2. Reference review and discussion

1. The relationship between volume and price

The link between volume and price in the stock market identify the relationship between the trading volume per unit time of a stock and the closing price of the stock. The same direction of volume and price means that the transaction volume is certainly correlated with the magnitude of price changes (Ying 1966; Karpoff 1987)-the stock price rises and the transaction volume increases, which means that the follow-up market is optimistic; the stock price declines and the volume shrinks, indicating that sellers are reluctant to sell and are optimistic about the future market. The deviation of volume and price means that the stock price and the trading volume show the opposite trend (Sheu et al. 1998)-the stock price rises but the trading volume decreases or stays the same, illustrates that individual stocks are not recommended by investors and the upward trend is difficult to preserve; the stock price declines and the transaction is locked. An boost in volume can be seen as an indicator of a downturn in the market outlook. Stockholder are not encouraged about the market perspective and sell off. Regardless of whether the volume and price are in the same direction or the volume and price deviate, they have a aggregate effect. Ying (1966) concludes that a model that only attentions at stock prices and trading volume will ultimately produce wrong or incomplete results.

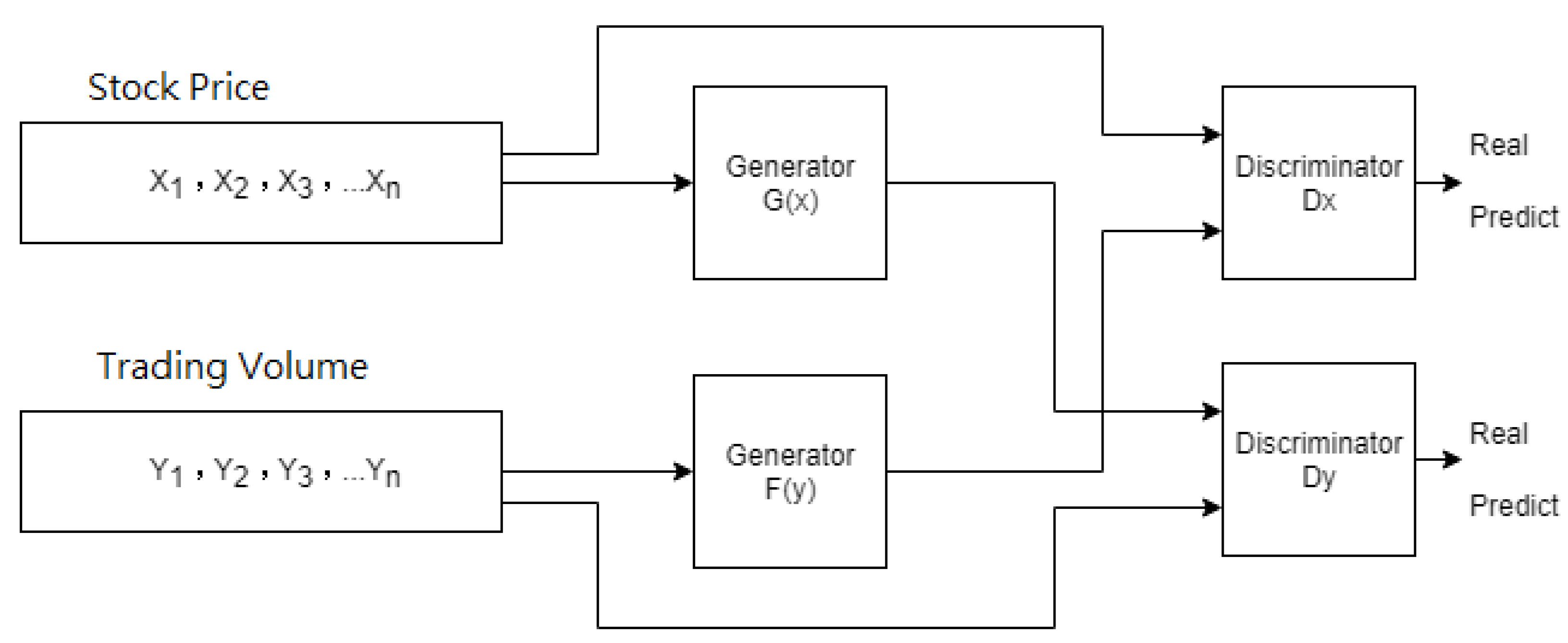

2. Cycle Generative Adversarial Network (Cycle GAN)

The Generative Adversarial Network (GAN) is a two-classifier (Ian et al. 2014) that adoption an adversarial process to develop a model framework, consisting of a Generative model and a Discriminator model. The generative model obtain random input values and can be transformed into an image through a deconvolutional neural network; the