Comparative Analysis of Tax Systems:

I. Individual Taxation

U.S. Individual Income Tax System: The U.S. Individual Income Tax system is comprehensive, featuring a progressive tax rate structure that includes all sources of income. This system is designed to address income inequality effectively, which is a key aspect of the advancement of social civilization. The U.S. tax brackets for individual income in 2024 range from 10% to 37%, providing a broad base for taxation with a progressive nature that ensures those with higher incomes contribute more significantly to the tax revenue. [

1]

China's Individual Income Tax System: China employs a classified income tax system with varying rates for different income streams. China's Individual Income Tax is structured with seven progressive tax brackets, ranging from 3% to 45%. This system is characterized by a segmented approach to taxation, with different rates applied to various types of income such as wages, business income, and investment returns. The personal allowance, known as the personal income tax exemption threshold, is set at 5000 RMB, which is lower than the U.S. standard deduction that varies based on filing status and income level. [

2]

Comparison and Analysis: The U.S. system's broader coverage and progressive nature more effectively address income inequality, a pivotal element in the advancement of social civilization. In contrast, China's classified system may result in a less equitable distribution of the tax burden across different income sources. The U.S. allows for various deductions that can reduce the taxable income, such as for dependents and education expenses, while China has fewer deductions, which can place a heavier burden on taxpayers.

II. Tax Structure for Individual Taxation

U.S. Tax Structure: The U.S. heavily relies on direct taxes, with individual income taxes and social security taxes constituting the primary sources, accounting for 72.6% of total taxes. This approach emphasizes personal responsibility and income redistribution, aligning with the country's focus on individual taxation and social welfare contributions. The U.S. tax system is characterized by a wide tax base and a progressive rate structure, which is effective in reducing income inequality and promoting social equity.

China's Tax Structure: China's tax structure is dominated by indirect taxes, such as VAT, which accounted for 36.8% of total tax revenue in 2020, reflecting a business-centric approach. This structure places a significant tax burden on businesses and consumers, rather than individual income earners directly. China's tax system is primarily focused on indirect taxes, which are less progressive and can have a regressive effect on lower-income individuals.

Comparison and Analysis: The reliance on direct taxes in the U.S. indicates a stronger focus on income redistribution and social welfare, while China's indirect tax dominance reflects a fiscal strategy that prioritizes revenue collection from business transactions over individual income. This difference has significant implications for economic behavior and policy effectiveness in both countries. The U.S. system's emphasis on direct taxes contributes to a more equitable distribution of the tax burden, while China's indirect tax focus may lead to a heavier burden on businesses and consumers. [

3]

III. Comparison of Corporate Tax Systems

-

A.

Tax Jurisdiction and Scope

The U.S. corporate tax system applies to both domestic and foreign companies with income sourced in the United States, following a global income principle. In contrast, China's corporate tax system adheres to a residence-based principle, taxing income derived within its borders.

-

B.

Tax Calculation Methods and Rate Comparison

The United States operates a progressive corporate tax system, with federal rates ranging from 10% to 37%, depending on the level of income. This is contrasted by China's more uniform approach, which applies a flat corporate tax rate of 25%. However, both systems offer incentives that can reduce these rates. In China, certain regions and industries receive preferential rates, which can range from 2.5% to 15%. High-tech enterprises and qualified technology-advanced service enterprises in China, for example, enjoy a reduced rate of 15%, while small and low-profit enterprises may be subject to as low as 2.5%. The U.S. federal corporate tax rate is 21%, but this is complemented by additional corporate taxes at the state level, with 44 states and the District of Columbia imposing their own corporate income taxes. When averaged across states, the combined U.S. corporate tax rate reaches 25.8%.[

4]

The U.S. system also allows for foreign tax credits to mitigate the impact of double taxation on multinational corporations, a provision that China does not equivalently offer. This can significantly affect the tax burden for companies operating internationally.

-

C.

Tax Filing and Payment

U.S. companies file annual tax returns with the IRS, while Chinese companies are subject to monthly or quarterly filings with the State Taxation Administration.

