1. Introduction

In conditions absent of perfect competition a firm may achieve pricing in excess of marginal cost and so enjoy monopoly rents through a price markup, where price markup is defined as price divided by marginal cost (µ = P/MC). This can be demonstrated as a production level equilibrium point producing deadweight loss and so is societally inefficient. Higher price mark ups are equally believed to decrease the share to labour, and so increase inequality, while reducing output and investment (inter alia De Loecker et al. 2020 and Syverson 2019)

Starting in the 1950’s the structure-conduct-performance paradigm (SCPP) framework was used to estimate measures of market power and price markup (Bain 1951). These studies attempted to regress structure, typically market concentration as measured by the Herfindahl-Hirschman index, with firm profits: namely investigating the hypothesis that high levels of concentration leads to market power. However, the approach has been largely abandoned in the face of criticism (see Bresnahan 1989). Structure will always likely be difficult to determine: what constitutes the market in which the firm operates? how might variation in a firm’s geographic footprint be accounted for? The black box of management conduct may represent a multiplicity of possibilities and furthermore, given prices and marginal costs are difficult or impossible to obtain, performance as based on those measures will be equally difficult to determine.

More recently, in the context of reported declines in the labour share (Elsby et al. 2013 and Karabarbounis 2014) and more broadly reports of rising inequality (Piketty 2014 and Stiglitz 2015), the last several decades have seen the development of new approaches to the measurement of price markup. With the afore-mentioned problems of measuring marginal cost, these methods seek alternative estimates according to market transactions, but which come not without their own methodological challenges. These studies are generally reporting markup levels rising over time and all in excess of one.

In assuming cost minimisation and profit maximisation, production-function methods back out the markup given production function inputs should be employed to the point where marginal returns, of the inputs, are equal to marginal costs. Hall (1988) determines markup as the ratio of the output elasticity to a variable input and the share of revenue paid to that input. The method assumes constant output elasticities, and in examining changes in inputs to outputs over time is only able to offer a picture of average markup over such, long, time frames. De Loecker and Eeckhout (2018) and De Loecker, Eeckhout and Unger (2020) further developed this production-function method in employing a single production input only and which does not require the calculation of profit. However, in assuming constant coefficients in the production function the approach cannot account for technical change and requires a broad set of data and so makes for further technical difficulty. Crucially marginal cost is assumed to be equal to average cost and so in an environment where fixed costs have outpaced variable costs markups will be overestimated. We will examine in the ensuing discussion the strong possibility that this has indeed been the case over the period studied with a growth in firm balance sheet intangibles, software and R&D. This observation seems to be reflected in the results for these studies which seem too high to be plausible: the reported global markup increasing from 1.15 in 1980 to 1.6 in 2016, and with the results for some countries (Denmark and Switzerland) more than doubling with markup levels approaching three. These estimates are greater than the rate required to explain declines in the labour share and fail to temporally match such labour share changes (Syverson 2019); the implied profit levels from such markups also did not translate into reported firm profits during the period studied. Further, Raval (2023) has recently shown considerable differences in computed markups according to the input employedi.

Another approach by Barkai (2020) under the assumption of constant returns to scale uses the identity that the markup is equal to the ratio of revenue to total labour and capital costs. These costs are determined using US National Accounts data for labour compensation and the capital stock, with a user cost of capital to impute the cost of capital. The depreciation and inflation elements of capital costs are not firm specific but rather limited to three categories; the cost of borrowing is similarly treated as the same across all firms and in using AAA bonds sets risk at a level highly likely to be lower than that faced by many firms. The study finds an increase in economic profits from 2.2% (1984) to 15.7% in 2014.

More generally, such an emergence of high levels of markup is not reflective of the near past empiric macroeconomic environment Basu (2019). If higher markups are not achieved through higher pricing (ie with ensuing inflation), then their source must be lower costs accruing from productivity gains; equally higher markups should be associated with lower employment given the output of the firm with market power will be lower than the firm in perfect competition. Instead, we have witnessed generally stable and near full employment, low inflation, and week productivity gains in the most recent past. We should also note that these approaches continue to rely on the ratio of price to marginal cost which ignores any notion that the firm will have fixed costs, which, to be profitable, they would need to recover through price. The historic definition of markup as the ratio of price to marginal cost remains problematic.

The most recent literature also points to a contemporaneous increase in Tobin’s Q Eggertsson et al. (2021). In a similar manner, we would expect the firm in perfect competition to have a Tobin’s Q of one. A market value exceeding replacement cost (so Q >1) signals anticipated future profit payments: economic rent. Under conditions of free market entry, we would imagine other firms entering the market and thus pushing the industry Q towards one as price competition takes hold. Lindenberg and Ross (1981) found a relationship between price mark upii and Tobin’s Q, and Eggertsson et al. (2021) show that ∂µ/∂Q > 0.

