1. Introduction

Regulation and supervision of financial markets primarily serve as a form of public administration as a means of streamlining the system and ensuring its stability in the internal and external financial and economic environment. Each country has historically developed its own system of financial regulation and supervision.

Regulation consists of generally binding requirements and procedures set for management objects (money, capital, currency, insurance, and gold markets) and various economic legal entities (banks, financial companies, and infrastructure institutions) to foster sustainable development of the national, regional and global economy, equality of economic actors, and the principles of fair competition.

Regulation, which falls into macroeconomic (monetary) and microeconomic regulation, entails certain targets, principles, norms and standards.

Regulatory institutions apply legal (laws, regulations, standards) and economic (indicative) tools for influence. Regulation, which is based on general macroeconomic goals, establishes specific targets for financial markets to achieve: stability of the financial system; stability of the banking system and national currency; inflation targeting; transparency of transactions and financial reporting; protection, hedging against systemic risks; protection of consumers and investors; creation of an efficient and reliable securities market. Microeconomic regulation involves the registration, supervision and control of market participants.

Regulation and supervision are basic, closely interlinked forms of a single financial regulatory system. It has emerged as a result of the failures of the capitalist market (imbalances, crises, poor competition) and has evolved with it. The state first regulated the banking sector, then the insurance market, the foreign exchange market and the stock market.

This chapter focuses on national models of financial regulation, international institutions and supervisory standards, and specific regulatory and supervisory systems in the UK, the US, Finland, Sweden, and the EU.

2. National models of financial regulation

There are 7 systems of regulation of financial markets in the world economy. They were the result of the development of models of national capitalism, state regulation of the economy. The world economic crises of 1929-1933, 2008-2009, World War II, the global financial and economic environment and system, information technologies have made serious changes in the models, goals, principles, institutions of regulation and supervision of financial market participants. Modern systems (models) of financial regulation in the countries of the world are presented in

Table 1.

In Asian countries, the Central Bank acts as the main regulator of financial markets (53% of countries in the region). This can be explained by the different level of development of financial markets. Fourteen countries (31%) have only one universal mega-regulator: in India it is the Securities and Exchange Board of India (SEBI, 2022), in China - China Securities Regulatory Commission (CSRC, 2021), in Turkey - Capital Markets Board of Turkey (CMB, 2021), in the Republic of Korea - Financial Services Commission of Korea (FSC, 2021).

In five countries (11%), the markets are regulated by the Central Bank and a special supervising body. In Israel, the Israel Securities Authority (ISA, 2022) and the Bank of Israel (BOI, 2022) issue the shekel, regulate the banking sector and manage the country's gold reserve.

Japan and Hong Kong have two different regulators (The Twin peaks). In Japan, the Financial Services Authority of Japan (FSA, 2022) is the state regulator, while the Japan Securities Dealers Association (JSDA, 2022) is a non-governmental dealers' association. In Hong Kong, the Securities and Futures Commission (SFC, 2022) and the Finance Commission (FinCom, 2022) act as regulators of forex brokers and financial companies.

The UAE has three regulators (Trident): The Dubai Financial Regulation and Supervision Authority, which is the financial regulator of the DIFC Special Economic Zone in Dubai (The Dubai Financial Services Authority (Dubai FSA, 2022)); UAE Securities and Commodities Authority (SCA, 2022), and the Central Bank of the United Arab Emirates (2022), which is the national currency issuer and banking sector financial regulator.

In Africa, only South Africa has a single specialised regulatory and supervisory agency - the Financial Sector Conduct Authority (FSCA, 2022). Other 45 countries have vested supervisory functions with the central banks, while in six dependent territories supervision is conducted by the Bank of France, the Bank of Spain, the Bank of Portugal and the ECB. In a number of countries, regulatory functions are performed by regional central banks: The Bank of Central African States and the Central Bank of West African States.

Europe has 20 mega-regulators. In nine countries it is the Central Bank and the regulator, in eight countries it is only the Central Bank. The mega regulators have been largely found in the EU member states. England has two regulators. The "central bank + special regulator" model can be found in Hungary, Italy, Slovakia, and Ireland. The Central Bank performs general supervisory functions in the Vatican, Serbia, Slovakia, the Czech Republic and Montenegro.

The countries of Oceania present a rather patchwork image. There is one mega-regulator in the region (Vanuatu), "two peaks" in Australia: Australian Securities and Investments Commission (ASIC, 2022) - financial regulator of banks, insurance companies, building societies, and pension funds; the Australian Prudential Regulation Authority (APRA, 2022) - state financial regulator of banks, insurance companies, building societies, pension funds. The central bank supervises Solomon Islands, Tonga and Fiji, while in six countries there is no regulator or central bank (Marshall Islands, Micronesia). New Zealand, however, has 3 regulators (Trident model): The Financial Markets Authority of New Zealand (FMA NZ, 2022), which is a state agency that issues licenses for brokers; the Financial Service Providers Register (FSPR, 2022) which registers and licenses financial services. As a government agency, it keeps a registry of companies. Brokerage services are registered with FMA NZ license; Financial Services Complaints Ltd (FSCL, 2022) is a non-profit organisation for resolving disputes between brokers and investors.

North America. Canada has 1 mega-regulator, the Investment Industry Regulatory Organization of Canada (IIROC, 2022), which is a non-profit self-regulatory organisation (SRO).

Historically, the USA has the most extensive two-level system of regulating financial markets formed by seven federal regulators: the Securities and Exchange Commission (SEC, 2022); the Commodity Futures Trading Commission (CFTC, 2022); the Federal Reserve System (FED, 2022) - the central bank of the USA; the Federal Deposit Insurance Corporation (FDIC, 2022) - the federal insurance agency; the U. S. Treasury (U.S. Department of the Treasury, 2022); Consumer Financial Protection Bureau (CFPB, 2010); and the Financial Stability Oversight Council (FSOC, 2010) - a division of the U.S. Treasury.

Furthermore, there are three self-regulatory organisations (SROs): National Futures Organisation (NFA, 2022), which regulates the futures market; the National Credit Union Administration (NCUA, 2022), the Federal Credit Union Regulatory, Supervisory Agency; and the Financial Industry Regulator (FINRA, 2022). The national financial regulatory system is further spread to the national level and is represented by four institutions: The State Banking Regulator; the State Securities Regulator (analogous to the SEC in the national market); the State Insurance Regulator with a mandate to supervise and regulate all insurance business in the state; and the State Attorney General.

In South America, there is one mega-regulator in Brazil, the Brazilian Securities and Exchange Commission (CVM, 2022). Argentina, Chile and Colombia employ the "Central Bank + 1 regulator" model. In eight countries it is the central bank that has universal regulatory functions.

Thus, the picture of the financial regulation systems in the world economy looks as follows: about 50% of countries vest the supervising functions exclusively in the Central Bank, over 22% of countries (developed economies) after the world crisis of 2008-2009 employ the system of one multifunctional mega-regulator. More than 10% of countries use the CB+1-regulator model, 1% of countries employ the model of 2 regulators and more than 3 special regulators. The following is a review of the main national models of financial market regulation systems. There are four models of financial regulation: 1. Conservative, sectoral model (the USA). 2. The " twin-peaks" model (Australia, England, Japan). 3. Mega-regulator model (with Sweden as an example). 4. The regional-national model (the EU and Finland as examples).

2.1 Conservative, Sectoral, Two-Tier Model

In the most obvious form, the model is found in the US (see Table 1.2) and goes back to the fundamental principles of capitalist economic development in the 18th century. It is based on the concept of cautious government intervention in the market, conservatism of the 19th century and the 1930s legislative acts in the 20th century.

The founding fathers of the American constitution and financial system, Alexander Hamilton, the first US Secretary of the Treasury, and Thomas Jefferson in 1790-1791 introduced the idea of a strong federal government supported by a national finance infrastructure, a national bank and industrial enterprises. This concept was concretised in five financial and commercial areas of the national economy: taxation, public credit, financial markets and organisations, financial stability and trade policy.

The 19th century saw the establishment of the State Banking Regulator (1851), the Office of the Comptroller of the Currency (1863) and the National Association of Insurance Commissioners (1871). The Federal Reserve System (1913) was established in the early 20th century. The Federal Deposit Insurance Corporation (1933), the Securities and Exchange Commission (1934), and state insurance regulators (1945) were created after the Great Depression (1929-1933). The emergence of the derivatives market led to the formation of the Commodity Futures Trading Commission (1974). Financial Stability Oversight Council, Consumer Financial Protection Bureau, Financial Industry Regulator were created in the aftermath of the global crisis (2007-2009).

The creation and evolution of the US financial regulatory system was determined by the development of financial markets, their scale, the emergence of new financial products, monopolies, financial holdings, and crises (disrupting business, jobs, income, investment, and savings). This has resulted in a complex regulatory infrastructure targeting different financial services markets (banking, capital markets, insurance and their segments), involving both the federal centre and individual states. This system comprises government agencies and SROs. Such a complex, multi-tiered model of financial regulation has emerged as a response to a large economy with a very developed financial market (see

Table 2).

