1. Introduction

This study analyzes the relationship between economic policy uncertainty (hereinafter EPU) and firm value, and verifies the differential effects of EPU on firm value according to corporate social responsibility (hereinafter CSR) activities. Globalization is the current trend due to technological innovation and the development of the internet, and economic uncertainty has been heightened recently as economic and non-economic factors are mixed due to the shocks of US-China trade friction and COVID-19, etc. Consequently, national economic policies change frequently and interest in the effects of EPU on the global financial market has been growing.

EPU is related to the overall business activities of companies. An increase in EPU can make it difficult for managers to grasp the future business environment and restrict efficient decision-making and business management. Al-Thaqeb et al. (2019) [

1] suggested that EPU can always cause side effects. An example is the recent economic downturn existing in many countries experiencing great policy uncertainty. First, according to the view that EPU greatly increases companies' wait-and-see attitude, it can be seen that the level of investment of firms is reduced or investments are delayed due to EPU through previous studies (Bernanke 1983 [

2]; Gulen and Ion 2016 [

3]). This can lead to a contraction of the real economy (Lee and Seo 2020 [

4]). Meanwhile, there is also a view that EPU can increase agency costs by causing the problem of information asymmetry. A positive (+) relationship was shown between EPU and excess cash holdings (Demir and Ersan 2017 [

5]; Duong et al. 2018 [

6]; Phan et al. 2019 [

7]; Shin 2012 [

8]). Jensen (1986) [

9] reported information asymmetry and agency costs as major factors for excess cash holdings, and Shin (2012) [

8] verified the negative effect of excess cash holdings on shareholder value. Therefore, the increase in EPU can cause information asymmetry and agency problems thereby damaging corporate value. Yung and Root (2019) [

10] reported that as EPU increases, the management attempts earnings management more frequently. This means that when the EPU is high, firm value can be damaged due to opportunistic earnings management by managers. Therefore, when the level of EPU is high, it is expected that the quality of accounting information will be low due to the agency problem, and due to the path as such, EPU is expected to have a negative effect on firm value. The relationship between EPU and firm value should be studied in-depth because studies on it have not yet been actively conducted. In particular, in the case of emerging markets, capital markets are not healthy, and additional studies on how EPU affects firm value should be conducted.

Therefore, the importance of studies on how managers can overcome crises and maintain safe business management in the face of the challenges posed by EPU is high. In an uncertain environment, stakeholders' confidence in the overall market dropped significantly, and in such cases, the level of trust in companies appeared to be more important (Sapienza and Zingales 2012 [

11]). Companies that conducted CSR activities well in such situations will be able to deliver more powerful and reliable signals to their stakeholders (Godfrey 2005 [

12]; Lins et al. 2017 [

13]; Bouslah et al. 2018 [

14]).

Various studies have been conducted on the relationship between CSR activities and firm value. Many studies have confirmed a significant positive (+) relationship between CSR activities and firm value (Na and Hong 2011 [

15]; Cho et al. 2019 [

16]). From the perspective of the agency theory, Cheng et al. (2014) [

17] argued through empirical analysis that CSR activities can improve the transparency of accounting information. This means that companies that more actively engage in CSR activities can provide more non-financial information and can reduce information asymmetry problems and agency costs by transmitting positive signals to the outside. Meanwhile, companies that actively carry out CSR activities can gain social capital by gaining a good reputation in the market. Campbell (2007) [

18] argued that CSR activities are closely related to the economic environment faced by companies. In a situation where ECU is high, CSR activities will receive more attention from stakeholders. In such cases, the social capital and reputation formed through the firm's active CSR activities play a role of protecting corporate assets in crisis situations (Lins et al., 2017 [

13]). In summary, non-financial information provided through CSR activities alleviates information asymmetry and agency problems, and this effect may be greater when EPU is higher. This suggests that CSR activities can be a strategic means to overcome EPU.

