Submitted:

23 September 2025

Posted:

24 September 2025

You are already at the latest version

Abstract

Keywords:

Introduction

- RQ1: What are the most commonly used methods in quantum finance?

- RQ2: How are the contributions of quantum approaches to finance evaluated?

- RQ3: What are the gaps, challenges, open questions, and future prospects of quantum computing?

I. Related Work

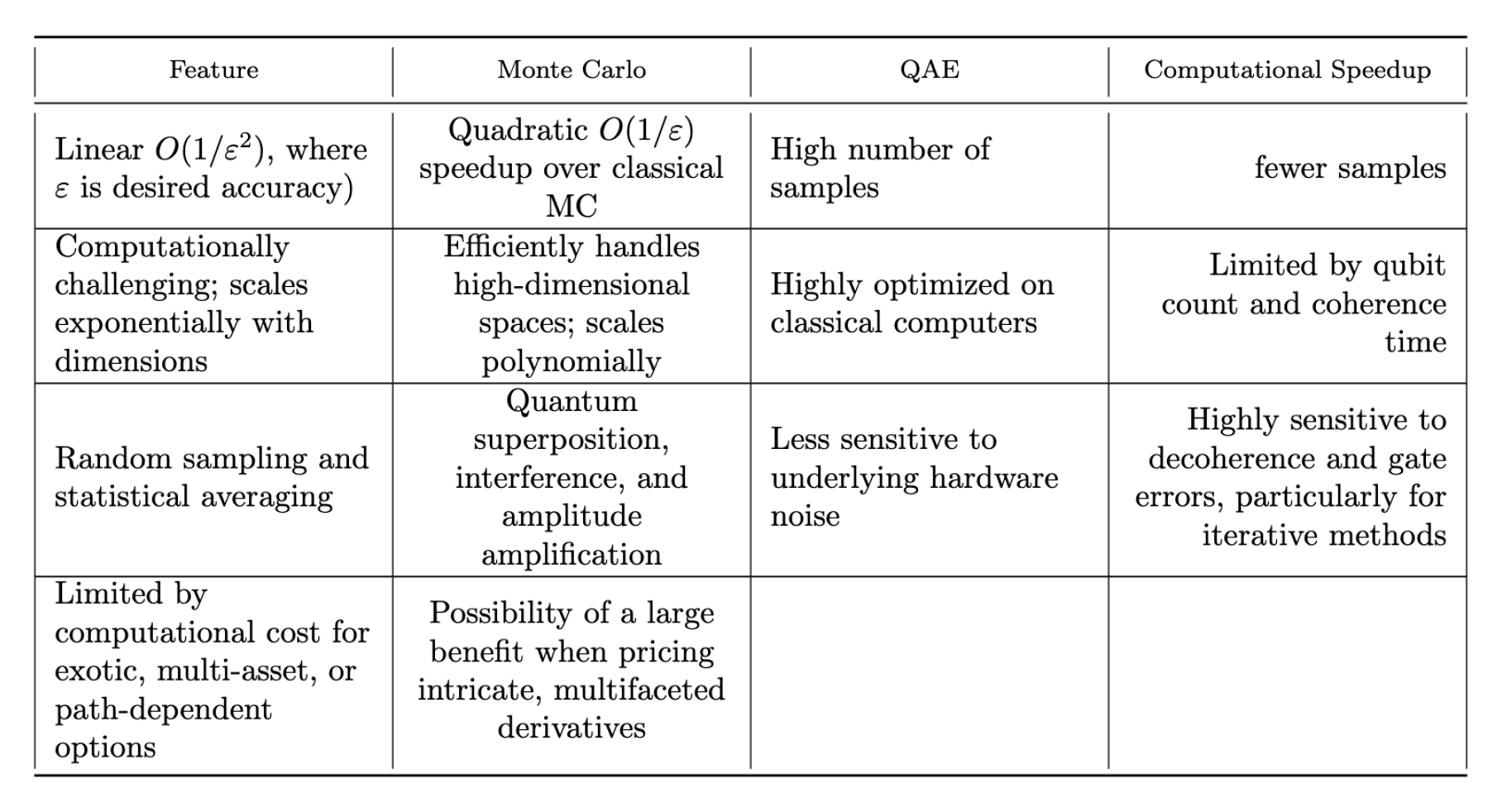

II. Quantum Quantitative Finance

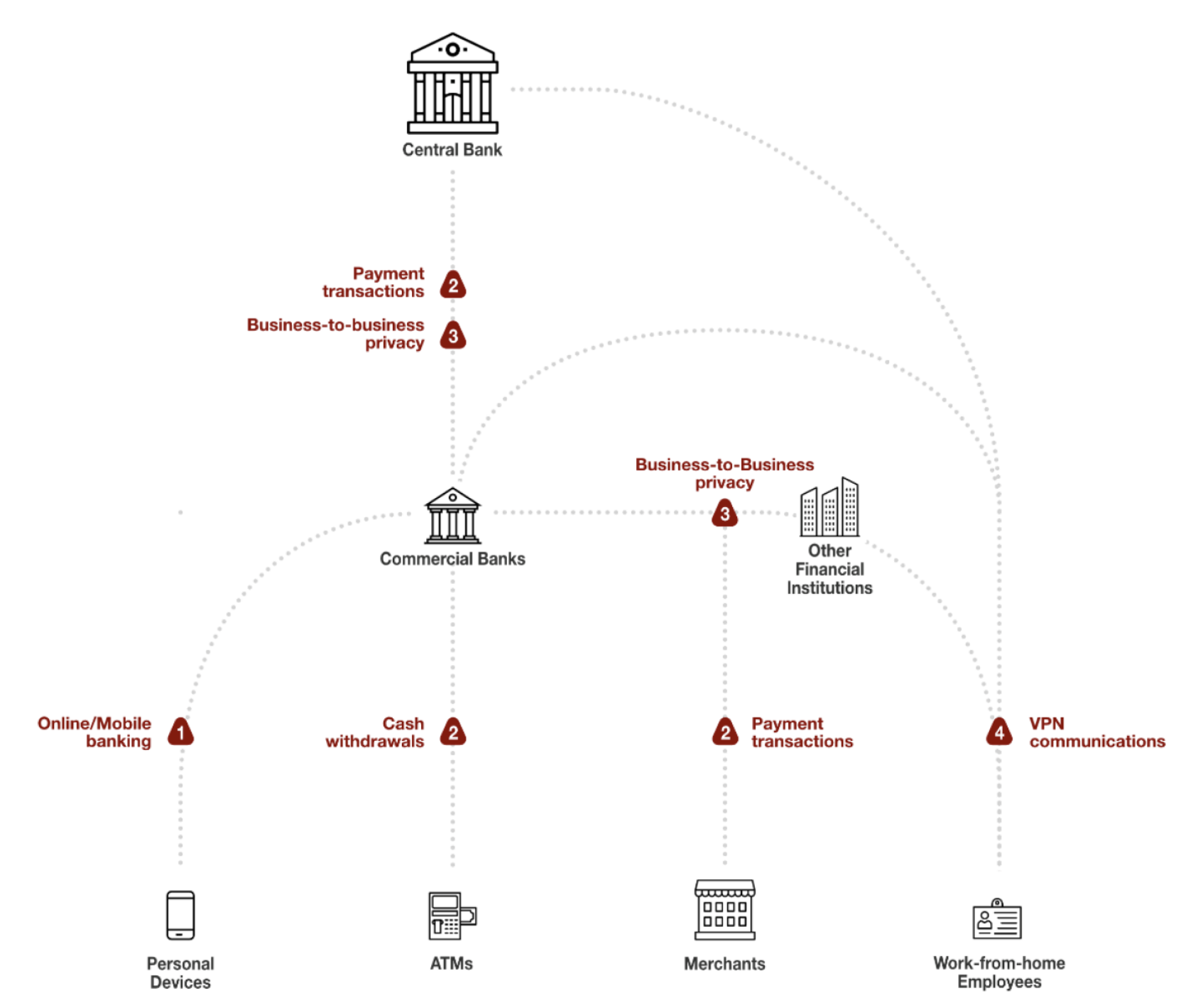

A. Problems in Financial Services

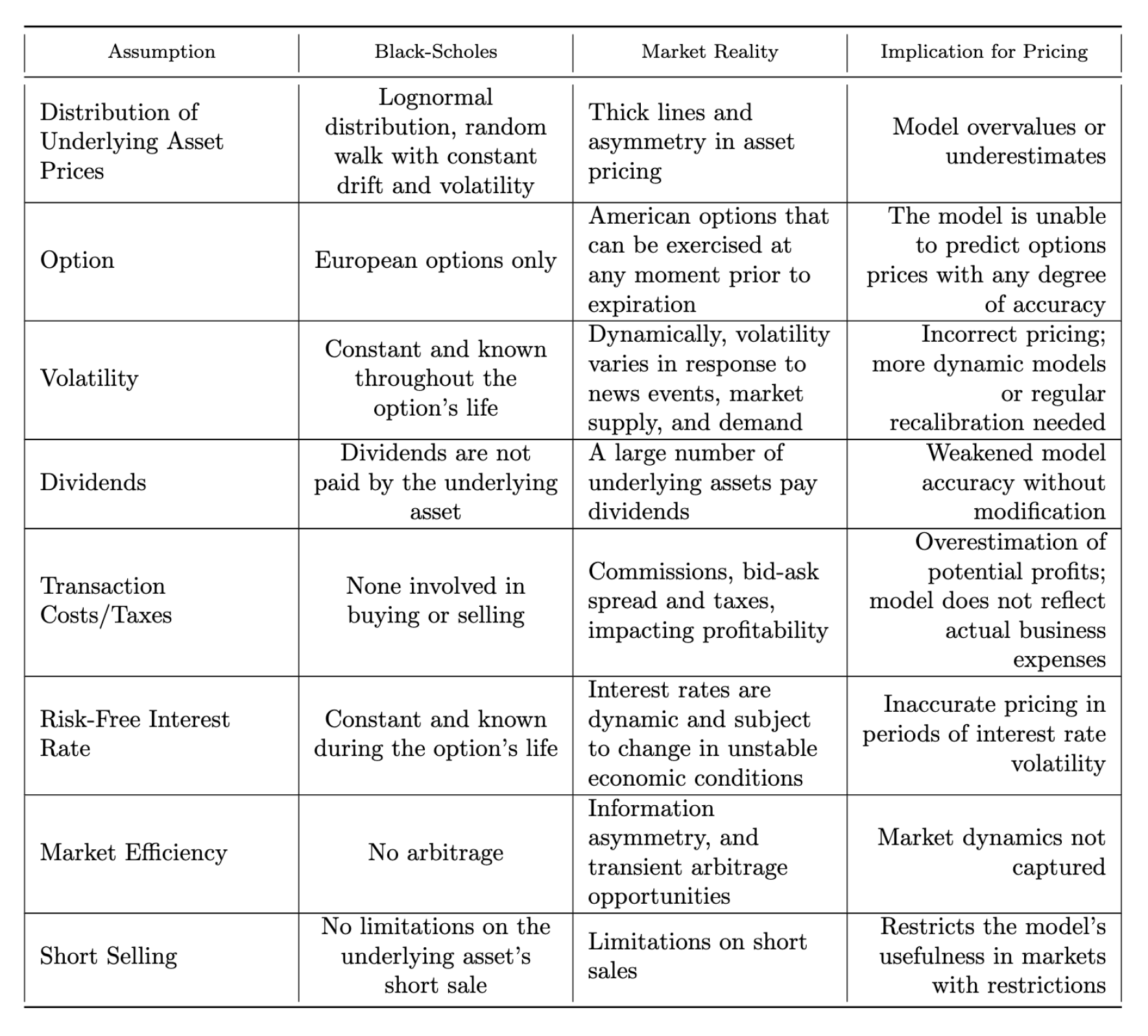

B. Black-Scholes PDE for Option Pricing

B.1. Geometric Brownian Motion Process

B.2. Quantum Black-Scholes Equation

C. Black-Scholes Pricing Formulae

| Calls | Puts | |

| Delta, | ||

| Gamma, | ||

| Vega, | ||

| Theta, | ||

| Rho, |

III. Quantum Finance: Quantum Black-Scholes Model and Pricing

A. Quantum Hardware

B. Financial Applications of Quantum Computing

| Quantum Finance | References |

|---|---|

| Transaction Settlement | [73] |

| Quantum Accounting | [74] |

| Predicting Financial Crashes | [75] |

| Quantum (Norm-Sampling) | [76,77,78,79,80,81,82] |

| Quantum Money | [83,84,85,86,87,88,89,90,91,92,93] |

| Blockchain | [94,95,96] |

| Risk Management | [97,98,99,100,101,102,103] |

| Fraud Detection | [104,105,106] |

| Asset Pricing | [27,35,57,107,108,109] |

| Portfolio Optimization | [77,110,111,112,113,114,115,116,117,118,119,120,121] |

