant as there are some countries in it that will certainly be the protagonists of world economic growth in the short and medium term or: Brazil, China, India, Indonesia, South Africa, and Turkey. Among these countries, which are also very relevant in terms of population and climatic impact it is possible to identify the following system or: China with 0.0536937, South Africa with 0.0221032, India with -0.294859, Turkey with -0, 385957, Indonesia with -0.427906, Brazil with -0.477816. As it is possible to notice only the value of China and South Africa is weakly positive with a significant approximation to zero, while the value of the control of corruption for other countries is negative even if it oscillates around zero.

Considering the variations of the variables in the period between 2011 and 2021 it is possible to verify that only in the case of Brazil and Turkey there was a worsening of the value of the corruption control. On the contrary, South Africa, India, Indonesia, and China have grown in their ability to fight corruption. This dynamic vision can make people understand how important the ethical-moral values are that are promoted in growing economies. Certainly China, Indonesia and India worked hard in the repression of public corruption, while Brazil and Turkey have worsened their condition. A clear sign of the fact that the Asian ruling classes intended the role of ethics in public affairs to attract capital and promote a widespread economic growth. While Brazil and Turkey show a growth of corruption which is worrying as it makes the presence of rent-seeking-oriented ruling classes understand that could subtract resources from the country for private interests. Finally, it is necessary to emphasize that corruption could reduce the efficiency of public administration and public spending, compromising the future possibilities of economic growth also in the countries that are oriented to an inevitable global success.

Overall, however, it is possible to identify a general positive trend at the reduction of corruption. In fact, by doing the average of the value observed for the countries considered in the period between 2011-2021 it is possible to note that the variable “Control of Corruption” improved by 7.85%.

