1. Introduction

Although there are important differences, the terms environmental, social, and governance (ESG), socially responsible investing (SRI), and impact investing are often used interchangeably. Besides typical financial indicators, ESG considers the company’s ESG activities (Zhou. M., 2019). Additionally, SRI entails selecting or rejecting assets based on certain ethical standards (Zhou. M., 2019). The SRI concept or Responsible Investment (RI) has emerged to be highly relevant among numerous investors in recent decades and gained increasing attention within academic literature (Derwall et al., 2011; Sievanen et al., 2013). As stated by the European Social Investment Forum (Eurosif, 2016), SRI can be comprehended as a long-term-oriented method for investment that targets to integrate ESG factors into decisions concerning investments. In the economics literature, corporate social responsibility (CSR) criteria is another commonly used term for ESG factors (Liang, H., & Renneboog, L. 2020; Gillan, S. L. et al., 2021). The Principles for Responsible Investment (PRI) (2015) outlined that ESG investment is an approach that focuses on improved risk management and better sustainability in long-term returns. An increasing number of investors are attempting organisations to act responsibly besides only delivering financial returns.

The bibliometric analytical technique (Gao, S. et al., 2021; Arslam, H. M., 2022; Baisenbina, M., 2022; Bosi, M. K. et al., 2022; Ellili, N. O. D., 2022; Galetta, S. et al., 2022; Lou, W., 2022; Khan, M. A., 2022; Passas, I. et al., 2022; Rodriguez-Rojas et al., 2022; Senadheera, S. et al., 2022) utilised in the present paper is proposed to examine the research on ESG. Galetta, S. et al. (2022) conducted a bibliometric analysis on 271 publications retrieved from the Web of Science (WOS) to examine intellectual development, authors’ characteristics, and ESG-related manuscripts in the banking industry and assess research trends. Nevertheless, the bibliometric analysis conducted only included publications that dealt with ESG performance within the banking sector. Bosi, M. K. et al. (2022) only examined publications that discussed ESG performance, specifically in the banking industry, using bibliometric analysis. In contrast, Khan, M. A. (2022) and Ellili, N. O. D. (2022) conducted bibliometric analyses that focused on publications about ESG disclosure and firm performance. Passas I. et al. (2022) analysed 228 publications related to ESG controversies by using bibliometric analysis to examine the key characteristics and ESG controversy trends in the European market. Gao S. et al. (2021) used various bibliographic approaches, including co-occurrence analysis and bibliographic coupling, to ascertain the publishing trend of ESG research from 1980 to 2020. The authors used SCOPUS data from 314 publications that included ESG-related material, although the field is vast in reality. There is a conspicuous absence of literature reviews that have endeavoured to investigate the burgeoning realm of ESG without imposing excessively restrictive constraints. For instance, Gao. S. et al.’s (2021) review evinces that overly rigorous criteria are employed to cull the corpus of literature for review to a practicable extent.

Thus, the present study considerably expands on Gao. S. et al.’s (2021) study by eliciting insights that they were unable to offer due to the intrinsic restriction of keywords chosen, which reduced the number of results available for their analysis. The present study also expanded Widyawati, L.’s (2020) study by evaluating ESG, SRI, ethical and impact investing publication data from 2013 to 2022 by utilising bibliometric analysis as opposed to systematic literature reviews. The bibliometric analysis, through visualisation and quantitative bibliometric tools, is viewed as complementary to the qualitative systematic literature review as it paints a picture of the state of the art in a specific research line (Liao et al., 2018). According to Gao Y. et al. (2019), bibliometrics is attractive as it enables researchers to examine particular research topics by analysing citations, co-citations, geographical distribution, and word frequency. It assists in drawing insightful conclusions, including the most prominent institutions, noteworthy authors, and influential journals. It offers a visual on knowledge development, the latest trends in research, and future directions regarding the topic.

The aim of the study was to conduct a bibliometric analysis on all publications related to ESG, SRI, ethical, and impact investing on SCOPUS. Bibliometric analysis, which is a quantitative review technique known for its objectivity and effectiveness, was employed due to its suitability in analysing fields with a large corpus of articles (Pattnaik et al., 2020; Donthu et al., 2021; Paul et al., 2021). A comprehensive examination of research progress could provide a meticulous assessment of various scientific aspects inherent in ESG, SRI, and ethical and impact investing in this context. Among the parameters utilised are the document type (all), publication language (English), and subject areas (accounting, business, economics, econometrics, finance, management, and social science). The study also examines the author, the publication models, thematic category distribution, the author’s keywords distribution, publication country and most frequently cited articles. The diverse rankings of bibliometric analysis emphasise the multidimensional nature of the scientific impact. Moreover, this type of analysis provides a notable illustration of how big data analytics and machine learning can be effectively utilised to facilitate academic research in two crucial ways:

- (1)

The search for big data through bibliometric analysis is conducted on SCOPUS, an AI-powered scientific database. The database employs specified keywords for supervised machine learning, a subset of AI, to obtain extensive bibliometric data on articles related to ESG, SRI, and ethical and impact investing.

- (2)

Bibliometric analysis, as a form of big data analysis, is characterised by its multifaceted nature, which includes various dimensions such as keywords, authorship, journal, institution, and country. The analysis also involves different formats, such as words and numbers, and it deals with a large-scale dataset comprising thousands of data points across multiple facets of 1319 articles. To uncover latent relationships and major themes, unsupervised machine learning techniques, which is a subset of artificial intelligence, are utilised to analyse the data.

Thus, this study attempted to synthesise literature related to the influence of ESG, SRI, and ethical and impact investing on financial and portfolio performance to determine the latest trends, key themes, authors, and influential journals in recent years. In response to recent demands for more comprehensive research on this subject, this study seeks to take a broader approach and answer the following three research questions:

- RQ1.

What are the most influential aspects of the influence of ESG, SRI, ethical and impact investing on financial and portfolio performance literature?

- RQ1.

What are the major patterns and core themes in this topic?

- RQ1.

What lessons can be drawn from the past literature to plan for the future, and what future agendas can be set?

In various respects, the study strengthens current research in ESG, SRI, ethical and impact investing, and business literature. Initially, big data technology termed bibliometric analysis was utilised to offer a comprehensive synthesis of this fragmented literature. Additionally, the study emphasises significant milestones in this field of study, such as notable publications, authors, journals, and institutions. This analysis also recognises the prevailing research trends and themes in the discipline. Finally, the research offers managers, policymakers, and regulators recommendations for the impact of ESG, SRI, and ethical and impact investing on financial and portfolio performance. Lastly, the study suggests ways for researchers to broaden the scope of their research.

The article is structured as follows:

Section 2 presents the materials and methods used in the study.

Section 3 investigates the significant attributes of the research. Subsequently,

Section 4 discusses the conceptual framework of the study.

Section 5 provides an analysis of the findings, while

Section 6 presents a summary of the study.

2. Materials and Methods

2.1. Five Steps of Bibliometric Analysis

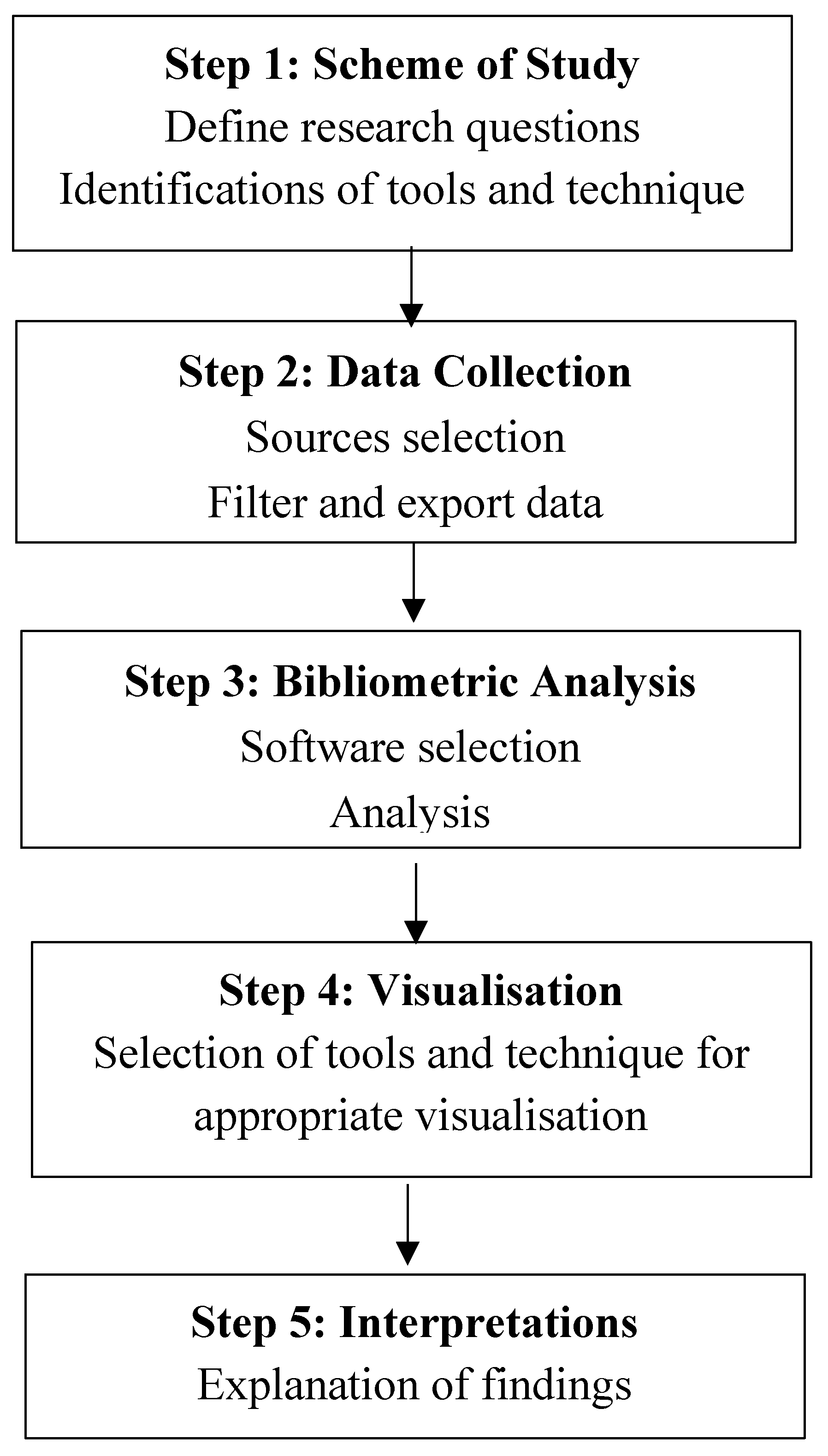

This article follows a bibliometric workflow, which is a five-step method proposed by Silvente et al. (2019).

