Submitted:

22 April 2024

Posted:

22 April 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Literature Review and Hypothesis Development

2.1. Financial Reporting Fraud and Investment Decision-making

2.2. Collusive Fraud and Investment Decision-making

3. Sample Selection and Research Design

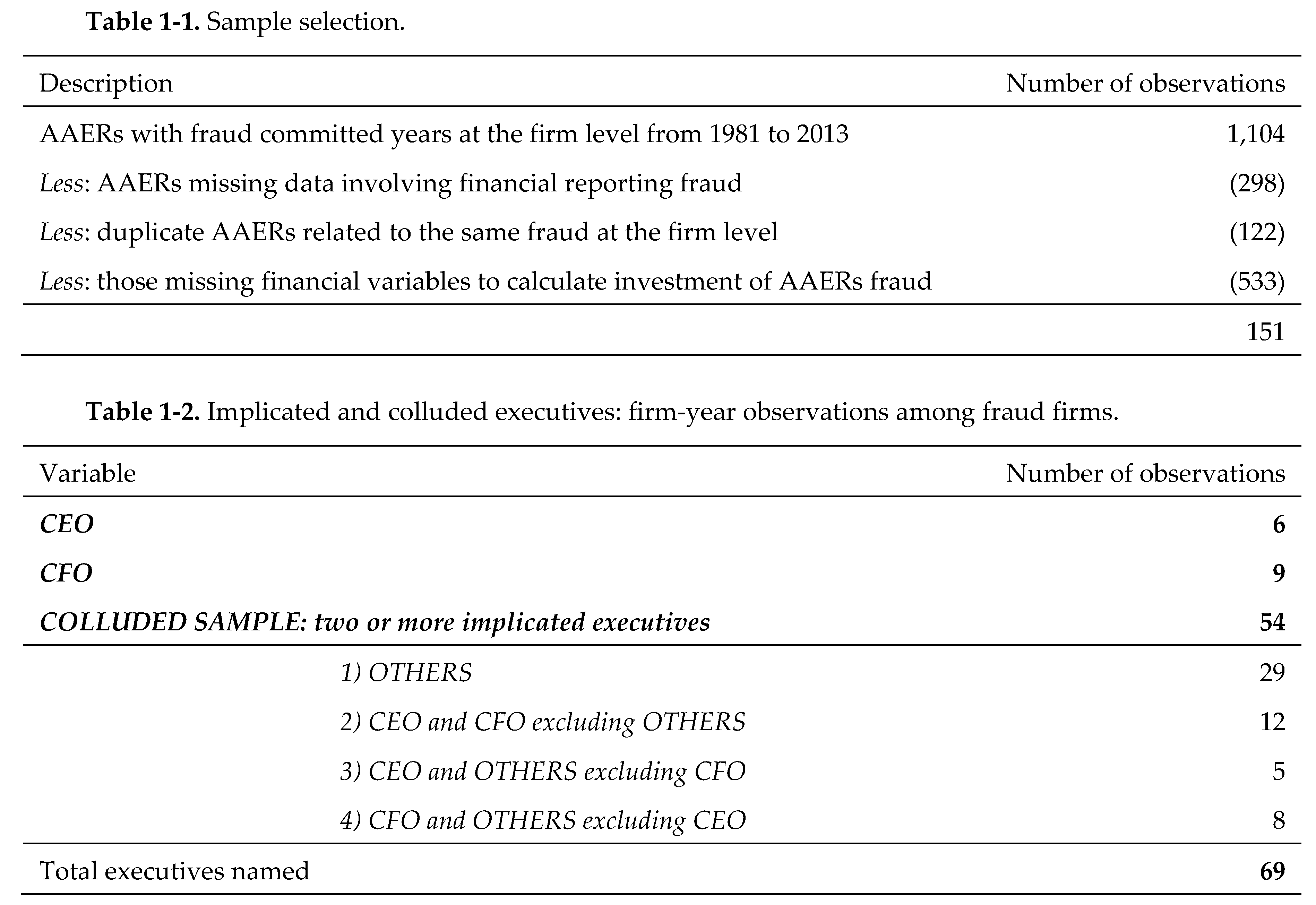

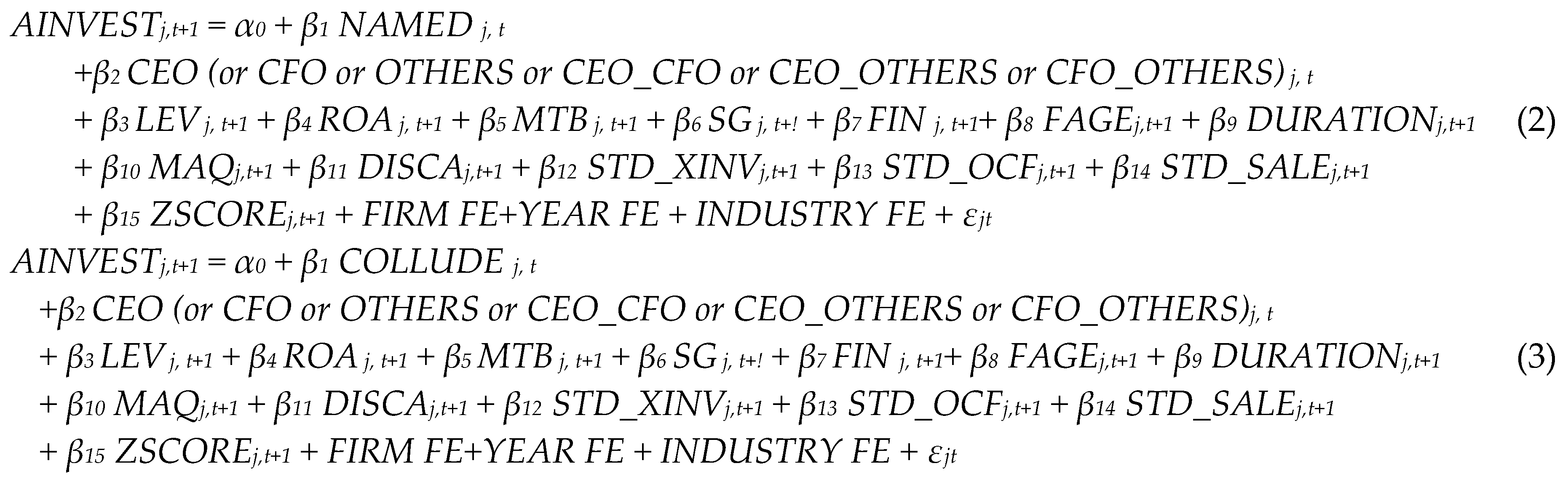

3.1. Sample Selection

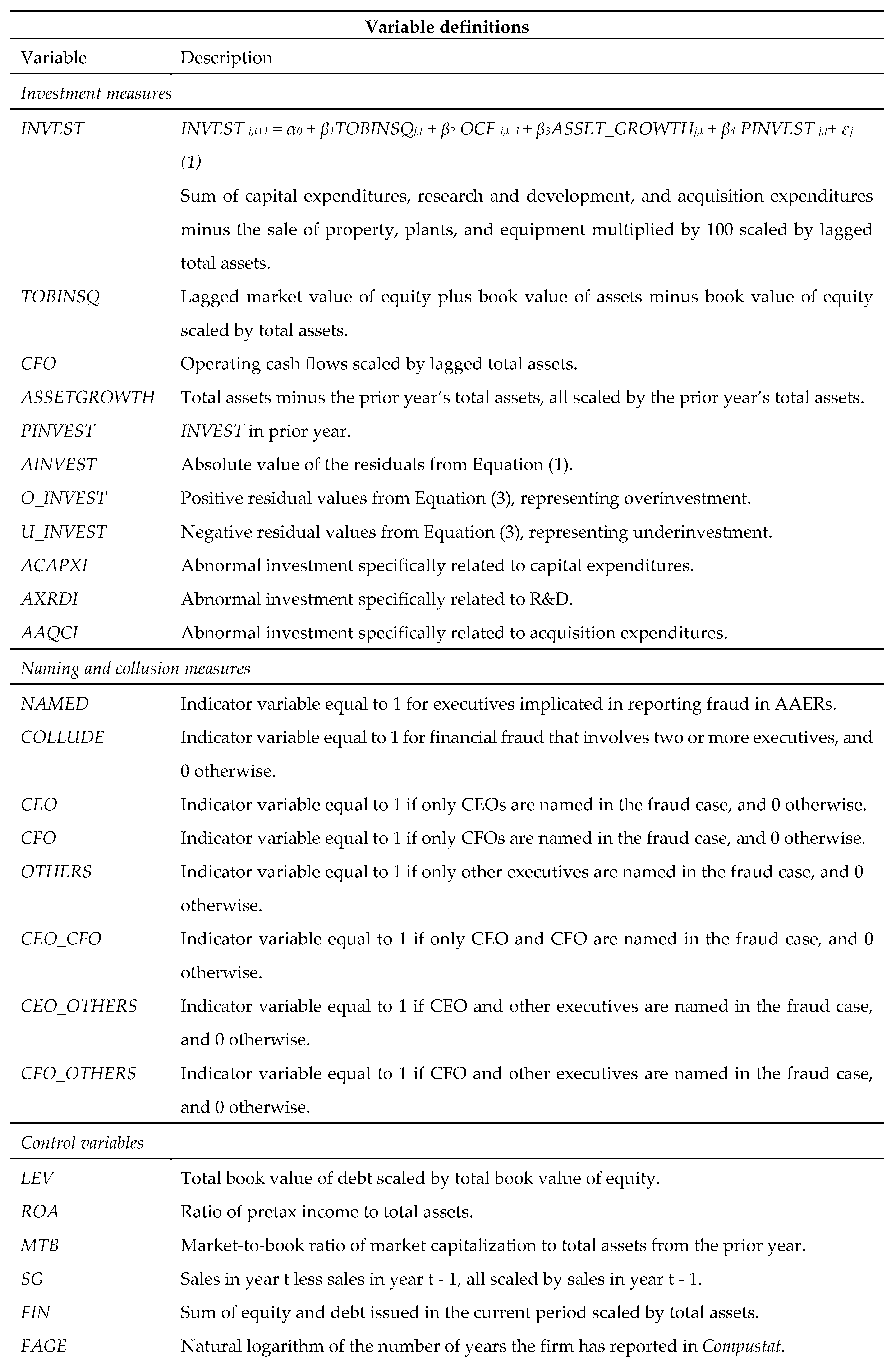

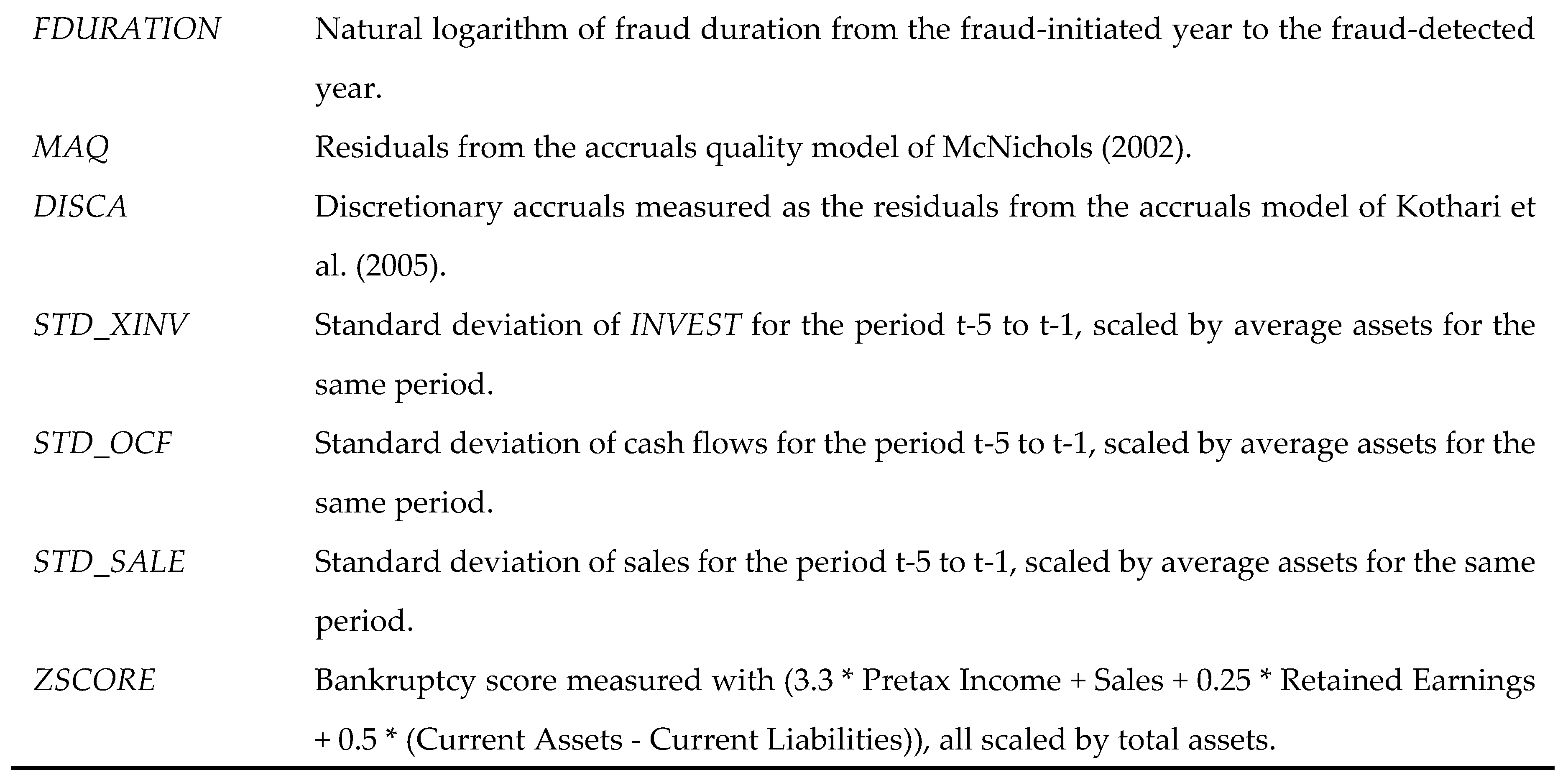

3.2. Abnormal Investment Measure

3.3. Firm-clustered Regression Model

where

