Submitted:

01 May 2023

Posted:

02 May 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Literature Review

2.1. The European Textile and Clothing Industry

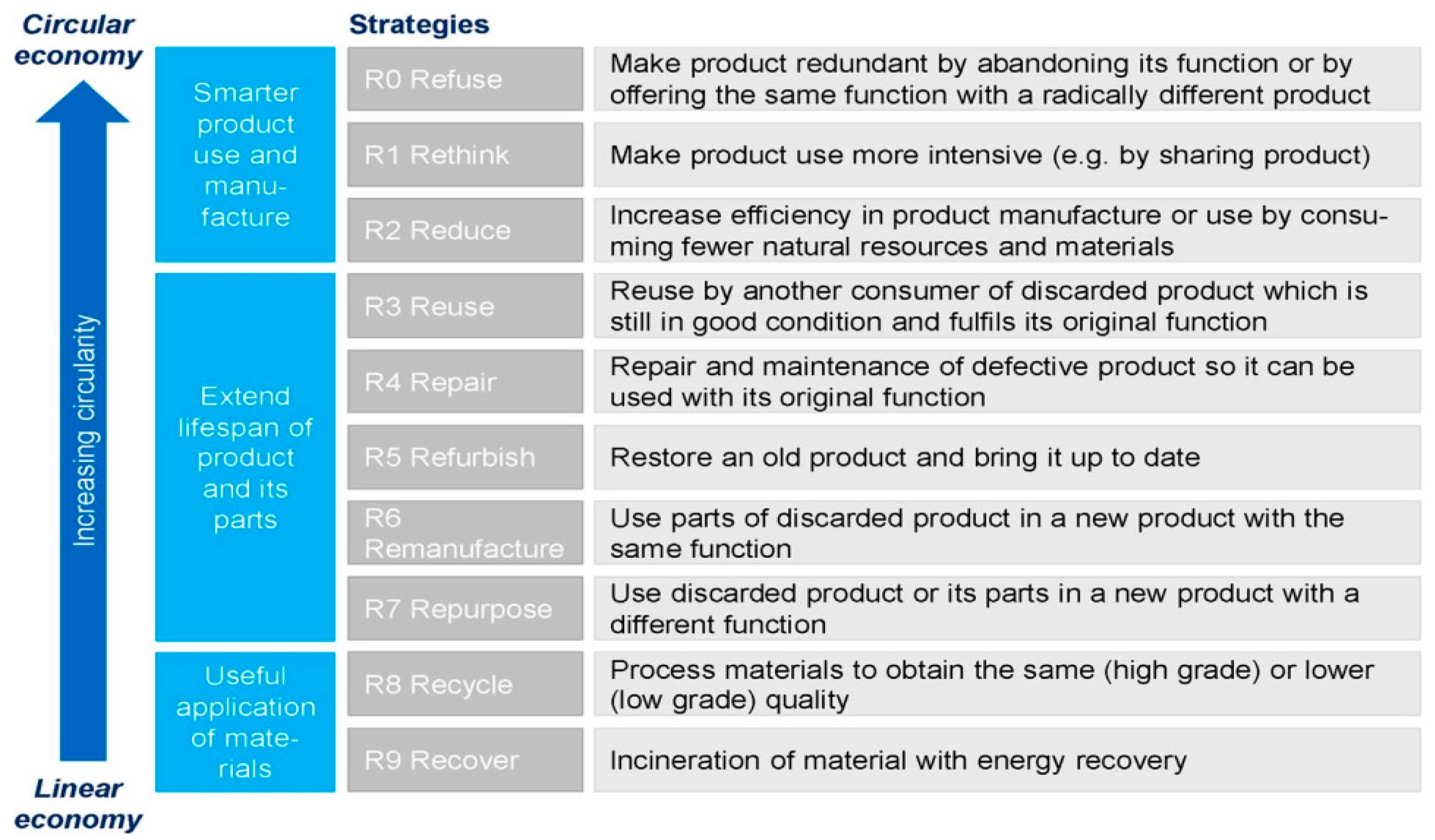