Figure 1 depicts the five phases of the bibliometric study. This research was conducted using an objective and dependable approach to cover three levels of analysis: sources, authors, and documents. Initially, the research concentrated on determining the relevance of issues associated with each level. In this context, relevance has been defined as the most productive or referenced item, depending on the unit of analysis. Second, knowledge structures were determined using various bibliometric methodologies. Specifically, conceptual structures were examined in terms of major topics and trends, intellectual structures regarding how individual works affect the scientific community, and social structures concerning author-country cooperation. The study was conducted using the bibliometric R-Tool (Aria & Cuccurullo, 2017). The recently released R package enables a highly comprehensive bibliometric analysis through utilising specialised tools for bibliometric and scientometric quantitative research.

In this context, R is one of the most powerful and versatile statistical software environments available, offering a path to involvement through open source. Thus, R is a collection of integrated software programmes for data processing, computation, and visualisation. In the case of bibliometrics, connecting it with other pertinent software packages is feasible. For example, the ‘biblioshiny’ package in RStudio is utilised to enhance the paper’s content analysis. The processes adopted to conduct the bibliometric analysis included data collecting and descriptive and bibliometric analysis by level.

2.2. Scheme of Study

Numerous concerns posed by the present global environment have to be addressed. The present study attempts to address RQ1 (What are the most influential aspects of the influence of ESG, SRI, ethical and impact investing on financial and portfolio performance literature?) by conducting a descriptive analysis and identifying key sources, publications, authors, countries, and affiliations within the relevant publications. Net publications (NP) per year, total citations, and source influence were used for authors and core sources. In order to categorise the primary sources, Bradford’s Law was employed to divide the sources into three zones. Area 1, or the nuclear zone, is the most active zone, followed by Zone 2, which is moderately active. Subsequently, compared to Zone 1 and Zone 2, Zone 3 is barely productive (Viju & Ganesh, 2013). The study suggests the top countries and affiliations according to the frequency of publications and total citations.

To address RQ 2, co-occurrence maps, thematic maps, and thematic evolution were utilised to detect significant patterns and topics within the literature. The authors’ keywords and system-generated keywords (known as “keywords plus”) from the chosen works were employed to recognise research streams and themes within the bibliometric tool called “biblioshiny,” which is provided by the R-programme. The keywords given by the author in an article indicate the study’s important content. The co-occurrence and intensity analysis of keywords in a research area allows for the discovery of research hotspots and frontiers. The affinity of certain phrases appearing together to suggest the field’s conceptual structure is shown by keyword co-occurrence analysis. The clustering analysis of keywords produces a map that represents the network of interrelationships between the phrases (Zupic & Cater, 2015). The study’s future research plan is developed on the findings for RQ3.

2.3. Objectives, Tools, and Technique

The aim of this study is to conduct a bibliometric analysis of ESG, SRI, ethical, impact, and performance investing, utilising the web-specific R package ‘biblioshiny’ (also known as ‘bibliometrix 3.0’). The primary objective is to use descriptive analysis to identify the most significant factors by utilising various research tools accessible through the biblioshiny GUI, including Bradford’s Law, global citation, h-index, g-index, and m-index. The second objective is to determine the primary sources and themes of the study, which will be accomplished through the scientific mapping approaches of conceptual structure and authors’ keywords and keywords plus, using them as input data. Once goals 1 and 2 were addressed, the study offered a brief interpretation and recommended future study priorities.

2.4. Composing of Bibliometric Data

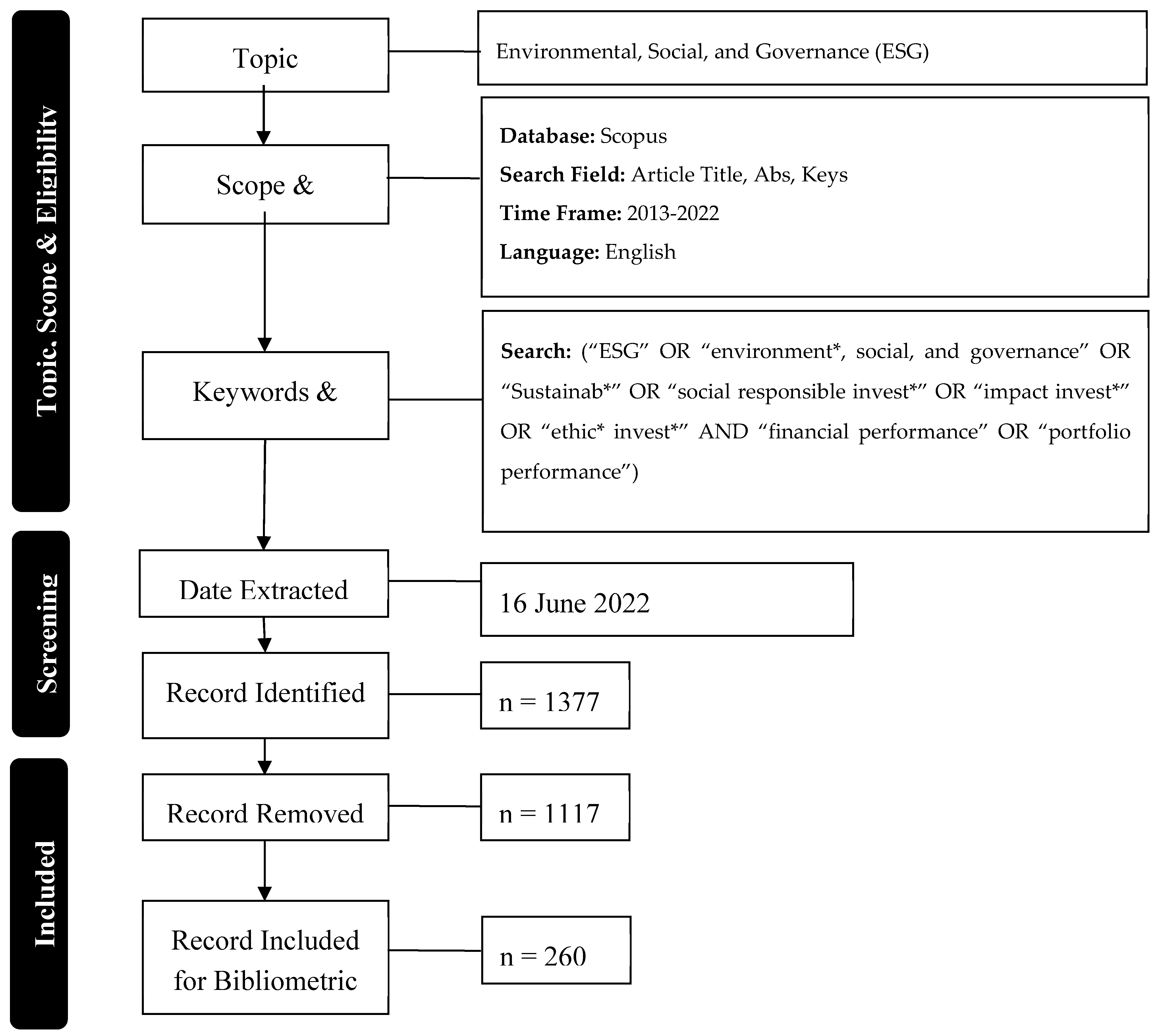

This analysis chose to utilise one database, SCOPUS, which is a larger database than WOS. The additional coverage is beneficial for mapping smaller research topics implicitly covered by the former (Zupic et al., 2015). In order to choose which papers to include in the study, the procedures involved in data synthesis must be identified. As per previous prior bibliometric studies (Arslam, H. M., 2022; Bosi, M. K. et al., 2022; Ellili, N. O. D., 2022; Gao, S. et al., 2021; Passas, I. et al., 2022; Khan, M. A., 2022; Senadheera, S. et al., 2022), the SCOPUS database was employed to choose the related literature. The final search query is (TITLE ABS-KEY (“ESG” OR “environment*, social, and governance” OR “Sustainab*” OR “social responsible invest*” OR “impact invest*” OR “ethic* invest*” AND “financial performance” OR “portfolio performance”). On 31st March 2023, the search was performed on the SCOPUS database. During the initial search, 1377 publications were found that appeared to be related to the topic being studied. After reviewing the initial 1377 publications, 1117 of them were removed because they did not meet certain criteria or were duplicates, leaving a total of 260 publications. According to studies that have analysed the linked subject, the most relevant publications on the topic, which was chosen, include 260 from 159 sources from 2013 to 2022. Since the focus of this article is to assess the latest trend of ESG, SRI, and ethical and impact investing research, the time span was limited to the previous ten years. The discipline category is confined to accounting, business, economics, econometrics, finance, management, and social sciences.

