Submitted:

14 March 2024

Posted:

14 March 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Preliminaries

2.1. The Index Tracking Problem

2.1.1. Optimization Problem as Sampling Problem

2.2. Sequential Monte Carlo Methods

2.2.1. Sequential Importance Sampling

2.2.2. Resampling

2.2.3. Support Boosting and Metropolis Hastings Algorithm

Summary of SMC Algorithm

- Fix the number of stocks used to replicate the index to p (using PCA).

- Draw n permutations of size p from , for computed as in Equation 9. Set the importance weights for each permutation to .

- Choose and increment such that .

- At , compute the importance weights for each permutation using recursive formulas in Section 2.2.1.

- Compute ESS

-

While

- (a)

- if ESS proceed to Step 3.

- (b)

- if ESS . Resample and initialise MH with an accumulative acceptance rate of 500%.

- (c)

- Set the weights of new samples computed in MH to and proceed to Step 3.

- At , samples from are obtained, represented as pairs of permutations and their respective weights.

- Resample once more to obtain new permutations with equal weights.

- Compute for the new sample of permutations to obtain the optimal that maximises given by Equation (8).

3. Transaction Costs

3.1. Dynamics of the Wealth Process Given Proportional Transaction Costs

3.2. Index Tracking Problem with Proportional Transaction Costs

4. Methodology and Data

4.1. Model cases

4.2. Constraints and Optimization

4.3. Data

4.3.1. Simulated Data

4.3.2. Empirical Data

4.4. Metrics

