1. Introduction

The banking sector has experienced multiple instances of digital change, commencing with the extensive integration of automated teller machines (ATMs) and credit cards. In the past decade, technology has become an integral component of the banking industry. The emergence of the Bank 4.0 idea is characterized by the conversion of a wide range of financial services into an online format (King, 2018). The rapid adoption of digital transformation has become imperative for banks to maintain competitiveness within an industry that today encompasses financial institutions, technology giants, start-ups, and media-telecommunication corporations.

The integration of financial technology (fintech) has the potential to enhance the ability of banks to cater to their clientele by offering financial services that are more easy and easily accessible. The current advancements in financial technology, commonly referred to as fintech, have facilitated the accessibility of credit and personal finance management tools for individuals and small enterprises. These innovations, including online lending platforms, have the potential to enhance financial management capabilities and enable clients to effectively handle their monetary resources. Furthermore, it can be inferred that this also entails enhanced levels of client satisfaction and retention, hence resulting in superior performance outcomes for the banking institution (Widharto et al., 2020).

The utilization of financial technology, commonly known as fintech, can aid banks in maintaining their competitiveness within a progressively digitized global landscape. Banks that exhibit limited success in adopting technology face the potential consequence of client attrition to micro-scale fintech businesses, which effectively cater to the demands of digitally proficient customers, particularly the younger demographic. According to Aysan and Unal (2021a), banks can maintain their relevance in a highly competitive market by embracing fintech solutions.

For many years, financial institutions have been faced with the complex challenge of effectively managing risk, which is a fundamental aspect of their operations. The advent of financial technology, commonly referred to as fintech, has brought about significant and revolutionary developments in the financial industry. This essay aims to explore the various ways in which financial technology (fintech) can greatly enhance risk management procedures within financial institutions.

The automation of risk assessment has been identified as a significant contribution of fintech to the field of risk management (Sibanda et al., 2020). Fintech advancements enable financial organizations to automate diverse aspects of risk assessment. By utilizing machine learning algorithms, these technologies have the capability to evaluate large datasets in real-time, enabling financial institutions to gain a more comprehensive and timely understanding of market conditions, creditworthiness, and operational risks. The implementation of automation mitigates reliance on manual procedures, thereby reducing the probability of human fallibility and enhancing the accuracy of risk assessments (Yunita, 2021).

The influence of financial technology (fintech) on the practice of credit scoring has been significant. Traditional approaches frequently depended on historical data and a restricted number of variables. In contrast, the field of financial technology (fintech) utilizes other data sources, such as social media behavior and transaction history, in order to construct credit profiles that encompass a broader range of information. The utilization of this methodology yields more accurate evaluations of credit risk, enabling financial institutions to make well-informed lending choices while minimizing the likelihood of loan defaults (Hasan et al., 2020).

Financial institutions face a substantial problem in the form of the ongoing and persistent threat of fraud. Fintech solutions provide a robust defense through the implementation of sophisticated fraud detection algorithms that are capable of promptly recognizing potentially fraudulent actions. According to Aysan et al. (2022), these systems utilize artificial intelligence and machine learning techniques to effectively counteract fraud by dynamically adjusting to emerging fraudulent strategies and enhancing their precision through iterative improvements.

Fintech platforms provide financial institutions with the ability to monitor transactions and market movements in real-time. This allows for the tracking of these activities as they occur. The ability to see and analyze data in real-time enables prompt reactions to newly identified hazards. Moreover, it has been observed that fintech systems possess the capability to provide automated notifications in the event of surpassing predetermined risk thresholds. This functionality enables prompt intervention and serves to mitigate potential financial losses (Diener & Špaček, 2021).

Compliance with regulatory mandates is a vital component of risk management within the realm of financial institutions. The implementation of financial technology (fintech) facilitates the streamlining of the compliance process through the automation of data collection, analysis, and reporting. The utilization of this technology not only alleviates the weight of chores associated with compliance, but also improves precision and openness, guaranteeing that organizations maintain adherence to the ever-changing regulatory environment (Widharto et al., 2020).

In order to ensure effective risk management, it is necessary to assess the capacity of an organization to withstand and recover from unfavorable circumstances. Fintech solutions enable this by employing stress testing and scenario analysis techniques. According to Giatsidis et al. (2019), financial institutions can utilize these tools to assess vulnerabilities and adopt risk mitigation methods by simulating different scenarios, such as economic downturns and market volatility.

In conclusion, the field of financial technology (fintech) has emerged as a crucial strategic partner for financial institutions in their endeavor to establish and maintain effective risk management practices. Fintech enables banks to enhance decision-making, enhance credit scoring, identify fraudulent activities, and assure regulatory compliance through the utilization of task automation, data analytics, and real-time monitoring (Aysan & Unal, 2021b). In addition, the implementation of fintech facilitates the practice of stress testing and scenario analysis, hence empowering institutions to take proactive measures in mitigating risks. Given the ongoing evolution of the financial landscape, it is anticipated that the incorporation of fintech advancements will assume greater significance for financial institutions in their efforts to proficiently handle and alleviate risks, thereby safeguarding the stability and resilience of the financial sector (Khanboubi & Boulmakoul, 2019; Abuhasan & Moreb, 2021).

The correlation between a bank’s performance and its risk management strategies is a vital and intricate facet of the financial sector. The implementation of efficient risk management strategies significantly influences a bank’s comprehensive performance, financial stability, and enduring viability. The nature of this relationship is marked by a fragile equilibrium, wherein the judicious management of risks has the potential to augment a bank’s performance, whilst insufficient risk management can result in financial instability and potential collapse (Firmansyah & Anwar, 2019).

The influence of risk management on a bank’s performance mostly manifests in its impact on profitability. Financial institutions are engaged in the endeavor of effectively overseeing a range of hazards, encompassing credit risk, market risk, operational risk, and liquidity risk. Banks can mitigate potential losses and maximize investment returns through the implementation of efficient risk management measures. For example, the effective management of credit risk portfolios ensures that loans are granted to individuals with a strong creditworthiness, hence decreasing the probability of loan defaults and enhancing the overall profitability of the institution (Khanboubi & Boulmakoul, 2019; Tsindeliani et al., 2021).

The implementation of robust risk management techniques plays a significant role in safeguarding a bank’s reputation and fostering trust among stakeholders. The potential for reputational risk is a matter of great importance for financial institutions, as any erosion of confidence can result in the attrition of both clientele and stakeholders. According to Diener and Špaček (2021), the ability of banks to accurately identify and efficiently manage risks plays a crucial role in preserving a favorable reputation, attracting a larger client base, and obtaining finance under advantageous conditions. These factors all contribute to the overall enhancement of the banks’ financial performance.

The strong relationship between regulatory compliance and risk management is a fundamental aspect, as the continuing functioning of a bank relies heavily on strict adherence to regulatory regulations. Financial institutions that fail to adhere to regulatory requirements not only expose themselves to potential monetary penalties, but also risk detrimental effects on their public image and standing. Therefore, it is imperative to implement effective risk management strategies that guarantee adherence to regulatory requirements in order to maintain long-term performance.

On the other hand, insufficient risk management practices can significantly impact the overall performance of a financial institution. For instance, a financial institution that engages in excessive risk-taking without implementing sufficient protective measures may encounter substantial financial losses, thereby diminishing its capital and liquidity positions. The aforementioned circumstances may result in a decrease in financial gains and, in more extreme scenarios, necessitate government involvement or potential insolvency (Widharto et al., 2020).

In summary, there exists a mutually beneficial association between a bank’s performance and its risk management strategies. The use of efficient risk management strategies has the potential to enhance a bank’s financial performance, reputation, and adherence to regulatory requirements, so facilitating its sustained prosperity. On the contrary, inadequate risk management practices can lead to financial instability and a deterioration in overall performance. Hence, it is imperative for banks to give precedence to the establishment of resilient risk management frameworks in order to effectively navigate the intricacies of the financial sector.

This study seeks to derive findings from a comprehensive financial performance analysis of Islamic banks on a global scale, with a particular focus on assessing their risk management practices based on the results obtained from surveys. Examining the risk management scenario of Islamic banks through an evaluation of their financial performance, as obtained from survey findings, encompasses a comprehensive methodology for evaluating the soundness and resilience of these financial establishments. Through the analysis of significant financial indicators, including capital adequacy ratios, asset quality, liquidity, and profitability, stakeholders and regulators can acquire useful insights into the effective management of diverse risks within Islamic banks. These insights are derived from survey responses and serve as a means to assess the banks’ risk management practices. This research facilitates the identification of possible vulnerabilities and areas of strength within the risk management frameworks of these organizations. Through the correlation of financial performance data and survey results pertaining to risk management practices, it becomes possible to establish a holistic comprehension of the risk environment prevalent in Islamic banks. This understanding facilitates the making of well-informed decisions, regulatory supervision, and the adoption of strategies aimed at bolstering their ability to withstand economic and financial uncertainties.

The subsequent sections of the paper are presented in the following manner. Chapter 2 provides a comprehensive overview of the existing scholarly works pertaining to the subject issue. In Chapter 3, a thorough exposition of the data and technique employed is presented. Chapter 4 delves into the outcomes derived from the data through the application of the recommended methodology. The final chapter encompasses the concluding remarks.