-

D.

Tax Incentives

Both countries offer tax incentives to encourage innovation and investment. The U.S. provides R&D tax credits and investment tax credits, while China offers preferential policies for high-tech companies and special economic zones.

-

E.

Necessity for Deepening Tax Reforms in China

The necessity for tax reform in China is underscored by the need to stimulate economic growth, encourage innovation, and align with global standards. The AI era presents an opportunity for China to rethink its tax policies to foster a conducive environment for technological advancement.

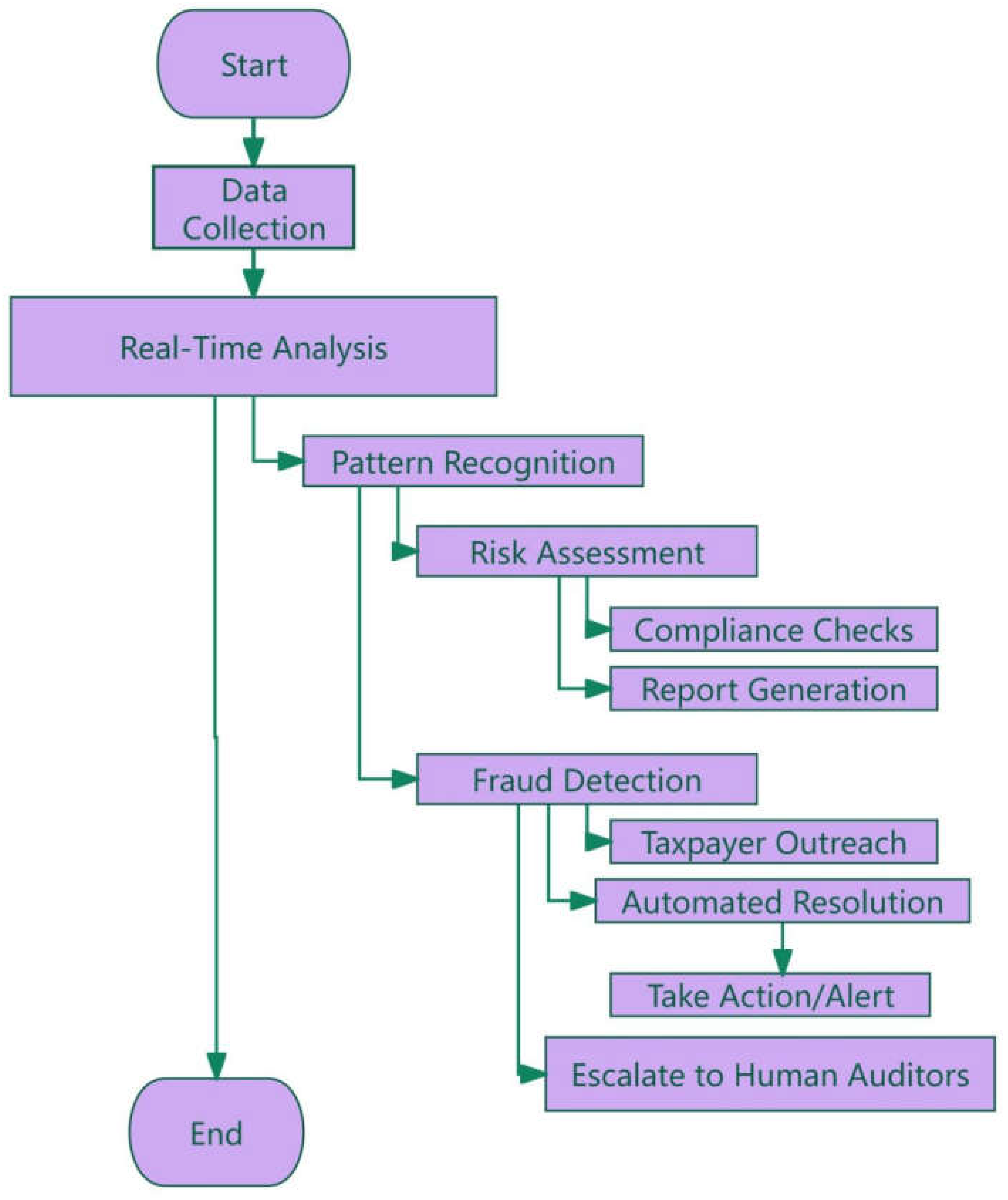

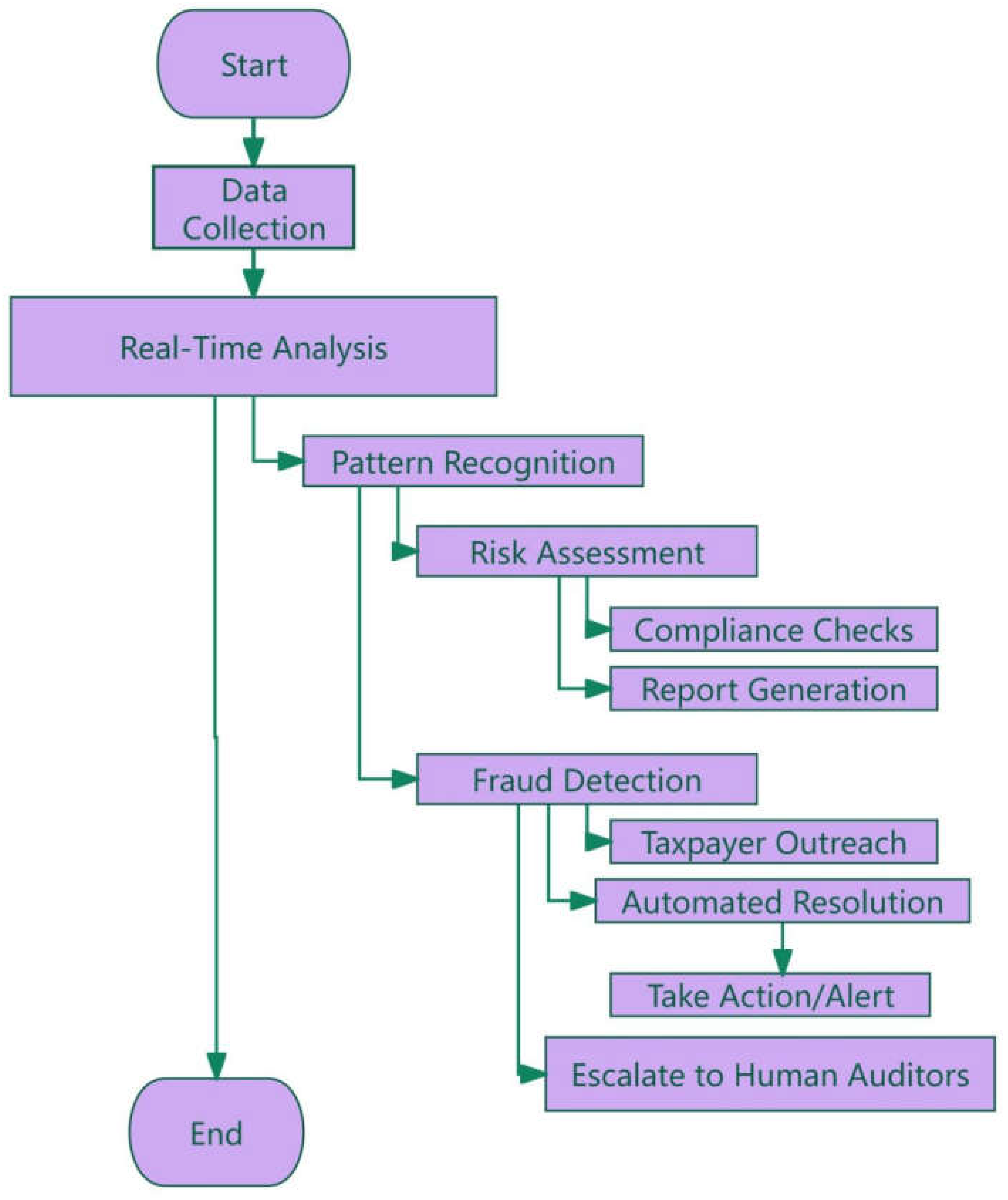

VII. AI’s role in tax administration

The integration of Artificial Intelligence (AI) in tax administration represents a significant advancement in the field, streamlining processes from data collection to fraud detection and compliance checks. Here is an integrated narrative and a comprehensive workflow algorithm that encapsulates the role of AI in tax administration:

A. Data Collection and Analysis: AI systems initiate the process by aggregating taxpayer data from digital platforms. This data serves as the foundation for subsequent analysis. AI technologies then automate the collection and analysis of this vast tax-related data, enhancing efficiency and accuracy in data processing.[

13]

B. Real-Time Analysis and Pattern Recognition:Utilizing machine learning algorithms, AI conducts real-time analysis to identify patterns and anomalies within the data. This analysis is instrumental in flagging potential issues early on.

C. Fraud Detection: AI systems cross-reference flagged data with third-party information to verify accuracy and detect fraudulent activities. This step is essential for upholding the integrity of the tax system.