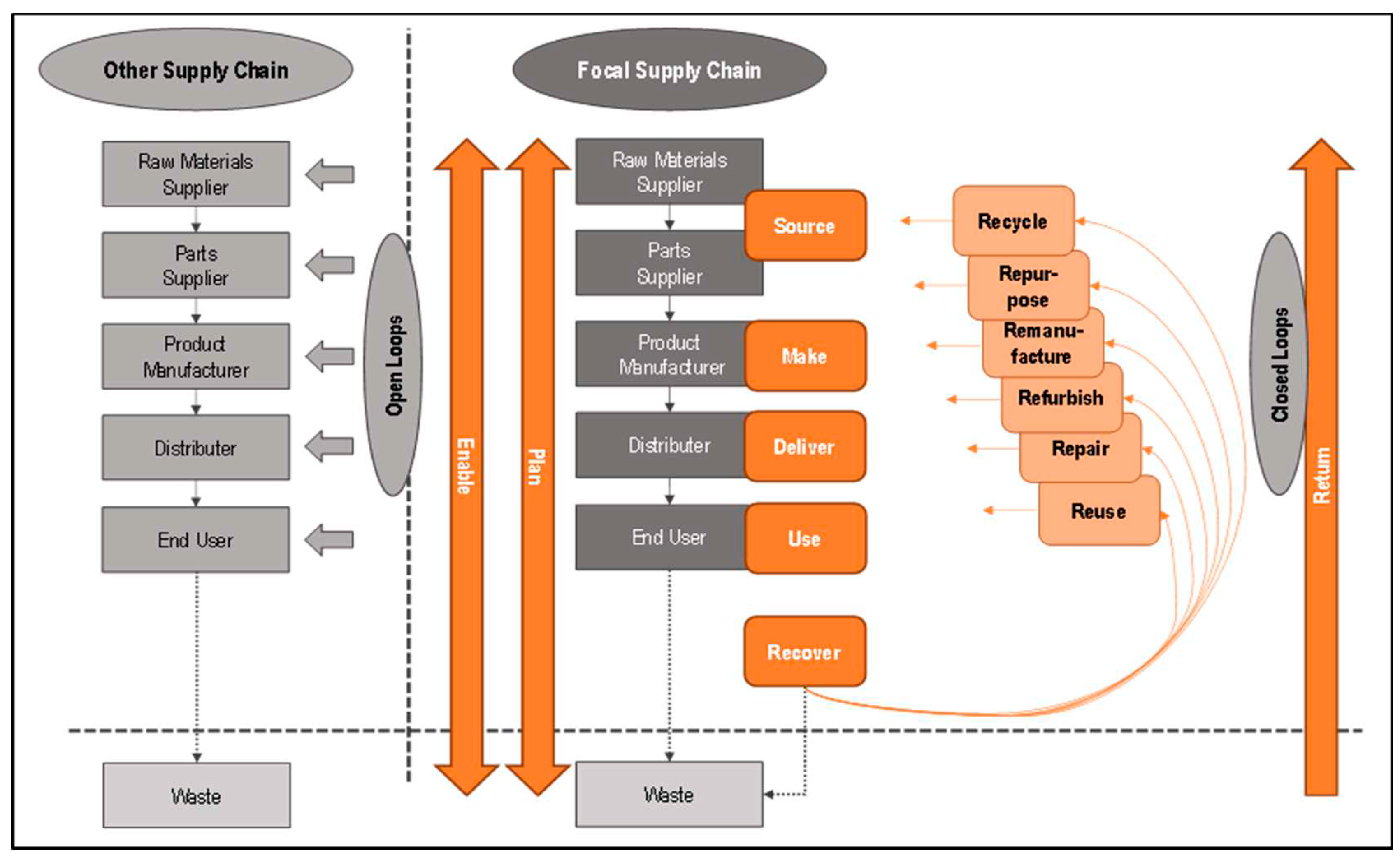

2.2. Sustainability and the Circular Economy

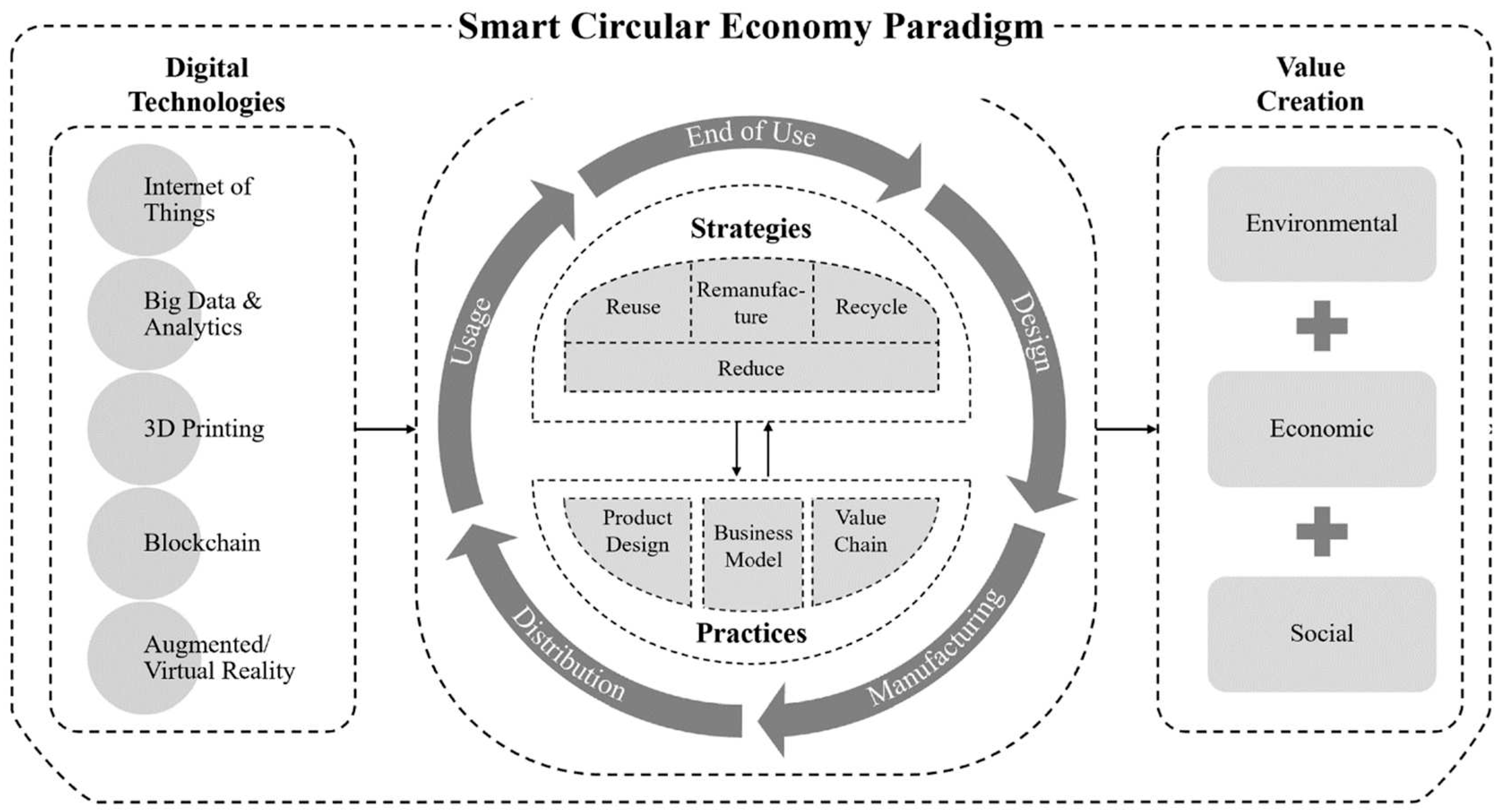

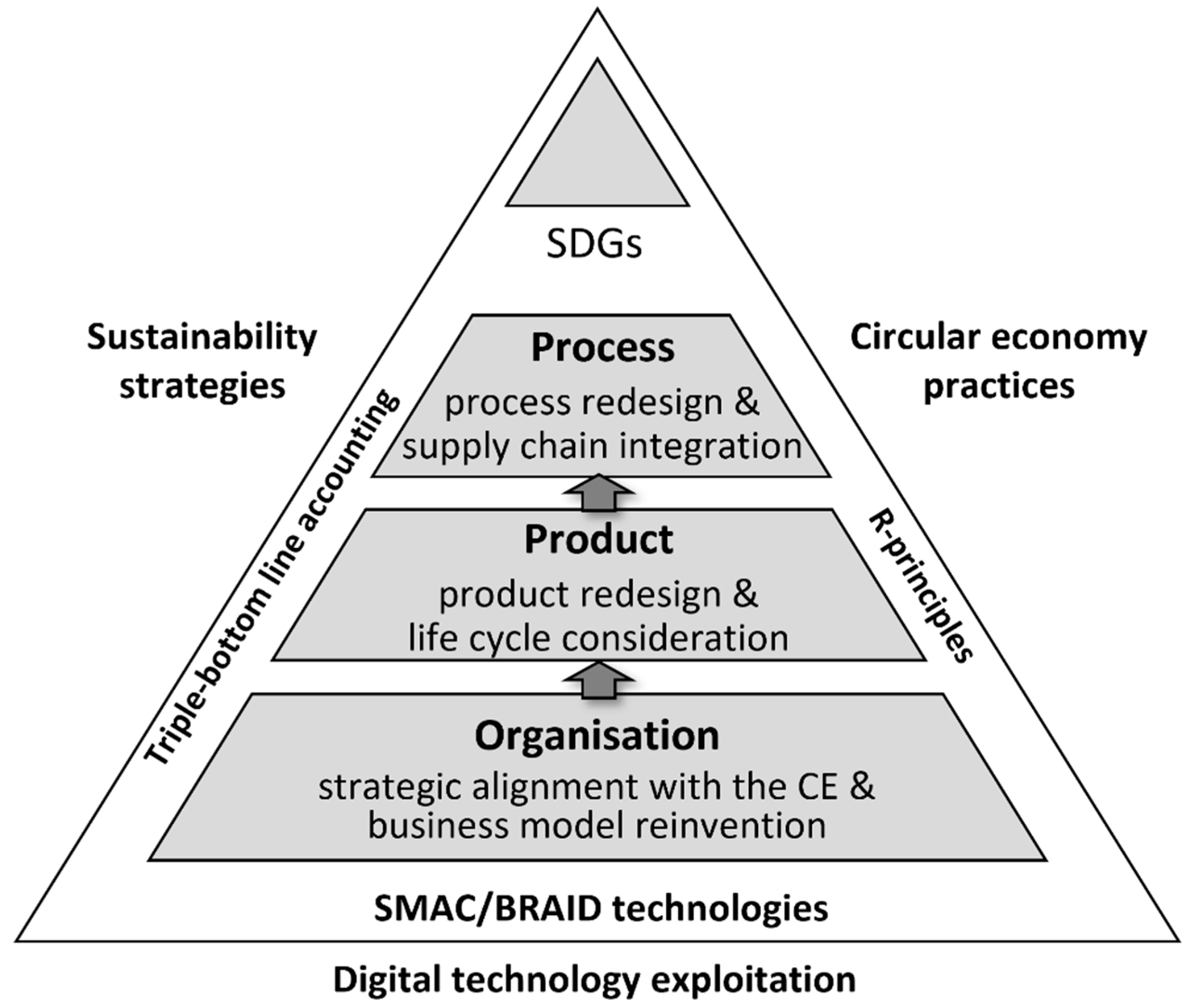

2.3. Digital Technologies and the Circular Economy