The subsequent stage was to analyse the indications in the data after cleansing the data from the literature. In bibliometric analysis, performance evaluation, and scientific mapping, two main types of indicators (Durieux & Gevenois, 2010) are commonly utilised in the literature. The number of citations and publications are used to assess productivity and impact in performance analysis. The objective of scientific mapping is to represent information from the literature in a clear and visual manner that highlights the research dynamics and structure of the field.

Figure 2.

Flow Diagram of the Search Strategy; Source: Zakaria et al. (2020).

Figure 2.

Flow Diagram of the Search Strategy; Source: Zakaria et al. (2020).

2.4. Bibliometric Analysis and Visualisation

Biblioshiny is an R-programme designed for individuals without coding experience, which offers comprehensive scientometric and bibliometric analysis options that are categorised into sources, records, authors, and conceptual, social, and intellectual structures (Moral-Munoz et al., 2020). The descriptions of the datasets are supplied in bibliometric style to help clarify the knowledge structure of the research linked to ESG, SRI, and ethical and impact investments. All linked articles that matched the search query were assessed using the criteria listed in

Table 1. From 2013 to 2022,

Table 1 covers 260 chosen papers from 159 publications, with 262 keywords plus and 704 authors’ keywords. The average number of citations per document is 26.55. On average, each document in the dataset has been cited about 27 times by other scholarly works. This indicates that the documents in the dataset are fairly well-cited and have likely had some impact in the scholarly community. The average number of citations per year per document is 5.392. This means that, on average, each document in the dataset has received about 5 citations per year since it was published. This metric provides a sense of how frequently the documents in the dataset have been cited over time, and suggests that they continue to be relevant and influential in the field. The dataset includes 14,731 references, which indicates that the documents draw on a wide range of prior research and scholarship in the field. The dataset contains a total of 624 different authors, who collectively appear 685 times as authors or co-authors of the documents in the dataset. This means that there are 624 unique authors who have contributed to the documents in the dataset, and some of them have contributed to multiple documents. This indicates that there is a relatively diverse set of contributors to the field, with many individuals contributing to multiple documents. The collaboration index is 2.81, indicating that, on average, documents in the dataset have just under three co-authors. Overall, these findings suggest that the dataset is a diverse and well-cited collection of research on the topic of interest.

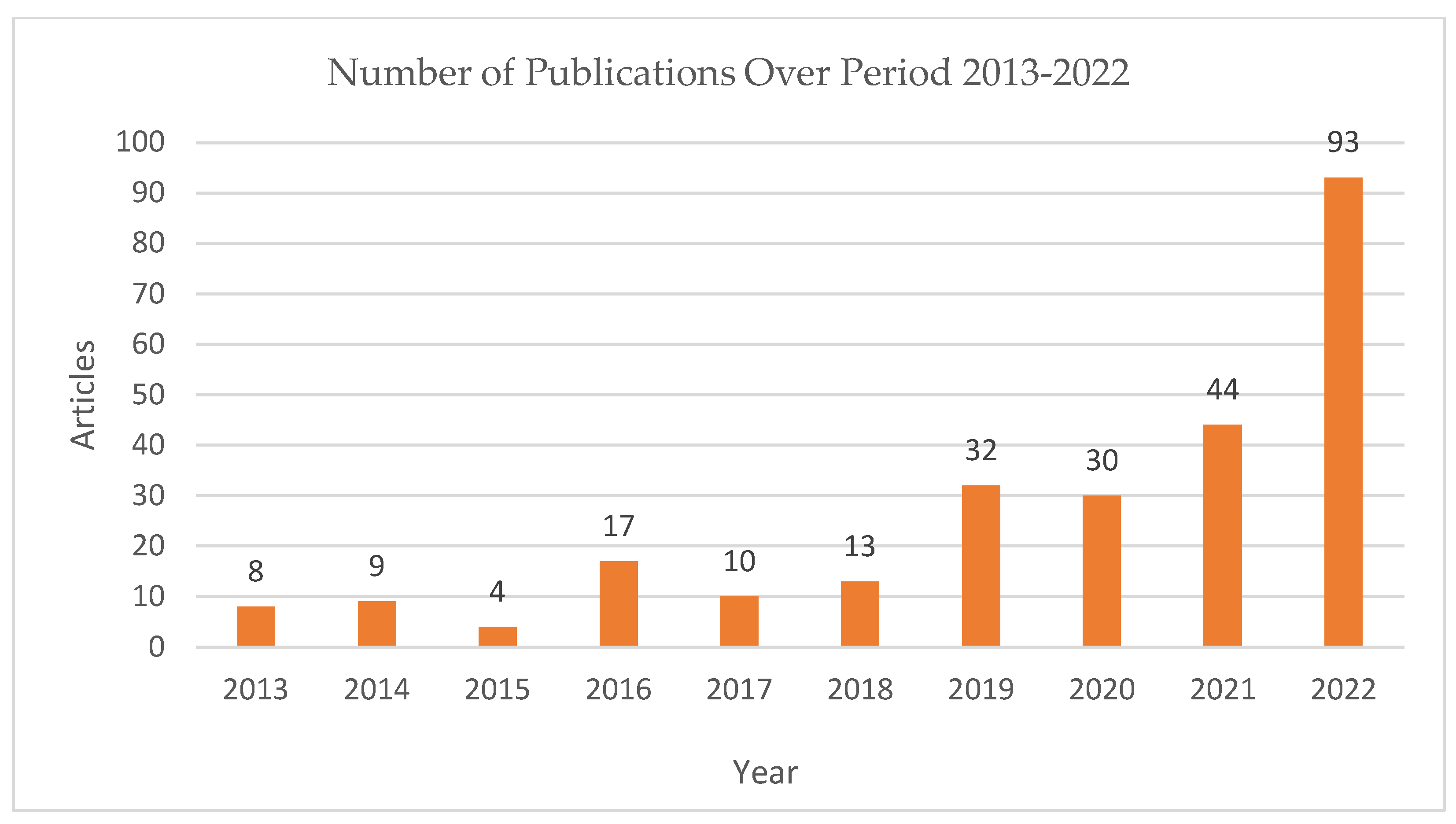

Figure 3 depicts the yearly output of ESG, SRI, ethical and impact investing and performance publications. From 2013 to 2014, the publishing of publications was significantly low among our chosen research. Nevertheless, an increase in articles published on the subject in 2016 has witnessed an increase.

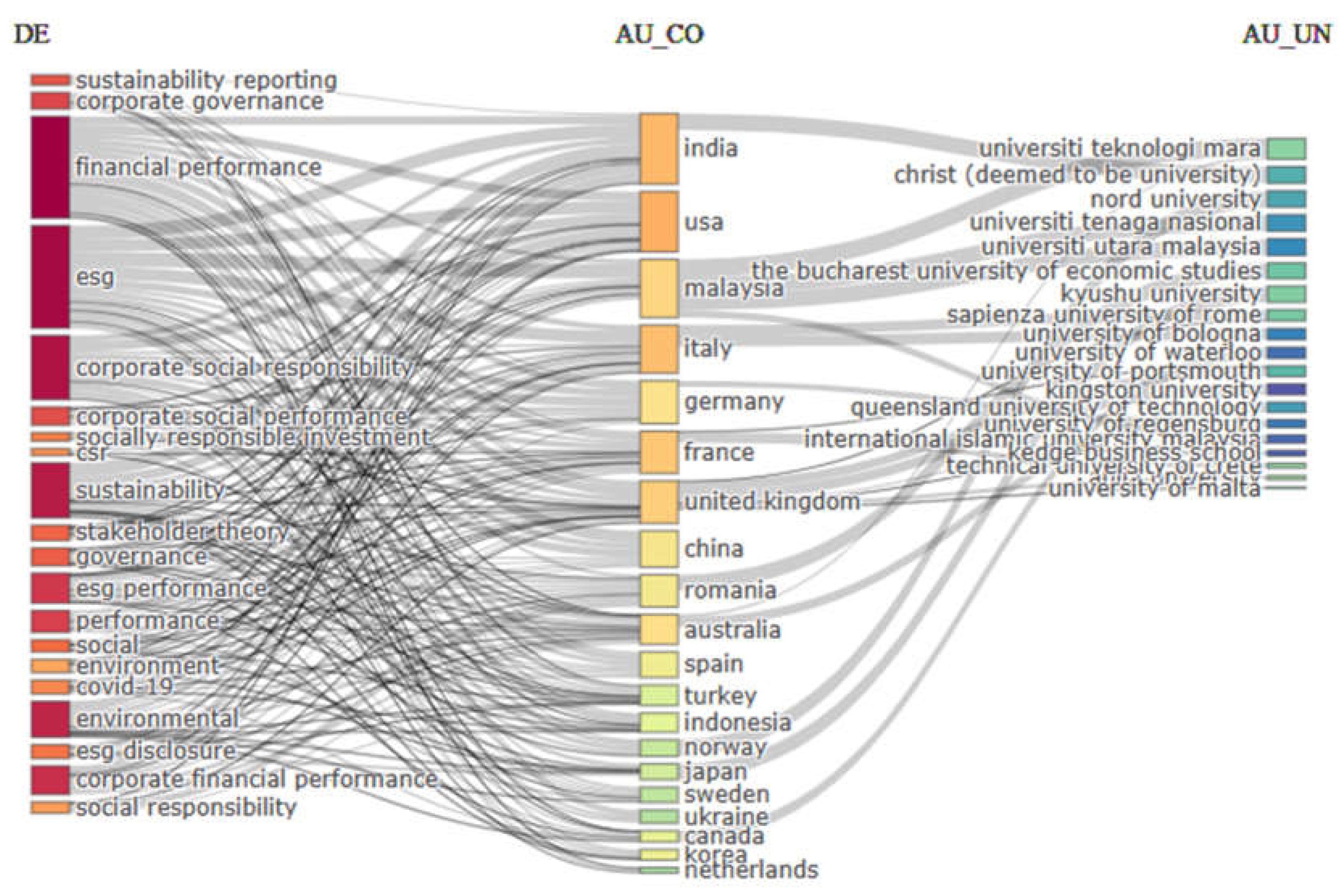

Figure 4 depicts a three-field (from left to right, keywords, nations, and their affiliation) examination of research on the link between financial and portfolio performance and ESG, SRI, impact investing, and ethical investing. In this literature, the most notable affiliations are the India, United States (USA), Malaysia, Italy, Germany, and France. Financial performance is the most used keyword (for example, corporate financial performance (CFP), CSR, financial performance, firm performance, sustainability, and sustainable development). As the universities from Malaysia and India are the most contributing affiliations, such as Universiti Teknologi Mara, Christ - Deemed to be University followed by others most contributing affiliations, such as the Nord University, Universiti Tenaga Nasional, Universiti Utara Malaysia, and the Bucharest University of Economic Studies.

