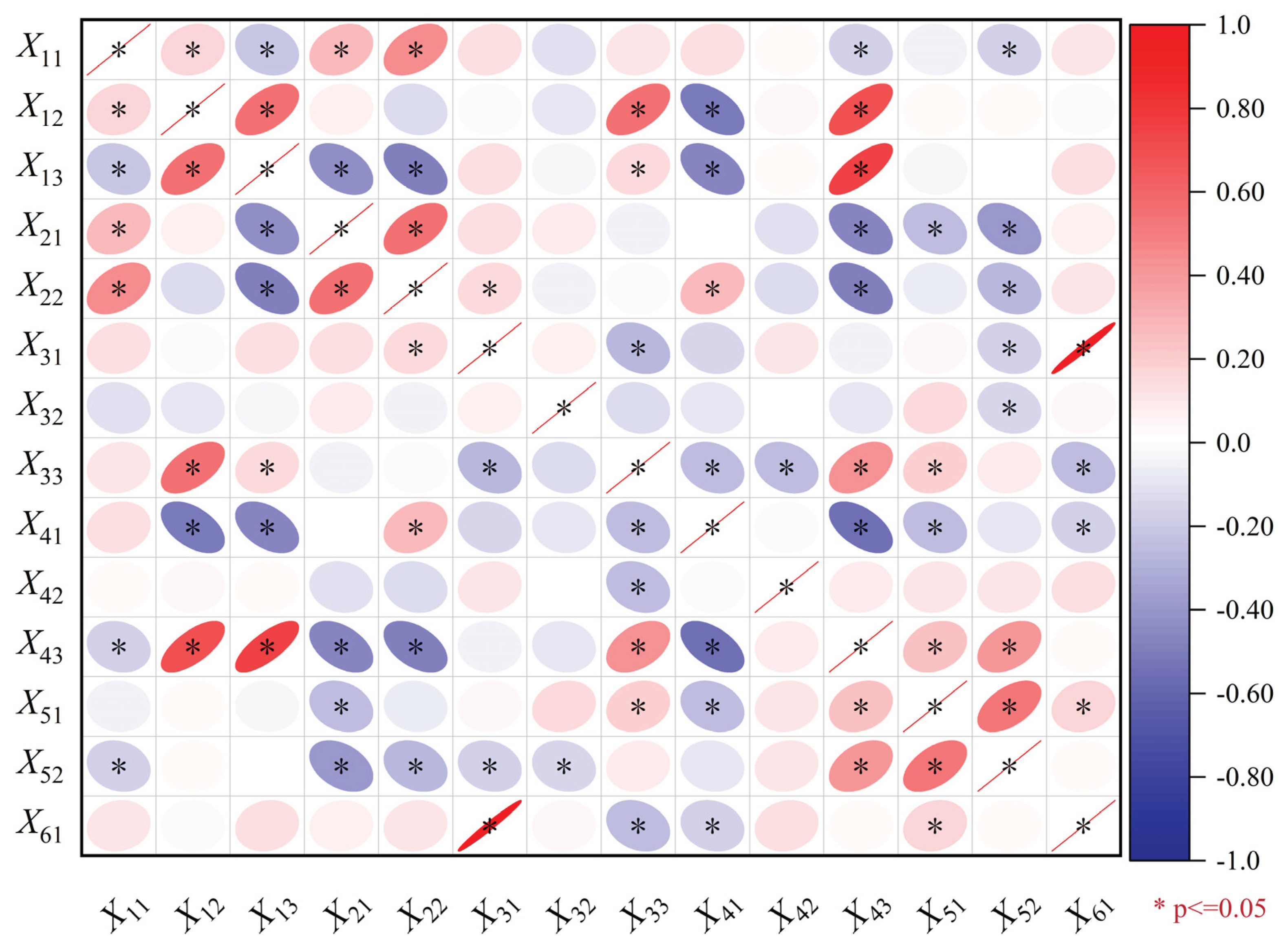

5.2.1. Calculation of AHM-CRITIC Weights

Although previous research has explored the factors of instability in global financial markets, there is still a lack of comprehensive evaluation regarding the interactions between these factors and their impact on market stress. To gain a more exhaustive perspective, we invited 15 experts with extensive backgrounds in financial risk management. This group includes 5 finance professors from renowned universities, 5 stock market experts, and 5 senior risk analysts from major global financial centers and regulatory agencies. These experts possess practical experience in areas such as financial market operations, policy formulation, asset risk assessment, and crisis response projects. By examining relevant literature on financial stress and integrating insights from these experts, we constructed a scoring matrix that covers key factors contributing to financial stress. This matrix not only reflects the impact of each factor on market stability but also elucidates their interrelations, providing a solid foundation for subsequent analysis.

The AHP discriminant matrix

K (see

Table 3) is constructed adopting expert scoring based on the Satty scale, subsequently converted into the attribute discriminant matrix

L (see

Table 4) through Equation (15). The AHP discrimination matrices for the sub-markets and the AHM attribute discrimination matrices are presented respectively in

Appendix A and

Appendix B. Due to the attribute discrimination matrix's consistency, construction of matrix eigenroots and eigenvectors or consistency test are not required [

66]. Attribute weights for each index are determined using Equation (16), yielding the overall weighting

of the AHM model.

The CRITIC weighting method is used to construct the correlation coefficient matrix through Equations (17~19), which in turn yields the weights of each indicator

, and the coupling of

and

is calculated using Equation (14). This gives the coupling weights

, the results are shown in

Table 5, which

denotes the result of the assignment to each sub-market,

denotes the results of assigning weights to the indicators in each sub-market to which they belong, separately in each sub-market,

indicates the weight of each indicator to the total market and is calculated as follows:

Table 5 shows that indicator

X42 has the highest combined weighting. In the process of assigning weights to this indicator, the AHM is considered as a subjective assignment method. The foreign exchange market in which indicator

