1. Introduction

Effective cash flow management is the cornerstone of sustainability and growth for SMEs worldwide (5). According to Rungani(23), the impact of small, medium, and micro enterprises (SMMEs) on the economies of other nations has grown in importance. Many governments throughout the world are placing increasing emphasis on the SMME sector is significant owing to its potential to alleviate unemployment and foster social development (23). However, many Small and Medium-sized Enterprises (SMEs) continue to experience cash flow challenges that can lead to operational disruptions or business failure, particularly in developing economies where resources and financial management capacity are often limited (24). Despite their vital economic role, SMEs frequently succumb to financial distress, with inadequate cash flow management often cited as a principal failure point (6). These businesses are inherently vulnerable to liquidity shocks due to irregular payment cycles, seasonal volatility, high operational expenditures, and difficulties in accessing finance (1), especially in emerging markets like South Africa.

Cash flow is vitally significant in determining a business’s financial performance (8). This is because a positive cash flow signifies robust financial health, with more cash inflows than outflows, while a negative cash flow reflects the opposite (11). In light of this, good cash flow management systems can assist managers in controlling expenditure in proportion to the stated budget, reducing borrowing, and optimizing the potential of their enterprise’s resources (3). Therefore, the financial performance of SMMEs is critical to measure, as it assesses the business’s capacity to use its resources efficiently and effectively in order to accomplish the intended result (26). To establish sustainable SMMEs capable of withstanding economic challenges and competing globally, there is a need to examine how these enterprises are currently supported and managed (16; 7).

In addressing this critical gap, this systematic literature review (SLR) synthesized the current body of research to identify, evaluate, and structure the most viable cash flow management strategies available to SMEs. The overarching aim of this study was to conduct a comprehensive literature analysis of strategic cash flow management strategies, with particular focus on their relevance to SMEs, a sector often characterized by pronounced cash flow fluctuations. The research further sought to compile recent evidence on strategies adopted by SME owners and assess their efficacy in mitigating common cash flow problems across various global contexts, while providing practical recommendations tailored for the financial development and sustainability of SMEs within the South African economy.