2. Literature Review

The connection between financial institutions and compliance-focused technical advancements is covered by Valkanov (2019), who also identifies three possible directions for future growth. He claims that big data, artificial intelligence, and blockchain-based technologies are becoming more and more popular across numerous financial industry segments, especially where it comes to regulatory compliance. Furthermore, the rise of regtech companies is changing the conventional method of dealing with regulatory concerns within financial intermediaries and opening up chances for cooperation with outside technological experts.

According to Radilov (2019), the knowledge economy is significant in the digital age and will likely continue to rule for the rest of the twenty-first century. According to this paradigm, people are the most important resources and true wealth because of their knowledge, cognition, and experience.

The present and potential future of higher education are examined by Zacharoula (2019). Her research has three main goals: first, it examines how worldwide innovation indicators are used in education; second, it maps school organizational cultures; and third, it investigates the relationship between innovation and school cultures.

According to Petrova (2018), emerging fintech technologies are poised to fundamentally alter accounting and pave the way for the adoption of cloud accounting. She focuses on the necessity of rationalizing and ongoing accounting processes modification to satisfy environmental and customer demands. Petrova (2018) adds that the accounting industry is developing and calls for knowledge beyond conventional procedures.

Blockchain functionality, according to Semova et al. (2018), is changing how data, particularly accounting data, is entered, processed, stored, and exchanged. They emphasize the development of public registries and the ability for transactions to take place without middlemen when certain conditions are met.

In their analysis of survey results from Swedish fintech CEOs, Larsson et al. (2018). The difficulties in finding qualified managers and navigating the legal system are mentioned by those that provide fintech services for accounting and the processing of accounting documents. They emphasize the necessity of modifying client perceptions and improving consumer attitudes regarding novel accounting goods and services.

Blockchain technology is shown to improve financial market analysis by supplying transparency, liquidity, and real-time transaction auditing in Yermack (2017). Blockchain technology is suggested by Yermak (2017) to outsource transaction audits in order to precisely identify shareholders and find unfavorable positions.

Ionescu et al. (2013) look at Romanian accounting firms that provide apps for cloud-based accounting. These programs enable paperless accounting procedures, which save costs and generate considerable financial benefits for Romanian businesses.

In their 2017 article, Tapscott and Tapscott examine how blockchain technology can change a number of organizational elements, including value creation, marketing, accounting, and employee incentives. They contend that emerging technologies, such as blockchain, would enable businesses to spread out overhead expenses, do away with mid-level managers, and depend less on middlemen.

In her survey of the literature on fintech technologies, Cai (2018) draws attention to the scant attention blockchain technology has received in studies pertaining to business. Cai (2018) notes that few research have delved into fundamental ideas, with the majority concentrating on blockchain developments and commercial uses.

Concerns are expressed by Ozdemir & Elitaş (2015) regarding the dangers of cloud computing in the accounting industry. They place emphasis on the duty of cloud-based accounting service providers to protect digital financial data as well as the necessity of building secure infrastructure and risk prediction algorithms.

Gerunov (2019) advocates for a comprehensive approach to risk management as a source of competitive advantage for contemporary enterprises by highlighting the interconnectivity and overlap of many types of hazards.

The management of risk effectively in the financial markets necessitates the disclosure of financial instruments. The concept of objective uncertainty leading to unfavorable events is often included in the definition of risk, which differs throughout economic literature. Risk management aims to evaluate and manage, rather than eliminate, risks that may result in either positive or negative deviations from expected outcomes.

In conclusion, the adoption of technological innovations, particularly within the financial and educational sectors, is transforming traditional practices and methodologies. Blockchain, artificial intelligence, big data, and cloud technologies are reshaping the landscape of risk management, accounting, education, and organizational structures. As organizations adapt to these changes, effective risk management becomes a critical component of their strategies to navigate the evolving landscape of the 21st century.

3. Data & Methodology

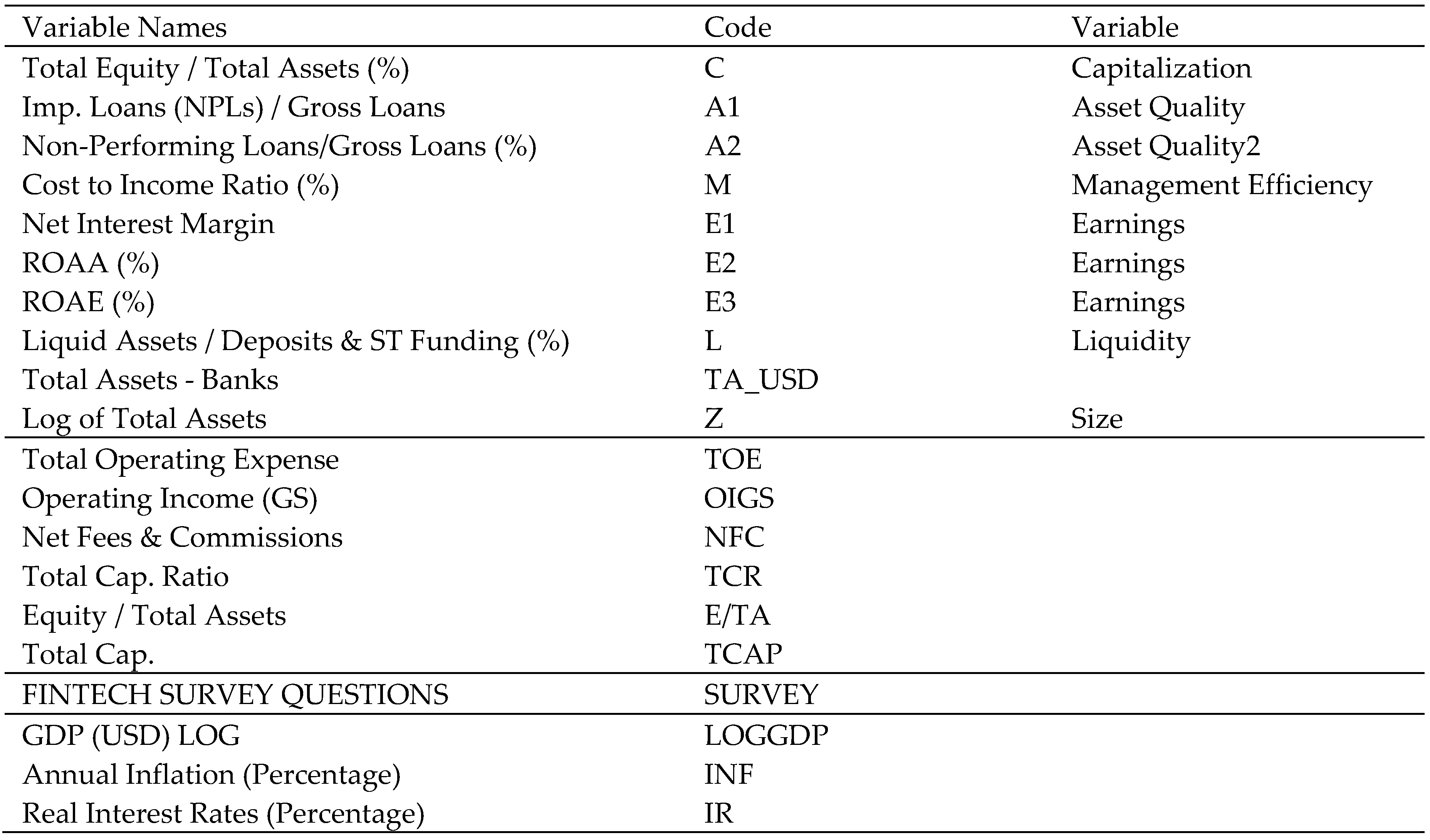

The data of this research consists of variables shown below the figure. Among these variables, the first group represents data for bank performance in CAMEL format, the second group represents bank-level data, the third group variable is the GIBS survey data, and the last group is country-level data for reducing error.

Figure 1 below illustrates the types of data used in this research.

Figure 1.

Types of data. Source: Author’s own.

Figure 1.

Types of data. Source: Author’s own.

- a.

GIBS Survey 2016-2021

The present study utilizes a distinctive dataset and implements a quantitative research methodology. The data utilized in this study is derived from the Global Islamic Bankers’ Survey, which was undertaken by the General Council for Islamic Banks and Financial Institutions (CIBAFI) over the period of 2016 to 2021.

The acronym CIBAFI stands for the General Council for Islamic Banks and Financial Institutions, which is a globally recognized entity that serves as a representative body for the Islamic finance sector. The organization was established in the year 1993 and is headquartered in Manama, Bahrain. The primary objective of the organization is to foster and enhance the global Islamic finance industry. The achievement of the aforementioned goals is facilitated through the establishment of a platform wherein member institutions can exchange knowledge and expertise. Additionally, the organization conducts research endeavors and disseminates publications pertaining to the Islamic finance industry. Furthermore, active engagement with regulators and policymakers is undertaken to foster the growth and advancement of the Islamic finance sector. According to CIBAFI (2022), the number of member institutions affiliated with CIBAFI exceeds 130, spanning over more than30 countries globally.

The Global Islamic Banking Survey (GIBS) is an annual survey conducted by CIBAFI among senior executives of Islamic banks worldwide. Its purpose is to get insights into the present state of the sector and its prospective trajectory. The survey plays a pivotal role in the direct observation of management goals and motivations of decision-makers, enabling the utilization of this knowledge in quantitative testing. The survey was initiated in 2016 and still ongoing. The dataset included in this paper encompasses survey data spanning from the year 2016 to 2021.

