Submitted:

10 September 2023

Posted:

12 September 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Literature review

2.1. Theoretical framework of business financing

2.1.1. Pecking order theory

2.1.2. Financial Life Cycle Theory

2.2. Variables of bank financing of SMEs

2.2.1. Size of the enterprise

2.2.2. Age of the enterprise

2.2.3. Economic sector

2.2.4. Legal status

2.2.5. Foreign participation and export capacity

2.2.6. Entrepreneur attributes

2.3. Empirical studies on the determinants of bank financing

3. Data and Methodology

3.1. Sample and Data

3.2. Variables

3.3. Research hypothesis

- H1. Economic sector. Enterprises in the manufacturing sector are more likely to access bank loans than those in other sectors. In contrast, those in the services sector are less likely to have access to bank financing than those in other sectors.

- H2. Enterprise size. The larger the enterprise, the greater the access to bank financing. Small enterprises are less likely to access bank loans.

- H3. Enterprise age. The older the enterprises, the greater the access to bank financing. Older enterprises are more likely to access bank loans.

- H4. Foreign participation. Foreign-owned enterprises are less likely to use bank credit.

- H5. Legal status. Enterprises legally incorporated as society or associations are more likely to access bank loans than enterprises that have a sole owner.

- H6. Exporter. Exporting enterprises are more likely to use bank loans.

- H7. Checking/saving account. Enterprises that have a checking or savings account are more likely to access bank financing.

- H8. Annual sales. The higher the annual sales of the enterprises, the greater the access to bank credits.

- H9. Permanent employees. The more full-time permanent employees an enterprise has, the greater the probability of accessing bank financing.

- H10. Manager female. Enterprises in which the general manager is a woman are less likely to access bank loans.

- H11. Manager experience. Enterprises in which the general manager has more experience are more likely to use bank financing.

3.4. Research design

4. Empirical results

4.1. Characterization of the sample and descriptive statistics

4.2. Correlations

4.3. Multivariate analysis: Probit regression model

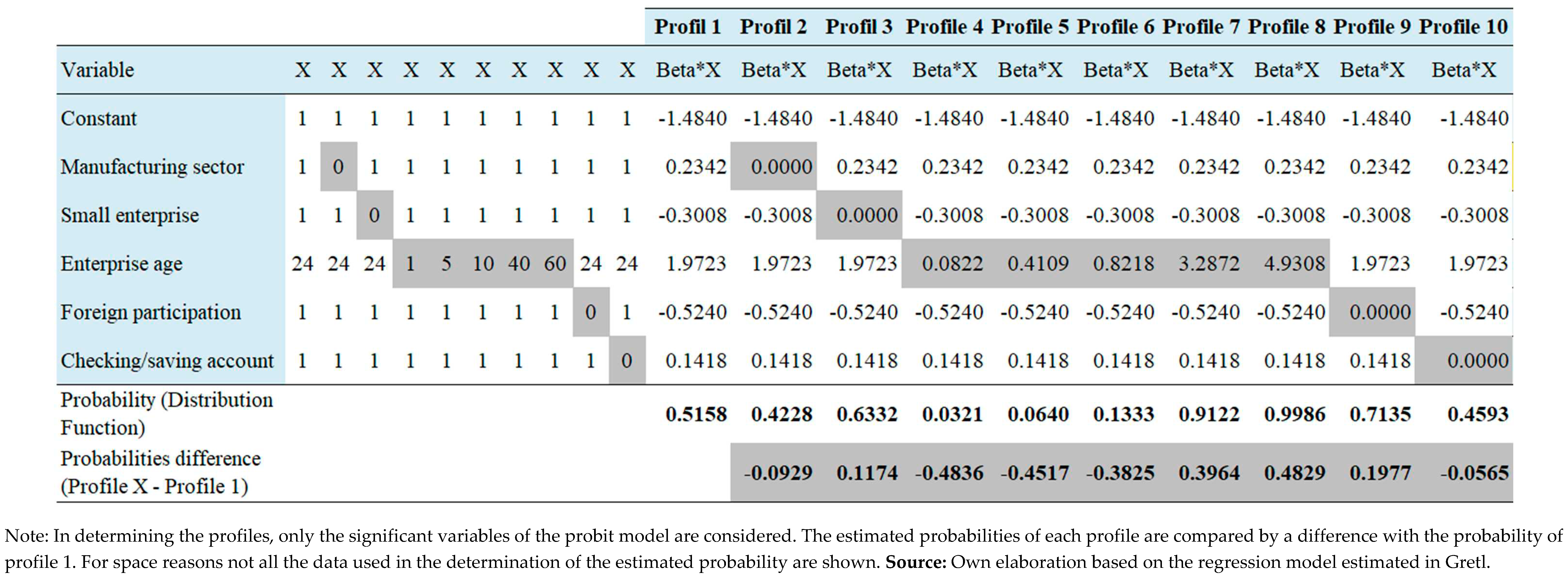

4.4. Profiles Analysis

5. Discussion and conclusions

5.1. Contributions of the research

- H1. Economic sector. It is confirmed that enterprises in the manufacturing sector are more probability to access bank loans than enterprises in other economic sectors; while those in the service sector are the least likely to have access to bank financing. In the same way, it is confirmed that the commerce variable does not have a significant relationship with the dependent variable, as had been proposed in the hypothesis.

