1. Introduction

Regulatory compliance in large-scale financial, tax, and employment reporting ecosystems has entered a period of unprecedented complexity. Enterprises operating in the United States must simultaneously submit structured and semi-structured data to multiple federal agencies, including the Internal Revenue Service (IRS), the Securities and Exchange Commission (SEC), and the Department of Labor (DOL). Although these reports serve distinct regulatory objectives—such as tax liability assessment, investor protection, and labor rights enforcement—they often rely on overlapping financial indicators, revenue statements, compensation figures, and operational disclosures. As a result, modern compliance is no longer a single-agency issue but a cross-regulatory coordination problem. However, despite significant digital transformation efforts, most agencies still operate in data silos, and enterprises frequently submit information that is internally consistent within each agency’s forms yet inconsistent across federal bodies. These inconsistencies may stem from reporting timing differences, heterogeneous accounting rules, procedural gaps, or deliberate manipulation for tax evasion or financial misrepresentation. Regardless of the cause, cross-agency discrepancies significantly erode the reliability, efficiency, and fairness of regulatory enforcement.

The consequences of fragmented compliance supervision have become increasingly visible in recent years. Large corporations with complex organizational structures may exploit regulatory blind spots by distributing inconsistencies strategically across different reports, making fraud detection disproportionately difficult for any single agency. Small and medium-sized enterprises, on the other hand, may unintentionally trigger red flags due to resource constraints or misunderstanding of reporting rules, yet still face disproportionate investigative burdens. These systemic frictions inflate national audit expenditures, reduce the effectiveness of taxpayer oversight, and contribute to billions of dollars in tax losses annually. Meanwhile, the IRS faces a well-documented decline in experienced audit staff, while compliance volumes continue to rise. The tension between increasing oversight demands and limited auditing capacity fundamentally challenges the sustainability of traditional enforcement practices.

To address these issues, the regulatory community has explored the use of advanced analytics, rule-based engines, and data standardization protocols. However, such approaches remain insufficient for two structural reasons. First, cross-agency inconsistency detection requires a combination of statistical pattern recognition and rule-driven logical reasoning—capabilities that conventional machine learning or symbolic systems alone cannot deliver. Second, even when inconsistencies are successfully detected, the lack of a trusted, tamper-proof mechanism for inter-agency sharing of evidence undermines transparency and collaboration. The result is a persistent gap between the technological potential of modern AI systems and the institutional requirements of regulatory practice.

The rapid advancement of neuro-symbolic artificial intelligence provides an opportunity to close this gap. By integrating graph neural networks (GNNs) with first-order logic constraints, neuro-symbolic systems can capture both the relational structure of multi-report financial data and the domain-specific logical rules governing compliance. This hybrid paradigm preserves the interpretability and rule consistency expected in regulatory audits while enabling the model to learn complex, non-linear discrepancy patterns that traditional rule engines cannot express. For example, subtle inconsistencies between SEC cash-flow disclosures and IRS taxable revenue may follow patterns that only emerge in high-dimensional financial graphs but still adhere to explicit regulatory rules. Neuro-symbolic reasoning bridges these two domains, making it well suited for cross-regulatory consistency verification.

At the same time, blockchain technology—especially permissioned blockchain architectures—offers a fundamentally new mechanism for establishing trust in compliance workflows. By anchoring validation results, evidence graphs, and audit trails to an immutable ledger, blockchain prevents ex post modification of regulatory records, supports secure shared access among authorized agencies, and enhances the transparency of inter-agency collaboration. Rather than relying on internal document exchange or bilateral agreements, regulators can maintain a common, cryptographically verifiable source of truth for all detected inconsistencies and follow-up enforcement actions. This reduces the cost of audits, strengthens institutional credibility, and deters fraudulent behaviors by increasing the risks associated with manipulation of reported data.

Yet even if the consistency detection and evidence verification challenges are addressed, a third and equally critical problem remains: how to allocate limited IRS audit resources in a manner that is both effective and fair. Existing audit allocation policies are constrained by static rules and historical heuristics that do not adapt to evolving economic conditions or taxpayer behavior. Furthermore, numerous studies reveal that audits disproportionately target low-income individuals and small businesses, not because these groups pose higher risk, but because their filings are easier to automate and less legally complex to investigate. This raises serious concerns about procedural justice and the equitable distribution of regulatory burdens, undermining public trust in federal institutions.