X42 is located has a greater impact on the financial markets as a whole, subjective weighting

is greater than objective weighting

; while indicator

X13 receives the smallest combined weighting, the objective weights are higher than the subjective weights in the process of assigning weights to the indicators, and the comparison shows that the coupled weighting method can effectively weaken the effect of subjective extremes; and in the analysis of the objective weights, it can be found that there are three indicators (

X11,

X42 ,

X61) where the coupled weight

is greater than the objective weight. This is also related to the mechanism of CRITIC itself, which is conservative and does not "react" well to indicators that do not change significantly in terms of pressure, and therefore needs to be corrected with the advantage of subjective weighting.

5.2.2. Trend Analysis of FSI

The indexes are weighted according to the weights obtained from Equations (14 ~ 20) to obtain the financial stress indices of the Money market (FSI Money), Bond market (FSI Bond), Stock market (FSI Stock), Foreign Exchange market (FSI Exchange), Trade credit market (FSI Trade Credit) and External Debt market (FSI External Debt) respectively. The financial stress indexes of six sub-markets, namely FSI Trade credit, FSI External debt, and FSI China, calculated according to Equation (7), are shown in

Figure 4.

According to

Figure 5(a), China's money market financial risk is characterized by three stages of change: January 2010 to February 2016 is the first stage, due to the global financial crisis in 2010, resulting in money market financial stress reached a very high value of 0.049 in November 2010, then in response to the financial crisis and to ease the money market financial stress, China adopted the implementation of this policy led to a sharp decline in money market financial stress, reaching a very small value of 0.001 in February 2011, followed by an oscillating rise and reaching a maximum value of 0.09 in the first stage in June 2015; the second stage was from July 2015 to May 2017, during which money market financial risk showed a sharp decline in financial stress, reaching a maximum value of 0.09 in May 2017. The decline in financial risk during this stage can be attributed to several factors. The imposition of USA sanctions and tariffs on China in November 2016 may have exerted a stabilizing influence on the financial market [

