1. Introduction

The importance of ESG activities has experienced a significant rise in prominence in the domains of academia, business, and government. Meyer and Hess (2018) assert that the early proponents of socially responsible investing (SRI) were the primary individuals who initially included ESG factors into their investment strategies. Therefore, the ESG framework is frequently cited as the "pillars of sustainability" (Kurtz, 2020; Townsend, 2020). The terms as mentioned earlier, namely "ethical," "green," "impact," "mission," "responsible," "socially responsible," "sustainable," and "values," encompass concepts that are relevant to strategies aimed at attaining a balanced state of corporate responsibility, social fairness, and environmental standards. The objective of these strategies is to provide advantages for society while also attaining sustainable competitive profitability in the long run.

Przychodzen et al. (2016) have pointed out that there has been substantial expansion in the worldwide socially responsible investment (SRI) business in recent years.

Umar et al. (Arjaliès, 2010) have observed a worldwide surge in attention given to ESG aspects. The ESG criteria provide a structured framework for assessing the managerial quality of potential investment opportunities. The three fundamental pillars of ESG encompass the domains of "environmental," "social," and "governance." The environmental factors encompassed within a corporate context are its waste management strategies, utilization of renewable energy resources, and dedication to mitigating greenhouse gas emissions. Social factors include the observance of human rights, the elimination of child labor, the provision of fair salaries, and the establishment of safe working conditions. SRI, as discussed by Bollen (2007) and Riedl & Smeets (2017), has several notable benefits. These advantages encompass enhanced financial returns, less risk in times of uncertainty, effective reputation management, and a sense of security. In contrast to modern finance's boundless investment portfolio, which is regarded as the most suitable option for an investor looking to allocate capital, the demand of ethically, environmentally, and SRI has declined in recent decades (EUROSIF, 2014). Financial scandals and crises, like the global financial crisis, have promoted ethical, environmentally friendly, and socially responsible investing in various ways.

Global investors are becoming increasingly interested in ESG investments (Sultana et al., 2017). ESG-driven investments take into consideration non-financial factors. Since events such as Enron and the Global Financial Crisis shook investor confidence, organizations have made more significant efforts to promote social change (Jeremy Galbreath, 2012). Since unethical or socially irresponsible behavior can result in legal repercussions or reputational harm for a business, investors are paying more attention to ESG issues. Investing in companies with a strong track record of positive environmental, social, and governance practices offers more than financial security.

Sultana et al. (2018) after this collapse, investors were under increased pressure as they had to take on financial losses as well as the psychological effects of more than a thousand people's fatalities, which also had an impact on thousands more people's lives and hopes. At the same time, they were charged with emphasizing business interests over the well-being of society and the local community (Aybars, Ataünal, & Gürbüz, 2019).

According to Chiromba (2019), investors are rational, long and short-term, as assumed by traditional financial theory; wealth maximizers who adopt basic financial principles and base their investment plans primarily on risk-return considerations. Rehman & Vo, (2020) in other words, investors are motivated by a desire to maximize both short- and long-term wealth/returns. However, Nilsson, (2008) SRI behavior indicated that consumer investment in socially responsible investments (SRIs) is associated with both financial opinions and pro-social approaches. Additionally, research (Ani, 2020; Shefrin, & Statman, 2011), internal and external behavioral or ethical considerations, which tend to contradict traditional finance, have also been shown to influence investors' financial decisions in behavioral finance.

Limited scholarly research has thus far examined the influence of non-financial metrics, encompassing moral, spiritual, and ESG considerations, in the context of investment choices (Clementino & Perkins, 2020; Gasperini, A., 2020; Przychodzen et al., 2016; Sairally, 2015; Sreekumar et al., 2014; Syed, 2017; Umar et al., 2020; Winegarden, 2019; Zain et al. et al., 2017; Aninze, et al., 2018; Stewardson, et al., 2023; Sandhu & El-Gohary, 2022; Omopariola, et al., 2021; Hussain, et al., 2020; Nkwocha, et al., 2019; and Owusu-Manu et al., 2019). However, our understanding remains limited regarding the impact of behavioral factors, such as attitudes, norms, and perceptions, on the investing selection of individual investors (Pellinen et al., 2015). This knowledge gap is particularly salient given that ESG factors cannot be assessed in isolation (Fin, 2012). Consequently, the present study seeks to address this void within the ESG literature by investigating the extent to which individual investors' attention to ESG considerations influences their behavior in the Pakistan stock market.

Ng (2018) Furthermore, this research examines individual investors in a developing country where ESG problems are important. One possible implication of the research is that effective communication with various stakeholders regarding investors' ESG inclinations could assist in altering attitudes about certain ESG concerns related to sustainable growth. The research has practical implications for businesses that can identify investor demand for ESG, behave sustainably, and build long-run value. Regulators can recognize the significance of this and establish procedures and laws to increase ESG performance & reporting. Furthermore, regulators might also initiate measures to introduce the ESG index in the Pakistan Stock Exchange or other nations with related cultural contexts. Investors are going to gain through sustainable investment returns, confirming their commitment to the environment, society, and stability of the economy. This will eventually be central to the nation and sustainable growth of the world.

The paper main goal is to define the impact of ESG concerns on individual investor behavior.

2. Review of Literature and Development of Hypotheses

The present study expands upon the foundational work of Ajzen and Icek's original Theory of Planned Behavior (TPB) developed in 1985, as well as the subsequent update of the TPB proposed by Wang et al. (2019). The TPB posits that individuals' willing to pursue in specific behaviors are shaped by their ideas about the value they attach to these behaviors, the level of control they perceive over their actions, and the significance of this control for their overall pleasure. This inquiry is grounded in the core principles of the TPB, specifically focusing on the constructs of "attitude" and "intention."