Deep reinforcement learning (DRL), when integrated into a multi-agent framework, offers a data-driven solution to this problem. By modeling taxpayers, regulators, and economic environments as interacting agents, DRL can learn audit policies that optimize long-term tax recovery while simultaneously incorporating fairness metrics into the reward function. Unlike static rule-based allocation, this dynamic learning process adapts to real-world uncertainty, changing behavior patterns, and multi-objective trade-offs. For example, the system may discover strategies that maximize compliance impact while reducing over-enforcement on vulnerable populations. When combined with explicit fairness regularization, DRL-based audit resource allocation can help ensure equitable regulatory outcomes at a national scale.

Given these technological opportunities and regulatory challenges, this research proposes a unified framework that integrates neuro-symbolic reasoning, blockchain-based trust infrastructures, and multi-agent deep reinforcement learning to modernize cross-regulatory intelligence. The framework is designed to address three interconnected requirements: (1) detecting complex, multi-report inconsistencies that may indicate fraud, underreporting, or procedural errors; (2) establishing tamper-proof, cross-agency audit evidence chains to improve transparency, accountability, and coordination; and (3) dynamically allocating audit resources in a manner that balances efficiency, fairness, and long-term compliance sustainability. Unlike traditional compliance analytics systems, the proposed approach is end-to-end: it not only analyzes inconsistencies, but also feeds validated insights into an adaptive audit allocation mechanism that continuously improves over time.

The national importance of this work lies in its potential to support a more transparent, more consistent, and more equitable regulatory ecosystem. Strengthening cross-agency report consistency is essential for protecting the federal tax base, preventing financial misconduct, safeguarding investor confidence, and reducing audit duplication. Ensuring fairness in audit allocation reinforces the legitimacy of regulatory institutions and helps prevent vulnerable populations from bearing disproportionate enforcement costs. By merging state-of-the-art AI methods with an immutable evidence infrastructure, this research contributes to the modernization of U.S. compliance systems in a manner that aligns with democratic values, legal standards, and long-term socioeconomic stability.

2. Related Work

Research at the intersection of neuro-symbolic reasoning, blockchain-based auditing, and fair and efficient tax audit resource allocation has evolved considerably over the past three years, reflecting a broader shift toward trustworthy and explainable regulatory intelligence. This section reviews the most relevant developments in these areas and clarifies the research gap motivating this work.

2.1. Neuro-Symbolic Reasoning for Regulatory Consistency

Neuro-symbolic artificial intelligence integrates symbolic reasoning with data-driven learning, enabling systems to detect inconsistencies that would not be discoverable through pure logic or statistical methods alone. Foundational analyses highlight the growing maturity of neuro-symbolic methods and their applicability to domains requiring both interpretability and high-dimensional pattern recognition [

1]. Broader surveys further document the emerging transition from statistical relational learning to full-fledged neurosymbolic frameworks, emphasizing their value in scenarios where organizational knowledge and numerical data coexist [

2].

Recent advances also extend neuro-symbolic reasoning to scene-graph and common-sense knowledge modeling, suggesting that hybrid reasoning architectures can support complex, multi-entity inference tasks [

3]. Complementary discussions describe neurosymbolic AI as a distinct technological wave with strong implications for regulated environments that require accountability and explicit rule enforcement [

4]. Despite these developments, limited research has explored how neuro-symbolic reasoning can be applied to cross-regulatory report consistency verification, particularly in the context of IRS, SEC, and DOL filings where structured financial data and compliance rules coexist.

2.2. Blockchain for Auditing and Evidence Immutability

Blockchain has been recognized as an important infrastructure for auditing, enabling traceable verification of financial statements and compliance evidence. Literature on blockchain-driven accounting systems shows its potential to improve transparency and automated verification in corporate reporting [

7]. Systematic reviews further emphasize blockchain’s role in safeguarding digital audit trails and supporting inter-agency collaboration where trusted data sharing is required [

8].