On the other hand, when facing an uncertain environment, managers must allocate resources efficiently so that they can adapt well to environmental changes. CSR activities can improve a company's image, but they also incur costs (Pava and Krausz 1996 [

19]). Therefore, studies on whether managers should actively carry out CSR activities with limited resources in the recent situation where economic policy uncertainty is high have an important practical implication. That is, it is necessary to study whether social capital and reputation acquired through firm’s active CSR activities can mitigate the negative effects of uncertainty.

Based on previous studies, this study will focus on the relationship between EPU and firm value, and the moderating effect of CSR activities on the foregoing relationship. The study period was from 2010 to 2020, and the EPU indexes measured by Baker et al. (2016) [

20]'s method and Hexun's CSR scores for companies listed on the Chinese stock market were used. Hexun is one of the three major evaluation agencies in China, and the CSR scores evaluated by this agency have been widely used in previous studies as a representative indicator of Chinese companies' CSR performance (Pan et al. 2014 [

21]; Yang et al. 2019 [

22]).

The results of this study are as follows. First, EPU and corporate value were found to have a negative (-) relationship. This is consistent with previous studies that showed a negative (-) relationship between EPU and management performance (Pástor and Veronesi 2013 [

23]; Yung and Root 2019 [

10]; Al-Thaqeb et al. 2019 [

1]). Second, active CSR activities relieved the negative (-) relationship between EPU and firm value. This is consistent with previous studies indicating that active CSR activities play a role in mitigating the problem of information asymmetry and protecting corporate assets in unstable times (Cheng et al. 2014 [

17]; Godfrey 2005 [

12]; Bouslah et al. 2018 [

14]). Additionally, firms were divided into groups according to CSR activity scores to analyze the relationship and according to the result, the negative (-) relationship between EPU and corporate value was greater in the groups with low CSR activity scores than in the groups with high CSR activity scores. A lag model was applied to control endogeneity, and the results were consistent with the main results above. In addition, considering the robustness of the analysis results, the results were re-verified using the EPU index measured by Davis et al. (2019) [

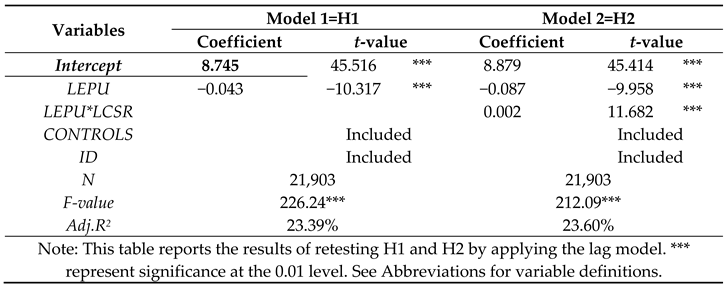

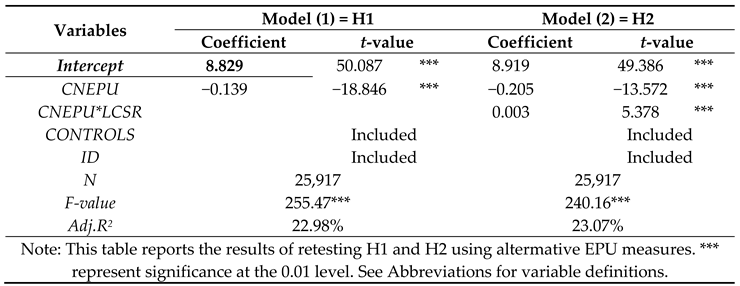

24]'s method, and the results consistent with the above results were obtained.

The contributions of this study are as follows. First, previous studies have mainly focused on microscopic factors to investigate factors affecting firm value. This study focused on macroeconomic policies and paid attention to the effects of changes in the macroenvironment caused by economic policy uncertainty on firm value. Second, when enacting economic policies, the policy-making body should consider the fact that frequent policy changes can negatively affect firm value and hinder corporate development. Third, this study is meaningful in that it expanded previous studies related to CSR activities by confirming that active CSR activities can be an advantageous tool for overcoming EPU. Finally, the implications of this study are in that this study can present the importance of CSR activities to companies and promote voluntary CSR activities by companies.

