Introduction:

There has been a notable surge in technological advancements, impacting various industries, both traditional and innovative (Caputo et al., 2021; Warner, 2019; Teece, 2010). Industries with technological innovation, such as media and finance, have undergone significant changes due to digital transformation (Zetzsche et al., 2019; Aversa et al., 2019). It has led to the recognition of a new industrial revolution, Industry 4.0. A noteworthy development in recent years is the digitization of accounting and auditing procedures (Lombardi, 2021; Manita et al., 2020). The practitioners highlight the shift, with the International Federation of Accountants stating that traditional finance and accounting backgrounds are no longer sufficient for long-term value-added business partnerships (Gould, 2019). Studies emphasize the need for auditors to update their models to align with emerging challenges, as digital transformation becomes a mandatory aspect for companies (Cingolani, 2013). This has transformed the audit process from a bureaucratic to a strategic function to adapt to dynamic and complex situations. external auditors (EA), with their unique characteristics, are positioned to reflect key practices in response to technological advancements. Researchers point out that external auditors (EA) procedures inherently have a direct interest in technical progress, unlike internal audit activities (Goodwin-Stewart and Kent, 2006; Kotb et al., 2020). EA focuses on evaluating organizational performance, while internal audits assess the advantages and disadvantages of an organization (Florio and Leoni, 2017; Velte, 2017; Dittenhofer, 2001; Ma'Ayan and Carmeli, 2016). The utilization of technological features is identified as a means to support actions aimed at minimizing expenses and maximizing profits. Additionally, regulators' increasing focus on emerging issues like cyber threats (La Torre et al., 2021; Lois et al., 2020).

The operational landscape of organizations has undergone significant transformation due to widespread digitization, globalization, and the intensification of knowledge and information competition (Lutfi et al., 2022). In the contemporary technological era, substantial investments have been made by numerous companies in computerized data processing (Alsyouf et al., 2021; Almaiah et al., 2022; Lotfi, 2020), leading to consequential changes in business practices related to accounting information systems (AIS). The adoption of AIS is seen as beneficial for large and medium-sized organizations, offering opportunities and advantages (Jaber et al., 2022; Lotfi, 2021) as they seek innovative ways to enhance productivity and sustain a competitive edge (Bani-Khaled, 2022; Lutfi, 2022). Technology and related information systems have become integral tools for organizations to operate more effectively and efficiently, utilizing computerized information systems to achieve their objectives (Lutfi et al., 2022; Syahidi et al., 2018). Information systems, particularly the AIS, play a significant role in organizational functioning, serving as the core that coordinates, integrates, and controls activities (Alshirah et al., 2021; Das, 1989). AIS collects, analyzes, evaluates, and disseminates financial data to stakeholders and management, facilitating informed decision-making (Al-Dalaien et al., 2018). Public audit software systems, described by Nguyen and Nguyen, (2020), encompass protocols, documents, and technical tools collaborating to collect, analyze, and distribute data for informed decision-making by internal and external stakeholders. These systems track events and transactions, generate performance-evaluating data, and report detailed financial transactions (Alshira’h et al., 2020). Companies have made continuous efforts to enhance operational capabilities through public audit programs, with governments and businesses providing subsidies to address resource scarcity (Idris and Mohamad, 2016). Despite these advancements, companies in Saudi Arabia and other Middle Eastern nations encounter challenges in fully leveraging public audit software systems, especially concerning decision-making modules, expansion to include business analytics, and overcoming implementation costs and complexities (Ibrahim et al., 2020).

A study on EA quality in Gulf Cooperation Council (GCC) countries investigated investment efficiency (Alsmady, 2022). The author established a strong positive correlation between investment efficiency and financial reporting caliber. Ouiddad et al. (2018) explored and recommended regulatory measures to ensure high-quality EA for obtaining more reliable data. Desoky and Khasharmeh (2018) found that non-audit services could compromise auditor impartial quality. Conversely, Albawwat et al. (2020) investigated the impact of audit quality on Saudi Arabia's compliance with international financial reporting requirements, revealing a robust positive relationship. Munif and Ben Hamouda (2020) delved into how managerial preferences for managing actual versus accrued earnings in oil and gas enterprises in the GCC were influenced by audit quality. Turning to governance functions affecting company profitability, Chen et al. (2019) examined the role of AIS, identifying it as a valuable governance mechanism for listed firms in China, which was supported Zhou and Chen (2008) by asserting that higher-quality AIS facilitated effective resource allocation, leading to improved company performance. In contrast, Farouq (2016) argued that investment efficiency was significantly influenced by AIS caliber, reducing information asymmetries and flaws in agreements between managers and external capital suppliers. Despite these findings, the literature lacks definitive answers or significant provisions specific to GCC countries. The governance function of AIS in Gulf firms' performance warrants further investigation. External audit quality (EAQ) is recognized as a crucial corporate governance tool for resolving agency conflicts and providing decision-makers with reliable accounting data. This oversight mechanism is particularly effective in monitoring the actions of opportunistic managers (Elaoud and Jarboui, 2017). Academic researchers have extensively explored EAQ from various perspectives (Al-Ahdal and Hashim, 2022). In a study focusing on Malaysian corporations, the impact of EAQ on performance revealed a significant enhancement in company performance (Sayyar, et al., (2015). Sulong et al. (2013) suggested that increasing EA fees could strengthen the client-auditor relationship, despite finding a substantial negative correlation between the performance of Malaysian firms and the quality of EA.

Literature Review and Hypotheses Development

Economic and technological experts have recently emphasized the significance of AIS in modern organizations, where the integration of computers and modern technologies is a widespread practice (Fordham and Hamilton, 2019; Mamić Sačer and Oluić, 2013). AIS plays a crucial role in enhancing productivity and efficiency, especially in accounting and auditing, where communication technologies are employed to improve interactions among information users (Toth, 2012; Anthony et al., 2019). Artificial intelligence, a key information-producing technology, significantly influences economic decisions, impacting societies' income, wealth, and resources (Trigo et al., 2014). Despite the doubts raised by the demise of some multinational corporations regarding the accuracy of auditors' findings, organizations and individuals rely on auditors' testimony and financial reports for making judgments (Fan and Wong, 2005; Alawaqleh et al., 2021; Shrivastava, et al., 2008; Awual et al., 2019). The competency of auditors in AIS and their training forms the foundation of EA operations, with AIS contributing to problem identification and resolution, enhancing the audit process, and producing reliable and accurate information that elevates the caliber of audit evidence and EA (Curtis et al., 2009; Janvrin et al., 2009; Kanakriyah, 2016; Almasria et al., 2018). Therefore, further research is necessary to assess how effectively AIS enhances EA.

H1: AIS positively affects EA.

Generalized Audit Software and external Audit

Auditors frequently transition into managerial roles outside of EA in nearly two-thirds of Fortune 500 organizations, potentially utilizing Internal Audit Programs (IAPs) or creating an impression that the organization serves as a training ground (Christ et al., 2015; Nkansa, 2016). This practice is puzzling, considering evidence from other studies suggesting that it compromises the objectivity of auditors (Rose et al., 2013). To build on existing research about the impact of generalized auditing software (GAS) on corporate external auditors, interviews with Chief Audit Officers and Audit Committee Chairpersons were conducted. The objective was to establish a preliminary framework to comprehend how this practice influences financial reporting and audit outcomes. An archival analysis was then conducted using this framework, seeking significant correlations between mainstream audit programs and audit quality. GAS is vital for assessing risk exposure and control efficacy in an audit system (IIARF, 2013). Auditing aims to reduce stringent financial reporting and prevent/detect false financial reporting (Krishnan, 2003; IPPF, 2012). General audit functions employ various human methods to fulfill their duties, including different audit programs. There are three main types of audit programs: (1) internal audit personnel temporarily working for the company; (2) new external auditors temporarily working on internal auditing before transitioning to an operational management position; and (3) "Professional" internal and external auditors temporarily dispatched to examine operational protocols before returning to internal audit. Despite the variety of audit programs, prior studies mainly focused on the first two, exploring how external auditors transitioning to management outside of internal audit impacts their effectiveness as internal auditors. These programs are commonly referred to as Management Training Grounds (MTGs) because their primary goal is to develop future managers' skills (Burton et al., 2015; Ege, 2015; Endaya and Hanefah 2013; Rose et al., 2013). This study specifically examines audit programs leading external auditors to managerial positions, as they are the most prevalent and have the potential to compromise auditing standards.

