Submitted:

07 November 2025

Posted:

12 November 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

- Financial Education As A Transformative Asset, Enabling Individuals To Adapt To Complex Economic Environments And Make Informed Decisions.

- The Mindset And Psychology Of Money, With An Emphasis On The Power Of Beliefs, Financial Self-Esteem, And Family Socialization.

- Savings And Smart Investing, As Practical Expressions Of Personal Economic Empowerment.

- Debt Management And The Redefinition Of Financial Freedom, Overcoming The Logic Of Survival To Build Well-Being.

- New Scenarios For Financial Education In The Face Of Digitalization, Technological Innovation, And Demands For Equity And Inclusion.

2. Theoretical Framework

2.1. Financial Education as a Transformative Asset

2.2. Mindset and Psychology of Money

2.3. Smart Saving and Investing

2.4. Debt and Financial Freedom

2.5. New Scenarios: Financial Education for the Future

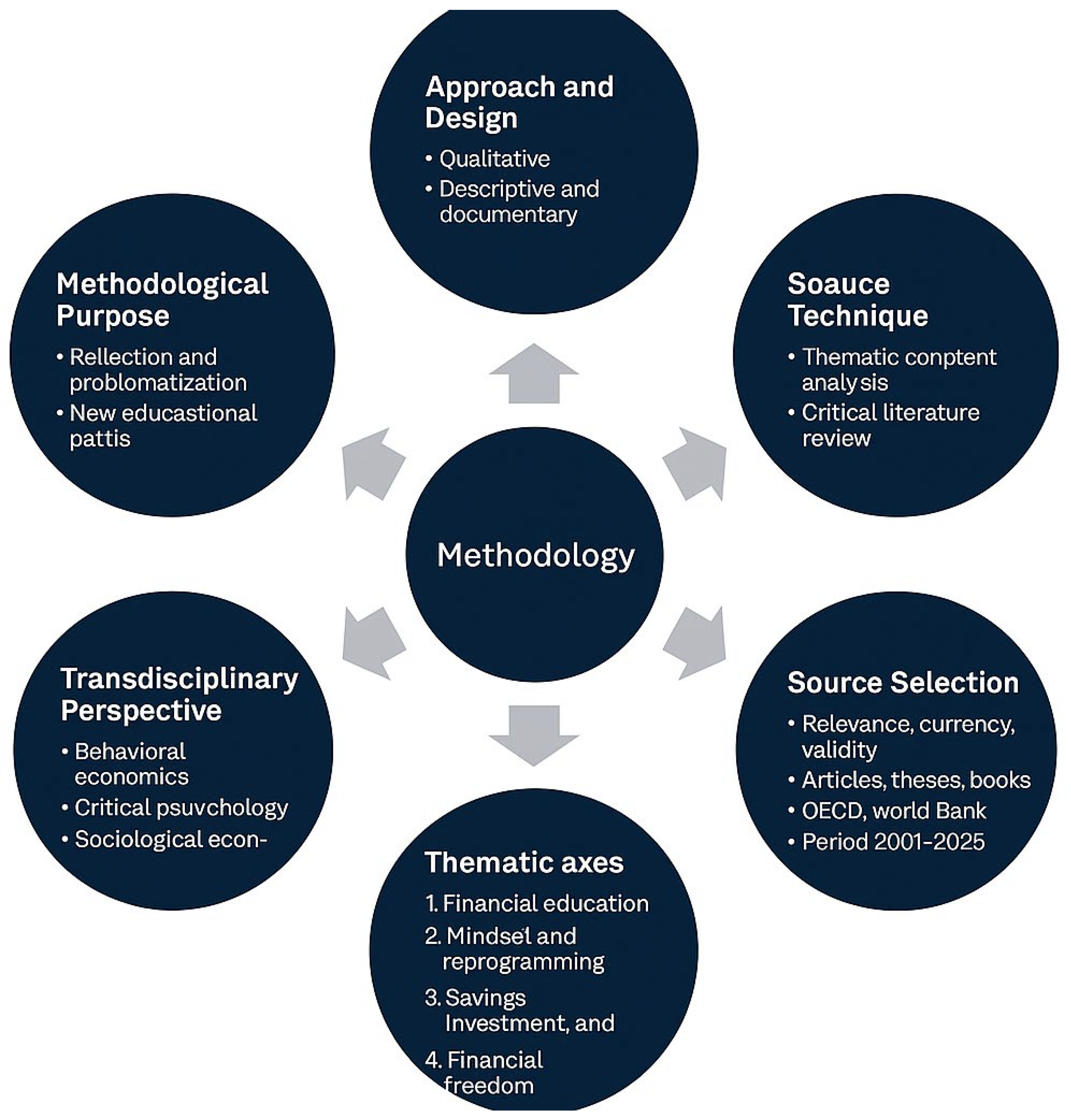

3. Methodology

- Financial Education As A Transformative Asset.

