4.2.2. Modeling Economic Convergence in Euro Area Countries in the Period 2000-2023

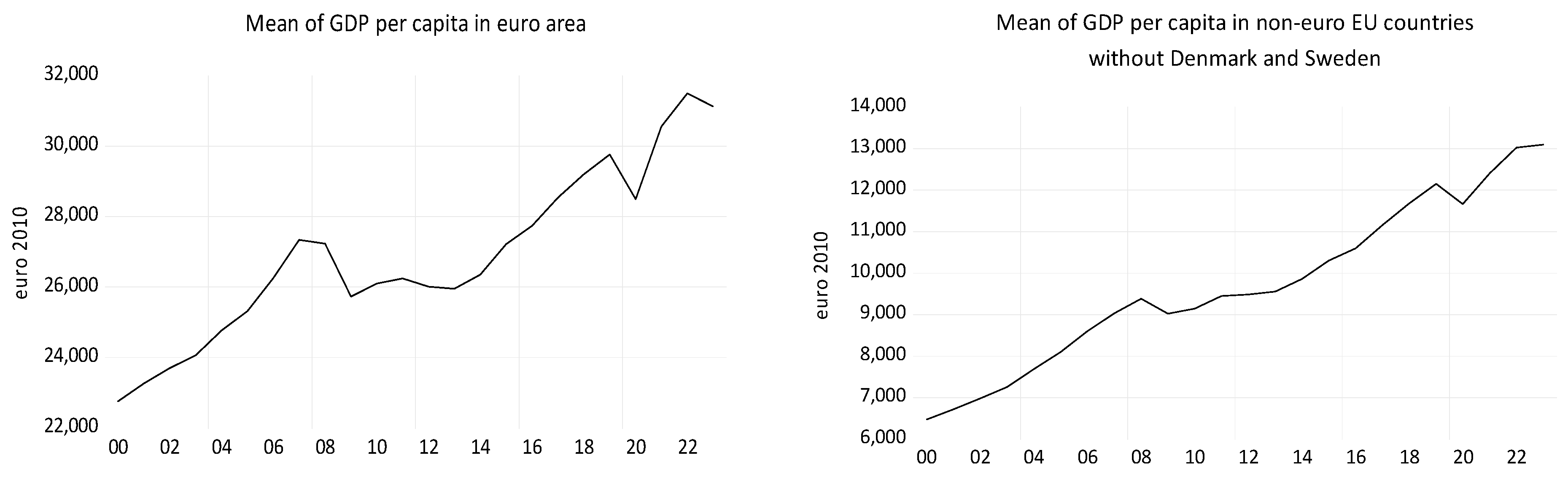

Economic convergence in EU countries is seen as a common direction of long-term GDP development, as a macroeconomic indicator characterizing the overall development performance of the EU.

All efforts to meet the convergence criteria are reflected in the size of GDP and its dynamics. All convergence criteria are global indicators that have a national level of determination, and the use of GDP instead of GDP per capita provides a better understanding of economic dynamics at the national and macroeconomic level of the EU. We use the logarithmic expression of GDP, denoted LN_GDP, which allows the interpretation of annual changes as its dynamic rates. Price stability ensures a balanced and predictable business environment. More stable exchange rate variations have positive effects on the efficiency of international trade flows, expressed by the international openness indicator, denoted by OPN. The long-term interest rate determines the basic mechanism of investments, expressed by the Gross Fixed Capital Formation indicator, which is used here as a logarithm and denoted by LN_GFCF. The national capital structure characterized by budgetary constraints is represented by the debt-to-GDP ratio, denoted as DEBT_GDP.

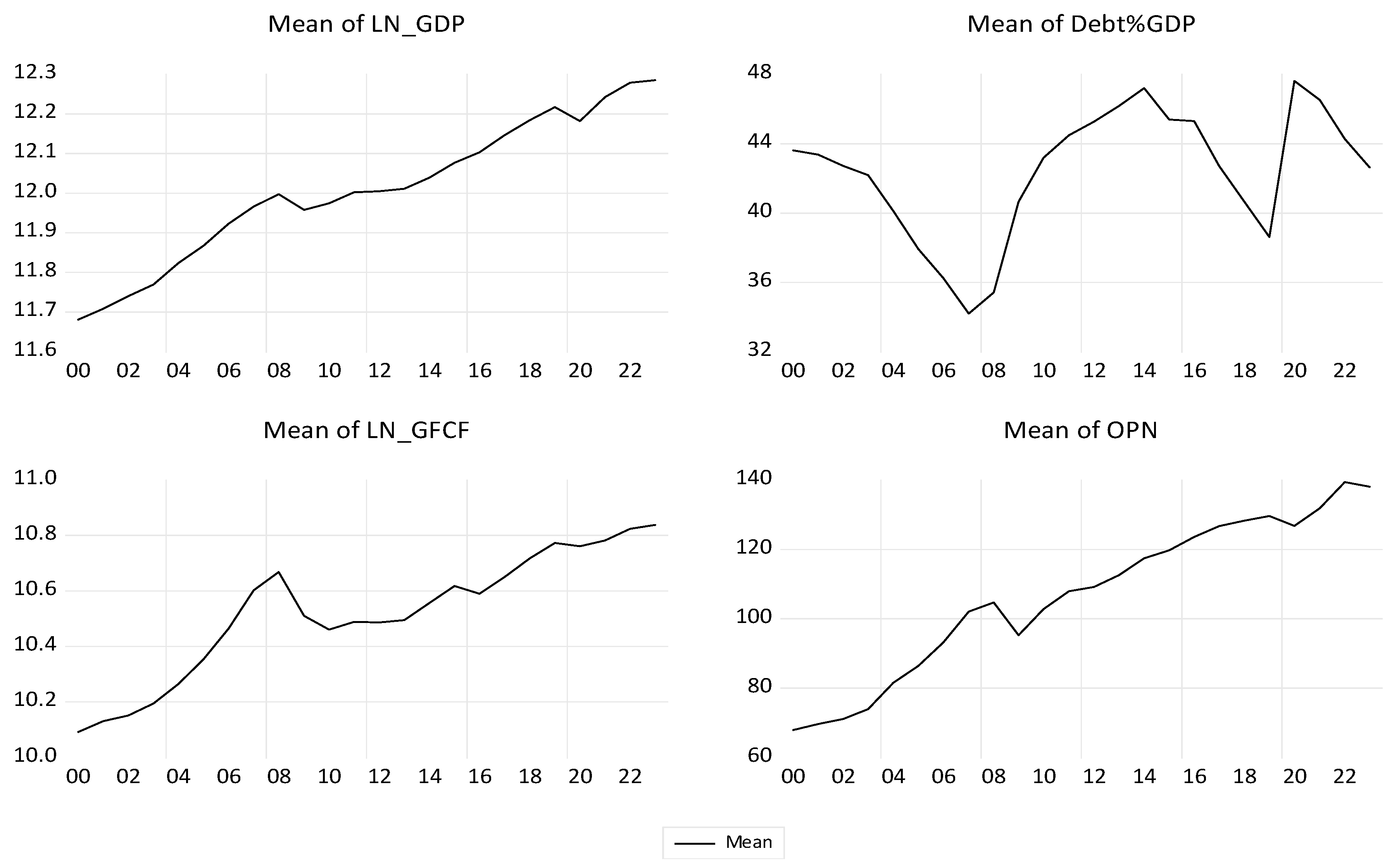

Considering the intensity and nature of the correlations between the variables LN_GDP and DEBT_GDP, LN_GFCF and OPN, we conclude that the results are similar for both sub-periods, before and after the 2008 economic crisis, as well as for the entire period presented in

Table 10.

