1. Introduction

Growing demands for reducing greenhouse gas emissions and the pursuit of sustainable transport development are driving the logistics sector to increasingly embrace electric drive solutions. Light commercial vehicles (LCVs) are a key element of urban freight distribution systems, and their electrification can significantly contribute to reducing emissions in urban areas. Despite the rapid development of battery technologies and charging infrastructure, these vehicles still face technical and operational limitations that impact their practical utility in the daily operations of transport fleets [

1].

The most important parameters determining the efficiency of LCV use include range, charging time, and payload. Range determines the ability to complete transport tasks without the need for charging breaks, while charging time directly impacts the vehicle’s availability and fleet productivity. Payload, in turn, determines the ability to transport goods, which is crucial for economic efficiency. In practice, there is a close relationship between these parameters – increasing payload or battery capacity can lead to an increase in vehicle weight, thus negatively impacting range and driving dynamics [

2]. A light commercial vehicle (LCV) is a commercial vehicle with a gross vehicle weight (GVW) of less than 3.5 tonnes, used for carrying goods. These vehicles, including vans and light trucks, are designed for transporting light to medium loads and are often used in urban and suburban areas due to their efficiency and maneuverability. Official weight categories for commercial vehicles:

N1 – Light Commercial Vehicles (LCV): gross vehicle weight up to 3.5 tonnes. They can be driven with a category B driving license. In addition to the driver, they can carry goods or up to 8 passengers,

N2 – Medium Commercial Vehicles (UV): weighing between 3.5 tonnes and 7.5 tonnes. They require a category C1 driving license and are primarily intended for freight transport,

N3 – Heavy Goods Vehicles: weighing over 7.5 tonnes, requiring a category C driving license.

It is worth noting that commercial vehicles (VU) can be distinguished from passenger vehicles (VP) by, among other things, the code in box J1 of the vehicle registration certificate (designations such as: VU, CTTE, DERIV-VP, or VTSU). Additionally, by definition, the cargo area must be at least half the length of the wheelbase and cannot be equipped with mounting elements for seats or seat belts [

3].

2. Number of Electric Light Commercial Vehicles

Although electric delivery vehicles still constitute a small percentage of the total commercial vehicle fleet in Poland, their number is steadily growing. This growth is supported by government programs such as “Mój Elektryk,” which offer subsidies for the purchase of new electric delivery vehicles. Furthermore, the development of charging infrastructure and growing environmental awareness among businesses are contributing to increased interest in this type of vehicle [

4].

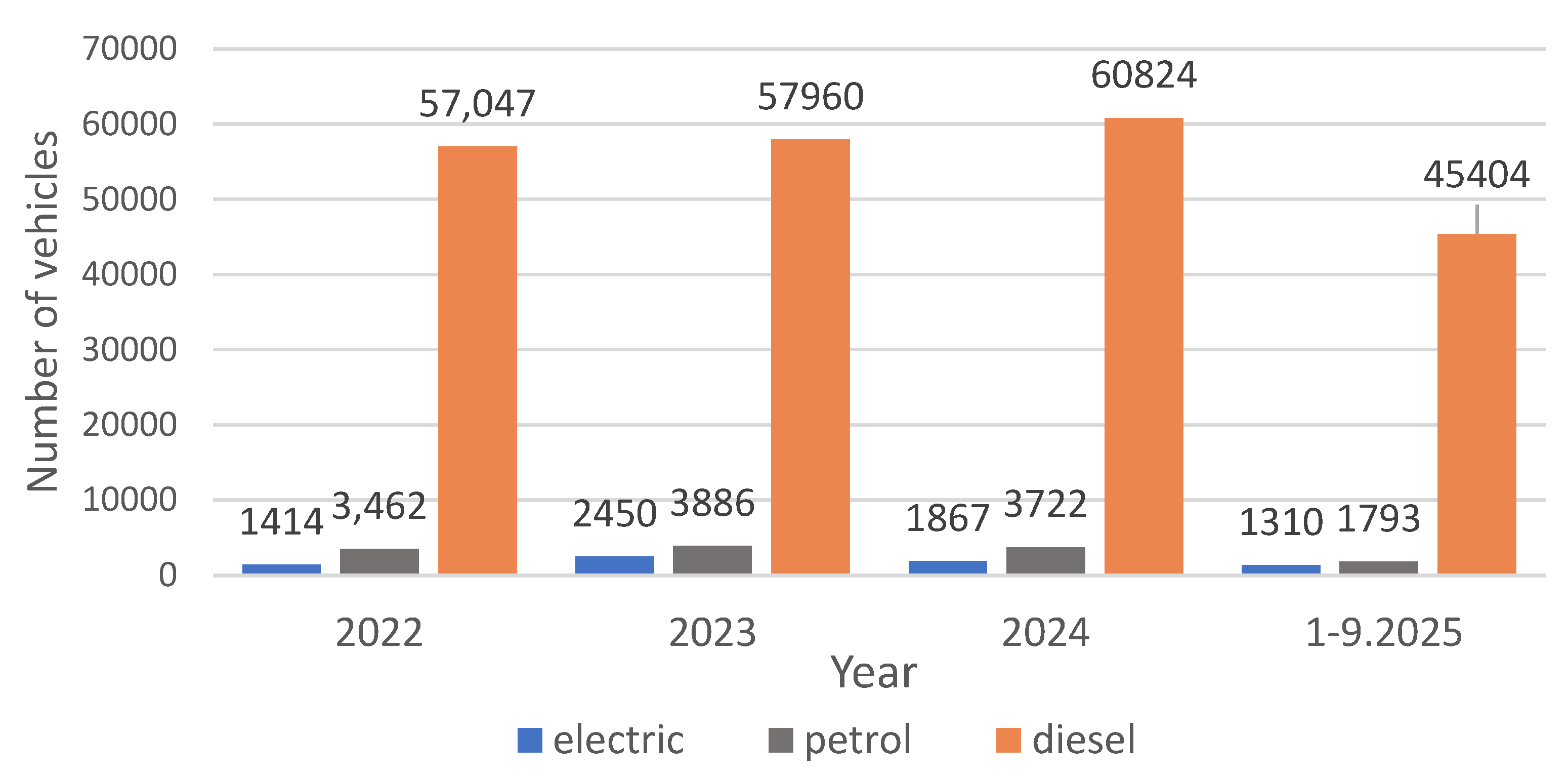

Diesel remains the dominant powertrain among newly registered delivery vehicles in 2022-2025. In 2022, 57,047 diesel vehicles were registered, a number that gradually increased to 60,824 in 2024. In 2025 (through September), the number of new diesel vehicle registrations reached 45,404, suggesting a continued high share of this type of powertrain throughout the year, although a slight decline compared to previous years is possible if the registration rate does not increase in the final quarter. For gasoline-powered vehicles, registrations remain significantly lower, ranging between 3,462 and 3,886 vehicles between 2022 and 2024, with a slight decline to 1,793 in 2025 (through September). This trend indicates a gradual decline in interest in gasoline vehicles in this market segment [

5,

6].

In turn, the number of electric vehicle registrations, while still relatively low, shows some fluctuations. In 2022, 1,414 electric delivery vans were registered, in 2023 this number increased to 2,450, before falling to 1,867 in 2024. In 2025 (through September), 1,310 new registrations were recorded. These data suggest that the development of electromobility in the delivery vehicle segment is progressing slowly and unevenly, although interest in this type of drivetrain remains strong. Despite the increasing promotion of alternative powertrains, the new commercial vehicle market in the analyzed period remains dominated by diesel vehicles. The share of electric and petrol vehicles remains marginal, and the observed changes do not yet indicate a clear trend toward zero-emission powertrains [

5,

6].

Figure 1.

Registration of new delivery vehicles due to their drivetrain [

5,

6]

Figure 1.

