1. Introduction

Climate change represents one of the most pressing challenges facing humanity in the 21st century and it is beyond country’s boarders, necessitating bold and concerted actions to achieve the objectives outlined in the United Nations Sustainable Development Goals (UN-SDGs) and the Paris Agreement. The consequences of climate change are far-reaching and multifaceted, impacting various aspects of the natural environment and human society. Among these impacts, alterations in global hydrological cycles pose significant challenges, particularly regarding water availability and quality. Climate change projections indicate a future marked by reduced accessibility to water resources, exacerbated spatial and temporal variations in water availability, and intensified frequency and severity of extreme weather events such as droughts and floods.

Developing countries, including Small Island Developing States (SIDS) and Least Developed Countries (LDCs), are disproportionately affected by the adverse impacts of climate change. These countries often possess fragile ecosystems, limited adaptive capacity, and high levels of exposure to climate-related hazards. As a result, they bear the brunt of climate-induced water shortages, flooding, and deteriorating water quality. The United Nations reports that nearly two-thirds of the global population experience severe water scarcity for at least one month annually, with the majority of affected individuals residing in developing countries. Furthermore, projections suggest that by 2025, approximately half of the world's population could inhabit areas grappling with water scarcity, with developing countries being particularly vulnerable to this challenge (UNICEF, 2024).

The economic implications of inadequate water security are substantial and wide-ranging. Inadequate access to safe and reliable water and sanitation services contributes to significant economic losses, including those associated with health care expenditures, decreased agricultural productivity, and damage to infrastructure and property due to flooding. The economic toll of gcwater insecurity extends to urban areas, where inadequate water supply and sanitation systems result in substantial financial losses stemming from property damage and disruption of essential services. Recent analyses estimate that inadequate water supply and sanitation alone lead to annual economic losses of USD 260 billion globally, while urban property flood damages and costs to existing irrigators amount to USD 120 billion and USD 94 billion per year, respectively (Brears).

Moreover, the escalating uncertainty and variability in climate patterns, particularly precipitation, exacerbate the challenges posed by water insecurity. The increasing intensity and frequency of droughts and floods not only strain existing water infrastructure and assets but also have profound socio-economic implications. These climate-induced extremes impact water-dependent sectors such as agriculture, energy, and industry, posing significant challenges to food security, energy production, and economic development. Furthermore, the socio-economic costs associated with floods and droughts, for which wastewater assets play a crucial role as mitigation and adaptation measures, are escalating, further underscoring the urgency of addressing water insecurity in the context of climate change.

In response to these challenges, transformative wastewater projects have emerged as pivotal initiatives for enhancing climate resilience and reducing greenhouse gas emissions, particularly in developing countries. These projects encompass a range of interventions aimed at improving wastewater management practices, including collection, treatment, and reuse. By treating and reusing wastewater, these projects mitigate the reliance on and depletion of freshwater resources, while advanced treatment technologies capture greenhouse gases like methane, contributing to low-emission development. Moreover, wastewater projects align with global climate goals, including the Paris Agreement, by mitigating climate change impacts and promoting sustainable environmental practices.

Furthermore, effective wastewater management contributes to climate resilience by mitigating the impacts of extreme weather events and sea-level rise, safeguarding infrastructure and livelihoods. However, despite their potential benefits, wastewater management initiatives face numerous challenges, including inadequate financing, technological limitations, and institutional barriers. Additionally, wastewater is often underutilized, with approximately 80% of global wastewater discharged without treatment, representing a significant missed opportunity for resource recovery and environmental sustainability.

In recent years, there has been a growing recognition of the untapped potential of wastewater as a valuable resource, prompting a paradigm shift in environmental management. Traditionally viewed as waste, wastewater is now being redefined as a new asset class [Elmahdi and Wong, 2022], emphasizing resource recovery and circular economy principles. This transformative approach focuses on extracting valuable elements such as water, nutrients, and energy from wastewater, which can be reused in various applications. By adopting advanced treatment technologies and innovative financing mechanisms, wastewater management projects offer the developing countries with significant opportunities for generating revenue, enhancing environmental sustainability, and contributing to sustainable development.

Despite the potential benefits of wastewater management projects, significant barriers hinder their investment, implementation and scale-up, particularly in developing countries. These barriers include undervaluation of water, underpriced water services, capital-intensive nature of projects, difficulty in monetizing benefits and co-benefits, context-specific project requirements, and poor business models design. Moreover, developing countries face a growing debt crisis. External debts further compound the challenges faced by developing countries, diverting scarce financial resources away from critical sectors such as health, education, and climate adaptation. The escalating cost of servicing past borrowing, driven by rising interest rates, has exacerbated debt vulnerabilities for low-income and middle-income countries. The latest International Debt Report from the World Bank highlighted a sharp rise in global borrowing costs, pushing payments on external debts of all developing countries to $443.5 billion in 2022. This alarming trend has set many countries on a path to crisis, with record debt levels and high interest rates intensifying debt distress among nations, which further complicates efforts to finance adaptation and mitigation actions and complicate the roles of key players such as government, policymakers, private sector, communities and creditors and debtors.

Against this backdrop of mounting debt burdens and water-related challenges, innovative financial mechanisms such as debt-for-climate swaps may offer potential solutions to enhance water security and promote climate action while maintaining the project bankability and affordability for end-users and borrowers. By converting debt obligations into investments in transformative wastewater projects, developing countries can simultaneously address water insecurity, mitigate climate change impacts, and promote sustainable development. Leveraging climate finance to transform debts into assets that facilitate climate action is imperative to overcome the financing barriers hindering progress in addressing water insecurity and climate change adaptation in developing countries.

Therefore, this paper aims to examine the potential of debt-for-climate swaps in advancing transformative wastewater projects using the concept of treating water as a new asset class, providing insights into their strategic utilization and best practices. Through analysis of case studies, empirical evidence, and stakeholder roles, the paper aims to offer actionable strategies and roadmaps to navigate the complex challenges of climate change and promote sustainable development in developing countries and provide policymakers, practitioners, and stakeholders with actionable strategies with clear roles and responsibilities.

