Submitted:

31 March 2025

Posted:

31 March 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Literature review

3.1. Digital Inclusive Finance

2.2. Rural Labor Economics

2.3. Influence Mechanism

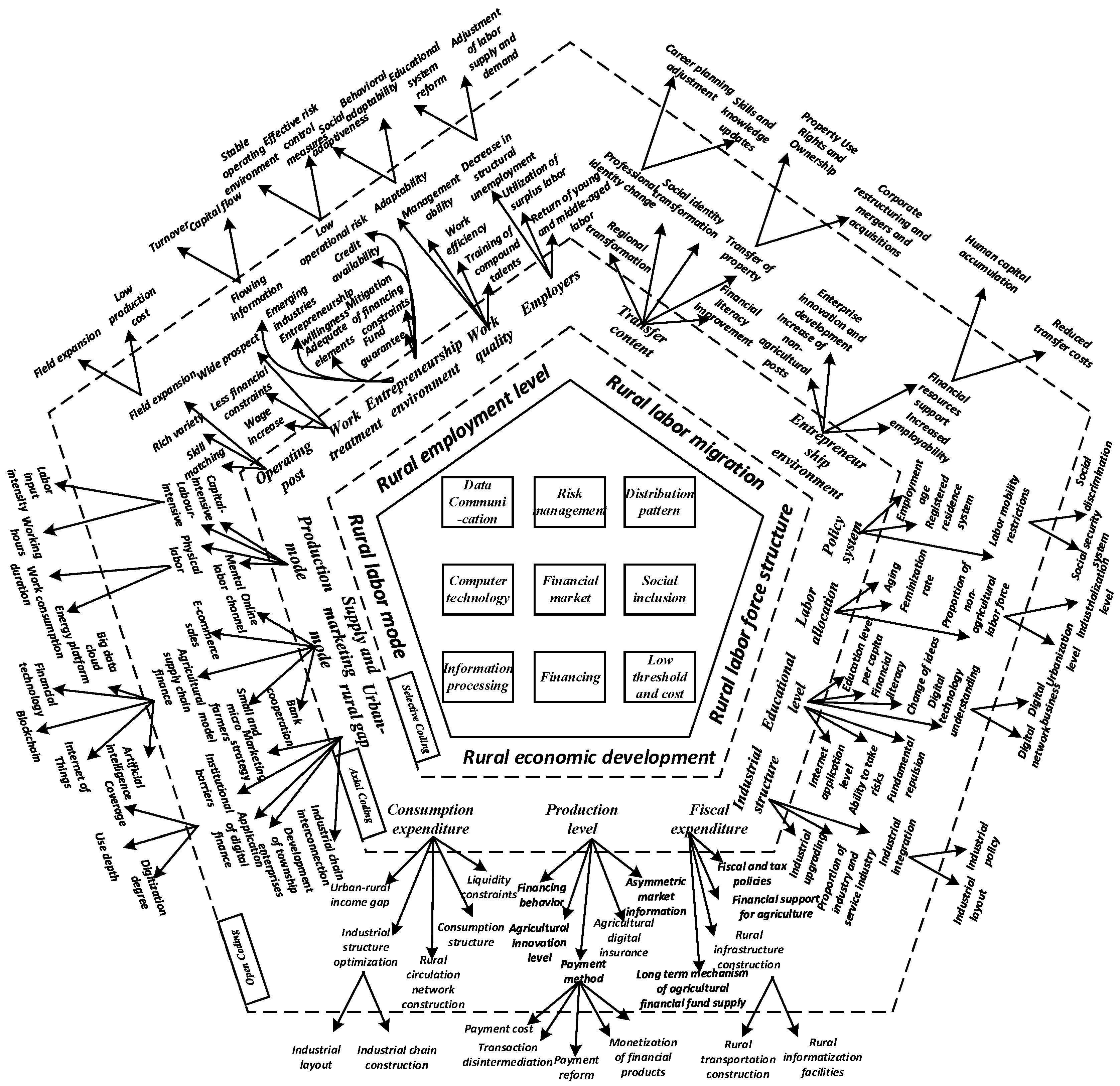

- Financial inclusion in the digital context can improve rural employment levels [53]. Digital inclusive finance makes it possible to diversify and match jobs. In addition, higher wages and lower financial constraints play an important role in easing the economic burden and increasing the level of consumption of farm households [54]. Digital inclusive finance can improve work efficiency and adaptability by increasing the training of complex talents. Meanwhile, digital inclusive finance can also enhance farmers' willingness to start their businesses by strengthening their access to credit, alleviating financing constraints [55], and spreading business risks.

- Digital inclusive finance provides an important channel for promoting rural out-migration and non-farm labor transfer [56]. Modern technology stimulates the emergence of new potential enterprises and the reform of existing enterprises [57], effectively increasing the types and numbers of non-farm jobs in society and broadening the scope of employment of rural laborers. At the same time, as digital inclusive finance eases the financial constraints of the labor force, it provides technical and financial resources to support the accumulation and transfer costs of their human capital and increases employment opportunities [58].

- Digital inclusive finance has a significant impact on the optimization of rural labor structure. On the one hand, the full flow of information and the rapid development of logistics brought about by digital inclusive finance have improved labor mobility constraints arising from policies such as the household registration system and employment age [59]. The allocation dividend of the workforce of different ages can be fully exploited. On the other hand, digital inclusive finance effectively promotes the integration of secondary and tertiary industries and accelerates the upgrading of industrial structures [60]. Rural laborers can fully enjoy the dividends of the sharing economy and enhance financial sector inclusion [61]. In addition, it can significantly improve the education level of the rural population and enhance their ability to access financial resources with modern technology.

- Digital inclusive finance is conducive to the enrichment of rural economic labor methods. With its new business model using the Internet, digital inclusive finance is transforming rural industries from labor-intensive to capital-intensive. This transformation promotes the efficient matching of factors [62], accelerates the development of township enterprises and the penetration of industrial chains, reduces the income gap between urban and rural areas [63], and "agriculture + e-commerce" is gradually becoming a new way of labor [64]. At the same time, digital inclusive finance reduces the cost of non-farm transfer of rural labor, facilitates the diversification of labor patterns, and increases the probability of success and the sharing of results.

- The synergistic effect of digital inclusive finance in the economic development of rural areas is significant, and the marginal benefits show an increasing trend. On the one hand, it affects agricultural output by influencing farmers' financing behavior [65], alleviating information asymmetry in agricultural markets, changing payment methods and transaction channels for selling agricultural products, and increasing the level of agricultural innovation. On the other hand, the use of fiscal policy to guide the role of inclusive finance [66], the establishment of a sound long-term mechanism for the supply of financial resources related to agriculture. By improving the rural logistics system and promoting the construction of a rural circulation network, it can meet the needs of rural residents to upgrade consumption and optimize the level of financial expenditure [67]. The key points of the impact of digital inclusive finance on rural labor economics mentioned in the above five-point mechanism are shown in Table 2 and Figure 2.