I propose an alternative approach for the calculation of price markup which is most closely related to the economic-profit approach of Barkai (2020) and others (Caballero 2017 & Gutiérrez 2017) and which avoids some of the problems with these aforementioned methods and which may bridge the gap between reported markups and the wider macroeconomic experience. This paper aims to: 1) offer an alternative definition of price markups 2) compute price markups for The UK’s FTSE 100 companies (2018 – 2023); 3) provide a theory for forward-looking price markups; 4) explain variance in modelled markups to expected price markups and, 5) provide microeconomic explanation where individual firm price markups appear significantly high.

2. Theory

2.1. Economic Rent and Price Markup

An accepted definition of economic rent is: ‘Those payments to a factor of production that are in excess of the minimum payment necessary to have that factor supplied’ (Varian 1987). I take the ‘payment’ as the firm’s income (Ii) and the ‘minimum payment necessary’ as the firm’s opportunity cost of equity (Ci).

Proposition 1: Economic Rent of the firm (E

i) is income minus the cost of equity.

Proposition 2: The economic rent of the firm may be normalised according to revenue giving markup, µ

i.

Where:

PYi : Revenue for firm i

Therefore, the markup for the market, µ

m, is:

where:

Em : economic rent of the market

2.2. Expected Markup

Proposition 3: The expected markup of the firm (µₑ) is equal to the firm’s current Tobin’s Q.

Where:

M : Market Equity Value of the firm

L : Book Value of Liabilities of the firm

T : Book Equity of the firm

Proof: µₑ = Q

M will be the sum of future economic rent (E) plus the cost of equity (C).

From financial Terminal Value Theory, will be equal to Et

Where:

t : terminal coefficient for the firm

Where:

g : growth of the firm

c : cost of equity (%)

Now,

is equal to

, and given the terminal coefficient for the cost of equity will have g = 0, we have that t as applied to cT will be equal to

. It follows that

will be equal to T.

Let Q

0 be the firm’s Tobin’s Q at the time of the inception of the firm, therefore:

Now at the inception of the firm, M will be equal to T: there will be no immediate economic rent (Q0 = 1).

At time N, Tobin’s Q will be:

With EN not constrained as being equal to zero.

If we now imagine that the firm is sold to new owners at time N, the sale price will be ENt + T0 + L.

The price markup will be sale price divided by cost

iii.

(13) is equal to (11), therefore we have that µₑ = Q.

3. Model and Data

The Capital Asset Pricing Model (CAPM) (Sharpe 1964) yields the expected return for an asset (the firm), R

ei

Where:

Rf : risk-free rate

βi : Beta of firm i

Rem : expected return of the market

We are modelling for current (historic) rents and markups, so we replace the firm’s expected return with the cost of equity (ci). Equally, the expected return of the market is replaced with the actual return of the market R(m).

Therefore, I use the CAPM to derive the firm’s cost of equity and as:

Therefore, the total cost of equity for the firm is:

I compute economic rent and markups according to propositions 1 and 2, and the CAPM derived cost of equity (17). I model for two alternate values for income: firm’ income-statement income, and secondly this income plus change in equity valuation (2018 to 2023), which I call ‘adjusted’ markup (µ

a). The market I use is The London Stock Exchange’s FTSE 100. I use firms’ accounts data for the financial years ending 2018 to 2023 and The Industry Classification Benchmark. The risk-free rate is the UK Debt Management Office’s long term rate. The market return and risk-free rate are both adjusted according to the reported Consumer Prices Index by the UK’s Office for National Statistics (ONS). I define the set of firms with significant markup (µ

s) over the period as those with markups one standard deviation greater than the mean of the market (18).

While Proposition 3 is concerned with expected markups, using firms’ accounts and market data I do compute Tobin’s Q and compare to actual markups.

4. Results

Market markup over the period is 0.99; annualised stock appreciations were 6.5% therefore increasing the markup estimate (µ

a) to 1.07; Tobin’s Q is computed as 1.06 (

Table 1).

