1. Introduction

Online shopping has become a daily shopping mode for many consumers, and it is expected that e-commerce sales will account for 20.8% of global retail sales in 2023 [

1]. In the agricultural product industry, the convenience of online shopping has led to rapid development of online sales of agricultural products. For China, agricultural e-commerce has experienced explosive growth in the past few years. In 2022, the online retail sales of agricultural e-commerce in China reached RMB 531.38 billion, a year-on-year increase of 9.2% [

2]. It can be seen that agricultural product e-commerce has huge development prospects and a vast consumer market. Therefore, it is necessary to explore consumers' online purchasing decisions for agricultural products and pricing optimization strategies for agricultural e-commerce.

Product price and customer preference are the two main factors that affect purchasing decisions [

3]. In practice, electronic retailers usually motivate customers by providing opportunities for savings. For example, retailers promote products through low price bundling. However, in the existing bundled pricing model, customers can only achieve savings by purchasing specific bundles [

4]. This fixed product bundling is too rigid because it ignores the issue of differences in customer preferences. When customers want to purchase other unbound products, they do not receive any savings.

In addition to environmental protection, organic agricultural products also have the characteristics of high quality and rich nutrition, so their selling price is higher than inorganic agricultural products [

5]. With the increase in income in developing countries such as China, more and more consumers are attempting to purchase organic products to improve their quality of life [

6]. For consumers with higher green preferences, they are willing to pay higher prices to purchase organic agricultural products. For consumers with lower green preferences, they are more inclined to choose inorganic agricultural products with higher cost-effectiveness. Therefore, in the pricing process of agricultural products, it is necessary to consider the degree of consumer organic preference.

In this paper, we propose an interactive bundling pricing strategy (IBPS) for agricultural e-commerce that considers consumer organic preferences. In addition, we introduce a free shipping strategy to enhance consumer surplus and maximize agricultural e-commerce profits. When customers shop online, they usually put the products they need into their shopping cart. At this point, IBPS can determine the bundled pricing of agricultural product combinations in the shopping cart. And when customers add or delete certain agricultural products in their shopping cart, IBPS can capture these real-time events and generate new bundled prices. Due to the fact that bundled prices are cheaper than the sum of individual selling prices, it can stimulate customers to purchase more agricultural products in a single transaction. Through numerical research, it has been found that this interactive bundling pricing strategy is a win-win strategy. It not only creates more profits for agricultural e-commerce, but also enables consumers to obtain higher consumer surplus.

2. Literature Review

Several streams of research are closely related to our study. In this section, we review the related research and emphasize the differences between our study and the existing literature.

The first stream of this study is mainly related to pricing strategies for agricultural products. Many scholars have studied the optimal pricing problem of agricultural products from the perspective of supply chain using game theory. He et al. (2022) [

7] studied the pricing strategies when the supplier has a limited output and the retailer has substitute suppliers in a fresh agricultural product supply chain. Wang et al. (2017) [

8] built a fresh produce supply chain consisting of a supplier and a retailer and derived the optimal pricing strategy of supplier in the presence of portfolio contracts and circulation losses. Wang et al. (2022) [

9] established the agricultural product supply chain with farmer cooperatives as the core enterprise and developed dynamic pricing models under decentralized decision-making and centralized decision-making. Li et al. (2023) [

10] built a three-level agricultural supply chain model and explored the impact of block-chain traceability and retailers’ altruistic preference on pricing decisions. Some articles have considered the characteristic attributes of agricultural products to study their optimal pricing strategies. Hasan et al. (2020) [

11] considered the effect of external factors that induce deterioration investigated ways to reduce the product deterioration rate by accelerating the sales of the near defective items at a discounted price. Perlman et al. (2019) [

12] assumed that the agricultural products can depreciate in value and studied the optimal pricing strategy for organic and inorganic agricultural products under dual channels. Zhang et al. (2018) [

13] combined transportation methods and market uncertainty risks to determine the optimal retail price, and set the optimal wholesale price based on the Stackelberg game.

The second stream of this research is related to bundle pricing. Some articles have studied bundling pricing strategies for complementary products. Taleizadeh et al. (2017) [

14] developed an integrated pricing-inventory model for two complementary products under three selling strategies (single, bundling and mixed bundling). Giri et al. (2020) [

15] compared the individual sales strategy and bundled sales strategy in a duopoly market where two manufacturers separately produce and sell two complementary products through a common retailer. And some scholars have studied bundling pricing from the perspective of perishability. Fang et al. (2018) [

16] considered the bundle pricing decisions for homogeneous fresh products with quality deterioration. Azadeh et al. (2017) [

17] studied the bundling pricing strategy for two perishable products, taking into account the benefit-lost cost and the shortage cost. In addition, some researchers have proposed bundling pricing strategies from a data-driven perspective. Ettl et al. (2020) [

18] constructed a data-driven model to recommend personalized discount product packages to shoppers while selecting products related to consumer preferences. Jiang et al. (2011) [

19] proposed an online dynamic bundling pricing model based on customer online behavior (e.g., clicking on Web pages, rating products).

