1. Introduction

Market risk refers to the risk of losses resulting from adverse movements in market prices, encompassing both on- and off-balance sheet positions. From a regulatory standpoint, market risk emanates from positions held in a bank trading book, as well as from commodity and foreign exchange risk positions within the entire balance sheet. Counterparty credit risk, on the other hand, relates to the risk that a counterparty in a transaction may get default before all the cash flows have been settled. Credit valuation adjustment (CVA) risk pertains to the risk of incurring losses due to fluctuations in CVA values triggered by changes in counterparty credit spreads and market risk factors. Financial risk management has always been a central activity in banking industry, but since the 2008 global financial crisis, it has become even more important: there is an increasing focus on how financial risks are being assessed, monitored and managed. In the last three decades, extensive research, spanning both academic and financial industry domains [

13,

15,

16,

48], has been dedicated to advancing banking practices and refining risk calculations to meet existing and forthcoming challenges.

The European Banking Authority (EBA) plays a crucial role in ensuring consistent implementation of the new regulations across the European Union, particularly with respect to the Fundamental Review of the Trading Book (FRTB) as part of the Basel III reforms [

3], by developing technical standards, guidelines, and reports. Specifically, the Basel Committee on Banking Supervision introduced the FRTB framework to enhance accuracy and consistency in trading book capital requirements. This initiative has compelled banks with trading operations to swiftly implement significant changes. Banks had to reinforce their models, data management, information technology infrastructure, and processes. Additionally, capital markets businesses had to optimize product structures, adjust hedging strategies, and reprice products. For some banks, unprofitable business lines due to FRTB led to downsizing or exiting their operations. The impact of FRTB on banks is multifaceted, affecting methodologies, data management, processes, and systems. These changes pose significant challenges, particularly in areas like non-modellable risk factors and the development of default risk charge (DRC) methodologies. Simultaneously, the implementation of FRTB necessitates substantial upgrades in banking systems, including computational capacities and alignment of risk factors. The FRTB also emphasizes the importance of market and reference data quality, demanding a coherent framework for sourcing and mapping positions accurately. These interconnected challenges highlight the intricate demands faced by banks in adapting to FRTB regulatory requirements. Banks must increase computational capacities, revalue positions daily, and develop new platforms to compute standardized capital charges: significantly higher calculation capacity will be required compared to that for current value-at-risk (VaR) calculations and banks estimate an increase in number of full revaluation runs by a factor of 5 to 10 [

4]. Simultaneously, the banking industry response to these complex demands involves exploring the potential of machine learning, which has gained prominence for big data management, function interpolation and exploration in various sectors. In finance, machine learning applications in, such as pricing, fraud detection, credit scoring, and portfolio management, have become increasingly significant [

17,

19,

36]. This technological advancement offers a potential solution to the intricate challenges posed by the FRTB, offering innovative ways to adapt and streamline banking processes in the face of regulatory requirements.

A recent study by the [

19] highlights the potential of machine learning in enhancing risk models by detecting complex patterns in large datasets. The neural network family, famous for its universal approximation and its customization flexibility, is applied to various financial tasks ranging from derivative pricing and hedging [

10,

29] to calibration [

26] and partial differential equations solving [

28]. [

50] show improvements in the volatility forecast using neural network and GELM, where the latter is a combination of the generalized autoregressive conditional heteroskedasticity (GARCH) model and extreme machine learning (ELM) model [

27], this then enhances the accuracy and efficiency in value-at-risk calculations. [

46] make a survey on the application of neural network models in quantitative finance. Bayesian models such as the Gaussian process regression can be explored for the yield curve forecast and derivatives pricing [

40], reducing computation time. [

14] apply GP models to the fast derivatives pricing and hedging under the assumption that the market is modelled by a limited set of parameters. They provide the numerical test of European call, American put and barrier option in the variance gamma and Heston models. [

23,

38] replace the linear regression model in the [

37] model by a Gaussian process regression to price Bermudan options. In particular, at each backward evaluation time step, they train a GP regression to estimate the time value of the option. [

12] focus on the approximation of European call in the Heston model, they furthermore study the multi-output Gaussian processes (GPs) structure to simultaneously estimate various option prices underwritten on the same asset. In [

34] the market value of the whole trading portfolio of different options on a common underlying is efficiently approximated by a Gaussian process regression. In a nutshell, the choice between neural networks and Gaussian process regression depends on the specific task requirements. The former is The latter is preferred when uncertainty analysis in predictions is crucial, or when there are limitations in the number of training points available. Despite these advancements, machine learning methods have not fully integrated into the financial risk measurement framework yet.

This work aligns with the research flow of [

34], which produced encouraging results for the

and

calculation of the portfolio consisting of financial instruments written on a single asset. However, one drawback of the approach is the curse of dimensionality. As the input space dimension of the pricing function increases, the number of sampling points required to train the machine learning algorithm, used as a proxy pricing function, increases substantially. This issue becomes practically challenging when evaluating multi-asset options such as best-of, worst-of and basket options. The GP techniques applied to fixed income derivatives like Bermudan swaptions also suffer from the curse of dimensionality. At this stage, the main difficulty lies in the limitation of training data rather than the scalability of Gaussian processes model for learning large datasets (cf.

Section 3.2). While the direct use of machine learning model may be efficient enough, some enhancement techniques can be applied to achieve optimal results. For example, when performing the risk calculation of an interest rate derivatives portfolio, [

47] apply dimensional reduction techniques, e.g. principal component analysis (PCA) or learning from diffusive risk factors [

1], to reduce the number of market risk factors before interpolating the portfolio value by Chebyshev tensors. However, when products are highly nonlinear and depend on many diffusive risk factors, e.g. multi-asset derivatives, the dimensional reduction techniques proposed in [

47] may be no longer appropriate. This leads us to explore other enhancement techniques such as multi-fidelity modeling. Fidelity in modeling refers the degree of detail and precision offered by a predictive model or simulation. High-fidelity models provide highly accurate outcomes but require substantial computational resources, for instance, the pricing engine in our financial case. Due to its high cost, the use of high-fidelity models is often limited in practice. By contrast, low-fidelity models, while resulting to less accurate outcomes, are cheaply accessible and often offer some useful insights of the learning problem. By combining models of different fidelity levels, multi-fidelity modeling exploits all the information along these models and their correlation structure to provide quick yet accurate predictions. [

18] do a survey of the multi-fidelity modeling. This technique can be used along with any machine learning models, such as neural networks [

35,

39] or Gaussian process regression [

6,

30,

32]. In the research, we investigate multi-fidelity Gaussian process regression (mGPR). While the latter is well-known and widely used in geostatistics and physics under the name cokriging (see lecture notes in

https://geostatisticslessons.com and references therein), to the best of our knowledge, we have not seen any of its application in quantitative finance. This motivates us to study this modeling for the financial application, where high-fidelity model is the derivative pricing engine and lower fidelity models can be either its simpler approximations or fast pricing engines of correlated products.

The rest of the chapter is organized as follows.

Section 2 introduces the principle of market risk according to the regulation, highlighting the computational challenge in the practical implementation of VaR and ES model.

Section 3 reviews the Gaussian process regression and its application in the risk calculation of the trading portfolios.

Section 4 describes multi-fidelity modeling and how it works with GP model, coming along with some ideas of their application in quantitative finance.

Section 5 sketches the setup and the training specification for our numerical experiments, which are reported in

Section 6.

Section 7 concludes our findings and provides perspectives for future research.

2. Market Risk Assessment and Computational Challenge

According to [

4], market risk is defined as

"the risk of losses (in on- and off-balance sheet positions) arising from movements in market prices". Market risks include default risk, interest rate risk, credit spread risk, equity risk, foreign exchange (FX) risk commodities risk, and so on. Regulatory separates market risk with other kinds of financial risk, for example, credit risks referring to the risk of loss resulting from counterparty (the party with whom the bank makes engagement in the contract) default or operational risk referring the risk of loss resulting from the failures of internal banking system. Under the FRTB framework, banks can choose either the standardized measurement method (SMM) or the internal model-based approach (IMA) to quantify their market risks. The first approach, which can be easily implemented, is not appealing to banks due to its overestimation of the capital required to cover market risks. The second approach more accurately reflects the risk sensitivities and better postulates the economic risk carried by the banking balance sheet. However, to use their own proposed internal model, banks must gain the regulatory approval through a rigorous backtesting procedure.

Under the internal model approach the calculation of capital charge is based on tail risk measures, namely value-at-risk (

) and expected shortfall (

), of the possible loss of the holding portfolio during a certain trading period.

and

are measured at typically high confidence levels

(for

) or

(for

) in a short liquidity horizon, i.e.

day or 10 days. Assume that the value of a considered trading portfolio

at date

t is a function of risk factors

, denoted by

. At date

, the possible loss of the portfolio (or profit and loss), denoted by

, is defined by

where

is the value of portfolio at date

and the approximation is probably the convention used by the bank, considering time horizon

h is small, e.g. one day or ten days. By the approximation in (

1),

can be interpreted as the potential loss of the portfolio resulted from the shock

of the risk factors

. The value-at-risk at a confidence level

represents the minimum capital required to cover the market risk, while the expected shortfall means the average loss given the latter exceeds the

. These two risk measures are defined by

Statistical methods for calculating (

2) include analytical, historical and Monte Carlo approaches ([

45]

Section 2.2 page 61). According to the the Monte Carlo method,

is the

-percentile of the set of possible losses simulated for time horizon

h, while

is the empirical average of losses above the

. Shocks of risk factors at date

are generated by synthetic dynamic models calibrated from the historical market data. The market risk calculation procedure by Monte Carlo is summarized in Algorithm 1, see also [

25] for a review of risk calculation by the Monte Carlo methods.

|

Algorithm 1:Calculation of and by full repricing approach |

|

input: Calibrated diffusion model, pricing engine , an actual vector of risk factors , a confidence level , time step h and a large number N

output: estimated and

Compute

Simulate N scenarios of shock using calibrated diffusion model

Compute N corresponding prices

Compute N scenarios of losses

Compute and by Monte Carlo

|

Remark 1. In the FRTB, the calculation of market risk for a trading book by the internal model-based approach needs to be implemented for various liquidity horizons associated with different risk factors. To be more specific, for a considered portfolio, banks need to classify involved risk factors into five categories of liquidity horizons: 10, 20, 40, 60 and 120 days. The FRTB requires banks to assess market risk for these liquidity horizons by taking into account shocks to risk factors at the same and longer horizons. For example, the risk calculation for 10-day horizon must consider shocks to risk factors from all five categories, while the risk calculation for 20-day horizon needs to consider shocks at 20 days and longer. This framework provides a more comprehensive and accurate assessment of market risk, but requires a complex and time-consuming calculation process.

2.1. Computational Challenge and Applications of Machine Learning

The market risk calculation appears to be doable by Algorithm 1. Nevertheless, we have not discussed yet about the computational complexity of the pricing engine. In banks, the pricing engine of a trading derivative portfolio involves various numerical algorithms depending on the nature of the portfolio. Some products or portfolios can be rapidly priced, such as using analytical formulas or accurately fast approximations. However, when financial models and/or products of the portfolio are complex as usually the case in practice, some heavily computational algorithms need to be referenced including Monte Carlo schemes, tree methods, see for example ( [

11] Chapter 6 and 7). The risk calculation using any of the algorithms mentioned above is referred to as the full repricing approach (i.e. full revaluation approach). The latter is the most accurate but very costly (for a portfolio of complex products) as the measurement of the tail risk, i.e. VaR and ES, of the portfolio needs to recall intensively the pricing engine.