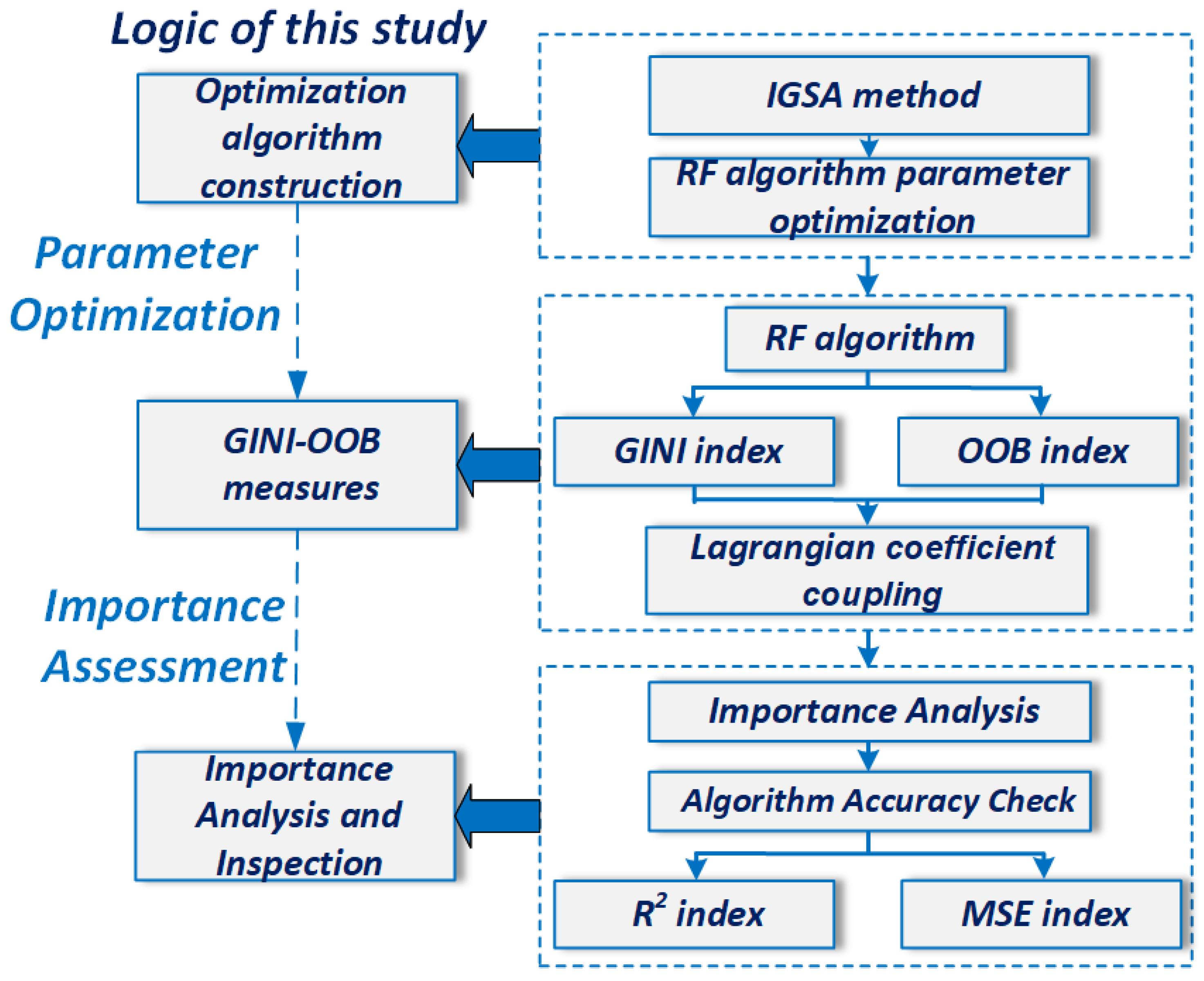

3. Methodology

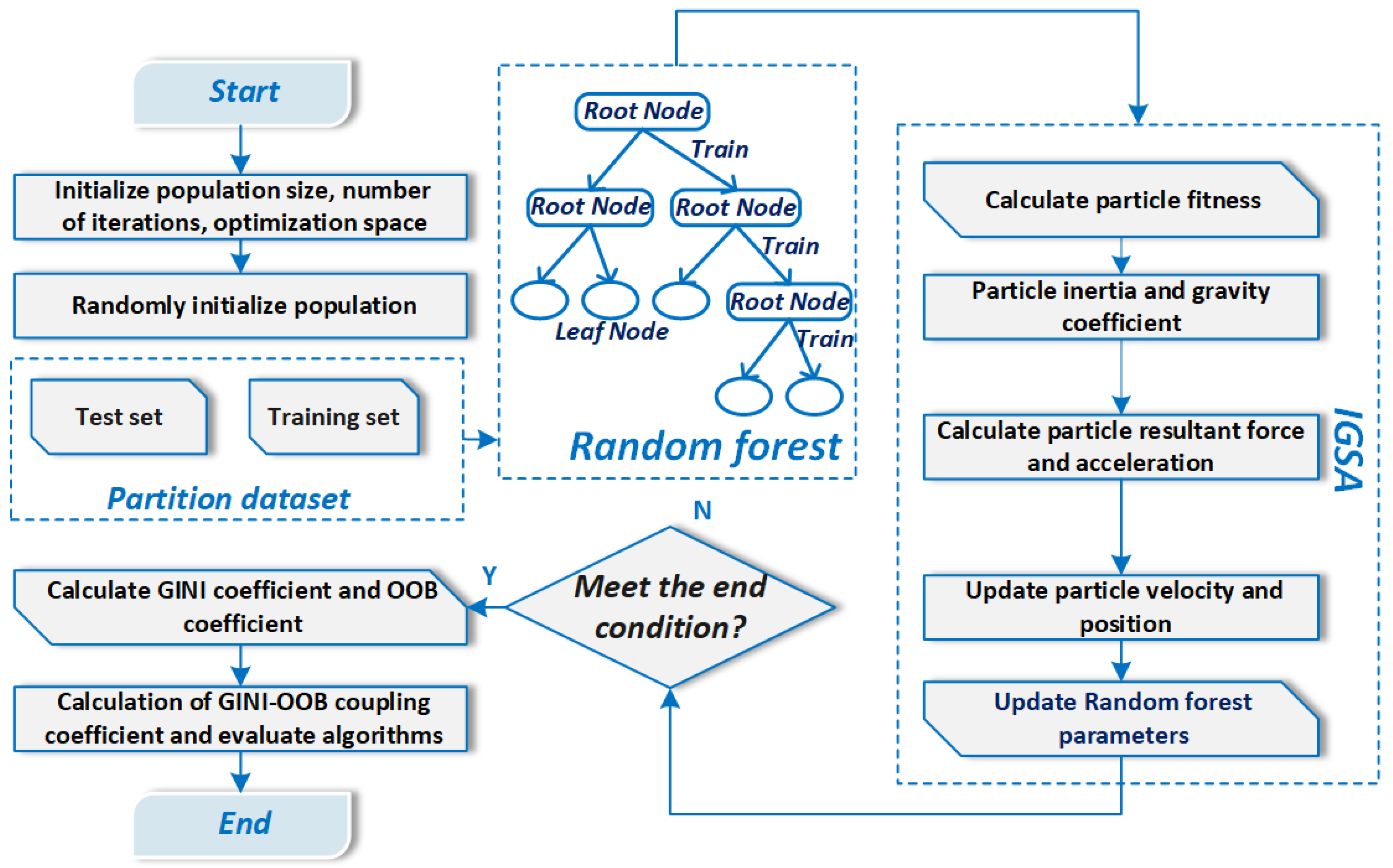

3.1. The IGSA Method

- Gravitational Coefficient Update: The gravitational coefficient is enhanced using a linear function, with the calculation given in Equations (7) and (8).