The dataset included in this study comprises around 37 countries and a total of 175 Islamic banks. Nevertheless, it should be noted that not all 175 banks participate in this poll on a regular basis each year. On average, there are approximately 100-105 banks included each year. These countries are classified into seven distinct groups in order to analyze and extrapolate geographical patterns. CIBAFI annually releases survey reports and executive summaries that provide comprehensive overviews of the important highlights within the worldwide Islamic banking business. From a scholarly standpoint, the Global Islamic Bankers Survey (GIBS) serves as a great resource for gathering a wide range of data pertaining to Islamic financial institutions across the world.

- b.

Bank-level & Country-level data from Fitch Connect & World Bank Databases

Fitch Connect is a platform provided by Fitch Ratings, global credit ratings, and research firms. It is a comprehensive resource for financial market participants, providing access to various credit ratings, research, and analytics tools. Fitch Connect gives users access to credit ratings, research, and analysis on different asset classes, including corporate bonds, structured finance, and public finance. It also offers tools for risk management, including default probability models and credit risk analytics (Aysan & Bergigui, 2021).

Bank-level data of this article is collected from Fitch Connect. Collected data includes “Total Equity / Total Assets (%), Imp. Loans (NPLs) / Gross Loans, Non-Performing Loans/Gross Loans (%), Cost to Income Ratio (%), Net Interest Margin, ROAA (%), ROAE (%), Liquid Assets / Deposits & ST Funding (%), Total Assets – Banks, Log of Total Assets, Total Operating Expense, Operating Income (GS), Net Fees & Commissions, Total Cap. Ratio, Equity / Total Assets, and Total Cap.”

More data on a country level are collected from the World Bank Database to be used for reducing errors. Country-level data includes GDP, inflation, and interest rates. All collected data are from 2016 to 2021.

Figure 2 below shows the number of columns for each variable. For the upcoming parts, these numbers will be used to represent each variable for a clear look at the figures:

Figure 2.

Variable numbers, Source: Author’s Own.

Figure 2.

Variable numbers, Source: Author’s Own.

- c.

Methodology

The global Islamic banking data exhibits many shortcomings, particularly in terms of its continuity. Certain regions exhibit a deficiency in maintaining meticulous records, hence posing challenges in obtaining a comprehensive set of bank-level data. Furthermore, it should be noted that out of the 175 Islamic banks included in the dataset, not all of them participate in the GIBS survey on an annual basis. However, it is important to clarify that this figure represents the cumulative count of banks that have participated in the survey at least once. Annually, approximately 100-105 banks become members of GIBS.

The presence of missing data compromises the integrity of the regression findings. To address this difficulty, it is necessary to employ a suitable approach for populating the vacant sections of the dataset. This research will employ the random forest strategy, which is well recognized as a highly practical and accurate method for compiling machine learning data.

The random forest classifier methodology is widely utilized in machine learning for a range of applications, encompassing classification, regression, and feature selection. The technique described in the study conducted by Speiser et al. (2019) involves the integration of numerous decision trees in order to generate predictions or assess the relative significance of various parameters.

The random forest technique is characterized by its excellent accuracy and robustness. The integration of numerous decision trees enables the detection and representation of diverse patterns and relationships within the dataset, hence mitigating the risk of overfitting and enhancing the overall performance of the model (Schonlau, 2020). The random forest technique is widely favored among data scientists and analysts due to its ease of use and implementation.

The methodology has the capability to effectively process extensive and intricate datasets. In contrast to the majority of machine learning approaches, the random forest algorithm exhibits a notable resilience towards the expansion of dataset size and dimensions. This characteristic enables the algorithm to effectively adjust and accommodate these particular attributes of the dataset (Ahmad et al., 2018). This feature renders it advantageous for applications involving picture or text categorization, particularly in scenarios where the dataset is voluminous and characterized by a high number of dimensions.

Although the random forest technique is widely used and well-regarded, it is not without its limits. One of the primary limitations of this approach pertains to its substantial computational expenses, particularly in instances where the dataset is of considerable size. The interpretability of this technique is comparatively lower than that of other machine learning methods, which poses challenges in comprehending the rationale behind the model’s predictions or the assessment of feature significance (Brieuc et al., 2018).

The random forest technique does not directly impute or replace missing or empty data. In contrast, the employed methodology involves the utilization of the bootstrapping technique to generate several decision trees, with each tree being trained on a distinct subset of the dataset (Egbert & Plonsky, 2020). The random forest technique utilizes all decision trees in order to make predictions, hence mitigating the influence of missing data on the overall performance of the model.

It is important to acknowledge that the random forest technique does not fully address the issue of missing data. The model’s performance may be adversely impacted if there is a substantial quantity of missing data or if the data is missing in a random manner. In instances of missing data, it may be imperative to employ alternative techniques, such as imputation, to address the gaps prior to training the random forest model. This approach has the potential to enhance both the performance and dependability of the model. Prior to applying the random forest algorithm, the necessary adoptions and manual fills were carried out on the data in order to obtain the most accurate prediction results.

The design of bank performance measurement is predicated on the objective of maximizing the proportion of non-blank data within the dataset. In order to achieve this objective, a conventional yet resilient method known as CAMEL will be employed. The CAMEL methodology is employed as a means of evaluating the comprehensive financial soundness of a banking institution. The abbreviation CAMEL stands for Capital adequacy, Asset quality, Management quality, Earnings, and Liquidity (Karma et al., 2019; Aysan et al., 2022). The CAMEL grading system is employed by bank regulators as a means of assessing a bank’s performance and detecting any potential dangers. The process entails conducting a comprehensive examination of a bank’s financial statements and operational aspects, encompassing factors such as capital adequacy, asset quality, managerial strategies, profitability, and liquidity. According to Naushad (2021), the CAMEL analysis outcomes are employed for the purpose of assigning a rating to the bank, whereby higher ratings are indicative of a more robust financial position, while lower ratings suggest a comparatively weaker financial situation.

The CAMEL approach possesses advantages and disadvantages. There are several advantages associated with the utilization of CAMEL. These include the provision of a comprehensive evaluation of a bank’s financial well-being, reliance on objective data for assessment, and the adoption of a standardized methodology that is employed on a global scale. Nevertheless, the CAMEL framework does include certain limitations, including its narrow focus on a restricted range of characteristics, susceptibility to subjective interpretation, and the potential to introduce delays in the rating procedure (Vadrale, 2019). In this research, the CAMEL technique is widely acknowledged and deemed appropriate for implementation.

The use of the methodology commences with the enhancements of the data. The utilization of the Google Colab application is employed for this particular section of the program. The process of implementing a machine learning application commenced with importing the requisite libraries, namely Pandas, Numpy, Seaborn, and MatPlot. Following the application of formatting parameters to the dataset, it is observed that the data has 948 rows and 72 columns. Following this procedure, the SkLearn libraries provide several tools such as the random forest classifier, random forest regressor, train test split model, and normalization tools. In addition to the random forest models, the K-Nearest regressor and K-Nearest classifiers were also obtained for the purpose of conducting a robustness assessment.

