Note that the model parameters are dependent also on the number of the particular N past years which have used to get the corresponding data. That is, an investor can use any N past years, not necessarily consecutive, in order to estimate the parameters of the model. A recent event has not left its mark on historical data, yet it is going to affect future ones. An investor should take this into account by increasing or decreasing the model parameters appropriately which has been calculated based on historical data.

4.1. Prices of the call and put options

Let us suppose that a writer want to sell a put and a call option on an underlying asset that follows the following sde

where

days and the strike price is

.

Let us recall here how the writer will compute the safe price for the put option as this was proposed in [

5]. For a given probability

p one has to find

Y such that

Under the assumption 2 about the price of the underlying asset is an easy problem to compute the safe price Y.

The price of the put option via replication (via the realistic binomial model) is about 2.8 with probability of profit 0.57 while the price without replication is 2.4 with the same probability of profit. Note that in order to construct the replicating portfolio the writer has to borrow some assets therefore under assumption 3 the writer will choose to sell without replication, i.e. at the price 2.4 or higher.

If she sell the put option at the price 2.4 then the price of the call option has to be 1.4 for the put - call parity to hold, assuming that the risk free rate is zero. Speaking about put - call parity, we can argue that taking for granted that different organizations can apply a different interest rate we find that the put - call parity is relative. At this price the probability of profit for the writer is about 0.677 for the call option without construction of a replicating portfolio. If she sell at this price the call option constructing a replicating portfolio via the realistic binomial model then the probability of profit is 0.49. In both these cases the possible loss for the writer is unbounded.

We will now describe another way of pricing a call option which we call it the -hedging strategy.

Theorem 2 (The

-hedging strategy).

Let a call option with strike price K and a tradable at the market underlying asset which satisfies assumption 2. Choose some , some and then a suitable . Then selling the call option at the price

the writer can have infinite possible profit if and bounded possible loss. Moreover, the probability of profit can be greater than p choosing big enough .

Proof. Indeed, the writer can borrow the amount and then buy shares of the underlying asset.

• If

then the profit

of the writer equals to

Therefore the possible profit is unbounded if while the possible loss is unbounded if .

• If

then the profit

of the writer equals to

Therefore the possible loss is bounded.

The probability of profit can be computed easily when

.

The above probability is a strictly increasing function of

z therefore for a given

we can compute a suitable

z such that this probability equals to

p.

If we choose a suitable z such that . In this case both the possible loss and the possible profit are bounded. □

Pricing the call option using the -hedging strategy and supposing for simplicity zero borrowing rate the writer can sell it at the price . She can borrow the amount in order to buy two shares of the underlying asset. The potential loss is limited while the potential gain is unlimited. The resulting probability of profit equals . The writer can design a similar hedging strategy by buying also a put option on a different strike price in order to shrink the possible loss. If the underlying asset is not tradable at the market the writer may choose another asset, if it is possible, which is tradable and behaves like the original one.

Remark 5 (

-hedging strategy selling at the price

Y).

Suppose that a writer of a call option sell it at the price Y and suppose that she wants to apply the -hedging strategy using this amount for a given γ. She can borrow the amount and buy shares of the underlying asset. The writer then, in fact, bets on the event

assuming zero interest rate for simplicity. Making an assumption about the random variable we can estimate the probability of the above event which is the probability of profit for the writer. A similar result holds for the put option.

We can have the following hedging strategy for a call option with a tradable underlying asset which we call it the -hedging strategy.

Proposition 1 (

-hedging strategy).

Let a call option with a tradable underlying asset which follows the geometric Brownian motion with parameters and strike price K. If the writer sell this option at the price Y she can buy shares of the asset in order the mean value and the probability of profit will be as follows

Proof. Indeed, the writer can buy

shares of the underlying asset and therefore the profit at time

T is as follows,

The probability of profit is as follows,

The result then follows easily. □

Remark 6 (

-hedging strategy selling at the price

Y).

