1. Introduction

The problems regarding information disclosure, where potential crowdfunding supporters and the public become more aware of important information required to make decisions, persist. A knowledge asymmetry between project creators and backers must be overcome despite privacy considerations. The criteria used for evaluating a crowdfunding campaign differ from person to person. Investors are more interested in the creativity of a project or idea, while others are more concerned with the profiles of the entrepreneurs (Wang, Chen, Zhu and Wang, 2020). The spread of Internet-based crowdfunding platforms throughout the world has played a significant role in the development and growing popularity of crowdfunding (Shneor, 2020). There are numerous sources of funding available for fundraising, such as banks, private foundations, government agencies, business angels (BAs) and venture capitalists (VCs) (Bruton, Khavul, Siegel and Wright, 2015). However, they are less accessible to aspiring entrepreneurs who do not yet have the collateral required to secure funding. Hence, crowdfunding is considered an alternative way for entrepreneurs to access financing.

Although entrepreneurship is frequently reported to promote economic growth, among the most significant barriers to entrepreneurship is access to financial resources (Duan, Hsieh, Wang, and Wang, 2020). The primary problem of information asymmetry persists in crowdfunding markets because these platforms provide limited information about anonymous fund seekers (entrepreneurs) (Li, Liu, Fan, Lim and Liu, 2022). An innovative way of obtaining financing for entrepreneurs, such as musicians, filmmakers, and artists, is through crowdfunding, which directly requests supporters or people in the public (Mamaro and Sibindi, 2023; Shneor and Munim, 2019). To address this challenge, this study investigates how successful crowdfunding of new businesses is influenced by the face trustworthiness of entrepreneurs.

As indicated, the guidelines used to evaluate a crowdfunding initiative vary from person to person. Whereas some investors are more invested in entrepreneurs' experiences and facial disclosure, others are more attracted to the originality of the project or the originality of the idea (Wang, Chen, Zhu and Wang, 2020). Creativity among entrepreneurs and SMEs attracts a more significant number of investors and backers. However, few studies have been conducted on the entrepreneurs’ profile (Mamaro and Sibindi, 2023; Duan et al., 2020). Traditional corporate financing solutions, such as professional venture capital and commercial business loans, can be accessed by only a few relatively more mature ventures. However, many people still choose to disclose their personal information on social media or online platforms. For example, many users post their facial images on crowdfunding platforms where financial transactions (e.g., borrowing and lending of loans) occur. However, information privacy has been a general concern among online users (Qi, Chen and Xu, 2022).

Crowdfunding thus provides another financing solution for a wide range of start-up businesses entering the venture market with limited product information or a short track record to attract commercial funding. In recent years, crowdfunding has grown exponentially and garnered attention from financial market practitioners and academic researchers. Statista (2019) states that reward-based crowdfunding reached $848 million in the United States and $4.795 billion globally in 2019.

The academic literature has examined the determinants of crowdfunding success almost exclusively based on the impact of facial disclosure on crowdfunding success (Koch and Sierring, 2019; Huang, Pickernell, Battisti and Nguyen, 2022). Despite several studies on the drivers of crowdfunding success, there has yet to be a universal agreement on the factors associated with crowdfunding success (Li, Yang, Zhao, Liao and Cao, 2022; Ma and Palacios, 2021). Prior studies have often focused on Kickstarter data from developed countries, which can yield different results when applied to unique African cultural, legal, social, political, and business environments. Therefore, the current study examines the role of transparency of entrepreneurs' face in the success of crowdfunding projects in Africa. Specifically, the two research questions are presented below : (1) What is the role of the disclosure of entrepreneurs' faces in crowdfunding success? (2) What are the factors that influence the success of crowdfunding?

Using econometric analysis to address the research gap, TheCrowDataCentre collected 859 data sets in all African crowdfunding categories from 2019 to 2020. In particular, the role of four different communication characteristics in the success of crowdfunding campaigns was investigated: (1) image, (2) video, (3) comments, and (4) face disclosure. The sample consisted of crowdfunding projects in African countries. The focus on Africa is derived from the importance crowdfunding has gained in this geographical area in recent years. The crowdfunding projects were featured on the international platforms Kickstarter, Indiegogo, and Fundraised, which are reward-based crowdfunding platforms that match the crowd with projects.

The study contributes to the literature in several ways. First, it contributes to the limited literature on the role of disclosure of entrepreneurs' faces in crowdfunding outcomes (e.g., Zribi, 2022; Liu, Chen and Fan, 2021; Teubner and Flath, 2019; Duan, Hsieh, Wang and Wang, 2020) by showing that entrepreneurs’ facial appearance may influence the evaluation of entrepreneurs’ trustworthiness by backers and consequently affect their crowdfunding success. Second, our study involved a cross-country of multiple crowdfunding platforms collected findings on facial trustworthiness in reward-based crowdfunding settings, thus expanding the applications of appearance-based trustworthiness judgments to the corporate finance setting. Furthermore, the study reports novel evidence that potential backers consider entrepreneurs’ facial disclosure credible and more trustworthy in a crowdfunding campaign than catoonized disclosure. Finally, the study expands the literature on managerial trust and corporate finance. Prior studies have found that trust increases the likelihood of crowdfunding success (Liu et al., 2021; Song, Berger, Yosipof and Barnes, 2019; Wehnert, Baccarella and Beckmann, 2019; Bukhari, Usman, Usman and Hussain, 2020). The study adds to this literature by underscoring the value of individual trust in crowdfunding, which acts as an innovative financing solution for a wide range of early-stage businesses. Information disclosure in the crowdfunding market needs to be improved by adding more transparent and reliable disclosure policies, thus providing critical practical guidelines for practitioners and regulators.

The remainder of the paper is organised as follows.

Section 2 reviews the related literature and the development of testable hypotheses.