C. Optimal Trading

D. Optimal Arbitrage

E. Risk Analysis

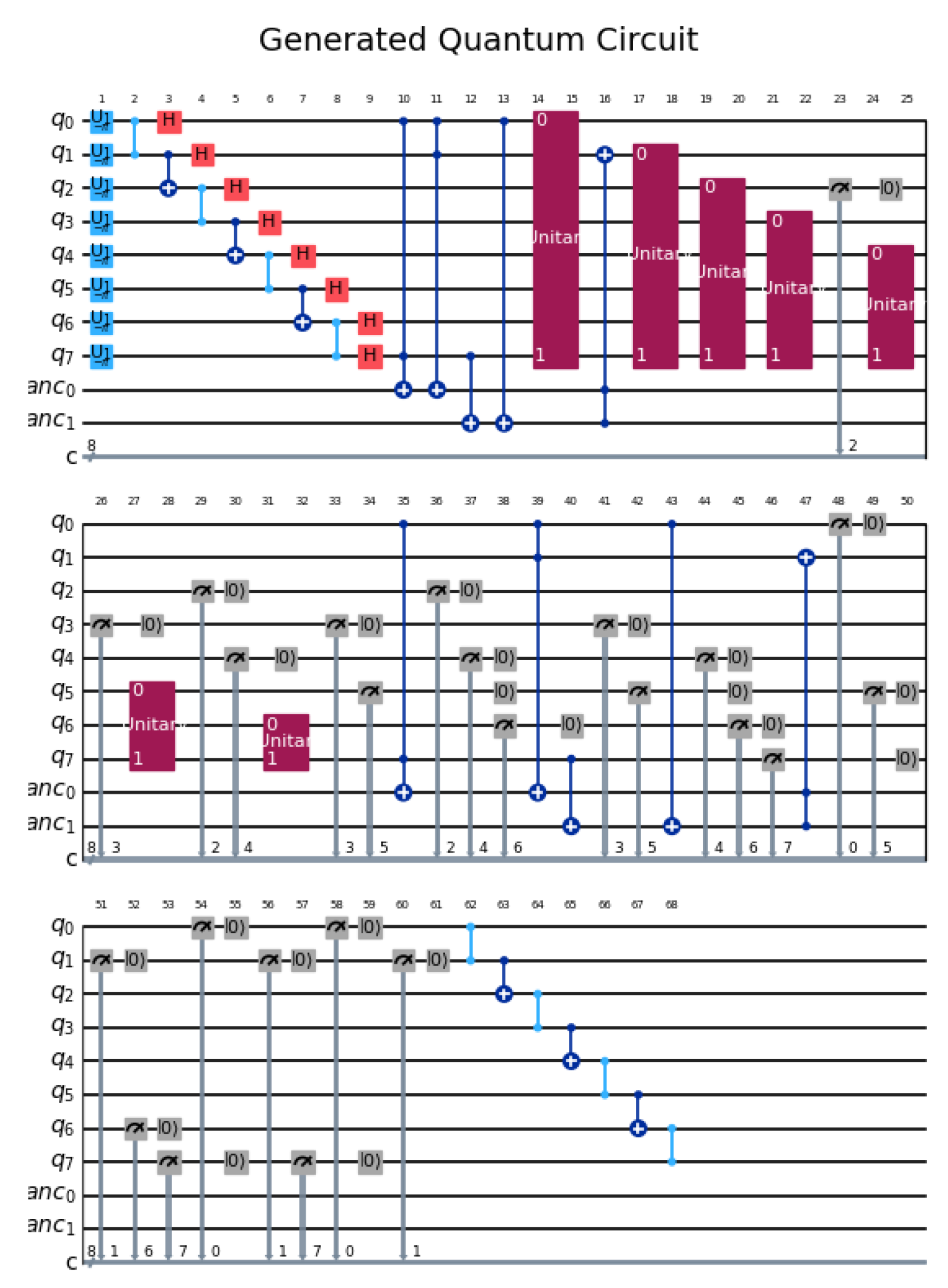

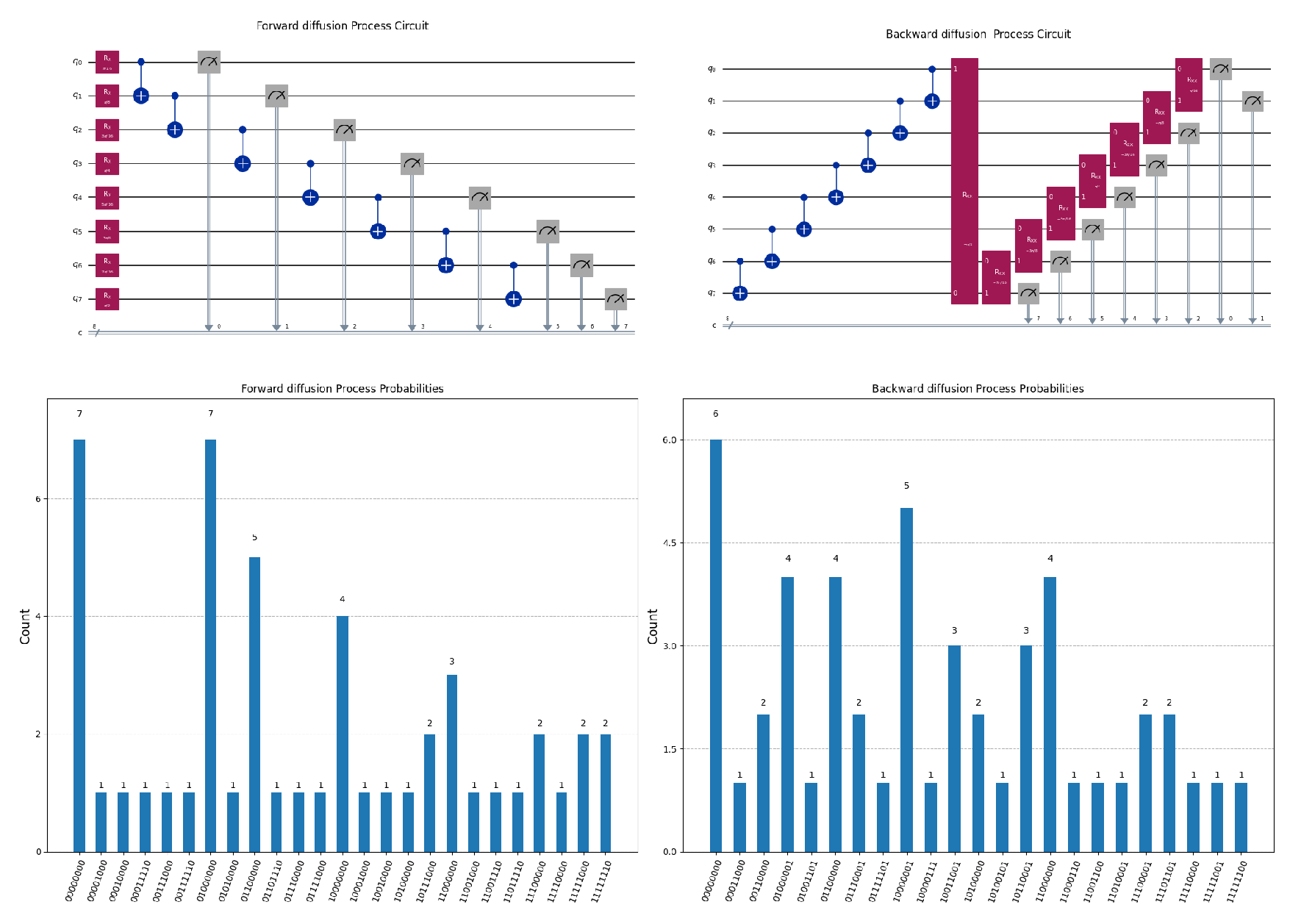

IV. Quantum Machine Learning

| Algorithm 1 Quantum Circuit Decoder |

|

| Algorithm 2 Monte Carlo Sampling for Quantum Circuit |

|

| Algorithm 3 Quantum Noise Process |

|

A. Generative Neural Networks and Generative Adversarial Network

B. Quantum Economics and Finance in Stock Markets

C. Financial Quantum Approach in Option Pricing

D. Reinforcement Learning

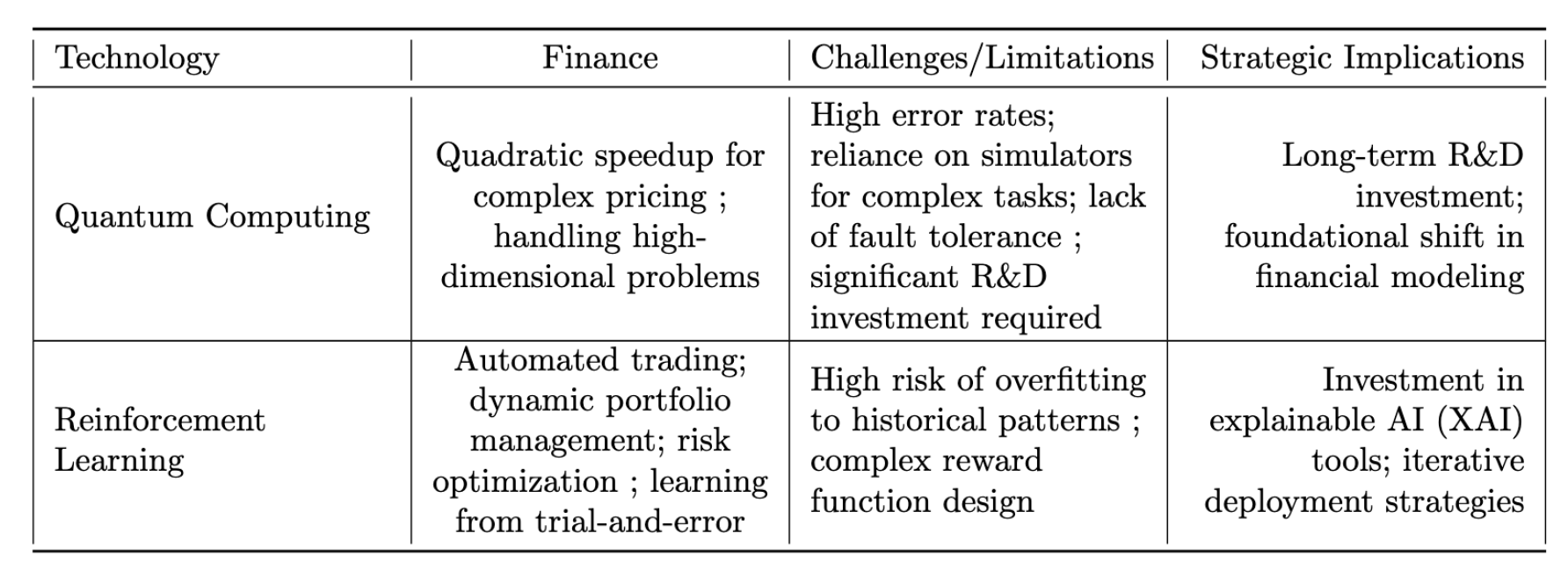

V. Challenges for Quantum Computing

Conclusions

Acknowledgments

References

- T. Ichikawa, H. Hakoshima, K. Inui, K. Ito, R. Matsuda, K. Mitarai, K. Miyamoto, W. Mizukami, K. Mizuta, T. Mori et al., “Current numbers of qubits and their uses,” Nature Reviews Physics, vol. 6, no. 6, pp. 345–347, 2024.

- P. Singh, R. Dasgupta, A. Singh, H. Pandey, V. Hassija, V. Chamola, and B. Sikdar, “A survey on available tools and technologies enabling quantum computing,” IEEE Access, 2024.

- R. Orús, S. Mugel, and E. Lizaso, “Quantum computing for finance: Overview and prospects,” Reviews in Physics, vol. 4, p. 100028, 2019.

- R. Scriba, Y. Li, and J. B. Wang, “Monte-carlo option pricing in quantum parallel,” arXiv preprint arXiv:2505.09459, 2025.

- D. Herman, C. Googin, X. Liu, Y. Sun, A. Galda, I. Safro, M. Pistoia, and Y. Alexeev, “Quantum computing for finance,” Nature Reviews Physics, vol. 5, no. 8, pp. 450–465, 2023.

- P. Rebentrost, A. Luongo, B. Cheng, S. Bosch, and S. Lloyd, “Quantum computational finance for martingale asset pricing in incomplete markets,” Scientific Reports, vol. 14, no. 1, p. 18941, 2024.

- Z. Yang, M. Zolanvari, and R. Jain, “A survey of important issues in quantum computing and communications,” IEEE Communications Surveys & Tutorials, vol. 25, no. 2, pp. 1059–1094, 2023.

- I. Hull, O. Sattath, E. Diamanti, and G. Wendin, Quantum technology for economists. Springer Nature, 2024.

- J. Zhou, “Quantum finance: Exploring the implications of quantum computing on financial models,” Computational Economics, pp. 1–30, 2025.

- A. M. Dalzell, S. McArdle, M. Berta, P. Bienias, C.-F. Chen, A. Gilyén, C. T. Hann, M. J. Kastoryano, E. T. Khabiboulline, A. Kubica et al., “Quantum algorithms: A survey of applications and end-to-end complexities,” arXiv preprint arXiv:2310.03011, 2023.

- L. Gyongyosi and S. Imre, “A survey on quantum computing technology,” Computer Science Review, vol. 31, pp. 51–71, 2019.

- N. K. Parida, C. Jatoth, V. D. Reddy, M. M. Hussain, and J. Faizi, “Post-quantum distributed ledger technology: a systematic survey,” Scientific Reports, vol. 13, no. 1, p. 20729, 2023.

- A. K. Mandal, M. Nadim, C. K. Roy, B. Roy, and K. A. Schneider, “Quantum software engineering and potential of quantum computing in software engineering research: a review,” Automated Software Engineering, vol. 32, no. 1, p. 27, 2025.

- F. D. Albareti, T. Ankenbrand, D. Bieri, E. Hänggi, D. Lötscher, S. Stettler, and M. Schöngens, “A structured survey of quantum computing for the financial industry,” arXiv preprint arXiv:2204.10026, 2022.

- Y. Lu and J. Yang, “Quantum financing system: A survey on quantum algorithms, potential scenarios and open research issues,” Journal of Industrial Information Integration, p. 100663, 2024.

- L. Bunescu and A. M. Vârtei, “Modern finance through quantum computing—a systematic literature review,” PloS one, vol. 19, no. 7, p. e0304317, 2024.

- C. Zhang and L. Huang, “A quantum model for the stock market,” Physica A: Statistical Mechanics and Its Applications, vol. 389, no. 24, pp. 5769–5775, 2010.

- L. P. Hughston and L. Sánchez-Betancourt, “Valuation of a financial claim contingent on the outcome of a quantum measurement,” Journal of Physics A: Mathematical and Theoretical, vol. 57, no. 28, p. 285302, 2024.

- H. Zheng and B. Dong, “Quantum temporal winds: Turbulence in financial markets,” Mathematics, vol. 12, no. 10, p. 1416, 2024.

- J. Eisert, M. Wilkens, and M. Lewenstein, “Quantum games and quantum strategies,” Physical Review Letters, vol. 83, no. 15, p. 3077, 1999.

- P. M. Agrawal and R. Sharda, “Quantum mechanics and human decision making,” Available at SSRN 1653911, 2010.

- C. P. Gonçalves, “Quantum financial economics—risk and returns,” Journal of Systems Science and Complexity, vol. 26, pp. 187–200, 2013.

- L. Li, “Quantum probability theoretic asset return modeling: A novel schrödinger-like trading equation and multimodal distribution,” Quantum Economics and Finance, vol. 2, no. 1, pp. 13–29, 2025.