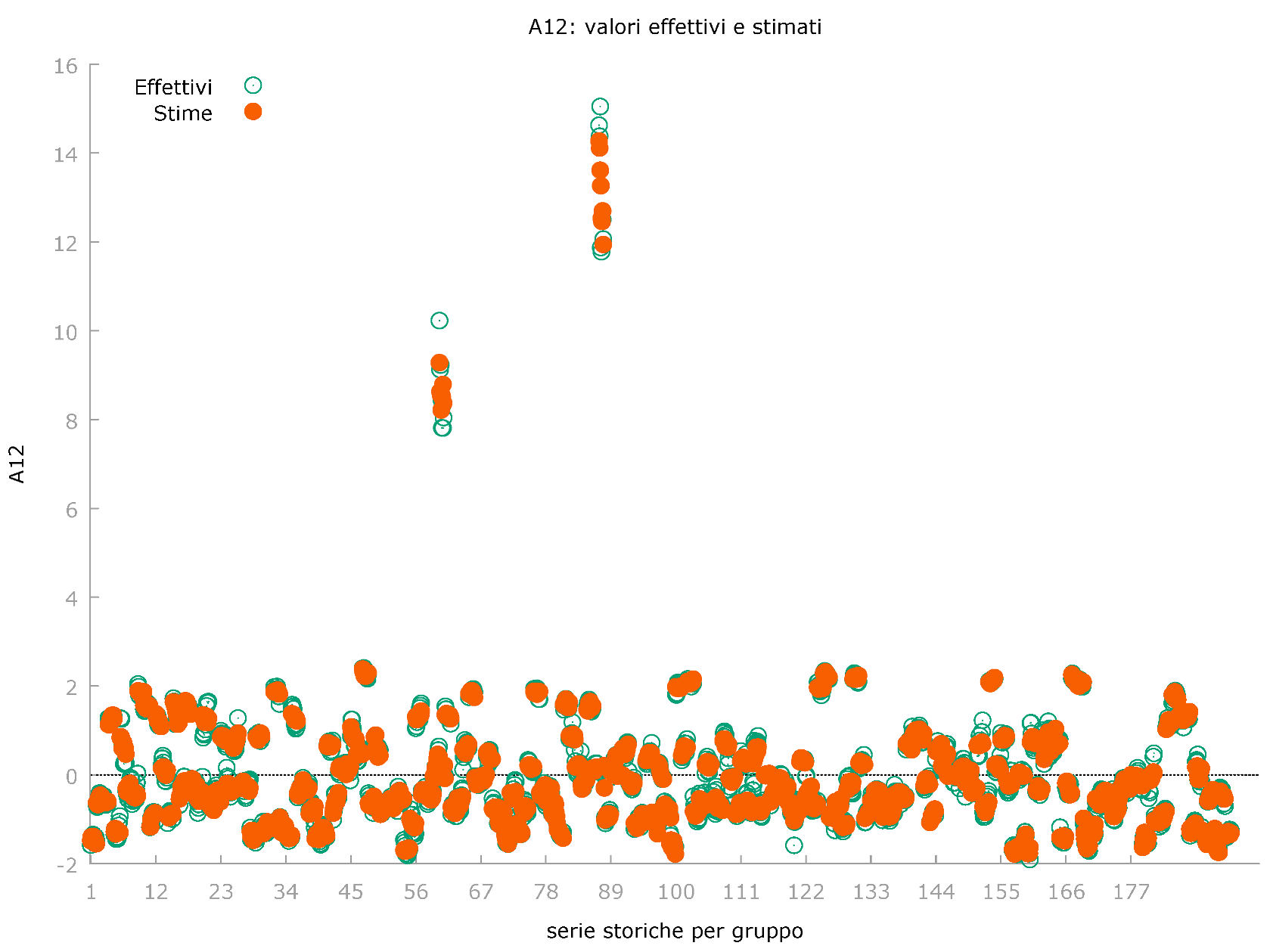

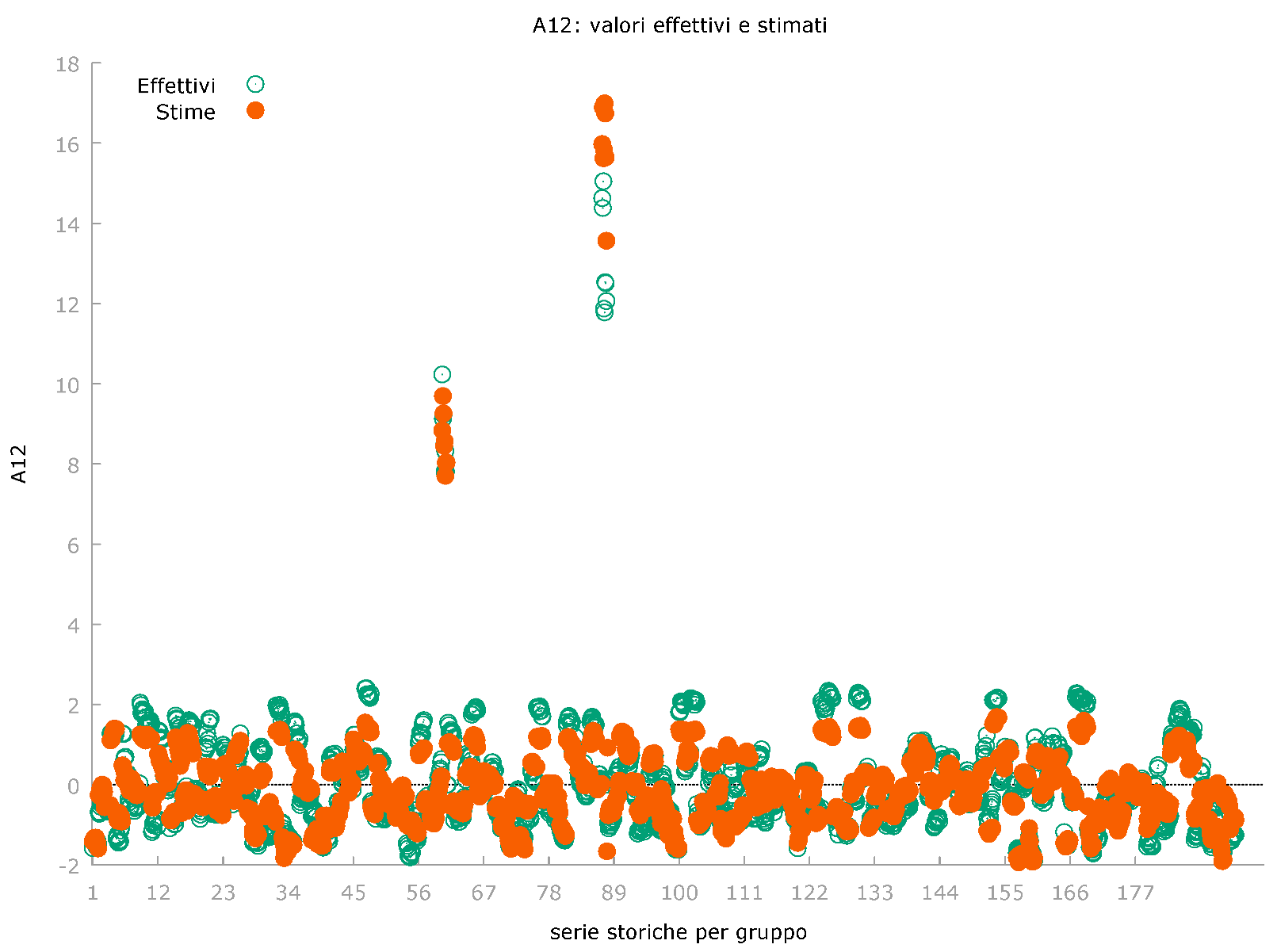

6. The Application of Machine Learning Techniques for the Prediction of the Future Level of Control of Corruption

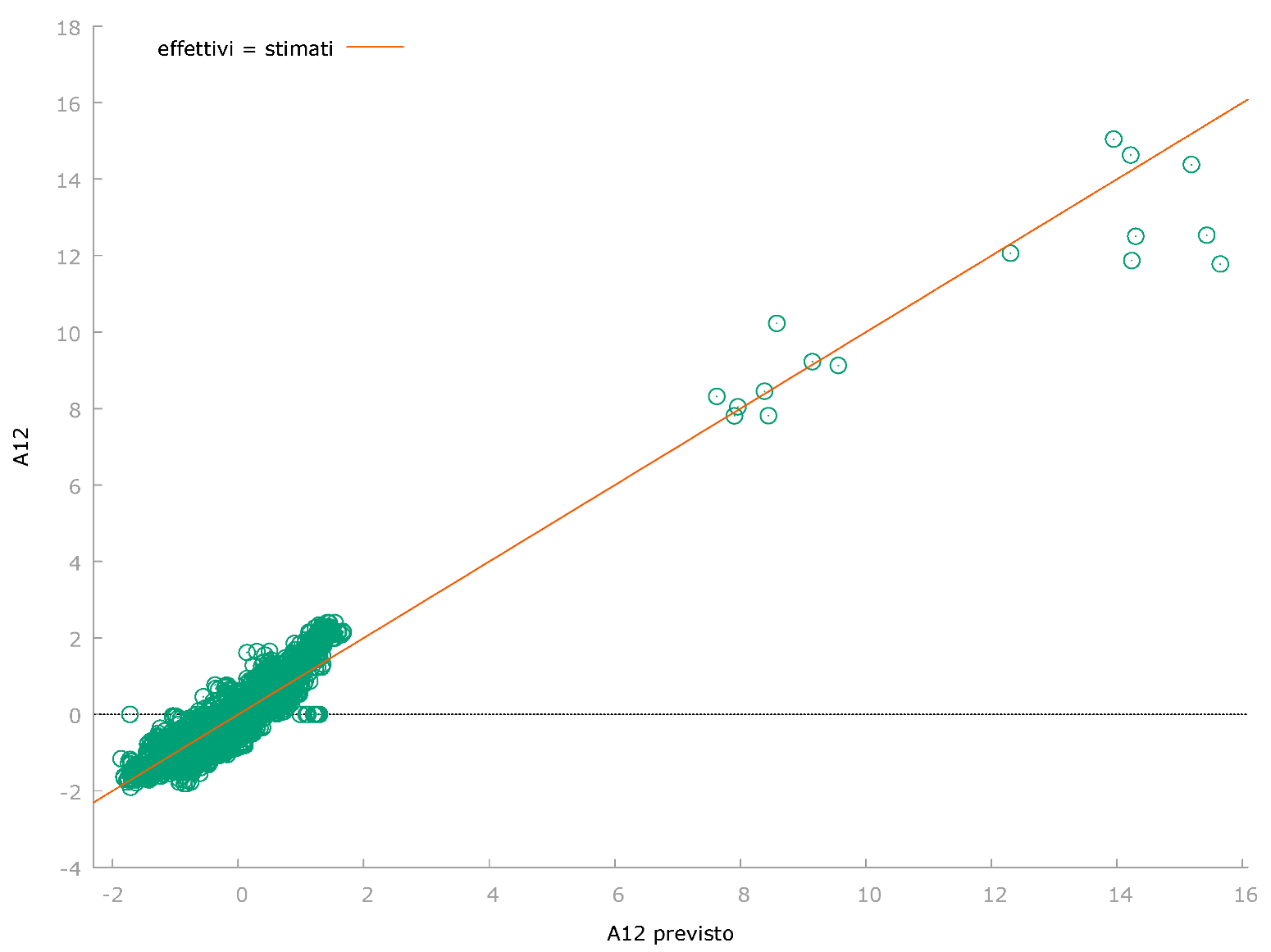

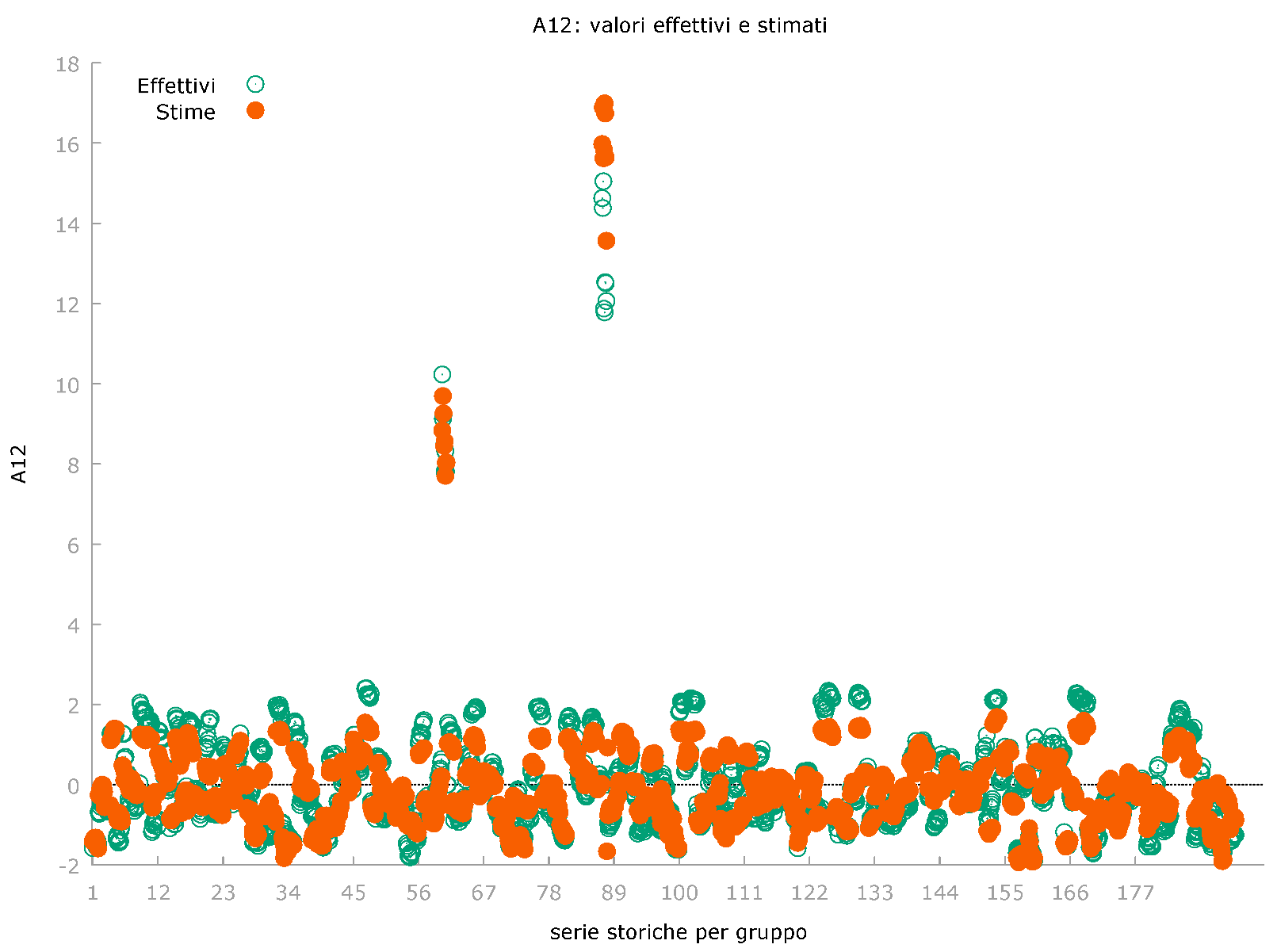

