1. Introduction

Corporate fraud represents a persistent challenge with profound implications for global markets, investor confidence, and societal trust in organizational governance. From financial statement manipulation to asset misappropriation fraud, the complexity and scope of fraudulent practices have increased dramatically in recent decades. To address this issue, scholars and practitioners have relied on theoretical models to better understand the conditions and motivations that lead to fraud. One of the most well-known models, the fraud triangle, was developed by Cressey (1953) and identifies three key factors: opportunity, pressure, and rationalization. This model has been instrumental in shaping both academic research and practical frameworks for fraud prevention.

Over the years, however, the fraud triangle has been critiqued for its simplicity and inability to fully capture the complexities of modern fraud schemes. In response, Wolfe and Hermanson (2004) introduced the fraud diamond, which added a fourth element: individual capability. This new dimension highlighted the importance of personal skills, knowledge, and traits in enabling perpetrators to successfully commit and conceal fraudulent activities. Marks (2012) further refined this understanding by proposing the fraud pentagon, which incorporates the dimension of aggressiveness, reflecting the predatory behaviour and assertive tendencies of some fraudsters.

More recently, scholars have begun to explore additional factors that may influence fraudulent behaviour, including cultural, organizational, and psychological drivers. As Dorminey et al. (2012) noted in their comprehensive analysis of fraud theories, the evolution of these frameworks reflects the need for more nuanced and holistic approaches to understanding fraud. Similarly, Kassem and Higson (2012) argued for the importance of integrating behavioural and environmental factors into fraud models to address the limitations of existing frameworks.

Building on these advancements, this article proposes the inclusion of a seventh dimension: the pleasure and thrill derived from risk-taking committing fraud. This dimension highlights the emotional and psychological gratification that individuals may derive from engaging in high-stakes situations or defying norms. Evidence from recent high-profile fraud cases, such as Société Générale, Enron, Theranos, Wirecard, and Parmalat, suggests that the thrill of risk-taking and the pursuit of challenge may play a significant role in motivating fraudulent actions. This perspective aligns with research on the behavioural and psychological aspects of fraud, such as the studies by Ramamoorti (2008), Heath (2008) and Lokan (2017), which emphasize the role of intrinsic motivations in unethical decision-making.

To explore this hypothesis, we adopted a qualitative research methodology, analysing five globally renowned and well-documented corporate fraud cases. These cases were selected based on specific criteria, including their scale, plurality of countries and sectors represented, media resonance, and the availability of public documentation. While we acknowledge the limitations of purposeful sampling—particularly the challenges of generalizing findings to broader contexts—we believe that this exploratory approach provides valuable insights into the underexplored dimension of risk-seeking behaviour in fraud.

This article introduces the fraud polygonal, an expanded framework that integrates the six identified elements of corporate frauds. By incorporating the element of risk-taking thrill, we aim to offer a more comprehensive understanding of corporate fraud, providing insights that are relevant for both academic research and practical applications in fraud prevention and detection. The implications of this expanded framework are particularly pertinent in an era marked by increasingly sophisticated fraud schemes and rapidly evolving organizational environments.

2. Literature Review

2.1. The Fraud Triangle: The Foundational Theory of Fraud

A fraud is a material misstatement of a fact that is proposed intentionally to deceive other parties and eventually will inflict a loss to these parties (Garner, 2004). According to the Association of Certified Fraud Examiners in its Report to the Nation 2024 (ACFE, 2024) fraud adverse organization’s revenues for around 5% of their value, of which the most common is asset misappropriation, followed by financial statement frauds and corruption. The fraud triangle, introduced by Donald Cressey (1953), is one of the earliest and most influential frameworks for understanding fraudulent behavior. This model identifies three core elements that must converge for fraud to occur: opportunity, pressure, and rationalization. Opportunity refers to the presence of circumstances, such as weaknesses in internal controls, that enable fraudulent activities. Pressure stems from personal or organizational motivations, such as financial difficulties or unrealistic performance expectations. Rationalization represents the cognitive process through which perpetrators justify their unethical behavior (Cressey, 1953; Singleton et al., 2006).

The opportunity element is often described as "objective" and situational. It arises primarily from systemic vulnerabilities, such as inadequate internal controls or ineffective oversight (Wolfe & Hermanson, 2004). By contrast, the other two elements—pressure and rationalization—are more subjective and tied to individual circumstances. Pressure often results from personal financial issues, professional competition, or organizational goals, while rationalization reflects the ethical justifications employed by fraudsters to reconcile their actions with their moral values (Kassem & Higson, 2012).

Although the literature identifies the simultaneous presence of the three elements of the fraud triangle in cases of fraud—opportunity, pressure, and rationalization or heat, fuel and oxygen in case of fire as the paragon proposed by Lister (2007)—opportunity is likely the most influential factor in pushing otherwise honest individuals to commit fraud (Lokanan, 2017). As reported by ACFE (2024), within organizations, approximately half of occupational fraud cases—those perpetrated by employees against their own organization—are primarily due to weaknesses in internal controls or their circumvention. Albrecht et al. (1984), in their work “Deterring Fraud: The Internal Auditor's Perspective”, redefine the concept of rationalization within the context of fraud prevention by emphasizing the role of ethical considerations in internal controls. They propose that personal integrity functions as a crucial counterbalance to the forces of opportunity and pressure, suggesting that a strong ethical foundation within both individuals and corporate culture can significantly reduce the likelihood of fraudulent behavior. By shifting the focus from merely rationalizing misconduct to the presence (or absence) of ethical resistance, their framework underscores integrity as a proactive deterrent against fraud.

According to the fraud triangle model, to effectively prevent fraud organizations must address the three dimensions of the fraud triangle—opportunity, pressure, and rationalization—through targeted strategies:

Reducing Opportunity: Opportunity is the most controllable element of the fraud triangle. Organizations can minimize it by implementing robust internal controls, such as segregation of duties, frequent audits, and continuous monitoring of high-risk activities. Technology, such as fraud detection software and real-time data analytics, can further enhance the ability to identify and mitigate potential fraud risks (Singleton et al., 2006). Strengthening whistleblowing systems and encouraging employees to report suspicious activities without fear of retaliation are also critical in reducing opportunities for fraud.

Alleviating Pressure: Organizations can address the pressure dimension by promoting a supportive work environment. This includes providing adequate resources, setting realistic performance targets, and fostering open communication between management and employees. Employee assistance programs (EAPs) can also play a vital role in helping staff manage personal and financial stress, thereby reducing the likelihood of fraud arising from desperate circumstances (Kassem & Higson, 2012).

Countering Rationalization: To prevent rationalization, organizations must cultivate an ethical culture where integrity is consistently prioritized. Leaders should act as role models by adhering to the highest ethical standards, as their behavior influences the entire workforce. Ethical training programs can help employees recognize and resist the cognitive biases that lead to rationalizing unethical behavior. Additionally, fostering a sense of collective accountability and regularly reinforcing the consequences of fraudulent actions can dissuade individuals from justifying unethical choices (Ramamoorti, 2008).