3. The Model

3.1. Hypothesis of the Research Object

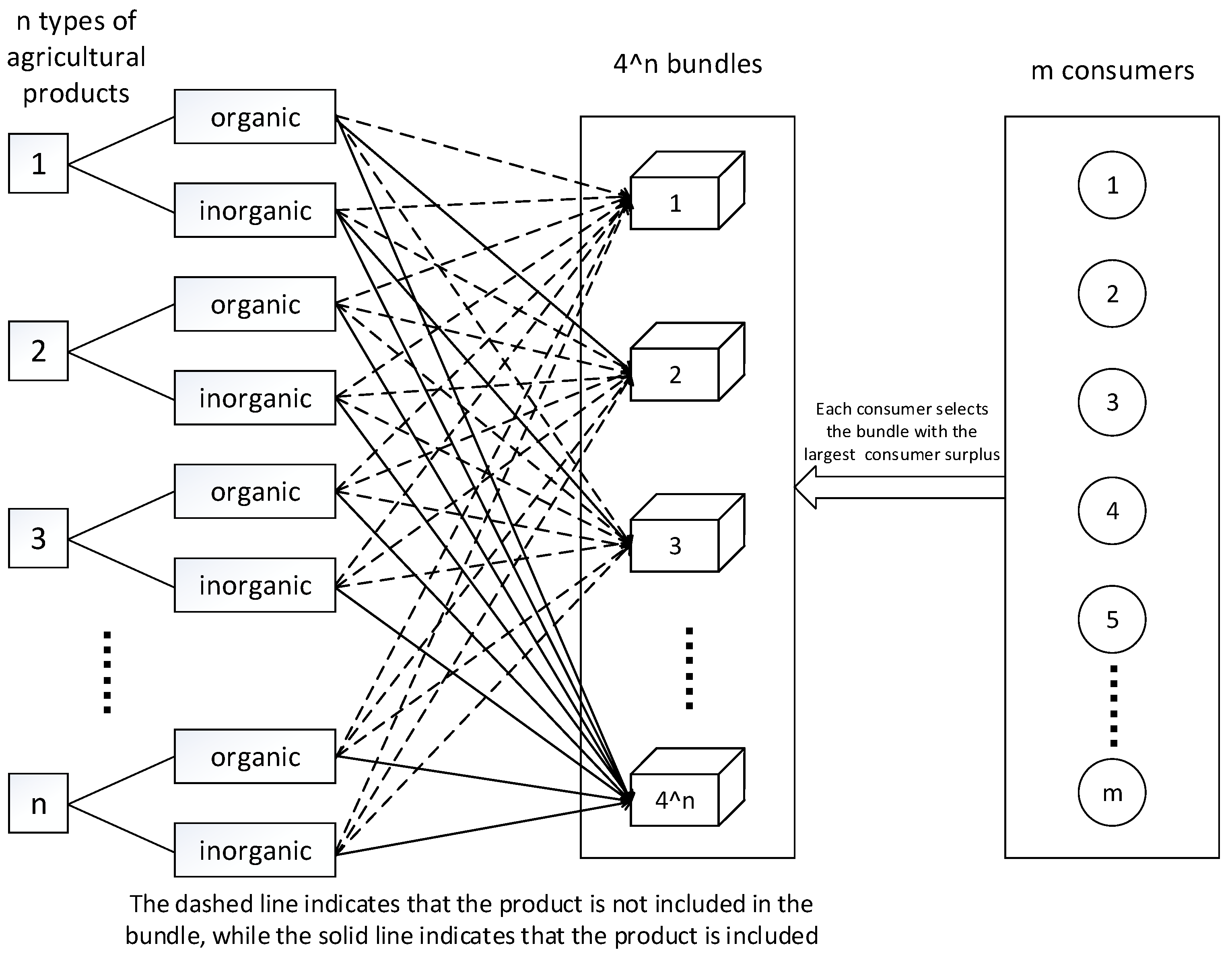

From the perspective of platform, this paper establishes a nonlinear mixed Integer programming model for interactive bundle pricing (IBPS) of organic and inorganic agricultural products with the goal of maximizing the profit of agricultural e-commerce platform and optimizing consumer surplus. Simultaneously, we consider the free shipping strategy and consumer organic preferences. The key point of the model is how agricultural product e-commerce platforms price packages to maximize profits under the optimal decision of consumer surplus. The core issue is the optimal price corresponding to each bundle combination. Consumers maximize their surplus based on the difference between the total retained price of the items in the package and their payment price, while agricultural e-commerce platforms maximize their total profit through pricing and free shipping. The specific bundled pricing process is shown in

Figure 1.

Assuming the following conditions:

(1) Each consumer purchases package with the largest consumer surplus within their own budget constraints;

(2) The consumer's reserve price for the package is equal to the sum of the consumer's reserve prices for all products in the package;

(3) Consumer costs include agricultural product prices and shipping costs. When the customer's purchase amount reaches a certain amount, the shipping costs are borne by the platform;

(4) Each type of agricultural product has two varieties: organic and inorganic;

(5) All agricultural products in one order are combined into one package and only one shipping cost is calculated. For the same product, each consumer is limited to purchasing one unit;

(6) The consumer reserve price is the highest price that consumers are willing to pay for the product, which is affected by the market price of the product, the organic attribute of the product, and the organic preference of consumers.