H2: GAS has a positive impact on EA.

Adoption of technology and auditing activities.

Maffei et al. (2021) improved accounting and auditing processes, technology adoption (TA), and business support within AAF. The report highlights that AAF with local government authorization are better positioned to stay informed about new technological developments and acquire innovative technology from both local and global markets. The contemporary business landscape has experienced a significant shift in operations, driven by increased awareness and acceptance of modern technologies. This transformation is evident in critical functions like accounting and auditing, which heavily rely on digital technologies. The integration of technology is instrumental in enhancing accounting and auditing procedures within organizations, with crucial support coming from AAF. Austin et, al. (2021) study underscores the interconnectedness of improved accounting and auditing practices, the TA, and institutional support for AAF. The moral, social, and economic backing provided by AAF plays a pivotal role in encouraging the TA and technological processes. Given the necessity for AAF to maintain accurate records, contributing to elevated accounting and auditing standards. Therefore, we can speculate that:

H3: TA has a positive impact on EA.

Trained human capital and external audit

Companies utilize auditing and accounting techniques to ensure accurate and transparent financial practices, which, in turn, enhance investment in the sector (Ha et al., 2020; Hair et al., 2019). The objective is to investigate how the integration of technology, knowledgeable trained human capital (THC), common audit software, and audit technology can lead to the implementation of best practices in accounting and auditing. Additionally, the study aims to understand how the organizational component supervises the relationship between audit programs, the benefits of adopting technology, skilled employees, and the enhancement of accounting and auditing procedures. Maintaining a positive reputation is crucial for businesses due to several reasons such as attracting investors, ensuring the commercial viability of goods and services, building an audience, and seeking support from government agencies and corporate regulators. The success of EA is contingent upon the validity, reliability, and honesty of financial statements. However, advancements in accounting and auditing processes depend on the efficiency of trained human resources and the application of modern technologies (McCarthy, 2019). Whether accountants and auditors process and document procedures manually or using automated methods, proficiency in their profession is essential. THC plays a vital role in creating skilled auditors and accountants through specialized training programs. McCarthy, et al., (2019) examined the influence of training on accounting and auditing efficiency, highlighting the need for specialized knowledge to operate technical methods or procedures in these operations. Human capital with experience in accounting and auditing processes is contrasted with those who have undergone several training courses (Tian et al., 2019). There is a significant improvement in the processes related to accounting and auditing. Taking advantage of the explanation provided previously, we may hypothesize that:

H4: THC positively affects EA.

H5: THC moderates the relationship between AIS and EA.

H6: THC moderates the relationship between GAS and EA.

H7: THC moderates the relationship between TA and EA.

Methods

This study investigates the impact of TA, generalized audit programs, AIS, and EA as both dependent and independent variables within Saudi AAF and listed companies. Additionally, it explores the moderating influence of human capital on the relationship between these factors and EA. Primary data was collected through a questionnaire distributed to external auditors, chosen from a stratified random sample. The questionnaire, initially developed based on previous research items, underwent a preliminary experimental test involving 25 senior external auditors in the accounting field in the Kingdom of Saudi Arabia by following Mumtaz et al., (2017) recommendation. Testing aimed to ensure the questionnaire's design, appropriateness, and clarity, resulting in adjustments to improve readability. The Likert scale was utilized for item measurement, with extreme scores indicating varying levels of agreement (1 strongly disagree, 2 disagree, 3 neutral, 4 agree, 5 strongly agree). The survey spanned two months from August 20, 2023, to October 20, 2023, employing email and personal visits for questionnaire distribution to participants.

170 questionnaires were distributed and 143 were returned with a completion rate of 84.11%. Seven questionnaires were excluded due to errors and repeated responses across multiple Likert scale columns. Consequently, 136 questionnaires, constituting 80% of the total, were deemed eligible for analysis. The study encompassed five factors: a modified variable representing THC, a dependent variable for EA, and three independent variables encompassing TA, generalized audit programs, and AIS. The questionnaire comprised 20 questions, with 10 allocated to independent variables, 4 for AIS, 3 for generalized audit programs, and 3 for TA. These questions were adapted from Shukla and Sharma (2018) and distributed across all study variables. The modified variable, denoting THC, included 5 questions sourced from Alshammari (2020), while the dependent variable, EA, was represented by 5 questions. The study employed the Smart-PLS program (Alshirah et al., 2021) to analyze the research hypotheses, noting its efficacy in handling primary data, sophisticated models, and large datasets (Hair et al., 2013).