- Financial Mindset And Reprogramming.

- Key Behaviors Related To Saving, Investing, And Debt Management.

- Financial Freedom As An Evolutionary And Multidimensional Dimension.

- New Educational Scenarios In The Face Of Emerging Technological, Social, And Economic Challenges.

4. Discussion

5. Conclusions

References

- Abdallah, W. , Tfaily, F., Harraf. A. The Impact Of Digital Financial Literacy On Financial Behavior: Customers’ Perspective. Competitiveness Review 2025, 35, 347–370. [Google Scholar] [CrossRef]

- Abdul Ghafoor, K. , & Akhtar, M. Parents’ Financial Socialization Or Socioeconomic Characteristics: Which Has More Influence On Gen-Z’s Financial Wellbeing? Humanities And Social Sciences Communications 2024, 11, 522. [Google Scholar] [CrossRef]

- Ahmed, Z. , Noreen, U., Ramakrishnan, S. A., & Abdullah, D. F. B. What Explains The Investment Decision-Making Behaviour? The Role Of Financial Literacy And Financial Risk Tolerance. Afro-Asian Journal Of Finance And Accounting 2021, 11, 1–19. [Google Scholar] [CrossRef]

- Álvarez-Avad, N. , Braiz-Panduro, C., Pizzán-Tomanguillo, S.L., & Villafuerte De La Cruz, A.S. Financial Literacy And Credit Card Indebtedness Of Credit Card Customers Of Plaza Vea – Peru. Sapienza: International Journal Of Interdisciplinary Studies 2022, 3, 830–842. [Google Scholar] [CrossRef]

- Álvarez-Gayou Jurgenson, J. L. (2003). Cómo Hacer Investigación Cualitativa: Fundamentos Y Metodología.

- Asiah, A.N. , Haryono, A., & Churiyah, M. Financial Wellness Of Students In East Java: The Role Of Parental Financial Education, Financial Status, Financial Literacy, And Financial Behavior. Jurnal Ekonomi Pendidikan Dan Kewirausahaan 2024, 12, 297–326. [Google Scholar] [CrossRef]

- Atkinson, A. , & Messy, F. (2012). Measuring Financial Literacy: Results Of The OECD / International Network On Financial Education (INFE) Pilot Study, 15. [CrossRef]

- Atkinson, A. , & Messy, F. (2013). Promoting Financial Inclusion Through Financial Education: OECD/INFE Evidence, Policies And Practice. [CrossRef]

- Aydin, A.E. & Selcuk, E.A. An Investigation Of Financial Literacy, Money Ethics And Time Preferences Among College Students: A Structural Equation Model. International Journal Of Bank Marketing 2019, 37, 880–900. [Google Scholar] [CrossRef]

- Bado, B. , Hasan, M. , Tahir, T., & Hasbiah, S. How Do Financial Literacy, Financial Management Learning, Financial Attitudes And Financial Education In Families Affect Personal Financial Management In Generation Z? International Journal Of Professional Business Review 2023, 8, E02001. [Google Scholar] [CrossRef]

- Bai, R. Impact Of Financial Literacy, Mental Budgeting And Self Control On Financial Wellbeing: Mediating Impact Of Investment Decision Making. PLOS ONE 2023, 18, E0294466. [Google Scholar] [CrossRef]

- Barua, R. , Koh, B., & Mitchell, O. S. Does Financial Education Enhance Financial Preparedness? Evidence From A Natural Experiment In Singapore. Journal Of Pension Economics And Finance 2018, 17, 254–277. [Google Scholar] [CrossRef]