where4. Empirical Results

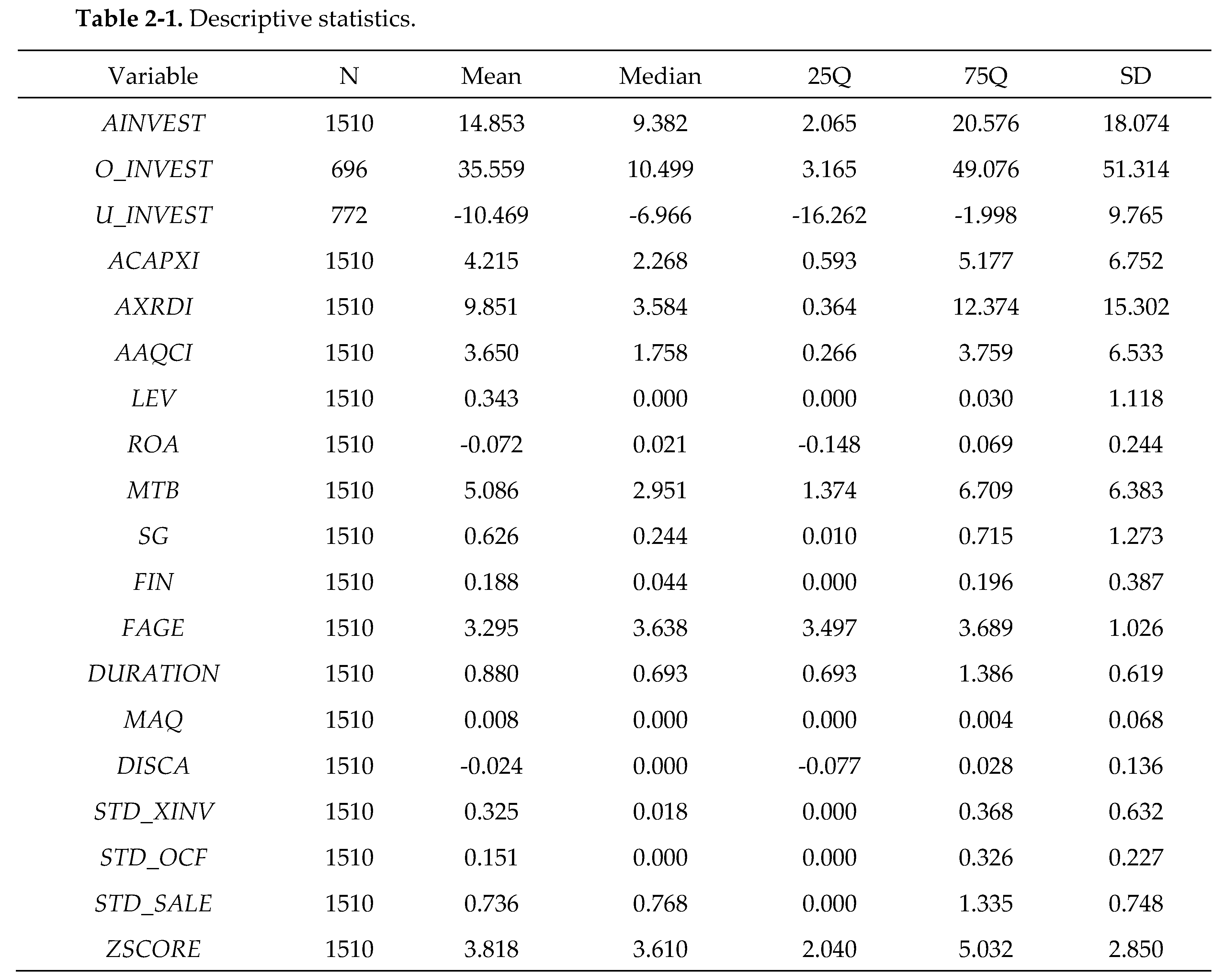

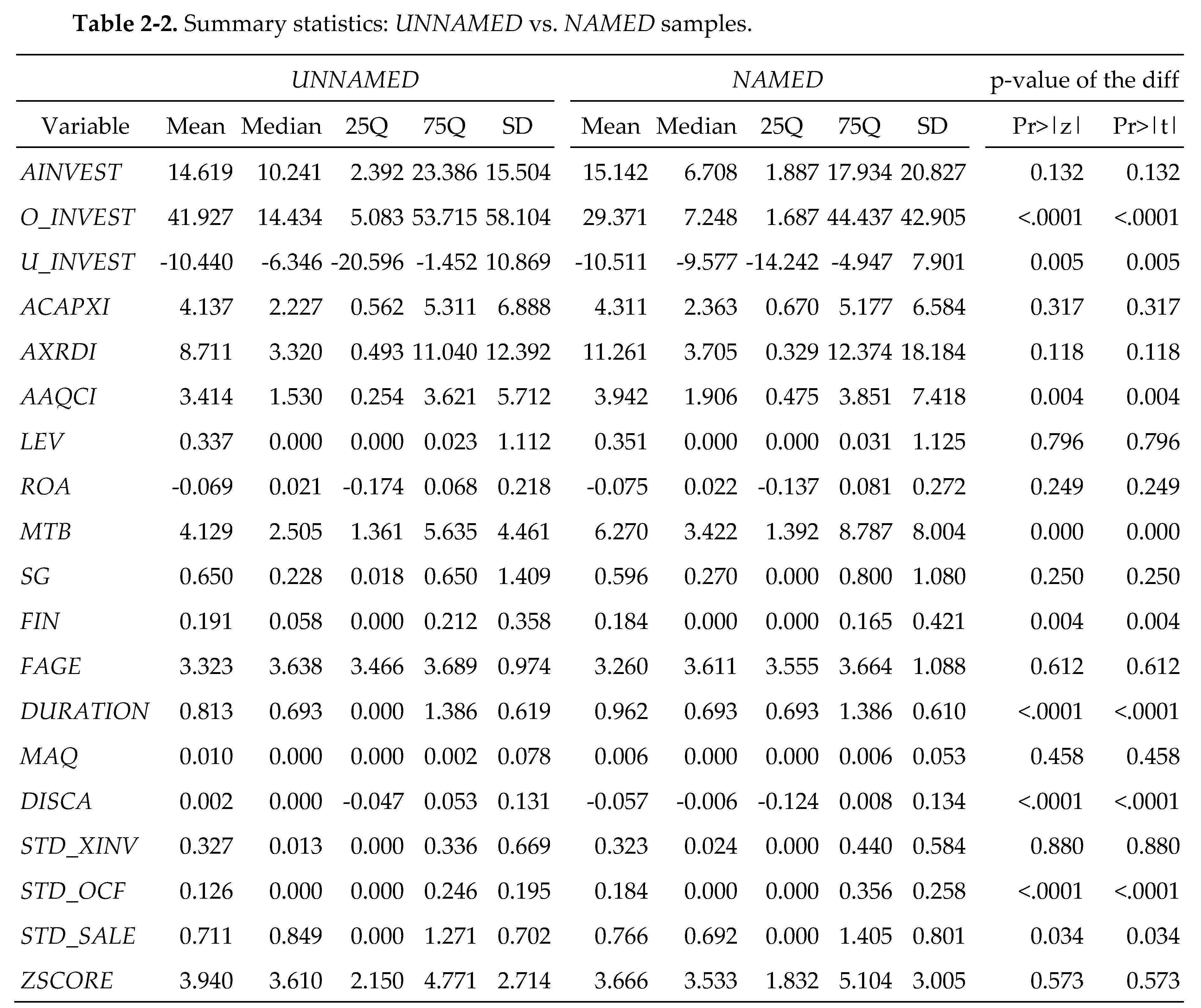

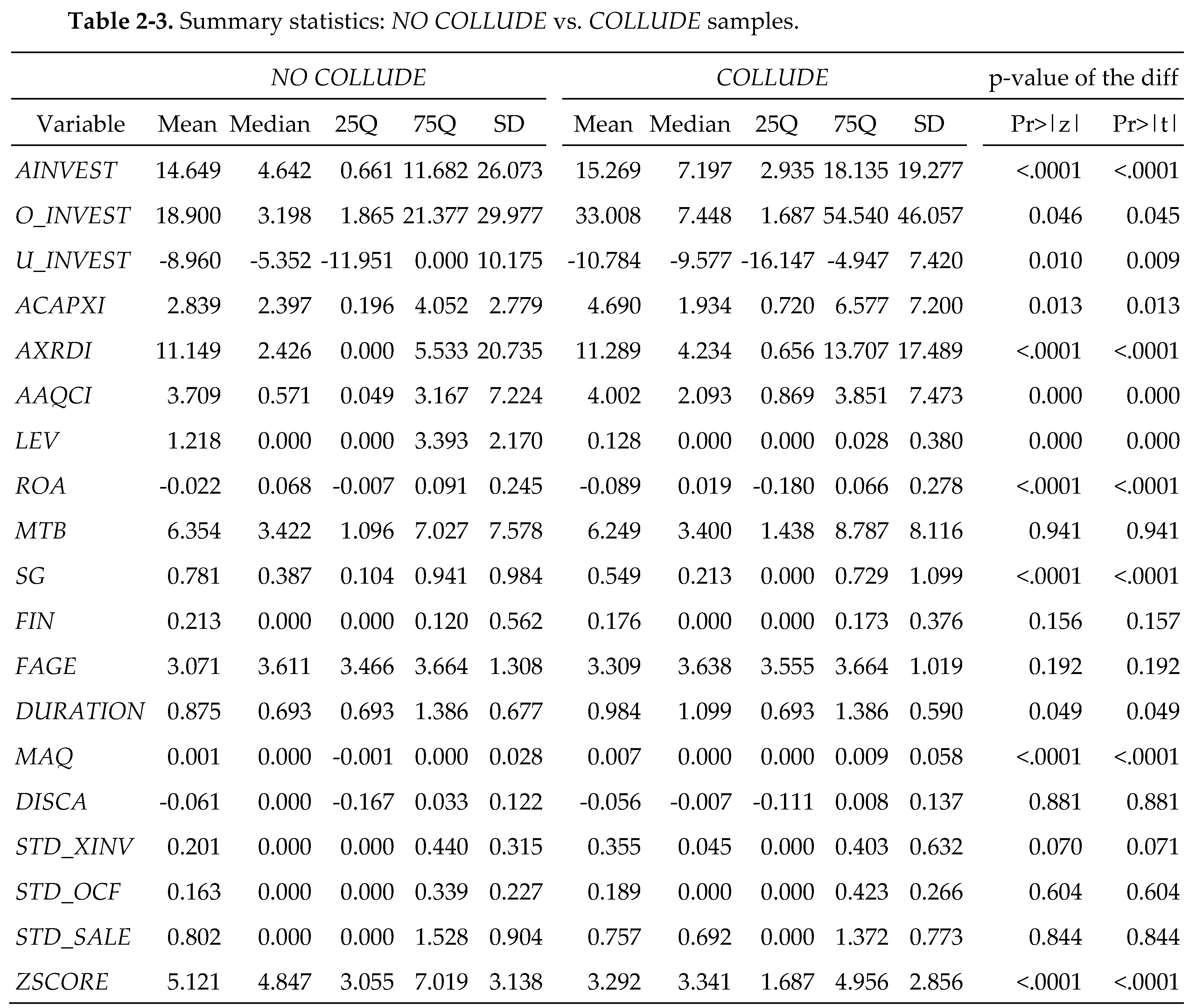

4.1. Descriptive Statistics

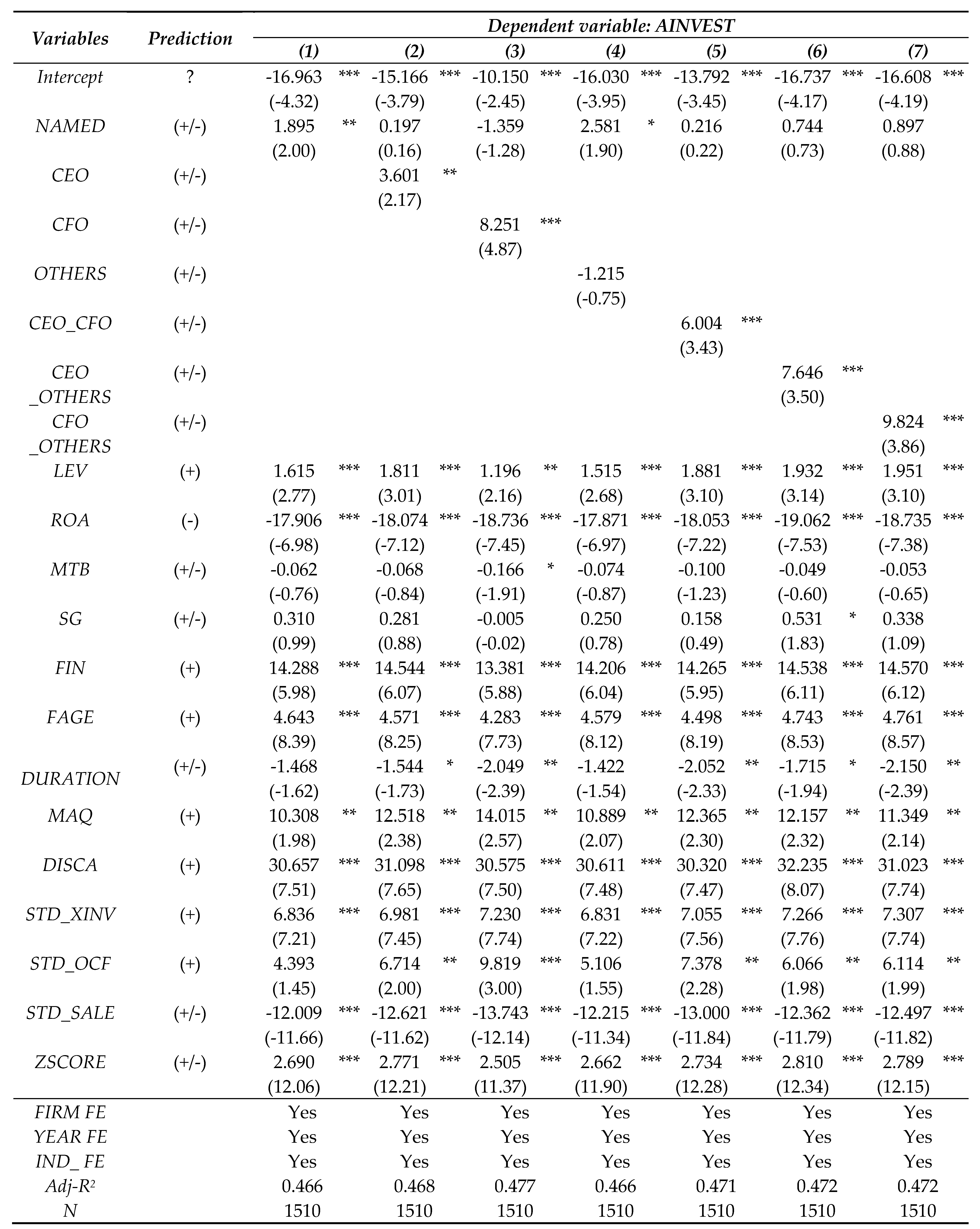

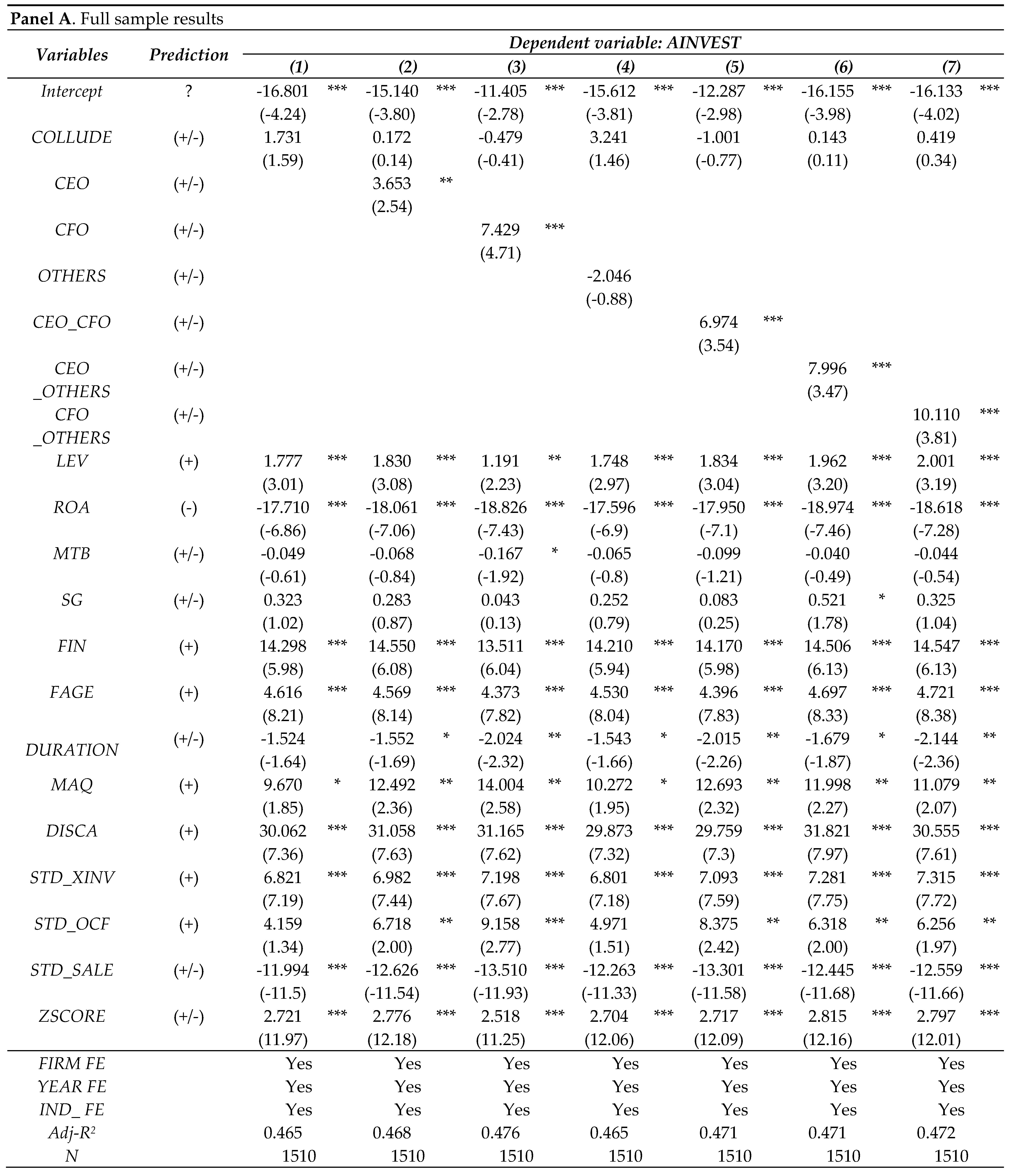

4.2. Main Analysis