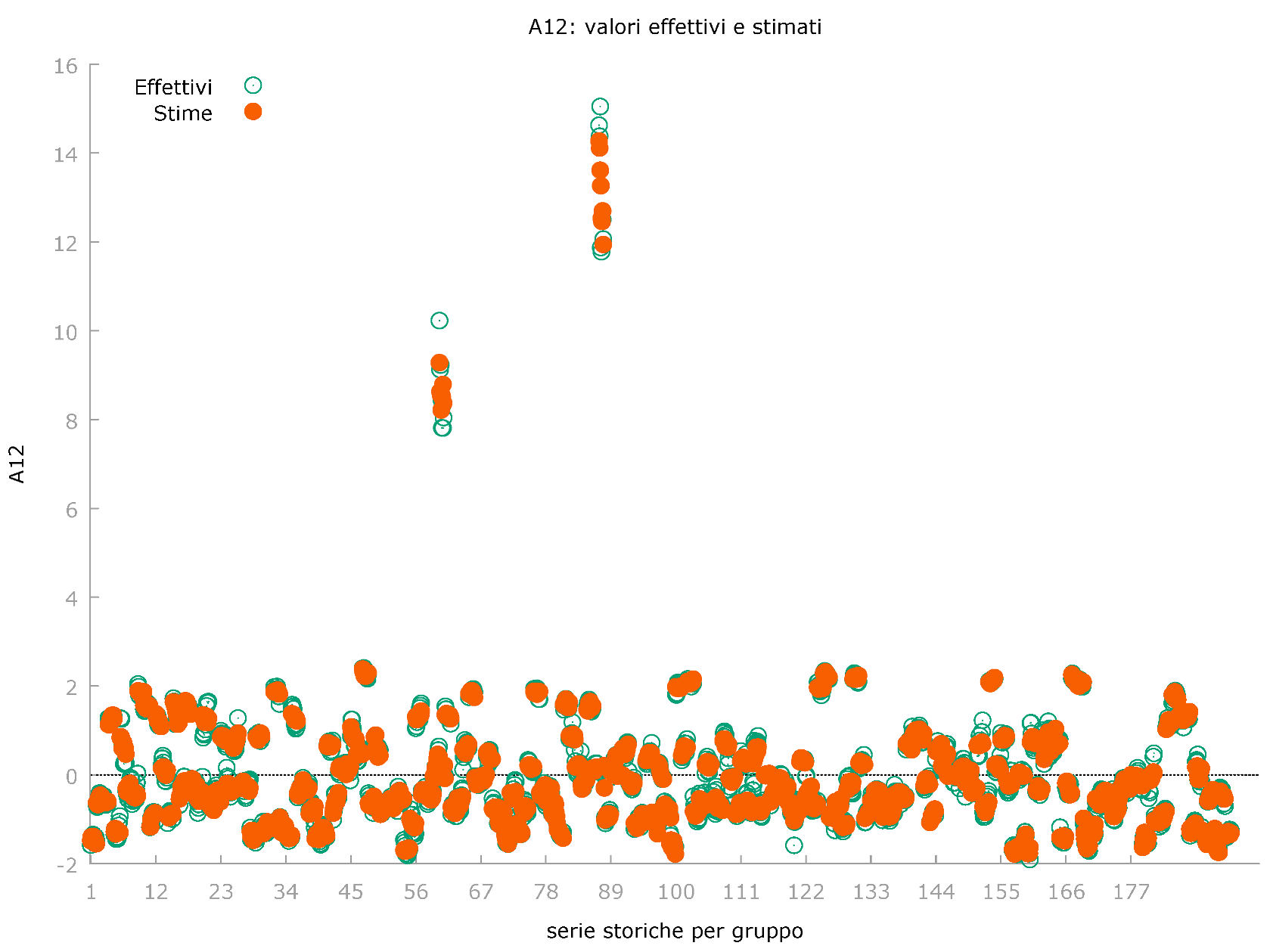

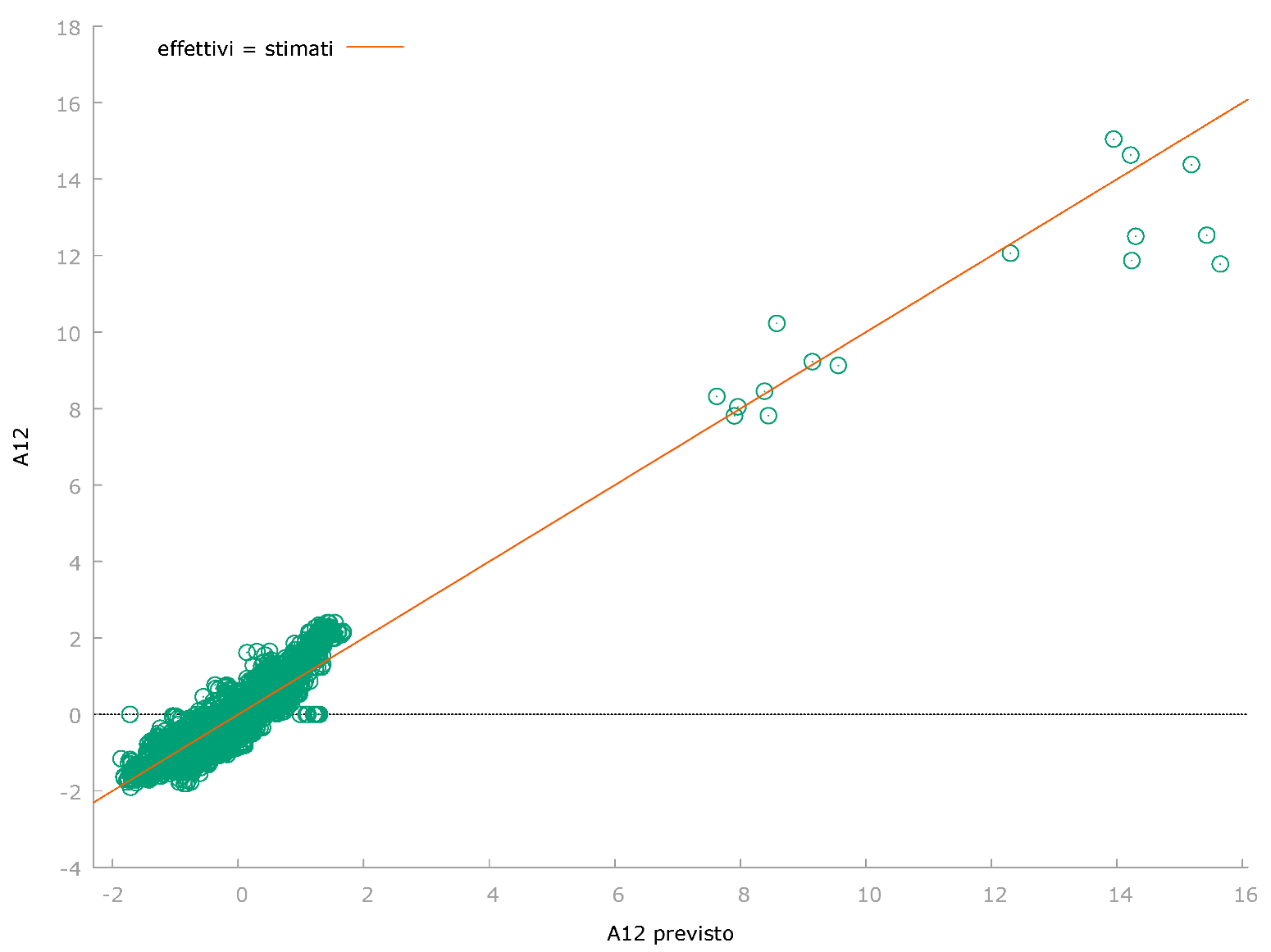

Below is a comparison for the choice of the best Machine Learning algorithm for the prediction of the future value of the control of corruption. Algorithms are trained with 70% of the available data while the remaining 30% constitutes the actual prediction. Algorithms are trained based on the ability to maximize the R-Squared and to minimize statistical errors or: MAE, MSE, RMSE. Precisely, we have used the following statistical indicators in explicit form:

For each algorithm a score is assigned in each of the ranking. The score obtained in each ranking is then added. It therefore derives an order of the algorithms as indicated below:

Polynomial Regression with a payoff value equal to 4;

Linear Regression with a payoff value equal to 7;

Simple Regression Tree with a payoff value of 11;

Random Forest Regression with a payoff value of 15;

Gradient Boosted Trees Regression with a payoff value of 19;

PNN-Probabilistic Neural Network with a payoff value of 23;

ANN-Artificial Neural Network with a payoff value of 27;

Tree Ensemble Regression with a payoff value of 31.

| Statistical Results of the Estimation of Machine Learning Algorithms for the Prediction of Control of Corruption |

| Algorithm |

R^2 |

MAE |

MSE |

RMSE |

| ANN-Artificial Neural Network |

0,9204770764 |

0,0583819349 |

0,0054460066 |

0,0737970634 |

| PNN-Probabilistic Neural Network |

0,9215074793 |

0,0463019953 |

0,0035992827 |

0,0599940219 |

| Gradient Boosted Trees Regression |

0,9545397043 |

0,0432577112 |

0,0028128493 |

0,0530363019 |

| Random Forest Regression |

0,9602057688 |

0,0406497867 |

0,0026047567 |

0,0510368169 |

| Tree Ensemble Regression |

-0,4452618418 |

0,2155327751 |

0,0786139394 |

0,2803817744 |

| Linear Regression |

0,9817334908 |

0,0237781142 |

0,0010000000 |

0,0311489542 |

| Polynomial Regression |

0,9872486547 |

0,0233143010 |

0,0010000000 |

0,0304628953 |

| Simple Regression Tree |

0,9633498737 |

0,0353094801 |

0,0019632376 |

0,0443084369 |

Therefore, the most performing algorithm is Polynomial Regression. Therefore by applying the Polynomial Regression it is possible to identify the following predictions or:

Angola with a diminutive variation from -0.655345798 up to a value of -0.833067764 or a variation of -0.17721966 equal to an amount of -27.12%;

Azerbaijan with a diminutive variation from an amount of -0.827584863 up to a value of -1.077886665 or equal to an amount of -0.250301802 equal to an amount of -30,24485024%;

Belarus with a variation from an amount of -0.23533681 up to a value of -0.095417651 or a variation equal to an amount of 0.13991916 equivalent to 59,45485514;

Bhutan with a diminutive variation from an amount of 1,553735256 up to a value of 1,343875712 or equal to an amount of -0.209859544 equivalent to -13.50%;

Bulgaria with a diminutive variation from an amount of -0.235711768 up to a value of -0.310113955 or a variation equal to an amount of -0.074402187 equivalent to an amount of -31.56%;

Burkina Faso with a diminutive variation from an amount of -0.059376009 up to a value of -0.159711458 or a variation equal to an amount of -0.100335449 equal to a value of -168.98%;

Green Cabo with a diminutive variation from an amount of 1,035422206 up to a value of 0.843640181 equal to a value of -0.191782024 equal to an amount of -18.5210851%;

Cambodia with a variation from an amount of -1.176956654 up to a value of -1,200095069 or a variation of -0.023138415 equal to an amount of -1.965953027%;

Canada with a variation from an amount of 1,64609468 up to a value of 1,729005345 or equal to an amount of 0.082910665, equal to an amount of 5.03%;

Chad with an increased variation from an amount of -1,47722049 up to a value of -1,265724374 or equal to an amount of 0.211997674 equal to a value of 14.35%;

Chile with an increased variation from an amount of 0.98372668 up to a value of 1,12749329 equal to an amount of 0.143722649 equal to a value of 14,61001841%;

| Ranking of Machine Learning Algorithms for Predictive Efficiency |

| Rank |

Algorithms |

R^2 |

MAE |

MSE |

RMSE |

Total |

| 1 |

Polynomial Regression |

1 |

1 |

1 |

1 |

4 |

| 2 |

Linear Regression |

2 |

2 |

1 |

2 |

7 |

| 3 |

Simple Regression Tree |

3 |

3 |

2 |

3 |

11 |

| 4 |

Random Forest Regression |

4 |

4 |

3 |

4 |

15 |

| 5 |

Gradient Boosted Trees Regression |

5 |

5 |

4 |

5 |

19 |

| 6 |

PNN-Probabilistic Neural Network |

6 |

6 |

5 |

6 |

23 |

| 7 |

ANN-Artificial Neural Network |

7 |

7 |

6 |

7 |

27 |

| 8 |

Tree Ensemble Regression |

8 |

8 |

7 |

8 |

31 |

Colombia with an increased variation from an amount of -0.344050169 up to a value of -0.215918237 equal to an amount of 0.128131932 equal to a value of 37.24%;

Congo with a diminutive variation from an amount of -1,37306428 up to a value of -1,484193168 equal to a variation of -0.11128889 equal to a variation of -8,093494977%;

Cote D’Ivoire with a diminutive variation from an amount of -0.371892631 up to a value of -0.489674904 or a variation equal to an amount of -0.117782273 equal to an amount of -31,67104252%;

Croatia with a variation from an amount of 0.061275687 up to a value of 0.178325192 or equal to an amount of 0.117049505 equal to a value of 191.021216%;