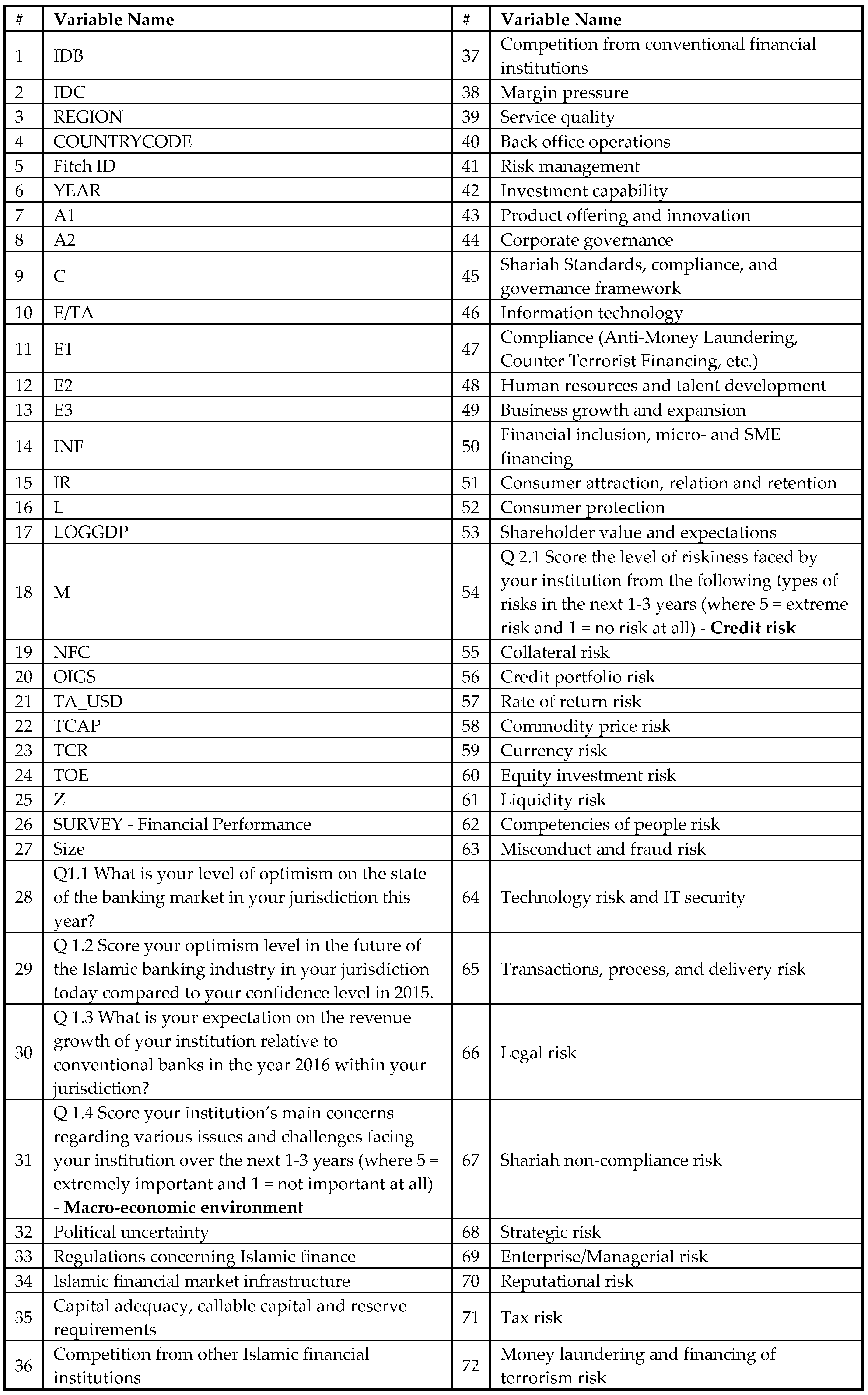

Figure 3 displays the number of non-null rows for each variable, out of a total of 948.

Figure 3.

non-Null rows. Source: Author’s Own, from Google Colab.

Figure 3.

non-Null rows. Source: Author’s Own, from Google Colab.

Figure 3 shows the empty cells of the data, especially in the survey answers. The main reason for this is explained above; many banks did not regularly attend the survey yearly. Instead, most of them joined the survey a few years on average. Some regions’ undisciplined bookkeeping caused the other missing data in the banking part.

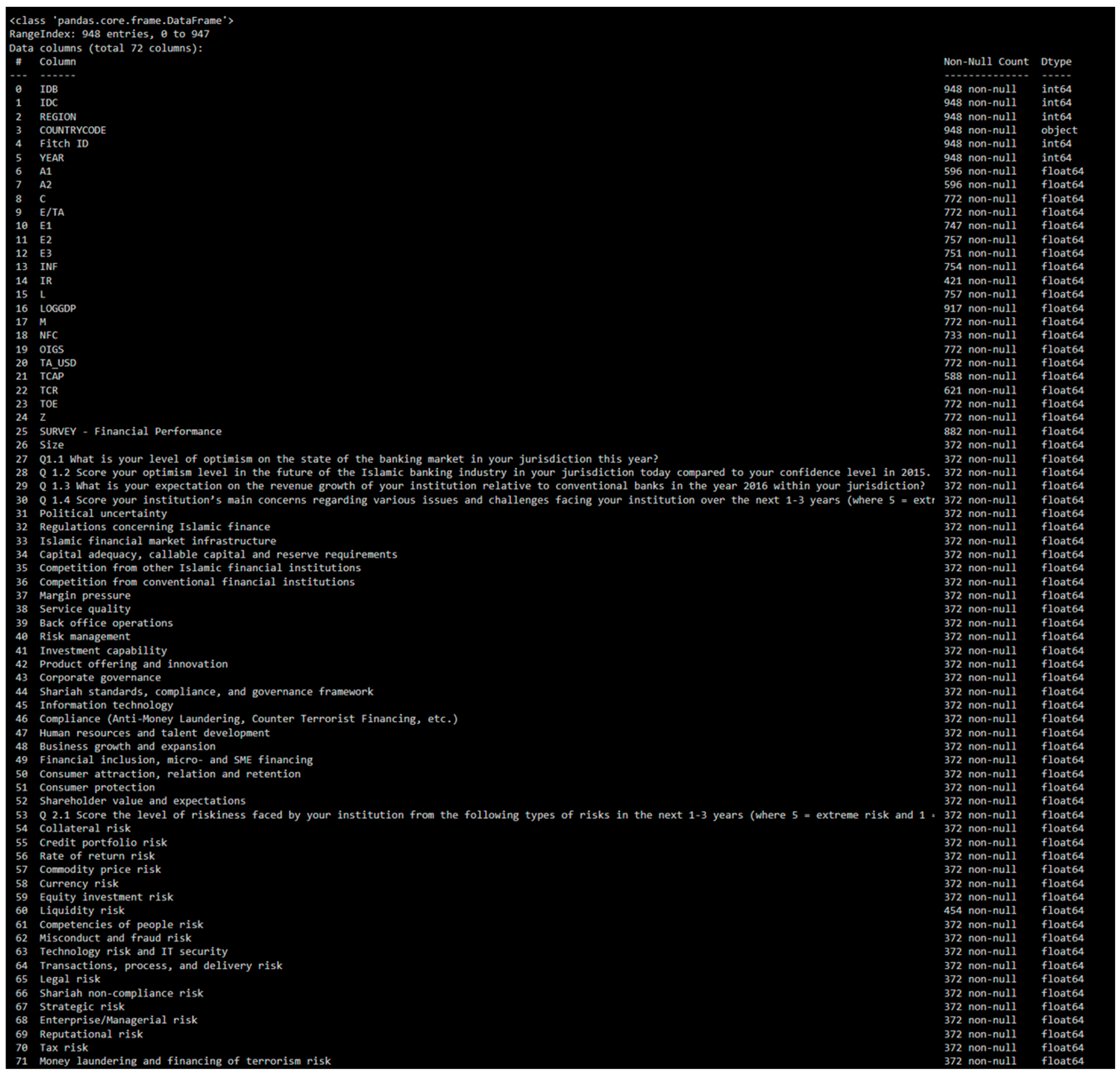

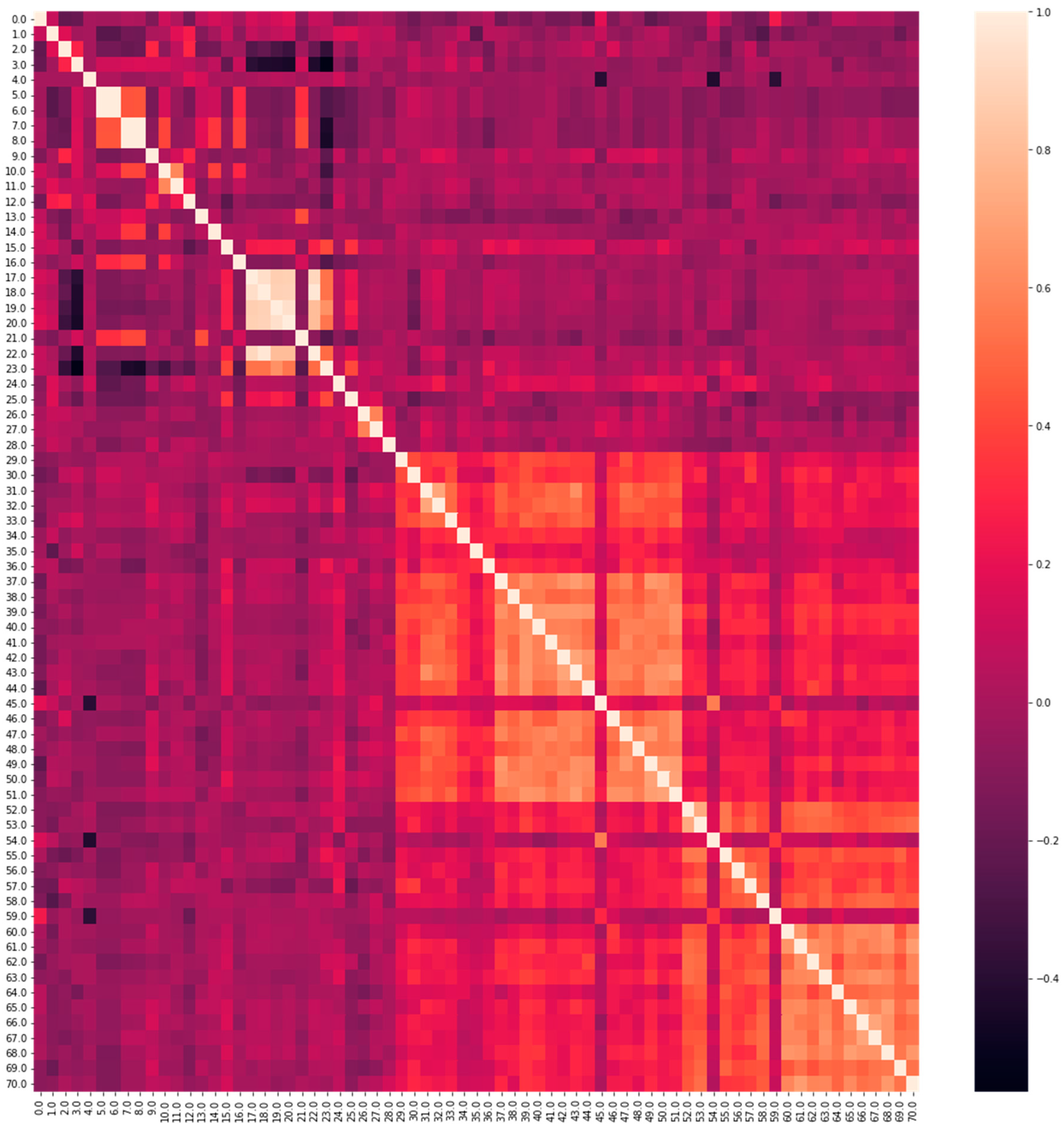

Figure 4 below shows the heatmap of the correlation for 72 variables before random forest application:

Figure 4.