2.2. Expanding the Fraud Triangle: The Fraud Diamond

In recognition of the fraud triangle’s limitations, Wolfe and Hermanson (2004) introduced the fraud diamond. This model added a fourth dimension, capability, which emphasizes the perpetrator's skills, position, and intelligence in executing fraudulent schemes. According to Wolfe and Hermanson (2004), even if opportunity, pressure, and rationalization exist, fraud may not occur unless the perpetrator possesses the capability to exploit these conditions. Capability is highly specific to the individual and includes attributes such as understanding of complex systems, ability to conceal fraud, and manipulation skills.

The inclusion of capability highlights a critical shift in fraud theory from systemic factors to individual traits. For instance, studies have shown that fraudsters often exploit gaps in internal controls with sophisticated methods, such as falsifying documentation or bypassing auditing systems (Singleton et al., 2006; Kassem & Higson, 2012). This aligns with findings in forensic accounting literature, which emphasize the importance of detecting the skills and strategies fraudsters use to avoid detection (Ramamoorti, 2008).

Capability focuses on the perpetrator's personal traits and skills, highlighting that fraud often requires a unique combination of technical expertise, intelligence, and confidence to execute and conceal. These skills possessed by the fraudster can be observed in both serial (or predatory) fraudsters and occasional (or first-time) offenders, considering that the greatest damages are expected to be caused by the former category (Hermanson et al., 2017). Preventing fraud through the lens of the fraud diamond requires organizations to address all three dimensions of the fraud triangle plus the four dimensions of capability that underscores the importance of identifying employees with access, skills, and confidence to exploit opportunities. Organizations can mitigate risks associated with capability by conducting thorough pre-employment background checks, including assessments of technical expertise and integrity. Regular job rotations and cross-functional training can limit employees’ ability to exploit control weaknesses, as they reduce the likelihood of any one individual having excessive control or access to sensitive systems (Wolfe & Hermanson, 2004). Additionally, monitoring high-risk roles or departments where fraud is more likely to occur can help identify potential threats early.

2.3. The Fraud Pentagon: Adding Arrogance

Crowe (2011) further advanced fraud theory by proposing the fraud pentagon, which introduced arrogance as a fifth dimension. Arrogance reflects a sense of superiority and entitlement, often leading perpetrators to believe they are above rules and consequences. This factor is particularly evident in cases involving executives or individuals in positions of power, where overconfidence in their abilities or perceived immunity from scrutiny drives fraudulent behavior (Crowe, 2011).

Arrogance is not merely a personality trait but also an indicator of an organizational culture where ethical standards are undervalued or ignored. It often manifests in a dismissive attitude toward compliance measures, internal controls, and ethical codes, undermining the organization's efforts to promote transparency and accountability. This dimension underscores the critical role of fostering a strong ethical culture within organizations. The evaluation of the ethical profiles of employees—particularly those in leadership positions—becomes a vital preventive measure against fraud. Studies have shown that leaders with high ethical standards are less likely to abuse their authority, and their behavior often cascades through the organization, influencing overall ethical conduct (Kassem & Higson, 2012). Conversely, a lack of ethical awareness in leadership can create an environment where arrogance and entitlement flourish, emboldening individuals to bypass controls and manipulate systems to their advantage.

Moreover, the implementation and enforcement of a comprehensive code of ethics is essential in mitigating the risk of fraud arising from arrogance. Such codes serve as a foundational framework that guides employees' behaviour, aligning their actions with the organization’s core values and regulatory requirements. When supported by regular training and a robust whistleblowing mechanism, codes of ethics can help ensure that employees internalize ethical principles, reducing the likelihood of fraudulent actions driven by arrogance or other factors.

Arrogance often correlates with a lack of accountability and transparency within the organization. Research by Ramamoorti (2008) highlights how individuals who perceive themselves as untouchable or indispensable may rationalize unethical behavior, believing that their actions will not lead to consequences. This dynamic can be counteracted by fostering a culture where accountability is ingrained, and no individual is perceived as being "above the law." Regular ethical audits, coupled with evaluations of employee integrity and adherence to the code of ethics, can identify and address potential red flags before they escalate into larger issues.

The introduction of arrogance in the fraud pentagon emphasizes the psychological and cultural dimensions of fraud. Addressing this factor requires a proactive approach that includes ethical education, leadership assessments, and the consistent reinforcement of values through a well-articulated and actively enforced code of ethics. By prioritizing these measures, organizations can mitigate the risks posed by individuals who view themselves as exempt from the rules, thus fostering a more transparent and ethical corporate environment.

2.4. The Fraud Hexagon: A More Comprehensive Framework

The fraud hexagon represents the latest evolution in fraud theory, reshaping arrogance to ego and incorporating a sixth dimension: collusion (Vousinas, 2019). Vousinas reshaped the concept of arrogance in the S.C.O.R.E. model by emphasizing its role as a fundamental psychological driver of fraud, beyond mere overconfidence or entitlement. He argued that ego fuels a perpetrator's sense of superiority, mastery, and invulnerability, leading them to rationalize fraudulent behavior as a demonstration of their intelligence or power over systems. This expansion aligns with psychological theories on narcissism and white-collar crime, illustrating how ego-driven fraudsters not only seek financial gain but also personal gratification from deception and control (Vousinas, 2019). Indeed, the topic of the subjective dimension related to personality traits, specifically the fraudster's ego, had already been explored by Kranacher et al. (2010) through the analysis of the underlying motivations for fraud in the model known as MICE—Money, Ideology, Coercion, and Ego. Along the same lines, which identify a specific role of the fraudster's ego, were the studies by Duffield and Grabosky (2001), Allan (2003), and Geis (2011), and Pedneault et al. (2012), which highlight the sense of power over others, the knowledge that they are fooling the world, the willingness to succeed at all costs, self-absorbed, self-confident and often narcissistic, as common traits of fraud.

The second modification to the former fraud pentagon proposed by Vousinas regards collusion. Collusion highlights the role of coordinated efforts between multiple actors in committing fraud. Without some form of cooperation or passive acquiescence of others, even in minor ways, it is exceedingly difficult for an individual to successfully commit fraud. This includes not only explicit conspiracies between multiple actors but also more subtle, unintentional forms of collusion, such as when employees fail to question suspicious transactions or when individuals unknowingly facilitate fraud, as seen in phishing schemes (Vousinas, 2019). The presence of collusion significantly amplifies the scale and impact of fraud, making detection and prevention more challenging (ACFE, 2024). This expansion acknowledges the interplay between systemic vulnerabilities and behavioral complexities, further bridging the gap between objective conditions and subjective motivations.

Research by Sihombing and Panggulu (2022) emphasizes that these six dimensions better capture the complexity of fraud in modern organizations. Their analysis of financial statement fraud in the ASEAN IT industry demonstrated that elements such as collusion and ego significantly influence fraudulent behavior, underscoring the importance of a comprehensive approach.