67] by incentivizing domestic production and reducing imports. Additionally, the Belt and Road Initiative (BRI) has also facilitated new investment and development opportunities in regions along its routes, thereby fostering economic growth in relevant countries and regions while potentially mitigating financial risks. Based on these findings, it is advisable to persist in implementing robust risk management strategies, encompassing the utilization of tariffs and other trade policies, to uphold financial stability. Moreover, it is imperative to diligently monitor and address any potential risks and vulnerabilities that may arise in the financial market as a result of economic events and policy changes. The third stage is from June 2017 to December 2023, where the financial risk of the money market shows frequent oscillations, fluctuating between 0.017 and 0.071.

From

Figure 5(b), the financial risk of China's bond market shows three stages of change: January 2010 to June 2011 is the first stage, from 0.064 in January 2010 to 0.002 in June 2011, the reason is that the relatively safe bond market has become the "safe haven" of the nation. The second stage is from July 2011 to September 2013, during which China's bond market developed steadily and expanded, and financial stress rose sharply from 0.016 in July 2011 to 0.116 in September 2013; The surge in financial stress during this phase can be attributed to the expansion of inter-bank liquidity and the subsequent escalation in inter-bank lending rates, which might have resulted in an augmentation of financial risk within the bond market. The increased competition for funds among banks likely contributed to the adoption of risky lending practices and subsequently resulted in a surge in non-performing loans [

68]. Therefore, it is imperative to persist in implementing robust risk management strategies, encompassing the vigilant monitoring and control of interbank liquidity, and adapting to fluctuations in interbank lending rates and other economic events so as to uphold financial stability. The third stage is from October 2013 to December 2023. The third stage is the period from October 2013 to December 2023, during which the financial stress in the bond market oscillates frequently, fluctuating between 0.056 and 0.121 overall.

From

Figure 5(c), it can be seen that Chinese stock market financial risk shows four stages of change: January 2010 to October 2010 is the first stage, during this interval due to the 2010 financial crisis, stock market financial stress rose sharply, reaching an extreme value of 0.18 in October 2010 in this interval; November 2010 to June 2016 is the second stage, during which the stock market gradually regained stability and stock market financial stress continued to oscillate, fluctuating between 0.072 and 0.148 overall; the third stage, from July 2016 to April 2017, during which the Chinese stock market was in the doldrums and stock market financial stress declined sharply, from 0.106 in July 2016 to 0.037 in April 2017. The occurrence of Brexit has instigated a state of uncertainty in the global market, encompassing apprehensions regarding international trade relations [

69]. This prevailing ambiguity may prompt investors to exercise prudence in light of an indeterminate future, consequently exerting a detrimental influence on financial markets such as the Chinese stock market. Moreover, the adjustment of the United States' tariff policies towards China has led to an escalation in tariffs between the two nations, triggering a ripple effect in the global economy. The aforementioned pressure has exerted an impact on Chinese export businesses and manufacturing, thereby augmenting uncertainty within the global supply chain and precipitating a decline in the profitability of certain companies, consequently leading to a downturn in stock market performance. In such circumstances, investors tend to gravitate towards safer haven assets, thus contributing to risk diversification within financial markets and mitigating portfolio volatility. May 2017 to December 2023 is the third stage, during which stock market financial stress oscillates frequently, fluctuating between 0.044 and 0.138 overall.

According to

Figure 5(d), China's foreign exchange market financial risk shows an overall oscillating upward trend, with a sharp rise in financial stress in the foreign exchange market at the beginning of each year due to economic recovery and a strong and slight rise in the external exchange rate; after this period, due to a slowdown in economic growth and a narrowing of external spreads; In response to the economic cycle, enterprises and investors may exhibit an increased demand for foreign exchange at the onset of a new year, thereby contributing to market volatility. When economic growth decelerates, the external interest rate spread contracts, potentially alleviating financial strain. Additionally, heightened external interest rates can exert increased financial pressure on the foreign exchange market [

