Introduction

Broad Overview

Deciphering human conduct in multifaceted systems has surfaced as a more prominent field of exploration, carrying considerable implications for financial systems and the oversight of public health. Human judgment processes, the aggregate of emotional experiences, and observable behavioral shifts often sway outcomes in ways that defy simple numerical analysis. Within financial markets, the current sentiment among investors can evoke significant changes in market stability, whereas in epidemiology, the communal adherence to health protocols is instrumental in shaping the course of disease epidemics. As a result, the examination and forecasting of human behavioral patterns through sophisticated computational methodologies have surfaced as a paramount challenge and prospect for scholars across a diverse array of academic fields.

Figure 1.

A conceptual diagram shows how advanced AI algorithms (transformer-based models, GPT) relate to financial markets and epidemic management, noting shared insights.

Figure 1.

A conceptual diagram shows how advanced AI algorithms (transformer-based models, GPT) relate to financial markets and epidemic management, noting shared insights.

Historical Background and Key Developments

During the previous decade, substantial improvements have been realized in the employment of artificial intelligence and machine learning frameworks to reflect human behavior inside financial domains. Approaches such as linguistic analysis and sophisticated learning algorithms have made it possible to gauge investor feelings from news sources, social networks, and financial statements, hence revealing patterns in market activity that surpass standard economic metrics (Pennington, 2025) [

1]. Recent empirical studies elucidate that transformer-based architectures, including those analogous to GPT, possess the capability to effectively discern intricate patterns of collective sentiment and behavioral bias within stock market dynamics (Agarwal & Rizvi, 2025) [

2]. New strides in computational epidemiology have triggered explorations into the deployment of artificial intelligence for forecasting human reactions to health interventions; still, these efforts are primarily underexplored (Lee et al., 2025) [

3].

Contemporary Relevance and Importance

Currently, the significance of amalgamating behavioral analytics with artificial intelligence-driven frameworks has reached unprecedented levels (ECB, 2024) [

4]. Within financial markets, the swift distribution of information via digital mediums perpetually intensifies investor responses, as evidenced during the tumultuous market phases spanning from 2020 to 2023, which were associated with various global crises (Arner et al., 2024) [

5]. The situation with COVID-19 brought to light the pivotal importance of human conduct in the unfolding of epidemics, indicating that health adherence, vaccination engagement, and social mobility collectively influenced the outbreak circumstances (Hu et al., 2023; Espinoza et al., 2024) [

6,

7]. The existing difficulties emphasize the imperative for computational frameworks that proficiently merge insights acquired from established financial analytics with the modulation of human behavior during public health crises, thereby underscoring the predictive and prescriptive functionalities embedded within transformer-based models (Ibitoye et al., 2024) [

8].

Key Areas or Themes of the Review

This comprehensive narrative review delves into various interrelated themes. Initially, it scrutinizes the methodologies and algorithms that have been devised for the analysis of behavior in financial markets, elucidating both their achievements and inherent constraints. In the next step, it evaluates the potential of these algorithms to better interpret human responses within epidemiological contexts. Besides, the critique examines the unification of behavioral models fueled by artificial intelligence alongside scenario planning and simulations based on agents to forecast group human behaviors. During our talk, we emphasize the powerful translation functions that sophisticated transformer models can offer in numerous sectors.

Objectives and Contribution of the Review

This narrative exploration predominantly aims to unify the latest innovations in AI-enhanced behavioral evaluations, particularly stressing transformer designs, while conducting a detailed assessment of their repercussions in multiple sectors, including economics and epidemic response.

Through the provision of a comparative analysis, this review seeks to elucidate existing research deficiencies, underscore transferable knowledge, and propose a conceptual schema for the application of sophisticated algorithms in the exploration and modulation of human behavior within intricate systems. At its core, this academic endeavor broadens the comprehensive grasp of how artificial intelligence can break through conventional boundaries and enhance both forecasting and guiding abilities in the management of human-affected occurrences.

Conceptual and Theoretical Background

Defining Key Terms and Concepts

Human interactions in complicated systems involve the mental models guiding their choices, the communal behaviors observed, and the flexible reactions displayed by people in connected environments (BIS, 2025) [

9]. Focusing on financial markets, this involves the shifts in investor attitudes, herd instincts, risk judgment, and responses to informational influences. In the realm of disease studies, the actions of individuals involve following health regulations, trends in movement, choices about getting vaccinated, and ways of engaging socially (Espinoza et al., 2024) [

7]. Fundamental to this narrative review is the notion of AI-enhanced behavioral analysis, which utilizes computational models—specifically transformer-based architectures such as GPT—to extract, synthesize, and forecast patterns of human behavior within these realms (Ibitoye et al., 2024) [

8]. Another key idea is the insight that crosses different domains, indicating the skill to employ analytical strategies and results from one sector (financial markets) to improve understanding and governance in another (epidemic control).

Major Theoretical Models and Frameworks

Numerous conceptual frameworks have greatly aided in the grasp of human conduct in financial and epidemiological realms. In the world of finance, prospect theory endures as an essential tenet, illustrating the skewed perspective with which people assess their winnings and defeats (Mazilu, 2024) [

10]. Lately, behavioral finance models have transformed through the incorporation of computational modeling that includes real-time sentiment assessment using natural language processing strategies (International Journal of Finance, Economics, and Management Studies, 2025) [

11]. Transformer-based architectures have been deployed to discern nuanced patterns of collective behavior derived from textual and social media sources (Li et al., 2022; Zhang & Chen, 2021), [

12,

13] thereby augmenting the accuracy of forecasts regarding market responses to news and events.

