Introduction

The origin of digitization can be traced back to the World War II era when the first electronic computers emerged (Navarrete, 2014). In the 1970s, institutions like libraries, museums, and galleries started to use computer systems to produce electronic catalogs that were later transformed into databases (Van Horik, 2005). These databases enabled automatic access to analog objects such as documents, artworks, and books (Van Horik, 2005). From the 1970s to the 1980s, various digitization projects were initiated to develop digital image storage and document preservation at both governmental and non-governmental institutions worldwide (Terras, 2011). The digitization projects further increased after the emergence of the global information network and the World Wide Web in the 1990s, with several public policies and research initiatives supporting the funding for the creation of online resources (Terras, 2011).

Digitization is a challenging concept to define due to its wide scope in the contemporary world, but some researchers have defined it as the creation of a digital representation of products or processes (Monaghan, et al., 2020). It has been recognized as one of the most significant technological advancements in society and business and the most important innovation in the transformation of the global economy since the Industrial Revolution (Navarrete, 2014; Leviäkangas, 2016; Parviainen, et al., 2017; Monaghan, et al., 2020).

Digitization is transforming the traditional financial services sector, especially the banking and insurance industries, by creating new opportunities for entrepreneurial companies (Bollaert, et al., 2021). The finance industry is undergoing rapid digitization, as evidenced by the emergence of innovative payment systems such as credit and debit cards, online payment markets such as PayPal, innovative trading markets and platforms for lending, and more (Chen, et al., 2019; Cong & He, 2019; Bertoni, et al., 2022). This rapid digitization has given rise to a concept called fintech, which is referred to as the use of technology and technological advancements to enhance finance (Bertoni, et al., 2022). The most noticeable result of this is the creation of alternative financial channels that have become a global phenomenon spreading from China to the United States and across Europe (Bertoni, et al., 2022).

Fintech has also started to transform finance in many developing countries such as India; it has also introduced innovations in banking and mobile payment systems in Africa, as evidenced by the development of new mobile payment systems such as Paga and Paystack (Bertoni, et al., 2022). The emergence of digitization is expected to bring positive changes to its financial landscape and overall economy (Myovella, et al., 2020). However, while many studies have shown the impacts of fintech in several high-income countries, there are limited studies done in low- and lower-middle-income countries (LLMICs).

Goal and Objectives of the Study

The main goal of this research is to examine the effects of digitization on the economies of LLMICs

Specifically, this study will:

- i.

Examine the trends in finance digitization in LLMICs.

- ii.

Ascertain the major drivers and barriers to finance digitization in LLMICs

- iii.

Assess the impact of finance digitization on economic growth.

- iv.

Predict the potential future outcomes in finance digitization across LLMICs

Literature Review

The concept of Digitization

Digitization is the process of using digital technologies to collect, analyze, store, and exchange information (International Labour Organization, 2023). Businesses have adapted to the digital age by incorporating various digital technologies into their business models to gain many advantages (Kohli & Melville, 2019). The concept of digitization has been examined in many scholarly works and although the term “digital transformation” was originated by business experts, it has been investigated by academics (Henriette, et al., 2016; Gebayew, et al., 2018; Vial, 2019).

It has been adopted rapidly by businesses and companies, but there is a large gap at the government level, and research on digitization in the government only makes up 1% of global research (Reis, et al., 2018). The effects of digitization on organizational management have been examined extensively since the 1960s (Kuusisto, 2017; Sambamurthy, et al., 2003; Brynjolfsson & Hitti, 1998). The initial studies focused on the value of digitization in organizations and most of the results claimed that digitization had no value in organizations (Kuusisto, 2017). As the research questions changed from ‘Does digitization provide value?’ to ‘How does digitization provide value?’, the value of digitization to enhance efficiency with new changes to business ecosystems became evident (Kuusisto, 2017).

Digitization adoption in various settings may be influenced by several factors (Kuusisto, 2017). One of the major drivers of digitization, as pointed out by Yao & Zhao (2009), is a larger investment in digitization which enhances digital innovation. One obstacle to the adoption of digitization is a phenomenon called ‘organizational inertia’. This term was described by Polites and Karahanna (2012) as ‘user attachment to, and persistence in, using an incumbent system even if there are better alternatives or incentives to change’. In the context of advancing digitization, the status quo must be challenged for new methods to be adopted (Kuusisto, 2017). In business management, digitization plays a crucial role in facilitating the automation of business transactions among other roles (Korperla, et al., 2013).

Finance Digitization and the Emergence of Fintech

The access and use of financial services have been changed by digitization; the World Bank reported that the utilization of digital finance services in developing countries has increased from 23% in 2014 to 57% in 2022 (Deirguc-Kunt, et al., 2022). The COVID-19 pandemic partly contributed to this increase, as it created a need for digital innovation to cope with the living and working conditions caused by the pandemic.

The finance sector has been transformed by digitization, which led to the emergence of ‘fintech’ as a concept that refers to companies that use technological solutions to enhance the financial services they provide (Bertoni, et al., 2021). Fintech companies have grown to become a global phenomenon, increasing from US$7.8 billion in 2017 to US$ 20 billion in 2020 according to the National Venture Capital Association. In Europe, several large fintech companies are operating in Germany, Netherlands, Sweden, and the United Kingdom, such as Revolut, Klarna, Mollie, and Adjen (Bertoni, et al., 2021). Some of the leading fintech industries in the world are based in China; they include Ant Financial, Du Xiaoman Finance, and JD Digits (Bertoni, et al., 2021). Moreover, some low-income countries have started to innovate their financial systems with new fintech developments such as Zerodha and Paytm in India and Paga and Paystack in Africa (Bertoni, et al., 2021).

The growth of alternative financial channels is one of the most evident indicators of finance digitization, which was enabled by the emergence and dissemination of digital platforms that simplify the process of sharing information, transferring securities, and making payments (Bertoni, et al., 2021). These platforms facilitated the growth of equity crowdfunding, initial coin offerings (ICOs), and peer-to-peer lending, which have changed finance in entrepreneurship (Block, et al., 2018; Bonini & Capizzi, 2019). Other indicators are the density and activeness of digital finance service account services, the number, and value of digital finance service transactions, the number and density of digital finance service agents, utilization of digital savings, digital insurance, and digital investments (Khera, et al., 2021; Khera, et al., 2022).

Finance Digitization in LLMICs

Research and research-based reports have extensively documented the trends, opportunities, and challenges of finance digitalization in high- and upper-middle-income countries (Chen, et al., 2022; Yao & Ma, 2022). However, there is a scarcity of research on these topics in LLMICs. In comparison to high-and upper middle-income countries, LLMICs have lower gross national income (GNI) (World Bank, 2021). GNI is a measure of income; the World Bank (2022c) defines low-income countries as countries with a GNI of US$1,135 and less, and LMICs as those countries with a GNI of US$1,136 to US$4,465.

Based on extant research, the process of digitizing finance can enhance the accessibility of financial services for many individuals who were previously excluded from conventional financial systems (Consumer International, 2023). Furthermore, it can enhance transparency, operational efficiency, and resilience within the financial sector, while concurrently mitigating the associated costs and risks of financial transactions. These advancements, in turn, can catalyze economic growth, foster competitive dynamics, and stimulate innovation (Ong et al., 2023).

However, it is imperative to note that the impacts of digital finance on LLMICs have thus far demonstrated constrained reach. Nevertheless, research conducted within an upper-middle-income country has yielded noteworthy insights into the consequences of finance digitization on income distribution. Specifically, the study conducted by Yao and Ma (2022) unveiled the presence of a Kuznets effect with finance digitization, signifying an initial surge in income inequality followed by a subsequent decline once a certain inflection point is reached within the region (Yao & Ma, 2022).

Methodology and Methods

Research Questions

- i.

What are the trends in finance digitization LLMICs?

- ii.

What are the major drivers and barriers to finance digitization in LLMICs?

- iii.

What is the nature of the relationship between finance digitization and economic growth in LLMICs?

- iv.

What is the future outcome of finance digitization in LLMICs?

Study design

This study used descriptive and analytic cross-sectional study designs to examine the trends, barriers, relationships, and prospects of finance digitization LLMICs. The descriptive cross-sectional study design was used to identify the trends in finance digitization indicators using descriptive analysis and to predict future outcomes in finance digitization using exponential smoothing. The analytic cross-sectional study design was used to assess the correlation between finance digitization and economic indicators using correlation analysis. The cross-sectional study design was suitable for this study because it allowed the comparison of different countries at a specific point in time using secondary data sources.

Hypothesis Testing

The hypothesis related to the research questions of the study is:

H1: Finance digitization has a positive effect on economic growth in LLMICs

Variables

The independent variable for this research is finance digitization while the dependent variable is economic growth.

Data Collection

Data was collected from the Global Findex and the World Development Indicators Databases. Indicators were selected based on the level of availability from the databases and results of the literature review.

The Global Findex Database offers data on savings, borrowings, payments, and financial risks among adults in more than 140 countries. The World Development Indicators Database provides data on various aspects of development for over 200 countries. The data collected for the study was from the years 2011 to 2022, which was the latest available data at the time of the study.

Five finance digitization indicators were selected from the Global Findex Database based on their availability, relevance, and validity for measuring finance digitization. These indicators were:

- i.

Finance digitization account subscriptions: The percentage of adults who have an account that can be accessed through a mobile phone or the internet.

- ii.

Digital payments received: The percentage of adults who received payments for work or sold goods or services utilizing a mobile phone or the Internet.

- iii.

Digital payments made: The percentage of adults who paid bills or sent remittances utilizing a mobile phone or the Internet.

- iv.

Digital savings: The percentage of adults who saved or set aside money through a mobile phone or the internet.

- v.

Digital borrowings: The percentage of adults who borrowed money utilizing a mobile phone or the internet.

Sample Size Determination

The number of countries included in the study was determined using the Cochrane formula for calculating sample size below:

Where:

Z = Z-score.

P = standard deviation

e = marginal error

N = Total Population

X = Sample Size

66 countries were selected using this formula. The countries selected were determined depending on the availability of data from the databases for each country.