In the context of implementing the

and

calculation using Monte Carlo simulation, banking institutions tend to avoid direct use of pricers, as it is time consuming and makes them inefficient. Certain banks prefer to use proxies based on sensitivity calculation and second-order Taylor developments to compute the possible losses of derivative portfolios [

8], see Section B. Although these approaches offer performance gains, their precision is often questioned. Recently, alternative approaches have emerged that aim to strike a balance between performance and precision in risk calculation, such as value-at-risk and expected shortfall. Among these methods, the works of [

12], and [

14] explore the application of Gaussian process regression in finance, and [

46] discuss the use of neural networks in the same context. The common idea behind these studies is to use machine learning models as interpolation tools, also known as surrogate models, to estimate derivative prices. More recently, [

47] use Chebyshev polynomials as interpolators, combined with principal component analysis techniques (PCA), for financial risk calculation, aligning with the same line of though.

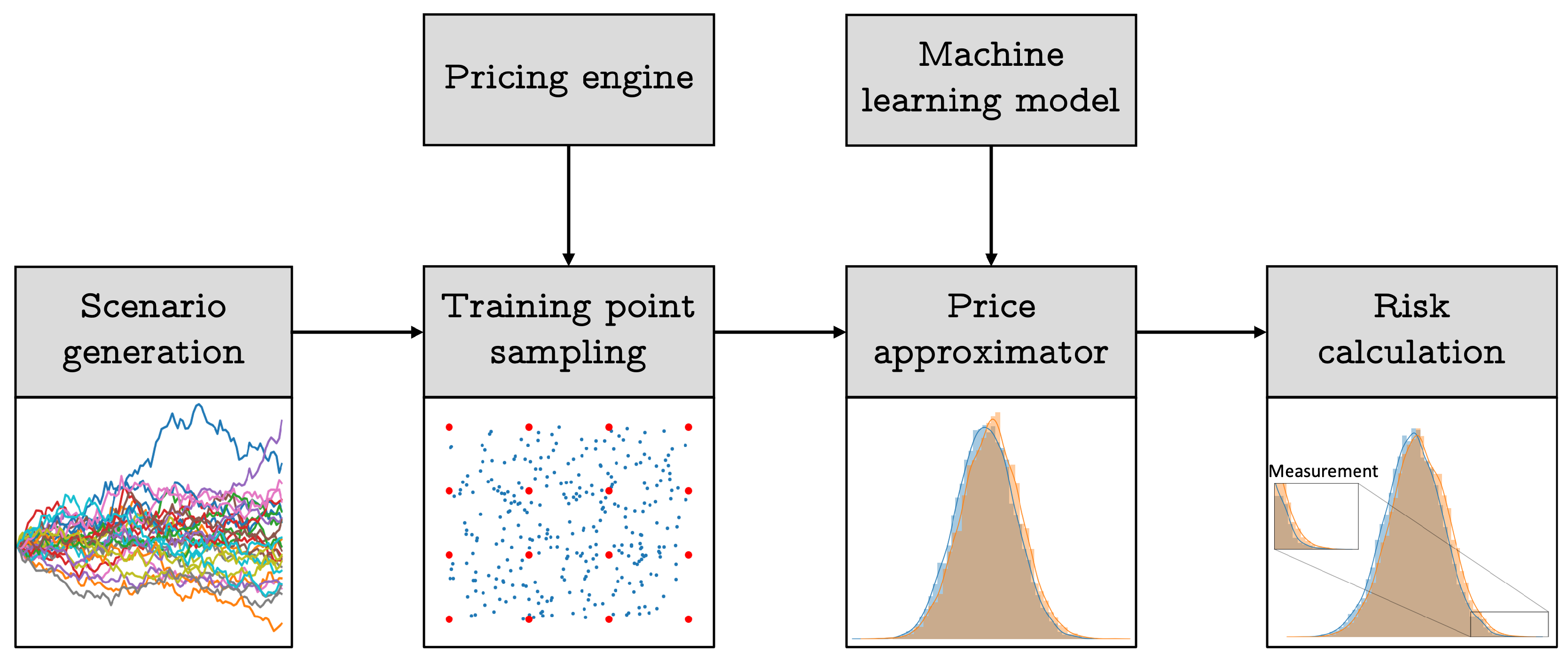

Figure 1 illustrates the risk calculation process that employs these innovative machine learning approaches, involving only a few complete revaluations of a derivative portfolio.

2.2. Equity Options

In the remainder of this chapter, the objective is to evaluate and manage the market risk associated with a trading portfolio consisting of equity derivatives. These products are written on a stock whose the price at date

t is denoted by

. Among these derivative products, vanilla options, barrier options, and American options on a single underlying asset can be mentioned. In the Black-Scholes model, the values of these options are simply determined by analytical formulas depending on the underlying asset price

, except the American option values for which a numerical method, e.g. binomial tree, is mandatory. The portfolio may also include multi-underlying options such as basket options, best-of options and worst-off options. For this case, we denote by

the prices of

d underlying assets that are governed by lognormal processes:

where

r is a risk-free rate,

denote the asset volatilities, and

are Brownian motions with a correlation matrix

. In what follows, we assume the constant risk-free rate and volatilities.

Let

denote the value of the European multi-asset derivative at the maturity

T, also called the payoff. Subject to the above assumptions, the value of the European multi-asset option

at date

t is the conditional expectation under the risk neutral probability of the discounted payoff, denoted by

,

We are particularly interested in four options whose the payoff can be written as a vanilla option payoff against a strike

K given in

Table 1.

Given (

3), the price of geometric average options are fast referenced by the Black-Scholes formula, and the price of basket options can be accurately approximated by the Black-Scholes formula thanks to the convention that the sum of lognormal variables is approximately a lognormal variable [

7]. Otherwise, the price of other options in

Table 1 are evaluated by Monte Carlo simulation.

4. Multi-fidelity Gaussian Processes Regression

In the previous section, we describe how to apply GPR to interpolate the surface of price function using a few number of price points. However, the number of required points increases dramatically with the number of risk factors. Suppose that we have access to other kinds of information, e.g. a weak pricing engine based on a lower number of Monte Carlo simulations or using few discretization time steps in the tree model, the question arises how to take into benefit of this knowledge in modeling. For this purpose, we investigate multi-fidelity Gaussian process regression (mGPR) that allows us to learn the ground truth target from several information sources, each with a different level of fidelity. Any detail of this model can be found in [

6,

30,

32].

Assuming that we have s data sets, denoted by

, sorted by increasing level of fidelity (i.e.

is the most accurate and expensive data whereas

is the most simplified and abundant data). In [

30], the autoregressive model is used to model the cross-correlation structure between different levels:

where are scalar correlation parameters between and , measures the mismatch between j and and ϵ is the while noise of the lowest fidelity model. In mGPR, is supposed independent of . The goal of the model is to lean which is the relationship between the input and the highest fidelity response.

4.1. Two-fidelity Gaussian Process Regression Model

In this section, we focus on the mGPR with two fidelity levels. Let assume a data set of

low-fidelity points, denoted by

and a second set of

high-fidelity points, denoted by

, such that

last points of low-fidelity data coincides with

high-fidelity data, i.e.

The multi-fidelity modeling involves the following regression functions

where the parameter ρ describes the correlation of the high- and low-fidelity data,

is a Gaussian process model of

against

and δ is the second GP model conditionally independent with the former. In what follows, we consider GP models with constant prior mean [

20,

30] parameterized by coefficient β, Marten kernel covariance function

with

and parameterized by θ as per (

7), and a multiplicative form of the marginal variance

. In particular, the prior model is

and

where l and ξ are mean vectors

and

, and the covariance matrices

. Hence the multi-fidelity model is characterized by the parameters of the first and second Gaussian processes:

and

, and the correlation parameter ρ.

4.2. Illustrative Application of Multi-Fidelity Model in Option Pricing

For the pricing and risk calculation problem, our proposed approach is to learn the pricing engine, cf. the high fidelity model, with the less precise price values, cf. lower fidelity data. For instance, if the pricing engine involves Monte Carlo simulation of

paths, we can sample weak price values calculated by only, e.g. 100 paths as low-fidelity data (see

Section 6.2 for numerical experiments). In the American option pricing case, where the accurate price value is calculated using a binomial tree with 100 time steps, the weaker price can be generated by a sparser tree with only, e.g. 10 time steps. Conversely, if the target is the American option, which is expensively computed by tree model, its European counterpart, which is quickly evaluated using the Black-Scholes formula, can serve as lower fidelity data.

Remark 4.[2] propose an analytic approximation of an American option which is equal to the value of its European counterpart plus an add-on or their intrinsic values with a switch condition detailed in Section A.

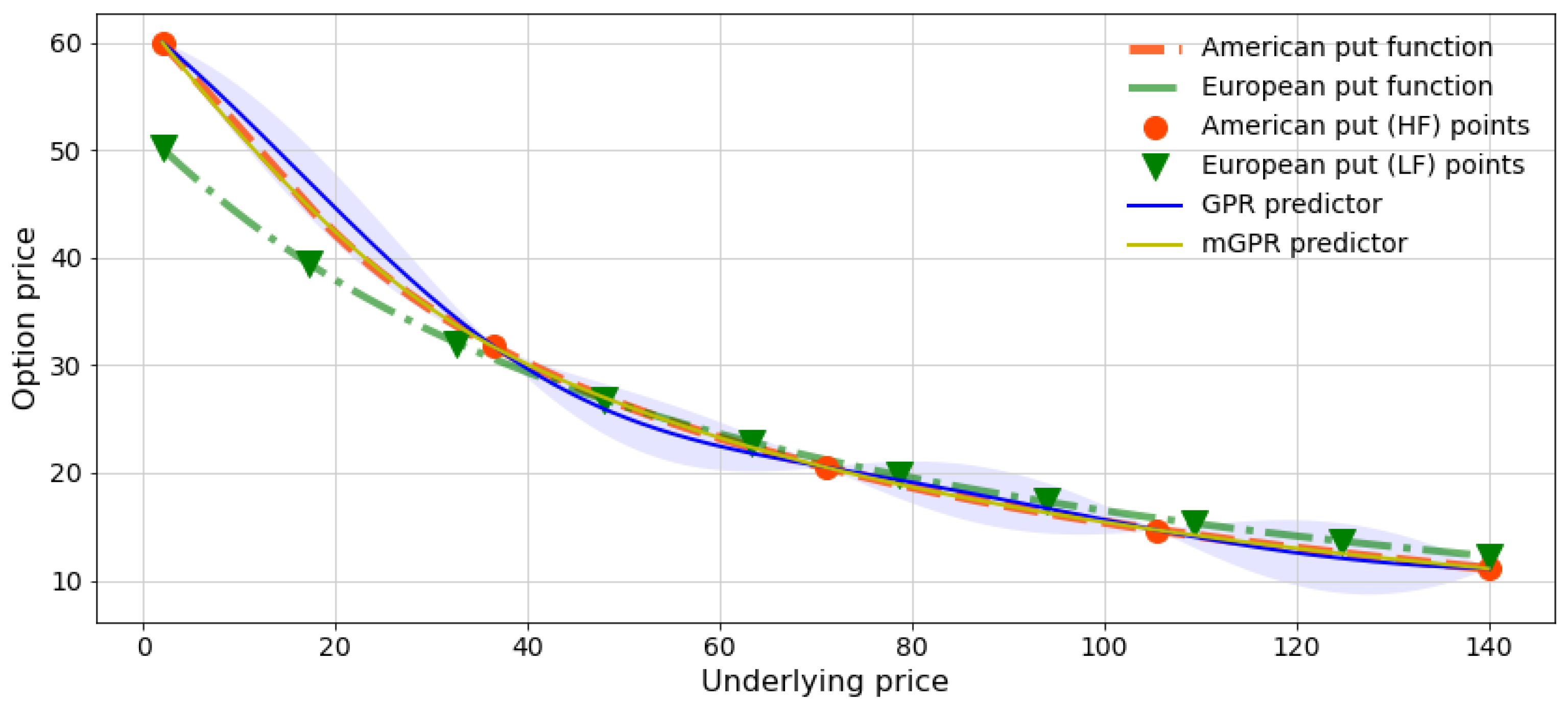

Figure 2 and

Table 2 demonstrate the numerical test of an American put of strike 62. The configuration of this experiment is detailed in