In epidemiological studies, theoretical frameworks including the Health Belief Model and the Theory of Planned Behavior (Fang et al., 2025) [

14] furnish important knowledge regarding the ways individuals and groups engage with health interventions. The domain of computational epidemiology is progressively incorporating these behavioral theories alongside artificial intelligence models, thereby facilitating the anticipation of compliance rates, vaccine adoption, and patterns of social mobility (Hu et al., 2023) [

6]. Remarkably, ongoing scholarly research indicates that transformer-based systems are skilled at effectively collating textual information concerning public sentiment, policy statements, and media commentary to project behavioral patterns pertinent to epidemic progressions (Ibitoye et al., 2024) [

8].

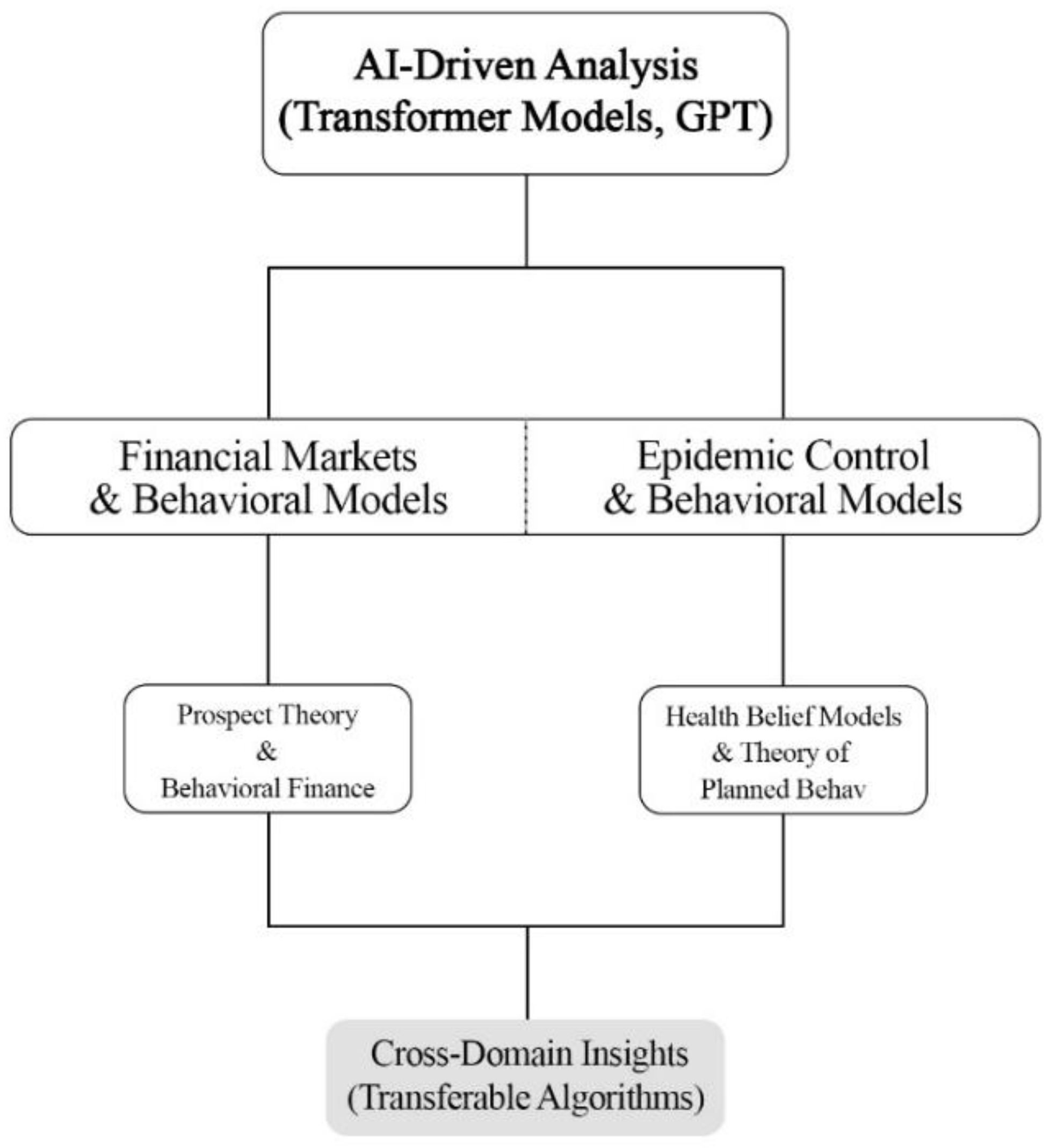

Figure 2.

This idea shows how advanced artificial intelligence, like GPT models, can bring together financial systems and disease control. Smaller models working in each field can share information, perhaps leading to new understandings.

Figure 2.

This idea shows how advanced artificial intelligence, like GPT models, can bring together financial systems and disease control. Smaller models working in each field can share information, perhaps leading to new understandings.