Section 3 contains the construction of the sample, the measurement of facial trustworthiness, and our empirical methodology.

Section 4 and

Section 5 present the main empirical results, additional analyses, and robustness tests.

Section 6 concludes the article.

2. Literature Review and the Theoretical Framework

The credibility of entrepreneurs, as well as trust and project quality, increase the probability of success. Previous studies on this phenomenon originated in developed countries (Shneor and Torjesen, 2020; Shneor and Flten, 2015). Active communication on the crowdfunding platform between potential backers and entrepreneurs or fund seekers includes images, comments, and video clips (Shneor and Vik, 2020; Mamaro and Sibindi, 2023). If the project creator posts a facial disclosure, this behaviour signals the potential backer that the campaign is credible and trustworthy. On the other hand, dishonest behaviour on the part of project creators discourages potential supporters from contributing to the crowdfunding campaign (Strohmaier, Zeng, and Hafeez, 2019; Chaney, 2019). Given the knowledge asymmetry, investors assess a project primarily on information provided by previous investors and their contributions. The duration of the crowdfunding campaign (usually ranging between 30 and 90 days) plays a role and is also essential to potential backers and investors (Salahaldin, Angerer, Kraus and Trabelsi, 2019). Previous studies on crowdfunding found a negative relationship between duration and crowdfunding success (Mamaro and Sibindi, 2023; Clauss, Breitenecker, Kraus, Brem and Ritchter, 2018). An excessively short funding period might be regarded as arrogance. If the period is long, it could indicate that the creator needs to be more confident in his idea. In contrast, Deng, Ye, Xu, Sun, and Jiang (2022) have found a positive association between duration and crowdfunding success.

2.1. Information Asymmetry in Crowdfunding

All parties involved are restricted due to a shortage of experienced investors, the asymmetry of information, the uncertainty regarding financing, the high opportunity costs, and the inadequate success rate of crowdfunding campaigns (Miglo and Miglo 2019). Thus, entrepreneurs must validate their projects' economic viability and potential, while the general public must determine which ideas have the most potential to attract funding. According to the signalling theory, the better-informed party, the business owners, can reduce information asymmetry in crowdfunding by sending signals to the less-informed side, the audience (Spence, 1973).