Section 5 and

Section 6.1. In particular, the GPR is trained with only 5 American put prices, while the mGPR integrates additionally 10 European prices as low-fidelity data. All training points are drawn from a regular grid of the underlying asset within an interval

, and test points are uniformly sampled within the same interval. We observe a significant mismatch of the GPR estimate (cf. blue curve), notably in the in-the-money region, whereas the mGPR estimate (cf. yellow curve) satisfactorily fits the American put price computed using a binomial tree with 100 time steps. Additionally, the mGPR provides smaller prediction uncertainty represented by the light yellow interval, which closely aligns with the yellow curve and is visually indistinguishable in

Figure 2. For further comparison, we also implement a second standard GPR, learning the discrepancy between American and European prices, and the approximation introduced in [

2] (see Section A). Their results are then reported in

Table 2.

4.3. Conditional Distribution of the Estimate

We describe now the posterior mean and variance of the prediction once the model is completely learned. Following the demonstration in Appendix A [

20], for a new point

, the prediction of the high-fidelity model follows normal distribution:

with mean and variance functions:

In addition,

is the covariance function between

and

and the covariance matrix

of vector

reads

We can notice that the computation of (

21) involves reversing the massive covariance matrix

of size

. To reduce the computational complexity, one can apply the Schur complement of block matrix

which is thus presented by Proposition 3.1 in [

32].

prop 4.1.By sorting the input data such that (cf. (16)) and with all above notations, the inverse matrix of in (24) has the form:

Instead of performing the inversion matrix in (

24) which has a complexity of

, the computation of

in (

25), involving the inverse of

and

, has a much lower complexity of

. By substituting (

25) into (

21) and doing some calculus, one can simplify the above formulas as follows

yielding the posterior mean and variance

4.4. Bayesian Estimation of Model Parameters

Due to the conditional independence assumption in the second line of (

17), the first set

can be separately learnt by, for example, the maximum likelihood method using data set

. While the parameters of the second Gaussian processes

and the correlation parameter ρ need to be jointly estimated to carry out the idea of formulation (

17) ([

32] Section 3.3.2). Similarly to (

12), the parameters of the low-fidelity model are estimated by maximizing the following log-likelihood

Differentiating the above equation w.r.t.

and

and solving it at 0 yield

and

By substituting (

29) and (

30) into (

28), we have the following optimization problem

To learn the second Gaussian process model, we define

The log-likelihood of the model reads

To compute the above parameters, one needs to estimate

by solving the following optimization

Note that (

36) can be directly solved by numerical methods mentioned in

Section 3.2 since the inversion of the small matrix of size

is not problematic. While the same procedure may not be applied for system (

31) when the number of low-fidelity

is large. We then present in the next subsection the sparse Gaussian process model for low-fidelity model.

5. Experiment Design and Model Specification

In this section, we present numerical tests dedicated to evaluating the accuracy and performance of the algorithms studied earlier in this chapter. More specifically, these experiments are conducted on two trading portfolios (cf.

Section 6.1 and

Section 6.3), interspersed by an examination of individual multi-asset calls (cf.

Section 6.2). The first one concerns a portfolio of single underlying derivatives, including plain vanilla (call and put), barrier and American options. The second one consists of multi-asset options, such as geometric, basket, best-of- and worst-of- options. The comparison is based on benchmark methods and scores explained below. We conclude this section by specifying the model of the implemented algorithms.

First, we analyze the case of the single-asset options portfolio described in [

34]. This portfolio, with a time maturity of ten years, consists of 100 distinct calls and puts issued on each of the four considered underlying assets. In particular, each asset is used to write 10 vanilla, 10 barrier and 5 American options with their strikes randomly generated from 60 to 140. More details about market and product parameters in the portfolio are presented in Tables 1 and A.1 [

34]. We then evaluate the price of each multi-asset option, as indicated in

Table 1. Each option expires after two years and is based on the same five assets. The actual values of geometric call options can be calculated using the Black-Scholes formula and serve as a reference. In the case of high dimensionality, the considered portfolio comprises 500 derivatives, depending on the performance of 20 stocks, generating a total of 20 market risk factors. Each derivative is characterized by various parameters, including a random selection of underlying assets from 2 to 20, a strike price ranging from 80 to 160, and a number of options from 100 to 500. It is noteworthy that each derivative can be either a call or a put option among the four types introduced in

Section 2.2. The portfolio maturity is set at 5 years, meaning that all its derivatives have a maturity ranging from 6 months to 5 years. In the Black-Scholes model framework, we choose a risk-free rate of

. Initial asset prices are arbitrarily chosen within a range of 100 to 120, and the volatility of these assets is set to vary between 0.2 and 0.5 with a random correlation matrix, refer to

Table 3 and

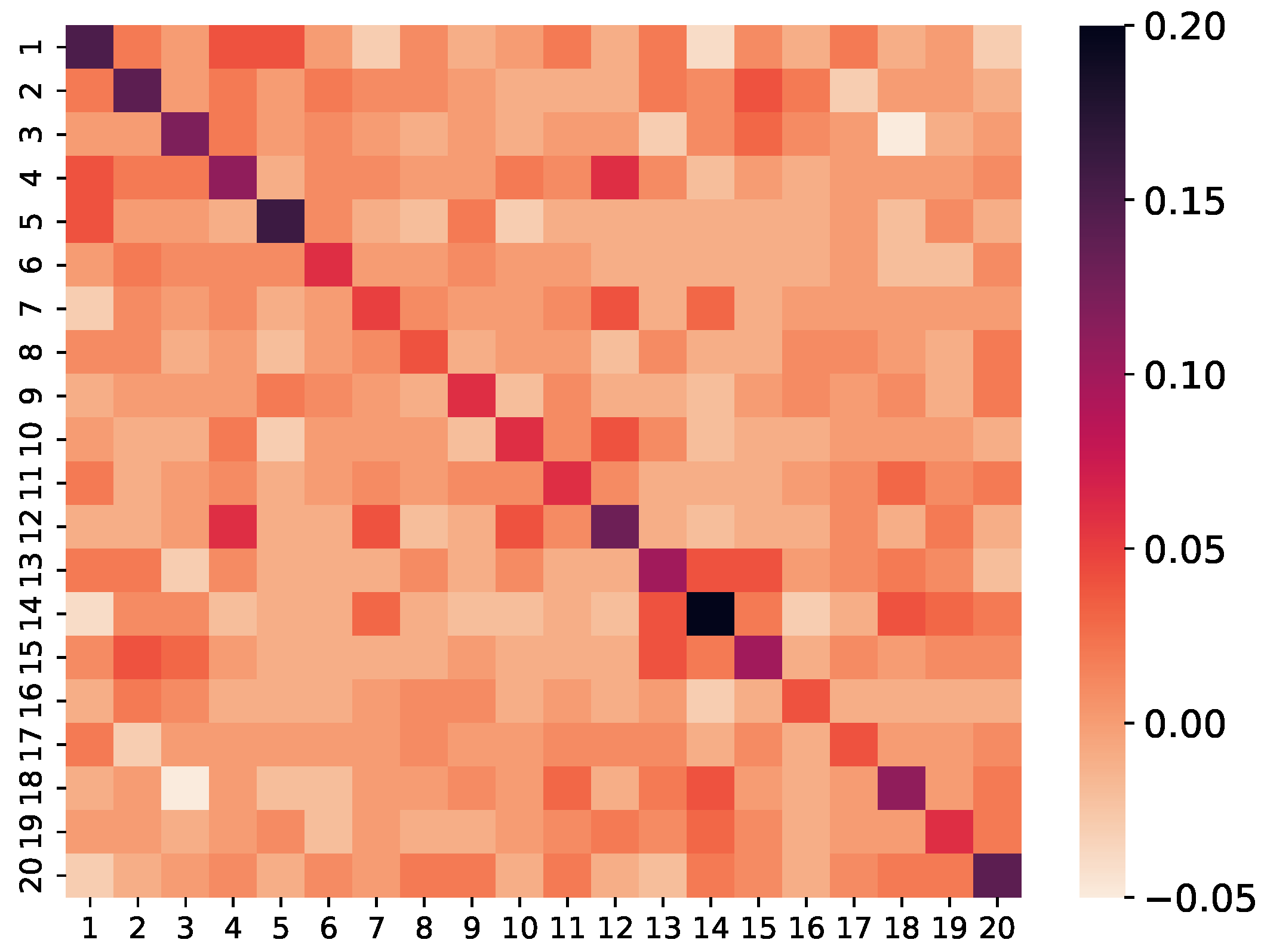

Figure 3. Finally, we examine the pricing and risk calculation problem for different time horizons, namely one day, ten days, and one month. At longer horizons, the magnitude of shocks and their volatilities increase, leading to a significant challenge in adapting the number of interpolation points. Financially, the price function becomes less linear, and the tail of the potential loss distribution becomes heavier.

5.1. Benchmarking

For the numerical implementation of market risk metrics calculation, the full pricing approach uses paths in any case. This level is chosen to ensure a satisfactory level of convergence of high quantiles estimation. However, a limited number () of these prices is chosen to train the machine learning models.

Regarding the exact pricing engine, the value of vanilla and barrier options in the mono-asset derivatives portfolio are calculated by analytical formulas, while the binomial tree with 100 time steps is used to evaluate American options. For multi-asset options, the exact pricing engine is defined by a Monte Carlo simulation of paths, except for geometric options whose the price can be computed by the Black-Scholes formula.

We implement the sensitivity-based pricing approximation (SxS) in Section B. To get sensitivities data, we shock relatively of each risk factor and use the central finite difference, yielding totally 40 portfolio evaluations for the first order sensitivity-based approach. The second order sensitivities are numerical unstable and lead to a worse approximation of the price. Hence they are not considered in our numerics.

