1. Introduction

The Colombian natural rubber sector has experienced notable expansion over the past two decades, fueled by reforestation incentives, state-supported planting programs, and the global demand for sustainable and deforestation-free commodities. Yet despite this growth, farmgate prices remain unstable and often disconnected from the costs borne by smallholders. Price volatility, frequently driven by shifts in international markets, has hindered income stability and discouraged long-term investment in Hevea brasiliensis cultivation, particularly in post-conflict and marginal rural areas.

In this context, the development of Colombia’s internal rubber market offers a promising but underexplored avenue. While most analyses of rubber pricing in developing economies emphasize global commodity prices, currency fluctuations, and export logistics, the potential for domestic demand to influence farmgate prices has received comparatively little empirical attention. As national consumption increases, driven by local tire manufacturing, construction, and public procurement, understanding the price effects of this internal demand becomes critical for policy and planning.

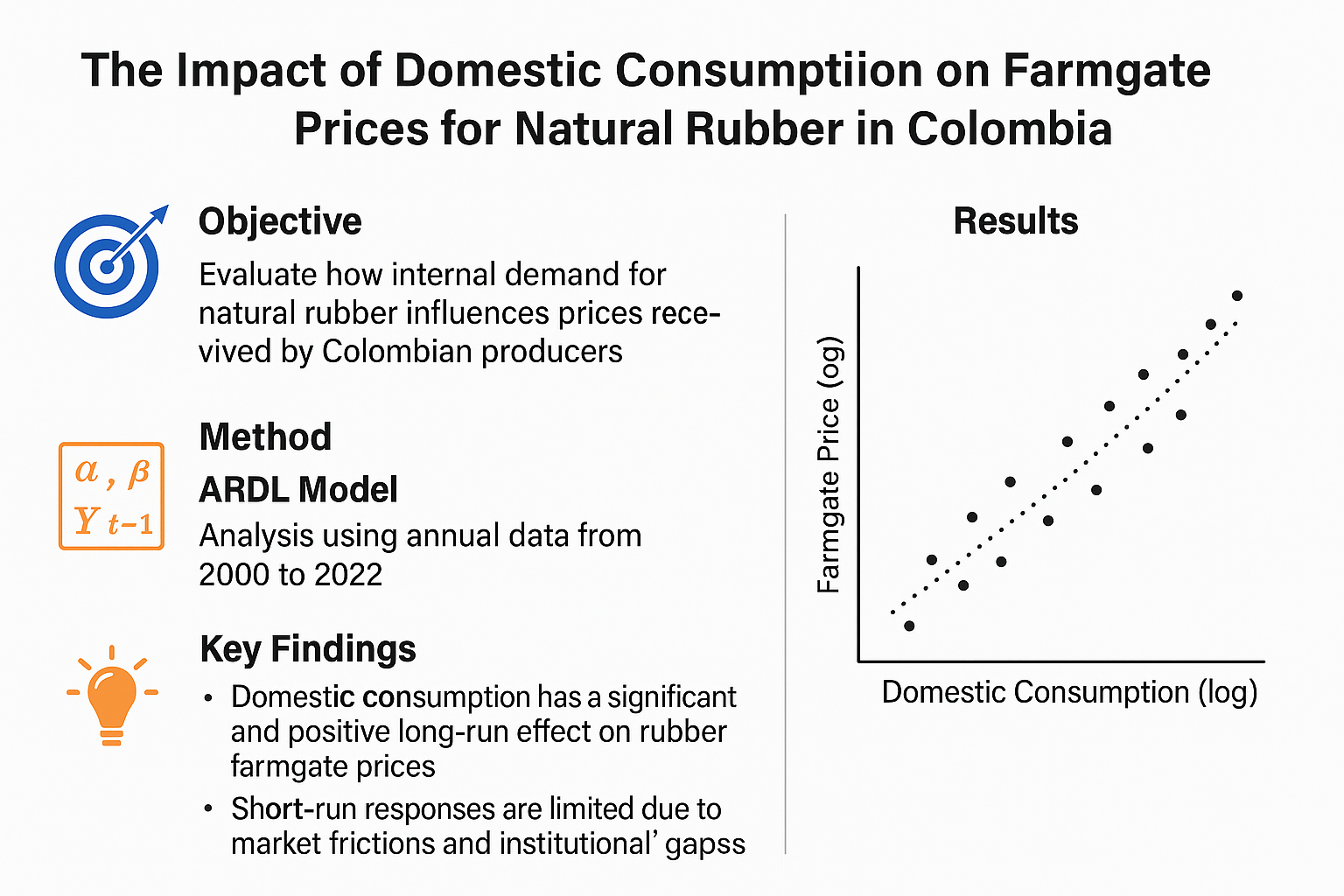

This study aims to fill that gap by addressing the question: To what extent does domestic consumption of natural rubber influence the farmgate price received by Colombian producers? Using an ARDL model with data from 2000 to 2022, we examine both the short- and long-run price effects of internal demand, controlling for global price trends and exchange rate movements.