3.2. Symbol Settings

The parameters and variables involved in the model are shown in

Table 1:

3.3. Modeling

Formula (1) is the objective function that represents the maximum profit of agricultural product e-commerce platforms, which is equal to sales revenue minus agricultural product costs and distribution costs; Constraint (2) refers to consumers reverse prices; Constraint (3) indicates that consumer surplus is equal to the difference between the consumer's reverse price and the actual paid price; Constraint (4) signals that consumers will choose to purchase the largest remaining bundled package; Constraint (5)describes that the pricing of the package is not less than the sum of the agricultural product costs within the package; Constraints (6) and (7) show that the price of each package is not greater than the sum of the prices divided into multiple packages; Constraint (8) denotes that the bundle purchased by consumers does not exceed their budget; Constraint (9) means that consumers will only purchase when their consumer surplus is not less than 0; Constraint (10) indicates that each consumer can purchase at most one package; Constraint (11) expresses that when the price of the bundle reaches a certain threshold, the distribution cost is borne by the platform; Constraint (12) represents 0-1 variables.

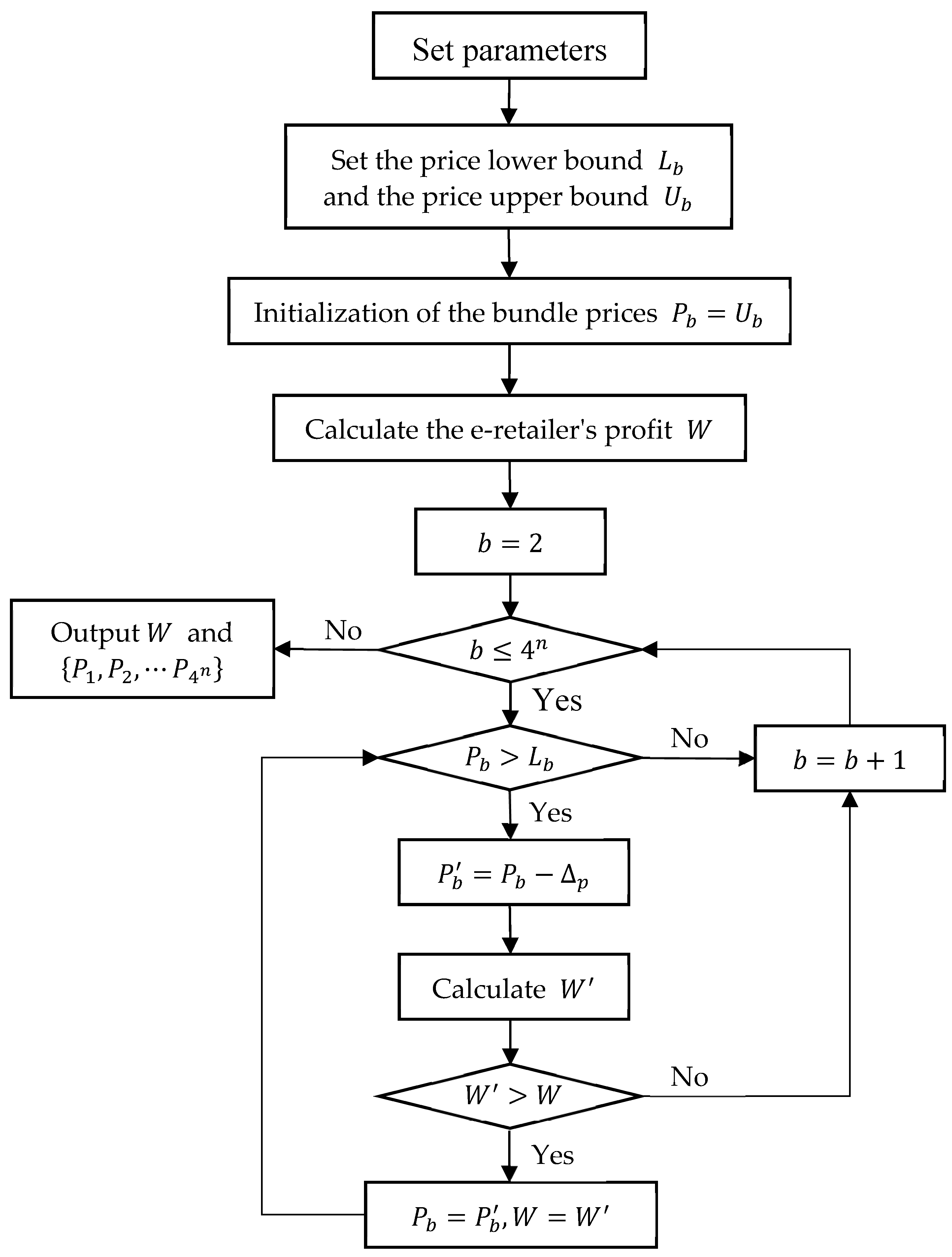

4. Algorithm

In the IBPS model, agricultural e-retailer aims to maximize profits, while the consumer chooses the bundle with the largest surplus. With reference to Jiang et al. (2011) [

19], local search is a mature solution to combinatorial optimization and a high-quality solution to practical problems within a reasonable time period. This paper proposes a heuristic algorithm based shrinkage to optimize the price of each bundle. The flow chart of the algorithm is shown in

Figure 2 and the specific steps are as follows:

Step 1: Set the consumer budget constraint , the distribution cost for each combination, and the free shipping threshold . Set the price reduction step , and the price adjustment for each bundle can only be an integer multiple of .

