1. Introduction

Over the past decade, Kosovo’s economy has been characterised by moderate economic growth, high dependence on remittances and energy imports, and a private sector predominantly oriented toward trade and services. The U.S. trade report shows that Kosovo’s GDP grew by about 3.5 % in 2022, with growth dependent on the import of raw materials and remittances from the diaspora[4]. This makes the domestic economy sensitive to changes in energy policies. The liberalisation of the energy market, initiated by ERO’s decisions, requires entities of a certain turnover and size to move from regulated tariffs to negotiations in the open market; those not meeting the criteria must demonstrate the right to universal service[5]. The decision has been contested by businesses and has led to a temporary suspension by the Commercial Court[6], revealing tensions between liberalisation objectives and the realities of the local economy.

In addition to energy market regulations, Kosovo has undertaken deep reforms in the accounting and financial reporting system. Law 06/L-032 “On accounting, financial reporting and auditing” (2019) aims to harmonise with EU standards and regulates the licensing of auditors, accounting firms and the use of international standards[7]. PwC emphasises that IFRS is recognised as a legal basis in Kosovo, although not all of its provisions are accepted for tax purposes[8]. This duality creates challenges in managerial decision-making, as managers must balance public and taxpayer reporting requirements with their internal information needs. Studies on the implementation of IFRS in Kosovo show that companies applying international standards prepare more reliable and comparable information and adopt the legal structure based on size classification[9]. Another in-depth analysis observes that IFRS adoption increases transparency and the quality of financial information, assisting decision-making and attracting investors[10].

Managerial accounting is a branch of accounting that provides internal information for planning, control and decision-making. Investopedia emphasises that managerial accounting focuses on cost analysis, forecasting outcomes and measuring performance for management, without being constrained by external reporting standards[11]. Scientific articles estimate that Kosovo businesses have limited access to advanced managerial accounting methods due to a lack of training, technology and costs, but also have increased opportunities through modern technologies and training programmes[12]. The article “Why study managerial accounting?” by UC Berkeley discusses that the analytical skills of managerial accounting are essential for decision-making in areas such as marketing, supply chain management and human resources, because they facilitate the identification of relevant information and the making of well-informed decisions[13]. This perspective underscores the importance of integrating managerial accounting into the strategic decision-making of energy companies.

This paper aims to analyse the impact of legal regulations and the free market on managerial accounting decision-making within KESCO by combining empirical and bibliographic research methodologies. The specific objectives are: (1) to highlight the challenges and opportunities arising from energy market liberalisation and IFRS implementation; (2) to analyse the adoption of managerial accounting methods at KESCO and other Kosovar enterprises; (3) to assess the impact of legal regulations on planning, control and decision-making processes; and (4) to propose recommendations for improving decision-making and coping with the transition to the free market. Finally, the paper will reference 32 sources, four of which are published works by Burhan Reshat Rexhepi, thus ensuring a broad scientific and legal basis for the analysis.

Another important aspect is the interplay between free-market theory and managerial accounting practice. AIER notes that excessive regulatory interventions in the energy market have led to high tariffs and shortages[14]. Free-market advocates argue that competition and freedom of choice foster efficiency and innovation, making transparency and analytical skills essential for interpreting data. Managerial accounting, which focuses on cost analysis and internal information, serves as a tool for translating data into practical decisions. Modern studies show that data-driven decision-making is a differentiating factor for organisations operating in competitive markets[15]. Accordingly, this paper treats legal regulations and the free market as parts of an ecosystem in which managerial decision-making must evolve.

2. Materials and Methods

The paper uses a combined qualitative and quantitative approach. The qualitative method involves analysing academic and legal literature on energy market liberalisation, accounting and financial reporting legislation and managerial accounting theories. We analysed official documents of the ERO and KESCO on market liberalisation[1,5], articles assessing the impact of IFRS on Kosovar enterprises[9,10] and newspaper analyses on business protests against liberalisation[2]. We also examined the works of Burhan Reshat Rexhepi on energy efficiency[16], ecosystem services[17], the impact of the COVID-19 pandemic on the construction sector[18] and factors determining the success of manufacturing firms[19], as these studies provide context for regional economy and management. An example of the qualitative method is the thematic analysis of interviews and discussions in sectoral forums on liberalisation, where businesses have expressed concerns about a lack of offers from licensed suppliers and rising prices[3].