5. Results of Additional Analyses

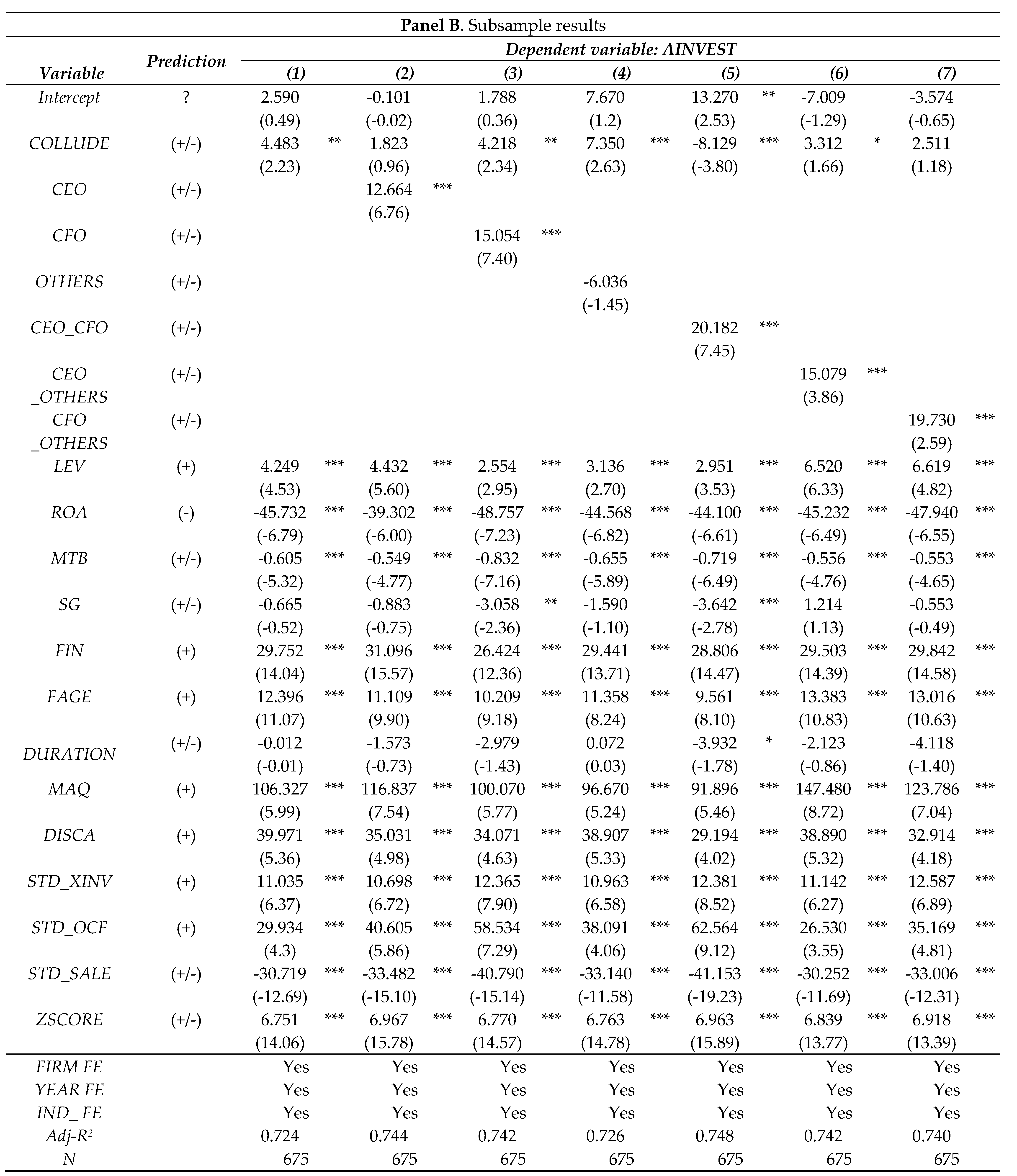

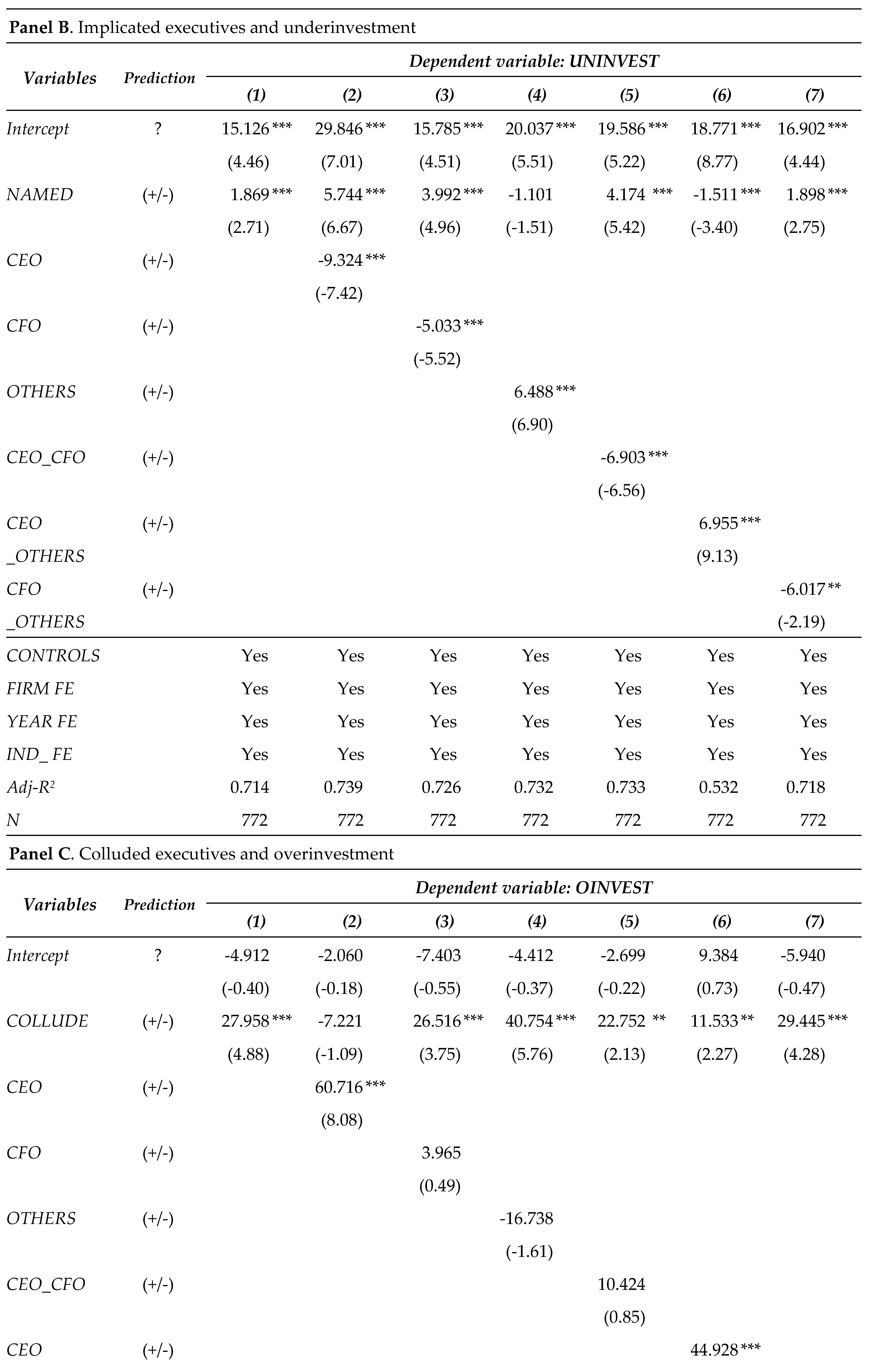

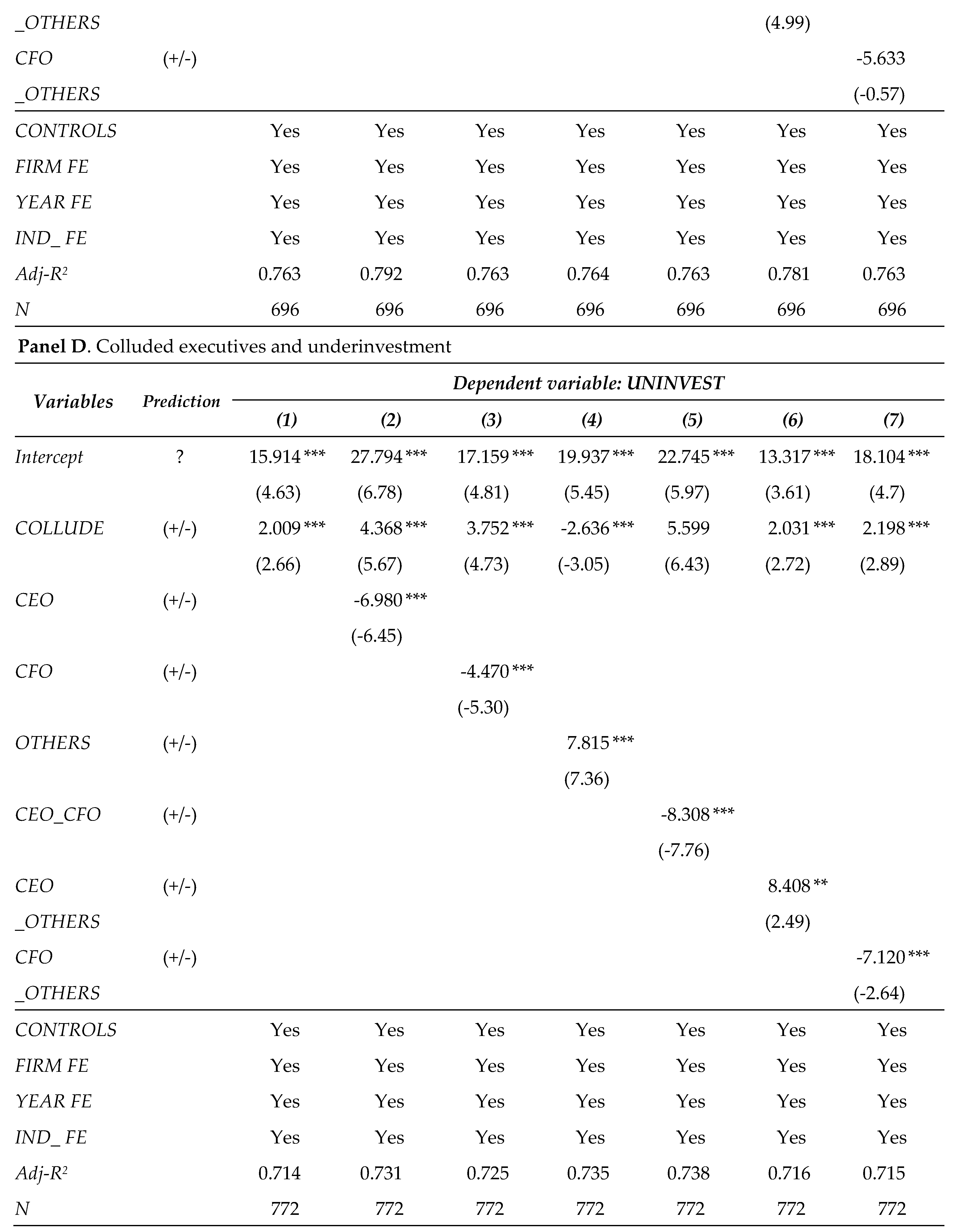

5.1. Additional Analysis 1: Overinvestment vs. Underinvestment

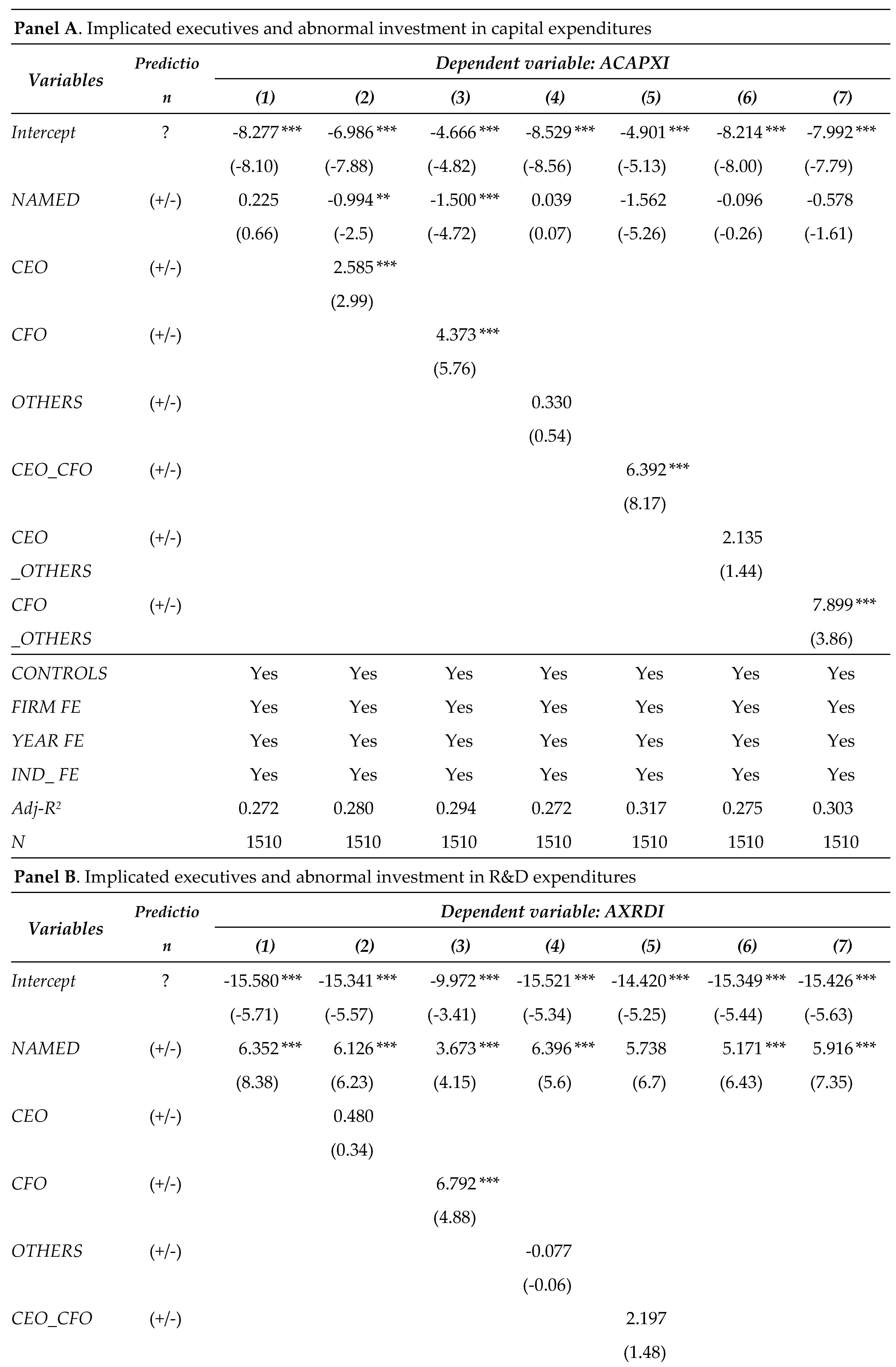

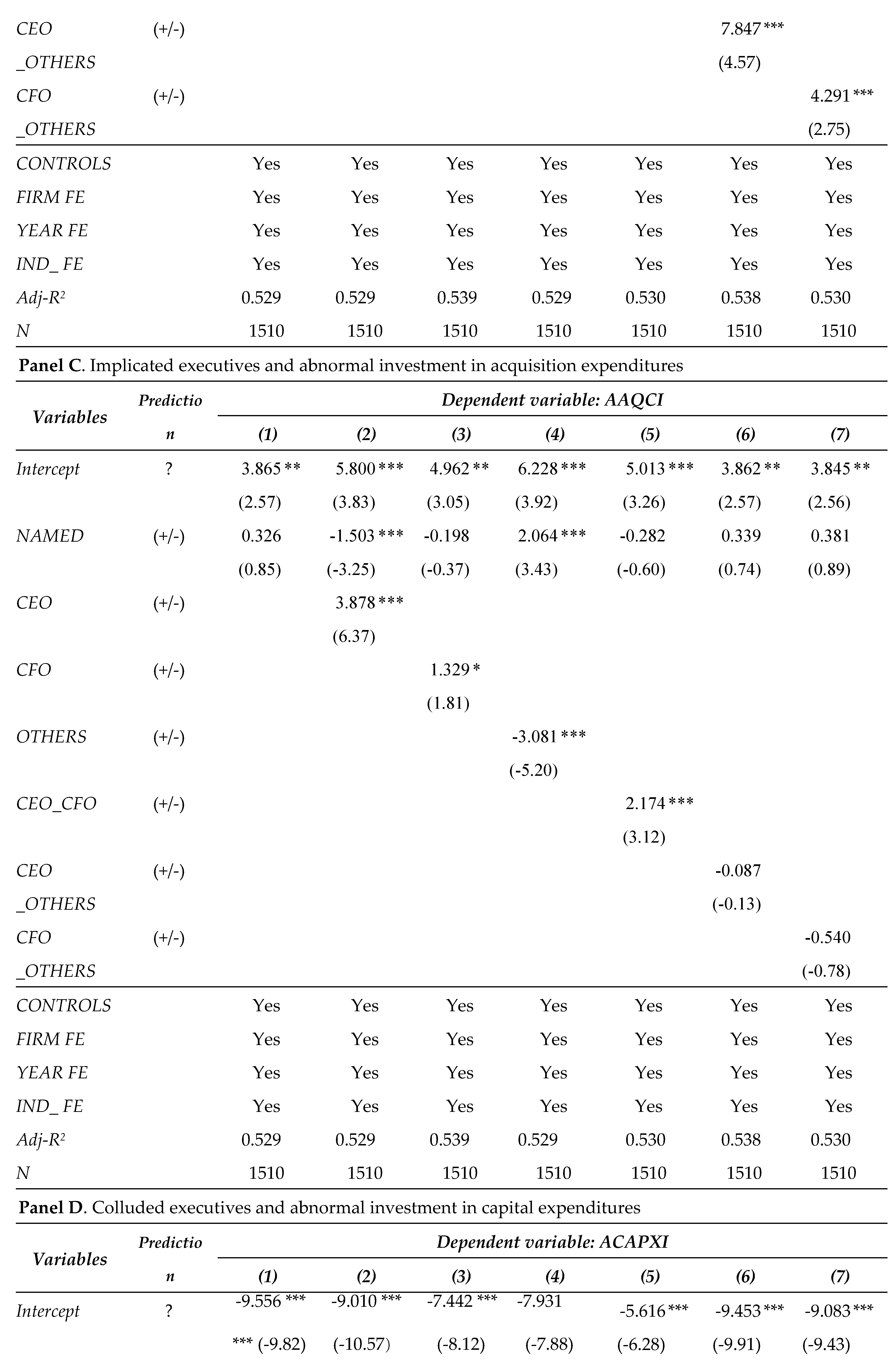