2. New Asset Class for WW Reuse

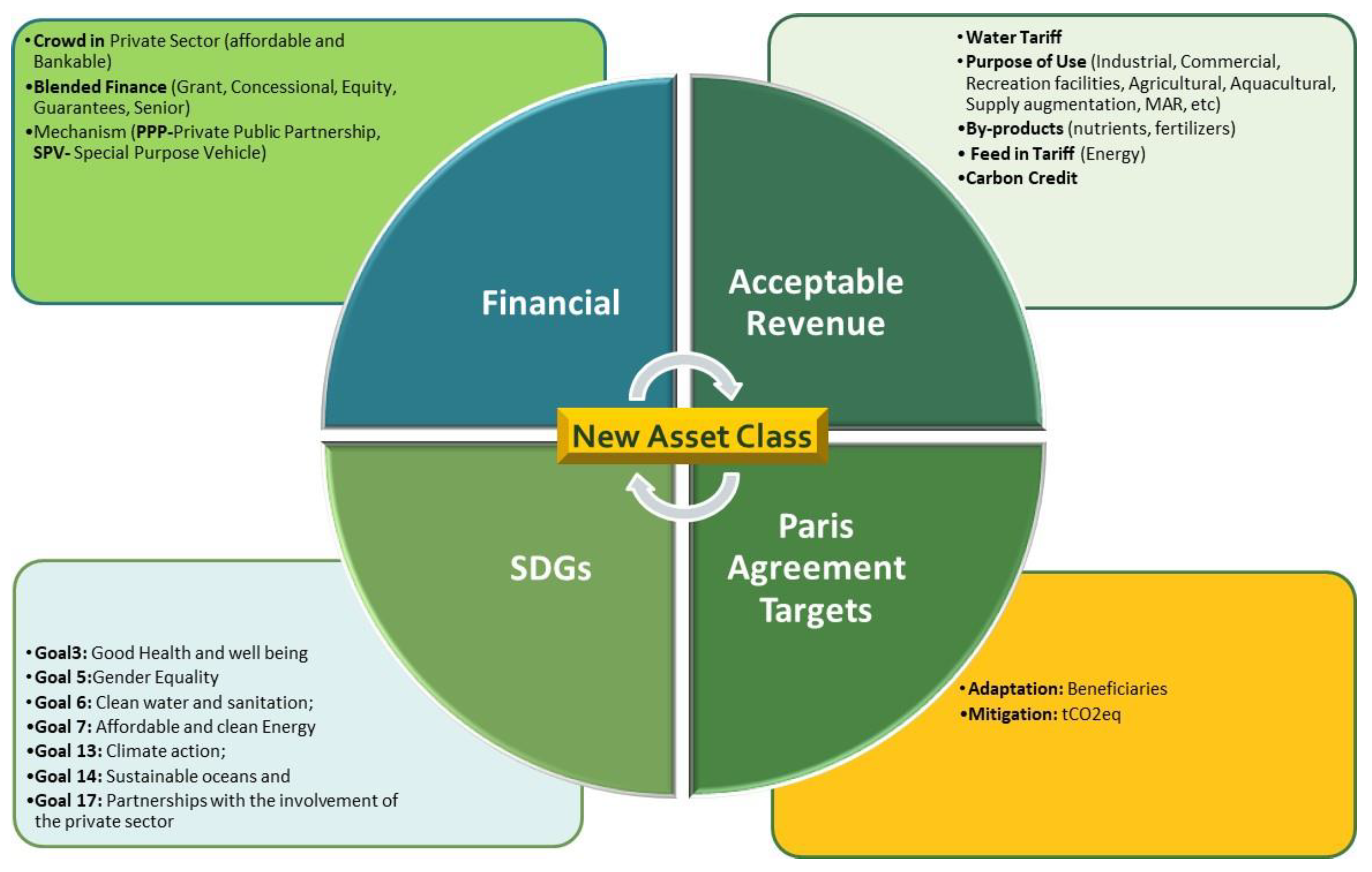

The new asset class is “an asset for adaptation and/or mitigation that is developed and funded using credit enhancement to crowd in private sector funding targeted towards developing debt capital market and acceptable revenue streams but remains in line with ESG impacts and help to meet the targets set in the Paris Agreement and contribute to UN SDGs (Goal 6 –clean water and sanitation; Goal 3 – Good health and wellbeing, Goal 5– Gender Equality, Goal 7- Affordable and clean Energy; Goal 13- climate action; Goal 14 – sustainable oceans and Goal 17– Partnerships with the involvement of the private sector) and providing water for domestic, municipal, and industrial purposes and allows municipalities to scale their water reuse projects in partnership with private sector and/or governments purchase a service instead of an asset”.

The emergence of a new asset class signifies a paradigm shift in the financing and management of water resources, particularly in the context of water reuse and sanitation projects. This innovative approach, outlined in detail by Elmahdi and Wong (2022), entails the development and funding of adaptation and/or mitigation assets using credit enhancement mechanisms to attract private sector investments. These investments are targeted towards developing debt capital markets and establishing revenue streams aligned with Environmental, Social, and Governance (ESG) impacts, as well as the objectives outlined in the Paris Agreement and the United Nations Sustainable Development Goals (SDGs).

In essence, the new asset class framework aims to transform water resources into investable assets that generate acceptable revenue while simultaneously addressing pressing socio-environmental challenges. This transformative approach reframes water as a valuable commodity, essential for meeting various societal needs, including domestic, municipal, and industrial purposes. Moreover, it enables municipalities and the private sector to scale up water reuse, sanitation, and desalination projects or allows governments to procure services rather than assets.

In this paper, we delve into upscaling the concept of treating water as a new asset class within the context of innovative financial mechanisms, such as debt-for-climate swaps. By exploring the intersection of these two concepts, we aim to address financial market barriers, ensure affordability and bankability, and unlock investments in transformative wastewater projects to improve water security in developing countries.

Several challenges must be overcome to effectively implement the new asset class approach. Firstly, it requires the redistribution of responsibilities among stakeholders involved in infrastructure design, procurement, construction, and long-term operations and maintenance. Secondly, while access to water is recognized as a human right, ensuring affordable tariffs remains a challenge in revenue models, necessitating innovative financing solutions. Additionally, constraints on commercial loan grace and maturation periods pose obstacles to long-term investments in water reuse and sanitation projects. Moreover, public finance restrictions limit municipalities' ability to commit to long-term financing, hindering the scalability of transformative water security interventions.