D. Risk Assessment and Compliance Checks: Based on the identified patterns and anomalies, AI assesses tax risks and performs automated compliance checks to ensure adherence to tax laws and regulations.

E. Taxpayer Outreach: Upon identifying potential discrepancies, the AI system automatically notifies the affected individuals or businesses, informing them of issues that require attention.

F. Automated Resolution and Escalation: AI resolves minor issues automatically, ensuring a swift and efficient process. For complex cases that necessitate a more nuanced understanding, the system escalates the matter to human auditors for further investigation and resolution.[

14]

G. Report Generation: Throughout the process, AI generates tax and compliance reports, providing a clear record of the tax administration activities and outcomes.

H. Continuous Monitoring and Action/Alert: AI models continuously monitor data to detect potential fraud, and when necessary, take action or issue alerts to relevant parties.

The integrated AI-driven tax compliance workflow can be visualized as follows:

This flowchart provides a logical and comprehensive overview of the AI integration in tax administration, from the initial data collection to the final stages of report generation and continuous monitoring. By automating routine tasks and enhancing compliance checks, AI significantly improves the efficiency of tax management and strengthens the tax system's ability to detect and prevent fraud.

VIII. Envisioning the Future:

As we progress towards the era of Artificial General Intelligence (AGI), Artificial Super Intelligence (ASI), and Universal Basic Income (UBI), the taxation model may undergo a paradigm shift. The advent of AGI could lead to a significant increase in productivity, necessitating a reevaluation of current tax policies. ASI, with its potential to outperform human capabilities, may prompt a rethinking of how income and wealth are taxed. UBI, aimed at addressing income inequality, could introduce a new layer of taxation to fund its implementation, potentially altering the tax landscape dramatically.

AGI and Taxation: The development of AGI could significantly boost economic productivity, which in turn would require tax policies to adapt to the new economic realities. For instance, increased automation and intelligentization could lead to a shift in the types of jobs available, necessitating a reevaluation of how personal income is taxed and potentially leading to a greater focus on wealth taxes or consumption taxes. [

15]

ASI and Taxation: ASI has the potential to create vast economic disparities, as those who own and control ASI technologies could amass significant wealth. This would require tax policies to address wealth concentration and ensure that the benefits of ASI are more equitably distributed across society. The emergence of robotics and automation technologies positions them as prospective new tax bases, signifying a pivotal transition in how economic value is generated and captured within the tax system. [

16]

UBI and Taxation: UBI represents a fundamental change in how societies approach social welfare and income distribution. Implementing UBI would likely require new forms of taxation, such as increased taxes on technology profits, wealth, or even a percentage of GDP contributed by automated systems. This could help fund the basic income while also addressing issues of economic inequality.

