Submitted:

19 September 2023

Posted:

19 September 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Literature Review

2.1. Prices Of Renewable And Conventional Energy Stocks

2.2. Precious Metals as Hedge for Stocks

3. Materials and Methods

3.1. Materials

| Indexes | Definitions | |

|---|---|---|

| WilderHill Clean Energy | ECO | The purpose of this index is to represent the success of clean energy enterprises in the United States. |

| S&P Global Clean Energy | SPGTCLEN | This index, which is part of the S&P 500 and Dow Jones Indexes, measures the performance of global clean energy companies. |

| Nasdaq Clean Edge Green Energy | CEXX | It is an index that tracks the performance of green energy companies listed on the NASDAQ market. |

| Gold | XAU | The international symbol for gold in financial markets is the XAU. Gold is a precious metal that is traded in international troy ounce commodities markets (31.1035 grams) and is commonly utilized as a hedge asset and safe haven. |

| Silver | XAG | The chemical symbol XAG is used to represent silver in financial markets and price quotations around the world. Silver's price, like gold's, is stated in international commodities markets and is measured per troy ounce (31.1035 grams). Silver, like gold, is seen as a safe haven in times of economic uncertainty and financial market instability. |

| Platinum | XPT | The XPT is both the chemical symbol and the symbol used to symbolize platinum in financial markets around the world. Platinum, like gold and silver, is a precious metal that may be utilized in a range of industrial applications. Its price is measured in troy ounces (31,1035 grams). |

| Aluminum | MAL3 | Aluminum is a metal that is utilized in a variety of industrial and consumer purposes, but its primary market commercialization happens through futures and options in the primary material markets. |

| Nickel Futures | NICKELc1 | Nickel is a metal that is used in a range of industrial applications, including the production of stainless steel and batteries, and its price is affected by a variety of factors, including industrial demand, supply, and worldwide demand. |

| Copper Futures | HGU3 | Copper futures are traded on commodities exchanges and are denoted by unique symbols such as "HGU3." The symbol "HG" stands for copper, while "U3" stands for the month and year in which the futures contract expires. In this scenario, "U3" could indicate a copper futures contract with a maturity date of September 2023, but it is important to double-check the specific maturity date because these contracts have multiple maturities throughout the year. |

