Capital structure can be defined as the proportion of debt and equity a company employs in order to finance its assets. It is the mixture of debt and equity the management feels should be used to finance the assets of a company.

Solvency ratio is often used to calculate the capital structure of any organization. It measures the extent to which the assets of a company are being financed through debt. It is the ratio amongst total debt and total assets of a company, manifesting the proportion of company’s assets being financed by debt. The study uses the very ratio as a proxy to measure capital structure.

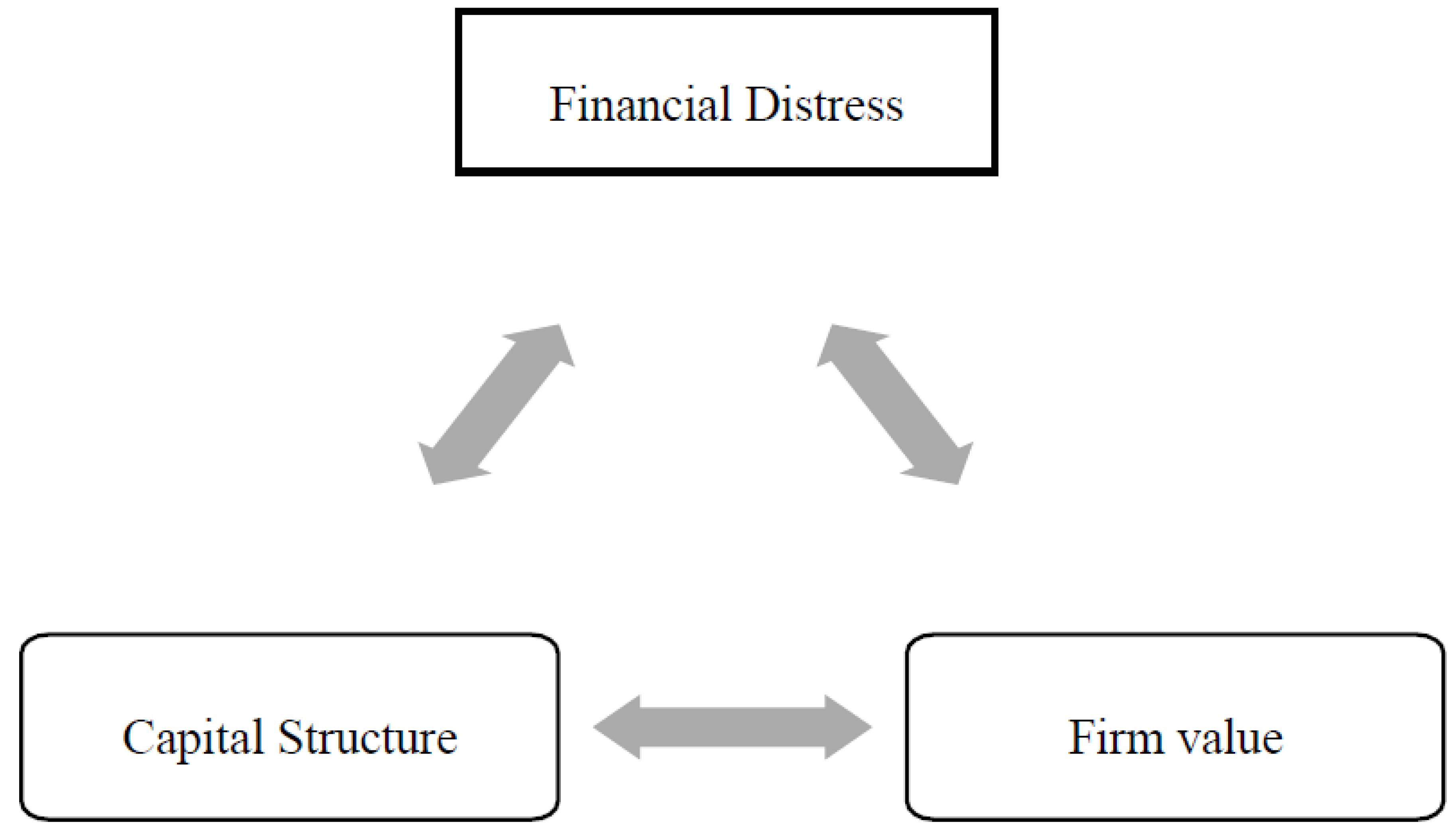

2.1.1. Capital Structure and Firm Value

Firm’s value is the extent to which the management has been able to effectively utilize firm’s resources as perceived by the investors. (