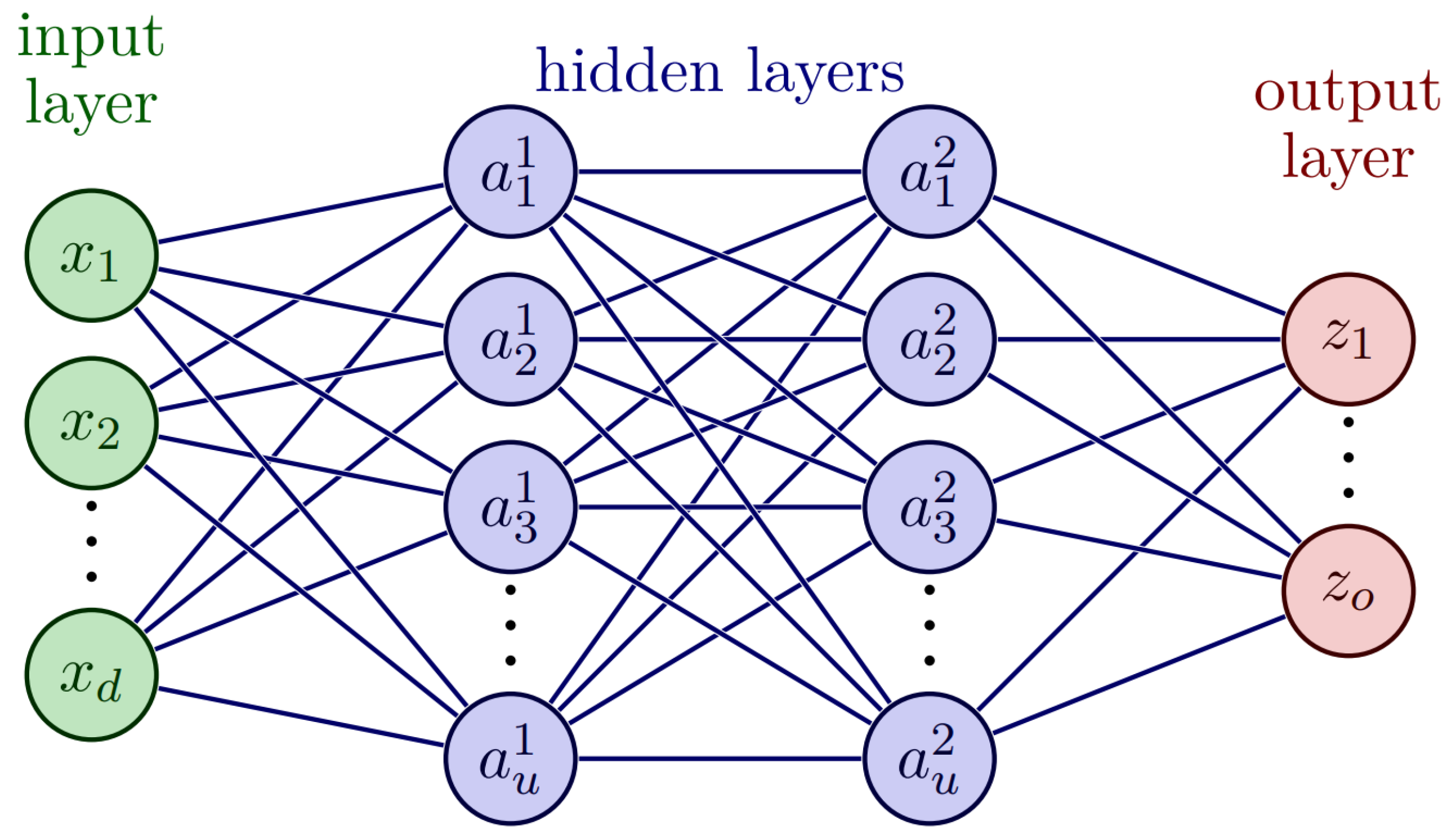

Regarding machine learning methods, we implement a two-hidden-layer neural network (see Section C) (NN) and two Gaussian process models introduced in

Section 3 (GPR) and

Section 4 (mGPR). In the latter, the high-fidelity data consists of the

Monte Carlo paths prices, while the low-fidelity comprises weak prices based on 100 MC paths in

Section 6.2 and 500 MC paths in

Section 6.3. For measuring the pricing mismatch, we use the mean absolute percentage error (MAPE) over

scenarios in the

and

computation:

where

and

are respectively actual price (i.e. analytical or Monte Carlo price) and predicted price (e.g. GPR approximative price), and

is the actual price without shock. The MAPE evaluating the average relative error of the estimate and the true observation is a common choice for benchmarking in finance. For risk assessment purpose, we measure the error of value-at-risk and expected shortfall calculated based on surrogate models (i.e.

and

) against the full revaluation ones calculated based on actual prices (i.e.

and

). For the relative measure, the error is then standardised by today price

Finally, the computation time is also reported to compare the resource efficiency.

5.2. Model Specification

For neural network model, we train a two-hidden-layer Relu network of 50 hidden units (cf. Section C). We observe numerically that more complex architectures do not significantly improve the approximation performance. Network parameters are calibrated by the stochastic gradient descent algorithm, i.e. Adam optimizer [

31], using 2000 epochs. The learning rate is set at

and each batch takes one fifth of the training data size.

The standard Gaussian process regression is trained using the scikit-learn Python package. We set a zero mean prior distribution and use Matern kernels with

(see (

7)) to model the covariance matrix. A single length-scale is selected; however, the input is normalized by subtracting its empirical mean and then dividing by its empirical standard error. The optimization is restarted 5 times for the numerical stability. To implement multi-fidelity Gaussian process regression, we use emukit package [

43] which is built upon the Gpy framework developed by machine learning researchers from the University of Sheffield. The model configuration is either set as the standard Gaussian processes or left at its default. The optimization is rerun 5 times.

7. Conclusions

We have introduced statistical and machine learning tools to handle the repeated valuation of extensive portfolios comprising linear and non-linear derivatives. To be more precise, we applied a Bayesian non-parametric technique, known as Gaussian process regression (GPR). To evaluate the accuracy and performance of these algorithms, we have considered a multi-asset options portfolio and a portfolio of non-linear derivatives, including vanilla and barrier/American options on an equity asset. The numerical tests demonstrated that the GPR algorithm outperforms pricing models in efficiently conducting repeated valuations of large portfolios. It is noteworthy that the GPR algorithm eliminates the need to separately revalue each derivative security within the portfolio, leading to a significant speed-up in calculating value-at-risk (VaR) and expected shortfall (ES). This independence from the size and composition of the trading portfolio is remarkable. Consequently, we argue that it is more advantageous for banks to construct their risk models using the power of GPR techniques in terms of calculation accuracy and speed-up.

Moreover, we have investigated multi-fidelity modeling technique and have explored its applications in pricing and risk calculation, a relatively novel concept in quantitative finance. The multi-fidelity modeling approach leverages limited access to the price engine while incorporating information from other related, more affordable resources to enhance the approximation. Trained regression models offer price estimates at the portfolio level, making them more favorable for risk calculation compared to classical pricing approaches that evaluate products individually. Our numerical findings indicate that machine learning models such as neural networks and Gaussian process regression provide more accurate results and significant time savings compared to traditional sensitivity-based approaches, maintaining precision in risk calculation akin to the full repricing approach. With the limitation of training price data, GPR models yield more impressive results than neural network. Despite the longer learning time required for mGPR, especially when low-fidelity data is available, it yields better or at least equal precision compared to the standard GPR model. Notably, as multi-fidelity modeling is not yet well-known in quantitative finance, it presents an intriguing direction for research, allowing scientists to explore traditional relationships in finance to define low-fidelity models and enhance the learning process.

Future research delves into other topics and applications of algorithms such that Gaussian process regression and multi-fidelity modeling, with a particular focus on the fixed income portfolio. We also envisage the use of the replicating portfolio value, assumed to be accessible, as low-fidelity data to leverage the learning of the target portfolio value. Additionally, the price of European basket options can serve as low-fidelity data to approximate the price of their American/Bermudian counterparts. The Black-Scholes price of derivatives can be used to improve the approximation of their Heston price. We leave these interesting applications there for future study.

Figure 1.

Risk calculation procedure.

Figure 1.

Risk calculation procedure.

Figure 2.

American put prices predicted by GPRs learned from 5 points. Red circles represent training points in GPR and high-fidelity points in mGPR, and green inverted triangles are low-fidelity points in mGPR. The light blue and light yellow (very close to yellow curve) regions depict the uncertainty of the GPR and mGPR predictions respectively.

Figure 2.

American put prices predicted by GPRs learned from 5 points. Red circles represent training points in GPR and high-fidelity points in mGPR, and green inverted triangles are low-fidelity points in mGPR. The light blue and light yellow (very close to yellow curve) regions depict the uncertainty of the GPR and mGPR predictions respectively.

Figure 3.

Heatmap of the stock covariance matrix.

Figure 3.

Heatmap of the stock covariance matrix.

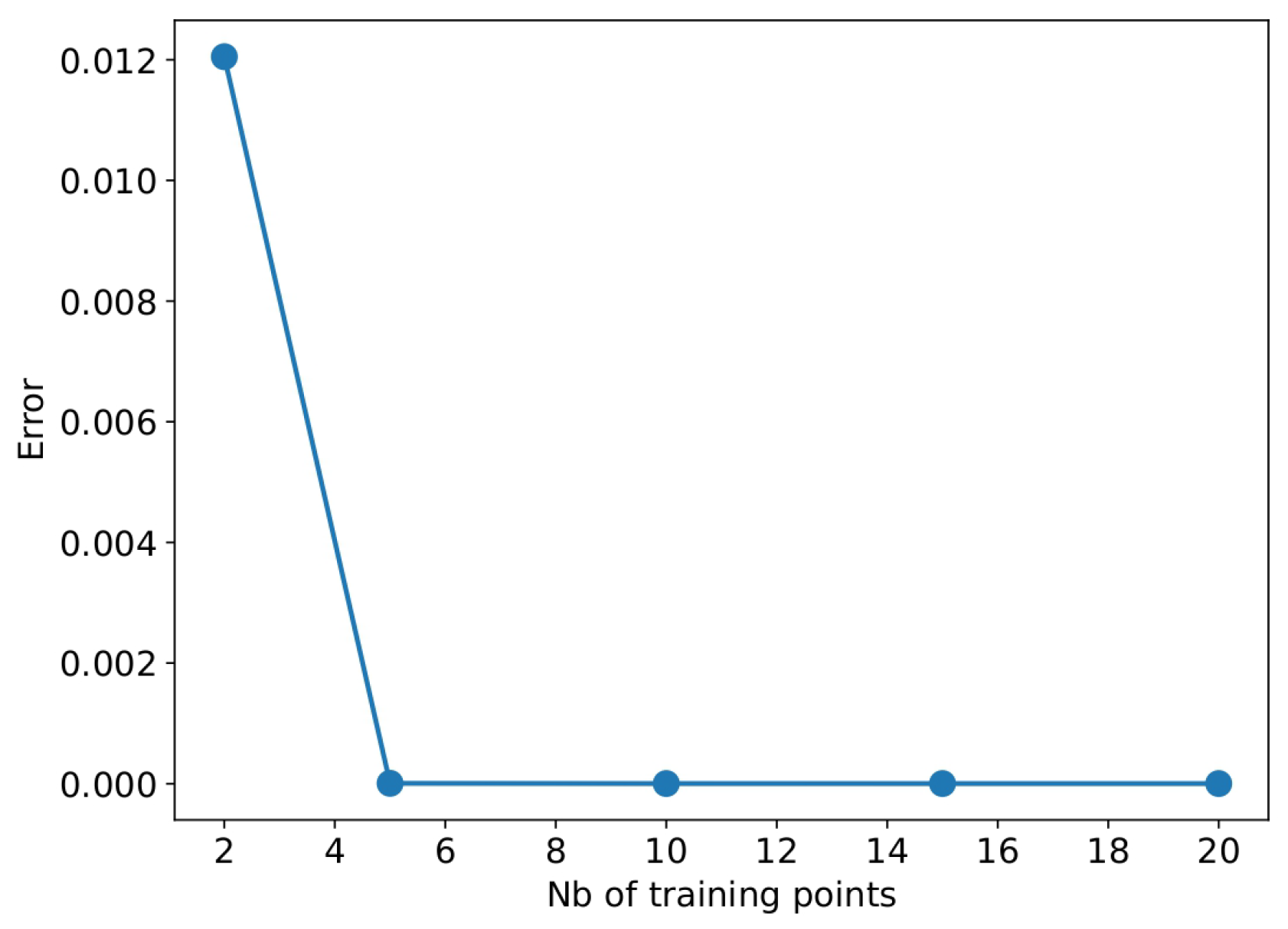

Figure 4.