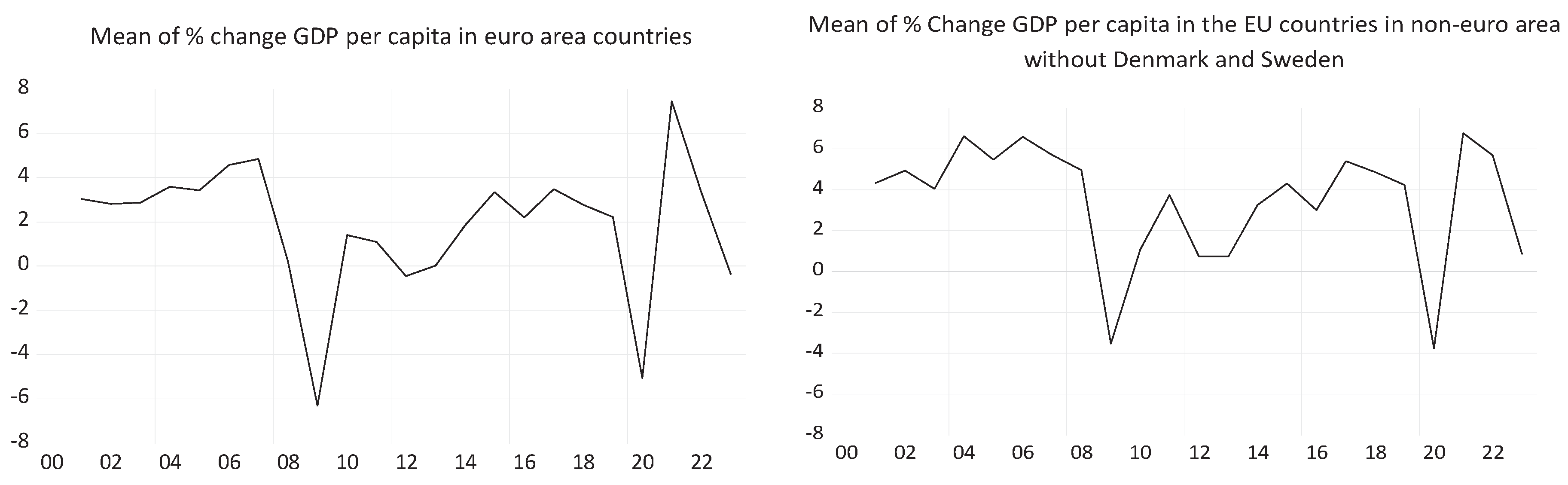

During the analyzed period, the GFCF indicator had a very strong and positive correlation with GDP. Debt-to-GDP ratio had a weak and positive correlation with GDP. International openness (OPN) had a weak and negative correlation with GDP, as well as a weak and negative correlation with investment and the debt-to-GDP ratio. In

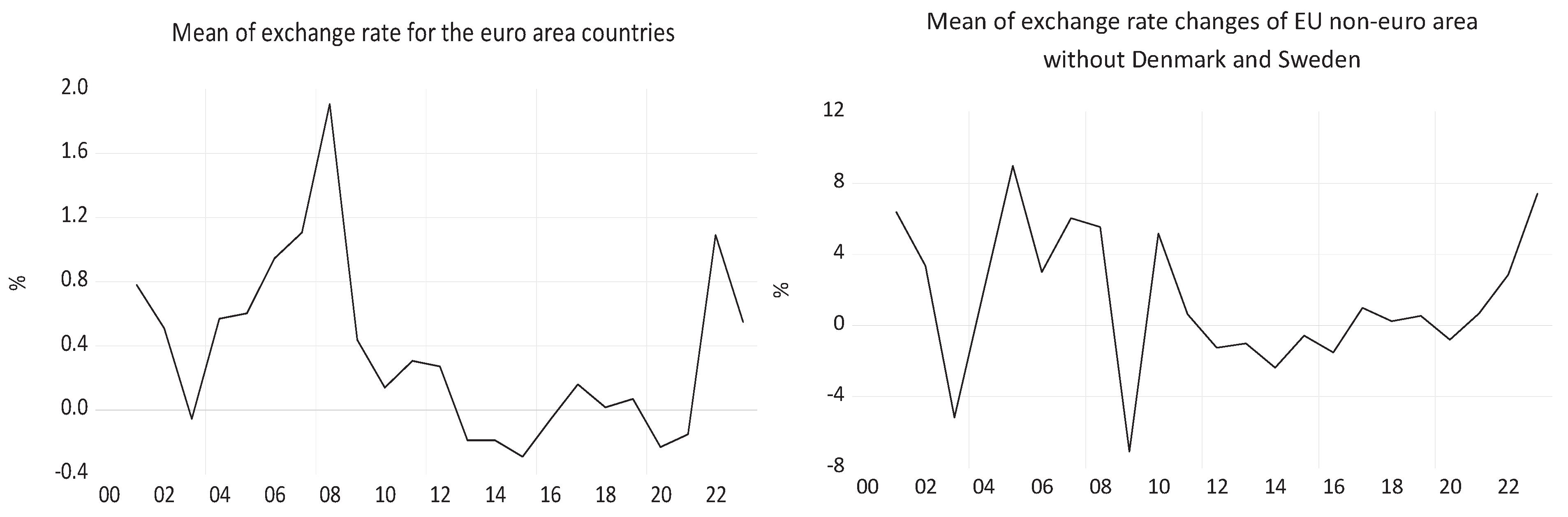

Figure 13, the evolution of the macroeconomic indicators considered in our econometric approach shows upward trends over the period 2000-2023.

In

Table 11, the Granger causality analysis reveals differences according to the sub-periods 2000-2008 and 2009-2023 and compared to the entire period 2000-2023.