This study is as follows. Section II reviews previous studies and develops hypotheses, and Section III describes data collection and variable settings, and presents the research models. In addition, Section IV reports the empirical results, and Section V concludes this study and presents limitations and contributions.

5. Conclusion

After the 2008 financial crisis, various countries have frequently adjusted their economic policies to cope with the shock of financial crises. Economic uncertainty has been heightened recently as economic and non-economic factors are mixed due to the shocks of US-China trade friction and COVID-19, etc. The exploration of whether such frequent economic policy changes will bring the financial market out of the shadow of a crisis or became burdens to companies has been conducted continuously. Al-Thaqebetal et al. (2019) [

1] reviewed the literature on EPU, corporate decision-making, and financial markets and found that policy uncertainty had always led to negative consequences. Macroeconomic policies are one of major challenges faced by managers and stakeholders because they affect the entire production and management process of companies. Since companies cannot predict the future policy direction and business environment, they cannot but be disadvantageous in efficient decision-making and operational management. . Therefore, when the level of EPU is high, it is expected that the quality of accounting information will be low due to the agency problem, and due to the path as such, EPU is expected to have a negative effect on firm value.

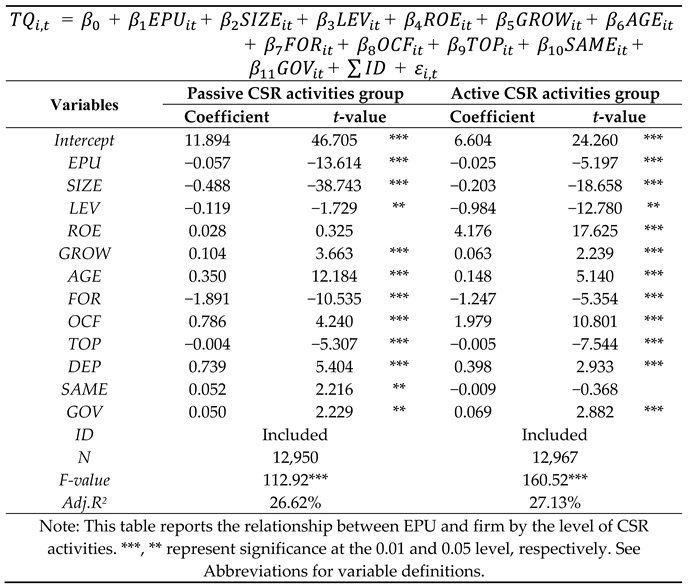

The results of this study show that EPU has a negative impact on firm value. Next, active CSR activities relieved the negative (-) relationship between EPU and corporate value. This is consistent with previous studies indicating that active CSR activities play a role in mitigating the problem of information asymmetry and protecting corporate assets in unstable times (Cheng et al. 2014; Godfrey 2005; Bouslah et al. 2018). Additionally, companies were divided into groups according to CSR activity scores to analyze the relationship and according to the result, the negative (-) relationship between EPU and firm value was greater in the groups with low CSR activity scores than in the groups with high CSR activity scores. A lag model was applied to control endogeneity, and the results were consistent with the main results above. In addition, considering the robustness of the analysis results, the results were re-verified using the EPU index measured by Davis' method, and the results consistent with the above results were obtained.

Unlike previous studies, this study provides evidence from emerging market and investigates whether EPU is related to firm value, and further investigates whether CSR activities can ultimately become an active tool in that relationship. The contributions of this study are as follows. First, this study found that EPU can be one of the factors affecting firm value, which makes additional contributions to prior research on firm value. Second, the results of this study have great implication not only for firm and market participants, but also for policy authorities. Specifically, if CSR activities can alleviate the negative impact of EPU on firm value, it is firms can cope with the complex business environment caused by EPU through active CSR activities. Lastly, by reporting that the impact of EPU on firm value may vary depending on the level of CSR activities, we provided additional evidence for the hypothesis that there is a positive relationship between CSR activities and firm value.