2.2. Signal Theory

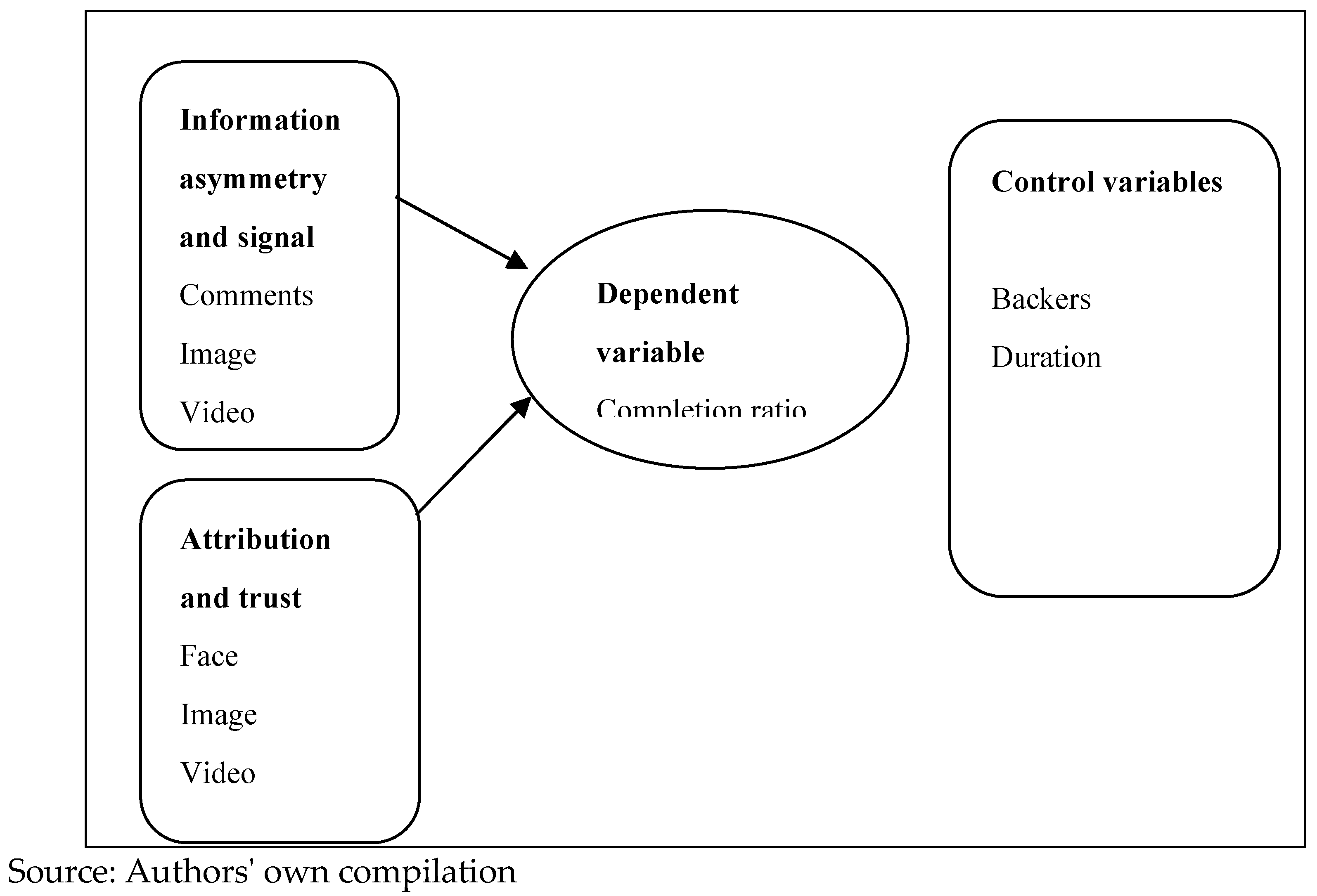

The signal theory originated by Spence (1973, 2002) was greatly accepted in crowdfunding research (Song, Shi, Shan and Zhang, 2021; Davies and Giovannetti, 2018). Given in the signalling theory is a signal environment in which a signaler sends a signal to a recipient, who interprets it and then transmits it back to the signaller (Connelly, Certo and Ireland, 2011). In crowdfunding campaigns, the public disclosure of an entrepreneur's image serves as a signal. A comprehensive entrepreneurial persona gives a good signal that reduces uncertainty and increases backers' confidence. Effective signals may positively impact backers' perspectives and allow crowdfunding projects to succeed. These signals include interactive elements, project updates, and personal fairy tales. The theory has been extensively used in entrepreneurial finance research to understand how entrepreneurs might use different signals to establish legitimacy for their entrepreneurial campaigns (Shafi and Colombo, 2020; Mochkabadi and Volkmann, 2020). Figure 2 below shows a theoretical framework.

Figure 1.

Theoretical framework.

Figure 1.

Theoretical framework.

2.3. Attribution Theory

Attribution theory was developed by Heider (1958) in the first decade of the twentieth century and was advanced by Kelley and Thibaut (1960). The study of attribution theory examines how people interpret and explain their own and other people's actions. Studies on the attribution theory of crowdfunding success have identified several important factors. Studies on the attribution theory of crowdfunding success have identified several important factors. Backers' attribution may be influenced by an entrepreneur's disclosure of their image in crowdfunding campaigns. An open and approachable image for the entrepreneur can improve opinions of dedication and trustworthiness, encouraging backers to make contributions.

1.4. Trust Theory

The change that occurs from institutional or centralised trust (belief in well-known institutions or brands) to decentralised trust is highlighted by Botsman's trust theory (Botsman, 2017). This translates to people expressing their trust in each other in the crowdfunding environment, frequently made possible by the platform's relationships with others, reputation systems, and reviews (Ferreira, Papaoikonomou and Terceno, 2022). Despite individual exchanges, social ties also play a role in establishing trust. To leverage social trust, crowdfunding platforms frequently include social elements that allow backers to know if friends or relations have contributed to confidence in a crowdfunding campaign (Kim, Shaw, Zhang, and Gerber, 2017). Therefore, it provides an analytical structure for understanding the dynamics of trust in online environments, such as platforms for crowdfunding. It emphasises the importance of decentralised trust, technology's role as a confidence enabler, reputation management, openness, social trust, and effective communication to the success of crowdfunding (Christie, 2020).

2.3. Research Hypotheses

Presenting the image of the fundraisers on the crowdfunding campaign page signals the trustworthiness of some backers, while other backers are more preoccupied with the creative idea (Qi et al., 2022). This study aims to investigate whether the success of crowdfunding campaigns could be impacted by trustworthiness based on the appearance of the entrepreneurs' faces, given the importance that society attaches to trustworthiness (Hsieh, Kim, Wang, and Wang, 2020). Studies have also shown that while there is always a demand for good ideas, there need to be more sufficiently competent entrepreneurs to make those ideas a reality (Shin and Kim, 2021). Interestingly, Shin and Kim (2021) found that face disclosure decreases the likelihood of crowdfunding success. However, others reason that disclosing entrepreneurs' faces signals a credible and reliable project, increasing the probability of success (Schwienbacher, 2018). Therefore, it is essential to portray a positive signal on the crowdfunding platform to increase the likelihood of success. Cultural factors influence the relationship between entrepreneurs' face disclosure and crowdfunding success in different regions or countries, such as collectivism versus individualism.

Lacking an effective team, entrepreneurial financial success remains unreliable even with great ideas. Therefore, the entrepreneur's profile is essential when choosing crowdfunding investments (Tang, Lu, Huang, and Liu, 2021). However, the implications of focussing on the profile or creativity of an entrepreneur have yet to be thoroughly investigated in the current literature. Previous studies (e.g., Teubner and Flath, 2019; Hsieh et al., 2020) have documented the importance of face trustworthiness in various business situations and have shown that people are more likely to trust someone who appears more trustworthy when making business decisions. Therefore, the hypothesis is proposed that the facial disclosure of entrepreneurs in the crowdfunding project increases the probability of success.

Hypothesis 1: Entrepreneurs who disclose their faces on crowdfunding platforms increase the likelihood of crowdfunding success.

Existing studies have found evidence that dynamic visual display and presentation of a video or information are more effective than static visual display (Koch and Siering, 2019; Jung, Lee and Hwang, 2022). Several important conclusions have been drawn from studies on the influence of photos on crowdfunding success. According to Ma (2023), the 'event' group has a detrimental effect on the project's success, although specific visual ideas, such as 'workspace', have a positive impact. Buskila and Parez (2022) found that photos showing victims participating in self-help activities significantly impact raising funds than projects with no images. Blanchard, Noseworthy, Pancer, and Poole (2022), in turn, found that the presence of image qualities substantially impacts the likelihood of crowdfunding success and that success is highly correlated with the number of photographs and videos. Finally, Hou Wu, Chen, and Zhou (2022) emphasise how particular picture qualities affect these feelings and, in turn, pledge intention and how image emotions drive crowdfunding success. These studies show the importance of image attributes and content for the crowdfunding campaign's success. The presentation of images in the project description can have a powerful, persuasive effect on backers and increase the likelihood of crowdfunding success. Therefore, the proposed hypothesis.

Hypothesis 2: Presentation of the image on the crowdfunding page increases the likelihood of crowdfunding success.