In the US model, regulation and supervision assume the specialisation of financial institutions (banks, insurance companies, securities companies), and the divide between markets for financial assets (money, capital, insurance, currency, gold and their financial instruments: credit/deposit contracts, shares, bonds, derivatives). They include federal and state supervisory institutions. The legislative focus of the system is to protect investors and consumers of financial services. The regulatory and supervisory system is the most complex, multi-tiered, multi-agency in the world. Its scale and the large number of responsibility centres make it less efficient, thus necessitating reforms after financial system failures and crises (after the Great Depression - Glass-Steagall Banking Act, 1933), establishment of the Federal Insurance Corporation's contributions (1934). The Dodd-Frank Act of 2010 and OTS were a response to the global crisis of 2008-2009. The Office of Thrift Supervision (OTS), which operated as a treasury agency from 1989-2011, was the primary regulator of federal savings and loan associations (Thrift) to pursue the 'American dream' of homeownership. Following the 2008-2009 crisis, when many large OTS-run mortgage companies went bankrupt (American International Group (AIG), Washington Mutual IndyMac), the USA implemented the largest reform since the Great Depression. The Dodd-Frank Wall Street Reform and Consumer Protection Act, passed on July 21, 2010 to reduce risks in the US financial system, transferred the functions of the OTS to five institutions - the new financial regulator, Financial Stability Oversight Council (FSOC), Office of the Comptroller of the Currency (OCC), Federal Deposit Insurance Corporation (FDIC), Federal Reserve Administration and Consumer Financial Protection Bureau (CFPB). On 21 July 2011, the OTS was terminated. The mortgage lending market and the construction industry stand at the centre of the national economy. It is supported by mortgage banks, savings and loan associations, and the strength of companies in the construction, steel, road, electrical, automotive and electronics industries depends on its scale and growth. By creating a "pool" of five supervisors, legislators responded to the collapse of the US mortgage market, which triggered the US financial system crisis and the global crisis of 2008-2009.

2.2 The Twin Peaks Model

The Twin Peaks model is well represented by Australia, England and Japan, all of which are economies with advanced financial markets. The Twin Peaks model was a response to the global crisis. The former supervisory institutions were unable to prevent the "financial tsunami waves" coming from the US markets. The institutions had to be reformed. The central bank retained the main macroeconomic functions of issuing money, inflation targeting, conducting monetary and exchange policies, while leaving the regulation and supervision of financial market participants to special supervisory institutions (committees, commissions, and agencies).

The model is best illustrated by England (see

Table 3). Conservative England, which has focused on liberal principles of functioning and regulation of the economy since the 17th century, implemented two reforms in 1986. Margaret Thatcher's government (the Big Bang reforms) ended the monopoly of the old brokerage houses and opened up the financial market to foreign investors and investment banks and free competition. A new regulatory structure, focused on the stability of the financial system as a whole, was established by 2012. It set out a hierarchy of goals: controlling the banks, protecting consumers, reducing risks from the probability of the outflow of banks, and minimising systemic risks.

The Bank of England kept its functions as a bank supervisor, insuring compliance with the new Basel III capital adequacy, asset liquidity and risk management requirements, as well as deposit insurance. Its supervisory powers have been expanded to include the infrastructural institutions of the financial system: payment systems for clearing settlements in the money (BACS (Bankers Automated Clearing Services), CHAPS (The Clearing House Automated Payment System), APACS (Association for Payment Clearing Services), Moneybookers), capital and foreign exchange markets, and the central securities depository.

The place and role of England in the global economy, as the world's centre for the euro currency and transactions, impose high requirements for the credibility of the national financial system and set out the target functions for regulators and supervisors of financial markets. The Financial Policy Committee (FPC), the new reform regulator of 2012, has focused on reducing systemic risk and combating money laundering. For England, the reliability of banks and the financial system is a strategic factor in attracting foreign capital. The Financial Conduct Authority (FCA), an independent regulator, seeks to maintain healthy competition, ensure the enforcement of laws and protect investors' rights. In the global financial markets, transactions (including Lloyd's insurance), arbitration and litigation are conducted largely under English law. Since 1968, the Panel on Takeovers and Mergers has been responsible for enforcing the City Code on Takeovers and Mergers and safeguarding shareholder protection. Its status as a currency haven and its attractiveness for business incorporation make the supervision of institutions particularly prudential.

2.3 The "Mega-Regulator" Model

The model is mainly found in advanced economies (Austria, Belgium, Canada, Denmark, Estonia, Finland, France, Germany, Greece, Poland, Latvia, Liechtenstein, Luxembourg, Malta, Monaco, Netherlands, Portugal, India, Slovenia, Singapore, Spain, Sweden, Switzerland, Norway). All financial markets are regulated by one regulator. The mega-regulator approach has proved reliable in medium and small economies with well-developed financial markets: Canada, Austria, Norway, Denmark, Sweden, Finland, Czech Republic, Singapore. More than 30% of the countries in the world use it.

Countries resort to a system of mega-regulators for a number of reasons. (1) The transformation of banks into "financial supermarkets", multi-purpose institutions, financial holdings in the money, debt, capital, forex, mortgage and insurance markets. (2) The emergence of TNBs with assets and entities in various financial markets across the world. (3) Rapid increase in the range of financial instruments within a single financial institution - from classical deposits/loans to derivatives, e-money, digital products. (4) Development of financial technologies - remote account management, securities transactions, contracts.

These new phenomena have enabled structurally complex transactions between institutions from different markets (including foreign markets), with the use of different financial instruments and financial technologies. This resulted in the diversification of risks due to a large number of transaction participants, financial markets and instruments. The stability of national financial systems no longer depended solely on the reliability of an individual national bank and banking system, but also on all participants of the financial market, their interaction with foreign ones, and the presence of foreign investors. The model with one mega-regulator can be illustrated by Sweden (

Table 4).

3. International Organisations, Standards and Legislation as Drivers for Strengthening Financial Systems

The global economy, exposed to global crises, is in dire need of stability in national and international financial systems and financial markets. These markets are deeply integrated, interdependent and require uniform standards, codes of conduct, best practice institutions, and recommendations for national regulation and supervision (see

Table 5).

In an effort to coordinate international and national institutions, the BIS hosted the Financial Stability Forum (FSF, 2020) in 1990 and the Financial Stability Board (FSB) in 2009. The international institutions have updated the international standards following best practices to make national financial systems less susceptible to crises and imbalances. However, priorities for the implementation of standards can only be set according to the specific circumstances of the country in question. Therefore, since 1999, the IMF and the World Bank Group within the framework of the joint Financial Sector Assessment Programme (FSAP) have conducted an initial assessment of the financial sector and existing regulatory practices by addressing financial market vulnerabilities and identifying potential for development. During the second phase, the Central Bank and Ministries of Finance have tailored the international recommendations to their own national environment. Their macroeconomic and microeconomic performance has become the key to motivating the adoption of international standards. It is no panacea, but a means of moving towards the creation of a sound and stable national financial system as a segment of the global system.

In 2011, the EU established the European System of Financial Supervision (ESFS), subordinated to the European Parliament, the Council of the EU and the European Commission. These bodies have been given the mandate to develop common binding regulations for all EU countries (the Single Rulebook). Macroeconomic regulation is carried out by the ECB, established in 1998, and the European Systemic Risk Board (ESRB recommendations, 2022). The European System of Financial Supervision (ESFS) covers macroprudential and microprudential supervision.

Macroprudential supervision includes the supervision of the EU financial system as a whole. It is carried out by the European Systemic Risk Board (ESRB) with the primary objective of preventing or mitigating risks to the EU financial system. The main tasks of the ESRB are: collecting and analysing information to identify systemic risks; issuing warnings where systemic risks are deemed significant; making recommendations to the ECB and national regulators regarding responses to identified risks; monitoring the follow-up to warnings and recommendations; and cooperating and coordinating with international forums.

Microprudential supervision is the supervision of individual institutions such as banks, insurance companies or pension funds. It is carried out by the European Supervisory Authorities (ESAs) (EBA, 2022; ESMA, 2022; EIOPA, 2022): European Banking Authority (EBA), European Securities and Markets Authority (ESMA), European Supervisory Authority for Insurance and Occupational Pensions, European Insurance and Occupational Pensions Authority (EIOPA). ESA works towards the harmonisation of financial supervision in the EU by developing a common set of rules - a set of prudential standards for individual financial institutions. ESA's supervisory institutions help ensure that the Rulebook is applied consistently to create a level playing field. They take authority to assess risks and vulnerabilities in the financial sector, developing macro-prudential policy measures (Measures of national macroprudential policy, 2023). The ECB works closely with supranational and national regulators as part of a single European supervisory framework.

The supervisory objects include monetary, capital and insurance market entities: credit institutions; payment institutions; financial conglomerates; investment companies and funds, trust companies, brokerage and other firms providing investment services; financial market infrastructure organisations (exchanges, central depositories, central counterparties; rating agencies (RAs); insurance and reinsurance organisations, insurance intermediaries; professional pension institutions.