- Velocity update. The velocity update is improved by incorporating the memory function and population information. This strategy maintains the laws of motion while enhancing memory and communication within the population. The new velocity update is defined in in Equation (9):where randi, randj, and randk are random variables in the interval [0,1]; and c1, c2 are constants in [0,1]; is the best position of particle i; and is the best position of all particles. By adjusting c1 and c2, the balance between gravity, memory, and population information can be controlled.

- Position update. The differential evolution algorithm uses a greedy selection mode, as shown in Equation (10). If the fitness value of the new individual surpasses the target individual, it is accepted; otherwise, the previous generation's individual remains in the population. The new position's fitness is lower than the target’s.

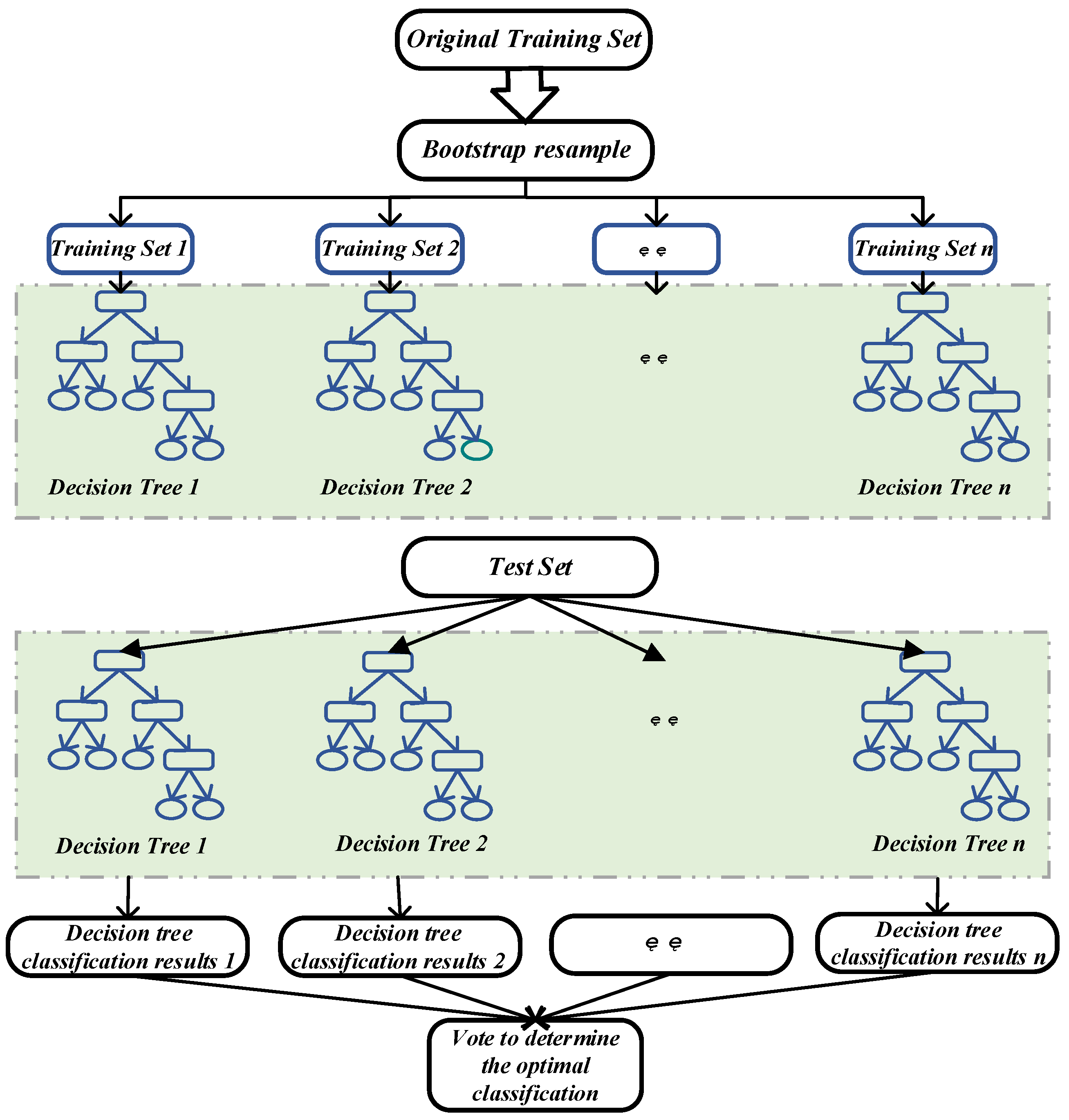

3.2. The RF Method

3.3. IGSA-RF Prediction Model

3.4. The GINI-OOB Coefficient

3.4.1. The GINI Coefficient

3.4.2. The OOB Coefficient

3.5. Evaluation Metrics

4. Case Study

4.1. Study Area

4.2. Empirical Data Collection

4.3. RF Result and Performance Evaluation

- (a)

- There is a significant positive correlation between the development of rural digital inclusive finance and the promotion of consumption expansion and consumption upgrading in labor economics.

- (b)

- The introduction of digital inclusive finance in rural areas helps promote high-quality regional GDP.

- (c)

- Digital inclusive finance can raise the average monetary wage index of employed people through various mechanisms of action. Combined with Figure 8, we can see that the indicator Ieamw has been maintained at the top level in recent years and is in the medium-high impact area. The coefficients range from 0 to 0.5 and are at the highest value of 0.487 in 2021, as shown in Figure 8(d). Overall, it has a strong influence and a growing trend. With the widespread use of the new generation of digital technology in the financial sector, digital inclusive finance is reducing the cost of services while providing more jobs for rural residents. It can optimize the structure of rural employment and guarantee the quality of employment so that rural residents can make better use of financial resources to increase their income. At the same time, the average monetary wage index of employed persons is raised to reduce the income gap between urban and rural areas.

- (d)

- Digital inclusive finance has no significant effect on gender differences and age differences in the structure of the rural labor force. Combined with Figure 8, it can be seen that the indicators Rf and Reb remain in the last three places for a long time and are in the low-impact area. The coefficient was always below 0.01 and Rf was at the lowest value of 0.0031 in 2019, see Figure 8(b). Reb was at the lowest value of 0.00299 in 2018, see Figure 8(a). Overall the impact is in a low posture. Gender and age differences in the use of digital inclusive finance persist due to differences in risk aversion, negative consumer experiences, lack of financial and digital literacy, and declining knowledge, skills, and behaviors over the years due to aging trends. Older people and women are more financially vulnerable than other groups, and the effect of digital inclusive finance on specific groups is relatively weak.