3.2. Methods

4. Results

4.1. Descriptive Statistics

4.2. Diagnostic

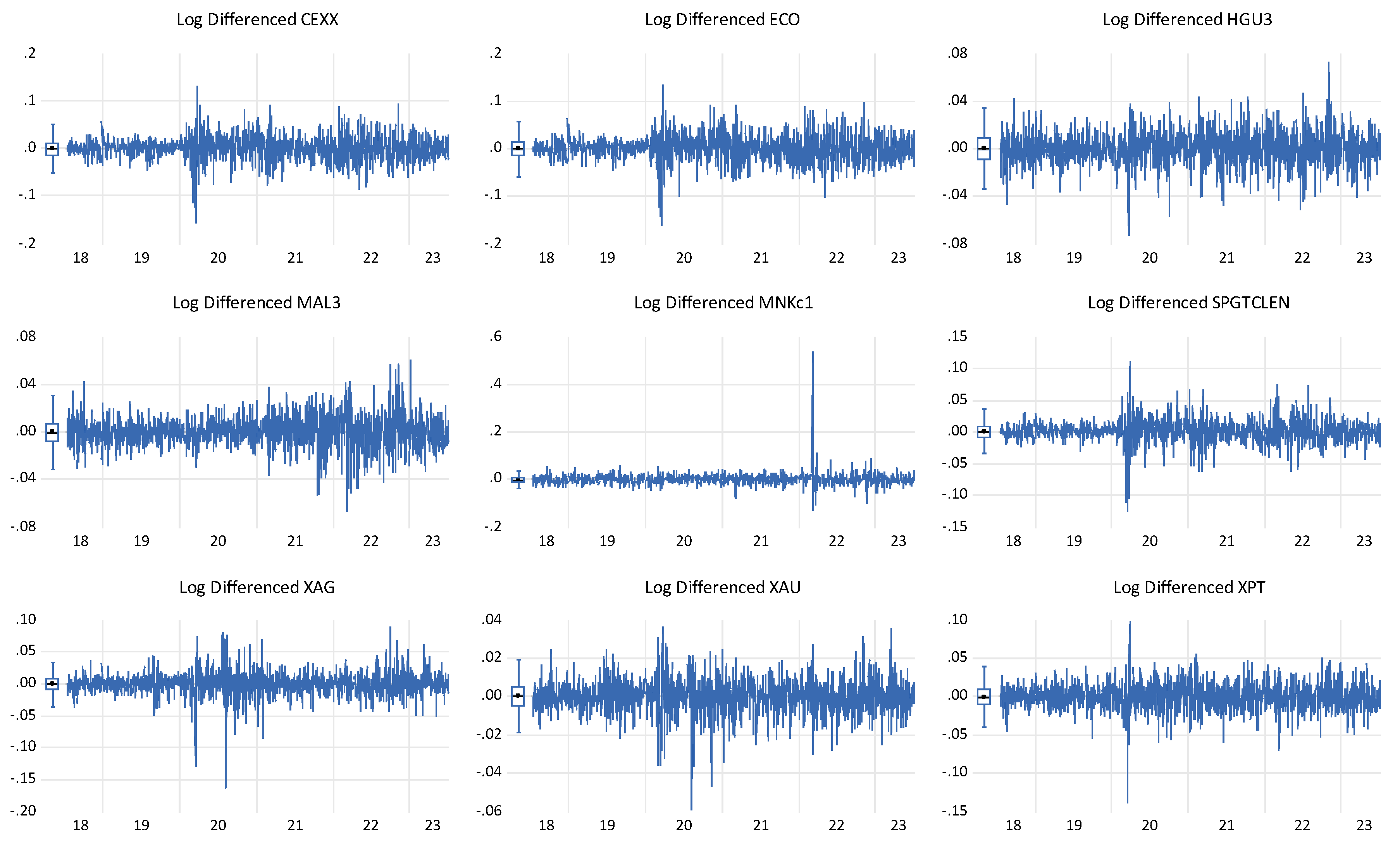

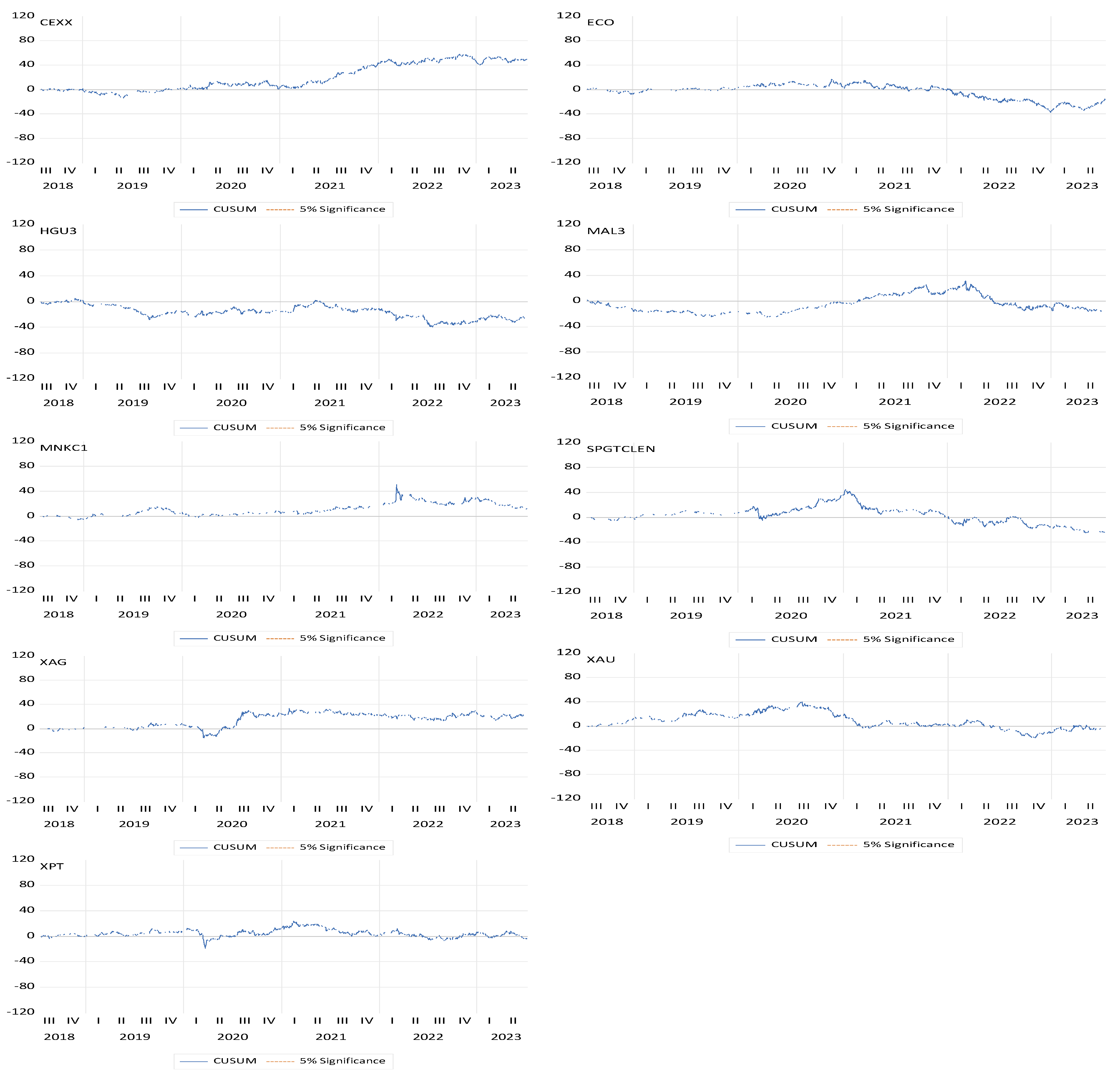

4.2.1. Time Series Stationarity

4.3. Methodological Results

5. Discussion

6. Conclusion

7. Practical Implications

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Ahmad, W. On the Dynamic Dependence and Investment Performance of Crude Oil and Clean Energy Stocks. Res Int Bus Finance 2017, 42. [Google Scholar] [CrossRef]

- Reboredo, J.C.; Ugolini, A. The Impact of Energy Prices on Clean Energy Stock Prices. A Multivariate Quantile Dependence Approach. Energy Econ 2018, 76, 136–152. [Google Scholar] [CrossRef]

- Dawar, I.; Dutta, A.; Bouri, E.; Saeed, T. Crude Oil Prices and Clean Energy Stock Indices: Lagged and Asymmetric Effects with Quantile Regression. Renew Energy 2021, 163, 288–299. [Google Scholar] [CrossRef]