Their main functions are: developing technical standards and guidelines for the implementation of Basel III; direct supervision of RAs and trade repositories; developing technical standards and guidelines for securities transactions; introducing prudential supervision requirements for insurance organisations; improving legislation on the regulation and supervision of financial markets, creating a common culture and practice of financial supervision in the EU.

The Eurozone Banking Union (19 countries) employs a Single Supervisory Mechanism (SSM) (see

Table 6) comprising the ECB and the Central Bank. The ECB supervises all Eurozone banks (4,700) and directly supervises 28 systemically important banks (E-SIBs), including 13 globally significant G-SIBs that meet Basel III requirements for capital adequacy (with a capital/asset range of 5-7.5%) and asset quality.

Thus, the Eurozone employs Subregional-national system for the regulation and supervision of financial markets. National regulators delegate to EU supervisory authorities the functions of harmonising technical standards and requirements for market participants and supervisory institutions. The ECB has a prominent role as a national regulator. A two-tiered supervisory system (EU level: ECB, EBA, ESMA, EIOPA and national regulators (Central Bank and mega regulators) jointly supervise financial markets for their reliability, sustainability, efficiency and minimisation of systemic risks.

4. Regulation of Financial Markets

The regulation of financial markets extends to macroeconomic and microeconomic regulation. Its fundamental principles, methods and instruments were formed after the Great Depression of 1929-1933. These principles have been implemented by the main US government monetary institutions: The Federal Reserve and the Treasury.

4.1 Macroeconomic and Monetary Regulation (Case Study of the USA)

The monetary policy of the Fed was defined by the Banking Act (1935). They come down to two objectives: to ensure maximum employment (without hindering economic growth) and to maintain price stability (including blocking inflationary expectations). The Fed determines monetary policy and pursues a specific set of objectives, centred on the regulation of the money supply and economic lending. By adjusting the money supply (MS), the Fed influences the price of money - interest rates and the performance of the US economy. Lowering the borrowing costs boosts the borrowing market for businesses and households, leading to increased investment and purchasing power (S-I according to Keynes), which stimulates the production of goods and services and the growth of the economy as a whole.

The Fed uses three main macroeconomic tactics and tools to conduct monetary policy: (1) Open market operations. (2) Regulation of discount rates. (3) Regulation of reserve requirements. These have good scientific rationale and are well understood by the markets.

The payment of interest income by the Central Bank on compulsory reserves and surpluses held in bank accounts in excess of regulatory requirements has introduced some innovations in addition to the classic three monetary instruments of the Fed. The Fed found itself in a competitive environment. Among the innovations are:

Term Auction Facility (TAF), where banks have the opportunity to borrow money from the Fed on full collateral terms (Fed also takes mortgage-backed low-rated securities as collateral).

Primary Dealer Credit Facility (PDCF) – overnight loans with qualified collateral.

Term Securities Lending Facility (TSLF). According to this procedure, banks-primary dealers can receive loans for a period in the form of Treasury securities secured by other securities.

The Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility (ABCP) repurchase program provides loans to banks to repurchase high-quality asset-backed commercial securities from mutual funds. The program is designed to help mutual funds that face a shortage of funds due to the desire of investors to withdraw their deposits.

Commercial Paper Funding Facility (CPFF) issuers of such securities (both secured and unsecured) through authorized primary dealers. Designed to improve the liquidity situation of commercial enterprises.

The Money Market Investor Financing Facility (MMIFF) is designed to buy back certain types of assets from qualified investors who have difficulties with liquid funds.

Term Asset-Backed Securities Lending Facility (TALF). According to the program, the Fed provides, without the right of turnover, up to $1 trillion to holders of securities created in the order of securitization of loans to students, households, small businesses, etc. The evaluation of such securities when issuing loans is carried out at market value.

While conducting monetary policy, the FOMC primarily monitors banking sector liquidity, money demand (MD) and money supply (MS), economic cycles and their forecasting, making active use of the FED funds rate indicative method. The FOMC's algorithm is determined by the regularity of action: overproduction and overstocking in key sectors of the economy necessitate a slowdown in growth, which means reducing bank liquidity by raising the interest rate on bank lending and increasing the yield on government debt. The offering price for securities is a function already performed by the Treasury in shifting banks from the real sector to T-bills of US government debt). To stimulate growth and replenish bank liquidity, the FOMC gradually lowers the key rate. The FED funds Rate serves as a benchmark for the money market, as does the LIBOR (except that in the former case it is set by the Central Bank, in the latter by twenty top-rated private banks with a AAA credit rating).

Rate trends reflect not the equilibrium real interest rate of the MD=MS, but rather the dynamics of the fundamental economic factors, including the unemployment rate, prices, productivity and economic growth (including the blue chips). The algorithm is simple: increase in GDP leads to a cautious rate cut policy; and decrease in GDP leads to an increase in the rate. Since 1980, the rate has followed the phases of crises and growth (booms): between 1980 and 1982, the Fed lowered the rate from 18% to 8% (and the Treasury lowered the corporate income tax from 52.8% to 32.58%). Between 1990 and 2000, during the decade of a balanced money market, sustained growth and low unemployment, the rate fluctuated within 5%. The global crisis of 2008-2009 increased unemployment to 10%, leading to a financial and economic collapse (negative real GDP). Quantitative easing (QE) has been part of the monetary policy programme until 2017: The Fed cut the US Treasury rate from 5% and kept it below 1%.

In the course of the post-crisis recovery, economic growth and low unemployment (2018-2019), the rates ranged between 2.25 and 2.50%. The COVID-19 crisis brought the Fed back to QE, forcing a rate cut to the zero lower bound (0.00-0.25%) in March 2020. Having achieved overall economic activity (including employment growth) in the second quarter of 2022 (15 June 2022), the FOMC raised its key rate by 75 basis points to 1.5-1.75% for the first time since 1994 (Federal Reserve issues FOMC statement, 2022). The Fed's analysis was apparently accurate: the most important stock indicators reacted positively, with the DJIA increasing by 0.96%, the S&P by 1.39% and the NASDAQ by 2.21%.

The Fed Funds rate remains a price benchmark for the commercial and government bond markets and commercial bank lending rates. There is a track record of joint action in monetary policy between the Fed and the Treasury. The correlation coefficient is high - for 10-year US T-bills 0.97, two-year 0.91. Inflation targeting at 2% and the active use of the "federal funds rate" constitute tactical and strategic tools of the Fed's monetary policy.

4.2 The Basel Regulatory Framework: US Implementation of the Basel Accords

The USA is a member of the Basel Committee on Banking Supervision (BCBS). The Fed has therefore developed guidelines for the supervised banks on the core documents of the Basel Committee (Basel I, II, III), Basel Coordination Committee bulletins, best practices for capital adequacy implementation, risk and liquidity management. In July 2013, the Federal Reserve Board adapted the Basel III requirements for bank capital in the USA, increasing both the quantity and quality of capital for US banking organisations. In October 2013, the Federal Reserve Board offered guidelines for the implementation of liquidity coverage ratio in the USA, which for the first time created standardised minimum liquidity requirements for large and international bank institutions and systemically important non-banking financial companies. These institutions would have to hold a minimum amount of high quality liquid assets, such as Central Bank reserves and government and corporate bonds, that could be easily converted into cash.

The Volcker rule prohibits banking institutions from conducting real estate transactions or investing in or sponsoring hedge funds or private equity funds. The rules have been developed by five federal financial regulatory agencies, which include the Federal Reserve, the Commodity Futures Trading Commission, the Federal Deposit Insurance Corporation, the Office of the Comptroller of the Currency and the Securities and Exchange Commission.

Since American financial market supervision practices by the Fed and Treasury have already been thoroughly examined, it is the European experience that draws most attention.