According to the proposition put forth by Fishbein and Ajzen (1977), the behavior of an individual is mainly influenced by their emotional state. In their comprehensive study, Jafarkarimi et al. (2016) undertake a thorough examination of the various aspects that impact users' moral discernment when engaging with social networking sites. This study highlights the intricate nature of the connection between an individual's viewpoint and their subsequent actions in such situations. The study conducted by Yadav and Pathak (2016) demonstrates that consumer purchasing decisions are highly influenced by their opinions of a product's environmental friendliness.

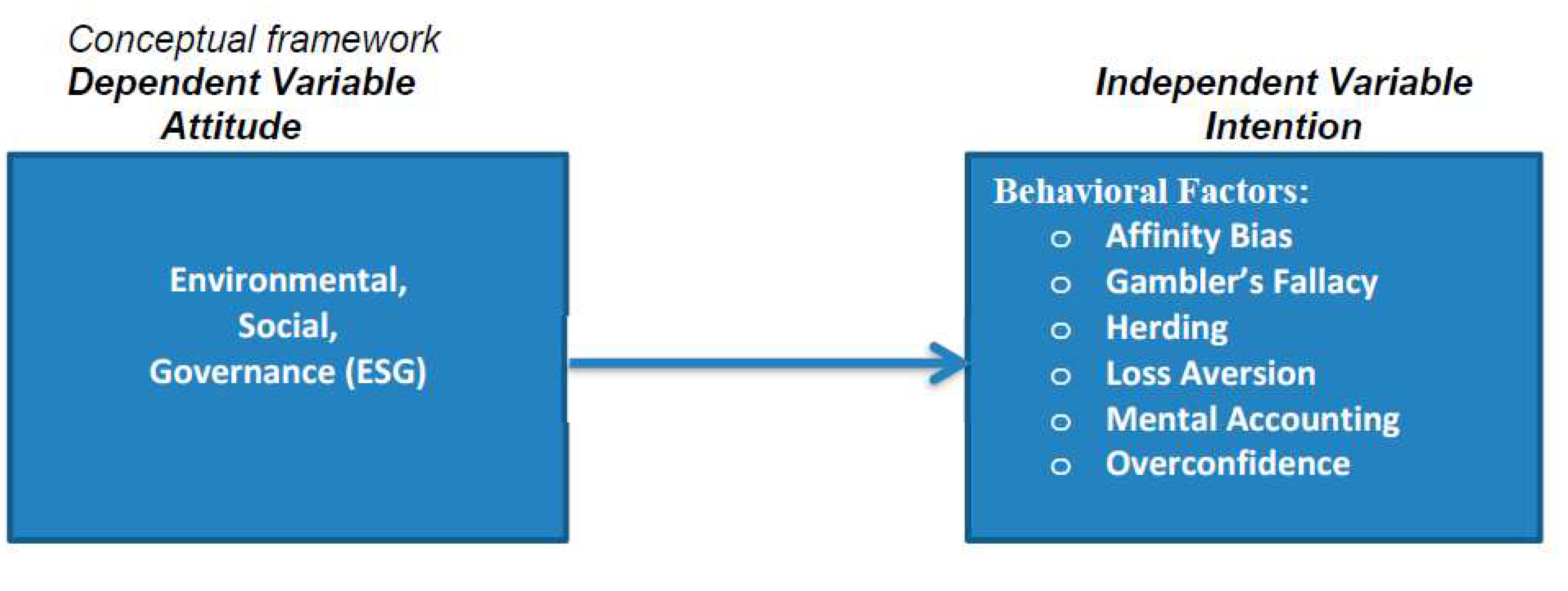

Despite the widespread popularity of the Technology Acceptance Model (TPB), there exists a notable deficiency in scholarly understanding regarding its potential application in examining the motivations and viewpoints of investors. The theoretical framework is further enhanced with the inclusion of the ESG notion as a behavioral determinant for individual investors. The conceptual framework for this investigation is depicted in

Figure 1.

A crucial phase in making an investing decision is selecting a stock from amongst the many possibilities accessible on different stock markets. According to conventional economic theory, people are rational actors who may benefit from opportunities and make appropriate choices based on their knowledge, skill, and anticipations. However the behavioral theory demonstrates the way investors comprehend the world and make investment choices based on emotional preference, ingrained cognitive behaviors, and psychological biases of individuals (Cohen & Kudryavtsev, 2012; Somathilake, 2020). ESG is critical for business and investment decisions, particularly when assessing long-term overall firm performance and risk (Anil Kumar et al., 2020).

Natural systems and environmental sustainability lie at the heart of environmental concerns. The factors above encompass pollution, water resources, alterations in land utilization, management of natural resources, and the utilization of sustainable energy sources (United et al. for Responsible Investment, 2015). The consideration of environmental effects has consistently played a significant role in shaping investment decisions, as shown by Sultana et al. (2017).

Conversely, social concerns involve a wide range of issues that impact the fundamental rights, freedoms, and overall well-being of individuals. (UN PRI, 2015) places significant emphasis on various aspects like human rights, freedom of expression, diversity, employee relations, efficient management of human capital, engagement with local communities, and consumer protection.

Governance concerns are governed by firms and other investee entities. concerns related to the management of an organization and other stakeholders in general, such as executive compensation, board structure, diversity, information disclosure, shareholder rights, risk management and internal controls (UN PRI, 2015). When making investment decisions, investors evaluate corporate governance practices as an essential measure of their state of economic prudence (Crifo, Forget, & Teyssier, 2015). Giannetti & Simonov (2006) Investors ought to refrain from supporting businesses with weak corporate governance. Investors have grown more worried about integrating governance concerns into investment decisions as a result of the corporate governance catastrophes involving Enron and others. Considering both the current situation with corporate governance challenges and the essential function of governance matters in investor decision globally (Sultana et al., 2018).

