1. Introduction

Digital transformation is reshaping traditional financial systems, offering unprecedented opportunities to enhance financial inclusion on a global scale (Arner et al., 2020; Beck et al., 2015). However, in many emerging economies, a significant portion of the population remains excluded from formal banking services due to structural barriers such as high transaction costs, limited access to banking infrastructure, and low financial literacy levels (Kanga et al., 2022; Lyons & Kass-Hanna, 2021). In this context, cryptocurrencies and decentralised finance (DeFi) have emerged as alternative solutions, enabling secure, instantaneous, and low-cost transactions without the need for traditional intermediaries (Alamsyah et al., 2024; El Hajj & Farran, 2024).

Cryptocurrencies, powered by blockchain technology, have demonstrated their ability to reduce remittance costs, provide accessible investment opportunities, and offer financial services to unbanked populations (Guo et al., 2025) Beyond their functional benefits, DeFi protocols are increasingly demonstrating strong economic viability, as evidenced by rising Total Value Locked (TVL), trading volumes, and revenue indicators. These metrics reflect the growing maturity and resilience of DeFi ecosystems, positioning them as credible alternatives to traditional financial intermediaries in both developed and emerging markets (Metelski & Sobieraj, 2022). In several developing countries, these digital assets have been adopted as an alternative to conventional financial systems, in particular to facilitate cross-border payments, circumvent banking inefficiencies, and improve financial access in rural areas (Islam et al., 2023). Despite their disruptive potential, however, the adoption of cryptocurrencies faces significant challenges, including technological constraints, regulatory uncertainties, and a lack of public awareness (Mohammed et al., 2023).

This raises a fundamental question: can cryptocurrencies truly foster financial inclusion, and under what conditions? While their adoption presents innovative solutions, their effectiveness largely depends on the regulatory framework in place, the level of financial literacy, and the quality of available digital infrastructure (Shahzad et al., 2018). Without a structured regulatory framework and strategic integration into the financial ecosystem, these technologies risk exacerbating financial access inequalities rather than mitigating them (Ozili, 2023).

This study analyses the role of cryptocurrencies and DeFi by identifying their potential benefits, the barriers to their adoption, and the key factors influencing their impact. Specifically, the article explores the relationship between cryptocurrency adoption and financial inclusion, examining the mediating role of financial literacy and the moderating effect of digital infrastructure (Kumari et al., 2023). To investigate these interactions, a mixed-method approach was adopted, combining a quantitative survey with qualitative interviews conducted with financial and technology experts. The analysis relies on a structural equation modeling (SEM) framework, allowing for the examination of complex relationships between variables and a deeper understanding of the underlying mechanisms influencing financial inclusion through cryptocurrencies (Ramayah et al., 2018).

This research is conducted in the specific context of Morocco, where the use of cryptocurrencies - despite being officially banned since 2017 - has been steadily growing, raising questions about regulation and the potential impact of these technologies on the national economy (Xie, 2019). Following this introduction,

Section 2 presents a literature review on financial inclusion and cryptocurrency adoption, drawing upon relevant theoretical models (Venkatesh et al., 2012).

Section 3 then outlines the research methodology, justifying the choice of the mixed-method approach and the SEM model (Hair et al., 2019).

Section 4 sets out and analyses the empirical results, highlighting the key determinants of cryptocurrency adoption and their impact on financial inclusion. Finally,

Section 5 discusses the implications of the findings, provides strategic recommendations for policymakers, and suggests future research directions.

By offering an in-depth analysis of the conditions necessary for the successful adoption of cryptocurrencies as a financial inclusion tool, this study contributes to academic and practitioner research and assessment of the role of digital technologies in the transformation of financial services, particularly in emerging economies (Chen & Bellavitis, 2020) . It also builds on previous research on digitalisation and corporate responsibility in the Moroccan context (Abdallah-Ou-Moussa et al., 2024), and aims to provide concrete recommendations to regulators, financial institutions, and technology innovators to promote the responsible and effective integration of cryptocurrencies into economic and social development strategies (El Chaarani et al., 2024).

2. Literature Review

This literature review comprises three sub-sections. First, an overview of relevant literature relating to cryptocurrencies is provided, complementing that included in the introductory section above, noting particularly the linkage with financial inclusion. Then, in sub-section 2.2, relevant theoretical frameworks and models are briefly reviewed and assessed. To conclude, sub-section 2.3 considers the various dimensions included in existing frameworks as they relate to financial inclusion.

2.1. Cryptocurrencies and Financial Inclusion

The rise of digital technologies has profoundly transformed the financial sector by facilitating access to banking services and fostering monetary innovation. These changes are particularly significant in emerging economies, where financial exclusion remains a major challenge. In this context, cryptocurrencies have emerged as a promising alternative to the limitations of traditional banking systems, offering innovative solutions to overcome barriers to accessing financial services (Demirgüç-Kunt et al., 2020). However, their widespread adoption and diffusion depend on the complex interplay of technological, economic, social, and regulatory factors (Kouam, 2023).

Being one of the most disruptive of innovations, cryptocurrencies—based on blockchain technology—are redefining the mechanisms of monetary exchange. This decentralised infrastructure ensures the security, transparency, and irreversibility of transactions, thereby enhancing user trust (Zohar, 2015). Since the emergence of Bitcoin in 2008 (Nakamoto, 2008), these digital currencies have been viewed as potential instruments for financial inclusion, particularly in regions where banking infrastructures are either insufficient or difficult to access (Gomber et al., 2018). They make it possible to bypass constraints related to having a bank account, high transaction fees, or geographical distance from banking agencies.

Nevertheless, despite their inclusive potential, the adoption of cryptocurrencies remains heterogeneous and limited in many regions. Several studies highlight barriers to their diffusion, including the technical complexity of digital interfaces (Steinmetz et al., 2021), price volatility (Baur & Dimpfl, 2021) , the risk of fraud (Foley et al., 2019), and the absence of clear regulations in some countries (Auer et al., 2023; Schaupp et al., 2022). These factors contribute to a sense of mistrust and hinder the integration of cryptocurrencies into everyday financial practices, especially in fragile institutional contexts. Yet, as observed in the aftermath of the COVID-19 pandemic, perceptions of cryptocurrencies can shift significantly in response to broader socio-economic disruptions. In countries such as Poland and Germany, the health crisis prompted an increased openness toward digital financial tools, particularly among younger users, thereby reinforcing the role of cryptocurrencies as legitimate alternatives to traditional forms of money (Maciejasz et al., 2024).

2.2. Theoretical Frameworks and Multidimensional Determinants of Cryptocurrency Adoption

To understand the underlying mechanisms driving the adoption of these innovations, the literature draws upon various theoretical frameworks from economics, social sciences, and technology studies. The Technology Acceptance Model (TAM), proposed by Davis (Davis, 1989), remains one of the most frequently used models. It posits that the intention to adopt a technology is primarily based on two dimensions: perceived usefulness and perceived ease of use (Davis et al., 1989; Islam et al., 2023) . In the case of cryptocurrencies, these elements are reflected in the ability to conduct secure transactions at a low cost, as well as the perceived complexity of using digital wallets or exchange platforms (Dabbous et al., 2022; Hidegföldi et al., 2025). From this perspective, Sham et al. (Sham et al., 2023) found that the perceived usefulness of cryptocurrencies—particularly their ability to facilitate fast and low-cost transactions—was a central driver of adoption. However, this usefulness is often offset by the perception of technical complexity, which may constitute a significant barrier, especially for less experienced users. Alharbi and Sohaib (2021) emphasise the importance of perceived ease of use, noting that an intuitive interface, simplified access to digital tools, and a seamless user experience are all critical conditions for effective adoption, particularly among novice users.

This approach is complemented by the Unified Theory of Acceptance and Use of Technology (UTAUT) model (Venkatesh et al., 2000, 2003) . This model introduces additional explanatory variables such as social influence, facilitating conditions (e.g., digital infrastructure, perceived trust), and performance expectancy (Al-Saedi et al., 2020; Williams et al., 2015) . It has been applied in recent studies on digital transformation and user engagement within the Moroccan insurance sector, where social and behavioral commitment emerged as key factors influencing technological adoption (Abdallah-Ou-Moussa et al., 2025). In emerging economies, these factors take on particular importance, as adoption behaviors are heavily influenced by peer perceptions, trust in digital tools, and the availability of an adequate technological environment (Shahzad et al., 2018; Alkhwaldi, 2024; Shuhaiber et al., 2025).

Chen et al. (2022) and Alomari and Abdullah (2023) conclude that both social influence and facilitating conditions—particularly the availability of reliable digital infrastructure—are key determinants in the adoption of cryptocurrencies in developing countries. At the same time, Yeong et al. (2019) point out that sociodemographic variables such as age, income, and education level significantly shape individuals’ perceptions of usefulness and ease of use regarding these financial technologies.

In parallel, the Diffusion of Innovations Theory (Rogers, 2003) provides an analytical framework for examining the speed and patterns of cryptocurrency adoption among different user categories. It identifies several key characteristics influencing adoption, including relative advantage, compatibility with existing values and needs, perceived complexity, trialability, and observability. Within this framework, cryptocurrencies may be perceived as value-generating innovations, yet their accessibility and comprehensibility remain limited for large segments of the population, particularly in contexts marked by low literacy levels or insufficient digitalisation (Böhme et al., 2015). In this regard, Rzayev et al. (2025) emphasise that the diffusion of cryptocurrencies is closely related to their ability to integrate with existing financial practices and to address users’ specific needs. This perceived compatibility thus emerges as a structuring factor in the adoption process, facilitating the appropriation of cryptocurrencies by users with diverse profiles and expectations (Sousa et al., 2022).