2.5. Organizational vs. Subjective Elements in Fraud Models

A key theme across these frameworks that can be introduced is the distinction between organizational or subjective elements, depending on the organization itself or to the fraudster person. Organizational elements, such as opportunity, like weak internal controls, poor governance, or inadequate oversight are often out of fraudster control. For example, PwC (2016) found that weaknesses in whistleblowing systems and audit processes create opportunities for fraud, which are frequently exploited by perpetrators. Collusion is also related to the organization and thus considered part of the contextual variables for fraud, although it can, in some ways, be created or influenced by the fraudster.

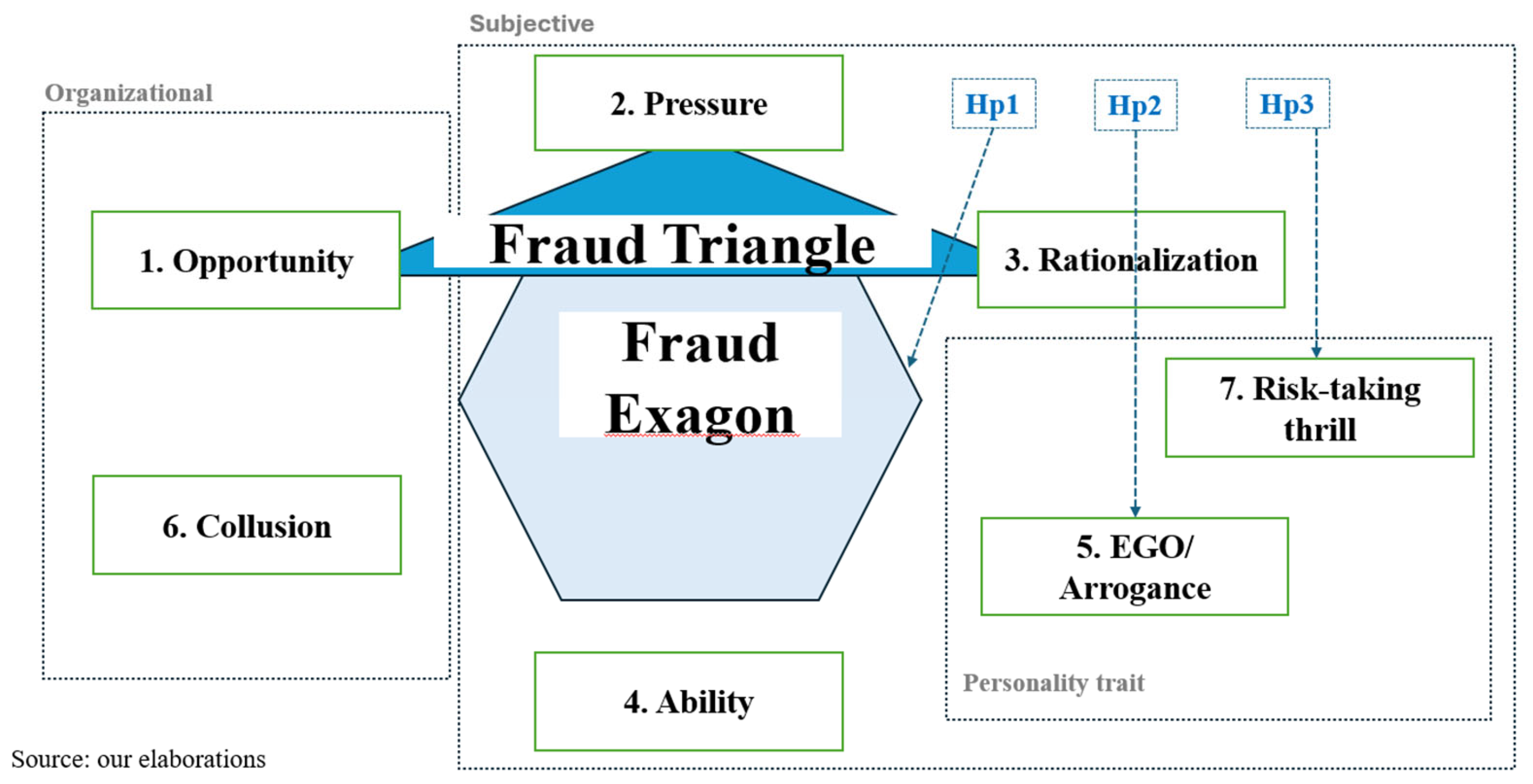

Figure 1 reports the evolution of fraud triangle and organizational and subjective elements.

In contrast, subjective elements—such as pressure, ability, and rationalization—are deeply rooted in individual psychology and circumstances. Pressure varies widely, encompassing personal financial stress, professional ambition, and even fear of failure (Kassem & Higson, 2012). Rationalization, meanwhile, is shaped by ethical values and moral reasoning, with some studies highlighting how cultural and organizational norms influence justifications for fraud (Sahla & Ardianto, 2023). Ability is strongly linked to the person or groups of people that perpetrate the fraud.

The evolution of fraud models beyond the original fraud triangle has significantly expanded the set of subjective factors associated with fraudulent behaviour. Early frameworks such as Cressey’s (1953) fraud triangle focused on elements like pressure, rationalization, and opportunity. Subsequent extensions, including the fraud diamond (Wolfe & Hermanson, 2004), the fraud pentagon (Crowe, 2011), incorporated additional personal traits such as capability and arrogance, reflecting the individual characteristics of perpetrators. These additions underscore the importance of understanding fraud not only as a product of systemic vulnerabilities but also as a reflection of the psychological and behavioural dimensions of the fraudster. Particularly, the inclusion of traits like arrogance has drawn attention to the role of personality in influencing fraudulent behaviour. Recent research in psychology, including experimental studies, has identified further individual traits, such as self-control, as critical in shaping criminal tendencies and fraudulent conduct (Vousinas, 2019). Self-control, as a measure of one’s ability to regulate impulses, has been extensively studied in criminology and is considered a pivotal factor in predicting deviant behaviour (Hirschi & Gottfredson, 1990). Individuals with low self-control are more likely to engage in risky or unethical behavior, as they prioritize immediate gratification over long-term consequences.

Specific studies, such as those by Ramamoorti (2008) and Sihombing & Panggulu (2022), have emphasized the importance of integrity and the pursuit of gratification as moderating factors in fraudulent behaviour. Integrity, defined as the alignment between one’s ethical values and actions, serves as a potential deterrent to fraud, while the desire for immediate rewards may exacerbate susceptibility to unethical actions. These dynamics suggest that individual personality traits operate in tandem with organizational elements, such as opportunity (and systemic vulnerabilities) and collusion, to influence the likelihood of fraud occurring.

The interaction between personality traits and fraud has important implications for organizational fraud prevention strategies (Rasheed et al. 2023). Enhancing internal controls alone may not suffice if individual behavioural tendencies, such as a lack of self-control or high levels of impulsivity, are not addressed. As Ramamoorti (2008) argues, a more integrated approach that combines behavioural analysis with systemic interventions is essential for effectively mitigating fraud risks.