Data Analysis

Descriptive analysis was used to identify the trends in finance digitization for each selected indicator and the barriers to finance digitization. The descriptive analysis included mean, minimum, maximum, and frequency distribution of each indicator for each country and region. The results were presented in tables and charts.

Correlation analysis was used to assess the nature of the relationship between finance digitization indicators and economic indicators. The correlation analysis involved computing the Pearson correlation coefficient (r) and the p-value for each pair of variables. The results were interpreted based on the direction, strength, and significance of the correlation coefficient. A direct relationship between the two variables was indicated by a positive correlation coefficient, while an inverse relationship was indicated by a negative correlation coefficient.

A correlation coefficient of r>0.5 indicated a strong relationship while r<0.3 indicated a weak relationship. The p-value denoted the level of significance of the correlation coefficient; p<0.05 reflected a significant correlation, while p>0.05 reflected a non-significant correlation between the two variables.

Exponential smoothing was used to predict future outcomes in finance digitization for each country and region. Exponential smoothing is a forecasting technique that assigns more weight to recent observations and less weight to older observations. The results were presented using graphs at a 95% confidence level. The forecasted values for each indicator were calculated using the formula:

Where:

yt+1 is the forecasted value for the period t+1

lt is the level component for period t1

bt is the trend component for period t.

Trends in Finance Digitization

To examine the trends in finance digitization among the 66 countries in the sample, five indicators of finance digitization were selected. These indicators were relevant to the research topic and had sufficient data availability. The following indicators were used to assess the trend in finance digitization in the selected countries:

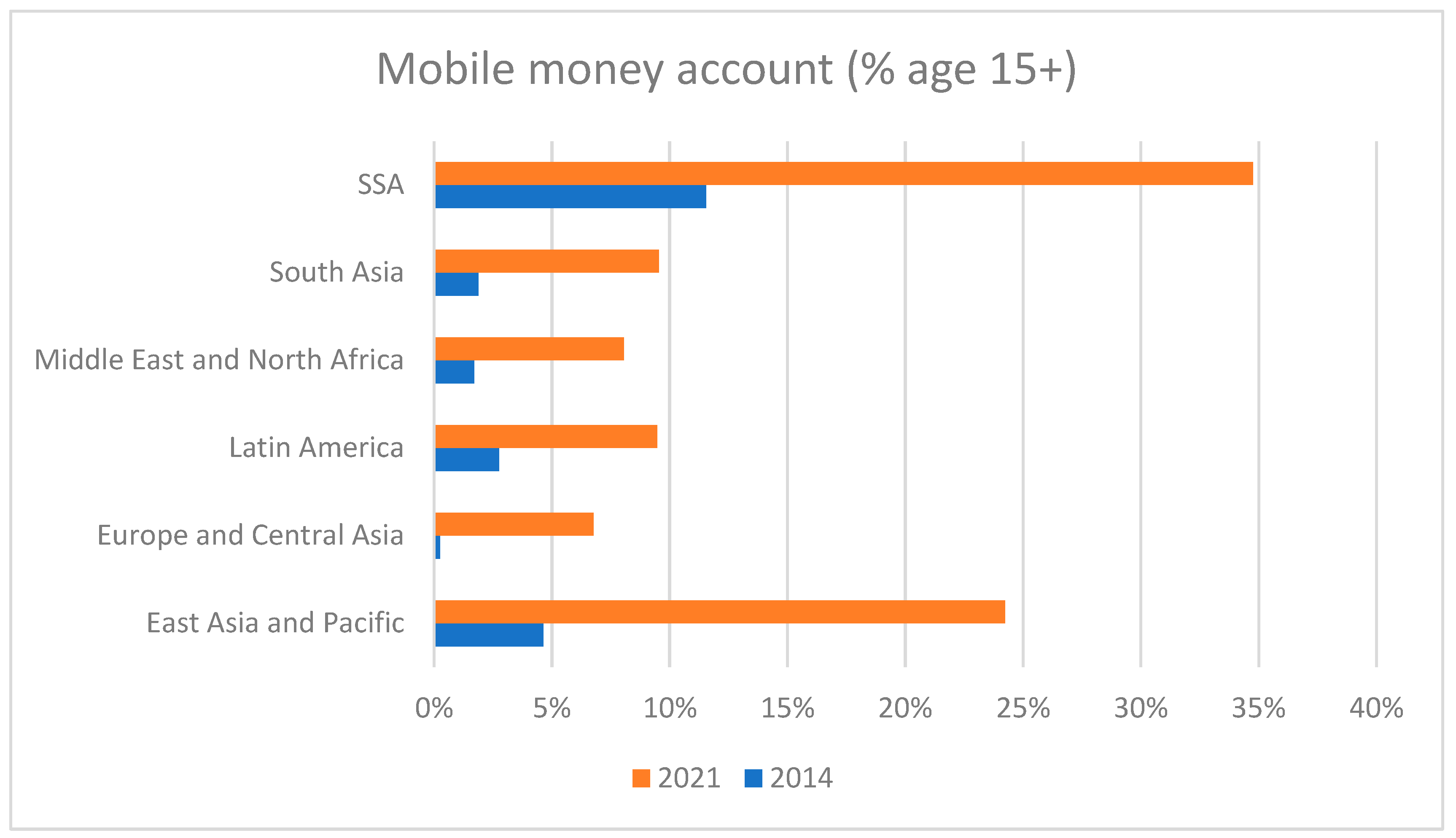

The 'mobile money account' indicator was used to measure the trends in digital finance account subscriptions. This indicator shows the proportion of people in LLMICs who own a digital finance account. Between 2011 and 2022, the ownership of digital finance accounts rose in these countries, but at different rates. For example, Senegal saw a 39% increase from 2011 to 2021, while Tunisia only experienced a 1% to 3% growth in the same period. The trends in digital finance account subscriptions across different regions of LLMICs from 2014 to 2021 were compared. The data revealed that Sub-Saharan Africa had the highest average rate of subscriptions, followed by East Asia and the Pacific (see

Figure 1 below). In contrast, Europe and Central Asia had the lowest average rate.

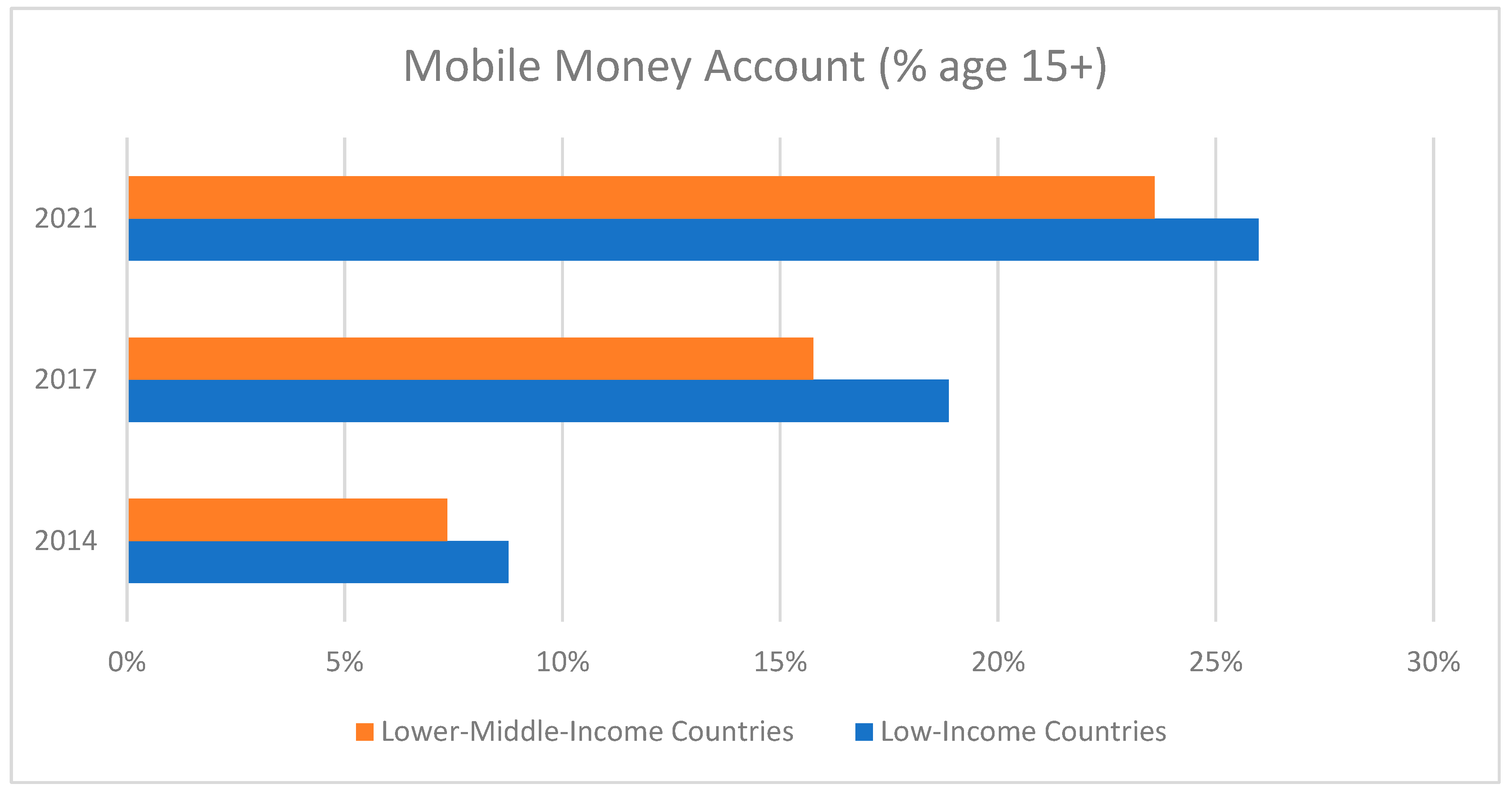

Comparing the digital finance account subscriptions by income group from 2014 to 2021, it was revealed that low-income countries had a higher average subscription rate than LMICs (see

Figure 2). Besides, the subscription rate grew faster in low-income countries than in LMICs in this period.