Beyond the empirical findings, this article contributes to the literature by grounding its analysis in a multi-theoretical framework. It combines insights from classical microeconomics, Structuralist Agricultural Economics, and New Institutional Economics to interpret the dynamics of price transmission in underdeveloped domestic markets. Special attention is also given to the behavioral dimensions of farmer decision-making and the role of selective exposure in shaping market expectations.

2. Theoretical Framework

Understanding how domestic consumption affects farmgate prices in agricultural markets requires an interdisciplinary approach. This section integrates microeconomic price theory with insights from Structuralist Agricultural Economics, behavioral economics, and New Institutional Economics. Together, these perspectives provide a robust conceptual foundation for examining Colombia’s natural rubber sector and the dynamics of domestic demand.

2.1. Microeconomic Price Theory and Market Structures

In classical microeconomic models, price formation occurs at the intersection of supply and demand. In theory, an increase in domestic consumption of a commodity such as natural rubber should raise equilibrium prices, assuming supply is at least partially inelastic in the short term. However, agricultural markets, particularly in developing countries, rarely behave in line with perfect competition assumptions.

In Colombia, rubber markets often resemble monopsonistic structures, where few buyers (processors or traders) dominate, while numerous dispersed producers operate with little bargaining power. This imbalance distorts price signals and reduces the responsiveness of farmgate prices to internal demand shocks. The literature on price transmission asymmetry suggests that farm-level prices tend to respond more fully and quickly to international price declines than to increases in local demand, particularly when value chains are fragmented (Meyer & von Cramon-Taubadel, 2004).

2.2. Domestic Demand as a Long-Run Price Driver

From a Keynesian demand-side perspective, increases in domestic consumption act as a positive demand shock, potentially raising output prices when supply constraints exist. In rubber markets, if downstream industries, such as tire manufacturing or rubber-based construction materials, expand their demand for local raw inputs, farmgate prices can increase even in the absence of rising global prices.

Structuralist Agricultural Economics extends this analysis by emphasizing the role of domestic market development in price formation. In many developing economies, underdeveloped industrial capacity and poor rural infrastructure prevent internal markets from absorbing local agricultural production. This results in export-dependence, where international price fluctuations dictate farmgate earnings. In Colombia, the historical neglect of domestic rubber processing has limited producers’ exposure to price incentives from local demand. Only in recent years have efforts emerged to expand internal use of natural rubber, particularly through state-led procurement and public-private processing initiatives (AGROSAVIA, 2018; Cenicaucho, 2021).

2.3. Behavioral Responses and Selective Exposure

Farmer behavior is often shaped not just by market fundamentals, but by expectations and information processing. According to the Cobweb theory, agricultural producers base their production decisions on past prices, given biological time lags and limited access to reliable forecasts. This leads to cyclical price patterns and potential oversupply or undersupply relative to current demand.

Moreover, insights from social psychology, including selective exposure and social influence theory, help explain how producers filter information. In rural Colombia, decision-making often relies on informal networks, cooperatives, community leaders, radio, and interpersonal observation, rather than formal market analytics. As a result, producers may underreact to shifts in internal demand until such signals are validated through trusted sources or observed in neighboring farms.

This behavioral inertia can dampen the short-run impact of rising domestic consumption on farmgate prices, even if long-run effects become more evident as expectations and investment gradually adjust.

2.4. Institutional and Transaction Cost Barriers

The role of institutions is crucial in mediating price outcomes. New Institutional Economics (North, 1990; Williamson, 1985) emphasizes how transaction costs, contract enforcement, and governance structures influence market efficiency. In the case of Colombian rubber producers:

High transaction costs, due to geographic dispersion, poor roads, or weak coordination, limit producers’ access to higher-paying domestic buyers.

Absence of forward contracts or cooperatives reduces producers’ ability to lock in prices based on expected demand.

Weak bargaining power and lack of quality standards further constrain their ability to benefit from local processing industries.

As a result, domestic consumption may not translate into short-run price gains unless institutional reforms are introduced to improve coordination, reduce costs, and strengthen producer participation in value-added activities.