Cuba with a variation from a diminutive variation from an amount of -0.009721875 up to a value of -0.142258721 equal to a value of -0.132536846 equivalent to a value of -1363,284792%;

Cyprus with an increased variation from 0.394521177 to 0.485884315 equal to 0.091363138 equivalent to 23.16%;

Czechia with a diminutive variation from 0.641104996 to 0.584291949 equal to -0.056813047 or -861738351%

Dominica with an increased variation from 0.576153934 up to 0.582809764 equal to an amount of 0.0066583 equivalent to 1.155217293%;

Ecuador with an increased variation from an amount of -0.57393404 up to a value of -0.47767551 equal to 0.095725854 equivalent to 16.69462065%;

Estonia with a diminutive variation from an amount of 1,535825491 up to a value of 1,346950283 equal to a value of -0.188875208 equivalent to -12,29796022%;

| |

Country |

2021 |

Prediction |

Abs Variation |

% |

| |

Variation |

| Best Ten |

Croatia |

0,06128 |

0,17833 |

0,1170 |

191,02 |

| Maldives |

-0,3712 |

-0,0193 |

0,35193 |

94,80 |

| Belarus |

-0,2353 |

-0,0954 |

0,13992 |

59,45 |

| Eswatini |

-0,6506 |

-0,2714 |

0,37914 |

58,28 |

| Micronesia, Fed, Sts, |

0,5628 |

0,86096 |

0,29816 |

52,98 |

| Trinidad and Tobago |

-0,2778 |

-0,1421 |

0,13563 |

48,83 |

| Colombia |

-0,3441 |

-0,2159 |

0,12813 |

37,24 |

| Jamaica |

-0,0293 |

-0,0195 |

0,00974 |

33,27 |

| Cyprus |

0,39452 |

0,48588 |

0,09136 |

23,16 |

| Turkey |

-0,386 |

-0,2978 |

0,08816 |

22,84 |

| Worst Ten |

Vietnam |

-0,2858 |

-0,3761 |

-0,0903 |

-31,61 |

| Cote d’Ivoire |

-0,3719 |

-0,4897 |

-0,1178 |

-31,67 |

| Guyana |

-0,1652 |

-0,2492 |

-0,084 |

-50,83 |

| Sao Tome and Principe |

0,25798 |

0,10782 |

-0,1502 |

-58,21 |

| Senegal |

0,05842 |

0,00942 |

-0,049 |

-83,88 |

| Greece |

0,20724 |

0,02259 |

-0,1847 |

-89,10 |

| Burkina Faso |

-0,0594 |

-0,1597 |

-0,1003 |

-168,98 |

| Timor-Leste |

-0,0525 |

-0,2786 |

-0,2261 |

-430,50 |

| Vanuatu |

-0,0176 |

-0,1731 |

-0,1555 |

-883,80 |

| Cuba |

-0,0097 |

-0,1423 |

-0,1325 |

-1363,28 |

Eswatini with an increased variation from an amount of -0.650570393 up to -0.271427698 equal to a value of 0.379142695 equivalent to +58.27%;

Finland with a diminutive variation from an amount of 2,270076752 up to a value of 2,258741001 equal to an amount of -0.011 units equal to -0.50%;

The Gambia with a variation from an amount of -0.35 units up to a value of -0.311 units equal to an amount of 0.0469 units equal to a value of 13.08%;

Greece with a variation from an amount of 0.207244009 up to a value of 0.022589483 equal to a value of -0.184654525 equal to a value of -89.10%;

Guatemala with an increased variation from an amount of -1.173671126 up to a value of -1.121651537 equal to a variation of 0.05201959 equal to a value of 4.43%;

Guyana with a diminutive variation from an amount of -0.165203333 up to a value of -0.249182648 equal to a value of -0.083979315 equal to a value of -50.83%;

Jamaica with a variation from an amount of -0.029271552 up to a value of -0.019533452 equal to an amount of 0.009738101 equivalent to a value of 33.27%;

Kyrgyz Republic with an increased variation from an amount of -1,12473806 up to a value of -1.060099224 or a variation equal to an amount of 0.064634582 equal to a value of 5.75%;

Lao Pdr with a diminutive variation from an amount of -1,03965342 up to a value of -1.06973281 equal to an amount of -0.027319861 equal to a value of -2.62%;

Latvia with a variation from an amount of 0.746790171 up to a value of 0.764788085 equal to an amount of 0.01797915 equal to a value of 2.41%;

Lithuania with a variation from an amount of 0.851239979 up to a value of 0.88750404 equal to an amount of 0.03626406 equal to a value of 4.26%;

Maldives with a variation of -0.371216476 up to a value of -0.019290637 equal to an amount of 0.351925839 equal to a value of 94.80%;

evils with a variation from an amount of -0.867007017 up to a value of -0.771915573 equal to an amount of 0.095091444 equivalent to a value of 10.97%;

Micronesia with a variation from an amount of 0.562800407 up to a value of 0.86095993 equal to an amount of 0.298159522 equivalent to a value of 52.98%;

Mongolia with a variation from an amount of -0.528645813 up to a value of -0.479272206 equal to a value of 0.0493 units equal to a value of 9.33%;

Pakistan with a variation from an amount of -0.785676658 up to a value of -0.807359632 equal to an amount of -0.021 unit equivalent to a value of -2.76%;

Panama with an increased variation from an amount of -0.570509851 up to a value of -0.542740537 equal to an amount of 0.028 units equal to a value of 4.87%;

Paraguay with an increased variation from an amount of -1.007155418 up to a value of -0.935241913 equal to an amount of 0.072 units equal to a value of 7.14%;

Peru with a variation from an amount of -0.63 units up to a value of -0.54 units equal to a value of 0.097 equal to a value of 15.28%;

Portugal with a variation from an amount of 0.77 up to a value of 0.72 units equal to an amount of -0.05 units equal to a value of -6.82%;

Sao Tome and Principe with a diminutive variation from an amount of 0.26 units up to a value of 0.10 units or equal to an amount of -0.15 units equal to an amount of -58.20%;

Senegal with a diminutive variation from an amount of 0.058 units up to a value of 0.009 units or equal to an amount of -0.049 units equal to an amount of -83.8 (%;