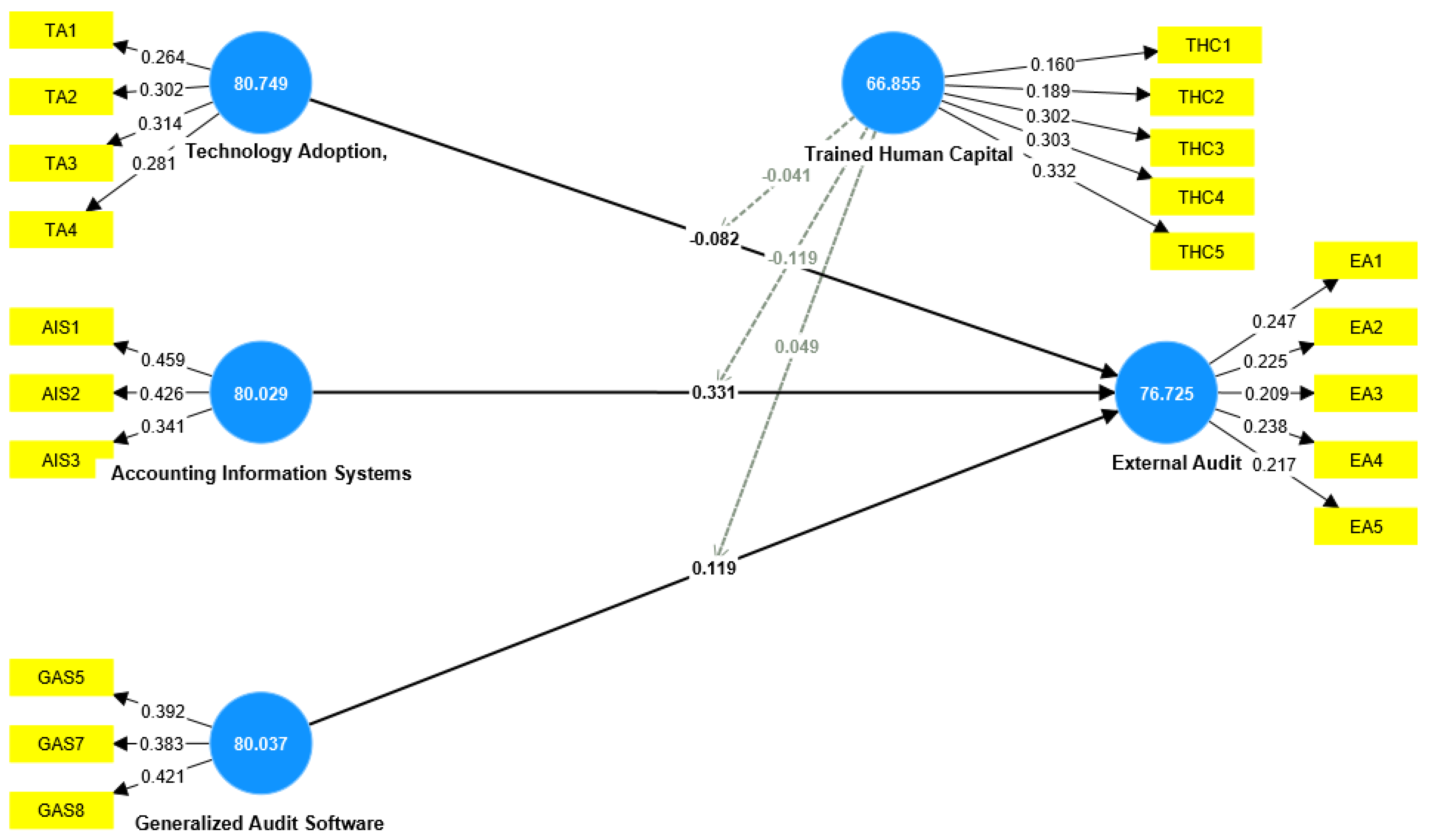

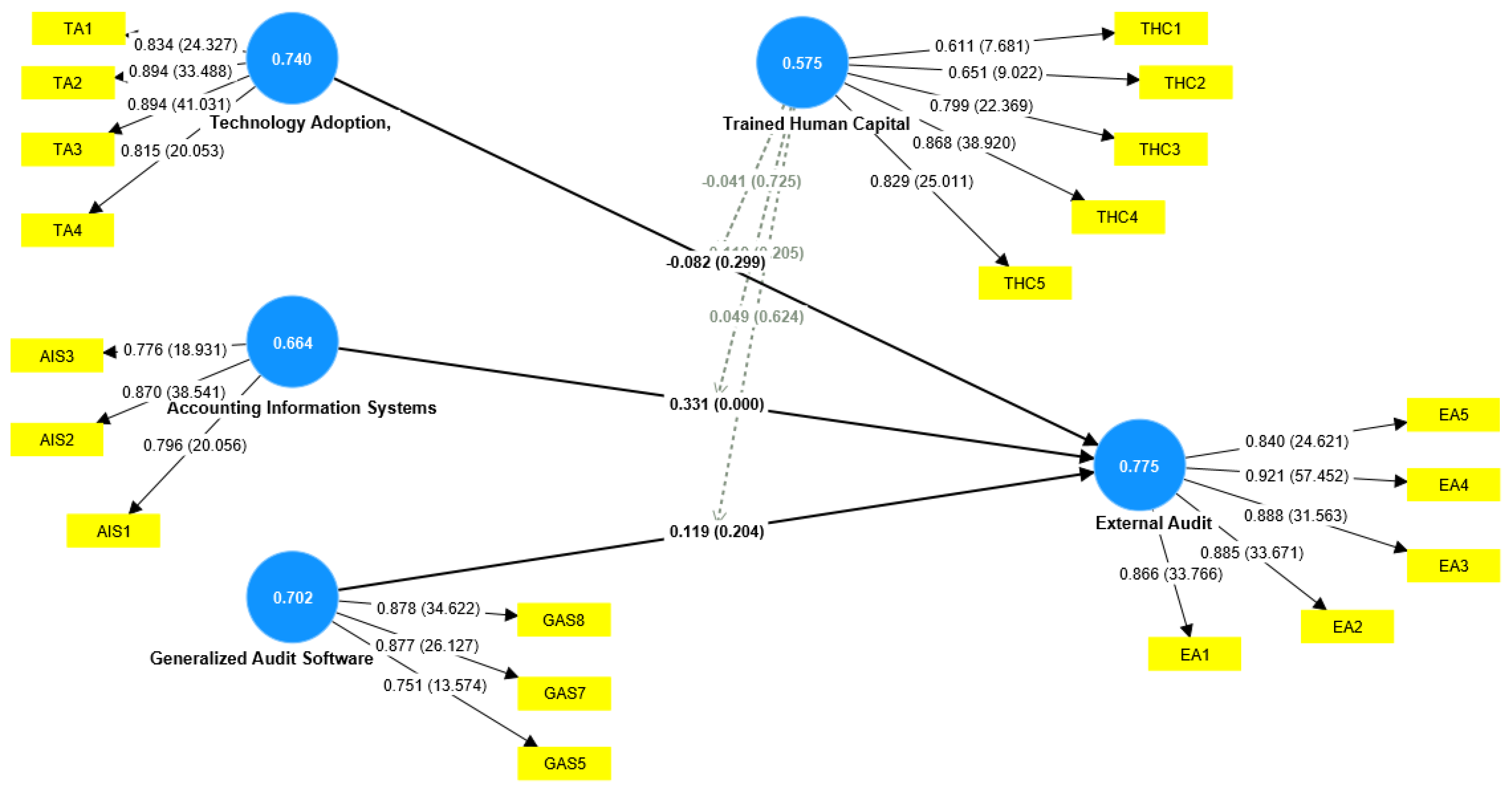

Figure 1 and

Figure 2 underwent experimental validation in this study using Structural Equation Modeling (SEM) methods, as outlined by Salvador-Gómez et al. (2023). Initially, factor analysis (PCA) was employed to evaluate the model's validity, ensuring the uni-dimensionality of the five sets of variables comprising a model (Kingir & Mesci, 2010). The factor B loadings and the percentage of variance explained by each unidimensional factor were scrutinized, as detailed in the presented table. CFA was then applied to the measurement or control model to assess its validity and reliability. The statistical validity of the test model values was confirmed, with most variables exhibiting significance levels higher than 0.05, as indicated in

Table 1. The t-test consistently produced values greater than 2, essential for testing the null hypothesis of population and sample equivalence (Heo and Han, 2003). Cronbach's alpha values are within specific latent groupings, and the resulting values (presented in the table) exceeding 0.7 demonstrated the good coherence of numerous variables within the five latent clusters identified in the tested model. The suggested model's feasibility for assessment using the data was supported by Cronbach's alpha values of more than 0.7 for four variables (Bou-Llusar et al., 2009). The discriminant validity was assessed through SEM, comparing pairs of latent question sets within the measurement model. Results for health discrimination and correlations between the five question sets are provided in the table. The dependent variable signifying EA exhibited a correlation score of 0.921 according to SEM correlations and Pearson coefficients. The remaining correlation values fell between 0.829, serving as the lowest score, and the maximum value. Among the independent variables, technological dependency displayed the lowest correlation degree (0.815) and the highest degree (0.894). The independent variable assessing AIS showed a maximum correlation value of 0.870 and a minimum value of 0.776. For the independent variable evaluating generalized audit programs, the maximum correlation score was 0.878, the lowest was 0.751, and other scores fell within these two values. The updated variable assessing THC had minimum and maximum values of 0.611 and scores within this range were deemed undesirable and rejected.

The study revealed that the study variables exhibited minimal correlation, particularly between technological accreditation and general auditing programs. The correlation coefficient between technological accreditation and EA was found to be -0.082. The correlation coefficient among the dependent variable, EA, and general audit programs was 0.119. Notably, the highest correlation degree (0.313) was observed between EA and AIS. Human capital played a moderating role in the negatively skewed (statistically significant) correlations between technological adoption (as the independent variable), EA (as the dependent variable), and human capital (as the moderating variable). LISREL v.16 software was employed for statistical data processing to validate the model presented in

Figure 1 and

Figure 2, given the sufficient statistical reliability of the data. Key performance indicators were utilized to assess the quality of the proposed model. The analysis of relevant indicators is detailed in the table. The Goodness of Fit Index (GFI) was employed to evaluate how well the model aligns with the data. According to Ruiz-Albaet, al.(2019), a robust fit is indicated by a GFI value exceeding 0.70. However, the observed GFI value of 0.56 falls below this threshold. It is important to note that a larger statistical sample size is likely to yield a higher GFI value. The RMSEA index was used to evaluate misfits for each degree of freedom, with a suitable RMSEA value falling within a specific range.

Figure 3.

The PLS algorithm.

Figure 3.

The PLS algorithm.

Table 1.

Confirmatory Factor Analysis (CFA).

Table 1.