The number of comments posted by all project participants serves as another form of communication of a crowdfunding campaign. It has been found that fundraising success and the number of comments received are significantly correlated (Wang, Li, Liang, Ye, and Ge, 2018). Research conducted by Wang et al. (2018) and Lai, Lo, and Hwang (2017) revealed a positive correlation between fundraising performance and the quantity, mood, and length of comments, as well as the speed and duration of replies. To increase the accuracy of success prediction, Lai et al. (2017) highlighted the importance of including dynamic features in comments and updates. Jiang, Han, Xu, and Liu (2020) also documented that project descriptions and the tone of project comments have an impact on the success of crowdfunding. Clauss, Breitenecker, Kraus, Brem and Richter (2018) emphasised how social engagement, including comments, helps to raise the possibility that a crowdfunding project will succeed.

All of the above findings indicate the critical role that comments play in the success of crowdfunding campaigns. Potential investors can observe the discussions and attitudes of other investors about the project and gain a better understanding of both the advantages and disadvantages of the project, which reduces the perception of investment uncertainty and encourages the public to make investment decisions.

Hypothesis 3: The reaction to/comments on the crowdfunding platform increases the likelihood of crowdfunding success.

The degree to which entrepreneurs have invested effort on the campaign page, as demonstrated by using texts, photos, and videos, indicates project preparedness (Calic and Mosakowski, 2016). The video presentation on the crowdfunding campaign page has been found to significantly impact the crowdfunding campaign's success. Cha (2017) has found that the success of video game crowdfunding campaigns is affected by factors such as human capital, location, preference of the media and level of exposure to the media. Ma and Palacios (2022) also confirm that fundraising success positively correlates with visual material. Funding levels in blockchain-based crowdfunding campaigns are increased by releasing video pitches, particularly those with information content and buzz phrases (Kolbe, Mansouri and Momtaz, 2021). Furthermore, viewers of the various project categories see videos differently, which affects how successful crowdfunding campaigns are (Dey, Duff, Karahalios and Fu 2017). Thus, the following hypothesis is put forward.

Hypothesis 4: Presentation of the video increases the probability of success in crowdfunding.

The fundraising duration refers to the time interval from the launching of the campaign to its end. Previous research indicates that a successful crowdfunding campaign should not last 40 days. It has been shown that the duration of a crowdfunding campaign has a negative correlation with its effectiveness; the longer a campaign lasts, the less likely it is to be successful (Mamaro and Sibindi, 2023). The duration's influence on crowdfunding's success is a complicated and diversified topic. Salahaldin, Angerer, Kraus, and Trabelsi (2019) and Chen, Zhang, Yan, and Jin (2020) all stress the significance of project duration. Furthermore, Cordova, Dolci, and Gianfrate (2015) show that project shorter duration enhances the probability of success. In turn, Devaraj and Patel (2016) note that a shorter duration increases the likelihood of meeting the financial goal. These studies suggest that a crowdfunding project’s success can be significantly impacted by a carefully considered and executed description length. Therefore, the following hypothesis is proposed.

Hypothesis 5: The longer the duration of a crowdfunding campaign, the less likelihood of crowdfunding success.

According to research, early supporters of crowdfunding projects are critical to the project's success, and their proximity to peers (socially and geographically) affects the result (Ma, 2023). Success is also significantly impacted by the communication that takes place between backers and artists, especially when it involves comments and responses (Wang et al., 2018). However, the presence of associations among supporters may also have an adverse impact, possibly resulting in reduced funding (Herd, Mallapragada and Narayan 2022). Still, serial creators might discover that it is easier to secure finance if they build up their internal social capital, especially if they have a history of successful projects (Skirnevskiy, Bendig, and Brettel, 2017). The more backers, the better the performance of crowdfunding. Thus, we hypothesise:

Hypothesis 6: The larger the number of backers in the crowdfunding campaign, the greater the likelihood of success in crowdfunding.

These hypotheses provide a starting point for investigating the role of entrepreneurs' face disclosure on crowdfunding success. Further research and empirical tests are needed to validate these hypotheses and explore additional factors that may influence the relationship. The central hypothesis is that an entrepreneur's facial disclosure significantly influences their crowdfunding success. This hypothesis suggests that the level of facial disclosure, including the facial expressions, emotions, and non-verbal cues an entrepreneur displays in their crowdfunding campaign, will impact the success of their fundraising efforts.

To test this hypothesis, the researchers conducted a study to analyse a sample of crowdfunding campaigns on various platforms. Data was collected on the facial disclosures of entrepreneurs in their campaign videos or photos, as well as the corresponding funding outcomes. By examining the relationship between facial disclosure and crowdfunding success, researchers could determine if there was a significant influence. The hypothesis predicts that higher levels of facial disclosure, such as genuine expressions of enthusiasm, trustworthiness, and confidence, will positively impact the campaign's success. On the contrary, lower levels of facial disclosure, such as neutral or unimpressive faces, may result in reduced funding success.

3. Research Method and Materials

Data were collected from multiple crowdfunding platforms: fundraised, Kickstarter, and IndieGoGo. Secondary data were coded characteristics, including geographic location, start and end dates, pledged goals, number of backers, the total amount pledged, project textual descriptions, and entrepreneurs' names and profile photos. Initially, extracts were taken from a thousand (1000) Kickstarter, Indiegogo, and Fundraise platforms operating in all crowdfunding categories with an active status from January 2019 to December 2020. Some 141 projects were excluded for which either no entrepreneurs’ profile headshots could be identified, or the identified profile headshots did not meet our criteria for measuring facial trustworthiness. It is important to note that this hypothesis requires careful consideration of other factors that could also influence crowdfunding success, such as the quality of the product or service being offered, the entrepreneur's credibility, and the overall appeal of the campaign.

Table 1.

The measurement of variables.

Table 1.