Putri & Rahyuda, 2020). Firm’s value is manifested by the firm’s stock price, with higher stock price indicating greater firm value and plentiful shareholders’ wealth. (

Sari & Sedana, 2020). According to the theory of firm, the over-arching objective of any company is to maximize the value of the company. Optimal firm value is accompanied by greater shareholder’s wealth.

Value of any firm is reflected in its stock prices, with higher prices manifesting alluring future prospects. Every company aspires to maximize the wealth of their shareholders by maximizing its share price.

This paper uses the proxy of price to book value (PBV) to measure the value of the firm. With higher price to book value indicating positive evaluation of a company’s performance as perceived by the investors, consequently, manifesting higher firm value. On the other hand, lower price to book value indicates unfavorable company’s performance as per the investor’s perception, and consequently, lower firm value.

Value of a firm is affected by a number of factors. Managerial decisions pertinent to financing capital structure potentially have a profound effect on the value of a firm.

Modigliani and Miller (1958), in their first proposition, presented a theory in which they asserted that, under perfect market conditions, the market value of any firm is independent of the proportion of debt or equity it possesses. It says that, whether the firm is financed completely by debt, or equity, or in any other proportion, will not affect the market value of the firm. M&M took two firms with varying capital structure, one with debt, other without debt, and proposed that the market value of the firms will not be affected by the financial decisions pertinent to the formation of capital structure, provided the perfect market conditions, and the fact that both have identical levels of cash flow.

In fact, according to M&M, it’s not the capital structure that affects the firm’s market value, but profitability and risk determine the market value of the firm.

It can be demonstrated through an equation:

VL = VU Where:

VL Shows the value of a firm with debt.

VU Shows the Value of a firm without debt.

According to them: Financial decisions pertinent to the capital structure of the firm would not affect its value, provided, all the other factors are controlled.

Modigliani & Miller (1963), in their subsequent proposition, incorporated the effects of tax in determining the value of the firm.

According to them, a firm which is financed through debt, carries a distinct advantage over the unlevered firm, this is due to the fact that, interest expense is tax deductible.

So, the more debt a firm has constituting its capital structure would mean that, it would be paying more interest on the debt, as the interest expense is tax deductible, more interest would mean lower tax, which in turn would increase the amount of money in the firm. This phenomenon is known as interest tax shield.

According to them: the market value of a firm having debt in their capital structure will be greater than the market value of a firm without debt, by the amount of tax shield it has, compared to the later firm.

It can be represented in an equation firm:

VL = VU + TC*D Where:

VU - Value of a firm without debt.

VL - Value of a firm with debt.

TC - Tax rate.

D - Amount of Debt.

Equation clearly shows that, the value of a levered firm is greater than the value of an unlevered firm, by the amount of interest tax-shield it holds.

Let’s look at the empirical evidence concerning the association amongst capital structure and firm value.

(

Hirdinis, 2019), in his study found a positive and substantial association amongst capital structure and firm value. (

Hasbi, 2015), tested the association amongst capital structure and firm value. He found that capital structure had a positive and substantial effect on firm value.

(

Sari & Sedana, 2020) in his study found a positive and substantial association amongst capital structure and firm value.

(

Osazuwa, 2016), reported a positive and substantial association amongst capital structure and firm value.

On the other hand, (

Saputra et al., 2019), found no substantial association amongst capital structure and firm value in their respective studies.

Looking at the empirical evidence from the past, it is conspicuous that the results are contrasting. So there is a further need to study this association.

So, based upon the theories and empirical evidence we propose that:

H1. Capital structure has a substantial effect on firm value.