- H2. Enterprise size. It was confirmed that small enterprises are less probability to access bank loans. Regarding the large variable, the hypothesis that the larger the companies, the greater the access to bank financing is rejected. On the other hand, it is confirmed that the medium enterprise variable does not have a significant relationship with the dependent variable.

- H3. Enterprise age. It is confirmed that older enterprises are more probability to access bank financing. The age of the enterprise is the most robust predictor of bank credit, according to the profile analysis, as the age of the enterprise increases, the probability of acquiring a bank loan increases progressively.

- H4. Foreign participation. It confirms that foreign - owned enterprises are less likely to obtain bank financing because foreign parent enterprises are the main source of financing for their subsidiaries.

- H5. Legal status. This hypothesis is partially confirmed. On the one hand, it is rejected that enterprises legally constituted as societies or associations are more likely to use bank financing than enterprises that have a sole owner because it did not result significantly in any of the regression models in which this variable was included. On the other hand, it is confirmed that the single owner variable does not have a significant influence on access to bank credit.

- H6. Exporter. The hypothesis that there is a positive relationship between exporting enterprises and the probability of using bank loans is rejected, it was only 90% significant in models M2 and M8, however, in all other models it was not significant.

- H7. Checking/saving account. It is confirmed that enterprises that have a checking or savings account are more likely to acquire bank loans than an enterprise that does not have such an account.

- H8. Annual sales. It is confirmed that enterprises with higher annual sales are more likely to use bank financing.

- Hypothesis H9, H10, and H11. The hypotheses H9, H10, and H11 are rejected, the regression models indicate that there is no significant relationship between the independent variables (permanent employees, manager female, and experience of the general manager) with the dependent variable, so they are not considered determinants of the access to bank financing.

5.2. Research recommendations and limitations

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix

| Author, year | Sample | Variables of interest related to the study | Methodology | Main results | ||

|---|---|---|---|---|---|---|

| Country | Size | Period | ||||

| Michaelas et al., 1999 | United Kingdom | 3,500 SMEs | 1986-1995 |

|

Panel data analysis |

|

| Beck et al., 2005 | 54 countries | 4,000 small, medium, and large enterprises | 1995-1999 |

|

Estimated regression |

|

| Gregory et al., 2005 | USA | 4,637 SMEs | 1994-1995 |

|

Multinomial LOGIT model |

|

| Beck, Demirgüç-Kunt, Laeven et al., 2006 | 80 countries | 10,000 small, medium, and large enterprises | 1995-1999 |

|

PROBIT model |

|

| López-Gracia and Sogorb-Mira, 2008 | Spain | 3,569 SMEs | 1995-2004 |

|

Panel data analysis |

|

| Gomez et al., 2009 | Mexico | 128 SMEs | 2007-2008 |

|

Logistic regression by the Wald method |

|

| Pasquini and De Giovanni, 2010 | Argentina | 5,536 SMEs | 2009 |

|

Heckmann’s correction |

|

| Cowling et al., 2012 | United Kingdom | 9,362 SMEs | 2007-2008 |

|

Multivariate regression |

|

| Botello, 2015 | Colombia | 85,000 SMEs | 2006-2010 |

|

Logit modelProbit model |

|

| Xiang et al., 2015 | Australia | 2,732 SMEs | 2005 - 2007 |

|

Panel data analysis |

|

| Briozzo, Vigier and Martinez, 2016 | Argentina | 222 SMEs | 2006 and 2010 |

|

Multinomial logit model |

|

| Cowling et al., 2016 | United Kingdom | More than 30,000 SMEs | 2011-2013 |

|

Probit model |

|

| Yazdanfar and Öhman, 2016 | Sweden | 15,952 SMEs | 2009-2012 |

|

ANOVAmultivariate regressions |

|

| Andrieu et al., 2018 | 12 European countries | 72,849 SMEs | 2009-2014 |

|

Binary probit model |

|

| Rao et al., 2018 | India | 174 SMEs | 2006-2013 |

|

Generalized method of moments |

|

| Nizaeva and Coskun, 2019 | 6 countries of Southeast Europe | 1,520 SMEs | 2012-2016 |

|

Ordered probit.Feasible Generalized Least Squares |

|

| Chaudhuri et al., 2020 | India | 1,155,877 MSMEs | 2006-2007 |

|

Bivariate probit model |

|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Manufacturing | 1.000 | |||||||||||||||

| 2. Commerce | -.620 ** | 1.000 | ||||||||||||||

| 3. Services | -.702 ** | -.124 ** | 1.000 | |||||||||||||

| 4. Small | .008 | .012 | -.022 | 1.000 | ||||||||||||

| 5. Medium | .045 | -.041 | -.020 | -.317 ** | 1.000 | |||||||||||

| 6. Large | -.046 | .024 | .036 | -.590 ** | -.578 ** | 1.000 | ||||||||||

| 7. Single owner | .034 | -.027 | -.019 | .444 ** | .040 | -.415 ** | 1.000 | |||||||||