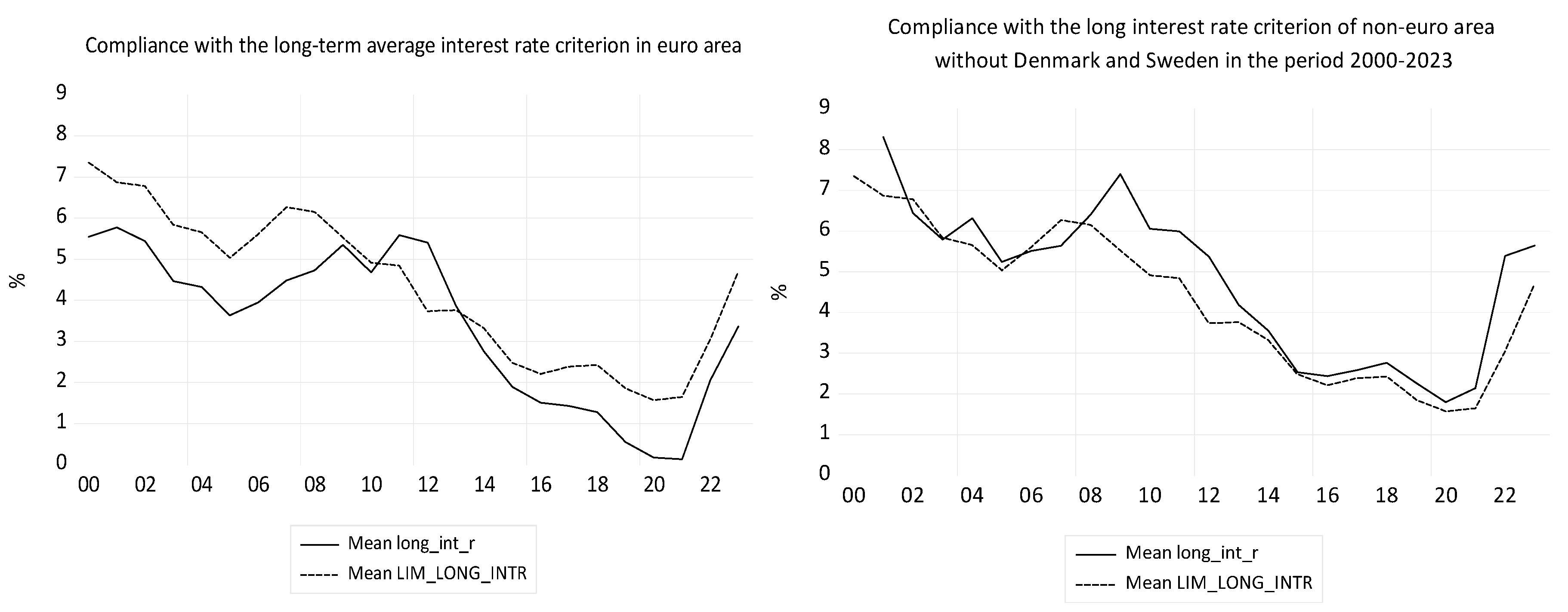

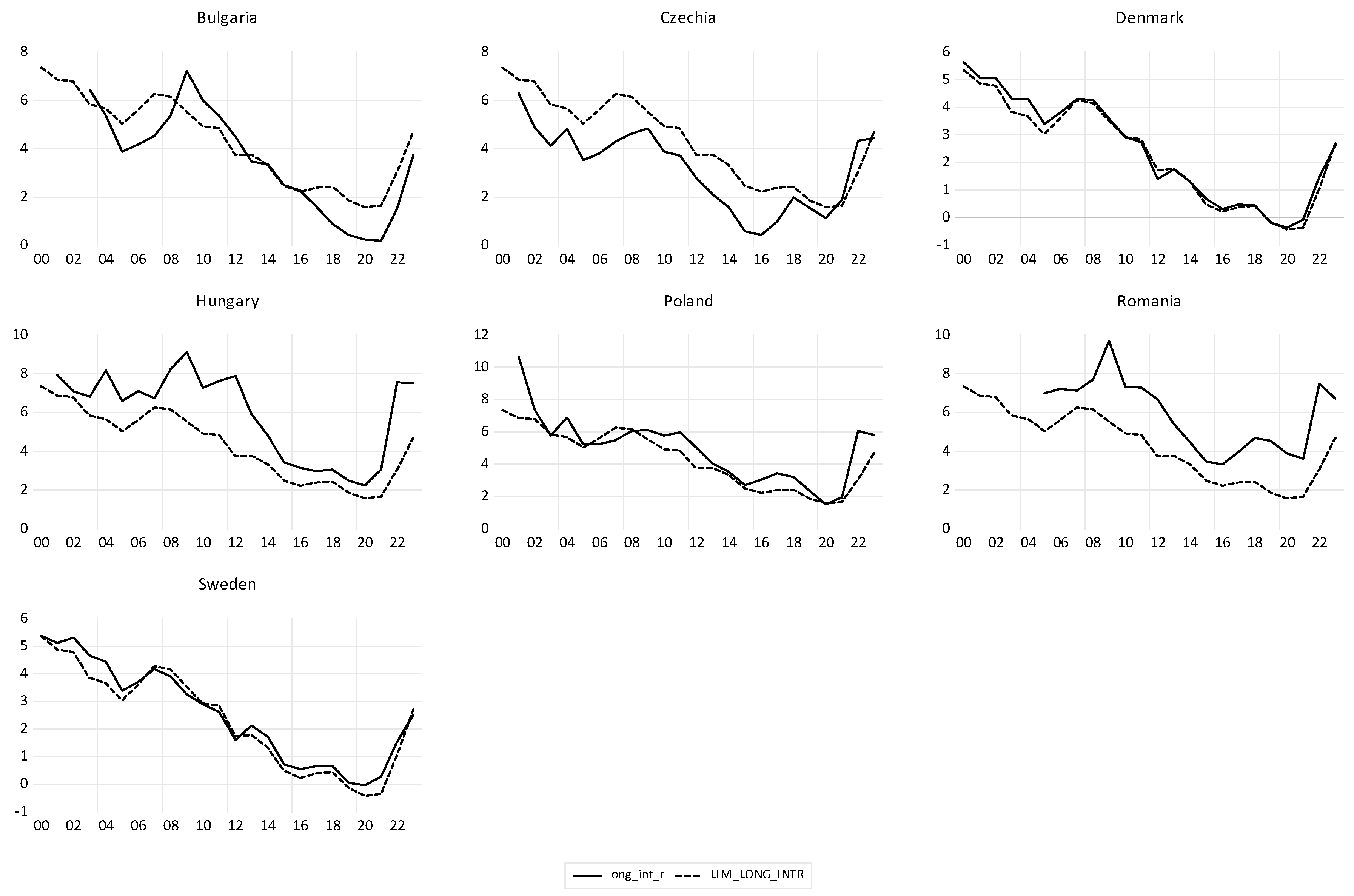

The medium intensity conformity of the long-term interest rate criterion in the three periods, in the euro area (

Table 9), determines LN_GDP to be Granger cause for LN_GFCF in both sub-periods and over the entire period.

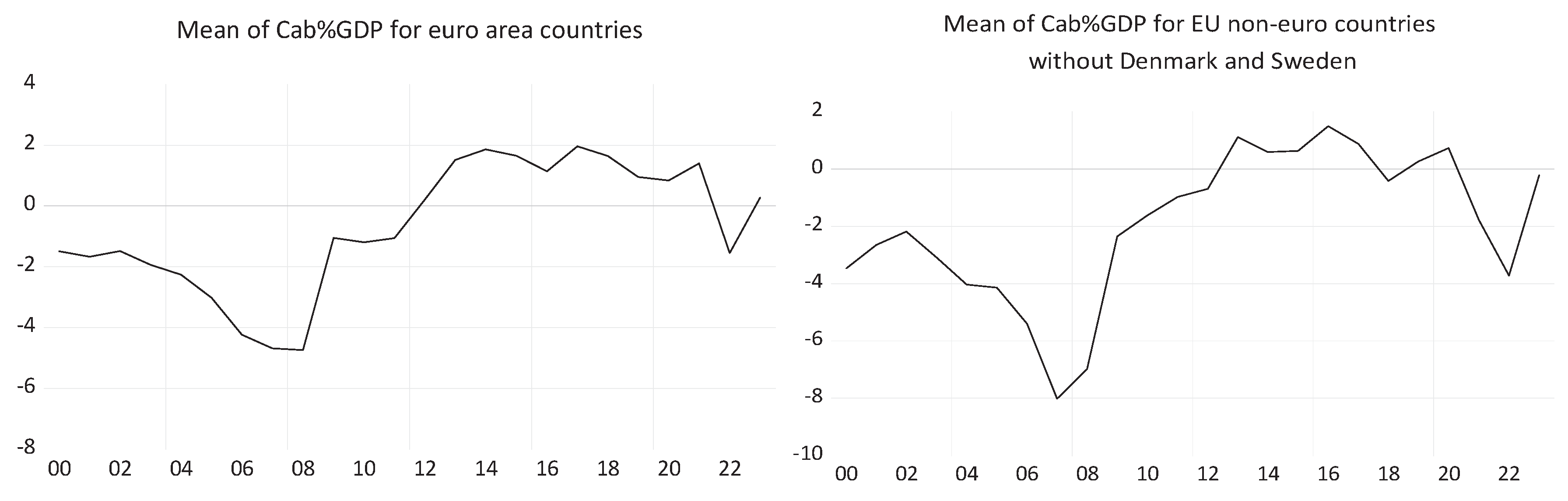

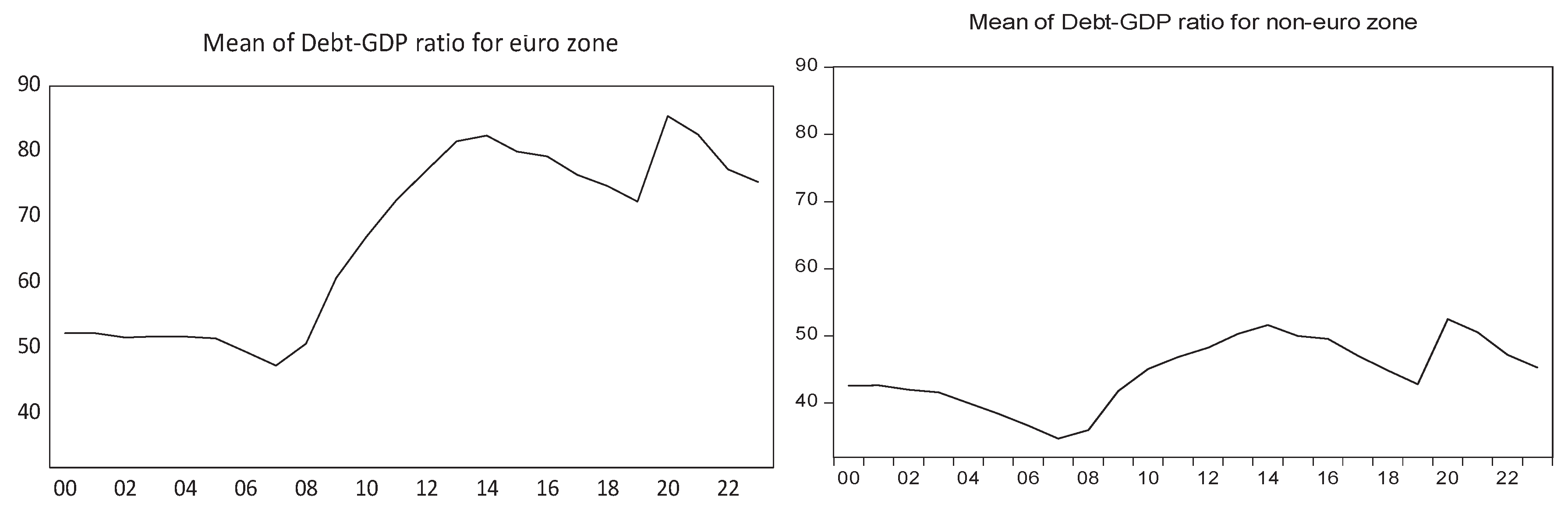

In the first sub-period 2000-2008, the debt-to-GDP ratio was much lower than 60% (

Figure 7, left), and the budget deficit was quite moderate (

Figure 5, left) and no Granger causality was linked to the DEBT_GDP variable. In the second sub-period 2009-2023, OPN is a Granger cause of DEBT_GDP and DEBT_GDP in turn Granger causes LN_GFCF. The variable LN_GFCF is a Granger cause of OPN.