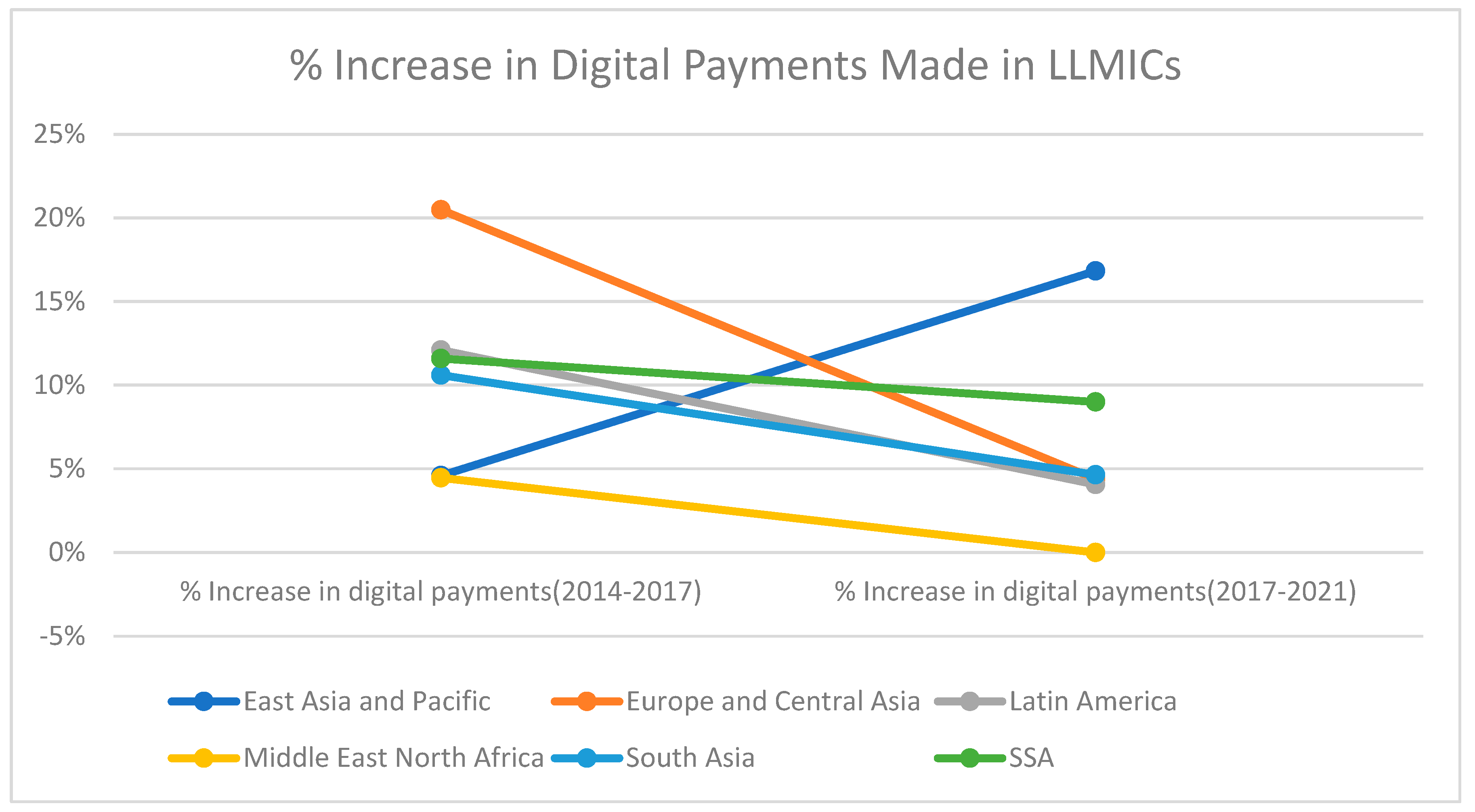

The 'percentage of adults who made payments digitally' indicator was used to measure the trends in digital payments. The data revealed that digital payment usage increased in all countries from 2014 to 2022. The percentage increase in digital payments made in different regions from 2014 to 2021 was examined and was found to be higher in the first period (2014-2017) than in the second period (2017-2021) for all regions except East Asia and the Pacific. The Middle East and North Africa had the lowest percentage increase in digital payments made in both periods, while Europe had the highest in the first period (about 20%) but a much lower in the second period (4%). East Asia and the Pacific had a moderate percentage increase in the first period (5%) but a higher percentage increase in the second period (17%), making it the region with the highest percentage increase in digital payments in the second period.

Figure 3.

% Increase in Digital Payments Made by Region.

Figure 3.

% Increase in Digital Payments Made by Region.