5. Subregional-National System of Financial Regulation and Supervision (The Case Study of The EU and Finland)

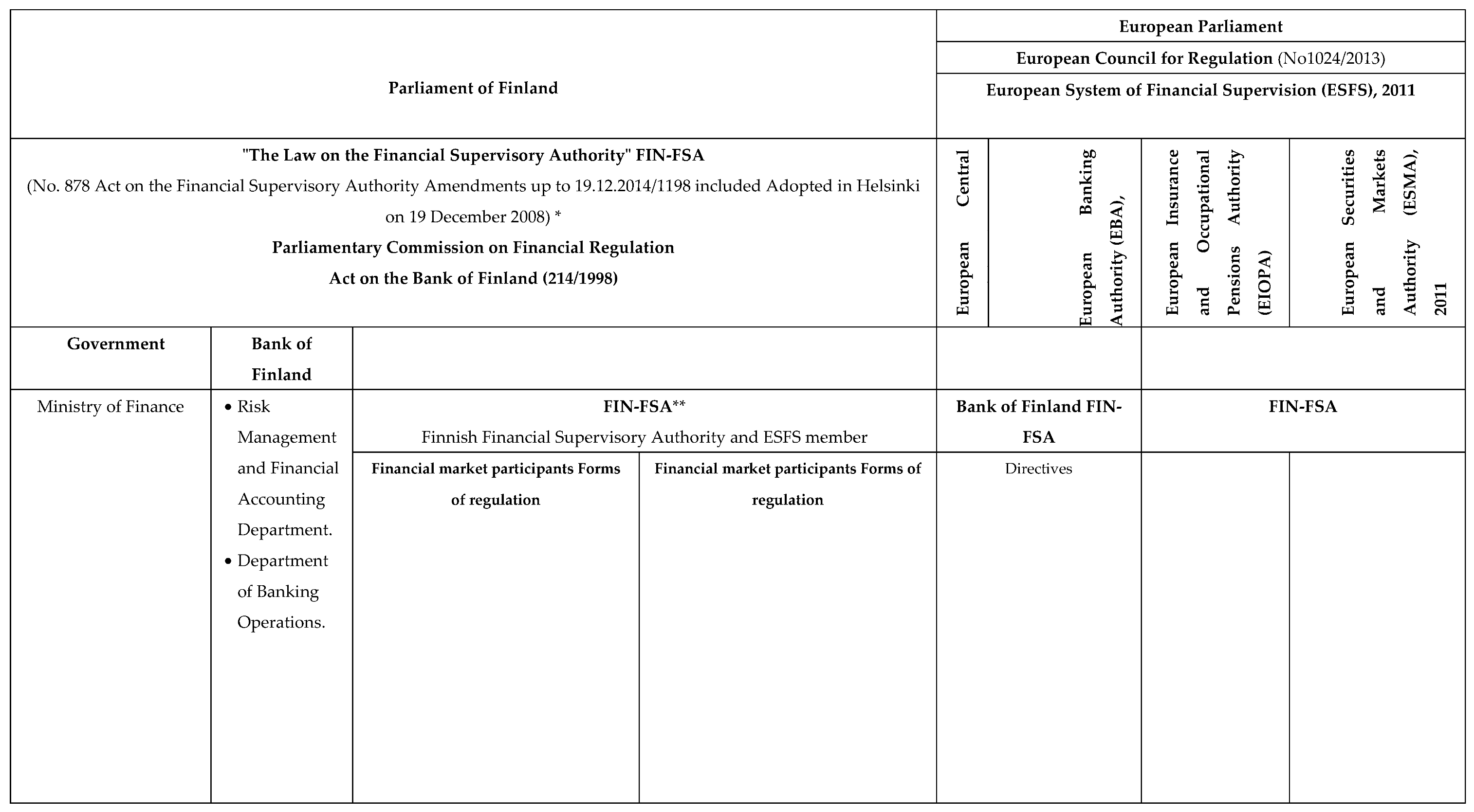

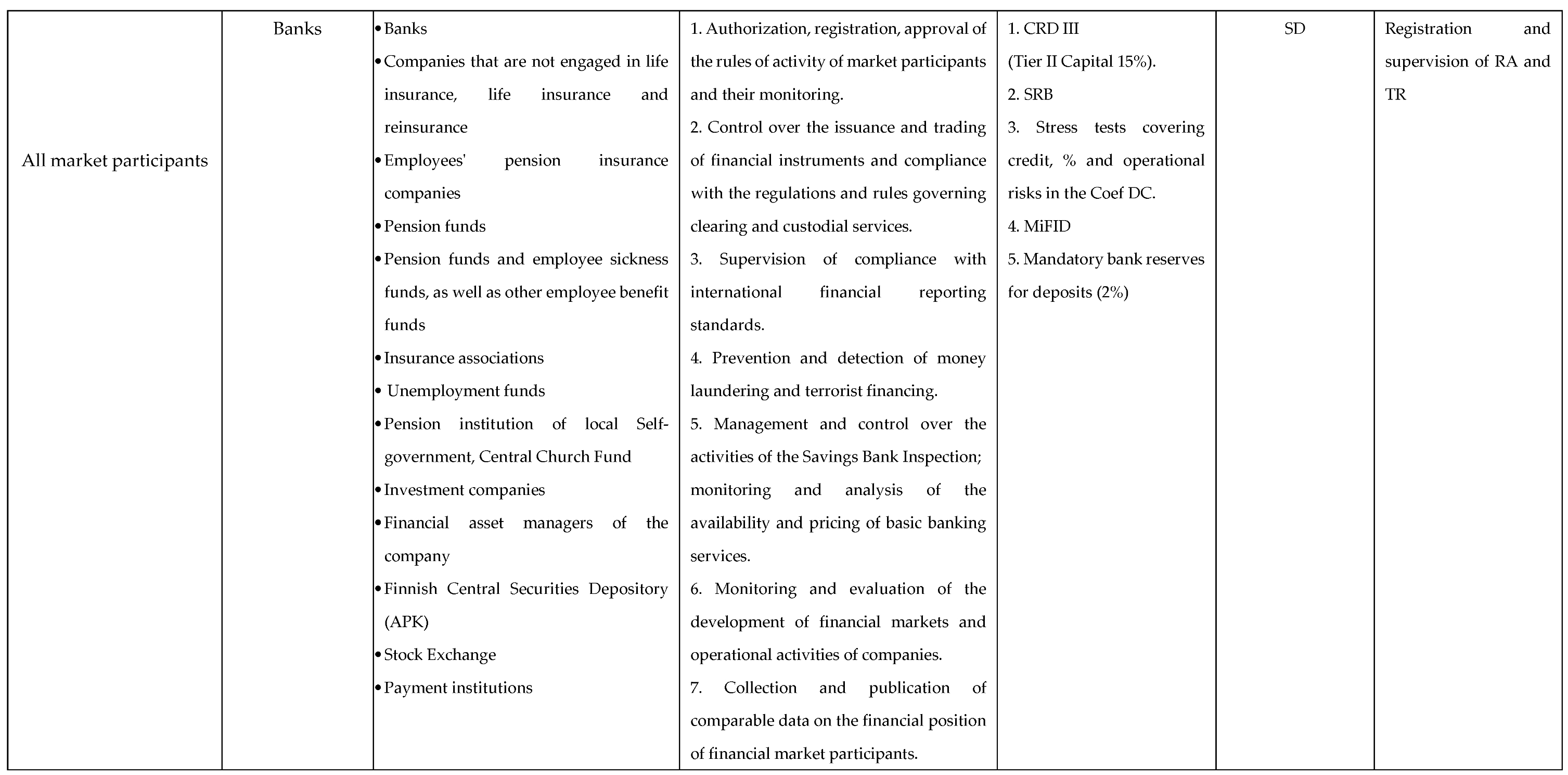

In Finland, macroprudential and microprudential supervision has been carried out since 2009 by the Finnish Financial Supervisory Authority (Finanssivalvonta, FIN-FSA), a special mega-regulator and supervisor of the financial sector of the economy. Finland, as a member of the EU, exercises its regulatory and supervisory functions in cooperation with the institutions of the European Financial Supervisory System (see

Table 7).

Where:

CRD – Capital requirement Directive

MiFID – Market in Financial Instruments Directive

ESRB – European Systemic Risk Board

SRB – Systemic Risk Buffer

RА – Rating Agencies

ТRs – Trade repository, TRs under Regulation EU No 648/2012. According to the ECB classification – “The central register of official copies of transactions concluded on the OTC derivatives market.”

Supervision covers banks, insurance and pension companies, investment firms and funds, as well as the Helsinki Stock Exchange. Up to 95% of FIN-FSA's activities are funded by supervised entities, with the Bank of Finland ensuring the remainder. FIN-FSA operates in cooperation with the Finnish Parliament (Financial Regulatory Commission), the Bank of Finland and the European Financial Supervisory Authority (ESFS), but takes independent decisions in its supervisory activities.

The goals and functions of FIN-FSA have been stipulated in the Financial Supervisory Authority Act (No. 878 Financial Supervisory Authority Act as amended before 19.12.2014/1198, enacted in Helsinki on 19 December 2008), which include four main goals: ensuring smooth operation of credit institutions, insurance and pension companies and other supervised entities in financial markets; protecting the rights of insured persons and building public confidence in financial market transactions; promoting best practices in financial markets and raising public awareness of financial markets.

FIN-FSA has developed target groups of guidelines and regulations to be followed in its supervisory activities: 1. Commencement of activities. 2. Organisation of supervised entities’ operations. 3. Risk management. 4. Accounting, financial statements and management report. 5. Capital adequacy. 6. Code of conduct. 7. Operations of securities markets. 8. Insurance operations. All activities of FIN-FSA-supervised entities are, however, considered from the perspective of consumer protection and financial market balance.

Regulation and supervision are the core activities of FIN-FSA. Regulation includes issuing regulations and guidelines, preparing legislation on the financial market, and advising on legislative initiatives in the Finnish Parliament and the European Parliament ("European Regulatory Council" (No1024/2013).

The code of conduct of the FIN-FSA binding regulations and guidelines for businesses is a regulatory tool. It is based on the Finnish and EU legislation and recommendations of the EU supervisory institutions: European Banking Authority (EBA), European Insurance and Occupational Pensions Authority (EIOPA) and European Securities and Markets Authority (ESMA). FIN-FSA also benefits from the advice of the Bank for International Settlements (BIS), the IMF and the World Bank (WB). It issues advisory statements on specific issues whenever appropriate.