2. Methods

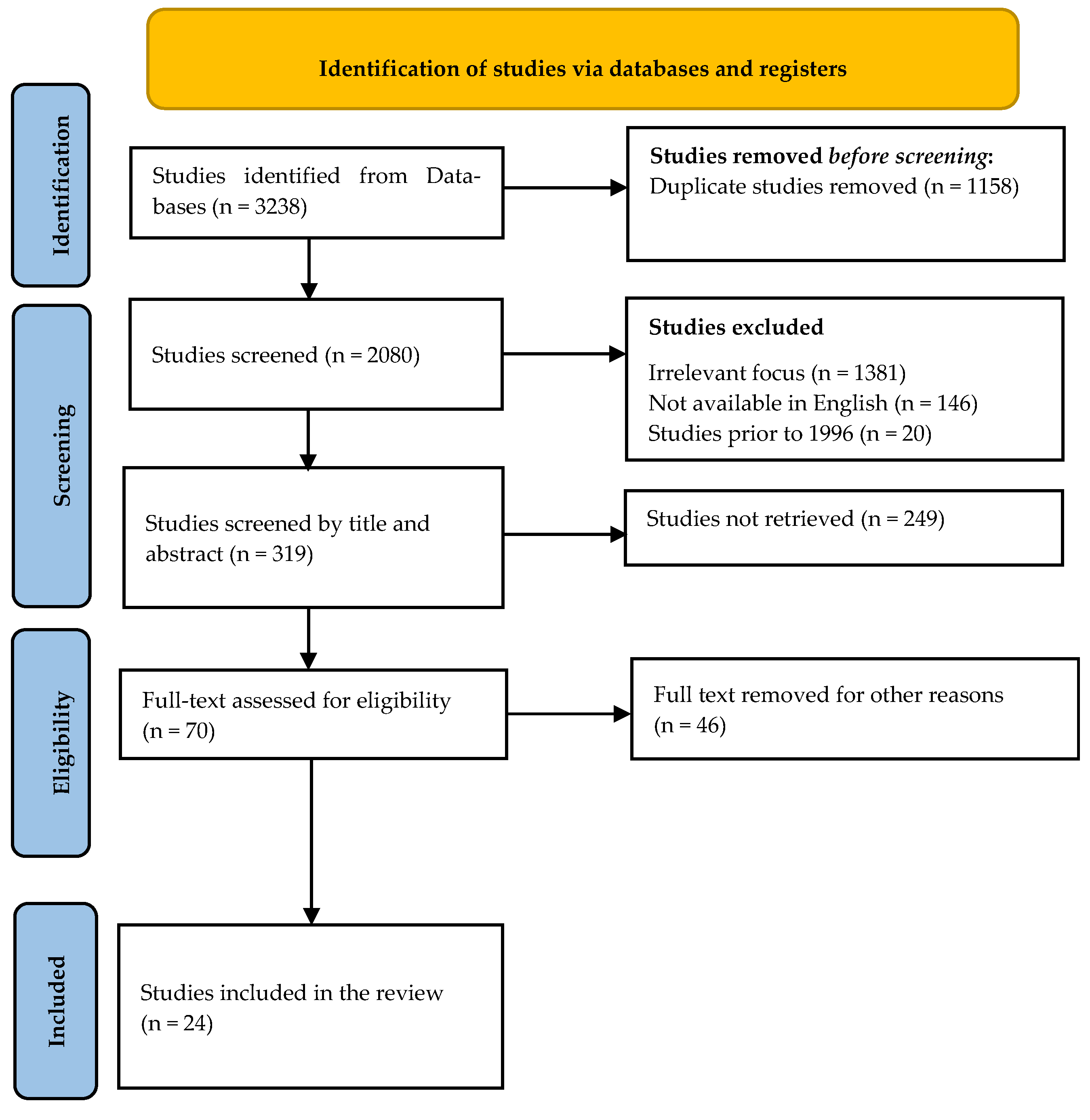

Methodically, the SLR was employed in this study which is a translucent and repeatable method of synthesizing scientific evidence to answer a particular research question (13). Muka et al. (20) define SLR as a rigorous and comprehensive approach to locating, selecting, and assessing pertinent literature on a certain research problem or subject. The interest in conducting this review was to examine the types of cash flow management strategies used by SME owners and how effectively they address typical cash flow problems across different global contexts, including South Africa. Additionally, because it allowed for the integration of various methodologies from studies, the systematic review method was deemed to be the optimum kind of research review for this study. The comprehensive review method, encompassing literature search and selection, was rendered transparent and systematic by adhering to the Preferred Reporting Items for Systematic Reviews and Meta-Analyses (PRISMA) criteria (19).

2.1. Literature Search

The following search keywords/statements were used: “Cash flow management strategies for SMEs”; “Strategies in cash flow management for SMEs”; “SMEs and Cash flow management”. These phrases were also used to identify and analyze main ideas from the literature.

A purposive sampling method was applied through the population, intervention, comparison, outcome, and context PICOC framework, which guided the eligibility and selection of the studies. This process defined which studies were selected for the review. When the database findings were evaluated, titles that appeared to meet the PICOC framework’s requirements and, consequently, the emphasis of the research questions were selected first. After reading the abstract, these were further investigated by comparing them to the framework’s contents once more. These were preserved for further analysis if the provided information aligned with the review’s objectives. Additionally, relevant studies were chosen and analyzed. To extend the search, some of the references in the chosen research were examined. After reading the abstract, these were further investigated by comparing them to the framework’s contents once more. If the information supplied matched the goals of the review, these were kept for additional examination.

Table 1 demonstrates how the PICOC framework was applied in the review.

2.2. Inclusion and Exclusion Criteria

The inclusion criteria included scholarly databases for peer-reviewed papers published in English between 1996 to 2025. The researcher selected papers from this period because SMEs of all types existed in South Africa before 1994. The post-Apartheid period marked a significant shift with a focus on supporting SMEs, particularly those owned by Black South Africans, through policy initiatives, such as BEE programs, and a broader emphasis on economic growth and socio-economic integration. Furthermore, studies that were conducted as both qualitative and quantitative studies, focusing on existing characteristics of SMEs’ cash flow management strategies, were included in the review.

Studies that were non-peer-reviewed literature, such as blog posts and opinion pieces, with insufficient empirical or theoretical basis, grey literature such as conference proceedings, book chapters, dissertations, and thesis were excluded from the review.

2.3. Data Extraction

To address the research topic, data extraction entailed methodically gathering pertinent data from the chosen studies. The procedure is crucial for combining data, comparing results from various investigations, and guaranteeing the authenticity and dependability of the conclusions reached after the review (14). According to Higgins et al. (10), data extraction usually includes important study features such as the authors, year of publication, study design, sample size, methodology, and major findings. To maintain consistency, these details are presented in an organized table, as shown in

Table 2. In the synthesis phase, it has also been demonstrated that using dual extraction methods in which two independent reviewers extract data and settle disagreements improves accuracy and lowers errors (4). In addition to reducing prejudice, this methodical approach to data extraction guaranteed a clear and repeatable review process in this study (25).