Confirmatory Factor Analysis (CFA).

| Factor analysis CFA |

| |

|

PCA

|

Reliability |

Convergent validity

|

| Construct |

Element |

Factor Loadings |

% of variance

explained by a factor

of uni-dimensionality |

Cronbach's alpha |

Factor

loading

b |

T values |

| AIS |

|

|

80.029 |

0.749 |

|

|

| |

AIS1 |

0.796 |

|

|

0.794 |

20.056 |

| |

AIS 2 |

0.870 |

|

|

0.869 |

38.541 |

| |

AIS 3 |

0.776 |

|

|

0.775 |

18.931 |

| GAS |

GAS5 |

0.751 |

80.037 |

0.784 |

0.748 |

13.574 |

| |

GAS7 |

0.877 |

|

|

0.875 |

26.127 |

| |

GAS8 |

0.878 |

|

|

0.878 |

34.622 |

TA

|

TA1 |

0.834 |

80.749 |

0.882 |

0.834 |

24.327 |

| |

TA2 |

0.894 |

|

|

0.894 |

33.488 |

| |

TA3 |

0.894 |

|

|

0.893 |

41.031 |

| |

TA4 |

0.815 |

|

|

0.812 |

20.053 |

| THC |

|

|

66.855 |

0.818 |

|

|

| |

THC1 |

0.611 |

|

|

0.606 |

7.681 |

| |

THC2 |

0.651 |

|

|

0.643 |

9.022 |

| |

THC3 |

0.799 |

|

|

0.797 |

22.369 |

| |

THC4 |

0.868 |

|

|

0.868 |

38.920 |

| |

THC5 |

0.829 |

|

|

0.830 |

25.011 |

EA

|

EA1 |

0.866 |

76.725 |

0.927 |

0.864 |

33.766 |

| |

EA2 |

0.885 |

|

|

0.884 |

33.671 |

| |

EA3 |

0.888 |

|

|

0.887 |

31.563 |

| |

EA4 |

0.921 |

|

|

0.921 |

57.452 |

| |

EA5 |

0.840 |

|

|

0.839 |

24.621 |

Table 2.

Cross loadings.

| |

AIS |

EA |

GAS |

TA |

THC |

| AIS1 |

0.796 |

0.510 |

0.563 |

0.628 |

0.456 |

| AIS2 |

0.870 |

0.472 |

0.448 |

0.474 |

0.311 |

| AIS3 |

0.776 |

0.378 |

0.465 |

0.487 |

0.247 |

| EA1 |

0.512 |

0.866 |

0.462 |

0.346 |

0.586 |

| EA2 |

0.506 |

0.885 |

0.427 |

0.347 |

0.503 |

| EA3 |

0.467 |

0.888 |

0.407 |

0.319 |

0.467 |

| EA4 |

0.534 |

0.921 |

0.458 |

0.387 |

0.534 |

| EA5 |

0.455 |

0.840 |

0.431 |

0.367 |

0.517 |

| GAS5 |

0.494 |

0.409 |

0.751 |

0.514 |

0.350 |

| GAS7 |

0.503 |

0.399 |

0.877 |

0.610 |

0.442 |

| GAS8 |

0.525 |

0.439 |

0.878 |

0.564 |

0.410 |

| TA1 |

0.500 |

0.314 |

0.529 |

0.834 |

0.310 |

| TA2 |

0.558 |

0.359 |

0.598 |

0.894 |

0.309 |

| TA3 |

0.586 |

0.373 |

0.609 |

0.894 |

0.340 |

| TA4 |

0.608 |

0.334 |

0.575 |

0.815 |

0.327 |

| THC1 |

0.280 |

0.268 |

0.416 |

0.308 |

0.611 |

| THC2 |

0.220 |

0.316 |

0.352 |

0.289 |

0.651 |

| THC3 |

0.376 |

0.507 |

0.387 |

0.300 |

0.799 |

| THC4 |

0.360 |

0.508 |

0.369 |

0.282 |

0.868 |

| THC5 |

0.351 |

0.557 |

0.355 |

0.283 |

0.829 |

The figure illustrates the relationships, control, and degrees of influence among technological adoption, AIS, public audit programs, skilled human capital, and EA. It emphasizes the necessity for firms to cultivate a supportive culture to establish a robust association between these elements. The study's results established a significant connection among the research variables. Additionally, the investigation delved into cross-loading constructs, assessing whether items exhibited stronger loadings on related constructs rather than unrelated ones, as proposed by Chin (1998) and Yi and Davis (2006). The results table highlights which items consistently loaded more heavily on their designated constructs than on others. This analysis underscores the meticulous nature of the measurement approach employed in the study.

Table 3.

Construct reliability and validity.

Table 3.

Construct reliability and validity.

| |

Cronbach's alpha |

Composite reliability (rho_a) |

Composite reliability (rho_c) |

Average variance extracted (AVE) |

| AIS |

0.749 |

0.759 |

0.855 |

0.664 |

| EA |

0.927 |

0.930 |

0.945 |

0.775 |

| GAS |

0.784 |

0.786 |

0.875 |

0.702 |

| TA |

0.882 |

0.887 |

0.919 |

0.740 |

| THC |

0.818 |

0.856 |

0.869 |

0.575 |

The table presented above indicates robust reliability for all variables, as evidenced by Cronbach's alpha values exceeding 0.70, signifying strong dependability. Similarly, exceptional reliability was observed, with all AVE scores surpassing 0.5. Additionally, both composite reliability (rho_a) and composite reliability (rho_c) values are elevated, exceeding 0.70, affirming the high reliability of the measurement model.

Table 4.

Discriminant Validity.

Table 4.

Discriminant Validity.

| |

AIS |

EA |

GAS |

TA |

THC |

THC x TA |

THC x AIS |

THC x GAS |

| AIS |

|

|

|

|

|

|

|

|

| EA |

0.665 |

|

|

|

|

|

|

|

| GAS |

0.787 |

0.582 |

|

|

|

|

|

|

| TA |

0.798 |

0.443 |

0.809 |

|

|

|

|

|

| THC |

0.519 |

0.648 |

0.617 |

0.453 |

|

|

|

|

| THC x TA |

0.216 |

0.228 |

0.359 |

0.316 |

0.093 |

|

|

|

| THC x AIS |

0.270 |

0.251 |

0.280 |

0.219 |

0.071 |

0.769 |

|

|

| THC x GAS |

0.219 |

0.252 |

0.392 |

0.282 |

0.177 |

0.861 |

0.784 |

|

Discriminant validity, a crucial evaluation criterion indicating the uniqueness of a variable relative to others, was addressed in this study (Hair et al., 2019; Duarte and Raposo, 2010). The greater the uniqueness of a variable in capturing the phenomenon compared to other factors, the higher its discriminant validity. In ensuring discriminant validity, the study considered both the square root of AVE and the significance of correlations between latent components (Hair et al., 2019). To establish discriminant validity and ensure external consistency, the squared AVE values for the constructs were examined, revealing the following results: TA (0.740), THC (0.575), EA (0.775), AIS (0.664), and Universal audit programs (0.702).

Table 5 illustrates the outcomes of the Fornell-Larcker criterion. The bolded values on the diagonals signify square roots of AVEs that are greater than the construct correlations. The robust discriminant validity of the constructs is apparent, demonstrating stronger associations with their respective indicators compared to other model constructs (Hult et al., 2017; Tatham et al., 2010; Fornell, 1981; Chin, 1998). Additionally, the exogenous component correlation, being less than 0.87, confirms the satisfactory discriminant validity of each construct.