Climate finance, particularly in the form of concessional financing, can play a pivotal role in facilitating the adoption of the new asset class approach. By supporting the development of enabling policy environments, financing transitions, and de-risking private investments, climate finance can help overcome financial market barriers and unlock investments in water reuse projects. For example, The case of South Africa's water reuse programme (Amgad Elmahdi, 2023) is a ground-breaking initiative for $1.5B that positions itself to unlock forthcoming economic growth while safeguarding its scarce and increasingly demanded water resources. By embracing the notion of water as a new asset class, the project seeks to establish and operationalise a national water reuse programme (WRP), a strategic response to the pressing issue of water scarcity by overhauling the nation's wastewater system. International financial institutions’ funding plays a pivotal role in diminishing risk exposure for potential private financiers and municipalities.

To ensure the successful implementation of the new asset class approach and the realization of its potential benefits, it is imperative to integrate four essential elements into its design, development, and financing (shown in

Figure 1). These elements include financial considerations, alignment with SDGs and Paris Agreement targets, and the establishment of revenue streams in line with SDGs, ESG impacts, and climate objectives. By addressing these elements holistically, stakeholders can effectively leverage the new asset class framework to promote sustainable development and resilience in the water sector.

However, while concessional climate finance presents opportunities, it alone cannot scale up this approach across all developing countries with the level of external debts. Hence, there is a critical need to explore complementary financial mechanisms such as debt-for-climate swaps to further enhance water security in developing countries in debts.

3. Financial Barriers for Water Projects

Addressing the global challenge of water security and advancing wastewater reuse through the implementation of the new asset class concept requires a comprehensive understanding of the economic implications and financing requirements of water infrastructure. Recent analyses highlight significant economic losses and the substantial financing gap, estimated to range from USD 6.7 trillion by 2030 to USD 22.6 trillion by 2050. However, numerous barriers impede the alignment of current financing with future needs. These barriers encompass the undervaluation of water, inadequate pricing of water services, the capital-intensive nature of water projects, challenges in monetizing benefits, project specificity, and ineffective business models (Kauffmann, 2011; OECD, 2018; Stanford Water in the West, 2018; Brears, R.C., 2019).

Water, as a fundamental public good, is often undervalued and marginalized in governmental and investment frameworks, impacting various sectors dependent on its availability. Moreover, underpricing of water services leads to insufficient cost recovery for essential investments. Additionally, water infrastructure projects entail significant upfront capital investments and extended pay-back periods, posing substantial financial challenges. The multifaceted benefits of water management are often difficult to quantify, resulting in limited revenue streams and creditworthiness.

Furthermore, water projects encounter contextual constraints, either due to their scale or specificity, escalating transaction costs and impeding innovative financing models. Moreover, existing business models frequently fail to ensure operational and maintenance efficiency, undermining the long-term sustainability and transparency of water services. These financial barriers deter investors and the private sector from participating in water projects, exacerbating the gap between financing capabilities and water security needs.

The escalating debt levels and high interest rates intensify debt distress among nations, complicating efforts to finance adaptation and mitigation actions. To address these challenges, adherence to the principles outlined by the High-Level Panel on Water is crucial, facilitating financing, enhancing water services, mitigating risks, and fostering sustainable growth. Additionally, climate finance initiatives, including blended finance approaches and strategic market interventions, aim to mobilize finance and reduce risks and barriers to transformative pathways in water conservation and preservation.

In this context, innovative financial mechanisms such as debt-for-climate swaps hold promise in enhancing water security and promoting climate action while ensuring project bankability and affordability. Converting debt obligations into investments in transformative wastewater projects enables developing countries to address water insecurity, mitigate climate change impacts, and promote sustainable development. Leveraging climate finance to transform debts into assets that facilitate climate action is imperative to overcome the financing barriers hindering progress in addressing water insecurity and climate change adaptation in developing countries.Top of Form

4. Debt Swap as a Financing Mechanism and Its Need

The Imperative for Debt Swaps and its Evolution

The concept of debt-for-climate swaps has evolved from the historical precedent of debt-for-nature swaps, which emerged in the 1980s as a response to escalating environmental degradation in heavily indebted developing countries. These swaps involved the forgiveness or acquisition of a portion of a country's debt by conservation entities, in exchange for commitments to environmental preservation endeavors. Over time, spurred by escalating global awareness of climate change, debt-for-nature swaps underwent a transformative evolution. This evolution expanded their scope beyond conservation efforts to encompass a broader range of climate-related challenges, reflecting a shift towards more inclusive climate change mitigation and adaptation initiatives.

Contemporary iterations of debt-for-climate swaps extend to initiatives aimed at mitigating greenhouse gas emissions, promoting renewable energy technologies, and fostering sustainable land management practices. As a specific category of debt swap, debt-for-climate swaps facilitate the exchange of a portion of a country's debt for investments in climate change mitigation and adaptation projects. These swaps serve as a strategic mechanism to assist Least Developed Countries (LDCs) and Small Island Developing States (SIDS) in managing their debt burdens while concurrently fostering investments in sustainability initiatives, such as wastewater management. This transformative approach signifies a departure from conventional debt management practices towards a more holistic framework prioritizing environmental stewardship alongside financial stability.

Regarding wastewater management, debt-for-climate swaps yield profound implications. By redirecting resources previously allocated to debt servicing, these swaps facilitate the enhancement of wastewater management systems, thereby ameliorating water quality, public health, and environmental sustainability. Furthermore, this transition underscores a nuanced understanding of environmental challenges, acknowledging the intricate interdependencies between ecological health and climate resilience.

Debt Swap Mechanisms encompass various innovative financial strategies enabling countries to manage foreign debt while investing in critical areas such as environmental conservation and education. A comparative overview of these mechanisms reveals their distinct benefits and applicability across diverse contexts.

Table 1 provides a comparative overview of various types of debt swaps and their relevance to climate change and vulnerable countries.

By aligning debt relief with environmental action, debt-for-climate swaps offer a pragmatic solution for countries grappling with high debt burdens and urgent climate change challenges. This integrated approach not only promotes financial stability but also fosters ecological sustainability, advancing the dual imperatives of economic prosperity and environmental resilience. Nonetheless, despite their potential benefits, debt-for-climate swaps often lack the involvement of climate finance entities, which could provide more affordable capital and broaden financial scope. Integrating these entities into debt-for-climate swaps could enhance their effectiveness and further promote sustainable development.