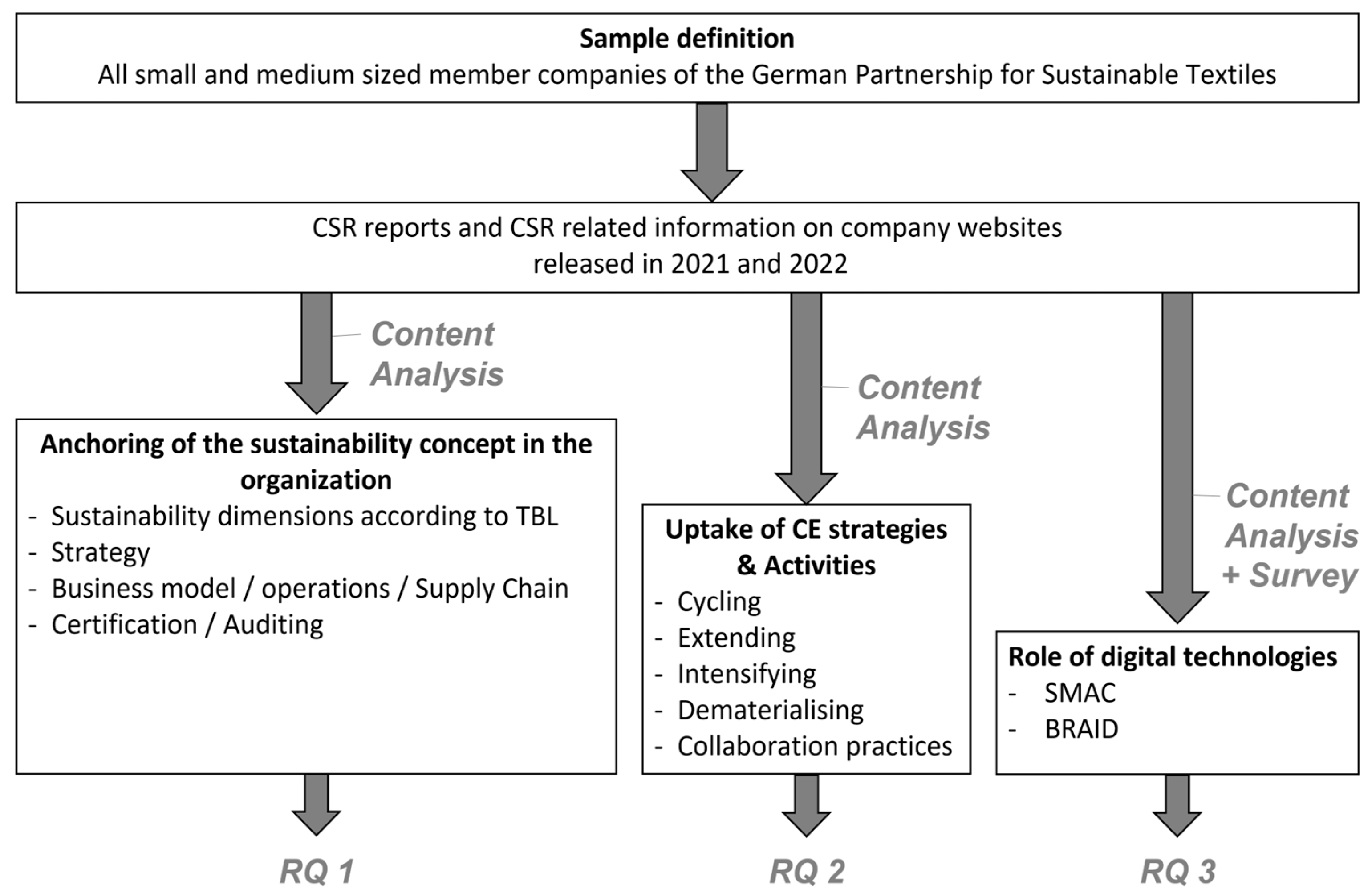

2.4. Conceptual Framework and Research Questions

- RQ1:

- How are German textile and clothing companies addressing sustainability in their corporate strategy and activities?