Registration of new delivery vehicles due to their drivetrain [

5,

6]

3. Advantages of Using Electric Delivery Vehicles

Recent years have seen a rapid increase in interest in the electrification of road transport, driven both by technological advances in energy storage and increasing regulatory pressure to reduce pollutant emissions. Electric light commercial vehicles (LCVs) are a particularly important segment in this context, as they are heavily used in urban distribution, where their operation can significantly contribute to reducing local emissions.

The primary advantage of electric LCVs is the absence of exhaust emissions at the point of use, which helps reduce the concentration of nitrogen oxides (NOₓ), particulate matter (PM), and carbon dioxide (CO₂) in the urban environment. This is particularly important in the context of achieving the European Union’s climate policy goals and implementing clean transport zones in cities. Unlike combustion vehicles, electric vehicles also feature lower noise levels, which positively impacts acoustic comfort in urban spaces, especially during nighttime deliveries.

Another advantage is lower operating costs resulting from the simpler drivetrain design and lower electricity costs compared to fossil fuels. Electric vehicles do not require regular replacement, such as engine oils, fuel filters, or exhaust systems, which reduces the frequency of technical inspections and lowers the total cost of fleet maintenance. Combined with the increasing availability of charging infrastructure and the possibility of using energy tariffs adapted to overnight charging, operating this type of vehicle is becoming increasingly economical [

14].

The operational aspect is also important. Electric delivery vehicles offer high torque engine available from the lowest speeds, facilitating maneuvering in urban environments and increasing dynamic starting. The range of modern models fully covers the needs of most last-mile distribution operations, and the ability to charge using fast chargers allows for flexible route planning and reduced downtime.

It’s worth noting that electric vehicles are equipped with a system for energy recuperation during braking. The amount of energy recovered depends on the braking method, the efficiency of the energy conversion system, and kinetic energy, which increases with increasing vehicle weight (carrying loads). Energy recuperation from a braking vehicle reduces the load on the braking system, which has a positive impact on particulate matter emissions into the environment [

15].

From a social and image perspective, the use of electric vehicles in light transport is also a component of a company’s sustainable development strategy. The introduction of low-emission transport solutions allows companies to build a reputation as innovative and environmentally responsible entities, which can have a positive impact on relationships with business partners and consumers. In summary, light-duty electric vehicles combine ecological, economic, and operational benefits, making them an attractive alternative to conventional combustion vehicles, especially for urban applications. Their further development and widespread adoption represent a significant step towards decarbonizing road transport and improving the quality of life in urban areas [

14].

4. Costs and Legal Aspects

The operating costs of electric delivery vehicles are increasingly favorable compared to their conventional combustion engine counterparts, especially in the long term. While the purchase price of an electric vehicle can be higher, operating one can be significantly cheaper, which in the long run can offset or even exceed the initial outlay. One of the main advantages of electric vehicles is the lower cost of refueling. Electricity—especially if it comes from a night-time tariff or from a private photovoltaic system—is significantly cheaper than fuel. Furthermore, electric vehicles have fewer mechanical parts that can fail—for example, they lack a gearbox, clutch, starter motor, or exhaust system. As a result, service and ongoing maintenance costs are typically lower than for diesel vehicles. Fees associated with daily use can also be more favorable. Many cities offer preferential parking conditions for zero-emission vehicles, and entry to clean transport zones (whose range will only increase) is usually free or significantly cheaper for electric vehicles [

7,

8].

Funding programs are available to provide additional support. The most well-known of these in Poland is the “Mój Elektryk” (My Electrician) program, which offers subsidies of up to PLN 70,000 for the purchase of a new N1 electric van (for businesses). In some cases, combining the subsidy with dealer promotions (e.g., year-end sales), the total financial support can reach up to PLN 140,000, significantly lowering the barrier to entry. [

4]

All this means that, despite their higher starting price, electric vans can prove more economical in terms of total cost of ownership (TCO). This is especially true for intensive urban use, where the benefits of quiet, emission-free driving and low operating costs become particularly noticeable. Requirements for Electric Vehicles in Fleets – Status as of 2025 [

9].

Poland has a 2018 Act on Electromobility and Alternative Fuels, which has been amended several times and sets specific limits on the share of electric vehicles in the fleets of various entities. According to this Act, public sector entities, such as municipalities, offices, and municipal companies, must ensure that at least 30% of their fleets are electric by the end of 2025. For some public entities, especially local governments with populations exceeding 50,000, these regulations are even more stringent [

10,

11].

Companies providing public services, such as waste collection, public transport, or government deliveries, are also required to meet specific thresholds for the share of electric vehicles, which, depending on the type of business, range from 10 to 30%. For private companies, however, mandatory thresholds for the share of electric vehicles have not yet been introduced, although work is underway on changes to the regulations, which may in the future apply, particularly to large corporate fleets.

At the same time, European Union regulations indirectly impact fleet policy, as from 2035, a ban on the sale of new combustion engine vehicles will apply across the EU, meaning all new vehicles will have to be zero-emission. Additionally, green public procurement rules are being introduced, requiring tenders to include a certain number of electric or low-emission vehicles [

1,

12,

13].

5. Research Object

The study focused on electric delivery vehicles from the small and medium-sized segments. Their technical parameters, operational characteristics, and applicability in urban environments were analyzed. Particular attention was paid to energy efficiency and range in real-world driving conditions.

Table 1.

Technical parameters of the small commercial vehicles

Table 1.

Technical parameters of the small commercial vehicles

| |

Peugeot E-Partner Base |

Opel Combo Cargo Electric |

Citroen Berlingo VAN XL |

Maxus E-Deliver 3 |

BYD ETP3 |

Toyota Proace City Long |

Mercedes E-Citan |

Renault Kangoo VAN E-Tech Electric |

Fiat e-Doblo L2 |

VW ID Buzz Cargo |

| Net purchase cost [PLN] |

156 013 |

148 774 |

153 334 |

139 985 |

111 382 |

122 230 |

172 222 |

158 700 |

153 334 |

227 920 |

| WLTP combined range [km] |

195 |

195 |

195 |

214 |

233 |

260 |

290 |

300 |

331 |

424 |

| Maximum cargo space [L] |

2400 |

3800 |

0.85 |

6300 |

3500 |

4400 |

3 620 |

4900 |

2800 |

2100 |

| Charging time with a standard charger AC |

480 |

510 |

480 |

480 |

330 |

300 |

270 |

420 |

330 |

480 |

| Charging time with a fast charger DC [min] |

30 |

40 |

30 |

45 |

30 |

30 |

38 |

85 |

30 |

30 |

| Energy efficiency kWh/100 km |

19,1 |

23,1 |

18,4 |

19,7 |

19,6 |

25,4 |

18,7 |

19,8 |

19,5 |

19,1 |

| Engine power [HP] |

136 |

136 |

136 |

160 |

136 |

136 |

122 |

120 |

136 |

201 |

| Battery capacity [kWh] |

50 |

50 |

50 |

50,23 |

44,9 |

50 |

45 |

45 |

50 |

82 |

| Permissible loading weight [kg] |

571 |

800 |

720 |

1095 |

780 |

1200 |

664 |

669 |

610 |

620 |

| Cargo space length [mm] |

2080 |

1817 |

2167 |

2770 |

1950 |

2131 |

1806 |

2230 |

2167 |

1300 |

Table 2.

Technical parameters of the small commercial vehicles

Table 2.