5. Structural Framework and Stakeholder Roles in Debt-for-Climate Swap Agreements for Wastewater Projects -Without Climate Finance

Mechanics and Structure: Debt-for-Climate Swaps

The process of structuring debt-for-climate swap agreements for wastewater projects is intricate and necessitates the involvement of multiple stakeholders, each playing a crucial role in ensuring the efficacy and success of these arrangements.

Figure 2 provides a visual representation of the structural framework and stakeholder roles in debt-for-climate swap agreements for wastewater projects without climate finance support.

Governments, serving as the initiators of debt-for-climate swaps, identify the need for such arrangements to address pressing environmental challenges, particularly in the domain of wastewater management. Subsequently, negotiation with creditors becomes paramount, forming the cornerstone of debt-for-climate swap agreements. Governments engage in delicate negotiations with creditors to strike a balance between debt relief and commitments to environmental projects, with the aim of aligning these swaps with national priorities and sustainable development goals. This negotiation process requires a strategic approach to ensure that the terms of the swaps effectively address both financial and environmental objectives.

International financial institutions also play a pivotal role in the debt-for-climate swap process. These institutions facilitate debt restructuring and provide oversight throughout the negotiation and implementation phases. Their involvement enhances the credibility and stability of swap agreements, ensuring a smoother process for both debtor countries and creditors. Moreover, financial institutions bring critical funding and investment expertise to the table, helping to structure swaps in a financially viable manner that is attractive to all parties involved.

Environmental non-governmental organizations (NGOs) contribute invaluable insights into the design and implementation of sustainable wastewater projects. These organizations identify, develop, and monitor projects to ensure they align with climate objectives and effectively meet environmental goals. Their expertise in areas such as biodiversity conservation and climate mitigation ensures that projects financed through swaps contribute meaningfully to environmental stewardship and resilience.

Once the terms of the debt-for-climate swap agreement are negotiated, the formulation and implementation of wastewater projects commence. Government agencies take on the responsibility of implementing these projects, ensuring regulatory compliance and adherence to agreed-upon terms. Financial oversight becomes crucial at this stage to prevent fund misuse, with regular audits and reports ensuring transparent and efficient fund management.

In conclusion, the success of debt-for-climate swap agreements relies on the coordination and collaboration of various stakeholders, including governments, financial institutions, and environmental NGOs. Through robust legal and financial frameworks, transparent fund management, and effective monitoring mechanisms, these agreements have the potential to catalyze meaningful change, advancing both environmental stewardship and economic resilience in vulnerable communities.

6. Challenges of Debt-for-Climate Swaps in LDCs and SIDS

In exploring debt-for-climate swaps, it becomes evident that they present a spectrum of advantages and challenges. This section will delve into the economic and environmental benefits these mechanisms offer, while also examining the intricate complexities and the potential obstacles involved in their implementation.

Debt-for-climate swaps offer significant dual benefits, addressing both economic and environmental concerns. Economically, these swaps provide much-needed debt relief to Least Developed Countries (LDCs) and Small Island Developing States (SIDS), reducing their financial burdens and freeing up resources for other critical areas of development. This aspect of the swaps is particularly crucial for LDCs and SIDS, where high debt levels often limit fiscal capacity and economic growth.

Environmentally, the funds released through these swaps are directed towards essential wastewater projects, which face considerable construction costs. These projects are not only pivotal in mitigating environmental degradation but also provide substantial public health benefits. Efficient wastewater management plays a crucial role in reducing waterborne diseases and preserving freshwater resources, fundamental for the health and prosperity of island communities. Moreover, the environmental advantages extend to the safeguarding of marine ecosystems, often integral to the livelihoods and cultural heritage.

Challenges

Implementing debt-for-climate swaps in Least Developed Countries (LDCs) and Small Island Developing States (SIDS) poses several significant challenges, which encompass various aspects of project selection, implementation, monitoring, and governance.

Criteria for Project Selection: Selecting suitable projects is critical for the success of debt-for-climate swaps. Criteria for project selection include the potential for positive environmental impact and feasibility. Identifying projects that align with national environmental priorities and have the potential to deliver tangible benefits is essential. However, determining the most suitable projects requires thorough assessment and analysis, considering factors such as the project's long-term sustainability and its contribution to climate resilience.

Terms of the Debt: Negotiating favorable terms for debt relief is essential but can be challenging. The terms of the debt must strike a balance between providing meaningful relief to the debtor country while ensuring the financial interests of creditors are safeguarded. Achieving this balance requires careful negotiation and coordination among stakeholders to establish mutually beneficial agreements.

Limited Institutional Capacity: Many countries in these regions lack the necessary infrastructure and expertise to effectively manage complex financial arrangements and environmental projects. While aligning priorities and leveraging innovative financial instruments can enhance the effectiveness of debt-swaps, limited institutional capacity can hinder the efficient and transparent execution of swap agreements, impacting their overall effectiveness.

Time-Intensive Process: Freeing up resources through debt swaps can be a time-intensive process, potentially delaying the initiation of urgent infrastructure projects and increasing construction costs. This delay may arise from complex negotiations and the need to meet stringent criteria for project selection, including the potential for positive environmental impact and feasibility.

Successful Implementation and Outcomes: Ensuring successful implementation and achieving desired outcomes from wastewater projects financed through debt-for-climate swaps is crucial. This involves effective project management, adherence to timelines and budgets, and the attainment of predetermined environmental objectives. Challenges may arise during implementation, including delays, cost overruns, and unforeseen technical or logistical issues, which can impact project outcomes and overall effectiveness.

Measuring Success: Measuring the success of debt-for-climate swaps involves assessing the successful implementation and outcomes of wastewater projects. This requires robust monitoring and evaluation mechanisms to ensure accountability and transparency, reinforcing the commitment of the indebted country to achieving the agreed-upon environmental goals in exchange for debt relief.

Legal and Financial Frameworks: Establishing clear legal and financial frameworks is crucial for the effective implementation of debt-for-climate swaps. These frameworks delineate roles, responsibilities, and terms of the debt, providing a foundation for accountability, enforcement, and dispute resolution. However, navigating legal complexities and ensuring compliance with international standards can pose significant challenges, particularly for countries with limited institutional capacity.

Addressing these challenges requires concerted efforts from all stakeholders involved in debt-for-climate swaps. Effective project management, capacity building, and community involvement are essential for overcoming implementation challenges and maximizing the environmental and economic benefits of these innovative financing mechanisms. Additionally, fostering transparency, accountability, and adherence to legal and financial frameworks are essential for ensuring the long-term success and sustainability of debt-for-climate swaps in LDCs and SIDS.

