Submitted:

23 November 2023

Posted:

23 November 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

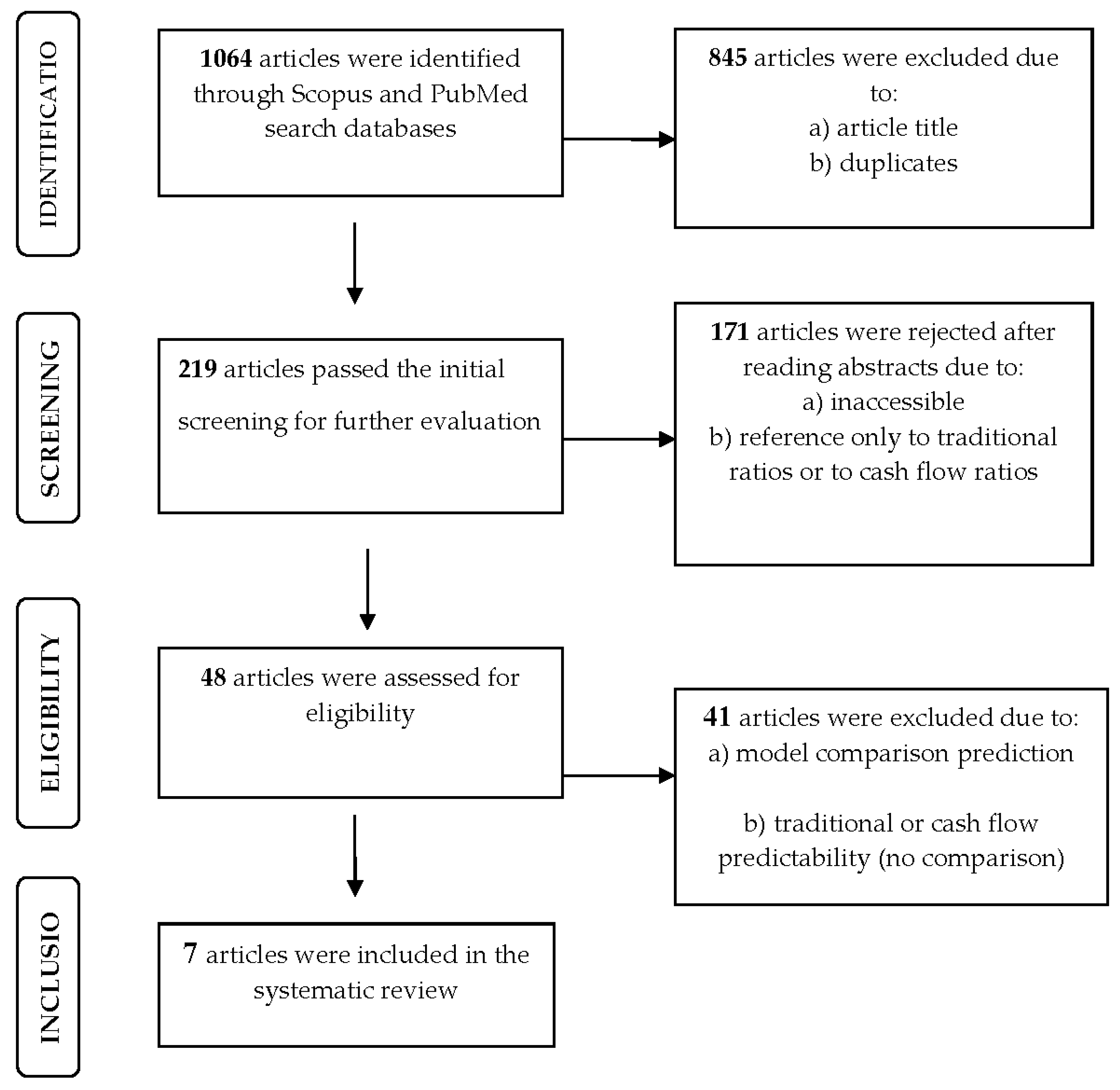

2. Methodology

3. Results

| Reference | Aim | Methodology | Results |

|---|---|---|---|

| (Bhandari, Showers, and Johnson-Snyder 2019) | Investigating the forecasting accuracy of six traditional ratios, six cash flow ratios, their combination (12 ratios), and a four-variable model containing two traditional and two cash flow-based ratios, based on financial data of companies during the period 2008- 2010. | The utilization of discriminant analysis (DA) involves the processing of a linear equation that is composed of numerous predictor variables. | a) Measures that focus on cash flow tend to be more effective in forecasting future outcomes. b) Models that employ both accrual-based and cash-flow-based ratios outperform other models in terms of their performance |