| 8. Society or association | -.034 | .027 | .019 | -.444 ** | -.040 | .415 ** | -1.00 ** | 1.000 | ||||||||

| 9. Foreign Participation | .017 | .021 | -.041 | -.151 ** | -.119 ** | .231 ** | -.158 ** | .158 ** | 1.000 | |||||||

| 10. Manager female | -.007 | .009 | .001 | .104 ** | .055 * | -.136 ** | .109 ** | -.109 ** | -.050 | 1.000 | ||||||

| 11. Exporter | .177 ** | -.121 ** | -.113 ** | -.229 ** | -.153 ** | .327 ** | -.206 ** | .206 ** | .291 ** | -.064 * | 1.000 | |||||

| 12. Checking/saving account | -.011 | .016 | -.001 | -.115 ** | -.051 | .143 ** | -.142 ** | .142 ** | .067 * | .015 | .091 ** | 1.000 | ||||

| 13. Enterprise age | .121 ** | -.038 | -.118 ** | -.198 ** | -.072 ** | .231 ** | -.146 ** | .146 ** | .048 | -.036 | .159 ** | .091 ** | 1.000 | |||

| 14. Manager experience | .109 ** | -.075 ** | -.069 ** | -.056 * | -.060 * | .099 ** | -.057 * | .057 * | -.043 | -.082 ** | .040 | .031 | .396 ** | 1.000 | ||

| 15. Annual sales | -.053 * | .084 ** | -.009 | -.616 ** | -.210 ** | .709 ** | -.498 ** | .498 ** | .300 ** | -.184 ** | .386 ** | .205 ** | .308 ** | .111 ** | 1.000 | |

| 16. Permanent employees | -.012 | .034 | -.016 | -.649 ** | -.226 ** | .750 ** | -.485 ** | .485 ** | .264 ** | -.174 ** | .387 ** | .180 ** | .323 ** | .125 ** | .877 ** | 1.000 |

| Variable | M1 | M2 | M3 | M4 | M5 | M6 | M7 | M8 | M9 | M10 |

|---|---|---|---|---|---|---|---|---|---|---|

| Constant | -1,484*** | -1,474*** | -1,758*** | -1,460*** | -1,330*** | -1,158** | -1,630*** | -1.333*** | -1,250*** | -1,648*** |

| (0.4757) | (0.3570) | (0.3809) | (0.5154) | (0.4491) | (0.5129) | (0.4653) | (0.3740) | (0.3923) | (0.3898) | |

| Economic sector | ||||||||||

| Manufacturing | 0.2342*** | 0.2595*** | 0.3019*** | 0.2254** | 0.2341*** | |||||

| (0.08990) | (0.08794) | (0.1109) | (0.08961) | (0.08971) | ||||||

| Commerce | 0.1574 | -0.1445 | -0.1563 | |||||||

| (0.1586) | (0.1302) | (0.1295) | ||||||||

| Services | -0.2626** | -0.2898*** | -0.3019*** | -0.2682** | -0.3001*** | |||||

| (0.1092) | (0.1087) | (0.1109) | (0.1093) | (0.1106) | ||||||

| Enterprise size | ||||||||||

| Small | -0.3008*** | -0.3988*** | -0.3332*** | -0.4051*** | -0.3334*** | -0.4051*** | -0.3537*** | -0.3670*** | -0.3167*** | -0.3381*** |

| (0.1097) | (0.1020) | (0.1070) | (0.1343) | (0.1061) | (0.1343) | (0.1048) | (0.1040) | (0.1090) | (0.1069) | |

| Medium | -0.08779 | -0.08779 | ||||||||

| (0.1059) | (0.1059) | |||||||||

| Large | 0.09026 | 0.1343 | 0.1186 | 0.1207 | ||||||

| (0.1056) | (0.09902) | (0.09962) | (0.09941) | |||||||

| Characteristics inherent to the enterprise | ||||||||||

| Age | 0.08218* | 0.09239** | 0.08904** | 0.06748 | 0.08906** | 0.06748 | 0.08293* | 0.09085** | 0.08532** | 0.08756** |

| (0.04336) | (0.04268) | (0.04255) | (0.04609) | (0.04311) | (0.04609) | (0.04297) | (0.04300) | (0.04301) | (0.04262) | |

| Foreign Participation | -0.5240*** | -0.5337*** | -0.5004*** | -0.5147*** | -0.4928*** | -0.5147*** | -0.5210*** | -0.5346*** | -0.5349*** | -0.5308*** |

| (0.1296) | (0.1302) | (0.1269) | (0.1308) | (0.1249) | (0.1308) | (0.1300) | (0.1297) | (0.1296) | (0.1303) | |

| Legal status of the enterprise | ||||||||||

| Single owner | -0.1108 | -0.09194 | -0.1231 | -0.09194 | -0.1244 | -0.1170 | ||||

| (0.09938) | (0.09991) | (0.09887) | (0.09991) | (0.09876) | (0.09918) | |||||

| Society or association | ||||||||||

| Linked to enterprise performance | ||||||||||

| Exporter | 0.1191 | 0.1681* | 0.1240 | 0.1240 | 0.1291 | 0.1646* | 0.1309 | 0.1301 | ||