Technical parameters of the small commercial vehicles

| |

MAN eTGE |

Nissan Townstar |

Renault Trafic E-Tech |

Mercedes E-Vito Ekstra Long |

Toyota Proace Long |

Opel Vivaro-e Furgon Extra Long |

Fiat E-Scudo |

Peugeot Expert Long |

Citroen E-Jumpy |

Maxus E-Deliver 7 |

| Net purchase cost [PLN] |

133 000 |

191 757 |

206 700 |

254 014 |

130 340 |

214 987 |

207 087 |

214 987 |

214 987 |

239 838 |

| WLTP combined range [km] |

173 |

287 |

297 |

304 |

330 |

339 |

347 |

348 |

348 |

362 |

| Maximum cargo space [L] |

10 700 |

4300 |

8900 |

6600 |

6600 |

6100 |

6000 |

6600 |

5800 |

6 700 |

| Charging time with a standard charger AC |

318 |

420 |

340 |

390 |

450 |

450 |

450 |

450 |

450 |

480 |

| Charging time with a fast charger DC [min] |

45 |

35 |

54 |

35 |

30 |

40 |

45 |

40 |

40 |

43 |

| Energy efficiency kWh/100 km |

29,9 |

22,4 |

21,0 |

20,7 |

23,1 |

26,1 |

24,0 |

23,6 |

23,0 |

24,2 |

| Engine power [HP] |

136 |

122 |

122 |

116 |

136 |

136 |

136 |

136 |

136 |

204 |

| Battery capacity [kWh] |

35,8 |

45 |

52 |

60 |

75 |

75 |

75 |

75 |

75 |

88,5 |

| Permissible loading weight [Kg] |

1058 |

800 |

1085 |

852 |

1200 |

1236 |

1150 |

1008 |

1000 |

1055 |

| Cargo space length [mm] |

3450 |

1800 |

4150 |

2831 |

4026 |

2862 |

2512 |

2862 |

2862 |

2950 |

6. Research and Discussion

6.1. Vehicle Energy Consumption per 100 km and Weight

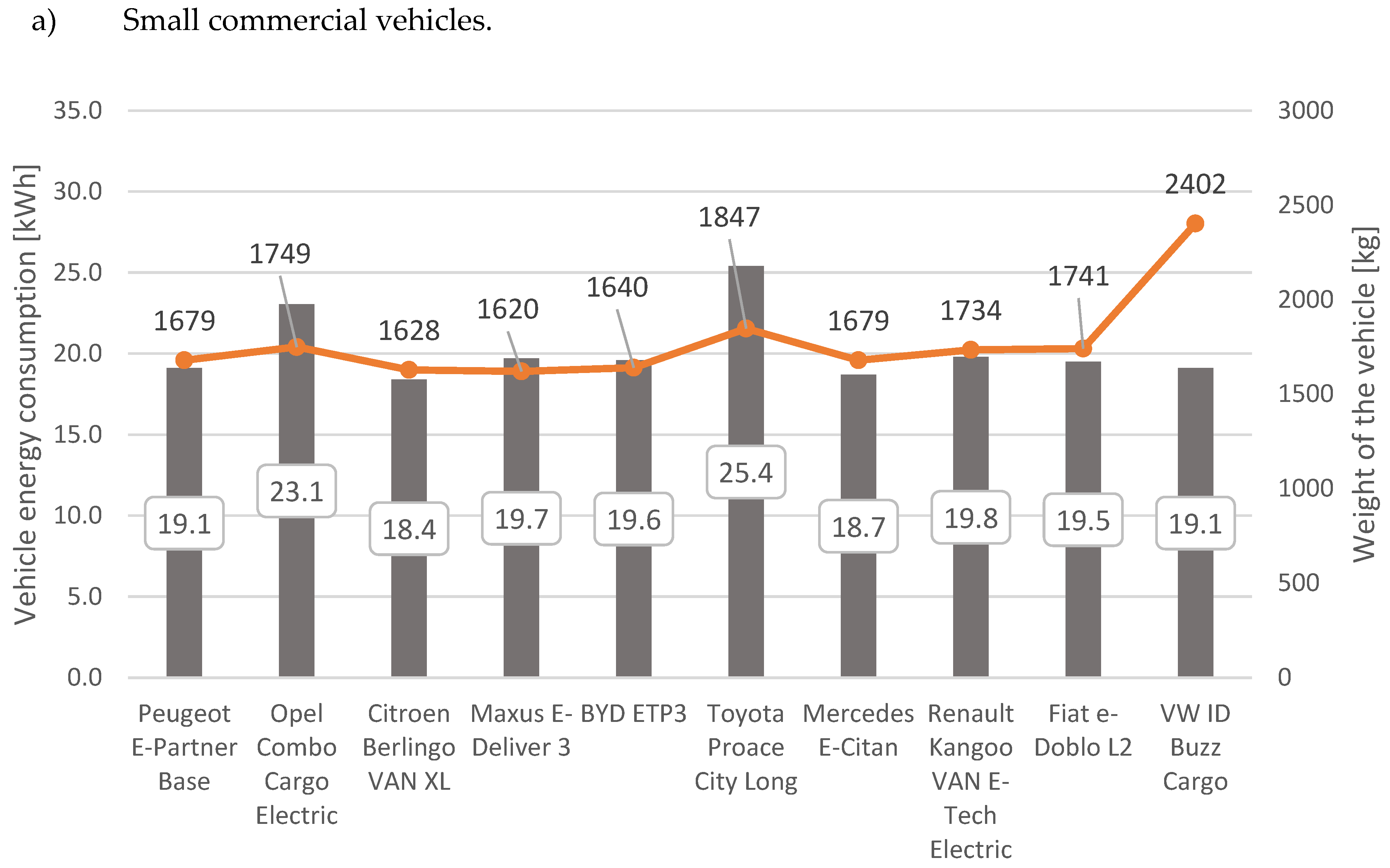

Figure 2.

Vehicle energy consumption per 100 km and weight of the small commercial vehicles [own study]

Figure 2.

Vehicle energy consumption per 100 km and weight of the small commercial vehicles [own study]