- S. Focardi, F. J. Fabozzi, and D. Mazza, “Quantum option pricing and quantum finance,” Journal of Derivatives, vol. 28, no. 1, pp. 79–98, 2020.

- F. Klug, “Quantum optimization algorithms in operations research: Methods, applications, and implications,” arXiv preprint arXiv:2312.13636, 2023.

- C. Huot, K. Kea, T.-K. Kim, and Y. Han, “Enhancing knapsack-based financial portfolio optimization using quantum approximate optimization algorithm,” IEEE Access, 2024.

- N. Stamatopoulos, D. J. Egger, Y. Sun, C. Zoufal, R. Iten, N. Shen, and S. Woerner, “Option pricing using quantum computers,” Quantum, vol. 4, p. 291, 2020.

- N. Srivastava, G. Belekar, N. Shahakar et al., “The potential of quantum techniques for stock price prediction,” in 2023 IEEE International Conference on Recent Advances in Systems Science and Engineering (RASSE). IEEE, 2023, pp. 1–7.

- S. Mugel, E. Lizaso, and R. Orús, “Use cases of quantum optimization for finance,” in International Conference of the Thailand Econometrics Society. Springer, 2022, pp. 211–220.

- M. Adegbola, A. Adegbola, P. Amajuoyi, L. Benjamin, and K. Adeusi, “Quantum computing and financial risk management: A theoretical review and implications,” Computer science & IT research journal, vol. 5, no. 6, pp. 1210–1220, 2024.

- K. Miyamoto, “Quantum algorithm for calculating risk contributions in a credit portfolio,” EPJ Quantum Technology, vol. 9, no. 1, pp. 1–16, 2022.

- S. Wilkens and J. Moorhouse, “Quantum computing for financial risk measurement,” Quantum Information Processing, vol. 22, no. 1, p. 51, 2023.

- M. A. Shafique, A. Munir, and I. Latif, “Quantum computing: circuits, algorithms, and applications,” IEEE Access, vol. 12, pp. 22 296–22 314, 2024.

- E. Dri, A. Aita, T. Fioravanti, G. Franco, E. Giusto, G. Ranieri, D. Corbelletto, and B. Montrucchio, “Towards an end-to-end approach for quantum principal component analysis,” in 2023 IEEE International Conference on Quantum Computing and Engineering (QCE), vol. 2. IEEE, 2023, pp. 1–6.

- P. Rebentrost, B. Gupt, and T. R. Bromley, “Quantum computational finance: Monte carlo pricing of financial derivatives,” Physical Review A, vol. 98, no. 2, p. 022321, 2018.

- S. Dutta, N. Innan, A. Marchisio, S. B. Yahia, and M. Shafique, “Qadqn: Quantum attention deep q-network for financial market prediction,” in 2024 IEEE International Conference on Quantum Computing and Engineering (QCE), vol. 2. IEEE, 2024, pp. 341–346.

- C. Dalyac, L. Henriet, E. Jeandel, W. Lechner, S. Perdrix, M. Porcheron, and M. Veshchezerova, “Qualifying quantum approaches for hard industrial optimization problems. a case study in the field of smart-charging of electric vehicles,” EPJ Quantum Technology, vol. 8, no. 1, p. 12, 2021.

- A. Bouland,W. van Dam, H. Joorati, I. Kerenidis, and A. Prakash, “Prospects and challenges of quantum finance,” arXiv preprint arXiv:2011.06492, 2020.

- Y.-J. Chang, W.-T. Wang, H.-Y. Chen, S.-W. Liao, and C.-R. Chang, “A novel approach for quantum financial simulation and quantum state preparation,” Quantum Machine Intelligence, vol. 6, no. 1, p. 24, 2024.

- H. Li, T. Xing, S. Wei, Z. Liu, J. Zhang, and G.-L. Long, “Bq-bank: A quantum software for finance and banking,” Quantum Engineering, vol. 2023, no. 1, p. 7810974, 2023.

- S. Fernández-Lorenzo, D. Porras, and J. J. García-Ripoll, “Hybrid quantum–classical optimization with cardinality constraints and applications to finance,” Quantum Science and Technology, vol. 6, no. 3, p. 034010, 2021.

- A. S. Naik, E. Yeniaras, G. Hellstern, G. Prasad, and S. K. L. P. Vishwakarma, “From portfolio optimization to quantum blockchain and security: A systematic review of quantum computing in finance,” Financial Innovation, vol. 11, no. 1, pp. 1–67, 2025.

- Y. Tang, J. Yan, G. Hu, B. Zhang, and J. Zhou, “Recent progress and perspectives on quantum computing for finance,” Service Oriented Computing and Applications, vol. 16, no. 4, pp. 227–229, 2022.

- L. Ingber, “Options on quantum money: Quantum path-integral with serial shocks,” L. Ingber," Options on quantum money: Quantum path-integral with serial shocks," International Journal of Innovative Research in Information Security, vol. 4, no. 2, pp. 1–13, 2017.

- D. Herman, C. Googin, X. Liu, A. Galda, I. Safro, Y. Sun, M. Pistoia, and Y. Alexeev, “A survey of quantum computing for finance,” arXiv preprint arXiv:2201.02773, 2022.

- S. Kumar and C. M. Wilmott, “Simulating the non-hermitian dynamics of financial option pricing with quantum computers,” Scientific Reports, vol. 15, no. 1, p. 13268, 2025.