Only in the entire period, being a sufficiently long period, LN_GDP was Granger cause for DEBT_GDP, LN_GFCF and OPN. LN_GDP Granger causes the DEBT_GDP ratio and also LN_GFCF with a p-value less than 5%, but the converse is not true, meaning that the debt/GDP ratio and LN_GFCF do not Granger cause LN_GDP. Furthermore, a dual Granger causality relationship emerges between LN_GFCF and DEBT_GDP.

The variables LN_GDP, DEBT_GDP, LN_GFCF and OPN are non-stationary, and for each of them, in the period 2000-2023 a common unit root with individual effects is present for all cross-sections analyzed, but the cross-sections also have their own unit roots.

The variables LN_GDP, OPN, LN_GFCF and DEBT_GDP are cointegrated only in the period 2009-2023, according to the Pedroni test of cointegration with eight out of eleven test statistics rejecting the null hypothesis of lack of cointegration, in

Table A1.1 (

Appendix A1); the variables are cointegrated and have a long-run equilibrium.

Since in the two sub-periods the OPN variable acts in the same sense as a Granger cause for LN_GDP, and throughout the period 2000-2023 the cause was reversed and only LN_GDP is a Granger cause for OPN, we carefully analyze this variable that determines the lack of cointegration in the entire period 2000-2023. After removing it, we find that the remaining variables LN_GDP, DEBT_GDP and LN_GFCF are cointegrated over the period 2000-2023, based on the Pedroni cointegration test, with eight out of eleven test statistics rejecting the null hypothesis (lack of cointegration) in

Table A1.2 (

Appendix A1). The variables LN_GDP, DEBT_GDP and LN_GFCF are cointegrated for the entire analyzed period 2000-2023 and we will use them in our econometric analysis. Based on Granger causality analysis, in the GDP econometric models we consider LN_GFCF and the lagged term of DEBT_GDP as explanatory variables.

The economic convergence of the euro area is expressed here by the long-run equilibrium, as resulting from the ARDL model, in

Table A2.1 (

Appendix A2). Another approach is the ECM model presented in

Table A2.2 and

Table A2.3 (

Appendix A2). The results of both approaches are presented in

Table 12. The ARDL approach consists of the long-run and short-run models in equation (5) and equation (6), respectively.

In

Table 12, the ARDL coefficients in equation (5) of the long run equation are significant at Prob. < 1%. The coefficient

of the ECT term, in equation (6), is significantly different from 0, negative and less than 1, which attests to the existence of a long-run relationship of the variables; it represents the speed of adjustment towards the long-run equilibrium.

In the long run, a 1 p.p. increase in the lagged DEBT-to-GDP ratio leads to an average increase of 0.29% in GDP, all other factors remaining constant. A 1% increase in GFCF leads to a 0.5795% increase in GDP, holding all other elements constant.

The term COINTEQ01 in

Table A2.1 (

Appendix A2) is the Error Correction Term (ECT) in

Table 12 and equation (6). The ECT contributes on average to the correction towards long-term equilibrium – economic convergence – with a proportion of 19.72%, this representing the speed of short-term adjustment over a one-year period of the panel of euro area countries.

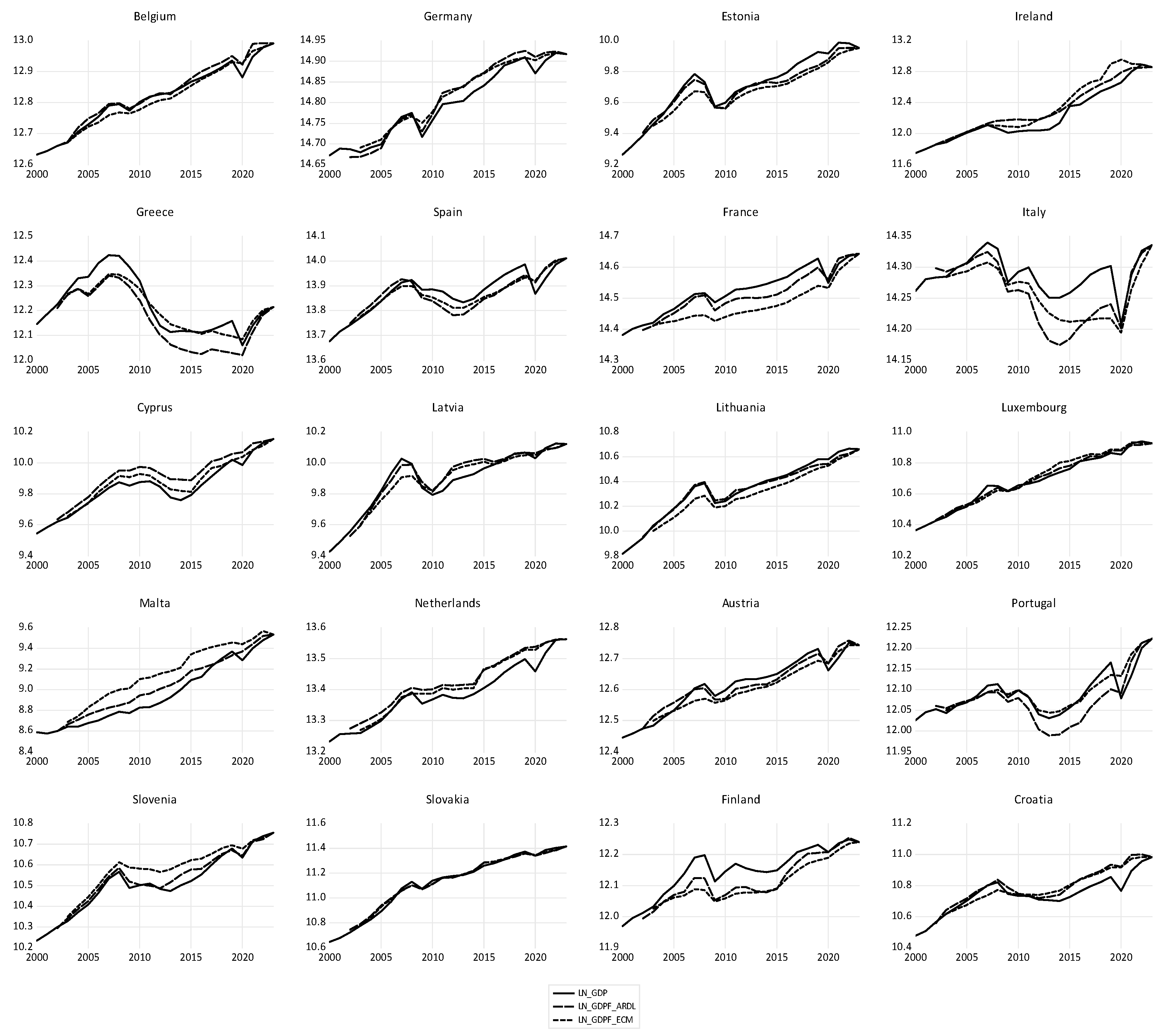

The adjustment speeds for each euro area country, resulting from the ARDL approach, in their models’ short-run coefficients, over the period 2000-2023, are presented in

Table 13.

Portugal has the highest adjustment speed, at 40.2% over a one-year period, followed by Belgium with 39.5% and Croatia with 36.2%. France, Italy and Malta have positive adjustment speeds towards equilibrium, which shows that the two countries are not converging towards the long-term equilibrium of the euro area. In

Table 13, we observe that France, Italy and Malta do not have a long-run relationship between GDP and the DEBT-to-GDP and GFCF. These two countries do not converge towards the euro area equilibrium.

The Error Correction Model approach has the long-term model in equation (7) and the short-term model in equation (8):

COINTREG LN_GDP DEBT_GDP(-1) LN_GFCF

LN_GDP = 0.0031*DEBT_GDP(-1) + 0.6629*LN_GFCF + [CX=DETERM]

LS(CX=F, WGT=CXSUR, KEEPWGTS) D(LN_GDP) D(DEBT_GDP(-1)) D(LN_GFCF) ECT(-1) C

D(LN_GDP) = 0.0009*D(DEBT_GDP(-1)) + 0.2463*D(LN_GFCF) - 0.1870* ECT(-1) + 0.0128+ [CX=F]

The ECM residuals have a normal distribution and respect the assumption that there are no correlations between the cross-sections. The coefficients of the two ECM equations (7) and (8) are presented in

Table 12, comparing them with ARDL coefficients.

The coefficients of variables are similar in the two approaches, being smaller in the short term than in the long term. The difference between the short term and the long term is corrected by the ECT term with the adjustment speed over a period of one year. In the ECM model, the ECT contributes on average to the correction towards the long-run equilibrium of the euro countries with the short-run adjustment speed of 18.70% over a one-year period.