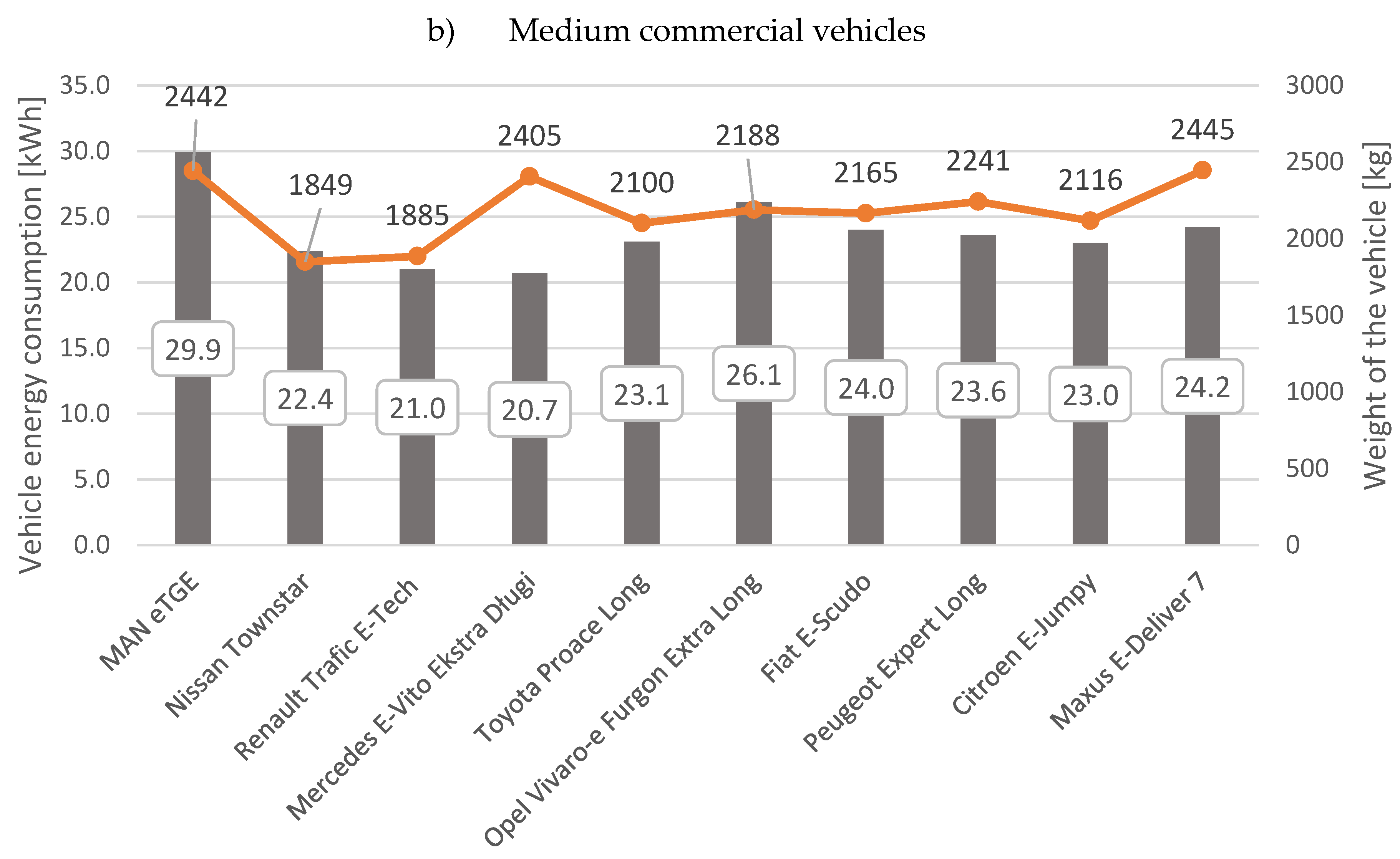

Figure 3.

Vehicle energy consumption per 100 km and weight of the medium commercial vehicles [own study]

Figure 3.

Vehicle energy consumption per 100 km and weight of the medium commercial vehicles [own study]

The average energy consumption in the WLTP test for small commercial vehicles is 20.4 kWh. Energy consumption for the three heaviest vehicles is noticeably higher. The Toyota Proace City Long consumes the most energy – a whopping 24.5% more than the average.

Analyzing the results presented in the two graphs, clear differences can be seen between small and medium commercial vehicles in terms of energy consumption and curb weight. Medium commercial vehicles are significantly heavier – in most cases, ranging from approximately 1,800 to 2,450 kg, while small vehicles range from approximately 1,600 to 2,400 kg. This increased weight translates directly into higher energy consumption: medium vehicles require 21 to 30 kWh per 100 km, while small vehicles require 18 to 25 kWh per 100 km.

In both groups, a general trend of increasing energy consumption with increasing vehicle weight can be observed, although this relationship is not entirely linear. Among small vehicles, the heaviest model, the VW ID Buzz Cargo, weighing 2,402 kg, consumes 19.1 kWh/100 km, which is not the highest value in its category. This may indicate good aerodynamic efficiency and a powerful drive system. By comparison, among medium-sized vehicles, the MAN eTGE, also one of the heaviest (2,442 kg), has a very high energy consumption of 29.9 kWh/100 km. This demonstrates that the impact of weight on energy efficiency becomes more noticeable at higher weights.

The most energy-efficient vehicle among small models is the Citroën Berlingo VAN XL, which consumes only 18.4 kWh/100 km, while among medium-sized vehicles, the Mercedes eVito Extra Long achieved the best result with 21.0 kWh/100 km. The highest energy consumption among small vehicles was recorded by the Toyota Proace City Long (25.4 kWh/100 km), and among medium-sized vehicles, the aforementioned MAN eTGE (29.9 kWh/100 km). The differences between the most and least efficient models in both categories are approximately 7–9 kWh/100 km, which can translate into significant differences in range and operating costs.

6.2. Vehicle Range and Energy Consumption per 100 km

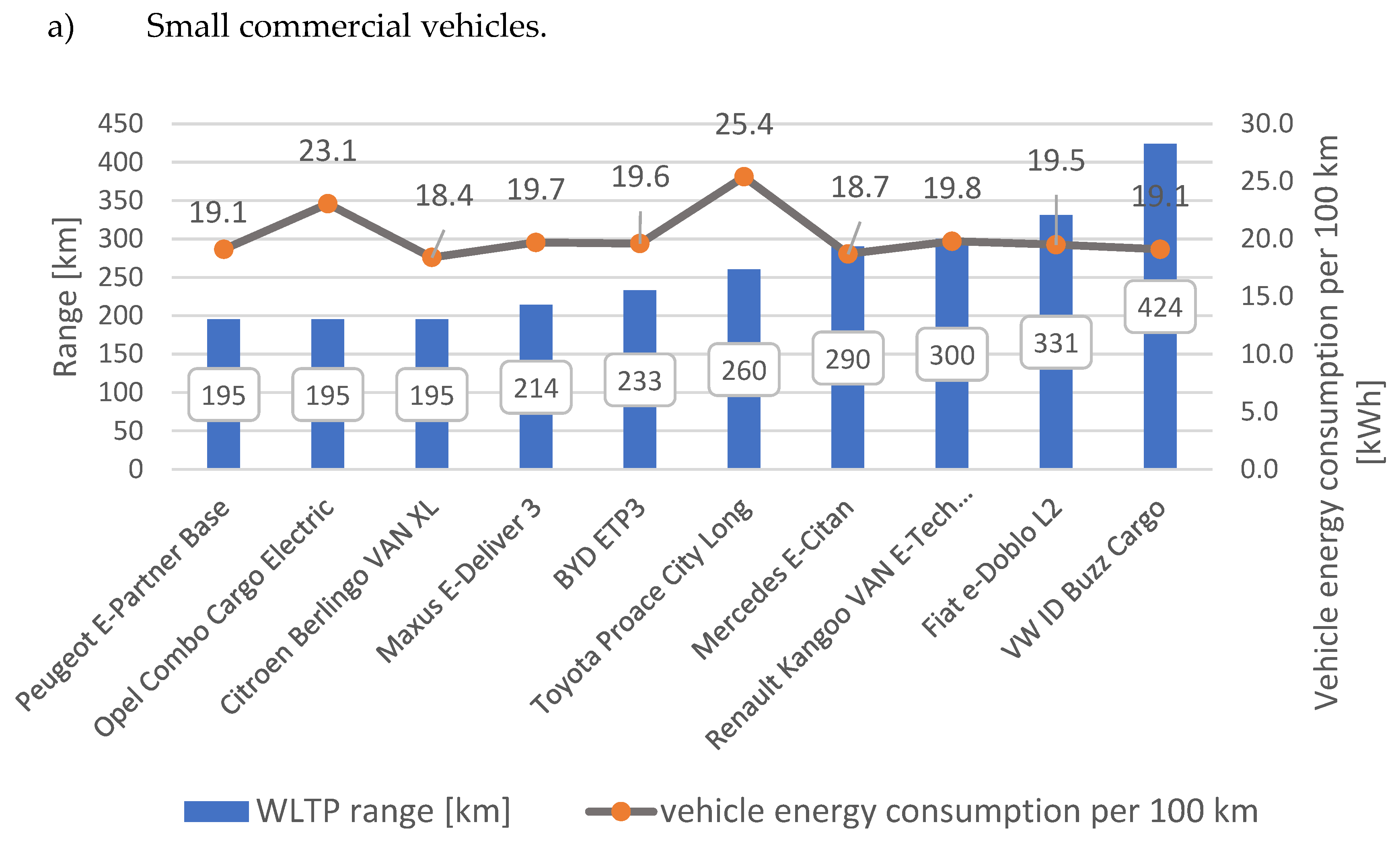

Figure 4.

Range and vehicle energy consumption per 100 km of the small commercial vehicles [own study]

Figure 4.