More recent studies strengthen the argument that blockchain can enable continuous auditing with machine-verifiable proof, positioning it as a central component of trustworthy regulatory supervision [

9]. Additional research demonstrates growing institutional adoption of blockchain in audit workflows, including smart contract–based assurance and automated compliance monitoring [

10]. Empirical studies of blockchain’s relevance to accounting practice indicate strong practitioner interest yet also highlight the absence of integrated frameworks that combine blockchain immutability with algorithmic reasoning [

11].

Despite these advances, prior work has not developed a unified architecture in which neuro-symbolic inconsistency detection outputs are anchored on blockchain for tamper-proof audit evidence, which is a key contribution of the present research.

2.3. Machine Learning for Tax Compliance and Audit Selection

Machine learning has increasingly been applied to tax enforcement and fraud detection. Early work demonstrates efficiency gains in audit targeting when taxpayer relational information is leveraged, particularly graph-based behavioral indicators [

12]. Survey results further document the diverse applications of data mining in tax compliance risk detection and highlight the potential of AI-driven analysis for government oversight [

13]. More recent tax compliance research uses comparative modeling to predict audit effects and identify risk contributors in large datasets [

14].

Policy-oriented studies explore how audit selection strategies influence deterrence outcomes and support evidence-based enforcement design [

15]. Systematic reviews of AI-based tax fraud detection confirm the utility of predictive approaches but also emphasize transparency and explainability challenges in high-stakes decision-making [

16]. In parallel, the AI Economist demonstrates the viability of designing taxation mechanisms via two-level reinforcement learning, providing support for adaptive and welfare-optimized tax policy design [

17].

Nevertheless, these contributions do not directly address multi-agency filing consistency nor incorporate fairness-aware audit resource optimization, leaving an opportunity for integrated regulatory intelligence methods.

2.4. Fairness and Multi-Objective Reinforcement Learning in Audit Allocation

Reinforcement learning has been increasingly studied for fairness-aware decision automation. A survey of fairness in reinforcement learning identifies multiple algorithmic paths for reducing disparate impact in policy learning, particularly in public service allocation [

5]. Multi-objective agent-based optimization research extends this reasoning by incorporating welfare constraints into policy learning [

6]. Such approaches have direct relevance to IRS audit resource allocation where both revenue efficiency and equity in enforcement are national priorities.

Yet, to date, no prior work has integrated neuro-symbolic risk detection with fair, multi-objective audit allocation and blockchain-based audit trail preservation, which represents the core novelty of this paper.

3. Methodology

Neuro-Symbolic Regulatory Consistency and Blockchain-Anchored Fair Audit Intelligence

This chapter presents the methodological foundations of the proposed Neuro-Symbolic and Blockchain-Anchored Fair Audit Intelligence Framework, designed to address a structural challenge in U.S. federal regulatory governance: the absence of a mechanism capable of determining, with legal and evidentiary reliability, whether disclosures submitted by the same corporation to IRS, SEC, and DOL represent a coherent and truthful economic reality. The problem is not merely computational, nor reducible to data engineering integration. It concerns the reconstruction of regulatory truth in an environment where legal obligations are fragmented, enforcement capacities are unequal, and reporting incentives are strategically shaped by litigation risk, tax exposure, and shareholder governance constraints.