discriminant model is a discriminator used to discriminate whether the input image is a real image provided by the training data set or is the image created by the generative model. The ultimate goal of GAN is to provoke a loss (Loss), which makes it arduous to distinguish between the generated image of the model and the real image; also because all computer graphics (Graph) are optimized for the target, GAN is exceptionally sufficient for image generation tasks.

However, the transformation between image and image is a kind of visual and graphic dispute. GAN needs to apply a training set with paired images to learn the mapping between the input image and the target image. However, in some effort, there is no training data that can be used for pairing. In order to solve this difficulty, a recurrent generation adversarial network (Zhu et al., 2017) came into being. The image is converted from domain X to domain Y. Two prerequisites must be met to use the Cycle Generative Adversarial Network: (1) the unpair of the domain X and the domain Y (unpair) is not provided; (2) it is assumed that there is a potential relationship between the domains of X and Y.

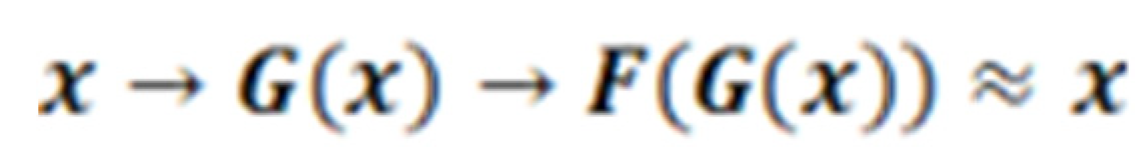

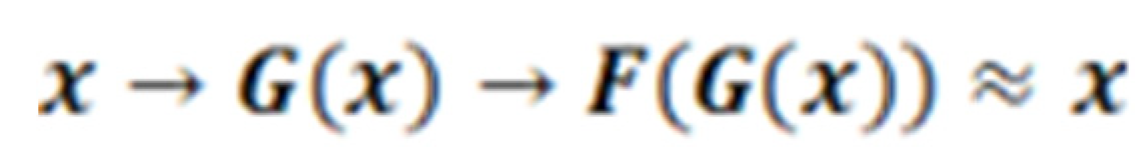

For independent confrontation targets that are difficult to optimize, it will cause a crash during training-that is, all images are mapped to the same output image, resulting in the failure of optimization. It is assumed that there are two converters G(X) → Y and F(Y) → X in the structure of the Cycle Generative Adversarial Network, and G and F are inverted to each other, and bijections are achieved; by simultaneously training the mapping G and F, and add cycle consistency loss to encourage F(G(x)) ≈ x and G(F(y)) ≈ y. Combining this loss and the confrontation loss on the fields X and Y can achieve the conversion between unpaired images and images.