The measurement of variables.

| Dependent Variables |

Measurements |

| Completion ratio (CR) |

Ratio of the amount raised over the amount of money requested |

| Success (SC) |

The binary variable of 1 if the target amount was obtained and 0 otherwise |

| Independent variables |

| Facial Disclosure (FD) |

The binary variable of 1 if there is a face disclosure on the crowdfunding page and 0 otherwise |

| Image (IM) |

The dummy variable is 1 if the image is available on the website and 0 otherwise. |

| Video (VD) |

The dummy variable is 1 if a video is available on the website and 0 otherwise. |

| Comments (CMM) |

Number of comments on the project between the entrepreneur and the backers (transformed into a log) |

| Duration (DRN) |

The number of days for a campaign to raise funds (transformed into a log) |

| Backers (BCK) |

The number of supporters who contributed to the project (transformed into a log) |

Model 1 ordinary least squares OLS (completion ratio)

Model 2 Ordinary least-squares OLS (Success)

4. Research Findings and Discussion

The table below presents the descriptive statistics as follows.

Table 2 study report presents the values of every variable considered. Funding success showed an average of 16% success (with a median of 0,00) and an average duration of about 44 days (with a median of 46 days). The minimum and maximum values reflect the extrema that some crowdfunding campaigns reveal. For example, a maximum funding goal of USD 1 arises from a campaign claiming to have collected only one dollar. In later analyses, care was taken that such outliers would not distort the results. Furthermore, the study revealed that about 42% of the projects provided a facial disclosure on the crowdfunding page. Approximately 86%, 206%, and 47% of the projects had images, comments, and videos, respectively. The crowdfunding platforms reported, on average, 19 backers.

Table 3 clarified whether there might be a problem of multicollinearity among the included variables. We calculated the correlation matrix for the variables and considered these analyses. We used logarithm values for duration and backers to reduce kurtosis and skewness. Based on the results from the table, there are no highly correlated variables. The correlation between the variables 'success' and 'backers' is because these variables are never included together in the regressions. The highest correlation between the explanatory variables was approximately 0.44 (success and backers). The correlation of all the other variables was low, so we could conclude there was no multicollinearity problem.

Additionally, we examined the variance inflation factors (VIFs) related to the pertinent variables, as Mubeen et al. (2022) recommend. For a fundamental regression design with squared variables or interactions, all elements were below or equal to 1.63. The squared variables increase the VIFs organically higher once all the variables are included but never exceed the value of 8. The correlations and the VIF values indicated that multicollinearity was not a problem.

Model 1 ordinary least squares (completion ratio as a dependent variable)

Table 5 presents the role of facial disclosure on crowdfunding success presented in model 1; the dependent variable is the completion ratio (crowdfunding success), which is the percentage of the target amount achieved. The facial disclosure of crowdfunding has a significant favourable influence on the success of fundraising in crowdfunding endeavours (β1=0.088, P<0.10). Potential backers and investors attracted by the entrepreneurs’ profile and facial disclosure indicate the likelihood of success. The presentation of images also significantly positively influences crowdfunding success (β2=0.146, P<0.01). Furthermore, comments presented on the crowdfunding page positively impact crowdfunding support (β3=0.02) but have no significant impact on the crowdfunding success rate. This implies that the popularity of comments reduces the information asymmetry between the crowd and the project creator.

The video presentation significantly positively impacts the fundraising success rate (β4=0.123, P<0.01). Presentation of the video on the crowdfunding campaign page can be considered crucial for fundraising success. Hence, it eliminates confusion arising from information asymmetry problems and signals success. A longer duration of a crowdfunding project has a significant negative influence on the fundraising success rate (β4=-0.0022, P<0.10). Several potential backers and investors are discouraged by prolonged periods, which tends to signal a failed project campaign. The confusion arises from information asymmetry, where the prolonged duration signals a lack of trustworthiness and credibility. The number of backers significantly positively influences crowdfunding success (β4=0.0025, P<0.01). A large number of potential investors signals the likelihood of success.

Model 2 Ordinary least squares (success as a dependent variable)

In this, OLS used binary variables linear probability models, which were used as recommended by Menard (1995). Table 5 indicates the role of facial disclosure in the success of crowdfunding. The dependent variable (crowdfunding success) was binary. Facial disclosure has a positive impact on crowdfunding success (β1=0.022). The presentation of images significantly positively impacts the fundraising success rate (β2=0.022, p<0.01). Backers and investors use images to evaluate the credibility of the project campaign and whether it is worth funding. Hence, the presentation of images signals the crowdfunding success, thus overcoming the information asymmetry. Strangely enough, the popularity of project comments significantly negatively influences social support in crowdfunding (β3=-0.0007, P<0.05), affecting the fundraising success rate. The availability of comments would generally signal transparency among crowdfunding stakeholders and enhance credibility and trustworthiness. The presence of video significantly positively impacts the fundraising success rate (β4=0.0546, p<0.01). The suggestion is that the video presentation attracts the participation of many potential sponsors.

The duration of the fundraising campaign has a significant negative impact on the probability of success of the crowdfunding success performance (β5=-0.0019, p<0.01). The results imply that a longer duration discourages potential backers from supporting the project, which signals a lack of credibility. A higher number of backers significantly positively impact the fundraising success rate (β5=0.0011, p<0.01) as it seems to signal a credible crowdfunding project, and the trustworthiness attracts more potential investors to support the project campaign.

5. Implications of the Study

Two questions were intended to be addressed in this study: (1) What impact does an entrepreneur's facial disclosure have on the success of crowdfunding? and (2) What factors affect the success of crowdfunding? The empirical study examined the factors influencing the success of 859 crowdfunding projects. It was discovered that the duration of a crowdfunding campaign had a negative correlation with crowdfunding success. In contrast, the facial disclosure of entrepreneurs and the presence of images, videos, and numerous backers had a positive impact. The findings of this research show the potential to improve the management procedures of backers and fundraisers who participate in crowdfunding.