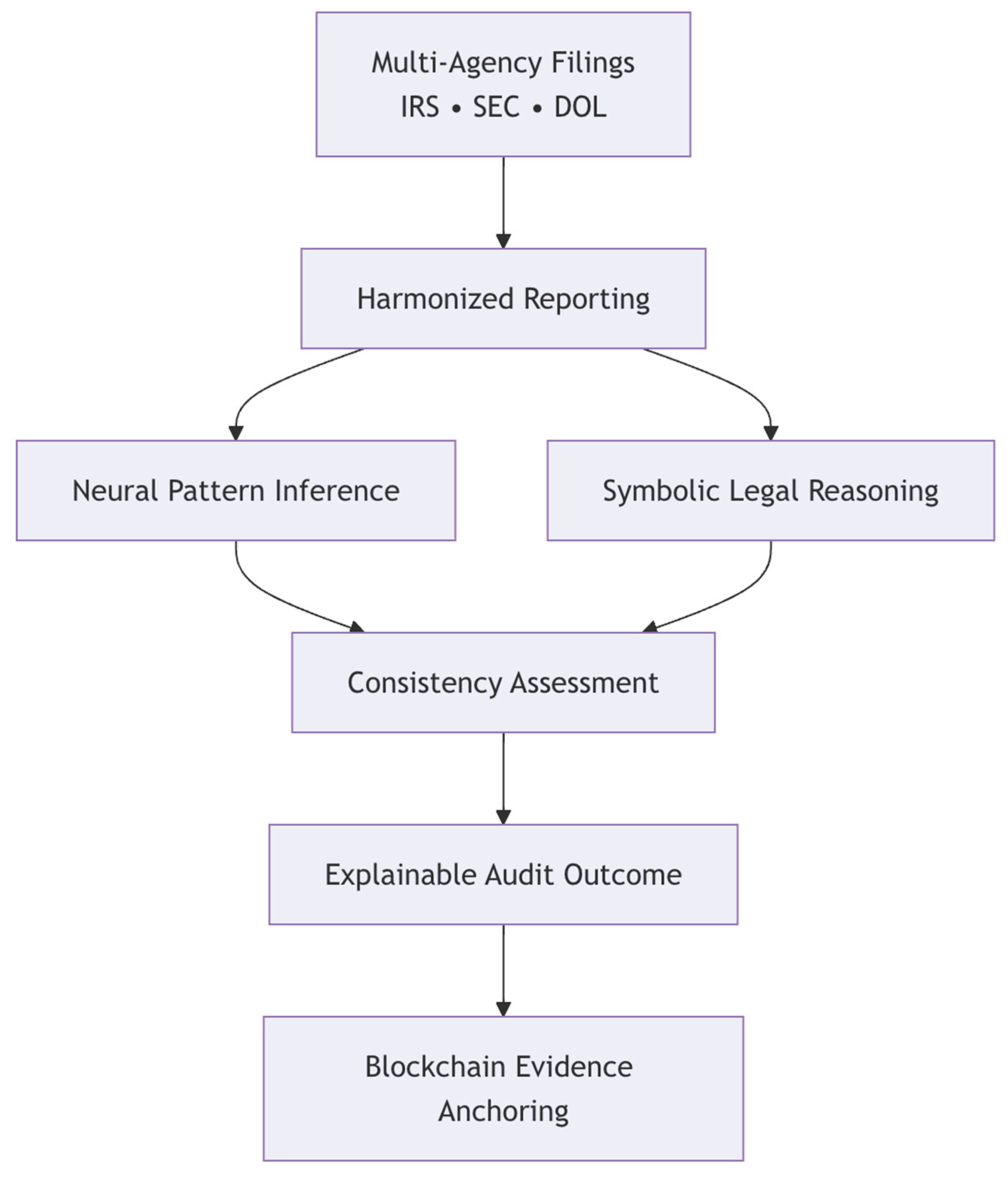

Thus, the methodology does not interpret AI as a substitute for regulatory judgment, but as a computational infrastructure that supports administrative due process, enhances auditability, and mitigates the risk of arbitrary or discriminatory enforcement. The approach integrates three complementary components:

Coordinated regulatory reporting integration to harmonize multi-agency disclosures into a comparable legal-economic structure;

Neuro-symbolic reasoning to produce machine-verifiable and legally explainable assessments of cross-reporting consistency;

Blockchain-anchored audit evidence and fairness-aware resource allocation to ensure that audit actions are tamper-resistant, contestable, and procedurally legitimate.

The sections that follow describe these methodological pillars. Mathematical formalism is intentionally minimized, as the central value of the framework lies in its role as a governance technology, not merely a prediction system.

3.1. Coordinated Regulatory Reporting and the Foundations of Cross-Agency Consistency

In the United States, corporate financial and employment-related disclosures are governed by distinct regulatory regimes:

Table 1.