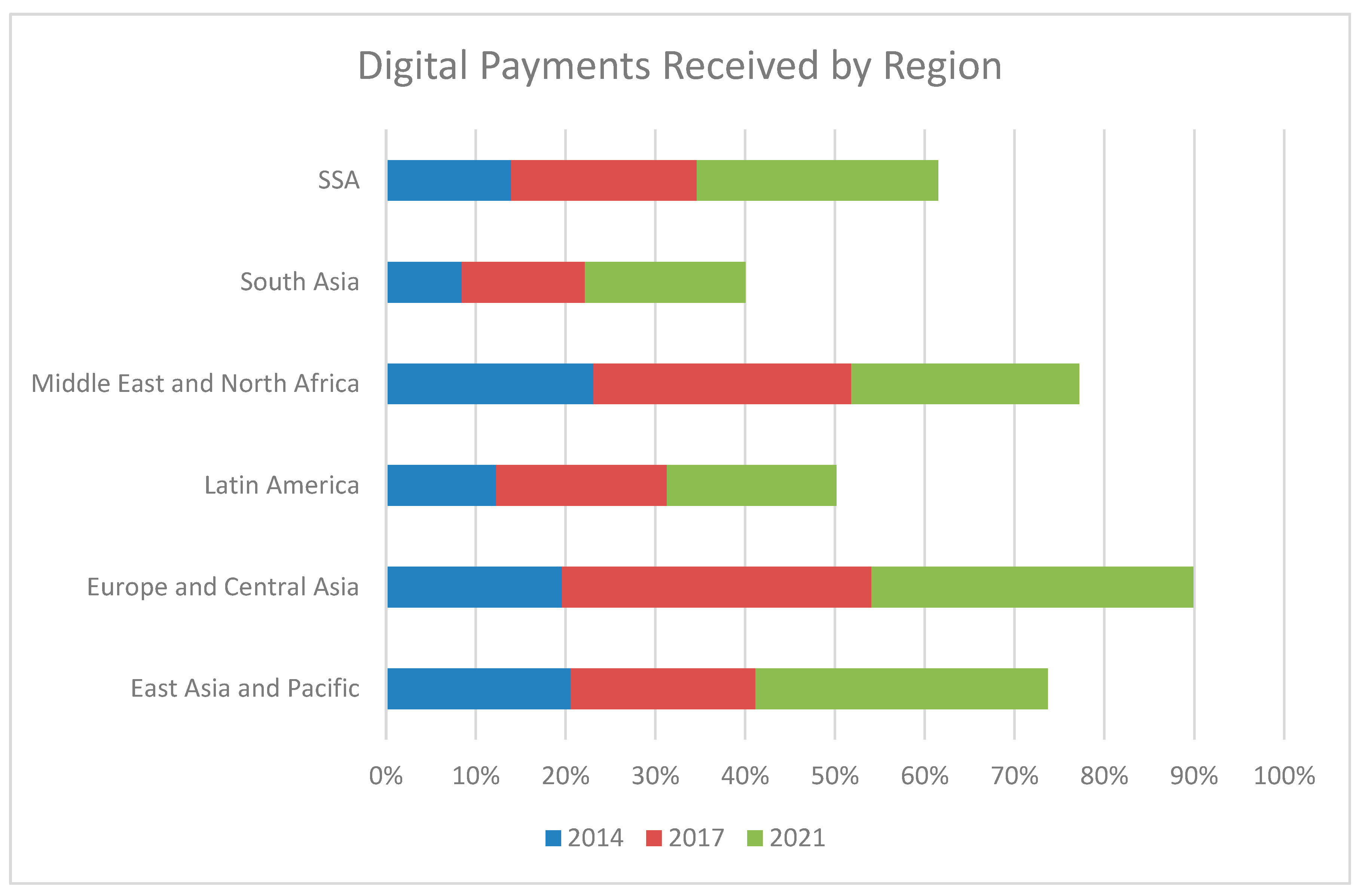

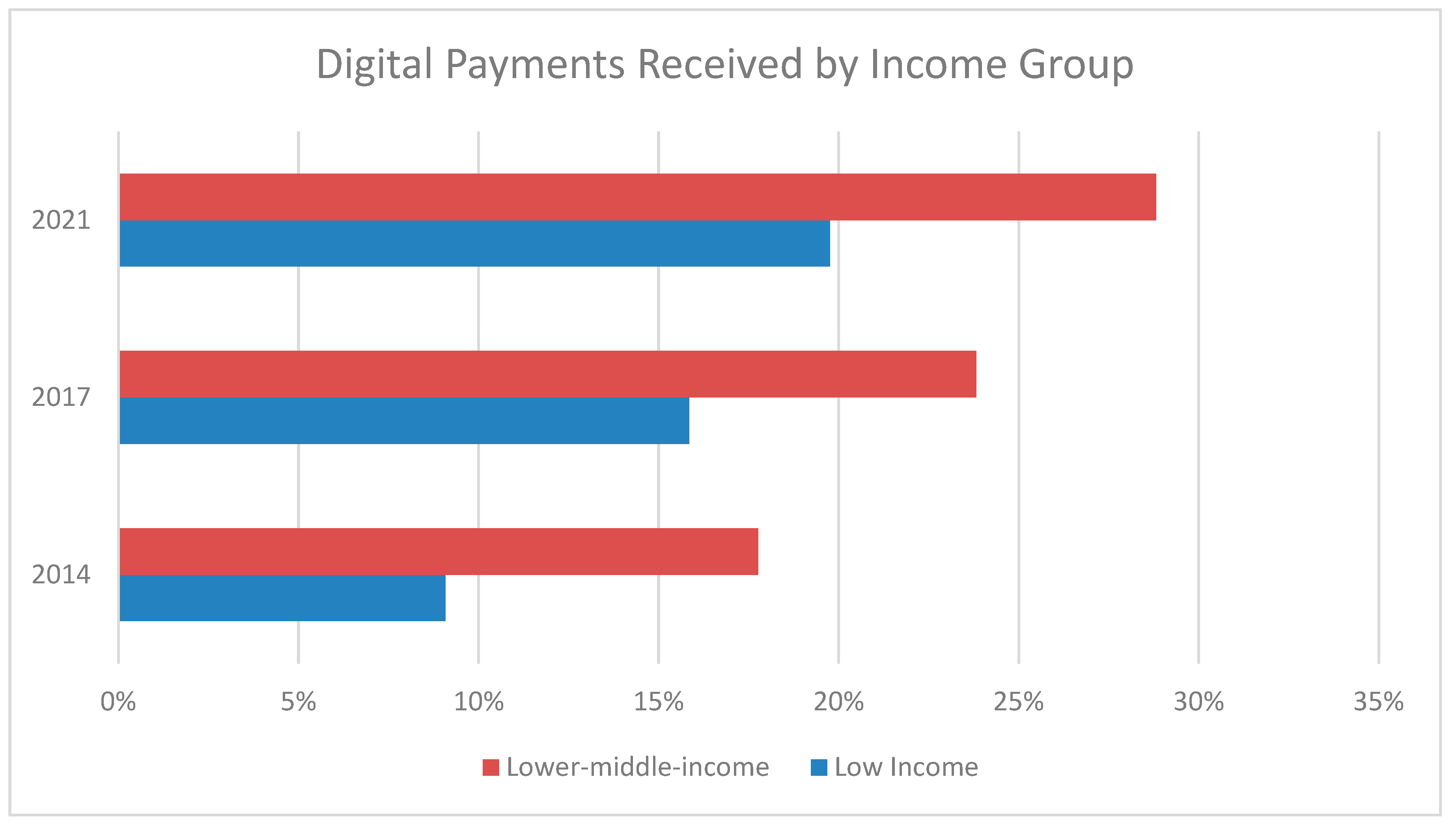

The receipt of payments through digital channels was one of the measures used to evaluate the progress of financial digitization in LLMICs. The data showed that the percentage of adults (aged 15 and above) who received payments through digital channels generally increased from 2014 to 2022. The increase was consistent across all countries from 2014 to 2017, with minor variations in the rate of increase. However, from 2017 to 2021, there was a slight decline in this indicator in several countries from different regions (Afghanistan, Burkina Faso, Egypt, Honduras, Iran Republic, Kenya, Lebanon, Nicaragua, South Sudan, Pakistan, Tajikistan, Uzbekistan, Tunisia, Zimbabwe). This decline in the receipt of digital payments from 2017 to 2021 affected both income groups and multiple regions. The regional analysis showed that Europe and Central Asia had the highest average percentage of adults who received digital payments from 2014 to 2021. The next highest regions were the Middle East and North Africa. The income group analysis revealed that LMICs had higher percentages of adults who received digital payments from 2014 to 2021.

Figure 4.

Digital Payments Received by Region.

Figure 4.

Digital Payments Received by Region.

Figure 5.

Digital Payments Received by Income Group.

Figure 5.

Digital Payments Received by Income Group.