Step 2: Divide all bundles into two groups. Group 1: denotes bundle with no produce. Group 2: denotes bundles containing one or more units of produce.

Step 3: For each bundle, the sum of the costs of all products in the bundle and the sum of the market prices are denoted as the price lower bound and the price upper bound of the bundle, respectively. Then the price of the bundle is initialized to the sum of the market prices of the products in the bundle, i.e., .

Step 4: Within the consumer budget , each consumer selects a bundle with the largest consumer surplus. We then calculate the e-retailer's profit, denoted as .

Step 5: Keeping the bundle price of group 1 unchanged, optimize the price of the remaining bundles, this is starting from .

Step 6: Get a new lower bound for bundle and set the price lower bound for bundle b to .

Step 7: When , the price of bundle b is reduced by one unit, i.e., . Within the consumer budget , each consumer chooses a bundle with the largest consumer surplus, and then we calculate the new total profit . If , reset the bundle price and total profit, i.e., , and return to step 6. When , if , reset and return to step 6, if , go to step 8.

Step 8: Output the optimal total profit and the set of optimal prices for the bundles .

5. Numerical Analysis

5.1. Example Analysis

This section verifies the effectiveness of the model and algorithm proposed above through numerical cases and simulation analysis. We analyze the trend of changes in agricultural e-commerce profits and consumer surplus by adjusting parameters such as free shipping thresholds and consumer organic preferences, providing management suggestions for agricultural e-commerce.

This paper assumes three types of agricultural products for online retail in agricultural e-commerce. By investigating the market prices and costs of three agricultural products, the average value is extracted to set the case parameters in this section. Suppose that the unit cost and market price of agricultural products follow uniform distribution, and the unit cost and market price of organic agricultural products are about 1.5 times and 2 times of inorganic agricultural products, respectively. The specific numerical distribution is shown in

Table 2, where 1nuit represents 500g.

Assuming that consumers' reserve prices for agricultural products follow a uniform distribution without considering their organic preferences, i.e.

.

and

respectively reserve the lower and upper limits of prices for consumers. According to Wu et al. (2008) [

20], the reserved price ceiling can be estimated by market price and unit cost, that is

(

is the market price of inorganic agricultural product

,

is the unit cost of inorganic agricultural product

). Reserve Price floor

is calculated based on the highest retention price

, which is defined as

. With the increase of

, the lower limit of reserve price floor magnifies, indicating that consumers are willing to pay higher prices for agricultural products. Therefore,

can be used to express the level of consumer consumption. The higher the value of

, the higher the level of consumer consumption. This section sets for

. In addition, considering that consumers are willing to pay higher prices for organic agricultural products, this paper introduces consumers' organic preference into the reserve price, i.e.

(represents the reserved price without considering consumer organic preferences). In this section we set consumer organic preferences

.

According to the actual operation of the platform, the distribution cost is equal to ¥ 4 plus ¥ 4 multiplied by the number of products in the bundle, setting the free shipping threshold as ¥ 30. We assume that the number of potential consumers for this agricultural product e-commerce is 50. Consumer budget value follows normal distribution

in which

. Based on the above data and parameters, calculate the optimal pricing decision for the platform. We compare sales data, consumer surplus, and total retailer profit under the IBPS strategy with traditional retail models. The specific details are shown in

Table 3:

Table 3 shows that the IBPS strategy exhibits a greater advantage both in terms of product sales and total sales revenue. Compared to the situation without IBPS, the improvement under the IBPS strategy is significant, including an 8.39% increase in total profit and a 10.86% increase in total consumer surplus. In addition, the decrease in the price of agricultural products under bundled pricing stimulates an increase in consumer demand, resulting in a 14.00% increase in total sales of agricultural products. Sales of inorganic products are up by 28.57% and sales of organic produce rise by 10.34%.

5.2. The Impact of Free Shipping Threshold on Bundled Pricing Strategies

On the one hand, the free shipping strategy reduces the profit per order, which is called the profit shrinkage effect; on the other hand, it can increase the consumer surplus and thus attract more consumers or make them buy more agricultural products, which is called the market expansion effect. The profit shrinkage effect and the market expansion effect jointly affect the profit of the agricultural e-commerce platform, and the profit of the retailer will decrease when the profit shrinkage effect is better than the market expansion effect, and the profit of the retailer will increase when the market expansion effect is better than the profit shrinkage effect. In this section, based on the heuristic algorithm and arithmetic parameters proposed in the previous section, the impact of free shipping threshold on bundle pricing strategy is discussed to find the optimal free shipping threshold.