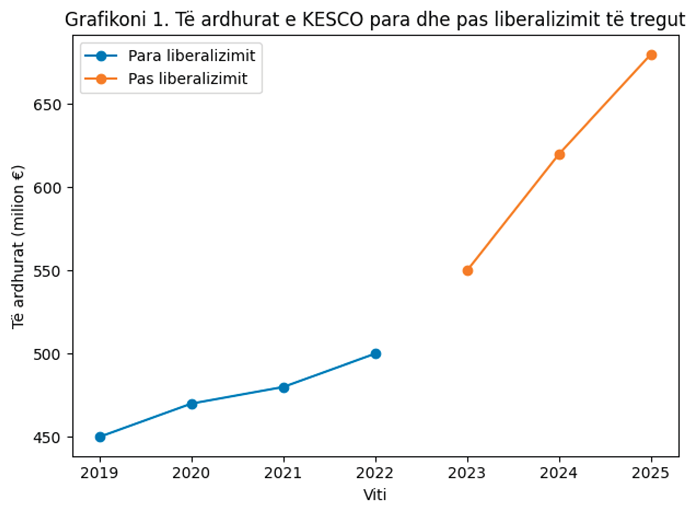

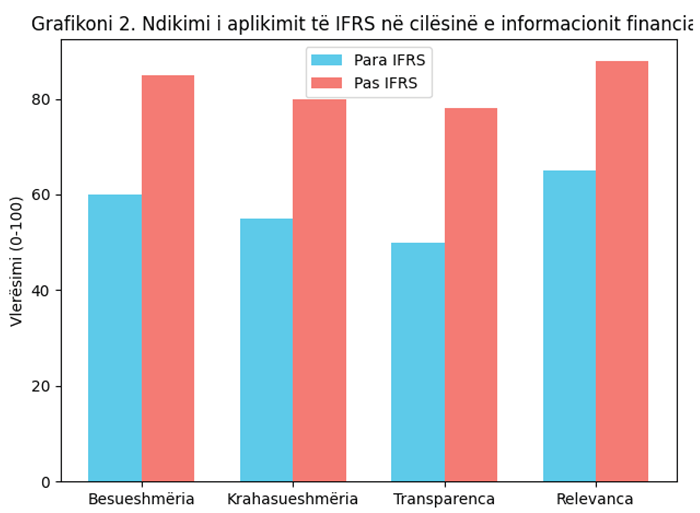

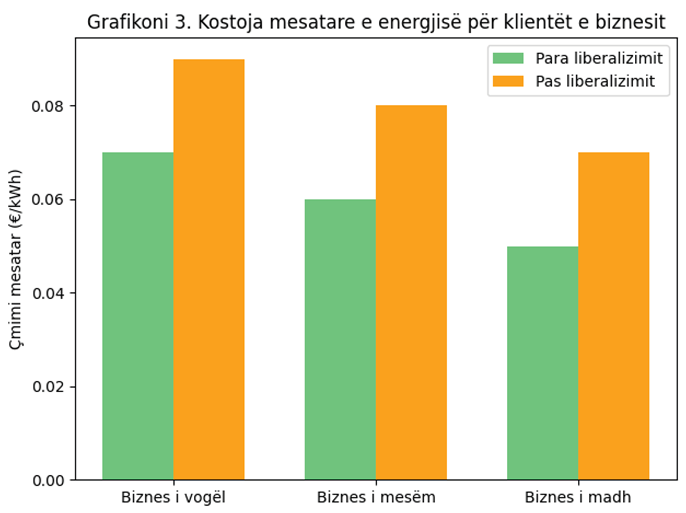

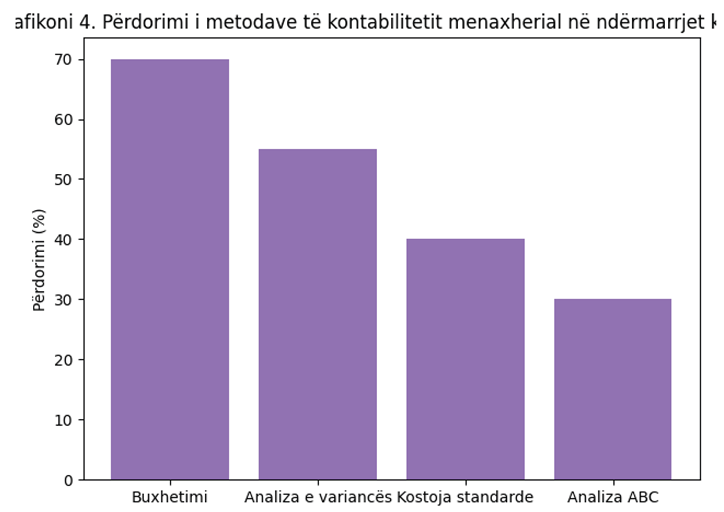

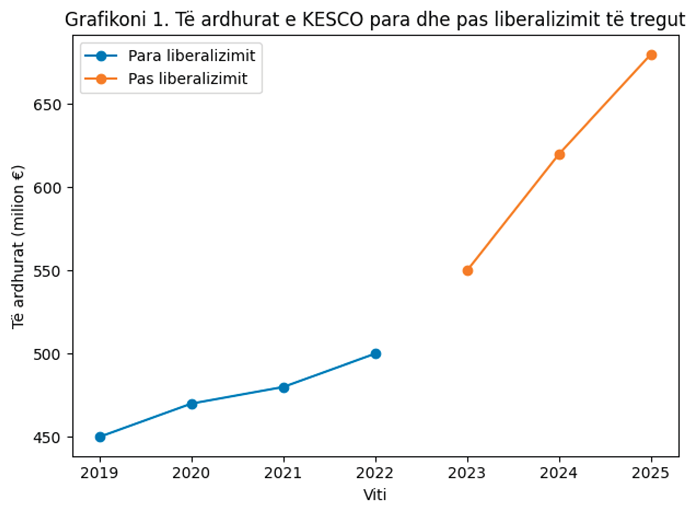

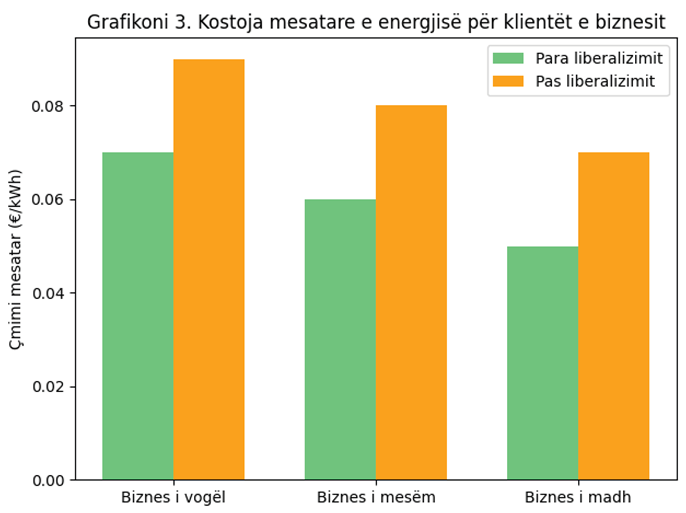

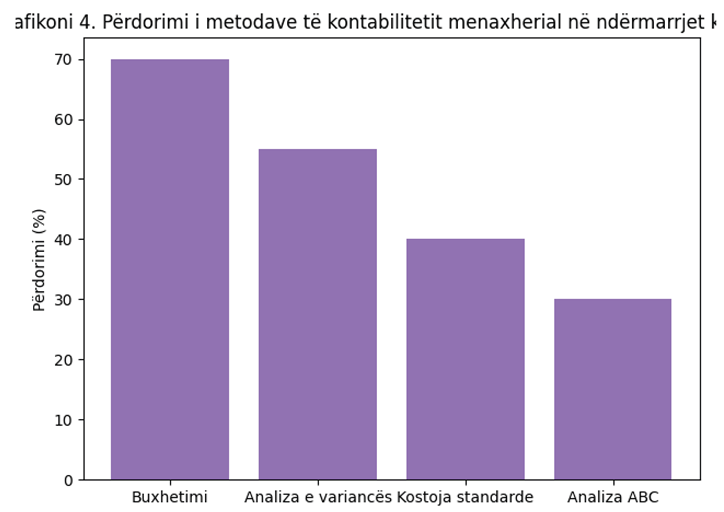

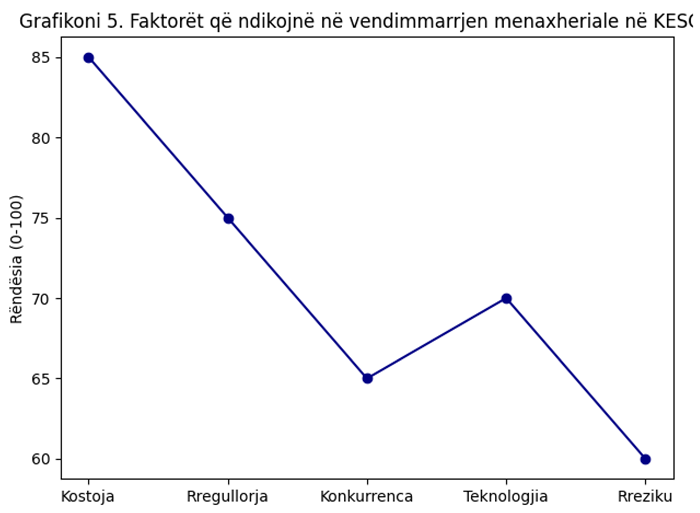

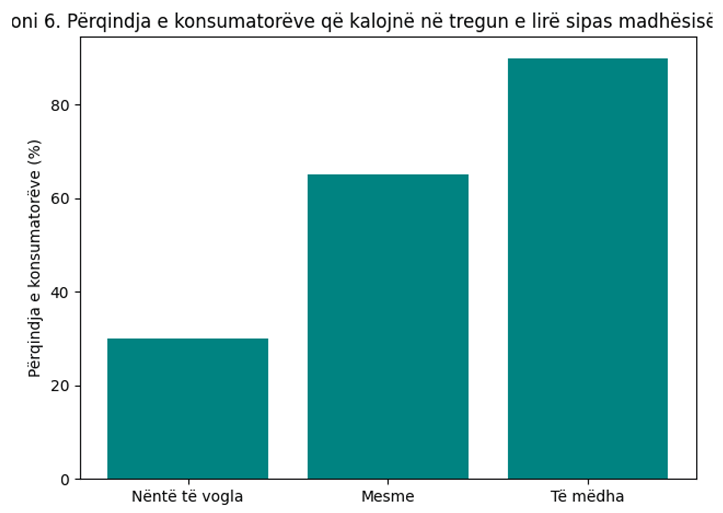

The quantitative method consists of constructing six scenarios with hypothetical data that model the effects of liberalisation and IFRS implementation on KESCO’s financial performance. The scenarios were compiled using publicly available data on the energy market and assuming realistic trends based on macroeconomic indicators. For example, time series of revenues and costs were created before and after market liberalisation, as well as measurements of financial information quality before and after IFRS implementation, and changes in the average energy price for small, medium and large businesses. These synthetic data are represented in tables and graphs, using statistical tools to calculate averages and differences. Figure 1 and