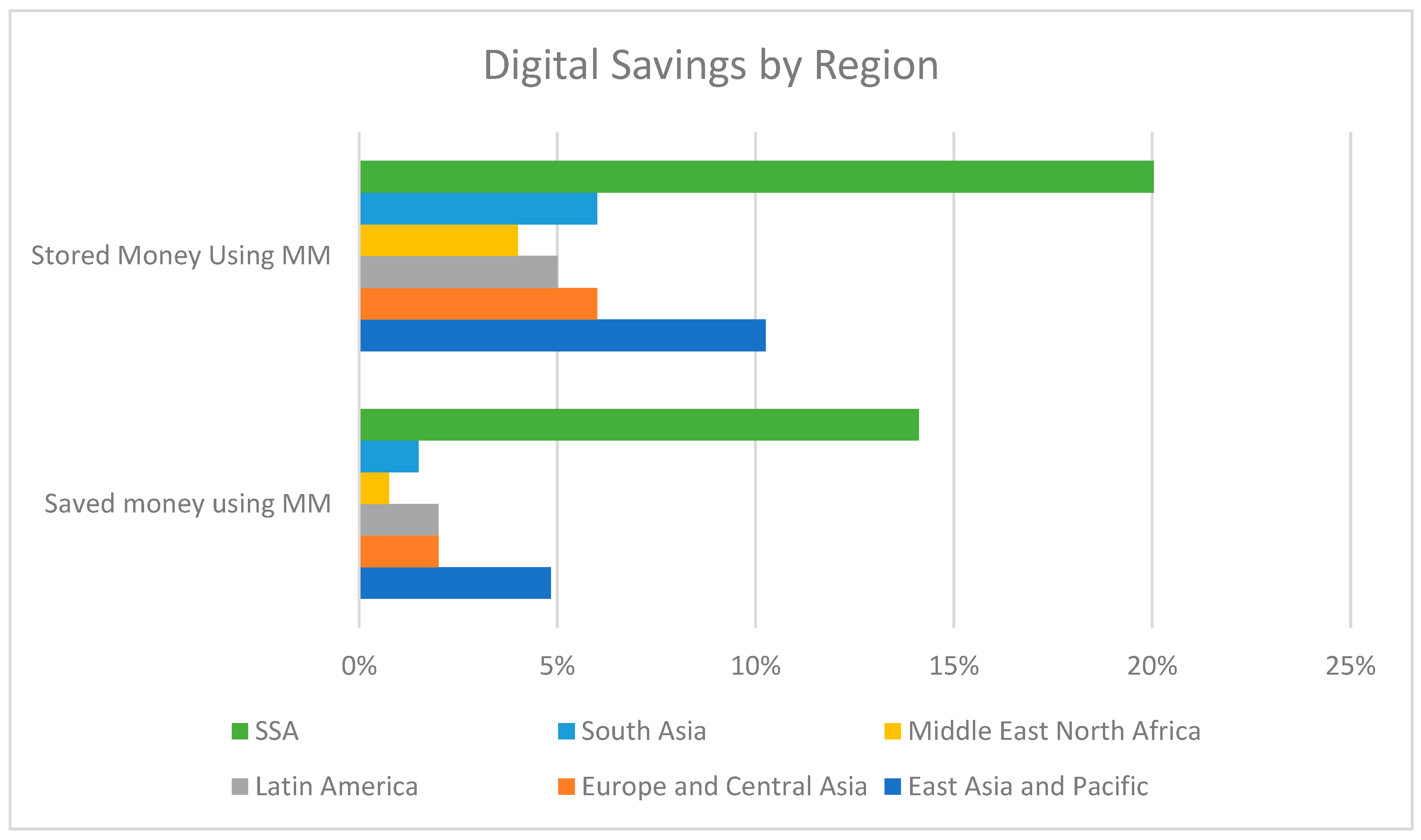

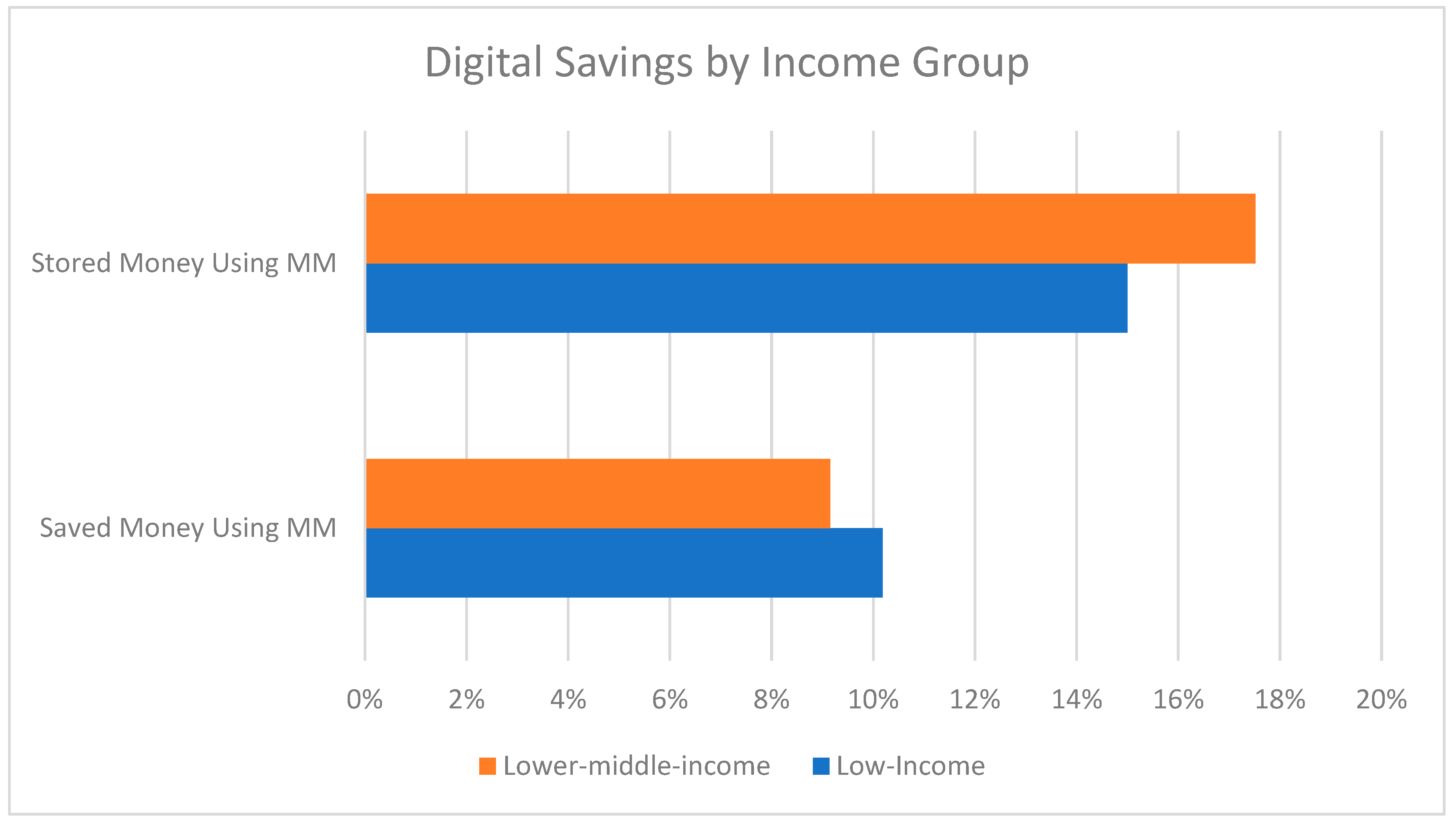

Another measure of financial digitization in LLMICs was the savings behavior using digital systems. The analysis showed that Sub-Saharan Africa had the highest percentages of adults who saved and stored money using mobile money accounts in LLMICs (

Figure 6). The data also revealed that more people used mobile money for storing money than for saving money. Moreover, more people saved and stored money using mobile money accounts in LMICs than in low-income countries.

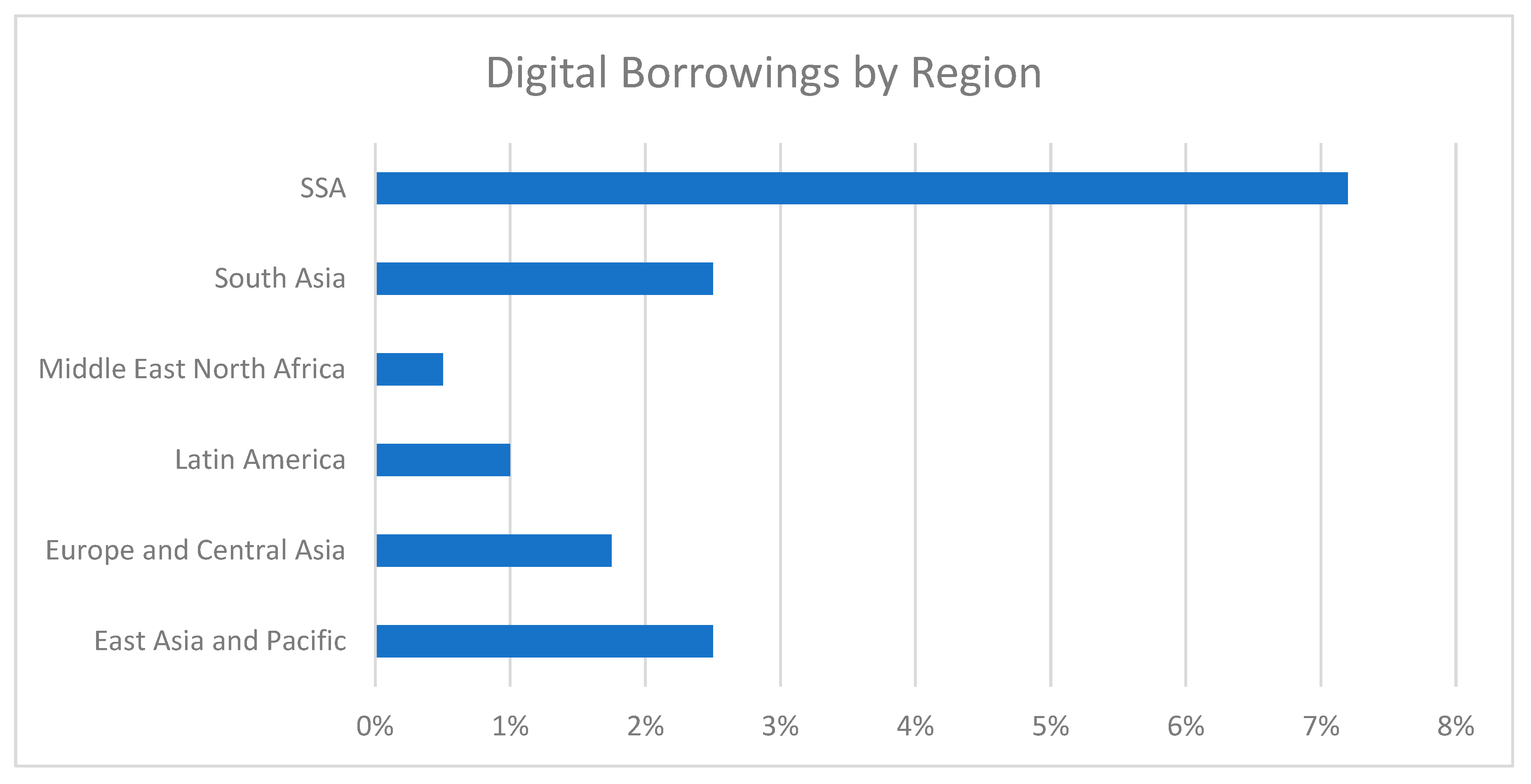

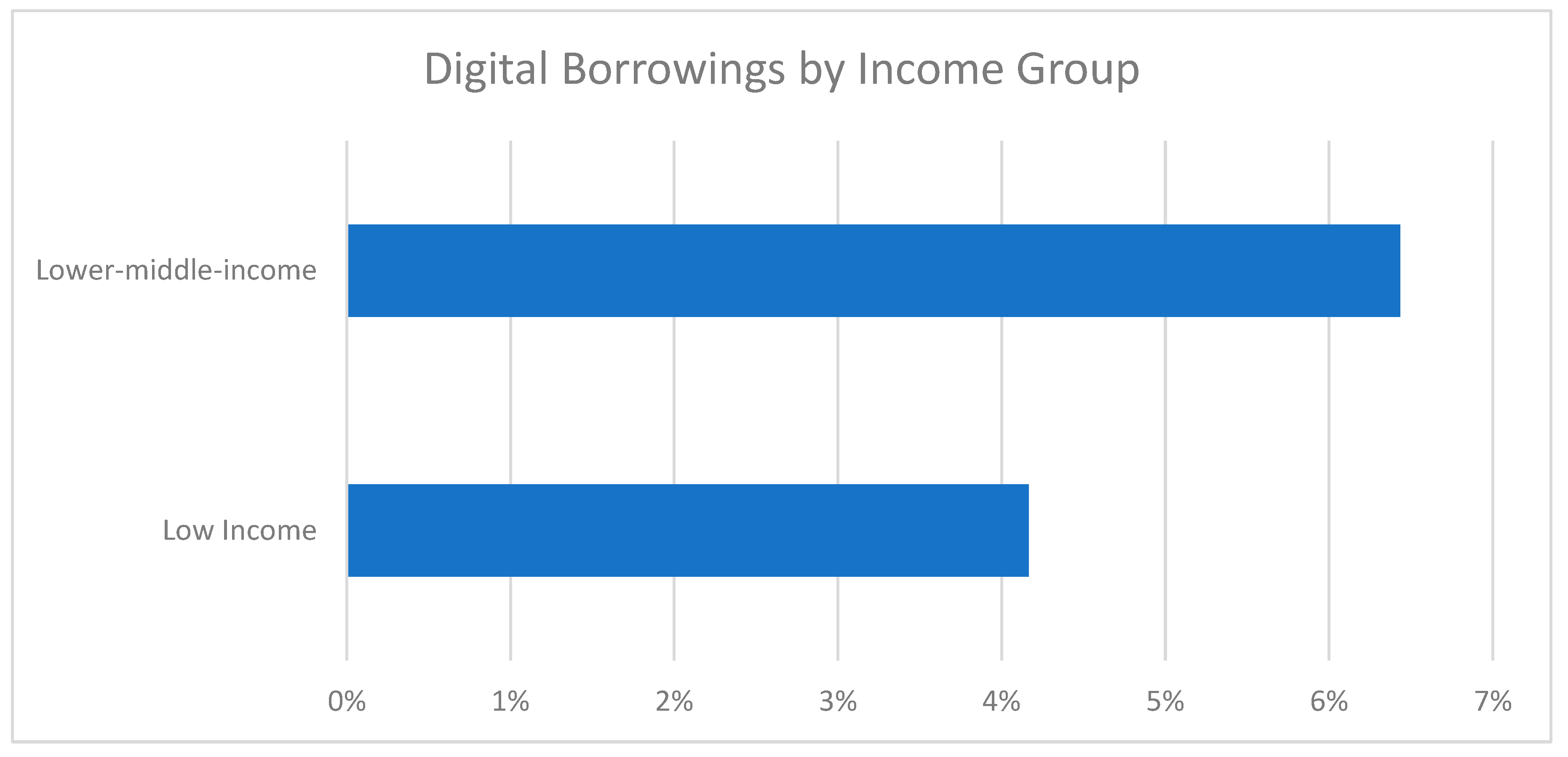

Digital borrowing was another measure of financial digitization in LLMICs. The regional analysis showed that Sub-Saharan Africa had the highest average percentage of adults who borrowed money using mobile money accounts compared to other regions of LLMICs. The income group analysis revealed that low-income countries had lower percentages of adults who borrowed money using mobile money accounts than LMICs.

Figure 8.

Digital Borrowings by Region.

Figure 8.

Digital Borrowings by Region.

Figure 9.

Digital Borrowings by Income Group.

Figure 9.

Digital Borrowings by Income Group.