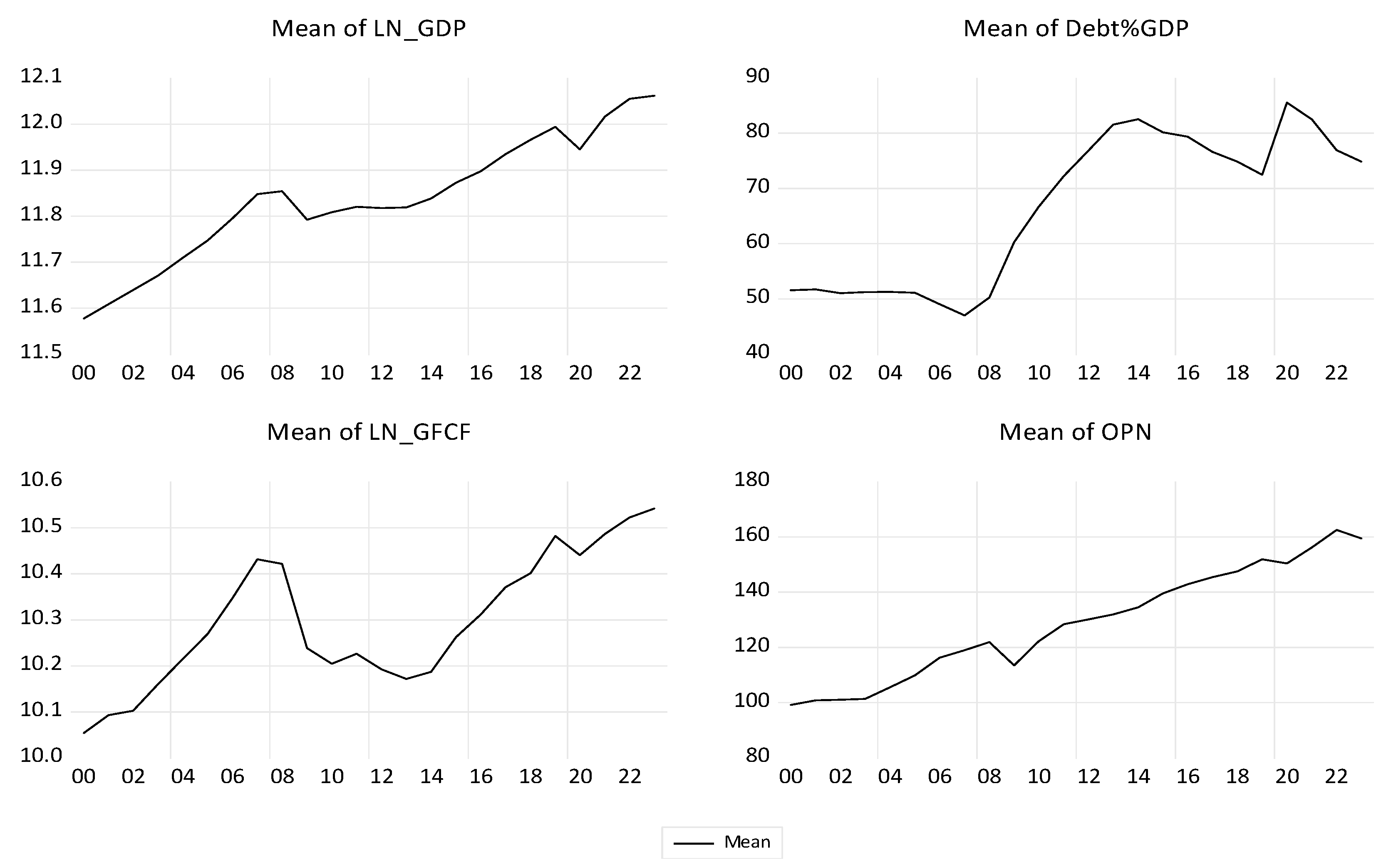

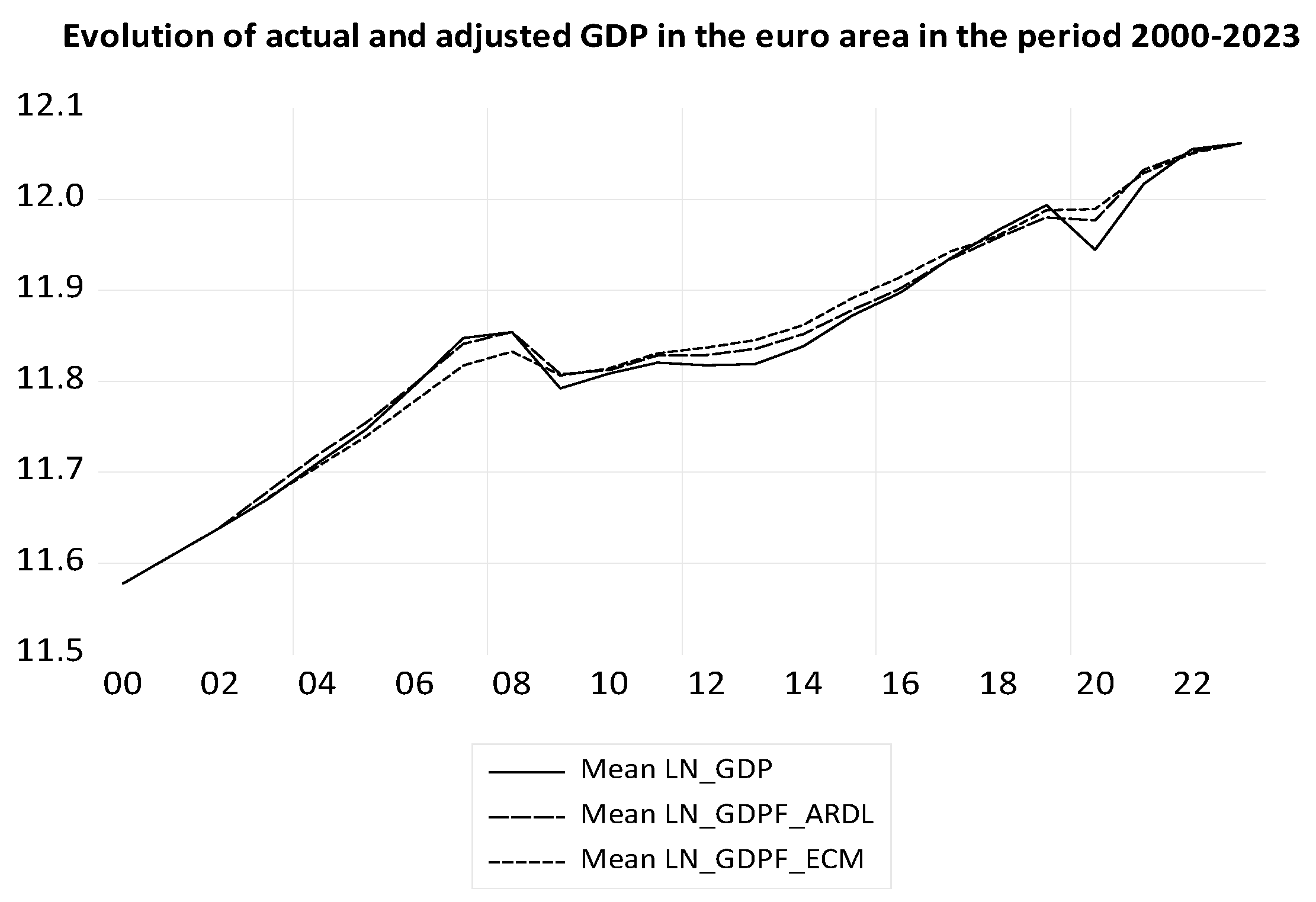

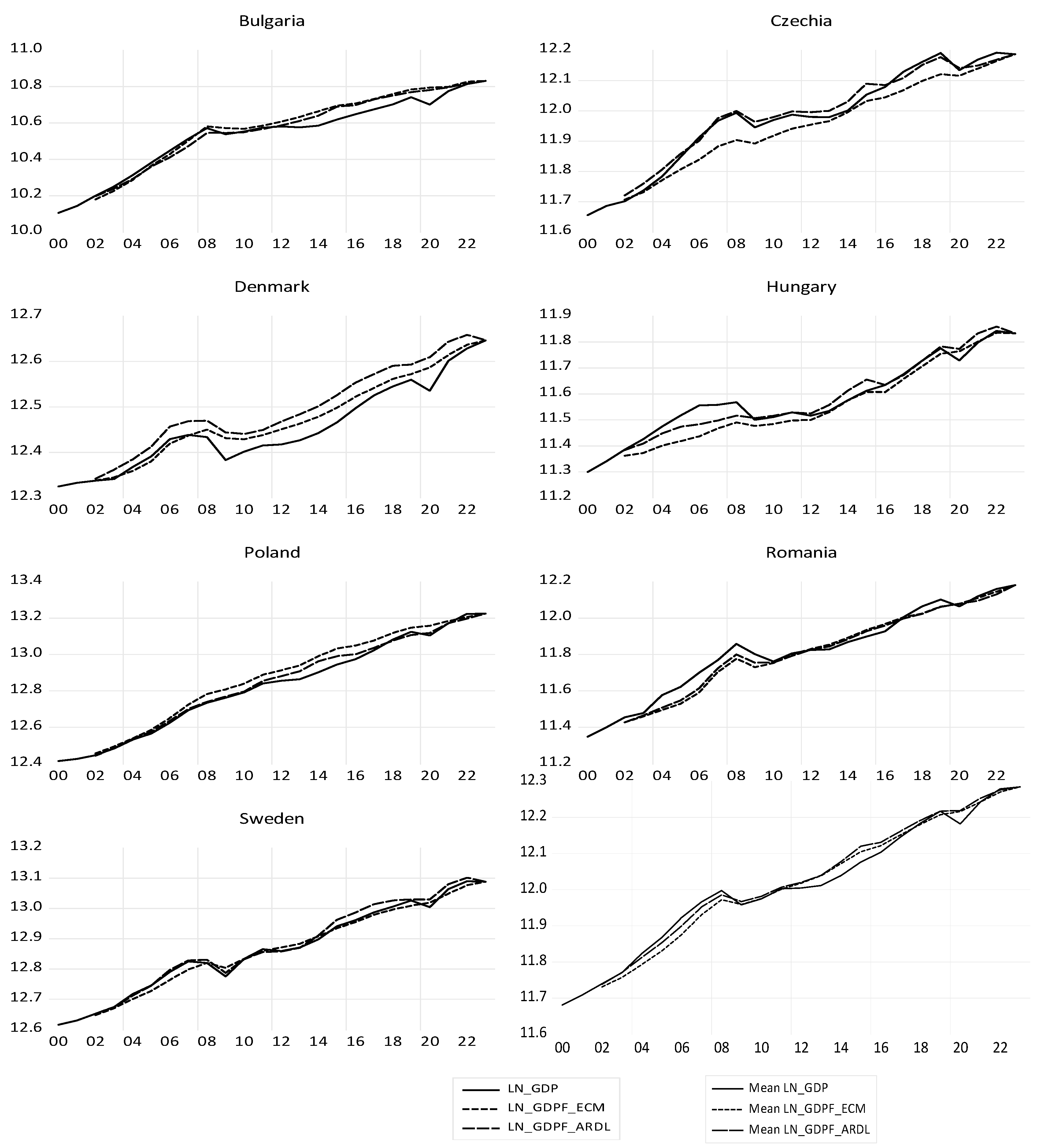

The theoretical values for euro area countries, calculated with both models, are presented in

Figure 14, together with the average level of LN_GDP.

The theoretical long-run average of LN_GDP (LN_GDPF_ARDL) is obtained from the ARDL model, and the theoretical average of LN_GDP (LN_GDPF_ECM) is obtained from the ECM model. The ARDL model appears to be better than the ECM model, in

Figure 14.

Figure 15 shows the evolution of GDP and its long-term economic convergence in the euro area countries over the period 2000-2023, calculated with ARDL model. There are positive and negative deviations of each euro area country's real GDP from the euro area's economic convergence. The theoretical values of LN_GDP with the ECM model are very close to those in the ARDL model.

Most euro area countries have their LN_GDP above the convergence line. Some of them even follow the convergence line closely, while other euro area countries are placed below the euro area convergence line, some especially in the recent sub-period.