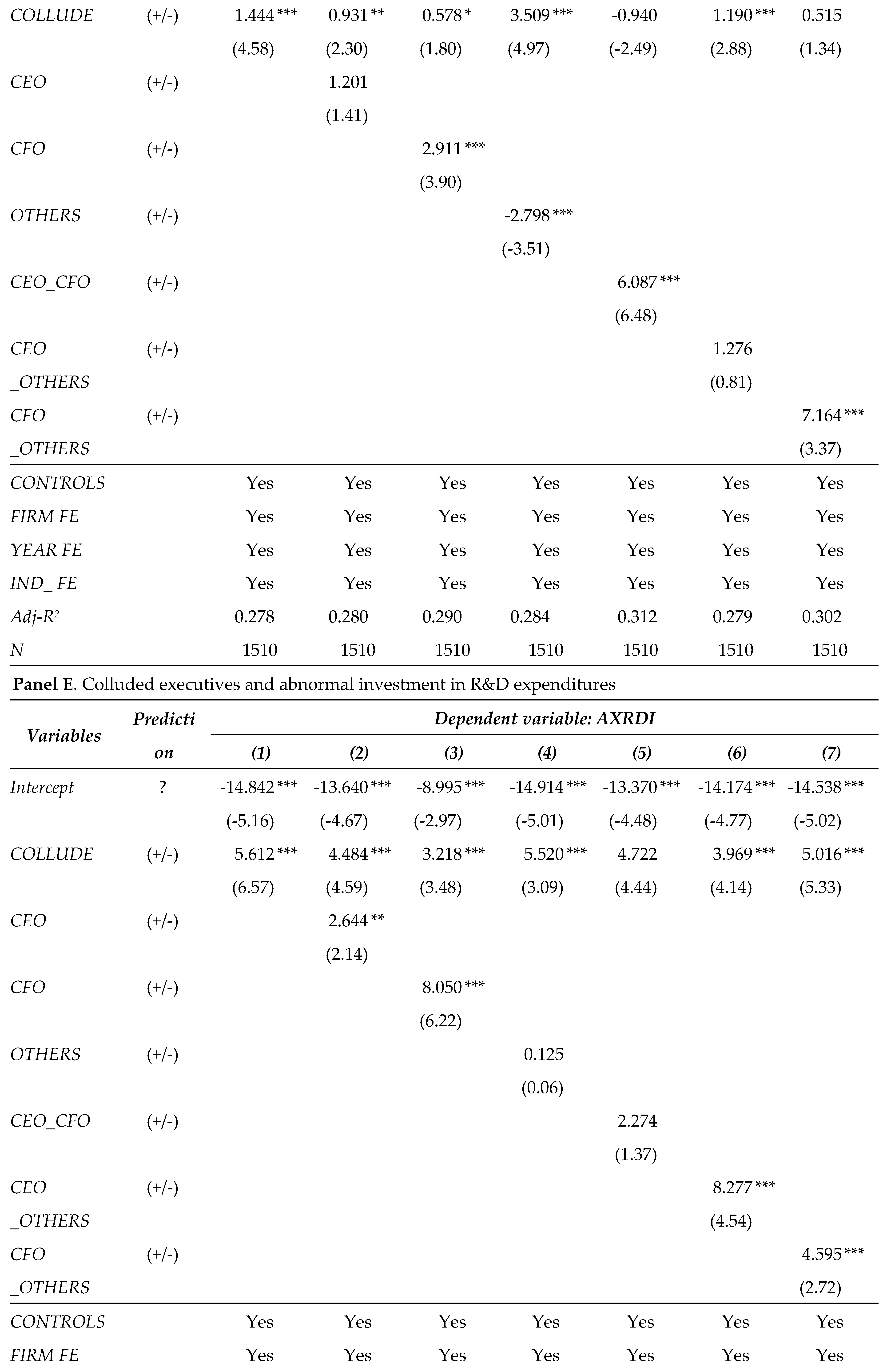

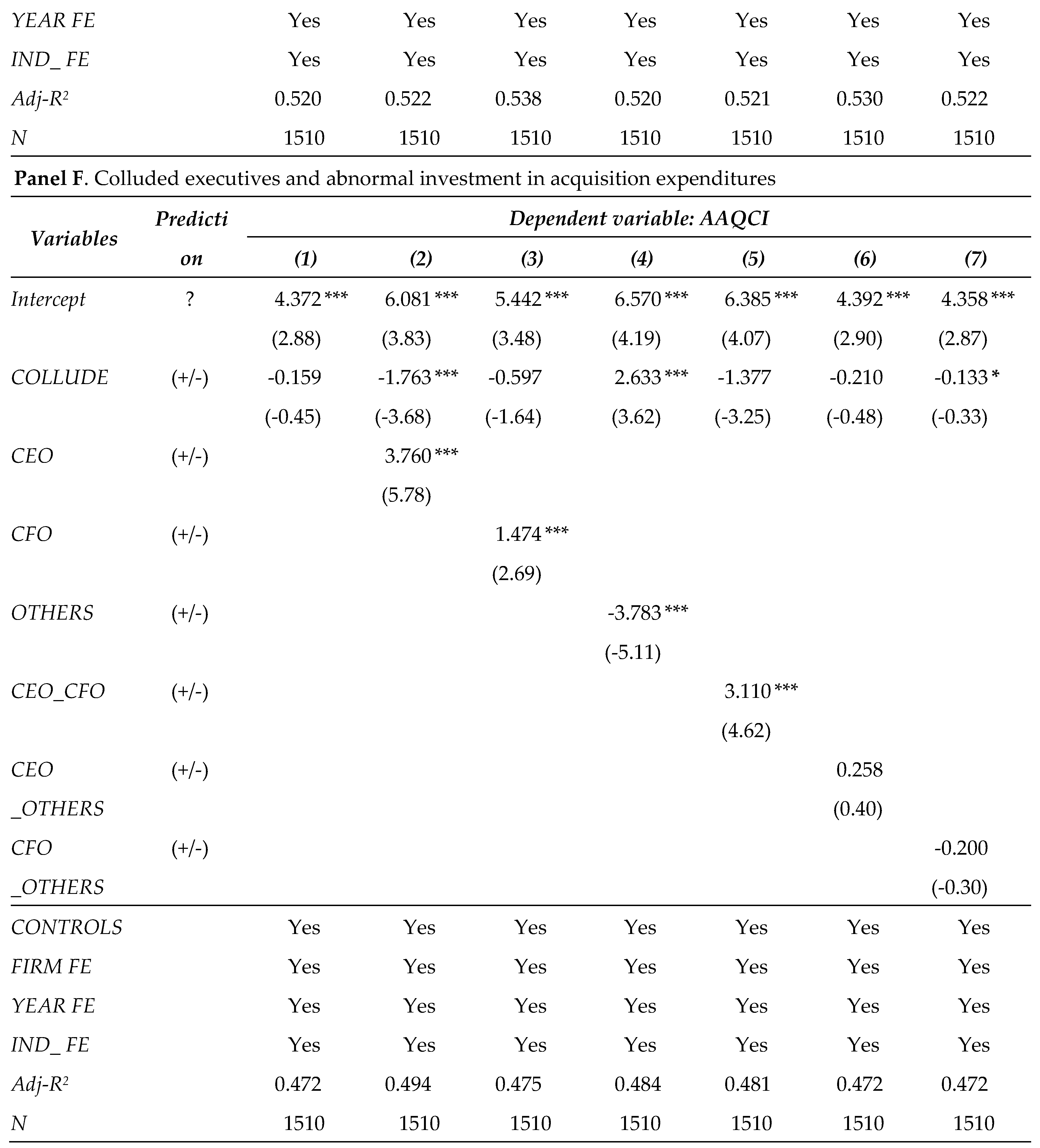

5.2. Additional Analysis 2: Disaggregated Investment by Type

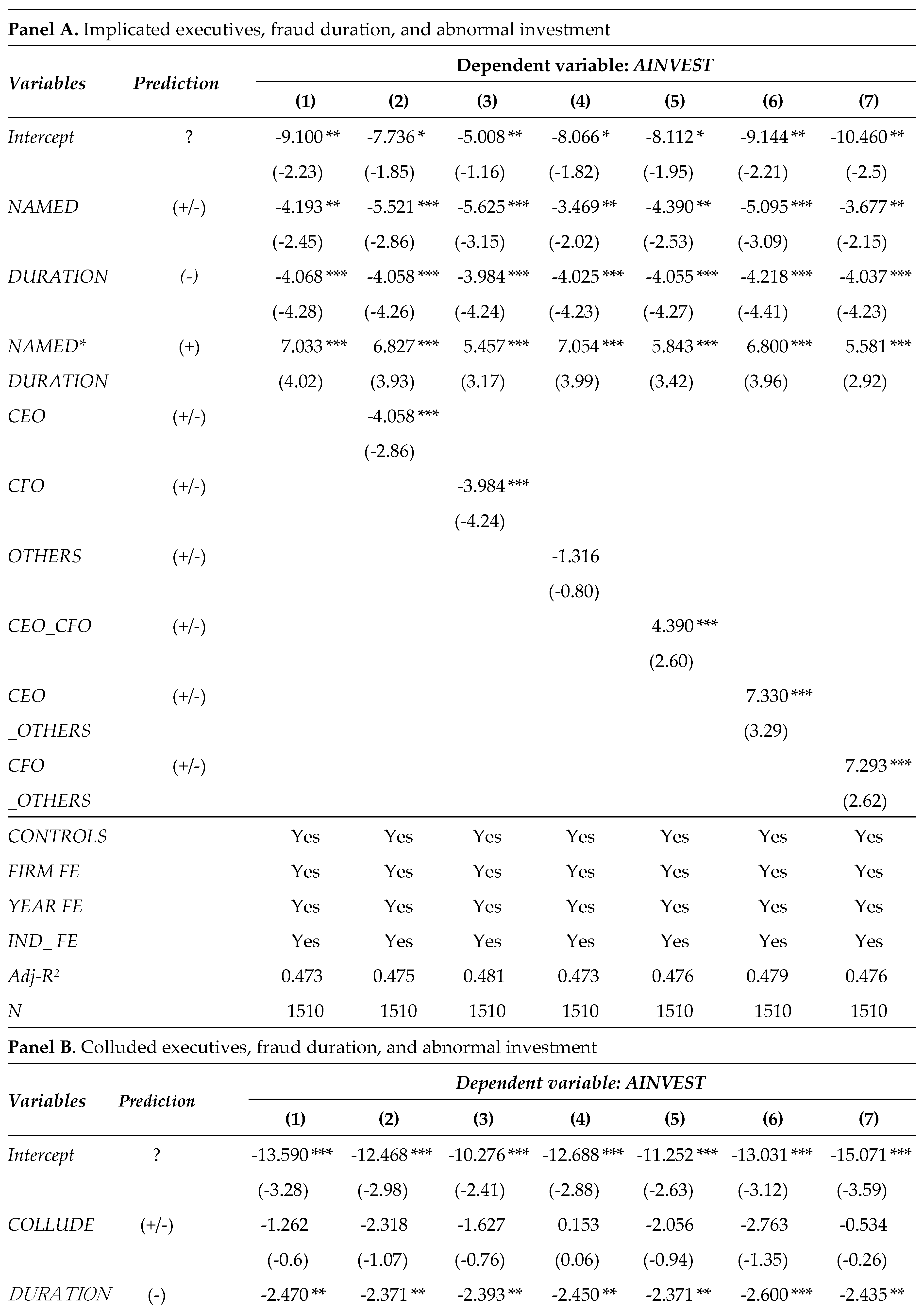

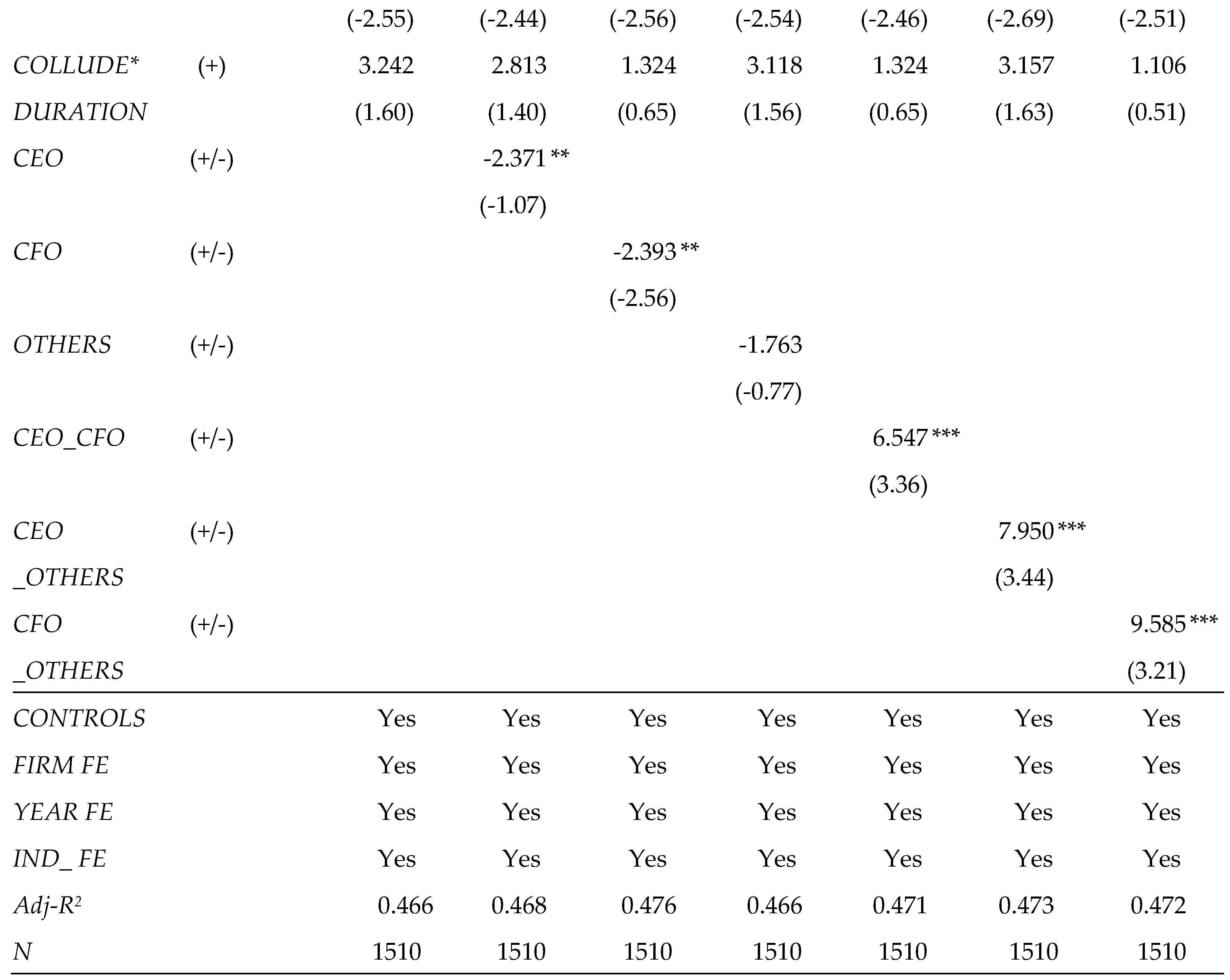

5.3. Additional Analysis 3: Impact of Fraud Duration