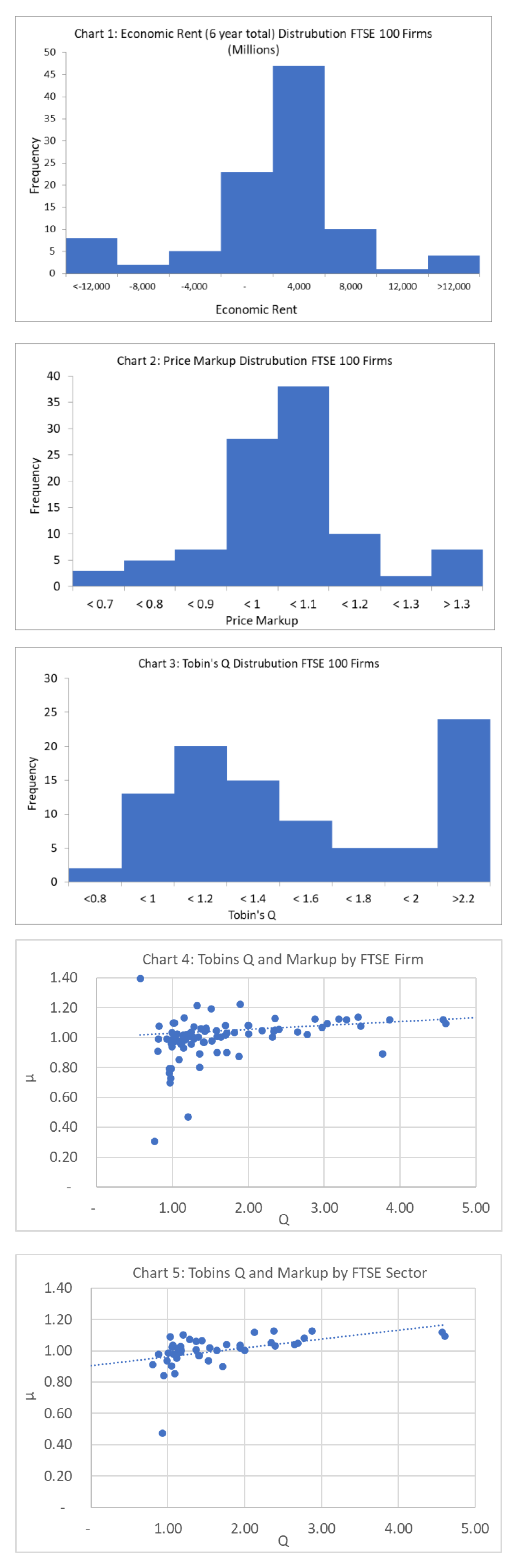

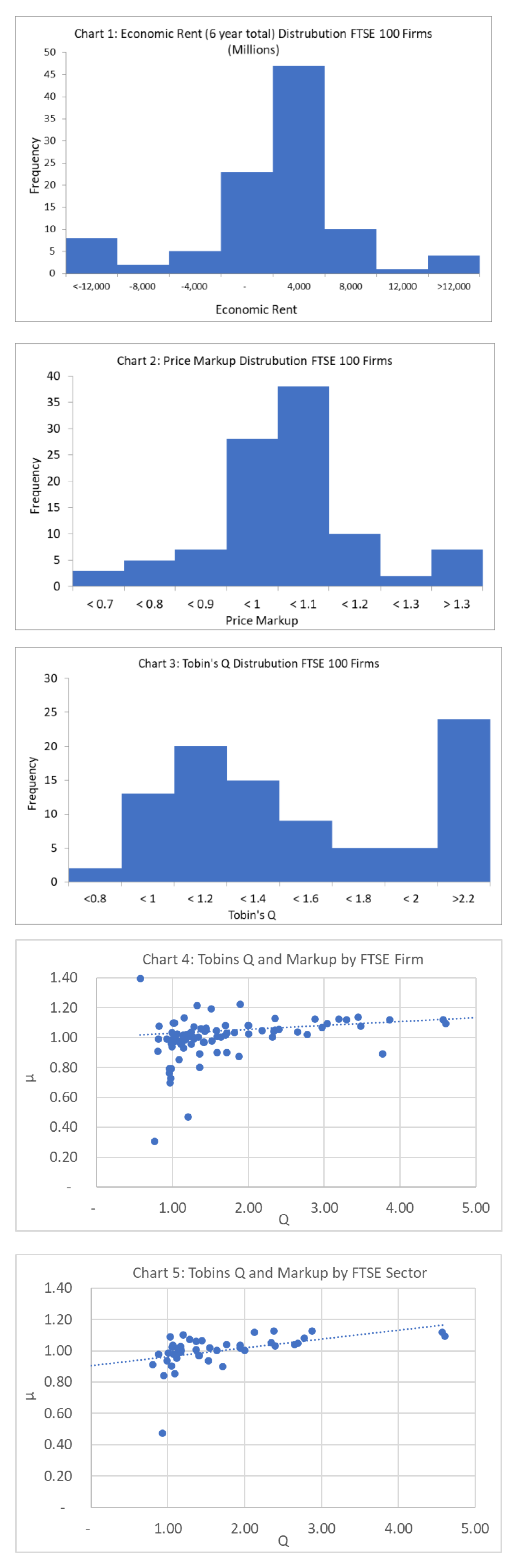

Across years, market markup is consistent at unity and largely shows consistency at the industry and sector levels. Most firms earn some level of economic rent with a µ>1 (Charts 1 & 2). While market Tobin’s Q is estimated as equivalent to the adjusted markup, firm values for Q are generally higher than their corresponding µ (medians are respectively 1.36 and 1.02) with the distribution for Q characterised by a number of liability heavy balance sheet financial firms with Qs closer to unity and with a larger right tail (Charts 2 - 6). This difference is also shown by the measure Q/µ (

Table 1).

Seven firms meet the definition for significant markup with industry/sector membership limited to Real Estate, Technology/Media and Financial Services/Equity Investment (

Table 2).