Dependent Variables

Affinity Bias and ESG

An investor frequently makes inefficient investment decisions reliant on in what way a sale or buying of a security will impact their morals. This bias in information processing is caused by emotion. In particular, investors frequently demonstrate "home-country bias" and favor acquiring shares in domestic companies. More patriotic regions or countries have lesser foreign equity interests. Affinity bias often leads investors to acquire stocks in selling businesses that enjoy shopping and “ ESG” companies they believe will have a great impact on the world, despite the reality that these companies may have poor future performance prospects (Pompian, 2017).

The phenomenon commonly referred to as the "law of small numbers" is alternatively recognized as the "gambler's fallacy." Concerning the stock market, there exists a common assumption among individuals that a stock is likely to undergo a decrease after a period of expansion. The investor will closely observe the performance of companies with positive growth prospects and meet all relevant ESG criteria. The investor will refrain from succumbing to the gambler's fallacy (Bloomfield & Hales, 2002) due to the similarity between these investments and lottery games, wherein there are no certainties, and the result is entirely contingent upon random chance.

In the study conducted by Ashish Kumar (2020), it was shown that the investment behavior known as "herding" is widely observed. Herd behavior is observed when individuals in the market choose to disregard their own personal beliefs and objective assessments and instead choose to imitate the actions and decisions of their fellow participants. As a consequence of such trading activity, the price of an asset has the potential to exhibit significant fluctuations, deviating considerably from its intrinsic worth. Research has shown that investors tend to exhibit herd behavior more frequently when faced with market instability. According to the study conducted by Lee et al. (2004), it was shown that private investors tend to display a higher propensity for engaging in herd behavior compared to institutional investors.

Based on the available data, it is observed that market participants who possess higher levels of expertise or hold prominent positions within the business often tend to reassess their investment evaluations promptly when confronted with ESG concerns. The statement above underscores the importance of incorporating ESG practices, as they have the potential to enhance an investor's standing within their professional network by positioning them as a more dependable and credible player (Semmann et al., 2005).

Loss aversion bias is a very significant bias, as stated by behavioral finance authors (Tversky, 1992). Tversky & Kahneman (1991) Loss aversion bias makes investors make irrational decisions, according to a study. Depending on one's attitude toward riskk, ESG shortcomings may play a greater or smaller role in the decision-making process for investments (Przychodzen et al., 2016). It's significant to remember that there is proof that risk aversion and loss aversion depend on the domain.

It is a well-known notion that Richard Thaler stated that the "two-pocket" idea and mental accounting bias are both cognitive biases in which people treat every aspect of their portfolio separately. Numerous categories are used to classify investments reliant on the financing or purpose of the account (Jain et al., 2019). Investors can use mental accounting to manage and organize their investment portfolios in many accounts (Mahapatra, Raveendran, & De, 2016), and significantly affects the asset prices (Barberis, and Huang, 2001). The investor who employs a value-based accounting system and seeks to enhance the socially responsible composition of their portfolio is referred to as a socially responsible investor (SRI) (Bilbao-Terol et al., 2016). Calvo et al. (2016) integrate the concept of social responsibility into the mean-variance portfolio selection model, thereby introducing an extra non-financial aim. When formulating investment selections, ESG investing incorporates non-financial aspects in addition to a company's financial success (Sairally, 2015).

When individuals exhibit overconfidence, they mistakenly believe they can successfully do a task, even in the face of substantial hurdles. Overconfidence can be regarded as a cognitive bias, as posited by Thaler (1995; Jain et al., 2015) conducted a study on this topic. The choice is bestowed with a higher level of trust than what would often be anticipated. Overconfident investors overreact to market information (Parveen et al., 2020). Tversky et al., (1990) have put out a theory that explains how individuals act when given unclear decisions. Dick et al., (2021) Executives at these companies who are overconfident tend to do better in terms of CSR. Consequently, overconfident executives could reduce the family's tendency for control by emphasizing establishing their reputation by functioning in a socially responsible manner.

Figure 1.

Conceptual framework.

Figure 1.

Conceptual framework.

Hypotheses of the Study:

H1: ESG has a positive effect on the Affinity Bias of individual Pakistan stock market investors.

H2: ESG has a positive effect on the Gambler's Fallacy of individual Pakistan stock market investors.

H3: Herding of individual investors in the Pakistan stock market is positively affected by ESG.

H4: ESG impacts Pakistani stock market investors' loss aversion.

H5: ESG impacts Pakistani stock market investors' mental accounting.

H6: ESG impacts Pakistani stock market investors' overconfidence.

A researcher has taken into account a 5% significance level.

3. Research Methodology

In order to achieve its objectives, this study uses quantitative methodologies. In order to evaluate the efficacy of a novel instrument, it is essential to employ quantitative data collection methods to analyze occurrences (Ivankova et al., 2006). The primary research approach entails conducting a questionnaire survey targeting individual investors in the PSX, aligning with the research objectives. The data was acquired through a simple random sampling technique. Consequently, this work adopts a positivist paradigm, as it seeks to uncover empirical regularities that can be subjected to testing using empirical datasets (Fraser, 2014; Lukka, 2010).

The research methodology encompassed the distribution of 500 surveys to a sample of 400 participants. This yielded a total of 393 valid responses, indicating a response rate of 78.6%. Based on previous scholarly investigations, the present study employed a modified questionnaire comprising three primary constructs. The constructs under consideration encompass ESG components (PRINCIPLES, 2004; Sultana et al., 2018), behavioral features (Antony & Joseph, 2017; Metawa et al., 2019; Mouna & Anis, 2015), and metrics of trading performance. Participants' responses were rated on a 5-point Likert scale from "strongly disagree" to "strongly agree." This research employs the UNGC (2004) and TRCRI (2013) ESG dimensions to investigate the ESG considerations of stock market investors. The selection of UNGC (2004) was based on its esteemed standing in the field. Using SmartPLS (Version 3.3.3), together with structural equation modeling, we determined the minimum sample size.