The main form of regulation of the financial markets is the granting of business permits, registrations, notifications, approval of rules for market participants and their monitoring (permits, registrations and notifications). These are tailored to each financial market segment (see

Table 8).

Thus, the FIN-FSA provides market access in accordance with the regulations. Failure to comply with these regulations would result in the loss of business permits and the exit of the companies from the market. By means of continuous supervision of the activities of market participants, the market is regulated. Therefore, the supervisory instruments serve at the same time as market regulation instruments in the hands of one supervisory body: 1. Supervision of the issuance and trading of financial instruments and compliance with regulations and rules governing clearing and custodial services. 2. Monitoring the compliance with international financial reporting standards. 3. Prevention and detection of money laundering and terrorism financing. 4. Management and supervision of the Savings Bank Inspectorate; monitoring and analysis of the availability and pricing of basic banking services. 5. Monitoring and evaluating the development of financial markets and company operations. 6. Collection and publication of compatible data on the financial position of financial market participants. In fact, FIN-FSA's regulatory and supervisory functions overlap.

5.1 FIN-FSA Register of Financial Market Participants

The FIN-FSA register includes lists of financial market prospectuses; supervised entities; notices/warnings; shared savings account providers; warnings and unauthorised service providers; and insurance intermediary registers.

Warning and rogue provider lists are an important regulatory tool for the FIN-FSA. In order to protect the interests of clients and investors, financial market operators should comply with financial regulations. The FIN-FSA publishes the following lists for this purpose: "Warnings concerning unauthorised service providers", "Warnings concerning prospectus and offering requirements", "Prohibitions concerning insurance brokerage" and "Warnings from foreign supervisory authorities".

The integration of financial markets and the expansion of online services offered more choice to customers, but at the same time customers are exposed to more risk. Despite supervision and regulation, dishonesty in financial markets is likely to affect honest private investors and depositors.

FIN-FSA is issuing warnings in the following cases: 1. A service provider contacts you by phone from outside the EU. A typical form of criminal activity is when the service provider, the investee (e.g. shares) and the address to make the payment are in different countries. 2. The service provider is overly hasty: "The decision must be taken immediately, otherwise the offer becomes null and void". 3. Payment is required in advance. 4. Payment is made to an organisation different from the service provider and may be addressed to a third country. 5. There is no written contract or other written documentation. 6. Maximum profit is promised in a short period of time and without risk. 7. The offer is made individually and must be kept confidential

The FIN-FSA recommends the following verification procedures before making a decision:

- Does the service provider actually exist? (The Internet has enabled the use of fictitious names and the creation of fake identities and company websites. Even well-known service providers and branded products have been used for some other purpose). The authenticity and reliability of the service provider can be verified through contact details, local authorities and governments.

- Who runs the company? What is the company's ownership structure and history?

- Is a permit required? Does the service provider have a permit?

The authorisation or registration of the service provider can be checked against the lists of supervised entities and FIN-FSA notifications.

Example of registration procedures for a payment service provider.

Payment service providers and electronic money institutions submit an application, complete authorisation forms and pay cross-border service fees. The activities of the applicant shall comply with the Payment Institutions Act (29/2010, in Finnish), which requires authorisation and compliance with the term "payment service", e.g. making a payment transaction, issuing payment instruments and transferring funds. In order to obtain authorisation, the applicant completes a compliance and due diligence form with the FIN-FSA, whereas the information service, if authorised, issues an invoice. Participants in certain market segments shall complete special registration forms (see hyperlinks in

Table 8).

5.2 The Financial Supervision Authority (FSA)

The report. The first supervisory tool is a company report prepared in compliance with the requirements (forms) of the FIN-FSA. Supervised entities in all financial markets shall regularly submit various financial and market information to the FIN-FSA, which shall be used to monitor the economic performance of companies, including their profitability, capital adequacy, systemic risks and business volumes. The reporting frequency is determined by FIN-FSA guidelines (see

Table 9).

Reporting of financial position and risks shall be conducted in a standardised and regular form (Jakelu FIN-FSA, 2022). Supervision of financial markets is sector-specific: for the banking sector - banking supervision, insurance market - insurance supervision, capital market - supervision of issuers, intermediaries, infrastructure institutions, market investors. However, there are general supervisory requirements for all financial market participants to respect licenses (permits), reporting, ethics, and consumer protection standards.

Banking supervision is at the core of financial supervision. The FIN-FSA, in cooperation with the European Central Bank (ECB), is responsible for the prudential supervision of credit institutions. The FIN-FSA oversees bank credibility, risk management practices and risk tolerance of credit institutions, processes applications for authorisation and registration, participates in the development of banking legislation, and monitors the compliance of banks and payment service providers with established practices and consumer protection rules. See consumer protection website (Financial Supervisory Authority, 2022, 2018a, 2018b, 2018c).

Supervision and monitoring reports are published on a regular basis (several times a month) in statements and risk assessments in various segments of the financial market. For example, in July and August 2020, there were published "Summary of the Industry Risk Assessment of Money Laundering with respect to Payment Service Providers", "Updated EVA recommendations on statutory and non-statutory loan repayment moratoria applied in light of the COVID-19 crisis, included in the FIN-FSA Rulebook and Recommendations", "FIN-FSA decision to extend the profit-sharing recommendation until 1 January 2021 and clarification of expectations related to capital buffers and liquidity" (Financial Supervisory Authority, 2020a, 2020b, 2021a, 2021b).

Insurance supervision. The FIN-FSA is responsible for the overall prudential supervision of the insurance sector. The purpose of supervision is to ensure that organisations have the financial means to meet their obligations, in particular the payment of premiums and pensions. The FIN-FSA is designed to monitor the compliance of insurance companies with established practices and consumer protection rules (see the consumer protection website above).

The FIN-FSA monitors companies for life, property, liability, financial and specific risks and pension institutions; the solvency and financial situation of insurance companies; internal risk management and risk management procedures; underwriting risks, in particular the calculation and adequacy of technical reserves; investment risks: employment funds; finance and solvency; governance; codes of conduct in dealing with customers and their implementation practices.

The insurance supervision includes monitoring the accuracy of the financial statements of the supervised entities in the insurance sector in accordance with the regulations and guidelines issued specifically for the insurance sector. Additionally, the insurance supervisor is responsible for cross-border co-operation with EIOPA and the College of Supervisory Authorities.

Capital market. The purpose of FIN-FSA's supervision of the markets and business conduct is to enhance confidence in the markets and in the activities of market service providers. The FIN-FSA exercises control over investments in securities and other investment products, including the disclosure and financial reporting obligations of listed companies under IFRS. The mega-regulator monitors trading on securities markets and their reports, and investigates cases of securities market abuse.

Moreover, the FIN-FSA exercises control over the codes of conduct in the financial sector, and the activities of investment service providers, management companies and managers of alternative investment funds (see consumer protection website above). The FIN-FSA also reviews applications for permits and registrations in its area of responsibility and participates in the development of supervisory regulations as approved by law and in international supervisory cooperation.

Finland and the EU conduct joint activities on topical financial market issues:Prevention of Money Laundering and Terrorist Financing, Financial Technology (FinTech), and Sustainable Finance.

6. Conclusions

Financial markets have been regulated throughout the 400-year history of capitalism. It began in the 17th and 18th centuries with mandates issued by royal courts to the Central Bank giving it the exclusive right to issue money, oversee money circulation and supervise second-tier banks. With the development of financial markets and the emergence of new instruments in the 20th century, the Central Bank, national regulators (ministries of finance) and special market-oriented institutions acquired new regulatory functions. Eventually, each country developed national systems of regulating and supervising financial markets. Being somewhat resistant to innovation, they are affected by the global economic crises (1929-1933, 2008-2009, COVID-crisis 2020-2021), new phenomena and financial instruments in the world economy (globalisation, derivatives, financial technology, e-money, digital products).

The Great Depression of 1929-1933 urged the creation of a regulatory and supervisory system for securities market participants and protection (insurance) for stockholders. The emergence of a global financial and economic environment in the 1980s of the 20th century and a system in which the national economy and its markets became a segment of the global, world economy, shaped a new agenda for regulatory institutions. In an open economy, the flow of foreign capital into national markets and the withdrawal of interest and non-interest income became relatively free and liberal. The movement of capital on a global scale was determined by the profitability and liquidity of assets and market conditions. Central banks remained the last outposts to protect the stability of national currencies before the influx of foreign direct and portfolio investment. The central banks of major economies were the initiators of Basel I, II and III, harmonising the methodology for assessing capital, capital adequacy and risks. For over 30 years (since 1988), the Basel Standards have formed the basis of the supervisory functions of the world's central banks over the banking industry.