- Ritchie, J.; Dowlatabadi, H. Divest from the Carbon Bubble ? Reviewing the Implications and Limitations of Fossil Fuel Divestment for Institutional Investors. Review of Economics & Finance 2015, 5. [Google Scholar]

- Henriques, I.; Sadorsky, P. Investor Implications of Divesting from Fossil Fuels. Global Finance Journal 2018, 38. [Google Scholar] [CrossRef]

- Blitz, D. Betting Against Oil: The Implications of Divesting from Fossil Fuel Stocks. SSRN Electronic Journal 2021. [Google Scholar] [CrossRef]

- Ahmad, W.; Rais, S. Time-Varying Spillover and the Portfolio Diversification Implications of Clean Energy Equity with Commodities and Financial Assets. Emerging Markets Finance and Trade 2018, 54. [Google Scholar] [CrossRef]

- Aslam, F.; Aziz, S.; Nguyen, D.K.; Mughal, K.S.; Khan, M. On the Efficiency of Foreign Exchange Markets in Times of the COVID-19 Pandemic. Technol Forecast Soc Change 2020, 161, 120261. [Google Scholar] [CrossRef]

- Alves Dias, P.; Blagoeva, D.; Pavel, C.; Arvanitidis, N. Cobalt: Demand-Supply Balances in the Transition to Electric Mobility; 2018. [Google Scholar]

- Dutta, A. Impact of Silver Price Uncertainty on Solar Energy Firms. J Clean Prod 2019, 225, 1044–1051. [Google Scholar] [CrossRef]

- Yahya, M.; Ghosh, S.; Kanjilal, K.; Dutta, A.; Uddin, G.S. Evaluation of Cross-Quantile Dependence and Causality between Non-Ferrous Metals and Clean Energy Indexes. Energy 2020, 202. [Google Scholar] [CrossRef]

- Baur, D.G.; McDermott, T.K. Is Gold a Safe Haven? International Evidence. J Bank Financ 2010, 34, 1886–1898. [Google Scholar] [CrossRef]

- Bulut, L.; Rizvanoghlu, I. Is Gold a Safe Haven? The International Evidence Revisited. Acta Oeconomica 2020, 70. [Google Scholar] [CrossRef]

- Chemkha, R.; BenSaïda, A.; Ghorbel, A.; Tayachi, T. Hedge and Safe Haven Properties during COVID-19: Evidence from Bitcoin and Gold. Quarterly Review of Economics and Finance 2021, 82. [Google Scholar] [CrossRef]

- Caporale, G.M.; Gil-Alana, L.A. Gold and Silver as Safe Havens: A Fractional Integration and Cointegration Analysis. PLoS ONE 2023, 18. [Google Scholar] [CrossRef] [PubMed]

- Azimli, A. Degree and Structure of Return Dependence among Commodities, Energy Stocks and International Equity Markets during the Post-COVID-19 Period. Resources Policy 2022, 77. [Google Scholar] [CrossRef]

- Hasan, M.B.; Hassan, M.K.; Rashid, M.M.; Alhenawi, Y. Are Safe Haven Assets Really Safe during the 2008 Global Financial Crisis and COVID-19 Pandemic? Global Finance Journal 2021, 50. [Google Scholar] [CrossRef]

- Gregory, A.W.; Hansen, B.E. Residual-Based Tests for Cointegration in Models with Regime Shifts. J Econom 1996, 70, 99–126. [Google Scholar] [CrossRef]

- Wang, Y.; Liu, Y.; Gu, B. COP26: Progress, Challenges, and Outlook. Adv Atmos Sci 2022, 39. [Google Scholar] [CrossRef]

- Arora, N.K.; Mishra, I. COP26: More Challenges than Achievements. Environmental Sustainability 2021, 4. [Google Scholar] [CrossRef]

- Lennan, M.; Morgera, E. The Glasgow Climate Conference (COP26). International Journal of Marine and Coastal Law 2022, 37. [Google Scholar] [CrossRef]

- Jacobs, M. Reflections on COP26: International Diplomacy, Global Justice and the Greening of Capitalism. Political Quarterly 2022, 93. [Google Scholar] [CrossRef]

- Dwivedi, Y.K.; Hughes, L.; Kar, A.K.; Baabdullah, A.M.; Grover, P.; Abbas, R.; Andreini, D.; Abumoghli, I.; Barlette, Y.; Bunker, D.; et al. Climate Change and COP26: Are Digital Technologies and Information Management Part of the Problem or the Solution? An Editorial Reflection and Call to Action. Int J Inf Manage 2022, 63. [Google Scholar] [CrossRef]

- Dias, R.; Horta, N.; Chambino, M. Clean Energy Action Index Efficiency: An Analysis in Global Uncertainty Contexts. Energies 2023, 16, 18. [Google Scholar] [CrossRef]

- Dias, R.; Teixeira, N.; Alexandre, P.; Chambino, M. Exploring the Connection between Clean and Dirty Energy: Implications for the Transition to a Carbon-Resilient Economy. Energies (Basel) 2023, 16, 4982. [Google Scholar] [CrossRef]

- Dias, R.; Alexandre, P.; Teixeira, N.; Chambino, M. Clean Energy Stocks : Resilient Safe Havens in the Volatility of Dirty Cryptocurrencies. 2023.