This study may have the following limitations. First, EPU is not an observable value and thus is estimated. Although this study checked the robustness by applying the EPU index measured by two measurement methods, still there is a possibility that the index is not perfect due to the measurement methods. In addition, although a lag model was applied, it cannot be said that the endogeneity problem was completely excluded. Lastly, since the soundness of the stock market may be different between emerging and developed markets, the effects of changes in economic policies may differ between emerging and developed markets. Therefore, further studies are necessary.

Table 1.

Sample distribution by year.

Table 1.

Sample distribution by year.

| Year |

Number |

Percentage (%) |

Cumulative percentage (%) |

| 2010 |

1,355 |

5.23 |

5.23 |

| 2011 |

1,700 |

6.56 |

11.79 |

| 2012 |

1,957 |

7.55 |

19.34 |

| 2013 |

2,078 |

8.02 |

27.36 |

| 2014 |

2,061 |

7.95 |

35.31 |

| 2015 |

2,142 |

8.26 |

43.57 |

| 2016 |

2,351 |

9.07 |

52.64 |

| 2017 |

2,649 |

10.22 |

62.86 |

| 2018 |

3,121 |

12.04 |

74.9 |

| 2019 |

3,193 |

12.32 |

87.22 |

| 2020 |

3,310 |

12.78 |

100 |

| Total |

5,178 |

100 |

100 |

Table 2.

Sample distribution by industry.

Table 2.

Sample distribution by industry.

| Industry |

Number |

Percentage (%) |

Cumulative percentage (%) |

| Agriculture, Foresty, and Fishing |

338 |

1.30 |

1.30 |

| Mining |

616 |

2.38 |

3.68 |

| Manufacturing |

16,718 |

64.51 |

68.19 |

| Power, Heat, and Gas Supply |

892 |

3.44 |

71.63 |

| Construction |

712 |

2.75 |

74.38 |

| Wholesale and Retail |

1,380 |

5.32 |

79.70 |

| Transportation |

854 |

3.30 |

83.00 |

| Accommodation and Food |

80 |

0.31 |

83.31 |

| Information Transmission and Software Information Technology Service |

1,691 |

6.52 |

89.83 |

| Real Estate |

1,112 |

4.29 |

94.12 |

| Rental and Business Service |

294 |

1.13 |

95.25 |

| Research and Technology Service |

243 |

0.94 |

96.19 |

| Repair, Environmental, and Public Facilities Management |

311 |

1.20 |

97.39 |

| Education and Other Service |

46 |

0.18 |

97.57 |

| Hygiene and Social Work |

61 |

0.24 |

97.81 |

| Culture, Sports, and Entertainment |

354 |

1.37 |

99.18 |

| Other |

215 |

0.83 |

100 |

| Total |

25,917 |

100 |

100 |

Table 3.

Descriptive statistics (N=25,917).

Table 3.

Descriptive statistics (N=25,917).

| Variable |

Mean |

Std. |

Min |

Median |

Max |

| TQ |

2.018 |

1.261 |

0.861 |

1.607 |

8.197 |

| EPU |

3.876 |

2.480 |

0.989 |

3.639 |

7.919 |

| CSR |

24.387 |

15.551 |

–3.260 |

22.130 |

74.370 |

| SIZE |

22.225 |

1.289 |

19.982 |

22.038 |

26.231 |

| LEV |

0.425 |

0.203 |

0.054 |

0.420 |

0.867 |

| ROE |

0.061 |

0.119 |

–0.623 |

0.069 |

0.305 |

| GROW |

0.172 |

0.394 |

–0.531 |

0.108 |

2.475 |

| AGE |

2.787 |

0.381 |

1.386 |

2.833 |

3.466 |

| FOR |

0.007 |

0.039 |

0.000 |

0.000 |

0.300 |

| OCF |

0.048 |

0.068 |

–0.150 |

0.047 |

0.239 |

| TOP |

58.580 |

15.023 |

23.470 |

59.550 |

90.280 |

| DEP |

0.381 |

0.073 |

0.250 |

0.364 |

0.600 |

| SAME |

0.263 |

0.441 |

0.000 |

0.000 |

1.000 |

| GOV |

0.379 |

0.485 |

0.000 |

0.000 |

1.000 |

| Note: See Abbreviations for variable definitions. |

Table 4.