Correlation heatmap, Source: Author’s Own, Google Colab.

Figure 4.

Correlation heatmap, Source: Author’s Own, Google Colab.

The heatmap shows higher correlations with a lighter color. From this point, variables 5 and 6, meaning A1 and A2 (Asset qualities), show 100% correlation, representing the same value. Similarly, variables 17 to 20 are in high correlation. These variables will be reduced into one value for representative purposes, as more than one variable for the exact measurements worsens the test quality of the random forest. This is explained as follows; While random forest builds the decision trees, it uses the closest variables to the empty target cell. A 100% correlation with this cell directly leads the random forest classifier to fill the cell with the same data, which may not be desired. The expected effort is to determine the empty cell value from the other cells’ correlation. Therefore, some of the values will be eliminated in this step.

Figure 4 correlations already give some clear results. However, the interpretation of the results requires the improvement of the data. In this part, random forest application will be explained:

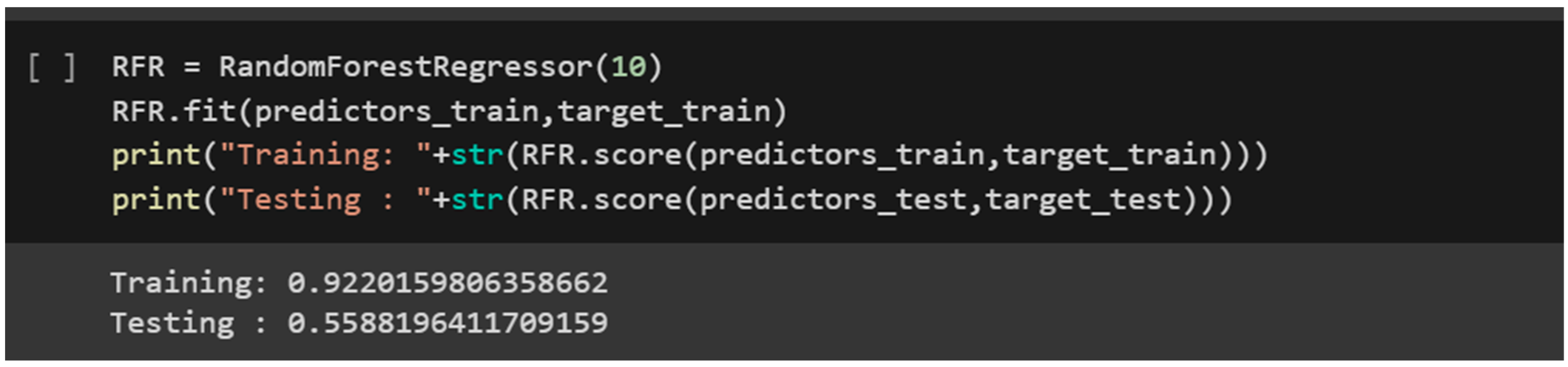

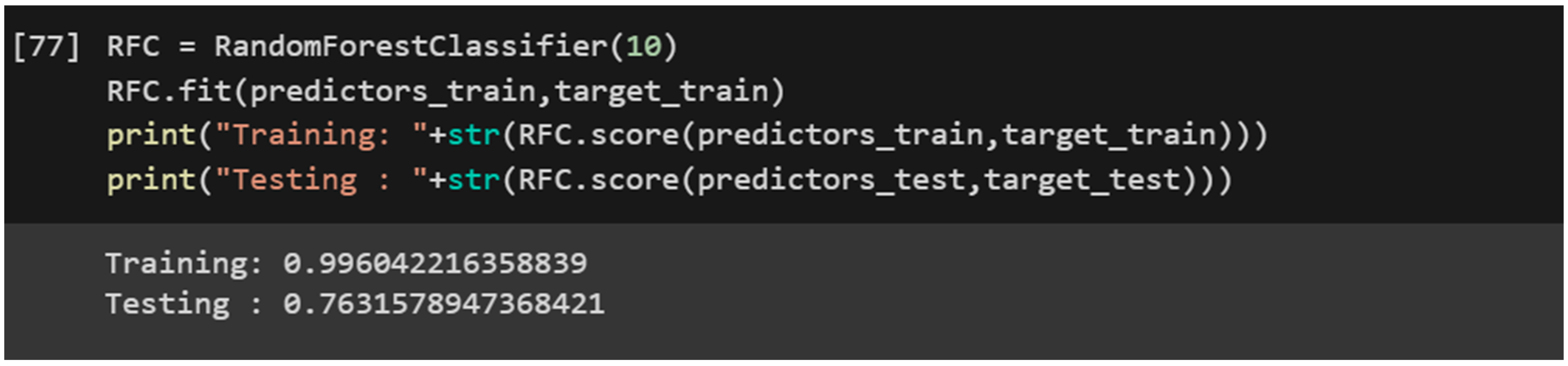

The test train split for this dataset is kept at 30-70%. Extensive test size is used to maintain high accuracy in results. With this application, a random forest classifier resulted in 99% accuracy in training and 76% in testing. Here a supposition is applied by considering if a bank has two or three close values for the same variable; other variables are also accepted as close. Random forest regressor also gives a similar accuracy result for both parts.

Figure 5.

Random Forest regressor accuracy.

Figure 5.

Random Forest regressor accuracy.

Figure 6.

Random Forest classifier accuracy.

Figure 6.

Random Forest classifier accuracy.

With this classification, the random forest has filled the dataset with below figure summary. K-Nearest methods resulted in much lower accuracy, possibly because the number of years is only 6, which is not enough for this method to predict the cells accurately. Therefore, a random forest will be used for the interpretation of the results.

Additionally, for a specific cell, if the specific bank has value for other years, random forest keeps a relationship between all years while considering a relationship web between all the bank performance, survey answers, and its country’s economic situation. Suppose there is no data for the specific variable for all years. In that case, the random forest engine predicts the relative value by considering other banks with similar performance, the bank’s overall variables for all years, and the country’s economic data. These decision trees help maintain highly accurate results without losing consistency. With this version of the data, we performed the random forest regression tests, and the results are given in the next chapter.

4. Results & Discussion

After data improvement, a dataset of 948x72 is repaired completely with around 85% accuracy in results. This accuracy is around 97-98% in bank-specific variables, while it is around 70% for survey questions.