In the wider context of information technology deployment and digital transformation, a number of frameworks and models provide guidance for technology implementation, as opposed to measuring acceptance factors. The TOE model (Depietro et al., 1990) is perhaps one of the most popular frameworks for evaluating the adoption of technologies in a variety of contexts. The model suggests that there are three main sets of factors – technological, organizational, and external environmental - which are seen as fundamental in decision-making regarding the implementation of new technologies. In an African context, Van Dyk and Van Belle, (2019) used the TOE model to evaluate digital transformation in South African retail organisations. Similarly, Olayinka and Wynn, (2022) utilised the model to evaluate e-business implementation in Nigerian companies, but also combined elements of other models to provide a four stage Engage-Deploy-Exploit-Transform (EDET) framework to track technology implementation. Heek's (2002) Design-Actuality gap has also been widely adapted to track technology change initiatives in developing world contexts, based on the model’s four change dimensions of Technology, Process, People and Structure. This includes studies of technology deployment in Iran (Rezaeian & Wynn, 2016) and Libya (Akeel & Wynn, 2015).

More specifically as regards the diffusion of cryptocurrencies, Hidegföldi et al. (2025) highlight the complexity of the implementation process underlining the close interaction between technological, social, and economic dimensions. These multiple interdependent factors explain the diversity of integration trajectories observed globally. From a critical perspective, Shin and Rice (2022) make the point that cryptocurrencies do not evolve in a neutral vacuum, but rather within specific institutional configurations shaped by local political, economic, and social structures, which influence both their perception and appropriation. Similarly, Bhimani et al. (2022) demonstrate that cryptocurrency adoption is strongly conditioned by structural factors such as the quality of governance, the level of financial literacy, and access to digital infrastructure. These elements play a decisive role in the capacity of individuals and institutions to appropriate blockchain-based innovations. The case of China, analysed by Allen et al. (2022), illustrates how cryptocurrencies and central bank digital currencies can, in certain contexts, act as catalysts for the structural transformation of the financial system by finely adapting to local economic and social needs.

2.3. Financial Literacy, Digital Infrastructure, and Institutional Environments: Drivers and Constraints of Inclusion

In addition to these structural factors, individual user characteristics—particularly their level of financial literacy—emerge as central determinants of cryptocurrency adoption. Beyond technological and behavioral dimensions, recent literature emphasises the importance of socio-educational conditions in the appropriation of financial innovations. Financial literacy, defined as the ability to understand, interpret, and effectively use financial information, appears as a fundamental lever for empowerment in digital environments. As Lusardi and Mitchell (2014), Morgan, (2021), Alomari and Abdullah, (2023) , Khan (2023), and Mhlanga (2023) all note, individuals with a high level of financial knowledge are better equipped to adopt emerging financial technologies in an informed manner, evaluating both the benefits and risks associated with their use.

Conversely, financially illiterate populations—often drawn from vulnerable groups—are more exposed to risks of fraud, loss of funds, and limited understanding of cryptographic mechanisms (Auer et al., 2020). Alomari and Abdullah (2023), as well as Long et al. (2023), confirm that financial literacy plays a moderating role in cryptocurrency adoption by strengthening user trust and reducing perceived risks. Morgan (2021) also emphasises that financial education is an essential pillar in promoting the responsible adoption of cryptocurrencies, particularly in regions where traditional financial systems are failing. Ultimately, financial literacy is not merely a protective factor—it is a prerequisite for active, critical, and secure participation in new digital ecosystems.

Moreover, the adoption of cryptocurrencies is closely tied to the availability and quality of digital infrastructure. Internet access, ownership of compatible mobile devices, and the stability of network connections are among the key technical prerequisites, without which the effective use of digital wallets and exchange platforms remains compromised. In this regard, Resource Dependence Theory (Celtekligil, 2020; Pfeffer & Salancik, 2015) suggests that the successful integration of any technological innovation depends on the availability of adequate material and institutional resources. In other words, adoption can only occur in environments with the structural capacities necessary for its appropriation.

This infrastructural requirement presents a major obstacle in many regions of the Global South—particularly Sub-Saharan Africa, South Asia, and Latin America—where digital divides persist. As highlighted by Nchofoung and Asongu (2022) and Asongu and Nwachukwu (2019), weak networks, limited access to digital tools, and precarious technological infrastructures considerably reduce the prospects of financial inclusion through blockchain technologies. In the same vein, Wong et al. (2020) emphasise that the adoption of blockchain technologies, including cryptocurrencies, is heavily influenced by the quality of digital infrastructure and the availability of technological resources. Likewise, Schuetz and Venkatesh (2020) confirm that in developing countries, cryptocurrency adoption is often constrained by insufficient infrastructure and unequal access to information technologies.

A more systemic perspective is provided by Complexity Theory (Kauffman, 1993), which views adoption trajectories as non-linear and often unpredictable dynamics. This approach highlights the multiple technological, economic, social, and regulatory interactions that coexist in a constantly reconfiguring financial ecosystem (Nishibe, 2024). In this framework, outcomes do not always follow a direct causal logic, but result from emergent processes, highly sensitive to contextual and institutional variations (Goutte et al., 2023; Shin & Rice, 2022).

The case of Morocco offers a particularly revealing illustration of the complexity surrounding cryptocurrency adoption dynamics in constrained regulatory contexts. Although the Bank Al-Maghrib (the Central Bank of the Kingdom of Morocco) officially banned the use of crypto-assets in 2017, their informal use has continued to grow among the population. This parallel adoption is explained by a combination of structural factors: mounting economic pressure, the search for alternatives to traditional transaction mechanisms, and persistent distrust toward conventional financial institutions. As Bziker (2021) highlights, this dynamic reflects a strategy of circumventing legal frameworks, with cryptocurrencies emerging as a pragmatic response to urgent needs for secure exchanges and value preservation. In a broader perspective, Howson and de Vries (2022) note that such behaviour is commonly observed in vulnerable communities, where cryptocurrencies become substitutes for institutional financial services, often perceived as inaccessible or ineffective. This trend is not unique to Morocco: Oxford Analytica (Analytica, 2022) observes sustained growth in the cryptocurrency market across the Middle East and North Africa (MENA) region, despite prevailing regulatory restrictions, reflecting a growing adoption that transcends legal frameworks. In this context, Nandal et al. ( 2024) point out that this rapid expansion raises significant legal and policy challenges, calling for a revision of existing legislative frameworks to support and channel these new monetary practices in a controlled and secure manner.

This dynamic underscores the urgent need to rethink existing legal and institutional frameworks. Ferreira and Sandner (2021), building upon the work of Cermeño (2016) , emphasise that the establishment of clear, balanced, and context-sensitive regulations is a sine qua non condition for ensuring responsible adoption, while also protecting users from systemic risks and the inherent volatility of cryptocurrencies.

3. Research Method

This section sets out the various elements of the adopted research method. First, an overview of the research process is provided. Sub-section 3.2 then notes data collection methods, entailing both a 500-respondent survey and semi-structured interviews. Sample selection, measures and variables are discussed in sub-section 3.3, followed by detail on the structural model, provisional conceptual framework and the three main hypotheses in sub-section 3.4. Finally, sub-section 3.5 sets out the data analysis techniques deployed in the study.

3.1. General Approach

This study adopts a mixed-methods approach (Venkatesh et al., 2013), combining both quantitative and qualitative techniques to explore the role of cryptocurrencies and DeFi in financial inclusion in Morocco. The objective is to analyze the complex relationships between cryptocurrency adoption, barriers to financial inclusion, and mediating factors such as financial literacy and digital infrastructure. To achieve this, a Structural Equation Modeling (SEM) framework is used to model these relationships and test related hypotheses. The adopted research philosophy is pragmatic, involving both deductive (survey) and inductive (interview) approaches. This facilitated the capture of both the objective dimensions (quantitative data) and the subjective perspectives (qualitative insights) of the phenomenon under study. This is discussed in more detail below.

3.2. Data Collection

The quantitative surveys targeted unbanked or underbanked individuals residing in both urban and rural areas of Morocco. Data collection was conducted through both face-to-face and online-administered questionnaires to ensure a diverse range of profiles were included. This phase of data collection was carried out over a period of three months. In contrast, qualitative interviews involved fifteen experts from various backgrounds, including representatives from banks, financial institutions, fintech startups, and academics specialising in blockchain and finance. These interviews followed a semi-structured approach (Miles, 1994), based on an outline guide covering the study’s key themes. Each interview, lasting between 45 and 60 minutes, was recorded with the participants' consent.

3.3. Sample Selection, Measures and Variables

The study sample was structured according to two complementary approaches. For the quantitative component, a sample of 500 respondents was selected to ensure statistical representativeness (Krejcie & Morgan, 1970). A stratified sampling method was employed to guarantee a balanced distribution between urban and rural areas, as well as across different socio-economic categories, taking into account income and education levels. Eligibility criteria required participants to be at least 18 years old and reside in Morocco. For the qualitative sample, expert selection was based on their expertise in finance, blockchain technology, and public policy. Particular attention was given to ensuring diversity among profiles, incorporating stakeholders from the public sector, private sector, and academia to provide a holistic and multidimensional perspective on the issues under study.