3. Influential Aspects of ESG, SRI, Impact Investing, and Ethical Investing

3.1. Core Journals

The source impact and Bradford Law were employed to identify the most important journals that publish ESG, SRI, ethical investing, impact investing, and performance literature. According to

Table 3, the Bradford rule categorises the journal into three zones. Zone 1, also known as a nuclear zone, is immensely valuable. Opposed to Zone 1, Zone 2 is slightly more productive. According to Bradford’s rule in Zone 1, the top-ranked journal is Sustainability (Switzerland), which has published 215 articles on ESG, SRI, impact investing, and ethical investing. Table A1 in Appendix A displays the ranks of publications based on the h-index, m-index, and g-index, total citations, net publications (NP), and the publication year (PY start). Additionally, top affiliations are indicated based on the frequency of publication and citations.

Table 2.

Journal Rankings.

Table 2.

Journal Rankings.

| Sources |

Rank |

Freq |

cumFreq |

Zone |

| Business Strategy and The Environment |

1 |

11 |

11 |

Zone 1 |

| Journal of Cleaner Production |

2 |

8 |

19 |

Zone 1 |

| Journal of Sustainable Finance and Investment |

3 |

8 |

27 |

Zone 1 |

| Journal of Business Ethics |

4 |

7 |

34 |

Zone 1 |

| Social Responsibility Journal |

5 |

6 |

40 |

Zone 1 |

| Corporate Social Responsibility and Environmental Management |

6 |

5 |

45 |

Zone 1 |

| Critical Studies on Corporate Responsibility, Governance and Sustainability |

7 |

5 |

50 |

Zone 1 |

| Borsa Istanbul Review |

8 |

4 |

54 |

Zone 1 |

| Finance Research Letters |

9 |

4 |

58 |

Zone 1 |

| Journal of Asset Management |

10 |

4 |

62 |

Zone 1 |

| Journal of Business Research |

11 |

4 |

66 |

Zone 1 |

| Journal of Global Responsibility |

12 |

4 |

70 |

Zone 1 |

| Australasian Accounting, Business and Finance Journal |

13 |

3 |

73 |

Zone 1 |

| Business Strategy and Development |

14 |

3 |

76 |

Zone 1 |

| Environmental, Development and Sustainability |

15 |

3 |

79 |

Zone 1 |

| Journal of Business Economics and Management |

16 |

3 |

82 |

Zone 1 |

| Journal of Portfolio Management |

17 |

3 |

85 |

Zone 1 |

| Review of Financial Economics |

18 |

3 |

88 |

Zone 1 |

| Accounting and Finance |

19 |

2 |

90 |

Zone 2 |

| Accounting Research Journal |

20 |

2 |

92 |

Zone 2 |

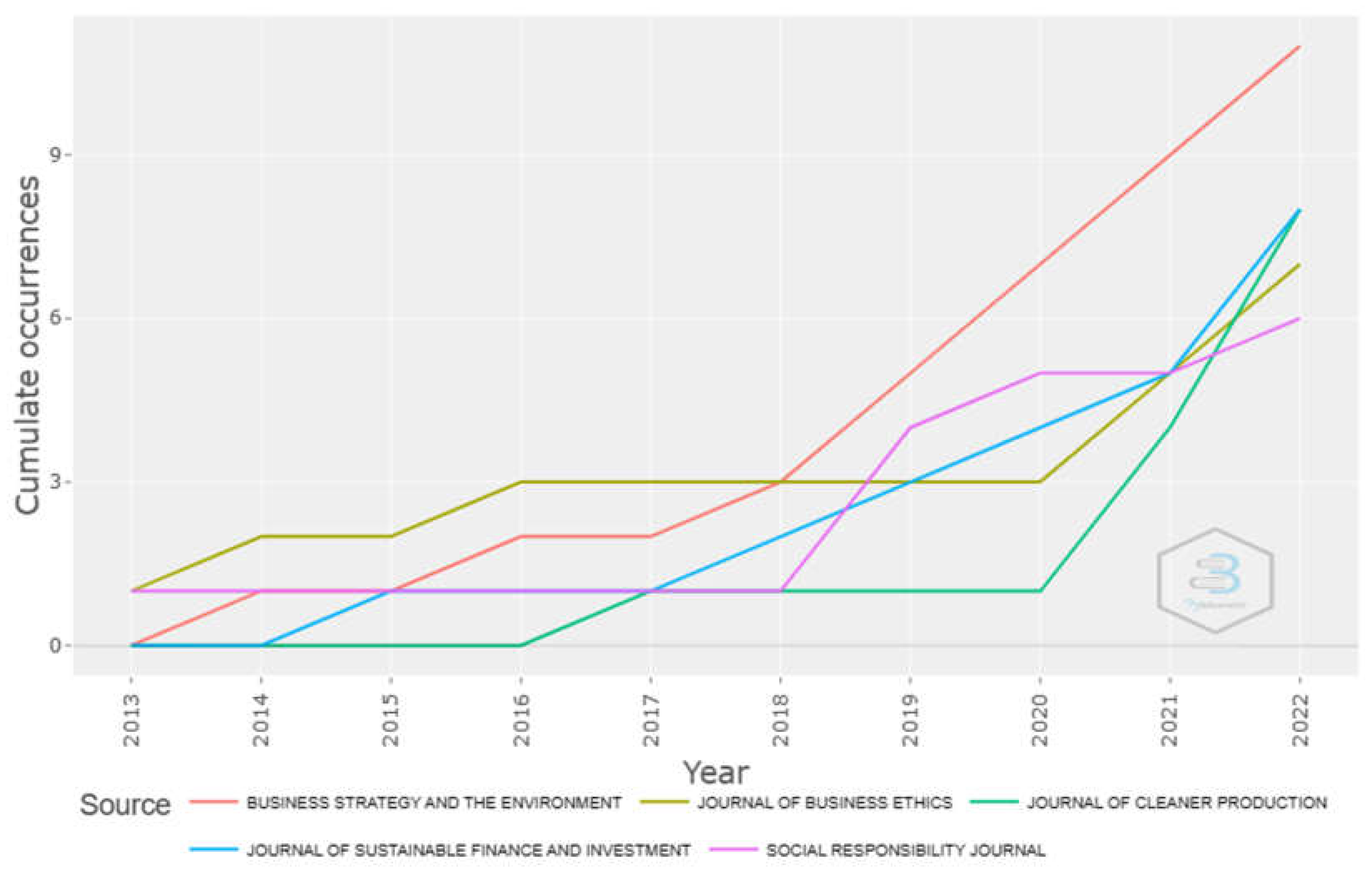

Figure 5 depicts the increase in publishing by leading journals. A downward trend was observed between 2013 and 2015. A significant surge in publications linked to ESG, SRI, impact investment, and ethical investing has been shown since 2016. After 2016, there was an increase in the number of articles in the journals of Sustainability, Journal of Cleaner Production, and Business Strategy and Environment.

3.2. Core Journal Articles

This section highlights the top articles in ESG, SRI, ethical investing, impact investing, and performance journals. Table A2 in Appendix A lists the top ten most-cited articles on the subject globally. In the first research, Saeidi. S. P et al. (2015) published the most referenced paper with 640 citations. They explored the direct association between CSR and business performance and three likely mediators in the relationship between CSR and firm performance. They discovered that CSR has a positive influence on business performance since it improves competitive advantage, reputation, and customer happiness. These data imply that CSR might indirectly promote corporate performance by strengthening reputation and competitive advantage while increasing consumer satisfaction. The meta-analysis on ESG criteria and CFP is the second most significant article on the list, with 478 citations. Friede et al. (2015) conducted a meta-analysis of over 2000 empirical research on ESG parameters and CFP. The results demonstrate that the business case for ESG investment is empirically sound. Around 90% of research discover a non-negative ESG-CFP relationship. Most significantly, the majority of research indicates good results. Similarly, significant additional research is given in Table A2 of Appendix A.