- Santana, T.P.; Horta, N.; Revez, C.; Dias, R.M.T.S.; Zebende, G.F. Effects of Interdependence and Contagion on Crude Oil and Precious Metals According to ΡDCCA: A COVID-19 Case Study. Sustainability (Switzerland) 2023, 15. [Google Scholar] [CrossRef]

- Henriques, I.; Sadorsky, P. Oil Prices and the Stock Prices of Alternative Energy Companies. Energy Econ 2008, 30. [Google Scholar] [CrossRef]

- Kumar, S.; Managi, S.; Matsuda, A. Stock Prices of Clean Energy Firms, Oil and Carbon Markets: A Vector Autoregressive Analysis. Energy Econ 2012, 34. [Google Scholar] [CrossRef]

- Sadorsky, P. Modeling Renewable Energy Company Risk. Energy Policy 2012, 40. [Google Scholar] [CrossRef]

- Managi, S.; Okimoto, T. Does the Price of Oil Interact with Clean Energy Prices in the Stock Market? Japan World Econ 2013, 27. [Google Scholar] [CrossRef]

- Sadorsky, P. Modeling Renewable Energy Company Risk. Energy Policy 2012, 40. [Google Scholar] [CrossRef]

- Bondia, R.; Ghosh, S.; Kanjilal, K. International Crude Oil Prices and the Stock Prices of Clean Energy and Technology Companies: Evidence from Non-Linear Cointegration Tests with Unknown Structural Breaks. Energy 2016, 101. [Google Scholar] [CrossRef]

- Vrînceanu, G.; Horobeț, A.; Popescu, C.; Belaşcu, L. The Influence of Oil Price on Renewable Energy Stock Prices: An Analysis for Entrepreneurs. Studia Universitatis „Vasile Goldis” Arad – Economics Series 2020, 30. [Google Scholar] [CrossRef]

- Asl, M.G.; Canarella, G.; Miller, S.M. Dynamic Asymmetric Optimal Portfolio Allocation between Energy Stocks and Energy Commodities: Evidence from Clean Energy and Oil and Gas Companies. Resources Policy 2021, 71. [Google Scholar] [CrossRef]

- Kanamura, T. A Model of Price Correlations between Clean Energy Indices and Energy Commodities. Journal of Sustainable Finance and Investment 2022, 12. [Google Scholar] [CrossRef]

- Asl, M.G.; Canarella, G.; Miller, S.M. Dynamic Asymmetric Optimal Portfolio Allocation between Energy Stocks and Energy Commodities: Evidence from Clean Energy and Oil and Gas Companies. Resources Policy 2021, 71. [Google Scholar] [CrossRef]

- Kanamura, T. A Model of Price Correlations between Clean Energy Indices and Energy Commodities. Journal of Sustainable Finance and Investment 2022, 12. [Google Scholar] [CrossRef]

- Farid, S.; Karim, S.; Naeem, M.A.; Nepal, R.; Jamasb, T. Co-Movement between Dirty and Clean Energy: A Time-Frequency Perspective. Energy Econ 2023, 119. [Google Scholar] [CrossRef]

- Dias, R.; Teixeira, N.; Alexandre, P.; Chambino, M. Exploring the Connection between Clean and Dirty Energy: Implications for the Transition to a Carbon-Resilient Economy. Energies (Basel) 2023, 16, 4982. [Google Scholar] [CrossRef]

- Dias, R.; Alexandre, P.; Teixeira, N.; Chambino, M. Clean Energy Stocks : Resilient Safe Havens in the Volatility of Dirty Cryptocurrencies. 2023.

- Baur, D.G.; Lucey, B.M. Is Gold a Hedge or a Safe Haven? An Analysis of Stocks, Bonds and Gold. Financial Review 2010, 45. [Google Scholar] [CrossRef]

- Baur, D.G.; McDermott, T.K. Is Gold a Safe Haven? International Evidence. J Bank Financ 2010, 34, 1886–1898. [Google Scholar] [CrossRef]

- Beckmann, J.; Berger, T.; Czudaj, R. Does Gold Act as a Hedge or a Safe Haven for Stocks? A Smooth Transition Approach. Econ Model 2015, 48. [Google Scholar] [CrossRef]

- Junttila, J.-P.; Pesonen, J.M.; Raatikainen, J. Commodity Market Based Hedging against Stock Market Risk in Times of Financial Crisis: The Case of Crude Oil and Gold. SSRN Electronic Journal 2017. [Google Scholar] [CrossRef]

- Beckmann, J.; Berger, T.; Czudaj, R. Does Gold Act as a Hedge or a Safe Haven for Stocks? A Smooth Transition Approach. Econ Model 2015, 48. [Google Scholar] [CrossRef]

- Junttila, J.-P.; Pesonen, J.M.; Raatikainen, J. Commodity Market Based Hedging against Stock Market Risk in Times of Financial Crisis: The Case of Crude Oil and Gold. SSRN Electronic Journal 2017. [Google Scholar] [CrossRef]

- Chen, K.; Wang, M. Is Gold a Hedge and Safe Haven for Stock Market? Appl Econ Lett 2019, 26. [Google Scholar] [CrossRef]

- Chang, B.H.; Rajput, S.K.O.; Ahmed, P.; Hayat, Z. Does Gold Act as a Hedge or a Safe Haven? Evidence from Pakistan. Pak Dev Rev 2020, 59. [Google Scholar] [CrossRef]