5. Discussion

My approach avoids the need to estimate marginal costs as employed by other more recently developed methodologies. I use audited expenses to determine income, those of labour, financing, depreciation, and other production inputs. In doing so I assume no rent is paid to labour, and that any rent paid to other inputs should be recorded and attributed as rents earnt by those suppliers. Using firm specific Betas, I am able to construct firm specific costs of equity and apply this to the book value of equity to impute firm total costs of equity and so rents and so the price markup. The integrity of firm financial balance sheet and income statements and in particular Total Equity and Income, are therefore critical to the validity of outcomes for my method and is discussed below.

5.1. Other Findings from the Literature

My estimations of markup are lower than those of recent reports which range from 1.1 to 1.67 (

Table 3) but may match more closely the results of those methodologies which determine profit share as a residual after calculating the capital and labour shares (Barkai 2020, Caballero 2017 & Gutiérrez 2017). The makeup of the FTSE 100 index which is largely absent of technology firms and predominated by materials (mining), financials, consumer, energy, and industrials should be considered when comparing results of other studies which are predominantly from the US. The UK’s ONS results (1.22 - 1.27) are based on the method of De Loecker and Warzynski (2019) and are notably lower than The US results using the same approach (De Loecker & Warzynski 2009, De Loecker & Eeckhout 2018 and De Loecker et al. 2020). Autor et al. (2020) demonstrate the labour share in the UK has been remarkably stable between 1970 to 2010 and in stark contrast to other OECD countries; this is suggestive of more moderate markup levels in The UK.

This study also finds of those firms earning an economic rent, five firms contribute an excess of 50% of the total rent earnt by the FTSE 100. This coupled with the longer right-hand tail for mark ups (Chart 2) is consistent with other studies (De Loecker et al. 2020 and Traina 2018). These higher markup firms are characterised by service and technology orientated sectors which is also seen in the UK specific ONS data. On the other side of performance, 43% of firms in my analysis have a markup of less than one; Hall (2018) finds this to be the case for 30% of firms.

5.2. Model Sensitivity

The return of the market (R

m) is not an independent variable in the model. The dynamic of markup with respect to changes in The Risk-Free Rate, Beta, Total Equity and Income are shown in

Table 4. While an investor may assume differing risk-free rates, this has no or limited influence on model calibration given ∂µ/∂R

f >0 if β>1 and vice-e-versa (19). In the case where either of Beta, Revenue or Total Equity are underestimated, price markup will be overestimated (∂µ/∂β, ∂µ/∂PY and ∂µ/∂T are all less than zero (20), (21) and (22)). The opposite holds for Income (23).

It further holds that changes in Income have a more substantive impact on the level of price markup than changes to either Total Equity, Beta or Revenue.

(25) holds if -PY

3 > Tβ

2(-R

m + R

f), which is highly likely given the magnitude of the cubed term (and is the case for all FTSE100 firms for the period studied).

(26) holds if

, which will be the case given T

2 > T and R

m > R

f - R

m, with R

f - R

m < 0.

(27) holds if (I/T)2 < Rm, which we would generally imagine to be the case. In this data set the ratio of Income to Total Equity (for the market) is close to one to ten (the square therefore being 1/100), with the return of the market at a similar level (9.76%).

5.3. Data Veracity

As demonstrated at (24) Income is the predicating variable with the greatest magnitude of effect within the model. Might Income somehow not be accurate as stated in company reporting? In the case where the firm uses mechanisms such as transfer pricing to take advantage of corporate tax arbitrage in different jurisdictions lower Income will be reported and so the price markup will be underestimated. (23). On balance it seems more likely that any transfer pricing involving UK legal entities would be to reduce income given the existence of other lower tax jurisdictions. Liu et al. (2017) report on this practice specific to the UK, ie that incomes may be under reported. Lower transfer prices would equally reduce Revenue, which would at the same time decrease the markup, but as we see at (24) and

Table 5 this has non-material impact to the markup: the net effect of low transfer pricing will be to decrease the reported markup. In a similar fashion intercompany liabilities (ie loans) of a multinational could be constructed to extract interest payments and so reduce income.

Market valuation of assets and liabilities may differ to book values and so misrepresent true Total Equity. With most firms owning and not leasing their capital stock, accurate measurement may be frustrated: a prevailing view is that the capital stock and so equity may be underestimated. Corrado et al. (2009) and Rivera-Padilla (2023) point to the growing economic importance of intangible assets including patents, copyrights, and brand value which have been historically excluded from balance sheet and public data sources; the same may be true for software and R&D (Barkai 2020 and Berry et al. 2019). In these findings, (

Table 1) those sectors with the highest Tobin’s Qs are those associated with the employment of these inputs, namely Technology and Healthcare. Underestimates in the capital stock will underestimate Total Equity and so overestimate the markup (22). The Bank of England rate as used for the Risk-Free rate in this study was fairly stable for the period only starting to rise in 2023 (The UK financial year ends in March; Q1 2023 was the last data point in this study). Never-the-less it is possible firms carried book value liabilities at odds with a current market rate.

