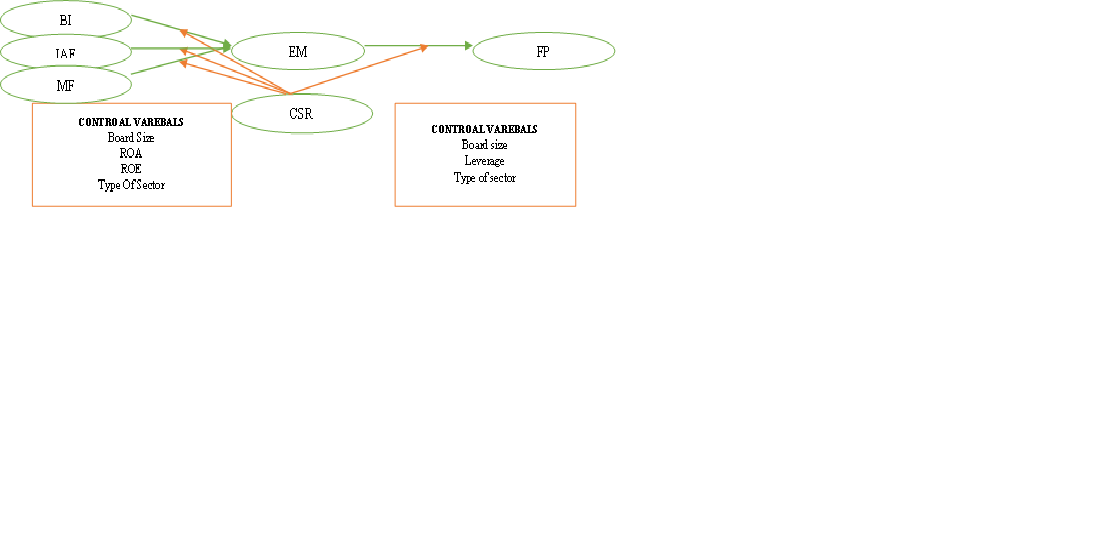

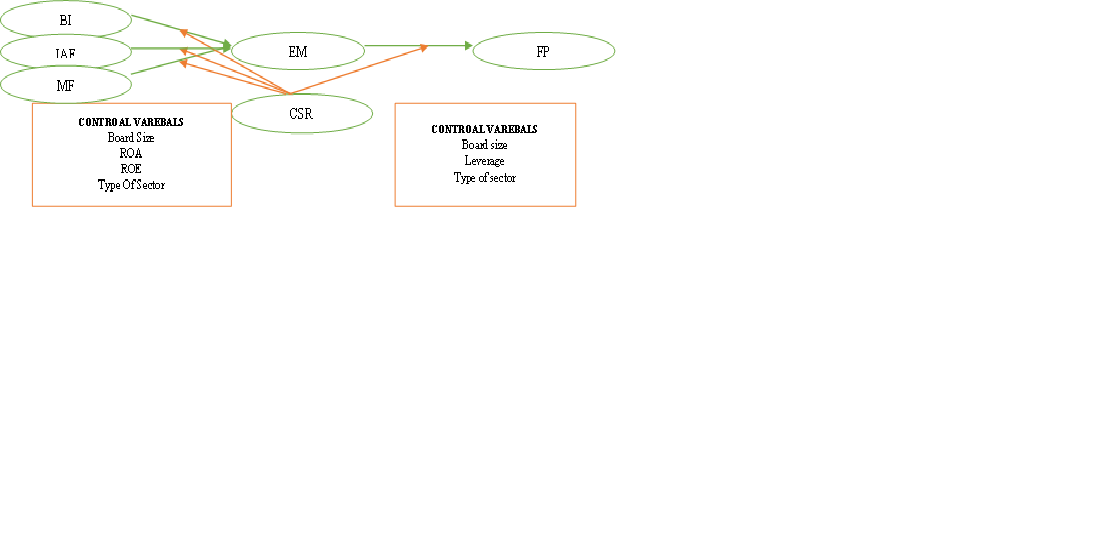

The increase in the number of firms manipulating financial reports has misled shareholders' investment decisions and resulted in an indelible blot on foreign investors’ trust. Due to earnings management (EM) practice, managers' inefficiency, and lack of transparency in Iraq companies. This study tested the influence of the corporate governance mechanisms (CG), (board independence, audit committee, meeting frequency) on EM based on agency theory, as well, to link between EM and firm's performance (FP) in Iraqi listed companies and the impact of moderating role of corporate social responsibility (CSR) based on the Stakeholder Theory. The study's sample consists of 65 companies for the 2013-2018 financial years. Data were collected mainly from the annual reports (secondary data) of the Iraqi listed firms. This study uses the M-score model to detect EM practices as practical techniques in detecting earnings manipulation practices. The panel static model estimators. Hence, this paper adds to the CG literature from the perspective of stakeholder theory using Iraq's unique industrial environment. Based on the research results, policy-makers might use the study‘s findings to recognize the essential roles of several CG mechanisms in alleviating the opportunistic practices in Iraq. Further, companies should also be encouraged to enhance the CSR disclosure quality.