4. Analysis and Results of the study

In this paper, the data was examined using Smart PLS 3 (SEM), and the outcomes of the analysis were presented using a two-step methodology (Henseler et al., 2009).

The current study employed the Partial Least Squares Structural Equation Modeling (PLS-SEM) approach, as suggested by Ringle et al. (2015), to assess the reliability and validity of the gathered data. The evaluation involved the utilization of factor loading, average variance extracted (AVE), Cronbach's alpha, composite reliability, and average extracted variance. The present analysis utilized the method developed by Fornell and Lacker (1981) to evaluate the discriminant validity. The results for the convergent validity and internal consistency reliability of the measurement model are presented in

Table 1. The methodology necessitated the establishment of accurate measurement standards for both items and metrics. Converged validity is achieved when the outer loadings of a model surpass a threshold of 0.650.

Furthermore, the discriminant validity of the model was confirmed by a mean-variance exceeding 0.50, as reported by Shiau et al. (2019). Based on the findings of Shiau et al. (2019), it can be inferred that an increase in the composite dependability score beyond 0.70 is indicative of an improvement in internal consistency. The assessment of the model's convergence validity, internal consistency, and general dependability can be accomplished by comparing its metrics to those of the studies above.

Alternatively, the Heterotrait-Monotrait ratio can be employed as a means of evaluating the discriminant validity of a construct in differentiating between two distinct groups. Discriminant validity pertains to the degree to which items belonging to one concept demonstrate associations with items from other constructions that are unrelated and should not demonstrate such relationships. To ascertain the extent of variance that can be ascribed to a collection of constructs, it is imperative to develop a statistically significant differentiation between two conceptually distinctive constructs (Henseler et al., 2012).

In order to ensure discriminant validity, it is recommended to maintain the HTMT (heterotrait-monotrait ratio) value at or below 0.85, as suggested by Kline (2011).

Table 3 provides evidence that the study meets the requirements for establishing discriminant validity.

Table 5 provides a visual representation of the evaluation of the structural model (Direct Effect). To assess the structural model within the SEM-PLS framework and validate the study's hypotheses, an investigation was conducted. Specifically, the study's first, third, fourth, fifth, and sixth hypotheses posit a significant positive association between ESG and variables such as overconfidence, mental accounting, loss aversion, and affinity bias. The outcomes of the structural model analysis reveal that the dependent variables exert a statistically significant influence on the independent variables, thereby confirming the hypotheses.

The analysis produced the following results: (β = 0.235, t = 3.007); (β = 0.241, t = 2.911); (β = 0.277, t = 2.059); (β = 0.303, t = 5.201); and (β = 0.386, t = 8.125). Consequently, these findings offer support for hypotheses H1, H3, H4, H5, and H6. However, in relation to the second hypothesis of the study, the connection between ESG and the gambler's fallacy (GF) is statistically insignificant. The study's outcomes reveal that ESG and the GF exhibit a negative but statistically insignificant relationship (β = -0.072, t = 0.938), thereby failing to provide statistical support for H2.

5. Discussion

This study investigates how ESG factors effect the investing selection of Pakistani stock market investors. This study in a rapidly expanding economy provides the first empirical evidence of individual ESG investor participation. This research expands the ESG and sustainability literature on Pakistani stock market investors.

The study provides evidence that investors hold a collective viewpoint on ESG matters and underscores the importance of integrating these aspects into financial decision-making. The findings above suggest that investors exhibit a keen interest in providing financial support to firms and projects that make significant contributions towards sustainable development at the regional, national, and international levels. The consensus among all participants of the survey was unanimous in acknowledging the inherent risk associated with investing in companies that exhibit subpar environmental standards. Furthermore, the conducted study substantiated the notion that investors had a genuine interest in integrating ESG factors into their decision-making processes regarding investments.

Furthermore, the study supports the notion that investors exhibit bounded rationality in their economic decisions, where they view the benefits of an investing in terms of its social, economic, and psychological contributions (Guzavicius et al., 2014). This stands in contrast to traditional financial theories that assume investors are primarily concerned with financial gains. ESG, however, represents an intersection of traditional finance theories and behavioral finance theories, as environmental and social concerns can significantly impact long-term investment returns. Consequently, factors such as economic preferences and social and environmental considerations may play a role in shaping investment decisions. In contrast, governance factors are primarily influenced by rationality and are supported by purely financial theories.

Based on the research findings, investors demonstrate a higher propensity to allocate their investments towards enterprises that prioritize ESG factors under the assumption that such investments will yield favorable outcomes for the environment. Pakistani stock market investors exhibit a much-diminished emphasis on ESG aspects compared to their previous experiences in the market. The available data indicates that Pakistani investors may possess an incomplete understanding of the societal implications associated with their stock market decisions.

Furthermore, the study reveals that individual investors in the stock market of Pakistan exhibit herd behavior despite possessing knowledge of ESG-oriented equities. According to a recent study conducted by Rubbaniy et al. (2021), it has been observed that investors commonly exhibit herd behavior while making decisions connected to ESG factors. These findings provide support for the existing understanding of this phenomenon.

Furthermore, the study provides evidence that loss aversion has a substantial impact on the improvement of ESG parameters. Investors are more inclined to allocate their investments towards companies that demonstrate awareness of ESG factors when they consider these organizations to have a reduced likelihood of incurring financial losses. Investors exhibit a preference for environmentally responsible enterprises due to their perception of them as being more financially stable and secure investment options. The findings of this study align with previous research that suggests ecological considerations serve as a mitigating influence in the process of making investment decisions (Dash & Kajiji, 2020).