Despite these challenges, debt-for-climate swaps present lucrative market opportunities and contribute to sustainable development. The following table (

Table 2) provides a clear breakdown of the advantages and limitations of debt swaps aspects, detailing the benefits like debt relief and economic advantages, as well as limitations such as complex negotiations and potential risks in project implementation. Additionally, the table outlines strategies to mitigate these challenges, ensuring a more effective application of debt-for-climate swaps in SIDS.

The commercialization of recovered resources and engagement in carbon markets offer additional economic benefits, while also supporting global climate change mitigation efforts. Moreover, by addressing both economic and environmental concerns, debt-for-climate swaps play a vital role in advancing the dual imperatives of economic prosperity and environmental resilience in vulnerable communities. Moving forward, the next section will explore the role of climate finance in overcoming some of these challenges and supporting the development and structure of debt-for-climate swaps.

7. How to Structure a Debt-For-Climate Swap to Serve Water Asset Class Concept for WW Reuse

Structuring a debt-for-climate swap to serve wastewater projects, utilizing the concept of water as "a new asset class," requires a systematic approach that integrates various stakeholders and leverages climate finance. Below are the key steps involved in structuring such a swap:

1. Identifying Wastewater Reuse Projects: Begin by identifying potential wastewater reuse projects that align with the concept of treating water as a new asset class. These projects should focus on transforming wastewater into a resource for various purposes, such as agricultural irrigation, industrial processes, or even potable water after advanced treatment. Wastewater reuse projects can encompass a range of initiatives, including upgrading existing wastewater treatment facilities, implementing decentralized treatment systems, and exploring innovative technologies for water reclamation. These projects should be selected based on their potential to address local water challenges, enhance water security, and contribute to sustainable development goals and aligned with Paris agreement targets.

2. Assessment and Valuation: Conduct a comprehensive assessment and valuation of the identified projects. This involves estimating the costs of project development and implementation, as well as assessing the potential economic, environmental, and social benefits. Factors such as resource savings, pollution reduction, and health improvements should be considered. The assessment process should also include a detailed analysis of the project's feasibility, including technical feasibility, financial viability, and regulatory considerations. This will help determine the project's potential for success and identify any potential barriers or challenges that need to be addressed.

3. Debt Appraisal: Evaluate the existing debt situation of the participating country to understand the extent of their debt obligations. Assess the feasibility of converting a portion of this debt into investments in the identified wastewater projects. Debt appraisal involves analyzing the country's debt profile, including the types of debt, interest rates, repayment schedules, and overall debt sustainability. This assessment helps determine the capacity of the country to engage in a debt-for-climate swap and identifies opportunities for debt restructuring or forgiveness.

4. Negotiating the Swap: Engage in negotiations between the debtor country and creditors to agree on terms where a portion of the country’s debt is forgiven or restructured in exchange for the country’s commitment to invest in the wastewater reuse projects. Negotiating the swap requires careful coordination between the debtor country, creditors, and other stakeholders involved in the process. Key considerations include the amount of debt to be converted, the terms of the swap agreement, and the specific projects to be funded with the proceeds from the swap.

5. Involvement of International Financial Institutions (IFIs): Leverage IFIs as facilitators and financiers, providing partial financing or guarantees to reduce risk for other investors and creditors. IFIs can also offer technical support to ensure projects align with climate goals and sustainable water management principles. IFIs play a crucial role in supporting debt-for-climate swaps by providing financial resources, technical expertise, and policy guidance. They can help mobilize additional financing for wastewater projects, facilitate knowledge exchange and capacity building, and ensure projects adhere to international best practices and standards.

6. Implementation and Monitoring: Implement the wastewater projects post-swap agreement, with continuous monitoring and evaluation to ensure they achieve intended environmental and economic benefits. Implementation involves overseeing the construction, operation, and maintenance of the wastewater projects in accordance with the terms of the swap agreement. This includes establishing project management structures, procuring necessary resources and materials, and engaging local stakeholders in project activities. Monitoring and evaluation are essential components of the implementation process, allowing stakeholders to track progress, identify challenges, and make necessary adjustments to ensure project success. Monitoring should include regular assessments of project performance, environmental impact, and financial management, with results reported transparently to stakeholders.

7. Community Engagement and Capacity Building: Engage local communities in project implementation through educational programs and capacity-building initiatives. This ensures sustainable management and operation of wastewater systems and fosters community ownership. Community engagement is critical for the success of wastewater projects, as it helps build trust, promote participation, and ensure projects meet the needs and priorities of local stakeholders. Capacity building initiatives should focus on enhancing local skills and knowledge in wastewater management, operation, and maintenance, empowering communities to take ownership of their water resources.

8. Reporting and Compliance: Establish a framework for regular reporting and compliance checks to ensure projects meet goals and that debt relief contributes effectively to sustainable water resource management. Reporting and compliance mechanisms should be transparent, accountable, and participatory, allowing stakeholders to access information and provide feedback on project activities. Compliance checks should ensure projects adhere to environmental, social, and financial standards, with corrective actions taken as needed to address any deviations.

In conclusion, integrating climate finance into the structure of debt-for-climate swaps for wastewater projects enhances their impact and sustainability, aligning financial mechanisms with climate goals and global development agendas. Through a systematic approach that involves stakeholder engagement, project assessment, debt appraisal, and monitoring, countries can effectively address water scarcity, promote sustainable wastewater management, and advance climate resilience, contributing to both economic development and environmental sustainability.

Potential Role of Climate Finance

Climate finance plays a crucial role in facilitating debt-for-climate swaps, offering a range of services that strengthen the effectiveness and impact of these financial mechanisms. Here are several key roles climate finance can fulfill in the context of debt swaps:

Financial Facilitator and Guarantor: Climate finance acts as a pivotal financial facilitator by providing partial funding or guarantees for debt-for-climate swaps. This involvement mitigates risk for other investors and creditors, enhancing the attractiveness of the swaps. By backing these initiatives, climate finance assists Least Developed Countries (LDCs) and Small Island Developing States (SIDs) in securing more favorable terms in swap agreements, ensuring that a significant portion of their debt is directed towards impactful wastewater projects.