The Structural Equation Model (SEM) used in this study includes several latent variables, such as cryptocurrency adoption, measured by usage frequency, transaction amounts, and cryptocurrency knowledge; financial inclusion, measured by access to financial services, use of bank accounts, and participation in formal economic activities; financial literacy, assessed by a score based on the understanding of basic financial concepts; and digital infrastructure, measured by access to the internet, smartphone ownership, and connectivity quality. The observable variables specific to each latent variable are detailed, with indicators such as usage frequency, transaction amounts, and cryptocurrency knowledge for cryptocurrency adoption, or the number of bank accounts and the frequency of financial services usage for financial inclusion.

The measurement instruments include a structured quantitative questionnaire divided into sections corresponding to the latent variables, based on validated scales from theoretical models, such as UTAUT, TAM, and the Theory of Planned Behavior (Yoon, 2011), and using 5-point Likert scales to measure perceptions and behaviours. A qualitative interview guide was used to explore expert perceptions on cryptocurrency adoption and financial inclusion, with open-ended questions designed to gather insights on topics like regulation, security, and the impact of cryptocurrencies on unbanked populations. The qualitative data were analyzed using thematic analysis, including verbatim transcription of the interviews, open coding to identify emerging themes, and result validation to ensure the reliability and consistency of the interpretations. The main themes identified include cost reduction, access to rural areas, regulation, security, and financial literacy, grouped into broader categories to facilitate interpretation.

3.4. Structural Model, Provisional Conceptual Framework and Hypotheses Development

SEM was selected for this study because of its ability to model complex relationships between multiple latent and observable variables (Fornell & Larcker, 1981; Wong, 2013). SEM allows for:

Validating an integrated theoretical model by simultaneously testing the relationships between cryptocurrency adoption, financial inclusion, and mediating factors (financial literacy, digital infrastructure).

Analyzing both direct and indirect effects: for example, the impact of cryptocurrencies on financial inclusion may be mediated by financial literacy.

Managing latent variables of concepts such as financial inclusion or financial literacy, which cannot be directly measured but are modeled from observable indicators.

The structural model is represented by the following equation:

η is the vector of dependent latent variables (financial inclusion).

ξ is the vector of independent latent variables (cryptocurrency adoption).

B and Γ are the matrices of structural coefficients.

ζ is the error term.

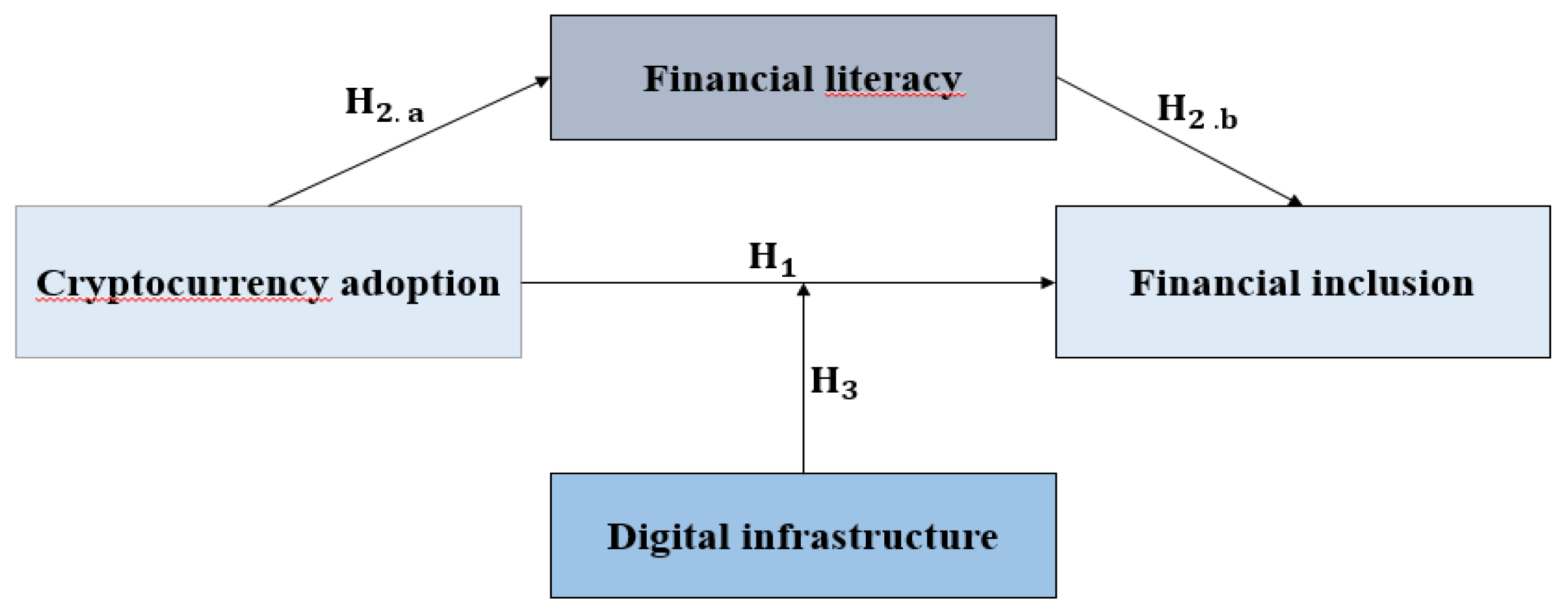

A provisional conceptual framework was developed based on the review of the extant literature and the models discussed above (

Figure 1). From here, three hypotheses were postulated, exploring direct, mediating, and moderating relationships between the main constructs:

H1: Cryptocurrency adoption has a direct positive impact on financial inclusion.

H2: Financial literacy mediates this effect.

H3: Digital infrastructure moderates the effect of cryptocurrencies on financial inclusion.

These hypotheses were tested in the primary research phase of the project. The analysis techniques are now discussed below.

3.5. Data Analysis

The data analysis was conducted in several stages, starting with a preliminary analysis that included descriptive statistics to summarize the characteristics of the sample, an assessment of the reliability of the measurement scales using Cronbach’s Alpha, and an exploratory factor analysis to verify the validity of the instruments. Following this, an SEM was applied, incorporating a Confirmatory Factor Analysis (CFA) to validate the structure of the latent variables and their indicators (Jorgensen et al., 2012), followed by a structural model to test the relationships between the latent variables.

The fit indices used to evaluate the model’s quality include the Comparative Fit Index (CFI) greater than 0.90, the Tucker-Lewis Index (TLI) also greater than 0.90, and the Root Mean Square Error of Approximation (RMSEA) less than 0.08. At the same time, qualitative data from interviews were transcribed and analyzed through thematic analysis to identify recurring patterns and key insights. The methodology, combining quantitative and qualitative approaches with an SEM model, allows for a thorough and multidimensional analysis of the role of cryptocurrencies in financial inclusion in Morocco. The results from this analysis provide new insights of relevance to policymakers, financial institutions, and fintech sector stakeholders.

4. Results

This results section has two parts. First, the demographic characteristics of the survey respondents are analysed, examining aspects relating to reliability and validity. The results of the testing of the three hypotheses are then set out, based on the SEM and confirmatory factor analysis (CFA).

4.1. Demographic Characteristics of the Sample

The majority of respondents (75%) are between 18 and 45 years old, reflecting a relatively young population (

Table 1). This suggests that young adults are more likely to be exposed to cryptocurrencies and emerging financial technologies, potentially influencing their adoption. As regards gender, the sample is slightly male dominated (55%), which may indicate a gender disparity in cryptocurrency adoption. Further studies could explore whether this trend is due to differences in access, interest, or financial literacy between genders. 75% of respondents have a secondary or university education level, suggesting that cryptocurrency adoption may be higher among educated populations.

This highlights the importance of financial and digital literacy in the adoption of these technologies. 50% of respondents have a monthly income ranging between 3,000 and 6,000 Moroccan dirham (approximately 300-600 euro), representing a middle-class segment. This indicates that cryptocurrencies may be perceived as a viable financial option for this income group, but further initiatives may be needed to reach lower-income populations. 65% of respondents have a bank account, while 35% are unbanked, suggesting that cryptocurrencies could play a key role in financial inclusion, particularly for unbanked populations in rural areas. Only 20% of respondents have used cryptocurrencies, indicating that adoption remains relatively low. This could be due to factors such as a lack of knowledge, restrictive regulations, or perceived risks.