- RQ2:

- What strategies and activities relating to the CE are being pursued in the German textile and clothing industry?

- RQ3:

- What role are digital technologies playing in the transition to sustainability and the CE in the German textile and clothing industry?

3. Research Method

3.1. Sample Definition

3.2. Analysis Methodology

4. Results

4.1. RQ1. How are German textile and clothing companies addressing sustainability in their corporate strategy and activities?Subsection

4.1.1. Integration of sustainability into company culture and structure

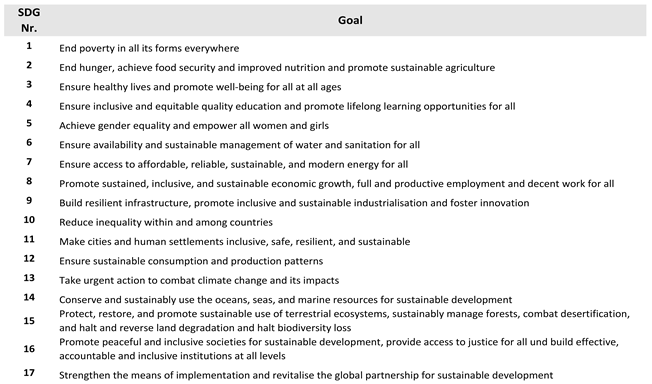

4.1.2. Adoption of the UN SDGs

4.1.3. Cross-supply chain transparency

4.1.4. Sustainability-related risk management

4.1.5. Supplier selection and influence

4.1.6. Emissions and chemicals reduction

4.1.7. Sustainable products and materials

4.1.8. Adopting sustainable business models

4.1.9. Other activities

4.2. RQ2. What strategies and activities relating to the CE are being pursued in the German textile and clothing industry?