Financial regulatory systems have evolved again since the global crisis of 2008-2009. National central banks and traditional mono-regulators of financial markets failed to prevent a recession as it spread from the markets of other countries. Neither could the US regulatory system prevent financial collapse. Post-crisis reforms of regulatory and supervisory systems have created a new architecture. Central banks all over the world continue to perform macroeconomic (monetary) regulatory functions, implementing monetary and credit policy. Central banks retain microeconomic supervisory functions in about 50 per cent of countries. These are mainly developing economies with limited financial market turnover and fairly simple financial instruments. The US remained committed to a sectoral system of financial regulation, with two peaks and a large number of supervising institutions. The rest of the world has built up systems with one mega-regulator (developed economies), and two/three regulators.

The logic behind the reforms stems from the new quality and scale of financial asset markets (money, debt and equity, currency, insurance, gold). These markets derive their revenues independently from the real asset markets, drawing on the national and foreign segments of global finance. The emergence of derivative financial instruments (turnover of more than 800% of annual global GDP), the multi-vector diversification of bank assets across economic sectors, the emergence of financial holdings and specialised financial companies have led to complex transactions using instruments from different financial markets. Credit and promissory note transactions use securities and guarantees. Transactions in underlying assets (from the world of commodities, securities, currencies, interest rates, indices, contracts, terms, etc.) are conducted using derivatives. Participants in financial transactions (banks, brokers, funds, etc.), infrastructure institutions (exchanges, payment systems, clearing houses), investors, depositors, customers are exposed to the risks of different markets, the interest rate fall/rise of the money or capital market, the devaluation of the national currency or reserve, the operational risks of any market participant.

The depth and scope of this study has a number of limitations. Identifying basic patterns, common and specific in national regulatory systems requires a much larger sample of countries. There is no audited database of regulators and their credibility reduces the validity of the comparative analysis. The research is conducted in accordance with moral, ethical and legal considerations and it is difficult to take into account the interdependence of national and international law. The future research might address such issues as exploring the relationship between sustainability of global and national economies, the competition between TNCs and national companies, the balance between inflows and outflows of direct/portfolio investments.

The modern economics of global and national finance has made markets more complex as regards instruments and transaction patterns. National and international regulatory institutions have therefore developed in a number of different directions.

(1) The requirements for minimum bank capital and credit risk (80s of the 20th century) have been extended to include buffer reserve, liquidity and leverage standards in the 21st century. The central and relevant focus nowadays is the forecasting, assessment and protection of balance and off-balance sheet liabilities against systemic risks. (2) The regulatory focus is on ensuring the stability of the national and global financial system as a driver of sustainable economic growth. (3) Expansion of the list of supervised institutions. (4) Division of functions between central banks (macroeconomic regulation) and one or two mega-regulators (microeconomic regulation and supervision). (5) Division of functions between international financial institutions (BIS, IMF, WB...) and national regulators in supervising financial market participants, while introducing unification of regulatory and supervisory requirements for financial markets (EU, USMCA, MERCOSUR, ASEAN, APEC, BRICS). (6) Protection of consumers and investors and combating money laundering and terrorist financing. (7) Standardisation of the overall approach of global central banks to new financial technologies and cybersecurity.

National systems of macro-prudential regulation and micro-prudential supervision of financial markets reflect the specific characteristics of each country and global practice and work in synergy with international and regional institutions. These are reflected in the register system of market participants, forms and procedures of supervision. There is no single regulatory and supervisory system. The systems change and will continue to change in response to new challenges and risks of the global financial market, the national market being an integral and organic part of it.

Funding

This research received no external funding.

Data Availability Statement

We encourage all authors of articles published in MDPI journals to share their research data. In this section, please provide details regarding where data supporting reported results can be found, including links to publicly archived datasets analyzed or generated during the study. Where no new data were created, or where data is unavailable due to privacy or ethical restrictions, a statement is still required. Suggested Data Availability Statements are available in section “MDPI Research Data Policies” at

https://www.mdpi.com/ethics.

References

- (Act on the Financial Supervisory Authority, 2018) Act on the Financial Supervisory Authority. (2018). Available online: https://www.finanssivalvonta.fi/globalassets/en/fin-fsa/fin-fsa_act.pdf (accessed on 10 September 2019).

- (APRA, 2022) APRA. The Australian Prudential Regulation Authority. (2022). Available online: https://www.apra.gov.au/ (accessed on 17 November 2022).

- (ASIC, 2022) ASIC. The Australian Securities and Investments Commission. (2022). Available online: 022 (accessed on 17 November 2022).

- (Bank of England, 2023) Bank of England. Prudential regulation. (2023). Available online: https://www.bankofengland.co.uk/prudential-regulation (accessed on 13 January 2023).

- (BOI, 2022) BOI. Bank of Israel. (2022). Available online: https://www.boi.org.il (accessed on 15 November 2022).

- (CFPB, 2010) CFPB. Consumer Financial Protection Bureau. (2010). Available online: https://www.consumerfinance.gov/ (accessed on 25 November 2022).

- (CFTC, 2022) CFTC. Commodity Futures Trading Commission. (2022). Available online: https://www.cftc.gov/ (accessed on 25 November 2022).

- (CMB, 2021) CMB. The Capital Markets Board of Turkey. (2021). Available online: https://www.cmb.gov.tr (accessed on 15 November 2022).

- (Commission Implementing Regulation (EU) No 680/2014, 2014). Commission Implementing Regulation (EU) No 680/2014 of 16 April 2014. Laying down implementing technical standards with regard to supervisory reporting of institutions according to Regulation (EU) No 575/2013 of the European Parliament and of the Council. Available online: https://eur-lex.europa.eu/eli/reg_impl/2014/680/2016-12-01 (accessed on 9 September 2020).

- (CSRC, 2021) CSRC. China Securities Regulatory Commission. (2021). Available online: https://www.csrc.gov.cn (accessed on 15 November 2022).

- (CVM, 2022) CVM. The Securities and Exchange Commission of Brazil. (2022). Available online: http://www.cvm.gov.br/ (accessed on 5 December 2022).

- (Dubai FSA, 2022) Dubai FSA. The Dubai Financial Services Authority. (2022). Available online: https://www.dfsa.ae/ (accessed on 15 November 2022).

- (EBA, 2022) EBA. European Banking Authority. (2022). Available online: https://eba.europa.eu/ (accessed on 5 December 2022).

- (EIOPA, 2022) EIOPA. European Insurance and Occupational Pensions Authority. (2022). Available online: https://www.eiopa.europa.eu/ (accessed on 5 December 2022).

- (ESMA, 2022) ESMA. European Securities and Markets Authority. (2022). Available online: https://www.esma.europa.eu/ (accessed on 5 December 2022).

- (ESRB recommendations, 2022) ESRB recommendations. (2022). Available online: https://www.esrb.europa.eu/mppa/recommendations/html/index.en.html (accessed on 5 December 2022).

- (European Banking Authority, 2022) European Banking Authority. (2022). Available online: https://eba.europa.eu/ (accessed on 10 September 2022).

- (European Central Bank, 2022) European Central Bank. (2022). Available online: https://www.ecb.europa.eu/home/html/index.en.html (accessed on 10 September 2022).

- (European Insurance and Occupational Pension Authority, 2022) European Insurance and Occupational Pension Authority. (2022). Available online: https://www.eiopa.europa.eu/ (accessed on 10 September 2022).

- (European Security and Markets Authority, 2022) European Security and Markets Authority. (2022). Available online: https://www.esma.europa.eu/ (accessed on 10 September 2022).

- (FCA, 2022) FCA. Financial Conduct Authority. (2022). Available online: https://www.fca.org.uk/ (accessed on 5 December 2022).

- (FDIC, 2022) FDIC. The Federal Deposit Insurance Corporation. (2022). Available online: https://www.fdic.gov/ (accessed on 25 November 2022).

- (FED, 2022) FED. Federal Reserve System. (2022). Available online: https://www.federalreserve.gov/ (accessed on 25 November 2022).

- (Federal Reserve issues FOMC statement, 2022) Federal Reserve issues FOMC statement (2022). Available online: https://www.federalreserve.gov/newsevents/pressreleases/monetary20220615a.htm (accessed on June 25, 2022).

- (Financial Regulator, 2020) Financial Regulator (2020). Available online: https://www.masterforex-v.org/wiki/finansovyj-rjeguljator.html (accessed on November 11, 2022).

- (Financial Supervisory Authority, 2018a) Financial Supervisory Authority (FIN-FSA). (2018b). “Before you invest or deposit money”. Available online: https://www.finanssivalvonta.fi/en/Consumer-protection/before-you-invest-or-deposit-money/ (accessed on 10 September 2019).

- (Financial Supervisory Authority, 2018b) Financial Supervisory Authority (FIN-FSA) (2018c) “Before you buy insurance”. Available online: https://www.finanssivalvonta.fi/en/Consumer-protection/before-you-buy-insurance/ (accessed on 10 September 2019).

- (Financial Supervisory Authority, 2018c) Financial Supervisory Authority (FIN-FSA) (2018d). “Financial Supervisory Authority’s role in customer protection”. Available online: https://www.finanssivalvonta.fi/en/Consumer-protection/financial-supervisory-authoritys_role-in-consumer-protection/ (accessed on 10 September 2019).