3.3. Core Words

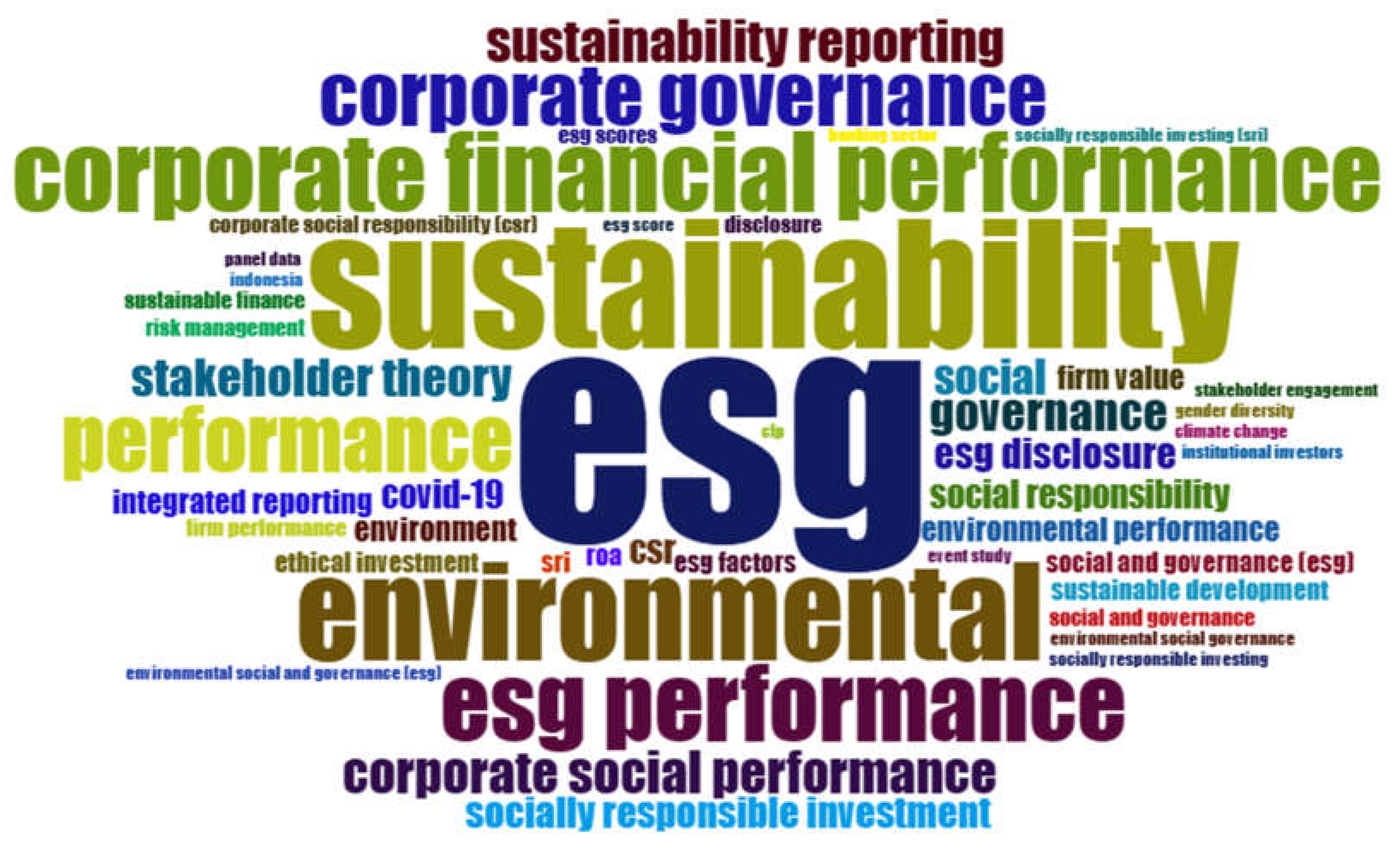

The most used terms in ESG, SRI, impact investing, and ethical investing literature is stated in

Table 3. The authors’ most frequent keywords include financial performance, ESG, Corporate Social Responsibilityand Sustainability, having the highest occurrence of 70 times.

Table 3.

Most Frequent Words.

Table 3.

Most Frequent Words.

| Author’s Keywords |

Occurrences |

| Financial Performance |

70 |

| ESG |

63 |

| Corporate Social Responsibility |

44 |

| Sustainability |

37 |

| Environmental |

28 |

| Corporate Financial Performance |

23 |

| ESG Performance |

22 |

| Performance |

19 |

| Corporate Governance |

18 |

| Corporate Social Performance |

12 |

| Sustainability Reporting |

12 |

| Governance |

11 |

| Stakeholder Theory |

11 |

| Social |

10 |

| ESG Disclosure |

9 |

| Socially Responsible Investment |

9 |

| Covid-19 |

8 |

| CSR |

8 |

| Social Responsibility |

8 |

| Environment |

7 |

Figure 6 depicts the word cloud created using keyword addition. Words that often recur in the text have greater font sizes. In the literature on ESG, SRI, impact investing, and ethical investing, the terms: financial performance, finance, financial system, and industrial performance appear most often. As a consequence, these terms are the most often used terms, followed by stakeholders, environmental management, governance approach, supply chain management, stakeholders, and profitability.

In addition to the word cloud,

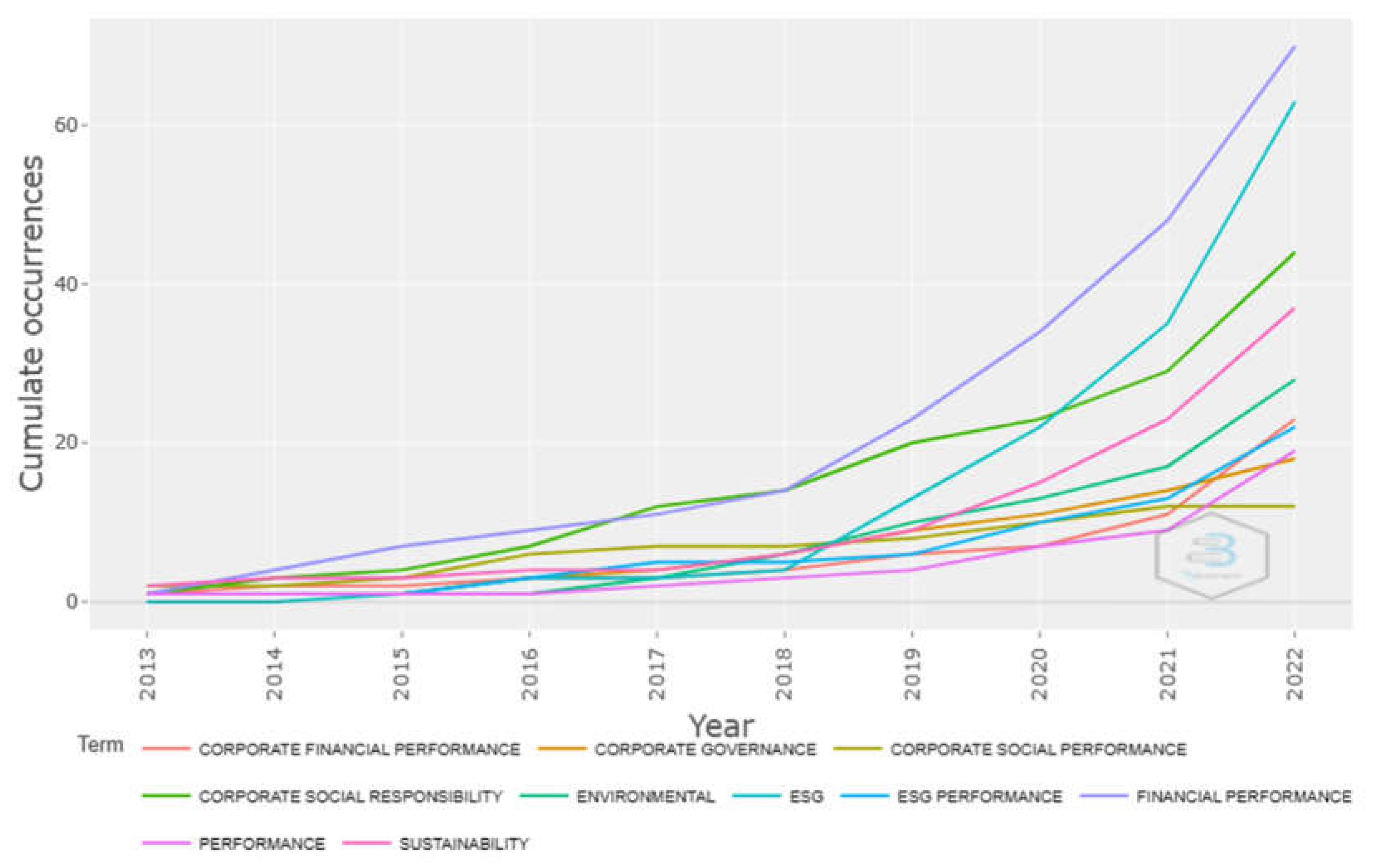

Figure 7 displays the evolution of terms in literature across time. As seen in the graph, the term sustainability started to grow in popularity in 2016. The keyword sustainable development is also on the rise since 2016.

Figure 6 shows how keywords evolve over time using a lowess smoothing approach. There was a significant increase in industry-related issues in 2017.