- Barua, R. , Shastry, G. K., & Yang, D. Financial Education For Female Foreign Domestic Workers In Singapore. Economics Of Education Review 2018, 78, 101920. [Google Scholar] [CrossRef]

- Brüggen, EC. , Hogreve, J., Holmlund, M., Kabadayi, S., & Löfgren, M. Financial Well-Being: A Conceptualization And Research Agenda. Journal Of Business Research 2017, 79, 228–237. [Google Scholar] [CrossRef]

- Bustamante, K.P. , & Cabrera, K.S. Microcrédito, Microempresa Y Educación En Ecuador. Caso De Estudio: Cantón Zamora. Revista Espacios, 1738. [Google Scholar]

- Cao-Alvira, J.J. , Novoa-Hoyos, A., & Núñez-Torres, A. On The Financial Literacy, Indebtedness, And Wealth Of Colombian Households. Review Of Development Economics 2021, 25, 978–993. [Google Scholar] [CrossRef]

- Collins, J.M. , & Urban, C. Measuring Financial Well-Being Over The Lifecourse. European Journal Of Finance 2020, 26, 341–359. [Google Scholar] [CrossRef]

- De Beckker, K.; De Witte, K.; Van Campenhout, G. Identifying Financially Illiterate Groups: An International Comparison. International Journal Of Consumer Studies 2019, 43, 490–501. [Google Scholar] [CrossRef]

- Desfrancois Fernand, P.G. La Educación Financiera Como Herramienta Para El Desarrollo De Hábitos Financieros Sostenibles En América Latina: La Educación Financiera Para El Desarrollo Financiero Sostenible. Mikarimin. Revista Científica Multidisciplinaria 2024, 10, 45–63. [Google Scholar] [CrossRef]

- Duhigg, C. (2012). The Power Of Habit: Why We Do What We Do In Life And Business. Random House, New York.

- Espino-Barranco, L.E. , Hernández-Calzada, M.A., & Pérez-Hernández, C.C. Educación Financiera En El Ecosistema Emprendedor. Investigación Administrativa 2021, 50, 12802. [Google Scholar] [CrossRef]

- Fan, L. , & Henager, R. A Structural Determinants Framework For Financial Well-Being. Journal Of Family And Economic Issues 2022, 43, 415–428. [Google Scholar] [CrossRef]

- Flick, U. (2014). An Introduction To Qualitative Research.

- Fraser, N. Reframing Justice In A Globalizing World. New Left Review 2005, 36, 69–88. [Google Scholar] [CrossRef]

- Gallo, G. , & Sconti, A. Could Financial Education Be A Universal Social Policy? A Simulation Of Potential Influences On Inequality Levels. Journal Of Accounting And Public Policy 2024, 46, 107231. [Google Scholar] [CrossRef]

- Garg, N. , & Singh, S. Financial Literacy Among Youth. International Journal Of Social Economics 2018, 45, 173–186. [Google Scholar] [CrossRef]

- Gulati, A. , & Singh, S. Financial Self-Efficacy Of Consumers: A Review And Research Agenda. International Journal Of Consumer Studies 2024, 48, E13024. [Google Scholar] [CrossRef]

- Gutiérrez-Andrade, O.W. , & Delgadillo-Sánchez, J.A. La Educación Financiera En Jóvenes Universitarios Del Primer Ciclo De Pregrado De La Universidad Católica Boliviana "San Pablo", Unidad Académica Regional De Cochabamba. Revista Perspectivas, /: 33-72. Recuperado De: Http, 1994. [Google Scholar]

- Hanson, T.A.; Olson, P.M. Financial Literacy And Family Communication Patterns. Journal Of Behavioral And Experimental Finance 2018, 19, 64–71. [Google Scholar] [CrossRef]

- Hernández-Pérez, J. , & Cruz-Rambaud, S. Uncovering The Factors Of Financial Well-Being: The Role Of Self-Control, Self-Efficacy, And Financial Hardship. Future Business Journal 2025, 11, 70. [Google Scholar] [CrossRef]

- Herrero, S. , Rubio, J., & León, M. Loans To Family And Friends And The Formal Financial System In Latin America. International Journal Of Financial Studies 2025, 13, 116. [Google Scholar] [CrossRef]

- Kaur, R. , & Singh, M. The Dynamics Of Family Financial Socialization: Impact On Financial Self-Efficacy And Financial Behavior. NMIMS Management Review 2024, 32, 106–117. [Google Scholar] [CrossRef]