Selling a call option at the price Y the writer can buy shares of the underlying asset. Then, in fact, bets on the event

Making any suitable assumption for the random variable we can estimate the probability of the above event which is the probability of profit for the writer.

In the same spirit we describe the -hedging strategy for the put option.

Theorem 3.

Let a put option with strike price K and a tradable at the market underlying asset which satisfies assumption 2. The writer of this put option can sell it at the price

for some and for some suitable chosen by the writer . She can invest this amount in a way that will have unbounded possible profit and bounded possible loss for a given probability of profit.

Proof. Indeed, she can buy

shares of the underlying asset borrowing the amount

. The profit at time

T will be

where

r is the borrowing rate. It is clear that if

then the possible profit for the writer is unbounded while if

then the possible loss for the writer is bounded by the amount

.

We can compute a suitable z in order to have a desired probability of profit as we did at the call option case. □

Using the -hedging strategy the writer can sell the put option at the price having probability of profit assuming zero borrowing rate for simplicity. The advantage however is that the possible profit is unbounded.

A useful criterion is to compute the mean value of the profit of each pricing method.

Corollary 1.

Let a call option with strike price K and suppose that the underlying asset satisfies the geometric Brownian motion with parameters . Then the mean values of the profits are

where and supposing zero interest rate for simplicity. Here the rates are some suitable rates in order the writer has a predefined probability of profit using the realistic binomial option pricing model.

Of course we can have similar computations for the , , and others.

Table 1.

We compare the four hedging strategies by computing the probability of profit and the mean value of profit selling the call option at the same price . Note that at the safe price hedging strategy, the -hedging strategy and the realistic binomial model hedging strategy the possible loss is unbounded while for the -hedging strategy the possible loss is bounded and the possible profit is unbounded! Selling at this price and using the hedging strategy proposed by the Black-Scholes model is impossible!

Table 1.

We compare the four hedging strategies by computing the probability of profit and the mean value of profit selling the call option at the same price . Note that at the safe price hedging strategy, the -hedging strategy and the realistic binomial model hedging strategy the possible loss is unbounded while for the -hedging strategy the possible loss is bounded and the possible profit is unbounded! Selling at this price and using the hedging strategy proposed by the Black-Scholes model is impossible!

|

Probability of profit |

Mean value of profit |

Loss and profit |

| Safe price hedging strategy |

|

|

Bounded profit but unbounded loss |

|

-hedging strategy |

|

|

Bounded profit but unbounded loss |

| Realistic binomial model |

|

|

Bounded profit but unbounded loss |

|

-hedging strategy |

|

|

Bounded loss and unbounded profit |

Let us suppose that the writer sell the put option at the price . Then the probability of profit without replication is about . But in this case the writer can construct a replicating portfolio without borrowing assets i.e. with and . In this case the writer will have a (possible unbounded!) profit if and the probability of this event is about .

The Black - Scholes model price for the put option is about

, constructing a (impossible!) replicating portfolio, while

under assumption 2. Here

with

. In the Black - Scholes setting one should borrow assets, assuming that can indeed rebuilt the portfolio continuously in time, while the physical meaning of the mean value of the payoff is clear without replication.

Suppose now that the underlying asset can not be traded at the market. The writer choose another asset which follows the following stochastic differential equation

where

is a Brownian motion independent (in general) of

. The writer decide to construct a portfolio containing the asset

which can be traded at the market. One way to choose such an asset is to choose between those having a high drift parameter and small diffusion parameter (i.e. volatility). The portfolio will contain

number of the asset

and

at the bank account. The writer, in order to price the contract, choose to solve the following minimization problem

where

and therefore

. Recall that

so from the equality

we deduce that

. That is we have to minimize the quantity

for

. It follows that the minimum is for

and

and consequently the suggested price is

recalling that we assumed that the interest rate is zero.