4.4.1. Tracking Error

4.4.2. Total Transaction Costs

4.4.3. Wealth Error

4.4.4. Other Cost Metrics

4.4.5. Retention

4.4.6. Maximum Weight

5. Results and Discussion

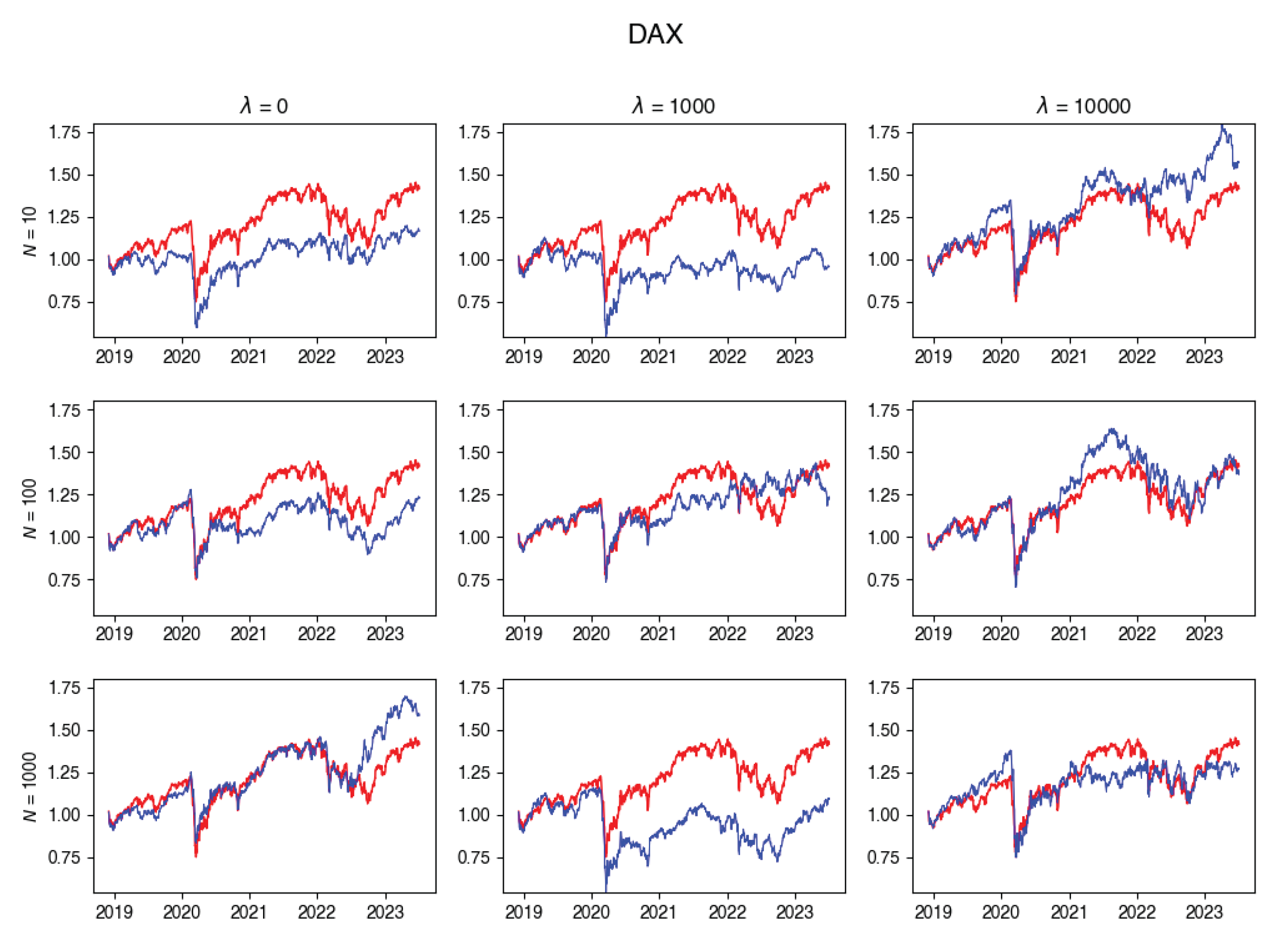

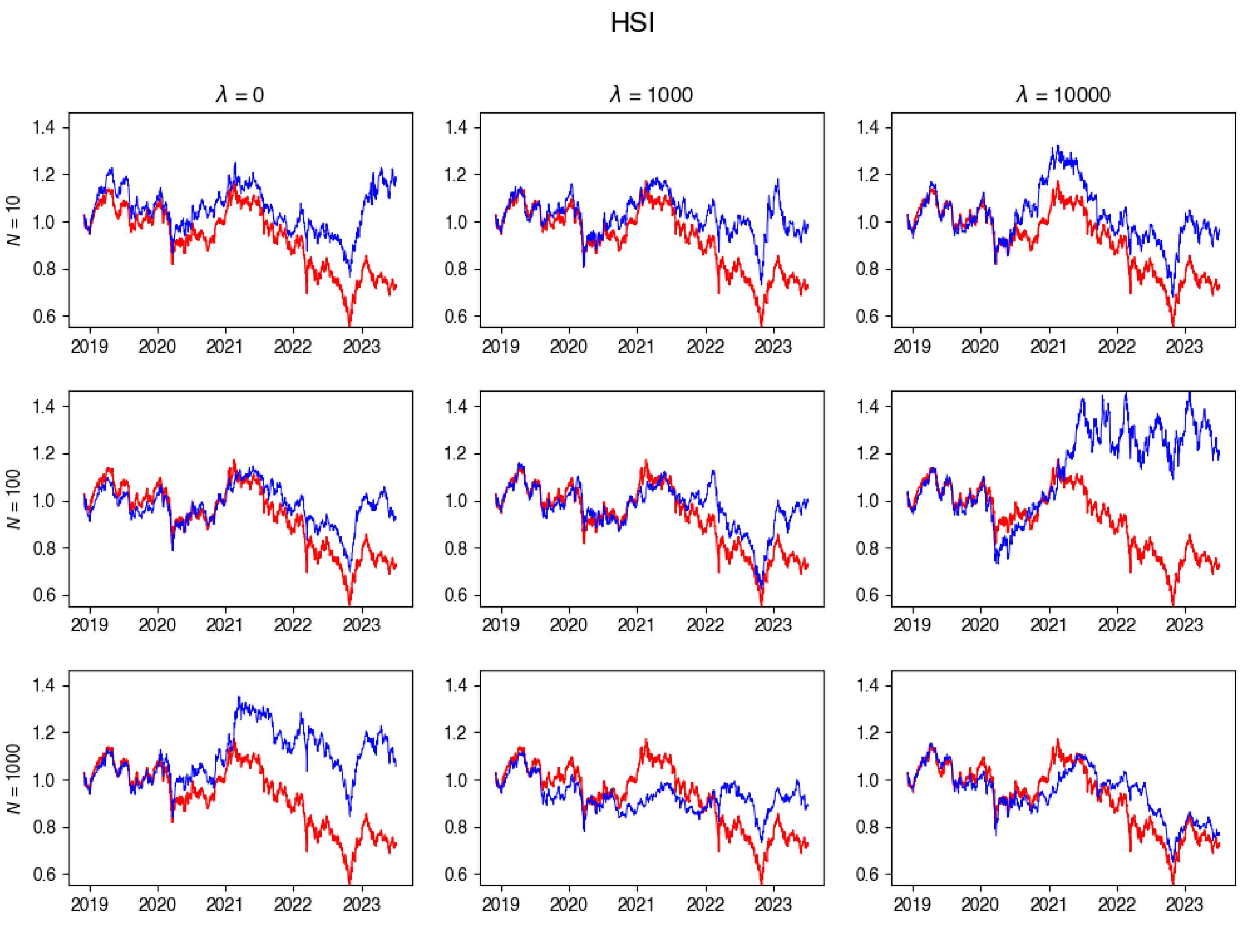

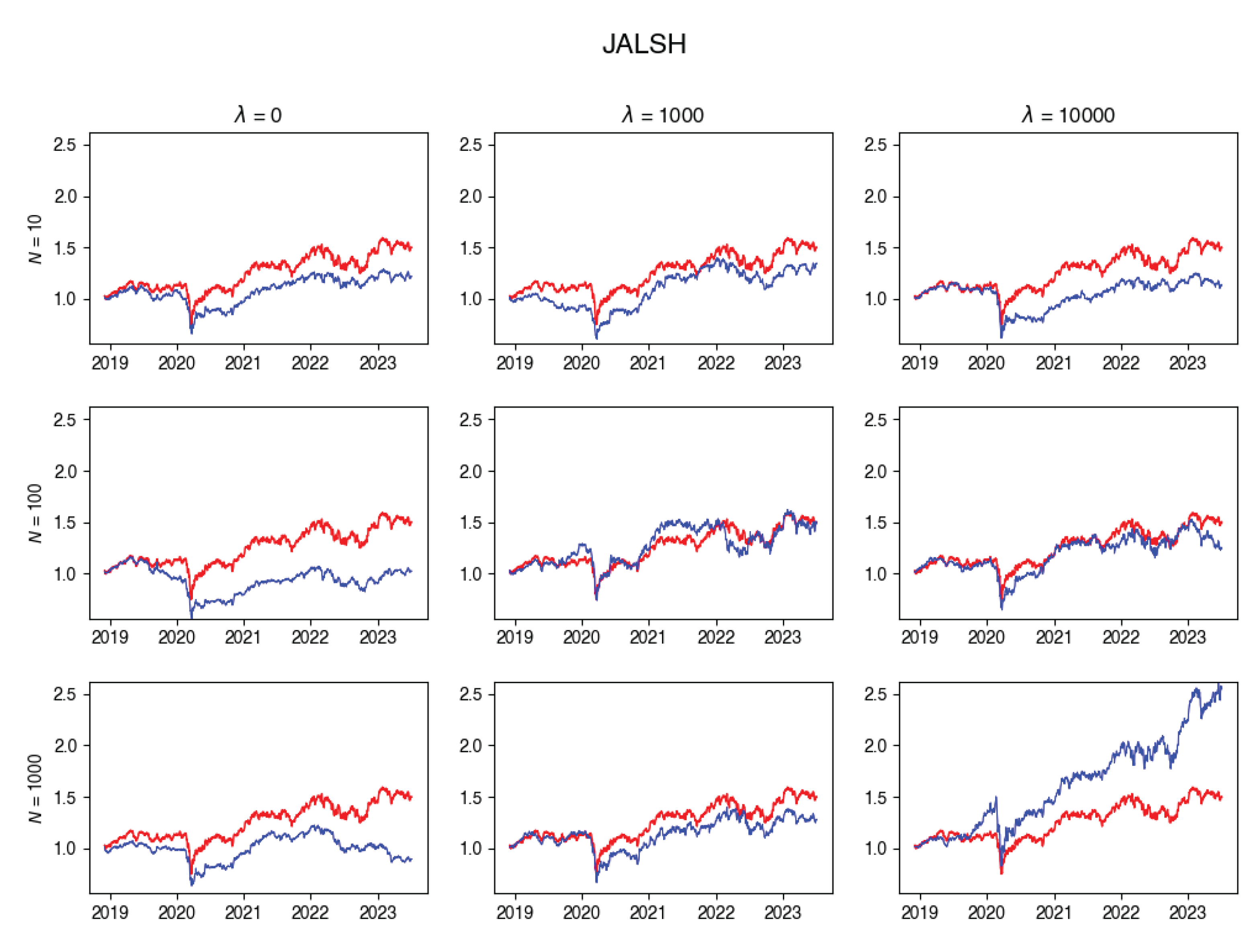

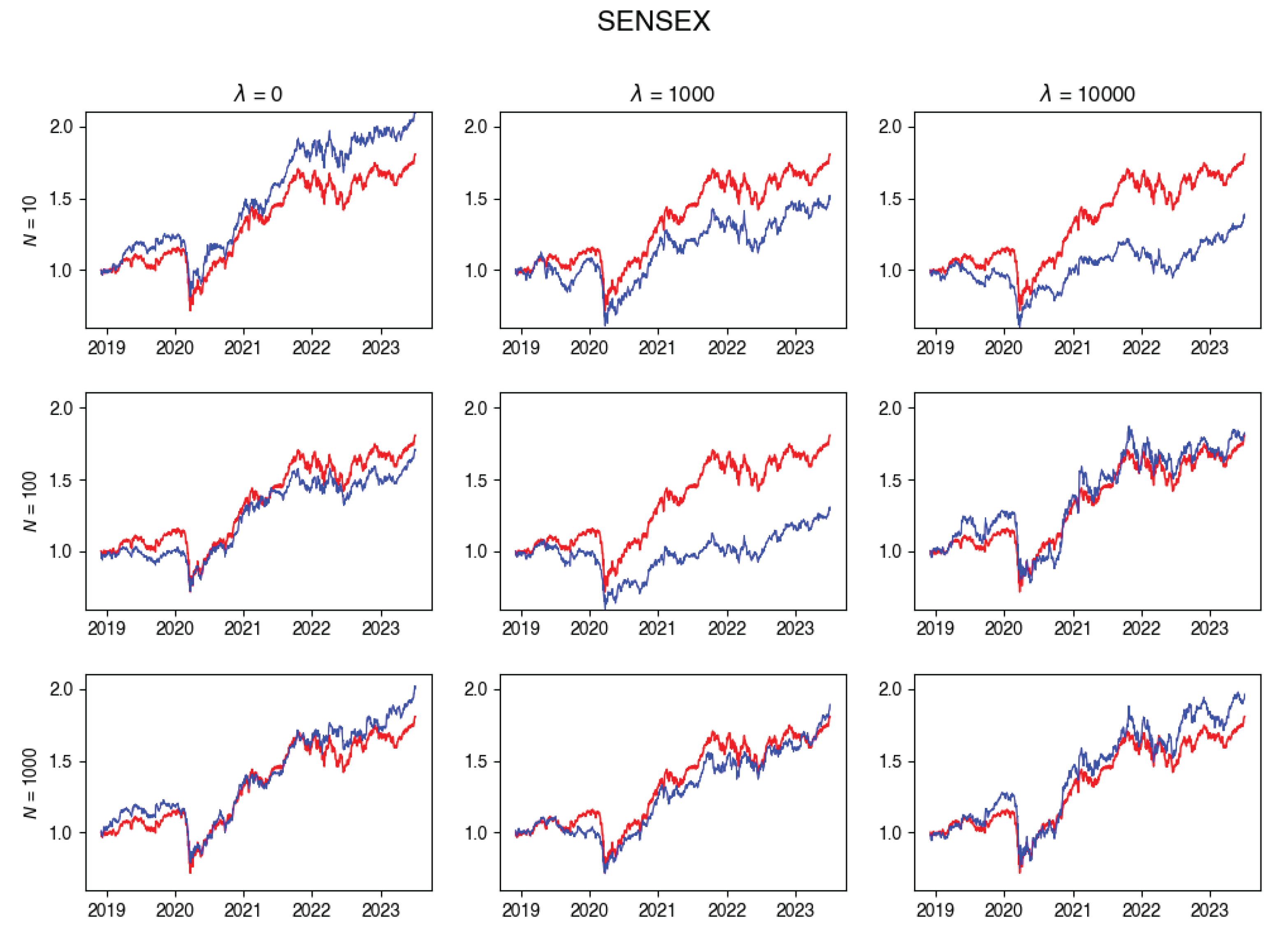

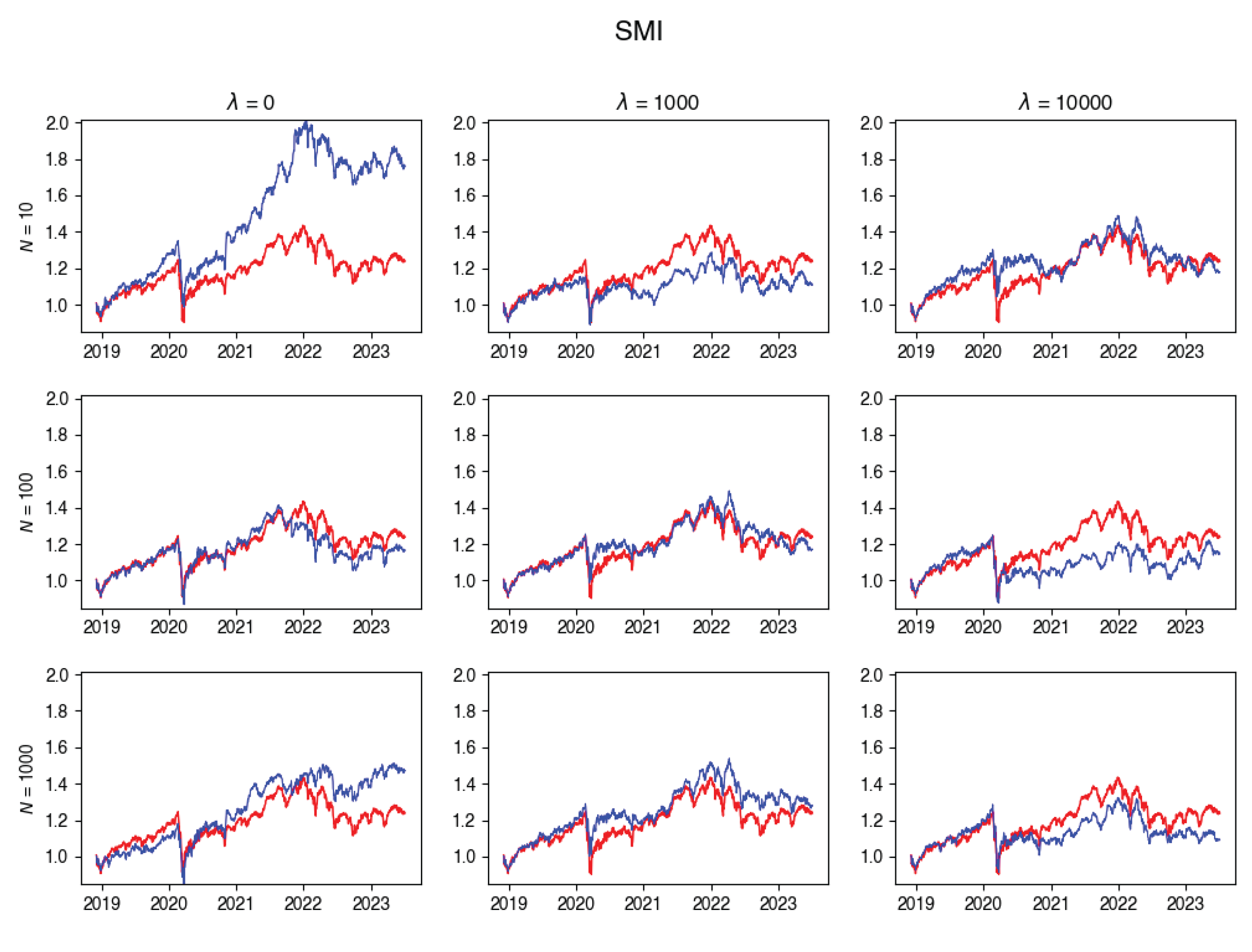

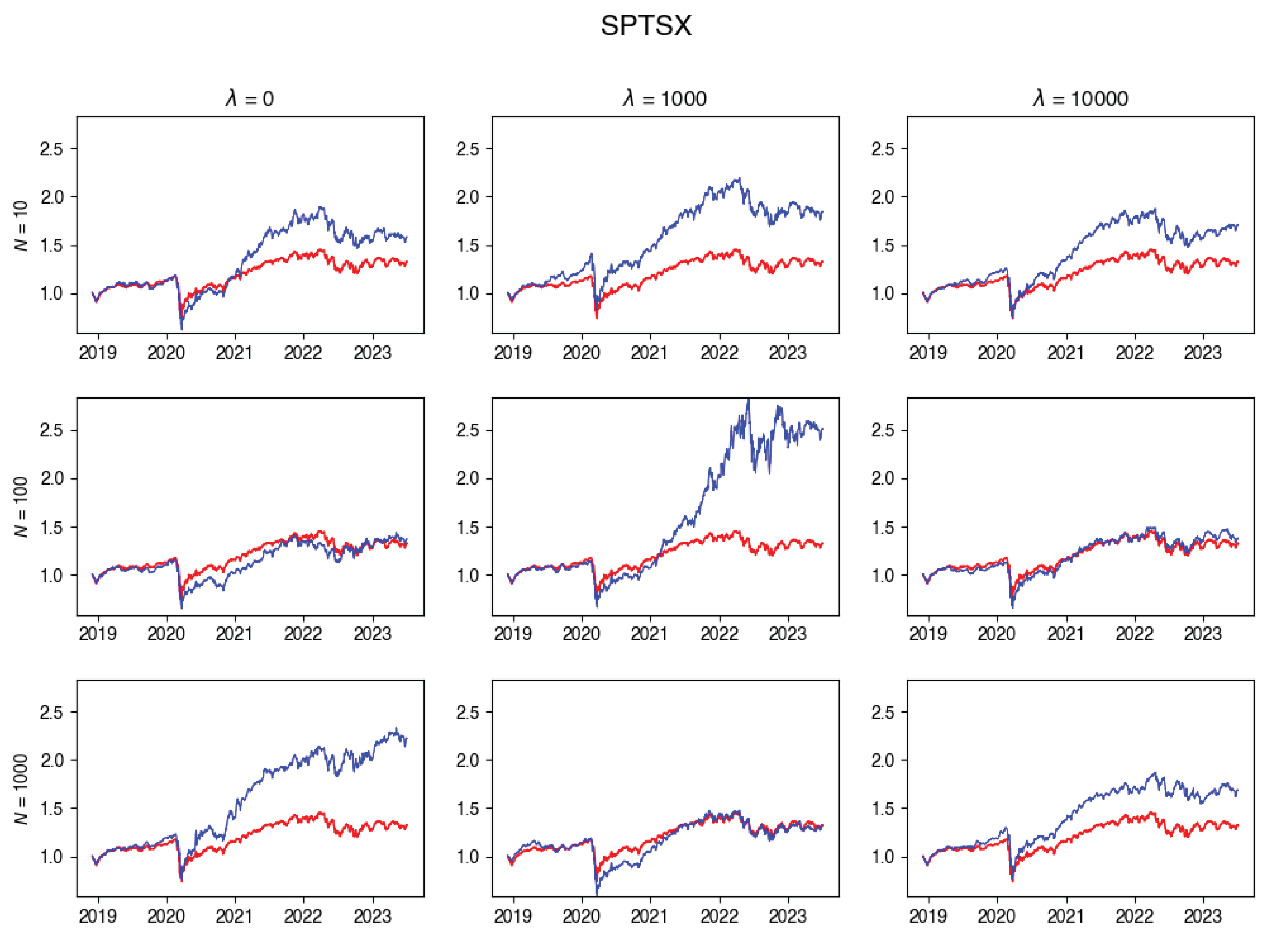

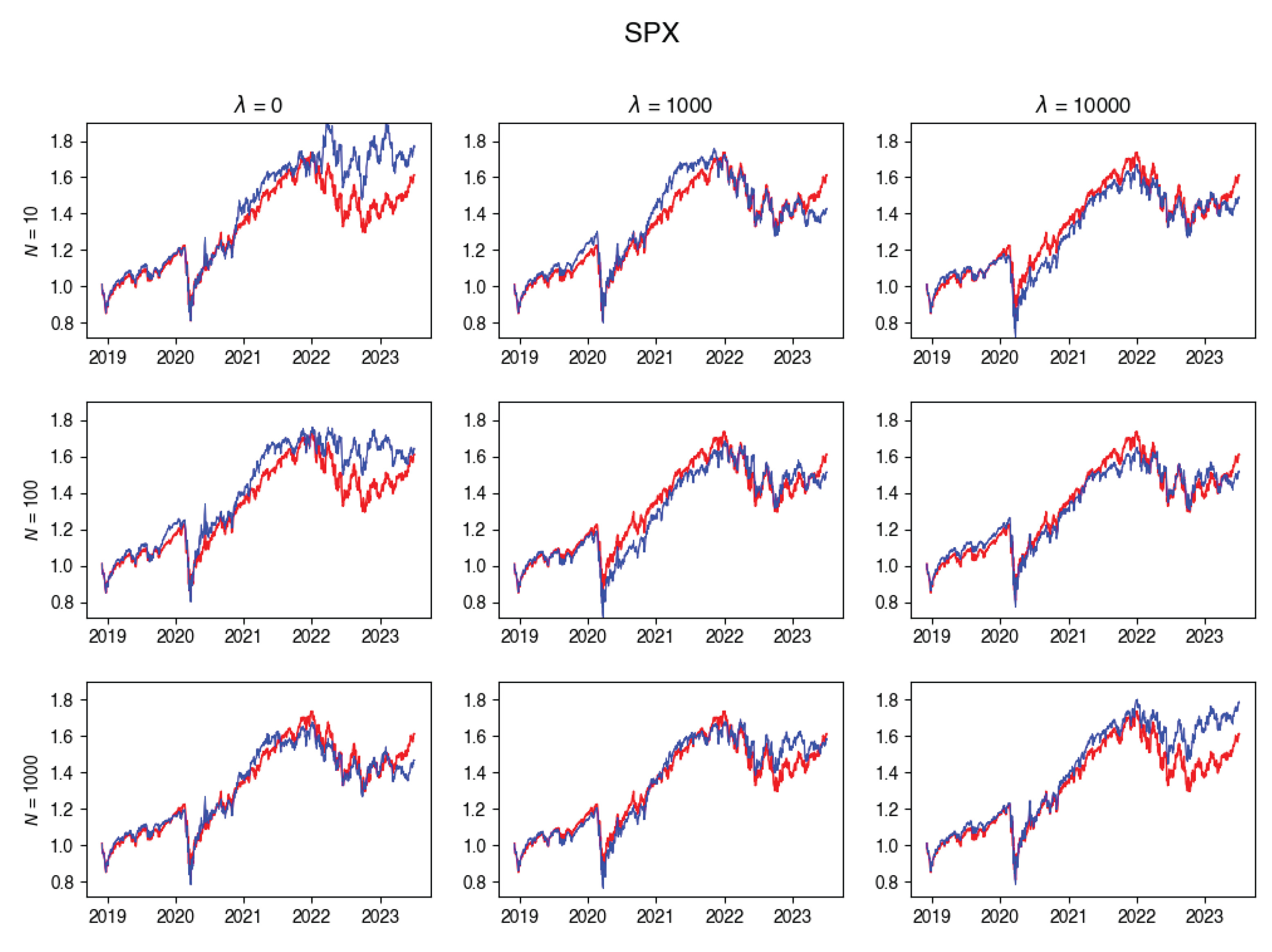

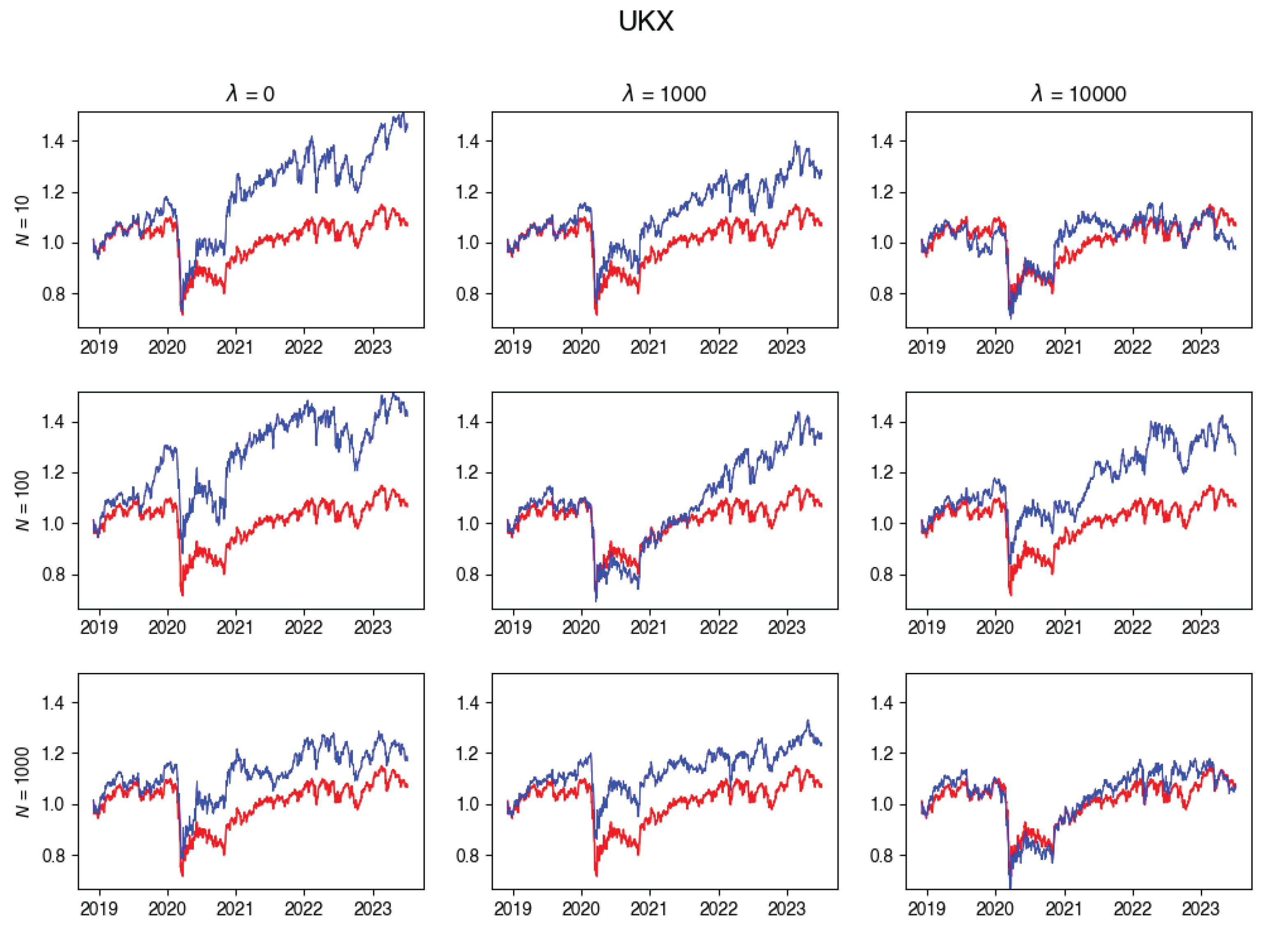

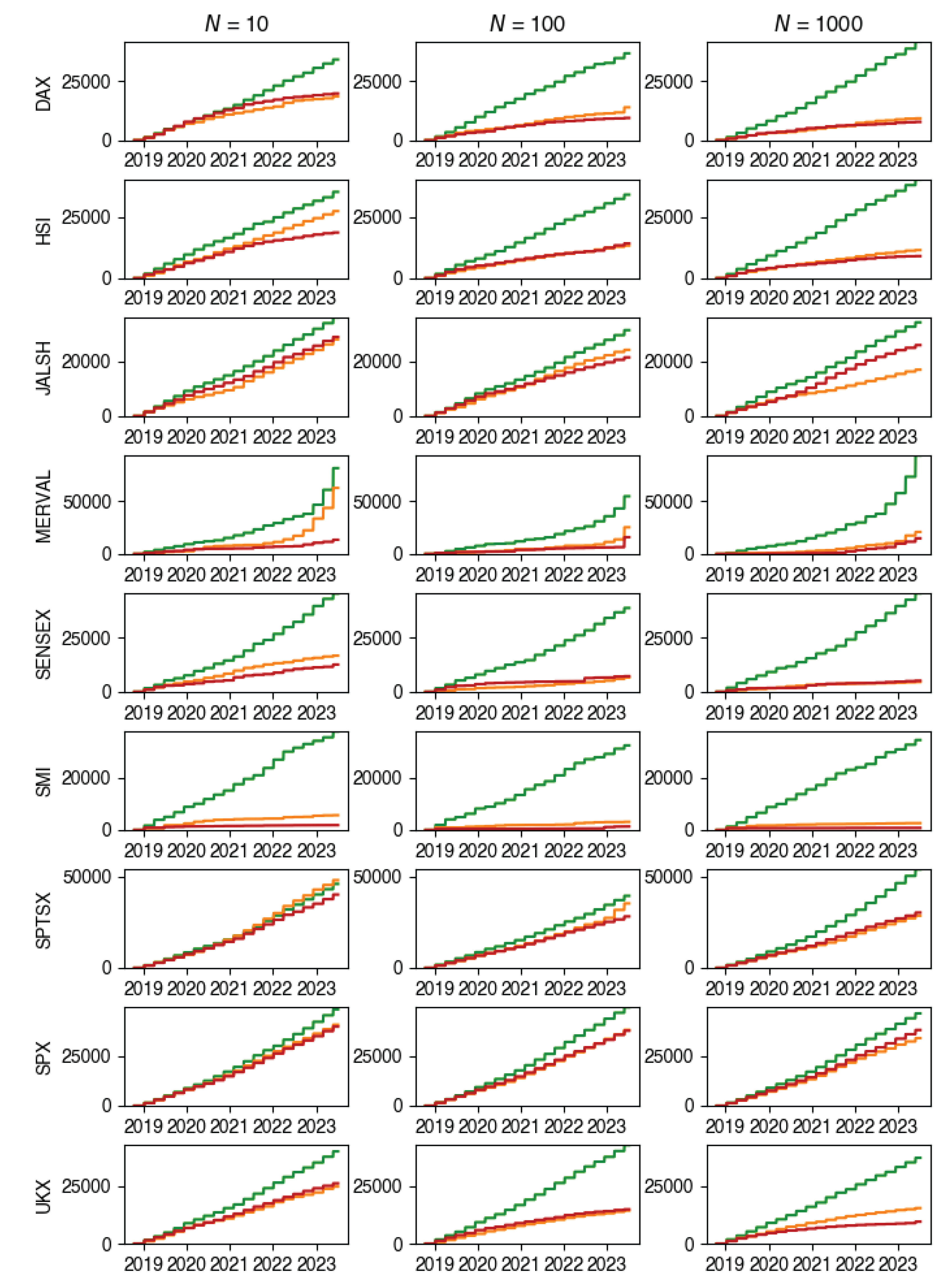

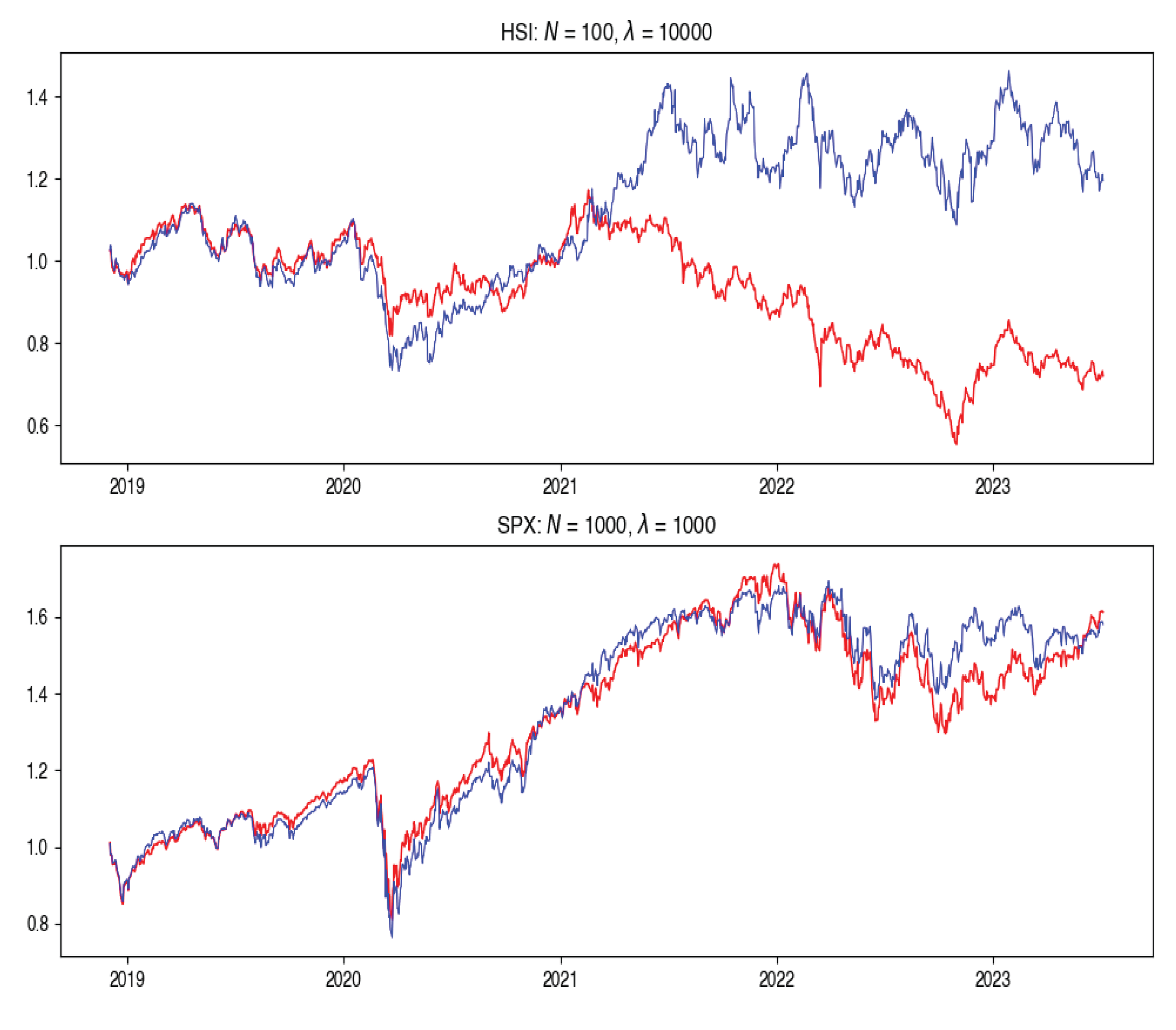

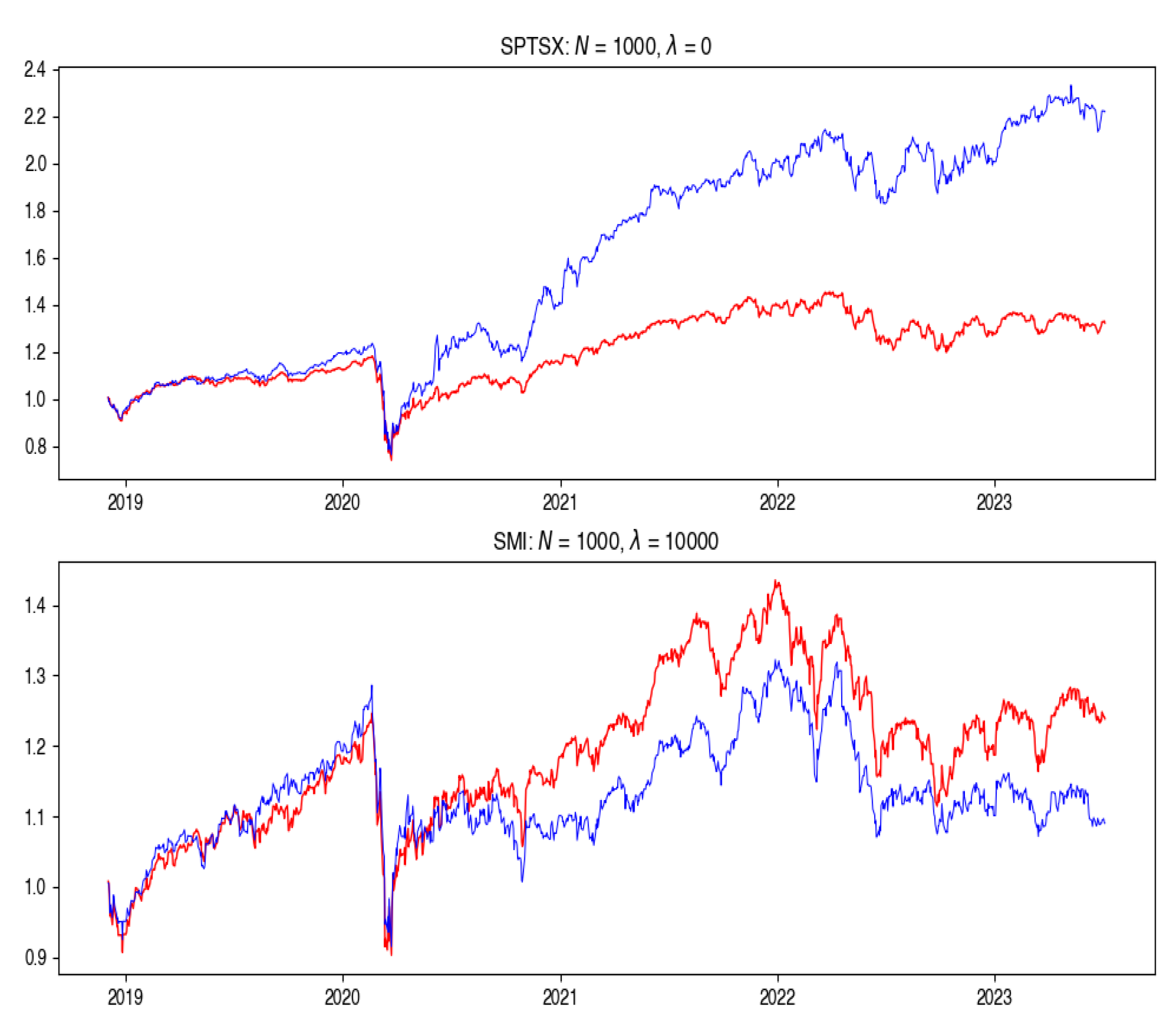

5.1. Tracking Error

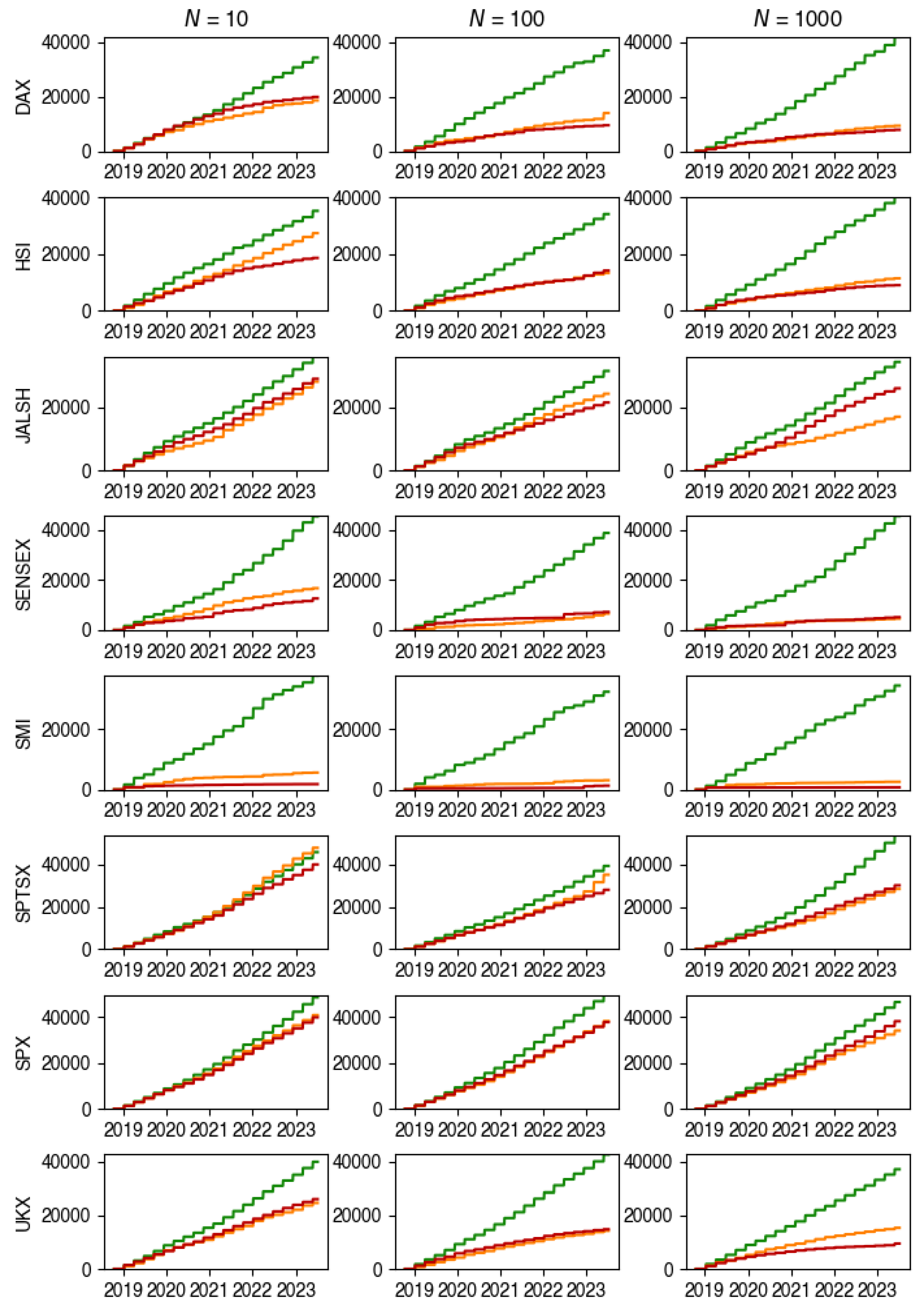

5.2. Total Cost

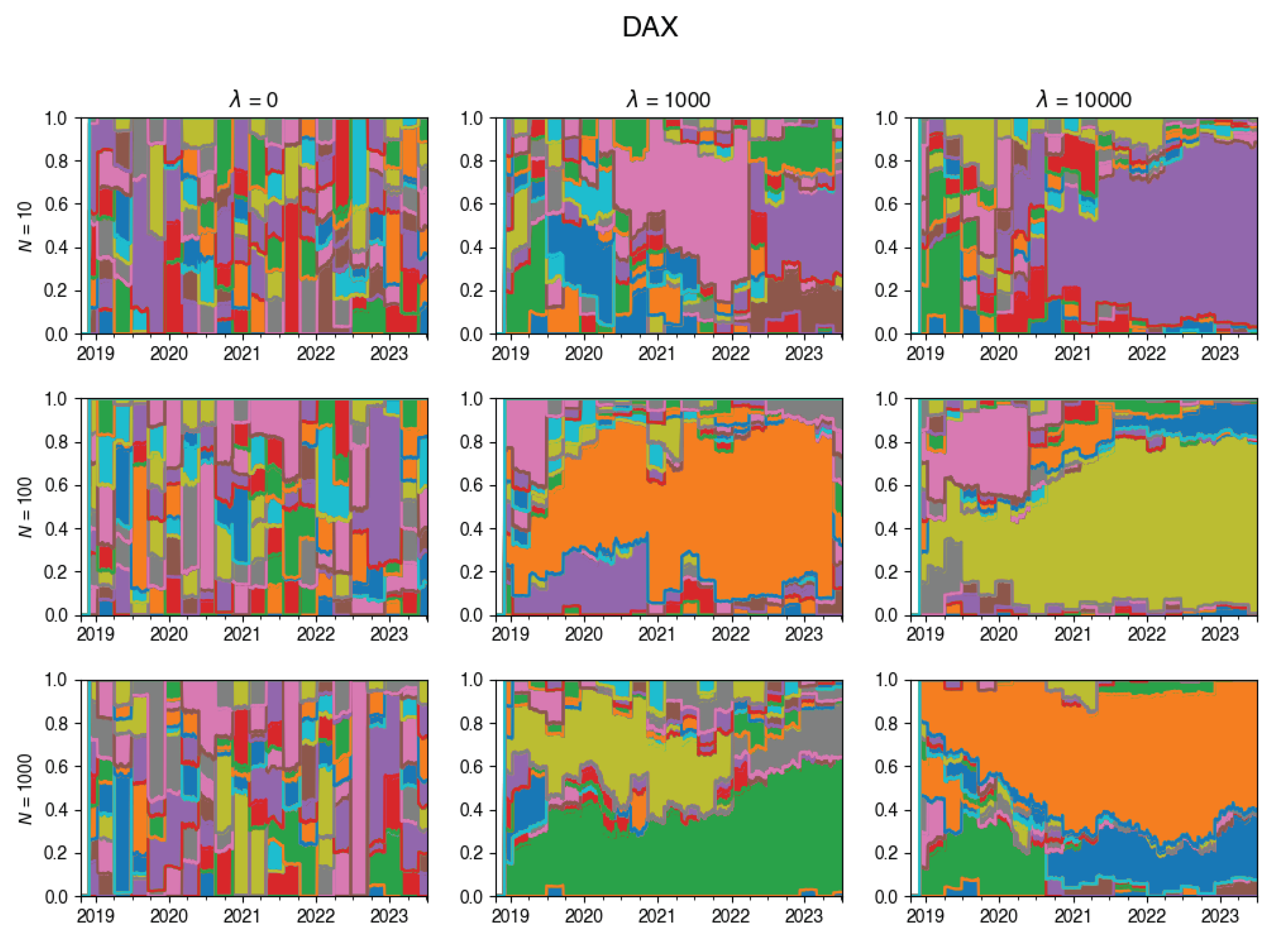