Integration Across Domains

An evident theoretical development is seen when we admit that AI-generated behavioral models possess translatable qualities in numerous contexts. Initially, algorithms crafted for assessing financial markets can be modified to manage epidemics because of the essential similarities that these two areas possess:

1. The actions of individuals significantly influence outcomes at the systemic level,

2. data frequently exhibit substantial noise and possess high dimensionality,

3. collective sentiment or adherence may result in non-linear consequences (Hansen et al., 2025) [

15].

For instance, models designed for the extraction of sentiment, which are developed using investor communications, can enhance the evaluation of public sentiment regarding immunization initiatives, thereby facilitating predictive insights pertaining to the dissemination of epidemics. This intermingling of concepts demonstrates the capacity of transformer-based artificial intelligence frameworks to operate as an integrated analytical instrument for comprehending and overseeing human behavior within various intricate systems.

Recent Empirical Illustrations

Many studies show how useful it is to combine theory with AI analytics. In the area of finance, modern investigations have demonstrated that frameworks relying on advanced language processing and sentiment metrics are capable of reliably predicting transient market shifts resulting from group investor dynamics (Xing et al., 2025) [

16]. In a like manner, within the public health sector, artificial intelligence-based behavioral frameworks have been leveraged to analyze adherence to preventive measures and to clarify the relationships between digital sentiment changes and real-life behavioral responses (Ajisafe & Bukhair, 2025) [

17]. These examples show that combining ideas from behavioral theories and artificial intelligence can give useful information. This information can help with things like predicting market trends and managing epidemics [

18].

Historical Development and Evolution

Early Ideas and Foundational Contributions

The exploration of human conduct within intricate systems possesses an extensive and multidisciplinary legacy, connecting fields such as economics, psychology, and public health. In the mid-20th century, seminal contributions to the field of behavioral economics, notably prospect theory articulated by Kahneman and Tversky (1979), [

19] posited that human decision-making consistently diverges from strictly rational paradigms (Ghule, 2025) [

20]. This examination established a fundamental framework for the domain of behavioral finance, underscoring the significance of investor emotions, cognitive heuristics, and inherent biases as essential elements in comprehending the dynamics of market volatility. Simultaneously, initial theoretical constructs regarding public health behavior, exemplified by the Health Belief Model (Rosenstock, 1966), [

21] established a conceptual basis for forecasting individual adherence to health interventions, emphasizing cognitive evaluations, perceived hazards, and advantages as pivotal factors.

Major Developments and Paradigm Shifts

As we transitioned from the 20th century into the 21st century, there was a striking rise in both realms. Within the sphere of financial markets, the advent of computational methodologies commenced to enhance and supplement established theoretical frameworks. In the 1990s and 2000s, initial paradigms of machine learning were employed to scrutinize market dynamics and investor conduct derived from historical datasets, thereby yielding prognostic insights that extended beyond traditional economic metrics (Hoang & Wiegratz, 2023) [

22]. The rise of natural language processing (NLP) has made it easier to gather insights on investor feelings from different written materials, including news reports and financial statements. The emergence of transformer-based architectures, particularly following the introduction of Generative Pre-trained Transformer models (Radford et al., 2018), [

23] has significantly altered the landscape of behavioral analysis by enabling a nuanced understanding of collective sentiment and textual patterns on an expansive scale (Li et al., 2022; Zhang & Chen, 2021) [

12,

13].

In the realm of public health, computational epidemiology has undergone a parallel evolution. The establishment of agent-oriented models and network-based simulations has been crucial in clarifying the complexities surrounding human interactions and disease propagation (Ye et al., 2025) [

24]. Bringing together behavioral theories like the Theory of Planned Behavior and adherence frameworks with AI-based analytics has produced better precision in predicting how populations will react to interventions (Kraemer et al., 2021) [

25]. It's noteworthy to highlight how the COVID-19 pandemic served as a practical catalyst for merging these approaches, emphasizing the crucial need for forecasting models that integrate human behavior and the complexities of intricate system interactions.

Key Milestones and Cross-Domain Insights

In recent years, considerable advancements have been achieved in correlating findings derived from financial behavioral analysis with applications in public health. The application of transformer-based architectures originally engineered for the analysis of market sentiment has been repurposed to assess public sentiment, regulatory adherence, and the propagation of information during epidemic occurrences (Zhou, 2025) [

26]. These advancements highlight a profound conceptual transformation: sophisticated artificial intelligence algorithms have the potential to function as interdisciplinary analytical instruments, adept at connecting ostensibly unrelated domains through the simulation of the cognitive processes that inform human decision-making (Liu et al., 2024) [

27]. This developmental evolution highlights a pathway that advances from core theoretical paradigms through the sphere of computational modeling to refined AI-facilitated, interdisciplinary behavioral examination, consequently establishing the theoretical and practical underpinnings of modern scholarly investigation (Moen et al., 2025; Martino et al., 2025) [

28,

29].

Current Trends and Key Issues

Prominent Trends

In the last few years, we've observed a clear escalation in the employment of refined artificial intelligence models, especially transformer-based systems like GPT, to scrutinize human conduct within elaborate frameworks. In the realm of financial markets, these theoretical frameworks are progressively employed to derive sophisticated insights into investor sentiment from textual datasets, encompassing news publications, financial disclosures, and social media platforms (Pennington, 2025; Maharajan, 2025) [

1,

30]. This phenomenon signifies a more extensive transition from dependence exclusively on historical pricing information and conventional indicators to the integration of behavioral signals as anticipatory variables (Faria & Lundquist, 2025; Song et al., 2025) [

31,

32]. Public health investigators are starting to use similar artificial intelligence methods to watch how people react to public health actions. They also use it to follow false information and guess how well people stick to health advice (Bose, 2025) [

33]. This shows that computer finance and the study of diseases are coming together in the study of behavior.