| (0.09663) | (0.09452) | (0.09695) | (0.09695) | (0.09613) | (0.09454) | (0.09646) | (0.09641) | |||

| Checking/saving account | 0.1418* | 0.1471* | 0.1476* | 0.1397* | 0.1397* | 0.1468* | 0.1415* | 0.1424* | 0.1475* | |

| (0.07558) | (0.07531) | (0.07544) | (0.07597) | (0.07597) | (0.07542) | (0.07544) | (0.07557) | (0.07546) | ||

| Annual sales | 0.05445 | 0.07233*** | 0.07256*** | 0.04485 | 0.06348* | 0.04485 | 0.06184* | 0.06568*** | 0.05864** | 0.06647*** |

| (0.03511) | (0.02145) | (0.02357) | (0.03563) | (0.03360) | (0.03563) | (0.03473) | (0.02222) | (0.02468) | (0.02399) | |

| Permanent employees | 0.02387 | 0.03470 | 0.04105 | 0.03470 | 0.03869 | |||||

| (0.05339) | (0.05347) | (0.04890) | (0.05347) | (0.05014) | ||||||

| Entrepreneur attributes | ||||||||||

| Manager female | -0.06397 | -0.06397 | ||||||||

| (0.1130) | (0.1130) | |||||||||

| Manager experience | 0.05697 | 0.05697 | ||||||||

| (0.05922) | (0.05922) | |||||||||

| Observations | 1374 | 1376 | 1376 | 1365 | 1376 | 1365 | 1375 | 1375 | 1375 | 1376 |

| McFadden’s R2 | 0.0639 | 0.0620 | 0.0623 | 0.0650 | 0.0604 | 0.0650 | 0.0632 | 0.0624 | 0.0640 | 0.0632 |

| Log-likelihood | -890.9 | -894.0 | -893.7 | −884.2 | -895.5 | -884.2 | -892.2 | -892.9 | -891.4 | -892.8 |

| Akaike criterion | 1803.9 | 1803.9 | 1803.4 | 1796.3 | 1807.0 | 1796.3 | 1802.5 | 1803.9 | 1804.8 | 1803.6 |

| Schwarz criterion | 1861.3 | 1845.7 | 1845.2 | 1869.4 | 1848.8 | 1869.4 | 1849.5 | 1850.9 | 1862.3 | 1850.6 |

| Hannan–Quinn criterion | 1825.4 | 1819.6 | 1819.1 | 1823.7 | 1822.7 | 1823.7 | 1820.1 | 1821.5 | 1826.3 | 1821.2 |

| Correctly predicted cases | 63.3% | 62.6% | 63.8% | 63.2% | 63.7% | 63.2% | 63.3% | 61.7% | 63.1% | 63.2% |

References

- Andrieu, G.; Staglianò, R.; van der Zwan, P. Bank debt and trade credit for SMEs in Europe: firm-, industry-, and country-level determinants. Small Bus. Econ. 2018, 51, 245–264. [Google Scholar] [CrossRef]

- Aterido, R.; Beck, T.; Iacovone, L. Access to Finance in Sub-Saharan Africa: Is There a Gender Gap? World Dev. 2013, 47, 102–120. [Google Scholar] [CrossRef]

- Baker, H.K.; Kumar, S.; Rao, P. Financing preferences and practices of Indian SMEs. Glob. Finance J. 2017, 43, 100388. [Google Scholar] [CrossRef]

- Bank of Mexico (Banco de México). (2022a). Evolución del Financiamiento a las Empresas durante el Trimestre octubre - diciembre de 2021. Available online: https://www.banxico.org.mx/publicaciones-y-prensa/evolucion-trimestral-del-financiamiento-a-las-empr/%7B7F3AFEC9-A775-BC0B-1640-5950FAAE46E3%7D.pdf.

- Bank of Mexico (Banco de México). (2022b). Resultados de la encuesta de evaluación coyuntural del mercado crediticio, octubre - diciembre 2021. Available online: https://www.banxico.org.mx/SieInternet/consultarDirectorioInternetAction.do?accion=consultarCuadro&idCuadro=CF471§or=19&locale=es.

- Bardasi, E.; Sabarwal, S.; Terrell, K. How do female entrepreneurs perform? Evidence from three developing regions. Small Bus. Econ. 2011, 37, 417–441. [Google Scholar] [CrossRef]

- Beck, T.; Demirguc-Kunt, A. Small and medium-size enterprises: Access to finance as a growth constraint. J. Bank. Finance 2006, 30, 2931–2943. [Google Scholar] [CrossRef]

- Beck, T.; Demirgüç-Kunt, A.; Laeven, L.; Maksimovic, V. The determinants of financing obstacles. J. Int. Money Finance 2006, 25, 932–952. [Google Scholar] [CrossRef]

- Beck, T.; Demirgüç-Kunt, A.; Maksimovic, V. Financial and Legal Constraints to Growth: Does Firm Size Matter? J. Finance 2005, 60, 137–177. [Google Scholar] [CrossRef]

- Berger, A.N.; Udell, G.F. The economics of small business finance: The roles of private equity and debt markets in the financial growth cycle. J. Bank. Financ. 1998, 22, 613–673. [Google Scholar] [CrossRef]

- Botello, H. (2015). Determinantes del acceso al crédito de las PYMES en Colombia. Ensayos de Economía, 25(46), 135-156. 5363. Available online: https://revistas.unal.edu.co/index.php/ede/article/view/53631/53078.