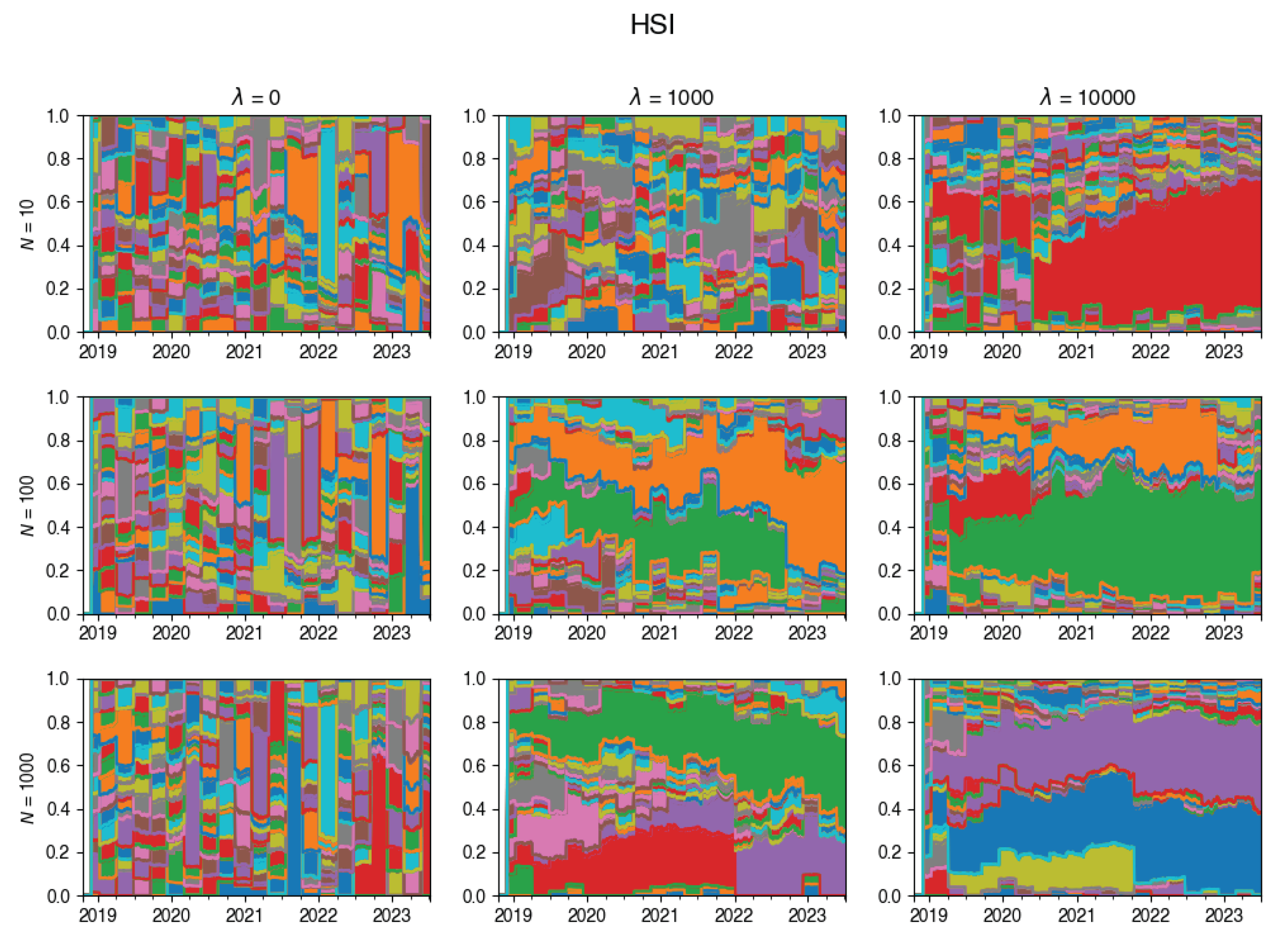

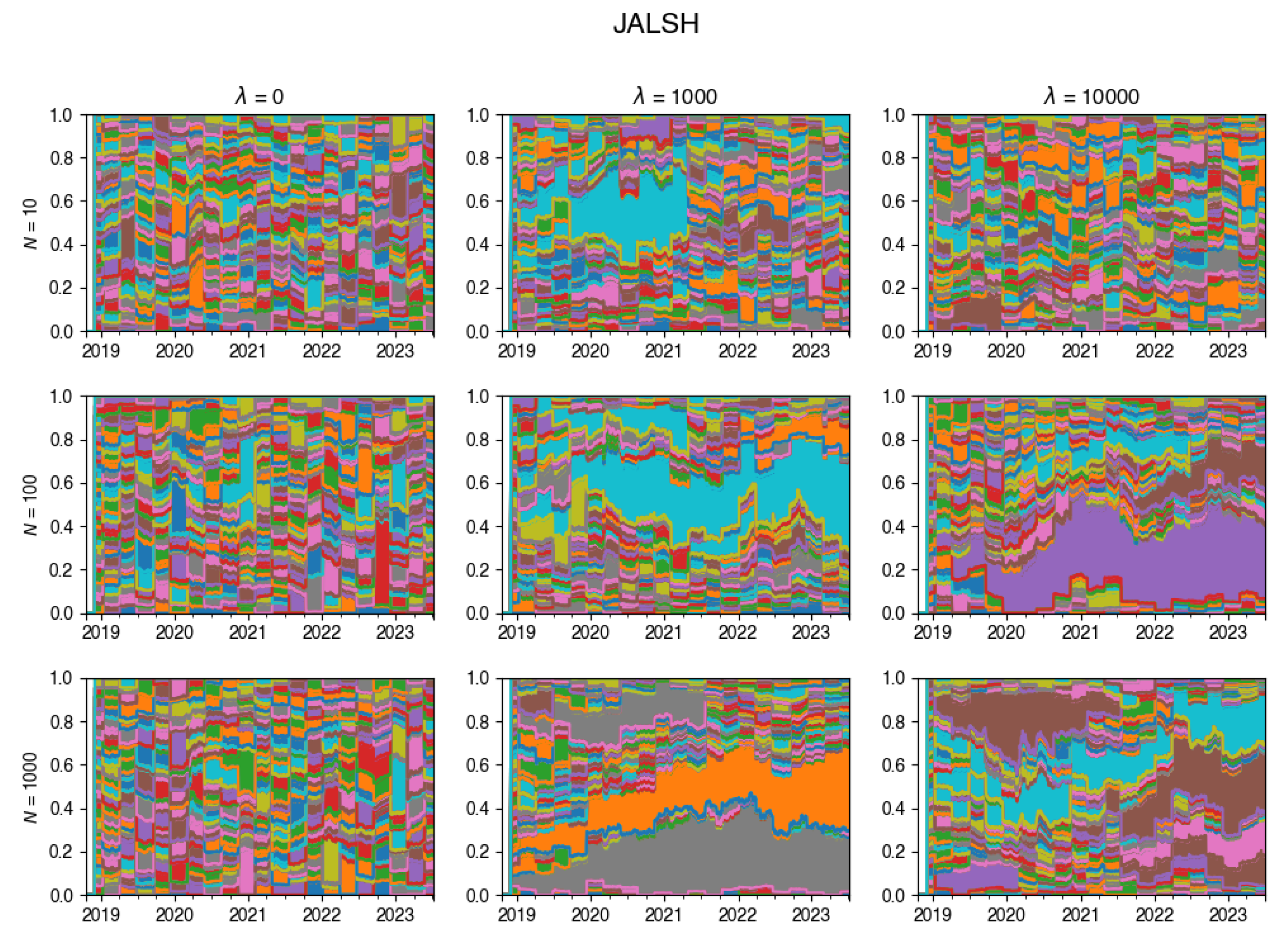

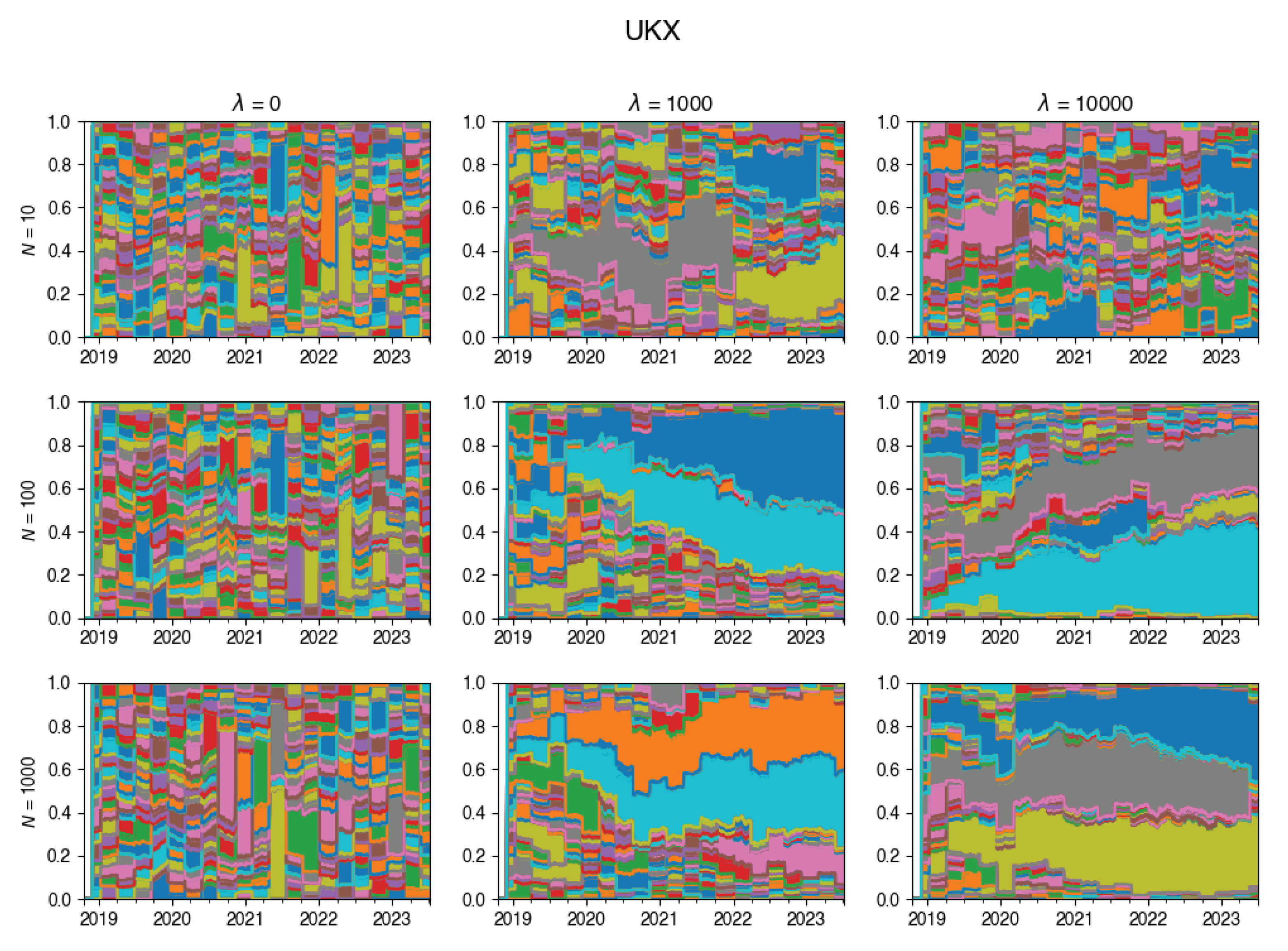

5.3. Retention

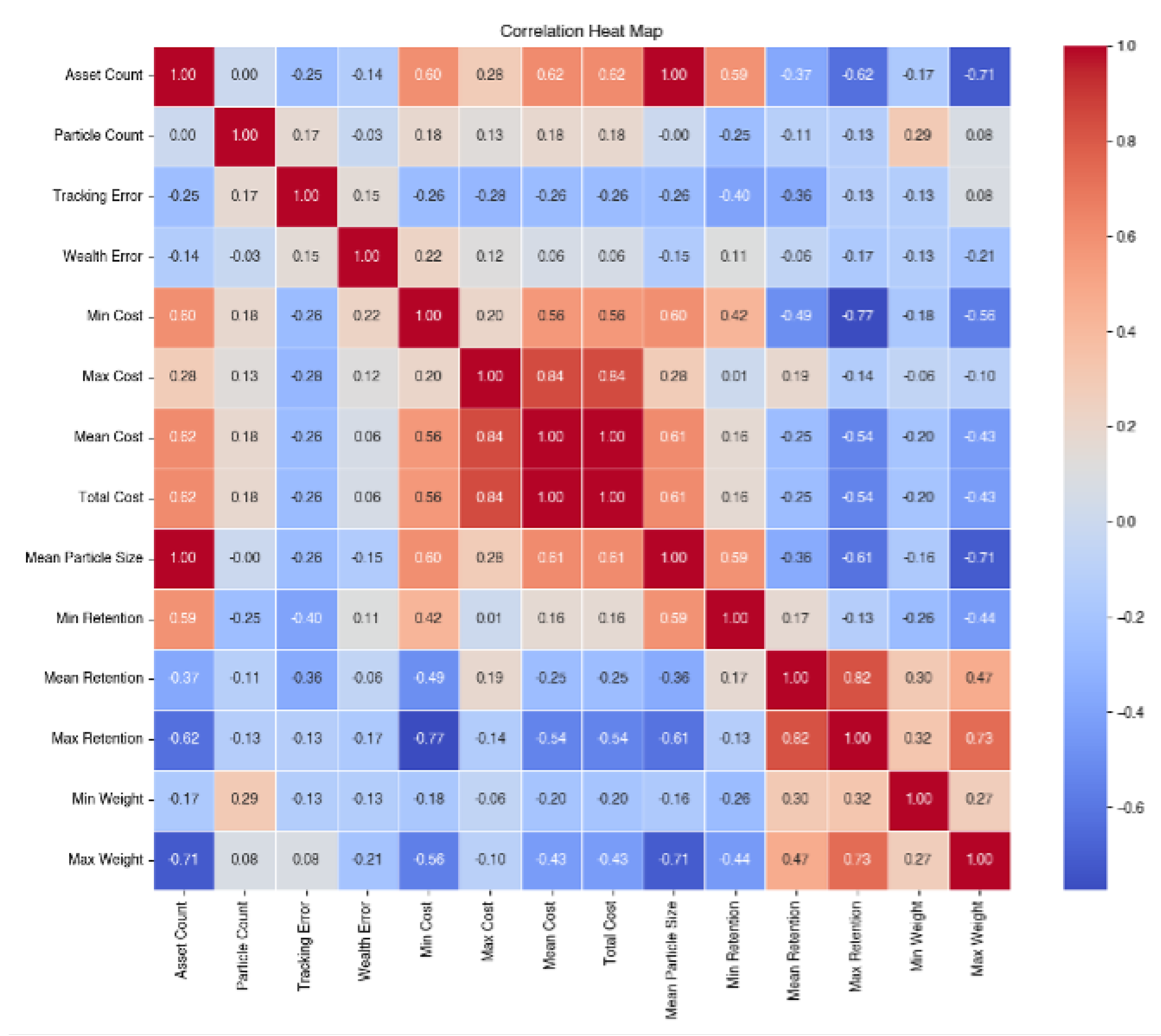

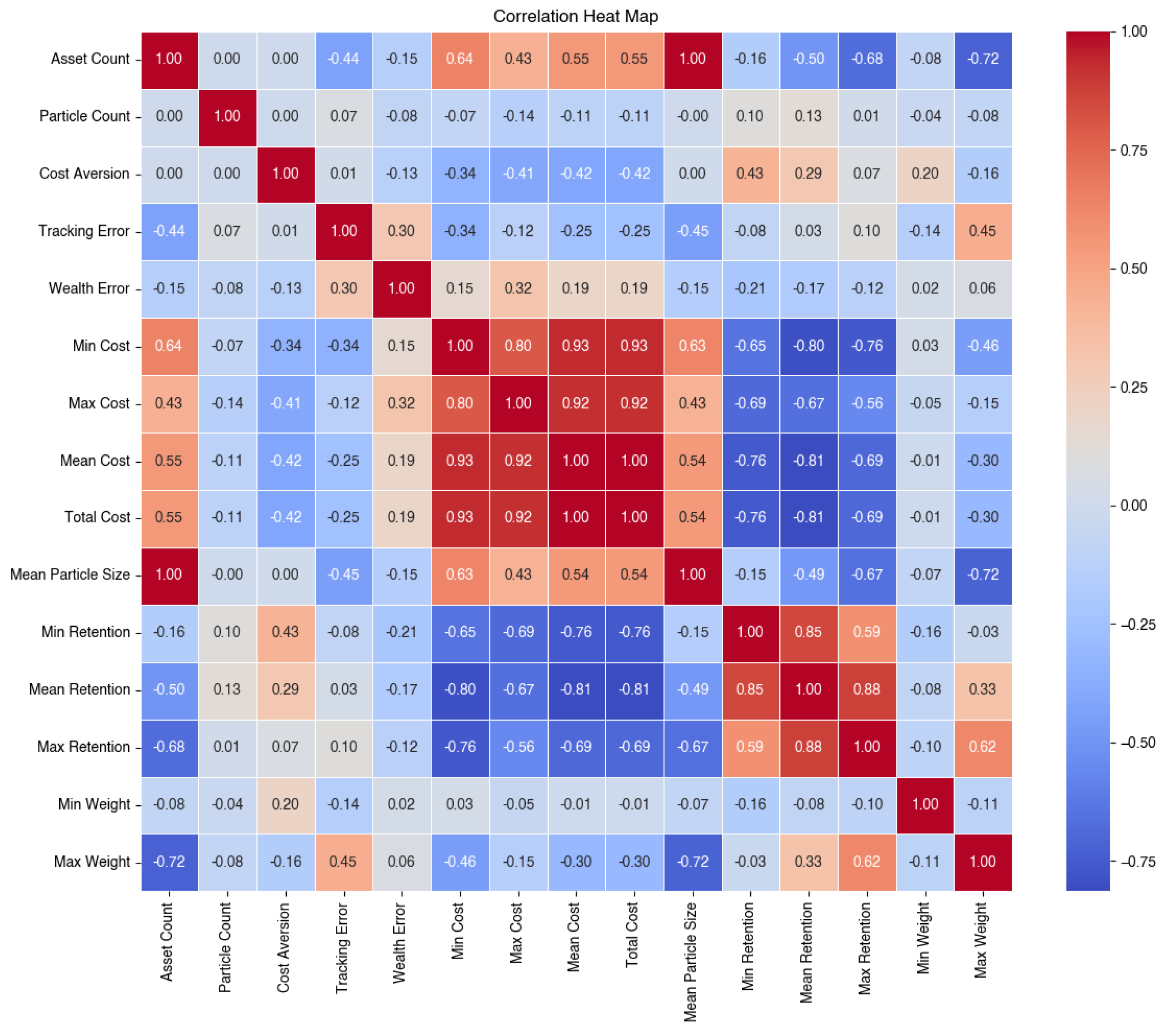

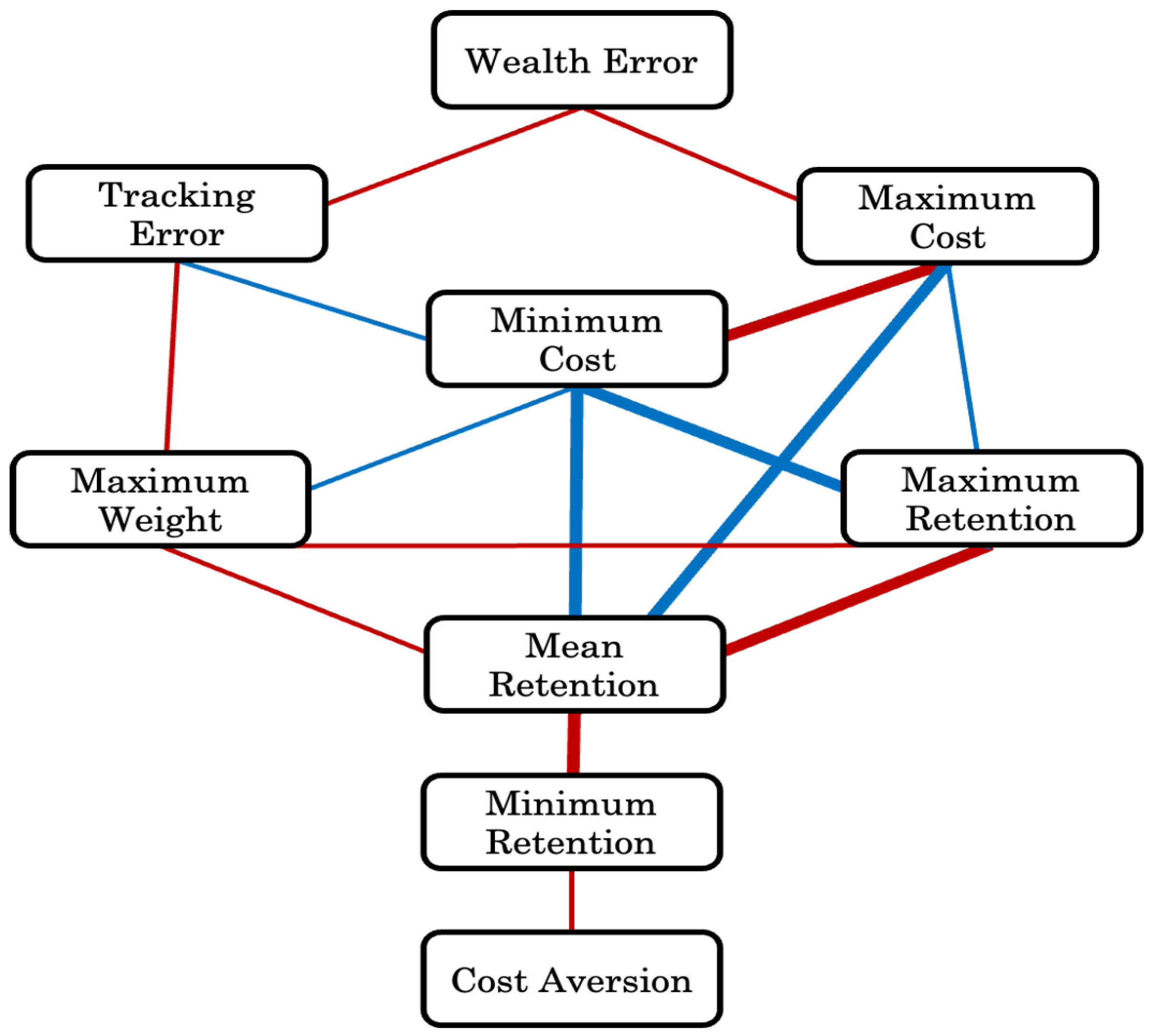

5.4. Mutual Correlation

6. Conclusions

- Consider the market impact as it can also lead to the additional losses when working with large volumes. Hence, investor should come up with smart order routing algorithms to optimize trade execution and reduce market impact. These algorithms can help split large orders into smaller ones and execute them in a way that minimizes price impact.

- Consider liquidity screening to avoid investing in assets that may have high transaction costs or are illiquid, as these can significantly impact the performance of your tracking strategy.