Pearson correlations (N=25,917).

Table 4.

Pearson correlations (N=25,917).

| Variable |

TQ |

EPU |

CSR |

SIZE |

LEV |

ROE |

GROW |

AGE |

FOR |

OCF |

TOP |

DEP |

SAME |

GOV |

| TQ |

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EPU |

–0.07 |

1 |

|

|

|

|

|

|

|

|

|

|

|

|

| |

*** |

|

|

|

|

|

|

|

|

|

|

|

|

|

| CSR |

–0.04 |

–0.23 |

1 |

|

|

|

|

|

|

|

|

|

|

|

| |

*** |

*** |

|

|

|

|

|

|

|

|

|

|

|

|

| SIZE |

–0.39 |

0.10 |

0.25 |

1 |

|

|

|

|

|

|

|

|

|

|

| |

*** |

*** |

*** |

|

|

|

|

|

|

|

|

|

|

|

| LEV |

–0.29 |

–0.03 |

–0.01 |

0.53 |

1 |

|

|

|

|

|

|

|

|

|

| |

*** |

*** |

|

*** |

|

|

|

|

|

|

|

|

|

|

| ROE |

0.09 |

–0.07 |

0.45 |

0.10 |

–0.15 |

1 |

|

|

|

|

|

|

|

|

| |

*** |

*** |

*** |

*** |

*** |

|

|

|

|

|

|

|

|

|

| GROW |

0.04 |

–0.09 |

0.10 |

0.03 |

0.04 |

0.24 |

1 |

|

|

|

|

|

|

|

| |

*** |

*** |

*** |

*** |

*** |

*** |

|

|

|

|

|

|

|

|

| AGE |

–0.03 |

0.36 |

–0.09 |

0.17 |

0.17 |

–0.05 |

–0.08 |

1 |

|

|

|

|

|

|

| |

*** |

*** |

*** |

*** |

*** |

*** |

*** |

|

|

|

|

|

|

|

| FOR |

–0.03 |

–0.03 |

0.02 |

–0.05 |

–0.07 |

0.05 |

0.03 |

–0.08 |

1 |

|

|

|

|

|

| |

*** |

*** |

*** |

*** |

*** |

*** |

*** |

*** |

|

|

|

|

|

|

| OCF |

0.13 |

0.11 |

0.17 |

0.05 |

–0.17 |

0.29 |

0.01 |

0.03 |

0.04 |

1 |

|

|

|

|

| |

*** |

*** |

*** |

*** |

*** |

*** |

** |

*** |

*** |

|

|

|

|

|

| TOP |

–0.29 |

0.01 |

0.16 |

0.14 |

–0.08 |

0.20 |

0.10 |

–0.19 |

0.17 |

0.12 |

1 |

|

|

|

| |

*** |

* |

*** |

*** |

*** |

*** |

*** |

*** |

*** |

*** |

|

|

|

|

| DEP |

0.06 |

–0.00 |

0.01 |

–0.04 |

–0.06 |

0.02 |

–0.00 |

–0.06 |

0.01 |

0.01 |

0.04 |

1 |

|

|

| |

*** |

|

|

*** |

*** |

*** |

|

*** |

|

|

*** |

|

|

|

| SAME |

0.09 |

0.07 |

–0.06 |

–0.18 |

–0.14 |

0.01 |

0.03 |

–0.09 |

0.04 |

–0.00 |

0.03 |

0.10 |

1 |

|

| |

*** |

*** |

*** |

*** |

*** |

|

*** |

*** |

*** |

|

*** |

*** |

|

|

| GOV |

–0.14 |

–0.11 |

0.13 |

0.35 |

0.30 |

–0.02 |

–0.07 |

0.17 |

–0.10 |

–0.01 |

–0.04 |

–0.14 |

–0.30 |

1 |

| |

*** |

*** |

*** |

*** |

*** |

*** |

*** |

*** |

*** |

** |

*** |

*** |

*** |

|

| Notes: This table presents Pearson correlations. . ***, **, and * represent significance at the 0.01, 0.05, and 0.1 level, respectively. See Abbreviations for variable definitions. |