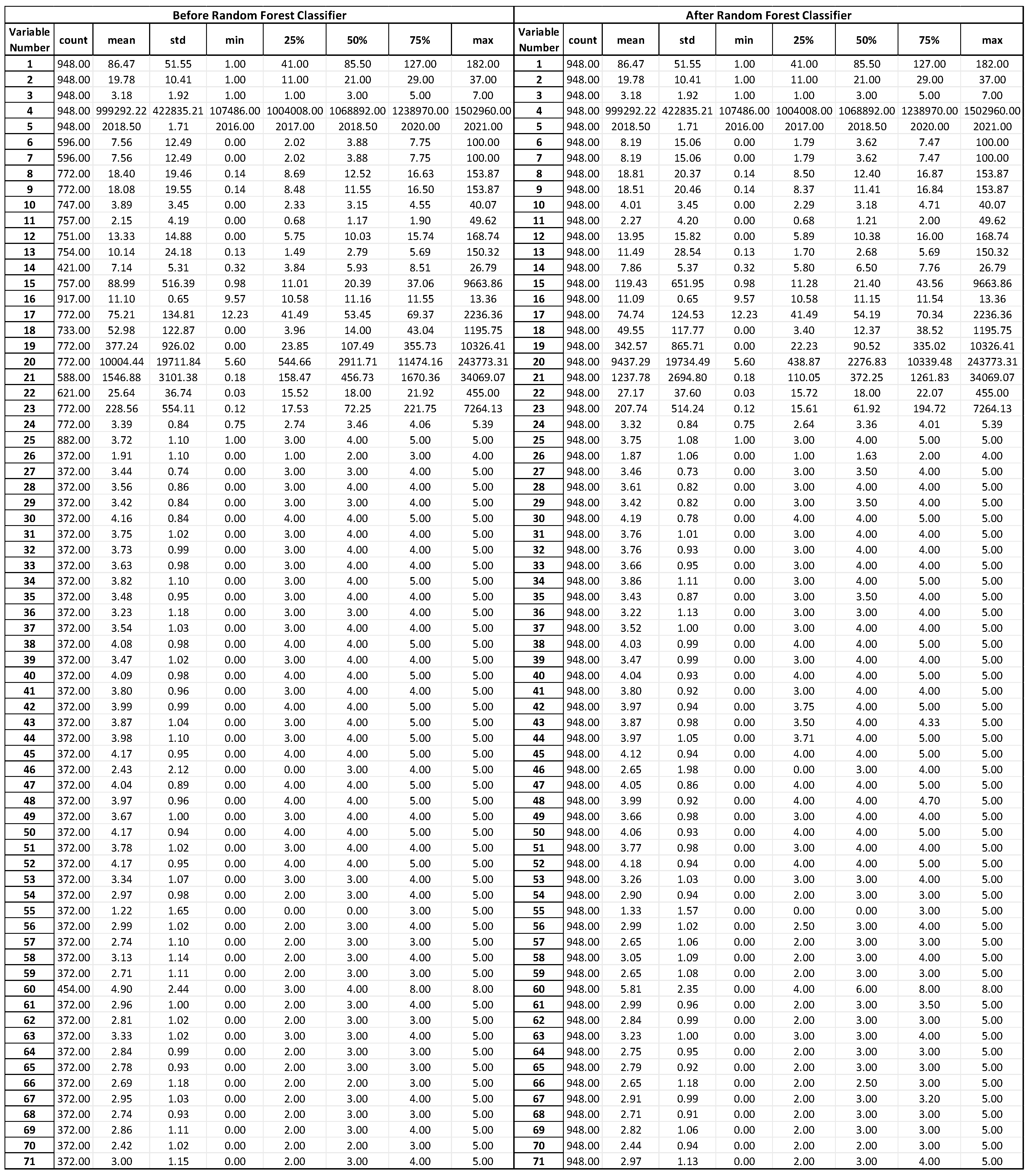

Figure 7 below shows the summary statistics before and after the random forest application. Improvements are visible in non-null data and the protection of the values in general.

Figure 7.

Summary of the data before random forest application. Source: Author’s Own.

Figure 7.

Summary of the data before random forest application. Source: Author’s Own.

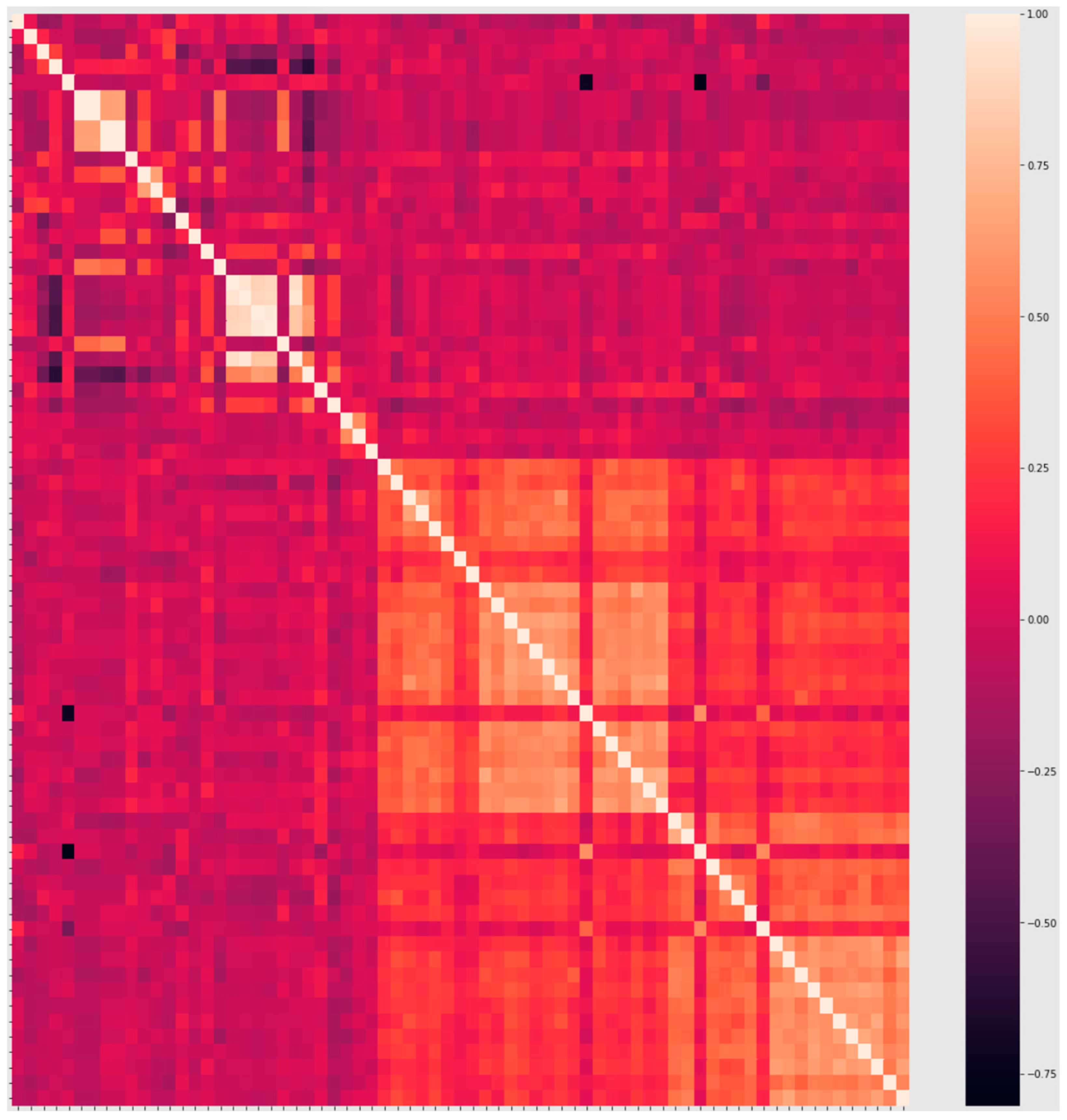

Figure 8 below is the correlation heatmap of the 72 variables after the random forest application. Denser colors are visible compared to the previous version of the heatmap, which means the correlation is positively or negatively higher after the improvement.

Figure 8.

Correlation heatmap after the random forest application. Source: Author’s Own.

Figure 8.

Correlation heatmap after the random forest application. Source: Author’s Own.

The utilization of bank-level data and a machine learning model in this work facilitates a comprehensive examination of the accuracy and reliability of banks’ survey responses. In the hypothetical scenario where a bank’s survey response fails to align with its current performance average as determined by the aggregate average of comparable banks. In this scenario, an inquiry arises regarding the accuracy of the response provided in the survey. Furthermore, the disparity between the responses provided in the survey and the real-world circumstances affords the opportunity to establish a consistency metric for every bank. The utilization of this model is imperative for establishments wherein surveys constitute a fundamental aspect of their operations, given the substantial expenses associated with conducting such surveys in terms of temporal, financial, and human resources.

The regression analysis reveals a positive relationship between consistency and bank size, country development, and bank profit. In regard to the size of banks, empirical findings indicate that larger banks tend to provide survey responses that more accurately align with their real operational circumstances. Although the existing literature does not provide much evidence on this outcome, it is expected that major banks will exhibit reduced apprehension in substantiating their institutional caliber and experience heightened confidence. Existing literature does not establish a direct correlation between the size of a bank and the quality of survey responses. Schiffer and Weder (2001) provided an explanation that suggests larger institutions may employ more decentralized decision-making methods. Consequently, the response provided by a particular department may not accurately represent the views of other departments, resulting in a lack of uniformity in the survey responses. However, given that the upper management of these institutions provides responses to the GIBS Survey, it is not expected to be a breakdown in communication between various sections. In contrast, larger financial institutions frequently possess a greater allocation of resources for conducting surveys, hence enabling the acquisition of more comprehensive and intricate data. This enhanced capacity facilitates the identification of incongruous responses. Furthermore, it can be seen that banks that generate substantial profits are often characterized by their advanced development and large-scale operations, hence reinforcing the correlation between bank size and profitability. Hence, there exists a positive correlation between bank profitability and survey responses.

The second finding demonstrates a significant correlation between the level of national development and the overall quality of the responses obtained from the survey participants. Banks situated in nations characterized by robust gross domestic product (GDP), minimal inflation rates, and low interest rates tend to provide more accurate representations of their prevailing circumstances within the context of survey responses. Existing literature indicates that countries with higher levels of development tend to exhibit more educational attainment (Darwish et al., 2018), more robust moral frameworks (Schillinger, 2006), and enhanced linguistic competency (Casale & Posel, 2011). These characteristics may contribute to a higher level of consistency in the responses provided by banks in industrialized countries during surveys. On the other hand, it is worth noting that in nations with lower levels of development, there may exist a lower degree of uniformity in the interpretation and response to survey questions. This can be attributed to variations in educational attainment, cultural practices, and linguistic obstacles.

The subsequent section of the study pertains to the hazards that are of concern to financial institutions. Upon analyzing the survey responses spanning from 2016 to 2021, a notable decrease in risk-related apprehensions pertaining to Islamic banks is observed. One finding indicates a considerable reduction in the credit portfolio risk of Islamic banks during the years covered by the sample data. One plausible explanation can be attributed to the implementation of enhanced risk management strategies by Islamic financial institutions. The utilization of sophisticated credit scoring algorithms, early warning systems, and stress testing has been employed to proficiently identify and reduce potential credit problems. The implementation of these techniques has led to enhancements in the risk management framework of Islamic banks, hence contributing to the establishment of a more secure and robust financial system.