Another important phenomenon observed is the unification of understanding across diverse realms. Methods initially crafted for a defined niche are being redirected toward alternative applications. For instance, models utilized for sentiment extraction within the financial sector are progressively being employed to evaluate public sentiment regarding vaccination initiatives or social distancing protocols (Villanueva-Miranda et al., 2025; Du, 2024) [

34,

35]. This suggests an increasing recognition that human behavior, regardless of its ties to economic or health-related sectors, embodies fundamental cognitive and social constructs that can be effectively emulated by similar AI models (Mao et al., 2024) [

36].

Key Issues and Challenges

Notwithstanding the aforementioned advancements, numerous obstacles persist. A crucial aspect addresses the standards and representational accuracy of the data. The behavioral signs pulled from digital media or social networks could be biased, incomplete, or may not truly depict the features of the larger demographic (Joseph, 2025) [

37]. In the realm of financial markets, dependence on specific sources may serve to enhance extraneous noise rather than meaningful signals, ultimately resulting in erroneous forecasts. Likewise, in the domain of epidemic management, excessive dependence on digital data streams may neglect at-risk or digitally marginalized populations, thereby diminishing the effectiveness of insights derived from artificial intelligence (Kostkova, 2021) [

38].

A further notable worry centers on the clarity and ethical aspects associated with these algorithms. Transformer-based architectures, despite their considerable efficacy, frequently operate as "black boxes", thereby complicating the ability of researchers and policymakers to comprehend the underlying mechanisms that inform the generated predictions (Jiang et al., 2025) [

39]. The situation needs investigation about clarity, answerability and trust because AI model-based findings lead to important social effects through public health and economic recommendations (Almada, 2025) [

40]. Besides, discussions remain active around algorithmic bias, where models may not mean to uphold existing discrepancies or misrepresent how behaviors manifest.

Emerging Debates and Future Directions

The current discourse emphasizes the limitations that hinder the exchange of knowledge among various academic disciplines. Human conduct shows comparable patterns in financial dealings and disease spread yet distinct motivational factors and risk assessment and environmental decision spaces make algorithm transfer between these two domains challenging. The research community focuses on constructing hybrid systems that combine domain-specific knowledge with general frameworks in artificial intelligence to accomplish sound predictions, as well as contextually relevant meaning. The conversation around real-time adaptation has gained traction as it involves tasks where an AI or machine learning model potentially receive Continuously updated streaming data to rapidly adjust to changing behavioral patterns during market shocks and new epidemic outbreaks (Li et al., 2025; Aravinth et al., 2025) [

41,

42].

The main structure of artificial intelligence-based behavioral analysis exists through fast technological advancements which combine with multidisciplinary development and complex moral and functional problems. Recognizing the trends and issues in this space is important for successful, risk-informed use of AI for actionable, valid, and socially responsible insights.