The long-term equilibrium of all euro area countries - economic convergence, is based on the correlation between real and theoretical LN_GDP and is of very strong intensity, both for the two sub-periods and for the entire period 2000-2023. The Pedroni test of residual cointegration rejects the null hypothesis of no cointegration with nine out of eleven test statistics, regarding the cointegration of LN_GDP and theoretical economic convergence, expressed by LN_GDPF, in

Table A1.3 (

Appendix A1).

The coefficients of the ECT cointegration terms for ECM and ARDL models, in

Table 12, are negative, less than 1 and significant at a p-value <1%, proving the existence of a long-term economic equilibrium in the euro area, which attests to

hypothesis H1.

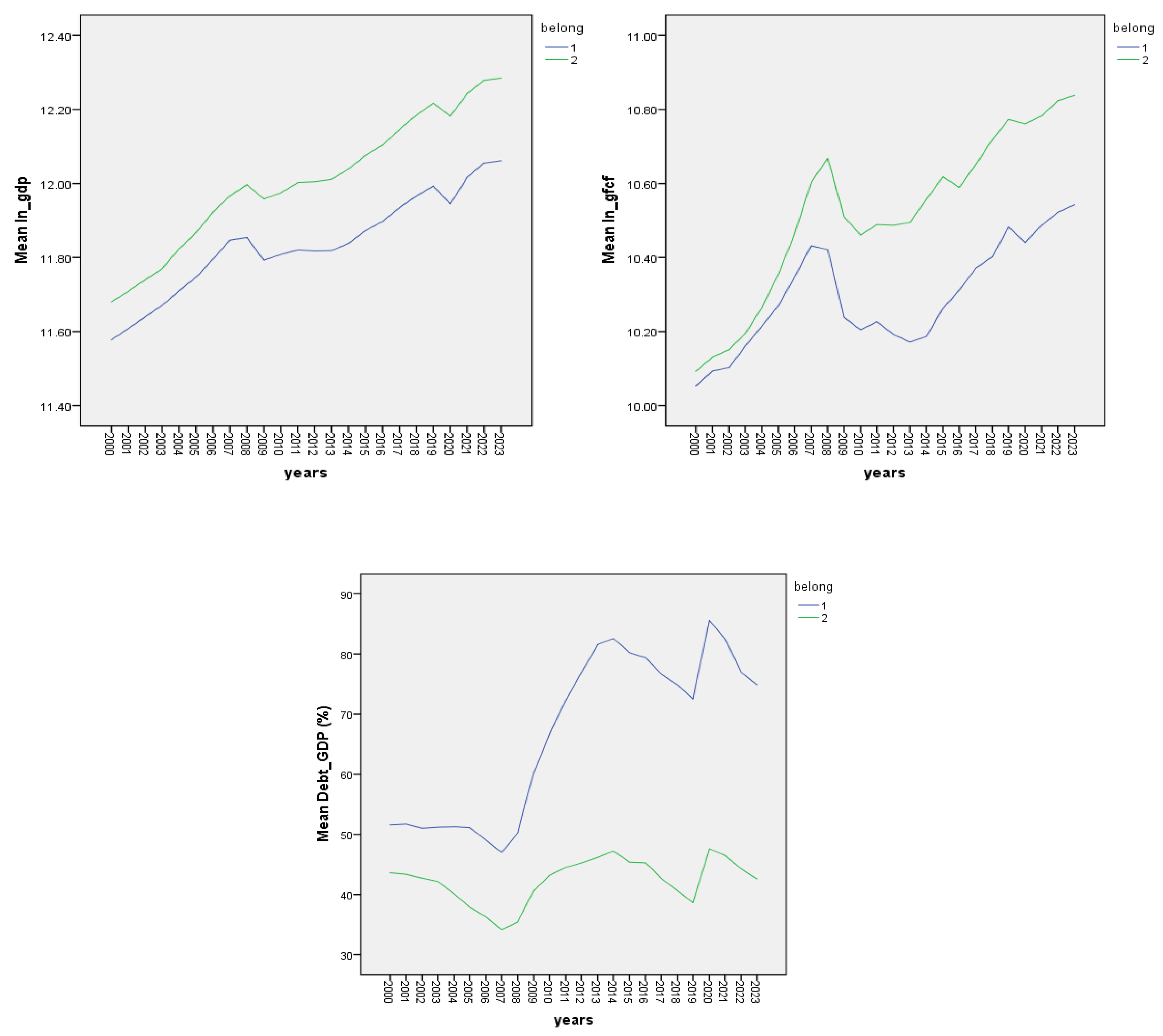

4.2.3. Modeling Economic Convergence in the Non-Euro EU countries in the Period 2000-2023

The variables for assessing the economic convergence of EU countries outside the euro area are the same as for euro area countries.

Section 4.1 showed that EU countries outside the euro area comply better with the financial convergence criteria than euro area countries, in particular the public debt criterion.