- Consider short sales so one can also track "short" indices. As well as considering short position, i.e. negative ’s which will relax the constraints in the proposed method.

- Consider other types of transaction costs: Tiered Commissions, Fixed-Plus-Percentage Commissions, Flat Fee Commissions.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

Appendix A.1. Tracking Performance

Appendix A.2. Transaction Costs

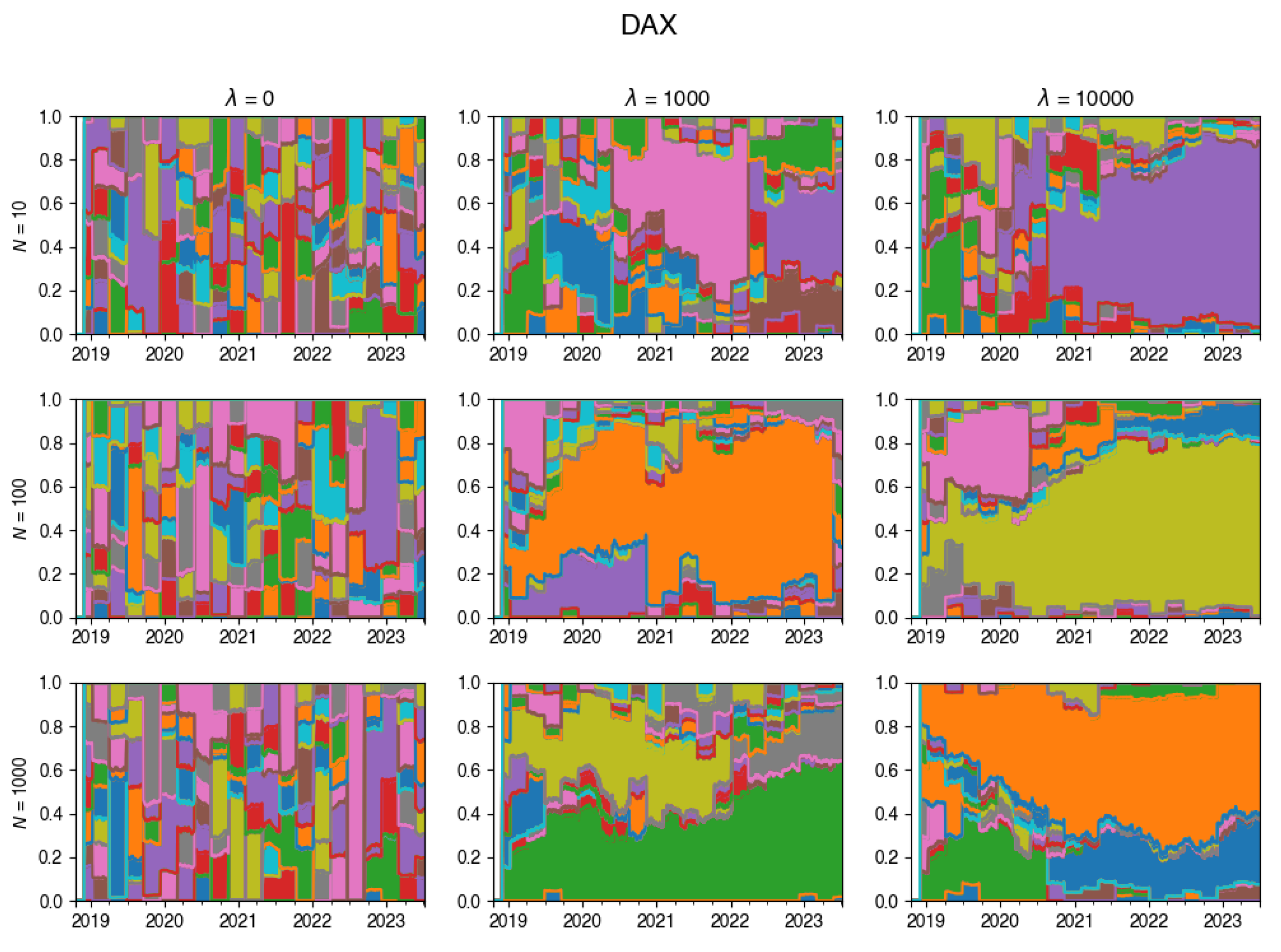

Appendix A.3. Composition Plots

References

- Barber, Brad and Terrance Odean. 2000. Trading is hazardous to your wealth: The common stock investment performance of individual investors. Journal of Finance 55(2), 773–806.