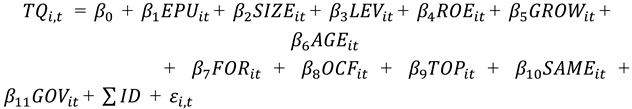

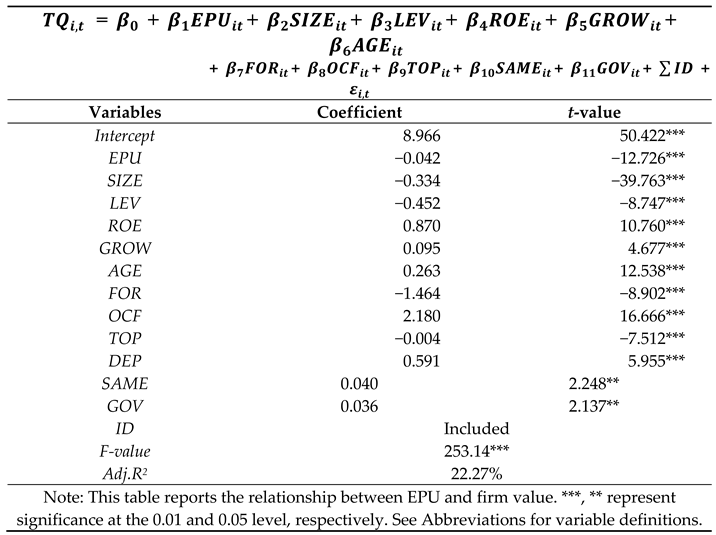

Table 5.

The relationship between EPU and firm value (N=25,917).

Table 5.

The relationship between EPU and firm value (N=25,917).

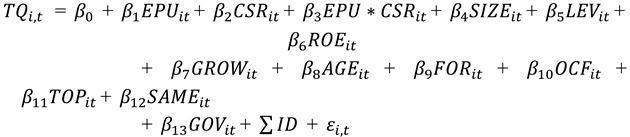

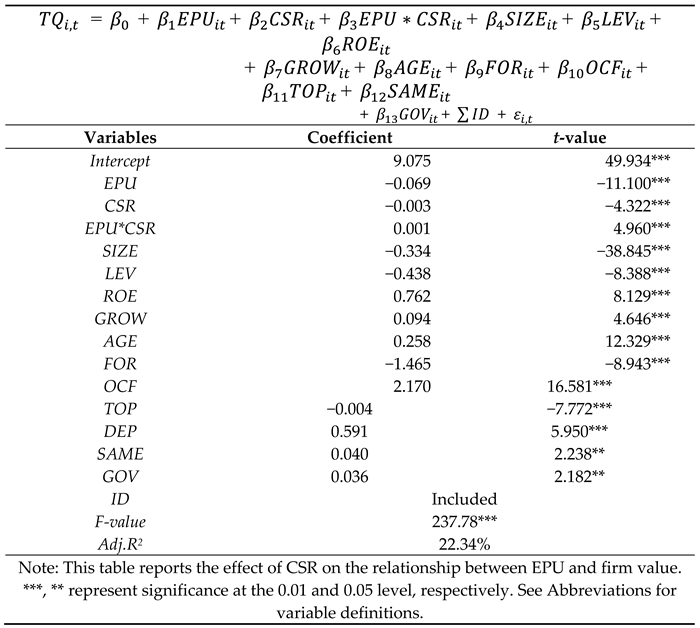

Table 6.

The effect of CSR on the relationship between EPU and firm value (N=25,917).

Table 6.

The effect of CSR on the relationship between EPU and firm value (N=25,917).

Table 7.

The relationship between EPU and firm value by the level of CSR activities.

Table 7.

The relationship between EPU and firm value by the level of CSR activities.

Table 8.

The results of re-testing H1 and H2 by applying the lag model.

Table 8.

The results of re-testing H1 and H2 by applying the lag model.

Table 9.

The results of re-testing H1 and H2 using alternative EPU measures.

Table 9.

The results of re-testing H1 and H2 using alternative EPU measures.