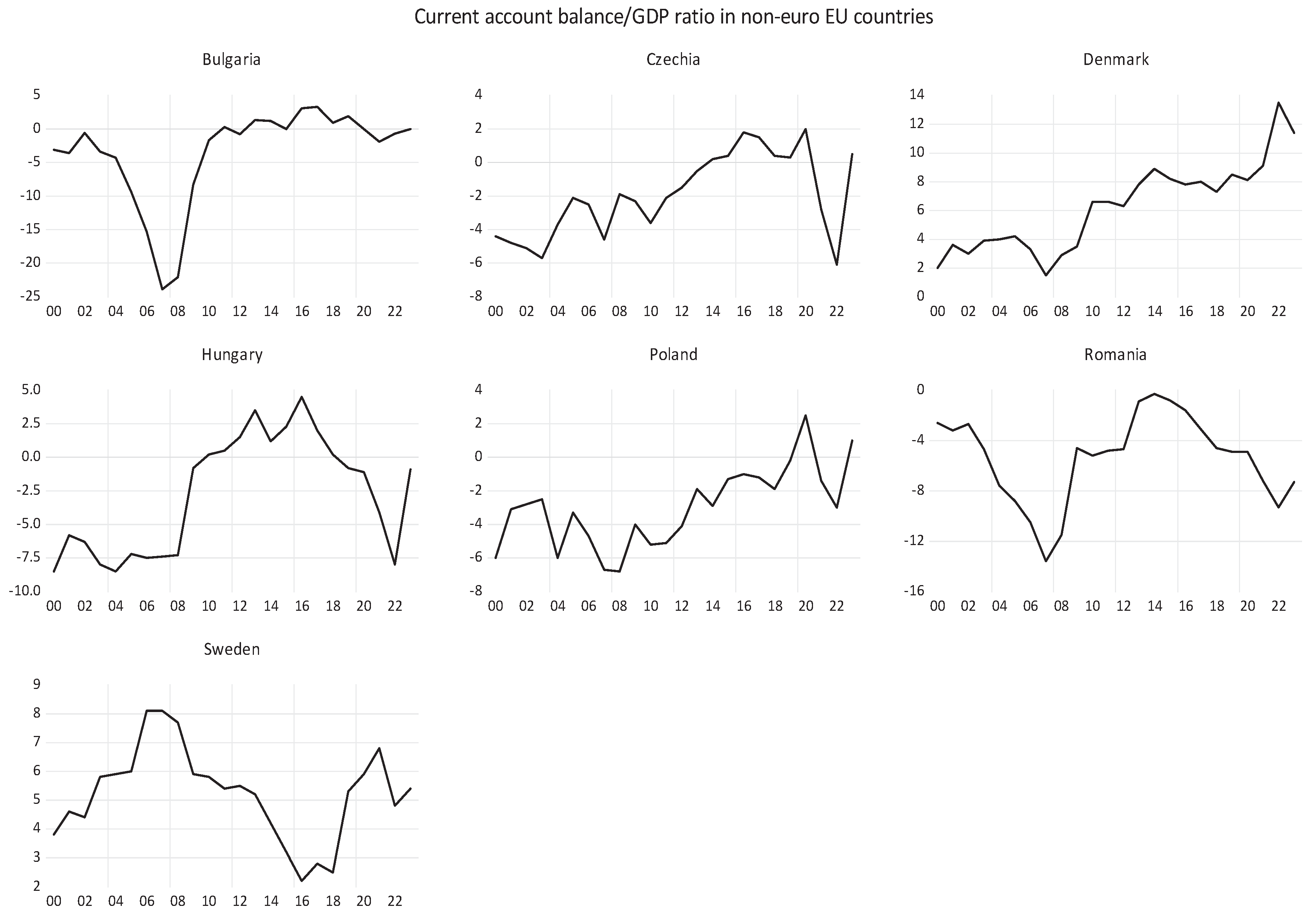

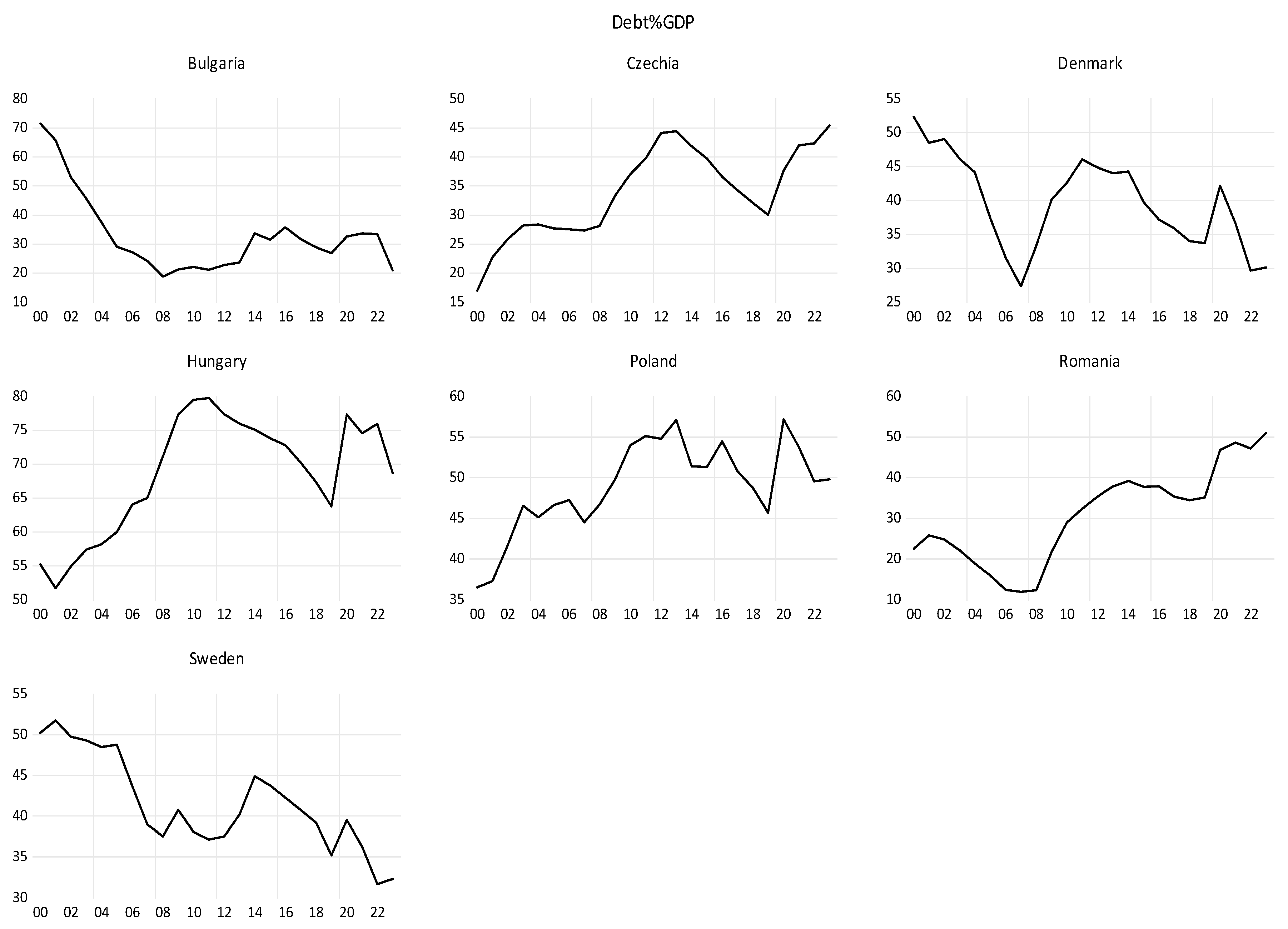

Figure 16 shows the evolution of the variables considered for EU countries outside the euro area over the period 2000-2023. The shocks of the 2008 economic crisis and the 2020 pandemic are evident in the evolution of each variable.

The correlation analysis reveals in

Table 14 the lack of correlation between DEBT_GDP and LN_GDP, which leads to the elimination of this variable from the econometric model. Investments are very strongly and positively correlated with GDP. International openness, OPN is very weakly and negatively correlated with GDP.

If we do not consider the two developed countries Denmark and Sweden, the correlations are similar, even lack of correlation between LN_GDP and OPN. This means that the two excluded countries contributed to international openness more than all other non-euro countries during the period under review.

The Granger causality analysis, in

Table 15, shows that, for non-euro EU countries, DEBT_GDP does not Granger influence any other variable in the period 2000-2023 and the same happens when excluding Denmark and Sweden. DEBT_GDP is a Granger cause for LN_GFCF in the sub-period 2009-2023 in both situations. According to Granger causality, during the analyzed period, the significant factors for economic development are investment and openness.