- Benidis, Konstantinos, Yiyong Feng, Daniel P Palomar, et al. 2018. Optimization methods for financial index tracking: From theory to practice. Foundations and Trends® in Optimization 3(3), 171–279.

- Chen, Zhe. 2003. Bayesian filtering: From Kalman filters to particle filters, and beyond. Statistics 182(1), 1–69. [CrossRef]

- Del Moral, Pierre, Arnaud Doucet, and Ajay Jasra. 2006, June. Sequential Monte Carlo Samplers. Journal of the Royal Statistical Society Series B: Statistical Methodology 68(3), 411–436.

- Duan, Jin-Chuan. 2019. Variable selection with big data based on zero norm and via sequential monte carlo. CompSciRN: Computational (Topic). [CrossRef]

- Gellert, Karol and Erik Schlögl. 2021, December. Parameter Learning and Change Detection Using a Particle Filter with Accelerated Adaptation. Risks 9(12), 228. [CrossRef]

- Rompotis, Gerasimos G. 2013. Actively vs. passively managed exchange traded funds. Aestimatio (6), 116–135.

- Ruf, Johannes and Kangjianan Xie. 2019. The impact of proportional transaction costs on systematically generated portfolios.

- Satpathy, Tanmay and Rushabh Shah. 2022, September. Sparse index tracking using sequential Monte Carlo. Quantitative Finance 22(9), 1579–1592. 1592.

- Speekenbrink, Maarten. 2016. A tutorial on particle filters. Journal of Mathematical Psychology 73, 140–152.

- Tibshirani, Robert. 1996. Regression shrinkage and selection via the lasso. Journal of the Royal Statistical Society Series B: Statistical Methodology 58(1), 267–288.

