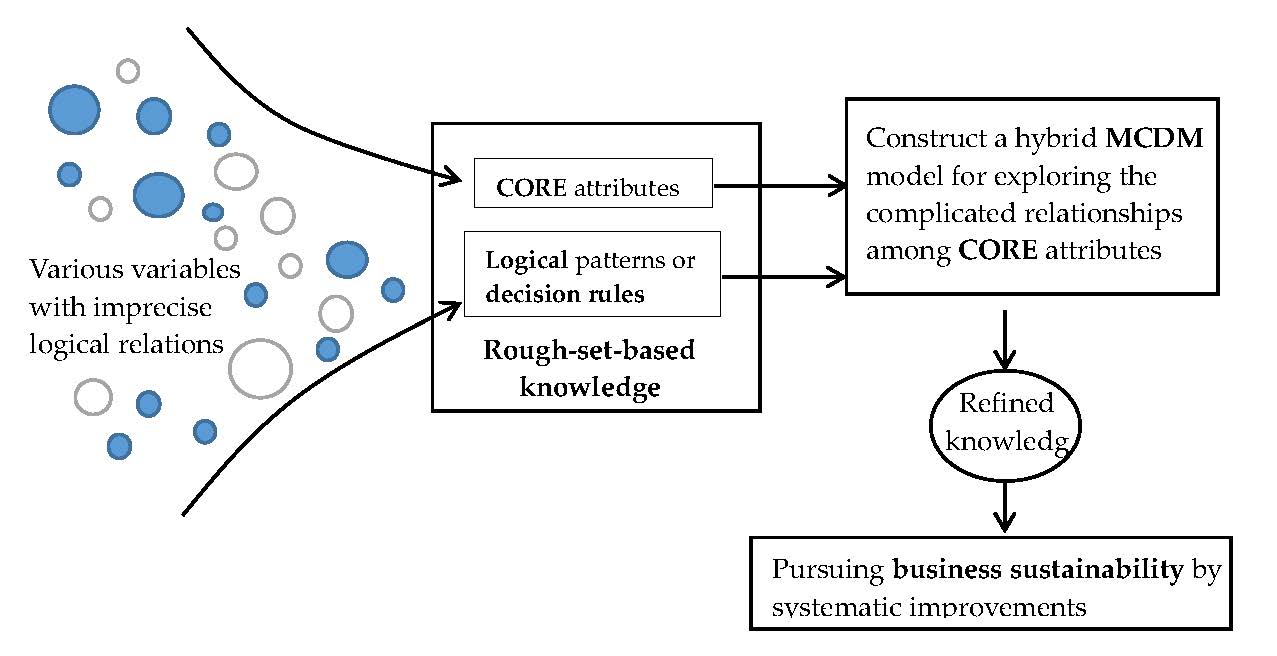

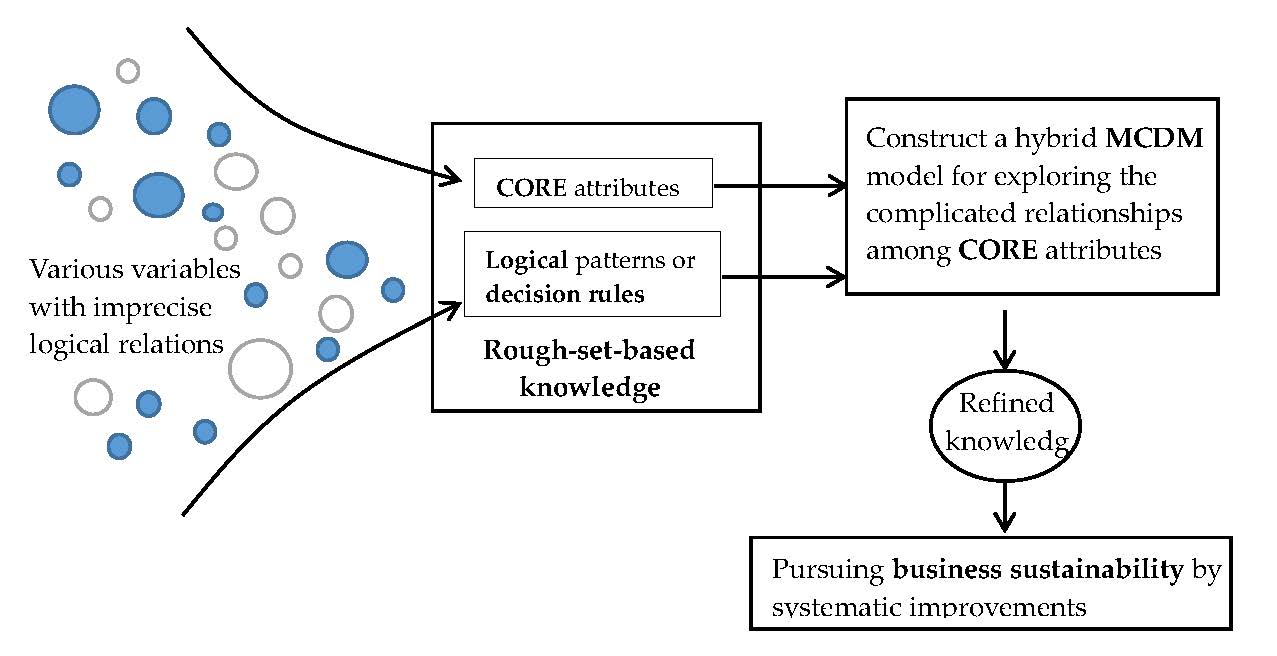

The influence and importance of research and development (R&D) for business sustainability have gained increasing interests, especially in the high-tech sector. However, the efforts of R&D might cause complex and mixed impacts on the financial results considering the associated expenses. Thus, this study aims to examine how R&D efforts may influence business to improve its financial performance considering the dual objectives: the gross and the net profitability. This research integrated a rough-set-based soft computing technique and multiple criteria decision-making (MCDM) methods to explore this complex and yet valuable issue. A group of public listed companies from Taiwan, all in the semiconductor sector, was analyzed as a case study. Initially, more than 30 variables were considered, and the adopted soft computing technique retrieved 14 core attributes—for the dual profitability objectives—to form the evaluation model. The importance of R&D for pursuing superior financial prospects is confirmed, and the empirical case demonstrates how to guide an individual company to plan for improvements to achieve its long-term sustainability by this hybrid approach.