In this study, three additional findings are added to the literature on crowdfunding. Firstly, this research advances our knowledge of the role of facial disclosure of entrepreneurs in crowdfunding markets. In particular, we know more about the relationship between entrepreneurs’ exposure to private information and their desire to access capital, even in light of privacy issues. Our study is among the first to investigate how the facial disclosure of entrepreneurs in crowdfunding affects the information asymmetry between private information protection and economic prospects in online markets (Teubner and Flath, 2019). Secondly, by showing the importance of facial image disclosure as a performance predictor of crowdfunding, this research contributes to the body of knowledge on market signals. The results show that although entrepreneurs who disclose facial images generally have a lower socioeconomic status, they are more likely to access the required target capital amount.

The findings show that the project signals positively impact the success of crowdfunding projects, initiators' face signals, and peer-review valence signals. To reduce the knowledge asymmetry between creators and backers, those prepared to start a crowdfunding project must provide as much information as possible to show their abilities. Finally, all platforms and project initiators involved in crowdfunding must acknowledge the implications of personal facial details. Unlike disclosing personal information in online reviews, facial disclosure positively affects prospective backers' trust in crowdfunding campaigns. Projects that use crowdfunding, particularly cultural or artistic, require additional time, money, and effort. Consequently, we have to think that a thriving culture and creative product will come from a team that is more capable than a single individual.

6. Conclusion and Recommendation for Future Studies

In this study, the role of facial disclosure of entrepreneurs on the success of crowdfunding in Africa was investigated. The results might persuade regulators and crowdfunding managers of the value of the facial trustworthiness of entrepreneurs in influencing contributors’ decisions. Additionally, more reliable and transparent disclosure regulations are advised to regulate crowdfunding marketplaces. Although the study provides valuable insights into the role of entrepreneur's face disclosure in fundraising outcomes in Africa, it also points out certain limitations and suggests possible directions for further study. This study used Kickstarter, Indiegogo, and other fundraising platforms for data collection. Further study efforts might examine the mechanisms associated with psychological and marketing theories. We believe investors gave the concept, or the entrepreneur aspect, more consideration; we originally juxtaposed the two (concept and entrepreneur). More aspects can be considered; this additional material is provided in addition to the two features, such as online communication in images and video. The preliminary findings of our study should stimulate more research into this new field of research. Future studies may be conducted country-specifically as a unit of analysis rather than cross-country data.

Author Contributions

Conceptualization, L.P.M. and A.B.S.; methodology, L.P.M.; software, L.P.M.; validation, L.P.M. and A.B.S.; formal analysis, L.P.M.; investigation, L.P.M.; resources, L.P.M.; data curation, L.P.M.; writing—original draft preparation, L.P.M.; writing—review and editing, A.B.S.; visualisation, L.P.M. and A.B.S.; supervision, A.B.S.; project administration, L.P.M.; funding acquisition, L.P.M. and A.B.S. All authors have read and agreed to the published version of the manuscript.

Funding

Please add: “This research received no external funding.”

Data Availability Statement

The data will be made available upon request.

Acknowledgements

Attendees at the African Association Conference 2024 (University of Cape Town Business School, South Africa) and Alternative Finance Conference 2024 (Krems an der Donau, Austria Europe) for their valuable inputs on this paper. We also wish to thank Daniel Makina for his valuable input. We are also indebted to Dr Malvin Vergie for the Language editing of the manuscript.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Botsman, Rachel. 2017. Who can you trust?: how technology brought us together–and why it could drive us apart. Penguin UK. Available online https://books.google.com/books?hl=en&lr=&id=7cGWDgAAQBAJ&oi=fnd&pg=PT13&dq=Botsman,+R.+(2017).+Who+can+you+trust%3F:+how+technology+brought+us+together%E2%80%93and+why+it+could+drive+us+apart.+Penguin+UK.&ots=W354N00M-o&sig=mCPlNoy-uQ9XBa4QvpuZZNeS1xM.

- Blanchard, Simon J., Theodore J. Noseworthy, Ethan Pancer, and Maxwell Poole. 2022. "Extracting image characteristics to predict crowdfunding success." arXiv preprint. arXiv:2203.14806. [CrossRef]

- Bruton, Garry, Susanna Khavul, Donald Siegel, and Mike Wright. 2015. "New financial alternatives in seeding entrepreneurship: Microfinance, crowdfunding, and peer–to–peer innovations." Entrepreneurship theory and practice 39, (1): 9-26. [CrossRef]

- Bukhari, Farasat Ali Shah, Sardar Muhammad Usman, Muhammad Usman, and Khalid Hussain. 2020. "The effects of creator credibility and backer endorsement in donation crowdfunding campaigns success." Baltic Journal of Management 15, (2): 215-235. [CrossRef]

- Buskila, Gadi, and Dikla Perez. 2022."The Impact of Victims’ Imagery on Charity Crowdfunding Campaigns: How Photos of Victims Doing Nothing to Help Themselves Elicit Fewer Donations." Journal of Advertising Research 62, (4): 385-396. [CrossRef]

- Calic, Goran, and Elaine Mosakowski. 2016."Kicking off social entrepreneurship: How a sustainability orientation influences crowdfunding success." Journal of Management Studies 53, (5): 738-767. [CrossRef]

- Cha, Jiyoung. 2017. "Crowdfunding for video games: factors that influence the success of and capital pledged for campaigns." International Journal on Media Management 19, (3): 240-259. [CrossRef]

- Chaney, Damien. 2019."A principal-agent perspective on consumer co-production: Crowdfunding and the redefinition of consumer power." Technological Forecasting and Social Change 14: 74-84. [CrossRef]

- Chen, Yue, Wentao Zhang, Xiangbin Yan, and Jiahua Jin. 2020."The life-cycle influence mechanism of the determinants of financing performance: an empirical study of a Chinese crowdfunding platform." Review of Managerial Science 14: 287-309. [CrossRef]