2.4. Data Screening

To address the research topic, data extraction entailed methodically gathering pertinent data from the chosen studies. The procedure was crucial for combining data, comparing results from various investigations, and guaranteeing the authenticity and dependability of the conclusions reached after the review (14). This methodical approach to data extraction also guarantees a clear and repeatable review process (25). The review yielded a total of 3,238 articles retrieved from the Herzing Publish or Perish database, which were then screened. These articles were exported from the Herzing Publish or Perish database onto Mendeley. This helped to identify and remove duplicate studies which were 1158; 2080 studies were screened; studies which were excluded for irrelevant focus were 1381; studies excluded as they were not available in English were 146; studies before 1996 were 20; studies screened by title and abstracts were 319; studies not retrieved were 249; full texts accessed for eligibility were 70 and full texts removed for other reasons were 46. Following the screening process, the review yielded a final sample size of 24 peer-reviewed articles deemed pertinent to the study. The review procedure facilitated the extraction of pertinent data from the selected research, ensuring accuracy and consistency to prevent the inclusion of irrelevant information. This also helped in confirming the authenticity of the sources used. See the illustrated process of selecting studies in

Figure 1 of the PRISMA diagram.

3. Findings and Discussion

3.1. Findings

Findings from the twenty-four (24) reviewed articles show that eight (8) main themes emerged on the existing strategies for cash flow management.

Table 3 below is a summary of findings on existing strategies on cash flow management, which were grouped into themes in alignment with the main research question namely, “What are the existing strategies in cash flow management for SMEs in South Africa?”

The themes include cash flow forecasting and planning, budgeting and cost control techniques, working capital management, digital tools and financial technology, managerial competence and financial training, government programs, risk management, and the application of depreciation techniques are some of these subjects.

3.2. Discussion

The findings highlight the need for efficient cash flow management for SMEs aiming for long-term sustainability and financial stability. Strategies like accurate cash flow forecasting, disciplined budgeting, cost control, and effective inventory, payables, and receivables management are essential for maintaining liquidity, according to evidence from the evaluated research. When combined, these strategies improve supplier relationships, increase operational performance, facilitate prompt decision-making, and lower the risk of financial crisis.

Furthermore, the use of risk-management techniques, the use of government assistance programs, and the deployment of digital financial technologies all contribute to increased resilience by allowing companies to adjust to changing and unpredictable market conditions. Together, these tactics provide a thorough framework that promotes steady cash flows, optimizes resource allocation, and boosts overall financial performance. SMEs that regularly use these strategies are better able to maintain their sustainability and competitiveness. While all eight themes provide valuable insights, it is important to recognize that certain strategies, such as government schemes and depreciation methods, though effective, are not consistently applied across successful cases. However, when used appropriately, these methods can also contribute to improved profitability for SMEs (2). Therefore, the integration of all eight themes offers a robust and well-rounded foundation as discussed below for developing strong and effective cash flow management strategies.

3.2.1. Cash Flow Forecasting and Planning

Cash flow forecasting helps SMEs anticipate periods of surplus or shortage, enabling timely financial decisions according to Okello et al. (21). Planning ensures optimal cash balances, reduces liquidity risk, and supports business continuity, particularly during short-term financial pressure.

3.2.2. Budgeting and Cost Control Strategy

Budgeting promotes disciplined spending, improves supplier relationships, and prevents misuse of funds (21). Effective cost control aligns expenses with income, preserves cash reserves, and enhances operational efficiency and long-term financial sustainability.

3.2.3. Working Capital Management

Working capital management improves liquidity through clear payment terms, timely invoicing, inventory control, and prioritized supplier payments (12). These practices reduce cash flow disruptions and help SMEs maintain operational continuity.

3.2.4. Digital Tools and Financial Technology

Digital financial tools enhance accuracy, speed, and transparency in cash flow management (9; 27). Automation and real-time reporting support informed decision-making, forecasting, and proactive liquidity control.

3.2.5. Risk Management

Risk management protects cash flow by identifying and mitigating financial, operational, and market threats (15; 22). Internal controls and proactive planning reduce losses, safeguard assets, and support business continuity.

3.2.6. Financial Training and Managerial Competence

Financial literacy and managerial competence enable better interpretation of financial data and effective cash flow decisions (17; 29). These skills reduce mismanagement and strengthen overall financial control.

3.2.7. Government Schemes

Government financial support can assist SMEs during cash shortages or economic downturns (12). However, such schemes are best used as supplementary measures rather than primary liquidity strategies.