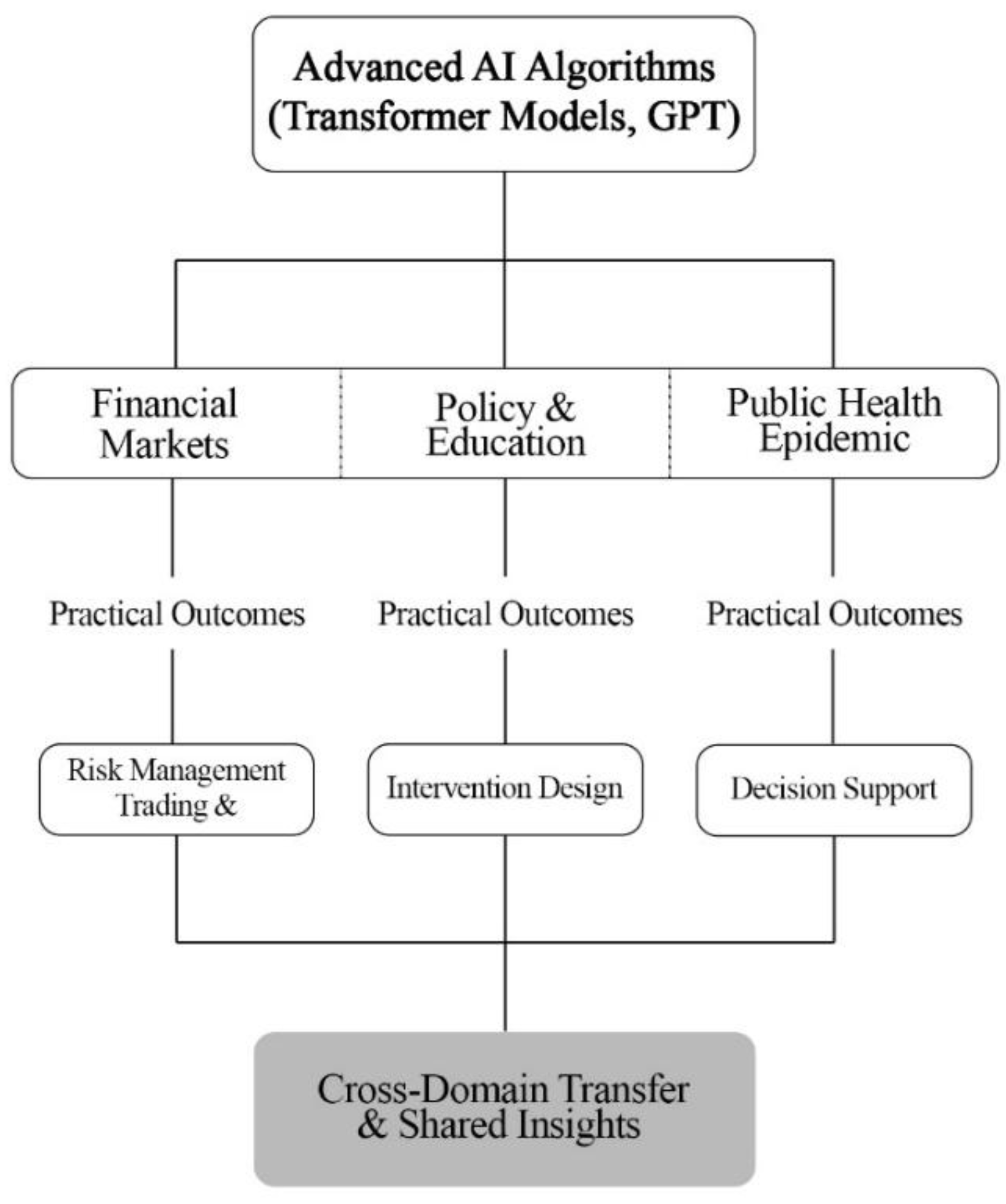

Applications and Practical Implications

Real-World Applications in Financial Markets

Sophisticated artificial intelligence algorithms, notably transformer architecture models like GPT, have been extensively utilized across diverse applications within the financial markets. They are utilized to derive and scrutinize investor sentiment from textual data repositories such as financial disclosures, journalistic publications, and social media platforms, thereby facilitating more enlightened trading methodologies and risk evaluation. For example, enterprises have employed sentiment-derived metrics to forecast market fluctuations and modify portfolio distributions instantaneously, thereby illustrating the pragmatic applicability of AI-facilitated behavioral analysis. These models, apart from their use in trading, assist with following rules by spotting odd patterns in market communication and predicting possible risks to the whole system, which helps both daily tasks and planning (Pennington, 2025; Maharajan, 2025; Song et al., 2025) [

1,

30,

32].

Applications in Public Health and Epidemic Management

Artificial intelligence approaches are turning out to be more frequent in public health for keeping track of how people act, whether they stick to intervention plans, and the spread of incorrect information. Transformer-based models analyze social media conversations and news content along with official statements to generate predictions about how people will respond to vaccine campaign recommendations and mask rules and social distancing measures (Muniasamy, 2025; Shmatko et al., 2025) [

43,

44]. The models used location-based public health guideline compliance data from the COVID-19 pandemic to create targeted communication plans and distribute resources to areas that showed low adherence (Moen, 2025) [

28]. These represent an example of how computational models developed for market research can be adapted to public health issues, and are an example of cross-domain adaptation and practice relevance to society (Aghaarabi et al., 2025) [

45].

Policy, Education, and Broader Societal Implications

The pragmatic ramifications of artificial intelligence-fueled behavioral analysis transcend the domains of finance and public health. Policymakers have the capacity to utilize these revelations to formulate interventions that are congruent with human behavior, augment compliance, and optimize the distribution of resources. In the domain of education, artificial intelligence models have the potential to facilitate the comprehension of student engagement dynamics and to anticipate behavioral reactions to novel curricula or digital learning platforms(Taiwo & Busari, 2025, Yuan et al., 2025) [

46,

47]. The ethical use of these tech affects talks on being open, responsible, and fair, pointing to our duty to society when using AI. By relating ideas to real results, these uses show that complex AI rules are helpful for study, decision-making, and planning in different fields (Umoke et al., 2025) [

48].

Figure 3.

Conceptual diagram demonstrating efficacious uses of artificial intelligence in practice (AI algorithms, transformer-based models, GPT) throughout financial markets, public health and policy/education, emphasizing discipline specific outcomes and cross-discipline transference of knowledge.

Figure 3.

Conceptual diagram demonstrating efficacious uses of artificial intelligence in practice (AI algorithms, transformer-based models, GPT) throughout financial markets, public health and policy/education, emphasizing discipline specific outcomes and cross-discipline transference of knowledge.

Integration and Cross-Domain Lessons

A particularly notable aspect is the integration of lessons from one domain to another. For instance, techniques that were developed for analysis of market sentiment were used off the shelf for understanding public responses to an epidemic (Villanueva-Miranda et al., 2025) [

34]. The ability of AI to predict human actions and grasp their behavior patterns enables businesses and social systems to shape their operations through strategic management. Again, it illustrates that such imposed -implementation needs to be constrained by contexts, ethical considerations, and representation of data, all of which indicate a need to consider practical results that are, sound, fair, and socially responsible (Jiang et al., 2025) [

39].

Critical Reflections and Gaps in the Literature

Strengths of Existing Research

Recent work on AI for studying behavior shows real gains. Sophisticated models like GPT let people carefully study text and social info, which betters predictions in finance and handling outbreaks. Research indicates that such models have the skills to find feeling trends, spot action patterns, and guess what will happen at the system level. This gives useful info to those who practice and make rules (Li et al., 2022). Also, AI works in many areas, showing it can connect different subjects by modeling behavior (Matheny et al., 2025) [

49].