| (Waqas and Md-Rus 2018) | Identifying Financial Indicators Predictors of Financial Distress Affecting Pakistani Firms. | The variables used to measure the financial performance of a firm include financial ratios that assess profitability, liquidity, leverage, and cash flows. Additionally, two major market factors are taken into account: the size and idiosyncratic standard deviation of the stock returns for each company (SIG). To forecast financial distress, a logit regression is used on a sample of 290 firms spanning from 2007 to 2016. | a) Profitability, liquidity, leverage, cash flow ratios, and firm size have a notable impact in predicting financial distress. b) The SIG factor is insignificant in this regard. |

| (Barua and Saha 2015) | The exploration of the potential of traditional and cash flow ratios in the prediction of forthcoming cash flows in Bangladeshi companies is the main focus of this study. | To maintain uniformity and simplify comparisons, the same technique is employed when analyzing the Balance Sheet, Income Statement, and Cash Flow Statement. Additionally, calculations of cash flow ratios and income statement-based ratios are included. The cash flow data is directly sourced from cash flow statements. To highlight any noteworthy discrepancies between the traditional income statement-based ratios and cash flow-based ratios, percentage differences are computed. | Based on empirical evidence, it has been established that the cash flow and accrual components of earnings are reliable indicators for forecasting future cash flows of Bangladeshi companies listed on the stock market. It has also been concluded that cash flow ratios are more effective in predicting future cash flows compared to traditional ratios. Nevertheless, it should be noted that the accuracy of the financial picture offered by cash flow ratios is not always superior and may vary. |

| (Mavengere 2015) | The examination of the significance of conventional ratios when compared to cash flow ratios in evaluating the liquidity of retail companies listed on the Zimbabwe Stock Exchange is a topic of great importance. This analysis is particularly relevant to investors who are seeking to make informed decisions. The emphasis of this examination is on the potential implications of these ratios for investor decision-making. | During a span of 5 years, from 2010 to 2014, an examination was conducted on businesses operating in the same industry. The financial data was gathered from the respective company websites. To determine the significance of statistical variations between conventional ratios and cash flow ratios, a non-parametric test known as the Mann-Whitney (U) test was employed. Traditional ratios used: Current ratio, Quick ratio, Interest coverage, and Operating income margin. Cash flow ratios used: Cash flow ratio, Critical needs cash coverage, Cash interest coverage, and Operating cash margin. |

a) When comparing the operating cash flow ratio and the critical needs ratio to the current ratios and quick ratios, substantial statistical disparities emerge. b) When comparing the ratios of interest coverage and operating margin to those of cash interest coverage and operating cash margin, there is no significant statistical variance. c) The utilization of traditional ratios, which combine current and quick ratios to evaluate a company's liquidity, can result in flawed decision-making on the part of investors. d) The use of cash flow ratios in liquidity analysis is notably more rigorous than traditional ratios. As a result, the quality of investment decisions is improved for investors. |

| (Atieh 2014) | Ιnvestigating the liquidity position of the Jordanian pharmaceutical sector using traditional ratios compared to cash flow ratios. | The research involved an examination of the financial ratios of both cash flow and traditional metrics for seven leading pharmaceutical businesses in Jordan. All of these companies were operating in the same industry, and their annual reports were the source of the data evaluated. This analysis was conducted over six years, from 2007 to 2012. | a) When comparing cash flow ratios and traditional ratios, such as the current ratio, notable disparities exist. b) It can be observed that there are no noteworthy distinctions between other ratios relating to cash flows and conventional ratios like cash interest coverage ratio and interest coverage ratio. c) Relying solely on conventional ratios to assess a company's liquidity can lead to erroneous conclusions. d) When evaluating a company's liquidity, cash flow ratios prove to be more productive measurements than traditional ratios. This is because cash flow ratios provide a more comprehensive understanding of the company's capacity to fulfill its obligations. |

| (Kirkham 2012) | Exploring the worth of scrutinizing a company's liquidity by comparing traditional ratios with cash flow ratios. | Over five-years, a study was conducted on twenty-five companies in the telecommunications sector to compare their traditional ratios and cash flow ratios. The Fin Analysis database provided the necessary data. The ratios analyzed included the current ratio, quick ratio, and interest coverage ratio, along with the cash flow ratio, critical needs cash coverage ratio, and cash interest coverage ratio. The primary objective of the comparative analysis was to identify and scrutinize trends and discrepancies between the traditional and cash flow ratios. | The study discovered that variances were present between the conventional liquidity ratios and the ratios concerning cash flow. If one were to base their conclusions solely on the traditional ratios, it could potentially result in an erroneous determination regarding the liquidity of various companies. In some cases, a company could be considered liquid despite facing issues with cash flow, or a company could be deemed illiquid even though it possessed adequate cash flow resources. |

| (Ryu and Jang 2004) | Investigating hotel and casino performance using cash flow ratios and traditional financial ratios. | The financial performance indicators that were used to measure liquidity, solvency, and operational efficiency consisted of five ratios. The study analyzed a period of five years, specifically from 1998 to 2002. To distinguish the variance in performance between two hotel segments, commercial and casino hotel companies, independent sample t-tests were conducted. | There are varying outcomes in liquidity when comparing the traditional ratio method to cash flow-based ratios. |

4. Discussion

5. Conclusions

- a)

- Cash flow ratios have better predictive power than traditional ratios.