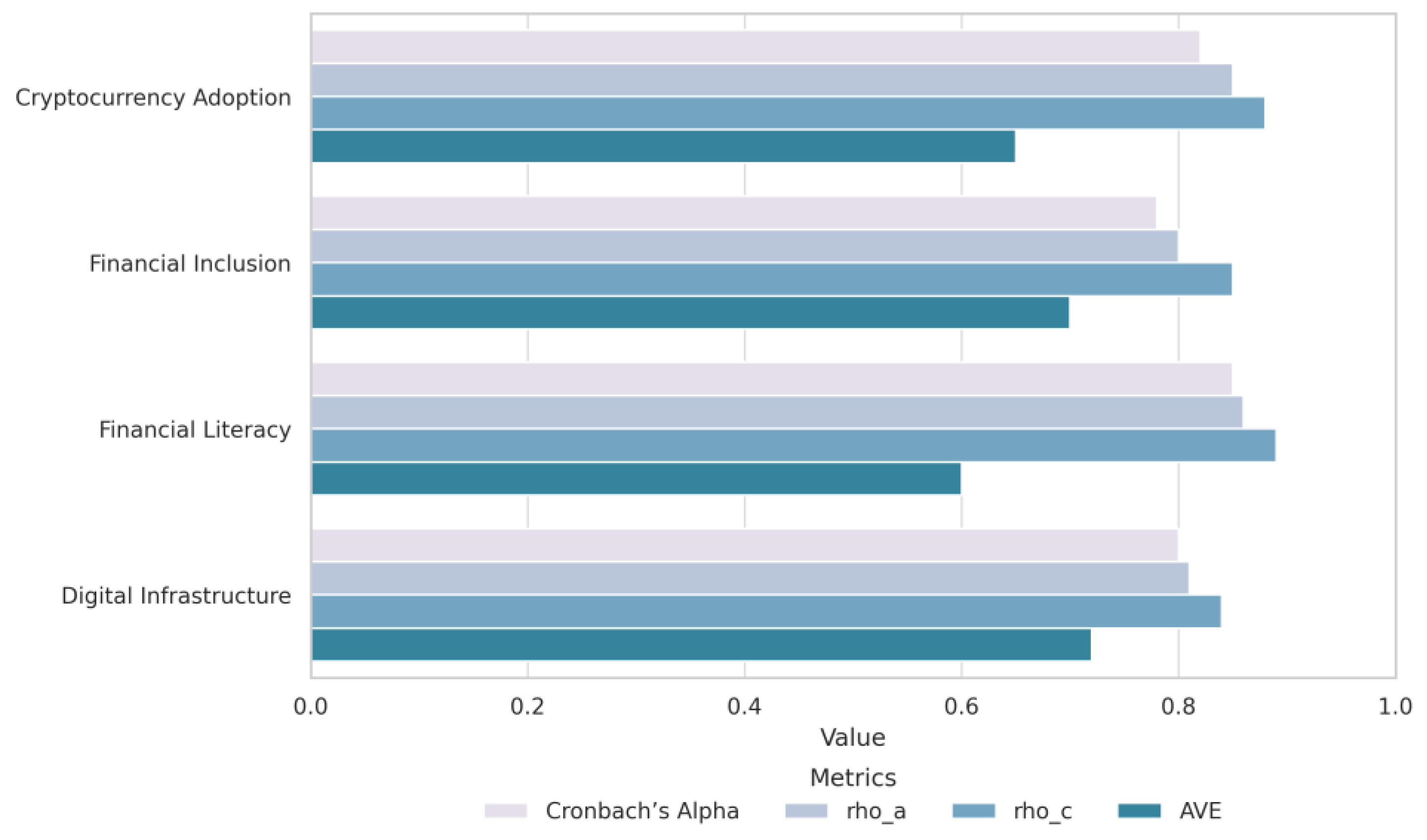

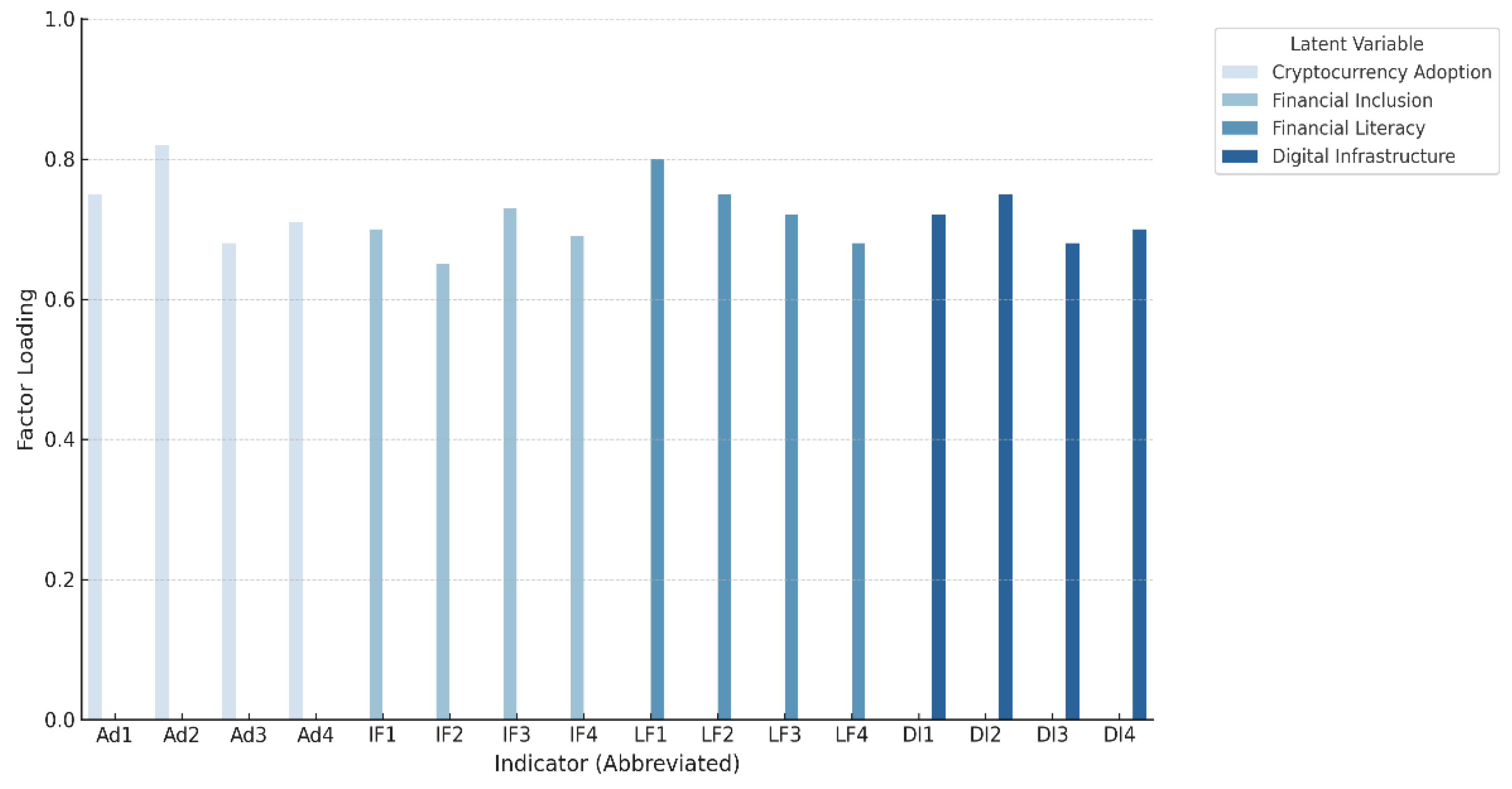

The results validate the reliability and convergent validity of the measurement scales (

Table 2). For the four main concepts included in the study (

Figure 1), considered here as latent variables, all Cronbach’s Alpha values exceed 0.70, indicating excellent internal reliability of the measurement scales. This confirms that the indicators used to measure each latent variable are consistent and reliable. The high values of rho_a (Dijkstra-Henseler rho) and rho_c (composite reliability) - all being above 0.80 - further reinforce the consistency of the measurements and confirm that latent variables are well represented by their respective indicators. All AVE (Average Variance Extracted) values exceed 0.50, indicating good convergent validity. This means that the indicators capture a significant portion of the variance of the latent variable they are intended to measure.

The internal consistency and convergent validity of the latent variables is depicted graphically in

Figure 2.