Limitations and Inconsistencies

Even with these strong points, some limits exist in what we know. A key issue is how well the data represents everyone. Many studies use things such as social media, which might not show what most people do, mainly those who are left out. This can cause errors in models and make it hard to apply them to everyone (Gorenc et al., 2025) [

50]. Also, it's hard to know how AI models work. Models using transformers can be hard to understand. This makes it tough for people to know why they make certain predictions. This lack of clarity can stop people from using them and bring up ethical issues, especially in health and government (Abbas et al., 2025) [

51].

Gaps and Overlooked Areas

Research still has some gaps. A key area involves long-term study of transfer between different fields. Some early work says that algorithms made for money matters can tell us something about disease spread. Still, not many studies have closely checked the limits, conditions, or context changes needed for good transfer. A remaining question involves integrating diverse data types. Most research focuses on either textual or numerical data. The combination of varied forms—such as financial transactions, social interactions, travel patterns, and disease symptoms—requires further investigation. Moreover, the ethical, societal, and equity-related factors associated with the implementation of AI-driven behavioral analysis are frequently recognized yet seldom methodically integrated into the design and execution of models.

Emerging Efforts to Address Gaps

Current work aims to fix some limits in the area. New studies use different types of data, like digital records and surveys, to better show and predict how humans act. At the same time, finance and health studies use feelings and actions to predict things better and lower mistakes. It is also becoming more important to add moral ideas and user-friendly designs to AI systems, pushing for openness, fairness, and responsibility. Notwithstanding, comprehensively integrated frameworks that facilitate unobstructed cross-domain data exchange, multimodal analytical processes, and substantial ethical protections are predominantly nascent and represent a pivotal avenue for forthcoming scholarly inquiry (Bae et al., 2025; Lu, 2025) [

52,

53].

Synthesis and Implications

The studies show much novelty and complex ideas. Still, they don't always represent everyone, are sometimes hard to interpret, lack validation across different areas, and don't always consider ethics. It's important to fix these problems to improve our understanding and use of AI in studying behavior. This holds particularly true when dealing with complex situations such as financial markets and epidemic management, where individual behavior has substantial influence. This review can guide later studies, pointing out that we need complete, relevant, and ethical ways to model what people do.

Conclusion

This review pulls together important ideas about how sophisticated AI, especially transformer models like GPT, helps us study human actions in finance and disease control. The critique showed how ideas changed, going from basic behavior models in economics and public health to modern ways of studying things using artificial intelligence. The review stresses that these algorithms are useful in many ways. They can find subtle patterns in behavior, pull out useful information, and be applied to diverse problems.

This review makes key contributions:

1. It clarifies the relationship between artificial intelligence, human actions, and how these apply to fields like finance and public health.

2. It examines how ideas changed from old behavioral theories to current artificial intelligence systems.

3. It provides a close look at the good points, limits, and new directions in current studies, mainly focusing on using what we learn in one field in other areas and how it works in real-world uses.

4. Areas that need more study include how models can be understood, if data accurately shows what is happening, how different types of data can be combined, and moral issues.

For future studies, a few paths stand out. First, we require long-term studies that think about context to prove that AI models of behavior can apply to different subjects. This will confirm they are both reliable and broad in use. Second, we should integrate different kinds of data such as text, numbers, movement, and disease data to improve how we understand behavior. Third, when we design models, we should add morals and ways to understand them. This will make the models more clear, trustworthy, and fair. Lastly, we can look into AI systems that adapt in real-time. These could better help decision-makers in fast-changing situations, like money or disease spread.

In summary, sophisticated AI methods give novel ways to study, predict, and shape how people act in several complicated situations. By bringing together theory, new tech, and real-world use, these tools offer a strong base for insights in many fields, helping with better choices and strategy. Filling the current holes will not just make the science here stronger but also grow its effect on society, putting AI-led behavior study as key for both study and doing in the future.

References

- Pennington, A. Stock Market News Sentiment Analysis and Trend Prediction Using Transformer Models. Journal of Computer Science and Software Applications 2025, 5(8). [Google Scholar]

- Agarwal, S; Rizvi, SWA. Enhancing Stock Market Forecasting using Transformer-based Models. International Journal of Computer Applications 2025, 187(6), 20–5. [Google Scholar] [CrossRef]

- Lee, C-Y; Anderl, E. Does business news sentiment matter in the energy stock market? Adopting sentiment analysis for short-term stock market prediction in the energy industry. Frontiers in Artificial Intelligence 2025, 8, 1559900. [Google Scholar] [CrossRef]

- Leitner, G; Singh, J; van der Kraaij, A; Zsámboki, B. The rise of artificial intelligence: benefits and risks for financial stability. Financial Stability Review 2024, 1. [Google Scholar]

- Ozili PK. Artificial intelligence (AI), financial stability and financial crisis. Financial Stability and Financial Crisis (September 05, 2024). 2024.

- Hu S, Xiong C, Zhao Y, Yuan X, Wang X. Vaccination, human mobility, and COVID-19 health outcomes: Empirical comparison before and during the outbreak of SARS-Cov-2 B. 1.1. 529 (Omicron) variant. Vaccine. 2023;41(35):5097–112.