- Bougheas, S.; Mizen, P.; Yalcin, C. Access to external finance: Theory and evidence on the impact of monetary policy and firm-specific characteristics. J. Bank. Finance 2006, 30, 199–227. [Google Scholar] [CrossRef]

- Briozzo, A.; Vigier, H. The role of personal loans in the financing of SMEs. Academia Revista Latinoamericana de Administración 2014, 27, 209–225. [Google Scholar] [CrossRef]

- Briozzo, A.; Vigier, H.; Martinez, L.B. Firm-Level Determinants of the Financing Decisions of Small and Medium Enterprises: Evidence from Argentina. Lat. Am. Bus. Rev. 2016, 17, 245–268. [Google Scholar] [CrossRef]

- Briozzo, A.; Vigier, H.; Pesce, G.; Castillo, N.; Speroni, M.C. Decisiones de financiamiento en pymes: ¿existen diferencias en funcioÌn del tamaño y la forma legal? Estud. Gerenciales 2016, 71–81. [Google Scholar] [CrossRef]

- Chaudhuri, K.; Sasidharan, S.; Raj, R.S.N. Gender, small firm ownership, and credit access: some insights from India. Small Bus. Econ. 2018, 54, 1165–1181. [Google Scholar] [CrossRef]

- Chittenden, F.; Hall, G.; Hutchinson, P. Small firm growth, access to capital markets and financial structure: Review of issues and an empirical investigation. Small Bus. Econ. 1996, 8, 59–67. [Google Scholar] [CrossRef]

- Cowling, M.; Liu, W.; Ledger, A. Small business financing in the UK before and during the current financial crisis. Int. Small Bus. Journal: Res. Entrep. 2012, 30, 778–800. [Google Scholar] [CrossRef]

- Cowling, M.; Liu, W.; Zhang, N. Access to bank finance for UK SMEs in the wake of the recent financial crisis. Int. J. Entrep. Behav. Res. 2016, 22, 903–932. [Google Scholar] [CrossRef]

- Cressy, R.; Olofsson, C. The Financial Conditions for Swedish SMEs: Survey and Research Agenda. Small Bus. Econ. 1997, 9, 179–192. [Google Scholar] [CrossRef]

- Demirguc-Kunt, A.; Love, I.; Maksimovic, V. Business environment and the incorporation decision. J. Bank. Finance 2006, 30, 2967–2993. [Google Scholar] [CrossRef]

- Fisher, A.J.; Donaldson, G. Corporate Debt Capacity: A Study of Corporate Debt Policy and the Determination of Corporate Debt Capacity. J. Finance 1962, 17, 554. [Google Scholar] [CrossRef]

- Ferrer, M. A. and Tresierra, A. (2009). Las PYMEs y las teorías modernas sobre estructura de capital. Compendium: revista de investigación científica, (22), 65-84. Available online: https://www.researchgate.net/publication/44897242.

- Gómez, A. , García, D. and Marín, S. (2009). Restricciones a la financiación de las PYME en México: una aproximación empírica. Análisis Económico, 24(57), 217-238. http://www.redalyc.org/articulo.oa? Available online: http://www.redalyc.org/articulo.oa?id=41312227011.

- Gregory, B.T.; Rutherford, M.W.; Oswald, S.; Gardiner, L. An Empirical Investigation of the Growth Cycle Theory of Small Firm Financing. J. Small Bus. Manag. 2005, 43, 382–392. [Google Scholar] [CrossRef]

- Guercio, M.B.; Briozzo, A.E.; Vigier, H.P.; Martinez, L.B. The financial structure of Technology-Based Firms. Revista Contabilidade & Finanças 2020, 31, 444–457. [Google Scholar] [CrossRef]

- Guercio, M.B.; Martinez, L.M.B.; Vigier, H. Las limitaciones al financiamiento bancario de las Pymes de alta tecnologà a. Estud. Gerenciales 2017, 3–12. [Google Scholar] [CrossRef]

- Gujarati, D. N. and Porter, D. C. (2010). Econometría. Ciudad de México, México: McGraw-Hill Education.

- Hall, G.C.; Hutchinson, P.J.; Michaelas, N. Determinants of the Capital Structures of European SMEs. J. Bus. Finance Account. 2004, 31, 711–728. [Google Scholar] [CrossRef]

- Hernández-Sampieri, R. and Mendoza, C. P. (2018). Metodología de la investigación. Las rutas cuantitativa, cualitativa y mixta. Ciudad de México, México: McGraw-Hill Education.

- Hutchinson, P. How Much Does Growth Determine SMEs’ Capital Structure? Small Enterp. Res. 2004, 12, 81–92. [Google Scholar] [CrossRef]

- National Institute of Statistic and Geography (Instituto Nacional de Estadística y Geografía). (2020). Resultados definitivos. Censos Económicos 2019. Available online: https://www.inegi.org.mx/programas/ce/2019/default.html#Documentacion.