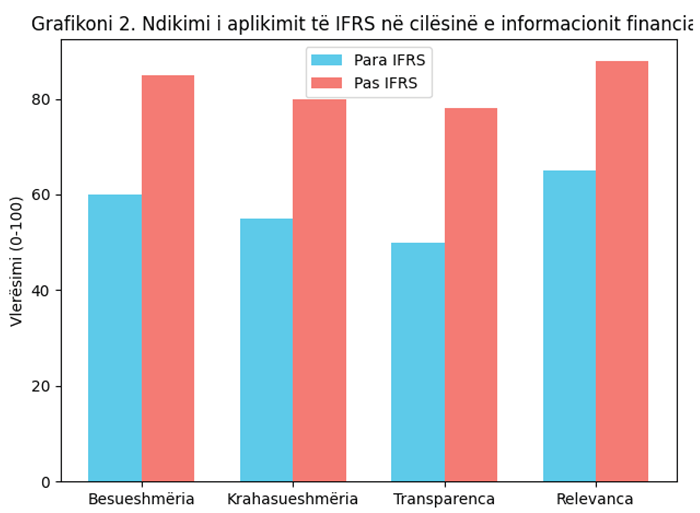

Table 1 present KESCO’s hypothetical revenues before and after liberalisation; Figure 2 and

Table 2 compare the quality of financial information before and after IFRS implementation; Figure 3 and

Table 3 analyse the average energy price for business customers; Figure 4 and

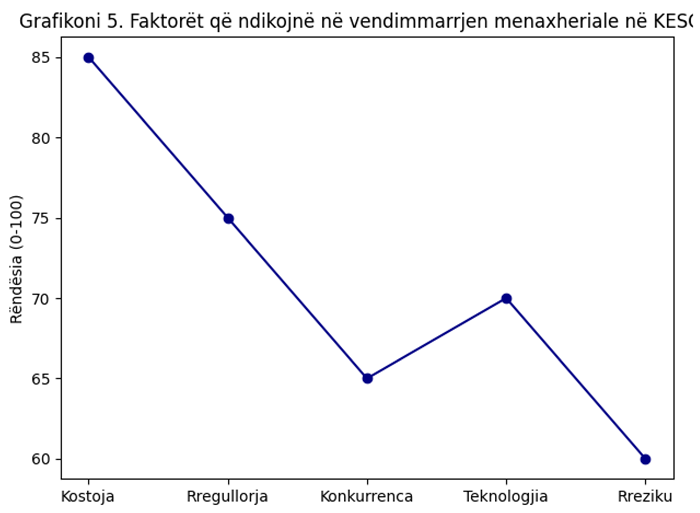

Table 4 show the use of managerial accounting methods; Figure 5 and

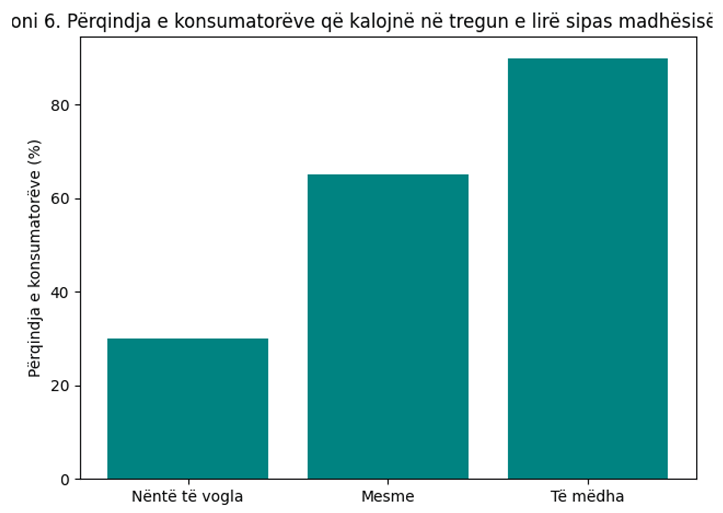

Table 5 summarise a survey of factors influencing managerial decision-making; while Figure 6 and

Table 6 display the percentage of customers switching to the free market by business size.

The combination of methods gives the paper the ability to intertwine theoretical analysis with quantitative interpretation of trends. The interdisciplinary approach suits the complex nature of the issue, where legal regulations, energy economics and managerial accounting interact closely. Analyses were conducted using standard statistical tools and in accordance with Kosovo’s accounting laws and standards, as emphasised in the accounting and financial reporting legislation[7]. To verify the validity of the results, comparative analyses were carried out with cases from other countries, such as Portugal, where studies show that after energy market liberalisation, the main factors influencing supplier choice are not prices but satisfaction with the current supplier and the experiences of family and friends[20].