- Espinoza, B; Saad-Roy, CM; Grenfell, BT; Levin, SA; Marathe, M. Adaptive human behaviour modulates the impact of immune life history and vaccination on long-term epidemic dynamics. Proceedings B 2024, 291(2033), 20241772. [Google Scholar] [CrossRef]

- Ibitoye, AO; Oladosu, OO; Onifade, OF. Contextual emotional transformer-based model for comment analysis in mental health case prediction. Vietnam Journal of Computer Science 2024, 1–23. [Google Scholar] [CrossRef]

- Aquilina M, de Araujo DKG, Gelos G, Park T, Perez-Cruz F. Harnessing artificial intelligence for monitoring financial markets. Bank for International Settlements; 2025.

- Mazilu SM. Behavioural Finance and Prospect Theory. 2024.

- Predictive Analytics in Behavioral Finance: Modeling Investor Sentiment with NLP Techniques. International Journal of Finance, Economics, and Management Studies 2025, 1(1), 19–28. [CrossRef]

- Li, Y; Lv, S; Liu, X; Zhang, Q. Incorporating transformers and attention networks for stock movement prediction. Complexity 2022, 2022(1), 7739087. [Google Scholar] [CrossRef]

- Zhang, Q; Qin, C; Zhang, Y; Bao, F; Zhang, C; Liu, P. Transformer-based attention network for stock movement prediction. Expert Systems with Applications 2022, 202, 117239. [Google Scholar] [CrossRef]

- 房立栋. Influencing factors and mechanisms promoting proactive health behavior intention: an integration of the health belief model and the theory of planned behavior. Frontiers in Public Health 2025, 13, 1629046. [CrossRef] [PubMed]

- Hansen, AL; Lee, SJ. Financial Stability Implications of Generative AI: Taming the Animal Spirits. arXiv preprint arXiv:251001451. 2025. [CrossRef]

- Xing, F; Du, K; Mengaldo, G; Cambria, E; Welsch, R. AI reshaping financial modeling. npj Artificial Intelligence 2025, 1(1), 29. [Google Scholar] [CrossRef]

- Ajisafe, T; Bukhari, T. The Future of Epidemiology: Ai-driven Predictive Data Analytics for Global Health Security. International Journal For Multidisciplinary Research 2025, 7. [Google Scholar]

- Kaur, J; Butt, ZA. AI-driven epidemic intelligence: the future of outbreak detection and response. Frontiers in Artificial Intelligence 2025, 8, 1645467. [Google Scholar] [CrossRef] [PubMed]

- Kai-Ineman, D; Tversky, A. Prospect theory: An analysis of decision under risk. Econometrica 1979, 47(2), 363–91. [Google Scholar] [CrossRef]

- Ghule PA. AI in Behavioral Economics and Decision-Making Analysis. JOURNAL FOR RESEARCH IN APPLIED SCIENCES AND BIOTECHNOLOGY Учредители: Stallion Publication. 2025;4(1):124–31.

- Cerasi, E; Luft, R. The plasma insulin response to glucose infusion in healthy subjects and in diabetes mellitus. European Journal of Endocrinology 1967, 55(2), 278–304. [Google Scholar] [CrossRef]

- Hoang, D; Wiegratz, K. Machine learning methods in finance: Recent applications and prospects. European Financial Management 2023, 29(5), 1657–701. [Google Scholar] [CrossRef]

- Radford, A; Narasimhan, K; Salimans, T; Sutskever, I. Improving language understanding by generative pre-training. 2018. [Google Scholar]

- Ye, Y; Pandey, A; Bawden, C; Sumsuzzman, DM; Rajput, R; Shoukat, A; et al. Integrating artificial intelligence with mechanistic epidemiological modeling: a scoping review of opportunities and challenges. Nature Communications 2025, 16(1), 581. [Google Scholar] [CrossRef]

- Kraemer, MU; Tsui, JL-H; Chang, SY; Lytras, S; Khurana, MP; Vanderslott, S; et al. Artificial intelligence for modelling infectious disease epidemics. Nature 2025, 638(8051), 623–35. [Google Scholar] [CrossRef]

- Zhou, J; Li, L; Su, J. Leveraging big data in health care and public health for AI driven talent development in rural areas. Frontiers in Public Health 2025, 13, 1524805. [Google Scholar] [CrossRef] [PubMed]

- Liu, Z; Liu, L; Heidel, RE; Zhao, X. Explainable AI and transformer models: Unraveling the nutritional influences on Alzheimer's disease mortality. Smart Health 2024, 32, 100478. [Google Scholar] [CrossRef]

- Moen, H; Raj, V; Vabalas, A; Perola, M; Kaski, S; Ganna, A; et al. Towards modeling evolving longitudinal health trajectories with a transformer-based deep learning model. Annals of Epidemiology 2025. [Google Scholar] [CrossRef]

- Zhao, D; Li, Y; Gu, R. Good and Bad Investments" in Public Health Stocks Amid the COVID-19 Shock: Evidence from a Transformer-Based Model. Frontiers in Public Health 13, 1644055. [CrossRef]

- Maharajan K, editor The Role of Sentiment Analysis and Transformer Models in Stock Market Price Forecasting. 2025 6th International Conference on Mobile Computing and Sustainable Informatics (ICMCSI); 2025: IEEE.

- Alvim de Faria M, Lundquist F. Financial sentiment analysis: evaluated on the stock market: A comparative study between Large-Language Models and Tranformer-based sentiment classifications, evaluated by the return of predictions in the stock market. 2025.