Model Fit Test

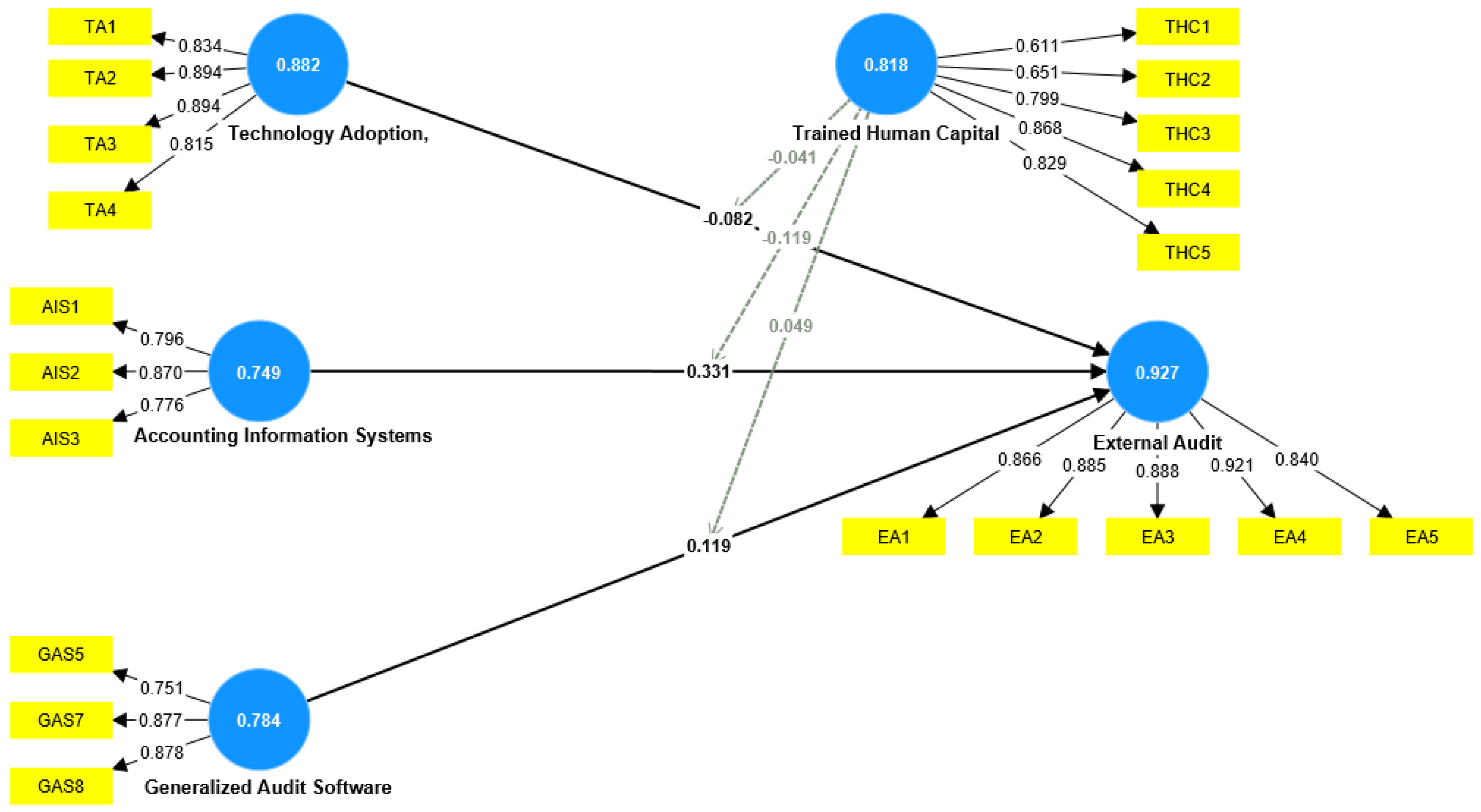

Figure 4.

The PLS algorithm of the measurement model.

Figure 4.

The PLS algorithm of the measurement model.

The coefficient of determination (R2), encompassing evaluation (R2), effect size (f2), and predictive significance (Q2), quantifies the variance in the endogenous variable attributable to exogenous sources. Suggested cut-off values by Hair et al. (2017) include 0.75 for strong, 0.50 for moderate, and 0.25 for weak associations. The findings in the table reveal a moderate level of predictive accuracy indicated by the R2 coefficient. Specifically, the R2 result of 0.497 for the association between EA and THC suggests an average predictive accuracy as it is below 0.75. Effect size measures the impact of exogenous factors on latent endogenous variables, with threshold values indicating medium (0.02), high (0.15), and weak (0.35) relationship sizes (Hair et al., 2013). The predictive significance metric, Q2, assesses model prediction accuracy for each endogenous latent concept. In this study, the route model demonstrates a respectable 49.7% predictive accuracy for the "external audit" concept, as indicated by the Q2 value of 0.366. This suggests a satisfactory level of prediction accuracy for the "external audit" notion. It is important to note that these results are within acceptable limits, supporting the reliability and validity of the model in predicting the relationship between EA and human capital.

The T-values for the hypotheses supported for the study are more than 1.65, as shown in

Table 7. As a result, all theories were confirmed and approved. The hypothesis has a clear relationship to current research. The first hypothesis, which is that AIS positively affect EA is accepted and supported (Beta value = 0.331; T = 4.662; P < 0.05), which indicates a positive effect. The type of relationship between them is positive, where the beta value = 0.331. The second hypothesis is that public audit software positively affects EA, as (beta value = 0.119; T = 1.269; P > 0.05), the hypothesis is rejected, meaning that public audit Software does not positively affect EA, as P value > 0.05 and T value < 2, but the relationship between them is positive as the beta value = 0.119, and therefore the hypothesis was rejected and not supported. The third hypothesis is that the TA positively affects EA, as (beta value = -0.082; T = 1.040; P > 0.05), the hypothesis is rejected, that is, the TA does not positively affect EA, as the value of P > 0.05 and the T value < 2, and the relationship between them is negative as the beta value = -0.082, and therefore the hypothesis was rejected and not supported. The fourth hypothesis is that THC positively affects EA, as (beta value = 0.428; T = 5.938; P < 0.05), the hypothesis is accepted and supported, meaning that THC positively affects EA, as the P value < 0.05 and the T value > 2, and the relationship between them is positive as the Beta value = 0.428, and therefore the hypothesis was accepted and supported. The fifth hypothesis is that human capital moderates the relationship between TA and EA. The results of the study showed that TA does not affect EA when using human capital as a modifying variable, where (beta value = -0.041; T = 0.352; P > 0.05), and therefore the hypothesis was rejected because the P value > 0.05 and the T value < 2, The relationship between TA and EA was negative when human capital was used as a moderating variable, and therefore the hypothesis was rejected and not supported. The sixth hypothesis is that human capital moderates the relationship between AIS and EA. The results of the study demonstrated that AIS do not affect EA when using human capital as a modified variable, where (beta value = -0.119; T = 1.267; P > 0.05). Therefore, the hypothesis was rejected because the P value > 0.05 and the T value < 2, and the relationship is “There is a negative relationship between AIS and EA when using human capital as a modifying variable”, and therefore hypothesis was rejected and not supported. The seventh hypothesis is that THC moderates the relationship between generated auditing Software and EA. The results of the study demonstrated that general auditing programs do not affect EA when using human capital. Human capital was a modified variable (Beta value = 0.049; T = 0.490; P > 0.05) and therefore the hypothesis was rejected because the P value > 0.05 and the T value < 2. However, the relationship is positive between public audit programs and EA when using human capital as a variable. Rate, and therefore the hypothesis was rejected and not supported.

Discussion of results

The present study aligns with various research findings (Alzoubi et al., 2020; Yakubu et al., 2018; Jaafreh, 2017; Tajuddin, 2015) that emphasize the positive and significant impact of AIS on EA. It corroborates the outcomes of previous research, supporting the effectiveness of AIS and its substantial influence on both external and internal audit processes. Additionally, this study extends its support to diverse dimensions such as audit programs, generalization, and human capital as moderating variables, enriching the understanding of factors influencing EA. Studies, like (Alzoubi et al., 2020; Lotfi, et al., 2022; Ghobakhloo and Tang, 2015; Marble, 2003), not only endorse the fundamental impact of AIS on EA but also align with this study on independent dimensions like audit programs and human capital moderation. The collective evidence reinforces the critical role of AIS in improving the speed, quality, and facilitation of EA performance.