- Kumar, S.; Sureka, R.; Colombage, S. Capital structure of SMEs: a systematic literature review and bibliometric analysis. Manag. Rev. Q. 2019, 1–31. [Google Scholar] [CrossRef]

- La Rocca, M.; La Rocca, T.; Cariola, A. Capital Structure Decisions During a Firm’s Life Cycle. Small Bus. Econ. 2009, 37, 107–130. [Google Scholar] [CrossRef]

- López-Gracia, J.; Sogorb-Mira, F. Testing trade-off and pecking order theories financing SMEs. Small Bus. Econ. 2008, 31, 117–136. [Google Scholar] [CrossRef]

- Bhaird, C.m.A.; Lucey, B. Determinants of capital structure in Irish SMEs. Small Bus. Econ. 2009, 35, 357–375. [Google Scholar] [CrossRef]

- Michaelas, N.; Chittenden, F.; Poutziouris, P. Financial Policy and Capital Structure Choice in U.K. SMEs: Empirical Evidence from Company Panel Data. Small Bus. Econ. 1999, 12, 113–130. [Google Scholar] [CrossRef]

- Muravyev, A.; Talavera, O.; Schäfer, D. Entrepreneurs’ gender and financial constraints: Evidence from international data. J. Comp. Econ. 2009, 37, 270–286. [Google Scholar] [CrossRef]

- Myers, S.C. The Capital Structure Puzzle. J. Finance 1984, 39, 574–592. [Google Scholar] [CrossRef]

- Myers, S.C.; Majluf, N.S. Corporate financing and investment decisions when firms have information that investors do not have. J. Financial Econ. 1984, 13, 187–221. [Google Scholar] [CrossRef]

- Nizaeva, M.; Coskun, A. Investigating the Relationship Between Financial Constraint and Growth of SMEs in South Eastern Europe. SAGE Open 2019, 9. [Google Scholar] [CrossRef]

- Pasquini, R. and De Giovanni, M. (2010). Access to financing of SMEs in Argentina. Working Papers No. 2010/08, CAF Development Bank Of Latinamerica, 1-51.

- Petersen, M.A.; Rajan, R.G. The Benefits of Lending Relationships: Evidence from Small Business Data. J. Finance 1994, 49, 3–37. [Google Scholar] [CrossRef]

- Presbitero, A.F.; Rabellotti, R.; Piras, C. Barking up the Wrong Tree? Measuring Gender Gaps in Firm’s Access to Finance. J. Dev. Stud. 2014, 50, 1430–1444. [Google Scholar] [CrossRef]

- Rao, P.; Kumar, S. Reflection of owner’s attributes in financing decisions of SMEs. Small Enterp. Res. 2018, 25, 52–68. [Google Scholar] [CrossRef]

- Serrasqueiro, Z.; Nunes, P.M. Is Age a Determinant of SMEs’ Financing Decisions? Empirical Evidence Using Panel Data Models. Entrep. Theory Pr. 2012, 36, 627–654. [Google Scholar] [CrossRef]

- Wooldridge, J. M. (2010). Econometric Analysis of Cross Section and Panel Data. Cambridge, Massachusetts, London, England: The MIT Press.

- World Bank. (2010). Enterprise Surveys 2010, Documentation, Core Questionnaire, Mexico. Available online: https://microdata.worldbank.org/index.php/catalog/870/download/19386.

- World Bank. (2011). Enterprise Surveys 2010, Documentation, Description of Mexico ES 2010 Implementation. Available online: https://microdata.worldbank.org/index.php/catalog/870/download/19390.

- Xiang, D.; Worthington, A.C.; Higgs, H. Discouraged finance seekers: An analysis of Australian small and medium-sized enterprises. Int. Small Bus. Journal: Res. Entrep. 2014, 33, 689–707. [Google Scholar] [CrossRef]

- Yazdanfar, D.; Öhman, P. Capital structure dynamics among SMEs: Swedish empirical evidence. J. Risk Finance 2016, 17, 245–260. [Google Scholar] [CrossRef]

| Item | Variables | Concept definition | Operational definition |

|---|---|---|---|

| Dependent variable | |||

| k8 | Bank credit | Indicates whether the enterprise has a bank loan from any financial institution. | Binary variable, where 1 indicates whether the enterprise has a bank loan and 0 otherwise. |

| Economicsector | |||

| a4a | Manufacturing | Includes enterprises that carry out their main activity in the manufacturing sector according to the classification of item a4a. | It was recoded to a dummy variable, where 1 indicates that the enterprise DOES belong to this economic sector and 0 that it does NOT belong to this sector. |

| a4a | Commerce | Includes enterprises that carry out their main activity in the commerce sector according to the classification of item a4a. | It was recoded to a dummy variable, where 1 indicates that the enterprise DOES belong to this economic sector and 0 that it does NOT belong to this sector. |

| a4a | Services | Includes enterprises that carry out their main activity in the services sector according to the classification of item a4a. | It was recoded to a dummy variable, where 1 indicates that the enterprise DOES belong to this economic sector and 0 that it does NOT belong to this sector. |

| Enterprise size | |||

| a6a | Small | A small enterprise is considered if it has between 5 and 19 employees. | It was recoded to a dummy variable, where 1 indicates that the enterprise DOES correspond to this size and 0 that it does NOT correspond. |