Barriers to Finance Digitization

The Global Findex database provides some evidence of the obstacles to financial digitization. These obstacles include insufficient internet access, inadequate documentation for account registration, lack of a device for account access, and high cost of signing up. The data showed that low-income countries faced more challenges to financial digitization than LMICs. Regarding the barriers to access, only 25% of adults in low-income countries had access to the Internet, while 38% of adults in LMICs had Internet access. Concerning utilization, 28% of adults in low-income countries without a financial digitization account reported that they could not use financial digitization products because of the high cost.

Table 1.

Barriers to Finance Digitization in LLMICs.

Table 1.

Barriers to Finance Digitization in LLMICs.

| Income group |

Low-income |

Lower-middle-income |

| Has access to the internet |

25% |

38% |

| Mobile money products are too expensive |

28% |

24% |

| Lack of documentation for mobile money products |

34% |

29% |

| Lack of enough money to use a mobile money account |

65% |

56% |

| Lack of a mobile device to use a mobile money account |

43% |

32% |

Effects of Finance Digitization on the Economy

The analysis of the available data revealed that financial digitization was significantly correlated with economic growth. The selected financial digitization indicators (mobile money account subscriptions, digital payments made, digital payments received) had a strong, negative, and significant correlation with GNI growth. Conversely, the financial digitization indicators had a positive and significant relationship with the other economic growth indicators.

Table 2.

Relationship Between Finance Digitization and Economic Growth.

Table 2.

Relationship Between Finance Digitization and Economic Growth.