3.2.8. Using the Depreciation Method

Depreciation allocates asset costs over time and improves financial reporting accuracy (28). While important for planning, it has a limited direct effect on short-term liquidity management.

4. Limitations

In evaluating the results of this SLR, this review recognises and acknowledges a number of limitations. Firstly, although the study synthesised a variety of cash flow management strategies from multiple countries, the majority of the included research was conducted outside of South Africa. This restricts the findings’ contextual relevance because financial support systems, legal frameworks, and economic conditions differ greatly between nations. Secondly, a significant portion of the research relied on self-reported data from owners of SMEs, which may be biased or erroneous, particularly when it comes to financial practices that respondents may overstate or underreport.

Additionally, the review mostly concentrated on scholarly articles, which could not have accurately represented the actual operations of SMEs. Therefore, a more comprehensive viewpoint might have been provided by a larger variety of materials, such as industry reports and book chapters.

Furthermore, the research found limited empirical data that directly evaluated how specific strategies like budgeting, forecasting, or adopting digital tools affect actual liquidity outcomes or long-term financial stability. Instead of providing measurable financial performance metrics, most studies emphasized the perceived importance of these strategies. This made it harder to establish definitive causal links. Lastly, variations in study designs, sample sizes, business types, and methodological rigor posed challenges in comparing results across sources. As a result, while the review offers useful insights into common strategies, additional research, particularly within the South African SMEs context, is needed to confirm the real impact of these practices on financial performance.

5. Recommendations

The study recommends further research that can provide more specific advice for SMEs by addressing gaps in cash flow management techniques and overall financial health. Future studies should explore the role of technology, including financial software, digital tools, automation, and data analytics in financial decision-making. Investigating regional differences will help to understand how economic conditions, cultural norms, and legal frameworks influence cash flow management. Longitudinal studies can establish long-term effects, sustainability, and effectiveness of strategies. Examining financial literacy and training programs is important, as a lack of information remains a major obstacle. Research should also assess access to capital and credit, as well as industry-specific cash flow management challenges and best practices.

6. Conclusions

Effective cash flow management is a critical component of SMEs’ survival and expansion, as this comprehensive literature review on cash flow management strategies for SMEs emphasizes. The results imply that SMEs have a difficult time controlling their cash flows, with many turning to unofficial methods and not having the necessary skills or resources to improve their financial management procedures. Using financial management software, budgeting, and cash flow forecasting are some of the key strategies that were found. The cash flow of SMEs can be directly affected by their difficulties in controlling seasonality and obtaining finance.

The study findings show that effective cash flow management is crucial for reducing financial risks and guaranteeing that SMEs can continue to operate even in unpredictable times. The study emphasises that SME owners need to make investments in developing financial literacy and putting proactive cash flow management techniques into practice in order to boost their long-term survival.

Author Contributions

Conceptualization, methodology, M. and L; validation, L; formal analysis, M.; investigation, resources, M.; data curation, M. and L; writing original draft preparation, M; writing review and editing, visualization, M. and L; supervision, project administration, L; funding acquisition, M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The study was conducted in accordance with the Declaration of Helsinki and approved by the Ethics Committee of the University of Johannesburg, registry number JBSREC202463, approved 28 June 2024.

Informed Consent Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Alarcon, J. L. J.; Kugel, R. Digital cash flow management advances in a post-pandemic world. Pennsylvania CPA Journal 2023, 94, 24–27. [Google Scholar]

- Atakul, N. Exploring the cash flow management strategies of Turkish construction companies. Journal of Construction Engineering, Management & Innovation 2022, 5. [Google Scholar] [CrossRef]

- Bari, M. A.; Muturi, W.; Samantar, M. S. Effect of cash management on the financial performance of food and beverage retailers in Puntland State, Somalia. International Journal of Contemporary Applied Researches 2019, 6, 130–153. [Google Scholar]

- Brown, J.; Miller, K.; Davis, R. Improving data extraction accuracy in systematic reviews: A dual-reviewer approach. Systematic Reviews 2023, 12, 102. [Google Scholar] [CrossRef]

- Campbell, C.; Guide, S.; from. Cash flow management: What it is & how to do it. Shopify. 15 July 2024. Available online: https://www.shopify.com/za/blog/cash-flow-management.

- Carlson, R. The importance of cash management to small business success. The Balance Small Business. 2019. Available online: https://www.thebalancesmb.com/cash-management.