57], particularly for enterprises that rely on borrowing in foreign currencies. The fluctuations in the global economy have a direct impact on the dynamics of the foreign exchange market. Due to the impact of the COVID-19 pandemic, the deceleration of the global economy has engendered apprehensions regarding exchange rates, thereby exacerbating uncertainty in the foreign exchange market. These intertwined factors give rise to a multifaceted scenario wherein overall financial risk in the foreign exchange market exhibits an oscillating upward trajectory. At the end of the year, the market operates smoothly and financial pressure fluctuates less. During the time interval from January 2010 to December 2023, from 0.194 in January 2010 to 0.174 in December 2023.

According to

Figure 5(e), the financial risk of China's trade credit market shows three stages of changes: January 2010 to July 2016 is the first stage, during which the financial stress of the trade credit market oscillated down and reached a very small value of 0.018 in July 2016 for this period; August 2016 to July 2017 is the second stage, during which the trade credit market showed a significant upward trend. The United Kingdom's decision to leave the European Union in June 2016 led to a surge in global market uncertainty, with the progress and uncertainties surrounding Brexit negotiations exacerbating financial market volatility [

69]. Consequently, this had an impact on the trade credit risks faced by multinational corporations. Additionally, in early 2017, the United States implemented a series of trade sanctions against China, sparking trade tensions between the two nations. This could have led to an increase in financial risk in the trade credit market, affecting trade financing and credit conditions for businesses. The U.S.-China trade dispute and Brexit have introduced a level of uncertainty into the global economy and trade system, exerting a direct impact on the trade credit market and reflecting the prevailing atmosphere of tension and unpredictability in global trade. The third stage is from August 2017 to December 2023, during which the financial risk in the trade credit market oscillates frequently, fluctuating between 0.013 and 0.079 overall.

According to

Figure 5(f), the financial risk in China's external debt market shows three stages of change: January 2010 to November 2016 is the first stage, during which the trend of financial stress in the external debt market is relatively stable; December 2016 to April 2017 is the second stage, during which the financial risk in the bond market first rises sharply and reaches a very large value of 0.45 in January 2017, after which it falls sharply and reaches a very small value of 0.06 in April 2017. Due to the United States implementing a series of trade sanctions against China in early 2017, it heightened the trade tensions between the U.S. and China. This likely contributed to an increase in financial risk in the bond market [

70], particularly in bonds related to U.S.-China trade relations. Additionally, the uncertainty surrounding the Brexit negotiations may have exerted an impact on the bond market during this period. Concerns regarding the post-Brexit UK economy and financial markets might have prompted investors to reevaluate bonds, thereby inducing fluctuations in financial risk. The significant surge and subsequent rapid decline in financial risk observed in the bond market during this period may suggest a high degree of market sensitivity to these events. It is possible that there were instances of market overreactions or short-term hedging actions by participants due to uncertainties surrounding the subsequent developments of these events. May 2017 to December 2023 is the third stage, during which the financial risk in the bond market shows a relatively stable trend of 0.06. The third stage is from May 2017 to December 2023, during which the financial risk in the bond market shows a relatively stable trend.