Depreciation should also be considered: imprecision in reporting will impact both stated income and the balance sheet reported capital stock. UK companies are governed of course by Generally Accepted Accounting Practice (UK GAAP)), and it would seem unlikely that these the largest UK, audited, publicly held firms were/are somehow systematically gaming depreciation charges to recognise financial profits either earlier or later. Miles (1987) reports rare cases of erroneous valuation. Finally, Beta may be subject to estimate error: the Betas I use are trailing and for a fixed five-year period, however as demonstrated at (24) and

Table 5, Beta is a relatively week predicating variable and of course for the market will be equal to one. This leaves the possibility that a suppression in reported Income would mean the markup is under-reported, while the quite likely possibility of underestimation in Total Equity will over-report the markup.

5.4. Regression Analysis

I believe this study is the first to propose and offer a proof that µ=Q. However, this empiric analysis suggests generally higher levels for Tobin’s Q than for the corresponding firm’ price markup: a regression analysis (Chart 4) gives a best fitviii of µ = 0.0261Q + 1.0041. A factored adjustment to Total Equity of 2.76 achieves a least-squares fit for 2 and gives a market mark up and Tobin’s Q of 0.86. Could the FTSE 100 price markup have been below one for the period and could equity have been underestimated to this degree? With sunk costs and intangibles accruing no costs we are remined that its perfectly possible for firms to turn profits whilst having a markup below one and this data set specifically shows this at the firm level. A factor of 2.76 seems high, but never-the-less this does further point to the possibility of an underestimation of firm’ book value equities and provides this work with a lower bound result for price markup of 0.86.

Several other explanations for any empiric disconnect between markup and Tobin’s Q might be considered. Lower current price markups may be the firm investing to erect entry barriers to generate future higher markups, however, considering the established nature of the FTSE 100 firms, and the industries in which they operate, this seems unlikely. Investment funds may be passive in nature or aimed with portfolio diversity in mind and made through vehicles such as index trackers (ie of the FTSE 100); such unitry market-level investments would achieve a closer one-to-one equivalence between price markup and Tobin’s Q (

Table 1). It is of course possible that the economic outlook for many firms is simply better than the near history: expected markups are greater than markups from the most recent past. Alternatively, in recognising that higher historic firm volatility with higher corresponding Betas will depress current markups, it might be that the optimism is for a less volatile future which would increase the markup. Alternatively, firms where Q/µ is greater than unity might simply be overvalued.

5.5. Firms with Significant Markup

SGRO (markup 3.5) report levels of income and economic rent greater than revenue: certain property gains are realised according to The UK’s IAS 40 accounting standard. Land is historically associated with economic rent, and the ONS data estimates Real Estate markup from 1.84 to 1.91 for the period, where as my measure is 0.47. This likely demonstrates the need for analysis over extended time periods given the possibility of windfalls or accounting practice.

RMV (markup 2.3) and AUTO (1.9) both operate within the media sector of the Technology industry and employ business models digitally connecting consumers with businesses: estate agents and car dealers respectively. Consumers and businesses may aggregate towards single digital domains benefitting from network effects (Berry et al. 2019) which Autor et al. (2020) refer to such as ‘superstar effects’ and which may explain the consistent higher level markups observed. The financial industry covers 10 different sectors with an overall markup less than unity. However, each of III (markup 1.8), HL (1.7), SMT (1.4) and PSH (1.4) are firms which may be characterised as investment entities (trusts / holdings / private equity / venture capital). Such markup may be interpreted as alpha generated by the fund manager. Those parts of alpha which can be attributed to rent might be subject to an appropriate taxation statute (Stiglitz 2015). These firms, according to the business models of the industrial sectors in which they sit are likely to have very low if not zero level marginal costs (consider the marginal costs to add a car to a website, or to an an additional set of funds to a portfolio), and hence we can imagine pure economic rent earnt at the marginal transaction.

The five banks all have negative rent and price markup less than one: performance is consistent over the period with limited variability. The Healthcare industry (markup 1.11) and more specifically the Pharmaceuticals & Biotechnology sector rely on patent law to support R&D investment and their business models. To the extent such assets are off balance sheet, price markups may be overestimated. Never-the-less markups as reported appear modest. Patent lengths might theoretically be optimised to manage any emergence of longer-term rents. The historic association of Utilities and Energy with markups (Verbruggen 2022) are not borne out in this analysis (markups of 1.05 and 0.98 respectively). That consumers staples (1.04) have higher markup than consumer discretionary (0.99) may also be notable and a function of elasticities for these respective sector groups.

6. Conclusion

Employing a definition for price markups based on economic rent and firm’ cost of equity, I find moderate levels of price markup (0.86 – 1.07) for The UK’s largest firms, which are lower than other recent reports but more congruent with the methodology calculating profit share as the residual from labour and capital shares (Barkai 2020, Caballero 2017 & Gutiérrez 2017). Income followed by Total Equity are the most sensitive variables in the model. While the result of µ = 0.86 (based on an underestimation of Total Equity) may be considered a lower bound, the multinationals’ financial management of Income (reducing it) could see the markup exceeding my principal result (0.99), but never-the-less a 50% underestimation of income only increases the markup to 1.07 (

Table 5). My generally lower results do better fit with the previously described near past macroeconomic experience. Those firms who do enjoy significant price markups are limited by industry and sector (Real Estate, Technology/Media and Financial Services and Equity Investment) (

Table 2) and aspects of their business models may explain their ability to charge such rents. I offer a formal proof that expected markups are equal to Tobin’s Q (µₑ = Q) and show a near equivalence at the level of the market between the two ratios but see differences in the distributions for the set of FTSE100 firms with generally higher results for Tobins’s Q.