- (e)

- Compared with capital-intensive industries, digital inclusive finance shows strong limitations for purely labor-intensive industries. Combined with Figure 8, it can be seen that the indicator Vlio is also in the low-impact area for a long time. The coefficient stabilized below 0.01 and Vlio reached its lowest value of 0.0035 in 2018, as shown in Figure 8(a). There was no significant performance in terms of impact across the years. Since labor-intensive industries as a whole are relatively low-skilled and less digitally influenced, the majority of the workforce still has only a relatively low level of financial literacy and modern knowledge. Therefore, the degree of influence of digital inclusive finance is limited, and there is relatively little room for development.

- (f)

- The development of inclusive digital finance has a certain long-term tendency toward the substitution of capital for labor in agricultural output. The combined Figure 8 shows that the indicator Ptam has a clear upward trend. From the last position in 2018 (coefficient 0.0026), see Figure 8(a), it rises steadily from year to year until the second position in 2024 (coefficient 0.134), see Figure8(g). Overall its influence has increased significantly. The development of digital inclusive finance has significantly improved agricultural output by increasing the utilization of agricultural machinery, promoting the impact of capital substitution for labor in agricultural production by farmers and the underlying mechanisms. And because the breadth of coverage and depth of use of digital inclusive finance has been further strengthened in recent years, the process of agricultural mechanization has accelerated.

5. Discussion

5.1. Policy Recommendations

- (a)

- To consolidate the construction of the bottom of digital inclusive finance in rural labor economics and further strengthen the rural digital infrastructure services. Due to the relatively backward level of development in rural areas, the emergence of modern digital trends in financial activities has led to significant structural changes in the agricultural economy, which coincides with mechanism ii proposed in Section 2.3. According to mechanism v, the full extent of the marginal contribution needs to rely on a strong, open, and efficient digital infrastructure. Considering the geographical differences, the breakthrough in rural areas focuses on establishing a sound Internet coverage and penetration rate and narrowing the "digital divide" arising from the difference between urban and rural infrastructure. The government can engage with traditional network service providers to offer specific subsidies and preferential services for rural areas to reduce costs and guarantee smooth network access. At the same time, the government optimizes the platform for providing digital financial services and vigorously promotes online banking, Customer Relationship Management (CRM), and other mobile financial products to ensure that rural residents can enjoy convenient and efficient financial services. It is also important to raise the level of financial literacy and digital skills of the rural population to guarantee that the mainstays of rural labor economics have full access to the benefits of digital financial inclusion.

- (b)

- To promote the horizontal and deep development of digital inclusive finance in rural areas, thus providing a guarantee for the comprehensive and high-quality development of rural labor economics. Firstly, focus on the breadth of coverage of digital inclusive finance in rural areas and improve infrastructure construction. Secondly, the use of modern information technology to expand the depth of digital inclusive finance. Especially for the majority of poor groups, according to mechanism i, financial service institutions, under the premise of controlling costs and risks, broaden innovative financial products and services to meet the diversified needs of farmers. At the same time, modern technology is used to improve the credit assessment system and reduce the credit constraints of vulnerable groups. It can also alleviate the imbalance between the supply and demand of financial resources caused by insufficient information, optimize the entrepreneurial environment, and tap the entrepreneurial potential. By strengthening the breadth of coverage and depth of use of digital inclusive finance, we can deeply integrate digital inclusive finance with the real economy and achieve the sustainable development of the economy and environment in rural areas.

- (c)

- Strengthen the top-level design of digital inclusive financial development and realize the long-term mechanism of high-quality development of rural labor economics. According to mechanism iv, with the penetration of digital inclusive finance, rural industries are gradually becoming dependent on the Internet and electronic information to a certain extent. However, the flow and control of online data are still highly risky. The legal regulation and rules of the relevant digital technology laws should be accelerated and improved. In addition to improving the service capability, the company also manages the potential internal and external risks to provide a stable and safe institutional environment for its long-term development. At the same time, relying on mechanism v, the government needs to set up a perfect financial management system and coordination mechanism. While safeguarding the development of the traditional financial industry, it should provide a basis for the development of digital inclusive finance and an incentive system. As a result, the value of business sustainability of digital inclusive finance, together with the complementary functions of traditional finance and digital inclusive finance, can be maximized.

- (d)

- To develop a differentiated development model of digital inclusive finance in different regions, and to implement precise policies according to local conditions. Heterogeneity still exists due to the different stages of infrastructure construction, economic and social development, financial service level, and policy system in each region. There is also a threshold effect in the development of digital inclusive finance in each region. In conjunction with mechanism iii, a differentiated and personalized digital inclusive financial system should be constructed in accordance with the characteristics of rural areas. Regions should also be encouraged to combine their characteristics and resource endowments to explore unique development paths for digital inclusive finance and improve their resource allocation and utilization efficiency. Concerning mechanism v, for the development of relatively backward rural areas, through the implementation of tax incentives, the introduction of talent, collaborative development of innovation issues, and other policies to attract industrial structure optimization and high-quality investment. The "vicious circle" of a widespread migration of talent and money can be avoided, and the promotion effect and balanced growth of digital inclusive finance can be further increased.

- (e)

- Unblocking the transmission channels between the various segments of rural labor economics to promote high-quality development and use digital inclusive finance to expand rural domestic demand. There is still a widespread internal circulation blockage and disconnect between production and demand in rural areas, while consumption-driven domestic demand is an intrinsic driver for rural labor economics development. According to mechanism i, digital inclusive finance can effectively drive demand related to production in rural areas in all urban and rural areas and international trade channels. Therefore, we should focus on developing more digitally inclusive financial products that can expand domestic demand and stimulate consumption. Combined with mechanism iv, with the help of network sales platform and multi-channel sales channels, continue to broaden the online consumption mode and consumption scene, pulling the post-epidemic era of consumption back to compensate and consumption augmentation. At the same time, each region should accelerate the construction of big data management and monitoring institutions. By improving the process of collecting, integrating, analyzing, and reporting relevant data, the information of rural residents is desensitized and incorporated into the local information-sharing platform. It will alleviate the information gap and inequality among various links, and build a closed-loop ecology of digital inclusive finance.

5.2. Algorithm Comparison

6. Conclusion and Prospect

6.1. Conclusions

6.2. Limitations and Future Work

- (1)

- The selected indicator dimensions in the model have certain shortcomings, such as incomplete consideration of social security and social insurance due to a significant amount of missing data. To achieve a comprehensive indicator dimension, improvements can be made by diversifying data collection channels or implementing indirect indicator measurement methods. Additionally, the direction can be dynamically adjusted based on the latest feedback results regarding changes in indicators to ensure the rationality and completeness of the model framework.

- (2)

- The impact of changes in the international environment and the occurrence of force majeure factors, such as COVID-19, is not taken into account in the calculation and analysis of the importance of the indicators. To excavate the dynamic relationship between digital inclusive finance and rural labor economics under the contingency scenario, the model parameters need to be further modified for the years including outliers.