| Variables |

R |

p-Value |

Mobile Money Account Subscriptions

GNI Growth

|

-0.974 |

p<0.05 |

| |

|

|

Digital Payments Made

GNI Growth

|

-0.95 |

p<0.05 |

| |

|

|

Digital Payments Received

GNI Growth

|

-0.97 |

p<0.05 |

| |

|

|

Mobile Money Account

Gross Savings

|

0.948 |

p<0.05 |

| |

|

|

Digital Payments Made

Gross Savings

|

0.973 |

p<0.05 |

| |

|

|

Digital Payments Received

Gross Savings

|

0.948 |

p<0.05 |

| |

|

|

Mobile Money Account

GDP

|

0.97 |

p<0.05 |

| |

|

|

Digital Payments Made

GDP

|

0.99 |

p<0.05 |

| |

|

|

Digital Payments Received

GDP

|

0.979 |

p<0.05 |

Forecasting Finance Digitization in LLMICs

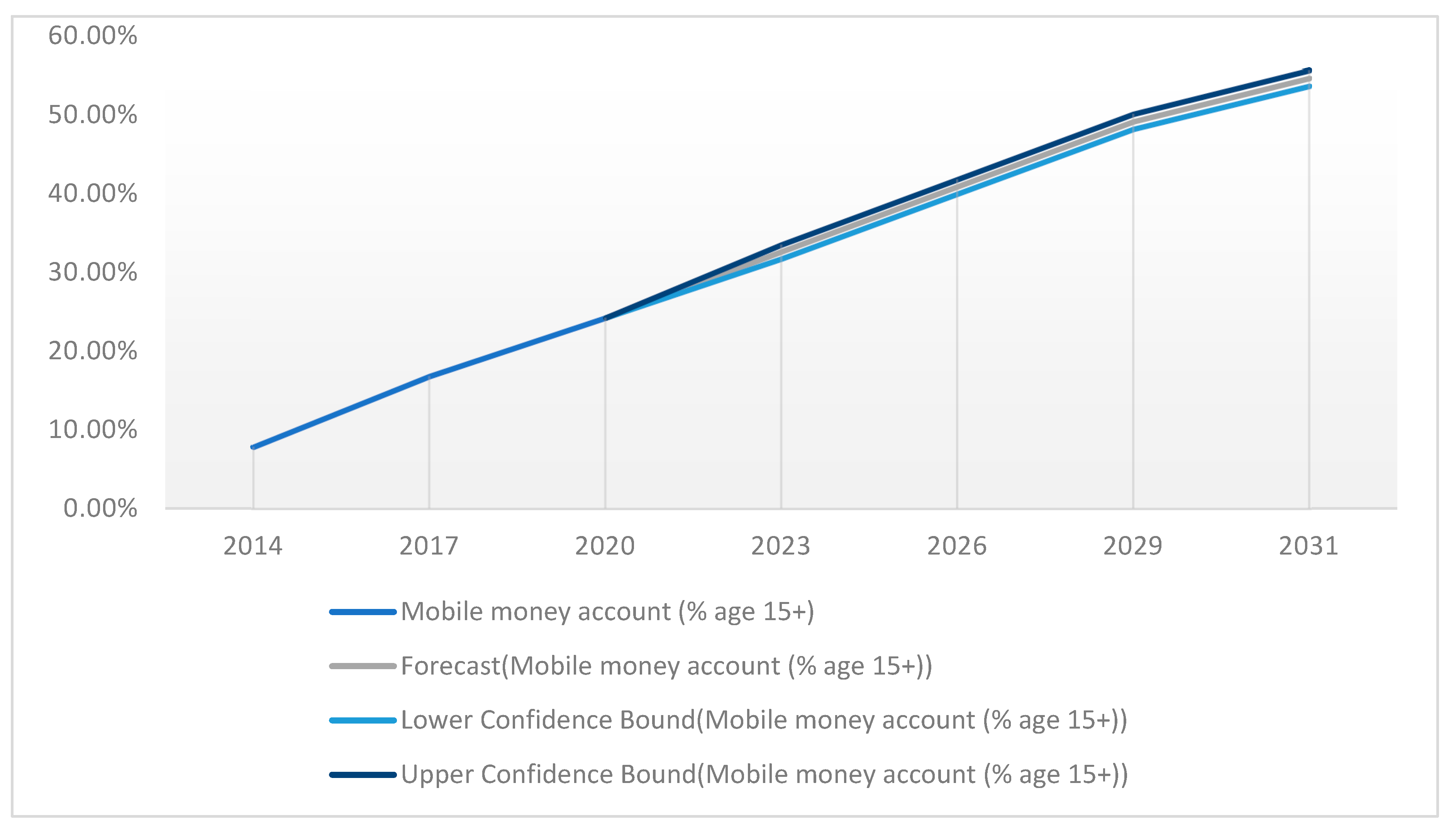

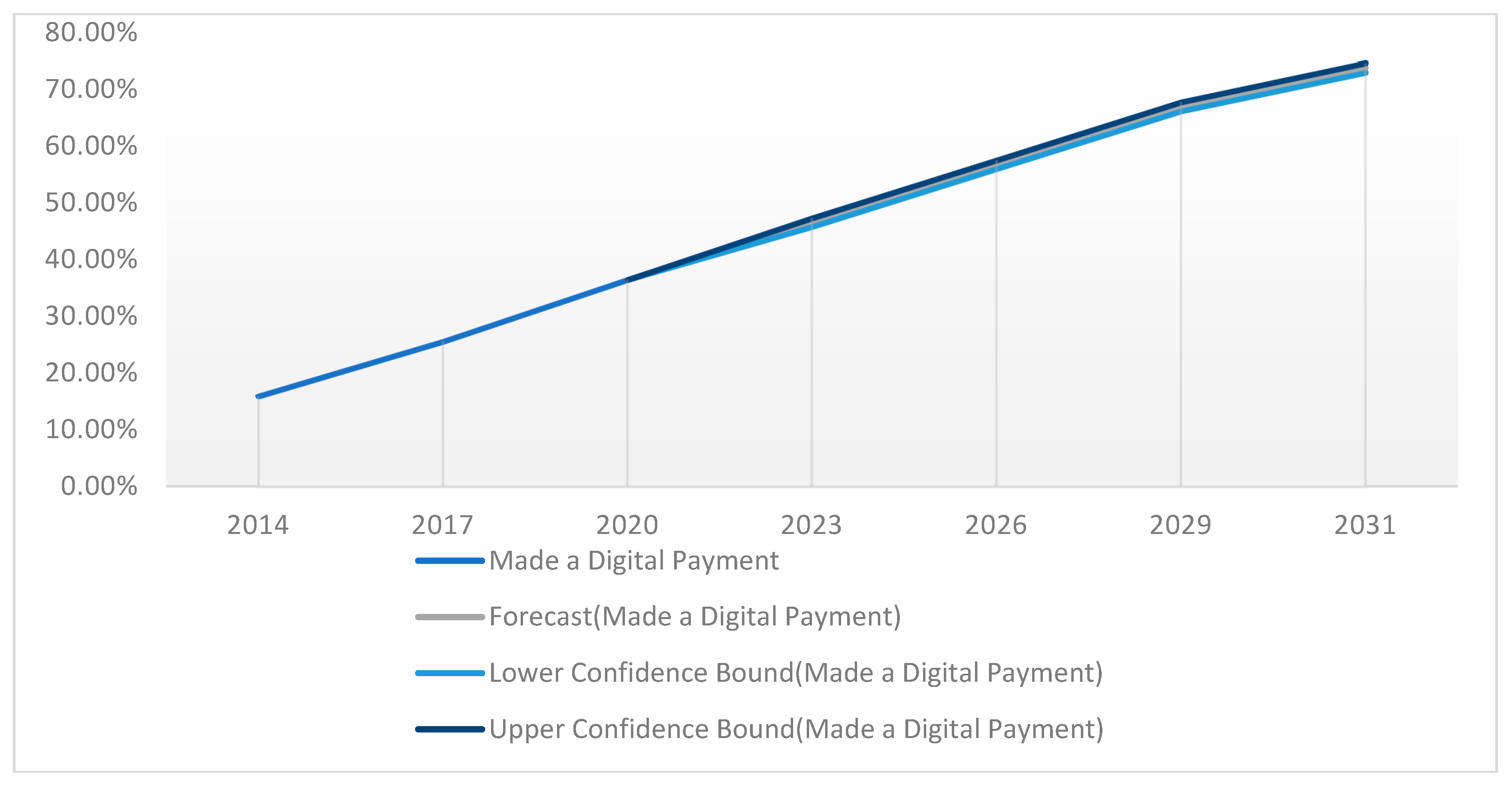

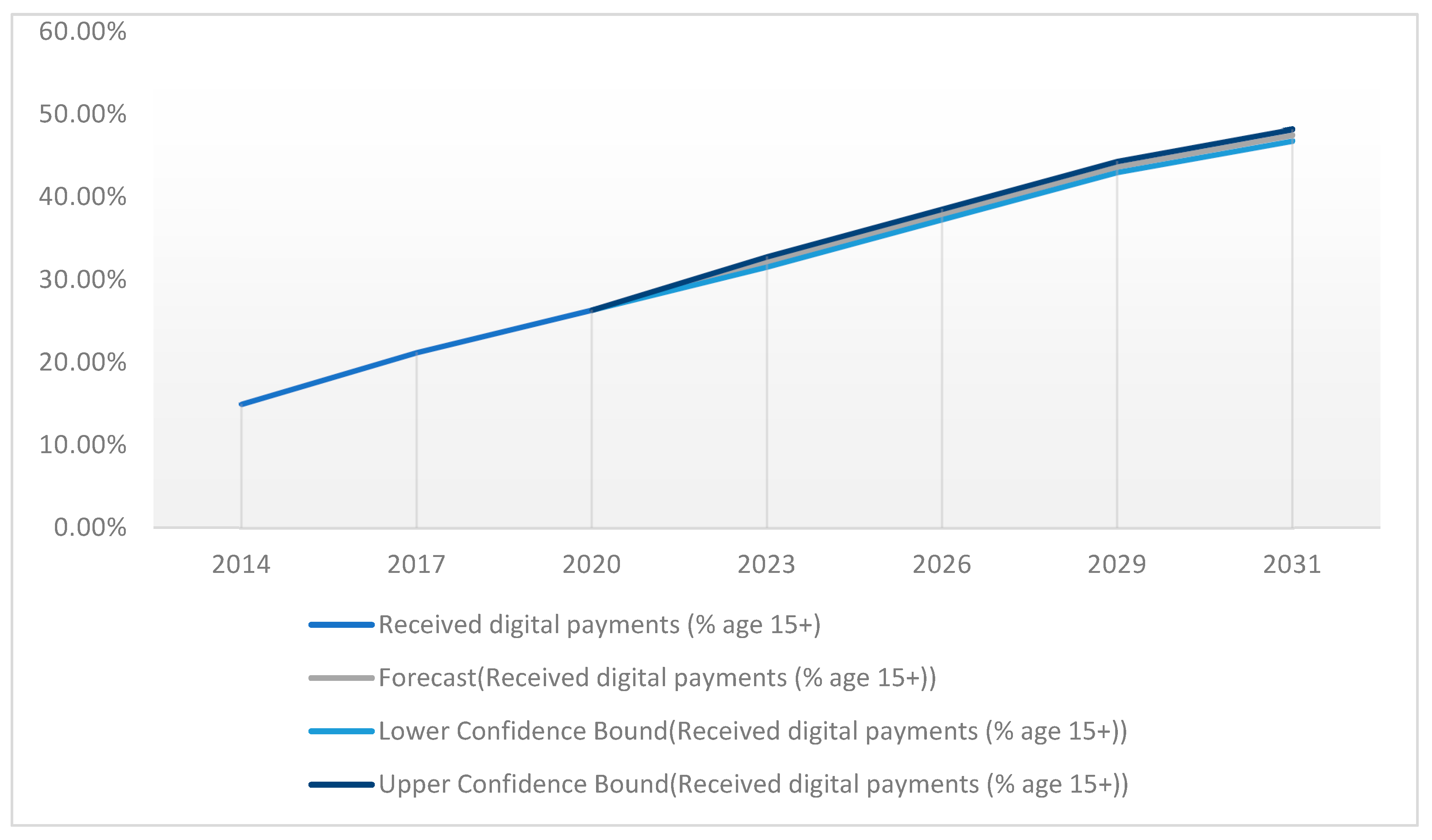

The Global Findex Database provided the data for the prediction of future trends in financial digitization. The prediction showed a consistent increase in the percentage of adults with mobile money account subscriptions and payments received and made through digital channels. The prediction estimated that by 2030, more than half (54.43%) of adults (aged 15 and above) in LLMICs will have a mobile money account. Conversely, 73.45% of adults (aged 15+) will use digital channels for making payments and only 47.50% will use digital channels for receiving payments (

Figure 10,

Figure 11 and

Figure 12).

Discussion

The study showed that financial digitization was increasing in LLMICs. The data indicates that while digital account subscriptions are growing in LLMICs, people in low-income countries are subscribing faster than those in LMICs. These findings contradict the claims by Ozili (2020) who questioned the ability of digital finance to serve poor people. However, the findings corroborate the studies by Jack & Suri (2011) and Khera, et al (2021) who reported that financial digitization created opportunities for financial inclusion. The study also found that Sub-Saharan African countries had higher percentages of accounts subscriptions to digital finance products than other LLMICs. This supports the findings by Sy, et al. (2019) who stated that the introduction of fintech into Sub-Saharan Africa had caused significant changes to the region’s financial sector due to widespread adoption.

This study also showed that the use of digital channels for making and receiving payments increased in the last decade. Several studies have examined the role of mobile money services in facilitating payment channels (Jack & Suri, 2011; Sy, et al., 2019; Demirguc-Kunt, et al., 2022; Khera, et al., 2021). Mobile money services were widely adopted because of their ability to enable peer-to-peer transfers, bill payments, and cash-in/cash-out transactions (Khera, et al., 2021). A report stated that 55% of the total value of transactions of the 6.6 million active mobile money agents in 90 countries worldwide were cash-in/cash-out transactions (Caputo, 2019). Moreover, a study in India, a lower-middle-income country, found that 78% of adults with digital accounts made digital payments (Demirguc-Kunt, et al., 2022).

In addition, the study revealed that the use of digital finance channels for making payments decreased slightly in most regions after COVID-19 compared to the reports before the pandemic. This finding contradicts several reports that the COVID-19 pandemic increased the use of electronic money transfers (World Bank, 2022a; World Bank 2022b). The reason for this discrepancy could be because this study focused on LLMICs, rather than the global population. Furthermore, reports from the World Bank (2021) have indicated that people in lower-income countries spent and made less money during and after the pandemic; besides, the pandemic reversed the development progress in these countries and reduced household consumption and spending (World Bank, 2021).

Despite the common claims that digital finance allows more people to access and use financial services, this study revealed that in LLMICs, many obstacles still hinder people from fully benefiting from digital finance solutions (Arner, et al., 2022; Ozili, 2018). These obstacles include insufficient internet access, inadequate documentation for registering with digital finance services, high transaction costs, and a lack of mobile devices for accessing the services. Pazarbasioglu, et al. (2020) argued that digital finance services could reduce costs and increase speed and outreach beyond conventional financial services. However, this study found that the costs of digital finance are still too high for many people in LLMICs worldwide.

The results of this study reveal that financial digitization has a positive association with economic growth as measured by GDP and gross savings. These findings are consistent with a study that found that the adoption of digital finance products could increase the GDPs of emerging economies (Manyika, et al., 2016; Khera, et al., 2021). In addition, the International Monetary Fund reported that digital finance grew significantly during the pandemic, especially in terms of mobile money usage, which rose by about 2% in LLMICs in 2020. This could have positive effects on financial inclusion, access to essential products, reduced transaction costs, and eventually the economy (von Allmen, et al. 2020). The positive association between finance digitization and gross savings and GDP also suggests that digital finance enhances the productivity and efficiency of the economy by enabling transactions, savings, investments, and innovation (Consumers International, 2023). Digital finance may also increase consumption and demand by enhancing the purchasing power and choices of consumers (Consumers International, 2023).

On the other hand, the study indicated that financial digitization had a negative association with GNI growth. Digital finance offers many opportunities for consumers, such as convenience, affordability, inclusion, and innovation (Consumers International, 2023). However, it also entails some challenges and risks that could affect consumer trust and confidence, such as technical failures, fraudulent activities, cyberattacks, data breaches, unclear pricing, and low digital literacy (Consumers International, 2023). These factors could limit the potential benefits of digital finance for economic development (Consumers International, 2023). Another possible factor that could explain its negative association with GNI growth is the unequal distribution of income and access to digital financial services in LLMICs. A study by PLOS ONE found that digital finance development had a negative impact on the Gini coefficient, which measures income inequality, in China (Yao & Ma, 2022). Yao & Ma (2022) argued that digital finance may favor the rich who have more resources and access to digital financial services, and thus widen the income gap.

The predictive analysis of this study showed a growth in the utilization of digital finance services. This finding is consistent with several global studies that forecast a rise in the utilization of digital finance (Hogan & Sher., 2020; Feyen, 2023).

Conclusion

This research examined the trends and barriers of finance digitization, its relationship with economic growth, and its prospects in LLMICs. The adoption and utilization of digital finance have increased in these countries over the years, but the growth rate varies by region and income group. Despite the potential benefits of finance digitization, this study identified the various barriers faced by residents of LLMICs in accessing and using digital finance products. The results also showed a positive association between finance digitization and economic growth indicators (gross savings and gross domestic product), but a negative correlation with gross national income. Furthermore, forecasting analysis indicated that finance digitization will continue to grow in LLMICs in the next decade.

Contributions to Knowledge

This study explores the trends in finance digitization and focuses on LLMICs, unlike previous studies that have examined global trends. This allows the study to assess and compare the nuances in these countries. The study finds that low-income countries have lower access to digital finance due to higher barriers, but they have a higher propensity to sign up for digital finance accounts and use them for saving or storing money. Conversely, LMICs have higher access to digital finance, but they use their digital accounts more for transactions and borrowing of funds. The results of the nature of the associations between digital finance indicators and economic growth indicators reveal that digital finance is not a simple solution for economic development, but rather a complex phenomenon that has both positive and negative effects on different aspects of the economy.