Some caution should be taken given the limited company membership (FTSE 100) and the relatively short period I have studied. Future research might expand this method to wider market data and that of The US where most research has historically been conducted to better compare results. An application of the methodology to a wider time period might also assist the debate with respect to the relationship between markups and the business cycle. This work should also encourage the further characterisation of any differences observed between µ and Q. More generally, further development of methodologies to accurately measure price markups are crucial for both economists and policy makers in understanding inequalities, market power, the results of mergers and acquisitions, and international trading arrangements.

Notes

| i |

Which may be explained by manufacturing level non-neutral technological differences. |

| ii |

The Lerner Index ([P-MC] / P). Notably they found no relationship between Tobin’s Q and concentration. |

| iii |

The profit (π) will be this sales price minus the cost (T0 + L): π = ENt + T0 + L - T0 + L = ENt |

| iv |

Sectors with three or more members only are highlighted. |

| v |

Office for National Statistics (UK), using the methodology of De Loecker and Warzynski 2019. |

| vi |

Based on the expanded identity for price markup µ = PY/ (PY – I + TRf + TβRm – TβRf) |

| vii |

Result from this study. |

| viii |

The outliers SGRO, RMV and AUTO are removed. |

References

- Autor D. (2020), The Fall of the Labor Share and the Rise of Superstar Firms. The Quarterly Journal of Economics, 135 (2): 645–709. [CrossRef]

- Bain, J. (1951), Relation of profit rate to industry concentration: American manufacturing.

- 1936-40. Quarterly Journal of Economics, 65:293-324. [CrossRef]

- Barkai S. (2020), Declining Labor and Capital Shares. The Journal of Finance, 75 (5): 2421-2463. [CrossRef]

- Basu S. (2019), Are Price-Cost Markups Rising in the United States? A Discussion of the Evidence. Journal of Economic Perspectives, 33 (3): 3-22. [CrossRef]

- Berry S, et al. (2019), Do Increasing Markups berryMatter? Lessons from Empirical Industrial Organization. Journal of Economic Perspectives, 33 (3): 44–68. [CrossRef]

- Bresnahan T (1989), Empirical Studies of Industries with Market Power. Chap. 17 in Handbook of Industrial Organization, vol. 2. Elsevier, Amsterdam: 1011–57.

- Caballero R, et al (2017), Rents, Technical Change, and Risk Premia Accounting for Secular Trends in Interest Rates, Returns on Capital, Earning Yields, and Factor Shares. American Economic Review, 107 (5): 614-20. [CrossRef]

- Corrado C, et al. (2009), Intangible Capital and U.S. Economic Growth. The Review of Income and Wealth, 55: 661-685. [CrossRef]

- De Loecker J, Eeckhout J (2018), Global Market Power. National Bureau of Economic Research, Working Paper 24768. http://www.nber.org/papers/w24768.

- De Loecker J, et al. (2020), The Rise of Market Power and the Macroeconomic Implications. The Quarterly Journal of Economics, 135 (2): 561-644. [CrossRef]

- De Loecker J, Warzynski F. (2009), Markups and Firm-Level Export Status. NBER Working Paper Series, 15198. http://www.nber.org/papers/w15198.

- Eggertsson G, et al. (2021), Kaldor and Piketty’s facts: The rise of monopoly power in the United States. Journal of Monetary Economics, 124: S19-S38. [CrossRef]

- Elsby M, et al. (2013), The Decline of the U.S. Labor Share. Brookings Papers on Economic Activity, Fall: 1-52. https://www.jstor.org/stable/23723432.

- Gutierrez G. (2017), Investigating Global Labor and Profit Shares. [CrossRef]

- Hall R. (1988), The Relation between Price and Marginal Cost in U.S. Industry. Journal of Political Economy, 96(5): 921–947. https://www.jstor.org/stable/1837241. [CrossRef]

- Hall R. (2018), new evidence on the markup of prices over marginal costs and the role of mega-firms in the us economy. NBER working paper series, Working Paper 24574. http://www.nber.org/papers/w24574.

- Karabarbounis L, Neiman B. (2014), The Global Decline of the Labor Share. The Quarterly Journal of Economics, 129 (1): 61–103. [CrossRef]

- Lindenberg E, Ross S. (1981), Tobin's q ratio and industrial organization. Journal of Business 54, 1-32.

- Liu L, et al. (2017), International Transfer Pricing and Tax Avoidance: Evidence from Linked Trade-Tax Statistics in the UK. Proceedings. Annual Conference on Taxation and Minutes of the Annual Meeting of the National Tax Association, 110: (1–38). https://www.jstor.org/stable/26794398.