Recalling that the price is the value which is such that , the writer can construct a portfolio with where . That is the probability . We can work of course directly on the probability but with a different result. It follows that the minimum portfolio is that with and . Here and are the parameters of . If the asset has small volatility, say and high drift term, say , then the value can be considered as a price for this contract with a clear physical meaning.

If the competition is strong the writers will try to find the lower price for the contract but with a physical meaning for them. Assuming that the competition is strong, the most likely price for the put option is about for which both the buyer and the writer have the same probability of profit (without replication), i.e. , while for both of them the possible profit is bounded. That is the notion of the fair price has a meaning only if both the buyer and the seller have bounded possible profits and does not come necessarily by a replicating portfolio! Of course this is true only if all the investors have the same beliefs about the future. The price of the call option then has to be 0.4 in order the put - call parity holds. The probability of profit is about for this price, that is far enough from the probability . The above holds in the case where all the investors have the same belief about the future!

Remark 7 (Arbitrage free prices). The put - call parity, which holds due to the arbitrageurs, is a relation between the prices of the call and put options which does not give us a specific price for these options. In the real world does not hold because of the transaction costs and maybe because of the lack of arbitrageurs! Supposing zero transaction costs the arbitrageurs (if any) will push high prices down and low prices up. Concerning all the above hedging strategies, this will happen by choosing suitable probability of profit.

One can construct infinitely many pricing models for the call and put options which preserve not only the put - call parity formula but also the bounds for their prices. It is well known that the prices of the call and put option should satisfy the following inequalities in order to be free of arbitrage,

where C is the price of the call option, P is the price of the put option, K is the strike price assuming zero interest rate for simplicity. Then one can price the options as follows

We should choose so that the put - call parity holds and we have infinite ways to do this. That is, for any the prices and are arbitrage free! In order to meet the definition 1 we should describe what the writer can do with this amount. For example, for the call option one suitable hedging strategy is the -hedging strategy in which the writer can borrow the amount in order to buy shares of the underlying asset. Under this hedging strategy the possible loss is bounded by the amount while the possible profit is unlimited. We can apply also the -hedging strategy for the put option. Therefore we have just presented infinitely many ways to produce arbitrage free prices for the call and put options and at the same time we have designed also a practical hedging strategy for each of them! The Black - Scholes hedging strategy propose arbitrage free prices but no practical hedging strategies!

If the writer want to estimate the probability of profit or the mean value of profit she should make an assumption about the price of the underlying asset.

It will be very interesting if we can find other, different from the above, realistic ways to price these options.

Consider now the case of a put option in which the Black - Scholes price equal , the safe price equal and the average value of the payoff equal with . If the writer sell the option at the price she should construct the replicating portfolio in order to have a meaning for her but this is not possible in practice. Selling the option either at the price or then the physical meaning is clear and therefore the competition will force the price of this contract to be .

Problem 2. What is the probability of profit for a call option using the n period realistic binomial model?

A partial answer is the following theorem. By

q we denote the probability

which we have computed in [

5].