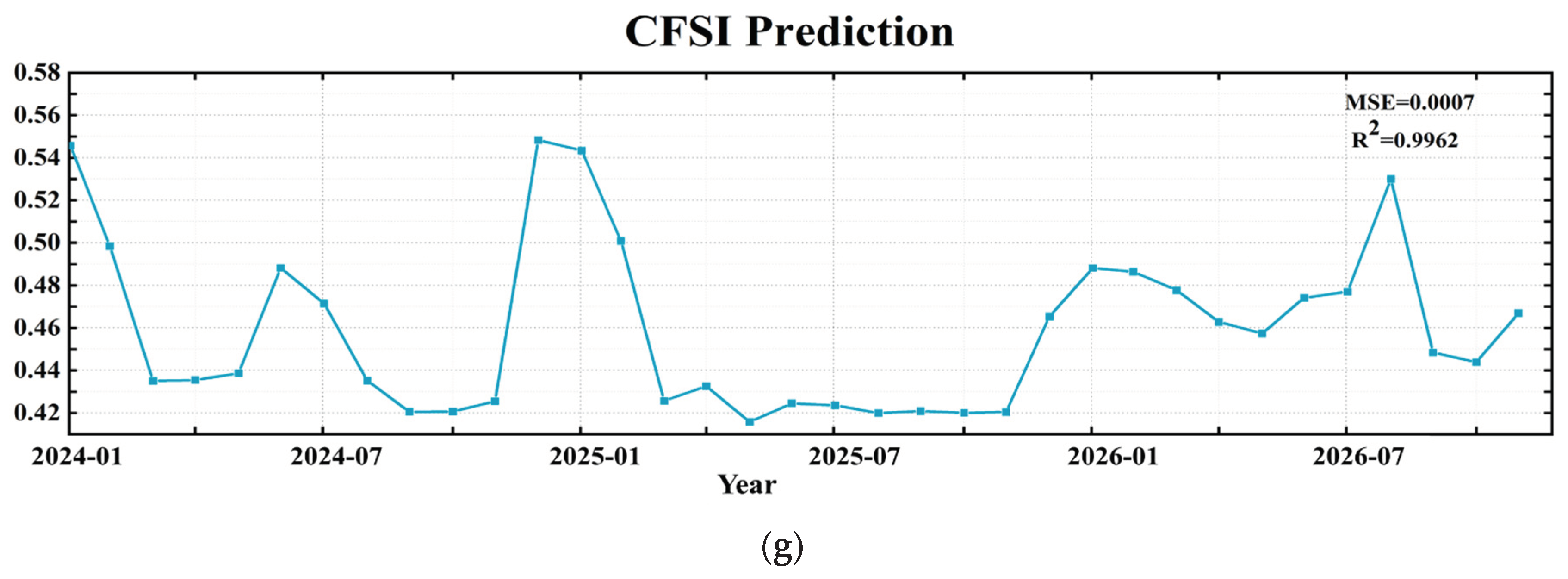

According to

Figure 5(g), the characteristics of China's financial market risk show three stages of change: January 2010 to February 2016 is the first stage, during which China's financial stress rose sharply and reached a very high value of 0.55 in February 2016; March 2016 to May 2017 is the second stage, during which China's financial stress index fell sharply and reached a very high value of 0.27. The third stage is from May 2017 to December 2023, during which China's financial market risk rises sharply and reaches a very high value of 0.42 in September 2023; except for this, in each year, China's financial market risk shows an increase followed by a decrease, rising sharply at the beginning of the year and then falling sharply thereafter.

These three stages indicate that despite the rapid and high-quality development of China's financial market, the potential risks and crises have been intensifying dynamically over the past decade [

62]. In the initial phase (January 2010 to February 2016), the financial market faced significant pressure due to repercussions from the global financial crisis and China's economic structural adjustments. This period witnessed sharp market fluctuations and increased pressure, indicating potential risks. The second stage (March 2016 to May 2017) may potentially reflect the favorable impacts of a series of macro-prudential policies and financial market reforms implemented by the Chinese government. The implementation of these policies might have contributed to mitigating financial risks and fostering market stability. The third stage (May 2017 to December 2023) may be subject to external influences, such as global economic uncertainty and trade tensions. This implies that China's financial market is confronted with emerging potential risks in the recent period, necessitating heightened vigilance, monitoring, and responsive measures. Over the past decade, China's financial market has undergone various stages of risks and crises, influenced by both global and domestic factors. The government has implemented effective policy measures to mitigate financial pressures corresponding to different economic conditions during diverse periods. Continued emphasis on monitoring global economic conditions and trade dynamics is strongly recommended. Moreover, it is imperative to prioritize timely and adaptable policy responses to effectively address potential emerging economic and financial challenges.