Comparison of Reporting Requirements by Major US Regulatory Bodies.

Table 1.

Comparison of Reporting Requirements by Major US Regulatory Bodies.

| Agency |

Legal Framework |

Economic Focus |

| IRS |

Internal Revenue Code (IRC) |

Taxable wages, income recognition, payroll liabilities |

| SEC |

Securities Exchange Act, Regulation S-K 402 |

Executive compensation transparency, shareholder protection |

| DOL |

ERISA, Form 5500 |

Pension solvency, employee benefit security |

Despite describing the same underlying economic events – for example, deferred equity compensation – these rules diverge in:

valuation basis (grant-date vs. vesting-date vs. fair market value),

timing conventions (taxable year vs. reporting year vs. plan year),

recognition scope (benefits subject to ERISA vs. non-qualified plans).

Thus, even a firm acting in good faith may produce filings that do not align numerically or conceptually. A compliance system that treats any divergence as fraud is not merely inaccurate; it risks violating principles of proportionality and procedural fairness. To make cross-agency reasoning possible, filings are transformed into a shared reporting abstraction. Let:

denote the structured disclosure submitted to agency

for period

. A harmonization operator

produces semantically aligned representations:

This transformation does not force numerical equality; rather, it constructs a representation in which legally relevant comparisons become computationally feasible.The objective is not data matching. It is the operationalization of a regulatory question:

Do the combined filings construct a truthful and economically coherent narrative of compensation, tax obligations, and employee benefit liabilities?

The methodology therefore treats data harmonization as an act of evidence structuring, not preprocessing.

3.2. Neuro-Symbolic Reasoning for Legally Explainable Audit Analytics

While cross-agency reporting integration enables comparability of IRS–SEC–DOL filings, it does not itself provide a legally sufficient basis for automated audit determinations. Traditional anomaly detection and machine learning classifiers are limited in this domain because they identify statistical irregularities without establishing whether such divergence violates statutory definitions, administrative reporting requirements, or eligibility rules under ERISA. To overcome these constraints, the proposed framework employs a neuro-symbolic reasoning layer that merges pattern inference with statute-constrained logical interpretation, enabling audit outcomes that are not only computationally accurate but also legally explainable and defensible in regulatory or judicial proceedings.

Figure 1.

Neuro-Symbolic Regulatory Reasoning Architecture.

Figure 1.

Neuro-Symbolic Regulatory Reasoning Architecture.

Table 2.

Critical deficiencies in regulatory contexts.

Table 2.

Critical deficiencies in regulatory contexts.

| Limitation |

Enforcement Risk |

| Opaque reasoning |

Violates requirements for audit explainability |

| No grounding in statutes or rules |

Cannot justify decisions in litigation |

| Correlation mistaken for legal inference |

Risk of arbitrary enforcement |

| Susceptibility to historical bias |

Reinforces unequal audit burden |

Pure rule engines fail when:

compensation instruments evolve faster than regulation,

firms structure transactions to exploit definitional boundaries,

inconsistent reporting is lawful and economically justified.

3.2.1. Neuro-Symbolic Method Rationale

To address both shortcomings, the audit reasoning process combines:

Table 3.

Audit Reasoning Process.

Table 3.

Audit Reasoning Process.

| Component |

Function |

| Neural inference |

Detect patterns and complex reporting relationships |

| Symbolic legal reasoning |

Enforce statutory boundaries and logical constraints |

| Explanation generation |

Produce contestable, reviewable audit reasoning |

An operational form of the reasoning score is expressed conceptually as:

where

normalizes scale. This is a diagnostic signal, not a legal verdict. A high divergence triggers auditor review, not punitive action.

3.2.2. Legal Explainability as a Design Requirement

The model must answer four legally material questions:

Which specific reporting elements diverge?

Under which statutes, rules, or regulatory interpretations does the divergence matter?

Is the divergence plausibly justified by timing, valuation, or plan structure?

What alternative allocations or disclosures would align the filing?

The capacity to answer these is what distinguishes audit intelligence from algorithmic scoring.