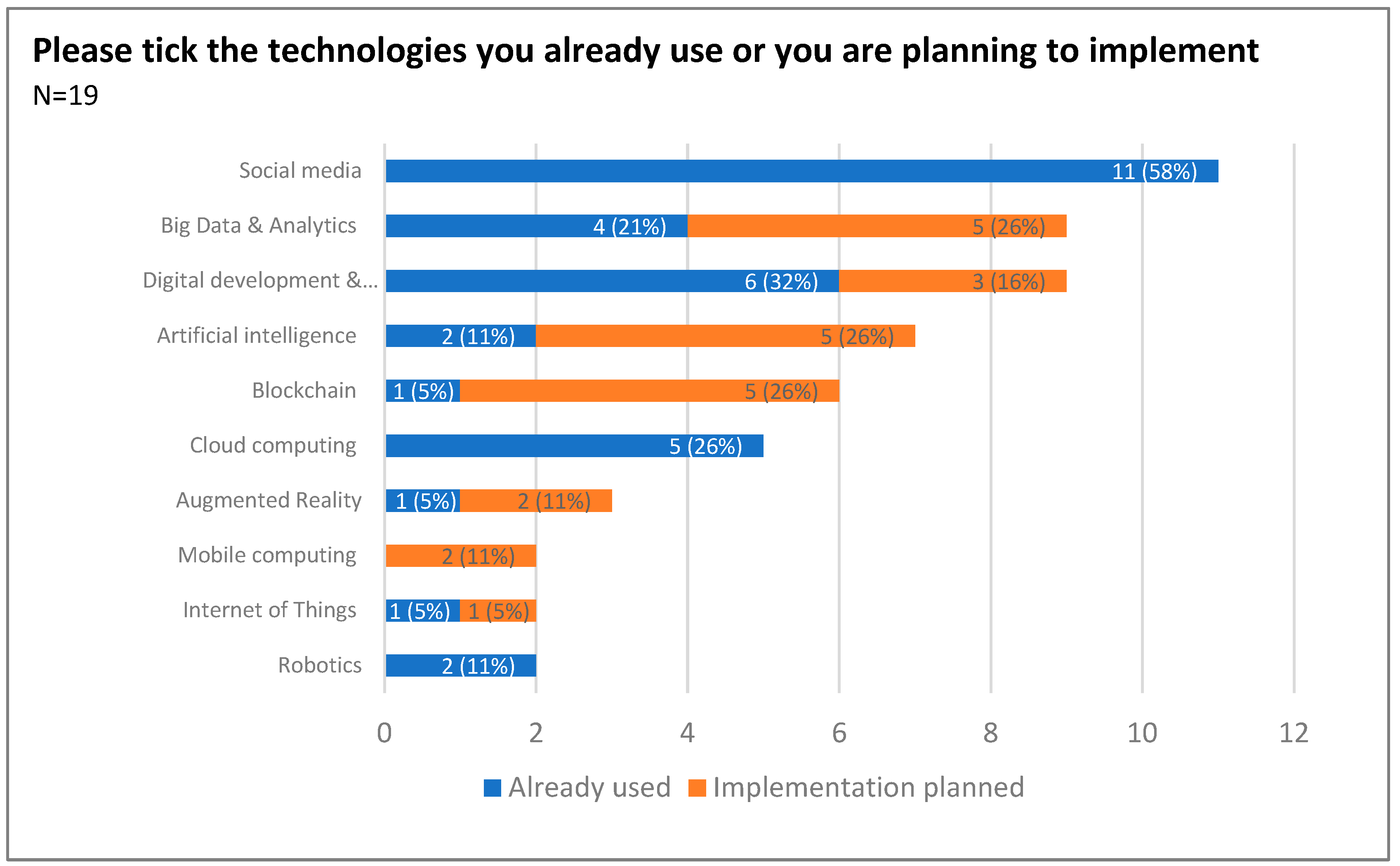

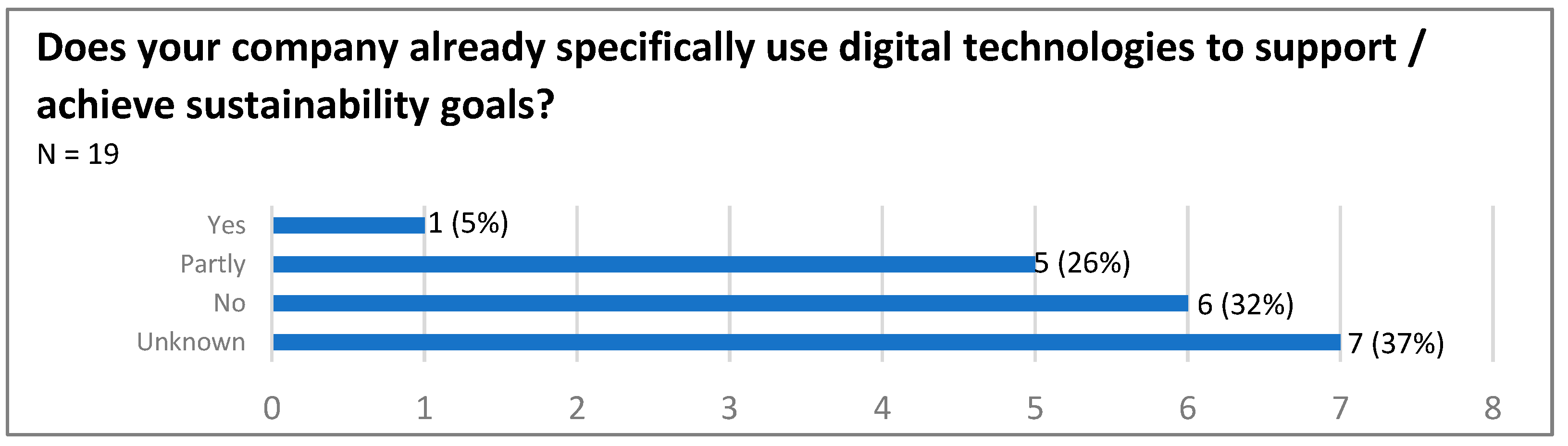

4.3. RQ3. What role are digital technologies playing in the transition to sustainability and the CE in the German textile and clothing industry?

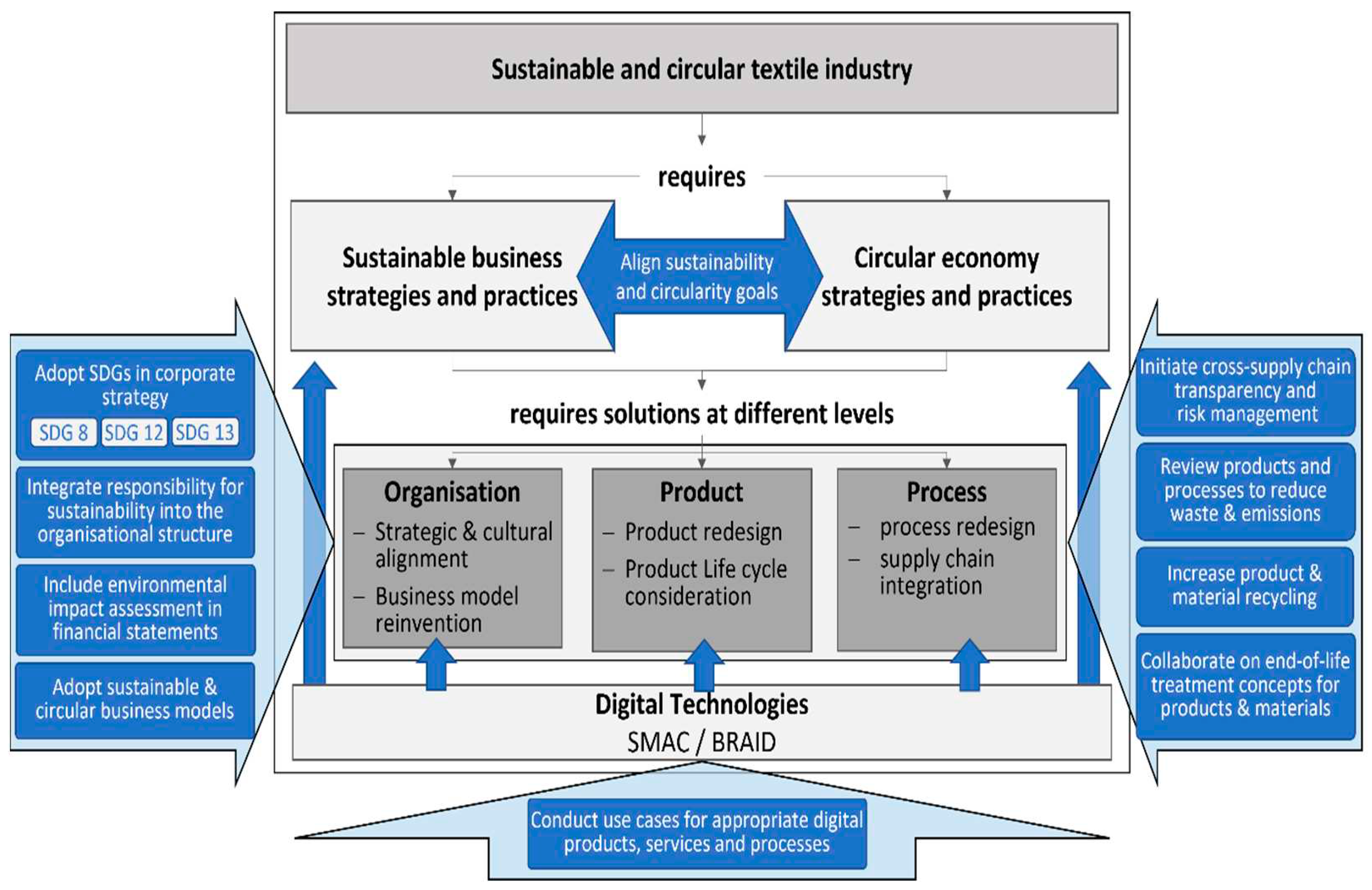

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- European Commission. Sustainability strategy for textiles. Available online: https://ec.europa.eu/growth/industry/sustainability/strategy-textiles_en (accessed on 28 December 2021).

- European Commission. Closing the loop - An EU action plan for the Circular Economy. Available online: https://ec.europa.eu/transparency/documents-register/api/files/COM(2015)614_0/de00000000332178?rendition=false (accessed on 11 March 2022).