Convergence of MAPE of GPR estimates when increasing the number of training points in mono-asset portfolio case.

Figure 4.

Convergence of MAPE of GPR estimates when increasing the number of training points in mono-asset portfolio case.

Figure 5.

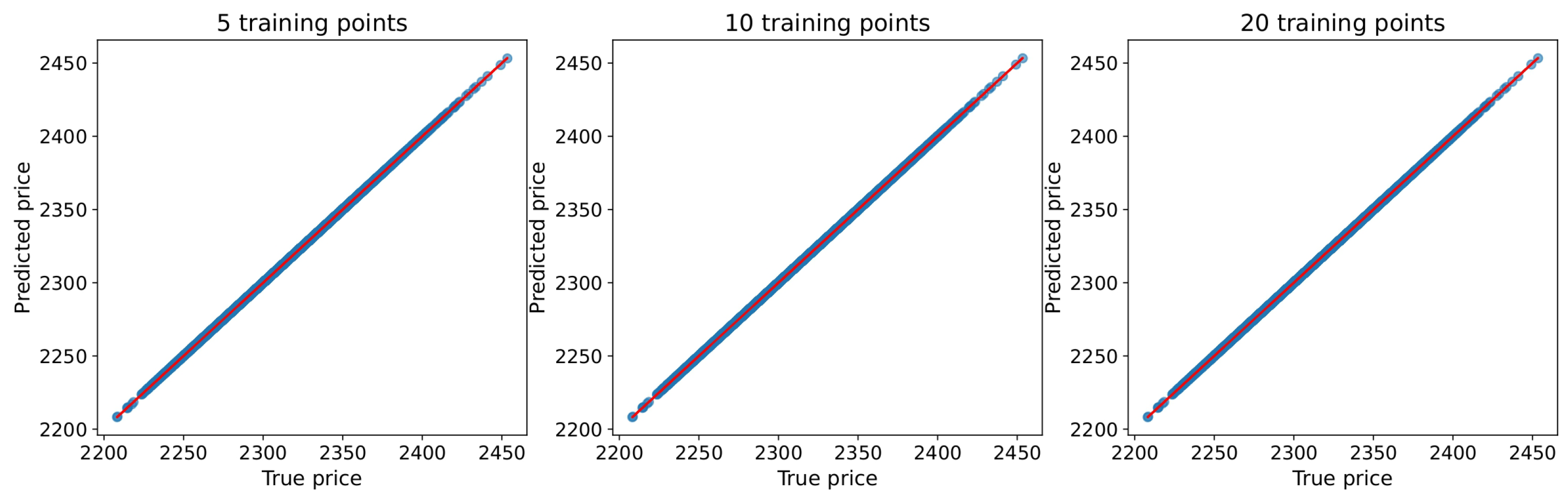

q-q plots of GPR predicted price using 5 (Left), 10 (Center) and 20 (Right) training points against the true price, i.e. analytical and binomial tree prices, in the mono-asset portfolio case.

Figure 5.

q-q plots of GPR predicted price using 5 (Left), 10 (Center) and 20 (Right) training points against the true price, i.e. analytical and binomial tree prices, in the mono-asset portfolio case.

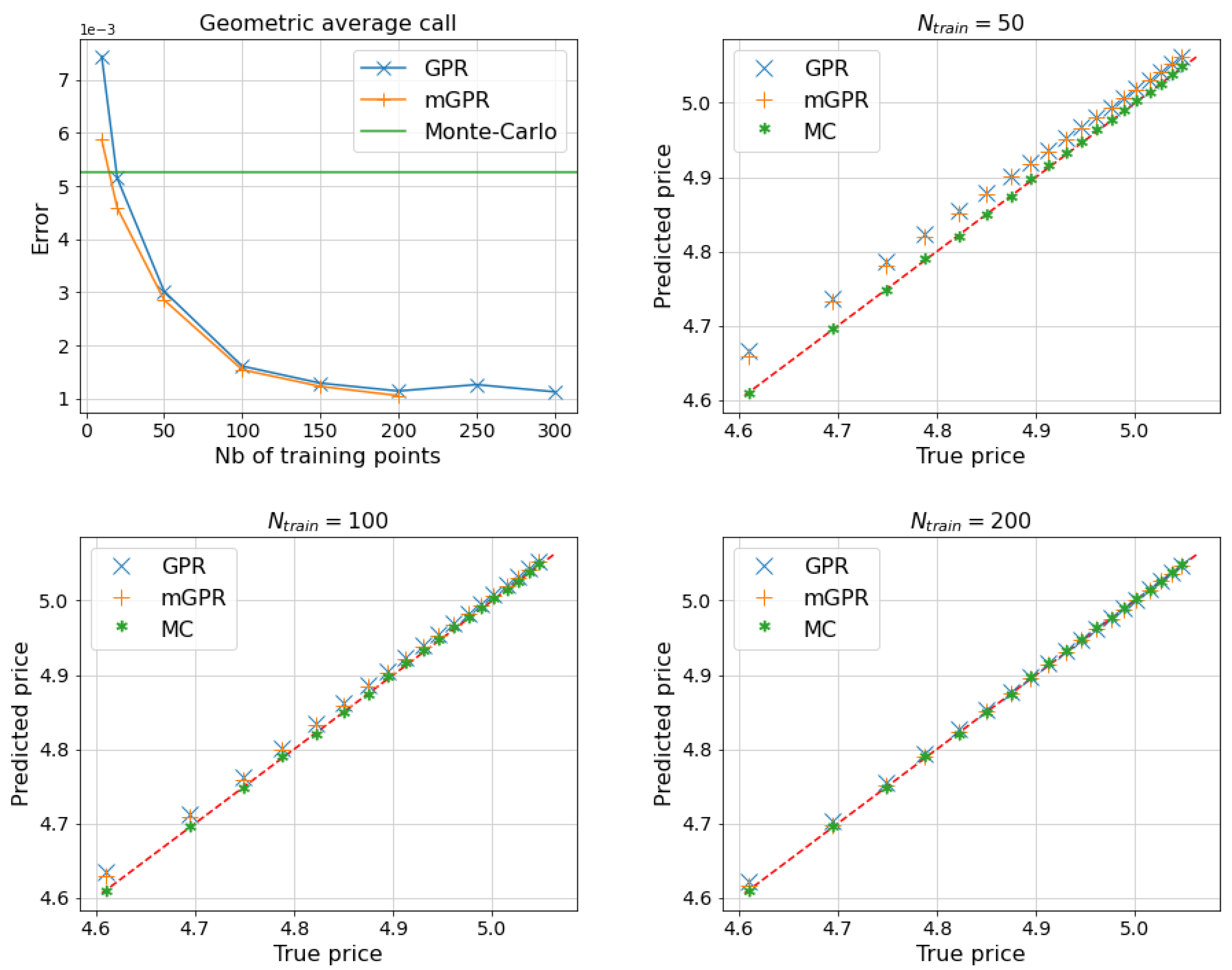

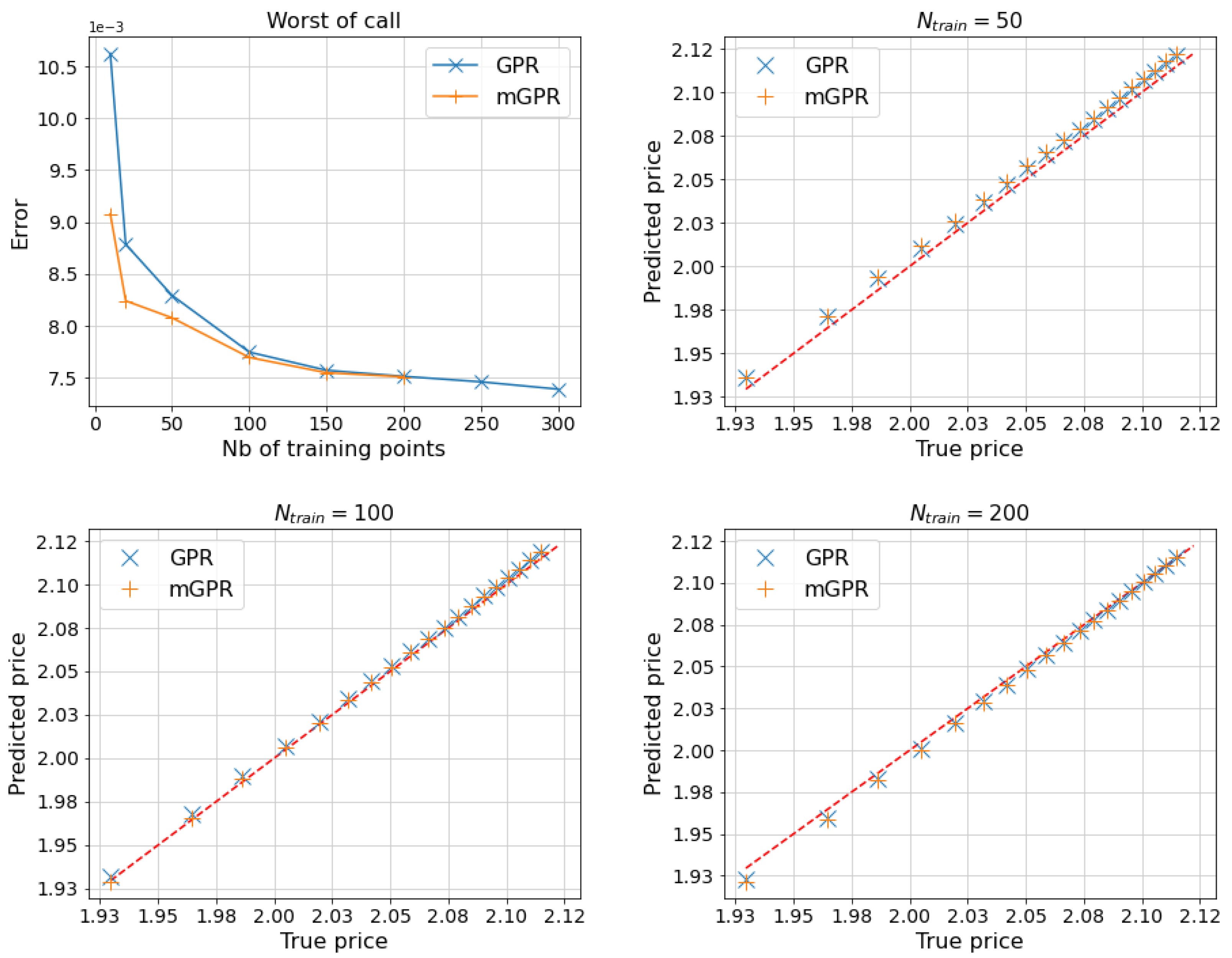

Figure 6.