- (3)

- Machine learning models, despite their high predictive accuracy, may exhibit instability and limited interpretability. To gain deeper insights into the underlying mechanisms governing the relationship between digital inclusive finance and rural labor economics, future research could integrate econometric models and systems engineering approaches to enhance theoretical rigor and explanatory power.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Elisa; Annalisa; Armin; Massimo; Alexander. Digital technologies and the changing entrepreneurial finance landscape: Status quo and perspectives for future research. Technol Forecast Soc 2021, 1.

- Wu Yanjun. Internet banking drives the high-quality development of digital inclusive finance. Modern Commercial Bank 2022, 48-51.

- Wang Yu. Realistic thinking on blockchain empowering the high-quality development of digital inclusive finance. Changbai Journal 2022, 113-122. [CrossRef]

- David-West, O.Y.L.E. The path to digital financial inclusion in Nigeria: Experiences of Firstmonie. Journal of Payments Strategy & Systems 2015, 256-273.

- Pinos, F. Inclusion financière et populations précarisées : effets des business models des services financiers en France. Type, Economies et finances. Université de Bordeaux, 2015.

- Li, C.; Zhang, Z.; Jin, Y. Economic Effect of Rural Labor Transfer in China. Journal of Financial Research 2021, 46-52.

- Tanimoto, M. PEASANT SOCIETY IN JAPAN'S ECONOMIC DEVELOPMENT: WITH SPECIAL FOCUS ON RURAL LABOUR AND FINANCE MARKETS. International Journal of Asian Studies 2018, 229-253.

- Lal, T.S.S.T. Measuring impact of financial inclusion on rural development through cooperatives. International Journal of Social Economics 2019, 352-376.

- Li Fengling. A brief discussion on the growth and development of labor economy under the new situation. Science and Technology Economic Market 2020, 96-98.

- Teng Lei; Zhang Heng; Tang Sisi. Digital financial innovation and rural economic development from the perspective of inclusiveness. Research World 2021, 34-42. [CrossRef]

- Luo Xiaofang; Wang Susu. Digital economy, employment and labor income growth: An empirical analysis based on the data of China Family Panel Studies (CFPS). Jianghan Forum 2021, 5-14.

- Du Jiating; He Yong; Gu Qiannong. The nonlinear impact of digital inclusive finance on the upgrading of rural residents' consumption structure. Statistics and Information Forum 2022, 37, 63-74.

- M., D.S. Digitalization as a Modern Mechanism for Managing the Financial-Economic Activities of Enterprises in Rural Territories. Bìznes Inform 2021, 56-62.

- Murendo, C.S.S.; Murenje, G.S.S.; Chivenge, P.P.S.S.; Mtetwa, R.S.S. Financial Inclusion, Nutrition and Socio-Economic Status Among Rural Households in Guruve and Mount Darwin Districts, Zimbabwe. J Int Dev 2021, 86-108.

- Sup, A.S.S.; Sup, A.A.S.; Sup, E.V.S.; Sup, K.B.S. Areas of development strategy for the regional agribusiness management system. IOP Conference Series: Earth and Environmental Science 2019, 12122.

- Thakur, K.K.S.A.; Prasad, R.S.B.S. Wi-Fi for affordable broadband & 5G in rural areas. Journal of Mobile Multimedia 2021, 225-244.

- Qinya, T.; Yuqing, L.; Kelin, C. Coordinated development of agricultural economy and rural tourism based on big data. E3S Web of Conferences 2021, 2001.

- Nyika, G.T. Use of ICTS for socio-economic development of marginalised communities in rural areas: Proposals for establishment of sectoral Rural Entrepreneurial Networks. Journal of Development and Communication Studies 2020, 71-91.

- Dai Xin; Min Yuqing. Research on the innovative development path of "blockchain + order-based agriculture" - Based on the financing development of rural economies in Xuzhou. Business Accounting 2020, 73-76.

- Cuneo, A.G. The Economics of Rural Populations in Sub-Saharan Africa: Financial Inclusion and Agriculture. Type, Georgetown University, 2019.

- Zhang Nan. Research on the innovative financial management model of rural collective economy in the era of artificial intelligence. Agricultural Economy 2021, 48-50.

- Ma, W.; Nie, P.; Zhang, P.; Renwick, A. Impact of Internet use on economic well-being of rural households: Evidence from China. Rev Dev Econ 2020.

- Briglauer, W.S.C.S.; Dürr, N.S.S.C.; Falck, O.S.C.S.; Hüschelrath, K.S.C.S. Does state aid for broadband deployment in rural areas close the digital and economic divide? Inf Econ Policy 2019, 68.

- Hoepner, A.G.F.; McMillan, D.; Vivian, A.; Simen, C.W. Significance, relevance and explainability in the machine learning age: an econometrics and financial data science perspective. The European Journal of Finance 2021, 1-7.

- Gogas, P.; Papadimitriou, T. Machine Learning in Economics and Finance. Comput Econ 2021, 1-4.

- Xu Peiwen; Yao Li. Research on the innovation risks and regulation of digital inclusive finance. Development 2022, 79-81.

- Kirana, M.Y.; Havidz, S.A.H. in Financial Literacy and Mobile Payment Usage as Financial Inclusion Determinants, 2020 International Conference on Information Management and Technology (ICIMTech), Bandung, Indonesia, 2020; Bandung, Indonesia, 2020.

- Sup, C.L.S.A.; Sup, C.W.S.B.; Sup, S.H.S.C. Financial inclusion, financial innovation, and firms’ sales growth. Int Rev Econ Financ 2020, 189-205.

- Chen Xiali. Human resource development path under labor economics theory. Human Resources 2020, 140-141.

- Luo Rundong; Shen Jun; Xu Dandan. Analysis of cutting-edge literature on labor economics theory research - based on the perspective of bibliometric analysis. Economic Dynamics 2014, 89-97.

- Die, H.; Menghan, H.; Yuxue, C.; Fang, Y. Research on the Main Body of Rural Economic Innovation Based on the Perspective of Public Policy. E3S Web of Conferences 2021, 3066.

- Svetlana, P. Methodological aspects of rural economy diversification in the context of modern civilizational transformations. E3S Web of Conferences 2021, 8041.

- Guo Yidi. Analysis of cutting-edge literature on labor economics theory research - bibliometric analysis of the WOS database in the last decade. Labor Economic Review 2019, 12, 22-34.

- Zou Jinhui. Empirical analysis of the factors affecting rural economic development in Zhejiang. Management and Technology of Small and Medium Enterprises (First Half) 2021, 51-52.

- Emran, M.S.; Shilpi, F. Land Market Restrictions, Women's Labour Force Participation and Wages in a Rural Economy. Oxford B Econ Stat 2017, 747-768.

- Li, Y.; Gan, J. The Impact of Income Gap between Urban and Rural on Chinese Economic Growth: Based on the Perspective of Fiscal Expenditure Structure. In 2018.

- Yin Zhaohui. Research on the impact of digital inclusive finance on urban-rural income gap. Type, Jilin University, 2022.