6. Discussion and Conclusion

Author Contributions

Acknowledgments

Conflicts of Interest

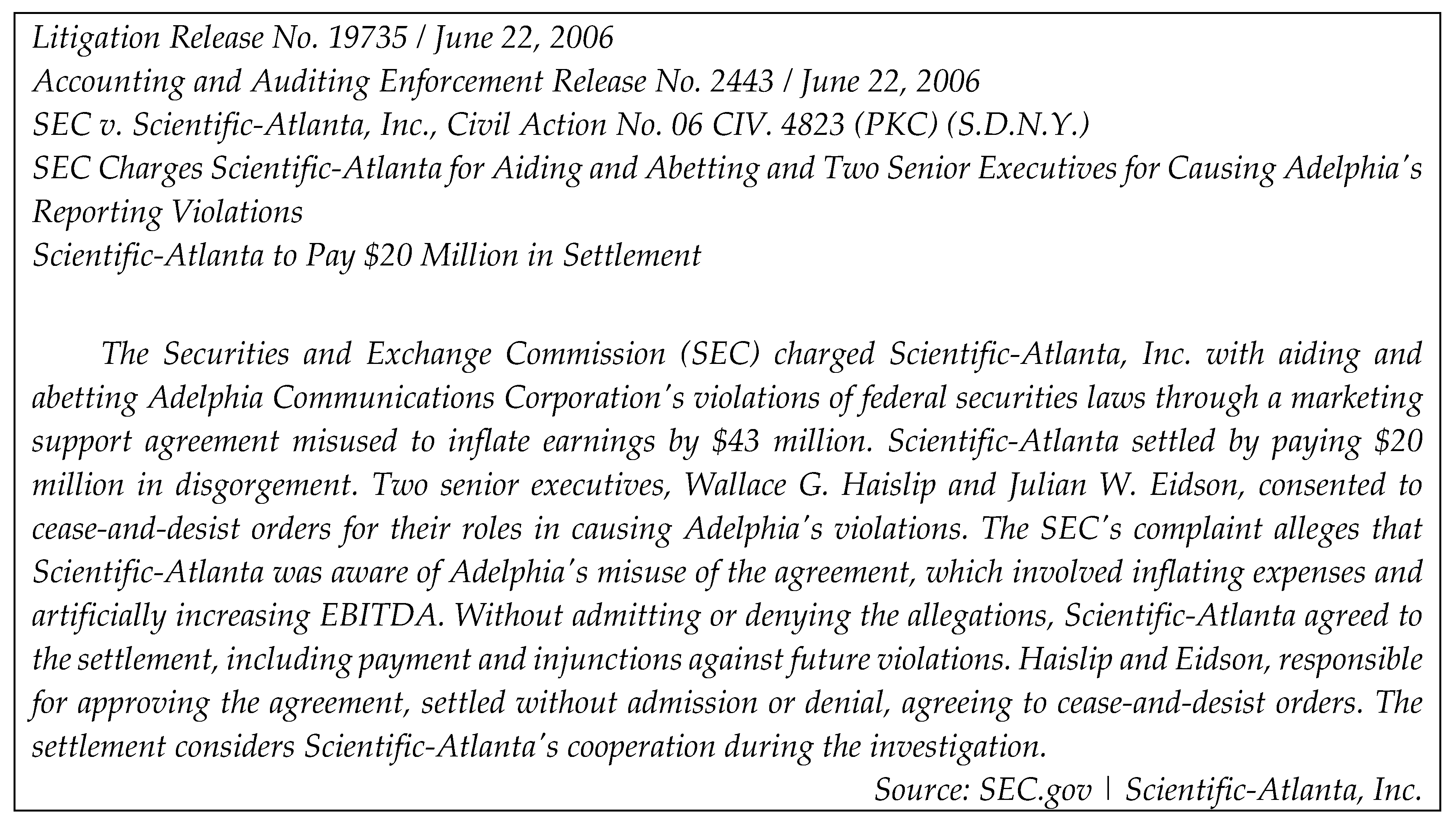

Appendix A. Title: U.S. SECURITIES AND EXCHANGE COMMISSION

Appendix B

References

- Beasley, M.; Carcello, J.; Hermanson, D.; Neal, T. Fraudulent Financial Reporting 1998-2007, an Analysis of U.S. Public Companies. Association Sections, Divisions, Boards Teams 2010. 453 Available at: "Fraudulent financial reporting: 1998-2007: An analysis of U.S. public companies" by Mark S. Beasley, Dana R. Hermanson et al. (olemiss.edu).