- Christie, Andrea. 2020."Can distributed ledger technologies promote trust in charities? A literature review." Frontiers in Blockchain 3: 1-20. [CrossRef]

- Clauss, Thomas, Robert J. Breitenecker, Sascha Kraus, Alexander Brem, and Chris Richter. "Directing the wisdom of the crowd: the importance of social interaction among founders and the crowd during crowdfunding campaigns." Economics of Innovation and New Technology 27, (8): 709-729. [CrossRef]

- Connelly, Brian L., S. Trevis Certo, R. Duane Ireland, and Christopher R. Reutzel. 2011."Signalling theory: A review and assessment." Journal of Management 37, (1): 39-67. [CrossRef]

- Davies, William E., and Emanuele Giovannetti. 2018."Signalling experience & reciprocity to temper asymmetric information in crowdfunding evidence from 10,000 projects." Technological Forecasting and Social Change 133: 118-131. [CrossRef]

- Devaraj, Srikant, and Pankaj C. Patel. 2016."Influence of several backers, goal amount, and project duration on meeting funding goals of crowdfunding projects." Economics Bulletin 36, (2): 1242-1249.Available online http://www.accessecon.com/Pubs/EB/2016/Volume36/EB-16-V36-I2-P121.pdf.

- Dey, Sanorita, Brittany Duff, Karrie Karahalios, and Wai-Tat Fu. 2017."The art and science of persuasion: not all crowdfunding campaign videos are the same." In Proceedings of the 2017 ACM Conference on Computer Supported Cooperative Work and Social Computing, pp. 755-769. [CrossRef]

- Duan, Yang, Tien-Shih Hsieh, Ray R. Wang, and Zhihong Wang. 2020."Entrepreneurs' facial trustworthiness, gender, and crowdfunding success." Journal of Corporate Finance 64: 1-24. [CrossRef]

- Ferreira, Valeria, Eleni Papaoikonomou, and Antonio Terceno. 2022."Unpeel the layers of trust! A comparative analysis of crowdfunding platforms and what they do to generate trust." Business Horizons 65, (1): 7-19. [CrossRef]

- Herd, Kelly B., Girish Mallapragada, and Vishal Narayan. 2022."Do backer affiliations help or hurt crowdfunding success?." Journal of Marketing 86, (5): 117-134. [CrossRef]

- Hou, Xiaoyan, Tailai Wu, Zhuo Chen, and Liqin Zhou. 2022."Success factors of medical crowdfunding campaigns: a systematic review." Journal of medical Internet research 24, (3):1-12. [CrossRef]

- Hsieh, Tien-Shih, Jeong-Bon Kim, Ray R. Wang, and Zhihong Wang. 2020."Seeing is believing? Executives' facial trustworthiness, auditor tenure, and audit fees." Journal of Accounting and Economics 69, (1): 1-23. [CrossRef]

- Huang, Shuangfa, David Pickernell, Martina Battisti, and Thang Nguyen. 2022."Signalling entrepreneurs’ credibility and project quality for crowdfunding success: cases from the Kickstarter and Indiegogo environments." Small Business Economics: 1-21. [CrossRef]

- Jiang, Cuixia, Ranran Han, Qifa Xu, and Yezheng Liu. 2020."The impact of soft information extracted from descriptive text on crowdfunding performance." Electronic commerce research and applications 43: 1-13. [CrossRef]

- Jung, Eunjun, Changjun Lee, and Junseok Hwang. 2022."Effective strategies to attract crowdfunding investment based on the novelty of business ideas." Technological Forecasting and Social Change 178: 1-16. [CrossRef]

- Koch, Jascha-Alexander, and Michael Siering. 2019."The recipe of successful crowdfunding campaigns: an analysis of crowdfunding success factors and their interrelations." Electronic Markets 29, (4): 661-679. [CrossRef]

- Kolbe, Maura, Sasan Mansouri, and Paul P. Momtaz. 2022."Why do video pitches matter in crowdfunding?." Journal of Economics and Business 122 (2022): 1-18. [CrossRef]

- Kim, Yongsung, Aaron Shaw, Haoqi Zhang, and Elizabeth Gerber. 2017."Understanding trust amid delays in crowdfunding." In Proceedings of the 2017 ACM Conference on computer supported cooperative work and social computing, pp. 1982-1996. 2017. [CrossRef]

- Li, Liangqiang, Liang Yang, Meng Zhao, Miyan Liao, and Yunzhong Cao. 2022."Exploring the success determinants of crowdfunding for cultural and creative projects: An empirical study based on signal theory." Technology in Society 70: 1-13. [CrossRef]

- Li, Yijing, Fei Liu, Wenjie Fan, Eric TK Lim, and Yong Liu. 2022."Exploring the impact of the initial herd on overfunding in equity crowdfunding." Information & Management 59, (3): 1-10. [CrossRef]

- Liu, Yang, Yuan Chen, and Zhi-Ping Fan. 2021."Do social network crowds help fundraising campaigns? Effects of social influence on crowdfunding performance." Journal of Business Research 122: 97-108. [CrossRef]

- Ma, Zecong. 2023."Early backers' social and geographic influences on the success of crowdfunding." Journal of Research in Interactive Marketing 17, (4): 510-526. [CrossRef]

- Ma, Zecong, and Sergio Palacios. 2021."Image-mining: exploring the impact of video content on the success of crowdfunding." Journal of Marketing Analytics 9, (4): 265-285. [CrossRef]

- Mamaro, Lenny Phulong, and Athenia Bongani Sibindi. 2023."The drivers of successful crowdfunding projects in Africa during the COVID-19 pandemic." Journal of Risk and Financial Management 16, (7): 1-17. [CrossRef]