Technical Advisor and Capacity Builder: Climate finance offers invaluable technical expertise in assessing the feasibility and potential impact of wastewater reuse projects. It assists in project evaluation to ensure proposed initiatives are environmentally sustainable and economically viable. Additionally, climate finance aids LDCs and SIDs in building the necessary technical and administrative capacity to implement, manage, and monitor these projects effectively, thereby strengthening their ability to achieve sustainable development objectives.

Negotiation Facilitator: Climate finance plays a crucial role in facilitating negotiations between debtor nations, creditors, and other stakeholders involved in debt-for-climate swaps. Acting as a mediator, the Fund helps balance the interests of all parties, ensuring that swap arrangements are equitable and aligned with broader goals of environmental sustainability and climate resilience.

Policy and Strategy Developer: Climate finance contributes to the development of policies and strategies that align wastewater reuse projects with national priorities and international climate goals. This includes integrating projects into national climate action plans and sustainable development agendas, thereby advancing objectives outlined in the Paris Agreement and the Sustainable Development Goals (SDGs).

Monitoring and Evaluation Partner: Post-implementation, climate finance plays a critical role in monitoring and evaluating project performance. Establishing frameworks for tracking project outcomes and assessing impact on climate resilience, public health, and environmental protection ensures that projects meet intended goals and contribute to sustainable water management.

Advocate for Innovative Financing: Climate finance advocates for innovative financing mechanisms such as debt-for-climate swaps at international forums. By raising awareness and promoting successful models, climate finance encourages countries and financial institutions to consider these mechanisms for funding climate resilience projects.

Catalyst for Private Sector Involvement: Leveraging funding and influence, climate finance catalyzes private sector involvement in wastewater projects. By attracting private investments, climate finance enhances project scale and impact, contributing to sustainable development goals and fostering collaboration between public and private sectors in addressing environmental challenges.

Model of Engagement of Climate Finance

Climate finance institutions play a crucial role in supporting the structuring and implementation of debt-for-climate swaps and wastewater projects, ensuring their viability, effectiveness, and sustainability. This model of engagement encompasses various components aimed at aligning environmental objectives with economic considerations, building capacity, and ensuring robust monitoring and evaluation mechanisms.

1. Structuring and Agreement Design

Climate finance institutions support the initial design and structuring of debt-for-climate swaps, aligning environmental objectives with economic considerations to ensure that agreements are viable and effective. They offer unique financial mechanisms, such as grants or concessional loans, to make swaps more attractive and feasible for all parties involved. Additionally, these institutions provide implementation support by offering necessary funds and resources to ensure that projects start on time and are executed efficiently. Result-based payment schemes are introduced during the evaluation phase, linking financial incentives to the achievement of specific environmental goals set in the swap agreements.

2. Capacity Building and Technical Assistance

Empowering Small Island Developing States (SIDS) to manage complex financial arrangements effectively is crucial for the success of debt-for-climate swaps. Climate finance institutions provide enhanced capacity-building initiatives, including government and local stakeholder training, equipping them with the necessary skills for financial negotiations and project management. Customized technical assistance is also provided to design and implement environmental projects financed through swaps. This assistance includes support for feasibility studies and engineering designs to ensure projects are environmentally, technically, and economically viable, aligned with best practices, and effectively planned and executed while meeting global environmental standards.

3. Monitoring and Evaluation

Climate finance institutions play a vital role in ensuring that projects meet their intended environmental and economic objectives through robust monitoring and evaluation mechanisms. They evaluate goal achievement, track progress to understand the effectiveness of swaps, and facilitate necessary adjustments. Impact analysis is conducted to gauge real-world effects on environmental conservation and climate action. Proper fund utilization is ensured to prevent misuse or misallocation of funds. Regular reporting and audits are conducted to maintain transparency and accountability, building trust among stakeholders. Moreover, result-based payment components are implemented to enhance the efficacy and accountability of projects, incentivizing the achievement of environmental goals.

By integrating these components into their engagement model, climate finance institutions contribute significantly to the success and sustainability of debt-for-climate swaps and wastewater projects, fostering resilience and promoting environmental stewardship in vulnerable regions.

Role of Key Stakeholders

Government and Policymakers

Government and policymakers play a central role in orchestrating debt-for-climate swaps and are involved at every stage of the process, from negotiation to implementation.

Negotiation: Governments negotiate the terms of these swaps, balancing debt relief with commitments to environmental projects. They ensure that agreements align with national priorities and sustainable development goals.

Implementation: Post-negotiation, governments are responsible for implementing the projects and ensuring regulatory compliance. This involves adhering to both national laws and the agreed-upon terms of the swaps to guarantee effective project execution.

Policy Making: Governments craft policies and regulations that facilitate and support the efficient execution of debt-for-climate swaps. This includes creating favorable legal environments, establishing frameworks for transparency and accountability, and ensuring that the swaps are integrated into broader national environmental and economic plans.

Private Sector

The private sector, particularly financial institutions, environmental organizations, and technology providers, plays crucial roles in debt-for-climate swaps:

Financial Institutions: Financial institutions bring critical funding and investment expertise to the table. They structure swaps in a way that is financially viable and attractive to all parties involved, ensuring that projects are adequately funded and implemented.

Environmental Organizations: Environmental organizations offer crucial insights into sustainable project design and implementation. They provide expertise on environmental best practices, ensuring that projects align with climate objectives and effectively mitigate environmental risks.

Technology Providers: Technology providers contribute innovative solutions to debt-for-climate swaps. They offer advanced tools and systems for project execution and monitoring, ensuring that the latest and most effective technologies are employed to maximize project impact and sustainability.

Community Engagement

Community engagement is essential for the success of debt-for-climate swaps:

Consultation: Engaging with local communities allows stakeholders to understand community perspectives, needs, and aspirations. This ensures that projects are shaped in the most relevant and beneficial ways to the local population, increasing community ownership and support.

Planning and Implementation: Community engagement leverages local knowledge and skills, enhancing the project's effectiveness and cultural appropriateness. By involving communities in project planning and implementation, stakeholders can tailor interventions to meet local needs and preferences.

Transparency and Accountability: Ensuring transparency and accountability in project execution is vital for building trust and support within communities. Transparent communication about project activities, progress, and outcomes fosters accountability and encourages community participation in project oversight and decision-making processes.

Debt for climate swap implementation:

Climate finance entry points:

Climate finance serves as a crucial enabler for the successful implementation of debt-for-climate swaps, offering various entry points and types of support to enhance environmental sustainability and economic resilience.