- B. E. Baaquie, Quantum finance: Path integrals and Hamiltonians for options and interest rates. Cambridge University Press, 2007.

- L. Sáez-Ortuño, R. Huertas-Garcia, S. Forgas-Coll, J. Sánchez-García, and E. Puertas-Prats, “Quantum computing for market research,” Journal of Innovation & Knowledge, vol. 9, no. 3, p. 100510, 2024.

- X.-N. Zhuang, Z.-Y. Chen, Y.-C. Wu, and G.-P. Guo, “Quantum computational quantitative trading: high-frequency statistical arbitrage algorithm,” New Journal of Physics, vol. 24, no. 7, p. 073036, 2022.

- I. Arraut, J. A. Lobo Marques, and S. Gomes, “The probability flow in the stock market and spontaneous symmetry breaking in quantum finance,” Mathematics, vol. 9, no. 21, p. 2777, 2021.

- A. Faccia, “Quantum finance. opportunities and threats.”,” Information Technology innovations in Economics, Finance, Accounting, and Law, vol. 1, no. 8, 2020.

- N. R. Mosteanu and A. Faccia, “Fintech frontiers in quantum computing, fractals, and blockchain distributed ledger: Paradigm shifts and open innovation,” Journal of Open Innovation: Technology, Market, and Complexity, vol. 7, no. 1, p. 19, 2021.

- M. Pistoia, S. F. Ahmad, A. Ajagekar, A. Buts, S. Chakrabarti, D. Herman, S. Hu, A. Jena, P. Minssen, P. Niroula et al., “Quantum machine learning for finance iccad special session paper,” in 2021 IEEE/ACM international conference on computer aided design (ICCAD). IEEE, 2021, pp. 1–9.

- P. Griffin and R. Sampat, “Quantum computing for supply chain finance,” in 2021 IEEE International Conference on Services Computing (SCC). IEEE, 2021, pp. 456–459.

- D. Koch, S. Patel, L. Wessing, and P. M. Alsing, “Fundamentals in quantum algorithms: A tutorial series using qiskit continued,” arXiv preprint arXiv:2008.10647, 2020.

- B. Coyle, M. Henderson, J. C. J. Le, N. Kumar, M. Paini, and E. Kashefi, “Quantum versus classical generative modelling in finance,” Quantum Science and Technology, vol. 6, no. 2, p. 024013, 2021.

- K. Miyamoto and K. Kubo, “Pricing multi-asset derivatives by finite-difference method on a quantum computer,” IEEE Transactions on Quantum Engineering, vol. 3, pp. 1–25, 2021.

- D. J. Egger, C. Gambella, J. Marecek, S. McFaddin, M. Mevissen, R. Raymond, A. Simonetto, S. Woerner, and E. Yndurain, “Quantum computing for finance: State-of-the-art and future prospects,” IEEE Transactions on Quantum Engineering, vol. 1, pp. 1–24, 2020.

- U. Fiore, F. Gioia, and P. Zanetti, “A perspective on quantum fintech,” Decisions in Economics and Finance, pp. 1–27, 2024.

- G. Kou and Y. Lu, “Fintech: a literature review of emerging financial technologies and applications,” Financial Innovation, vol. 11, no. 1, p. 1, 2025.

- P. Schulte and D. K. C. Lee, AI & Quantum Computing for Finance & Insurance: Fortunes and Challenges for China and America. World Scientific, 2019, vol. 1.

- L. Accardi and A. Boukas, “The quantum black-scholes equation,” arXiv preprint arXiv:0706.1300, 2007.

- A. Bhatnagar and D. D. Vvedensky, “Quantum effects in an expanded black–scholes model,” The European Physical Journal B, vol. 95, no. 8, p. 138, 2022.

- F. Fontanela, A. Jacquier, and M. Oumgari, “A quantum algorithm for linear pdes arising in finance,” SIAM Journal on Financial Mathematics, vol. 12, no. 4, pp. SC98–SC114, 2021.

- X.-N. Zhuang, Z.-Y. Chen, C. Xue, Y.-C. Wu, and G.-P. Guo, “Quantum encoding and analysis on continuous time stochastic process with financial applications,” Quantum, vol. 7, p. 1127, 2023.

- E. E. Haven, “A discussion on embedding the black–scholes option pricing model in a quantum physics setting,” Physica A: Statistical Mechanics and its Applications, vol. 304, no. 3-4, pp. 507–524, 2002.

- Ö. Yeşiltaş, “The black-scholes equation in finance: Quantum mechanical approaches,” Physica A: Statistical Mechanics and its Applications, vol. 623, p. 128909, 2023.

- N. P. De Leon, K. M. Itoh, D. Kim, K. K. Mehta, T. E. Northup, H. Paik, B. Palmer, N. Samarth, S. Sangtawesin, and D. W. Steuerman, “Materials challenges and opportunities for quantum computing hardware,” Science, vol. 372, no. 6539, p. eabb2823, 2021.

- F. T. Chong, D. Franklin, and M. Martonosi, “Programming languages and compiler design for realistic quantum hardware,” Nature, vol. 549, no. 7671, pp. 180–187, 2017.

- B. E. Baaquie, C. Coriano, and M. Srikant, “Quantum mechanics, path integrals and option pricing: Reducing the complexity of finance,” in Nonlinear Physics: Theory and Experiment II. World Scientific, 2003, pp. 333–339.

- M. Ansari, A. Chhabra, N. Hasan, and M. Alam, “Quantum finance: Revolutionizing financial markets with quantum computing,” in AI-Driven Finance in the VUCA World. Auerbach Publications, 2025, pp. 96–105.

- G. Buonaiuto, F. Gargiulo, G. De Pietro, M. Esposito, and M. Pota, “Best practices for portfolio optimization by quantum computing, experimented on real quantum devices,” Scientific Reports, vol. 13, no. 1, p. 19434, 2023.

- L. Braine, D. J. Egger, J. Glick, and S. Woerner, “Quantum algorithms for mixed binary optimization applied to transaction settlement,” IEEE Transactions on Quantum Engineering, vol. 2, pp. 1–8, 2021.

- J. Fellingham, H. Lin, D. Schroeder et al., “Entropy, double entry accounting and quantum entanglement,” Foundations and Trends® in Accounting, vol. 16, no. 4, pp. 308–396, 2022.

- R. Orús, S. Mugel, and E. Lizaso, “Forecasting financial crashes with quantum computing,” Physical Review A, vol. 99, no. 6, p. 060301, 2019.

- E. Tang, “A quantum-inspired classical algorithm for recommendation systems,” in Proceedings of the 51st annual ACM SIGACT symposium on theory of computing, 2019, pp. 217–228.

- J. M. Arrazola, A. Delgado, B. R. Bardhan, and S. Lloyd, “Quantum-inspired algorithms in practice,” arXiv preprint arXiv:1905.10415, 2019.

- C. Shao and A. Montanaro, “Faster quantum-inspired algorithms for solving linear systems,” ACM Transactions on Quantum Computing, vol. 3, no. 4, pp. 1–23, 2022.

- P. Sangeetha and P. Kumari, “Quantum algorithms for machine learning and optimization,” in 2020 2nd PhD Colloquium on Ethically Driven Innovation and Technology for Society (PhD EDITS). IEEE, 2020, pp. 1–2.

- C. Ding, T.-Y. Bao, and H.-L. Huang, “Quantum-inspired support vector machine,” IEEE Transactions on Neural Networks and Learning Systems, vol. 33, no. 12, pp. 7210–7222, 2021.

- N.-H. Chia, A. P. Gilyén, T. Li, H.-H. Lin, E. Tang, and C. Wang, “Sampling-based sublinear low-rank matrix arithmetic framework for dequantizing quantum machine learning,” Journal of the ACM, vol. 69, no. 5, pp. 1–72, 2022.

- A. Gilyén, Z. Song, and E. Tang, “An improved quantum-inspired algorithm for linear regression,” Quantum, vol. 6, p. 754, 2022.

- M. Zhandry, “Quantum lightning never strikes the same state twice. or: quantum money from cryptographic assumptions,” Journal of Cryptology, vol. 34, pp. 1–56, 2021.

- J.-Y. Guan, J. M. Arrazola, R. Amiri, W. Zhang, H. Li, L. You, Z. Wang, Q. Zhang, and J.-W. Pan, “Experimental preparation and verification of quantum money,” Physical Review A, vol. 97, no. 3, p. 032338, 2018.

- M. Bozzio, A. Orieux, L. Trigo Vidarte, I. Zaquine, I. Kerenidis, and E. Diamanti, “Experimental investigation of practical unforgeable quantum money,” npj Quantum Information, vol. 4, no. 1, p. 5, 2018.

- N. Kumar, “Practically feasible robust quantum money with classical verification,” Cryptography, vol. 3, no. 4, p. 26, 2019.

- S. Aaronson and G. N. Rothblum, “Gentle measurement of quantum states and differential privacy,” in Proceedings of the 51st Annual ACM SIGACT Symposium on Theory of Computing, 2019, pp. 322–333.

- A. Coladangelo and O. Sattath, “A quantum money solution to the blockchain scalability problem,” Quantum, vol. 4, p. 297, 2020.

- R. Amos, M. Georgiou, A. Kiayias, and M. Zhandry, “One-shot signatures and applications to hybrid quantum/classical authentication,” in Proceedings of the 52nd Annual ACM SIGACT Symposium on Theory of Computing, 2020, pp. 255–268.

- O. Shmueli, “Public-key quantum money with a classical bank,” in Proceedings of the 54th Annual ACM SIGACT Symposium on Theory of Computing, 2022, pp. 790–803.

- J. Liu, H. Montgomery, and M. Zhandry, “Another round of breaking and making quantum money: How to not build it from lattices, and more,” in Annual International Conference on the Theory and Applications of Cryptographic Techniques. Springer, 2023, pp. 611–638.

- S. Ben-David and O. Sattath, “Quantum tokens for digital signatures,” Quantum, vol. 7, p. 901, 2023.

- C. McMahon, D. McGillivray, A. Desai, F. Rivadeneyra, J.-P. Lam, T. Lo, D. Marsden, and V. Skavysh, “Improving the efficiency of payments systems using quantum computing,” Management Science, vol. 70, no. 10, pp. 7325–7341, 2024.

- E. O. Kiktenko, N. O. Pozhar, M. N. Anufriev, A. S. Trushechkin, R. R. Yunusov, Y. V. Kurochkin, A. Lvovsky, and A. K. Fedorov, “Quantum-secured blockchain,” Quantum Science and Technology, vol. 3, no. 3, p. 035004, 2018.

- M. Allende, D. L. León, S. Cerón, A. Pareja, E. Pacheco, A. Leal, M. Da Silva, A. Pardo, D. Jones, D. J. Worrall et al., “Quantum-resistance in blockchain networks,” Scientific Reports, vol. 13, no. 1, p. 5664, 2023.

- M. Y. Shalaginov and M. Dubrovsky, “Quantum proof of work with parametrized quantum circuits,” arXiv preprint arXiv:2204.10643, 2022.

- S. Woerner and D. J. Egger, “Quantum risk analysis,” npj Quantum Information, vol. 5, no. 1, p. 15, 2019.

- P. K. Barkoutsos, G. Nannicini, A. Robert, I. Tavernelli, and S. Woerner, “Improving variational quantum optimization using cvar,” Quantum, vol. 4, p. 256, 2020.