- Miglo, Anton, and Victor Miglo. 2019. "Market imperfections and crowdfunding." Small Business Economics 53: 51-79. [CrossRef]

- Mochkabadi, Kazem, and Christine K. Volkmann. 2020."Equity crowdfunding: a systematic review of the literature." Small Business Economics 54: 75-118. [CrossRef]

- Mubeen, Riaqa, Dongping Han, Jaffar Abbas, Saqlain Raza, and Wang Bodian. 2022."Examining the relationship between product market competition and Chinese firms performance: the mediating impact of capital structure and moderating influence of firm size." Frontiers in Psychology 12: 1-13. [CrossRef]

- Qi, Zhiyuan, Dongyu Chen, and Jennifer J. Xu. 2022."Do facial images matter? Understanding the role of private information disclosure in crowdfunding markets." Electronic Commerce Research and Applications 54: 1-14. [CrossRef]

- Riegelsberger, Jens, M. Angela Sasse, and John D. McCarthy. 2005."The mechanics of trust: A framework for research and design." International journal of human-computer studies 62, (3): 381-422. [CrossRef]

- Salahaldin, Linda, Martin Angerer, Sascha Kraus, and Donia Trabelsi. 2019."A duration-based model of crowdfunding project choice." Finance Research Letters 29: 404-410. [CrossRef]

- Schwienbacher, Armin. 2018."Entrepreneurial risk-taking in crowdfunding campaigns." Small Business Economics 51: 843-859. [CrossRef]

- Shafi, Kourosh, and Massimo Colombo. 2020."A theory of sequential-stage signalling: evidence from equity-crowdfunding."1-31. Available online https://scholar.archive.org/work/j35sxjkevvbhbcpcwnjkgrrkta/access/wayback/https://files.osf.io/v1/resources/f62ke/providers/osfstorage/5f6ed58446080902de1b7453?format=pdf&action=download&direct&version=2.

- Shin, Dong-Hoon, and Hyo-Jung Kim. 2021."How to Make Successful Campaigns in Donation-based Crowdfunding: The Role of Facial Expression and Content."9 (2):45-52. Available online https://siim.org.tw/IJIiM/DW/V9N1/IJIiM-21-009.pdf.

- Shneor, Rotem. 2020."Crowdfunding models, strategies, and choices between them." Advances in crowdfunding: Research and practice: 21-42. [CrossRef]

- Shneor, Rotem, and Bjørn-Tore Flåten. 2015."Opportunities for entrepreneurial development and growth through online communities, collaboration, and value-creating and co-creating activities." Entrepreneurial Challenges in the 21st Century: Creating Stakeholder Value Co-Creation: 178-199. Available online https://link.springer.com/chapter/10.1057/9781137479761_11.

- Shneor, Rotem, and Stina Torjesen. 2020."Ethical considerations in crowdfunding." Advances in Crowdfunding: Research and Practice: 161-182. [CrossRef]

- Shneor, Rotem, and Amy Ann Vik. 2020."Crowdfunding success: a systematic literature review 2010–2017." Baltic Journal of Management 15, (2): 149-182. [CrossRef]

- Skirnevskiy, Vitaly, David Bendig, and Malte Brettel. 2017."The influence of internal social capital on serial creators’ success in crowdfunding." Entrepreneurship theory and practice 41, (2): 209-236. [CrossRef]

- Song, Qi, Nan Zhang, and Huizhu Liang. 2021."Review of the Chinese internet philanthropy research (2006-2020): an analysis based on cite space." The China Nonprofit Review 13, (1&2): 1-25. [CrossRef]

- Song, Yang, Ron Berger, Abraham Yosipof, and Bradley R. Barnes. 2019."Mining and investigating the factors influencing crowdfunding success." Technological Forecasting and Social Change 148: 1-10. [CrossRef]

- Spence, Michael. 1974."Competitive and optimal responses to signals: An analysis of efficiency and distribution." Journal of Economic Theory 7, (3): 296-332. [CrossRef]

- Spence, Michael. 2002."Signalling in retrospect and the informational structure of markets." American Economic Review 92, (3): 434-459. [CrossRef]

- Statista (2019b). Value of alternative finance transactions in Europe (excluding the UK) as of 2017 by market segment (in million euros). Available online https://www.statista.com/statistics/412394/europe-alternative-finance-transaction-value-market-segment/.

- Strohmaier, David, Jianqiu Zeng, and Muhammad Hafeez. 2019."Trust, distrust, and crowdfunding: A study on perceptions of institutional mechanisms." Telematics and Informatics 43: 1-21. [CrossRef]

- Tang, Xin, Haibing Lu, Wei Huang, and Shulin Liu. 2023."Investment decisions and pricing strategies of crowdfunding players: In a two-sided crowdfunding market." Electronic Commerce Research 23, (2): 1209-1240. [CrossRef]

- Wang, Nianxin, Qingxiang Li, Huigang Liang, Taofeng Ye, and Shilun Ge. 2018."Understanding the importance of interaction between creators and backers in crowdfunding success." Electronic Commerce Research and Applications 27: 106-117. [CrossRef]

- Wang, Wei, Wei Chen, Kevin Zhu, and Hongwei Wang. 2020."Emphasising the entrepreneur or the idea? The impact of text content emphasis on investment decisions in crowdfunding." Decision Support Systems 136: 1-13. [CrossRef]

- Wehnert, Peter, Christian V. Baccarella, and Markus Beckmann. 2019."In crowdfunding, we trust? Investigating crowdfunding success as a signal for enhancing trust in sustainable product features." Technological Forecasting and Social Change 141: 128-137. [CrossRef]

- Zribi, Sirine. 2022."Effects of social influence on crowdfunding performance: Implications of the COVID-19 pandemic." Humanities and Social Sciences Communications 9, (1). 1-8. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and the editor(s). MDPI and the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).