Range and vehicle energy consumption per 100 km of the small commercial vehicles [own study]

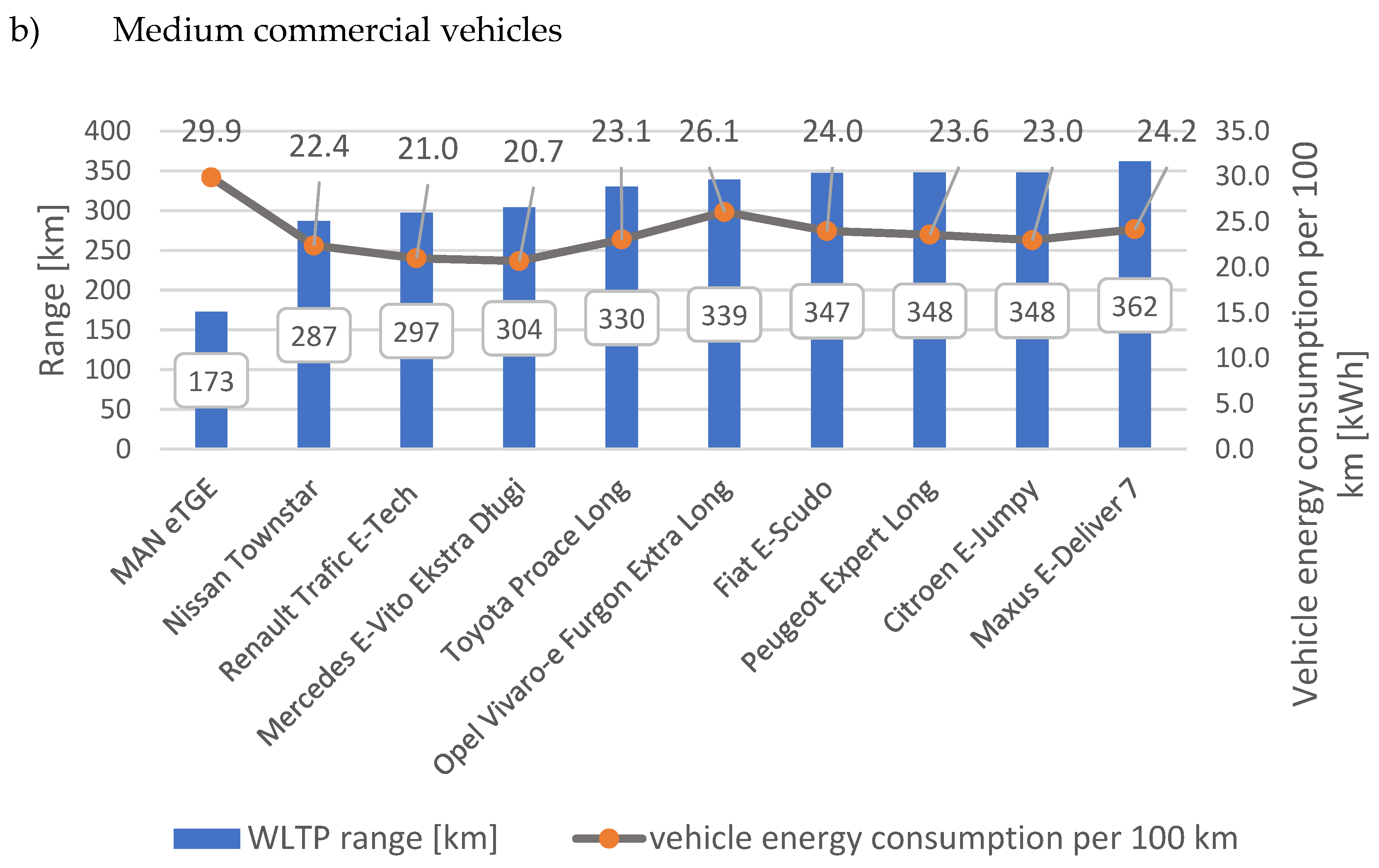

Figure 5.

Range and vehicle energy consumption per 100 km of the medium commercial vehicles [own study]

Figure 5.

Range and vehicle energy consumption per 100 km of the medium commercial vehicles [own study]

The range of the analyzed vehicles depends, among other things, on the capacity of the traction battery and energy consumption. According to the WLTP test, the VW ID Buzz Cargo achieves the longest range (424 km), more than twice that of the vehicles with the lowest range analyzed. It’s worth noting, however, that the aforementioned vehicle has the largest battery capacity (82 kWh). This difference directly translates to vehicle weight, but the permissible load weight is not noticeably reduced compared to other vehicles. This can be explained by the fact that the VW ID Buzz Cargo is a new design in which the vehicle manufacturer designed a battery compartment under the entire cargo area, which was impossible for older vehicles that were converted to electric drive from conventional versions.

Analysis of the results presented in the figures regarding vehicle range and energy consumption per 100 km reveals a clear correlation between energy efficiency and vehicle size and characteristics. For small delivery vehicles, WLTP range values range from 195 to 424 km, demonstrating the significant variation in the capabilities of individual models. The Peugeot e-Partner and Opel Combo-e Cargo have the shortest range, while the VW ID Buzz Cargo has the highest. Average energy consumption in this group ranges from 18.7 to 25.4 kWh/100 km, with the lowest values being found in vehicles with lower weight and less powerful engines, while higher values are found in those with larger battery capacity and higher performance, such as the Toyota Proace City Long. It’s noticeable that vehicles with longer ranges don’t always consume proportionally more energy – for example, the VW ID Buzz Cargo, which, despite its highest range, maintains a moderate energy consumption level (20.1 kWh/100 km), indicating good optimization of the drivetrain and vehicle aerodynamics.

In the case of medium-sized commercial vehicles, higher energy consumption is observed, a consequence of their greater curb weight and carrying capacity. The WLTP range in this group ranges from 173 to 362 km, with the MAN eTGE achieving the lowest result and the Nissan e-NV200 achieving the highest. Energy consumption per 100 km ranges from 21.0 to 29.9 kWh, indicating that medium-sized vans require on average 3–5 kWh more energy per 100 km than vehicles in the smaller segment. Vehicles with the longest range are not always the most energy-efficient, suggesting that factors such as aerodynamics, payload, and drivetrain characteristics become increasingly important with larger designs. Despite their higher energy consumption, some models—such as the Fiat e-Doblo L2 and Renault Kangoo VAN E-Tech—achieve a relatively good compromise between range and energy consumption, making them competitive in their class.