- Khan, F. , Siddiqui, M. A., & Imtiaz, S. Role Of Financial Literacy In Achieving Financial Inclusion: A Review, Synthesis And Research Agenda. Cogent Business & Management 2022, 9, 2034236. [Google Scholar] [CrossRef]

- Khan, M.A. , Li, X., Lebaron-Black, A. B., & Serido, J. Socialización Financiera De Los Padres, Comportamientos Financieros Y Bienestar Entre Los Adultos Jóvenes De Hong Kong En Medio De La COVID-19. Relaciones Familiares 2023, 72, 2279–2296. [Google Scholar] [CrossRef]

- Kharel, K. R, Upadhyaya, Y.M., Acharya, B., Budhathoki, D.K., & Gyawali, A. Financial Literacy Among Management Students: Insights From Universities In Nepal. Knowledge And Performance Management 2024, 8, 63–73. [Google Scholar] [CrossRef]

- Kobsch, H. , Conrad, R., Goetze, M., Stricker, S. (2023). Digital Communication Strategies: The Impact Of Framing In Debt Collection Messages. In: Schmidt, C.M., Heinemann, S., Banholzer, V.M., Nielsen, M., Siems, F.U. (Eds) Soziale Themen In Unternehmens- Und Wirtschaftskommunikation. Europäische Kulturen In Der Wirtschaftskommunikation, Vol 35. Springer VS, Wiesbaden. [CrossRef]

- Leong, C. (2026). Navigating Sustainability In Digital Financial Services: Transforming The Future. In M. Ali, S. Raza, & C. Puah (Eds.), Emerging Trends And Innovations In Financial Services: A Futurology Perspective (Pp. 103-122). IGI Global Scientific Publishing. [CrossRef]

- López-Lapo, J.L. , Hernández Ocampo, S.E., Peláez Moreno, L.E., Sarmiento Castillo, G. Del P., Peña Vélez, M.J., Cueva Jiménez, N.C., & Sánchez Loor, J.P. Educación Financiera En América Latina. Ciencia Latina Revista Científica Multidisciplinar 2022, 6, 3810–3826. [Google Scholar] [CrossRef]

- López-Medina, T. , Mendoza-Ávila, I., Contreras-Barraza, N., Salazar-Sepúlveda, G., & Vega-Muñoz, A. (2022). Bibliometric Mapping Of Research Trends On Financial Behavior For Sustainability. Sustainability. [CrossRef]

- Lusardi, A. , & Mitchell, O. S. The Economic Importance Of Financial Literacy: Theory And Evidence. Journal Of Economic Literature 2014, 52, 5–44. [Google Scholar] [CrossRef]

- Lusardi, A. , & Tufano, P. Debt Literacy, Financial Experiences, And Overindebtedness. Journal Of Pension Economics & Finance 2015, 14, 332–368. [Google Scholar] [CrossRef]

- Mahendru, M. , Sharma, G.D., Hawkins, M. Toward A New Conceptualization Of Financial Well-Being. Journal Of Public Affairs 2022, 22, E2505. [Google Scholar] [CrossRef]

- Mancone, S. , Tosti, B., Corrado, S., Spica, G., Zanon, A., & Diotaiuti, P. Youth, Money, And Behavior: The Impact Of Financial Literacy Programs. Frontiers In Education 2024, 9, 1397060. [Google Scholar] [CrossRef]

- Masten, A.S. , Lucke, C.M., Nelson, K.M., & Stallworthy, I.C. Resilience In Development And Psychopathology: Multisystem Perspectives. Annual Review Of Clinical Psychology 2021, 17, 521–549. [Google Scholar] [CrossRef] [PubMed]

- Meier, S. , & Sprenger, C.D. Discounting Financial Literacy: Time Preferences And Participation In Financial Education Programs. Journal Of Economic Behavior & Organization 2013, 95, 159–174. [Google Scholar] [CrossRef]

- Menberu, A.W. Technology-Mediated Financial Education In Developing Countries: A Systematic Literature Review. Cogent Business & Management 2024, 11, 2294879. [Google Scholar] [CrossRef]