The above considerations lead us to pay particular attention to the influence that personality traits can have on the potential for fraud. Recent research highlights the role of gratification, and the pleasure derived from committing fraud as additional motivational factors for financial misconduct (Ramamoorti, 2008; Murphy & Dacin, 2011). Studies in behavioural ethics and criminology suggest that fraud is not always purely instrumental but can also be driven by psychological gratification, including the thrill of deception, the sense of power over systems, and the satisfaction of outsmarting controls (Heath, 2008; Ramamoorti, 2008). These findings align with theories of white-collar crime, where some individuals exhibit intrinsic enjoyment in exploiting financial loopholes (Piquero et al., 2005; Blickle et al., 2006). Additionally, research on self-control and deviant behaviour suggests that individuals with high risk-taking tendencies and a strong desire for immediate gratification are more prone to engaging in fraudulent activities (Gottfredson & Hirschi, 1990; Strang, 2016).

Based on the above consideration we formulate the following three research hypothesis:

Hp1: All the six elements included in the fraud hexagon are simultaneously present in the most recent and important corporate frauds.

Hp2: The Personal traits included in the ego element of the fraud hexagon are present in the most recent and important corporate frauds.

Hp3: Thrill from risk-taking and from the challenge of committing fraud constitute a seventh element common to corporate fraud.

3. Research Methodology and Case Study Selection

Based on the findings from the previous literature review and considering the aims and research questions already outlined in the introduction of this article, we decided to adopt a qualitative research methodology based on the analysis of five recent case studies (occurring after the year 2000). These case studies focused on large companies (i.e., with sales revenues exceeding 1 billion euros) where significant occupational fraud (greater than 1 million euros) had been confirmed and had received substantial media attention, ensuring the availability of articles, interviews, reports, or other public documents.

We are aware of the limitations inherent in this research methodology, which relies on purposeful sampling, particularly regarding the difficulties in generalizing and extending the results and observations to different contexts, even with a sample that is appropriately diversified in terms of countries, sectors of activity, and fraud schemes considered. However, given the exploratory nature of this research and the topic under study, we deemed this approach acceptable as an initial step, reserving the possibility for further exploration using alternative methods in the future. It is important to note that, in the context of corporate fraud, it is particularly challenging to conduct interviews or obtain responses to questionnaires due to the confidentiality of the data provided (often disclosed only after market closures and with specific notifications to the competent authorities) and the natural reluctance of companies to admit weaknesses in their internal control systems, as the literature on the topic has already highlighted (ACFE, 2018).

With this premise, the five selected cases, which operate in different sectors and involve distinct fraud schemes, were: Société Générale, Enron, Wirecard, Parmalat, and Theranos.

3.1. The First Case Study: Société Générale and the Unauthorized Subscriptions

The first case study considered is that of Société Générale and the fraud perpetrated by Jerome Kerviel, one of its employees, in 2008. Société Générale, based on the size of its managed assets, was the second-largest bank in France, with assets under management amounting to €473 billion. The fraud occurred through the unauthorized and covert subscription of forward transactions on stocks and futures, totaling nearly €50 billion, resulting in an established loss of approximately €4.9 billion (Allegrini et al., 2003).

Based on Cressey’s pioneering work on the topic, the occurrence of corporate fraud is typically attributed to the simultaneous presence of three elements: opportunity, pressure, and rationalization. As discussed in the literature review, more recent research has added two additional factors: the fraudster's capability and arrogance (Wolfe & Hermanson, 2004; Marks, 2012). Let us now examine each of these elements in detail.

Regarding opportunity, Jerome Kerviel exploited numerous weaknesses in Société Générale’s internal control system, as revealed post facto by both PwC, the consulting firm commissioned by the Paris Tribunal, and the Commission Bancaire, the supervisory authority of the French banking system until 2010 (Di Gennaro, 2013). These weaknesses included insufficient supervision of traders’ activities and the inability of information systems to promptly flag anomalies (Wolfe & Hermanson, 2004).

In terms of pressure, Jerome Kerviel’s criminal behavior originated from his desire to distinguish himself from colleagues who came from more privileged social backgrounds and had attended more prestigious educational institutions. In contrast, immediate personal enrichment does not appear to have been his primary motivation (Jannone, 2016).

With respect to rationalization (Kassem & Higson, 2012), Jerome Kerviel consistently claimed that his actions were aimed at generating profits in the interest of Société Générale. He also asserted that his direct supervisors tacitly supported his activities as long as the results were favorable (Der Spiegel, 2010).

Concerning capability (Wolfe & Hermanson, 2004), Jerome Kerviel had prior experience in back-office operations, enabling him to manipulate information systems to conceal unauthorized exposures, falsify documentation, and generate fake email messages. Moreover, his interpersonal skills allowed him to be convincing when providing explanations and to secure the collaboration of colleagues when necessary (Tutino & Merlo, 2019).

As for arrogance (Marks, 2012), Jerome Kerviel exhibited an evidently excessive confidence in his ability to control situations and a sense of superiority over others and the rules. In official statements, he claimed to have been "sure of winning" and that "if he had won, nothing would have happened to him" (Di Gennaro, 2013). The very notion that he was acting in the bank’s interest reflects his conviction that he alone knew what the bank needed, regardless of the instructions received or even the law (Dorminey et al., 2012).

In relation to collusion (Vousinas, 2019), the sixth factor of the fraud hexagon, played a role in the Société Générale fraud. While Kerviel acted as an individual, the lack of intervention from supervisors, coupled with the tacit acceptance of his actions while results remained favorable, suggests a degree of implicit collusion within the organization. The failure of risk management and compliance teams to detect and address the fraud sooner indicates that systemic negligence or willful ignorance, where multiple parties overlook red flags due to financial incentives or institutional complacency (Sihombing & Panggulu, 2022), facilitated the perpetuation of fraudulent activities.

Additionally, in interviews he revealed that he spent days and days in front of his terminal from dawn to dusk, often without sleeping or eating, with the only interest in trading and interacting just with colleagues in the trading room (Der Spiegel, 2010), behaviors that are comparable to gambling addiction, when individuals are dominated by an overwhelming need to gamble.

Considering the foregoing analysis, it can be concluded that all six conditions outlined in the fraud hexagon were simultaneously present in the Société Générale fraud case in 2008. However, it can be observed that an additional personality trait of the fraudster can be found: the thrill and dependence from risk-taking in committing fraud, which will be further discussed in the dedicated section.

3.2. The Second Case Study: Enron and the Special Purposes Vehicles

The second case study analyzed is that of Enron Corporation, one of the most infamous corporate fraud cases in history, an American energy company that collapsed in 2001 due to widespread accounting fraud. Before its downfall, Enron was one of the largest energy traders in the world, with reported revenues exceeding $100 billion. However, behind its apparent success, the company engaged in systematic financial manipulation to inflate its earnings and conceal massive debt. The fraud led to the company's bankruptcy, wiping out $74 billion in shareholder value, causing the loss of thousands of jobs, and leading to the dissolution of Arthur Andersen, one of the world's largest auditing firms (McLean & Elkind, 2003; Healy & Palepu, 2003).