- N. Stamatopoulos, G. Mazzola, S. Woerner, and W. J. Zeng, “Towards quantum advantage in financial market risk using quantum gradient algorithms,” Quantum, vol. 6, p. 770, 2022.

- D. J. Egger, R. G. Gutiérrez, J. C. Mestre, and S. Woerner, “Credit risk analysis using quantum computers,” IEEE transactions on computers, vol. 70, no. 12, pp. 2136–2145, 2020.

- K. Kaneko, K. Miyamoto, N. Takeda, and K. Yoshino, “Quantum speedup of monte carlo integration with respect to the number of dimensions and its application to finance,” Quantum Information Processing, vol. 20, no. 5, p. 185, 2021.

- A. M. Aboussalah, C. Chi, and C.-G. Lee, “Quantum computing reduces systemic risk in financial networks,” Scientific Reports, vol. 13, no. 1, p. 3990, 2023.

- E. Dri, A. Aita, E. Giusto, D. Ricossa, D. Corbelletto, B. Montrucchio, and R. Ugoccioni, “A more general quantum credit risk analysis framework,” Entropy, vol. 25, no. 4, p. 593, 2023.

- O. Kyriienko and E. B. Magnusson, “Unsupervised quantum machine learning for fraud detection,” arXiv preprint arXiv:2208.01203, 2022.

- M. Grossi, N. Ibrahim, V. Radescu, R. Loredo, K. Voigt, C. Von Altrock, and A. Rudnik, “Mixed quantum–classical method for fraud detection with quantum feature selection,” IEEE Transactions on Quantum Engineering, vol. 3, pp. 1–12, 2022.

- N. Mitsuda, T. Ichimura, K. Nakaji, Y. Suzuki, T. Tanaka, R. Raymond, H. Tezuka, T. Onodera, and N. Yamamoto, “Approximate complex amplitude encoding algorithm and its application to data classification problems,” Physical Review A, vol. 109, no. 5, p. 052423, 2024.

- A. Martin, B. Candelas, Á. Rodríguez-Rozas, J. D. Martín-Guerrero, X. Chen, L. Lamata, R. Orús, E. Solano, and M. Sanz, “Toward pricing financial derivatives with an ibm quantum computer,” Physical Review Research, vol. 3, no. 1, p. 013167, 2021.

- D. Orrell, “A quantum walk model of financial options,” Wilmott, vol. 2021, no. 112, pp. 62–69, 2021.

- Z. Kakushadze, “Path integral and asset pricing,” Quantitative Finance, vol. 15, no. 11, pp. 1759–1771, 2015.

- D. Venturelli and A. Kondratyev, “Reverse quantum annealing approach to portfolio optimization problems,” Quantum Machine Intelligence, vol. 1, no. 1, pp. 17–30, 2019.

- I. Kerenidis, A. Prakash, and D. Szilágyi, “Quantum algorithms for portfolio optimization,” in Proceedings of the 1st ACM Conference on Advances in Financial Technologies, 2019, pp. 147–155.

- N. Slate, E. Matwiejew, S. Marsh, and J. B. Wang, “Quantum walk-based portfolio optimisation,” Quantum, vol. 5, p. 513, 2021.

- R. Yalovetzky, P. Minssen, D. Herman, and M. Pistoia, “Nisq-hhl: Portfolio optimization for near-term quantum hardware,” arXiv preprint arXiv:2110.15958, 2021.

- D. Lim and P. Rebentrost, “A quantum online portfolio optimization algorithm,” Quantum Information Processing, vol. 23, no. 3, p. 63, 2024.

- P. Niroula, R. Shaydulin, R. Yalovetzky, P. Minssen, D. Herman, S. Hu, and M. Pistoia, “Constrained quantum optimization for extractive summarization on a trapped-ion quantum computer,” Scientific Reports, vol. 12, no. 1, p. 17171, 2022.

- E. Aguilera, J. de Jong, F. Phillipson, S. Taamallah, and M. Vos, “Multi-objective portfolio optimization using a quantum annealer,” Mathematics, vol. 12, no. 9, p. 1291, 2024.

- A. Abbas, A. Ambainis, B. Augustino, A. Bärtschi, H. Buhrman, C. Coffrin, G. Cortiana, V. Dunjko, D. J. Egger, B. G. Elmegreen et al., “Challenges and opportunities in quantum optimization,” Nature Reviews Physics, pp. 1–18, 2024.

- Y.-H. Chou, Y.-C. Jiang, and S.-Y. Kuo, “Portfolio optimization in both long and short selling trading using trend ratios and quantum-inspired evolutionary algorithms,” IEEE Access, vol. 9, pp. 152 115–152 130, 2021.

- J. Lang, S. Zielinski, and S. Feld, “Strategic portfolio optimization using simulated, digital, and quantum annealing,” Applied Sciences, vol. 12, no. 23, p. 12288, 2022.

- J. Gacon, C. Zoufal, and S. Woerner, “Quantum-enhanced simulation-based optimization,” in 2020 IEEE International conference on quantum computing and engineering (QCE). IEEE, 2020, pp. 47–55.

- K. Blekos, D. Brand, A. Ceschini, C.-H. Chou, R.-H. Li, K. Pandya, and A. Summer, “A review on quantum approximate optimization algorithm and its variants,” Physics Reports, vol. 1068, pp. 1–66, 2024.

- N. Schetakis, D. Aghamalyan, M. Boguslavsky, A. Rees, M. Rakotomalala, and P. R. Griffin, “Quantum machine learning for credit scoring,” Mathematics, vol. 12, no. 9, p. 1391, 2024.

- S. Mugel, C. Kuchkovsky, E. Sánchez, S. Fernández-Lorenzo, J. Luis-Hita, E. Lizaso, and R. Orús, “Dynamic portfolio optimization with real datasets using quantum processors and quantum-inspired tensor networks,” Physical Review Research, vol. 4, no. 1, p. 013006, 2022.

- G. Rosenberg, P. Haghnegahdar, P. Goddard, P. Carr, K. Wu, and M. L. De Prado, “Solving the optimal trading trajectory problem using a quantum annealer,” in Proceedings of the 8th workshop on high performance computational finance, 2015, pp. 1–7.

- M. Marzec, “Portfolio optimization: Applications in quantum computing,” Handbook of High-Frequency Trading and Modeling in Finance, pp. 73–106, 2016.

- S. Palmer, S. Sahin, R. Hernandez, S. Mugel, and R. Orus, “Quantum portfolio optimization with investment bands and target volatility,” arXiv preprint arXiv:2106.06735, 2021.

- S. Bravyi, G. Smith, and J. A. Smolin, “Trading classical and quantum computational resources,” Physical Review X, vol. 6, no. 2, p. 021043, 2016.

- G. Carrascal, P. Hernamperez, G. Botella, and A. del Barrio, “Backtesting quantum computing algorithms for portfolio optimization,” IEEE Transactions on Quantum Engineering, vol. 5, pp. 1–20, 2023.

- V. Palaniappan, I. Ishak, H. Ibrahim, F. Sidi, and Z. A. Zukarnain, “A review on high-frequency trading forecasting methods: Opportunity and challenges for quantum based method,” IEEE Access, vol. 12, pp. 167 471–167 488, 2024.

- S.-Y. Kuo, C. Kuo, and Y.-H. Chou, “Dynamic stock trading system based on quantum-inspired tabu search algorithm,” in 2013 IEEE Congress on Evolutionary Computation. IEEE, 2013, pp. 1029–1036.

- A. Khang, K. C. Rath, K. Madapana, J. Rao, L. P. Panda, and S. Das, “Quantum computing and portfolio optimization in finance services,” in Shaping Cutting-Edge Technologies and Applications for Digital Banking and Financial Services. Productivity Press, 2025, pp. 27–45.

- J. F. Doriguello, A. Luongo, J. Bao, P. Rebentrost, and M. Santha, “Quantum algorithm for stochastic optimal stopping problems with applications in finance,” arXiv preprint arXiv:2111.15332, 2021.

- G. Carrascal, B. Roman, A. del Barrio, and G. Botella, “Differential evolution vqe for crypto-currency arbitrage. quantum optimization with many local minima,” Digital Signal Processing, vol. 148, p. 104464, 2024.

- Y.-J. Chang, M.-F. Sie, S.-W. Liao, and C.-R. Chang, “The prospects of quantum computing for quantitative finance and beyond,” IEEE Nanotechnology Magazine, vol. 17, no. 2, pp. 31–37, 2023.

- R. Sotelo, “Applications of quantum computing to optimization,” in 2021 IEEE CHILEAN Conference on Electrical, Electronics Engineering, Information and Communication Technologies (CHILECON). IEEE, 2021, pp. 1–5.

- S. N. Morapakula, S. Deshpande, R. Yata, R. Ubale, U.Wad, and K. Ikeda, “End-to-end portfolio optimization with quantum annealing,” arXiv preprint arXiv:2504.08843, 2025.

- A. Gómez, Á. Leitao, A. Manzano, D. Musso, M. R. Nogueiras, G. Ordóñez, and C. Vázquez, “A survey on quantum computational finance for derivatives pricing and var,” Archives of computational methods in engineering, vol. 29, no. 6, pp. 4137–4163, 2022.

- M. Rutkowski and S. Tarca, “Regulatory capital modeling for credit risk,” International Journal of Theoretical and Applied Finance, vol. 18, no. 05, p. 1550034, 2015.

- P. Lamichhane and D. B. Rawat, “Quantum machine learning: Recent advances, challenges and perspectives,” IEEE Access, 2025.

- D. Peral-García, J. Cruz-Benito, and F. J. García-Peñalvo, “Systematic literature review: Quantum machine learning and its applications,” Computer Science Review, vol. 51, p. 100619, 2024.

- G. Hellstem, “Hybrid quantum network for classification of finance and mnist data,” in 2021 IEEE 18th international conference on software architecture companion (ICSA-C). IEEE, 2021, pp. 1–4.

- V. Dunjko and H. J. Briegel, “Machine learning & artificial intelligence in the quantum domain: a review of recent progress,” Reports on Progress in Physics, vol. 81, no. 7, p. 074001, 2018.

- T. Sakuma, “Application of deep quantum neural networks to finance,” arXiv preprint arXiv:2011.07319, 2020.

- K. Zaman, A. Marchisio, M. A. Hanif, and M. Shafique, “A survey on quantum machine learning: Current trends, challenges, opportunities, and the road ahead,” arXiv preprint arXiv:2310.10315, 2023.

- Y. Liu, S. Arunachalam, and K. Temme, “A rigorous and robust quantum speed-up in supervised machine learning,” Nature Physics, vol. 17, no. 9, pp. 1013–1017, 2021.

- M. Schuld and N. Killoran, “Quantum machine learning in feature hilbert spaces,” Physical review letters, vol. 122, no. 4, p. 040504, 2019.

- M. Schuld, I. Sinayskiy, and F. Petruccione, “An introduction to quantum machine learning,” Contemporary Physics, vol. 56, no. 2, pp. 172–185, 2015.

- J. Biamonte, P. Wittek, N. Pancotti, P. Rebentrost, N. Wiebe, and S. Lloyd, “Quantum machine learning,” Nature, vol. 549, no. 7671, pp. 195–202, 2017.

- Y. Zhang and Q. Ni, “Recent advances in quantum machine learning,” Quantum Engineering, vol. 2, no. 1, p. e34, 2020.