3. Methodology

3.1. Research Design and Approach

To assess the impact of domestic consumption on the farmgate price of natural rubber in Colombia, this study employs a time-series econometric approach using an Autoregressive Distributed Lag (ARDL) model. This method, introduced by Pesaran, Shin, and Smith (2001), is particularly suitable for datasets with limited sample sizes and mixed orders of integration (i.e., when variables are I(0) and I(1), but not I(2)).

The ARDL framework is chosen because it enables the simultaneous estimation of short-run dynamics and long-run equilibrium relationships, while also allowing lag structure flexibility for each explanatory variable. This is especially useful in the agricultural context, where price adjustments often occur with delay due to biological lags and market frictions.

3.2. Data Sources and Variable Construction

The study uses annual data from 2000 to 2022. The dependent variable is the farmgate price of natural rubber in Colombia, measured in real Colombian pesos per kilogram. Independent variables include:

Domestic Consumption of Natural Rubber (X) – Measured in metric tons, sourced from national industry reports, CCC (Confederación Cauchera de Colombia), and official statistics.

World Price of Natural Rubber (W) – Measured in USD/kg, obtained from the World Bank Commodity Price Database.

Exchange Rate (E) – Expressed as the annual average COP/USD exchange rate, sourced from Banco de la República de Colombia.

To ensure consistency and comparability, all monetary variables are converted into real values using the Producer Price Index (PPI) as the deflator. The natural logarithm of each variable is used to interpret coefficients as elasticities and reduce heteroskedasticity.

3.3. Model Specification

The ARDL model is specified as follows:

Where:

Δ is the first difference operator,

ln denotes the natural logarithm,

εt is the error term,

λ1,λ2,λ3,λ4 capture long-run relationships,

The summation terms represent short-run effects.

The inclusion of lagged differences and levels allows for flexibility in capturing both immediate reactions and gradual adjustments in farmgate prices.

3.4. Estimation Procedure

The estimation process follows these steps:

- 2.

-

Lag Selection

The optimal lag structure for each variable is determined using the Akaike Information Criterion (AIC), ensuring model parsimony while minimizing information loss.

- 3.

-

Bounds Testing for Cointegration

To test for the existence of a long-run equilibrium relationship between the variables, the ARDL bounds testing approach is used. Critical values are taken from Narayan (2005), which adjusts for small sample sizes.

- 4.

-

Estimation of Long-Run and Short-Run Models

Upon confirming cointegration, long-run coefficients are estimated from the levels portion of the ARDL model. The short-run dynamics are captured using an Error Correction Model (ECM), where the coefficient of the error correction term (ECT) indicates the speed of adjustment to equilibrium.

- 5.

-

Diagnostic Testing

Post-estimation diagnostics are conducted to verify the robustness of the model, including tests for:

- ○

Autocorrelation (Breusch-Godfrey LM Test),

- ○

Heteroskedasticity (White Test),

- ○

Normality (Jarque-Bera),

- ○

Stability (CUSUM and CUSUMSQ).

3.5. Software

All estimations are performed using EViews 12, a widely used econometrics software, which allows for efficient specification, estimation, and diagnostic testing of ARDL models.

4. Results

This section presents the outcomes of the empirical analysis, including descriptive statistics, unit root testing, cointegration analysis, and the estimation of both long-run and short-run effects within the ARDL framework.

4.1. Descriptive Statistics and Variable Trends

The descriptive analysis highlights moderate trends and fluctuations in the main variables from 2000 to 2022:

The farmgate price of natural rubber (in real COP/kg) exhibits substantial volatility, influenced by global commodity cycles, exchange rate variations, and inconsistent domestic market demand.

Domestic consumption follows a slow upward trend, reflecting increased national interest in replacing imported rubber products and developing local rubber-based industries.

The world price shows pronounced global cycles, particularly spikes around 2008 and post-2020 pandemic supply disruptions.

The exchange rate fluctuates with broader macroeconomic conditions and has a clear depreciating trend, impacting input costs and local pricing behavior.

All variables were log-transformed and deflated prior to estimation to ensure comparability and eliminate scale-related distortions.

4.2. Unit Root and Stationarity Tests

Unit root tests were performed using the Augmented Dickey-Fuller (ADF) and Phillips-Perron (PP) approaches. The results show:

lnY (farmgate price) and lnW\ln WlnW (world price) are integrated of order one, I(1).

lnX (domestic consumption) and lnE (exchange rate) are stationary at levels, I(0).

These mixed orders of integration confirm the suitability of the ARDL modeling strategy, which permits such a configuration as long as no variable is I(2).