- Gargallo, P.; Lample, L.; Miguel, J.A.; Salvador, M. Dynamic Risk Management in European Energy Portfolios: Evolution of the Role of Clean and Carbon Markets. Energy Reports 2022, 8. [Google Scholar] [CrossRef]

- Ozdurak, C.; Umut, A.; Ozay, T. The Interaction of Major Crypto-Assets, Clean Energy, and Technology Indices in Diversified Portfolios. International Journal of Energy Economics and Policy 2022, 12. [Google Scholar] [CrossRef]

- Elie, B.; Naji, J.; Dutta, A.; Uddin, G.S. Gold and Crude Oil as Safe-Haven Assets for Clean Energy Stock Indices: Blended Copulas Approach. Energy 2019, 178. [Google Scholar] [CrossRef]

- Jiang, S.; Li, Y.; Lu, Q.; Wang, S.; Wei, Y. Volatility Communicator or Receiver? Investigating Volatility Spillover Mechanisms among Bitcoin and Other Financial Markets. Res Int Bus Finance 2022, 59. [Google Scholar] [CrossRef]

- Sharma, U.; Karmakar, M. Are Gold, USD, and Bitcoin Hedge or Safe Haven against Stock? The Implication for Risk Management. Review of Financial Economics 2023, 41. [Google Scholar] [CrossRef]

- Mensi, W.; Maitra, D.; Selmi, R.; Vo, X.V. Extreme Dependencies and Spillovers between Gold and Stock Markets: Evidence from MENA Countries. Financial Innovation 2023, 9. [Google Scholar] [CrossRef] [PubMed]

- Bahloul, S.; Mroua, M.; Naifar, N. Re-Evaluating the Hedge and Safe-Haven Properties of Islamic Indexes, Gold and Bitcoin: Evidence from DCC–GARCH and Quantile Models. Journal of Islamic Accounting and Business Research 2023. [Google Scholar] [CrossRef]

- Yousaf, I.; Plakandaras, V.; Bouri, E.; Gupta, R. Hedge and Safe-Haven Properties of FAANA against Gold, US Treasury, Bitcoin, and US Dollar/CHF during the Pandemic Period. North American Journal of Economics and Finance 2023, 64. [Google Scholar] [CrossRef]

- Tsay, R.S. Analysis of Financial Time Series; 2002. [Google Scholar]

- Jarque, C.M.; Bera, A.K. Efficient Tests for Normality, Homoscedasticity and Serial Independence of Regression Residuals. Econ Lett 1980, 6. [Google Scholar] [CrossRef]

- Ljung, G.M.; Box, G.E.P. On a Measure of Lack of Fit in Time Series Models. Biometrika 1978, 65. [Google Scholar] [CrossRef]

- Inclán, C.; Tiao, G.C. Use of Cumulative Sums of Squares for Retrospective Detection of Changes of Variance. J Am Stat Assoc 1994, 89. [Google Scholar] [CrossRef]

- Breitung, J. The Local Power of Some Unit Root Tests for Panel Data. Advances in Econometrics 2000, 15. [Google Scholar] [CrossRef]

- Levin, A.; Lin, C.F.; Chu, C.S.J. Unit Root Tests in Panel Data: Asymptotic and Finite-Sample Properties. J Econom 2002, 108. [Google Scholar] [CrossRef]

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for Unit Roots in Heterogeneous Panels. J Econom 2003. [Google Scholar] [CrossRef]

- Dickey, D.; Fuller, W. Likelihood Ratio Statistics for Autoregressive Time Series with a Unit Root. Econometrica 1981, 49, 1057–1072. [Google Scholar] [CrossRef]

- Perron, P.; Phillips, P.C.B. Testing for a Unit Root in a Time Series Regression. Biometrika 1988, 2, 335–346. [Google Scholar] [CrossRef]

- Choi, I. Unit Root Tests for Panel Data. J Int Money Finance 2001, 20, 249–272. [Google Scholar] [CrossRef]

- Santana, T.P.; Horta, N.; Revez, C.; Dias, R.M.T.S.; Zebende, G.F. Effects of Interdependence and Contagion on Crude Oil and Precious Metals According to ΡDCCA: A COVID-19 Case Study. Sustainability (Switzerland) 2023, 15. [Google Scholar] [CrossRef]

- Phillips, P.C.B.; Perron, P. Testing for a Unit Root in Time Series Regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