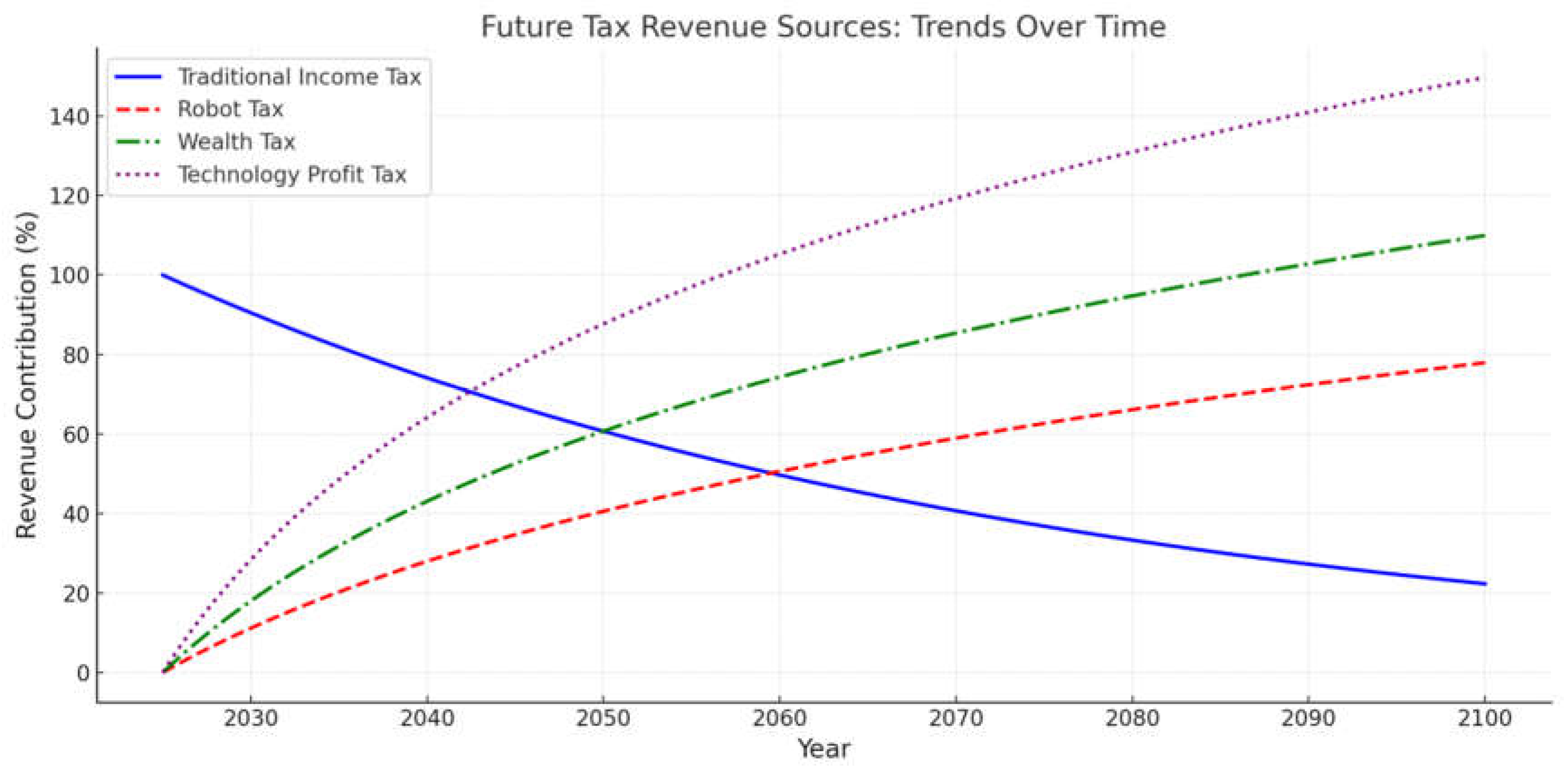

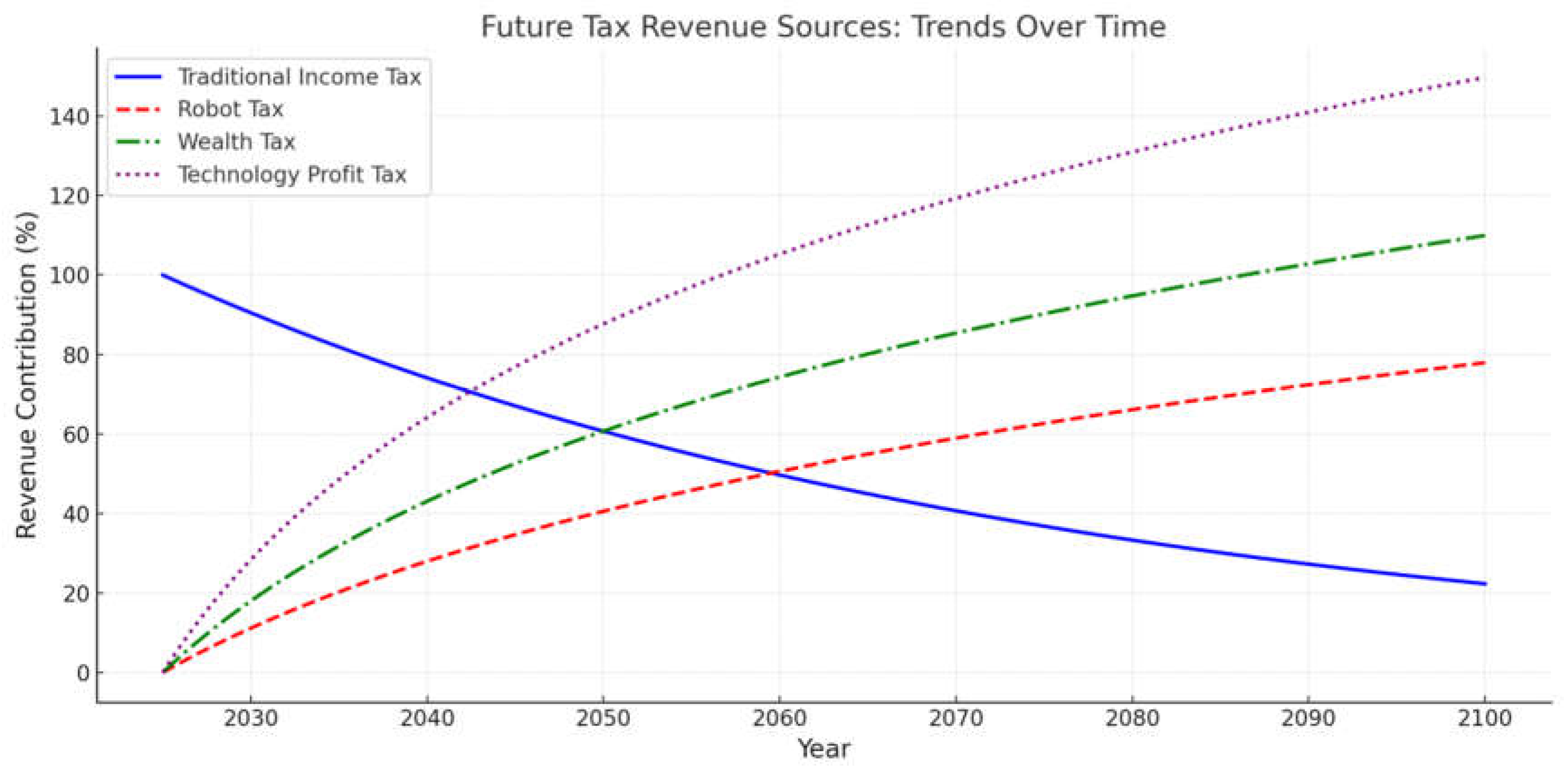

Visualizing the Future Tax Landscape:

The chart illustrates the evolving tax revenue landscape from 2025 to 2100, highlighting the transition from traditional income tax to novel sources such as robot taxes, wealth taxes, and technology profit taxes. Here's an analytical breakdown:

Traditional Income Tax (Blue Line): The declining trajectory indicates reduced reliance on conventional income tax revenue, likely due to automation diminishing human labor's economic contribution.