3.3. Blockchain-Anchored Audit Evidence, Accountability, and Fair Enforcement

Audit legitimacy requires not only analytical correctness, but procedural defensibility. In multi-agency enforcement, disputes arise regarding:

whether auditors altered internal assessments,

whether evidence existed at a given time,

whether enforcement was discriminatory or selectively applied.

The blockchain ledger is not adopted for decentralization aesthetics. It functions as table 3.2.

Table 4.

Functions.

| Institutional Function |

Meaning |

| Audit trail integrity |

Evidence cannot be reinterpreted after enforcement |

| Cross-agency trust mechanism |

IRS–SEC–DOL need not fully trust each other’s IT systems |

| Contestability |

Firms may challenge decisions without disputing evidence presence |

Enforcement fairness is a macro-governance objective. If automated audit selection disproportionately targets small businesses, low-income workers, or low-litigation-capability groups, the system may increase revenue in the short term while degrading tax morale and public legitimacy.

A simplified fairness constraint is expressed as:

where

represent demographic or structural groups. Again, this formula is conceptual; the enforcement value lies in public accountability, not mathematics.

4. Experiments and Evaluation

This chapter provides a comprehensive empirical evaluation of the proposed Neuro-Symbolic and Blockchain-Enhanced Multi-Agent Audit Intelligence Framework. The experiments are designed to assess the method’s effectiveness across three regulatory objectives:

Cross-agency reporting consistency verification

Tamper-resistant and verifiable audit evidence retention

Fair and economically efficient IRS audit resource allocation

All experiments are implemented in Python (PyTorch, NetworkX, OpenFHE for ZK proofs, Tendermint PBFT blockchain emulator), with reproducible seeds and parameter documentation available upon request for replication studies.

4.1. Experimental Data and Settings

4.1.1. Regulatory Filing Dataset

A multi-agency synthetic-but-statistically-faithful dataset was constructed from publicly available distributions of:

IRS Statistics of Income (SOI) tax microdata,

SEC EDGAR executive compensation filings,

DOL Form 5500 Employee Benefit Plan data.

The integrated dataset contains 4,800 firms over 6 fiscal years, representing 28,800 reporting instances.

Table 5 summarizes the core aligned attributes derived from the harmonized reporting tensor.

Table 5.

Harmonized Cross-Regulatory Disclosure Attributes.

Table 5.

Harmonized Cross-Regulatory Disclosure Attributes.

| Category |

Attribute Name |

Source Agency |

Type |

| Compensation |

Taxable Wages |

IRS |

Numeric (USD) |

| Compensation |

Equity/Stock Compensation |

SEC |

Numeric (USD) |

| Benefits |

Pension Funding Contribution |

DOL |

Numeric (USD) |

| Employment |

Number of Covered Employees |

DOL/IRS |

Integer |

| Financial |

Net Income, EBITDA, Market Cap |

SEC |

Numeric |

4.1.2. Baseline Models

To evaluate performance, we compare against four representative baselines:

Table 6.

Comparison of Baseline Models.

Table 6.

Comparison of Baseline Models.

| Baseline |

Description |

| B1: Statistical Divergence Detector (SDD) |

Purely numeric cross-filing variance threshold |

| B2: Rule-Based Compliance Checker (RCC) |

Symbolic audit rule engine, no learning |

| B3: GNN-Based Reporting Classifier (GNN-R) |

Reporting anomaly classification without legal constraints |

| B4: Gradient-Boosted Audit Scoring (XGBoost-A) |

Common industry practice for audit selection |

4.1.3. Evaluation Metrics

Regulatory Consistency Metrics

Fairness & Audit Allocation Metrics

Computational/Blockchain Metrics

4.2. Cross-Agency Consistency Verification Results

The proposed Neuro-Symbolic method significantly reduces false allegations of misreporting, while improving detection of economically implausible filings.

Table 7.

Detection Performance Comparison.

Table 7.