4. Conceptual Framework

4.1. Co-Occurrence Network

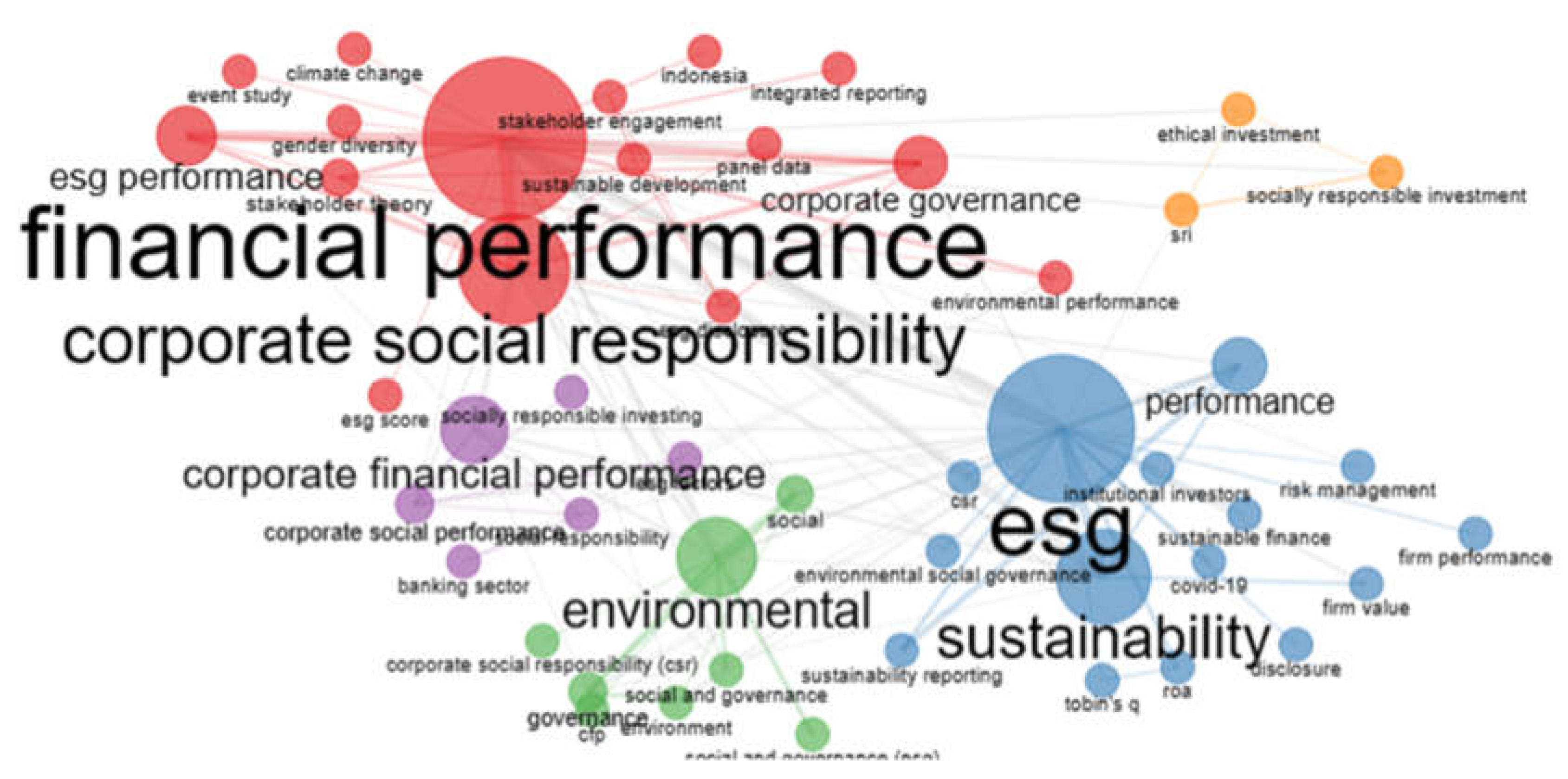

Figure 8 depicts the co-occurrence network of the authors’ terms. The illustration is from the R package ‘biblioshiny’ (‘bibliometrix’). The keyword co-occurrence network exposes three separate streams of ESG, SRI, impact investing, and ethical investing and categorises this literature into three different clusters, green, red, and blue.

The red and purple cluster focuses on the following research areas: the impact of sustainability on firm performance, including environmental performance, social performance, environmental sustainability, and sustainable development. According to the corporate perspective, companies that place a high value on ESG and perform well outperform their rivals in ESG risk management. Besides, organisations that do well in ESG have a long-term and consistent positive association between ESG performance and financial success. In developing countries, ESG investing techniques might provide large excess profits. Numerous studies in this cluster have investigated environmental performance and its impact on European listed firms’ financial performance (Wamba L.D., 2022), Serbia (Hanic A et al., 2021), and China (Cheng H et al., 2021). Friede et al. (2015) reviewed over 2200 relevant papers and discovered that over 2100 empirical studies (particularly company-centric empirical studies) demonstrated a favourable association between ESG and CFP.

The blue cluster’s issues were on ESG, such as ESG reporting, sustainability reporting, integrated reporting, stakeholder engagement, sustainability performance, company value, and governance. The disclosure of environmental, social responsibility and corporate governance (Environment, Social, and Governance, or ESG) information is referred to as ESG disclosure. Businesses have made efforts towards internal improvement by implementing sustainable and socially responsible policies and reporting them in order to stay competitive, as the demands for corporate transparency and accountability for ESG reporting have increased dramatically over the last few decades. In addition to non-financial reporting, corporate sustainability reports (CSR), CSR disclosures (CSRD), and economic, governance, social, ethical, and environmental (EGSEE) reports have all been used to express the idea of ESG reporting (Rezaee, 2016). ESG factors are increasingly a crucial component of many finance providers’ investment decisions. Sustainable investing ideas have already been implemented by several conventional fund managers (Van Duuren et al., 2016). Besides financial performances, ESG performances are one of the important factors that effectively can encourage investors.

The green cluster focuses on the study of CSR, which includes the social, financial, and environmental aspects of company performance and corporate governance. In fact, CSR and ESG vary from one another in a few ways. Accordingly, CSR prioritises the needs of a variety of stakeholders and organisations, and ESG has emerged as a crucial tenet of CSR (Gao S., 2021). Primarily, ESG begins from the viewpoint of capital market investors, concentrating on the connection between corporate social performance and shareholder returns (Gao S., 2021). The ESG application scenarios concentrate on the capital market, particularly between investors and listed firms. In contrast, CSR application scenarios are rather wide and may emerge in sectors including company supply chain management, brand marketing, community communication, and employee management (Gao S., 2021).

4.2. Thematic Map

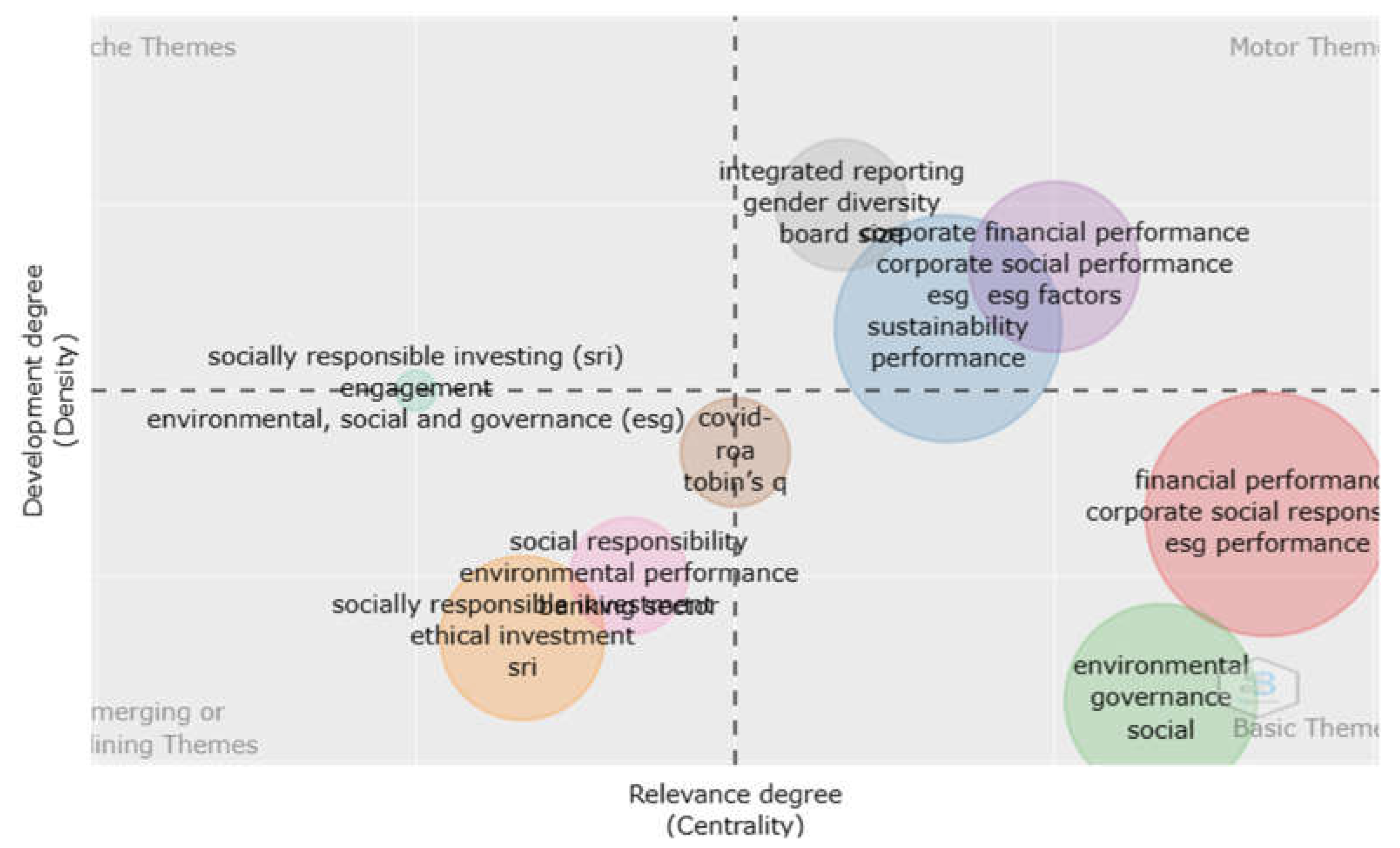

This research has defined a few study topics to help readers comprehend the results. The developed themes can be integrated into a strategic diagram to assess the importance and conception of the study subject.