6.3. Vehicle Range Depending on Payload

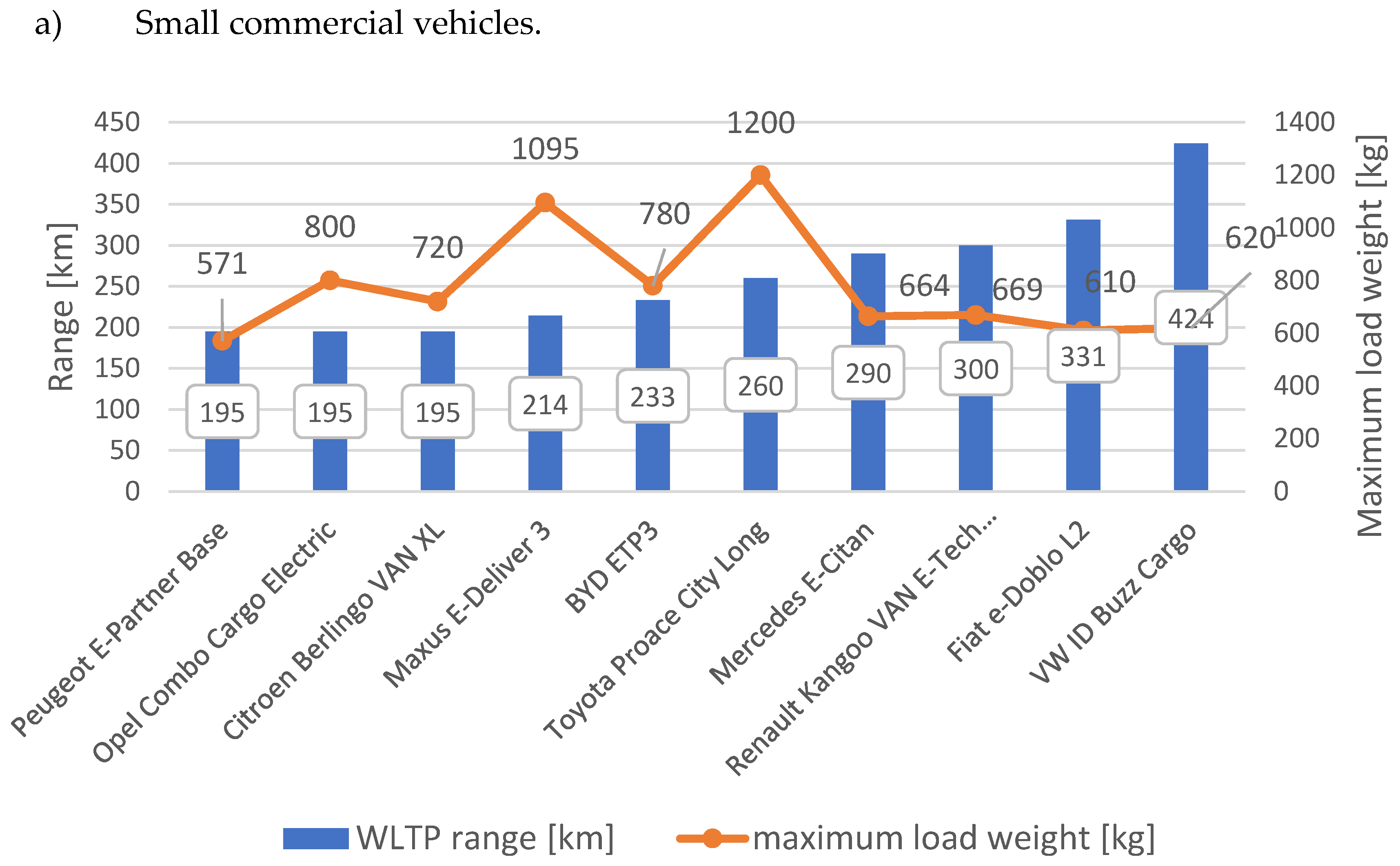

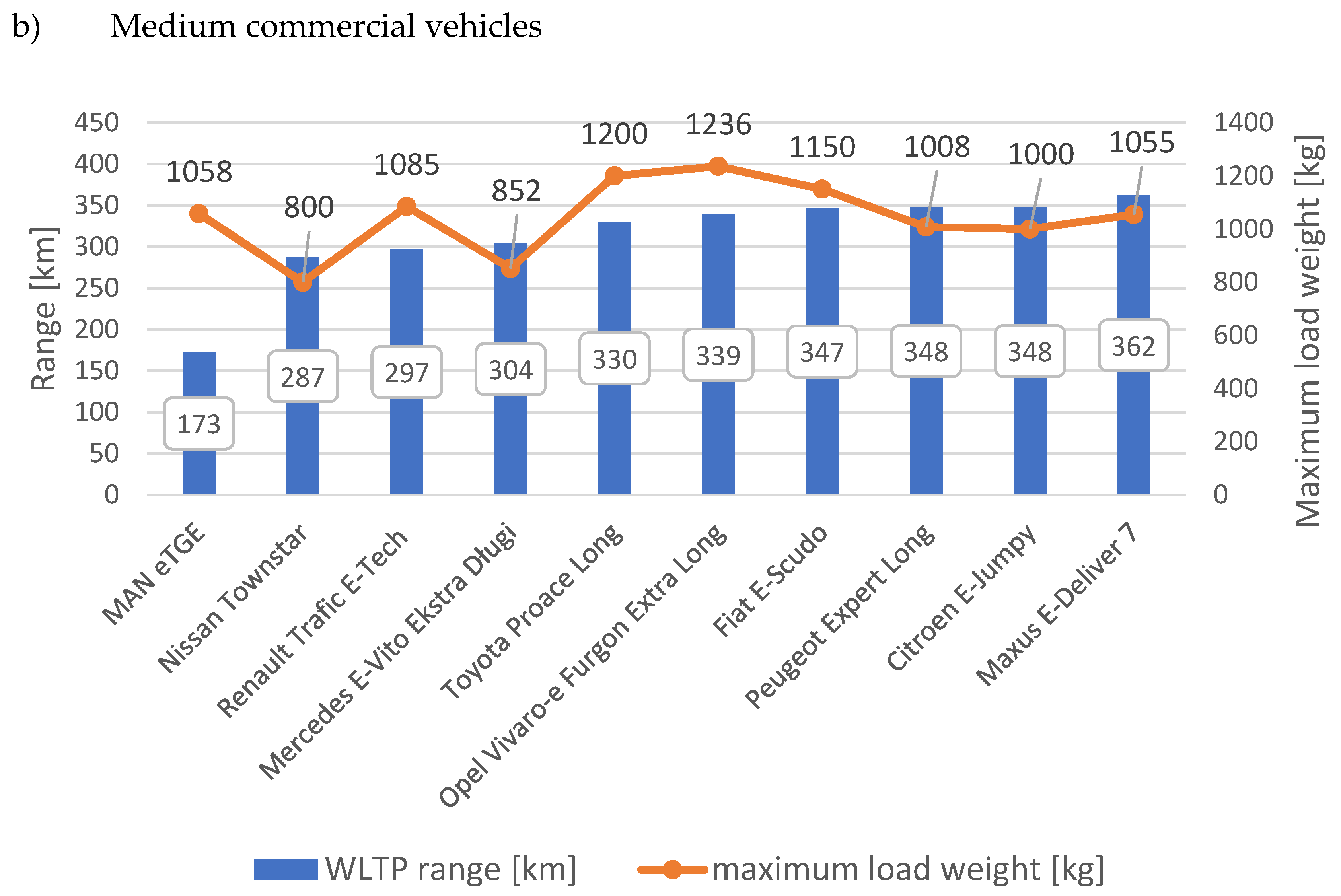

Figure 6.

Range and maximum load weight of the small commercial vehicles [own study]

Figure 6.

Range and maximum load weight of the small commercial vehicles [own study]

Figure 7.

Range and maximum load weight of the medium commercial vehicles [own study]

Figure 7.

Range and maximum load weight of the medium commercial vehicles [own study]

Based on the graphs showing the relationship between vehicle range and maximum payload, significant differences can be seen between small and medium-sized commercial vehicles. For small commercial vehicles, the WLTP range ranges from approximately 195 to 390 km. The Opel Combo Cargo Electric has the shortest range (195 km), while the VW ID Buzz Cargo has the longest (390 km). It’s worth noting that increased range doesn’t always translate to increased payload. For example, the Renault Kangoo VAN E-Tech Electric has one of the highest payloads (1,200 kg), yet only has a range of 260 km. Meanwhile, the VW ID Buzz Cargo, despite its significantly lower payload (424 kg), boasts the highest range in its class. This means that design priorities vary across manufacturers in the small vehicle segment – some models are designed with longer range in mind, others with higher carrying capacity. Overall, there’s no clear correlation between payload weight and range in this group—these parameters seem to be largely independent of each other.