Singapore with a variation from an amount of 2.17 units up to a value of 2.07 units or equal to an amount of -0.10 units equal to a value of -4.88%;

Spain with a variation from an amount of 0.74 up to a value of 0.80 units or equal to a value of 0.060 units equal to a value of 8.00%;

Sweden with an increased variation from an amount of 2.13 units up to a value of 2.19 equal to an amount of 0.065 units equal to a value of 3.05%;

Tajikistan with an increased variation from an amount of -1.33 units up to a value of -1.28 units equal to an amount of 0.060 units equal to a value of 4.51%;

Timor with a diminutive variation from an amount of -0.05 units up to a value of -0.27 units equal to a variation of -0.23 units equal to a value of 430.50%;

Tonga with a diminutive variation from an amount of -0.38 units up to a value of -0.40 units equal to a value of -0.02 units equal to a value of -6.32%;

Trinidad and Tobago with an increased variation from an amount of -0.28 units up to a value of -0.14 units or equal to a value of 0.14 units equal to a value of 48.83%;

Turkey with an increased variation from an amount of -0.38 units up to a value of -0.30 units or equal to a value of 0.08 units equal to a value of 22.84%;

Turkmenistan with an increased variation from a value of -1.42 units up to a value of -1.28 units or equal to an amount of 0.14 units equal to a value of 9.93%;

United Arab Emirates with a diminutive variation from an amount of 1.18 units up to a value of 1.07 units or equal to a value of -0.10 units equal to a value of -8.66%;

United States with an increased variation from an amount of 1,046 units up to a value of 1.107 units or equal to a value of 0.06 units equal to a value of 5.76%;

Uruguay with a diminutive variation from an amount of 1.61 units up to a value of 1.41 units or equal to a value of -0.20 units equal to -12.40%;

Vanuatu with a diminutive variation from an amount of -0.017 to a value of -0.017 or equal to a value of -0.15 units equal to a value of -883.80%;

Vietnam with a diminutive variation from an amount of -0.285784245 up to a value of -0.376130635 equal to a value of -0.090346391 equivalent to a value of -31.61%;

Zambia with an increased variation from an amount of -0.75 units up to a value of -0.70 units equal to a value of 0.046 units equal to a value of 6.16%;

On average, the value of the prediction, for the countries considered, is expected to grow from an amount of 0.025 units up to a value of 0.028 units or equal to a value of 0.002 units equal to a growth of an amount of 10.35%.