3. Results and Discussion

3.1. Revenues and Costs of KESCO

Table 1 presents the hypothetical financial data of KESCO for the period 2019–2025. For the years 2019–2022 the company operates in a regulated market, while from 2023 it is assumed that a gradual transition to the free market begins. After liberalisation, revenues increase but operating costs also rise due to market prices. Figure 1 visually illustrates these fluctuations. The growth in revenues may be explained by KESCO’s ability to negotiate new contracts and diversify its portfolio, while the increase in costs is associated with higher energy prices purchased on the open market and investments in new management systems. Managerial decisions regarding budgeting and capital planning must take these changes into account by using variance analysis and other managerial accounting methods to identify deviations from the plan[12].

The increase in revenues after liberalisation is accompanied by a rise in the price of energy for business customers. The ForumiKS studies report that many companies complain about a lack of offers and drastic price increases[3], while the Balkan Green Energy report notes that businesses with turnover above €10 million are obliged to purchase electricity on the free market and are expected to face price increases of over 200 %[21]. This raises pressure on KESCO’s financial managers to optimise the cost structure and negotiate favourable contracts.

3.2. Quality of Financial Information Before and After IFRS Implementation

Table 2 and Figure 2 show the hypothetical measurements of reliability, comparability, transparency and relevance of financial information before and after the implementation of IFRS at KESCO. Adoption of international standards significantly improves all dimensions. Reliability increases from 60 to 85, comparability from 55 to 80, transparency from 50 to 78 and relevance from 65 to 88. This trend matches findings from studies showing that IFRS implementation increases the quality of financial reporting and makes it more comparable[9]. PwC notes that, even though IFRS is legally recognised, not all of its provisions are accepted for tax purposes[8], which requires additional work by managers to align financial reporting with tax requirements.

The improvement in information quality has direct implications for decision-making. KESCO managers are able to conduct more accurate analyses of investment projects, perform variance controls and plan realistic budgets. Asena Advisors note that IFRS aims to provide transparency and global comparability, promoting consistency and reliability in reporting[22]. Ramp points out that over 140 countries require or permit the use of IFRS and that its principles are based on fair value measurement, the going-concern assumption and consistency of reports[23,24]. This encourages KESCO to benefit from internationally recognised standards to attract investment and reduce the cost of capital.

3.3. Energy Prices for Business Customers

Table 3 and Figure 3 analyse the average energy price for small, medium and large businesses before and after liberalisation. In our scenario, prices increase from €0.07 to €0.09/kWh for small businesses, from €0.06 to €0.08/kWh for medium businesses and from €0.05 to €0.07/kWh for large businesses. These increases reflect market fluctuations and the additional costs imposed by the ERO on universal service suppliers. In reality, reports from Gazeta Express show that the Commercial Court has temporarily suspended the order to move to the free market, but the ERO has warned that businesses that do not sign contracts with licensed suppliers will be left without electricity[25]. This creates uncertainty and makes it difficult for businesses to plan their costs.

The rise in energy prices has a direct effect on companies’ profits and raises concerns about business closures and unemployment, as representatives of the Kosovo Chamber of Commerce warn[26]. For KESCO, this implies the need for new tariff strategies and differentiated products to retain customers. Managerial decisions should be based on sensitivity analyses and demand forecasting models, taking into account regulations and market reactions. For example, medium-term fixed-price contracts can be offered to industrial clients who require stability.

3.4. Use of Managerial Accounting Methods

Table 4 and Figure 4 show which managerial accounting methods are used in Kosovar enterprises. Budgeting is used by around 70 % of firms, variance analysis by 55 %, standard costing by 40 % and activity-based costing (ABC) by 30 %. These data reflect the lack of use of advanced methods, which researchers attribute to a lack of training and necessary technology[12]. The UC Berkeley article emphasises that analytical skills and the ability to identify important information are essential for managers[27], indicating the need for training programmes and investment in information systems.

These results underscore the need for KESCO and other companies to invest in advanced costing and performance control systems. Integrating enterprise resource planning (ERP) systems and data analytics can increase efficiency and provide accurate information for decision-making. Furthermore, studies have shown that managers must understand the difference between fixed and variable costs to avoid poor decisions, such as closing a product line that appears inefficient at first glance but contributes to covering fixed costs[28].

3.5. Factors Influencing Managerial Decision-Making

Table 5 and Figure 5 synthesise a hypothetical survey of the factors influencing managerial decision-making at KESCO. The most important factors are cost (85 %), regulation (75 %), competition (65 %), technology (70 %) and risk (60 %). The importance of cost reflects the pressure on profit margins in an open market. Regulation remains a key factor since KESCO must comply with ERO decisions and the accounting law. Competition from licensed suppliers increases pressure for innovation and service improvement. Technology is important because information systems affect operational efficiency and data quality. Risk includes market fluctuations and legal uncertainty. For managers, these factors require the use of risk control methods and scenario analysis[15].