- b)

- A mixed model consisting of traditional ratios and cash flow ratios performs better in forecasting than individual models.

- c)

- Cash flow ratios possess the capacity to provide the most precise and comprehensive depiction of a company's financial standing. It can also serve as an indicator of potential financial difficulties and bankruptcy. Additionally, it can provide insight into a company's capability to meet its financial obligations, thereby improving the quality of investor decision-making

- d)

- A conclusion based solely on the traditional indicators could lead to a wrong decision about the liquidity of some companies.

Author Contributions

Funding

Conflict of Interest

References

- Abualrob, Laith Abdel Rahman, and Sanaa N. Maswadeh. 2020. “The Effect of Financial Ratios Derived From Operating Cash Flows on Jordanian Commercial Banks Earnings per Share.” International Journal of Financial Research 11 (1): 394–404. https://ideas.repec.org//a/jfr/ijfr11/v11y2020i1p394-404.html. [CrossRef]

- Adnan Aziz, M., and Humayon A. Dar. 2006. “Predicting Corporate Bankruptcy: Where We Stand?” Corporate Governance: The International Journal of Business in Society 6 (1): 18–33. [CrossRef]

- Agarwal, Vineet, and Richard Taffler. 2008. “Comparing the Performance of Market-Based and Accounting-Based Bankruptcy Prediction Models.” Journal of Banking & Finance 32 (8): 1541–51. [CrossRef]

- Altman, Edward I. 1968. “Financial Ratios, Discriminant Analysis and the Prediction of Corporate Bankruptcy.” The Journal of Finance 23 (4): 589–609. [CrossRef]

- Arlov, OGNJAN, SINISA Rankov, and SLOBODAN Kotlica. 2013. “Cash Flow in Predicting Financial Distress and Bankruptcy.” Advances in Environmental Science and Energy Planning 42 (2/3): 421–41.

- Atieh, Sulayman H. 2014. “Liquidity Analysis Using Cash Flow Ratios as Compared to Traditional Ratios in the Pharmaceutical Sector in Jordan.” International Journal of Financial Research 5 (3): 146–58. https://ideas.repec.org/a/jfr/ijfr11/v5y2014i3p146-158.html. [CrossRef]

- Bartolucci, Alfred A., and William B. Hillegass. 2010. “Overview, Strengths, and Limitations of Systematic Reviews and Meta-Analyses.” In, edited by Francesco Chiappelli, 17–33. Berlin, Heidelberg: Springer Berlin Heidelberg. [CrossRef]

- Barua, Suborna, and Anup Kumar Saha. 2015. “Traditional Ratios vs. Cash Flow Based Ratios: Which One Is Better Performance Indicator?” Advances in Economics and Business 3 (6): 232–51. [CrossRef]

- Bauer, Julian, and Vineet Agarwal. 2014. “Are Hazard Models Superior to Traditional Bankruptcy Prediction Approaches? A Comprehensive Test.” Journal of Banking & Finance 40 (March): 432–42. [CrossRef]

- Bellovary, Jodi L., Don E. Giacomino, and Michael D. Akers. 2007. “A Review of Bankruptcy Prediction Studies: 1930 to Present.” Journal of Financial Education 33: 1–42. https://www.jstor.org/stable/41948574.

- Bhandari, Shyam, Vince Showers, and Anna J. Johnson-Snyder. 2019. “A Comparison: Accrual Versus Cash Flow Based Financial Measures’ Performance in Predicting Business Failure.” Journal of Accounting and Finance 19 (6). [CrossRef]

- Biddle, Gary C, Mary LZ Ma, and Frank M Song. 2022. “Accounting Conservatism and Bankruptcy Risk.” Journal of Accounting, Auditing & Finance 37 (2): 295–323. [CrossRef]

- DAHIYAT, Ahmad Abdelrahim, Sulaiman Raji WESHAH, and Mohammad ALDAHIYAT. 2021. “Liquidity and Solvency Management and Its Impact on Financial Performance: Empirical Evidence from Jordan.” The Journal of Asian Finance, Economics and Business 8 (5): 135–41. [CrossRef]

- Fawzi, Noor Salfizan, Amrizah Kamaluddin, and Zuraidah Mohd Sanusi. 2015. “Monitoring Distressed Companies through Cash Flow Analysis.” Procedia Economics and Finance, 7th INTERNATIONAL CONFERENCE ON FINANCIAL CRIMINOLOGY 2015, 7th ICFC 2015, 13-14 April 2015,Wadham College, Oxford University, United Kingdom, 28 (January): 136–44. [CrossRef]

- Jahan, Nusrat, Sadiq Naveed, Muhammad Zeshan, and Muhammad A Tahir. 2016. “How to Conduct a Systematic Review: A Narrative Literature Review.” Cureus 8 (11). [CrossRef]

- Jones, Stewart, and Maurice Peat. 2014. “Predicting Corporate Bankruptcy Risk in Australia: A Latent Class Analysis.” Journal of Applied Management Accounting Research 12 (1): 13.