- Mihalcova, B. , Gallo, P., & Lukac, J. Management Of Innovations In Finance Education: Cluster Analysis For OECD Countries. Marketing And Management Of Innovations 2020, 1, 235–244. [Google Scholar] [CrossRef]

- Moazezi Khah Tehran, A. , Hassani, A. , Mohajer, S., Darvishan, S., Shafiesabet, A., & Tashakkori, A. The Impact Of Financial Literacy On Financial Behavior And Financial Resilience With The Mediating Role Of Financial Self-Efficacy. International Journal Of Industrial Engineering And Operational Research 2025, 7, 38–55. [Google Scholar] [CrossRef]

- Mouffe, C. Deliberative Democracy Or Agonistic Pluralism? Social Research 2000, 66, 745–758. [Google Scholar]

- Mungaray, A. , Gonzalez, N., & Osorio, G. Educación Financiera Y Su Efecto En El Ingreso En México. Problemas Del Desarrollo. Revista Latinoamericana De Economía 2021, 52, 55–78. [Google Scholar] [CrossRef]

- Murniawaty, I. , Sangadah, N., Pujiati, A., Prasetyo, P. E., & Suryanto, E. Does Peer Conformity Have Moderating Effects On University Students’ Consumptive Behavior? A Focus On Self-Concept, Economic Literacy, And E-Money Adoption. Innovative Marketing 2024, 20, 25–40. [Google Scholar] [CrossRef]

- Netemeyer, R.G. , Lynch, J.G., Lichtenstein, D.R., & Dobolyi, D. Financial Education Effects On Financial Behavior And Well-Being: The Mediating Roles Of Improved Objective And Subjective Financial Knowledge And Parallels In Physical Health. Journal Of Public Policy & Marketing 2024, 43, 254–275. [Google Scholar] [CrossRef]

- Noh, M. Effect Of Parental Financial Teaching On College Students’ Financial Attitude And Behavior: The Mediating Role Of Self-Esteem. Journal Of Business Research 2022, 143, 298–304. [Google Scholar] [CrossRef]

- Nourallah, M. , Chan, H.R., Chien, C.-L., & Öhman, P. Financial Capability, Behavior, Well-Being, And Stress Among Financial Advisors. Financial Planning Review 2025, 8, E70002. [Google Scholar] [CrossRef]

- Nussbaum, M. C. (2011). Creating Capabilities: The Human Development Approach.

- OECD. (2014). PISA 2012 Results: Financial Literacy Skills For The 21st Century.

- OECD. (2017). G20/OECD INFE Report On Adult Financial Literacy In G20 Countries.

- Pandey, A. , & Utkarsh. Determinants Of Positive Financial Behavior: A Parallel Mediation Model. International Journal Of Emerging Markets 2024, 19, 4073–4093. [Google Scholar] [CrossRef]

- Prakash, N. , & Hawaldar, A. Investigating The Determinants Of Financial Well-Being: A SEM Approach. Business Perspectives And Research 2024, 12, 11–25. [Google Scholar] [CrossRef]

- Pulungan, A.H. , Abdurrahman, D.A., Canara, B., & Ramadhan, R. The Impact Of Parental Financial Teaching On University Students’ Financial Attitudes: The Mediating Role Of Self-Control. Jurnal Pendidikan Bisnis Dan Manajemen 2024, 10, 43–57. [Google Scholar] [CrossRef]

- Quibra, R.K. Financial Knowledge, Behavior, And Attitude On The Financial Well-Being Of The Sustainable Livelihood Program Associations. Revista De Gestão - RGSA 2024, 18, E06225. [Google Scholar] [CrossRef]

- Ramon-Arteaga, B. D. , & Malla-Alvarado, F. Y. Incidencia De La Educación Financiera En Los Comerciantes Del Centro De Transferencia Comercial Mayorista Puerto Seco. Ciencia Latina Revista Científica Multidisciplinar 2022, 6, 4178–4200. [Google Scholar] [CrossRef]

- Rani, R. , (2023). The Impact Of Financial Literacy On Financial Well-Being: The Meditational Role Of Personal Finance Management, 6th International Conference On Contemporary Computing And Informatics (IC3I), Gautam Buddha Nagar, India, 2023, Pp. 2350-2355. [CrossRef]