MAPE of estimates of 5-asset geometric average call as a function of the number of training points (Top Left) and q-q plots comparing predictors learned from 50 (Top Right), 100 (Bottom Left) and 200 (Bottom Right) points against the true price, i.e. Black-Scholes price, below their quantile levels. The mGPR uses 200 low-fidelity points.

Figure 6.

MAPE of estimates of 5-asset geometric average call as a function of the number of training points (Top Left) and q-q plots comparing predictors learned from 50 (Top Right), 100 (Bottom Left) and 200 (Bottom Right) points against the true price, i.e. Black-Scholes price, below their quantile levels. The mGPR uses 200 low-fidelity points.

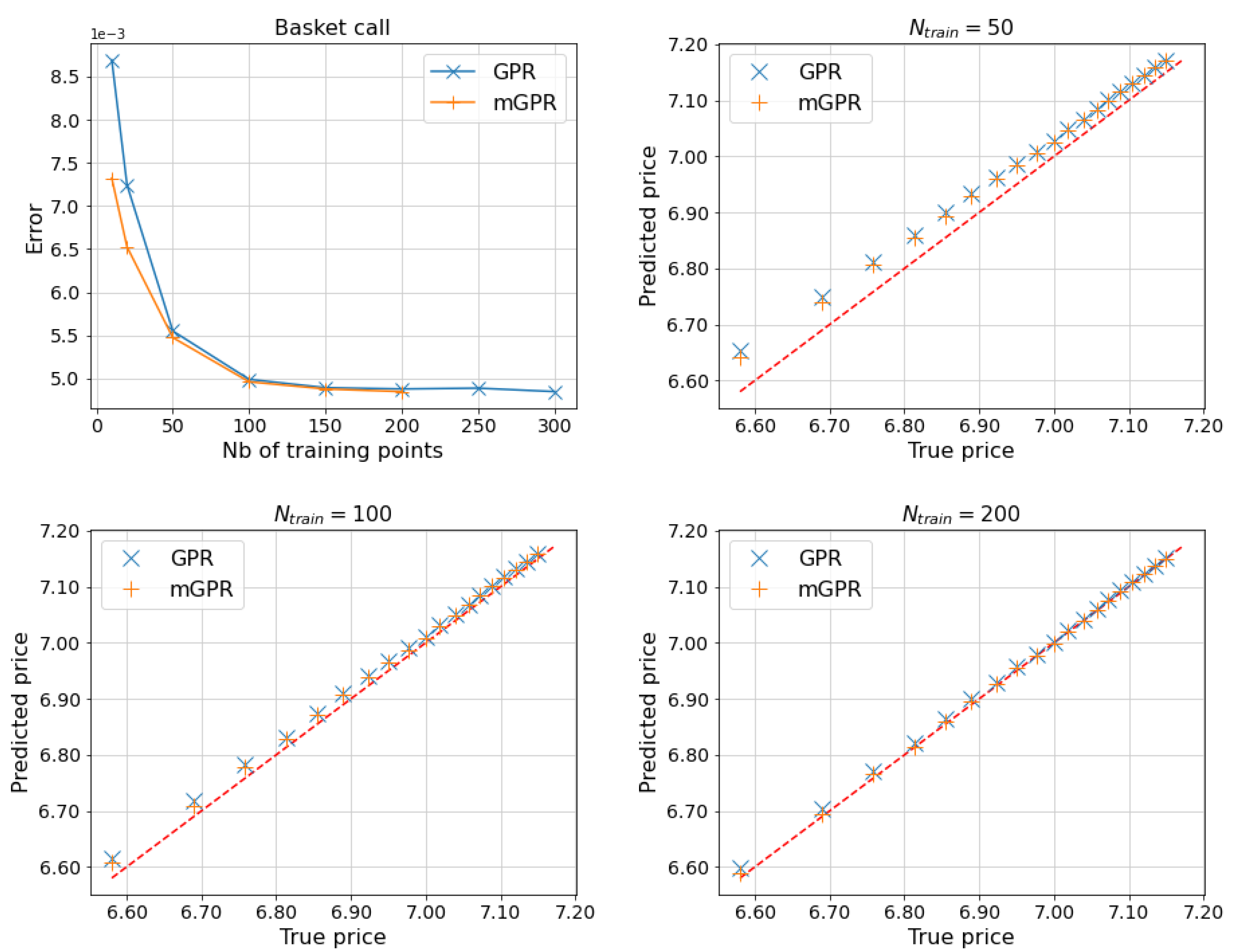

Figure 7.

MAPE of estimates of 5-asset basket call as a function of the number of training points (Top Left) and q-q plots comparing predictors learned from 50 (Top Right), 100 (Bottom Left) and 200 (Bottom Right) points against the true price, i.e. Monte-Carlo price with paths, below their quantile levels.

Figure 7.

MAPE of estimates of 5-asset basket call as a function of the number of training points (Top Left) and q-q plots comparing predictors learned from 50 (Top Right), 100 (Bottom Left) and 200 (Bottom Right) points against the true price, i.e. Monte-Carlo price with paths, below their quantile levels.

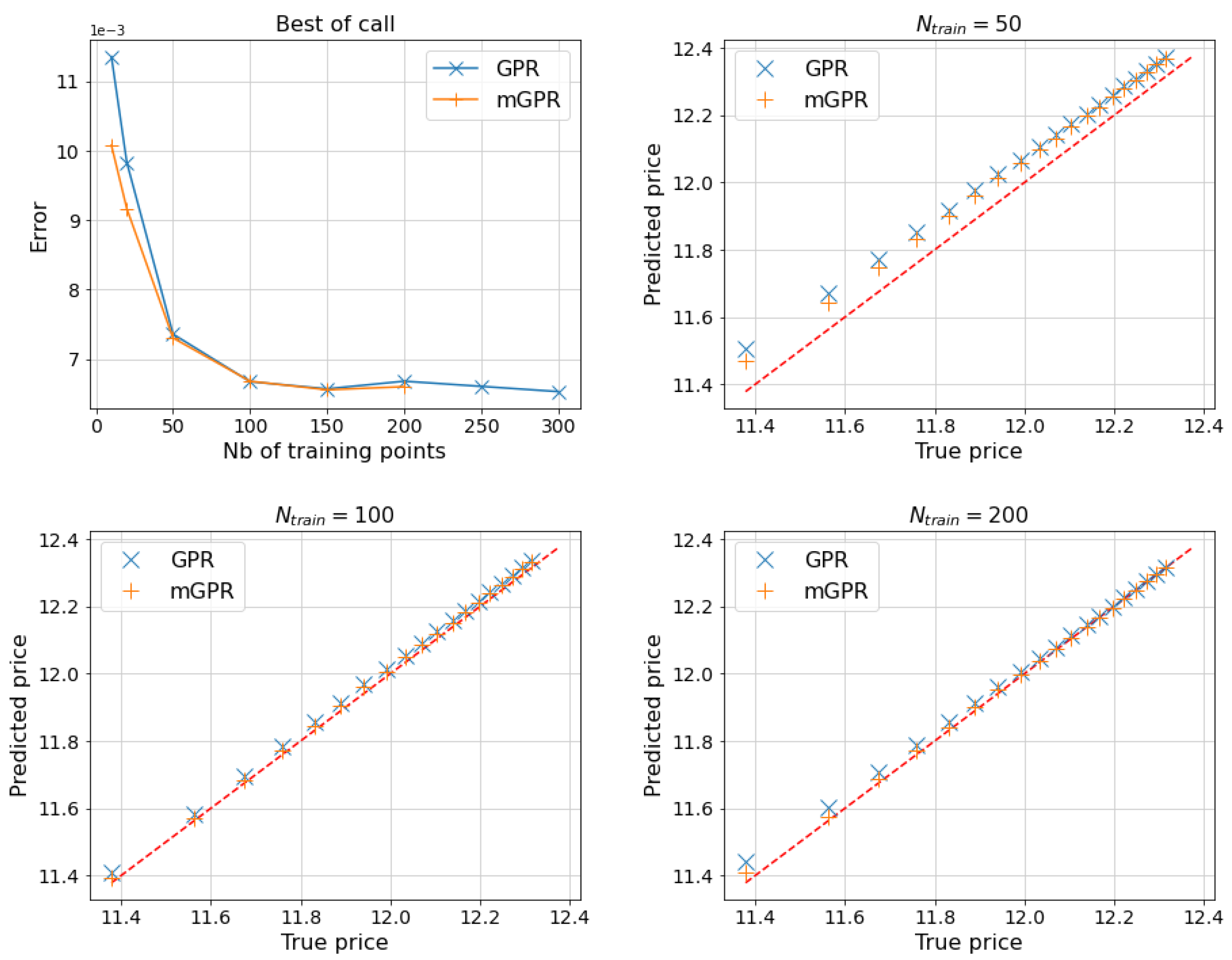

Figure 8.

MAPE of estimates of 5-asset best-of-call as a function of the number of training points (Top Left) and q-q plots comparing predictors learned from 50 (Top Right), 100 (Bottom Left) and 200 (Bottom Right) points against the true price, i.e. Monte-Carlo price with paths, below their quantile levels.

Figure 8.

MAPE of estimates of 5-asset best-of-call as a function of the number of training points (Top Left) and q-q plots comparing predictors learned from 50 (Top Right), 100 (Bottom Left) and 200 (Bottom Right) points against the true price, i.e. Monte-Carlo price with paths, below their quantile levels.

Figure 9.

MAPE of estimates of 5-asset worst-of call as a function of the number of training points (Top Left) and q-q plots comparing predictors learned from 50 (Top Right), 100 (Bottom Left) and 200 (Bottom Right) points against the true price, i.e. Monte-Carlo price with paths, below their quantile levels.

Figure 9.

MAPE of estimates of 5-asset worst-of call as a function of the number of training points (Top Left) and q-q plots comparing predictors learned from 50 (Top Right), 100 (Bottom Left) and 200 (Bottom Right) points against the true price, i.e. Monte-Carlo price with paths, below their quantile levels.