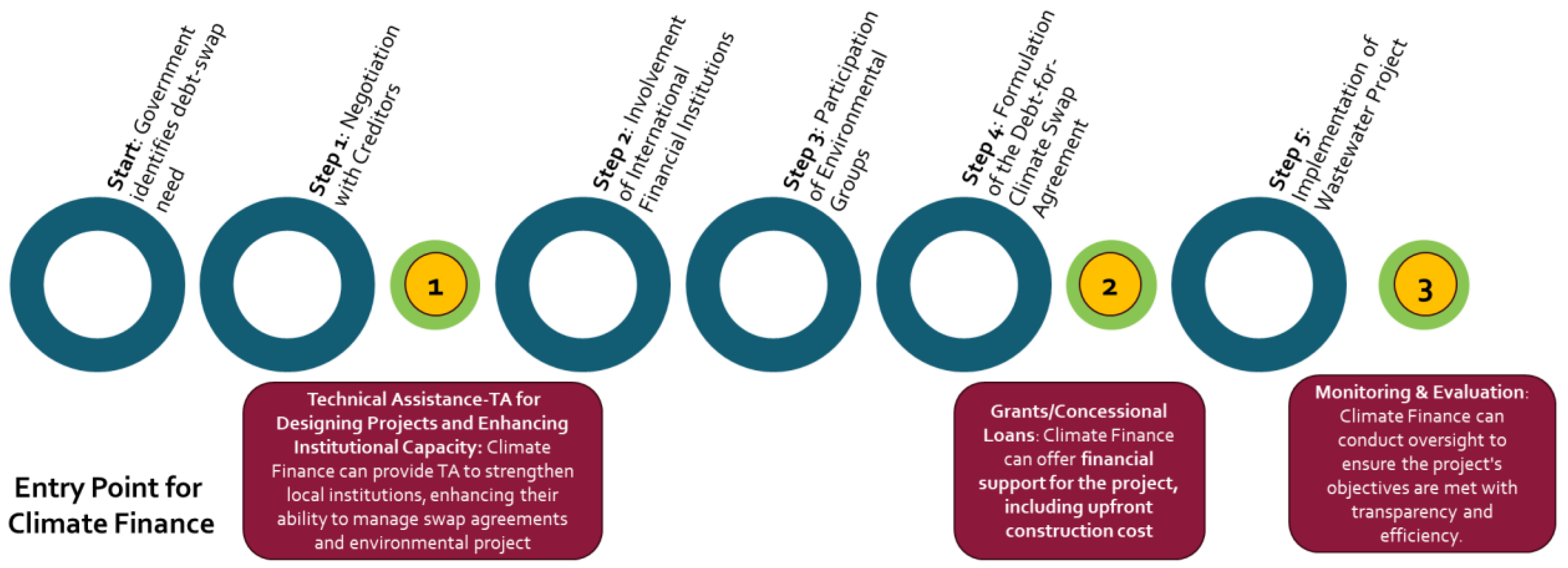

Figure 3 outlines key entry points for climate finance and the corresponding types of support provided.

Technical Assistance for Designing Projects and Enhancing Institutional Capacity: Climate finance entities, play a pivotal role in providing technical assistance (TA) to support the design and implementation of environmental projects financed through debt-for-climate swaps. This includes strengthening the capacity of local institutions involved in managing swap agreements and overseeing project execution. Through tailored capacity-building initiatives, climate finance entities empower governments and local stakeholders with the necessary skills and knowledge to effectively negotiate swap terms, select appropriate projects, and ensure their successful implementation. By enhancing institutional capacity, climate finance contributes to the long-term sustainability and impact of swap initiatives, fostering local ownership and expertise in environmental management.

Grants/Concessional Loans: In addition to technical assistance, climate finance offers financial support in the form of grants or concessional loans to fund environmental projects associated with debt-for-climate swaps. This financial assistance covers various aspects of project implementation, including upfront construction costs, equipment procurement, and operational expenses. By providing upfront funding, climate finance entities help alleviate the financial burdens associated with swap agreements, making environmental projects more feasible and attractive for all parties involved. Moreover, grants and concessional loans ensure that projects can proceed without imposing excessive debt burdens on participating countries, promoting sustainable development and poverty reduction in debt-distressed regions.

Monitoring & Evaluation: Climate finance entities play a crucial role in monitoring and evaluating the progress and impact of projects financed through debt-for-climate swaps. Through rigorous oversight mechanisms, such as regular site visits, progress reports, and performance evaluations, climate finance entities ensure that project objectives are met with transparency and efficiency. Monitoring and evaluation activities enable stakeholders to track the effectiveness of swap agreements, identify potential challenges or bottlenecks, and make informed decisions to optimize project outcomes. By promoting accountability and transparency, monitoring and evaluation efforts enhance the credibility and effectiveness of debt-for-climate swap initiatives, building trust among stakeholders and maximizing the impact of climate finance investments.

In conclusion, climate finance serves as a critical catalyst for driving environmental sustainability and economic resilience through debt-for-climate swaps. By providing technical assistance, grants/concessional loans, and monitoring & evaluation support, climate finance entities enable governments and local stakeholders to effectively design, implement, and oversee environmental projects associated with swap agreements. Moving forward, continued collaboration and innovation in climate finance are essential to further enhance the effectiveness and scalability of debt-for-climate swap initiatives, ensuring their alignment with global sustainability goals and maximizing their impact on vulnerable communities and ecosystems.

Legal and policy aspects to support implementation

The successful implementation of debt-for-climate swaps requires a robust legal and policy framework tailored to the unique challenges faced by different regions. These policies must effectively address the dual pressures of high debt and environmental degradation, providing a pathway to redirect financial resources towards sustainable environmental initiatives. By harmonizing debt relief efforts with crucial climate action, these policies not only alleviate financial burdens but also promote ecological stewardship, creating synergy between economic resilience and environmental sustainability.

Establishing Legal Frameworks

Creating effective legal frameworks for debt-for-climate swaps is a complex yet essential task. These frameworks must be comprehensive, enforceable, adaptable, and integrated with existing national environmental legislation and fiscal policies. Key aspects of these frameworks include:

Defining Clear Legal Pathways for Debt Restructuring: This involves establishing clear procedures for debt restructuring negotiations between debtor nations and creditors, ensuring transparency and fairness in the process.