- Xu, Kelvin, Jimmy Ba, Ryan Kiros, Kyunghyun Cho, Aaron Courville, Ruslan Salakhudinov, Rich Zemel, and Yoshua Bengio. 2015. Show, attend and tell: Neural image caption generation with visual attention. In International conference on machine learning, pp. 2048–2057. PMLR.

| 1 | In Satpathy and Shah (2022) the sparse index problem is solved without considering any constraints on the . In such a case the optimal solution admits an explicit form. |

| 2 | Going forward particles, samples and permutations will be used interchangeably, i.e., each particle represents a particular subset of p of the n stocks comprising the index. |

| 3 | The proposal in MH algorithm has no relation to the proposal in the Importance Sampling step. |

| Hyper-parameters | Values |

|---|---|

| Step Size () | 0.2 |

| Lookback Window Size (T) | 30 |

| ESS Threshold | |

| Number of Particles (n) | |

| Variance Explained | 95% |

| Rebalance Frequency (Observations) | 60 |

| Transaction Cost per Unit Nominal () | 0.001 |

| Transaction Cost Penalty () |

| Index | Location | Number of Stocks | Sectors |

|---|---|---|---|

| SMI | Switzerland | 20 | Financials, industrials, pharmaceuticals and technology |

| SENSEX | India | 30 | Information technology, financial services, energy, and consumer goods. |

| DAX | Germany | 30 | Automotive, financial services, industrials and technology. |

| HSI | Hong Kong | 50 | Financials, real estate, technology and consumer goods. |

| UKX | United Kingdom | 100 | Financials, energy, consumer goods and pharmaceuticals. |

| JALSH | South Africa | 164 | Financials, mining, consumer goods and telecommunications. |

| SPTSX | Canada | 230 | Financials, energy, materials, and industrials. |

| SPX | United States | 500 | Financials, technology, healthcare and consumer discretionary. |

| Tracking Error | Wealth Error | Total Cost | |||||||

|---|---|---|---|---|---|---|---|---|---|

| N = 10 | 0.59877% | 0.58457% | 0.59178% | 17.27785% | 16.36773% | 13.40419% | 40393.76 | 26249.92 | 23510.09 |

| DAX | 0.58689% | 0.72071% | 0.76259% | 18.71743% | 26.21527% | 11.35055% | 34235.95 | 18562.46 | 19843.48 |

| HSI | 0.82953% | 0.63888% | 0.69552% | 12.35483% | 10.12154% | 10.09875% | 35225.75 | 27373.53 | 18640.06 |

| JALSH | 0.64292% | 0.62397% | 0.69927% | 17.15719% | 15.79817% | 20.58057% | 36106.94 | 28107.81 | 29007.45 |

| SENSEX | 0.61286% | 0.67109% | 0.74528% | 16.08276% | 19.30123% | 30.29464% | 45328.63 | 16664.50 | 12578.89 |

| SMI | 0.50931% | 0.55798% | 0.57527% | 29.17910% | 8.33662% | 5.28817% | 37639.89 | 5636.16 | 1827.69 |

| SPTSX | 0.54980% | 0.57193% | 0.39170% | 17.28082% | 35.47859% | 20.98324% | 45940.40 | 48004.04 | 40105.69 |

| SPX | 0.57546% | 0.38831% | 0.37443% | 9.85225% | 4.74101% | 4.52234% | 48630.53 | 40897.98 | 39905.47 |

| UKX | 0.48338% | 0.50373% | 0.49014% | 17.59846% | 10.94941% | 4.11529% | 40042.00 | 24752.89 | 26171.98 |

| N = 100 | 0.65428% | 0.68345% | 0.67622% | 13.24902% | 14.64676% | 9.74140% | 38163.94 | 18630.72 | 16815.02 |

| DAX | 0.69572% | 0.83409% | 0.83155% | 12.95641% | 7.62099% | 6.69474% | 36843.25 | 13963.39 | 9471.72 |

| HSI | 0.81485% | 0.77457% | 1.08637% | 7.70339% | 6.42025% | 23.29781% | 34100.34 | 13288.64 | 14176.46 |

| JALSH | 0.76951% | 0.81020% | 0.77314% | 31.79696% | 6.70502% | 6.78045% | 31491.44 | 24276.11 | 21502.14 |

| SENSEX | 0.67007% | 0.68515% | 0.87292% | 9.05378% | 34.55286% | 7.30683% | 38671.82 | 6561.78 | 7200.32 |

| SMI | 0.51122% | 0.47362% | 0.43846% | 4.21370% | 3.68650% | 10.42701% | 32318.57 | 3103.56 | 1326.33 |

| SPTSX | 0.59226% | 0.98857% | 0.40284% | 6.73261% | 44.14928% | 3.91737% | 39423.03 | 35252.99 | 28133.31 |

| SPX | 0.58038% | 0.41832% | 0.38740% | 8.34139% | 4.98613% | 3.90626% | 49695.05 | 38282.31 | 37832.97 |

| UKX | 0.60027% | 0.48307% | 0.61705% | 25.19396% | 9.05303% | 15.60073% | 42768.02 | 14316.99 | 14876.88 |

| N = 1000 | 0.66062% | 0.63942% | 0.65255% | 15.06630% | 10.34565% | 12.39240% | 41729.76 | 15367.46 | 15836.81 |

| DAX | 0.67222% | 0.90155% | 1.01459% | 6.95423% | 26.81817% | 7.27033% | 41729.35 | 9298.69 | 7814.12 |

| HSI | 0.84903% | 0.90031% | 0.98868% | 17.99268% | 9.28388% | 5.53880% | 40210.23 | 11448.09 | 9021.65 |

| JALSH | 0.78545% | 0.69222% | 0.79928% | 25.66035% | 12.01656% | 37.61821% | 34345.00 | 16989.90 | 25995.95 |

| SENSEX | 0.70163% | 0.78741% | 0.70523% | 6.79509% | 7.14030% | 8.94453% | 45435.92 | 4534.44 | 5113.80 |

| SMI | 0.57148% | 0.41061% | 0.41420% | 9.44854% | 6.38063% | 6.90988% | 34374.99 | 2601.58 | 778.90 |

| SPTSX | 0.65343% | 0.50946% | 0.42155% | 39.18594% | 4.76414% | 21.71314% | 53907.41 | 28532.57 | 30234.32 |

| SPX | 0.52266% | 0.36746% | 0.40129% | 3.65117% | 4.24413% | 7.47839% | 46589.27 | 34119.90 | 38219.30 |

| UKX | 0.52907% | 0.54635% | 0.47563% | 10.84243% | 12.11736% | 3.66587% | 37245.90 | 15414.52 | 9516.43 |

| AVERAGE | 0.63789% | 0.63582% | 0.64018% | 15.19773% | 13.78671% | 11.84600% | 40095.82 | 20082.70 | 18720.64 |

| Min Retention | Mean Retention | Max Retention | Max Weight | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 10 | 8.705% | 15.408% | 21.348% | 25.048% | 32.504% | 33.770% | 46.902% | 52.568% | 48.031% | 50.386% | 45.648% | 42.404% |

| DAX | 0.000% | 14.286% | 14.286% | 17.826% | 34.398% | 32.989% | 42.857% | 62.500% | 57.143% | 63.028% | 71.368% | 84.534% |

| HSI | 7.143% | 12.500% | 18.750% | 22.676% | 28.691% | 30.356% | 56.250% | 53.846% | 50.000% | 67.825% | 31.116% | 62.487% |

| JALSH | 12.500% | 16.000% | 12.000% | 21.952% | 27.401% | 26.963% | 38.462% | 34.615% | 38.462% | 20.843% | 34.718% | 16.469% |

| SENSEX | 0.000% | 16.667% | 33.333% | 30.961% | 43.818% | 45.447% | 50.000% | 66.667% | 66.667% | 56.195% | 74.368% | 64.280% |

| SMI | 16.667% | 25.000% | 50.000% | 44.474% | 55.088% | 59.211% | 80.000% | 100.000% | 75.000% | 85.063% | 84.874% | 65.526% |

| SPTSX | 11.905% | 11.111% | 11.628% | 21.558% | 21.741% | 23.810% | 31.707% | 31.111% | 33.333% | 41.747% | 22.745% | 14.569% |

| SPX | 16.162% | 17.172% | 15.000% | 20.936% | 22.124% | 21.799% | 28.571% | 26.804% | 26.804% | 25.796% | 10.552% | 7.094% |

| UKX | 5.263% | 10.526% | 15.789% | 20.000% | 26.773% | 29.584% | 47.368% | 45.000% | 36.842% | 42.592% | 35.445% | 24.272% |

| 100 | 9.665% | 22.845% | 25.789% | 25.532% | 37.482% | 39.257% | 50.660% | 57.074% | 57.471% | 55.490% | 50.188% | 47.683% |

| DAX | 0.000% | 14.286% | 25.000% | 21.930% | 38.158% | 45.019% | 66.667% | 62.500% | 71.429% | 73.474% | 79.150% | 78.900% |

| HSI | 6.667% | 25.000% | 18.750% | 21.583% | 34.948% | 33.136% | 50.000% | 50.000% | 50.000% | 62.346% | 52.145% | 60.134% |

| JALSH | 11.538% | 20.000% | 20.000% | 23.593% | 32.551% | 30.030% | 42.308% | 46.154% | 42.308% | 40.864% | 40.055% | 41.143% |

| SENSEX | 0.000% | 28.571% | 33.333% | 28.321% | 45.405% | 54.595% | 50.000% | 83.333% | 83.333% | 66.602% | 63.731% | 63.303% |

| SMI | 16.667% | 50.000% | 50.000% | 43.684% | 67.456% | 69.912% | 100.000% | 100.000% | 100.000% | 90.251% | 50.437% | 53.204% |

| SPTSX | 17.778% | 11.111% | 15.909% | 23.719% | 24.644% | 25.510% | 38.636% | 35.714% | 37.778% | 53.869% | 54.694% | 26.812% |

| SPX | 14.141% | 18.000% | 17.000% | 20.069% | 22.703% | 23.017% | 26.087% | 26.263% | 27.551% | 15.480% | 14.424% | 13.783% |

| UKX | 10.526% | 15.789% | 26.316% | 21.357% | 33.989% | 32.839% | 31.579% | 52.632% | 47.368% | 41.030% | 46.865% | 44.187% |

| 1000 | 5.721% | 25.437% | 28.054% | 23.525% | 41.154% | 43.755% | 43.607% | 57.573% | 55.807% | 56.290% | 39.176% | 38.516% |

| DAX | 0.000% | 14.286% | 28.571% | 18.252% | 46.523% | 47.932% | 50.000% | 71.429% | 71.429% | 100.000% | 62.516% | 69.324% |

| HSI | 0.000% | 25.000% | 20.000% | 16.684% | 36.394% | 37.876% | 28.571% | 57.143% | 46.667% | 71.379% | 43.143% | 42.285% |

| JALSH | 8.333% | 16.000% | 23.077% | 21.220% | 30.132% | 32.222% | 42.308% | 40.000% | 40.000% | 26.412% | 39.078% | 30.861% |

| SENSEX | 0.000% | 42.857% | 50.000% | 30.326% | 58.312% | 66.458% | 57.143% | 66.667% | 83.333% | 55.485% | 51.655% | 48.034% |

| SMI | 0.000% | 50.000% | 50.000% | 35.175% | 73.509% | 81.842% | 75.000% | 100.000% | 100.000% | 83.152% | 45.231% | 40.284% |

| SPTSX | 11.905% | 18.182% | 11.111% | 21.700% | 26.451% | 26.308% | 31.818% | 41.463% | 33.333% | 38.698% | 21.954% | 27.368% |

| SPX | 15.000% | 17.172% | 20.619% | 21.358% | 23.893% | 24.524% | 27.174% | 31.250% | 29.592% | 25.586% | 14.770% | 13.270% |

| UKX | 10.526% | 20.000% | 21.053% | 23.485% | 34.017% | 32.881% | 36.842% | 52.632% | 42.105% | 49.609% | 35.064% | 36.699% |

| AVERAGE | 8.030% | 21.230% | 25.064% | 24.702% | 37.047% | 38.927% | 47.056% | 55.738% | 53.770% | 54.055% | 45.004% | 42.868% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).