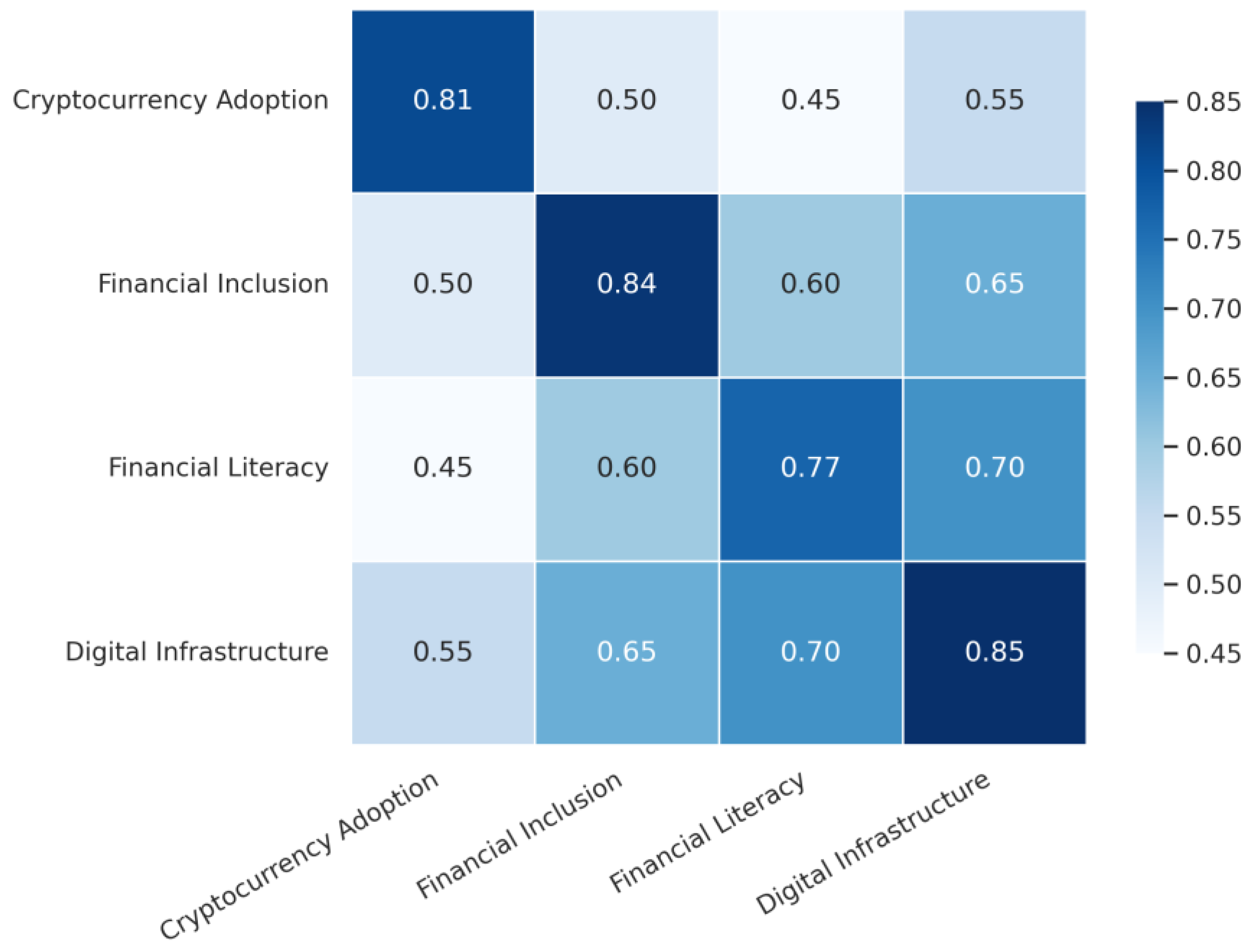

Discriminant validity can also be assessed (

Table 3). For each latent variable, the square root of AVE (in bold in

Table 3) is greater than the correlations with other latent variables. This confirms that the latent variables are distinct from one another and measure different concepts. For example, cryptocurrency adoption (AVE = 0.81) is distinct from financial inclusion (correlation = 0.50) and financial literacy (correlation = 0.45). Ensuring discriminant validity is of value because it confirms that relationships tested in the SEM model are not biased by conceptual overlaps between variables. These discriminant validity results are shown graphically in

Figure 3.

4.2. Results of Hypothesis Testing

The results of hypotheses testing are shown in

Table 4, and are summarized as follows:

H1: Cryptocurrency adoption has a positive and significant impact on financial inclusion (β = 0.45, p < 0.001). This confirms that cryptocurrencies can play an important role in improving access to financial services, particularly for unbanked populations.

H2: Financial literacy partially mediates the effect of cryptocurrencies on financial inclusion (β = 0.28, p < 0.01). This underscores the importance of understanding financial concepts to maximize the impact of cryptocurrencies. Individuals with better financial literacy are more likely to adopt and use these technologies to access financial services.

H3: Digital infrastructure positively moderates the effect of cryptocurrencies on financial inclusion (β = 0.32, p < 0.05). This suggests that access to the internet and digital technologies amplifies the impact of cryptocurrencies by facilitating their adoption and usage. This highlights the need to invest in digital infrastructure to maximize the benefits of cryptocurrencies.

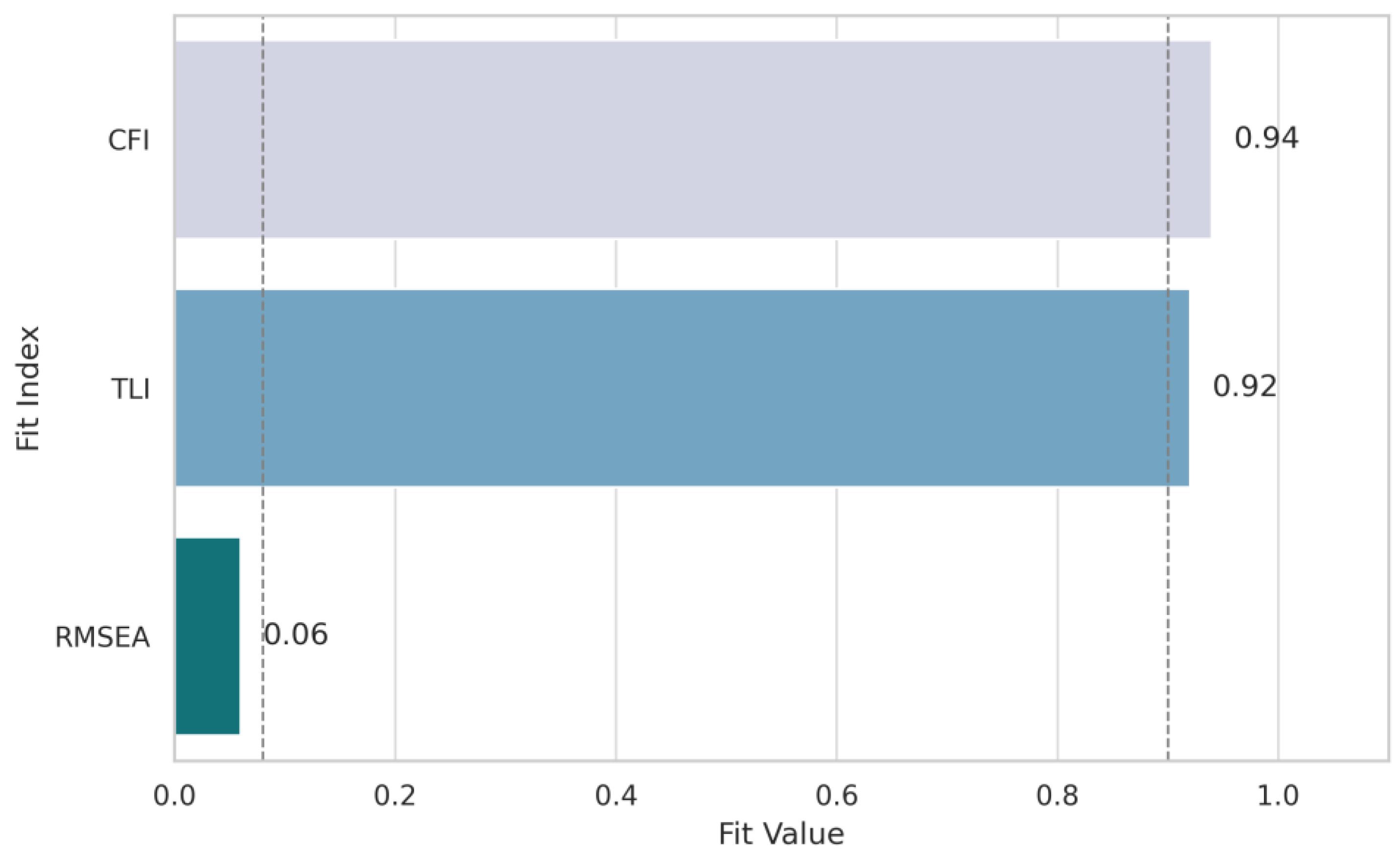

Further tests confirm the goodness of fit of the model (

Table 5). The Comparative Fit Index (CFI), with a value of 0.94 (greater than 0.90), demonstrates an excellent fit with the data. This indicates that the proposed theoretical model is well supported by empirical data. Similarly, the Tucker-Lewis Index (TLI), with a value of 0.92 (greater than 0.90) also confirms a good model fit, reinforcing the validity of the structural model used to test the hypotheses. Finally, the Root Mean Square Error of Approximation (RMSEA, with a value of 0.06 (less than 0.08), exhibits a good fit, meaning that approximation errors are low and the model is well suited to the data.

Figure 4 visually confirms the overall goodness-of-fit indices of the model.

Confirmatory factor analysis (CFA) indicates that all factor loadings exceed 0.65, indicating good convergent validity (

Table 6). The indicators are strongly linked to their respective latent variables, confirming the robustness of the measurements. For cryptocurrency adoption, transaction volume (loading = 0.82) is a particularly strong indicator, suggesting that cryptocurrency users engage in significant transactions. For financial inclusion, access to credit (loading = 0.73) is a crucial indicator, demonstrating that credit access is a key aspect of financial inclusion. For financial literacy, the comprehension score (loading = 0.80) is a strong indicator, highlighting the importance of understanding basic financial concepts. For digital infrastructure, smartphone ownership (loading = 0.75) is a key indicator, showing that access to mobile devices is essential for cryptocurrency adoption.

As regards p-values, all p-values are below 0.001, confirming that the relationships between indicators and latent variables are statistically significant.

Figure 5 summarises the standardised factor loadings for all indicators.

In summary, all three hypotheses were supported by the results, confirming clear relationships between cryptocurrency adoption, financial inclusion, financial literacy and digital infrastructure. The following section now looks beyond these statistical results to discuss related issues.

5. Discussion

The above results confirm the validity of the three hypotheses posited above, but beyond this, these results raise a number of issues worthy of further discussion.