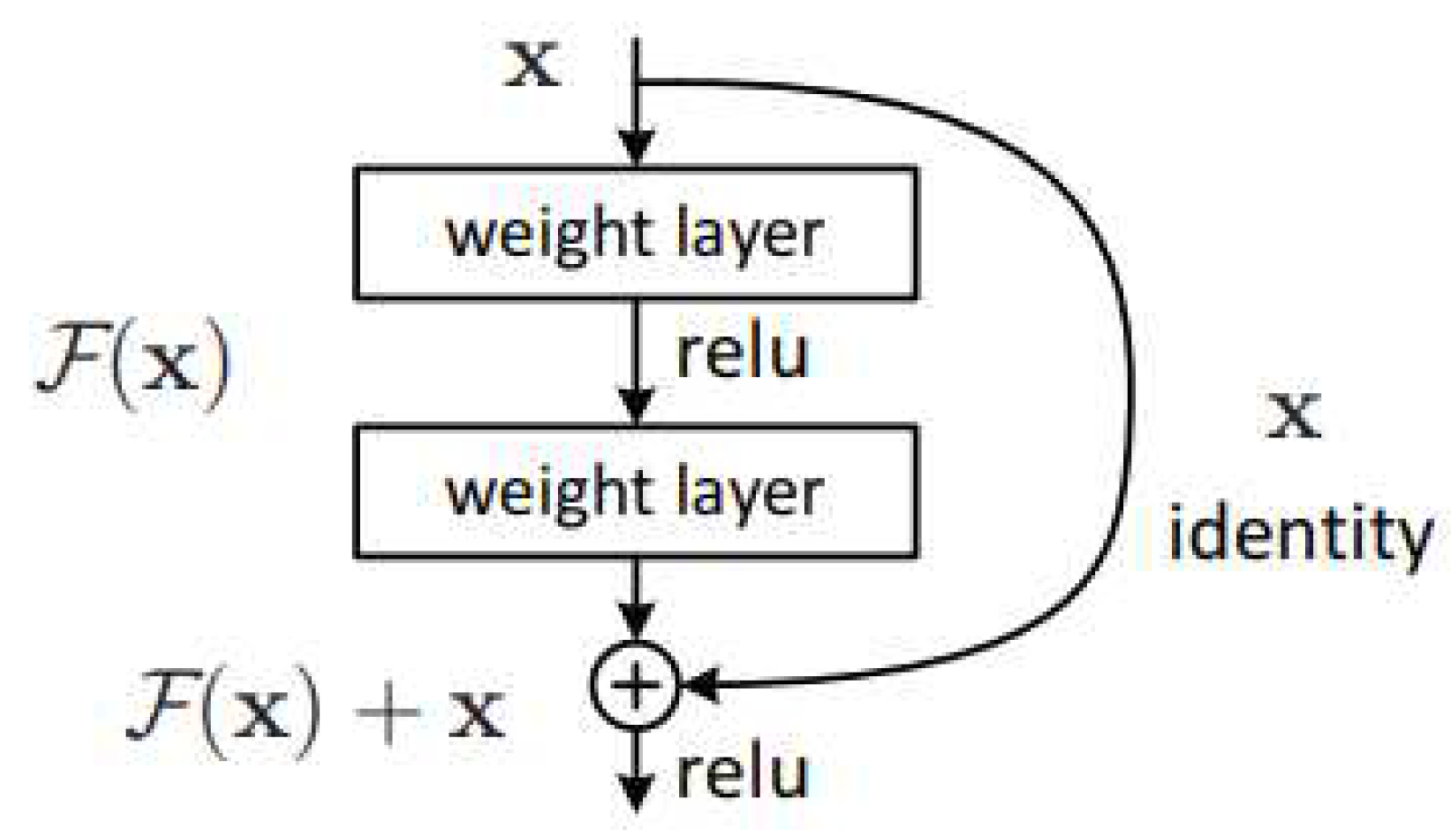

3. Residual Neural Network (Residual Neural Network, ResNet)

Deep neural networks have two main issues. One is Gradient Vanishing-when the gradient is too small, it will cause Back Propagation to make the model unable to converge to the optimal value. The second is the gradient degradation- the gradient cannot be backpropagated and the error accumulates, so that the deeper the network, the higher the error value. The Residual Block (He et al., 2016) (

Figure 1) is proposed in the Residual Neural Network. In addition to having the same architecture as the original neural network, there is also a shortcut connection. Assuming that the originally expected output is H(x), the original neural network output of this layer is F(x). If H(x) = F(x)+x, it can be verified that the output of this residual module H(x) can make the overall optimization of the neural network better.