4.3. ARDL Bounds Test for Cointegration

The ARDL bounds test for cointegration indicates the existence of a stable long-run relationship among the variables. The calculated F-statistic is 5.73, which exceeds the upper bound critical value at the 5% level, according to Narayan (2005). This result confirms the presence of cointegration and justifies estimation of long-run and short-run dynamics.

4.4. Long-Run Coefficient Estimates

The long-run elasticities are summarized in the table below:

| Variable |

Coefficient |

Std. Error |

t-Statistic |

Significance |

| ln(Domestic Consumption) (X) |

0.49 |

0.17 |

2.88 |

p < 0.01 |

| ln(World Price) (W) |

0.21 |

0.13 |

1.62 |

Not significant |

| ln(Exchange Rate) (E) |

-0.35 |

0.11 |

-3.18 |

p < 0.01 |

The elasticity of 0.49 on domestic consumption implies that a 1% increase in internal demand raises the farmgate price by nearly 0.5% over the long term. This supports the central hypothesis: domestic consumption acts as a price stabilizer and revenue booster in Colombia’s rubber economy. Meanwhile, exchange rate depreciation exerts downward pressure on farmgate prices, reflecting cost pressures and potential market distortions. The world price, although positively signed, is statistically insignificant in the long run, indicating a decoupling of local prices from global benchmarks.

4.5. Short-Run Dynamics and Error Correction

The short-run estimates and adjustment mechanism are reported as follows:

| Variable |

Coefficient |

Std. Error |

t-Statistic |

Significance |

| Δ ln(Domestic Consumption) |

0.07 |

0.06 |

1.12 |

Not significant |

| Δ ln(World Price) |

0.04 |

0.05 |

0.80 |

Not significant |

| Δ ln(Exchange Rate) |

-0.10 |

0.05 |

-2.00 |

p < 0.05 |

| Δ ln(Farmgate Price)ₜ₋₁ |

0.43 |

0.14 |

3.07 |

p < 0.01 |

| Error Correction Term (ECTₜ₋₁) |

-0.51 |

0.12 |

-4.25 |

p < 0.01 |

Key findings:

Short-run effects of domestic consumption on price are statistically insignificant, suggesting institutional frictions delay transmission.

The exchange rate retains a significant short-run effect, indicating immediate input cost pass-through.

The error correction term (ECT) is negative and significant, confirming convergence to equilibrium. The magnitude (-0.51) indicates that deviations from long-run equilibrium are corrected at a speed of 51% per year.

4.6. Diagnostic Checks

Post-estimation diagnostic tests confirm model robustness:

No autocorrelation: Breusch-Godfrey LM test p > 0.1

Homoscedasticity: White test p > 0.1

Normality: Jarque-Bera test p > 0.05

Model stability: CUSUM and CUSUMSQ within critical bounds

These results validate the reliability of the ARDL model and its suitability for inference.

5. Discussion

The results of this study confirm a key hypothesis: domestic consumption positively influences farmgate prices for natural rubber in Colombia, but only in the long run. This outcome is particularly relevant in a country where smallholders, often operating in post-conflict regions, are vulnerable to price volatility and market dependency on global trends. However, the lack of short-run effects and the continued significance of exchange rate fluctuations reflect structural constraints that still limit the efficiency and inclusiveness of domestic market integration.

5.1. Long-Run Elasticity and Demand-Led Price Formation

The estimated long-run elasticity of 0.49 for domestic consumption implies a moderately strong transmission channel from internal demand to producer prices. This finding is consistent with Keynesian demand-side theory and Structuralist Agricultural Economics, which argue that endogenous market growth can uplift primary producers, provided domestic value chains are active and capable of absorbing local supply.

Similar patterns have been observed in other emerging rubber-producing countries, such as India and Thailand, where strategic industrial policies have tied domestic production to national manufacturing and infrastructure programs (Acharya et al., 2018). In Colombia’s case, the elasticity is likely muted compared to those settings due to relatively lower industrial processing capacity and the nascent stage of internal demand channels.

5.2. Time Lags, Behavioral Frictions, and Selective Exposure

The absence of a statistically significant short-run impact of domestic consumption underscores behavioral and structural lag effects. Farmers in rural Colombia make decisions in environments of uncertainty, often relying on past price trends rather than real-time demand signals. The significance of the lagged dependent variable supports the presence of cobweb dynamics, where current output and pricing behaviors are guided by past prices.

This inertia can also be interpreted through the lens of selective exposure theory. Limited access to timely and trusted market information, especially in areas with weak institutional presence, means producers often delay their response to internal market shifts until signals become visible through peers or trusted intermediaries. Thus, the observed long-run adjustment likely reflects gradual alignment between market expectations and real demand conditions, mediated by experience and social learning.