As analysed in fraud theory, fraudulent schemes often arise from a combination of opportunity, pressure, rationalization, capability, arrogance, and collusion—all six elements of the fraud hexagon were clearly present in the Enron scandal (Dorminey et al., 2012).

Regarding opportunity, Enron’s executives exploited weak regulatory oversight and loopholes in accounting rules to engage in fraudulent activities (Benston, 2003). The company's complex financial structure, which included off-balance-sheet special purpose entities (SPEs), allowed Enron to hide debt and inflate profits. The absence of effective internal controls, combined with Arthur Andersen’s failure to act as an independent auditor, provided the perfect conditions for fraud ((Healy & Palepu, 2003).

Considering Pressure, the company faced intense pressure to meet Wall Street’s expectations for continuous profit growth. Enron’s corporate culture was highly aggressive, rewarding short-term success over long-term stability (Sridharan et al., 2002). Executives were driven by stock price performance, as their personal wealth was tied to stock options. This pressure to deliver ever-increasing profits incentivized fraudulent reporting (McLean & Elkind, 2003).

Rationalization was present as executives, including CEO Jeffrey Skilling and CFO Andrew Fastow, justified their actions by arguing that they were using "creative accounting" rather than outright fraud. They believed they were protecting shareholder value and maintaining Enron’s market position. Many employees were also misled into thinking that financial manipulation was merely part of the company’s innovative strategy (Healy & Palepu, 2003).

The fraud at Enron required highly skilled financial engineering, therefore capability of the fraudster was fundamental. CFO Andrew Fastow was instrumental in designing the network of SPEs, which were used to hide debt and create the illusion of profitability (Benston, 2003). His deep understanding of accounting and financial instruments allowed him to manipulate financial statements without immediate detection. Furthermore, Skilling’s charismatic leadership and ability to manipulate stakeholders helped sustain the deception for years (Sridharan et al., 2002; Fraud Magazine, 2016).

Regarding arrogance, Enron’s top executives displayed extreme overconfidence in their ability to deceive regulators and the market. Jeffrey Skilling openly mocked analysts who questioned the company’s financials, while Ken Lay, the chairman, maintained that Enron was financially sound even as it was collapsing (McLean & Elkind, 2003). Their belief in their invincibility led them to continue fraudulent activities despite growing scrutiny.

Lastly, collusion too was present as unlike many fraud cases perpetrated by a single individual, Enron’s fraud was enabled by a network of insiders, including executives, board members, auditors (Arthur Andersen), and even some financial institutions (Healy & Palepu, 2003). Arthur Andersen not only failed to detect the fraud but also actively destroyed documents to cover up evidence (Benston, 2003). Major banks also facilitated Enron’s deceptive practices by funding its SPEs despite clear risks.

In addition, regarding the pleasure and thrill of taking risks and challenges through fraud, Andrew Fastow, in an interview, candidly stated: 'I think my ability to do structured financing, to finance things off-balance sheet and to find ways to manipulate financial statements — there's no nice way to say it. I was good at finding loopholes... I'm not proud of it now, but I was very proud of it at that time.'. Also in this case study, it is possible to observe the presence of an additional personality trait of the fraudster not included in the other six: the thrill in risk-taking when committing fraud.

3.3. The Third Case Study: Wirecard and the Non-Existing Liquidity

The third case study considered is that of Wirecard, a company in the electronic payments sector listed on the Frankfurt Stock Exchange. In 2020, Wirecard collapsed, destroying a market capitalization of over €13 billion and rendering an additional €1.6 billion in bank loans irrecoverable. The cause of the collapse was a fraud involving the accounting of non-existent cash reserves amounting to €1.9 billion. The responsibility for this fraud has been attributed to Markus Braun, CEO, and Jan Marsalek, COO. Both are currently facing criminal charges for accounting fraud, false corporate disclosures, embezzlement, and criminal conspiracy. Specifically, Jan Marsalek is also under investigation for additional charges related to the disclosure of sensitive national security information. Currently, Markus Braun is in custody, while Jan Marsalek remains a fugitive.

The case provides an opportunity to analyse how the five elements of fraud interact.

Regarding opportunity, Wirecard’s fraudulent management exploited the lack of transparency in certain Southeast Asian jurisdictions to generate fake business transactions through complicit third parties (Financial Times, 2020). Furthermore, they took advantage of an inadequate internal control system (KPMG, 2020) and negligent audits by external auditors (Financial Times, 2023). Finally, they leveraged Wirecard’s image as an innovative start-up to secure protection from regulatory authorities and even gain the support of certain political figures (Frankfurter Allgemeine, 2020).

In terms of pressure, both Markus Braun and Jan Marsalek pursued personal enrichment and accumulated significant wealth. However, for both individuals, the priority seemed to be building a fantastical narrative around their personas. Through Wirecard, Markus Braun aimed to embody the visionary high-tech entrepreneur (the “German Steve Jobs”), while Jan Marsalek lived out an adventure-film fantasy filled with femme fatales and dangerous alliances (Der Spiegel, 2024).

As for rationalization, both Markus Braun and Jan Marsalek deny any responsibility, leaving their justification for their misconduct unclear. However, Markus Braun strongly identified with Wirecard, and his desire to protect his “creation” could explain certain ethical compromises (Handelsblatt, 2023). Jan Marsalek, on the other hand, maintained long-standing relationships with dubious individuals, suggesting that, in his value system, these connections outweighed his obligations to employers, investors, and the law.

Concerning capability, both Markus Braun and Jan Marsalek were charismatic figures capable of earning the trust of their interlocutors. Markus Braun presented investors with futuristic visions within a framework of apparent technological and financial solidity, while Jan Marsalek promoted implausible projects that the organization nonetheless perceived as game changing (Handelsblatt, 2018).

In relation to aggressiveness, Markus Braun and Jan Marsalek did not hesitate to communicate unrealistic growth prospects, provided vague answers to questions on sensitive issues, and reacted aggressively when their actions were questioned. These behaviors demonstrated a lack of regard for shareholders, the press, and institutional counterparts.

Furthermore, collusion played a significant role in enabling the Wirecard fraud. The company’s executives were aided by a network of auditors, regulators, and financial institutions that either ignored or actively facilitated fraudulent activities (Götz, 2021). Ernst & Young (EY), Wirecard’s external auditor, failed to detect clear red flags over several years, while BaFin (Germany’s financial regulator) was accused of protecting Wirecard rather than investigating it properly (Köhler & Stehle, 2021). The fraudulent activities were further facilitated by banks and business partners who knowingly participated in suspicious transactions, allowing Wirecard to sustain its deception for years. The fraud hexagon model suggests that collusion between internal and external actors significantly amplifies the scale and impact of fraud (Vousinas, 2019).