4. Long Short-Term Memory (LSTM)

When training with back propagation while Recurrent Neural Networks (Recurrent Neural Networks, RNN) deal with hidden states that change over time, it encounters gradient vanishing and gradient explosion, which makes it impossible to process time series data, the Long-term Dependency problem. To solve this problem, the Long Short-Term Memory model (Hochreiter & Schmidhuber 1997) added a gate mechanism to the block of the recurrent neural network, which can memorize the input value of a variable length of time and adjust the model input and output values for processing Long-term dependency data.

5. System engineering and Dynamic Behavior

Seely (1972) segregates system engineering modules into three basic types: Physical, Analytical and Descriptive. The most traditional and distinquished module is the physical system. The advantage of physical system is, it can be verified by experiment, but its cost is relatively high; the descriptive model is to build a model with text and pictures for decision-making; while the analytical model applys mathematics to present the peculiarity of the system, it is usually presented in the form of simultaneous equations. This research uses several components of the analytical module:

1. Mass: When considering Newton’s second law of motion, the mass M is defined by the formula.

Formula: , is the speed, is the differential, is the time, is the acceleration.

2. Damper (friction force): There are three different important mechanisms of friction: static, coulomb and viscous. This study uses static friction. Static friction is directly related to motion, and is the state of motion initiated by the contact between two surfaces.

Formula: , is the friction constant, and is the speed.

3. Spring (spring force) A spring is an element that stores mechanical potential energy through elastic deformation.

Formula: , is the spring constant, is the speed, is the differential, and is the time.

6. Bollinger Bands

Bollinger Bands (BBands), also known as Bollinger Bands, Bollinger Bands, Bollinger Channels or Brigger Channels, are technical analysis tools originated by John Bollinger. The application incorporates the concepts of moving average and standard deviation, and its basic form is a strip channel composed of three bands (one for the middle band and one for the upper band and one for the lower band). The middle band is the average cost of the stock price, and the upper band and the lower band can be regarded as the resistance and support of the stock price, respectively.

1. Bollinger band definition

The formula of the simple moving average for N time period is:

Where P is the stock price.

