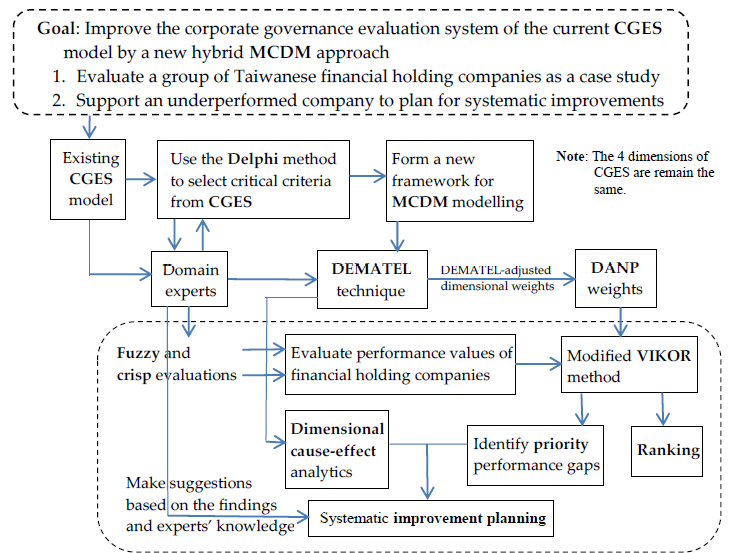

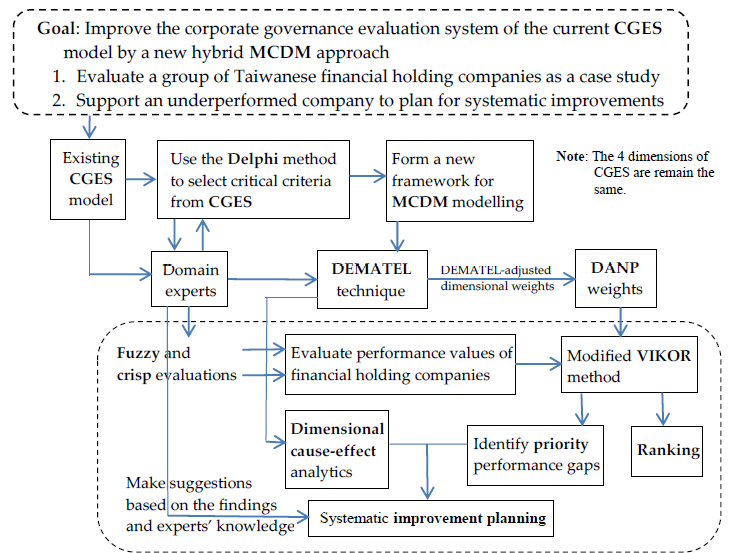

While the importance of corporate governance has been broadly acknowledged in global financial markets and academic research, how to devise a practical evaluation system is relatively unexplored. This paper attempts to refine the Corporate Governance Evaluation System (CGES), constructed by the Taiwan Stock Exchange (TWSE) since 2014. The current CGES has several debatable issues in its complicated design (e.g., it comprises over 80 indicators in different types). To resolve those issues, this study invited ten senior domain experts (including several CEOs of financial holding companies) to retrieve 13 essential criteria from the CGES in four dimensions. And this study integrates several multiple criteria decision-making (MCDM) methods (i.e., Decision-making trial and evaluation laboratory (DEMATEL), modified VIKOR, DEMATEL-based analytical network process (DANP)) and the fuzzy evaluation technique to rank the exemplary companies. The obtained ranking is consistent with the one released from the CGES in 2017. This study conducted additional experiments to ensure the robustness of the findings. The newly devised model not only supports the ranking decisions but also provides a managerial guidance for companies to pursue systematic improvements. These findings enrich the understanding of corporate governance and contribute to gaining business sustainability for financial holding companies.