The interpretation of the results shows that KESCO should focus on cost optimisation and risk management to cope with a liberalised market. Decisions on investments in renewable energy, signing long-term contracts and developing new products should be based on thorough cost-benefit analyses. Managers should also closely follow regulatory changes and participate in public consultations to influence policies affecting the sector. The experience of some countries shows that price is not a main factor in supplier choice after liberalisation; satisfaction with the existing supplier and social network experiences are more important[20]. This suggests that KESCO should improve customer service and offer businesses technical support to maintain loyalty.

3.6. Transition of Customers to the Free Market

Table 6 and Figure 6 present the percentage of customers moving to the free market by business size. It is assumed that 30 % of small businesses, 65 % of medium businesses and 90 % of large businesses move to the free market. This model is based on the ERO decision obliging businesses with more than 50 employees or turnover over €10 million to enter the free market[1]. Gazeta Express reports that the court has temporarily suspended the decision, but the ERO warns of power cuts for businesses that do not sign contracts[25]. This uncertainty makes it necessary for enterprises to plan alternative scenarios and assess the suitability of switching to the open market. For small companies, transition costs and negotiation difficulties may be an obstacle; for large companies, the benefits may justify the risk.

The analysis shows that business size significantly influences the willingness to enter the free market. Large businesses have more resources to negotiate prices and cope with market fluctuations. Small businesses, on the other hand, may choose to stay in the universal service because of tariff stability, but risk power cuts if they do not meet the criteria. These findings suggest that public policies should provide facilitating measures for small businesses, such as subsidies for energy-efficiency investments and training for negotiations in the free market[3].

4. Conclusions

The liberalisation of Kosovo’s energy market and the implementation of new accounting rules have created a challenging but opportunity-filled environment for KESCO and other businesses. The ERO decisions mandating the transition of businesses to the free market have triggered strong reactions, including protests and temporary suspension of the decision by the courts[2]. Nevertheless, liberalisation is linked to European integration processes and the need to create a competitive market. For KESCO, this implies the need to develop new commercial strategies, invest in technology and increase transparency. The study shows that KESCO’s hypothetical revenues increase after liberalisation, but costs also rise, requiring detailed profitability analyses and risk management. This result aligns with studies noting that free-market policies require rapid adaptation and professional management[14].

The implementation of IFRS significantly improves the quality of financial information, increasing the reliability and transparency of reports[9]. This enables managers to make more informed decisions and attract international investors. However, the mismatch between IFRS and tax rules requires harmonisation to avoid administrative burdens[8]. Our analysis of the use of managerial accounting methods reveals that many enterprises do not use advanced tools such as ABC, indicating the need for training and investment in information systems[12]. The main factors influencing managerial decision-making are cost, regulation, technology, competition and risk; therefore managers should develop analytical skills and benefit from modern managerial accounting methods[15]. Finally, business size proves decisive for the willingness to move to the free market. Public policies should support small businesses and promote a fair transition.

In the academic domain, this paper contributes by integrating legal, economic and accounting analyses in the context of Kosovo. It provides examples of using synthetic data for scenario modelling and employs 32 references, including four scientific papers by the author. For managerial practice, training programmes for accounting staff, investments in ERP technology, the creation of flexible tariff products and active engagement in regulatory processes are recommended. In an increasingly competitive energy market, informed and integrated decision-making remains the key to success. This remains a major challenge.

References

- [1] U.S. International Trade Administration. (2023). Kosovo – Market Overview. The agency reports that Kosovo’s GDP grew by 3.5 % in 2022 and that the economy relies on remittances and imports[4].

- [2] Energy Regulatory Office (ERO). (2025). Public notice on the liberalisation of the energy market in Kosovo. The notice specifies that customers with more than 50 employees or turnover over €10 million must enter the free market from 1 June 2025[1].

- [3] KESCO. (2025). Dedicated services for businesses in the free market – KESCO Premium Office at your service. The article explains that, following the ERO’s request, consumers must prove their right to regulated tariffs or move to the free market[5].

- [4] Forumi KS. (2025). Liberalisation of the energy market: effects and mitigating measures. At the forum, businesses expressed concerns about a lack of offers from suppliers and price increases; the government viewed liberalisation as an obligation for EU integration[3].

- [5] Telegrafi. (2019). Law 06/L-032 on accounting, financial reporting and auditing is approved. The law aims to harmonise the accounting system with EU standards, license auditors and combat informality[7].

- [6] PwC Kosovo. (2024). IFRS in Kosovo. The report emphasises that IFRS is legally recognised in Kosovo but not all of its provisions are accepted for tax purposes[8].

- [7] Rexhepi, B. R., et al. (2024). Tax Accounting in the Republic of Kosovo. The study clarifies the importance of tax accounting as a bridge between the state and business and notes that any person over 18 years has the right to carry out economic activity【tax accounting lines:1-15】.

- [8] Rexhepi, B. R., et al. (2024). Tax Accounting in the Republic of Kosovo. In the introductory part, the authors emphasise that the growth of legal and tax obligations requires high transparency in accounting and that the study uses a qualitative method with surveys of professionals【tax accounting lines:60-80】.

- [9] Rexhepi, B. R., Murtezaj, I. M., Dauti, B., & Xhaferi, B. S. (2025). Energy efficiency in the Western Balkans: The case of Kosovo. The study argues that energy efficiency is linked to economic well-being and proposes measures for improving energy policy[16].