Standard deviation of the middle band + K × N time period

Middle track-standard deviation of K × N time period

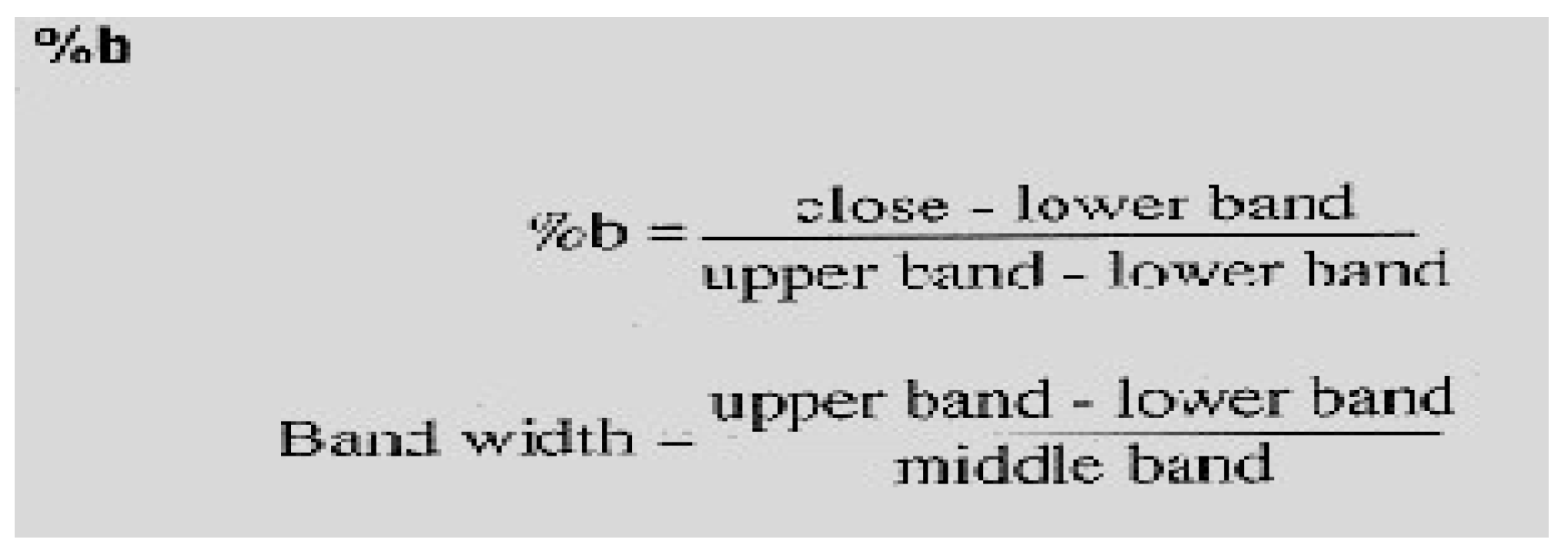

1. Extended index──%b index

The position of the closing price in the Bollinger Bands is presented in digital form as a key indicator for trading decisions. The formula is:

Since the closing price will oscillate on the upper and lower band, the amplitude is even greater than the band range (0~1), so the %b value has no upper and lower limits. When the trend breaks upward and the closing price falls above the upper band, the %b value is> 1. When the trend breaks downward and the closing price falls below the lower band, the %b value <0.

Observation and analysis of the “%b indicator” can provide investment references, and make trading decisions based on the strength and weakness of the indicator.

7. F1 score is a way to evaluate the accuracy of the test. It takes into account the accuracy and recall in the test to calculate this score.

Table 1.

Confusion Matrix.

Table 1.

Confusion Matrix.

| |

The model predicts a rise |

The model predicts a fall |

| The actual stock price is up |

True Postive |

False Negative |

| The actual stock price is down |

False Postive |

True Negative |

Recall = TP / (TP+FN), the recognition ability of this model for positive samples, the higher the score, the stronger the recognition ability.

Precision = TP / (TP+FP) , the proportion of positive samples in the correct classification of this model. If it is higher than 0.5, it means that it has a strong ability to distinguish rising, and if it is lower than 0.5, it means that it has a strong ability to distinguish falling.

F1 Score = 2 * Precision * Recall / (Precision + Recall), F1 is the combination between the two, the closer to 1, the better the classification effect of this model.