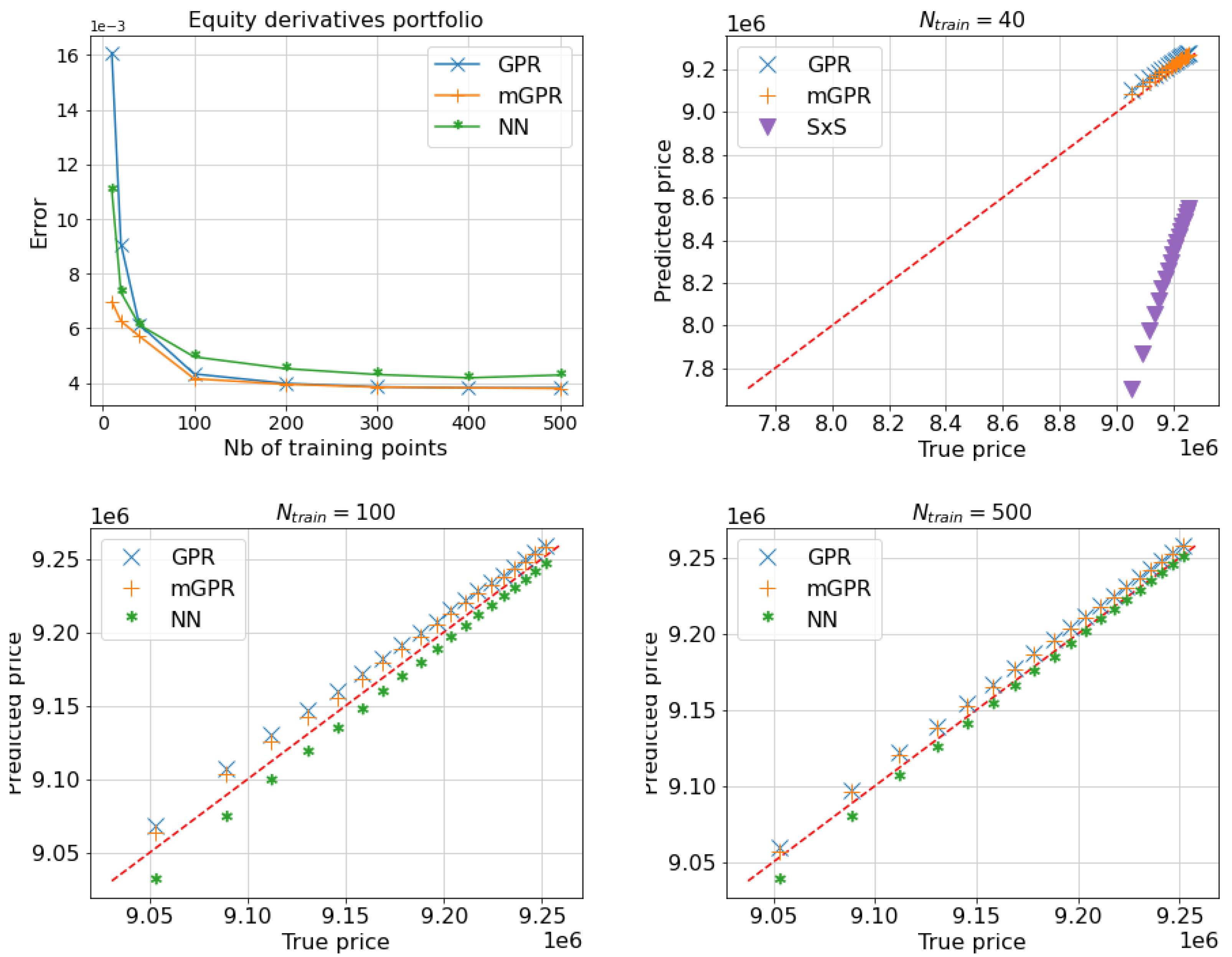

Figure 10.

MAPE of estimates of equity option portfolio with one day horizon as a function of the number of training points (Top Left) and q-q plots comparing predictors learned from 40 (Top Right), 100 (Bottom Left) and 500 (Bottom Right) points against the true price, i.e. Monte-Carlo price with

paths, below their

quantile levels. The MAPE of SxS prediction is not included in figures due to its high value but can be found in

Table 9.

Figure 10.

MAPE of estimates of equity option portfolio with one day horizon as a function of the number of training points (Top Left) and q-q plots comparing predictors learned from 40 (Top Right), 100 (Bottom Left) and 500 (Bottom Right) points against the true price, i.e. Monte-Carlo price with

paths, below their

quantile levels. The MAPE of SxS prediction is not included in figures due to its high value but can be found in

Table 9.

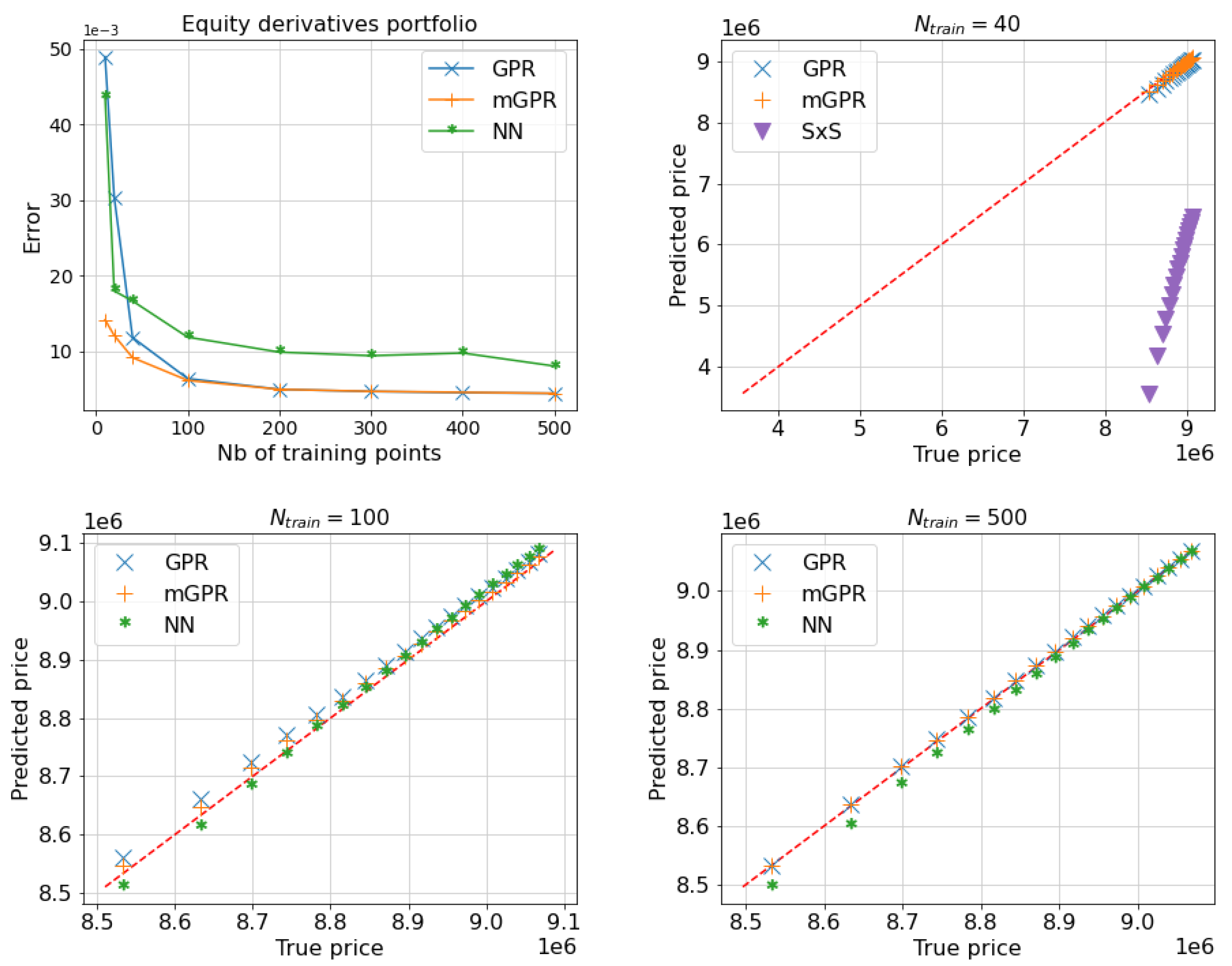

Figure 11.

MAPE of estimates of equity option portfolio with ten days horizon as a function of the number of training points (Top Left) and q-q plots comparing predictors learned from 40 (Top Right), 100 (Bottom Left) and 500 (Bottom Right) points against the true price, below their

quantile levels. The MAPE of SxS prediction is not included in figures due to its high value but can be found in

Table 11.

Figure 11.

MAPE of estimates of equity option portfolio with ten days horizon as a function of the number of training points (Top Left) and q-q plots comparing predictors learned from 40 (Top Right), 100 (Bottom Left) and 500 (Bottom Right) points against the true price, below their

quantile levels. The MAPE of SxS prediction is not included in figures due to its high value but can be found in

Table 11.

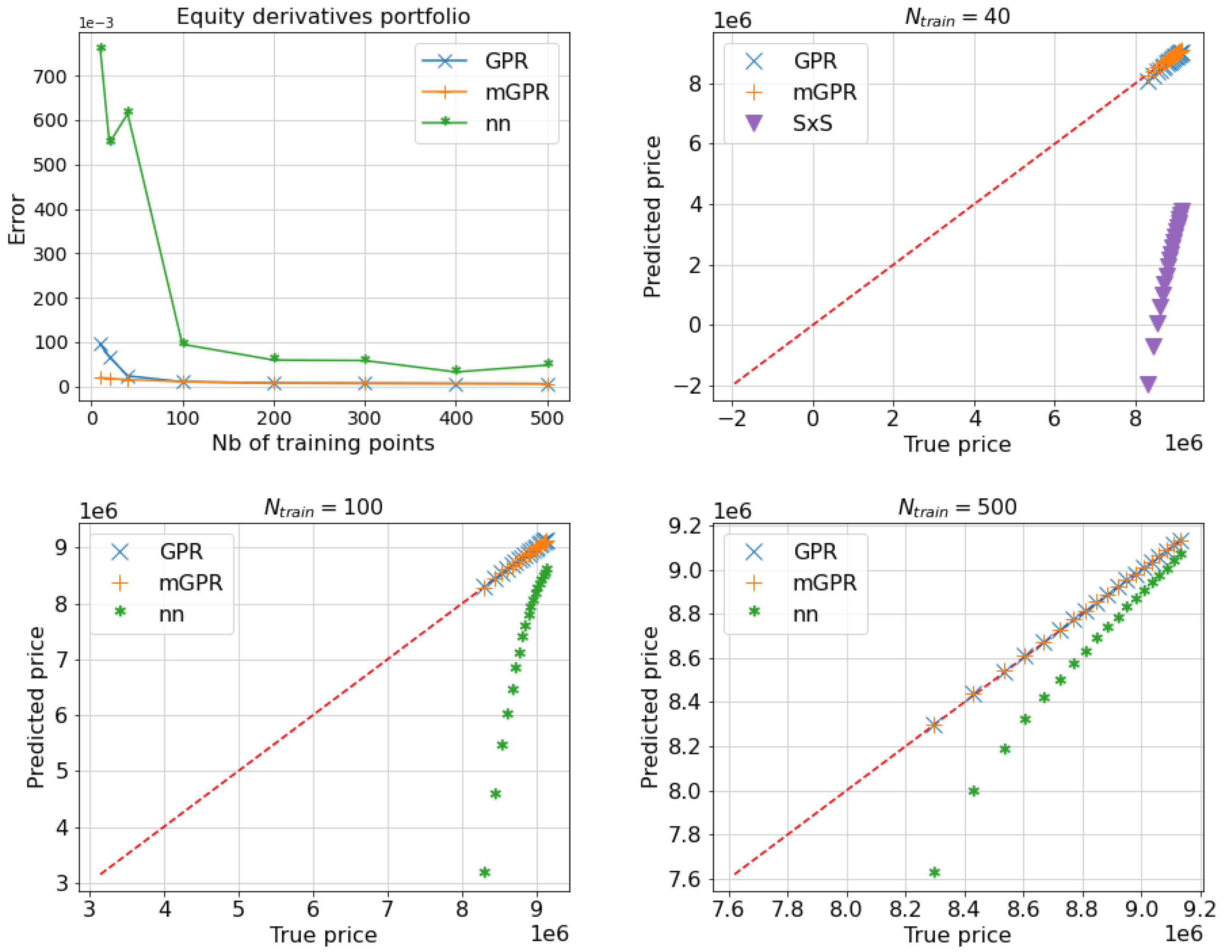

Figure 12.