Figure 9 displays the thematic map based on density (y-axis) and centrality (x-axis). The centrality of the selected theme is a gauge of its importance. In contrast, the density of the selected subject is used to gauge its development. Furthermore, the subject’s relevance within the broader field of inquiry may be inferred from its centrality, and the subject’s development can be gauged from its density. The author’s keywords are those that the original authors gave at the time the text was published. It is possible to draw attention to the many themes within a specific area by using the clustering method on the term network. A strategic or thematic map is a specific plot that may show each cluster or topic.

There are four sections to the graph. Themes that appear in the lower-left corner are those that are emerging or waning. These fresh ideas can emerge and advance the subject of study, or they might disappear. The thematic map’s bottom right corner contains the fundamental or transversal topics. Although having a modest density, these motifs are immensely important. Based on the information provided, the ideas of corporate financial performance, corporate social performance, ESG, and ESG factors are located in the top right corner of the thematic map, which is known as the motor theme. These themes demonstrate how these ideas have developed in ESG, SRI, ethical and impact investing and performance literature. Socially responsible investment (SRI), engagement, and ESG are in the upper left corner of the thematic map called the niche theme, representing the well-developed concepts in the literature on ESG, SRI, and ethical and impact investing and performance. These ideas are featured in this topic’s specialised subject. The terms socially responsible investment, ethical investment, environmental performance, and SRI may be found in the lower-left corner under the heading highly developed topic/emerging or decreasing theme. Financial performance, corpoprate social responsibility, esg performance, environemnetal, social, and governance in sustainability literature are the less developed and basic concepts present in the lower right corner named basic or transversal theme. More study on these topics in the particular situation described by the fundamental theme is required to bring value to this subject. Difficulties that are in a hybrid situation, such as two quadrants, may also be detected. They are social responsible investing, engagement, and ESG, implies a position between niche themes and highly developed topic/emerging or decreasing theme, while, covid, ROA, and tobin’s Q, implies a position between highly developed topic/emerging or decreasing theme and basic theme.

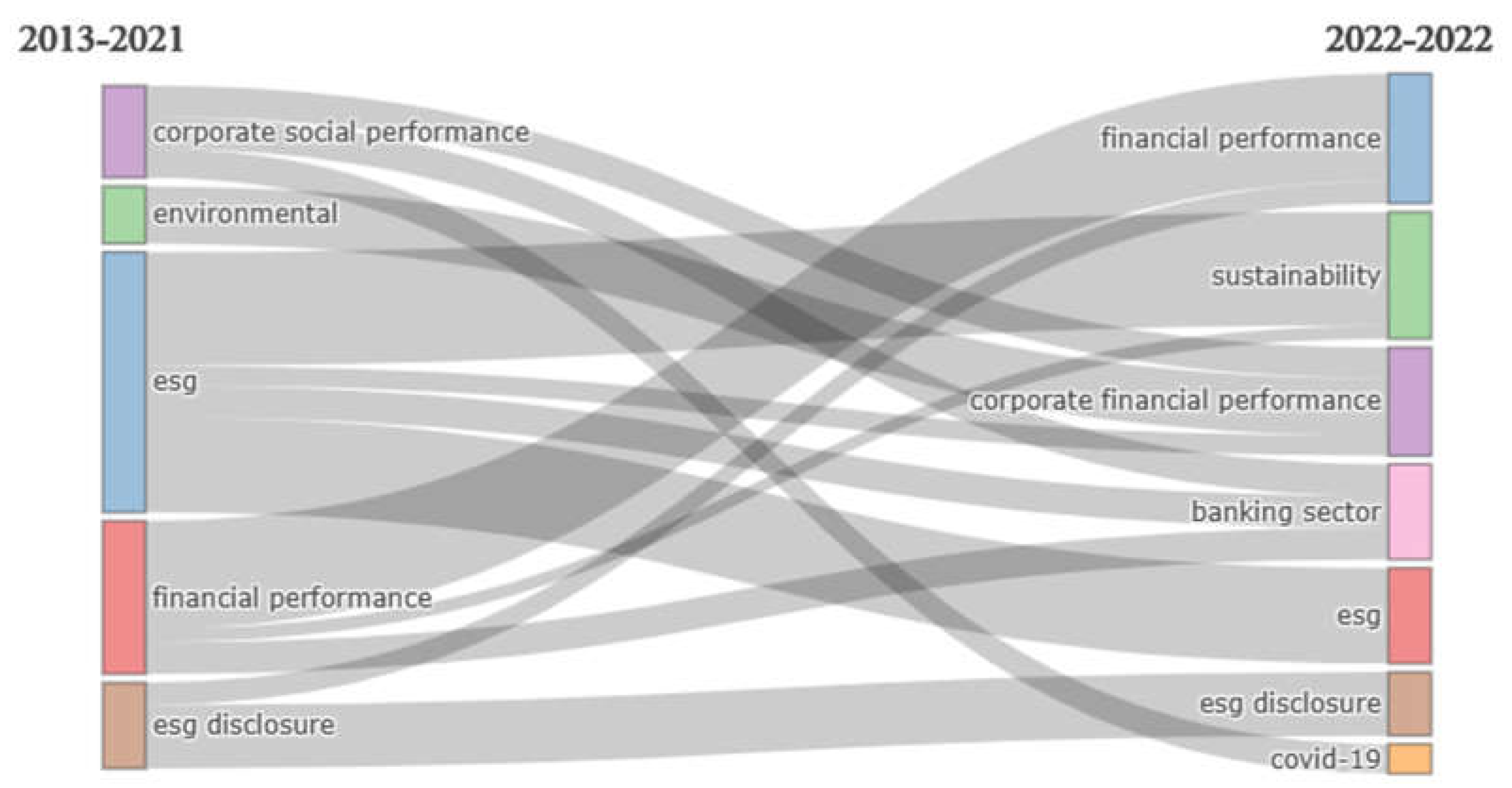

4.3. Thematic Evolution

Thematic evolution (

Figure 10) displays the history of literature through time and the theme diagram. Keywords and thematic evolution are used to show the history and development of themes. Thematic development is accomplished by the usage of ‘biblioshiny’ and the division of thematic evolution into two sections. The first portion ranges from 2013 to 2019. The first phase of this research focused on the impact of sustainability and ESG on financial performance and company financial performance. The performance of sustainability, ESG, and productivity has been given enormous weightage in the final time segment covering 2021 to 2022 in sustainability disclosure literature.

5. Discussions and Future Research Directions

The present study offers numerous insights into ESG, SRI, ethical, impact investing, and performance literature. Initially, in response to the research question, the following influential factors were discovered:

- (1)

The recent years, 2021-2022, had the largest number of publications. The findings suggest that ESG, SRI, ethical investing, impact investing and performance literature remains a potential concern for ESG, SRI, ethical investing, and impact investing scholars seeking additional study contributions.

- (2)

Business Strategy and the Environment, Journal of Cleaner Production, amd Journal of Sustainable Finance and Investment are the primary avenues for publishing additional studies on this topic.

- (3)

The most significant articles on this subject were recognised as Saeidi. S. P et al (2015) and Friede et al (2015). According to Saeidi. S. P et al. (2015), the link between CSR and firm performance is more complicated than prior research has demonstrated. As a result, the neglected sustainable competitive advantage as a result of customer happiness and reputation is thought to be another effective mediator in the relationship. Friede et al. (2015) examined over 2,200 independent studies on the ESG-CFP link. According to the findings, 90% of research reveals a non-negative ESG-CFP relationship. Most significantly, the majority of research indicates good results. The study’s recent citations may help the researchers contribute increasingly advanced research in this area.

- (4)

India is the most active researcher in this subject. Future studies are recommended to undertake further cross-country research using a panel of organisations from high and low-carbon-emitting nations.

Second, the answers to the second research question on the most typical trends in this area bring up new possibilities for future research. The first trend in ESG, SRI, and ethical and impact investing is financial performance, followed by sustainability and CSR. Nonetheless, earlier research has been confined to a particular context, for instance, in the USA (Jeong et al., 2021; Wamba L.D., 2022), China (Cheng H et al., 2019; Zhang, 2022), and Serbia (Hanic A et al., 2021). As a result, it is advised that future studies expand this study in cross-country situations with varying economic and political backgrounds. Finally, the results show that new themes are developing, including SRI, social responsibility, and SRI. Recently, much research has been conducted on ESG and intellectual capital. Future studies will add to these rising cross-national issues and novel research designs.

This study has several drawbacks compared to other academic works. Originally, only the SCOPUS database was used for the study’s data. In the future, bibliographic information may be extracted from other databases, such as WOS. Second, the results often include comparable duplicate data, such as the same keyword used in both the single and plural or the usage of hyphens within one compound word, which rather compromises the validity of the findings. Future researchers are advised to use a variety of retrieval techniques, including more relevant searches. Furthermore, future studies might create networks of term co-occurrence and bibliographical coupling with looser threshold settings to find additional connections between discovered sub-themes. As a result, additional prospective areas of research might be investigated by connecting pertinent subtopics or using other grouping strategies in the literature.

6. Conclusions

The major goal of this research is to emphasise the contributions made by academics in the fields of ESG, SRI, ethical investing, and impact investing. This research has specifically highlighted the significant factors, current trends, and major topics using bibliometric analysis of 262 papers from 2013 to 2022. This analysis identified the top journals, authors, nations, keywords, and most significant papers on this subject as some of the influencing factors. Three important streams have been discovered by this study: ESG, SRI, ethical investing, and impact investing. The thematic map classified the ESG, SRI, and performance relationship themes into four categories of themes: niche themes, motor themes (corporate financial performance, corporate social performance, ESG, ESG factors, sustainability, performance, integrated reporting, gender diversity, and board size), emerging or declining themes (social responsibility, environmental performance, socially responsible investment, ethical investment, and SRI), and basic or transversal themes (financial performance, corporate social performance, ESG performance, environmental, social, and governance). Social responsible investing, engagement, and ESG, implies a position between niche themes and highly developed topic/emerging or decreasing theme, and covid, ROA, while, tobin’s Q, implies a position between highly developed topic/emerging or decreasing theme and basic theme. Based on the research results, this study has offered implications and suggestions for further research. The main trends in the link between performance and ESG, SRI, ethical, and impact investing are presented in this systematic and bibliometric study. Nevertheless, the study has brought to light several contractionary results in the chosen papers that might be efficiently addressed by this field’s meta-analysis.