Firstly, results indicate that cryptocurrencies have a positive and significant impact on financial inclusion (β=0.45, p<0.001). This relationship suggests that cryptocurrencies can play a crucial role in improving access to financial services, particularly for unbanked populations. These findings align with the work of Tapscott and Tapscott (Tapscott & Tapscott, 2017), which emphasises the potential of cryptocurrencies to reduce transaction costs and facilitate money transfers, especially in developing countries. In Morocco, where a significant portion of the population remains excluded from the traditional banking system, cryptocurrencies could thus offer a viable alternative for accessing basic financial services.

Secondly, financial literacy plays a crucial mediating role in the impact of cryptocurrencies on financial inclusion (β=0.28, p<0.01). This suggests that individuals with a better knowledge and understanding of financial concepts are more likely to adopt and use cryptocurrencies to access financial services. This finding is consistent with the conclusions of Lusardi and Mitchell (2014), who demonstrate that financial literacy is a key determinant in the adoption of financial innovations. In the Moroccan context, this underscores the importance of strengthening educational programs aimed at improving knowledge of cryptocurrencies and emerging financial technologies. Furthermore, recent evidence from Africa indicates that digital financial inclusion can also promote women’s labor force participation, particularly when access to mobile technologies and digital services is expanded. However, gender-specific barriers such as limited access to smartphones and high service costs continue to hinder the full potential of these technologies for female empowerment (Elouardighi & Oubejja, 2023).

Thirdly, digital infrastructure positively moderates the effect of cryptocurrencies on financial inclusion (β=0.32, p<0.05). This indicates that access to the internet and digital technologies amplifies the impact of cryptocurrencies by facilitating their adoption and usage. These results are in line with GSMA (2017), which underscores the importance of digital infrastructure for the development of digital financial services. In Morocco, where rural areas still suffer from limited internet access, investing in digital infrastructure could therefore be a key strategy to maximise the benefits of cryptocurrencies. These two factors – the significance of financial and technology literacy and the availability of digital infrastructure - align with other wider studies on achieving successful digitalisation in developing country environments (Wynn et al., 2024).

Fourthly, this study makes several contributions to the existing literature in this field. On the one hand, it represents a new application of the UTAUT model by integrating variables specific to the Moroccan context, such as financial literacy and digital infrastructure. On the other hand, it empirically validates the role of cryptocurrencies in financial inclusion by highlighting the underlying mechanisms (direct, mediating, and moderating effects). In addition, by focusing on Morocco, this study helps fill a gap in the literature, providing valuable insights for developing countries facing similar challenges. The development of an operational model to underpin the introduction of cryptocurrencies would be a valuable next step. This could usefully build upon existing models such as, for example, the Design-Actuality gap model developed by Heeks (2002). Such implementation frameworks could centre on the key change dimensions identified in this study: cryptocurrency availability and regulation (process), financial literacy progression (people) and digital infrastructure availability (technology).

Fifthly, there are implications from this study for policymakers, financial institutions, and fintech stakeholders, as implied above. Cryptocurrencies may potentially play a key role in the growing use of “mobile money”, which encompasses financial transactions and services that can be carried out using a mobile device such as a mobile phone or tablet. GSMA (2017) report that, to the south of Morocco, “over the past few years, West Africa has emerged as mobile money’s new powerhouse” (p. 6). Furthermore, mobile money is seen “as a key enabler of the United Nations’ Sustainable Development Goals (SDGs)”, and that “many mobile money users are now able to access productive services that were previously inaccessible” (p.7). In this context, Sila (2022) recently observed “with the introduction of cryptocurrency and its increased usability, mobile banking needs to consider the ways that cryptocurrency transfers can be integrated into mobile banking, ACH {automated clearing house] digital wallets, and online banking methods” (para. 2). For policymakers, it is essential to establish a clear regulatory framework to govern cryptocurrency use while promoting its responsible adoption via mobile and other devices. Initiatives aimed at improving financial literacy and strengthening digital infrastructure should also be prioritised. For financial institutions, partnerships with fintech firms could enable the integration of cryptocurrencies into their service offerings, while educational programs could enhance understanding and acceptance of these technologies. Fintech stakeholders need to provide solutions tailored to the needs of unbanked populations, particularly in rural areas, whilst also ensuring security and ease of use.

6. Conclusions

This study explored the role of cryptocurrencies in financial inclusion in Morocco, shedding light on the key mechanisms influencing their adoption and impact. The findings reveal that cryptocurrencies have a positive and significant impact on financial inclusion, confirming their potential to improve access to financial services, particularly for unbanked populations. Additionally, financial literacy plays a crucial mediating role, emphasising the importance of understanding financial concepts for the adoption of these technologies. Further, digital infrastructure positively moderates this impact, highlighting the need to invest in digital technologies to maximize the benefits of cryptocurrencies. From a theoretical perspective, this study extends the UTAUT model by incorporating variables specific to the Moroccan context, such as financial literacy and digital infrastructure, and empirically validates the role of cryptocurrencies in financial inclusion. The study demonstrates that cryptocurrencies hold significant potential to enhance financial inclusion in Morocco, provided that efforts are made to strengthen financial literacy, improve digital infrastructure, and establish an appropriate regulatory framework. By fully leveraging these innovations, Morocco could take a significant step toward broader financial inclusion and sustainable socio-economic development.

This study has a number of limitations. Firstly, the sample may not be fully representative of the Moroccan population due to challenges in accessing rural areas, and future studies could valuably include a larger and more diverse sample. Secondly, self-reported data may be subject to social desirability bias, despite the use of mixed methods (quantitative and qualitative) to triangulate the results and enrich the analysis. Finally, this study focuses on Morocco, which limits the generalisability of the findings to other contexts.

Several future research directions are thus worthy of exploration. As noted above, longitudinal studies could examine the evolution of cryptocurrency adoption in other environments to underpin the development of an implementation model and guidelines. International comparisons could also be conducted to compare Morocco's results with those of other developing countries where the role of digitalisation in the financial sector is under study (Zetzsche et al., 2019) . The impact of regulations on cryptocurrency adoption and their role in financial inclusion is another area that could usefully be researched.

In conclusion, this study highlights the potential of cryptocurrencies to enhance financial inclusion in Morocco while emphasising the importance of financial literacy and digital infrastructure. These insights provide a solid foundation for policy and strategic recommendations aimed at integrating cryptocurrencies responsibly into Morocco's financial system. By establishing a clear regulatory framework, strengthening financial literacy, and improving digital infrastructure, Morocco could fully leverage cryptocurrencies to achieve its financial inclusion and socio-economic development goals. This study thus makes a small contribution to addressing a gap in the literature regarding the role of cryptocurrencies in developing countries and opening avenues for future research, particularly on regulatory impacts and international comparisons.

Author Contributions

Conceptualization, S.A.-O.-M., M.W. and O.K.; methodology, S.A.-O.-M. and O.K.; software, S.A.-O.-M. and O.K.; validation, S.A.-O.-M., M.W. and O.K.; formal analysis, S.A.-O.-M.; investigation, S.A.-O.-M..; resources, S.A.-O.-M., M.W. and O.K.; data curation, S.A.-O.-M. and O.K.; writing—original draft preparation, S.A.-O.-M., M.W. and O.K.; writing—review and editing, S.A.-O.-M. and M.W.; visualization, S.A.-O.-M., M.W. and O.K.; supervision, S.A.-O.-M., M.W. and O.K; project administration, S.A.-O.-M., M.W. and O.K. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Institutional Review Board Statement

This study qualified for institution IRB waiver. Ethical issues were reviewed in accordance with institutional rules, and it was determined that a mandatory referral to an ethics committee was not necessary at the time of this research.

Data Availability Statement

The data used in this study is held in a university environment and is not currently publicly available. Enquiries regarding further information on the data and testing methods used in this project can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Abdallah-Ou-Moussa, S., Wynn, M. G., Kharbouch, O., El Aoufi, S., & Rouaine, Z. (2025). Technology Innovation and Social and Behavioral Commitment : A Case Study of Digital Transformation in the Moroccan Insurance Industry. Big Data and Cognitive Computing, 9(2), art-31.

- Abdallah-Ou-Moussa, S., Wynn, M., Kharbouch, O., & Rouaine, Z. (2024). Digitalization and corporate social responsibility : A case study of the moroccan auto insurance sector. Administrative Sciences, 14(11), 282.

- Akeel, H., & Wynn, M. G. (2015). ERP Implementation in a Developing World Context : A Case Study of the Waha Oil Company, Libya. eKnow 2015 7th International Conference on Information, Process and Knowledge Management, 126-131. https://eprints.glos.ac.uk/2072/.

- Alamsyah, A., Kusuma, G. N. W., & Ramadhani, D. P. (2024). A review on decentralized finance ecosystems. Future Internet, 16(3), 76.

- Alharbi, A., & Sohaib, O. (2021). Technology readiness and cryptocurrency adoption : PLS-SEM and deep learning neural network analysis. IEEE access, 9, 21388-21394.

- Alkhwaldi, A. F. (2024). Digital transformation in financial industry : Antecedents of fintech adoption, financial literacy and quality of life. International Journal of Law and Management. https://www.emerald.com/insight/content/doi/10.1108/ijlma-11-2023-0249/full/html.

- Allen, F., Gu, X., & Jagtiani, J. (2022). Fintech, cryptocurrencies, and CBDC : Financial structural transformation in China. Journal of International Money and Finance, 124, 102625.

