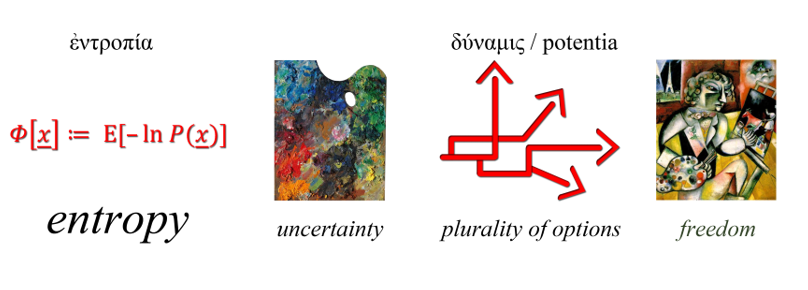

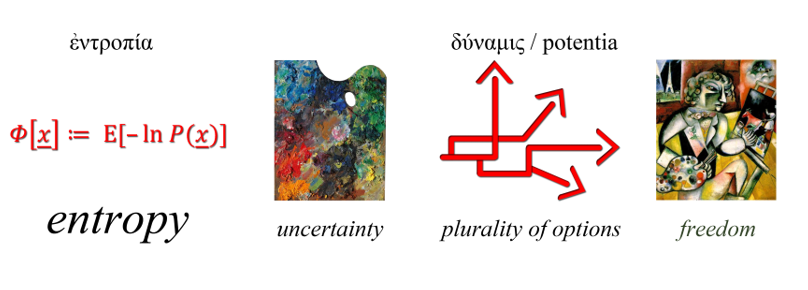

While entropy was introduced in the second half of the 19th century in the international vocabulary as a scientific term, in the 20th century it became common in colloquial use. Popular imagination has loaded “entropy” with almost every negative quality in the universe, in life and in society, with a dominant meaning of disorder and disorganization. Exploring the history of the term and many different approaches on it, we show that entropy has a universal stochastic definition which is not disorder. The accompanying principle of maximum entropy, which lies behind the Second Law, gives explanatory and inferential power to the concept and promotes entropy as the mother of creativity and evolution. As social sciences are often contaminated by subjectivity and ideological influences, we try to explore whether the maximum entropy, applied to the distribution of wealth quantified by annual income, can give an objective description. Using publicly available income data, we show that the income distribution is consistent with the principle of the maximum entropy. The increase of entropy is associated to increase of society’s wealth yet a standardized form of entropy can be used to quantify inequality. Historically, technology has played a major role in development and increase of the entropy of income. Such findings are contrary to the theories of ecological economics and other theories which use the term entropy in a Malthusian perspective.