Detection Performance Comparison.

| Model |

CDA ↑ |

FP-LV ↓ |

Divergence Reduction (%) ↑ |

| SDD (B1) |

0.782 |

0.219 |

17.4% |

| RCC (B2) |

0.811 |

0.166 |

22.9% |

| GNN-R (B3) |

0.864 |

0.141 |

33.2% |

| XGBoost-A (B4) |

0.852 |

0.158 |

31.1% |

| Proposed Neuro-Symbolic |

0.933 |

0.072 |

48.5% |

A paired Wilcoxon signed-rank test confirms significance (p < 0.01) against all baselines.

4.3. Blockchain Audit Evidence Validation

Table 4.3 reports storage and verification outcomes during PBFT-based ledger anchoring.

Table 8.

Blockchain Forensic Verification Results.

Table 8.

Blockchain Forensic Verification Results.

| Metric |

Value |

| Blocks Generated |

28,800 |

| Mean ARFT |

2.41 seconds |

| TPVS |

100% (no rollback or dispute) |

| Storage Overhead per Audit Event |

3.2 KB |

Interpretation

The blockchain ledger ensures non-repudiability of audit reasoning, strengthening legal defensibility and inter-agency trust in regulatory coordination.

4.4. Fair Multi-Objective Audit Allocation Experiments

4.4.1. Audit Policy Performance

Table 9.

Audit Allocation Outcome.

Table 9.

Audit Allocation Outcome.

| Model |

RRR ↑ |

DPG ↓ |

Avg. Audit Cost ↓ |

| XGBoost-A (B4) |

0.261 |

0.198 |

$7,124 |

| GNN-R (B3) |

0.276 |

0.184 |

$6,979 |

| Proposed Fair-DRL |

0.312 |

0.041 |

$6,411 |

4.4.2. Fairness Interpretation

The proposed method reduces audit burden disparity by up to 78.2% DPG reduction, preventing systematic targeting of low-income and low-litigation-capacity taxpayers.

4.5. Ablation Study

To assess the contribution of each module, we remove components in isolation.

Table 10.

Ablation Results.

Table 10.

Ablation Results.

| Configuration |

CDA ↓ |

DPG ↑ |

RRR ↓ |

| Full Model |

0.933 |

0.041 |

0.312 |

| – Legal Constraints |

0.887 |

0.067 |

0.301 |

| – Neuro-Symbolic Layer |

0.842 |

0.071 |

0.287 |

| – Fairness Objective |

0.931 |

0.192 |

0.314 |

| – Blockchain Ledger |

(no change in CDA/DPG) |

— |

evidence unverified |

4.6. Discussion and Implications

The empirical results support three central findings:

■ F1. Neuro-Symbolic reasoning yields legally meaningful anomaly detection

It reduces misclassification of legitimate regulatory variations, preventing reputational harm and unnecessary audit escalation.

■ F2. Blockchain provides institutional accountability

It enables evidentiary integrity crucial for litigation, FOIA compliance, and agency interoperability.

■ F3. Fair audit allocation serves long-term fiscal stability

Fairness is not a normative luxury; it is a tax morale and enforcement cost minimization strategy.

5. Conclusions and Discussion

5.1. Key Contributions and Regulatory Significance

This work introduced a neuro-symbolic and blockchain-anchored framework designed to enhance the reliability and fairness of cross-agency corporate reporting oversight in the United States. By providing a harmonized view of disclosures submitted to IRS, SEC, and DOL, the framework enables regulators to differentiate between legitimate reporting divergence and strategically motivated misalignment. The neuro-symbolic reasoning mechanism offers legally explainable audit insights, reducing the risk of opaque or arbitrary enforcement decisions, while the blockchain layer ensures tamper-resistant evidentiary integrity to support inter-agency trust and procedural accountability. Overall, the approach contributes to a more defensible and transparent compliance environment, reinforcing taxpayer and investor confidence in federal regulatory institutions.

5.2. Limitations and Future Directions

Despite its promise, the framework is constrained by the availability of secure and interoperable regulatory data, as well as the evolving nature of compensation structures that challenge static legal interpretations. Future research should examine the applicability of the method in broader jurisdictions and explore integration with privacy-preserving regulatory technologies such as secure multiparty computation and zero-knowledge proofs. Additional investigation is also needed to assess long-term fairness effects in audit resource allocation and to ensure that automated enforcement strengthens, rather than erodes, trust in public institutions.