MAPE of estimates of equity option portfolio with one month horizon as a function of the number of training points (Top Left) and q-q plots comparing predictors learned from 40 (Top Right), 100 (Bottom Left) and 500 (Bottom Right) points against the true price, i.e. Monte-Carlo price with

paths, below their

quantile levels. The MAPE of SxS prediction is not included in figures due to its high value but can be found in

Table 12.

Figure 12.

MAPE of estimates of equity option portfolio with one month horizon as a function of the number of training points (Top Left) and q-q plots comparing predictors learned from 40 (Top Right), 100 (Bottom Left) and 500 (Bottom Right) points against the true price, i.e. Monte-Carlo price with

paths, below their

quantile levels. The MAPE of SxS prediction is not included in figures due to its high value but can be found in

Table 12.

Figure A1.

Two-hidden-layer neural network architecture.

Figure A1.

Two-hidden-layer neural network architecture.

Table 1.

Multi-asset options covered in our numerics.

Table 1.

Multi-asset options covered in our numerics.

| Option |

Geometric

average call/put |

Basket call/put |

Best-of

call/put |

Worst-of

call/put |

| Payoff |

|

|

|

|

Table 2.

Out-of-sample mean absolute error (MAE) of the predictors against the American put price computed by binomial tree of 100 time steps. The GPR with control variate learns the discrepancy between American price and its European counterpart. The BW approximation refers to the [

2] approach.

Table 2.

Out-of-sample mean absolute error (MAE) of the predictors against the American put price computed by binomial tree of 100 time steps. The GPR with control variate learns the discrepancy between American price and its European counterpart. The BW approximation refers to the [

2] approach.

| Model |

GPR |

GPR with

control variate |

BW

approximation |

mGPR |

| MAE |

0.6848 |

0.3199 |

0.2859 |

0.1367 |

Table 3.

Initial stock prices.

Table 3.

Initial stock prices.

|

103.79 |

|

115.33 |

|

100.41 |

|

102.28 |

|

109.73 |

|

118.77 |

|

115.22 |

|

118 |

|

108.82 |

|

103.47 |

|

110.19 |

|

113.28 |

|

100.27 |

|

100.43 |

|

110.23 |

|

102.45 |

|

119.78 |

|

106.64 |

|

117.87 |

|

103.32 |

Table 4.

VaR and ES estimates using GPR against the true measures in the mono-asset portfolio case.

Table 4.

VaR and ES estimates using GPR against the true measures in the mono-asset portfolio case.

| |

Confidence level |

True measure |

|

|

|

| VaR |

|

39.83 |

39.84 |

39.83 |

39.83 |

| |

|

50.90 |

50.89 |

50.92 |

50.91 |

| |

|

60.28 |

60.29 |

60.29 |

60.29 |

| |

|

70.53 |

70.55 |

70.56 |

70.54 |

| ES |

|

53.98 |

53.98 |

53.99 |

53.98 |

| |

|

63.02 |

63.02 |

63.03 |

63.02 |

| |

|

70.95 |

70.95 |

70.97 |

70.96 |

| |

|

80.15 |

80.15 |

80.17 |

80.15 |

| |

Speed-up |

2h25 - benchmark |

x2000 |

x1000 |

x500 |

Table 5.

One day and of 5-asset geometric average call estimated by proxy pricing models.

Table 5.

One day and of 5-asset geometric average call estimated by proxy pricing models.

| |

Model |

Number of training points () |

| |

|

10 |

20 |

50 |

100 |

150 |

200 |

VaR

99% |

GPR |

0.6900 |

0.7639 |

0.7768 |

0.8007 |

0.7989 |

0.8108 |

| |

mGPR |

0.7749 |

0.8028 |

0.7815 |

0.8054 |

0.8018 |

0.8155 |

| |

MC |

0.8220 |

| |

True |

0.8190 |

ES

97.5% |

GPR |

0.6931 |

0.7650 |

0.7757 |

0.8011 |

0.8005 |

0.8108 |

| |

mGPR |

0.7781 |

0.8060 |

0.7811 |

0.8057 |

0.8033 |

0.8159 |

| |

MC |

0.8235 |

| |

True |

0.8202 |

Computational

time (in second) |

GPR |

0 |

1 |

3 |

6 |

10 |

13 |

| |

mGPR |

10 |

10 |

12 |

23 |

30 |

32 |

| |

MC |

7488 |

| True initial price |

5.5135 |

Table 6.

One day and of 5-asset basket call estimated by proxy pricing models.

Table 6.

One day and of 5-asset basket call estimated by proxy pricing models.

| |

Model |

Number of training points () |

| |

|

10 |

20 |

50 |

100 |

150 |

200 |

VaR

99% |

GPR |

0.9163 |

1.0067 |

1.0289 |

1.0597 |

1.0588 |

1.0732 |

| |

mGPR |

1.0123 |

1.0550 |

1.0371 |

1.0673 |

1.0630 |

1.0824 |

| |

True |

1.1013 |

ES

97.5% |

GPR |

0.9199 |

1.0077 |

1.0280 |

1.0615 |

1.0607 |

1.0748 |

| |

mGPR |

1.0143 |

1.0583 |

1.0371 |

1.0674 |

1.0643 |

1.0832 |

| |

True |

1.1016 |

| True initial price |

7.7770 |

Table 7.

One day and of 5-asset best-of-call estimated by proxy pricing models.

Table 7.

One day and of 5-asset best-of-call estimated by proxy pricing models.

| |

Model |

Number of training points () |

| |

|

10 |

20 |

50 |

100 |

150 |

200 |

VaR

99% |

GPR |

1.4704 |

1.5850 |

1.6380 |

1.7258 |

1.6907 |

1.7064 |

| |

mGPR |

1.5869 |

1.6604 |

1.6682 |

1.7403 |

1.6982 |

1.7346 |

| |

True |

1.7483 |

ES

97.5% |

GPR |

1.4714 |

1.5878 |

1.6435 |

1.7279 |

1.6928 |

1.7084 |

| |

mGPR |

1.5906 |

1.6675 |

1.6721 |

1.7438 |

1.7010 |

1.7373 |

| |

True |

1.7517 |

| True initial price |

13.3101 |

Table 8.

One day and of 5-asset worst-of call estimated by proxy pricing models.

Table 8.

One day and of 5-asset worst-of call estimated by proxy pricing models.

| |

Model |

Number of training points () |

| |

|

10 |

20 |

50 |

100 |

150 |

200 |

VaR

99% |

GPR |

0.3153 |

0.3447 |

0.3584 |

0.3619 |

0.3661 |

0.3704 |

| |

mGPR |

0.3625 |

0.3673 |

0.3584 |

0.3640 |

0.3677 |

0.3711 |

| |

True |

0.3651 |

ES

97.5% |

GPR |

0.3625 |

0.3673 |

0.3584 |

0.3640 |

0.3677 |

0.3711 |

| |

mGPR |

0.3624 |

0.3670 |

0.3587 |

0.3645 |

0.3681 |

0.3715 |

| |

True |

0.3657 |

| True initial price |

2.3296 |

Table 9.

Pricing approximation and risk calculation of the portfolio with one day horizon.

Table 9.

Pricing approximation and risk calculation of the portfolio with one day horizon.

|

Full

pricing |

40 |

100 |

500 |

| model |

|

SxS |

GPR |

mGPR |

NN |

GPR |

mGPR |

NN |

GPR |

mGPR |

| MAPE |

9,447,616 |

6.13% |

0.61% |

0.57% |

0.48% |

0.43% |

0.42% |

0.43% |

0.38% |

0.38% |

|

358,862 |

1,575,039 |

307,983 |

325,145 |

374,986 |

340,394 |

343,926 |

368,887 |

350,397 |

351,493 |

|

359,972 |

1,584,907 |

309,301 |

328,193 |

377,288 |

342,130 |

347,312 |

370,475 |

351,211 |

353,116 |

| Err.

|

- |

12.87% |

0.54% |

0.36% |

0.17% |

0.20% |

0.16% |

0.11% |

0.09% |

0.08% |

| Err.

|

- |

12.97% |

0.54% |

0.34% |

0.18% |

0.19% |

0.13% |

0.11% |

0.09% |

0.07% |

Table 10.

Computation time comparison of and calculation by alternative methods.

Table 10.

Computation time comparison of and calculation by alternative methods.

|

Full

valorisation |

40 |

100 |

500 |

| model |

|

SxS |

GPR |

mGPR |

NN |

GPR |

mGPR |

NN |

GPR |

mGPR |

| Learning time |

0 |

0 |

1 |

41 |

25 |

2 |

56 |

30 |

13 |

135 |

| Sampling time |

600 |

0.2 |

0.6 |

3 |

Table 11.

Pricing approximation and risk calculation of the portfolio with ten days horizon.

Table 11.

Pricing approximation and risk calculation of the portfolio with ten days horizon.

|

Full

pricing |

40 |

100 |

500 |

| model |

|

SxS |

GPR |

mGPR |

NN |

GPR |

mGPR |

NN |

GPR |

mGPR |

| MAPE |

9,447,616 |

20.27% |

1.18% |

0.92% |

1.19% |

0.64% |

0.61% |

0.8% |

0.44% |

0.44% |

|

814,166 |

5,252,412 |

896,191 |

843,186 |

835,971 |

785,850 |

799,501 |

847,257 |

810,857 |

811,540 |

|

814,604 |

5,320,871 |

895,574 |

843,831 |

836,584 |

787,204 |

800,163 |

848,514 |

812,423 |

812,947 |

| Err.

|

- |

46.98% |

0.87% |

0.31% |

0.23% |

0.30% |

0.16% |

0.35% |

0.04% |

0.03% |

| Err.

|

- |

47.70% |

0.86% |

0.31% |

0.23% |

0.29% |

0.15% |

0.36% |

0.02% |

0.02% |

Table 12.

Pricing approximation and risk calculation of the portfolio with one month horizon.

Table 12.

Pricing approximation and risk calculation of the portfolio with one month horizon.

|

Full

pricing |

40 |

100 |

500 |

| model |

|

SxS |

GPR |

mGPR |

NN |

GPR |

mGPR |

NN |

GPR |

mGPR |

| MAPE |

9,447,616 |

38.44% |

2.35% |

1.50% |

9.48% |

1.02% |

1.09% |

1.72% |

0.60% |

0.60% |

|

1,016,862 |

10,137,189 |

1,175,837 |

1,046,029 |

1,092,622 |

995,794 |

1,006,735 |

1,103,964 |

1,009,737 |

1,010,166 |

|

1,011,890 |

10,267,028 |

1,177,443 |

1,042,407 |

1,104,343 |

991,431 |

1,004,123 |

1,119,376 |

1,005,141 |

1,005,065 |

| Err.

|

|

96.54% |

1.68% |

0.31% |

0.8% |

0.22% |

0.11% |

0.92% |

0.08% |

0.07% |

| Err.

|

|

97.96% |

1.75% |

0.32% |

0.98% |

0.22% |

0.08% |

1.14% |

0.07% |

0.07% |