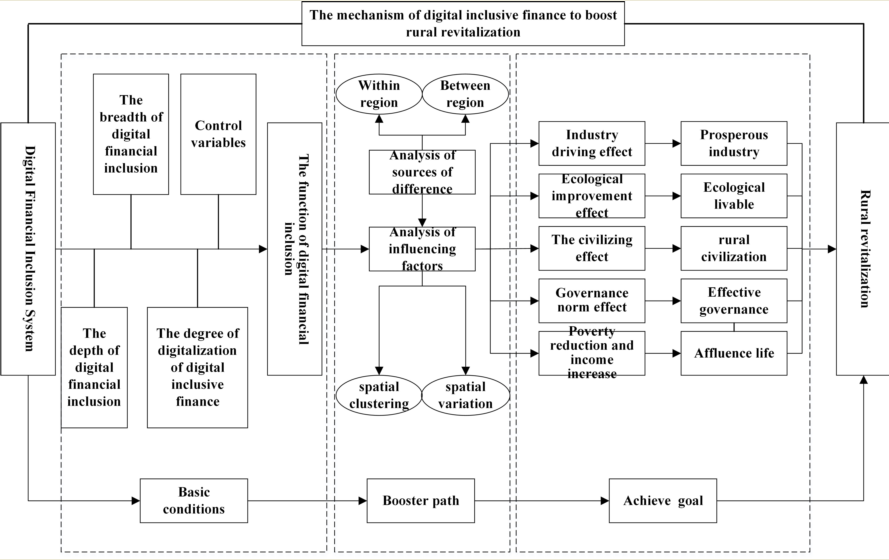

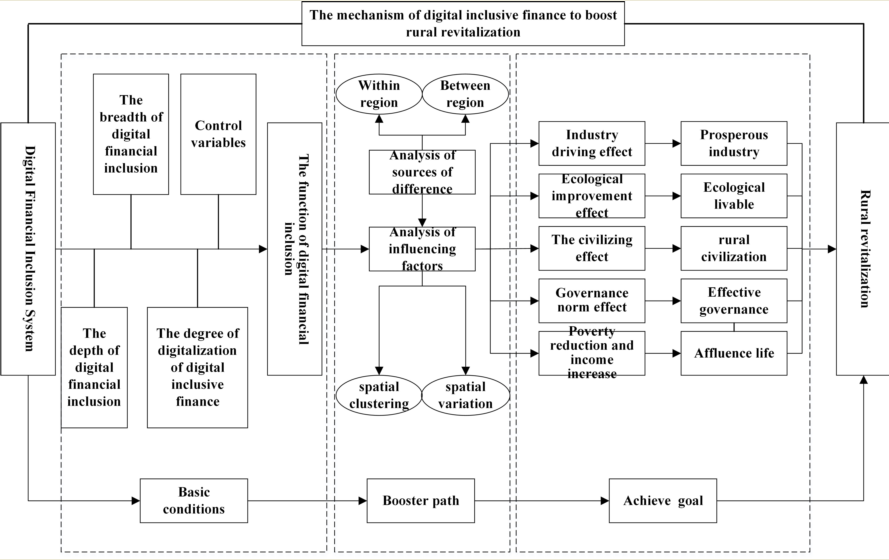

Using the 2011-2020 digital inclusive finance data released by Peking University and the index system constructed by the Blue Book of China Rural Revitalization and Development Index (2018), this paper analyzes the dynamic evolution of the digital inclusive finance and the rural revitaliza-tion from time and space dimensions with the help of kernel density estimation, Markov chain and Moran index. Using The Gini coefficient decomposition method to analyze the source of differ-ences in digital inclusive finance, and then using the spatial autoregressive (SAR) model and ge-ographically weighted regression (GWR) model to study the boosting effect of digital inclusive finance on rural revitalization from the perspective of spatial aggregation and spatial differentia-tion, respectively. The results show that: (1) The growth rate of China's digital inclusive finance slows down year by year, and the inter-provincial differences increase year by year and show gradient characteristics, indicating that there may be a trend of multipolar differentiation. The overall level of Rural Revitalization shows an increasing trend, and the gap between provinces is still apparent. (2) The evolution of digital inclusive finance and rural revitalization is a slow ad-justment process, and there has been no cross-level jump in the past ten years. In digital inclusive finance, the liquidity from the highest and lowest levels to the medium level is high. However, the liquidity in the states of rural revitalization development level is not high. (3) Rural revitalization has a positive spatial spillover effect. The level of rural revitalization in the western area is signif-icantly lower than in the eastern area. At the same time, there is no significant difference between the east and central areas. The depth of the use of digital inclusive finance has a significant positive impact on the revitalization and development of rural areas, indicating that the further promotion of digital inclusive finance business in rural areas can substantially boost the revitalization of rural areas. (4) The boosting effect of digital inclusive finance on rural revitalization shows prominent spatial differentiation characteristics. The depth of use and the degree of digitization generally show a positive impact. The central and eastern coastal cities have the highest impact, decreasing toward the southwest and northeast. The areas with the lowest usage depth impact are clustered in the northeast, and the areas with the lowest digitization impact are clustered in the southwest.