The current global economic development and stability is an additional aspect that contributes to the mitigation of credit risk for Islamic institutions. Consequently, there has been a notable upsurge in economic activity and investment prospects, so fostering a more robust loan landscape for banks, particularly those adhering to Islamic principles. The enhancement of borrowers’ creditworthiness has been facilitated by both economic growth and stability, hence resulting in a subsequent decrease in credit risk.

The involvement of regulatory frameworks has been crucial in mitigating credit risk for Islamic banks. The implementation of stricter regulations and supervision requirements by regulatory authorities has resulted in a safer and more stable financial system for Islamic banks. According to Mahomed et al. (2021), the implementation of these standards has led to enhanced governance, heightened transparency, and a more efficient risk management structure within Islamic banks.

In conclusion, the practice of diversifying asset portfolios has proven to be effective in mitigating credit risk for Islamic banks. Islamic banks have effectively mitigated their overall credit risk by diversifying their investments across a wider array of assets, hence reducing their vulnerability to any single sector or borrower. The process of diversification has additionally facilitated the ability of Islamic banks to access novel investment prospects, hence leading to the establishment of an income stream that is characterized by enhanced stability and diversification.

In summary, the decline in credit risk for Islamic banks in recent times can be ascribed to a confluence of variables, encompassing the adoption of enhanced risk management methodologies, the presence of a stable and growing global economy, the establishment of regulatory frameworks, and the diversification of asset portfolios. These many variables have played a role in enhancing the safety and stability of the banking sector, hence mitigating credit risk exposure for Islamic financial institutions. An essential aspect to consider within this discourse is the incorporation of responses spanning the years 2016 to 2021 in the dataset. Hence, the impact of the COVID-19 issue may not be readily discernible in the available data. It is important to do a distinct analysis including the years 2022 and 2023 in order to eliminate the influence of the pandemic.

Furthermore, the aforementioned data demonstrates a comparable decrease in both terrorism funding and cybersecurity risk concerns across the Islamic banking sector. One potential factor is the heightened consciousness and implementation of legislation pertaining to anti-money laundering (AML) and counter-terrorism funding (CTF). In recent times, there has been an implementation of more stringent anti-money laundering (AML) and countering the financing of terrorism (CTF) legislation by regulatory bodies. These restrictions have been extended to encompass financial institutions, including Islamic banks, with the aim of mitigating the risk of terrorist financing. The enhancement of due diligence and risk assessment procedures in Islamic banks has resulted in a reduction of the risk associated with terrorism financing.

Islamic financial institutions are increasingly embracing a risk-based approach (RBA) to anti-money laundering and countering the financing of terrorism (AML/CFT) compliance, thereby mitigating these apprehensions. The Reserve Bank of Australia (RBA) mandates that financial institutions do a comprehensive evaluation of the risks connected with their clients and transactions, and thereafter adopt appropriate steps to minimize these risks. The implementation of a Risk-Based Approach (RBA) by Islamic banks has facilitated the enhanced identification and management of transactions with elevated risk levels. Consequently, this has led to a notable mitigation of the risk associated with supporting terrorism.

One plausible cause for the worries surrounding cybersecurity risks is the heightened allocation of resources towards the development and implementation of cybersecurity infrastructure and technology. In response to the escalating cyberattack risks observed in the past seven years, Islamic banks have made substantial investments in bolstering their cybersecurity infrastructure. These investments primarily encompass the implementation of various protective measures such as firewalls, intrusion detection and prevention systems, as well as data encryption technologies. These precautions have been implemented to safeguard their systems and data against cyber assaults.

In addition, the enhancement of cybersecurity threat awareness among both staff and customers plays a significant role in mitigating cybersecurity risks within the context of Islamic banks. Islamic financial institutions have made strategic investments in cybersecurity training initiatives aimed at imparting knowledge to their workforce regarding the significance of cybersecurity and equipping them with the necessary skills to identify and mitigate cyber risks. Additionally, the organization has developed consumer education initiatives aimed at enhancing customer awareness regarding the potential hazards linked to internet banking and providing guidance on safeguarding oneself against cyber threats.

5. Conclusion

- a.

Weaknesses of the Study

It is important to consider that the data included in this study is derived from survey responses provided by senior executives in the banking industry. Surveys are frequently employed as a means of acquiring valuable insights into the performance and strategies of banks through the collection of responses from bank managers. Nevertheless, it is imperative to identify and take into account the various limitations inherent in this study methodology. The present setting entails several constraints pertaining to surveys, which are outlined below:

Response bias can have an impact on the accuracy of survey responses, as participants may feel inclined to submit answers that are socially desirable or deliberately misleading information. Bank managers may exhibit hesitancy in revealing sensitive or confidential information pertaining to their organizations, so potentially jeopardizing the accuracy of the data.

The potential for sample selection bias in the survey exists when researchers face restricted access to specific categories of bank managers or when the respondents themselves hold attributes that deviate from the wider community of bank managers. The presence of bias has the potential to impede the capacity to generalize the findings.

Surveys are dependent on data that is self-reported by individuals, so introducing the potential for recall bias or inaccuracies in reporting. Managers may possess faulty or partial knowledge pertaining to their bank’s performance or strategies, which can result in inadvertent errors or answers influenced by bias.

Surveys predominantly record subjective opinions and perceptions, which may not consistently correspond with objective performance measurements or methods. The perceptions of bank managers may be influenced by personal prejudices, individual experiences, or a limited grasp of industry-wide trends.

Surveys commonly yield data of either quantitative or qualitative nature, presented in a concise manner. Although they possess the capability to provide a comprehensive comprehension of bank performance and strategies, it is possible that they may not fully encompass the intricate nature or subtle intricacies inherent in the subject matter. In order to achieve a more comprehensive study, it may be imperative to incorporate other research methods, such as interviews or document analysis.

Surveys primarily emphasize the examination of associations and correlations, rather than the establishment of causal linkages. The precise reasons for the adoption of various tactics or the direct influence of specific elements on bank performance remain elusive and cannot be conclusively elucidated. Alternative research designs, such as experimental or longitudinal studies, are more appropriate for investigating causality.

Surveys are capable of capturing data at a certain moment, which can potentially restrict their relevance in businesses characterized by constant change, such as the banking sector. The dynamics of bank performance and strategy are subject to rapid evolution, and it is important to note that survey responses may not accurately capture the most current information or adequately account for contextual changes.

In order to mitigate these limitations, scholars may utilize supplementary research methodologies, corroborate survey results with alternative data sources, and strive to obtain a sample that is both representative and diverse, so augmenting the dependability and credibility of the investigation.

- b.

Future Research Recommendations

Future study in the field of Islamic banking and risk management should endeavor to investigate several possible paths in order to enhance our comprehension of this pivotal domain. To begin with, the implementation of comprehensive case studies on distinct Islamic banks across various geographical areas can yield significant insights into the practical obstacles and optimal strategies pertaining to risk management. The case studies ought to take into account the distinct cultural, regulatory, and economic settings within which these banks function.

Furthermore, there is a need to do research on the potential effects of emerging technologies, including blockchain and artificial intelligence, on the risk management strategies employed by Islamic banks. This particular domain presents a promising avenue for further investigation. This study has the potential to provide valuable insights into the ways in which these technologies can improve the processes of identifying, measuring, and mitigating risks inside Islamic financial institutions.

Moreover, there is a growing significance attached to the investigation of the incorporation of environmental, social, and governance (ESG) elements within the risk management techniques of Islamic banking. The examination of the compatibility between Islamic banking principles and environmental, social, and governance (ESG) factors can offer valuable perspectives on the ability of Islamic banks to effectively handle both conventional financial risks and ethical and sustainability-related problems.

Furthermore, with the ongoing expansion of Islamic banking on a worldwide scale, it would be worthwhile to do comparative research examining the effectiveness, efficiency, and resilience of risk management practices between Islamic and conventional banks.

In conclusion, the implementation of longitudinal studies aimed at monitoring the progression of risk management techniques inside Islamic banks can facilitate the identification of industry trends, difficulties, and advancements. These studies can also provide significant insights for regulators, practitioners, and policymakers.

Future research should seek to enhance our comprehension of how Islamic banks effectively handle risks within a swiftly evolving financial environment. This can be accomplished by incorporating case studies, technological advancements, environmental, social, and governance (ESG) considerations, comparative analyses, and longitudinal studies. These approaches will contribute to a comprehensive understanding of this crucial domain.

- c.

Concluding remarks

In summary, the correlation between a bank’s performance and its risk management methods is indisputably complex and significantly influential. The implementation of efficient risk management practices is not solely a mandated obligation, but rather a crucial strategic necessity for financial institutions. The aforementioned factor significantly influences a bank’s financial performance, resilience, and public perception. Prudent risk management strategies facilitate banks in maximizing profits on their investments, upholding the confidence of customers and investors, and ensuring adherence to regulatory norms. On the other hand, insufficient risk management practices can result in substantial monetary setbacks, harm to one’s reputation, and potentially even the threat of bankruptcy.

Moreover, the correlation between performance and risk management is particularly emphasized within the framework of Islamic banking. Islamic banks, under the guidance of Sharia rules, encounter a distinctive risk environment that necessitates specific methodologies for identifying, quantifying, and mitigating risks. The incorporation of ethical and moral factors, adherence to Islamic law (Sharia), and the exclusion of certain financial instruments present unique obstacles and prospects for risk management within Islamic banking institutions. Further investigation in this field ought to persist in examining these particular characteristics in order to construct resilient risk management frameworks customized for the Islamic financial sector.