- Dithebe, K.; Thwala, W. D.; Aigbavboa, C.; Madumelane, B. Performance of South Africa’s construction industry post-Covid-19. IOP Conference Series: Materials Science and Engineering 2022, 1218, 012031. [Google Scholar] [CrossRef]

- Fijabi, L.; Dada, B.; Lasisi, O.; Akenroye, C. Cash flow effects and financial performance of quoted oil and gas firms. Journal of Accounting and Taxation 2023. [Google Scholar]

- Hamza, K.; Zubieru, M.; Antwi, S. K. Cash management practices and financial performance of SMEs in Ghana. International Journal of Economics, Commerce and Management 2015, 3, 456–480. [Google Scholar]

- Higgins, J.; Thomas, J.; Chandler, J. Cochrane Handbook for Systematic Reviews of Interventions; Wiley-Blackwell, 2023. [Google Scholar]

- Imhanzenobe, Japhet; Adeyemi, Semiu. Financial Decisions and Sustainable Cash Flows in Nigerian Manufacturing Companies. International Journal of Management, Economics and Social Sciences 2020, 9, 90–112. [Google Scholar] [CrossRef]

- Islam, M.; Khan, M. Financing behaviour and liquidity strategies of micro-businesses. Asian Journal of Economics and Empirical Research 2024, 11, 12–25. [Google Scholar]

- Lamé, Guillaume. Systematic Literature Reviews: An Introduction. Proceedings of the Design Society: International Conference on Engineering Design 2019, 1, 1633–1642. [Google Scholar] [CrossRef]

- Liberto, D. Quantity Discount: Benefits, Risks, and How They Work. Investopedia. 2025. Available online: https://www.investopedia.com/terms/q/quantity-discount.asp.

- Lucko, G. Financial Planning and Management Practices of Electrical Contractors. Organization, technology & management in construction: an international journal 2016, 8. [Google Scholar]

- Manzoor, F.; Wei, L.; Sahito, N. The role of SMEs in rural development: Access of SMEs to finance as a mediator. PloS one 2021, 16, e0247598. [Google Scholar] [CrossRef] [PubMed]

- Marivate, S. P. The relationship between growth in small businesses and cash flow: A study of small businesses in Tshwane. European Journal of Research and Reflection in Management Sciences 2014, 2, 19. [Google Scholar]

- Moher, D; Liberati, A; Tetzlaff, J; Altman, DG; Moher, D; Liberati, A; Tetzlaff, J; Altman, DG. Group PPreferred reporting items for systematic reviews and meta-analyses: the PRISMA statement. PLoS Med Open medicine : a peer-reviewed, independent, open-access journal. 3. e123-30. 2009, 6, e1000097 3. e123–30. [Google Scholar] [CrossRef]

- Muka, T.; Glisic, M.; Milic, J.; et al. A 24-step guide on how to design, conduct, and successfully publish a systematic review and meta-analysis in medical research. Eur J Epidemiol 2020, 35, 49–60. [Google Scholar] [CrossRef]

- Okello, G. N.; Layet, S. A.; Olido, K. Cash flow management and growth of SMEs in Uganda. Research Journal of Finance and Accounting 2024, 15, 25–35. [Google Scholar]

- Przychocka, I.; Sikorski, M.; Milewski, L. Cash flow management in small and medium enterprises in times of economic uncertainty. 2024. [Google Scholar] [CrossRef]

- Rungani, Ellen. towards a comprehensive SMME support framework in South Africa. Journal of Contemporary Management 2022, 19, 654–674. [Google Scholar] [CrossRef]

- Sikhosana, R. Financial literacy and SMEs: Bridging the gap for better cash flow management. Journal of Business Finance and Economics 2024, 12, 51–67. [Google Scholar]

- Williams, S.; White, L. Standardized templates for data extraction in systematic reviews. Journal of Research Methodology 2024, 48, 210–218. [Google Scholar]

- Ugo, C. C.; Egbuhuzor, C. A. Effect of cashflow management on financial performance: Evidence from the pharmaceutical industry in Nigeria. African Journal of Accounting and Financial Research 2022, 5, 1–13. [Google Scholar] [CrossRef]

- Vismaya, C.; Sandhya, P. D. S. Working capital management strategies and financial performance of MSMEs in Kerala. Al-Shodhana 2025, 26 13, 113–129. [Google Scholar] [CrossRef]

- Yohanis, A.P. Cost Management Strategies in Small Business Development. SSRN Electronic Journal 2023. [Google Scholar] [CrossRef]

- Zendrato, M. W.; Octafian, R. Analysis of financial management to enhance profitability in micro, small, and medium enterprises (MSMEs). International Journal of Economics, Business Management and Accounting 2025, 7, 259–270. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2026 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).