| a6a | Medium | A medium enterprise is considered if it has between 20 and 99 employees. | It was recoded to a dummy variable, where 1 indicates that the enterprise DOES correspond to this size and 0 that it does NOT correspond. |

| a6a | Large | A large enterprise is considered if it has 100 or more employees. | It was recoded to a dummy variable, where 1 indicates that the enterprise DOES correspond to this size and 0 that it does NOT correspond. |

| Characteristics inherent to the enterprise | |||

| b5 | Age | It represents the number of years between the start of operations of the enterprise and the year in which the survey was applied. | Quantitative variable. Logarithm of the enterprise age in number of years. |

| b2b | Foreign Participation | It means that private foreign persons, enterprises, or organizations have an ownership interest in the enterprise. | It was recoded to a dummy variable, where 1 indicates that the enterprise has a % of foreign ownership and 0 otherwise. |

| Legal status of the enterprise | |||

| b1 | Single owner | Represents the legal status of the enterprise when it has a sole owner | It was recoded to a dummy variable, where 1 indicates that the enterprise has a sole owner and 0 otherwise |

| b1 | Society or association | It represents the legal status of the enterprise when it is legally constituted as a society or association of any type. | It was recoded to a dummy variable, where 1 indicates that the enterprise is legally constituted as a society or association of any type and 0 otherwise. |

| Linked to enterprise performance | |||

| d3c | Exporter | It means that the enterprise makes direct exports of a percentage or the total of its sales. | It was recoded to a dummy variable, where 1 indicates that the enterprise directly exports part or all its sales and 0 otherwise. |

| k6 | Checking/saving account | Indicates whether the enterprise has a checking or savings bank account at the time of the survey. | Binary variable, where 1 indicates whether the enterprise has a checking or savings bank account and 0 otherwise. |

| d2 | Annual sales | Total annual sales in pesos of the last fiscal year of the enterprise. | Quantitative variable. Logarithm of the total annual sales in pesos of the last fiscal year of the enterprise. |

| l1 | Permanent employees | Full-time permanent employees of the enterprise at the end last fiscal year. | Quantitative variable. Logarithm of the total number of permanent full-time employees in the last fiscal year of the enterprise. |

| Entrepreneur attributes | |||

| b7a | Manager female | Indicates when the general manager of the enterprise is a woman. | Binary variable, where 1 indicates if the general manager of the enterprise is a woman and 0 otherwise. |

| b7 | Manager experience | It represents the number of years of experience of the general manager working in the sector. | Quantitative variable. Logarithm of the number of years of experience of the general manager working in the sector. |