- (Financial Supervisory Authority, 2020a) Financial Supervisory Authority (FIN-FSA). (2020a). “Summary of sector-specific assessment of money laundering risk concerning payment service providers has been published”. 53/2020. Available online: https://www.finanssivalvonta.fi/en/publications-and-press-releases/supervision-releases/2020/summary-of-sector-specific-assessment-of-money-laundering-risk-concerning-payment-service-providers-has-been-published/ (accessed on 10 September 2021).

- (Financial Supervisory Authority, 2020b) Financial Supervisory Authority (FIN-FSA). (2020b). “Updated EBA Guidelines on legislative and non-legislative moratoria on loan repayments applied in the light of the COVID-19 crisis incorporated into FIN-FSA’s set of regulations and guidelines”. 52/2020. Available online: https://www.finanssivalvonta.fi/en/publications-and-press-releases/supervision-releases/2020/updated-eba-guidelines-on-legislative-and-non-legislative-moratoria-on-loan-repayments-applied-in-the-light-of-the-covid-19-crisis-incorporated-into-fin-fsas-set-of-regulations-and-guidelines/ (accessed on 10 September 2021).

- (Financial Supervisory Authority, 2021a) Financial Supervisory Authority (FIN-FSA). (2021a). “Supervised entities”. Available online: https://www.finanssivalvonta.fi/en/registers/supervised-entities/ (accessed on 10 September 2021).

- (Financial Supervisory Authority, 2021b) Financial Supervisory Authority (FIN-FSA). (2021b). “Banking supervision”. Available online: https://www.finanssivalvonta.fi/en/banks/#panel-TiedotteetEN-0 (accessed on 10 September 2021).

- (Financial Supervisory Authority, 2022) Financial Supervisory Authority (FIN-FSA). (2022). “Consumer protection”. Available online: https://www.finanssivalvonta.fi/en/Consumer-protection/ (accessed on 10 September 2022).

- (Finansinspektionen, 2020) Finansinspektionen – Sweden's financial supervisory authority. (2020). Available online: https://www.fi.se/en/financial-stability/ (accessed on September 03, 2020).

- (FinCom, 2022) FinCom. The Financial Commission. (2022). (Available online:. Available online: https://www.financialcommission.org (accessed on 15 November 2022).

- (FIN-FSA, 2022) Finnish Financial Supervisory Authority (FIN-FSA). (2022). Available online: https://www.finanssivalvonta.fi/en (accessed on June 25, 2022).

- (FINRA, 2022) FINRA. Financial Industry regulatory authority. (2022). Available online: https://www.finra.org/#/ (accessed on 5 December 2022).

- (FMA NZ, 2022) FMA NZ. Financial Markets Authority of New Zealand (2022). Available online: https://www.fma.govt.nz/ (accessed on 17 November 2022).

- (FPC, 2022) FPC. The Financial Policy Committee. (2022). Available online: https://www.bankofengland.co.uk/about/people/monetary-policy-committee (accessed on 5 December 2022).

- (FSA, 2022) FSA. The Financial Services Agency. (2022). Available online: https://www.fsa.go.jp/en/ (accessed on 15 November 2022).

- (FSC, 2021) FSC. Korea's Financial Services Commission. (2021). Available online: http://www.fsc.go.kr/eng/ (accessed on 15 November 2022).

- (FSCA, 2022) FSCA. Financial Sector Conduct Authority. (2022). Available online: https://www.fsca.co.za (accessed on 17 November 2022).

- (FSCL, 2022) FSCL. Financial Services Complaints Ltd. (2022). Available online: https://www.fscl.org.nz/ (accessed on 25 November 2022).

- (FSF, 2020) FSF. Financial Stability Forum. (2020). Available online: https://www.fsb.org/history-of-the-fsb/ (accessed on September 03, 2020).

- (FSOC, 2010) FSOC. Financial Stability Oversight Council. (2010). Available online: https://home.treasury.gov/policy-issues/financial-markets-financial-institutions-and-fiscal-service/fsoc (accessed on 25 November 2022).

- (FSPR, 2022) FSPR. Financial Service Providers Register. (2022). Available online: https://fsp-register.companiesoffice.govt.nz/ (accessed on 17 November 2022).

- (IIROC, 2022) IIROC. Investment Industry Regulatory Organization of Canada. (2022). Available online: https://www.iiroc.ca/Pages/default.aspx (accessed on 25 November 2022).

- (ISA, 2022) ISA. Israel Securities Authority. (2022). Available online: https://www.isa.gov.il (accessed on 15 November 2022).

- (Jakelu FIN-FSA, 2022) Jakelu FIN-FSA. (2022). Available online: https://jakelu.finanssivalvonta.fi/jakelu/english/ (accessed on 10 September 2022).

- (JSDA, 2022) JSDA. Japan Securities Dealers Association. (2022). Available online: https://www.jsda.or.jp/en (accessed on 15 November 2022).

- (Langdon, 2001) Langdon K. (2001). "Implementing international standards for stronger financial systems", BIS Quarterly Review, Bank for International Settlements, March. P.51.

- (Measures of national macroprudential policy, 2023) Measures of national macroprudential policy: Capital conservation buffer (CCoB), Countercyclical capital buffer (CCyB), Systemic risk buffer (SyRB), Systemically important institutions (Global-SIIs, Europe-SIIs). (2023). Available online: https://www.esrb.europa.eu/national_policy/html/index.en.html (accessed on 20 January 2023).

- (NCUA, 2022) NCUA. National Credit Union Administration. (2022). Available online: https://www.ncua.gov/ (accessed on 5 December 2022).

- (NFA, 2022) NFA. National Futures Association. (2022). Available online: https://www.nfa.futures.org/ (accessed on 5 December 2022).

- (PRA, 2022) PRA. Prudential Regulation Authority. (2022). Available online: https://www.bankofengland.co.uk/prudential-regulation (accessed on 25 November 2022).

- (SCA, 2022) SCA. Securities & Commodities Authority. (2022). Available online: https://www.sca.gov.ae/default.aspx (accessed on 15 November 2022).

- (SEBI, 2022) SEBI. Securities and Exchange Board of India. (2022). Available online: https://www.sebi.gov.in (accessed on 15 November 2022).

- (SEC, 2022) SEC. The United States Securities and Exchange Commission. (2022). Available online: https://www.sec.gov/ (accessed on 25 November 2022).

- (SFC, 2022) SFC. Securities and Futures Commission. (2022). Available online: https://www.sfc.hk/web/EN/index.html (accessed on 15 November 2022).

- (The Central Bank of the United Arab Emirates (2022)) The Central Bank of the United Arab Emirates. (2022). Available online: https://www.centralbank.ae/ar (accessed on 15 November 2022).

- (The Panel on Takeovers and Mergers, 2022) The Panel on Takeovers and Mergers. (2022). Available online: https://www.thetakeoverpanel.org.uk/ (accessed on 5 December 2022).

- (U.S. Department of the Treasury, 2022) U.S. Department of the Treasury. (2022). Available online: https://home.treasury.gov/ (accessed on 25 November 2022).

Table 1.

Financial regulators of the countries of the World, 2020.

Table 1.

Financial regulators of the countries of the World, 2020.

| Macro region |

Specialized Regulators |

1

+ CB*

|

CB* |

Other |

| Mega Regulator |

2 Regulators

“The Twin Peaks” |

3 and more Regulators “Trident”

|

2

+ CB* |

No Regulator |

Region banks, Foreign CB |

| Asia |

13 |

2 |

3 |

5 |

24 |

1 |

|

|

| Africa |

1 |

|

|

|

45 |

|

|

9 |

| Europe |

20 |

1 |

|

10 |

7 |

|

|

|

| Oceania |

1 |

1 |

1 |

|

3 |

|

6 |

|

| North America |

1 |

|

1 |

|

|

|

|

|

| South America |

1 |

|

|

3 |

8 |

|

|

|

| Total |

37 |

4 |

5 |

18 |

87 |

1 |

6 |

9 |

Table 2.

Financial Services (Assets) Markets and Regulators in the USA, 2020.

Table 2.

Financial Services (Assets) Markets and Regulators in the USA, 2020.

| Financial services markets |

Regulators |

| Banking |

Federal Reserve System, FED – The central bank was established on December 23, 1913 with the mandate of centralized control over the US banking system, ensuring price stability and economic growth. Website: https://www.federalreserve.gov/ |

|

The Office of the Controller of the Currency, OCC, 1863 – U.S. Department of Treasury (1789) with the task of regulating and supervising all banks of the country, federal national associations, 50 branches and agencies of foreign banks according to the Charter. Website: https://www.occ.gov/ |

|

The Federal Deposit Insurance Corporation, FDIC. Website: https://www.fdic.gov/It was created in 1933 in the wake of bank defaults to protect individual savings after the closure/bankruptcy of banks. Since 2011, the Corporation provides deposit insurance of up to $250 thousand for all accounts in one bank. |

|

National Credit Union Administration, NCUA, established in 1970, carries out state supervision of federal and state credit unions. At the same time insures the savings of individuals. Website: https://www.ncua.gov/ |

|

The State Banking Regulator, established in 1851 in each state, it is engaged in licensing and approving the charters of national banks, foreign agencies, savings institutions, trust companies. The oldest in the country New York State Banking Department.

|

| Stock market and Investment banks |

Stock Exchange Commission, SEC. It was established in 1934 by the Government Agency for Regulation and Supervision of the Securities Market.