- Free, C.; Murphy, P.R. The ties that bind: The decision to co-offend in fraud. Contemporary Accounting Research 2015, 32, 18–54. [Google Scholar] [CrossRef]

- Li, V. Groupthink tendencies in top management teams and financial reporting fraud. Accounting and Business Research 2023, 54, 255–277. [Google Scholar] [CrossRef]

- Rezaee, Z. Causes, consequences, and deterrence of financial statement fraud. Critical Perspectives on Accounting 2005, 16, 277–298. [Google Scholar] [CrossRef]

- Hogan, C.E.; Rezaee, Z.; Riley, R.A.; Velury, U. Financial statement fraud: Insights from the academic literature. Auditing: A Journal of Practice and Theory 2008, 27, 231–252. [Google Scholar] [CrossRef]

- Trompeter, G.; Carpenter, T.; Desai, N.; Jones, K.; Riley, R. A synthesis of fraud related research. Auditing: A Journal of Practice and Theory. [CrossRef]

- Feroz, E.; Park, K.; Pastena, V. The financial and market effects of the SEC’s accounting and auditing enforcement releases. Journal of Accounting Research 1991, 29, 107–142. [Google Scholar] [CrossRef]

- Dechow, P.M.; Sloan, R.G.; Sweeney, A.P. Causes and consequences of earnings manipulation: An analysis of firms subject to enforcement actions by the SEC. Contemporary Accounting Research 1996, 13, 1–36. [Google Scholar] [CrossRef]

- Efendi, J.; Srivastava, A.; Swanson, P. Why do corporate managers misstate financial statements? The role of option compensation and other factors. Journal of Financial Economics 2007, 85, 667–708. [Google Scholar] [CrossRef]

- Schrand, C.; Zechman, S. Executive overconfidence and the slippery slope to financial misreporting. Journal of Accounting and Economics 2012, 53, 311–329. [Google Scholar] [CrossRef]

- Armstrong, C.; Larcker, D.; Ormazabal, G.; Taylor, D. The relation between equity incentives and misreporting: The role of risk-taking incentives. Journal of Financial Economics 2013, 109, 327–350. [Google Scholar] [CrossRef]

- Davidson, R.H. Who did it matters: Executive equity compensation and financial reporting fraud. Journal of Accounting and Economics 2022, 73, 1–24. [Google Scholar] [CrossRef]

- McNichols, M.F.; Stubben, S.R. Does earnings management affect firms’ investment decisions? The Accounting Review 2008, 83, 1571–1603; [Google Scholar] [CrossRef]

- Amiram, D.; Bozanic, Z.; Cox, J.D.; Dupont, Q.; Karpoff, J.M.; Sloan, R. Financial reporting fraud and other forms of misconduct: A multidisciplinary review of the literature. Review of Accounting Studies 2018, 23, 732–783. [Google Scholar] [CrossRef]

- Clatworthy, M.A.; David, A.P.; Peter, F.P. Evaluating the properties of analysts’ forecasts: A bootstrap approach. The British Accounting Review 2007, 39, 3–13. [Google Scholar] [CrossRef]

- American Institute of Certified Public Accountants (AICPA). SAS No. 99: Consideration of Fraud. New York: AICPA, 1988.

- International Auditing and Assurance Standards Board (IAASB). International standard on auditing 240: The auditor’s responsibilities relating to fraud in an audit of financial statements, 2006. Available at: http://www.ifac.org/.

- Bell, T.B.; Carcello, J.V. A decision aid for assessing the likelihood of fraudulent financial reporting. Auditing: A Journal of Practice and Theory 2000, 19, 169–184. [Google Scholar] [CrossRef]

- Lee, T.A.; Ingram, R.W.; Howard, T.P. The difference between earnings and operating cash flow as an indicator of financial reporting fraud. Contemporary Accounting Research 1999, 16, 749–786. [Google Scholar] [CrossRef]

- Farber, D. Restoring trust after fraud: Does corporate governance matter? The Accounting Review 2005, 80, 539–561. [Google Scholar] [CrossRef]

- Beasley, M. An empirical analysis of the relation between Board of Director composition and financial statement fraud. The Accounting Review 1996, 71, 443–465. [Google Scholar]

- Beasley, M.S.; Carcello, J.V.; Hermanson, D.R.; Lapides, P.D. Fraudulent financial reporting: Consideration of industry traits and corporate governance mechanisms. Accounting Horizon 2000, 14, 441–454. [Google Scholar] [CrossRef]

- Uzen, H.; Szewczyk, S.H.; Varma, R. Board composition and corporate fraud. Financial Analysts Journal 2004, 60, 33–43. [Google Scholar] [CrossRef]

- Nourayi, M.M. Stock price responses to the SEC's enforcement actions. Journal of Accounting and Public Policy 1994, 13, 333–347. [Google Scholar] [CrossRef]

- Silvers, R. The valuation impact of SEC enforcement actions on nontarget foreign firms. Journal of Accounting Research 2016, 54, 187–234. [Google Scholar] [CrossRef]

- Biddle, G.; Hilary, G. Accounting quality and firm-level capital investment. The Accounting Review 2006, 81, 963–982. [Google Scholar] [CrossRef]

- Biddle, G.; Hilary, G.; Verdi, R.S. How does financial reporting quality relate to investment efficiency? Journal of Accounting and Economics 2009, 48, 112–131. [Google Scholar] [CrossRef]

- Bar-Gill, O.; Bebchuk, L. Misreporting corporate performance (working paper). Harvard University, 2003. [CrossRef]

- Kedia, S.; Philippon, T. The economics of fraudulent accounting. Review of Financial Studies 2009, 22, 2169–2199. [Google Scholar] [CrossRef]

- International Auditing and Assurance Standards Board (IAASB). International standard on auditing 200: Overall objectives of the independent auditor and the conduct of an audit in accordance with International Standards on Auditing, 2006. Available at: http://www.ifac.org/.

- International Auditing and Assurance Standards Board (IAASB). International standard on auditing 315: Identifying and assessing the risks of material misstatement through understanding the entity and its environment, 2006. Available at: http://www.ifac.org/.

- Khanna, V.; Kim, E.H.; Lu, Y. CEO connectedness and corporate fraud. The Journal of Finance 2015, 70, 1203–1252. [Google Scholar] [CrossRef]

- Robson, K.; Young, J.; Power, M. Themed section on financial accounting as social and organizational practice: Exploring the work of financial reporting. Accounting, Organizations and Society 2017, 56, 35–37. [Google Scholar] [CrossRef]

- Bruynseels, L.; Cardinaels, E. The audit committee: Management watchdog or personal friend of the CEO? The Accounting Review 2014, 89, 113–145. [Google Scholar] [CrossRef]

- Kuang, Y.F.; Liu, X.K.; Paruchuri, S.; Qin, B. CFO social ties to non-CEO senior managers and financial restatements. Accounting and Business Research 2020, 52, 115–149. [Google Scholar] [CrossRef]

- Janis, I.L. Groupthink: Psychological Studies of Policy Decisions and Fiascos (2nd ed.). Boston, MA: Houghton Mifflin, 1982.

- Moorhead, G.; Neck, C.P.; West, M.S. The tendency toward defective decision making within self-managing teams: The relevance of groupthink for the 21st century. Organizational Behavior and Human Decision Processes 1998, 73, 327–351. [Google Scholar] [CrossRef]

- Hogg, M.A.; Hains, S.C. Friendship and group identification: A new look at the role of cohesiveness in groupthink. European Journal of Social Psychology 1998, 28, 323–341. [Google Scholar] [CrossRef]

- Tetlock, P.E. Identifying victims of groupthink from public statements of decision makers. Journal of Personality and Social Psychology 1979, 37, 1314–1324. [Google Scholar] [CrossRef]

- Ntayi, J.M.; Byabashaija, W.; Eyaa, S.; Ngoma, M.; Muliira, A. Social cohesion, groupthink and ethical behavior of public procurement officers. Journal of Public Procurement 2010, 10, 68–92. [Google Scholar] [CrossRef]

- Weick, K.E.; Roberts, K.H. Collective mind in organizations: Heedful interrelating on flight decks. Administrative Science Quarterly 1993, 38, 357–381. [Google Scholar] [CrossRef]

- Jehn, K. A multimethod examination of the benefits and detriments of intragroup conflict. Administrative Science Quarterly 1995, 40, 256–557. [Google Scholar] [CrossRef]

- Abernathy, J.L.; Beyer, B.; Downes, J.F.; Rapley, E.T. High-quality information technology and capital investment decisions. Journal of Information Systems 2020, 34, 1–29. [Google Scholar] [CrossRef]

- Goodman, T.H.; Neamtiu, M.; Shroff, N.; White, H.D. Management forecast quality and capital investment decisions. The Accounting Review 2014, 89, 331–365. [Google Scholar] [CrossRef]

- Koh, P.-S.; Reeb, D.M. Missing R&D. Journal of Accounting and Economics 2015, 60, 73–94. [Google Scholar] [CrossRef]

|

|

|

|

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).