5.3. Institutional Barriers and Transaction Costs

The continued importance of the exchange rate, both in the short and long run, suggests that price formation remains partially externalized, influenced more by macroeconomic conditions and global commodity flows than by local demand. This pattern aligns with New Institutional Economics, which highlights how high transaction costs, weak coordination, and limited contracting mechanisms inhibit efficient price transmission in agricultural markets.

In the Colombian rubber sector, key bottlenecks include:

Fragmented production with little aggregation capacity.

Scarcity of local processors and absence of guaranteed minimum prices.

Lack of quality grading systems that would allow producers to benefit from product differentiation.

These constraints limit the producer’s ability to negotiate or respond to growing domestic demand, thereby delaying the materialization of consumption-driven price gains.

5.4. Toward a Domestic Market Strategy

The findings point to the strategic value of building Colombia’s internal rubber economy. While international markets will remain important, a more resilient and equitable price system requires domestic anchors, such as local processing, state procurement, and coordinated market information systems.

By facilitating vertical coordination and strengthening farmer access to downstream markets, Colombia could not only raise long-term farmgate prices but also reduce exposure to global price swings. Moreover, by stimulating internal demand for natural rubber products, especially in public infrastructure, transportation, and industrial sectors, policy can activate a virtuous cycle of rural income generation and industrial upgrading.

6. Conclusion and Policy Recommendations

6.1. Conclusion

This study has shown that domestic consumption plays a meaningful role in shaping farmgate prices for natural rubber in Colombia, albeit primarily in the long run. Using an ARDL model with annual data from 2000 to 2022, we find that a 1% increase in internal demand is associated with a 0.49% rise in producer prices over time. However, short-run effects are limited, pointing to behavioral inertia, institutional gaps, and transaction costs that delay price transmission.

These findings validate the relevance of multi-theoretical approaches, drawing on microeconomic price theory, Structuralist Agricultural Economics, and New Institutional Economics, to explain how underdeveloped domestic markets can slowly evolve into viable sources of stability and growth for rural producers. The rubber sector in Colombia is not yet fully integrated into national industrial value chains, but the long-run elasticity indicates that such integration can yield substantial welfare gains for smallholders.

6.2. Policy Recommendations

To unlock the full potential of domestic demand as a driver of rural development, the following policy measures are recommended:

- 2.

-

Develop Inclusive Market Infrastructure

- ○

Invest in collection centers and cooperatives to reduce transportation and coordination costs.

- ○

Support logistics and cold-chain improvements for quality preservation and product aggregation.

- 3.

-

Enhance Market Information Systems

- ○

Create real-time, decentralized information platforms (SMS, radio) tailored to rural literacy and connectivity.

- ○

Promote transparency in farmgate pricing and buyer behavior.

- 4.

-

Institutionalize Price Stabilization Mechanisms

- ○

Introduce conditional minimum price schemes or price bands indexed to local production costs.

- ○

Support insurance products or income support mechanisms tied to market shocks.

- 5.

-

Build Farmer Capacity for Market Participation

- ○

Offer training on price trends, contract negotiation, and product quality standards.

- ○

Incentivize producer association formation to improve bargaining power and economies of scale.

Through these interventions, Colombia can convert rising domestic consumption into a robust foundation for inclusive, stable, and sustainable rural growth.

References

- Acharya, R. N., Koirala, K. H., & Mishra, A. K. (2018). Market participation and farmgate prices: Evidence from organic and conventional vegetable farms. Food Policy, 79, 1–10.

- AGROSAVIA. (2018). Modelo productivo para el cultivo de caucho en Colombia, con énfasis en la Orinoquia y el Magdalena Medio. Mosquera: Corporación Colombiana de Investigación Agropecuaria. [CrossRef]

- Cenicaucho. (2021). Boletín técnico y comercial del caucho natural colombiano. Confederación Cauchera de Colombia (CCC).

- Meyer, J., & von Cramon-Taubadel, S. (2004). Asymmetric price transmission: A survey. Journal of Agricultural Economics, 55(3), 581–611. [CrossRef]

- Narayan, P. K. (2005). The saving and investment nexus for China: Evidence from cointegration tests. Applied Economics, 37(17), 1979–1990. [CrossRef]

- North, D. C. (1990). Institutions, institutional change and economic performance. Cambridge University Press.

- Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289–326. [CrossRef]

- Williamson, O. E. (1985). The economic institutions of capitalism. Free Press.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).