As in the other cases, all six conditions outlined in the "fraud hexagon" are simultaneously present in the Wirecard scandal. We have the hedonistic sense of gratification from committing fraud and a strong sense of pleasure or thrill from risk-taking, to the point that in November 2020, Markus Braun had hired McKinsey & Co to help prepare his most audacious idea yet—a plan to take over Deutsche Bank, the crowning achievement for a company that, within a few years, had become one of the most valuable in the country, earning the label of 'Germany’s PayPal' (Financial Times, 2020).

3.4. The Fourth Case Study: Parmalat and the Non-Existing Liquidity

The fourth case study is the Parmalat scandal, revealed in 2003, that is one of the most significant corporate frauds in European history. Once considered a global leader in the dairy industry, Parmalat collapsed after it was discovered that the company had engaged in massive accounting fraud to conceal financial losses and fabricate fictitious liquidity. The fraud, which resulted in €14 billion in missing funds, led to one of the largest bankruptcies in Europe (Allegrini et al., 2003).

At the center of the fraud was Calisto Tanzi, Parmalat’s founder and CEO, alongside Fausto Tonna, the company’s CFO, who was instrumental in orchestrating fraudulent financial transactions. The company used a complex network of offshore subsidiaries, including the so-called "Buco Nero", a fictitious financial entity designed to absorb company losses and create the illusion of solvency (Di Gennaro, 2013).

Additionally, auditors failed to conduct proper verification procedures, which allowed fraud to persist for over a decade. One of the most striking failures was the acceptance of a fax as proof of liquidity, a document that falsely claimed that a Parmalat subsidiary in the Cayman Islands held €3.95 billion in cash reserves (Healy & Palepu, 2003). Parmalat fraud offers a clear opportunity to analyze the six elements of the fraud hexagon (Vousinas, 2019).

Regarding opportunity, Parmalat executives exploited weak regulatory oversight and inadequate auditing practices to manipulate financial statements. The creation of the "Buco Nero" served as an off-the-books entity to absorb financial losses while maintaining the appearance of profitability (Di Gennaro, 2013). Furthermore, external auditors overlooked glaring inconsistencies, such as the acceptance of the fraudulent fax as proof of liquidity, demonstrating serious weaknesses in financial oversight (Healy & Palepu, 2003).

In the two decades preceding the outbreak of the crisis the company faced significant financial pressure due to high debt levels and an aggressive expansion strategy. To maintain investor confidence and secure additional financing, Parmalat manipulated financial reports to reflect fictitious profits and liquidity (Murphy & Dacin, 2011). Tanzi and Tonna were under intense pressure to sustain Parmalat’s market position and avoid the repercussions of a financial collapse.

Like many corporate fraudsters, Tanzi and Tonna rationalized their actions, claiming they were acting in Parmalat’s best interest. Tanzi argued that temporary financial manipulation would allow the company to recover and eventually generate real profits (Kassem & Higson, 2012). This aligns with psychological research indicating that fraudsters often justify unethical actions as necessary for the survival of the company (Heath, 2008).

Regarding capability, fraud involved a sophisticated financial structure, requiring advanced accounting expertise to create falsified financial statements, offshore accounts, and forged documents. Fausto Tonna played a pivotal role in designing and executing these fraudulent schemes. His financial knowledge and ability to manipulate reporting procedures were essential in sustaining the deception (Wolfe & Hermanson, 2004).

Calisto Tanzi and Fausto Tonna displayed an extreme sense of invincibility, believing that their financial manipulations would never be discovered. Despite growing skepticism from analysts, they dismissed concerns and continued to deceive investors and regulators (Marks, 2012). This reflects findings in fraud research, where executives who perceive themselves as untouchable are more likely to engage in fraudulent activities (Dorminey et al., 2012).

Unlike cases of individual fraud, the Parmalat scandal involved an extensive network of collusions. Banks, auditors, and financial institutions played a role in facilitating or ignoring fraudulent activities. Notably, external auditors failed to perform basic verification checks, including blindly accepting a fax as proof of cash reserves, a fundamental oversight that enabled the fraud to continue (Sihombing & Panggulu, 2022). Additionally, financial institutions approved questionable transactions, further sustaining the deception (Vousinas, 2019).

The Parmalat case also exhibited a conscious pleasure for thrill in committing fraud, which is strongly tied to the earlier decision to cancel the sale of certain assets to the Kraft Group—partly due to alarming levels of debt—and instead pursue a stock market listing, with all the ensuing consequences in terms of required profitability, financial position, and periodic shareholder returns.

3.5. The Fifth Case Study: Theranos and the Non-Existing Testing Machine

The fifth case study is Theranos fraud, exposed in 2015, that is one of the most notorious cases of corporate fraud in the healthcare industry. Theranos, a Silicon Valley startup founded by Elizabeth Holmes in 2003, claimed to have revolutionized blood testing with its proprietary Edison device, which supposedly required only a few drops of blood to conduct a wide range of tests. However, investigations later revealed that Theranos' technology did not work, and the company had deceived investors, regulators, and patients by fabricating test results and using conventional laboratory equipment while falsely claiming they were using its own technology (Cohen et al., 2022; Carreyrou, 2018).

At its peak, Theranos was valued at $9 billion, with high-profile investors including Rupert Murdoch, the Walton family, and former U.S. Secretary of State Henry Kissinger. However, when the fraud was uncovered, the company collapsed, investors lost billions, and Holmes was charged with multiple counts of fraud. In 2022, Holmes was sentenced to 11 years in prison, while Ramesh "Sunny" Balwani, the company’s COO and Holmes' business partner, received nearly 13 years (U.S. Department of Justice, 2022). The Theranos case presents an ideal opportunity to analyze the six elements of the fraud hexagon (Vousinas, 2019).

Considering the opportunity element, Holmes and Balwani exploited weak regulatory oversight in the medical startup sector, where disruptive innovation is often prioritized over rigorous scientific validation. Theranos operated without proper peer-reviewed studies, evaded regulatory scrutiny, and misled investors by restricting access to independent verification of its technology (Carreyrou, 2018). Additionally, Walgreens and Safeway failed to conduct proper due diligence before partnering with Theranos, allowing fraud to continue (Healy & Palepu, 2003).

Theranos faced immense financial and market pressure to meet investors’ high expectations. Holmes, who styled herself as "the next Steve Jobs," was determined to live up to Silicon Valley’s culture of "fake it until you make it." She needed to demonstrate rapid technological breakthroughs and secure partnerships with major healthcare providers to keep the company afloat (McLean & Elkind, 2003). Research indicates that executives in high-pressure environments are more likely to engage in fraudulent activities to meet unrealistic targets (Murphy & Dacin, 2011).

Holmes justified her actions by claiming she was protecting the future of Theranos, believing that minor fabrications were necessary to achieve an eventual breakthrough. She argued that the company was on the brink of success and that temporary deception was a means to secure long-term benefits (Kassem & Higson, 2012). This aligns with research showing that fraudsters often convince themselves that short-term dishonesty serves a greater good (Heath, 2008).