- Alonso-Muñoz, S.; González-Sánchez, R.; Siligardi, C.; García-Muiña, F.E. New Circular Networks in Resilient Supply Chains: An External Capital Perspective. Sustainability 2021, 13, 6130. [CrossRef]

- European Commission. COM(2020) 98 final: A new Circular Economy Action Plan: For a cleaner and more competitive Europe. Available online: https://eur-lex.europa.eu/resource.html?uri=cellar:9903b325-6388-11ea-b735-01aa75ed71a1.0017.02/DOC_1&format=PDF (accessed on 5 May 2022).

- EURATEX. Circular textiles: Prospering in the circular economy. Available online: https://euratex.eu/wp-content/uploads/EURATEX-Prospering-in-the-Circular-Economy-2020.pdf (accessed on 28 December 2021).

- Okorie, O.; Salonitis, K.; Charnley, F.; Moreno, M.; Turner, C.; Tiwari, A. Digitisation and the Circular Economy: A Review of Current Research and Future Trends. Energies 2018, 11, 3009. [CrossRef]

- Wynn, M.; Jones, P. Digital Technology Deployment and the Circular Economy. Sustainability 2022, 14, 9077. [CrossRef]

- World Economic Forum. Why digitalization is critical to creating a global circular economy (accessed on 9 December 2021).

- Kottmeyer, B. Digitisation and Sustainable Development: The Opportunities and Risks of Using Digital Technologies for the Implementation of a Circular Economy. Journal of Entrepreneurship and Innovation in Emerging Economies 2021, 7, 17–23. [CrossRef]

- Ranta, V.; Aarikka-Stenroos, L.; Väisänen, J.-M. Digital technologies catalyzing business model innovation for circular economy—Multiple case study. Resources, Conservation and Recycling 2021, 164, 105155. [CrossRef]

- EEA. Textiles and the environment in a circular economy: Eionet Report - ETC/WMGE 2019/6. Available online: file:///C:/Users/Twiegand4/Downloads/ETC-WMGE_report_final%20for%20website_updated%202020.pdf (accessed on 22 August 2022).

- Neugebauer, C.; Schewe, G. Wirtschaftsmacht Modeindustrie – Alles bleibt anders [In English: Economic Power of the Fashion Industry - Everything Remains Different]. Aus Politik und Zeitgeschichte 2015, 65, 31–41.

- Gözet, B.; Wilts, H. Die Kreislaufwirtschaft als neues Narrativ für die Textilindustrie: Eine Analyse der textilen Wertschöpfungskette mit Blick auf Deutschlands Chancen einer kreislaufwirtschaftlichen Transformation [In English: The Circular Economy as a New Narrative for the Textile Industry: An Analysis of the Textile Value Chain with a View to Germany's Opportunities for a Circular Economy Transformation]. Zukunftsimpuls No. 23, Wuppertal, 2022. Available online: http://hdl.handle.net/10419/260402.

- European Commission. COM(2020) 102 final: A New Industrial Strategy for Europe. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52020DC0102&from=EN (accessed on 5 May 2022).

- European Commission. COM (2022) 141 final: EU Strategy for Sustainable and Circular Textiles. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52022DC0141.

- CSIL. Center for Industrial Studies: Final Roport on Data on the EU Textile Ecosystem and its Competitiveness. Available online: https://op.europa.eu/o/opportal-service/download-handler?identifier=574c0bfe-6142-11ec-9c6c-01aa75ed71a1&format=pdf&language=en&productionSystem=cellar&part=.

- Ki, C.-W.; Chong, S.M.; Ha-Brookshire, J.E. How fashion can achieve sustainable development through a circular economy and stakeholder engagement: A systematic literature review. Corp Soc Responsib Environ Manag 2020, 27, 2401–2424. [CrossRef]

- Stewart, R.; Niero, M. Circular economy in corporate sustainability strategies: A review of corporate sustainability reports in the fast-moving consumer goods sector. Bus. Strat. Env. 2018, 27, 1005–1022. [CrossRef]

- Franco, M.A. Circular economy at the micro level: A dynamic view of incumbents’ struggles and challenges in the textile industry. Journal of Cleaner Production 2017, 168, 833–845. [CrossRef]

- Ghisellini, P.; Cialani, C.; Ulgiati, S. A review on circular economy: the expected transition to a balanced interplay of environmental and economic systems. Journal of Cleaner Production 2016, 114, 11–32. [CrossRef]

- Farooque, M.; Zhang, A.; Thürer, M.; Qu, T.; Huisingh, D. Circular supply chain management: A definition and structured literature review. Journal of Cleaner Production 2019, 228, 882–900. [CrossRef]

- World Commission on Environment and Development. Our common future. Available online: https://digitallibrary.un.org/record/139811 (accessed on 1 May 2022).

- Montiel, I. Corporate Social Responsibility and Corporate Sustainability. Organization & Environment 2008, 21, 245–269. [CrossRef]

- Elkington, J. Cannibals with forks: The triple bottom line of 21st century business; New Society Publishers: Gabriola Island, B.C., 1998, ISBN 0865713928.

- Amini, M.; Bienstock, C.C. Corporate sustainability: an integrative definition and framework to evaluate corporate practice and guide academic research. Journal of Cleaner Production 2014, 76, 12–19. [CrossRef]

- Hallstedt, S.; Ny, H.; Robèrt, K.-H.; Broman, G. An approach to assessing sustainability integration in strategic decision systems for product development. Journal of Cleaner Production 2010, 18, 703–712. [CrossRef]

- Porter, M.E.; Kramer, M.R. Strategy and Society: The Link Between Competitive Advantage and Corporate Social Responsibility. Harvard Business Review 2006, 78–92.

- Seuring, S.; Müller, M. From a literature review to a conceptual framework for sustainable supply chain management. Journal of Cleaner Production 2008, 16, 1699–1710. [CrossRef]

- United Nations. Transforming Our World: The 2030 Agenda for Sustainable Development. Available online: https://sustainabledevelopment.un.org/post2015/transformingourworld (accessed on 24 May 2022).

- European Commission. The 2010 Agenda for Sustainable Development and the SDGs. Available online: http://ec.europa.eu/environment/sustainable-development/SDGs/index_en.htm (accessed on 24 May 2022).

- PricewaterhouseCoopers. Making It Your Business; Engaging with the Sustainable Development Goals. Available online: https://www.pwc.com/gx/en/sustainability/SDG/SDG%20Research_FINAL.pdf (accessed on 24 May 2022).