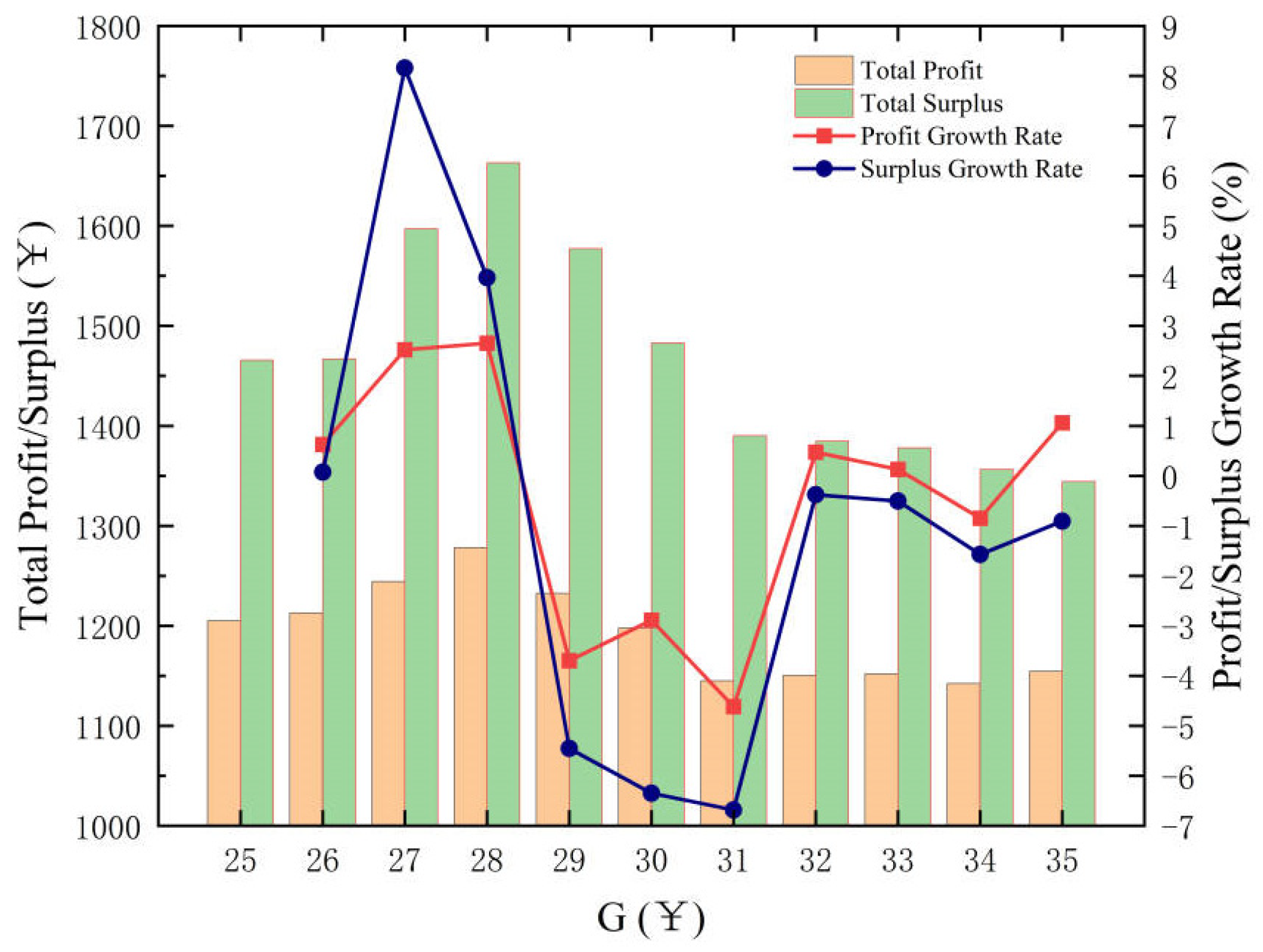

Figure 3 shows the trend of total profit and total consumer surplus as the free shipping threshold changes between 25 and 35.

Figure 3 shows that as the free shipping threshold increases in the range of 25-35¥, the total profit and the total consumer surplus both show an overall trend of increasing and then decreasing. The growth rate first elevates and then decreases, and finally equilibrium is maintained around 0. We find that the total platform profit and total consumer surplus reach their maximum values when the free shipping threshold is 28¥, indicating that 28¥ is the optimal free shipping threshold.