The findings emphasize that companies utilizing AIS, especially mainframe computers, exhibit a heightened focus on EA reports, underscoring the pivotal role of these systems in shaping auditing priorities (Peter et al., 2008). The adaptability and reliability of AIS contribute significantly to EA, fostering user motivation and engagement (Lotfi, et al., 2022; Lin, 2010; Hsu, et al., 2015). The study also concurs with the assertion of Alawi and Belfaqih (2018) that THC positively influences EA activities. The integration of technological advancements in accounting and auditing is acknowledged to reveal the true nature of business transactions, evaluate credibility, and enhance financial assessments. Trained human resources play a crucial role in executing these technical procedures, improving accounting and auditing processes. Contrary to findings by Pimentel and Boulianne (2020), which advocate for the positive impact of technology on accounting and auditing efficiency through tools, this study suggests a negative influence of technology on accounting and auditing processes. These contradictory results highlight the complexity of technology's role and underscore the need for further exploration in diverse contexts.

Conclusion

The study sets out to assess the efficacy of accounting information systems, generalized auditing software, technology adoption, and trained human capital in the context of AAF and listed companies in Saudi Arabia. The objective was to examine the contributions of these factors to the improvement and facilitation of external auditors performance. The study revealed a positive correlation and impact between accounting information systems and external auditors. Conversely, a negative relationship was identified between generalized auditing software and external auditors. Furthermore, the findings indicated a negative correlation and impact associated with technology adoption.

Upon introducing human capital as a moderating variable between accounting information systems, generalized auditing software, technology adoption (as independent variables), and external auditors (as a dependent variable), the authors observed that accounting information systems and technology adoption did not positively influence external auditors when human capital was considered a moderating factor. The relationship between accounting information systems, technology adoption, and external auditors was found to be negative. Interestingly, generalized audit programs were shown not to positively impact external auditors when human capital was introduced as a moderating variable, although the relationship between them was positive. These outcomes contribute valuable insights into the relationship between technological and human factors in the realm of external auditors performance.

Acknowledgment

The author extend his appreciation to Prince Sattam bin Abdulaziz University for funding this research work through the project number (PSAU/2023/01/25911)

References

- Al-ahdal, W. M., & Hashim, H. A. (2022). Impact of audit committee characteristics and external audit quality on firm performance: evidence from India. Corporate Governance: The International Journal of Business in Society, 22(2), 424-445. [CrossRef]

- Alawaqleh, Q. A., Almasria, N. A., & ALSAWALHAH, J. M. (2021). The effect of board of directors and CEO on audit quality: Evidence from listed manufacturing firms in Jordan. The Journal of Asian Finance, Economics and Business, 8(2), 243-253. [CrossRef]

- Alawi, N. A., & Belfaqih, H. M. (2018). Human resources disclosure: an exploratory study of the quality in Qatar. World Journal of Entrepreneurship, Management and Sustainable Development, 15(1), 84-95. [CrossRef]

- Albawwat, A. H., Zureiqat, B., Al–Omari, M., Sulaihat, N., & Al-Haziamah, A. (2020). Possible Interaction between Corporate Governance and Timeliness of Jordanian Interim Financial Reporting. Productivity Management, 25, 463-482.

- Al-Dalaien, B. O. A., & Dalayeen, B. O. A. (2018). Investigating the impact of accounting information system on the profitability of Jordanian banks. Research Journal of Finance and Accounting, 9(18), 110-118.

- Almaiah, M. A., Al-Otaibi, S., Lutfi, A., Almomani, O., Awajan, A., Alsaaidah, A., & Awad, A. B. (2022). Employing the TAM model to investigate the readiness of M-learning system usage using SEM technique. Electronics, 11(8), 1259. [CrossRef]

- Almasria, N., Clark, J., & Choudhury, S. (2018). Empirical Evidence on the Relationship between Internal Audit Factors and the Quality of External Audit. International Journal of Management and Applied Science, 4. https://ssrn.com/abstract=4339309.

- Alshammari, A. A. (2020). The impact of human resource management practices, organizational learning, organizational culture and knowledge management capabilities on organizational performance in Saudi organizations: a conceptual framework. Revista Argentina de Clínica Psicológica, 29(4), 714. https://www.ccsenet.org/journal/index.php/ijbm/article/view/29715.

- Alshira’h, A. F., Alsqour, M. D., Lutfi, A., Alsyouf, A., & Alshirah, M. (2020). A socio-economic model of sales tax compliance. Economies, 8(4), 88. [CrossRef]

- Alshira'h, A. F., & Abdul-Jabbar, H. (2020). Moderating role of patriotism on sales tax compliance among Jordanian SMEs. International Journal of Islamic and Middle Eastern Finance and Management, 13(3), 389-415. [CrossRef]

- Alshirah, A., Magablih, A., & Alsqour, M. (2021). The effect of tax rate on sales tax compliance among Jordanian public shareholding corporations. Accounting, 7(4), 883-892. [CrossRef]

- Alsmady, A. A. (2022). Accounting information quality and tax avoidance effect on investment opportunities evidence from Gulf Cooperation Council GCC. Cogent Business & Management, 9(1), 2143020. [CrossRef]

- Alsyouf, A. (2021). Self-efficacy and personal innovativeness influence on nurses beliefs about EHRS usage in Saudi Arabia: Conceptual model. Int. J. Manag.(IJM), 12, 1049-1058. [CrossRef]

- Alzoubi, M. M., & Snider, D. H. (2020). Comparison of factors affecting enterprise resource planning system success in the Middle East. International Journal of Enterprise Information Systems (IJEIS), 16(4), 17-38. [CrossRef]

- Anthony, B., Kamaludin, A., Romli, A., Raffei, A. F. M., Nincarean A/L Eh Phon, D., Abdullah, A.,... & Baba, S. (2019). Exploring the role of blended learning for teaching and learning effectiveness in institutions of higher learning: An empirical investigation. Education and Information Technologies, 24, 3433-3466. [CrossRef]

- Austin, A. A., Carpenter, T. D., Christ, M. H., & Nielson, C. S. (2021). The data analytics journey: Interactions among auditors, managers, regulation, and technology. Contemporary Accounting Research, 38(3), 1888-1924. [CrossRef]

- Aversa, P., Hervas-Drane, A., & Evenou, M. (2019). Business model responses to digital piracy. California Management Review, 61(2), 30-58. [CrossRef]

- Awual, M. R., Hasan, M. M., Islam, A., Rahman, M. M., Asiri, A. M., Khaleque, M. A., & Sheikh, M. C. (2019). Offering an innovative composited material for effective lead (II) monitoring and removal from polluted water. Journal of cleaner production, 231, 214-223. [CrossRef]

- Bani-Khalid, T., Alshira’h, A. F., & Alshirah, M. H. (2022). Determinants of tax compliance intention among Jordanian SMEs: A focus on the theory of planned behavior. Economies, 10(2), 30. [CrossRef]

- Bou-Llusar, J. C., Escrig-Tena, A. B., Roca-Puig, V., & Beltrán-Martín, I. (2009). An empirical assessment of the EFQM Excellence Model: Evaluation as a TQM framework relative to the MBNQA Model. Journal of Operations Management, 27(1), 1-22. [CrossRef]

- Burton, F. G., Starliper, M. W., Summers, S. L., & Wood, D. A. (2015). The effects of using the internal audit function as a management training ground or as a consulting services provider in enhancing the recruitment of internal auditors. Accounting Horizons, 29(1), 115-140. [CrossRef]

- Caputo, A., Pizzi, S., Pellegrini, M. M., & Dabić, M. (2021). Digitalization and business models: Where are we going? A science map of the field. Journal of business research, 123, 489-501. [CrossRef]

- Chen, X., Dai, Q., & Na, C. (2019). The value of enterprise information systems under different corporate governance aspects. Information Technology and Management, 20, 223-247. [CrossRef]

- Chin, W. W. (1998). Commentary: Issues and opinion on structural equation modeling. MIS quarterly, vii-xvi. https://www.jstor.org/stable/249674.