Furthermore, the evidence suggests that investors who exhibit overconfidence tend to assign greater importance to their viewpoints compared to the perspectives of their acquaintances, relatives, and coworkers. In the context of making decisions regarding finances, it has been discovered that persons who display overconfidence and a reluctance to adjust their methods in reaction to fluctuations in the market are more likely to take into consideration the implications that their decisions will have on the community. The statement above corroborates the outcomes of prior investigations conducted by Sultana et al. (2018).

Finally, the study reveals that investors opt for a diversified portfolio and consider socially responsible stocks, perpetually evaluating a range of investment opportunities to construct a diversified portfolio and explore socially responsible investment options, which is consistent with prior research (Lungeanu & Weber, 2021).

The findings of the study give arguments against commonly held ideas, as they demonstrate that a variety of variables other than financial considerations influence Pakistani investors. In addition, concerns pertaining to culture, economics, and psychology are taken into account. This observation is consistent with the concepts of behavioral finance, demonstrating the complex nature of the decision-making process involved in investing and providing scholars on the subject with a vital insight into the behavior of investors.

By highlighting that both financial and non-financial factors, such as ESG, influence Pakistani investors, the study contributes to the ongoing dialogue that bridges traditional financial theories with behavioral finance. It posits that investors are not always the rational agents as traditionally portrayed, but rather complex decision-makers influenced by a myriad of factors. The unique cultural, economic, and socio-political milieu of Pakistan provides a novel context for the application of ESG and behavioral finance theories. This study adds depth to the literature by showcasing how ESG considerations play out in a rapidly expanding economy, which might differ from established Western markets.

By dissecting ESG into its components - environmental, social, and governance - and analyzing their differential impacts, this research adds nuance to the understanding of ESG as a multi-faceted construct. It moves the discourse beyond monolithic ESG discussions to a more nuanced understanding of each dimension. The study’s findings on herd behavior and loss aversion, in the context of ESG factors, offer further insights into the variability of investor behavior. It posits that even when armed with knowledge, investors may still fall prey to certain behavioral biases, complicating the predictable models of investor behavior.

This study analyzes the impact that ESG factors have on the process of making financial decisions. The aspects of an organization that are typically associated with governance have a greater degree of congruence with rationality and finance theories. At the same time, environmental and social considerations have a significantly more significant impact on the method by which decisions are arrived at. This variation highlights the complex influence of ESG issues on investor behavior. As a result, it provides valuable insights for the research that will be conducted in the future by academics.

The findings suggest that Pakistani investors exhibit a solid inclination to match their investment portfolios with the objectives of sustainable development. In order to facilitate increased capital allocation towards firms prioritizing environmental sustainability, investors and financial institutions should contemplate the integration of ESG issues into their investment strategies and offerings.

Given the growing importance of ESG factors among Pakistani investors, publicly traded companies on the Pakistani stock market could be encouraged, or even mandated, to provide clearer and more comprehensive ESG reporting. This transparency would allow investors to make more informed decisions and align their portfolios with their ESG preferences. Additionally, financial institutions can introduce investment products that have a distinct ESG focus, catering to the growing segment of the market that values these factors. Examples might include ESG-focused mutual funds or ETFs. In the simialr context, regulatory bodies or trade associations could launch campaigns aimed at improving the understanding of ESG issues among both individual and institutional investors. These campaigns can dispel myths, provide clear data on the financial performance of ESG-focused investments, and educate on the broader societal benefits.

It is imperative to provide investors with education and awareness regarding social issues, as a significant proportion of them may lack knowledge in this domain. The potential for the Pakistani stock market to experience positive outcomes lies in the adoption of sustainable investment practices. The facilitation of this transition could be achieved by the enhancement of ESG knowledge among investors.

Notwithstanding several constraints, this study elucidates the impact of ESG variables on the decision-making process of investors in the Pakistani stock market. The study's conclusions may be limited due to several issues, including a small sample size, reliance on self-reported data, utilization of a cross-sectional methodology, a restricted number of contextual elements considered, and the potential inability to generalize the findings to other markets. To overcome these issues, future research endeavors may consider utilizing experimental designs, conducting cross-national data comparisons, and employing longitudinal approaches. Gaining a comprehensive understanding of the importance of ESG variables in investment decision-making necessitates conducting further study on distinct behavioral biases, regulatory consequences, information dissemination channels, and intervention tactics.

6. Conclusions and Recommendations

This paper makes a significant scholarly and practical contribution by examining the dynamic field of ESG investing in the context of the PSX. The results of the study reveal the demographic makeup and investing inclinations of individual investors in Pakistan, highlighting the significant worldwide relevance of ESG considerations. This report offers crucial insights into the current state of the sustainable investing sector. This phenomenon may compel corporations to reassess their operational strategies, hence enhancing the probability of stock market authorities incorporating investor preferences into the formulation of legislative measures. The research findings indicate that the establishment and implementation of ESG policies and protocols have the potential to enhance the overall ESG landscape in Pakistan. This, in turn, can foster ecological and social balance and make a positive contribution to long-term development.

This study provides empirical evidence indicating a positive association between self-confidence among investors and their inclination to adhere to ESG principles. However, the underlying reasons for this relationship remain unexplained. Further investigation is necessary to explore the impacts of social, economic, affective, value-based, and societal issues.

The approach employed in this study is characterized by its distinctiveness, which stems from the utilization of ESG metrics sourced from recognized organizations across the world. This particular feature received limited attention in earlier ESG studies. The utilization of the TRCRI (2013) measurement methodologies, along with the analysis of the ESG attributes of significant multinational corporations, serves to enhance the empirical basis of ESG research.