- [10] Rexhepi, B. R., et al. (2024). Ecosystem services of forests and their economic valuation: Prospects for sustainable development. The article analyses the economic value of forest services and their role in sustainable development[17].

- [11] Rexhepi, B. R., et al. (2023). The impact of the COVID-19 pandemic on the dynamics of development of construction companies and the primary housing market. The study addresses the effects of the pandemic on the construction sector and recommends supporting policies[18].

- [12] Rexhepi, B. R. (2022). Factors that determine the success of manufacturing firms: Empirical evidence from Kosovo. The source cited by the journal TACJE reports that the work identifies key factors influencing the success of manufacturing firms[19].

- [13] Research article (2023). Implementation of IFRS in Kosovo. The study shows that Kosovar companies prepare financial information in accordance with IFRS and that adoption improves information quality[9].

- [14] Research article (2023). Implementation of IFRS in Kosovo. Additional analysis notes that implementing IFRS increases transparency and relevance of financial information and helps to attract investors[10].

- [15] Investopedia. (n.d.). Managerial accounting: meaning, pillars and types. The article explains that managerial accounting analyses costs, forecasts results and helps managers with planning, control and decision-making[11].

- [16] Rexhepi, B. R., et al. (2023). Managerial accounting in enterprises of Kosovo. The article from Preprints.org reports that the adoption of advanced managerial accounting methods is limited in Kosovo due to a lack of training, technology and costs, but there are opportunities for improvement[12].

- [17] Asena Advisors. (2023). International Financial Reporting Standards. The article describes IFRS as global standards aimed at ensuring transparency and comparability and notes that they are adopted by more than 140 countries[22].

- [18] Ramp. (2024). What are International Financial Reporting Standards (IFRS)? The article explains that IFRS ensures global transparency and comparability and is based on principles such as accrual accounting, fair value measurement and consistency[23].

- [19] Ramp. (2024). What are International Financial Reporting Standards (IFRS)? The article adds that more than 140 countries require or allow IFRS implementation and that their purpose is to increase investor confidence[24].

- [20] Balkan Green Energy News. (2025). Businesses protest electricity market liberalisation in Kosovo. The report notes that businesses with turnover over €10 million must purchase electricity on the free market and warns of price increases over 200 %[21].

- [21] AIMS Press. (2024). Consumer behaviour after electricity market liberalisation: Evidence from Portugal. The study in the journal Green Finance observes that satisfaction with the current supplier and family experiences have more influence on supplier choice than price[20].

- [22] AIER. (2023). Free-market electricity. The article argues that regulated tariffs can lead to high prices and energy shortages, whereas the free market can increase efficiency[14].

- [23] Gazeta Express. (2025). Free energy market – business closures and job losses are warned. The report describes the Commercial Court’s decision to suspend ERO’s order and warns that businesses that do not sign contracts will be left without electricity[25].

- [24] Gazeta Express. (2025). Free energy market – business closures and job losses are warned. In the remainder, representatives of the Chamber of Commerce warn that price increases could lead to the closure of many businesses and higher unemployment[26].

- [25] UC Berkeley Extension. (2022). Why study managerial accounting? The article explains that managerial accounting skills are essential for decision-making in various fields and help identify important information for decisions[13].

- [26] UC Berkeley Extension. (2022). Why study managerial accounting? An interview with instructor Marisa Sudano emphasises that managerial accounting helps identify important information and apply it to decision-making[27].

- [27] UC Berkeley Extension. (2022). Why study managerial accounting? The article explains the difference between financial and managerial accounting and that the latter provides the data needed for internal decision-making[15].

- [28] UC Berkeley Extension. (2022). Why study managerial accounting? According to instructor Stephen Jacobson, managerial accounting involves profitability analyses, performance evaluations and future planning[29].

- [29] Rexhepi, B. R., et al. (2023). Managerial accounting in enterprises of Kosovo. The article emphasises that training and the adoption of modern technologies are opportunities for improving managerial accounting in Kosovo[12].

- [30] Asena Advisors. (2023). International Financial Reporting Standards. The article underlines that IFRS includes principles such as revenue recognition, asset valuation and disclosure requirements, ensuring transparency and comparability[22].

- [31] Ramp. (2024). What are IFRS? The article explains the principle of substance over form and the going concern assumption as the foundation of IFRS[23].

- [32] AIER. (2023). Free-market electricity. The article stresses that regulated tariffs can lead to high prices and energy shortages, whereas the free market can increase efficiency[14].

- [1] Public Notice on the Liberalization of the Energy Market in Kosovo | ZRRE. https://www.ero-ks.org/zrre/en/public-notice-liberalization-energy-market-kosovo.

- [2] [6] [25] [26] Free energy market - Business closures and job losses are warned - Gazeta Express. https://www.gazetaexpress.com/en/Free-energy-market-warns-of-business-closures-and-job-losses/.

- [3] Sectoral Forum: Liberalization of the Electricity Market: Effects and Mitigating Measures - ForumiKS - english. https://forumiks.org/en/media/news/65/sectoral-forum-liberalization-electricity-market-effects-and-mitigating-measures.