- J. D. Martín-Guerrero and L. Lamata, “Quantum machine learning: A tutorial,” Neurocomputing, vol. 470, pp. 457–461, 2022.

- L. Lamata, “Quantum machine learning and quantum biomimetics: A perspective,” Machine Learning: Science and Technology, vol. 1, no. 3, p. 033002, 2020.

- Y. Gujju, A. Matsuo, and R. Raymond, “Quantum machine learning on near-term quantum devices: Current state of supervised and unsupervised techniques for real-world applications,” Physical Review Applied, vol. 21, no. 6, p. 067001, 2024.

- P. Wittek, Quantum machine learning: what quantum computing means to data mining. Academic Press, 2014.

- C. Ciliberto, M. Herbster, A. D. Ialongo, M. Pontil, A. Rocchetto, S. Severini, and L. Wossnig, “Quantum machine learning: a classical perspective,” Proceedings of the Royal Society A: Mathematical, Physical and Engineering Sciences, vol. 474, no. 2209, p. 20170551, 2018.

- T. M. Khan and A. Robles-Kelly, “Machine learning: Quantum vs classical,” IEEE Access, vol. 8, pp. 219 275–219 294, 2020.

- S. Jerbi, L. J. Fiderer, H. Poulsen Nautrup, J. M. Kübler, H. J. Briegel, and V. Dunjko, “Quantum machine learning beyond kernel methods,” Nature Communications, vol. 14, no. 1, p. 517, 2023.

- M. Krenn, J. Landgraf, T. Foesel, and F. Marquardt, “Artificial intelligence and machine learning for quantum technologies,” Physical Review A, vol. 107, no. 1, p. 010101, 2023.

- Y. Wang and J. Liu, “A comprehensive review of quantum machine learning: from nisq to fault tolerance,” Reports on Progress in Physics, 2024.

- A. Zeguendry, Z. Jarir, and M. Quafafou, “Quantum machine learning: A review and case studies,” Entropy, vol. 25, no. 2, p. 287, 2023.

- X. Gao, Z.-Y. Zhang, and L.-M. Duan, “A quantum machine learning algorithm based on generative models,” Science advances, vol. 4, no. 12, p. eaat9004, 2018.

- E. Paquet and F. Soleymani, “Quantumleap: Hybrid quantum neural network for financial predictions,” Expert Systems with Applications, vol. 195, p. 116583, 2022.

- D. Emmanoulopoulos and S. Dimoska, “Quantum machine learning in finance: Time series forecasting,” arXiv preprint arXiv:2202.00599, 2022.

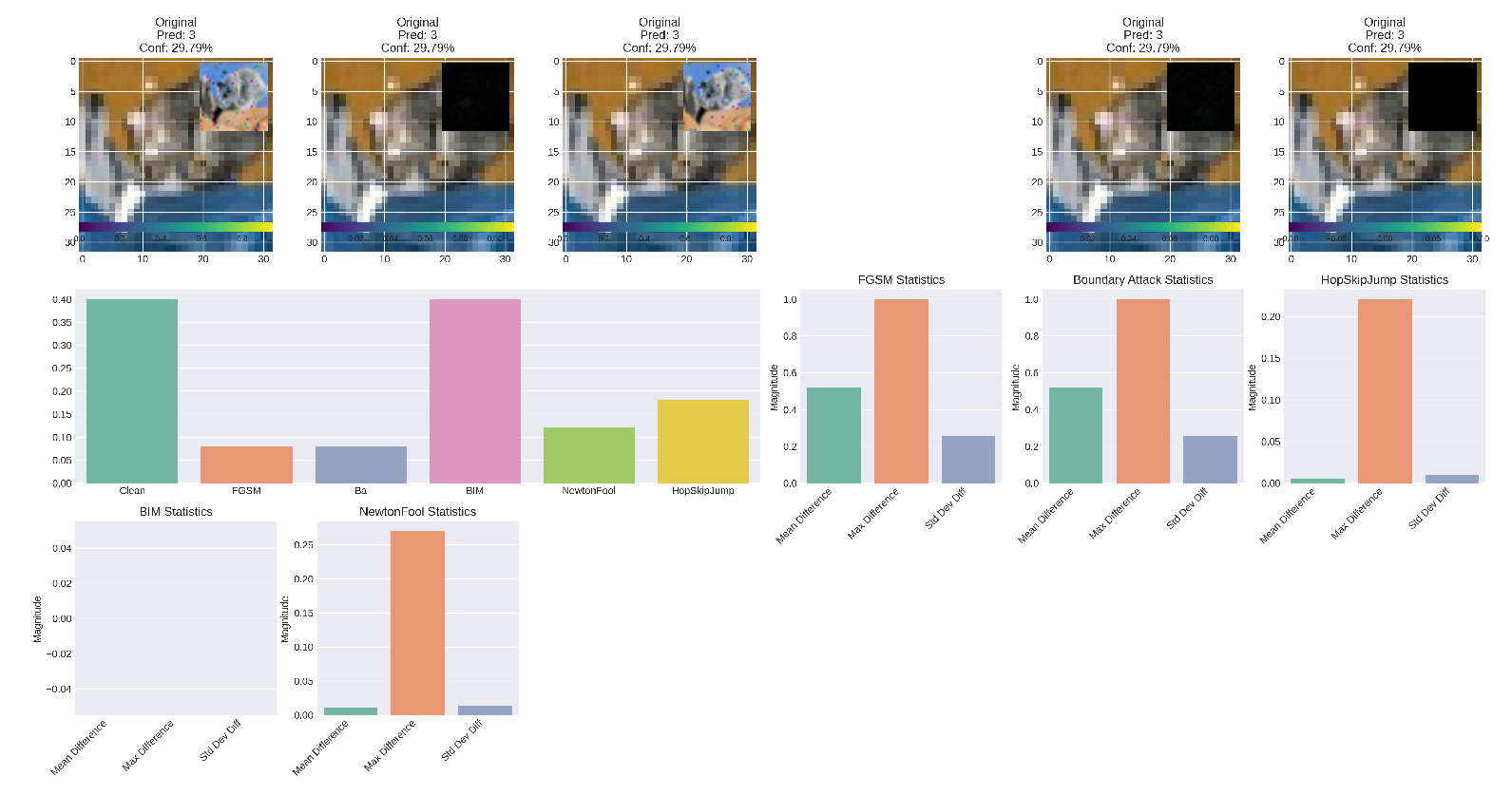

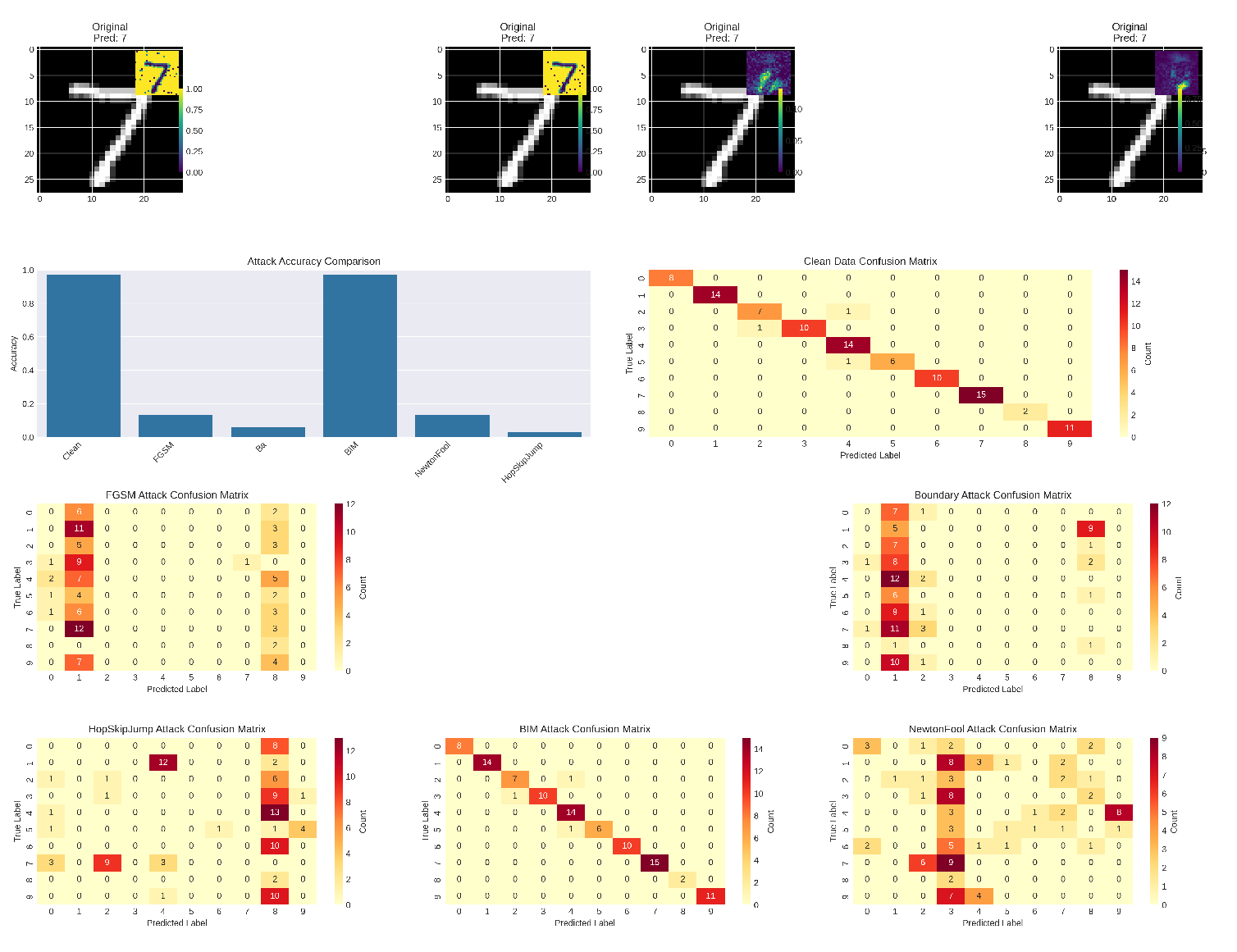

- M.-I. Nicolae, M. Sinn, M. N. Tran, B. Buesser, A. Rawat, M. Wistuba, V. Zantedeschi, N. Baracaldo, B. Chen, H. Ludwig et al., “Adversarial robustness toolbox v1. 0.0,” arXiv preprint arXiv:1807.01069, 2018.