- Han, L. in Analysis of Rural Surplus Labor Migration under Institutional Economics Perspective, Tianjin, PEOPLES R CHINA, 2015; Tianjin, PEOPLES R CHINA, 2015.

- Behera, M.; Mishra, S.; Behera, A.R. The COVID-19-Led Reverse Migration on Labour Supply in Rural Economy: Challenges, Opportunities and Road Ahead in Odisha. The Indian Economic Journal 2021, 392-409.

- Zou, X.; Xie, M.; Li, Z.; Duan, K. Spatial Spillover Effect of Rural Labor Transfer on the Eco-Efficiency of Cultivated Land Use: Evidence from China. Int J Env Res Pub He 2022, 9660.

- Kiyoto, K. A Comparative Study on The Rural Economic Policy under The Aging Society between Northeast Thailand and Shiga Prefecture, Japan = The Ritsumeikan economic review : the bi-monthly journal of Ritsumeikan University 2017, 838-847.

- Li Xu; Li Yanyu. The Impact of Rural Population Aging on Rural Economy in Jilin Province. Modern Marketing 2022, 139-141. [CrossRef]

- Zhang, Z.; Li, Z. Development and Utilization of Female Labor Force in Rural Areas in Guizhou During Economic Transformation Period—— A Survey of 10 Villages in Guizhou in 2016. American Journal of Agriculture and Forestry 2018, 103-110.

- Li Fanghua; Ji Chenyang. Estimation of the elasticity of rural labor return from the perspective of rural revitalization - a study based on spatial discontinuity regression. China Rural Economy 2022, 36-55.

- Fang Guanfu; Cai Li. How does digital inclusive finance affect agricultural output: facts, mechanisms and policy implications. Agricultural Economic Issues 2022, 97-112. [CrossRef]

- Liao Qiqi. Research on the transformation of rural economic development under the new situation. Rural Economy and Science and Technology 2022, 33, 21-24.

- Zhang Helin; Wu Tiankai. Structural decomposition and dynamic analysis of China's rural economic growth. Statistics and Decision 2021, 37, 108-111. [CrossRef]

- Shen Yang; You Yuhan; Zhou Pengfei. The impact of digital inclusive finance on new urbanization. Finance and Economy 2021, 46-53. [CrossRef]

- Asibey, M.O.; Ocloo, K.A.; Amponsah, O. Gender differences and productive use of energy fuel in Ghana’s rural non-farm economy. Energy 2021, 119068.

- Williams, S.L. Closing the Financial Inclusion Gap by Understanding What Factors Drive Consumer Selection of Financial Service Providers. Type, Temple University, 2019.

- Wang Gengnan; Zhang Guojun; Zhou Chunshan. Temporal and spatial evolution characteristics and influencing factors of digital inclusive finance in the Pearl River Delta. Regional Research and Development 2022, 41, 25-31.

- Ahmad, N.; Reinsdorf, J.R.A.M. Can potential mismeasurement of the digital economy explain the post-crisis slowdown in GDP and productivity growth? OECD Publishing 2017.

- Xie, W.A.; Wang, T.A.Q.C.; Zhao, X.A. Does Digital Inclusive Finance Promote Coastal Rural Entrepreneurship? J Coastal Res 2020, 240-245.

- Mauritzen, J. Will the locals benefit? The effect of wind power investments on rural wages. Energ Policy 2020, 111489.

- Aisaiti, G.; Liu, L.; Xie, J. An empirical analysis of rural farmers’ financing intention of inclusive finance in China. Ind Manage Data Syst 2019, 1535-1563.

- Zhang Bing; Li Na. Research on the impact of digital inclusive finance on non-agricultural transfer of rural labor force: an empirical analysis based on Mlogit and threshold models. World Agriculture 2022, 65-75. [CrossRef]

- Balci, G. Digitalization in container shipping: Do perception and satisfaction regarding digital products in a non-technology industry affect overall customer loyalty? Technol Forecast Soc 2021, 1.

- Cirillo, V.; Evangelista, R.; Guarascio, D.; Sostero, M. Digitalization, routineness and employment: An exploration on Italian task-based data. Res Policy 2020, 104079.

- Beg, S. Digitization and Development: Property Rights Security, and Land and Labor Markets. J Eur Econ Assoc 2022, 395-429.

- Tian Lin; Zhang Yuanyuan; Zhang Shijie. Research on the dynamic impact of digital inclusive finance on rural revitalization - based on system GMM and threshold effect test. Journal of Chongqing University 2022, 28, 25-38.

- Ren, B.R.B.; Li, L.L.L.; Zhao, H.Z.H.; Zhou, Y.Z.Y. THE FINANCIAL EXCLUSION IN THE DEVELOPMENT OF DIGITAL FINANCE - A STUDY BASED ON SURVEY DATA IN THE JINGJINJI RURAL AREA(Article). Singap Econ Rev 2018, 65-82.

- Mora-Rivera, J.; García-Mora, F. Internet access and poverty reduction: Evidence from rural and urban Mexico. Telecommun Policy 2021, 1.

- Qiu, L.; Zhong, S.; Sun, B. Blessing or curse? The effect of broadband Internet on China’s inter-city income inequality. Economic Analysis and Policy 2021, 626-650.

- Chen Linlin. Research on the impact of digital inclusive finance on rural residents’ consumption potential-based on the intermediary effect of rural e-commerce. Reform and Opening 2022, 26-33. [CrossRef]

- Huang, F. in Rural E-commerce Investment and Financing Model Based on Blockchain and Data Mining, 2021 5th International Conference on Computing Methodologies and Communication (ICCMC), Erode, India, 2021; Erode, India, 2021.

- Nguyen-Hoang, P. The Fiscal Effects of Tax Increment Financing on Rural School Districts: The Case of Iowa. AERA Open 2021.

- Yue Xiyou; Chen Guisheng. Fiscal support for agriculture, digital inclusive finance and rural residents' consumption upgrade. China Circulation Economy 2022, 36, 60-70. [CrossRef]

- Han, H.; Guo, X.; Yu, H. in Variable Selection Using Mean Decrease Accuracy And Mean Decrease Gini Based on Random Forest, 2016 IEEE 7th International Conference on Software Engineering and Service Science, supported by the National Natural Science Foundation of China Grant Numbers 70971128 and 71450009, 2016; supported by the National Natural Science Foundation of China Grant Numbers 70971128 and 71450009, 2016.

- Mawonou, K.S.R.; Eddahech, A.; Dumur, D.; Scopus Preview Beauvois, D.; Godoy, E. State-of-health estimators coupled to a random forest approach for lithium-ion battery aging factor ranking(Article). J Power Sources 2020, 229154.