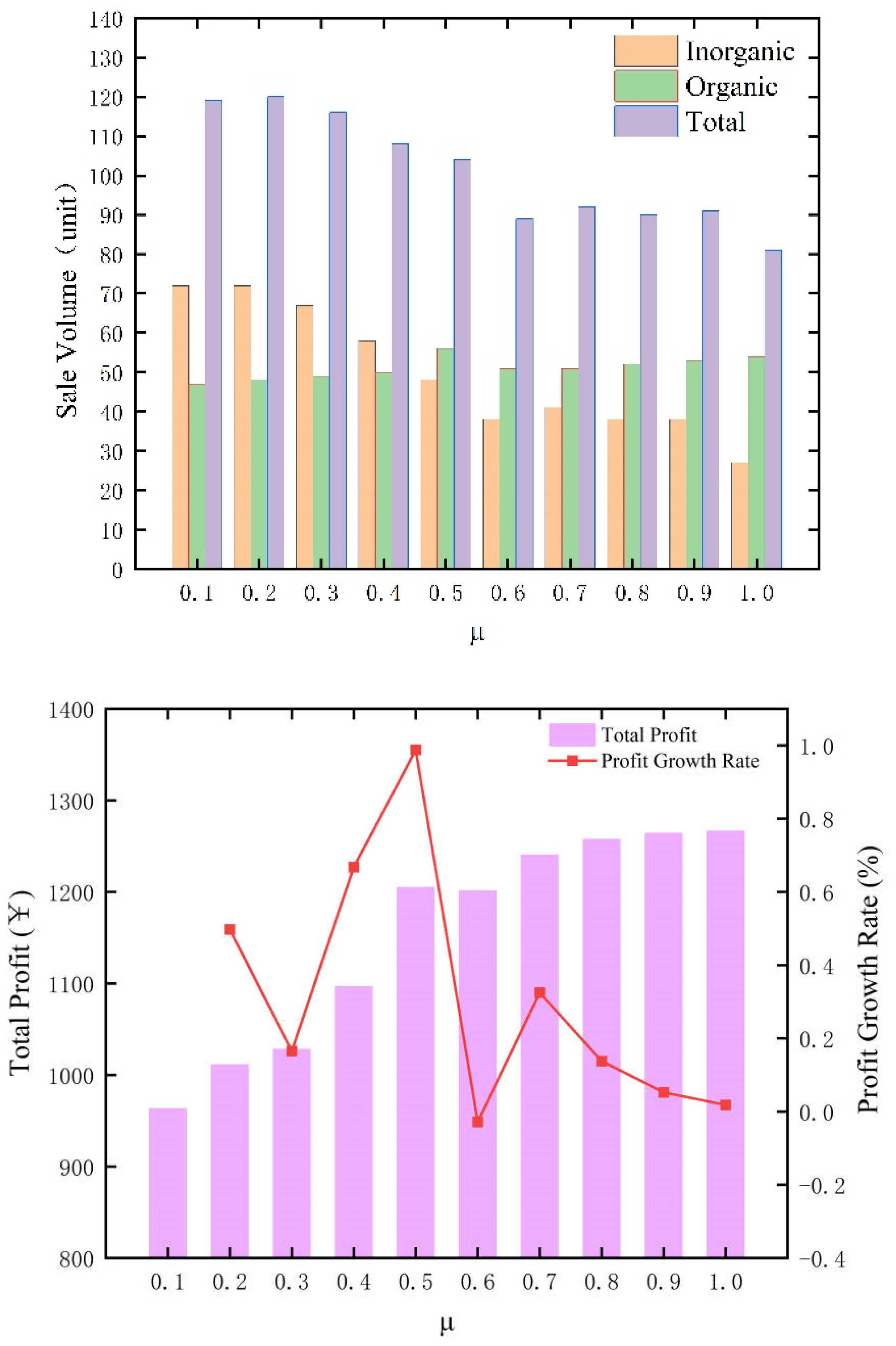

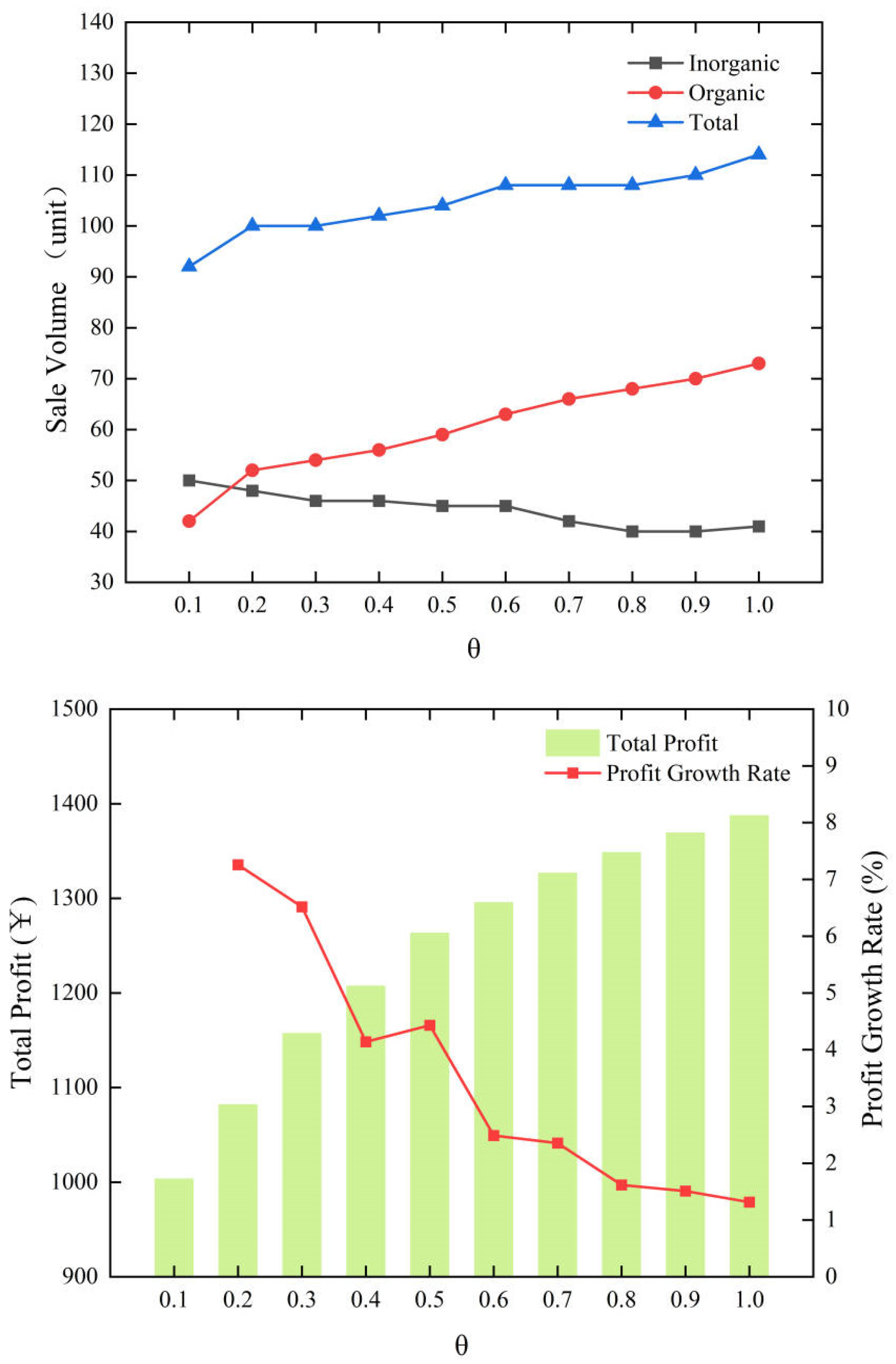

5.3. The Impact of Consumer Organic Preferences on Bundling Pricing Strategies

Organic preference refers to the extent to which consumers are willing to pay a higher purchase price for organic agricultural products. To explore the effect of consumers' organic preference on the bundle pricing strategy of agricultural products, this section analyzes the changes in the quantity of agricultural products sold and the total profit under the optimal pricing strategy when

varies in the range of 0-1. And based on this, we propose reasonable management countermeasures and suggestions for agricultural products e-commerce. The trends of the sales volume and total profit of agricultural products with consumers' organic preferences are shown in

Figure 4:

Figure 4 shows that as consumer green preferences increase, the sales of inorganic agricultural products decrease rapidly, while the sales of organic agricultural products show a slow upward trend. The reason is that the greater the consumers' organic preference, the higher their reservation price for organic agricultural products, i.e., they are willing to spend more to purchase organic agricultural products to increase their consumer surplus. At the same time, we found that the total sales volume of produce decreased with increasing consumer organic preference. This is because organic produce sells at a higher price than inorganic produce, and under budget constraints, consumers with high organic preferences are more likely to choose to buy small amounts of organic produce rather than large amounts of inorganic produce. In addition,

Figure 4 shows that the total platform profit increases with the increase of consumers' organic preference, which indicates that selling organic agricultural products can bring more profit for agricultural e-commerce.

5.4. The Impact of Consumption Level on Bundling Pricing Strategies

Consumption level