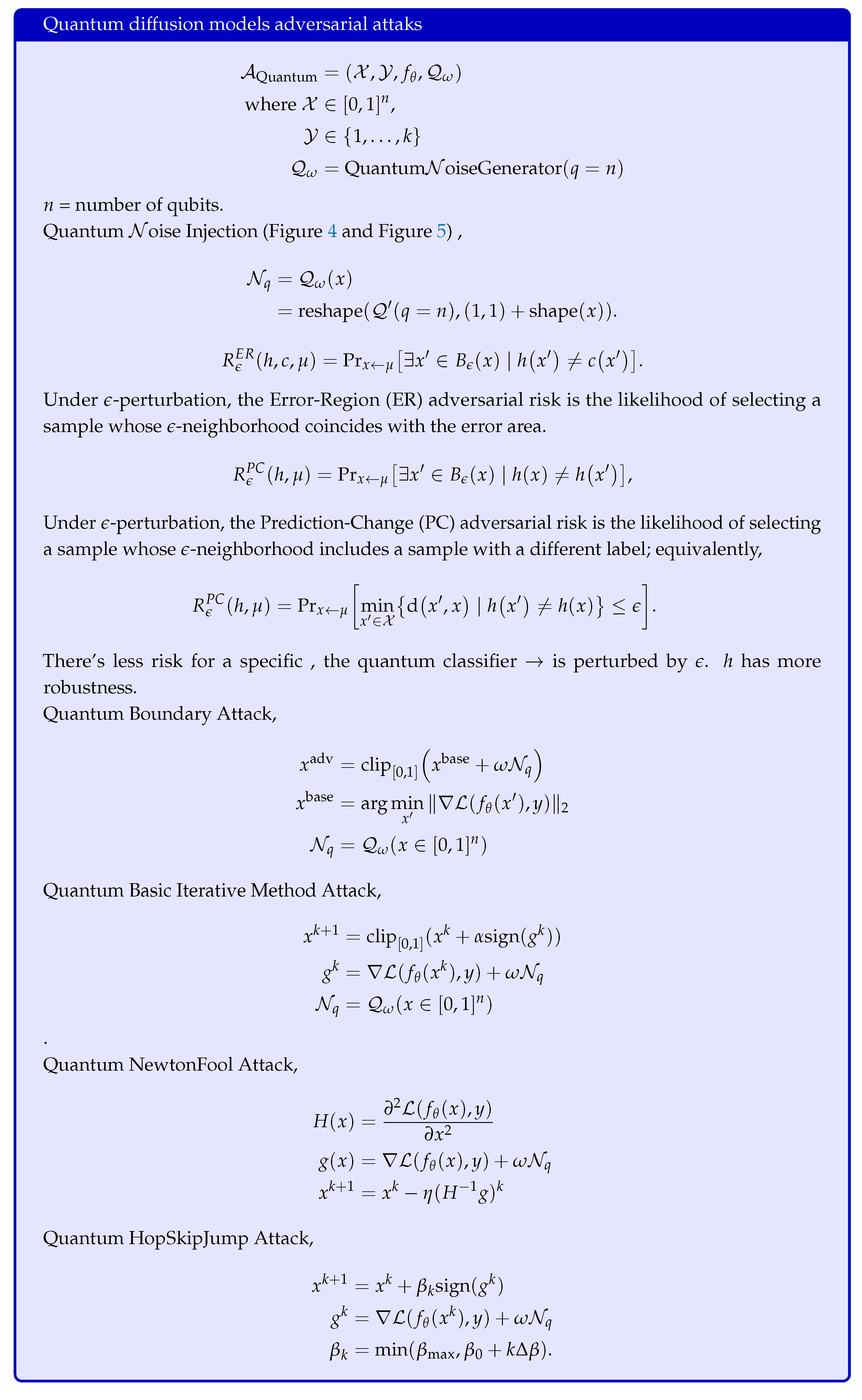

- H. Liao, I. Convy, W. J. Huggins, and K. B. Whaley, “Robust in practice: Adversarial attacks on quantum machine learning,” Physical Review A, vol. 103, no. 4, p. 042427, 2021.

- J.-C. Huang, Y.-L. Tsai, C.-H. H. Yang, C.-F. Su, C.-M. Yu, P.-Y. Chen, and S.-Y. Kuo, “Certified robustness of quantum classifiers against adversarial examples through quantum noise,” in ICASSP 2023-2023 IEEE International Conference on Acoustics, Speech and Signal Processing (ICASSP). IEEE, 2023, pp. 1–5.

- N. Dowling, M. T. West, A. Southwell, A. C. Nakhl, M. Sevior, M. Usman, and K. Modi, “Adversarial robustness guarantees for quantum classifiers,” arXiv preprint arXiv:2405.10360, 2024.

- K. A. Tychola, T. Kalampokas, and G. A. Papakostas, “Quantum machine learning—an overview,” Electronics, vol. 12, no. 11, p. 2379, 2023.

- E. H. Houssein, Z. Abohashima, M. Elhoseny, and W. M. Mohamed, “Machine learning in the quantum realm: The state-of-the-art, challenges, and future vision,” Expert Systems with Applications, vol. 194, p. 116512, 2022.

- G. Carleo, I. Cirac, K. Cranmer, L. Daudet, M. Schuld, N. Tishby, L. Vogt-Maranto, and L. Zdeborová, “Machine learning and the physical sciences,” Reviews of Modern Physics, vol. 91, no. 4, p. 045002, 2019.

- V. Havlíček, A. D. Córcoles, K. Temme, A. W. Harrow, A. Kandala, J. M. Chow, and J. M. Gambetta, “Supervised learning with quantum-enhanced feature spaces,” Nature, vol. 567, no. 7747, pp. 209–212, 2019.

- P. B. Upama, M. J. H. Faruk, M. Nazim, M. Masum, H. Shahriar, G. Uddin, S. Barzanjeh, S. I. Ahamed, and A. Rahman, “Evolution of quantum computing: A systematic survey on the use of quantum computing tools,” in 2022 IEEE 46th Annual Computers, Software, and Applications Conference (COMPSAC). IEEE, 2022, pp. 520–529.

- Y. Du, M.-H. Hsieh, T. Liu, D. Tao, and N. Liu, “Quantum noise protects quantum classifiers against adversaries,” Physical Review Research, vol. 3, no. 2, p. 023153, 2021.

- W. Gong, D. Yuan, W. Li, and D.-L. Deng, “Enhancing quantum adversarial robustness by randomized encodings,” Physical Review Research, vol. 6, no. 2, p. 023020, 2024.

- B. Li, T. Alpcan, C. Thapa, and U. Parampalli, “Computable model-independent bounds for adversarial quantum machine learning,” IEEE Transactions on Quantum Engineering, 2025.

- T. A. Ngo, T. Nguyen, and T. C. Thang, “A survey of recent advances in quantum generative adversarial networks,” Electronics, vol. 12, no. 4, p. 856, 2023.

- C. Zoufal, A. Lucchi, and S. Woerner, “Quantum generative adversarial networks for learning and loading random distributions,” npj Quantum Information, vol. 5, no. 1, p. 103, 2019.

- K. Huang, Z.-A. Wang, C. Song, K. Xu, H. Li, Z. Wang, Q. Guo, Z. Song, Z.-B. Liu, D. Zheng et al., “Quantum generative adversarial networks with multiple superconducting qubits,” npj Quantum Information, vol. 7, no. 1, p. 165, 2021.

- G. Agliardi and E. Prati, “Optimal tuning of quantum generative adversarial networks for multivariate distribution loading,” Quantum Reports, vol. 4, no. 1, pp. 75–105, 2022.

- L. Liu, T. Song, Z. Sun, and J. Lei, “Quantum generative adversarial networks based on rényi divergences,” Physica A: Statistical Mechanics and its Applications, vol. 607, p. 128169, 2022.

- H. Situ, Z. He, Y. Wang, L. Li, and S. Zheng, “Quantum generative adversarial network for generating discrete distribution,” Information Sciences, vol. 538, pp. 193–208, 2020.

- S. A. Stein, B. Baheri, D. Chen, Y. Mao, Q. Guan, A. Li, B. Fang, and S. Xu, “Qugan: A quantum state fidelity based generative adversarial network,” in 2021 IEEE International Conference on Quantum Computing and Engineering (QCE). IEEE, 2021, pp. 71–81.

- S. Chakrabarti, H. Yiming, T. Li, S. Feizi, and X. Wu, “Quantum wasserstein generative adversarial networks,” Advances in Neural Information Processing Systems, vol. 32, 2019.

- A. Assouel, A. Jacquier, and A. Kondratyev, “A quantum generative adversarial network for distributions,” Quantum Machine Intelligence, vol. 4, no. 2, p. 28, 2022.

- P.-L. Dallaire-Demers and N. Killoran, “Quantum generative adversarial networks,” Physical Review A, vol. 98, no. 1, p. 012324, 2018.

- S. Lloyd and C. Weedbrook, “Quantum generative adversarial learning,” Physical review letters, vol. 121, no. 4, p. 040502, 2018.

- W. Ma, K.-C. Chen, S. Yu, M. Liu, and R. Deng, “Robust decentralized quantum kernel learning for noisy and adversarial environment,” arXiv preprint arXiv:2504.13782, 2025.

- E. Yocam, A. Rizi, M. Kamepalli, V. Vaidyan, Y. Wang, and G. Comert, “Quantum adversarial machine learning and defense strategies: Challenges and opportunities,” arXiv preprint arXiv:2412.12373, 2024.

- S. L. Tsang, M. T. West, S. M. Erfani, and M. Usman, “Hybrid quantum–classical generative adversarial network for high-resolution image generation,” IEEE Transactions on Quantum Engineering, vol. 4, pp. 1–19, 2023.

- D. Edwards and D. B. Rawat, “Quantum adversarial machine learning: Status, challenges and perspectives,” in 2020 Second IEEE international conference on trust, privacy and security in intelligent systems and applications (TPS-ISA). IEEE, 2020, pp. 128–133.

- L. Hu, S.-H. Wu, W. Cai, Y. Ma, X. Mu, Y. Xu, H. Wang, Y. Song, D.-L. Deng, C.-L. Zou et al., “Quantum generative adversarial learning in a superconducting quantum circuit,” Science advances, vol. 5, no. 1, p. eaav2761, 2019.

- P. Georgiou, S. T. Jose, and O. Simeone, “Adversarial quantum machine learning: An information-theoretic generalization analysis,” in 2024 IEEE International Symposium on Information Theory (ISIT). IEEE, 2024, pp. 789–794.

- M. Parigi, S. Martina, and F. Caruso, “Quantum-noise-driven generative diffusion models,” Advanced Quantum Technologies, p. 2300401, 2024.

- S. Lu, L.-M. Duan, and D.-L. Deng, “Quantum adversarial machine learning,” Physical Review Research, vol. 2, no. 3, p. 033212, 2020.

- C. Chu, F. Chen, P. Richerme, and L. Jiang, “Qdoor: Exploiting approximate synthesis for backdoor attacks in quantum neural networks,” in 2023 IEEE International Conference on Quantum Computing and Engineering (QCE), vol. 1. IEEE, 2023, pp. 1098–1106.

- J. Aumentado, G. Catelani, and K. Serniak, “Quasiparticle poisoning in superconducting quantum computers,” Physics Today, vol. 76, no. 8, pp. 34–39, 2023.

- C. Chu, L. Jiang, M. Swany, and F. Chen, “Qtrojan: A circuit backdoor against quantum neural networks,” in ICASSP 2023-2023 IEEE International Conference on Acoustics, Speech and Signal Processing (ICASSP). IEEE, 2023, pp. 1–5.

- S. Kundu and S. Ghosh, “Adversarial poisoning attack on quantum machine learning models,” arXiv preprint arXiv:2411.14412, 2024.

- C. Portmann and R. Renner, “Security in quantum cryptography,” Reviews of Modern Physics, vol. 94, no. 2, p. 025008, 2022.

- D. Chawla and P. S. Mehra, “A survey on quantum computing for internet of things security,” Procedia Computer Science, vol. 218, pp. 2191–2200, 2023.