- Song, Y; Zhang, Y; Huang, J; Yang, A. Volatility and value-at-risk forecasting using BERT and transformer models incorporating investors' textual sentiments. Finance Research Letters 2025, 85, 108210. [Google Scholar] [CrossRef]

- Bose, P. Leveraging AI to improve patient adherence in healthcare systems. International Journal For Multidisciplinary Research 2025, 7(4). [Google Scholar]

- Villanueva-Miranda, I; Xie, Y; Xiao, G. Sentiment analysis in public health: a systematic review of the current state, challenges, and future directions. Frontiers in Public Health 2025, 13, 1609749. [Google Scholar] [CrossRef] [PubMed]

- Du, K; Xing, F; Mao, R; Cambria, E. Financial sentiment analysis: Techniques and applications. ACM Computing Surveys 2024, 56(9), 1–42. [Google Scholar] [CrossRef]

- Mao, Y; Liu, Q; Zhang, Y. Sentiment analysis methods, applications, and challenges: A systematic literature review. Journal of King Saud University - Computer and Information Sciences 2024, 36(4), 102048. [Google Scholar] [CrossRef]

- Joseph, J. Algorithmic bias in public health AI: a silent threat to equity in low-resource settings. Frontiers in Public Health 2025, 13, 1643180. [Google Scholar] [CrossRef] [PubMed]

- Kostkova, P; Saigí-Rubió, F; Eguia, H; Borbolla, D; Verschuuren, M; Hamilton, C; et al. Data and digital solutions to support surveillance strategies in the context of the COVID-19 pandemic. Frontiers in digital health 2021, 3, 707902. [Google Scholar] [CrossRef] [PubMed]

- Jiang, Z; Zhang, Z. From black box to transparency: Enhancing automated interpreting assessment with explainable AI in college classrooms. Research Methods in Applied Linguistics 2025, 4(3), 100237. [Google Scholar] [CrossRef]

- Almada M. Technical AI transparency: A legal view of the black box. 2025.

- Li, J; Qu, L; Cai, T; Zhao, Z; Haldar, NAH; Krishna, A; et al. AI-Generated Content in Cross-Domain Applications: Research Trends, Challenges and Propositions. Knowledge-Based Systems 2025, 114634. [Google Scholar] [CrossRef]

- Aravinth, S; Nagamani, GM; Kumar, CK; Lasisi, A; Naveed, QN; Bhowmik, A; et al. Dynamic cross-domain transfer learning for driver fatigue monitoring: multi-modal sensor fusion with adaptive real-time personalizations. Scientific Reports 2025, 15(1), 15840. [Google Scholar] [CrossRef] [PubMed]

- Muniasamy, A. Revolutionizing health monitoring: Integrating transformer models with multi-head attention for precise human activity recognition using wearable devices. Technology and Health Care 2025, 33(1), 395–409. [Google Scholar] [CrossRef]

- Shmatko, A; Jung, AW; Gaurav, K; Brunak, S; Mortensen, LH; Birney, E; et al. Learning the natural history of human disease with generative transformers. Nature 2025, 1–9. [Google Scholar] [CrossRef]

- Aghaarabi, E; Murray, D. Transformer-Based Language Models for Group Randomized Trial Classification in Biomedical Literature: Model Development and Validation. JMIR Medical Informatics 2025, 13(1), e63267. [Google Scholar] [CrossRef]

- Taiwo, KA; Busari, IO. Leveraging AI-driven predictive analytics to enhance cognitive assessment and early intervention in STEM learning and health outcomes. World Journal of Advanced Research and Reviews 2025, 27(01), 2658–71. [Google Scholar] [CrossRef]

- Yuan, C; Xiao, N; Pei, Y; Bu, Y; Cai, Y. Enhancing Student Learning Outcomes through AI-Driven Educational Interventions: A Comprehensive Study of Classroom Behavior and Machine Learning Integration. International Theory and Practice in Humanities and Social Sciences 2025, 2(2), 197–215. [Google Scholar] [CrossRef]

- Umoke, CC; Nwangbo, SO; Onwe, OA. AI-Driven Educational Policy Design: Enhancing Equity and Access through Intelligent Data Analytics.

- Matheny, ME; Goldsack, JC; Saria, S; Shah, NH; Gerhart, J; Cohen, IG; et al. Artificial Intelligence In Health And Health Care: Priorities For Action: Article examines priorities for the uses of artificial intelligence in health and health care. Health Affairs 2025, 44(2), 163–70. [Google Scholar] [CrossRef]

- Gorenc, N. AI embedded bias on social platforms. International Review of Sociology 2025, 1–20. [Google Scholar] [CrossRef]

- Abbas Q, Jeong W, Lee SW, editors. Explainable AI in Clinical Decision Support Systems: A Meta-Analysis of Methods, Applications, and Usability Challenges. Healthcare; 2025: MDPI. [CrossRef]

- Bae, S; Hong, J; Ha, S; Moon, J; Yu, J; Choi, H; et al. Multimodal AI for risk stratification in autism spectrum disorder: integrating voice and screening tools. npj Digital Medicine 2025, 8(1), 538. [Google Scholar] [CrossRef] [PubMed]

- Lu, K-T. User Acceptance Behavior Analysis of Multimodal Generative AI. Journal of Information and Computing 2025, 3(2), 23–40. [Google Scholar]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).