Robot Tax (Red Line): Gradual growth reflects the increasing significance of taxing automated labor as robotics and AI systems dominate industries.

Wealth Tax (Green Line): This exhibits a steeper increase, suggesting a growing emphasis on redistributive mechanisms to address inequality in wealth accumulation.

Technology Profit Tax (Purple Line): The most pronounced growth trend aligns with the explosive profitability of tech enterprises as AGI and ASI become central to the economy.

The convergence of these lines toward a balanced system implies a diversified tax strategy aimed at sustainably funding initiatives like UBI while avoiding overdependence on any single sector.

This envisioned future underscores the need for proactive tax policy reform to ensure that the benefits of advanced AI technologies are broadly shared, and that the tax system remains equitable and sustainable in the face of rapid technological change.

Conclusion: China's tax reform is pivotal for fostering social civilization and aligning with the digital era's demands. The proposed reforms, from transitioning to direct taxes to embracing digital economy taxation, are essential for equity, efficiency, and sustainability. As AI and automation reshape the global landscape, China's tax system must adapt to ensure fair distribution of wealth and remain a catalyst for economic and social advancement. By implementing these reforms, China can lead in creating a tax system that is future-proof, promoting both innovation and inclusivity in the AI-driven economy.

References

- "Historical Federal Individual Income Tax Rates & Brackets, 1862-2021", Tax Foundation, August 24, 2021.

- "Individual Income Tax Law of the People's Republic of China", on www.npc.gov.cn, December 20, 2024.

- Sino-U.S. Tax System and Tax Burden Comparison (2023)", Tencent News, November 29, 2023.

- “Comparing the Corporate Tax Systems in the United States and China” by Erica York, Alex Durante, Alex Muresianu on May 3,2022 on Tax Foundation (https://taxfoundation.org/research/all federal/us-china-competition-corporate-tax/).

- "Taxing Artificial Intelligence and Robots: Critical Assessment of Potential Policy Solutions and Recommendation for Alternative Approaches", IBFD, September 9, 2021.

- "Digital taxation, artificial intelligence and Tax Administration 3.0: improving tax compliance behavior - a systematic literature review using textometry (2016-2023)", published on Accounting Research Journal (ISSN: 1030-9616).

- OECD Economic Outlook, Interim Report September 2024.

- “Shifting the balance from direct to indirect taxes: bringing new challenges” on Tax policy and administration - Global perspectives June 2013 from PwC official website.

- “Tax Policy Reforms 2024” on OECD and Selected Partner Economies published on September 30, 2024.

- “International Tax Competitiveness Index 2024” by Alex Mengden, Tax Foundation, on October 21, 2024.

- “A comparative study on the environmental and economic effects of a resource tax and carbon tax in China: Analysis based on the computable general equilibrium model” on ScienceDirect 2021.

- “Social security reforms, capital accumulation, and welfare: A notional defined contribution system vs a modified PAYG system”Published on 24 February 2024 ,Volume 37, article number 27, (2024).

- “The Role of Artificial Intelligence In Tax Administration And Compliance: A New Era of Digital Taxation” published on May 7,2024 by Shalini Aggarwal. [CrossRef]

- “Tax transformation: Adopting AI to drive efficiencies” by Randy Carpenter (EY partner) & Daren Campell on July 22, 2024 on 2023 EY Tax and Finance Operations survey.

- PwC China's '2023 China Tax Policy Review and 2024 Outlook.

- “Artificial Super Intelligence(ASI) in Tax Administration: Role and Limitations” issued by Hong Zhigang & Chen Yiming from New Rights Journal, Volume 2, 2024 (A Collection of Studies on Emerging Rights in the Context of Artificial Intelligence).

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).