indicates the difference between the minimum reserve price and the maximum reserve price. A higher value of

means that the minimum reserve price is closer to the maximum reserve price and the consumer heterogeneity is lower. To analyze the effect of consumption level on the bundle pricing strategy of agricultural products, we set the consumption level as 0.1-1 with a step of 0.1.

Figure 5 represents the effect of the change in consumption level on the sales volume and the total profit of e-retailer.

Figure 5 shows that as the consumption level increases, the sales of inorganic products decrease and the sales of organic products rise, with an upward trend in the total sales volume. This indicates that consumers prefer environmentally friendly and healthy organic agricultural products when the consumption level allows. In addition, the total profit of e-retailers of agricultural products improves significantly at high consumption levels, and the profit growth rate decreases gradually. This indicates that the increase in sales of organic agricultural products can effectively increase the total profit.

6. Conclusions

In this paper, with the objective of profit maximization and consumer surplus optimality for agricultural e-retailers, an interactive bundle pricing strategy (IBPS) is proposed. Compared to the traditional bundle pricing strategy with fixed products, IBPS is more flexible and allows consumers to have more choices. Thus, a bundle pricing model is developed, and consumer green preferences and free shipping strategies are considered. Then we use a heuristic algorithm to solve the model. Through numerical analysis, we compare the differences between IBPS and traditional online retailing methods and find that IBPS can effectively enhance the profits and consumer surplus of agricultural e-retailers. In addition, we analyze the impact of free shipping thresholds, consumers' organic preferences and the level of consumer consumption on the bundle pricing strategy and propose some management insights for produce e-retailers accordingly.