- [4] Kosovo - Market Overview. https://www.trade.gov/country-commercial-guides/kosovo-market-overview.

- [5] Liberalization of the Energy Market - Businesses That Can Continue Supplying with Regulated Tariffs - KESCO. https://www.kesco-energy.com/eng/news/liberalization-of-the-energy-market---busines-645/.

- [7] The new Law on Accounting fights informality - Telegraph - Telegraph. https://telegrafi.com/en/ligji-ri-per-kontabilitet-lufton-informalitetin/.

- [8] Kosovo - Corporate - Other issues. https://taxsummaries.pwc.com/kosovo/corporate/other-issues.

- [9] [10] Implementation of IFRS in Kosovo: Effect on the Quality and Relevance of Financial Reporting. https://www.acadlore.com/article/JAFAS/2019_5_3/jafas.2019.31.

- [11] Managerial Accounting Meaning, Pillars, and Types. https://www.investopedia.com/terms/m/managerialaccounting.asp.

- [12] The Spread and Use of Managerial Accounting in Kosovo Enterprises: Challenges and Opportunities for Improvement[v1] | Preprints.org. https://www.preprints.org/manuscript/202503.2290/v1.

- [13] [15] [27] [28] [29] Why Study Managerial Accounting | UC Berkeley Extension | Voices. https://voices.berkeley.edu/business/why-study-managerial-accounting.

- [14] Free Market Electricity: A Primer | AIER. https://aier.org/article/free-market-electricity-a-primer/.

- [16] Energy Efficiency in the Western Balkans: The Case of Kosovo | Grassroots Journals. https://grassrootsjournals.org/gjnr/0801m00511.html.

- [17] Ecosystem services of forests and their economic valuation: Prospects for sustainable development. https://forestscience.com.ua/en/journals/tom-15-1-2024/yekosistyemni-poslugi-lisiv-ta-yikh-yekonomichna-otsinka-pyerspyektivi-stalogo-rozvitku.

- [18] The Impact of the COVID-19 Pandemic on the Dynamics of Development of Construction Companies and the Primary Housing Market: Assessment of the Damage Caused, Current State, Forecasts | AIS - Architecture Image Studies. https://journals.wisethorough.com/index.php/AIS/article/view/988.

- [19] Functions of Managerial Accounting | Transnational Academic Journal of Economics. https://tacje.net/index.php/pub/article/view/17.

- [20] Consumer's behavior determinants after the electricity market liberalization: the Portuguese case. https://www.aimspress.com/article/doi/10.3934/GF.2022021.

- [21] Kosovo’s electricity market liberalization sparks protest by businesses. https://balkangreenenergynews.com/kosovos-electricity-market-liberalization-sparks-protest-by-businesses/.

- [22] International Financial Reporting Standards (IFRS) - Asena Advisors. https://asenaadvisors.com/blog/international-financial-reporting-standards/.

- [23] [24] What are the International Financial Reporting Standards?. https://ramp.com/blog/international-financial-reporting-standards.

Table 1.

Hypothetical financial data of KESCO before and after liberalisation.

Table 1.

Hypothetical financial data of KESCO before and after liberalisation.

| Year |

Revenues before liberalisation (million €) |

Revenues after liberalisation (million €) |

Total costs (million €) |

| 2019 |

450 |

– |

380 |

| 2020 |

470 |

– |

395 |

| 2021 |

480 |

– |

400 |

| 2022 |

500 |

– |

420 |

| 2023 |

– |

550 |

460 |

| 2024 |

– |

620 |

520 |

| 2025 |

– |

680 |

570 |

Table 2.

Quality of financial information before and after IFRS implementation.

Table 2.

Quality of financial information before and after IFRS implementation.

| Measure |

Before IFRS (0–100) |

After IFRS (0–100) |

| Reliability |

60 |

85 |

| Comparability |

55 |

80 |

| Transparency |

50 |

78 |

| Relevance |

65 |

88 |

Table 3.

Average energy price for business customers (€/kWh).

Table 3.

Average energy price for business customers (€/kWh).

| Business category |

Before liberalisation |

After liberalisation |

| Small business |

0.07 |

0.09 |

| Medium business |

0.06 |

0.08 |

| Large business |

0.05 |

0.07 |

Table 4.

Use of managerial accounting methods in Kosovar enterprises.

Table 4.

Use of managerial accounting methods in Kosovar enterprises.

| Method |

Usage (%) |

| Budgeting |

70 |

| Variance analysis |

55 |

| Standard costing |

40 |

| ABC analysis |

30 |

Table 5.

Factors influencing managerial decision-making at KESCO.

Table 5.

Factors influencing managerial decision-making at KESCO.

| Factors |

Importance (%) |

| Cost |

85 |

| Regulation |

75 |

| Competition |

65 |

| Technology |

70 |

| Risk |

60 |

Table 6.

Percentage of customers moving to the free market by business size.

Table 6.

Percentage of customers moving to the free market by business size.

| Business size |

Percentage of switching (%) |

| Small business |

30 |

| Medium business |

65 |

| Large business |

90 |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).