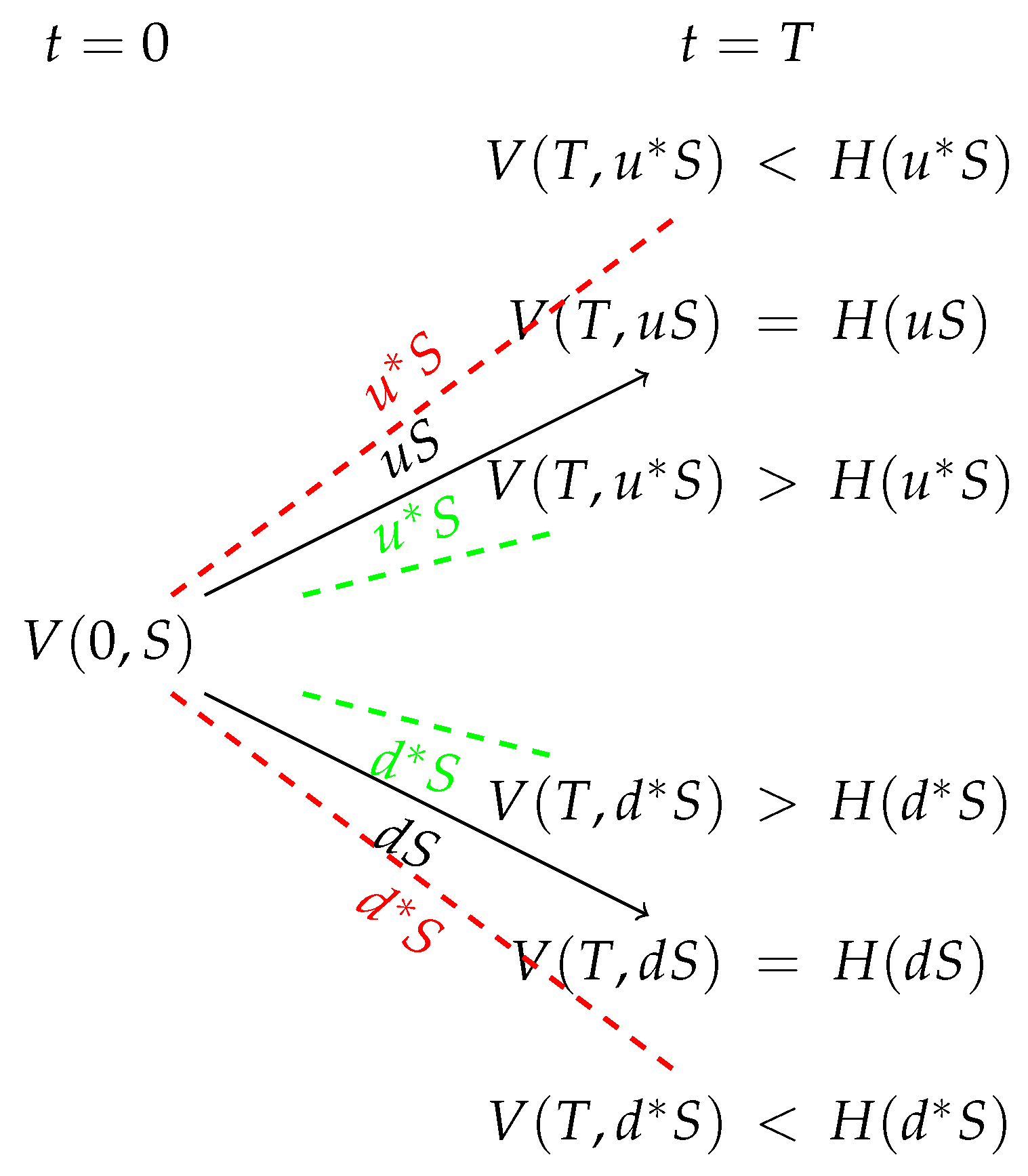

Theorem 4.

Let a call option with strike price K. Suppose that the writer has priced it by using the n - period realistic binomial model under assumption 2 with

Here is such that with p chosen by the writer and is such that and . Then the probability of profit at the last step as assuming that the writer construct the replicating portfolio as she design it at first by placing or withdrawing corresponding amounts of money.

Proof. Let’s assume that the writer constructs the replicated portfolio as she originally designed it by placing or withdrawing corresponding amounts of money. This is because the asset price will almost never receive the appraised values.

The profit at time

T is

where

and

are such that

and

. Finally

is the real value of the asset at time

T after some upward and downward jumps. From now on we will denote by

the

and

and by

the estimated value of the asset after the same upward and downward jumps.

Suppose that

. Then the profit is

and it follows that

. If

then

and if

then

because

and

. Similarly, if

, it follows that

if

and

if

.

Therefore the profit is no-negative in the case where and non positive otherwise.