Furthermore, the utilization of technological advancements, such as blockchain and artificial intelligence, alongside the incorporation of environmental, social, and governance (ESG) considerations, offer potential opportunities for improving risk management strategies in both conventional and Islamic banking institutions. The significance of proficient risk management persists as the financial sector undergoes continuous transformation. To adapt and innovate risk management techniques in response to the evolving landscape of risks and opportunities, it is imperative to engage in ongoing research endeavors.

References

- Abuhasan, F., & Moreb, M. (2021, July). The Impact of the Digital Transformation on Customer Experience in Palestine Banks. In 2021 International Conference on Information Technology (ICIT) (pp. 43-48). IEEE.

- Ahmad, I., Basheri, M., Iqbal, M. J., & Rahim, A. (2018). Performance comparison of support vector machine, random forest, and extreme learning machine for intrusion detection. IEEE Access, 6, 33789-33795. [CrossRef]

- Aysan, A. F., Belatik, A., Unal, I. M., & Ettaai, R. (2022). Fintech Strategies of Islamic Banks: A Global Empirical Analysis. Fintech, 1(2), 206-215. [CrossRef]

- Aysan, A., & Unal, I. M. (2021a). Is Islamic Finance Evolving Into Fintech and Blockchain: A Bibliometric Analysis. Efil Journal of Economic Research.

- Aysan, A. F., & Unal, I. M. (2021b). A Bibliometric Analysis of Fintech and Blockchain in Islamic Finance, MPRA Paper No. 109712, Muenchen, Sep 2021.

- Aysan, A.F. and Bergigui, F., 2021. Sustainability, Trust, and Blockchain Applications in Islamic Finance and Circular Economy: Best Practices and Fintech Prospects. In Islamic Finance and Circular Economy (pp. 141-167). Springer, Singapore.

- Aysan, A. F., Bergigui, F. & Disli, M., 2021. Blockchain-Based Solutions in Achieving SDGs After COVID-19, Journal of Open Innovation: Technology, Market, and Complexity, 7(2), p.151. [CrossRef]

- Brieuc, M. S., Waters, C. D., Drinan, D. P., & Naish, K. A. (2018). A practical introduction to Random Forest for genetic association studies in ecology and evolution. Molecular ecology resources, 18(4), 755-766. [CrossRef]

- Cai, C. (2018). Disruption of financial intermediation by FinTech: a review on crowdfunding and blockchain. Accounting & Finance. 10.1111/acfi.12405. [CrossRef]

- Casale, D., & Posel, D. (2011). English language proficiency and earnings in a developing country: The case of South Africa. The Journal of Socio-Economics, 40(4), 385-393. [CrossRef]

- CIBAFI, (2022). General Council for Islamic Banks and Financial Institutions, Bahrain.

- Darwish, H., Farran, N., Assaad, S., & Chaaya, M. (2018). Cognitive reserve factors in a developing country: Education and occupational attainment lower the risk of dementia in a sample of Lebanese older adults—frontiers in aging neuroscience, 10, 277.

- Diener, F., & Špaček, M. (2021). Digital transformation in banking: A managerial perspective on barriers to change. Sustainability, 13(4), 2032. [CrossRef]

- Egbert, J., & Plonsky, L. (2020). Bootstrapping techniques. In A Practical Handbook of Corpus Linguistics (pp. 593-610). Springer, Cham.

- Firmansyah, E. A., & Anwar, M. (2019, January). Islamic financial technology (FINTECH): its challenges and prospect. In Achieving and Sustaining SDGs 2018 Conference: Harnessing the Power of Frontier Technology to Achieve the Sustainable Development Goals (ASSDG 2018) (pp. 52-58). Atlantis Press.

- Gerunov, A. (2019). Risk management: typologies, principles and approaches, Entrepreneurship. Volume: VІI, Issue: 2, pp. 205-244.

- Giatsidis, I., Kitsios, F., & Kamariotou, M. (2019, May). Digital transformation and user acceptance of information technology in the banking industry. In Proc. 8th Int. Symp. 30th Natl. Conf. Oper. Res (pp. 6-10).

- Hasan, R., Hassan, M. K., & Aliyu, S. (2020). Fintech and Islamic finance: literature review and research agenda. International Journal of Islamic Economics and Finance (IJIEF), 3(1), 75-94. [CrossRef]

- Ionescu, B., Ionescu, I., Bendovschi, A., Tudoran, L. (2013). Traditional accounting vs. Cloud accounting. Conference: Accounting and Management Information Systems - AMIS 2013.

- Karma, I. G. M., & Sukasih, N. K. (2019, October). Designing Application for Determining the Health Level of Village Credit Institutions with the CAMEL Method. In International Conference On Applied Science and Technology 2019-Social Sciences Track (iCASTSS 2019) (pp. 386-390). Atlantis Press.

- King, B. (2018). Bank 4.0: Banking everywhere, never at a bank. John Wiley & Sons.

- Khanboubi, F., & Boulmakoul, A. (2019). Digital Transformation Metamodel in Banking. INTIS, 2019, 8th.

- Larsson, A., Teigland, R., Siri, S., Puertas, A., Bogusz, C. (2018). The Rise and Development of FinTech: Accounts of Disruption from Sweden and Beyond.

- Mahomed, Z., Unal, I. M., & Mohamad, S. (2021). Funding the refugee crisis in Turkey: A case for social impact Sukuk. In COVID-19 and Islamic Social Finance (pp. 148-164). Routledge.

- Naushad, M. (2021). Comparative analysis of Saudi sharia compliant banks: A CAMEL framework. Accounting, 7(5), 1119-1130. [CrossRef]

- Özdemir, S., Elitaş, C. (2015). The Risks of Cloud Computing in Accounting Field and the Solution Offers: The Case of Turkey. İşletme Araştırmaları Dergisi, 7, pp. 43-59.

- Petrova, P. (2018). Industriya 4.0 i schetovodstvoto: predizvikatelstva i vazmozhnosti, Mezhdunarodna konferentsiya „Ikonomicheski i upravlenski politiki i predizvikatelstva kam Industriya 4.0. Tehnologiya ili ideologiya“, Sbornik s dokladi, str. 242- 247.

- Radilov, D. S. (2019). Statistical information and the digital economy in the globalized world. Economics and Management, XVІ (2), pp.1-10.

- Schiffer, M., & Weder, B. (2001). Firm size and the business environment: Worldwide survey results (Vol. 43). World Bank Publications.

- Schillinger, M. (2006). Learning environment and moral development: How university education fosters moral judgment competence in Brazil and two German-speaking countries (Doctoral dissertation, Aachen: Shaker).

- Schonlau, M., & Zou, R. Y. (2020). The random forest algorithm for statistical learning. The Stata Journal, 20(1), 3-29. [CrossRef]

- Semova, M,, Dimitrova, V., Haralampiev, K. (2018). Kriptovaluti i finansirane na sotsialni i protivoobshtestveni proekti. Mezhdunarodna konferentsiya „Ikonomicheski i upravlenski politiki i predizvikatelstva kam Industriya 4.0. Tehnologiya ili ideologiya“, Sbornik s dokladi, str. 270-279.

- Sibanda, W., Ndiweni, E., Boulkeroua, M., Echchabi, A., & Ndlovu, T. (2020). Digital technology disruption on bank business models. International Journal of Business Performance Management, 21(1-2), 184-213.

- Speiser, J. L., Miller, M. E., Tooze, J., & Ip, E. (2019). A comparison of random forest variable selection methods for classification prediction modeling. Expert systems with applications, 134, 93-101. [CrossRef]

- Tapscott, D., Tapscott, A. (2017). How blockchain will change organizations. MIT Sloan Management Review, 58(2), pp. 10–13.

- Tsindeliani, I. A., Proshunin, M. M., Sadovskaya, T. D., Popkova, Z. G., Davydova, M. A., & Babayan, O. A. (2021). Digital transformation of the banking system in the context of sustainable development. Journal of Money Laundering Control. [CrossRef]

- Vadrale, K. S. (2019). Financial performance of selected public and private sector banks in the light of CAMEL model. Wealth, 8(1), 49-58.

- Valkanov, N. (2019). Mitigation of regulations burden in financial sector by application of high-tech solutions, Economics and Management, XVІ (1), pp. 19- 30.

- Widharto, P., Pandesenda, A. I., Yahya, A. N., Sukma, E. A., Shihab, M. R., & Ranti, B. (2020, October). Digital Transformation of Indonesia Banking Institution: Case Study of PT. BRI Syariah. In 2020 International Conference on Information Technology Systems and Innovation (ICITSI) (pp. 44-50). IEEE.

- Yermack, D. (2017). Corporate governance and blockchain. Review of Finance, 21(1), pp.7–31. [CrossRef]

- Yunita, P. (2021). The Digital Banking Profitability Challenges: Are They Different Between Conventional And Islamic Banks? Jurnal Akuntansi dan Keuangan Indonesia, 18(1), 4.

- Zacharoula, L. (2019). Innovate practices in education management in Greece. Economics and Management, XVІ (2), pp.141-156.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions, or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).