Author Contributions

Conceptualization, Anna Shi and Xijia Liu; Data curation, Xijia Liu; Investigation, Xijia Liu; Methodology, Xijia Liu and Anna Shi; Project administration, Xijia Liu; Resources, Xijia Liu; Validation, Anna Shi; Visualization, Xijia Liu; Writing-original draft, Xijia Liu; Writing-review & editing, Anna Shi. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Key Projects of The National Social Science Fund of China (19AGL023).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Rinda, N.; Satrio, P.T.; Naufal, H.; Herena, P. Biplot analysis: a study of the change of customer behaviour on e-commerce. Procedia Computer Science 2023, 216, 524–530. [Google Scholar] [CrossRef]

- Ante, R.; Viktorija, S. The influence of social trends on the sale of agricultural products. CroDiM: International Journal of Marketing Science 2023, 6, 33–42. [Google Scholar]

- Woojae, K.; Yuri, P.; Jungwoo, S.; Manseok, J. Consumer preference structure of online privacy concerns in an IoT environment. International Journal of Market Research 2022, 64, 630–651. [Google Scholar] [CrossRef]

- Jena, S.K. Impact of bundling on the omnichannel supply chain under price competition. The Journal of Business & Industrial Marketing 2022, 37, 2468–2487. [Google Scholar] [CrossRef]

- Wang, E.; Liu, Z.Z.; Gao, Z.F; Wen, Q.; Geng, X.H. Consumer preferences for agricultural product brands in an E-commerce environment. Agribusiness 2022, 38, 312–327. [Google Scholar] [CrossRef]

- Arijit, R.; Arpita, G.; Devika, V. The consumer perception and purchasing attitude towards organic food: a critical review. Nutrition & Food Science 2023, 53, 578–599. [Google Scholar] [CrossRef]

- He, X.M.; Zhang, C.; Guo, X.T. Pricing and distribution strategies of fresh agricultural product supply chain considering substitutes. Mathematical Problems in Engineering 2022, 2022. [Google Scholar] [CrossRef]

- Wang, C.; Chen, X. Option pricing and coordination in the fresh produce supply chain with portfolio contracts. Annals of Operations Research 2017, 248, 1–2. [Google Scholar] [CrossRef]

- Wang, J.L.; Huo, Y.J; Guo, X.Y.; Xu, Y. The pricing strategy of the agricultural product supply chain with farmer cooperatives as the core enterprise. Agriculture 2022, 12, 732–732. [Google Scholar] [CrossRef]

- Li, T.; Xu, X.T.; Liu, W.R.; Shi, C.D. Pricing decision of three-level agricultural supply chain based on blockchain traceability and altruistic preference. Sustainability 2023, 15, 3304–3304. [Google Scholar] [CrossRef]

- Hasan, M.R.; Mashud, A.H.M.; Daryanto, Y.; Wee, H.M. A non-instantaneous inventory model of agricultural products considering deteriorating impacts and pricing policies. Kybernetes 2020, 50, 2264–2288. [Google Scholar] [CrossRef]

- Perlman, Y.; Ozinci, Y.; Westrich, S. Pricing decisions in a dual supply chain of organic and conventional agricultural products. Annals of Operations Research 2019, 314, 1–16. [Google Scholar] [CrossRef]

- Zhang, R.; Liu, J.; Liu, B. Pricing decisions and channel coordination of fresh produce supply chain under multi-transportation modes. ICIC Express Letters 2018, 12, 9–21. [Google Scholar]

- Taleizadeh, A.A.; Babaei, M.S.; Niaki, S.T.A.; Noori-daryan, M. Bundle pricing and inventory decisions on complementary products. Operational Research 2017, 20, 1–25. [Google Scholar] [CrossRef]

- Giri, R.N; Mondal, S.K.; Maiti, M. Bundle pricing strategies for two complementary products with different channel powers. Annals of Operations Research 2020, 287, 701–725. [Google Scholar] [CrossRef]

- Fang, Y.; Jiang, Y.P.; Han, X.X. Bundle pricing decisions for fresh products with quality deterioration. Journal of Food Quality 2018, 2018, 1–8. [Google Scholar] [CrossRef]

- Azadeh, A.; Songhori, H.; Salehi, N. A unique optimization model for deterministic bundle pricing of two products with limited stock. International Journal of System Assurance Engineering and Management 2017, 8, 1154–1160. [Google Scholar] [CrossRef]

- Ettl, M.; Harsha, P.; Papush, A.; Perakis, G. A data-driven approach to personalized bundle pricing and recommendation. Manufacturing & Service Operations Management 2020, 22, 429–643. [Google Scholar] [CrossRef]

- Jiang, Y.; Shang, J.; Kemerer, C.F. Optimizing E-tailer profits and customer savings: Pricing multistage customized online bundles. Marketing Science 2011, 30, 737–752. [Google Scholar] [CrossRef]

- Wu, S.Y.; Hitt, L.M.; Chen, P.Y. Customized bundle pricing for information goods: A nonlinear mixed-integer programming approach. Management Science 2008, 54, 608–622. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).