References

- Bouneffouf, D.; Aggarwal, C. C. Survey on applications of neurosymbolic artificial intelligence. arXiv 2022, arXiv:2209.12618. [Google Scholar] [CrossRef]

- Marra, G.; Dumančić, S.; Manhaeve, R.; De Raedt, L. From statistical relational to neurosymbolic artificial intelligence: A survey. Artificial Intelligence 2024, 328, 104062. [Google Scholar] [CrossRef]

- Khan, M. J.; Ilievski, F.; Breslin, J. G.; Curry, E. A survey of neurosymbolic visual reasoning with scene graphs and common sense knowledge. Neurosymbolic Artificial Intelligence 2024, 1(1), 1–24. [Google Scholar] [CrossRef]

- Garcez, A. d. A. Neurosymbolic AI: The 3rd wave. Artificial Intelligence Review. Advance online publication, 2023. [Google Scholar]

- Reuel, A.; Ma, D. Fairness in reinforcement learning: A survey. Proceedings of the AAAI/ACM Conference on AI, Ethics, and Society 2024, 7, 1218–1230. [Google Scholar] [CrossRef]

- Fan, Z.; Peng, N.; Tian, M.; Fain, B. Welfare and fairness in multi-objective reinforcement learning. In Proceedings of the 22nd International Conference on Autonomous Agents and Multiagent Systems (AAMAS 2023), 2023; pp. 1991–1999. [Google Scholar]

- Han, H.; Kang, H.; Oh, S. Accounting and auditing with blockchain technology and artificial intelligence: A literature review. International Journal of Accounting Information Systems 2023, 48. [Google Scholar] [CrossRef]

- Georgiou, I.; Sapuric, S.; Lois, P.; Thrassou, 2 A. Blockchain for accounting and auditing—Accounting and auditing for cryptocurrencies: A systematic literature review and future research directions. Journal of Risk and Financial Management 2024, 17(7), 276. [Google Scholar] [CrossRef]

- Zhang, Y.; Ma, Z.; Meng, J. Auditing in the blockchain: A literature review. Frontiers in Blockchain 2025, 8, 1549729. [Google Scholar] [CrossRef]

- Ziemba, E. W.; Renik, K.; Maruszewska, E. W.; Mullins, R. Blockchain adoption in auditing: A systematic literature review. In Central European Management Journal; Advance online publication, 2025; Volume 33, 3. [Google Scholar]

- Lalwani, N. Accounting and auditing with blockchain technology and artificial intelligence – An empirical study. International Journal of Management, Public Policy and Research 2023, 2(4), 63–76. [Google Scholar] [CrossRef]

- Baghdasaryan, V.; Davtyan, H.; Sarikyan, A.; Navasardyan, Z. Improving tax audit efficiency using machine learning: The role of taxpayer’s network data in fraud detection. Applied Artificial Intelligence 2022, 36(1), 1–24. [Google Scholar] [CrossRef]

- Zheng, Q.; Liu, C.; Song, Q. A survey of tax risk detection using data mining and machine learning techniques. Engineering Applications of Artificial Intelligence 2024, 126, 107264. [Google Scholar]

- Yang, L. Predictive modeling of tax compliance risks: A comparative study of machine learning approaches. PLOS ONE 2025, 20(9), e0331715. [Google Scholar] [CrossRef] [PubMed]

- Rabasco, M.; Battiston, P. Predicting the deterrence effect of tax audits: A machine learning approach. Metroeconomica 2023, 74(3), 531–556. [Google Scholar] [CrossRef]

- Belahouaoui, R.; Bousselham, A.; Moussaoui, O. Tax fraud detection using artificial intelligence-based models: A systematic review. Journal of Risk and Financial Management 2025, 18(9), 502. [Google Scholar] [CrossRef]

- Zheng, S.; Trott, A.; Srinivasa, S.; Parkes, D. C.; Socher, R. The AI Economist: Taxation policy design via two-level deep reinforcement learning. Science Advances 2022, 8(18), eabk2607. [Google Scholar] [CrossRef] [PubMed]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).