Website: https://www.sec.gov/. |

| State Attorney General |

|

State Security Regulator – an analogue of the SEC within the state market. |

Financial Industry regulatory authority, FINRA, created in 2007 to protect investors. Authorized by Congress, the SRO monitors firms doing business in the United States with securities, compliance with the rules of trading on the OTC market, including 624,000 brokers, 175,000 branches, more than 650,000 representative offices.

Website: https://www.finra.org/#/ |

| Commodity/Futures |

Commodity Futures Trading Commission, CFTC. The independent agency was established by Congress in 1974 to regulate the market of commodity and financial futures and options. Website: https://www.cftc.gov/\ |

| Insurance |

State Insurance Regulators with a mandate to oversee and regulate the entire insurance business in the state. The principles of insurance regulation were fixed in 1945 by the (McCarran-Ferguson Act), which determined that the regulation of insurance in the United States does not fall within the competence of federal authorities, but within the competence of each state separately. For example, Insurance Department Consumer Services of Arkansas. Website: https://insurance.arkansas.gov/ |

National Association of Insurance Commissioners (NAIC), 1871, SRO – develops rules and regulatory requirements, many of which are approved by the states.

Website: https://content.naic.org/ |

| All financial markets |

Consumer Financial Protection Bureau (CFPB), 2010.

Websites: https://www.consumerfinance.gov/;

https://www.consumerfinance.gov/language/ru//. The Government Bureau monitors banks, credit unions and other financial companies to ensure compliance with financial laws that protect against unfair treatment, fraud and abuse. |

Financial Stability Oversight Council (FSOC). The division of U.S.T (2010). Website: https://home.treasury.gov/policy-issues/financial-markets-financial-institutions-and-fiscal-service/fsoc/.

The Board is responsible for identifying risks to U.S. financial stability, encouraging market discipline, and responding to emerging risks to the stability of the financial system. |

Table 3.

Twin Peaks model (the case of England) based on the financial regulatory reform in the UK 2012 (Financial Services Act 2012).

Table 3.

Twin Peaks model (the case of England) based on the financial regulatory reform in the UK 2012 (Financial Services Act 2012).

| Regulatory Goals |

Forms of regulation |

Regulatory institutions |

Objects of regulation |

Financial system Stability:

- Bank control and monitoring

- Consumer protection

- Reducing risks from the potential outflow of banks

- Minimization of systemic risks |

Banking conduct regulation

Tightening of capital adequacy and reliability requirements |

Bank of England |

Prudential supervision of

system infrastructure institutions:

recognized payment systems, central securities depositories, central counterparties (CCPs).

|

Deposit insurance

in case of default, loss of liquidity and bank flight |

Prudential Regulation Authority (PRA),

subsidiary of the Bank of England |

Prudential supervision of

institutions accepting deposits:

|

| Countering money laundering and attempts to conceal a transaction under the guise of a financial fund and shell companies (Financial firewalls) |

The Financial Policy Committee (FPC),

Independent authority.

Functions: Recommendations to PRA and financial institutions to limit systemic risk. |

Recommendations on reserve capital in order to implement countercyclical policy (Countercyclical capital buffer, CCB).

Capital requirements in certain sectors (Sector capital requirements, SCR).

Financial leverage control. |

| |

Financial Conduct Authority (FCA),

independent agency.

Functions:

Protecting investors and maintaining healthy competition, countering transactions by persons with insider information,

investigating and monitoring the enforcement of laws aimed at protecting and regulating the financial system. |

Trust companies, hedge funds, brokers, independent financial advisors, financial companies that are not subject to PRA regulation. |

| |

The Committee on Takeovers and Mergers (the Panel on Takeovers and Mergers), an independent body, 1968.

Functions: monitoring compliance with the "City Code" on takeovers and mergers, guaranteeing protection of shareholders in transactions related to the takeover of companies. |

All companies involved in M&A transactions. |

Table 4.

The Swedish Financial Regulation System.

Table 4.

The Swedish Financial Regulation System.

| Swedish Ministry of Finance |

Finansinspektionen (FI)

Swedish Financial Supervisory Authority (FSA Sweden), 1991

|

| Goals |

Consumer protection |

Financial literacy of the population.

Education. Various educational programs with Pension and Consumer agencies. Youth programs |

| Increasing the share of private investors |

| Verification of counterparty firms through the Register of Companies |

| Warning from ESMA (European Association of Securities and Markets) |

| |

Areas |

|

| Financial stability |

Transfer of savings to financing (investment) S – I |

|

| Risk Management |

|

| Reliability of payments |

|

| Banking supervision |

Capital buffer requirements |

|

| Insurance |

Institute of Risk Management, Firm Stability and Asset Protection. |

Objectives: prevention of problems, finding a reasonable balance between risks and payments, consumer protection. |

| Markets |

FI is the administrator of the Benchmark regulation (BMR) in the ESMA registry. |

Securities markets, and infrastructure

(trading platforms and transactional systems) – a key element of the financial system is regulated through licensing, analysis of reports and BMR. |

| Functions |

Report on the financial stability of the financial system, firms and markets in terms of risks |

The report is prepared 2 times a year with an analysis of the risk system and recommendations for their reduction |

|

| Regulatory objects, areas of responsibility |

Banks |

|

|

| Insurance Co |

FI supervision objects: life insurance companies (approx. 300), Mutual insurance companies (approx. 55), pension funds (75), insurance intermediaries (1000). |

|

| Securities, derivatives, Forex markets |

brokers, market makers, jobbers, dealers of large traders, clearing and payment companies. |

Represent the interests of investors, Exchange Traded Funds, (ETFs), issuers of shares, bonds, promissory notes, derivatives and other financial instruments,

listed securities on a major international stock exchange with headquarters in Stockholm OMX Nasdaq Nordic Exchange |

| Forms of regulation and supervision |

Supervision |

Assessment of the financial condition of companies and the entire market. Risk assessment and management systems. |

|

| Regulation |

Determination of countercyclical capital buffer for banks |

|

| Issuing permits |

Permission to banks, insurance companies, firms for payment services with a turnover of 3 million euros / year, brokers, traders, stock exchanges, service providers APA, ARM, CTP. |

Permits for financial services under the "Law on Permits" (2015:1016, Chapter 1, section 1. |

Table 5.

International standards and institutions with regard to the stability of financial systems.

Table 5.

International standards and institutions with regard to the stability of financial systems.

| Area |

Key Standard |

Who Released |

References |

| Transparency of Macroeconomic policy and Information |

|---|

| Transparency of monetary and financial policy |

Code of Good Practices on Transparency in Monetary and

Financial Policies |

IMF |

www.imf.org

https://www.imf.org/en/Publications/CR/Issues/2016/12/31/Spain-Financial-Sector-Assessment-Program-Detailed-Assessment-of-the-IMF-Code-of-Good-19347 |

| Transparency of fiscal policy |

Code of Good Practices on Fiscal Transparency |

IMF |

https://www.imf.org/external/np/fad/trans/code.htm |

| Dissemination of information |

Special Data Dissemination Standard (SDDS)/General Data

Dissemination System (GDDS) |

IMF |

www.imf.org |

| Institutional and Market Infrastructure |

| Insolvency |

Principles and guidelines for effective systems of insolvency risk management and Protection of Creditors' Rights. |

World bank |

https://www.worldbank.org/ |

| Corporate Governance |

Principles of Corporate Governance |

OECD |

www.oecd.org

https://www.oecd.org/daf/ca/Corporate-Governance-Principles-ENG.pdf |

| Bookkeeping |

International Accounting Standards (IAS) |

International Accounting Standards Committee

(IASC) |

https://www.iasplus.com/en/resources/ifrsf/history/resource25 |

| Audit |

Standards on Auditing (ISA) |

International Federation of Accountants (IFAC) |

www.ifac.org |

| Payments and settlements |

Core Principles for Systemically Important Payment Systems |

Committee on Payment and Settlement Systems (CPSS) |

https://www.bis.org/

https://www.bis.org/cpmi/info_pfmi.htm?m=3%7C16%7C598 |

| Market integrity |

The Forty Recommendations of the Financial Action Task Force

on Money Laundering |

Financial Action Task Force (FATF) |

https://www.fatf-gafi.org/home/ |

| Financial Regulation and Supervision |

| Banking Supervision |

Core Principles for Effective Banking Supervision |

Basel Committee on Banking Supervision (BSBC) |

https://www.bis.org/bcbs/index.htm?m=3%7C14%7C625 |

| Security markets Regulation |

Objectives and Principles of Securities Regulation |

International Organization of Securities Commissions (IOSCO) |

https://www.iosco.org/ |

| Supervision of insurance activities |

Insurance Core Principles |

International Association of Insurance Supervisors (IAIS) |