Funding

This research is funded by YTI Professorial Chair Programme (YTIPC) grant with tittle: Application of Maqasid Al-Shariah and Siyasah Shar’iyyah in Responsible Investment and Practices Towards Environmental, Social, and Governance Concern: Evidence from Pemodalan Nasional Berhad Investment. Research code: (USIM/YTI/FEM/LUAR-S/41821).

Data Availability Statement

This study employed the published studies’ publicly available meta-data.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Aria, M.; Cuccurullo, C. A brief introduction to bibliometrix. Journal of Informetrics 2017, 11, 959–975. [Google Scholar] [CrossRef]

- Aria, M.; Cuccurullo, C. bibliometrix: An R-tool for comprehensive science mapping analysis. J. Informetr. 2017, 11, 959–975. [Google Scholar] [CrossRef]

- Arslan, H.M.; Chengang, Y.; Siddique, M.; Yahya, Y. Influence of Senior Executives Characteristics on Corporate Environmental Disclosures: A Bibliometric Analysis. J. Risk Financial Manag. 2022, 15, 136. [Google Scholar] [CrossRef]

- Bosi, M.K.; Lajuni, N.; Wellfren, A.C.; Lim, T.S. Sustainability Reporting through Environmental, Social, and Governance: A Bibliometric Review. Sustainability 2022, 14, 12071. [Google Scholar] [CrossRef]

- Chang, H.-Y.; Liang, L.-W.; Liu, Y.-L. Using Environmental, Social, Governance (ESG) and Financial Indicators to Measure Bank Cost Efficiency in Asia. Sustainability 2021, 13, 11139. [Google Scholar] [CrossRef]

- Chaudhuri, R.; Vrontis, D.; Chavan, G.; Shams, S.M.R. Social Business Enterprises as a Research Domain: A Bibliometric Analysis and Research Direction. J. Soc. Entrep. 2020, 14, 186–200. [Google Scholar] [CrossRef]

- Derwall, J.; Koedijk, K.; Ter Horst, J. A tale of values-driven and profit-seeking social investors. J. Bank. Finance 2011, 35, 2137–2147. [Google Scholar] [CrossRef]

- Donthu, N.; Kumar, S.; Mukherjee, D.; Pandey, N.; Lim, W.M. How to conduct a bibliometric analysis: An overview and guidelines. J. Bus. Res. 2021, 133, 285–296. [Google Scholar] [CrossRef]

- Ellili, N.O.D. Bibliometric analysis and systematic review of environmental, social, and governance disclosure papers: current topics and recommendations for future research. Environ. Res. Commun. 2022, 4, 092001. [Google Scholar] [CrossRef]

- Eurosif. European SRI study 2016. 2016. Available online: http://www.eurosif.org/sri-study-2016/ (accessed on 9 February 2018).

- Faruk, M.; Rahman, M.; Hasan, S. How digital marketing evolved over time: A bibliometric analysis on scopus database. Heliyon 2021, 7, e08603. [Google Scholar] [CrossRef]

- Friede, G.; Busch, T.; Bassen, A. ESG and financial performance: aggregated evidence from more than 2000 empirical studies. J. Sustain. Finance Invest. 2015, 5, 210–233. [Google Scholar] [CrossRef]

- Galletta, S.; Mazzù, S.; Naciti, V. A bibliometric analysis of ESG performance in the banking industry: From the current status to future directions. Res. Int. Bus. Finance 2022, 62, 101684. [Google Scholar] [CrossRef]

- Gao, S.; Meng, F.; Gu, Z.; Liu, Z.; Farrukh, M. Mapping and Clustering Analysis on Environmental, Social and Governance Field a Bibliometric Analysis Using Scopus. Sustainability 2021, 13, 7304. [Google Scholar] [CrossRef]

- Gao, Y.; Ge, L.; Shi, S.; Sun, Y.; Liu, M.; Wang, B.; Shang, Y.; Wu, J.; Tian, J. Global trends and future prospects of e-waste research: a bibliometric analysis. Environ. Sci. Pollut. Res. 2019, 26, 17809–17820. [Google Scholar] [CrossRef] [PubMed]

- Gillan, S.L.; Koch, A.; Starks, L.T. Firms and social responsibility: A review of ESG and CSR research in corporate finance. J. Corp. Finance 2021, 66, 101889. [Google Scholar] [CrossRef]

- Yas, H.; Jusoh, A.; Abbas, A. F.; Mardani, A.; Nor, K. M. A review and bibliometric analysis of service quality and customer satisfaction by using SCOPUS database. Int. J. Manag. 2020, 11. [Google Scholar]

- Hanić, A.; Jovanović, O.; Stevanović, S. Environmental disclosure practice in the Serbian banking sector. Management 2021, 26, 115–144. [Google Scholar] [CrossRef]

- Khan, M.A. ESG disclosure and Firm performance: A bibliometric and meta analysis. Res. Int. Bus. Finance 2022, 61, 101668. [Google Scholar] [CrossRef]

- Khudzari, J.M.; Kurian, J.; Tartakovsky, B.; Raghavan, G. Bibliometric analysis of global research trends on microbial fuel cells using Scopus database. Biochem. Eng. J. 2018, 136, 51–60. [Google Scholar] [CrossRef]

- Liang, H.; Renneboog, L. Corporate social responsibility and sustainable finance: A review of the literature. European Corporate Governance Institute–Finance Working Paper 2020. [Google Scholar] [CrossRef]

- Liao, H.; Tang, M.; Luo, L.; Li, C.; Chiclana, F.; Zeng, X.-J. A Bibliometric Analysis and Visualization of Medical Big Data Research. Sustainability 2018, 10, 166. [Google Scholar] [CrossRef]

- Moral-Muñoz, J.A.; Herrera-Viedma, E.; Santisteban-Espejo, A.; Cobo, M.J. Software tools for conducting bibliometric analysis in science: An up-to-date review. Prof. Inf. 2020, 29, e290103. [Google Scholar] [CrossRef]

- Passas, I.; Ragazou, K.; Zafeiriou, E.; Garefalakis, A.; Zopounidis, C. ESG Controversies: A Quantitative and Qualitative Analysis for the Sociopolitical Determinants in EU Firms. Sustainability 2022, 14, 12879. [Google Scholar] [CrossRef]

- Pattnaik, D.; Hassan, M.K.; Kumar, S.; Paul, J. Trade credit research before and after the global financial crisis of 2008 – A bibliometric overview. Res. Int. Bus. Finance 2020, 54, 101287. [Google Scholar] [CrossRef] [PubMed]

- Paul, J.; Bhukya, R. Forty-five years of International Journal of Consumer Studies: A bibliometric review and directions for future research. Int. J. Consum. Stud. 2021, 45, 937–963. [Google Scholar] [CrossRef]

- Rezaee, Z. Business sustainability research: A theoretical and integrated perspective. J. Account. Lit. 2016, 36, 48–64. [Google Scholar] [CrossRef]

- Saeidi, S.P.; Sofian, S.; Saeidi, P.; Saeidi, S.P.; Saaeidi, S.A. How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, reputation, and customer satisfaction. J. Bus. Res. 2015, 68, 341–350. [Google Scholar] [CrossRef]

- Senadheera, S.S.; Gregory, R.; Rinklebe, J.; Farrukh, M.; Rhee, J.H.; Ok, Y.S. The development of research on environmental, social, and governance (ESG): A bibliometric analysis. Sustain. Environ. 2022, 8, 2125869. [Google Scholar] [CrossRef]

- Sievänen, R.; Rita, H.; Scholtens, B. The Drivers of Responsible Investment: The Case of European Pension Funds. J. Bus. Ethic- 2012, 117, 137–151. [Google Scholar] [CrossRef]

- Sievänen, R.; Rita, H.; Scholtens, B. The Drivers of Responsible Investment: The Case of European Pension Funds. J. Bus. Ethic- 2012, 117, 137–151. [Google Scholar] [CrossRef]

- Silvente, G. A.; Ciupak, C.; da Cunha, J. A. C. Study on business model components: A bibliometric research from 2009 to 2014. International Journal of Innovation: IJI Journal 2019, 7, 359–372. [Google Scholar] [CrossRef]

- Van Duuren, E.; Plantinga, A.; Scholtens, B. ESG Integration and the Investment Management Process: Fundamental Investing Reinvented. J. Bus. Ethic- 2015, 138, 525–533. [Google Scholar] [CrossRef]

- Viju, V. G. W.; Ganesh, V. Application of Bradford’s Law of scattering to the literature of library & information science: a study of doctoral theses citations submitted to the Universities of Maharashtra, India. Library Philosophy and Practice 2013, 1–45. [Google Scholar]

- Widyawati, L. A systematic literature review of socially responsible investment and environmental social governance metrics. Bus. Strat. Environ. 2019, 29, 619–637. [Google Scholar] [CrossRef]

- Zhang, X.; Zhao, X.; He, Y. Does It Pay to Be Responsible? The Performance of ESG Investing in China. Emerg. Mark. Finance Trade 2022, 58, 3048–3075. [Google Scholar] [CrossRef]

- Zhou, M. (2019). ESG, SRI, and Impact Investing: What’s the Difference. Retrieved October, 10, 2019.

- Zupic, I.; Čater, T. Bibliometric methods in management and organization. Organ. Res. Methods 2015, 18, 429–472. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).