- A. Abbas, A. Ambainis, B. Augustino, A. Bärtschi, H. Buhrman, C. Coffrin, G. Cortiana, V. Dunjko, D. J. Egger, B. G. Elmegreen et al., “Quantum optimization: Potential, challenges, and the path forward,” arXiv preprint arXiv:2312.02279, 2023.

- D. An, N. Linden, J.-P. Liu, A. Montanaro, C. Shao, and J. Wang, “Quantum-accelerated multilevel monte carlo methods for stochastic differential equations in mathematical finance,” Quantum, vol. 5, p. 481, 2021.

- G. Wang and A. Kan, “Option pricing under stochastic volatility on a quantum computer,” Quantum, vol. 8, p. 1504, 2024.

- A. Espinoza-García, P. Vega-Lara, L. R. Díaz-Barrón, and F. Grovas, “On noncommutative quantum mechanics and the black-scholes model,” arXiv preprint arXiv:2502.00938, 2025.

- T. Matsakos and S. Nield, “Quantum monte carlo simulations for financial risk analytics: scenario generation for equity, rate, and credit risk factors,” Quantum, vol. 8, p. 1306, 2024.

- S. Raj, I. Kerenidis, A. Shekhar, B. Wood, J. Dee, S. Chakrabarti, R. Chen, D. Herman, S. Hu, P. Minssen et al., “Quantum deep hedging,” Quantum, vol. 7, p. 1191, 2023.

- M. Schuld, I. Sinayskiy, and F. Petruccione, “The quest for a quantum neural network,” Quantum Information Processing, vol. 13, pp. 2567–2586, 2014.

- N. Killoran, T. R. Bromley, J. M. Arrazola, M. Schuld, N. Quesada, and S. Lloyd, “Continuous-variable quantum neural networks,” Physical Review Research, vol. 1, no. 3, p. 033063, 2019.

- A. Zafar, “Quantum computing in finance: Regulatory readiness, legal gaps, and the future of secure tech innovation,” European Journal of Risk Regulation, pp. 1–32, 2025.

- I. Arraut, “Gauge symmetries and the higgs mechanism in quantum finance,” Europhysics Letters, vol. 143, no. 4, p. 42001, 2023.

- B. E. Baaquie, “Interest rates in quantum finance: The wilson expansion and hamiltonian,” Physical Review E—Statistical, Nonlinear, and Soft Matter Physics, vol. 80, no. 4, p. 046119, 2009.

- A. Montanaro, “Quantum speedup of monte carlo methods,” Proceedings of the Royal Society A: Mathematical, Physical and Engineering Sciences, vol. 471, no. 2181, p. 20150301, 2015.

- R. Kothari and R. O’Donnell, “Mean estimation when you have the source code; or, quantum monte carlo methods,” in Proceedings of the 2023 Annual ACM-SIAM Symposium on Discrete Algorithms (SODA). SIAM, 2023, pp. 1186–1215.

- J. F. Ralph, S. Maskell, and K. Jacobs, “Multiparameter estimation along quantum trajectories with sequential monte carlo methods,” Physical Review A, vol. 96, no. 5, p. 052306, 2017.

- J. Gubernatis, N. Kawashima, and P. Werner, Quantum Monte Carlo Methods. Cambridge University Press, 2016.

- M. Paris and J. Rehacek, Quantum state estimation. Springer Science & Business Media, 2004, vol. 649.

- D. Layden, G. Mazzola, R. V. Mishmash, M. Motta, P. Wocjan, J.-S. Kim, and S. Sheldon, “Quantum-enhanced markov chain monte carlo,” Nature, vol. 619, no. 7969, pp. 282–287, 2023.

- L. Leclerc, L. Ortiz-Gutiérrez, S. Grijalva, B. Albrecht, J. R. Cline, V. E. Elfving, A. Signoles, L. Henriet, G. Del Bimbo, U. A. Sheikh et al., “Financial risk management on a neutral atom quantum processor,” Physical Review Research, vol. 5, no. 4, p. 043117, 2023.

- A. M. Dalzell, B. D. Clader, G. Salton, M. Berta, C. Y.-Y. Lin, D. A. Bader, N. Stamatopoulos, M. J. Schuetz, F. G. Brandão, H. G. Katzgraber et al., “End-to-end resource analysis for quantum interior-point methods and portfolio optimization,” PRX Quantum, vol. 4, no. 4, p. 040325, 2023.

- I. Halperin, “Qlbs: Q-learner in the black-scholes (-merton) worlds,” arXiv preprint arXiv:1712.04609, 2017.

- Y. Zhang, Y. Huang, J. Sun, D. Lv, and X. Yuan, “Quantum computing quantum monte carlo algorithm,” Physical Review A, vol. 112, no. 2, p. 022428, 2025.

- A. Raab, “Monte carlo simulation of random circuit sampling in quantum computing,” arXiv preprint arXiv:2509.04401, 2025.

- M.-O. Wolf, T. Ewen, and I. Turkalj, “Quantum architecture search for quantum monte carlo integration via conditional parameterized circuits with application to finance,” in 2023 IEEE international conference on quantum computing and engineering (QCE), vol. 1. IEEE, 2023, pp. 560–570.

- I. Arraut, A. Au, and A. C.-b. Tse, “Spontaneous symmetry breaking in quantum finance,” Europhysics Letters, vol. 131, no. 6, p. 68003, 2020.

- D. Alaminos, M. B. Salas, and M. Á. Fernández-Gámez, “Quantum monte carlo simulations for estimating forex markets: a speculative attacks experience,” Humanities and Social Sciences Communications, vol. 10, no. 1, pp. 1–21, 2023.

- V. Rishiwal, U. Agarwal, M. Yadav, S. Tanwar, D. Garg, and M. Guizani, “A new alliance of machine learning and quantum computing: concepts, attacks, and challenges in iot networks,” IEEE Internet of Things Journal, 2025.

- S. Y.-C. Chen, C.-H. H. Yang, J. Qi, P.-Y. Chen, X. Ma, and H.-S. Goan, “Variational quantum circuits for deep reinforcement learning,” IEEE access, vol. 8, pp. 141 007–141 024, 2020.

- Q. Wei, H. Ma, C. Chen, and D. Dong, “Deep reinforcement learning with quantum-inspired experience replay,” IEEE Transactions on Cybernetics, vol. 52, no. 9, pp. 9326–9338, 2021.

- N. Meyer, C. Ufrecht, M. Periyasamy, D. D. Scherer, A. Plinge, and C. Mutschler, “A survey on quantum reinforcement learning,” arXiv preprint arXiv:2211.03464, 2022.

- V. Dunjko, J. M. Taylor, and H. J. Briegel, “Advances in quantum reinforcement learning,” in 2017 IEEE international conference on systems, man, and cybernetics (SMC). IEEE, 2017, pp. 282–287.

- D. Dong, C. Chen, H. Li, and T.-J. Tarn, “Quantum reinforcement learning,” IEEE Transactions on Systems, Man, and Cybernetics, Part B (Cybernetics), vol. 38, no. 5, pp. 1207–1220, 2008.

- X. Dai, T.-C. Wei, S. Yoo, and S. Y.-C. Chen, “Quantum machine learning architecture search via deep reinforcement learning,” in 2024 IEEE International Conference on Quantum Computing and Engineering (QCE), vol. 1. IEEE, 2024, pp. 1525–1534.

- V. Saggio, B. E. Asenbeck, A. Hamann, T. Strömberg, P. Schiansky, V. Dunjko, N. Friis, N. C. Harris, M. Hochberg, D. Englund et al., “Experimental quantum speed-up in reinforcement learning agents,” Nature, vol. 591, no. 7849, pp. 229–233, 2021.

- T. Fösel, P. Tighineanu, T. Weiss, and F. Marquardt, “Reinforcement learning with neural networks for quantum feedback,” Physical Review X, vol. 8, no. 3, p. 031084, 2018.

- K.-C. Chen, S. Y.-C. Chen, C.-Y. Liu, and K. K. Leung, “Quantum-train-based distributed multi-agent reinforcement learning,” in 2025 IEEE Symposium for Multidisciplinary Computational Intelligence Incubators (MCII Companion). IEEE, 2025, pp. 1–5.

- S. S. Gill, A. Kumar, H. Singh, M. Singh, K. Kaur, M. Usman, and R. Buyya, “Quantum computing: A taxonomy, systematic review and future directions,” Software: Practice and Experience, vol. 52, no. 1, pp. 66–114, 2022.

- A. Perdomo-Ortiz, M. Benedetti, J. Realpe-Gómez, and R. Biswas, “Opportunities and challenges for quantum-assisted machine learning in near-term quantum computers,” Quantum Science and Technology, vol. 3, no. 3, p. 030502, 2018.

- R. Biswas, Z. Jiang, K. Kechezhi, S. Knysh, S. Mandra, B. O’Gorman, A. Perdomo-Ortiz, A. Petukhov, J. Realpe-Gómez, E. Rieffel et al., “A nasa perspective on quantum computing: Opportunities and challenges,” Parallel Computing, vol. 64, pp. 81–98, 2017.

- A. Di Meglio, K. Jansen, I. Tavernelli, C. Alexandrou, S. Arunachalam, C. W. Bauer, K. Borras, S. Carrazza, A. Crippa, V. Croft et al., “Quantum computing for high-energy physics: State of the art and challenges,” Prx quantum, vol. 5, no. 3, p. 037001, 2024.

- A. Ajagekar and F. You, “Quantum computing for energy systems optimization: Challenges and opportunities,” Energy, vol. 179, pp. 76–89, 2019.

- C. D. Bruzewicz, J. Chiaverini, R. McConnell, and J. M. Sage, “Trapped-ion quantum computing: Progress and challenges,” Applied physics reviews, vol. 6, no. 2, 2019.

- K. Bharti, A. Cervera-Lierta, T. H. Kyaw, T. Haug, S. Alperin-Lea, A. Anand, M. Degroote, H. Heimonen, J. S. Kottmann, T. Menke et al., “Noisy intermediate-scale quantum algorithms,” Reviews of Modern Physics, vol. 94, no. 1, p. 015004, 2022.

- J. J. Meyer, “Fisher information in noisy intermediate-scale quantum applications,” Quantum, vol. 5, p. 539, 2021.

- J. Kusyk, S. M. Saeed, and M. U. Uyar, “Survey on quantum circuit compilation for noisy intermediate-scale quantum computers: Artificial intelligence to heuristics,” IEEE Transactions on Quantum Engineering, vol. 2, pp. 1–16, 2021.

- C.-C. Chen, S.-Y. Shiau, M.-F. Wu, and Y.-R. Wu, “Hybrid classical-quantum linear solver using noisy intermediate-scale quantum machines,” Scientific reports, vol. 9, no. 1, p. 16251, 2019.

- S. Lloyd, S. Garnerone, and P. Zanardi, “Quantum algorithms for topological and geometric analysis of data,” Nature communications, vol. 7, no. 1, p. 10138, 2016.

- R. R. Wahlstrøm, F. Paraschiv, and M. Schürle, “A comparative analysis of parsimonious yield curve models with focus on the nelson-siegel, svensson and bliss versions,” Computational Economics, vol. 59, no. 3, pp. 967–1004, 2022.

| 1 | |

| 2 | |

| 3 | |

| 4 | |

| 5 |

Quantum machine learning,emmanoulopoulos2022quantum |

| 6 | |

| 7 | |

| 8 | |

| 9 | |

| 10 | |

| 11 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).