For medium-sized delivery vehicles, the range range is slightly higher, ranging from 173 to 362 km, with an average payload also being higher, ranging from approximately 850 to 1,236 kg. As with smaller vehicles, there’s no clear correlation between payload and range. For example, the MAN eTGE, which has a relatively high payload (1,058 kg), achieves the shortest range—just 173 km. Meanwhile, the Maxus E Deliver 7, with a very similar payload (1,055 kg), offers a much longer range—362 km. This demonstrates that the factors influencing range are more complex and depend not only on the weight of the cargo being transported, but also on battery capacity, drive efficiency, and vehicle aerodynamics.

6.4. Vehicle Range Depending on Charging Time

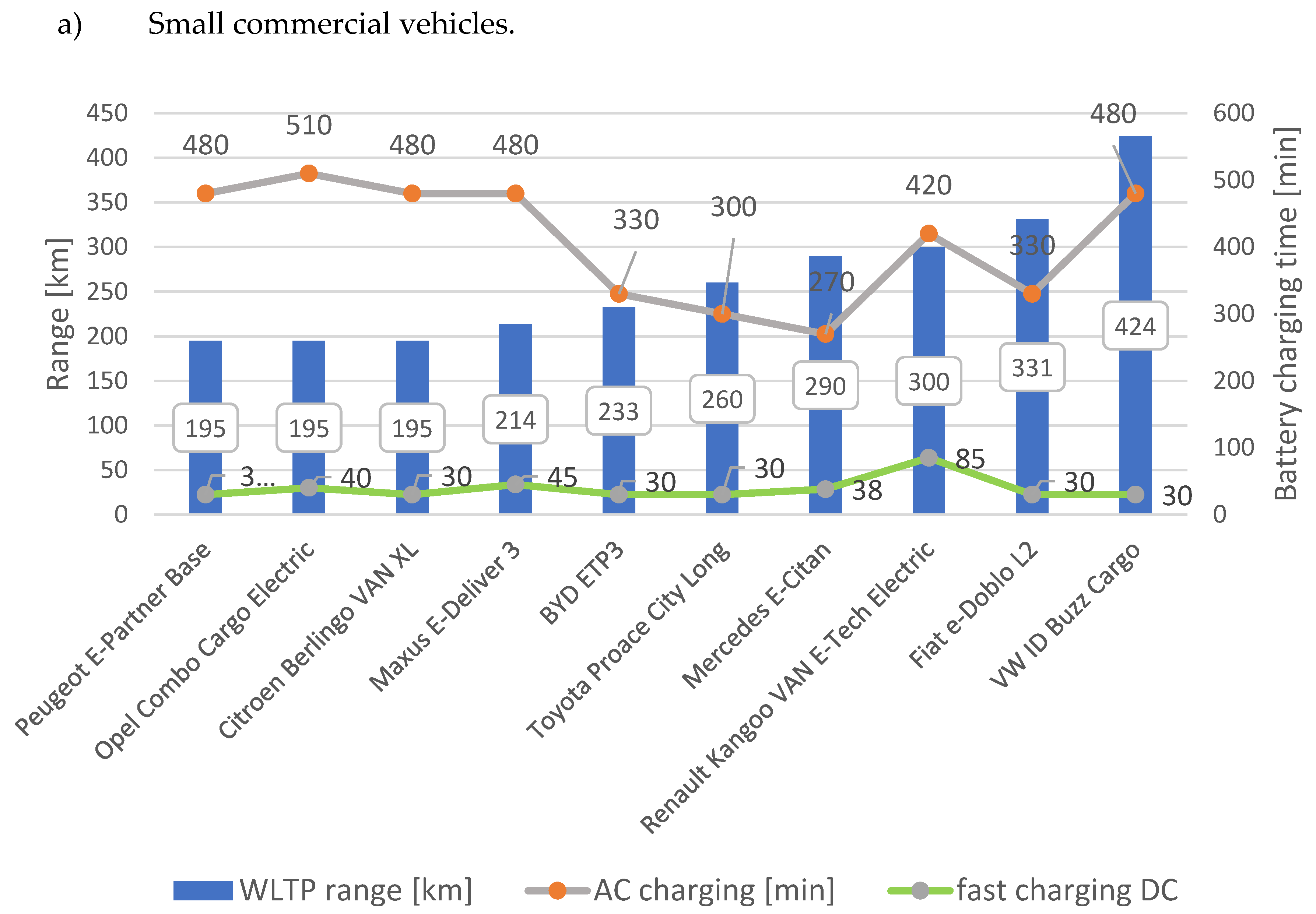

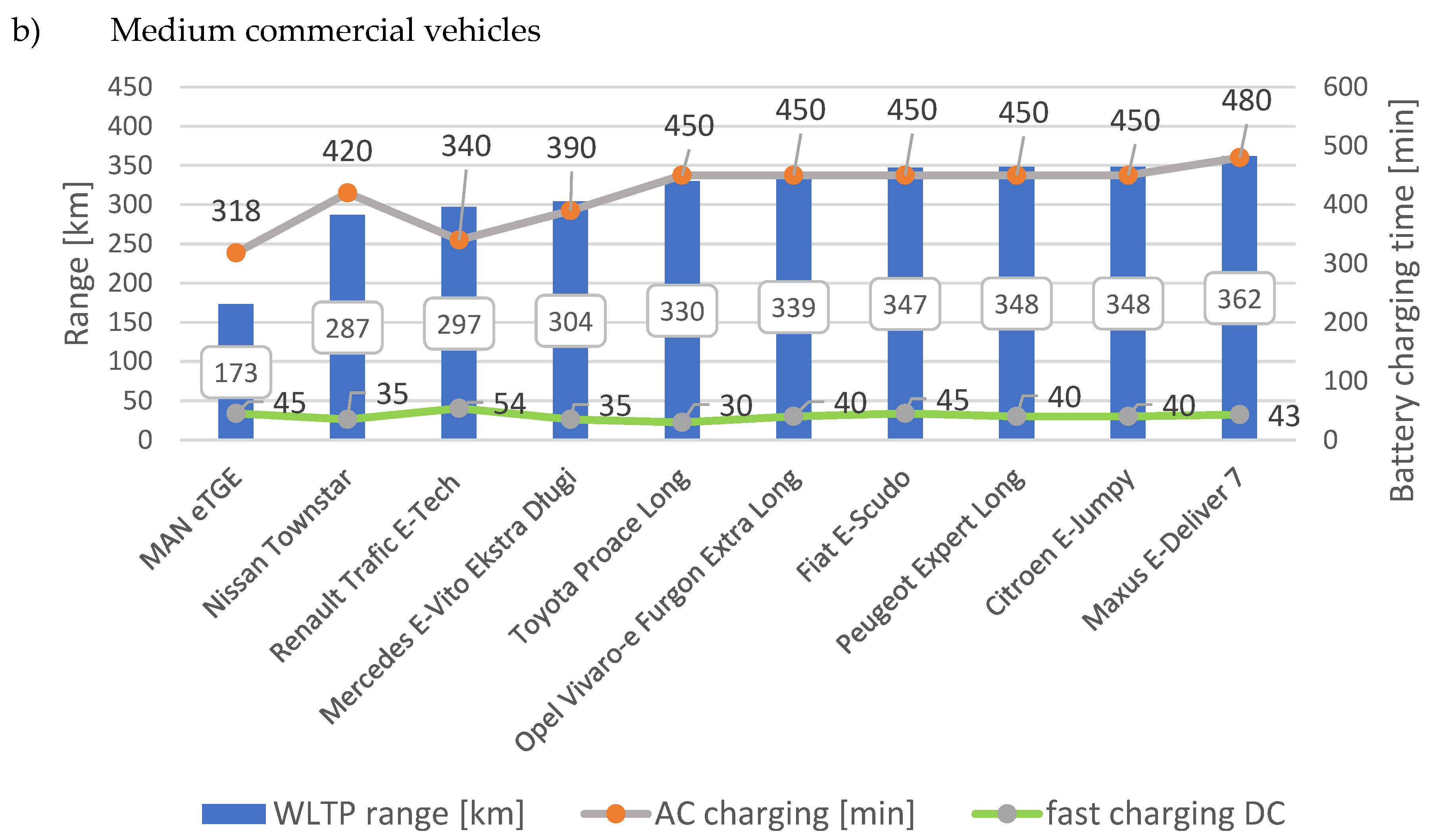

Figure 8.