The probability of profit is then

But

Therefore

Therefore, the probability of profit at the last step is getting smaller as

and of course that means that the probability of loss is getting bigger. □

Problem 3. At time k, knowing the actual path of the asset’s price until that time, what the writer can do concerning the hedging strategy in order to increase the profit and the probability of profit? What about other types of options written on one asset, for example path dependent options?

Remark 8. Intuitively speaking, the realistic binomial model can be used for one period without troubles while for n periods there are open questions concerning the hedging strategy and how should be modified by the writer given the actual path of the asset’s price. Theorem 4 together with problem 3 can be considered as a recommendation for static hedging only and in particular for only one time. The situation for more complex options seems to be worse.

Example 1.

Suppose that the underlying asset today price is and the strike price is . Suppose that the writer prices a call option using the two period realistic binomial model choosing and . It follows that the initial price of the replicating portfolio is .

Suppose now that the first jump of the asset is upward but with . Then, the replicating portfolio has the price . At time the writer should reconstruct the replicating portfolio and chooses to stay at the as these have computed at first. To do so, the writer has to put the amount , which is such that . Supposing that the next jump is upward with we have that the writer profit is

Is there another reconstruction which will drive the writer to a less loss or even to a positive profit?

At the time new information from the market has arrived so the writer can use these information to make a better guess of the future. At time the value of the replicating portfolio is and the writer decides to construct the portfolio with and using this amount of money. Suppose that at the time the asset goes upward with , that is the value of the asset at time is while the value of the portfolio is . The payoff in this case is . Therefore the writer make a profit in this case. If the writer deems it appropriate, she can reconstruct the portfolio more often or less frequently than she originally planned.

In short, it may be preferable (in a multi-period binomial model) for the seller to reconstruct the portfolio not as originally designed but using new information as well as making new guesses.

Remark 9 (Conclusions that are independent of the assumptions).

We have assumed that the price of the underlying asset follows the geometric Brownian motion with parameters . Some conclusions depends strongly on this assumption but there are some other which are independent! For example, concerning the realistic binomial hedging strategy for the call and put options the conclusion that the writer will have a profit if is independent of the assumption about the price of the underlying. The conclusion, however, concerning the probability of this event depends on this assumption. Concerning the -hedging strategy we have concluded that if then the writer will have unlimited possible profit and bounded possible loss and the bound of loss equals to the amount which the writer have borrowed. Again, the probability of profit and the mean value of profit depends on the assumption that we will make about the price of the underlying asset. For the safe price the conclusion that the writer will have a profit if (concerning the call option) is independent of the assumption while the probability of profit of course depends on this. The same hold about the -hedging strategy. Here the Black-Scholes hedging strategy has again a disadvantage. It is seems that there is no conclusion which is independent of the assumption concerning the price of the underlying asset even if we could indeed construct this portfolio in the real world!

| Hedging strategy |

Conclusions independent of the assumption 2 |

| Black-Scholes hedging strategy |

None! |

|

-hedging strategy and Safe price hedging strategy |

Profit if for the call option

while for the put option there will be a profit if . The possible loss is unlimited while the possible profit is bounded. |

| Binomial model |

Profit if and loss otherwise. The possible loss is unlimited while the possible profit is bounded. |

|

-hedging strategy |

Unlimited possible profit and bounded possible loss if ! |

Therefore any conclusion which is independent of the assumption 2 can be used safely by the writer in order to make a decision while any conclusion that depends on this assumption do not.

Summing up, the well known binomial option pricing model has no meaning because the writer’s guess will not come true in the real world and in addition the writer does not know anything about a possible profit and what is the probability of profit. On the other hand, concerning the realistic binomial model, given that the corresponding replicating portfolio has the profit property, the writer knows what is the probability of profit and in which cases will have a profit, at least for the one period model. Pricing by the Black - Scholes model the problem is that the writer can not built the replicating portfolio in order to hedge the risk and therefore nobody will price a contract in this way.