- Miles J, (1987), Depreciation and Valuation Accuracy. Journal of Valuation, Vol. 5 No. 2, pp. 125-137. [CrossRef]

- Office for National Statistics https://www.ons.gov.uk/economy/inflationandpriceindices/timeseries/l55o/mm23.

- Office for National Statistics https://www.ons.gov.uk/economy/economicoutputandproductivity/productivitymeasures/articles/estimatesofmarkupsmarketpowerandbusinessdynamismfromtheannualbusinesssurveygreatbritain/1997to2019.

- Piketty, Thomas, 2014. Capital in the Twenty-First Century. Harvard University Press, Cambridge, MA. [CrossRef]

- Raval D. (2023), Testing the Production Approach to Markup Estimation. The Review of Economic Studies 90: 2592–2611. [CrossRef]

- Rivera-Padilla A. (2023), Market power, output, and productivity. Economics Letters, 2023. [CrossRef]

- Sharpe W. (1964), Capital Asset Prices: A Theory of Market Equilibrium under Conditions of Risk. The Journal of Finance, 19: 425-442. [CrossRef]

- Stiglitz J. (2015), The Origins of Inequality, and Policies to Contain It. National Tax Journal, 68 (2): 425–448. [CrossRef]

- Syverson, C. (2019), Macroeconomics and Market Power: Context, Implications, and Open Questions. Journal of Economic Perspectives, 33 (3): 23-43. [CrossRef]

- Traina, J. (2018), Is Aggregate Market Power Increasing? Production Trends using Financial Statements. SSRN: https://ssrn.com/abstract=3120849 or http://dx.doi.org/10.2139/ssrn.3120849. [CrossRef]

- United Kingdom Debt Management Office. https://www.dmo.gov.uk/data/ExportReport?reportCode=D4H.

- Varian H. (1987) Intermediate Microeconomics: A Modern Approach. Norton, New York: 396.

- Verbruggen A. (2022), The geopolitics of trillion US$ oil & gas rents. International Journal of Sustainable Energy Planning and Management 36: 3–10. [CrossRef]

Table 1.

Markup and Tobin’s Q by Industry (bold), Sector and Year.

Table 1.

Markup and Tobin’s Q by Industry (bold), Sector and Year.