Range and battery charging time of the small commercial vehicles [own study]

Figure 8.

Range and battery charging time of the small commercial vehicles [own study]

Figure 9.

Range and battery charging time of the medium commercial vehicles [own study]

Figure 9.

Range and battery charging time of the medium commercial vehicles [own study]

All analyzed electric vehicles could be charged with both alternating current and direct current using fast chargers. It can be seen that for vehicles with a longer range (233 km or more), fast charging times are noticeably shorter and are determined by the individual parameters of each model (maximum charging current). The battery capacity of the small delivery vehicles in the study ranged between 45 and 50 kWh. The VW ID Buzz Cargo was an exception. Stored energy density is the main determinant of electric vehicle range.

An analysis of the presented results regarding vehicle range and battery charging times indicates significant variation among both small and medium-sized delivery vehicles. In the case of small delivery vehicles (Figure 5), it is noticeable that WLTP range values range from approximately 195 to 480 km. The VW ID Buzz Cargo achieves the longest range (480 km), while the Peugeot e-Partner achieves the shortest (195 km). At the same time, charging times using alternating current (AC) range between 330 and 510 minutes, with the highest values observed for vehicles with larger battery capacity, such as the VW ID Buzz Cargo and Opel Combo-e Cargo. Charging times using direct current (DC), on the other hand, are significantly shorter, in most cases ranging from 30 to 85 minutes, confirming that fast charging technology significantly shortens the time required to recharge. In the context of the relationship between range and charging time, it can be observed that vehicles with longer ranges typically have longer AC charging times, but not necessarily proportionally longer DC charging times, suggesting limitations in charger power and battery thermal management.

In the group of medium-sized commercial vehicles (Figure 6), range values are similar but generally lower compared to the smaller vehicle segment, ranging from 173 to 362 km. The MAN eTGE has the lowest range, while the Nissan e-NV200 has the highest. AC charging times are also high, ranging from 318 to 480 minutes, which is typical for larger vehicles equipped with larger batteries. DC charging, on the other hand, remains similar to smaller vehicles, ranging from 30 to 45 minutes. Analyzing the relationship between range and charging time, it can be seen that despite the generally longer AC charging times compared to the small vehicle segment, the ranges of medium-sized vans are not significantly longer, indicating a trade-off between vehicle weight, battery capacity, and energy efficiency.

7. Conclusions

A comparative analysis of key technical parameters of zero-emission vans available on the market clearly identifies the differences between small and medium-sized vehicles. Small vans are more energy-efficient, making them an optimal choice for urban applications, where low energy consumption and adequate range are particularly important. Meanwhile, mid-sized vehicles, despite their higher energy consumption resulting from their greater weight and dimensions, offer significantly greater payload capacity, making them more suitable for tasks requiring the transport of larger or heavier loads.

In both segments, there is a clear trend that modern models – particularly the VW ID Buzz Cargo and the Nissan e-NV200 – effectively combine relatively long range with moderate energy consumption, distinguishing themselves from the competition. At the same time, the analysis revealed no clear correlation between maximum payload and range, although it can be observed that vehicles with longer ranges often have lower payload capacity. This likely stems from the need to achieve a design compromise between battery weight and gross vehicle weight.

Small vehicles offer a better range-to-weight ratio, confirming their high suitability for urban mobility. On the other hand, mid-size vans, thanks to their larger cargo space, better meet the requirements of regional transport, albeit at the cost of lower energy efficiency.

Another important finding is the relationship between range and charging time with AC current, while DC fast charging technology significantly shortens charging times regardless of vehicle segment. Models with the longest ranges – such as the VW ID Buzz Cargo and Nissan e-NV200 – stand out with a particularly favorable range-to-charging time ratio, making them the most efficient in the entire analysis.

Author Contributions

Conceptualization, W.C., P.M.; methodology P.M., W.C., formal analysis, W.C.; writing—original draft preparation W.C., P.M..; writing—review and editing, P.M., W.C. visualization. All authors have read and agreed to the published version of the manuscript.

Funding

The Article Processing Charge was financed under the European Funds for Silesia 2021–2027 Program co-financed by the Just Transition Fund—project entitled “Supporting the staff in intensifying scientific activities in the field of transport transformation towards a green and digital economy”. Project number: FESL.10.25-IZ.01-03AF/23-00; Project number at the Silesian University of Technology: 12/010/FSD24/1161.

Data Availability Statement

All data are included in the article.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Figenbaum, E. Can battery electric light commercial vehicles work for craftsmen and service enterprises? Energy Policy 2018, 120, 58–72. [CrossRef]

- Christensen, L.; Klauenberg, J.; Kveiborg, O.; Rudolph, C. Suitability of commercial transport for a shift to electric mobility with Denmark and Germany as use cases. Res. Transp. Econ. 2017, 64, 48–60. [CrossRef]

- European Union. (2021, July 7). Road safety: driving licences. EUR-Lex. Retrieved November 20, 2025, from https://eur-lex.europa.eu/EN/legal-content/summary/road-safety-driving-licences.html.

- Sendek-Matysiak, E.; Pyza, D.; Łosiewicz, Z.; Lewicki, W. Total Cost of Ownership of Light Commercial Electrical Vehicles in City Logistics. Energies 2022, 15(22), 8392. [CrossRef]

- https://www.pzpm.org.pl/pl/Elektromobilnosc/eRejestracje, accessed on November 7, 2025.

- https://www.acea.auto/files/ACEA_vans_by_fuel_type_FY2022.pdf, accessed on November 7, 2025.

- Dablanc, L.; Morganti, E.; Arvidsson, N.; Woxenius, J.; Browne, M.; Saidi, N. The rise of on-demand ‘Instant Deliveries’ in European cities. Supply Chain Forum: An Int. J. 2017, 18, 203–217. [CrossRef]

- Foltyński, M. Electric fleets in urban logistics. Procedia Soc. Behav. Sci. 2014, 151, 48–59. [CrossRef]

- European Commission. TRIMIS – Transport and Research and Innovation Monitoring and Information System. 2017. Dostępne online: https://trimis.ec.europa.eu/.

- Tsakalidis, A.; Krause, J.; Julea, A.; Peduzzi, E.; Pisoni, E.; Thiel, C. Electric light commercial vehicles: Are they the sleeping giant of electromobility? Transp. Res. Part D: Transp. Environ. 2020, 86, 102421. [CrossRef]

- Camilleri, P.; Dablanc, L. An assessment of present and future competitiveness of electric commercial vans. J. Earth Sci. Geotech. Eng. 2017, 7, 337–364.

- Szewczyk, P.; Łebkowski, A. Studies on Energy Consumption of Electric Light Commercial Vehicle Powered by In-Wheel Drive Modules. Energies 2021, 14(22), 7524. [CrossRef]

- European Commission. EU Reference Scenario 2016 – Energy, transport and GHG emissions: Trends to 2050. Publications Office of the European Union, Luxembourg, 2016. [CrossRef]

- Hao, X.; et al. Electrification pathways for light-duty logistics vehicles in urban areas. Carbon Footprints (OAE Publishers) 2024, 24. https://www.oaepublish.com/articles/cf.2024.24, accessed on November 12, 2025.

- Gil Ribeiro, C.; Thakur, J.; Henrysson, M. Exploring the macro environment determinants behind the diffusion of electric Light Commercial Vehicles. Transportmetrica A: Transport Science 2025, in press. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).