- Chin, W. W. (1998). The partial least squares approach to structural equation modeling. Modern methods for business research, 295(2), 295-336.

- Christ, M. H., Masli, A., Sharp, N. Y., & Wood, D. A. (2015). Rotational internal audit programs and financial reporting quality: Do compensating controls help? Accounting, Organizations and Society, 44, 37-59. [CrossRef]

- Cingolani, R. (2013). The road ahead. Nature Nanotechnology, 8(11), 792-793. [CrossRef]

- Das, A. (1989). Integrable models (Vol. 30). World Scientific.

- Desoky, A., & Khasharmeh, H. A. (2018). Does the provision of non-audit services affect auditor independence and audit quality? Evidence from Bahrain. Evidence from Bahrain (March 18, 2019).• Khasharmeh, HA and Desoky, AM, 25-55. 18 March.

- Dittenhofer, M. (2001). Internal auditing effectiveness: an expansion of present methods. Managerial auditing journal, 16(8), 443-450. [CrossRef]

- Duarte, P. A. O., & Raposo, M. L. B. (2010). A PLS model to study brand preference: An application to the mobile phone market. Handbook of partial least squares: Concepts, methods and applications, 449-485. [CrossRef]

- Ege, M. S. (2015). Does internal audit function quality deter management misconduct? The Accounting Review, 90(2), 495-527. [CrossRef]

- Elaoud, A., & Jarboui, A. (2017). Auditor specialization, accounting information quality and investment efficiency. Research in International Business and Finance, 42, 616-629. [CrossRef]

- Endaya, K. A., & Hanefah, M. M. (2013). Internal audit effectiveness: An approach proposition to develop the theoretical framework. Research Journal of Finance and Accounting, 4(10), 92-102.

- Fan, J. P., & Wong, T. J. (2005). Do external auditors perform a corporate governance role in emerging markets? Evidence from East Asia. Journal of Accounting Research, 43(1), 35-72. [CrossRef]

- Farouq, B. U. (2016). Effect of Financial Management Practices on the Business Efficiency of Small and Medium Enterprises in Nigeria (Doctoral dissertation, COHRED, JKUAT).

- Florio, C., & Leoni, G. (2017). Enterprise risk management and firm performance: The Italian case. The British Accounting Review, 49(1), 56-74. [CrossRef]

- Fordham, D. R., & Hamilton, C. W. (2019). Accounting information technology in small businesses: An inquiry. Journal of Information Systems, 33(2), 63-75. [CrossRef]

- Fornell, C. (1981). A comparative analysis of two structural equation models: LISREL and PLS applied to market data.

- Ghobakhloo, M., & Tang, S. H. (2015). Information system success among manufacturing SMEs: case of developing countries. Information Technology for Development, 21(4), 573-600. [CrossRef]

- Goodwin-Stewart, J., & Kent, P. (2006). Relation between external audit fees, audit committee characteristics and internal audit. Accounting & Finance, 46(3), 387-404. [CrossRef]

- Ha, S., Nguyen, H., Nguyen, N., & Do, D. (2020). The outside determinants influencing quality of accounting human resources for sustainability through the lens accounting service firms in Hanoi, Vietnam. Management Science Letters, 10(3), 543-550. [CrossRef]

- Hair, J. F., Ringle, C. M., & Sarstedt, M. (2013). Partial least squares structural equation modeling: Rigorous applications, better results and higher acceptance. Long range planning, 46(1-2), 1-12. [CrossRef]

- Hair, J. F., Risher, J. J., Sarstedt, M., & Ringle, C. M. (2019). When to use and how to report the results of PLS-SEM. European Business Review, 31(1), 2-24. [CrossRef]

- Hair, J., Hollingsworth, C. L., Randolph, A. B., & Chong, A. Y. L. (2017). An updated and expanded assessment of PLS-SEM in information systems research. Industrial management & data systems, 117(3), 442-458. [CrossRef]

- Heo, J., & Han, I. (2003). Performance measure of information systems (IS) in evolving computing environments: an empirical investigation. Information & Management, 40(4), 243-256. [CrossRef]

- Hsu, P. F., Yen, H. R., & Chung, J. C. (2015). Assessing ERP post-implementation success at the individual level: Revisiting the role of service quality. Information & Management, 52(8), 925-942. [CrossRef]

- Hult, G. T. M., Morgeson, F. V., Morgan, N. A., Mithas, S., & Fornell, C. (2017). Do managers know what their customers think and why? Journal of the Academy of Marketing Science, 45(1), 37-54. [CrossRef]

- Ibrahim, F., Ali, D. N. H., & Besar, N. S. A. (2020). Accounting information systems (AIS) in SMEs: Towards an integrated framework. International Journal of Asian Business and Information Management (IJABIM), 11(2), 51-67. [CrossRef]

- Idris, K. M., & Mohamad, R. (2016). The influence of technological, organizational and environmental factors on accounting information system usage among Jordanian small and medium-sized enterprises. International Journal of Economics and Financial Issues, 6(7), 240-248.

- Institute of Internal Auditors. Research Foundation. (2013). International Professional Practices Framework (IPPF). Institute of Internal Auditors.

- Jaafreh, A. B. (2017). Evaluation information system success: applied DeLone and McLean information system success model in context banking system in KSA. International review of management and business research, 6(2), 829-845.

- Jaber, M. M., Alameri, T., Ali, M. H., Alsyouf, A., Al-Bsheish, M., Aldhmadi, B. K.,... & Jarrar, M. T. (2022). Remotely monitoring COVID-19 patient health condition using metaheuristics convolute networks from IoT-based wearable device health data. Sensors, 22(3), 1205. [CrossRef]

- Janvrin, D., Bierstaker, J., & Lowe, D. J. (2009). An investigation of factors influencing the use of computer-related audit procedures. Journal of Information Systems, 23(1), 97-118. [CrossRef]

- Kanakriyah, R. (2016). Voluntary disclosure and its effect on the quality of accounting information according to users' perspective in Jordan. American Journal of Business, Economics and Management, 4(6), 134-146.

- Kingir, S., & Mesci, M. (2010). Factors that affect hotel employees motivation, the case of Bodrum. Serbian journal of management, 5(1), 59-76.

- Kotb, A., Elbardan, H., & Halabi, H. (2020). Mapping of internal audit research: a post-Enron structured literature review. Accounting, Auditing & Accountability Journal, 33(8), 1969-1996. [CrossRef]

- Krishnan, G. V. (2003). Does Big 6 auditor industry expertise constrain earnings management? Accounting horizons, 17, 1-16.

- La Torre, M., Botes, V. L., Dumay, J., & Odendaal, E. (2021). Protecting a new Achilles heel: the role of auditors within the practice of data protection. Managerial Auditing Journal, 36(2), 218-239. [CrossRef]

- Lin, H. F. (2010). An investigation into the effects of IS quality and top management support on ERP system usage. Total Quality Management, 21(3), 335-349. [CrossRef]

- Lois, P., Drogalas, G., Karagiorgos, A., & Tsikalakis, K. (2020). Internal audits in the digital era: opportunities risks and challenges. EuroMed Journal of Business, 15(2), 205-217.Lois, P. [CrossRef]

- Lombardi, R., & Secundo, G. (2021). The digital transformation of corporate reporting–a systematic literature review and avenues for future research. Meditari Accountancy Research, 29(5), 1179-1208. [CrossRef]

- Lutfi, A. (2020). Investigating the moderating role of environmental uncertainty between institutional pressures and ERP adoption in Jordanian SMEs. Journal of Open Innovation: Technology, Market, and Complexity, 6(3), 91. [CrossRef]

- Lutfi, A. (2021). Understanding cloud based enterprise resource planning adoption among SMEs in Jordan. J. Theor. Appl. Inf. Technol, 99(24), 5944-5953.