| Sample | Bank credit | |||||

|---|---|---|---|---|---|---|

| Independent variable | Total | % | No | % | Yes | % |

| Manufacturing | 1145 | 77.8% | 569 | 49.7% | 576 | 50.3% |

| Commerce | 144 | 9.8% | 83 | 57.6% | 61 | 42.4% |

| Services | 182 | 12.4% | 109 | 59.9% | 73 | 40.1% |

| 1471 | 100% | 761 | 51.7% | 710 | 48.3% | |

| Small | 358 | 24.3% | 251 | 70.1% | 107 | 29.9% |

| Medium | 349 | 23.7% | 182 | 52.1% | 167 | 47.9% |

| Large | 764 | 51.9% | 328 | 42.9% | 436 | 57.1% |

| 1471 | 100% | 761 | 51.7% | 710 | 48.3% | |

| Single owner | 319 | 21.7% | 209 | 65.5% | 110 | 34.5% |

| Society or Association | 1151 | 78.3% | 551 | 47.9% | 600 | 52.1% |

| 1470 | 100% | 760 | 51.7% | 710 | 48.3% | |

| No foreign participation | 1324 | 90.1% | 676 | 51.1% | 648 | 48.9% |

| With foreign participation | 145 | 9.9% | 84 | 57.9% | 61 | 42.1% |

| 1469 | 100% | 760 | 51.7% | 709 | 48.3% | |

| General manager is not a woman | 1310 | 89.1% | 665 | 50.8% | 645 | 49.2% |

| General manager is Female | 160 | 10.9% | 96 | 60.0% | 64 | 40.0% |

| 1470 | 100% | 761 | 51.8% | 709 | 48.2% | |

| Non-exporter | 1160 | 78.9% | 636 | 54.8% | 524 | 45.2% |

| Exporter | 311 | 21.1% | 125 | 40.2% | 186 | 59.8% |

| 1471 | 100% | 761 | 51.7% | 710 | 48.3% | |

| No checking/savings account | 506 | 34.5% | 299 | 59.1% | 207 | 40.9% |

| With checking/savings account | 961 | 65.5% | 460 | 47.9% | 501 | 52.1% |

| 1467 | 100% | 759 | 51.7% | 708 | 48.3% | |

| Bank credit | |||

|---|---|---|---|

| Independent variable | Sample average | No | Yes |

| Enterprise age (average years) | 24.0 | 22.2 | 25.9 |

| Manager experience (average years) | 23.0 | 22.3 | 23.8 |

| Permanent employees (average number) | 216.2 | 170.0 | 267.8 |

| Annual sales Quantile 1 (%) | 72.4% | 27.6% | |

| Quantile 2 (%) | 49.4% | 50.6% | |

| Quantile 3 (%) | 43.2% | 56.8% | |

| Quantile 4 (%) | 41.3% | 58.7% | |

| Variable | Obs. | Minimum | Maximum | Mean | Standard deviation |

|---|---|---|---|---|---|

| Manufacturing | 1480 | 0 | 1 | 0.7784 | 0.4155 |

| Commerce | 1480 | 0 | 1 | 0.0986 | 0.2983 |

| Services | 1480 | 0 | 1 | 0.1230 | 0.3285 |

| Small | 1480 | 0 | 1 | 0.2446 | 0.4300 |

| Medium | 1480 | 0 | 1 | 0.2372 | 0.4255 |

| Larger | 1480 | 0 | 1 | 0.5182 | 0.4998 |

| Single owner | 1478 | 0 | 1 | 0.2185 | 0.4134 |

| Society or association | 1478 | 0 | 1 | 0.7815 | 0.4134 |

| Foreign Participation | 1478 | 0 | 1 | 0.0981 | 0.2976 |

| Manager female | 1479 | 0 | 1 | 0.1089 | 0.3116 |

| Exporter | 1480 | 0 | 1 | 0.2115 | 0.4085 |

| Checking/saving account | 1475 | 0 | 1 | 0.6549 | 0.4756 |

| Enterprise age (Log)* | 1470 | 0.0000 | 5.3083 | 2.8686 | 0.8593 |

| Manager experience (Log)* | 1467 | 0.0000 | 4.1744 | 2.9697 | 0.6430 |

| Annual Sales (Log)* | 1396 | 10.5970 | 27.6310 | 16.7550 | 2.3187 |

| Permanent employees (Log)* | 1479 | 0.6932 | 9.9968 | 3.8116 | 1.5840 |

| Variables | Hypothesis | Expected effect | Real effect | Empirical studies coincident with results | Empirical studies do not coincide with results |

|---|---|---|---|---|---|

| Economicsector | |||||

| Manufacturing | H1 | Positive | Positive | Beck, Demirgüç-Kunt, Laeven et al., 2006 Botello, 2015 Briozzo, Vigier and Martinez, 2016 Andrieu et al., 2018 |

|

| Commerce | H1 | NS | NS | Xiang et al., 2015 Cowling et al., 2016 |

Positive effect: Nizaeva and Coskun, 2019 |

| Services | H1 | Negative | Negative | Botello, 2015 | |

| Enterprise size | |||||

| Small | H2 | Negative | Negative | Michaelas et al., 1999 Beck et al., 2005 Beck, Demirgüç-Kunt, Laeven et al., 2006 López-Gracia and Sogorb-Mira, 2008 Gómez et al., 2009 Pasquini and De Giovanni, 2010 Botello, 2015 Xiang et al., 2015 Briozzo, Vigier and Martinez, 2016 Cowling et al., 2016 Yazdanfar and Öhman, 2016 Andrieu et al., 2018 Rao et al., 2018 |

|

| Medium | H2 | NS | NS | Nizaeva and Coskun, 2019 | Positive effect: Gomez et al., 2009 |

| Large | H2 | Positive | NS | Nizaeva and Coskun, 2019 | Positive effect: Beck et al., 2005 Beck, Demirgüç-Kunt, Laeven et al., 2006 |

| Characteristics inherent to the enterprise | |||||

| Age | H3 | Positive | Positive | Beck, Demirgüç-Kunt, Laeven et al., 2006 Botello, 2015 Briozzo, Vigier and Martinez, 2016 Cowling et al., 2016Yazdanfar and Öhman, 2016 Andrieu et al., 2018 Rao et al., 2018 |

Negative effect: Michaelas et al., 1999 López-Gracia and Sogorb-Mira, 2008 Nizaeva and Coskun, 2019 |

| Foreign Participation | H4 | Negative | Negative | Beck, Demirgüç-Kunt, Laeven et al., 2006 Xiang et al., 2015 |

|

| Legal status of the enterprise | |||||

| Single owner | H5 | NS | NS | Andrieu et al., 2018 | |

| Society or association | H5 | Positive | NS | No matching study | Positive effect: Briozzo, Vigier and Martinez, 2016 |

| Linked to enterprise performance | |||||

| Exporter | H6 | Positive | NS | Cowling et al., 2012 Cowling et al., 2016 |

Positive effect: Pasquini and De Giovanni, 2010 |

| Checking/saving account | H7 | Positive | Positive | Botello, 2015 Chaudhuri et al., 2020 |

|

| Annual sales | H8 | Positive | Positive | Pasquini and De Giovanni, 2010 Xiang et al., 2015 Rao et al., 2018 |

|

| Permanent employees | H9 | Positive | NS | No matching study | |

| Entrepreneur attributes | |||||

| Manager female | H10 | Negative | NS | No matching study | Negative effect: Cowling et al., 2012 Chaudhuri et al., 2020 |

| Manager experience | H11 | Positive | NS | Cowling et al., 2012 Cowling et al., 2016 |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).