The study suggests that the increasing interest of investors in ESG principles could lead to the creation of guidelines and benchmarks aimed at enhancing ESG performance and transparency. The implementation of these programs may lead to the creation of an ESG index in Pakistan, which has the potential to yield advantages for both foreign investors and foreign direct investment (FDI). This phenomenon demonstrates significant efficacy in nations characterized by similar cultural standards, hence making a substantial contribution to the enduring stability of stock markets.

The study's findings offer empirical support for the notion that cultural factors play a significant role in shaping the practice of ESG investment, particularly in emerging economies like Pakistan, where a shared cultural framework exists among its populace. In future studies, it is imperative to integrate a diverse range of religious and cultural perspectives. It is imperative to attain a comprehensive understanding of the benefits and drawbacks associated with ESG initiatives. Additional research is required to examine the unobserved variability present in ESG variables. Conducting comparative research with other emerging nations can provide valuable insights into this subject matter, and it is strongly advised to pursue such investigations. This study represents a notable advancement in the realm of sustainable and responsible investment as it aids various stakeholders, including investors, corporations, regulators, and scholars, in gaining a deeper comprehension of the dynamic characteristics of ESG issues.

Author Contributions

S.R. and S.M.A.S. conducted the conceptualization of the study, while S.R. and I.K developed the methodology. S.R. and S.M.A.S developed the software used in the study. The validation process was carried out by S.R. and I.K. Formal analysis of the data was performed by S.R. H.A.G led the investigation. S.A. prepared the original draft of the manuscript, and S.A. also contributed to the writing, review, and editing of the manuscript. S.R did the visualization of the data. H.A.G provided the overall supervision of the study. The published version of the work has been reviewed and approved by all authors.

Conflicts of Interest

According to the authors, there are no instances of conflicts of interest.

References

- Accountants, T. I. F. of. (2012). Investor demand for environmental, social, and governance disclosures: Implications for professional accountants in business.

- Ajzen, I. From Intentions to Actions: A Theory of Planned Behavior. In Action Control; Springer: Berlin/Heidelberg, Germany, 1985; pp. 11–39. [Google Scholar]

- Ani, N. C. (2020). BEHAVIORAL FINANCE: INVESTOR’S PSYCHOLOGY (Doctoral dissertation).

- Antony, A.; Joseph, A.I. Influence of Behavioural Factors Affecting Investment Decision—An AHP Analysis. Metamorph. A J. Manag. Res. 2017, 16, 107–114. [Google Scholar] [CrossRef]

- Aninze, F., El-Gohary, H. and Hussain, J., (2018). The Role of Microfinance to Empower Women: The Case of Developing Countries, International Journal of Customer Relationship Marketing and Management, 9(1), pp: 54-78. [CrossRef]

- Arjaliès, D.-L. A Social Movement Perspective on Finance: How Socially Responsible Investment Mattered. J. Bus. Ethic- 2010, 92, 57–78. [Google Scholar] [CrossRef]

- Aybars, A. , Ataünal, L., & Gürbüz, A. O. (2019). ESG and financial performance: impact of environmental, social, and governance issues on corporate performance. In Handbook of Research on Managerial Thinking in Global Business Economics, 520–536.

- Barberis, N. and Huang, M. (2001). Mental Accounting, Loss Aversion, and Individual Stock Returns. The Journal of Finance, 65(4), 1247–1292.

- Bilbao-Terol, A.; Arenas-Parra, M.; Cañal-Fernández, V.; Bilbao-Terol, C. Multi-criteria decision making for choosing socially responsible investment within a behavioral portfolio theory framework: a new way of investing into a crisis environment. Ann. Oper. Res. 2015, 247, 549–580. [Google Scholar] [CrossRef]

- Bollen, N.P.B. Mutual Fund Attributes and Investor Behavior. J. Financial Quant. Anal. 2007, 42, 683–708. [Google Scholar] [CrossRef]

- Calvo, C.; Ivorra, C.; Liern, V. Fuzzy portfolio selection with non-financial goals: exploring the efficient frontier. Ann. Oper. Res. 2014, 245, 31–46. [Google Scholar] [CrossRef]

- Chiromba, C. Responsible Investment and Its Impact on Investment Decisions: Zimbabwe Scenario. J. Invest. 2019, 29, 98–109. [Google Scholar] [CrossRef]

- Clementino, E.; Perkins, R. How Do Companies Respond to Environmental, Social and Governance (ESG) ratings? Evidence from Italy. J. Bus. Ethics 2020, 171, 379–397. [Google Scholar] [CrossRef]

- Cohen, G.; Kudryavtsev, A. Investor Rationality and Financial Decisions. J. Behav. Finance 2012, 13, 11–16. [Google Scholar] [CrossRef]

- Dick, M.; Wagner, E.; Pernsteiner, H. Founder-Controlled Family Firms, Overconfidence, and Corporate Social Responsibility Engagement: Evidence From Survey Data. Fam. Bus. Rev. 2020, 34, 71–92. [Google Scholar] [CrossRef]

- Fin, R. F. F. (2012). Environmental, social, and governance investing from an idea to getting it done. In Finance,. 126(2), 42.

- Fraser, K. Position paper: Defeating the ‘paradigm wars’ in accounting: A mixed-methods approach is needed in the education of PhD scholars. Int. J. Mult. Res. Approaches 2014, 8, 49–62. [Google Scholar] [CrossRef]

- Gasperini. A. (2020). Principles for Responsible Investment (PRI) and ESG Factors. Climate Action, 737–749.