- Koc, K.; Budayan, C.; Ekmekcioglu, O.; Tokdemir, O.B. Predicting Cost Impacts of Nonconformances in Construction Projects Using Interpretable Machine Learning. J Constr Eng M 2024, 150. [CrossRef]

- Zhai, Z.; Liu, S.; Li, Z.; Ma, R.; Ge, X.; Feng, H.; Shi, Y.; Gu, C. The spatiotemporal distribution patterns and impact factors of bird species richness: A case study of urban built-up areas in Beijing, China. Ecol Indic 2024, 169. [CrossRef]

- Dipankar Mandal, A.C.B.T. A deep neural network and random forests driven computer vision framework for identification and prediction of metanil yellow adulteration in turmeric powder. Concurrency and Computation: Practice and Experience 2022, e6500.

- Hu Hui; Song Chuanzhou; Gao Yu; Wang Min; Zhao Xiaofeng; Wan Renwei. Research on aviation material consumption prediction based on random forest algorithm. Environmental Technology 2021, 39, 210-214.

- Kumar, G.V.; Avdhesh, G.; Dinesh, K.; Anjali, S. Prediction of COVID-19 Confirmed, Death, and Cured Cases in India Using Random Forest Model. Big Data Mining and Analytics 2018, 116-123.

- Gwetu, M.V.; Tapamo, J.; Viriri, S. Random Forests with a Steepend Gini-Index Split Function and Feature Coherence Injection. Machine Learning for Networking 2020, 255-272.

- Wu, C.; Su, X.; Xu, C.; Jian, G.; Li, J. Seafloor topography refinement from multisource data using genetic algorithm-backpropagation neural network. Geophys J Int 2024, 238, 1417-1428. [CrossRef]

- Qian, Z.; Xie, Y.; Xie, S. MAR-GSA: Mixed attraction and repulsion based gravitational search algorithm. Inform Sciences 2024, 662. [CrossRef]

- Zhou, X.; Zheng, W.; Li, Z.; Wu, P.; Sun, Y. Improving path planning efficiency for underwater gravity-aided navigation based on a new depth sorting fast search algorithm. DEFENCE TECHNOLOGY 2024, 32, 285-296. [CrossRef]

- Menze, B.H.; Kelm, B.M.; Masuch, R.; Himmelreich, U.; Bachert, P.; Petrich, W.; Hamprecht, F.A. A comparison of random forest and its Gini importance with standard chemometric methods for the feature selection and classification of spectral data. Bmc Bioinformatics 2009, 1.

- Yao Rui; Hui Meng; Li Jun; Bai Lin; Wu Qisheng. Research on partial discharge feature extraction and optimization based on random forest. Journal of North China Electric Power University (Natural Science Edition) 2021, 48, 63-72.

- Mitchell, M.W. Bias of the Random Forest Out-of-Bag(OOB) Error for Certain Input Parameters. Open Journal of Statistics 2011, 205-211.

- Chen, M.S.S.; Wang, Y.S.S.; Wu, B.S.S.; Huang, D.S.S. Dynamic Analyses of Contagion Risk and Module Evolution on the SSE A-Shares Market Based on Minimum Information Entropy. Entropy-Switz 2021, 434.

- Mariia V Guryleva, D.D.P.D. Investigation of the Role of PUFA Metabolism in Breast Cancer Using a Rank-Based Random Forest Algorithm. Cancers 2022, 4663.

- Yi, X.; Jue, W.; Huan, H. Does economic development bring more livability? Evidence from Jiangsu Province, China. J Clean Prod 2021, 126187.

- Wei Luyao; Lu Yuqi; Chen Yu. Spatial-temporal analysis of the coupling and coordination between the transformation of rural regional functions and economic development in counties of Jiangsu Province. World Geography Research, 1-14.

- Lyu, H.; Dong, Z.; Roobavannan, M.; Kandasamy, J.; Pande, S. Prospects of interventions to alleviate rural–urban migration in Jiangsu Province, China based on sensitivity and scenario analysis. Hydrological Sciences Journal 2020, 2175-2184.

- Liu, K.; Cao, Y.; Xu, E.; Chong, Z.; Chai, L.; Wang, Y.; Xu, Y.; Wang, Y.; Zhang, J.; Mueller, O., et al. Predicting the risk of malaria importation into Jiangsu Province, China: a modeling study. Globalization Health 2024, 20. [CrossRef]

- Luo, K.; Chen, C.; Liu, Y.; Liu, F.; Shen, Q. Study on the Comprehensive Assessment and its Application of Environmental Pollution Governance Effect of Low-carbon Tourism Emissions from Energy Consumption in Jiangsu Province. Rocz Ochr Sr 2024, 26, 465-478. [CrossRef]

- Chen, H.; Sun, Q.; Xuan, L.; Lin, Z.; Yang, Z.; Huang, X.; Li, Z.; Gao, W.; Ren, J.; Shi, J., et al. Ultrasonic technology for predicting beef thawing degree and endpoint. J Food Eng 2024, 383. [CrossRef]

- Nabil, N.; Najib, N.; Abdellah, J. Leveraging Artificial Neural Networks and LightGBM for Enhanced Intrusion Detection in Automotive Systems. Arab J Sci Eng 2024, 49, 12579-12587. [CrossRef]

| First Indicators | Secondary Indicators | Data Dimension | Reference |

| Rural Labor Economics Indicators | Rural employment | Number of rural employees (Nre) | [34] |

| Average monetary wage index of employees (Ieamw) | [35] | ||

| The ratio of urban and rural disposable income (Rurdi) | [36,37] | ||

| Rural labor migration | Number of rural labor emigration (Nrle) | [38,39] | |

| Number of non-agricultural transfers of rural labor (Nntrl) | [40] | ||

| Rural labor force structure | Burden ratio of the elderly population (Reb) | [41,42] | |

| Feminization rate (Rf) | [43,44] | ||

| Total power of rural machinery (Ptam) | [45] | ||

| The proportion of labor force in industry and service industry (Plfis) | [46] | ||

| Rural labor mode | The output value of labor-intensive industries (Vlio) | [47] | |

| Urbanization level (Ul) | [48] | ||

| The proportion of non-agricultural income in total income (Pniti) | [49] | ||

| Rural economic development | Consumption expenditure (Ce) | [50] | |

| Fiscal expenditure (Cf) | [51] | ||

| Regional GDP (GDP) | [52] |

| Sr.No | Model | Algorithm | Conclusion | Data | Year | Reference |

| 1. | PM | TR, EA | Digital inclusive finance can boost coastal rural entrepreneurial activity. | 10524 | 2022 | [53] |

| 2. | BM | MCMC | Investing in wind farms can raise local wages. | 32807 | 2024 | [54] |

| 3. | MRA | BOO | There is a correlation between financing willingness and knowledge mastery in inclusive finance. | 160 | 2019 | [55] |

| 4. | MNL, TR | EA | Digital inclusive finance has a positive effect on the off-farm transfer of rural laborers. | 19287 | 2023 | [56] |

| 5. | PLS-SEM | TAM | Digital services and operations have a positive effect on non-technical industries. | 418 | 2021 | [57] |

| 6. | WLS | DI | The impact of digitalization on employment is mediated by the level of routineness in each occupation. | 400 | 2020 | [58] |

| 7. | DID, C-D | TFP, MPL | Digitization leads to increased productivity in rural areas. | 6600 | 2024 | [59] |