- Jooste, Leonie. 2007. “An Evaluation of the Usefulness of Cash Flow Ratios to Predict Financial Distress.” Acta Commercii 7 (1): 1–13. [CrossRef]

- Kirkham, Ross1, rkirkham@usc.edu.au. 2012. “Liquidity Analysis Using Cash Flow Ratios and Traditional Ratios: The Telecommunications Sector in Australia.” Journal of New Business Ideas & Trends 10 (1): 1–13. http://search.ebscohost.com/login.aspx?direct=true&db=ofs&AN=78172370&site=ehost-live.

- Kundu, Prosenjit, Runlong Tang, and Nilanjan Chatterjee. 2019. “Generalized Meta-Analysis for Multiple Regression Models across Studies with Disparate Covariate Information.” Biometrika 106 (3): 567–85. [CrossRef]

- Linares-Mustarós, Salvador, Maria Àngels Farreras-Noguer, Núria Arimany-Serrat, and Germà Coenders. 2022. “New Financial Ratios Based on the Compositional Data Methodology.” Axioms 11 (12): 694. [CrossRef]

- Mavengere, Kudakwashe. 2015. “Liquidity Analysis of Zimbabwe Stock Exchange (ZSE) Listed Retail Companies Using Traditional Ratios and Cash Flow Ratios.” International Journal of Management Sciences and Business Research 4 (7).

- Mills, John, and Jeanne H. Yamamura. 1998. “The Power of Cash Flow Ratios.” Journal of Accountancy; New York 186 (4): 53,55+. http://search.proquest.com/docview/206784897/abstract/7CED98DB61B64DA6PQ/1.

- Page, Matthew J, Joanne E McKenzie, Patrick M Bossuyt, Isabelle Boutron, Tammy C Hoffmann, Cynthia D Mulrow, Larissa Shamseer, Jennifer M Tetzlaff, Elie A Akl, and Sue E Brennan. 2021. “The PRISMA 2020 Statement: An Updated Guideline for Reporting Systematic Reviews.” International Journal of Surgery 88: 105906.

- Pao, Hsiao-Tien. 2008. “A Comparison of Neural Network and Multiple Regression Analysis in Modeling Capital Structure.” Expert Systems with Applications 35 (3): 720–27. [CrossRef]

- Porwal, Hamendra Kumar, and Shashank Jain. 2013. “Cash Flow Ratios to Predict Investment’s Soundness.” Asia-Pacific Finance and Accounting Review 1 (4): 55.

- Rahman, Abdul Aziz A Abdul. 2017. “The Relationship between Solvency Ratios and Profitability Ratios: Analytical Study in Food Industrial Companies Listed in Amman Bursa.” International Journal of Economics and Financial Issues 7 (2): 86–93.

- Ryu, Kisang, and Shawn Jang. 2004. “Performance Measurement Through Cash Flow Ratios and Traditional Ratios: A Comparison of Commercial and Casino Hotel Companies.” The Journal of Hospitality Financial Management 12 (1): 15–25. [CrossRef]

- Sharma, Divesh S, and Errol R Iselin. 2003. “The Relative Relevance of Cash Flow and Accrual Information for Solvency Assessments: A Multi-Method Approach.” Journal of Business Finance & Accounting 30 (7-8): 1115–40. [CrossRef]

- Waqas, Hamid, and Rohani Md-Rus. 2018. “Predicting Financial Distress: Importance of Accounting and Firm-Specific Market Variables for Pakistan’s Listed Firms.” Edited by Mohammed M Elgammal. Cogent Economics & Finance 6 (1): 1545739. [CrossRef]

- Yap, Ben Chin-Fook, David Gun-Fie Yong, and Wai-Ching Poon. 2010. “How Well Do Financial Ratios and Multiple Discriminant Analysis Predict Company Failures in Malaysia.” International Research Journal of Finance and Economics 54 (13): 166–75.

- Zhai, Shuang, and Zhu Zhang. 2023. “Read the News, Not the Books: Forecasting Firms’ Long-Term Financial Performance via Deep Text Mining.” ACM Transactions on Management Information Systems 14 (1): 1–37.

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).