- Alomari, A. S. A., & Abdullah, N. L. (2023). Factors influencing the behavioral intention to use Cryptocurrency among Saudi Arabian public university students : Moderating role of financial literacy. Cogent Business & Management, 10(1), 2178092. [CrossRef]

- Al-Saedi, K., Al-Emran, M., Ramayah, T., & Abusham, E. (2020). Developing a general extended UTAUT model for M-payment adoption. Technology in society, 62, 101293.

- Analytica, O. (2022). Crypto market to grow in Middle East and North Africa. Emerald Expert Briefings, oxan-db. https://www.emerald.com/insight/content/doi/10.1108/OXAN-DB274583/full/html.

- Arner, D. W., Buckley, R. P., Zetzsche, D. A., & Veidt, R. (2020). Sustainability, FinTech and Financial Inclusion. European Business Organization Law Review, 21(1), 7-35. [CrossRef]

- Asongu, S. A., & Nwachukwu, J. C. (2019). ICT, Financial Sector Development and Financial Access. Journal of the Knowledge Economy, 10(2), 465-490. [CrossRef]

- Auer, R., Cornelli, G., & Frost, J. (2020). Rise of the central bank digital currencies : Drivers, approaches and technologies. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3723552.

- Auer, R., Farag, M., Lewrick, U., Orazem, L., & Zoss, M. (2023). Banking in the shadow of Bitcoin? The institutional adoption of cryptocurrencies. CESifo Working Paper. https://www.econstor.eu/handle/10419/271999.

- Baur, D. G., & Dimpfl, T. (2021). The volatility of Bitcoin and its role as a medium of exchange and a store of value. Empirical Economics, 61(5), 2663-2683. [CrossRef]

- Beck, T., Senbet, L., & Simbanegavi, W. (2015). Financial inclusion and innovation in Africa : An overview. Journal of African Economies, 24(suppl_1), i3-i11.

- Bhimani, A., Hausken, K., & Arif, S. (2022). Do national development factors affect cryptocurrency adoption? Technological Forecasting and Social Change, 181, 121739.

- Böhme, R., Christin, N., Edelman, B., & Moore, T. (2015). Bitcoin : Economics, technology, and governance. Journal of economic Perspectives, 29(2), 213-238.

- Bziker, Z. (2021). The status of cryptocurrency in Morocco. Research in Globalization, 3, 100040.

- Celtekligil, K. (2020). Resource Dependence Theory. In H. Dincer & S. Yüksel (Éds.), Strategic Outlook for Innovative Work Behaviours (p. 131-148). Springer International Publishing. [CrossRef]

- Cermeño, J. S. (2016). Blockchain in financial services : Regulatory landscape and future challenges for its commercial application. BBVA Research Madrid, Spain. https://www.smallake.kr/wp-content/uploads/2017/01/WP_16-20.pdf.

- Chen, X., Miraz, M. H., Gazi, M. A. I., Rahaman, M. A., Habib, M. M., & Hossain, A. I. (2022). Factors affecting cryptocurrency adoption in digital business transactions : The mediating role of customer satisfaction. Technology in Society, 70, 102059.

- Chen, Y., & Bellavitis, C. (2020). Blockchain disruption and decentralized finance : The rise of decentralized business models. Journal of Business Venturing Insights, 13, e00151.

- Dabbous, A., Merhej Sayegh, M., & Aoun Barakat, K. (2022). Understanding the adoption of cryptocurrencies for financial transactions within a high-risk context. The Journal of Risk Finance, 23(4), 349-367.

- Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS quarterly, 319-340.

- Davis, F. D., Bagozzi, R. P., & Warshaw, P. R. (1989). User Acceptance of Computer Technology : A Comparison of Two Theoretical Models. Management Science, 35(8), 982-1003. [CrossRef]

- Demirgüç-Kunt, A., Klapper, L., Singer, D., Ansar, S., & Hess, J. (2020). The Global Findex Database 2017 : Measuring financial inclusion and opportunities to expand access to and use of financial services. The World Bank Economic Review, 34(Supplement_1), S2-S8.

- Depietro, R., Wiarda, E., & Fleischer, M. (1990). The context for change : Organization, technology and environment. The processes of technological innovation, 199(0), 151-175.

- El Chaarani, H., EL Abiad, Z., El Nemar, S., & Sakka, G. (2024). Factors affecting the adoption of cryptocurrencies for financial transactions. EuroMed Journal of Business, 19(1), 46-61.

- El Hajj, M., & Farran, I. (2024). The cryptocurrencies in emerging markets : Enhancing financial inclusion and economic empowerment. Journal of Risk and Financial Management, 17(10), 467.

- Elouardighi, I., & Oubejja, K. (2023). Can Digital Financial Inclusion Promote Women’s Labor Force Participation? Microlevel Evidence from Africa. International Journal of Financial Studies, 11(3), Article 3. [CrossRef]

- Ferreira, A., & Sandner, P. (2021). Eu search for regulatory answers to crypto assets and their place in the financial markets’ infrastructure. Computer Law & Security Review, 43, 105632.

- Foley, S., Karlsen, J. R., & Putniņš, T. J. (2019). Sex, drugs, and bitcoin : How much illegal activity is financed through cryptocurrencies? The Review of Financial Studies, 32(5), 1798-1853.

- Fornell, C., & Larcker, D. F. (1981). Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. Journal of Marketing Research, 18(1), 39-50. [CrossRef]

- Gomber, P., Kauffman, R. J., Parker, C., & Weber, B. W. (2018). On the Fintech Revolution : Interpreting the Forces of Innovation, Disruption, and Transformation in Financial Services. Journal of Management Information Systems, 35(1), 220-265. [CrossRef]

- Goutte, S., Le, H.-V., Liu, F., & Von Mettenheim, H.-J. (2023). Deep learning and technical analysis in cryptocurrency market. Finance Research Letters, 54, 103809.

- GSMA, G. (2017). State of the industry report on mobile money. GSMA London, UK.

- Guo, Y., Yousef, E., & Naseer, M. M. (2025). Examining the Drivers and Economic and Social Impacts of Cryptocurrency Adoption. FinTech, 4(1), 5.

- Hair, J. F., Ringle, C. M., Gudergan, S. P., Fischer, A., Nitzl, C., & Menictas, C. (2019). Partial least squares structural equation modeling-based discrete choice modeling : An illustration in modeling retailer choice. Business Research, 12(1), 115-142. [CrossRef]

- Heeks, R. (2002). Information Systems and Developing Countries : Failure, Success, and Local Improvisations. The Information Society, 18(2), 101-112. [CrossRef]

- Hidegföldi, M., Csizmazia, G. L., & Karpavičė, J. (2025). Understanding the Drivers of Cryptocurrency Acceptance : An Empirical Study of Individual Adoption. Procedia Computer Science, 256, 547-556.

- Howson, P., & de Vries, A. (2022). Preying on the poor? Opportunities and challenges for tackling the social and environmental threats of cryptocurrencies for vulnerable and low-income communities. Energy research & social science, 84, 102394.

- Islam, H., Rana, M., Saha, S., Khatun, T., Ritu, M. R., & Islam, M. R. (2023). Factors influencing the adoption of cryptocurrency in Bangladesh : An investigation using the technology acceptance model (TAM). Technological Sustainability, 2(4), 423-443.

- Jorgensen, T. D., Pornprasertmanit, S., Schoemann, A. M., & Rosseel, Y. (2012). semTools : Useful Tools for Structural Equation Modeling (p. 0.5-7) [Jeu de données]. [CrossRef]

- Kanga, D., Oughton, C., Harris, L., & Murinde, V. (2022). The diffusion of fintech, financial inclusion and income per capita. The European Journal of Finance, 28(1), 108-136. [CrossRef]

- Kauffman, S. A. (1993). Origins of Order : Self-Organization and Selection in Evolution Oxford University Press: NY. US.

- Khan, M. T. I. (2023). Literacy, profile, and determinants of Bitcoin, Ethereum, and Litecoin : Survey results. Journal of Education for Business, 98(7), 367-377. [CrossRef]

- Kouam, H. (2023). Challenges and Implications of Cryptocurrencies, Central Bank Digital Currencies, and Electronic Money. In F. A. Yamoah & A. U. Haque (Éds.), Corporate Management Ecosystem in Emerging Economies (p. 147-163). Springer International Publishing. [CrossRef]

- Krejcie, R. V., & Morgan, D. W. (1970). Determining Sample Size for Research Activities. Educational and Psychological Measurement, 30(3), 607-610. [CrossRef]

- Kumari, V., Bala, P. K., & Chakraborty, S. (2023). An empirical study of user adoption of cryptocurrency using blockchain technology : Analysing role of success factors like technology awareness and financial literacy. Journal of Theoretical and Applied Electronic Commerce Research, 18(3), 1580-1600.

- Long, T. Q., Morgan, P. J., & Yoshino, N. (2023). Financial literacy, behavioral traits, and ePayment adoption and usage in Japan. Financial Innovation, 9(1), 101. [CrossRef]

- Lusardi, A., & Mitchell, O. S. (2014). The economic importance of financial literacy : Theory and evidence. American Economic Journal: Journal of Economic Literature, 52(1), 5-44.