| 8. | GMM | TOPSIS, EEM | Digital inclusive finance has a positive impact on the development of rural industries. | 31 Province | 2024 | [60] |

| 9. | CPM | RPM | Accurately targeting excluded groups in rural areas can help formulate policies to enhance the inclusiveness of the financial industry. | 940 | 2018 | [61] |

| 10. | PSM | EA | Internet access helps reduce poverty levels in rural areas. | 244911 | 2021 | [62] |

| 11. | FE | RF | Broadband internet provides digital dividends for low-income groups. | 1292010 | 2021 | [63] |

| 12. | GMM | BOO | Digital inclusive finance, using rural e-commerce as an intermediary effect, contributes to unleash the rural consumption potential. | 240 | 2022 | [64] |

| 13. | LM | GA | Rural smart e-commerce investment and financing models contribute to local development. | 1258 | 2021 | [65] |

| 14. | DID | ESE | Tax Increment Financing has a positive effect on the property tax base in rural areas. | 267 | 2021 | [66] |

| 15. | PVAR | EA | There is a lagging positive relationship between fiscal support for agriculture and digital inclusive finance. | 31 Province | 2023 | [67] |

| Indicator code/Unit | Count | Max | Min | Mean | Median | Std. dev. |

| /CNY per person | 424 | 25675.00 | 6362.00 | 14672.06 | 14596.00 | 4318.22 |

| /CNY per person | 424 | 3656687.00 | 48.90 | 909622.90 | 743152.50 | 591408.44 |

| GDP/CNY per person | 424 | 242576.00 | 337.03 | 98763.82 | 89937.00 | 51126.84 |

| 424 | 99.41 | 43.09 | 60.99 | 59.46 | 8.99 | |

| /10000 person unit | 424 | 82.32 | 0.51 | 34.26 | 35.72 | 14.43 |

| 424 | 23776.00 | 4212.00 | 11839.66 | 11098.50 | 4525.42 | |

| /% | 424 | 2.24 | 1.31 | 1.91 | 1.93 | 0.17 |

| /person unit | 424 | 29674.00 | 777.00 | 5584.79 | 4189.50 | 4252.63 |

| /10000 person unit | 424 | 53.75 | 0.47 | 24.61 | 23.86 | 10.56 |

| /% | 424 | 1.09 | 0.45 | 0.76 | 0.76 | 0.13 |

| /% | 424 | 54.90 | 0.42 | 3.06 | 0.48 | 11.12 |

| /% | 424 | 1.59 | 0.20 | 0.50 | 0.48 | 0.18 |

| /10000 CNY unit | 424 | 2321069.00 | 12521.00 | 916171.59 | 844549.50 | 448327.45 |

| /kW | 424 | 223.50 | 2.48 | 68.29 | 59.30 | 43.27 |

| /% | 424 | 0.93 | 0.38 | 0.74 | 0.75 | 0.09 |

| Index classification | Index definition | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Labor economic indicator system | Ce | 0.3244 | 0.5104 | 0.3739 | 0.1349 | 0.3236 | 0.4025 | 0.5328 |

| Cf | 0.0107 | 0.0494 | 0.0075 | 0.0320 | 0.0255 | 0.0433 | 0.0506 | |

| GDP | 0.3840 | 0.1691 | 0.2352 | 0.1247 | 0.2028 | 0.1529 | 0.0081 | |

| Ul | 0.0295 | 0.0724 | 0.1158 | 0.0490 | 0.0905 | 0.0360 | 0.0193 | |

| Nre | 0.0105 | 0.0057 | 0.0236 | 0.0287 | 0.0097 | 0.0119 | 0.0182 | |

| Ieamw | 0.0598 | 0.0416 | 0.0569 | 0.4490 | 0.2509 | 0.2079 | 0.0829 | |

| Rurdi | 0.0120 | 0.0062 | 0.0151 | 0.0129 | 0.0174 | 0.0190 | 0.0204 | |

| Nrle | 0.0046 | 0.0120 | 0.0084 | 0.0096 | 0.0115 | 0.0143 | 0.0061 | |

| Nntrl | 0.0102 | 0.0030 | 0.0174 | 0.0241 | 0.0044 | 0.0058 | 0.0137 | |

| Reb | 0.0038 | 0.0071 | 0.0316 | 0.0302 | 0.0060 | 0.0043 | 0.0056 | |

| Rf | 0.0083 | 0.0054 | 0.0085 | 0.0092 | 0.0051 | 0.0121 | 0.0077 | |

| Plfis | 0.1182 | 0.0480 | 0.0284 | 0.0260 | 0.0093 | 0.0159 | 0.0197 | |

| Vlio | 0.0047 | 0.0045 | 0.0260 | 0.0075 | 0.0102 | 0.0069 | 0.0057 | |

| Ptam | 0.0041 | 0.0528 | 0.0291 | 0.0538 | 0.0250 | 0.0594 | 0.2003 | |

| Pniti | 0.0153 | 0.0126 | 0.0228 | 0.0085 | 0.0082 | 0.0077 | 0.0090 |

| Index classification | Index definition | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Labor economic indicator system | Ce | 0.3379 | 0.5927 | 0.3083 | 0.3414 | 0.242 | 0.3594 | 0.6154 |

| Cf | 0.2793 | 0.1064 | 0.1745 | 0.062 | 0.1633 | 0.0874 | 0.0662 | |

| GDP | 0.0952 | 0.0603 | 0.1016 | 0.0591 | 0.1282 | 0.0701 | 0.0198 | |

| Ul | 0.0179 | 0.0207 | 0.0268 | 0.0505 | 0.1106 | 0.0495 | 0.0191 | |

| Nre | 0.0158 | 0.0203 | 0.0234 | 0.0284 | 0.0112 | 0.0316 | 0.018 | |

| Ieamw | 0.0089 | 0.0128 | 0.0208 | 0.0242 | 0.0103 | 0.0187 | 0.0179 | |

| Rurdi | 0.0077 | 0.0102 | 0.0202 | 0.021 | 0.0097 | 0.018 | 0.0095 | |

| Nrle | 0.0067 | 0.0078 | 0.0147 | 0.0204 | 0.0078 | 0.011 | 0.0084 | |

| Nntrl | 0.0047 | 0.0048 | 0.0124 | 0.0203 | 0.0063 | 0.0071 | 0.0055 | |

| Reb | 0.0044 | 0.0031 | 0.0103 | 0.0083 | 0.0048 | 0.0058 | 0.0044 | |

| Rf | 0.0032 | 0.0023 | 0.0092 | 0.007 | 0.0047 | 0.0052 | 0.0044 | |

| Plfis | 0.0028 | 0.0022 | 0.0092 | 0.0058 | 0.0039 | 0.0047 | 0.0044 | |

| Vlio | 0.002 | 0.0016 | 0.0079 | 0.0043 | 0.0031 | 0.0046 | 0.0036 | |

| Ptam | 0.0018 | 0.0014 | 0.0058 | 0.003 | 0.0027 | 0.0042 | 0.0032 | |

| Pniti | 0.0013 | 0.0011 | 0.0022 | 0.0019 | 0.0006 | 0.0015 | 0.0027 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).