- Riitsalu, L. , Sulg, R., Lindal, H., Remmik, M., & Vain, K. From Security To Freedom— The Meaning Of Financial Well-Being Changes With Age. Journal Of Family And Economic Issues. [CrossRef]

- Rodríguez, V. , Vílchez, P.A., Oscanoa, B.F., & Barrantes, A.M. Educación Financiera Con Enfoque Conductual Y Mitigación De Sesgos En Decisiones Crediticias. Revista Venezolana De Gerencia 2024, 29, 1560–1578. [Google Scholar] [CrossRef]

- Rubio, J. , & León, M. Financial Inclusion As A Pathway To Poverty Alleviation And Equality In Latin America: An Empirical Analysis. Journal Of Risk And Financial Management 2025, 18, 392. [Google Scholar] [CrossRef]

- Sangeeta, Aggarwal P. K., Sangal A. Determinants Of Financial Literacy And Its Influence On Financial Wellbeing — A Study Of The Young Population In Haryana, India. Finance: Theory And Practice 2022, 26, 121–131. [Google Scholar] [CrossRef]

- Sconti, A. , Caserta, M., & Ferrante, L. Gen Z And Financial Education: Evidence From A Randomized Control Trial In The South Of Italy. Journal Of Behavioral And Experimental Economics 2024, 112, 102256. [Google Scholar] [CrossRef]

- Sen, A. (1999). Development As Freedom.

- She, L. , Ma, L., Pahlevan Sharif, S., & Karim, S. Millennials’ Financial Behaviour And Financial Well-Being: The Moderating Role Of Future Orientation. Journal Of Financial Services Marketing 2024, 29, 1207–1224. [Google Scholar] [CrossRef]

- Spivak, I. , Mihus, I., & Greben, S. Financial Literacy And Government Policies: An International Study. Public Administration And Law Review 2024, 2, 21–33. [Google Scholar] [CrossRef]

- Tan, X. , Xiao, J.J., Meng, K., Xu, J. Financial Education And Budgeting Behavior Among College Students: Extending The Theory Of Planned Behavior. International Journal Of Bank Marketing 2025, 43, 506–521. [Google Scholar] [CrossRef]

- Tang, N. , & Baker, A. Self-Esteem, Financial Knowledge And Financial Behavior. Journal Of Economic Psychology 2016, 54, 164–176. [Google Scholar] [CrossRef]

- Tiananta, S. A. M. L. , & Anwar, M. Lifestyle Mediates Financial Attitudes And Self-Concept In Student Consumption. Academia Open 2025, 10, 11237. [Google Scholar] [CrossRef]

- Vieira, K.M. , Delanoy, M.M., Potrich, A.C.G., & Bressan, A.A. Financial Citizenship Perception (FCP) Scale: Proposition And Validation Of A Measure. International Journal Of Bank Marketing 2021, 39, 127–146. [Google Scholar] [CrossRef]

- Vieira, K.M. , Potrich, A.C.G., Matheis, T.K., & De Carvalho Puhle, M. Perception Of Financial Freedom: Is Financial Literacy A Relevant Background? International Review Of Economics 2025, 72, 13. [Google Scholar] [CrossRef]

- World Bank Group. (2013). Global Financial Development Report 2014: Financial Inclusion (Vol. 2). Washington, DC: World Bank Publications.

- Zelenova, K. , Raine, B., Chen, R., Williams, R.E., Davis, A.E., Loree, T., Burke, M., Nagai, M., & Frey, J. Twelve Steps To Financial Freedom For Plastic Surgeons. Plastic And Reconstructive Surgery. Global Open 2023, 11, E4990. [Google Scholar] [CrossRef]

- Zhang, Y. , & Chatterjee, S. Financial Well-Being In The United States: The Roles Of Financial Literacy And Financial Stress. Sustainability 2023, 15, 4505. [Google Scholar] [CrossRef]

- Zhu, A.Y.F. Upgrading Financial Education By Adding Python-Based Personalized Financial Projection: A Randomized Control Trial. British Journal Of Educational Technology 2024, 55, 731–750. [Google Scholar] [CrossRef]