| |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

TOTAL - all years |

|

| Industry /Sectoriv (No. of firms) |

µ |

µ |

µa

|

Q |

Q/µ |

σ (µ) |

| Technology (7) |

1.19 |

1.15 |

1.14 |

1.13 |

1.12 |

1.07 |

1.13 |

2.52 |

4.51 |

3.99 |

0.04 |

| Media (3) |

1.29 |

1.25 |

1.26 |

1.22 |

1.24 |

1.21 |

1.24 |

0.95 |

1.17 |

0.94 |

0.03 |

| Health Care (6) |

1.08 |

1.10 |

1.08 |

1.16 |

1.03 |

1.22 |

1.11 |

2.02 |

4.11 |

3.71 |

0.06 |

| Pharmaceuticals & Biotechnology (3) |

1.08 |

1.11 |

1.08 |

1.17 |

1.03 |

1.25 |

1.12 |

2.22 |

1.93 |

1.73 |

0.07 |

| Utilities (5) |

1.05 |

1.03 |

0.98 |

1.10 |

1.08 |

1.06 |

1.05 |

1.19 |

1.23 |

1.17 |

0.04 |

| Gas, Water & Multi-utilities (3) |

1.18 |

1.06 |

1.04 |

1.10 |

1.02 |

1.29 |

1.11 |

1.39 |

1.20 |

1.08 |

0.09 |

| Consumer Staples (10) |

1.07 |

1.05 |

1.02 |

1.08 |

1.03 |

1.03 |

1.04 |

1.07 |

1.33 |

1.28 |

0.02 |

| Industrials (10) |

1.08 |

1.00 |

1.02 |

1.00 |

1.04 |

1.03 |

1.03 |

1.24 |

1.54 |

1.49 |

0.03 |

| Support Services (4) |

1.1 |

1.03 |

1.06 |

1.06 |

1.04 |

1.03 |

1.05 |

1.42 |

2.22 |

2.11 |

0.02 |

| Basic Materials (12) |

1.01 |

1.02 |

1.01 |

1.02 |

1.05 |

1.04 |

1.02 |

1.09 |

1.21 |

1.19 |

0.02 |

| Mining (6) |

1.00 |

1.02 |

1.00 |

1.02 |

1.06 |

1.04 |

1.03 |

1.09 |

1.17 |

1.14 |

0.02 |

| Consumer Discretionary (18) |

1.03 |

1.04 |

1.01 |

0.89 |

0.96 |

0.99 |

0.99 |

1.07 |

1.54 |

1.56 |

0.05 |

| Household Goods & Home Construction (4) |

1.03 |

1.03 |

1.06 |

1.04 |

0.96 |

0.94 |

1.00 |

0.98 |

1.11 |

1.11 |

0.04 |

| Media (3) |

1.01 |

0.95 |

0.98 |

0.79 |

0.94 |

1.02 |

0.95 |

0.95 |

1.17 |

1.23 |

0.08 |

| Travel & Leisure (4) |

1.03 |

1.02 |

1.00 |

0.70 |

0.85 |

0.96 |

0.94 |

1.11 |

1.53 |

1.63 |

0.12 |

| Energy (3) |

0.97 |

1.00 |

0.99 |

0.85 |

0.99 |

1.01 |

0.98 |

1.02 |

0.89 |

0.91 |

0.05 |

| Telecommunications (3) |

0.95 |

0.85 |

0.94 |

0.98 |

0.94 |

1.07 |

0.95 |

0.90 |

0.88 |

0.92 |

0.07 |

| Financials (23) |

0.92 |

0.84 |

0.96 |

1.04 |

0.90 |

0.02 |

0.91 |

0.96 |

0.98 |

1.07 |

0.35 |

| Financial Services (9) |

1.01 |

1.05 |

1.05 |

1.34 |

1.16 |

0.78 |

1.09 |

2.26 |

1.03 |

0.95 |

0.17 |

| Life Insurance (3) |

1.00 |

1.01 |

1.00 |

1.04 |

0.94 |

1.05 |

0.99 |

0.99 |

1.01 |

1.02 |

0.04 |

| Banks (5) |

0.8 |

0.80 |

0.86 |

0.95 |

0.83 |

0.83 |

0.84 |

0.86 |

0.95 |

1.13 |

0.05 |

| Real Estate (3) |

0.47 |

0.49 |

0.40 |

0.50 |

-3.19 |

0.25 |

0.47 |

0.71 |

0.97 |

2.07 |

1.35 |

| FTSE 100 |

0.99 |

0.99 |

0.99 |

1.00 |

1.00 |

1.00 |

0.99 |

1.07 |

1.06 |

1.07 |

0.01 |

Table 2.

Significant markup.

Table 2.

Significant markup.

| Company |

Industry |

Sector |

µ |

| Segro PLC – SGRO |

Real Estate |

Real Estate Investment Trusts |

3.5 |

| Rightmove PLC – RMV |

Technology |

Media |

2.3 |

| Auto Trader Group PLC – AUTO |

Technology |

Media |

1.9 |

| 3I Group PLC – III |

Financials |

Financial Services |

1.8 |

| Hargreaves Lansdown PLC – HL |

Financials |

Financial Services |

1.7 |

| Scottish Mortgage Investment Trust PLC - SMT |

Financials |

Equity Investment Instruments |

1.4 |

| Pershing Square Holdings LTD – PSH |

Financials |

Financial Services |

1.4 |

Table 3.

Findings from the Literature.

Table 3.

Findings from the Literature.

| Author |

Year |

Country |

µ |

| De Loecker & Warzynski (2009) |

1994-2000 |

Slovenia |

1.17 - 1.28 |

| Caballero et al (2017) |

2008-2015 |

US |

1.02 - 1.12 |

| De Loecker & Eeckhout (2018) |

1980-2016 |

Global |

1.15 - 1.60 |

| De Loecker et al. (2020) |

1980-2016 |

US |

1.21 - 1.61 |

| Barkai (2020) |

1984-2014 |

US |

1.02 - 1.19 |

| Gutiérrez (2017) |

2014 |

US |

1.21 |

| Traina (2018) |

2016 |

US |

1.15 |

| Eggertsson et al. (2021) |

2018 |

US |

1.22 |

| Hall (2018) |

2018 |

US |

1.27 |

| ONSv

|

2018 |

UK |

1.22 |

| ONS |

2021 |

UK |

1.27 |

Table 4.

Derivativevi.

|

(19) |

|

(20) |

|

(21) |

|

(22) |

|

(23) |

Table 5.

models and demonstrates the effect of changes in these predicating variables.

Table 5.

models and demonstrates the effect of changes in these predicating variables.

| Risk free rate (Rf) |

0.25Rf

|

0.5 Rf |

Rf = 1.92%vii

|

2 Rf |

4Rf |

| µ |

0.99 |

0.99 |

0.99 |

0.99 |

1.00 |

| |

|

|

|

|

|

| Revenue (Index) |

0.25PY |

0.5 PY |

1.0 |

2 PY |

4 PY |

| µ |

0.99 |

0.99 |

0.99 |

0.99 |

0.99 |

| |

|

|

|

|

|

| Beta |

β = 0.70 |

β = 0.85 |

β = 1.0 |

β = 1.15 |

β = 1.3 |

| µ |

1.01 |

1.00 |

0.99 |

0.98 |

0.97 |

| |

|

|

|

|

|

| Total Equity (index) |

0.25 |

0.5 |

1.0 |

2 |

4 |

| µ |

1.06 |

1.04 |

0.99 |

0.91 |

0.79 |

| |

|

|

|

|

|

| Income (index) |

0.25 |

0.5 |

1 |

2 |

4 |

| µ |

0.94 |

0.95 |

0.99 |

1.07 |

1.29 |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).