| Mean | Std. Dev. | Skewness | Kurtosis | JB | Probability | Observations | |

|---|---|---|---|---|---|---|---|

| CEXX | 0.000818 | 0.025233 | -0.344916 | 6.583154 | 699.0304 | 0.000000 | 1260 |

| ECO | 0.000412 | 0.027667 | -0.303020 | 5.930867 | 470.2566 | 0.000000 | 1260 |

| HGU3 | 0.000242 | 0.014330 | -0.182271 | 4.602964 | 141.8751 | 0.000000 | 1260 |

| MAL3 | 5.46E-05 | 0.013571 | -0.042690 | 5.078401 | 227.1697 | 0.000000 | 1260 |

| MNKC1 | 0.000491 | 0.024283 | 8.135917 | 185.9311 | 1770749. | 0.000000 | 1260 |

| SPGTCLEN | 0.000639 | 0.018158 | -0.439446 | 9.671195 | 2377.058 | 0.000000 | 1260 |

| XAG | 0.000303 | 0.018690 | -0.582112 | 11.71614 | 4059.640 | 0.000000 | 1260 |

| XAU | 0.000351 | 0.009164 | -0.430383 | 6.273462 | 601.4647 | 0.000000 | 1260 |

| XPT | 8.94E-05 | 0.018104 | -0.570660 | 8.079954 | 1423.198 | 0.000000 | 1260 |

| Group unit root test: Summary | ||||

|---|---|---|---|---|

| Method | Statistic | Prob* | Cross- sections |

Obs. |

| Null: Unit root (assumes common unit root process) | ||||

| Levin, Lin & Chu t | -184.570 | 0.0000 | 9 | 11319 |

| Breitung t-stat | -90.1528 | 0.0000 | 9 | 11310 |

| Null: Unit root (assumes individual unit root process) | ||||

| Im, Pesaran and Shin W-stat | -118.841 | 0.0000 | 9 | 11319 |

| ADF - Fisher Chi-square | 2370.52 | 0.0000 | 9 | 11319 |

| PP - Fisher Chi-square | 2370.52 | 0.0000 | 9 | 11322 |

| Markets | Test | Stat. | Method | Lags | Break Date | Results |

|---|---|---|---|---|---|---|

| MAL3 | HGU3 | Zt | -5.91*** | Trend | 2 | 25/10/2028 | Shocks |

| MAL3 | NICKELc1 | ADF | -5.57*** | Trend | 2 | 02/11/2018 | Shocks |

| MAL3 | XAU | ADF | -5.76*** | Trend | 2 | 02/11/2018 | Shocks |

| MAL3 | XPT | Za | -57.86*** | Trend | 0 | 24/10/2018 | Shocks |

| MAL3 | XAG | ADF | -5.60*** | Trend | 2 | 02/11/2018 | Shocks |

| MAL3 | ECO | Zt | -5.71*** | Trend | 0 | 02/01/2019 | Shocks |

| MAL3 | SPGTCLEN | ADF | -5.59*** | Trend | 2 | 23/10/2018 | Shocks |

| MAL3 | CEXX | Zt | -6.21*** | Trend | 0 | 02/01/2019 | Shocks |

| HGU3 | MAL3 | Zt | -3.97 | Trend | 0 | Non-existent | |

| HGU3 | NICKELc1 | Zt | -4.20 | Trend | 0 | Non-existent | |

| HGU3 | XAU | ADF | -4.93* | Trend | 0 | 01/05/2019 | Shocks |

| HGU3 | XPT | ADF | -4.27 | Trend | 0 | Non-existent | |

| HGU3 | XAG | ADF | -4.94* | Trend | 0 | 01/05/2019 | Shocks |

| HGU3 | ECO | ADF | -5.05** | Trend | 0 | 22/05/2019 | Shocks |

| HGU3 | SPGTCLEN | ADF | -4.70 | Trend | 0 | Non-existent | |

| HGU3 | CEXX | ADF | -4.72* | Trend | 1 | 02/10/2018 | Shocks |

| NICKELc1 | MAL3 | Zt | -3.29 | Trend | 2 | Non-existent | |

| NICKELc1 | HGU3 | Za | -19.65 | Trend | 3 | Non-existent | |

| NICKELc1 | XAU | Za | -24.67 | Trend | 1 | Non-existent | |

| NICKELc1 | XPT | Zt | -3.14 | Trend | 0 | Non-existent | |

| NICKELc1 | XAG | Zt | -4.17 | Trend | 0 | Non-existent | |

| NICKELc1 | ECO | Zt | -3.48 | Trend | 2 | Non-existent | |

| NICKELc1 | SPGTCLEN | Zt | -3.72 | Trend | 2 | Non-existent | |

| NICKELc1 | CEXX | Zt | -3.23 | Trend | 2 | Non-existent | |

| XAU | MAL3 | Zt | -5.71*** | Regime | 2 | 27/06/2019 | Shocks |

| XAU | HGU3 | Zt | -3.47 | Regime | 0 | Non-existent | |

| XAU | NICKELc1 | ADF | -3.36 | Regime | 1 | Non-existent | |

| XAU | XPT | Zt | -3.26 | Regime | 0 | Non-existent | |

| XAU | XAG | Zt | -3.64 | Regime | 5 | Non-existent | |

| XAU | ECO | Zt | -3.49 | Regime | 0 | Non-existent | |

| XAU | SPGTCLEN | Zt | -4.02 | Regime | 0 | Non-existent | |

| XAU | CEXX | Zt | -3.38 | Trend | 1 | Non-existent | |

| XPT | MAL3 | Zt | -4.77* | Regime | 1 | 22/08/2019 | Shocks |

| XPT | HGU3 | ADF | -4.95** | Regime | 3 | 08/08/2019 | Shocks |

| XPT | NICKELc1 | ADF | -3.85 | Regime | 0 | Non-existent | |