- Zhu, T. , & Xiao, J. J. Consumer Financial Education And Risky Financial Asset Holding In China. International Journal Of Consumer Studies 2022, 46, 56–74. [Google Scholar] [CrossRef]

| Apartado | Ideas Clave | Referencias Principales | Transición Evolutiva |

| 2.1 Financial Education As A Transformative Asset | From A Technical Vision To A Comprehensive Vision. Competencies: Knowledge, Skills, Attitudes, And Behaviors. Gaps In Latin America: Low Literacy Levels, Inequality, And Exclusion. Financial Education As Inclusion And Social Justice. |

Atkinson & Messy (2012, 2013); OECD (2014); Aydin & Selcuk (2019); Zhu & Xiao (2022); De Beckker Et Al. (2019); Mungaray Et Al. (2021); Asiah Et Al. (2024); Pulungan Et Al. (2024); Barua Et Al. (2018); Quibra, (2024). | It Paves The Way For Understanding That Technical Knowledge Is Not Enough: Psychological And Emotional Factors Must Also Be Integrated. |

| 2.2 Mindset And Psychology Of Money | Psychological, Emotional, And Social Factors Influence Decisions. Cognitive Biases And Limiting Beliefs. Dimensions: Reprogramming Beliefs, Economic Self-Concept, Financial Self-Education. Impact On Young People And Generational Differences. |

Khan Et Al. (2023); Noh (2022); Bai (2023); Asiah Et Al. (2024); Pandey & Utkarsh (2024); Quibra, (2024); Gutiérrez-Andrade & Delgadillo-Sánchez (2018); Abdul & Akhtar (2024); (Pandey & Utkarsh, (2024); Duhigg (2012); Vieira Et Al. (2021); Lusardi & Tufano (2015); Kharel Et Al. (2024); Pulungan Et Al. (2024). |

Leads To Concrete Practices: How These Beliefs And Attitudes Are Reflected In Saving, Investing, And Resource Management. |

| 2.3 Smart Saving And Investing | Systematic Saving As The Basis For Stability. Investment As Financial Maturity: Risk, Knowledge, And Opportunity. Principle Of The “Circle Of Competence.” Digital Risks: Speculation, Fraud, Overexposure To Networks. Sustainable And Ethical Finance. |

Ramon-Arteaga & Malla-Alvarado (2022); Zhang, & Chatterjee (2023); Pulungan Et Al. (2024); Zelenova Et Al. (2023); Leong (2026); Mihalcova Et Al. (2020); Asiah Et Al. (2024); Zelenova Et Al. (2023). | Opens Up The Discussion On How Resource Management Is Conditioned By Debt And How This Can Be An Obstacle Or Lever Toward Financial Freedom. |

| 2.4 Debt And Financial Freedom | Debt As An Obstacle When Managed Without Planning. Debt As A Leverage Tool If Used Strategically. Financial Freedom As A Comprehensive And Evolving Process. Psychological Well-Being And Social Justice. Financial Citizenship As A Right. |

Ramon-Arteaga & Malla-Alvarado (2022); Cao-Alvira Et Al. (2021); Zhang & Chatterjee (2023); Herrero Et Al. (2025); Asiah Et Al. (2024); Pulungan Et Al. (2024); Brüggen Et Al. (2017); Álvarez-Avad Et Al. (2022); Tang & Baker (2016); Vieira Et Al. (2021); Sangeeta Et Al. (2022); Bustamante & Cabrera (2017); López-Medina Et Al. (2022); (Herrero Et Al. (2025); Zhang & Chatterjee (2023); Nussbaum (2011); Nourallah Et Al. (2025). |

Looks Ahead To Future Scenarios: How Financial Education Must Adapt To Digitalization, Inequality, And Sustainability. |

| 2.5 New Scenarios: Financial Education For The Future | Challenges Of Digitalization, Fintech, And Inequality. Limitations Of Traditional Programs. Transdisciplinary Approach: Sustainability, Innovation, Consumer Ethics. Financial Education As A Citizen's Right And Public Policy. Digital Self-Education And Economic Resilience. |

Zhu (2024); Mihalcova Et Al. (2020); Zelenova Et Al. (2023); Ramon-Arteaga & Malla-Alvarado (2022); Gallo & Sconti (2024); Vieira Et Al. (2025); World Bank Group (2013); Espino-Barranco (2021); López-Lapo Et Al. (2022). | Close The Flow By Showing The Need To Reinvent Financial Education As A Tool For Personal Transformation, Economic Justice, And Social Sustainability. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).