Holmes and Balwani had the technical and strategic knowledge to mislead investors, regulators, and the media. Holmes’ charismatic leadership helped her secure deals with Walgreens, Safeway, and the U.S. Department of Defense, while Balwani controlled the internal operations, enforcing a strict culture of secrecy and intimidation (Carreyrou, 2018). The fraud diamond model suggests that a high degree of intelligence and confidence is necessary to execute large-scale fraud successfully (Wolfe & Hermanson, 2004).

Holmes displayed extreme arrogance, believing she was above scrutiny and that her vision justified bending the rules. She ignored warnings from employees, dismissed whistleblowers, and threatened lawsuits against journalists investigating Theranos (Marks, 2012). Her sense of invincibility and entitlement aligns with studies suggesting that fraudsters with high levels of arrogance feel immune to consequences (Dorminey et al., 2012).

Unlike lone-wolf fraudsters, the Theranos case involved collusion between executives, board members, and business partners. Holmes and Balwani worked together to manipulate test results, mislead investors, and pressure employees into silence. Furthermore, board members and investors failed to conduct proper due diligence, enabling the fraud to persist (Sihombing & Panggulu, 2022). Research suggests that collusion amplifies the impact of fraud, making detection more difficult and extending its duration (Vousinas, 2019).

The Theranos case study includes a specific trait of the personality of Holmes and Balwani who fundamentally derived gratification from the risk-taking thrill in committing fraud. They bet on being able to invent a technology that did not exist and continued to do so until the very end, likely knowing they would never be able to achieve it. “They chose to be dishonest. That choice was not only callous; it was criminal” (Cohen et al., 2022).

4. Discussion

The fraud hexagon model, which incorporates opportunity, pressure, rationalization, capability, ego/arrogance, and collusion (Vousinas, 2019), has significantly enhanced our understanding of corporate fraud. In all the cases considered in our analysis, this model has been fully validated, confirming our Hp1.

The element of ego, included by Vousinas in the fraud hexagon model, as a personality trait of the fraudster, is also confirmed, thus Hp2 is also validated.

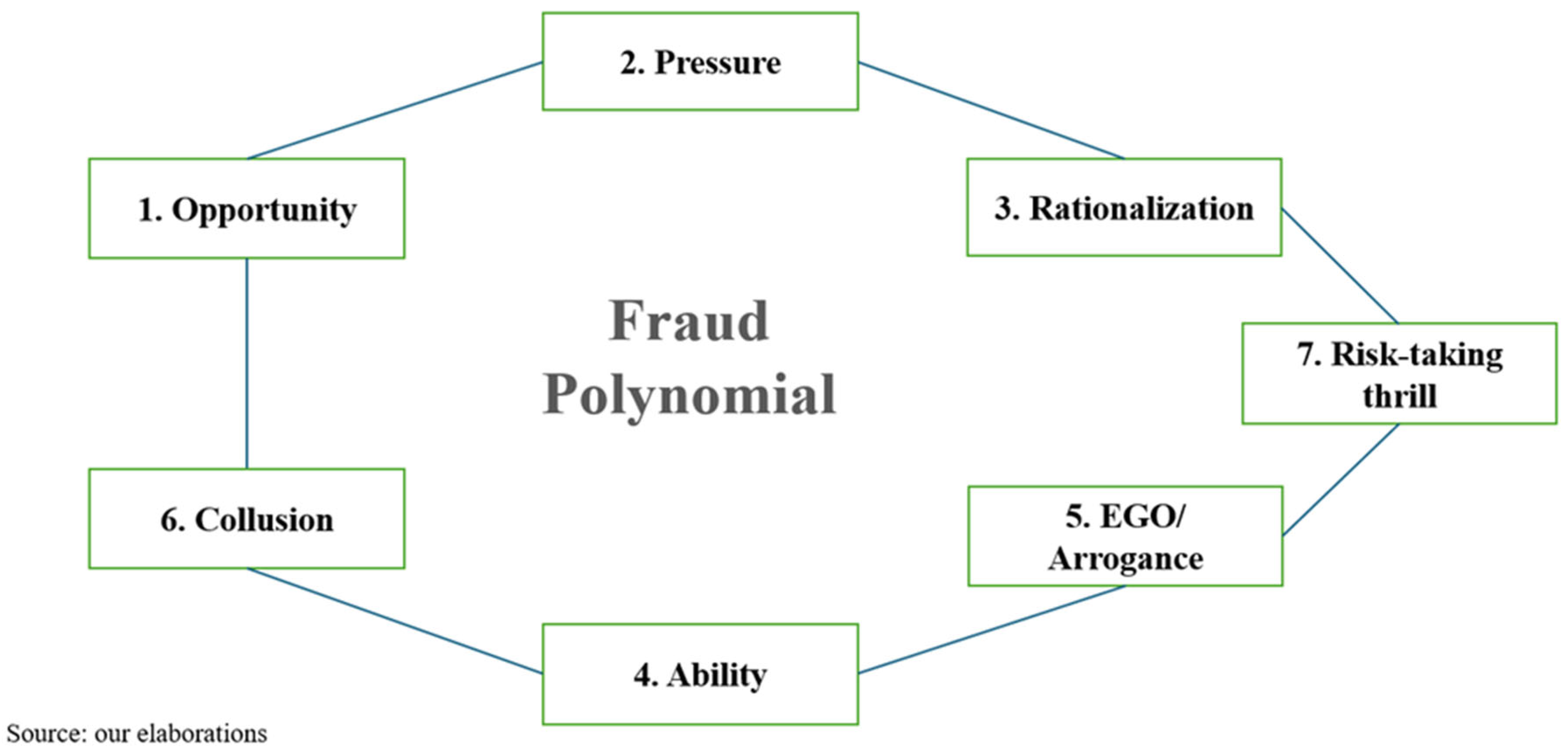

However, the qualitative analysis of major fraud cases examined in our study over the past 25 years—Société Générale, Enron, Wirecard, Parmalat, and Theranos—suggests the presence of an additional personality trait, beyond ego, that plays a crucial role in enabling fraud: the gratification derived from the thrill of risk-taking and the challenge involved in committing fraud.

This seventh element, which we propose as part of a "fraud polygon", represents an intrinsic motivation that extends beyond financial gain or organizational pressure. Certain fraudsters experience a form of hedonistic gratification from engaging in deceptive practices, outsmarting controls, and manipulating systems. This sense of thrill, often linked to risk-taking tendencies, has been documented in behavioural ethics and criminology studies (Heath, 2008; Ramamoorti, 2008; Blickle et al., 2006).