| XPT | XAU | Zt | -4.00 | Regime | 0 | Non-existent | |

| XPT | XAU | ADF | -3.78 | Regime | 0 | Non-existent | |

| XPT | ECO | Zt | -4.30 | Regime | 0 | Non-existent | |

| XPT | SPGTCLEN | Zt | -4.42 | Regime | 0 | Non-existent | |

| XPT | CEXX | Zt | -4.29 | Regime | 5 | Non-existent | |

| XAG | MAL3 | Zt | -4.69 | Regime | 1 | Non-existent | |

| XAG | HGU3 | ADF | -4.35 | Regime | 1 | Non-existent | |

| XAG | NICKELc1 | Zt | -4.66 | Regime | 0 | Non-existent | |

| XAG | XAU | ADF | -4.40 | Regime | 5 | Non-existent | |

| XAG | XPT | Zt | -3.77 | Regime | 0 | Non-existent | |

| XAG | ECO | Zt | -4.44 | Regime | 1 | Non-existent | |

| XAG | SPGTCLEN | Zt | -4.47 | Regime | 1 | Non-existent | |

| XAG | CEXX | Zt | -4.39 | Regime | 1 | Non-existent | |

| ECO | MAL3 | Zt | -4.68 | Trend | 0 | Non-existent | |

| ECO | HGU3 | Zt | -4.30 | Trend | 1 | Non-existent | |

| ECO | NICKELc1 | Zt | -3.95 | Trend | 1 | Non-existent | |

| ECO | XAU | Zt | -3.83 | Trend | 1 | Non-existent | |

| ECO | XPT | Zt | -3.66 | Trend | 1 | Non-existent | |

| ECO | XAU | Zt | -4.03 | Trend | 1 | Non-existent | |

| ECO | SPGTCLEN | ADF | -3.41 | Trend | 0 | Non-existent | |

| ECO | CEXX | Zt | -3.65 | Trend | 0 | Non-existent | |

| SPGTCLEN | MAL3 | Zt | -3.76 | Trend | 0 | Non-existent | |

| SPGTCLEN | HGU3 | Zt | -3.67 | Trend | 1 | Non-existent | |

| SPGTCLEN | NICKELc1 | Zt | -3.69 | Trend | 1 | Non-existent | |

| SPGTCLEN | XAU | Zt | -3.83 | Trend | 1 | Non-existent | |

| SPGTCLEN | XPT | Zt | -3.39 | Trend | 1 | Non-existent | |

| SPGTCLEN | XAU | Zt | -3.59 | Trend | 1 | Non-existent | |

| SPGTCLEN | ECO | Zt | -3.82 | Trend | 0 | Non-existent | |

| SPGTCLEN | CEXX | Za | -4.28 | Trend | 2 | Non-existent | |

| CEXX | MAL3 | ADF | -5.01** | Trend | 0 | 04/02/2019 | Shocks |

| CEXX | HGU3 | ADF | -5.12** | Trend | 0 | 03/10/2019 | Shocks |

| CEXX | NICKELc1 | Zt | -3.97 | Trend | 1 | Non-existent | |

| CEXX | XAU | Zt | -3.95 | Trend | 1 | Non-existent | |

| CEXX | XPT | Zt | -3.93 | Trend | 1 | Non-existent | |

| CEXX | XAU | Zt | -3.89 | Trend | 1 | Non-existent | |

| CEXX | ECO | ADF | -3.93 | Trend | 0 | Non-existent | |

| CEXX | SPGTCLEN | ADF | -3.72 | Trend | 0 | Non-existent |

| Markets | Test | Stat. | Method | Lags | Break Date | Results |

|---|---|---|---|---|---|---|

| MAL3 | HGU3 | ADF | -3.84 | Regime | 0 | Non-existent | |

| MAL3 | NICKELc1 | Zt | -6.66*** | Trend | 5 | 02/03/2022 | Shocks |

| MAL3 | XAU | Zt | -4.19 | Trend | 5 | Non-existent | |

| MAL3 | XPT | Za | -27.73 | Trend | 0 | Non-existent | |

| MAL3 | XAG | Zt | -3.78 | Trend | 1 | Non-existent | |

| MAL3 | ECO | Zt | -3.58 | Trend | 1 | Non-existent | |

| MAL3 | SPGTCLEN | ADF | -3.49 | Trend | 1 | Non-existent | |

| MAL3 | CEXX | Zt | -3.51 | Trend | 1 | Non-existent | |

| HGU3 | MAL3 | Zt | -4.32 | Regime | 0 | Non-existent | |

| HGU3 | NICKELc1 | Zt | -5.61*** | Trend | 0 | 01/03/2022 | Shocks |

| HGU3 | XAU | Zt | -4.77* | Trend | 0 | 05/02/2021 | Shocks |

| HGU3 | XPT | ADF | -5.04** | Trend | 0 | 20/06/2022 | Shocks |

| HGU3 | XAG | Za | -39.08 | Trend | 0 | Non-existent | |

| HGU3 | ECO | Zt | -4.61 | Trend | 0 | Non-existent | |

| HGU3 | SPGTCLEN | Zt | -4.63 | Trend | 0 | Non-existent | |

| HGU3 | CEXX | Zt | -4.57 | Trend | 1 | Non-existent | |

| NICKELc1 | MAL3 | Zt | -8.14*** | Trend | 0 | 02/03/2022 | Shocks |

| NICKELc1 | HGU3 | Za | -7.04*** | Trend | 0 | 28/02/2022 | Shocks |

| NICKELc1 | XAU | Za | -44.38* | Trend | 0 | 21/01/2022 | Shocks |

| NICKELc1 | XPT | Za | -48.32** | Trend | 0 | 21/01/2022 | Shocks |

| NICKELc1 | XAG | ADF | -5.10** | Trend | 0 | 21/01/2022 | Shocks |