4.2. An option written on two underlying assets

Let two assets

that follows the following sdes

where

days and

are independent (in general) Brownian motions. Let

and consider the option that pays

at the time

T. The writer of the option computes a replicating portfolio via the realistic binomial model with probability of profit

and finds that she should buy

shares of the

asset,

shares of the

asset and

at the bank account assuming zero risk free rate. To be more precise the probability

is not the probability of profit but the probability of the event

. The probability of profit in this case is not so easy to compute as in the call and put options. The initial value of this portfolio is

. It is easy to prove that this replicating portfolio has the profit property. In fact any replicating portfolio with

has the profit property concerning this type of contract. That is we can find the minimum replicating portfolio for

therefore this portfolio will have the profit property. The writer, if she wants to be more competitive, she will try to find the replicating portfolio with the profit property having the minimum initial value. At this example the notion of the fair value does not have any sense because the possible profit of the buyer is unbounded while the possible profit for the writer is bounded.

The writer computes also the safe price under the same hypotheses as above and finds that this price is

with the same probability

p but without replication. Let us recall here how to compute the safe price under the above assumptions as we have proposed in [

5]. For a given probability

p we find the prices

and

so that

Then the safe price is

.

The writer has to buy some call options in order to eliminate the risk of bankruptcy. At the first case, i.e. with the construction of the replicating portfolio, should buy calls with underlying asset for some strike price and calls with underlying asset for some strike price . At the second case she should buy one call per asset.

The final price will be computed after the estimation of the transactions costs for the replication and the cost of the call options, i.e. in the first case the price will be where are the call options and T the transactions costs. At the second case the final price will be .

We give below the definition of the binomial replicating portfolio for a contract with payoff where are the underlying assets.

Definition 3.

Let for be given. We say that a portfolio is a binomial replicating portfolio for the contract with payoff if

where or for assuming zero interest rate.

We can now easily prove the following proposition concerning the profit property of the binomial replicating portfolio.

Proposition 2.

Let a replicating portfolio for the contract with payoff for some with and for and . Then the writer will have a profit using the binomial hedging strategy at least on the event

Proof. The payoff can be

,

or

. We will prove in either case that the profit is nonnegative at the event

We suppose that

. Then the profit

is as follows, denoting by

,

We suppose that . The proof is similar to the previous case.

We suppose that

. Then the profit

is as follows, denoting by

,

□

Remark 10 (Hedging strategies for the ). One hedging strategy for the contract with payoff is to first buy call options (in order to eliminate the risk of bankruptcy) with underlying assets while the remaining amount can be used for the binomial hedging strategy. The writer in this case bets, at least, on the event . The writer can borrow an amount if she want to increase the probability of profit.

The -hedging strategy can be used also to hedge this type of contract. For example, the writer can sell this option at the price Y and then borrow the amount in order to buyshares ofand shares of. Then the profit for the writer equal to

Similar as before conclusions can be made about the event on which the writer will have a profit and moreover if for then there is no risk for bankruptcy.

As we have seen in [

5] there is also another way to compute a price for some given probability of profit for the writer. The writer can assume that

for a stochastic process

suitably chosen by her. This point of view is very useful in the case where the underlying assets are not tradable. In fact the same assumption can be done by the buyer in order to estimate the probability of profit for her, however, the way that the two parties estimates the probability of profit are in general different from each other.

After the decision of the writer about the price (say U) of this option the buyer can compute also the probability of profit for her buying at this price. This probability is more likely to be under but this is acceptable by the buyer because the profit is unbounded from above. Recall that the call options will pay this extra difference.

Problem 4.

Does the (realistic) binomial model can produce a replicating portfolio with the profit property for any known contract? Let a replicating portfolio such that

and the minimum is taken over all the replicating portfolios. The question is: does this portfolio has the profit property for a specific contract? If yes, what is the probability of profit for the writer?