4.1. The Psychological Gratification from the Thrill of Risk-Taking in Fraud

Contrary to the early fraud models that focused on the organizational and subjective elements derived from fraudster personal position, our findings, in line with the fraud hexagon, highlight the importance of personal trait of the personality of the fraud perpetrators that derive emotional satisfaction from committing fraud. And in fact, the work of Vousinas (2019) had already moved in the direction of recognizing the importance of ego, expanding upon the arrogance previously introduced by Crowe (2011). This aligns with theories in psychology and white-collar crime research, which indicate that certain individuals view fraud not just as a means to an end but as a source of excitement and self-validation (Piquero et al., 2005; Strang, 2016).

Indeed, across the five fraud cases analyzed, the presence of this seventh factor is evident:

Société Générale: Jerome Kerviel exhibited a high-risk tolerance and continued his unauthorized trading despite accumulating enormous exposures. His own statements suggest that he believed he had mastered the financial markets, reinforcing the idea that his fraudulent activity provided a psychological rush (Di Gennaro, 2013).

Enron: The company’s aggressive corporate culture encouraged executives like Jeffrey Skilling and Andrew Fastow to engage in increasingly complex fraudulent schemes. Their arrogance and enjoyment of deception suggest that part of their motivation stemmed from the thrill of pushing boundaries and evading detection (Healy & Palepu, 2003).

Wirecard: Jan Marsalek displayed a fascination with espionage, deception, and illicit dealings. Reports indicate that he enjoyed orchestrating fraud as if it were a strategic game, making it likely that his fraud was not only financially motivated but also personally gratifying (Götz, 2021).

Parmalat: Calisto Tanzi and Fausto Tonna did not merely conceal losses but actively engaged in complex deception, creating fictitious assets and manipulating financial structures over decades. The elaborate nature of the fraud suggests that part of their motivation was the risk-taking thrill associated with the gamble of going public (Di Gennaro, 2013).

Theranos: Elizabeth Holmes and Ramesh "Sunny" Balwani cultivated an atmosphere of secrecy and control, not only to sustain deception but also to maintain an illusion of power and dominance over regulators, investors, and employees. Holmes displayed a fixation on maintaining the image of a revolutionary entrepreneur, even as the company’s fraud became increasingly untenable (Carreyrou, 2018).

4.2. Supporting Evidence from Behavioural Studies

Behavioral criminology and forensic psychology offer insights into why some individuals engage in fraud despite immense personal risk. Several studies identify risk-seeking behavior, low self-control, and the pursuit of excitement as predictors of unethical conduct (Gottfredson & Hirschi, 1990; Ramamoorti, 2008).

Self-Control Theory (Hirschi & Gottfredson, 1990) suggests that individuals with low self-regulation are more prone to impulsive and high-risk behavior, including financial fraud.

Thrill-Seeking and White-Collar Crime (Piquero et al., 2005) identifies a subset of fraudsters who are motivated not solely by financial rewards but by the psychological rush of deception and risk-taking.

Dark Triad Personality Traits (Blickle et al., 2006) highlight how individuals with narcissistic and psychopathic tendencies may engage in fraud for the excitement and sense of superiority it provides.

The Enjoyment of Outsmarting Controls (Strang, 2016) describes how some individuals derive satisfaction from exploiting loopholes in regulations and internal controls, further supporting the case for including this dimension in fraud models.

In essence, based on the theoretical studies on fraud presented and the analysis of the case studies considered, we believe that also Hp2 can be confirmed—that is, the context conducive to committing fraud is also one in which the fraudster experiences gratification, emotional satisfaction and thrill derived from risk-taking and the challenge of committing fraud. This constitutes a seventh, distinct element common to corporate fraud.

Figure 2 represents the consequent Fraud Polynomial.

5. Conclusions, Limitations, Implications and Future Research Directions

This study has revisited and expanded existing fraud models by proposing a seven-sided polygon of fraud, integrating a seventh dimension: the thrill from risk-taking and challenge. Through a qualitative analysis of five high-profile fraud cases—Société Générale, Enron, Wirecard, Parmalat, and Theranos—we have highlighted that beyond opportunity, pressure, rationalization, capability, ego/arrogance, and collusion, a psychological gratification derived from thrill committing fraud plays a fundamental role in perpetrators' motivations.

This additional factor, supported by criminology and behavioral ethics literature, emphasizes that some fraudsters are not solely driven by financial incentives or external pressures but by psychological gratification from the thrill of risk-taking, deception, and challenge (Gottfredson & Hirschi, 1990; Ramamoorti, 2008; Piquero et al., 2005; Strang, 2016). The presence of this personality trait across all five case studies suggests that fraud is, in some instances, a hedonistic act rather than merely an instrumental one.

Despite its contributions, this study has several limitations. First, we used a qualitative case study approach. While the selection of five major fraud cases provides robust insights, the generalizability of findings is limited. Further quantitative research is needed to establish statistical correlations between fraud and thrill-seeking behavior. Second, the study focused on well-documented corporate frauds that gained significant media attention, which may not fully represent smaller-scale frauds or those that remain undetected, thus with potential selection bias. Third, unlike experimental studies in behavioral criminology, this research relies on secondary sources and post-facto analyses, limiting the ability to measure fraudsters’ motivations with precision for a lack of direct behavioral data. Fourth, there is a potential overlap with existing factors as while the gratification of risk-taking is conceptually distinct, it may overlap with arrogance or rationalization in some cases. Future research should further delineate these two constructs.

This study advances fraud theory by extending the fraud hexagon into a seven-sided polygon model, which incorporates intrinsic motivation and psychological gratification as a key factor in fraud. It also aligns fraud studies with behavioral criminology and psychology, drawing parallels between white-collar crime and risk-seeking behaviors. In addition, we offer a new perspective for forensic accounting, fraud auditing, and risk management research, highlighting the need to assess psychological predispositions in fraud risk assessments.

It also has some practical implications for corporate governance and fraud prevention, because our findings suggest the necessity of psychological profiling in hiring processes, particularly for high-risk roles (e.g., finance, executive leadership); highlights the importance of continuous ethics training that emphasizes self-awareness, impulse control, and ethical decision-making; strengthens whistleblower protections and behavioral monitoring to detect not just financial anomalies but also behavioral red flags (e.g., high-risk tolerance, aggressive decision-making, excessive secrecy), and points out the need for more rigorous external audits, ensuring that auditors recognize fraud not only as a financial manipulation but also as a behavioral phenomenon.

To refine and validate the proposed model, future research should conduct large-scale surveys or meta-analyses to measure correlations between fraud and risk-taking personality traits and utilize behavioral simulations or psychological testing to assess whether thrill-seeking individuals are more prone to unethical decision-making. We also plan to expand our research including ad in depth cross-sector and cross-country analysis, to examine whether the pleasure of fraud is more prevalent in certain industries (e.g., finance, technology, healthcare) o countries than others, also investigating whether fraudsters develop risk-seeking tendencies over time or if these traits are present before engaging in fraudulent acts.

In sum, corporate fraud remains a dynamic and evolving challenge, and understanding the subjective dimensions of fraud is crucial for both prevention and detection. By acknowledging the role of thrill-seeking behavior in fraud, this study paves the way for a more comprehensive and psychologically informed approach to financial crime prevention.