Limitations

This study has some limitations due to the incomplete and inconsistent data on digital finance and economic indicators for some LLMICs. The databases used in this study, such as the Global Findex Database and World Development Indicators, have some missing values, different definitions, or different periods for the variables of interest. Moreover, the data is based on self-reported responses from individuals and countries and may be subject to recall errors and misinterpretation of questions. This may affect the accuracy, reliability, and comparability of the results across countries and regions. Another limitation of this study is the potential endogeneity problem between digital finance and economic indicators. Digital finance may not only influence GNI, gross savings, and GDP but also be influenced by them. For instance, higher income levels may increase the demand for and supply of digital financial services. Therefore, it is challenging to establish a causal relationship between digital finance and economic indicators using the methods employed in this study.

Recommendations

Policymakers should promote the advancement and implementation of digital finance in LLMICs as it has positive effects on economic growth indicators such as gross savings and GDP. Moreover, more research and policy interventions are needed to ensure that digital finance is inclusive, safe, data-protected, and sustainable for consumers and society.

Global databases should improve the frequency and timeliness of data collection to capture the dynamic nature of finance digitization, the financial sector, and economic growth. Furthermore, the accuracy and consistency of data should be enhanced using standard definitions, methodologies, and quality controls. Lastly, future research should employ more rigorous methods to determine the causal effects of digital finance on economic indicators.

References

- Arner, D., Buckley, R., Zetzsche, D., & Sergeev, A. (2022). Digital Finance, Financial Inclusion, and Sustainable Development: Building Better Financial Systems. Fintech and COVID-19, 176.

- Bertoni, F., Bonini, S., Capizzi, V., Colombo, M. G., & Manigart, S. (2022). Digitization in the market for entrepreneurial finance: Innovative business models and new financing channels. Entrepreneurship Theory and Practice, 46(5), 1120-1135. [CrossRef]

- Block, J. H., Colombo, M. G., Cumming, D. J., Vismara, S. (2018). New players in entrepreneurial finance and why they are there. Small Business Economics 50, 239–250. [CrossRef]

- Bollaert, H., Lopez-de-Silanes, F., & Schwienbacher, A. (2021). Fintech and access to finance. Journal of corporate finance, 68, 101941. [CrossRef]

- Bonini, S., & Capizzi, V. (2019). The role of venture capital in the emerging entrepreneurial finance ecosystem: future threats and opportunities. Venture Capital, 21(2-3), 137-175. [CrossRef]

- Brynjolfsson, E., & Hitt, L. M. (1998). Beyond the productivity paradox. Communications of the ACM, 41(8), 49-55. [CrossRef]

- Caputo, S. (2019). The Pivotal Role of Mobile money Agents in Driving Financial Inclusion. GSMA. https://www.gsma.com/mobilefordevelopment/blog/the-pivotal-role-of-mobile-money-agents-in-driving-financial-inclusion/.

- Chen, M. A., Wu, Q., & Yang, B. (2019). How valuable is FinTech innovation?. The Review of Financial Studies, 32(5), 2062-2106. [CrossRef]

- Chen, X., Teng, L., & Chen, W. (2022). How does FinTech affect the development of the digital economy? Evidence from China. The North American Journal of Economics and Finance, 61, 101697. [CrossRef]

- Cong, L. W., & He, Z. (2019). Blockchain disruption and smart contracts. The Review of Financial Studies, 32(5), 1754-1797. [CrossRef]

- Consumer International (2023). Digital Finance: The Consumer Experience, 2023. https://www.consumersinternational.org/media/451453/digital-finance-the-consumer-experience-2023-final.pdf.

- Demirgüç-Kunt, A., Klapper, L., Singer, D., & Ansar, S. (2022). The Global Findex Database 2021: Financial inclusion, digital payments, and resilience in the age of COVID-19. World Bank Publications.

- Feyen, E., Natarajan, H., & Saal, M. (2023). Fintech and the Future of Finance: Market and Policy Implications. World Bank Publications.

- Gebayew, C., Hardini, I. R., Panjaitan, G. H. A., & Kurniawan, N. B. (2018). A systematic literature review on digital transformation. International Conference on Information Technology Systems and Innovation, 260-265.

- Henriette, E., Feki, M., & Boughzala, I. (2016). Digital Transformation Challenges. MCIS 2016 Proceedings. 33.http://aisel.aisnet.org/mcis2016/33.

- International Labour Organisation. (2023). Digitalization in Organizations. https://www.oitcinterfor.org/en/digitalizacion/digitalization-organizations .

- Jack, W. & Suri, T. 2011. Mobile Money: The Economics of M-PESA. National Bureau of Economic Research, 16721. https://www.nber.org/papers/w16721.

- Khera, P., Ng, S. Y., Ogawa, S., & Sahay, R. (2021). Digital financial inclusion in emerging and developing economies: A new index. International Monetary Fund (Working Paper).

- Khera, P., Ng, S., Ogawa, S., & Sahay, R. (2022). Measuring digital financial inclusion in emerging market and developing economies: A new index. Asian Economic Policy Review, 17(2), 213-230. [CrossRef]

- Kohli, R., & Melville, N. P. (2019). Digital innovation: A review and synthesis. Information Systems Journal, 29(1), 200-223. [CrossRef]

- Korpela, K. Korpela, K., Ritala, P., Vilko, J., & Hallikas, J. (2013). A management and orchestration model for integrating Digital Business Ecosystems. International Journal of Integrated Supply Management, 8(1/2/3), 24-51. [CrossRef]

- Kuusisto, M. (2017). Organizational effects of digitalization: A literature review. International Journal of Organization Theory & Behavior, 20 (3), 341-362. [CrossRef]

- Leviäkangas, P. (2016). Digitalisation of Finland's transport sector. Technology in Society, 47, 1-15.

- Manyika, J., Lund, S., & Bughin, J. (2016). Digital globalization: The new era global flows. McKinsey Global Institute.

- Monaghan, S., Tippmann, E., & Coviello, N. (2020). Born digitals: Thoughts on their internationalization and a research agenda. Journal of International Business Studies, 51, 11-22. [CrossRef]

- Myovella, G., Karacuka, M., & Haucap, J. (2020). Digitalization and economic growth: A comparative analysis of Sub-Saharan Africa and OECD economies. Telecommunications Policy, 44(2), 101856. [CrossRef]

- Navarrete, T. (2014). A history of digitization: Dutch museums. University of Amsterdam.

- Ong, H. B., Wasiuzzaman, S., Chong, L. L., & Choon, S. W. (2023). Digitalisation and financial inclusion of lower middle-income ASEAN. Heliyon, 9(2). [CrossRef]

- Ozili, P. K. (2018). Impact of digital finance on financial inclusion and stability. Borsa Istanbul Review, 18(4), 329-340. [CrossRef]

- Ozili, P. K. (2020). Contesting digital finance for the poor. Digital Policy, Regulation and Governance, 22(2), 135-151. [CrossRef]

- Parviainen, P., Tihinen, M., Kääriäinen, J., & Teppola, S. (2017). Tackling the digitalization challenge: how to benefit from digitalization in practice. International Journal of Information Systems and Project Management, 5(1), 63-77. [CrossRef]

- Pazarbasioglu, C., Mora, A. G., Uttamchandani, M., Natarajan, H., Feyen, E., & Saal, M. (2020). Digital financial services. World Bank.

- Polites, G. L., Karahanna, E. (2012). Shackled to the Status Quo: The Inhibiting Effects of Incumbent System Habit, Switching Costs, and Inertia on New System Acceptance. MIS Quarterly, 36(1),.21-42. [CrossRef]

- Reis, J., Amorim, M., Melão, N., & Matos, P. (2018). Digital transformation: a literature review and guidelines for future research. Trends and Advances in Information Systems and Technologies, 1(6), 411-421. [CrossRef]

- Sambamurthy, V., Bharadwaj, A., & Grover, V. (2003). Shaping agility through digital options: Reconceptualizing the role of information technology in contemporary firms. MIS quarterly, 237-263. [CrossRef]

- Sher, A. & Hogan, S. (2020). Finance 2025: Digital Transformation in Finance. Deloitte. https://www.deloitte.com/global/en/services/financial-advisory/perspectives/gx-finance-digital-transformation-for-cfos.html.

- Sy, A. N. R., Maino, R. Massara, A. & Perez-Saiz, H. (2019). Digitization in Sub-Saharan Africa. IMF.

- Terras, M. M. (2011). The rise of digitization: an overview. Digitisation perspectives, 1-20.

- The World Bank. (2022a). COVID-19 Boosted the Adoption of Digital Financial Services. https://www.worldbank.org/en/news/feature/2022/07/21/covid-19-boosted-the-adoption-of-digital-financial-services .

- The World Bank. (2022b). COVID-19 Drives Global Surge in Use of Digital Payments. Press Release. https://www.worldbank.org/en/news/press-release/2022/06/29/covid-19-drives-global-surge-in-use-of-digital-payments.

- The World Bank. (2022c). World Bank Country and Lending Groups. https://datahelpdesk.worldbank.org/knowledgebase/articles/906519-world-bank-country-and-lending-groups .

- Van Horik, R. (2005). Permanent pixels: Building blocks for the longevity of digital surrogates of historical photographs. DANS.

- Vial, G. (2019). Understanding digital transformation: A review and a research agenda. Journal of Strategic Information Systems, 28, 118–144. [CrossRef]

- von Allmen, U. C. Khera, P., Ogawa, S., Sahay, R. (2020). Digital Financial Inclusion in the Times of COVID-19. IMF. https://www.imf.org/en/Blogs/Articles/2020/07/01/blog-digital-financial-inclusion-in-the-times-of-covid-19#:~:text=We%20found%20that%20digitalization%20increased%20financial%20inclusion%20between,financial%20inclusion%2C%20but%20with%20significant%20variation%20across%20countries.

- Yao, L., & Ma, X. (2022). Has digital finance widened the income gap? Plos one, 17(2), e0263915. [CrossRef]

- Yao, L., & Zhao, P. (2009). Digital libraries in China: progress and prospects. The Electronic Library, 27(2), 308-318. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).