Specifying Conditions for Environmental Project Selection and Funding: Legal frameworks should outline criteria for selecting and funding environmental projects, considering their relevance to national fiscal outlooks and global conservation goals.

Setting Up Mechanisms for Monitoring and Evaluation: Establishing mechanisms for ongoing monitoring and evaluation ensures transparency and accountability in project implementation. These mechanisms should adhere to United Nations rules and regulations, fostering trust among stakeholders.

Legal provisions should ensure enforceability and accountability, outlining recourse in cases of non-compliance or dispute resolution. Integrating these frameworks with existing national environmental legislation and fiscal policies is crucial to ensure alignment with broader sustainability goals and economic plans. Flexibility is also essential, allowing for adjustments in response to evolving environmental priorities and economic circumstances.

Policy Integration of Debt-for-Climate Swaps

Integrating debt-for-climate swaps into broader national policies is vital for ensuring holistic contributions to a country’s development goals. This integration involves:

Aligning Swaps with Environmental Protection Policies: By aligning swaps with environmental protection policies, countries can advance conservation and sustainability objectives, enhancing environmental resilience.

Incorporating Swaps into Economic Development Strategies: Integrating swaps into economic development strategies ensures that financial relief and investments support broader economic goals, such as infrastructure development and sustainable industry practices.

Integrating Swaps into Climate Change Adaptation Plans: Integrating swaps into climate change adaptation plans ensures that funded projects directly address pressing climate-related challenges, such as sea-level rise and extreme weather events.

This comprehensive policy integration ensures that debt-for-climate swaps are not standalone initiatives but integral components of national efforts towards sustainable and resilient development.

Setting Standards and Criteria

Establishing clear standards and criteria is fundamental for selecting, monitoring, and evaluating projects financed through debt-for-climate swaps. These criteria ensure alignment with environmental and climate objectives and adherence to global sustainability frameworks. Key criteria include:

Environmental and Climate Impact: Projects should yield a substantial positive impact on the environment and contribute to climate change mitigation and adaptation, aligning with the climate finance’s focus areas.

Feasibility and Bankability: Projects must be practical to implement and financially viable, ensuring they are bankable and capable of attracting necessary funding.

Cost-effectiveness and Affordability: Projects should offer significant environmental benefits relative to their cost and be affordable for end users.

Alignment with National and Global Sustainability Goals: Projects should align with the country’s sustainability goals and broader frameworks such as Environmental, Social, and Governance (ESG) principles, the Sustainable Development Goals (SDGs), and the Paris Agreement.

Social Considerations: Projects should positively impact local communities, incorporating social aspects like community engagement, equity, and inclusivity.

Adherence to these rigorous standards and criteria ensures that debt-for-climate swaps effectively contribute to a country’s environmental goals, aligning national efforts with global climate commitments including NAPS and NDCs. Regular monitoring and evaluation are crucial to assess project effectiveness and ensure transparency and accountability in implementation. Through diligent adherence to these standards, debt-for-climate swaps can serve as powerful mechanisms for advancing environmental sustainability and resilience while fostering social and economic development.

8. Conclusion and Key Messages

In conclusion, the integration of debt-for-climate swaps in upscaling transformative wastewater projects presents a transformative opportunity to simultaneously address the escalating financial burdens and pressing environmental challenges in developing countries, particularly Small Island Developing States (SIDS) and Least Developed Countries (LDCs). This approach, as exemplified by the Santiago Biogas Project, not only unlocks lucrative market opportunities but also fosters sustainable development and supports a circular economy through innovative resource management.

The successful implementation of these swaps hinges on the establishment of robust legal frameworks, effective policy alignment, and stringent standards and criteria. These elements are foundational, ensuring that debt restructuring is financially viable and aligns with critical environmental and climate objectives. Additionally, this paper has demonstrated that the strategic deployment of debt-for-climate swaps, through rigorous stakeholder collaboration, transforms national liabilities into valuable assets that advance sustainable development goals.

The active involvement of diverse stakeholders is paramount to the success of these initiatives. Governments and policymakers play a crucial role in skillfully negotiating and implementing swap terms, integrating these into national development strategies. The private sector's contribution is equally indispensable, providing financial expertise, technological innovation, and environmental insights. Furthermore, community engagement is critical for the success and sustainability of projects, ensuring they are aligned with local needs and perspectives.

Climate finance emerges as a linchpin in the success of debt-for-climate swaps, serving multiple pivotal roles throughout the process. Firstly, as a financial facilitator and guarantor, climate finance entities offer unique financial solutions such as grants or concessional loans to make swaps more attractive and feasible for all parties involved. By reducing perceived risks, climate finance entities enhance the attractiveness of swaps, encouraging greater participation from both public and private sectors. Moreover, their involvement ensures that swaps are structured in a way that aligns with global sustainability objectives and meets stringent environmental and climate standards.

Secondly, climate finance entities serve as technical advisors and capacity builders, leveraging their expertise to assess the feasibility and potential impact of wastewater reuse projects. Through tailored technical assistance, they empower LDCs and SIDS to effectively design, implement, and monitor these projects, ensuring they are both environmentally sustainable and economically viable. By building local capacity, climate finance entities contribute to the long-term success and sustainability of swap initiatives, fostering local ownership and expertise.

Thirdly, climate finance entities play a crucial role in facilitating negotiations between debtor nations, creditors, and other stakeholders. By acting as mediators, they help balance the interests of all parties, ensuring that swap agreements are equitable and aligned with broader goals of environmental sustainability and climate resilience. Their involvement fosters trust and cooperation among stakeholders, essential for the successful implementation of swap initiatives.

Moving forward, there is a need for continued collaboration and innovation to further enhance the effectiveness and scalability of debt-for-climate swaps in addressing the dual challenges of high debt burdens and climate change vulnerability. Future research could focus on refining criteria for project selection, enhancing monitoring and evaluation mechanisms, and exploring new sources of financing to complement debt relief efforts. Additionally, efforts to strengthen the integration of swaps into national policy frameworks and align them with broader sustainability goals will be crucial for maximizing their impact and ensuring long-term sustainability.

In summary, debt-for-climate swaps with climate finance represent a strategic approach to tackling the dual challenges of high debt burdens and climate change vulnerability in LDCs and SIDS. With comprehensive planning, collaboration among stakeholders, and alignment with global sustainability goals, these swaps have the potential to significantly enhance environmental resilience and economic stability in developing countries, paving the way for a more sustainable and prosperous future for all.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).