| Prediction of Control of Corruption with the Polynomial Regression |

| Country |

2021 |

Prediction |

Abs Variation |

%

Variation

|

| Angola |

-0,655345798 |

-0,833067764 |

-0,177721966 |

-27,11880766 |

| Azerbaijan |

-0,827584863 |

-1,077886665 |

-0,250301802 |

-30,24485024 |

| Belarus |

-0,23533681 |

-0,095417651 |

0,13991916 |

59,45485514 |

| Bhutan |

1,553735256 |

1,343875712 |

-0,209859544 |

-13,50677624 |

| Bulgaria |

-0,235711768 |

-0,310113955 |

-0,074402187 |

-31,56490129 |

| Burkina Faso |

-0,059376009 |

-0,159711458 |

-0,100335449 |

-168,9831488 |

| Cabo Verde |

1,035422206 |

0,843640181 |

-0,191782024 |

-18,52210851 |

| Cambodia |

-1,176956654 |

-1,200095069 |

-0,023138415 |

-1,965953027 |

| Canada |

1,64609468 |

1,729005345 |

0,082910665 |

5,036810238 |

| Chad |

-1,477722049 |

-1,265724374 |

0,211997674 |

14,3462483 |

| Chile |

0,98372668 |

1,127449329 |

0,143722649 |

14,61001841 |

| Colombia |

-0,344050169 |

-0,215918237 |

0,128131932 |

37,24222313 |

| Congo, Rep, |

-1,37306428 |

-1,484193168 |

-0,111128889 |

-8,093494977 |

| Cote d’Ivoire |

-0,371892631 |

-0,489674904 |

-0,117782273 |

-31,67104252 |

| Croatia |

0,061275687 |

0,178325192 |

0,117049505 |

191,0211216 |

| Cuba |

-0,009721875 |

-0,142258721 |

-0,132536846 |

-1363,284792 |

| Cyprus |

0,394521177 |

0,485884315 |

0,091363138 |

23,15798077 |

| Czechia |

0,641104996 |

0,584291949 |

-0,056813047 |

-8,861738351 |

| Dominica |

0,576153934 |

0,582809764 |

0,00665583 |

1,155217293 |

| Ecuador |

-0,573393404 |

-0,477667551 |

0,095725854 |

16,69462065 |

| Estonia |

1,535825491 |

1,346950283 |

-0,188875208 |

-12,29796022 |

| Eswatini |

-0,650570393 |

-0,271427698 |

0,379142695 |

58,27850435 |

| Finland |

2,270076752 |

2,258741001 |

-0,01133575 |

-0,499355374 |

| Gambia, The |

-0,358450145 |

-0,311538313 |

0,046911831 |

13,08740749 |

| Greece |

0,207244009 |

0,022589483 |

-0,184654525 |

-89,1000548 |

| Guatemala |

-1,173671126 |

-1,121651537 |

0,05201959 |

4,432211767 |

| Guyana |

-0,165203333 |

-0,249182648 |

-0,083979315 |

-50,83391066 |

| Jamaica |

-0,029271552 |

-0,019533452 |

0,009738101 |

33,26813867 |

| Kyrgyz Republic |

-1,124733806 |

-1,060099224 |

0,064634582 |

5,746655938 |

| Lao PDR |

-1,03965342 |

-1,066973281 |

-0,027319861 |

-2,627785387 |

| Latvia |

0,746790171 |

0,764788085 |

0,017997915 |

2,410036344 |

| Lithuania |

0,851239979 |

0,88750404 |

0,03626406 |

4,260145352 |

| Maldives |

-0,371216476 |

-0,019290637 |

0,351925839 |

94,80339965 |

| Mali |

-0,867007017 |

-0,771915573 |

0,095091444 |

10,96778247 |

| Micronesia, Fed, Sts, |

0,562800407 |

0,86095993 |

0,298159522 |

52,97784407 |

| Mongolia |

-0,528645813 |

-0,479272206 |

0,049373608 |

9,339638464 |

| Pakistan |

-0,785676658 |

-0,807359632 |

-0,021682974 |

-2,759783376 |

| Panama |

-0,570509851 |

-0,542740537 |

0,027769314 |

4,867455649 |

| Paraguay |

-1,007155418 |

-0,935241913 |

0,071913505 |

7,140258969 |

| Peru |

-0,63322556 |

-0,536434277 |

0,096791283 |

15,28543529 |

| Portugal |

0,768555641 |

0,716105212 |

-0,052450429 |

-6,824545508 |

| Sao Tome and Principe |

0,257983625 |

0,107820602 |

-0,150163023 |

-58,20641646 |

| Senegal |

0,058420014 |

0,00941535 |

-0,049004663 |

-83,88334825 |

| Singapore |

2,171539545 |

2,066568681 |

-0,104970864 |

-4,833937469 |

| Spain |

0,741642237 |

0,800912845 |

0,059270608 |

7,991805917 |

| Sweden |

2,130344868 |

2,195412358 |

0,06506749 |

3,054317207 |

| Tajikistan |

-1,338215113 |

-1,277840933 |

0,06037418 |

4,511545221 |

| Timor-Leste |

-0,052512504 |

-0,278579548 |

-0,226067044 |

-430,5013587 |

| Tonga |

-0,384434402 |

-0,408724256 |

-0,024289854 |

-6,318335049 |

| Trinidad and Tobago |

-0,277760476 |

-0,142127378 |

0,135633098 |

48,83095677 |

| Turkey |

-0,385957003 |

-0,297793953 |

0,088163049 |

22,84271272 |

| Turkmenistan |

-1,41950345 |

-1,278431794 |

0,141071656 |

9,938098863 |

| United Arab Emirates |

1,178225279 |

1,076165694 |

-0,102059585 |

-8,662145208 |

| United States |

1,046862006 |

1,107222532 |

0,060360526 |

5,765853173 |

| Uruguay |

1,61529088 |

1,414962778 |

-0,200328102 |

-12,4019831 |

| Vanuatu |

-0,017598171 |

-0,173130624 |

-0,155532453 |

-883,7989741 |

| Vietnam |

-0,285784245 |

-0,376130635 |

-0,090346391 |

-31,61349594 |

| Zambia |

-0,753424048 |

-0,707000101 |

0,046423947 |

6,161728896 |

| Average |

0,02542309 |

0,028056052 |

0,002632961 |

10,35657532 |

From a quantitative point of view, it is possible to verify that the countries for which greater economic growth is expected are: Croatia with a +191.02%, the Maldives with a value equal to 94.80%, and Belarus with a value equal to +59.45%. The countries for which a significant deterioration in the control of corruption is instead expected are Timor with a value equal to -430.50%, followed by Vanuatu with a value equal to -883.80%, and Cuba with a value equal to -1,363.28%.

7. Limitations, Implications and Further Research

Limitations. The article has many limitations. First, the variable analyzed, or “Control of Corruption” is not able to give a complete representation of corruption at the country level. For example, the case of distinguishing corruption since it mainly affects the public sector and the private sector. The “Control of Corruption” variable should therefore consist of a fuzzy variable structure, i.e., composed of a public component and a private component. Furthermore, a detailed analysis of the relationship between corruption and lobbying should also be carried out. Indeed, it is not clear whether lobbying eliminates corruption or whether lobbying makes corruption legal. In fact, regardless of the legal definition, the effects of the lobbyist and the corruptor on the political system are very similar if not identical: using financial power to direct the legislator to write rules in his favor. In the same way, it is also necessary to consider the relationship between systems and schemes of corruption and the tax advantage models that are practiced by many countries to host the headquarters of multinationals. This is the case, for example, of tax havens and of many countries also in Europe such as Ireland and Luxembourg. In fact, in this case it is as if the company were bribing the State by asking for a favorable tax treatment in exchange for the domiciliation of its company. Another limitation is the fact that the value of corruption should also be considered with respect to the presence of social capital at the national level. In fact, lack of trust in politicians and in society could be a trigger or the very product of corruption.

Implications. The implications of the analysis carried out are of a political nature. Indeed, it is necessary to invest in the creation of political systems that are capable of repelling corruption. However, the fight against corruption can only be achieved in the presence of a political class that is oriented towards ethically correct behavior. In fact, often in the literature, and in metric analysis, reference is made to the presence of a “Rule of Law”. It is true the “Rule of Law” is important. But no less important is the “Rule of Ethics” or the role of the ethical-moral motivations that push the population to engage in politics, in companies, in public institutions and in third sector organizations. It is therefore necessary to invest even more in the formation of human capital, social capital, for the formation of civil servants, i.e., politicians who look to the interest of the nation, the public good and the population and not their own mere economic-financial interest of part.

Further research. In the future analysis it would be necessary to carry out an in-depth analysis first of a geographical type or to switch from the type of analysis by nation to an analysis by city or by region. In this way it would also be possible to create rankings of the most corrupt cities and regions and to investigate the socio-economic and technological reasons for corruption at the local level. Furthermore, a further check that should be carried out concerns the presence of gender parity in public administrations, i.e., verifying whether the countries in which there is greater gender parity are corrupt. Finally, it is necessary to increase the analysis with further variables that take into consideration the political dimension, i.e., the state of the parties, the number of re-elected MPs, and their legislative production, to verify whether there is a continuity in the relationship between corrupt politicians and corrupt entrepreneurs.

8. Conclusions

The analysis conducted appears that corruption is a social, economic, political and institutional phenomenon. Corruption must not be understood as a behavior that can be correct with some nudges. Corruption is an implicit rule that operates in the depth of the economic imagination and incentives for the action of the population. It is also necessary to pay attention to the new forms that corruption or phenomena like corruption can take, not only in developing countries, but especially in industrialized countries. For example, widespread lobbyism in the US or tax competition from countries such as Ireland can be understood as new and more creative forms of corruption. In fact, both lobbyism and tax competition produce the same effects as corruption or: use the financial instruments of private individuals or groups to guide the legislator to regulatory interventions in favor.