- Wynn, M.; Jones, P. The Sustainable Development Goals; Routledge, 2019, ISBN 9780429281341.

- United Nations. Summary Table of SDG Indicators. Available online: https://unstats.un.org/sdgs/files/meetings/iaeg-sdgs-meeting-06/Summary%20Table_Global%20Indicator%20Framework_08.11.2017.pdf (accessed on 24 May 2022).

- Deloitte. How Deloitte supports the United Nations Sustainable Development Goals. Available online: https://www2.deloitte.com/content/dam/Deloitte/global/Documents/About-Deloitte/gx_SDGs_Deloitte.pdf (accessed on 4 June 2022).

- Kirchherr, J.; Reike, D.; Hekkert, M. Conceptualizing the circular economy: An analysis of 114 definitions. Resources, Conservation and Recycling 2017, 127, 221–232. [CrossRef]

- Murray, A.; Skene, K.; Haynes, K. The Circular Economy: An Interdisciplinary Exploration of the Concept and Application in a Global Context. J Bus Ethics 2017, 140, 369–380. [CrossRef]

- Ellen McArthur Foundation; Mc Kinsey Center for Business and Environment. GROWTH WITHIN: A CIRCULAR ECONOMY VISION FOR A COMPETITIVE EUROPE. Available online: https://emf.thirdlight.com/link/8izw1qhml4ga-404tsz/@/preview/1?o (accessed on 1 May 2022).

- Bocken, N.; Short, S.W. Towards a sufficiency-driven business model: Experiences and opportunities. Environmental Innovation and Societal Transitions 2016, 18, 41–61. [CrossRef]

- Geissdoerfer, M.; Morioka, S.N.; Carvalho, M.M. de; Evans, S. Business models and supply chains for the circular economy. Journal of Cleaner Production 2018, 190, 712–721. [CrossRef]

- Geissdoerfer, M.; Pieroni, M.P.; Pigosso, D.C.; Soufani, K. Circular business models: A review. Journal of Cleaner Production 2020, 277, 123741. [CrossRef]

- Fluchs, S.; Neligan, A.; Schleicher, C.; Schmitz, E. Zirkuläre Geschäftsmodelle. Wie zirkulär sind Unternehmen? [In English: Circular Business Models. How circular are Businesses?]. Available online: https://www.iwkoeln.de/studien/sarah-fluchs-adriana-neligan-wie-zirkulaer-sind-unternehmen.html (accessed on 7 October 2022).

- Nußholz, J. Circular Business Models: Defining a Concept and Framing an Emerging Research Field. Sustainability 2017, 9, 1810. [CrossRef]

- Brown, P.; Daniels, C. von; Bocken, N.; Balkenende, A.R. A process model for collaboration in circular oriented innovation. Journal of Cleaner Production 2021, 286, 125499. [CrossRef]

- Montag, L.; Klünder, T.; Steven, M. Paving the Way for Circular Supply Chains: Conceptualization of a Circular Supply Chain Maturity Framework. Front. Sustain. 2021, 2. [CrossRef]

- Association for Supply Chain Management. The SCOR Digital Standard. Available online: https://www.ascm.org/corporate-solutions/standards-tools/scor-ds/ (accessed on 29 April 2023).

- Montag, L.; Pettau, T. Process performance measurement framework for circular supply chain: An updated SCOR perspective. CE 2022. [CrossRef]

- Turchi, P. The Digital Transformation Pyramid: A Business-driven Approach for Corporate Initiatives. Available online: https://www.thedigitaltransformationpeople.com/channels/the-case-for-digital- (accessed on 4 October 2021).

- Lang, V. Digitalization and Digital Transformation. In Digital Fluency; Lang, V., Ed.; Apress: Berkeley, CA, 2021; pp 1–50, ISBN 978-1-4842-6773-8.

- Frost & Sullivan. The Impact of Digital Transformation on the Waste Recycling Industry: Capitalizing on Opportunities in the Emerging Digital Economy: Research Code: Maab-01-00-00-00. Sku: En01044-Gl-Mo_21500, 2018.

- Reuter, M.A. Digitalizing the Circular Economy. Metall and Materi Trans B 2016, 47, 3194–3220. [CrossRef]

- Salminen, V.; Ruohomaa, H.; Kantola, J. Digitalization and Big Data Supporting Responsible Business Co-evolution. In Advances in Human Factors, Business Management, Training and Education; Kantola, J.I., Barath, T., Nazir, S., Andre, T., Eds.; Springer International Publishing: Cham, 2017; pp 1055–1067, ISBN 978-3-319-42069-1.

- Bressanelli, G.; Perona, M.; Saccani, N. Challenges in supply chain redesign for the Circular Economy: a literature review and a multiple case study. International Journal of Production Research 2019, 57, 7395–7422. [CrossRef]

- Owen-Jackson, C. Reducing waste and cutting costs: How digital tech is powering up the circular economy. Available online: https://www.kaspersky.com/blog/secure-futures-magazine/circular-economy-it/31811/.

- Pagoropoulos, A.; Pigosso, D.C.; McAloone, T.C. The Emergent Role of Digital Technologies in the Circular Economy: A Review. Procedia CIRP 2017, 64, 19–24. [CrossRef]

- Antikainen, M.; Uusitalo, T.; Kivikytö-Reponen, P. Digitalisation as an Enabler of Circular Economy. Procedia CIRP 2018, 73, 45–49. [CrossRef]

- Del Giudice, M.; Chierici, R.; Mazzucchelli, A.; Fiano, F. Supply chain management in the era of circular economy: the moderating effect of big data. IJLM 2021, 32, 337–356. [CrossRef]

- Bressanelli, G.; Adrodegari, F.; Pigosso, D.C.A.; Parida, V. Circular Economy in the Digital Age. Sustainability 2022, 14, 5565. [CrossRef]

- Neligan, A. Digitalisation as Enabler Towards a Sustainable Circular Economy in Germany. Intereconomics 2018, 53, 101–106. [CrossRef]

- Wynn, M.; Jones, P. ICTs and the Localisation of the Sustainable Development Goals. International Journal of Social Ecology and Sustainable Development 2022, 13, 1–15. [CrossRef]

- Cagno, E.; Neri, A.; Negri, M.; Bassani, C.A.; Lampertico, T. The Role of Digital Technologies in Operationalizing the Circular Economy Transition: A Systematic Literature Review. Applied Sciences 2021, 11, 3328. [CrossRef]

- Laskurain-Iturbe, I.; Arana-Landín, G.; Landeta-Manzano, B.; Uriarte-Gallastegi, N. Exploring the influence of industry 4.0 technologies on the circular economy. Journal of Cleaner Production 2021, 321, 128944. [CrossRef]

- Jabareen, Y. Building a Conceptual Framework: Philosophy, Definitions, and Procedure. International Journal of Qualitative Methods 2009, 8, 49–62. [CrossRef]

- Leshem, S.; Trafford, V. Overlooking the conceptual framework. Innovations in Education and Teaching International 2007, 44, 93–105. [CrossRef]

- Miles, M.B.; Huberman, A.M.; Saldaña, J. Qualitative data analysis: A methods sourcebook, Fourth edition; SAGE: Los Angeles, 2020, ISBN 9781506353081.