| NICKELc1 | ECO | Zt | -5.19** | Trend | 0 | 21/01/2022 | Shocks |

| NICKELc1 | SPGTCLEN | Zt | -5.23** | Trend | 0 | 21/01/2022 | Shocks |

| NICKELc1 | CEXX | Zt | -5.40** | Trend | 0 | 21/01/2022 | Shocks |

| XAU | MAL3 | Zt | -4.04 | Trend | 1 | Non-existent | |

| XAU | HGU3 | Zt | -5.01** | Trend | 1 | 05/02/2021 | Shocks |

| XAU | NICKELc1 | Zt | -3.55 | Trend | 0 | Non-existent | |

| XAU | XPT | Zt | -3.56 | Trend | 0 | Non-existent | |

| XAU | XAG | Zt | -4.03 | Trend | 0 | Non-existent | |

| XAU | ECO | Zt | -3.95 | Trend | 1 | Non-existent | |

| XAU | SPGTCLEN | Zt | -3.97 | Trend | 1 | Non-existent | |

| XAU | CEXX | Zt | -4.35 | Trend | 1 | Non-existent | |

| XPT | MAL3 | Zt | -4.36 | Trend | 2 | Non-existent | |

| XPT | HGU3 | Zt | -4.75* | Trend | 0 | 13/07/2021 | Shocks |

| XPT | NICKELc1 | ADF | -4.15 | Trend | 1 | Non-existent | |

| XPT | XAU | Zt | -4.31 | Trend | 2 | Non-existent | |

| XPT | XAG | ADF | -4.83 | Regime | 2 | 22/12/2020 | Shocks |

| XPT | ECO | Zt | -4.32 | Trend | 0 | Non-existent | |

| XPT | SPGTCLEN | Zt | -3.90 | Regime | 0 | Non-existent | |

| XPT | CEXX | Zt | -4.35 | Trend | 0 | Non-existent | |

| XAG | MAL3 | Zt | -3.61 | Regime | 0 | Non-existent | |

| XAG | HGU3 | ADF | -4.41 | Regime | 0 | Non-existent | |

| XAG | NICKELc1 | Zt | -4.42 | Trend | 0 | Non-existent | |

| XAG | XAU | Zt | -4.28 | Trend | 0 | Non-existent | |

| XAG | XPT | Zt | -4.51 | Trend | 0 | Non-existent | |

| XAG | ECO | Zt | -4.28 | Trend | 0 | Non-existent | |

| XAG | SPGTCLEN | Zt | -4.21 | Trend | 0 | Non-existent | |

| XAG | CEXX | Zt | -4.40 | Trend | 0 | Non-existent | |

| ECO | MAL3 | Zt | -4.21 | Trend | 2 | Non-existent | |

| ECO | HGU3 | Zt | -3.83 | Trend | 2 | Non-existent | |

| ECO | NICKELc1 | Zt | -4.77* | Regime | 0 | 23/02/2021 | Shocks |

| ECO | XAU | Zt | -4.37 | Trend | 2 | Non-existent | |

| ECO | XPT | Zt | -4.16 | Trend | 2 | Non-existent | |

| ECO | XAG | Zt | -4.61 | Trend | 2 | Non-existent | |

| ECO | SPGTCLEN | Zt | -4.33 | Trend | 4 | Non-existent | |

| ECO | CEXX | Zt | -4.39 | Trend | 0 | Non-existent | |

| SPGTCLEN | MAL3 | Zt | -4.60 | Trend | 2 | Non-existent | |

| SPGTCLEN | HGU3 | Zt | -5.91*** | Regime | 5 | 25/02/2021 | Shocks |

| SPGTCLEN | NICKELc1 | Zt | -6.20*** | Regime | 2 | 24/02/2021 | Shocks |

| SPGTCLEN | XAU | Zt | -3.50 | Regime | 1 | Non-existent | |

| SPGTCLEN | XPT | Zt | -4.66 | Regime | 2 | Non-existent | |

| SPGTCLEN | XAG | Zt | -3.64 | Regime | 2 | Non-existent | |

| SPGTCLEN | ECO | Zt | -5.86*** | Regime | 1 | 11/02/2021 | Shocks |

| SPGTCLEN | CEXX | Za | -41.10 | Regime | 0 | Non-existent | |

| CEXX | MAL3 | Zt | -4.10 | Trend | 3 | Non-existent | |

| CEXX | HGU3 | Zt | -3.94 | Trend | 0 | Non-existent | |

| CEXX | NICKELc1 | Zt | -4.21 | Trend | 0 | Non-existent | |

| CEXX | XAU | Zt | -4.20 | Trend | 0 | Non-existent | |

| CEXX | XPT | Zt | -4.03 | Trend | 0 | Non-existent | |

| CEXX | XAG | Zt | -4.26 | Trend | 0 | Non-existent | |

| CEXX | ECO | Zt | -4.45 | Trend | 0 | Non-existent |

| Market | Tranquil Subperiod | Stress Subperiod | Evolution |

|---|---|---|---|

| SPGTCLEN | 0 / 8 possibilities | 3 / 8 possibilities | ↑ |

| CEXX | 2 / 8 possibilities | 0 / 8 possibilities | ↓ |

| ECO | 0 / 8 possibilities | 1 / 8 possibilities | ↑ |

| XAU | 1 / 8 possibilities | 1 / 8 possibilities | = |

| XAG | 0 / 8 possibilities | 0 / 8 possibilities | = |

| XPT | 2 / 8 possibilities | 2 / 8 possibilities | = |

| MAL3 | 8 / 8 possibilities | 1 / 8 possibilities | ↓ |

| NICKELc1 | 0 / 8 possibilities | 8 / 8 possibilities | ↑ |

| HGU3 | 4 / 8 possibilities | 3 / 8 possibilities | ↓ |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).