- Lyons, A. C., & Kass-Hanna, J. (2021). Financial Inclusion, Financial Literacy and Economically Vulnerable Populations in the Middle East and North Africa. Emerging Markets Finance and Trade, 57(9), 2699-2738. [CrossRef]

- Maciejasz, M., Poskart, R., & Wotzka, D. (2024). Perceptions of Cryptocurrencies and Modern Money before and after the COVID-19 Pandemic in Poland and Germany. International Journal of Financial Studies, 12(3), Article 3. [CrossRef]

- Metelski, D., & Sobieraj, J. (2022). Decentralized Finance (DeFi) Projects : A Study of Key Performance Indicators in Terms of DeFi Protocols’ Valuations. International Journal of Financial Studies, 10(4), Article 4. [CrossRef]

- Mhlanga, D. (2023). Block Chain for Digital Financial Inclusion Towards Reduced Inequalities. In D. Mhlanga, FinTech and Artificial Intelligence for Sustainable Development (p. 263-290). Springer Nature Switzerland. [CrossRef]

- Miles, M. B. (1994). Qualitative data analysis : An expanded sourcebook. Thousand Oaks. https://books.google.com/books?hl=fr&lr=&id=U4lU_-wJ5QEC&oi=fnd&pg=PR12&dq=85.%09Miles,+M.+B.%3B+Huberman,+A.+M.+Qualitative+data+analysis:+An+expanded+sourcebook.+Sage:+Thousand+Oaks,+CA,+USA,+1994.&ots=kGWEZLVXYN&sig=RrWCFfmaf7TiRsz6gu0CNMriPhU.

- Mohammed, M. A., De-Pablos-Heredero, C., & Montes Botella, J. L. (2023). Exploring the factors affecting countries’ adoption of blockchain-enabled central bank digital currencies. Future Internet, 15(10), 321.

- Morgan, P. J. (2021). Fintech, financial literacy, and financial education. The Routledge Handbook of Financial Literacy, 239-258.

- Nakamoto, S. (2008). Bitcoin : A peer-to-peer electronic cash system. https://assets.pubpub.org/d8wct41f/31611263538139.pdf.

- Nandal, N., Nandal, N., Gulati, S., & Mehta, C. (2024). The Growth of Cryptocurrency across the Globe : Its Challenges and Potential Impacts on Legislation. In Integrating Advancements in Education, and Society for Achieving Sustainability (p. 228-235). Routledge. https://www.taylorfrancis.com/chapters/edit/10.4324/9781032708461-36/growth-cryptocurrency-across-globe-challenges-potential-impacts-legislation-nisha-nandal-naveen-nandal-shaurya-gulati-chakshu-mehta.

- Nchofoung, T. N., & Asongu, S. A. (2022). Effects of infrastructures on environmental quality contingent on trade openness and governance dynamics in Africa. Renewable Energy, 189, 152-163.

- Nishibe, M. (2024). The Transdisciplinary Approach to Evolutionary Economics : An Integrated Science of Economics and Biology. In K. Yagi, Y. Shiozawa, Y. Aruka, M. Nishibe, & A. Isogai (Éds.), Present and Future of Evolutionary Economics (Vol. 31, p. 25-39). Springer Nature Singapore. [CrossRef]

- Olayinka, O., & Wynn, M. G. (2022). Digital Transformation in the Nigerian Small Business Sector: In M. G. Wynn (Éd.), Advances in E-Business Research (p. 359-382). IGI Global. [CrossRef]

- Ozili, P. K. (2023). Determinants of interest in eNaira and financial inclusion information in Nigeria : Role of Fintech, cryptocurrency and central bank digital currency. Digital Transformation and Society, 2(2), 202-214.

- Pfeffer, J., & Salancik, G. (2015). External control of organizations—Resource dependence perspective. In Organizational behavior 2 (p. 355-370). Routledge. https://www.taylorfrancis.com/chapters/edit/10.4324/9781315702001-24/external-control-organizations%E2%80%94resource-dependence-perspective-jeffrey-pfeffer-gerald-salancik.

- Ramayah, T., Cheah, J., Chuah, F., Ting, H., & Memon, M. A. (2018). Partial least squares structural equation modeling (PLS-SEM) using smartPLS 3.0. An updated guide and practical guide to statistical analysis, 1(1), 1-72.

- Rezaeian, M., & Wynn, M. (2016). The implementation of ERP systems in Iranian manufacturing SMEs. International Journal on Advances in Intelligent Systems, 9(3 & 4), 600-614.

- Rogers, E. M. (2003). Diffusion of Innovations, 5th Edition. Simon and Schuster.

- Rzayev, K., Sakkas, A., & Urquhart, A. (2025). An adoption model of cryptocurrencies. European Journal of Operational Research, 323(1), 253-266.

- Schaupp, L. C., Festa, M., Knotts, K. G., & Vitullo, E. A. (2022). Regulation as a pathway to individual adoption of cryptocurrency. Digital Policy, Regulation and Governance, 24(2), 199-219.

- Schuetz, S., & Venkatesh, V. (2020). Blockchain, adoption, and financial inclusion in India : Research opportunities. International journal of information management, 52, 101936.

- Shahzad, F., Xiu, G., Wang, J., & Shahbaz, M. (2018). An empirical investigation on the adoption of cryptocurrencies among the people of mainland China. Technology in Society, 55, 33-40.

- Sham, R., Aw, E. C.-X., Abdamia, N., & Chuah, S. H.-W. (2023). Cryptocurrencies have arrived, but are we ready? Unveiling cryptocurrency adoption recipes through an SEM-fsQCA approach. The Bottom Line, 36(2), 209-233.

- Shin, D., & Rice, J. (2022). Cryptocurrency : A panacea for economic growth and sustainability? A critical review of crypto innovation. Telematics and Informatics, 71, 101830.

- Shuhaiber, A., Al-Omoush, K. S., & Alsmadi, A. A. (2025). Investigating trust and perceived value in cryptocurrencies : Do optimism, FinTech literacy and perceived financial and security risks matter? Kybernetes, 54(1), 330-357.

- Sousa, A., Calçada, E., Rodrigues, P., & Pinto Borges, A. (2022). Cryptocurrency adoption : A systematic literature review and bibliometric analysis. EuroMed Journal of Business, 17(3), 374-390.

- Steinmetz, F., Von Meduna, M., Ante, L., & Fiedler, I. (2021). Ownership, uses and perceptions of cryptocurrency : Results from a population survey. Technological Forecasting and Social Change, 173, 121073.

- Tapscott, D., & Tapscott, A. (2017). La revolución blockchain. Deusto Barcelona. https://static0planetadelibroscommx.cdnstatics.com/libros_contenido_extra/35/34781_La_revolucion_blockchain.pdf.

- Van Dyk, R., & Van Belle, J.-P. (2019). Factors influencing the intended adoption of digital transformation : A South African case study. 2019 federated conference on computer science and information systems (fedcsis), 519-528. https://ieeexplore.ieee.org/abstract/document/8860025/.

- Venkatesh, V., Brown, S. A., & Bala, H. (2013). Bridging the qualitative-quantitative divide : Guidelines for conducting mixed methods research in information systems. MIS quarterly, 21-54.

- Venkatesh, V., Morris, M. G., & Ackerman, P. L. (2000). A longitudinal field investigation of gender differences in individual technology adoption decision-making processes. Organizational behavior and human decision processes, 83(1), 33-60.

- Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User acceptance of information technology : Toward a unified view. MIS quarterly, 425-478.

- Venkatesh, V., Thong, J. Y., & Xu, X. (2012). Consumer acceptance and use of information technology : Extending the unified theory of acceptance and use of technology. MIS quarterly, 157-178.

- Williams, M. D., Rana, N. P., & Dwivedi, Y. K. (2015). The unified theory of acceptance and use of technology (UTAUT) : A literature review. Journal of enterprise information management, 28(3), 443-488.

- Wong, K. K.-K. (2013). Partial least squares structural equation modeling (PLS-SEM) techniques using SmartPLS. Marketing bulletin, 24(1), 1-32.

- Wong, L.-W., Tan, G. W.-H., Lee, V.-H., Ooi, K.-B., & Sohal, A. (2020). Unearthing the determinants of Blockchain adoption in supply chain management. International Journal of Production Research, 58(7), 2100-2123. [CrossRef]

- Wynn, M. G., Adejumo, D., & Vale, V. (2024). Digitalization and country image : Key influencing factors (a case example of Nigeria). Journal of Policy and Society, 2(2), 1-16.

- Xie, R. (2019). Why China had to ban cryptocurrency but the US did not : A comparative analysis of regulations on crypto-markets between the US and China. Wash. U. Global Stud. L. Rev., 18, 457.

- Yeong, Y.-C., Kalid, K. S., & Sugathan, S. K. (2019). Cryptocurrency adoption in Malaysia : Does age, income and education level matter? International Journal of Innovative Technology and Exploring Engineering, 8(11), 2179-2184.

- Yoon, C. (2011). Theory of Planned Behavior and Ethics Theory in Digital Piracy : An Integrated Model. Journal of Business Ethics, 100(3), 405-417. [CrossRef]

- Zetzsche, D. A., Buckley, R. P., & Arner, D. W. (2019). Regulating LIBRA : The Transformative Potential of Facebook’s Cryptocurrency and Possible Regulatory Responses. http://hub.hku.hk/handle/10722/276462.

- Zohar, A. (2015). Bitcoin : Under the hood. Communications of the ACM, 58(9), 104-113. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).