- Giannetti, M.; Simonov, A. Which Investors Fear Expropriation? Evidence from Investors' Portfolio Choices. J. Finance 2006, 61, 1507–1547. [Google Scholar] [CrossRef]

- Guzavicius, A. , Vilkė, R., & Barkauskas, V. (2014). Behavioral finance: Corporate social responsibility approach. Procedia-social and behavioral sciences. 156, 518-523.

- Hussain, J.; Sandhu, N.; El-Gohary, H.; Edwards, D.J. The Reality of Financing Small Tourism Firms: The Case of Indian Tourism SMEs. Int. J. Cust. Relatsh. Mark. Manag. 2020, 11, 64–80. [Google Scholar] [CrossRef]

- Ioannou, I.; Serafeim, G. The impact of corporate social responsibility on investment recommendations: Analysts' perceptions and shifting institutional logics. Strat. Manag. J. 2014, 36, 1053–1081. [Google Scholar] [CrossRef]

- Ivankova, N.V.; Creswell, J.W.; Stick, S.L. Using Mixed-Methods Sequential Explanatory Design: From Theory to Practice. Field Methods 2006, 18, 3–20. [Google Scholar] [CrossRef]

- Jafarkarimi, H.; Saadatdoost, R.; Sim, A.T.H.; Hee, J.M. Behavioral intention in social networking sites ethical dilemmas: An extended model based on Theory of Planned Behavior. Comput. Hum. Behav. 2016, 62, 545–561. [Google Scholar] [CrossRef]

- Jain, J.; Walia, N.; Gupta, S. Evaluation of behavioral biases affecting investment decision making of individual equity investors by fuzzy analytic hierarchy process. Rev. Behav. Finance 2019, 12, 297–314. [Google Scholar] [CrossRef]

- Jain, R., Jain, P., & Jain, C. (2015). Behavioral Biases in the Decision Making of Individual Investors. IUP Journal of Management Research, 14(3), 7. 3).

- Jeremy Galbreath. (2012). Page 1 of 20 ANZAM 2012. 1–20.

- Kahneman, D.; Tversky, A. Prospect theory: An analysis of decision under risk. Econometrica 1979, 47, 263–292. [Google Scholar] [CrossRef]

- Kumar, A.; Moktadir, A.; Liman, Z.R.; Gunasekaran, A.; Hegemann, K.; Khan, S.A.R. Evaluating sustainable drivers for social responsibility in the context of ready-made garments supply chain. J. Clean. Prod. 2019, 248, 119231. [Google Scholar] [CrossRef]

- Kumar, A. Empirical investigation of herding in cryptocurrency market under different market regimes. Rev. Behav. Finance 2020, 13, 297–308. [Google Scholar] [CrossRef]

- Kurtz, L. Three Pillars of Modern Responsible Investment. J. Invest. 2020, 29, 21–32. [Google Scholar] [CrossRef]

- Lukka, K. The roles and effects of paradigms in accounting research. Manag. Account. Res. 2010, 21, 110–115. [Google Scholar] [CrossRef]

- Mahapatra, M. S. , Raveendran, J., & De, A. (2016). Mental Proposing the Role of Accounting and Financial Cognition on Personal Financial Planning: A Study in Indian Context. Journal of Economic Policy and Research, 12(1), 62-73.

- Metawa, N.; Hassan, M.K.; Metawa, S.; Safa, M.F. Impact of behavioral factors on investors’ financial decisions: case of the Egyptian stock market. Int. J. Islam. Middle East. Finance Manag. 2019, 12, 30–55. [Google Scholar] [CrossRef]

- Meyer, J. , & Hess, K. (2018). (2018). Investments for Development in Switzerland: A Sub-type of Impact Investing with Strong Growth Dynamics. In Positive Impact Investing. Springer, Cham, 177–195.

- Mouna, A.; Anis, J. A study on small investors’ sentiment, financial literacy and stock returns: evidence for emerging market. Int. J. Account. Econ. Stud. 2014, 3, 10. [Google Scholar] [CrossRef]

- Ng, A.W. From sustainability accounting to a green financing system: Institutional legitimacy and market heterogeneity in a global financial centre. J. Clean. Prod. 2018, 195, 585–592. [Google Scholar] [CrossRef]

- Nilsson, J. Investment with a Conscience: Examining the Impact of Pro-Social Attitudes and Perceived Financial Performance on Socially Responsible Investment Behavior. J. Bus. Ethic- 2007, 83, 307–325. [Google Scholar] [CrossRef]

- Nkwocha, O.U.; Hussain, J.; El-Gohary, H.; Edwards, D.J.; Ovia, E. Dynamics of Group Lending Mechanism and the Role of Group Leaders in Developing Countries: Evidence from Nigeria. Int. J. Cust. Relatsh. Mark. Manag. 2019, 10, 54–71. [Google Scholar] [CrossRef]

- Omopariola, E. , Windapo, A., Edward, D., and El-Gohary, H. (2021). Level of financial performance of selected construction companies in South Africa, Journal of Risk and Financial Management, 14(1), pp. 1–18.

- Parveen, S.; Satti, Z.W.; Subhan, Q.A.; Jamil, S. Exploring market overreaction, investors’ sentiments and investment decisions in an emerging stock market. Borsa Istanb. Rev. 2020, 20, 224–235. [Google Scholar] [CrossRef]

- Pellinen, A.; Törmäkangas, K.; Uusitalo, O.; Munnukka, J. Beliefs affecting additional investment intentions of mutual fund clients. J. Financial Serv. Mark. 2015, 20, 62–73. [Google Scholar] [CrossRef]

- Pompian, M. M. (2017). Risk Tolerance and Behavioral Finance. Investment Management Consultants Association Inc, 1, 1–5.

- PRI, U. (2015). United Nations Principles of Responsible Investment.