- Lutfi, A. (2022). Factors influencing the continuance intention to use accounting information system in Jordanian SMEs from the perspectives of UTAUT: Top management support and self-efficacy as predictor factors. Economies, 10(4), 75. [CrossRef]

- Lutfi, A. (2022). Understanding the Intention to Adopt Cloud-based Accounting Information System in Jordanian SMEs. International Journal of Digital Accounting Research, 22. [CrossRef]

- Lutfi, A., Al-Khasawneh, A. L., Almaiah, M. A., Alsyouf, A., & Alrawad, M. (2022). Business sustainability of small and medium enterprises during the COVID-19 pandemic: The role of AIS implementation. Sustainability, 14(9), 5362. [CrossRef]

- Lutfi, A., Alshira’h, A. F., Alshirah, M. H., Al-Okaily, M., Alqudah, H., Saad, M.,... & Abdelmaksoud, O. (2022). Antecedents and impacts of enterprise resource planning system Adoption among Jordanian SMEs. Sustainability, 14(6), 3508. [CrossRef]

- Lutfi, A., Saad, M., Almaiah, M. A., Alsaad, A., Al-Khasawneh, A., Alrawad, M.,... & Al-Khasawneh, A. L. (2022). Actual use of mobile learning technologies during social distancing circumstances: Case study of King Faisal University students. Sustainability, 14(12), 7323. [CrossRef]

- Ma’Ayan, Y., & Carmeli, A. (2016). Internal audits as a source of ethical behavior, efficiency, and effectiveness in work units. Journal of Business Ethics, 137, 347-363. [CrossRef]

- Maffei, M., Casciello, R., & Meucci, F. (2021). Blockchain technology: uninvestigated issues emerging from an integrated view within accounting and auditing practices. Journal of Organizational Change Management, 34(2), 462-476. [CrossRef]

- Mamić Sačer, I., & Oluić, A. (2013). Information technology and accounting information systems’ quality in Croatian middle and large companies. Journal of information and organizational sciences, 37(2), 117-126.

- Manita, R., Elommal, N., Baudier, P., & Hikkerova, L. (2020). The digital transformation of external audit and its impact on corporate governance. Technological Forecasting and Social Change, 150, 119751. [CrossRef]

- Marble, R. P. (2003). A system implementation study: management commitment to project management. Information & Management, 41(1), 111-123. [CrossRef]

- McCarthy, M., Kusaila, M., & Grasso, L. (2019). Intermediate accounting and auditing: Does course delivery mode impact student performance? Journal of Accounting Education, 46, 26-42. [CrossRef]

- Mumtaz, A. M., Ting, H., Ramayah, T., Chuah, F., & Cheah, J. H. (2017). Editorial,‘a review of the methodological misconceptions and guidelines related to the application of structural equation modelling: a Malaysian scenario’. Journal of applied structural equation modeling, 1(1), 1-13. [CrossRef]

- Nguyen, H., & Nguyen, A. (2020). Determinants of accounting information systems quality: Empirical evidence from Vietnam. Accounting, 6(2), 185-198. [CrossRef]

- Nkansa, P. C. (2016). Professional Skepticism and Fraud Risk Assessment: An Internal Auditing Perspective.

- Ouiddad, A., Chafik, O. K. A. R., Chroqui, R., & Hassani, I. B. (2018, November). Does the adoption of ERP systems help improving decision-making? A systematic literature review. In 2018 IEEE International Conference on Technology Management, Operations and Decisions (ICTMOD) (pp. 61-66). IEEE.

- Petter, S., DeLone, W., & McLean, E. (2008). Measuring information systems success: models, dimensions, measures, and interrelationships. European journal of information systems, 17, 236-263. [CrossRef]

- Pimentel, E., & Boulianne, E. (2020). Blockchain in accounting research and practice: Current trends and future opportunities. Accounting Perspectives, 19(4), 325-361. [CrossRef]

- Rose, A. M., Rose, J. M., & Norman, C. S. (2013). Is the objectivity of internal audit compromised when the internal audit function is a management training ground? Accounting & Finance, 53(4), 1001-1019. [CrossRef]

- Ruiz-Alba, J. L., Nazarian, A., Rodríguez-Molina, M. A., & Andreu, L. (2019). Museum visitors’ heterogeneity and experience processing. International Journal of Hospitality Management, 78, 131-141. [CrossRef]

- Salvador-Gómez, A., Bou-Llusar, J. C., & Beltrán-Martín, I. (2023). A multi-actor perspective on the effectiveness of human resource management implementation: an empirical analysis based on the ability-motivation-opportunity framework. The International Journal of Human Resource Management, 34(20), 3963-4002. [CrossRef]

- Sayyar, H., Basiruddin, R., Rasid, S. Z., & Elhabib, M. A. (2015). The impact of audit quality on firm performance: Evidence from Malaysia. Journal of Advanced Review on Scientific Research, 10(1), 1-19.

- Shrivastava, S., Goudar, R. H., & Aital, P. (2008, July). A Plausible Inference Applied to the Mechanism of Semantic Web Searching. In 2008 First International Conference on Emerging Trends in Engineering and Technology (pp. 1136-1139). IEEE.

- Shukla, A., & Sharma, S. K. (2018). Evaluating consumers’ adoption of mobile technology for grocery shopping: an application of technology acceptance model. Vision, 22(2), 185-198. [CrossRef]

- Sulong, Z., Gardner, J. C., Hussin, A. H., Mohd Sanusi, Z., & Mcgowan, C. B. (2013). Managerial Ownership, leverage and audit quality impact on firm performance: evidence from the Malaysian ace market. Accounting & Taxation, 5(1), 59-70.

- Syahidi, A. A., & Asyikin, A. N. (2018, August). Strategic planning and implementation of academic information system (AIS) based on website with D&M model approach. In IOP Conference Series: Materials Science and Engineering (Vol. 407, No. 1, p. 012101). IOP Publishing. [CrossRef]

- Tajuddin, M. (2015). Modification of DeLon and Mclean Model in the Success of Information System for Good University Governance. Turkish Online Journal of Educational Technology-TOJET, 14(4), 113-123.

- Tatham, P. H., & Pettit, S. J. (2010). Transforming humanitarian logistics: the journey to supply network management. International Journal of Physical Distribution & Logistics Management, 40(8/9), 609-622. [CrossRef]

- Teece, D. J. (2010). Business models, business strategy and innovation. Long range planning, 43(2-3), 172-194. [CrossRef]

- Tian, C., Peng, J. J., Zhang, S., Zhang, W. Y., & Wang, J. Q. (2019). Weighted picture fuzzy aggregation operators and their applications to multi-criteria decision-making problems. Computers & Industrial Engineering, 137, 106037. [CrossRef]

- Toth, Z. (2012). The current role of accounting information systems. Theory, Methodology, Practice-Review of Business and Management, 8(01), 91-95.

- Trigo, A., Belfo, F., & Estébanez, R. P. (2014). Accounting information systems: The challenge of the real-time reporting. Procedia Technology, 16, 118-127. [CrossRef]

- Velte, P. (2017). The link between audit committees, corporate governance quality and firm performance: a literature review. Corporate Ownership & Control, 14(1), 15-31. [CrossRef]

- Warner, K. S., & Wäger, M. (2019). Building dynamic capabilities for digital transformation: An ongoing process of strategic renewal. Long Range Planning, 52(3), 326-349. [CrossRef]

- Yi, M. Y., Fiedler, K. D., & Park, J. S. (2006). Understanding the role of individual innovativeness in the acceptance of IT-based innovations: Comparative analyses of models and measures. Decision sciences, 37(3), 393-426. [CrossRef]

- Zetzsche, D. A., Veidt, R., Buckley, R., & Arner, D. (2019). Sustainability, FinTech and Financial Inclusion. European Business Organization Law Review.

- Zhou, Z., & Chen, H. (2008). Accounting information transparency and resources allocation efficiency: theory and empirical evidence. Accounting Research, 2, 53-62.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).