We prefer as explanatory variables DEBT_GDP and LN_GFCF for explaining the GDP growth, in order to compare with the euro-area economic convergence. We find the cointegration of the variables LN_GDP, LN_GFCF and DEBT_GDP for the period 2000-2023 affirmed by to six of the eleven test statistics, presented in

Table A1.4 (

Appendix A1).

The ECM model of the LN_GDP, DEBT_GDP and LN_GFCF variables for the period 2000-2023 has all long-run and short-run equation coefficients significant at Prob.<5%, as presented in

Table A2.5 and

Table A2.6 (

Appendix A2) and summarized in

Table 16. The residuals of the ECM model with significant fixed effects tested for cross-sectional and SUR GLS weights meet the requirements for model validation, of normal distribution and no correlation between cross-sections. The coefficient of determination, R-squared is 65%. The ECT contributes on average to the correction towards the long-term equilibrium of non-euro countries with an adjustment speed of 9.88% over a one-year period.

The approach of Error Correction Model has the equation of long-run (8) and the equation on short-run (9):

The results of ARDL model are presented in

Table 16 and

Table A2.4 (

Appendix A2) and we see that the coefficients of the long-term model are significant at Prob. < 1%. The speed of adjustment of ECT on short-term towards the long-term equilibrium is 15.83% over a one-year period, for the group of EU countries of non-euro area.

The ARDL short-run coefficients for each non-euro EU country over the period 2000-2023 are presented in

Table 17.

In

Table 17 the countries are in descending order of adjustment speed on short-term to move the system towards the long-term equilibrium. Hungary has the highest speed of adjustment to the long-term equilibrium, at 47.5%, followed by all other countries in the non-euro group, with less than 20%. All coefficients of the cross-sectional models, both of the COINTEQ01 term and of the short-term DEBT_GDP(-1) and LN_GFCF variables, are significant at Prob. <1%. At the level of countries outside the EU area, the lagged term coefficient of the DEBT_GDP variable is not significant in the short-run model, but is significant in the equation of each country.

The short-term influence of DEBT_GDP is even negative for Romania and Hungary, meaning that the debt/GDP ratio from the previous year causes a decrease in GDP growth of these countries. In

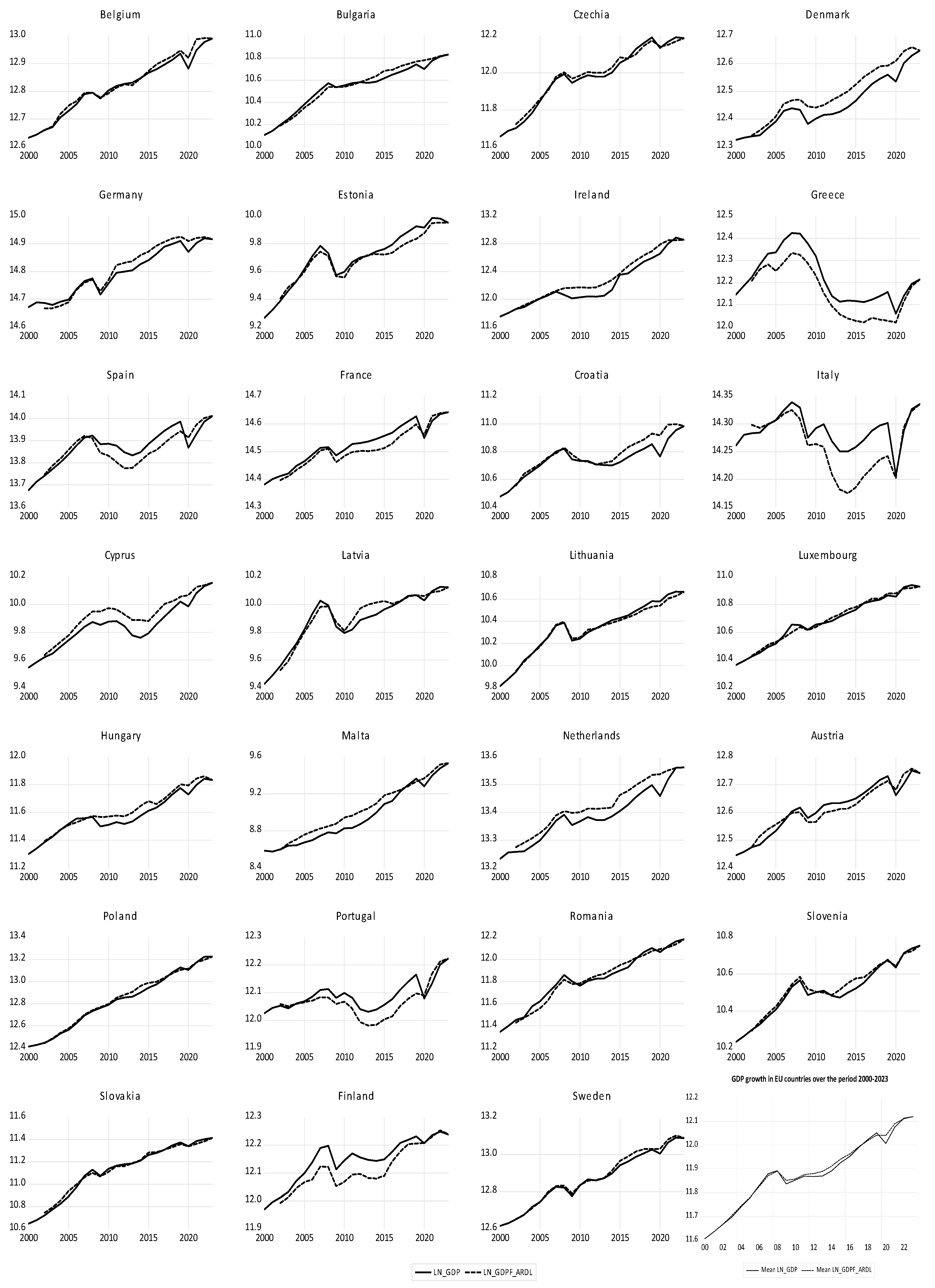

Figure 17, GDP evolution and economic convergence are represented on the same graphs for each non-euro EU country and as group average values. The theoretical values of LN_GDP with the ECM and ARDL models represent the economic convergence on the graph of each country and for the group of EU countries outside the euro area.

The ARDL model appears to be better than the ECM model. The coefficients of the ECT cointegration terms for ECM and ARDL models, in

Table 16, are negative, less than 1 and significant at a p-value <1%, proving the existence of a long-term economic equilibrium in the EU non-euro area, which attests to

hypothesis H2.

4.2.4. Modeling Economic Convergence in EU Countries in the Period 2000-2023

The variables LN_GDP, DEBT_GDP and LN_GFCF for all 27 countries of European Union are cointegrated in the period 2000-2023. The Pedroni tests reject null hypothesis of no cointegration with six of eleven statistics, in

Table A1.6 (

Appendix A1), both for “no deterministic trend” and for “no deterministic intercept or trend”.

The correlation matrix at the EU level is presented in

Table 18. The correlations between the variables of EU countries are similar to those of the two groups of EU countries: the euro area and the non-euro area.

The corresponding models at EU level over the period 2000-2023 are presented as follows in

Table A2.7 for the ARDL approach and in

Table A2.8 and

Table A.2.9 for the ECM approach. The coefficients of the ECM and ARDL models can be compared in

Table 19.

The ECM with significant cross-sections and period fixed effects is in

Table A2.9 (

Appendix A2) has the determination coefficient, R-squared of the ECM of 75.7%. The model with significant fixed effects for cross-sections and periods ensures the lack of correlation in the cross-section residuals. The coefficients of the models in

Table 19 are significant, except for the short-run ARDL approach, which has non-significant coefficient for the lagged term of DEBT_GDP at the EU level. However, for each EU country, the short-run ARDL coefficients of the explanatory variables, as well as COINTEQ01, are significant at Prob. <1%. Almost all EU countries act towards a long-term relationship between economic growth and the two factors analyzed. France, Italy and Malta have positive values of the cointegration term in the ARDL model, which demonstrates the lack of a long-term relationship between the variables analyzed.

The results of the ARDL model at the EU level are consistent with those of the ARDL model in the euro area countries (

Table 13), which show the same situation for the three countries.

The theoretical values of GDP (LN_GDP) calculated with both models are very close. The ARDL model allows the identification of the annual speed of adjustment of each EU country towards the long-term equilibrium, the economic convergence at the EU level. The graphs of GDP and economic convergence for each country and for the EU are presented in

Figure 18.

The coefficients of the ECT cointegration terms for ECM and ARDL models, in

Table 19, are negative, less than 1 and significant at a p-value <1%, proving the existence of a long-term economic equilibrium at the EU level, which attests to

hypothesis H3.