- PRINCIPLES, E. (2004). The Equator Principles: an industry approach for financial institutions in determining, assessing, and environmental & social risk in project financing.

- Przychodzen, J.; Gómez-Bezares, F.; Przychodzen, W.; Larreina, M. ESG Issues among Fund Managers—Factors and Motives. Sustainability 2016, 8, 1078. [Google Scholar] [CrossRef]

- Rehman, M.U.; Vo, X.-V. Is a portfolio of socially responsible firms profitable for investors? J. Sustain. Finance Invest. 2019, 10, 191–212. [Google Scholar] [CrossRef]

- Riedl, A.; Smeets, P. Why Do Investors Hold Socially Responsible Mutual Funds? J. Finance 2017, 72, 2505–2550. [Google Scholar] [CrossRef]

- Sairally, B. S. (2015). Integrating Environmental, Social, and Governance (ESG) Factors in Islamic Finance: Towards the Realisation of Maqasid Al-Shari’Ah. ISRA International Journal of Islamic Finance, 7(2), 145. http://search.proquest.com/openview/70dbf2bbb93fb0415e956ef5b9cbcd88/1?pq-origsite=gscholar&cbl=2031957.

- Sarwar, A.; Afaf, G. A comparison between psychological and economic factors affecting individual investor’s decision-making behavior. Cogent Bus. Manag. 2016, 3. [Google Scholar] [CrossRef]

- Semmann, D.; Milinski, M.; Krambeck, H.-J. Reputation is valuable within and outside one?s own social group. Behav. Ecol. Sociobiol. 2005, 57, 611–616. [Google Scholar] [CrossRef]

- Sandhu, N.; El-Gohary, H. Unveiling the Impact of Psychological Traits on Innovative Financial Decision-making in Small Tourism Businesses. J. Knowl. Econ. 2022, 14, 2284–2317. [Google Scholar] [CrossRef]

- Shefrin, H. , & Statman, M. (2011). Behavioral finance in the financial crisis: market efficiency, Minsky, and Keynes. Santa Clara University, November.

- Somathilake, H. Factors Influencing Individual Investment Decisions In Colombo Stock Exchange. Int. J. Sci. Res. Publ. (IJSRP) 2020, 10, 579–585. [Google Scholar] [CrossRef]

- Nair, A.S.; Ladha, R. Determinants of non-economic investment goals among Indian investors. Corp. Governance: Int. J. Bus. Soc. 2014, 14, 714–727. [Google Scholar] [CrossRef]

- Stewardson, A. , Edwards, D., Asamoah, E., Aigbavboa, C.O., Lai, J., & El-Gohary, H., (2023). The Late Payment Epidemic in UK Construction, Journal of Financial Management of Property and Construction, forthcoming.

- Sultana, S. , Zainal, D., & Zulkifli, N. (2017). The influence of environmental, social and governance (ESG) on investment decisions: The Bangladesh perspective. Pertanika Journal of Social Sciences and Humanities, 25(November), 155–173.

- Sultana, S.; Zulkifli, N.; Zainal, D. Environmental, Social and Governance (ESG) and Investment Decision in Bangladesh. Sustainability 2018, 10, 1831. [Google Scholar] [CrossRef]

- Syed, A.M. Environment, social, and governance (ESG) criteria and preference of managers. Cogent Bus. Manag. 2017, 4. [Google Scholar] [CrossRef]

- Thaler, D. and. (1995). Financial decision-making in markets and firms: A behavioral perspective. Handbooks in Operations Research and Management Science, 9, 385–410.

- Townsend, B. From SRI to ESG: The Origins of Socially Responsible and Sustainable Investing. J. Impact ESG Invest. 2020, 1, 10–25. [Google Scholar] [CrossRef]

- Tversky, A., & Kahneman, D. (1991). Loss Aversion in Riskless Choice : A Reference-Dependent Model Author ( s ): Amos Tversky and Daniel Kahneman Published by : Oxford University Press. The Quarterly Journal of Economics, 106(4), 1039–1061. http://www.jstor.org/stable/2937956?seq=1#page_scan_tab_contents%5Cnhttp://qje.oxfordjournals.org/content/106/4/1039.full.pdf+html.

- Tversky, A. , Slovic, P., & Kahneman, D. (1990). American Economic Association The Causes of Preference Reversal. Source: The American Economic Review, 80(1), 204–217.

- Tversky, D. K. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty.

- Umar, Z.; Kenourgios, D.; Papathanasiou, S. The static and dynamic connectedness of environmental, social, and governance investments: International evidence. Econ. Model. 2020, 93, 112–124. [Google Scholar] [CrossRef] [PubMed]

- Wang, C. , Zhang, J., Cao, J., Hu, H., & Yu, P. (2019). The influence of environmental background on tourists’ environmentally responsible behavior. Journal of Environmental Management, 231, 804–810.

- Widianto, S. , Kautsar, A. P., Sriwidodo, Abdulah, R., & Ramadhina, R. (2021). Pro-environmental behavior of healthcare professionals: a study applying the theory of planned behavior. International Journal of Business and Globalisation, 28(3), 219–232.

- Winegarden, W. (2019). ENVIRONMENTAL, SOCIAL, AND GOVERNANCE (ESG) INVESTING: An Evaluation of the Evidence. 1–28.

- Yadav, R.; Pathak, G.S. Young consumers' intention towards buying green products in a developing nation: Extending the theory of planned behavior. J. Clean. Prod. 2016, 135, 732–739. [Google Scholar] [CrossRef]

- Abdin, S.Z.U.; Sultana, N.; Farooq, M.; Shah, S.Z.A. Stock Market Anomalies as Mediators Between Prospect Factors and Investment Decisions and Performance: Findings at the Individual Investor Level. 2017, 6, 21–40. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).