- European Commission. SEM definition. Available online: https://single-market-economy.ec.europa.eu/smes/sme-definition_en (accessed on 5 May 2022).

- Mayring, P. Qualitative content analysis: theoretical foundation, basic procedures and software solution; Klagenfurt, 2014.

- Saidani, M.; Yannou, B.; Leroy, Y.; Cluzel, F. How to Assess Product Performance in the Circular Economy? Proposed Requirements for the Design of a Circularity Measurement Framework. Recycling 2017, 2, 6. [CrossRef]

- Hch. Kettelhack GmbH & Co. KG. Our supply chains. Available online: https://nachhaltigkeit.kettelhack.de/sustainable-textile/our-supply-chains/?lang=en (accessed on 17 June 2022).

- Sympatex Technologies GmbH. SYMPATEX® SUSTAINABILITY MANAGEMENT. Available online: https://www.sympatex.com/wp-content/uploads/2021/04/Sympatex-Sustainability-management_April-2021.docx.pdf (accessed on 3 May 2022).

- OECD. Due Diligence Guidance for Responsible Supply Chains in the Garment and Footwear Sector; OECD Publishing: Paris, 2018, ISBN 978-92-64-29058-7.

- Bierbaum-Proenen GmbH & Co. KG. BP ® SUSTAINABILITY REPORT 2021. Available online: https://www.bp-online.com/media/90/51/ca/1654068086/BP_Sustainability%20report_2021.pdf (accessed on 3 July 2022).

- ESSENZA HOME GmbH & CO KG. CSR Jahresbericht 2020 [In English: CSR Annual Report 2020). Available online: https://www.essenzahome.de/csr-jahresberichte (accessed on 18 May 2022).

- Schöffel Sportbekleidung GmbH. Sustainability Report 2021. Available online: https://schoeffel-b2c.cdn.prismic.io/schoeffel-b2c/2d0b155f-667b-42e2-93e2-c5f4a86d251e_DE_Schoeffel_SustainabilityReport21_A4_de_Screen.pdf (accessed on 30 May 2022).

- Hakro GmbH. Nachhaltigkeitsbericht 2019 [In English: Sustainability Report 2019]. Available online: https://hkweb2019fe-prod.azureedge.net/HAKRO-Social%20Report%202022_DE.pdf (accessed on 23 June 2022).

- Software AG. How to invest in sustainability by investing in technology - the “Genius of the And”. White Paper. Available online: https://www.softwareag.com/en_corporate/resources/software-ag/wp/sustainability-digital-transformation.html?utm_source=google&utm_medium=cpc&utm_campaign=swag-brand_umbrella&utm_region=hq&utm_subcampaign=stg-1&utm_content=stg-1_whitepaper_how-to-invest-in-sustain-by-technology&gclid=CjwKCAjwq-WgBhBMEiwAzKSH6GYqWqGSReIiYDXyqEyz5efb2vAH-AmWtM5Tc2pK3gtmB8ntaaKe_RoCd0kQAvD_BwE (accessed on 30 March 2023).

- Saccani, N.; Bressanelli, G.; Visintin, F. Circular supply chain orchestration to overcome Circular Economy challenges: An empirical investigation in the textile and fashion industries. Sustainable Production and Consumption 2023, 35, 469–482. [CrossRef]

- melliand Textilberichte. CO2-neutrale und digitale Produktion in Deutschland [In English: CO2-neutral and digital manufacturing in Germany. Available online: https://www-wiso-net-de.ezproxy.hof-university.de/document/MTB__adf17bcce60851170c0ba68a6867e55eefff568b (accessed on 20 August 2022).

- Claudio, L. Waste couture: environmental impact of the clothing industry. Environ. Health Perspect. 2007, 115, A448-54. [CrossRef]

| Activity/Company | AT | BI | BL | BR | CH | DE | DS | DI | EL | VO | ES | GR | GG | HA | HK | IV | JA | KA | LA | LO | MA | OR | PA | PE | RE | SC | SY | TE | TH |

| Integration of sustainability into corporate culture/structure | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | ||

| Adoption of UN SDGs | x | x | x | x | x | x | x | x | x | ||||||||||||||||||||

| Cross-supply chain transparency | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | ||

| Sustainability risk management | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | |||||||

| Supplier selection and influence | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x |

| Emissions and chemicals reduction | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x |

| Sustainable products and materials | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x |

| Adopting sustainable business models | x | x | x | x | x | x | x | x | x | x | x | x | |||||||||||||||||

| Other activities | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x |

| CE activity/Company | AT | BI | BL | BR | CH | DE | DS | DI | EL | VO | ES | GR | GG | HA | HK | IV | JA | KA | LA | LO | MA | OR | PA | PE | RE | SC | SY | TE | TH |

| Reduction of emissions and waste in operations | x | x | x | x | x | x | x | x | x | x | x | x | x | X | x | x | x | x | x | x | x | x | x | x | x | x | x | x | |

| Use of recycled materials | x | x | x | x | x | x | x | x | x | x | x | X | x | x | x | x | x | x | x | x | x | x | x | x | x | x | |||

| Production of recyclable/biodegradable products | x | x | x | X | x | x | x | x | x | x | |||||||||||||||||||

| Activities to extend product use phase | x | x | x | x | x | x | x | X | x | x | x | x | x | x | x | x | |||||||||||||

| Reverse logistics processes/take back schemes | x | x | x | x | x | x | x | ||||||||||||||||||||||

| Reuse or recycling of materials or products | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | ||||||||||||||

| Cooperation/collaboration with partners | x | x | x | x | x | x | x | x | x | x | x |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).