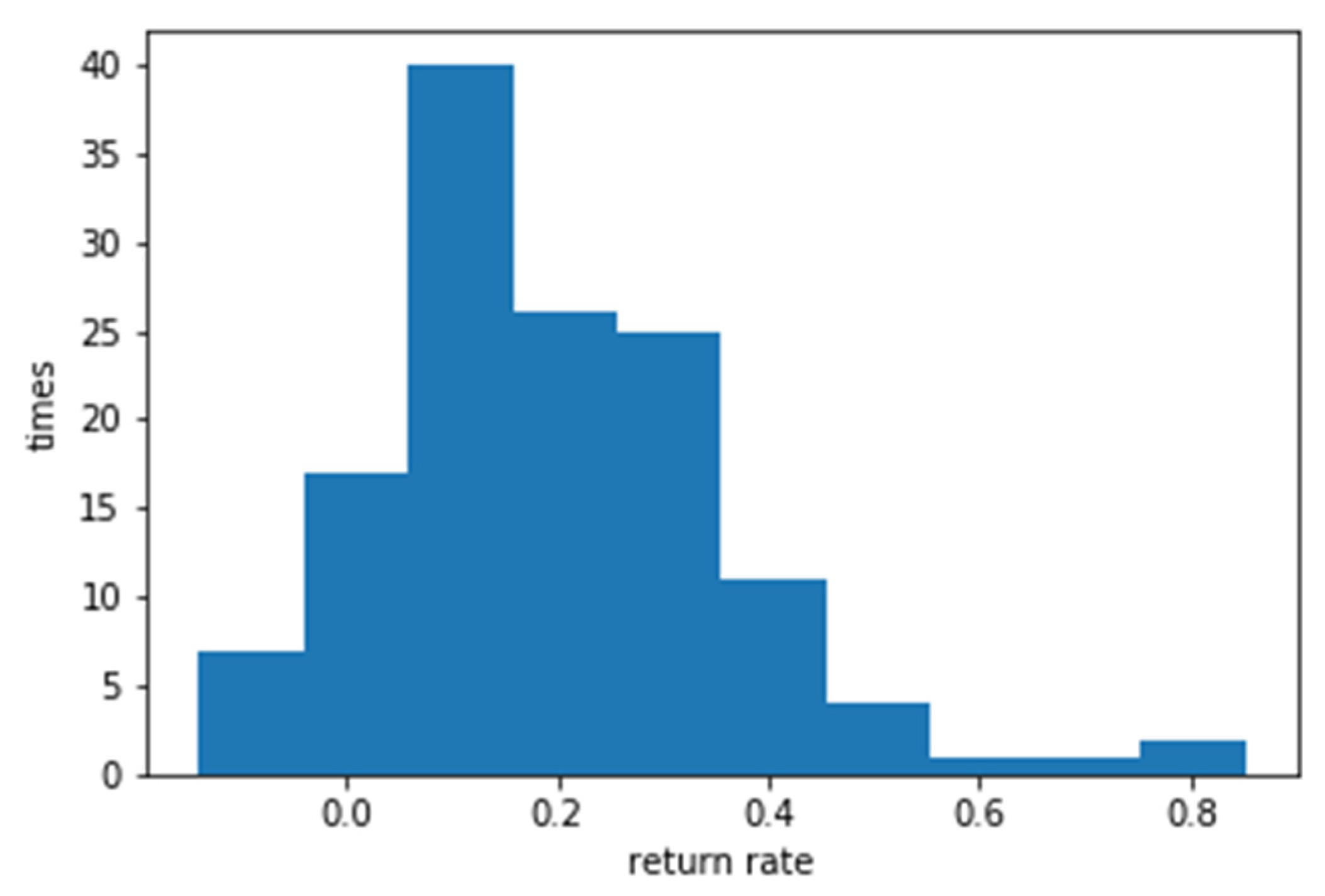

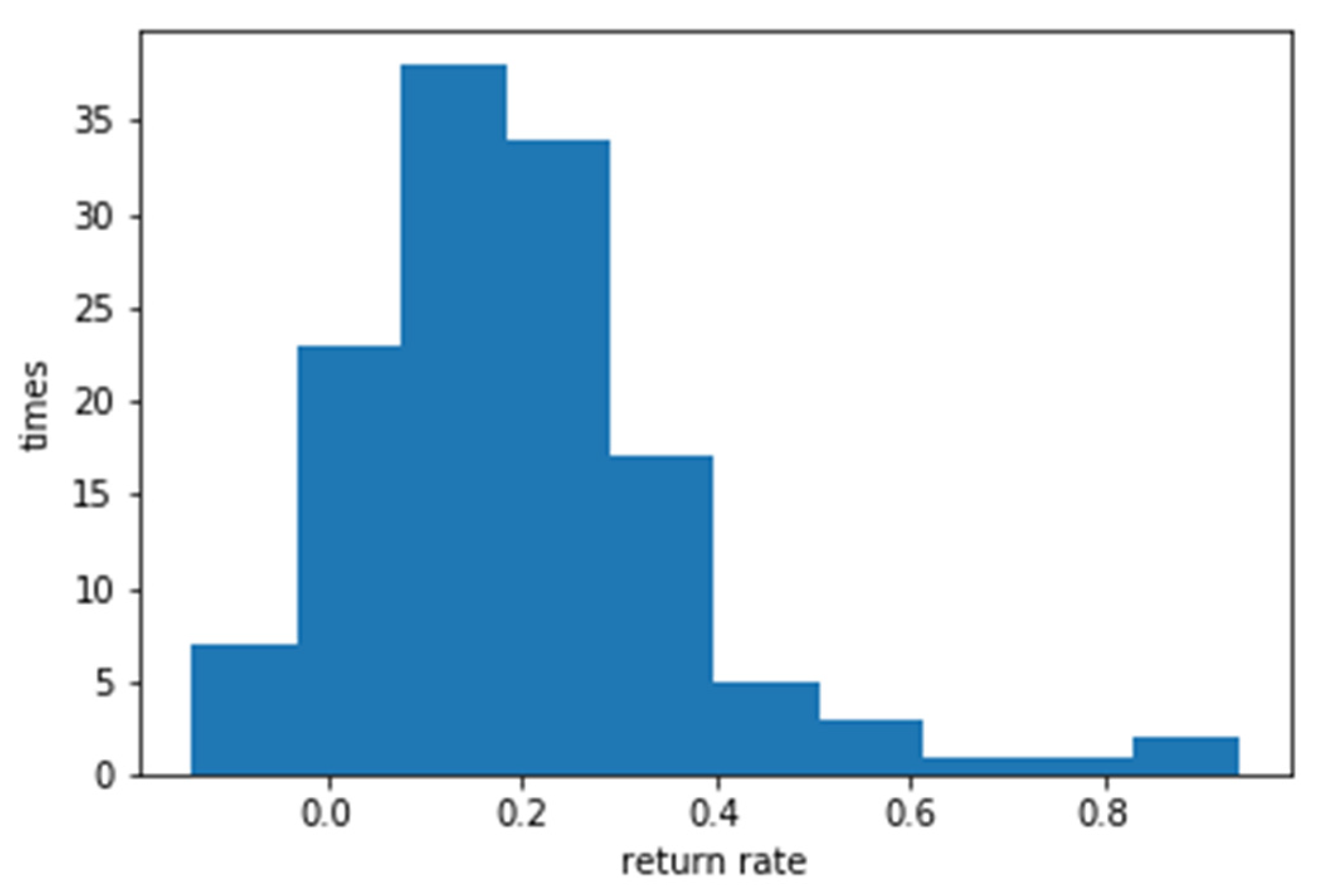

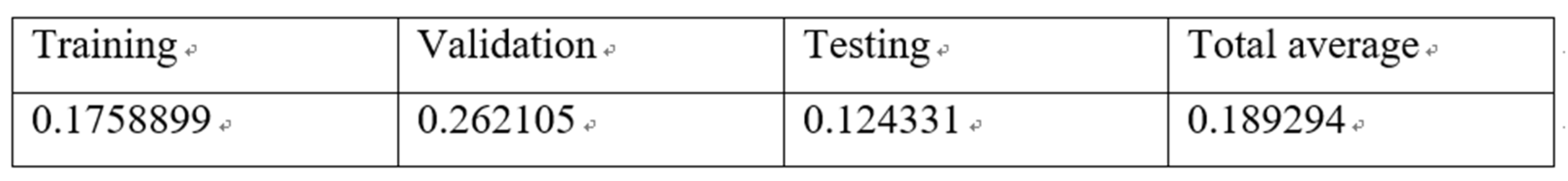

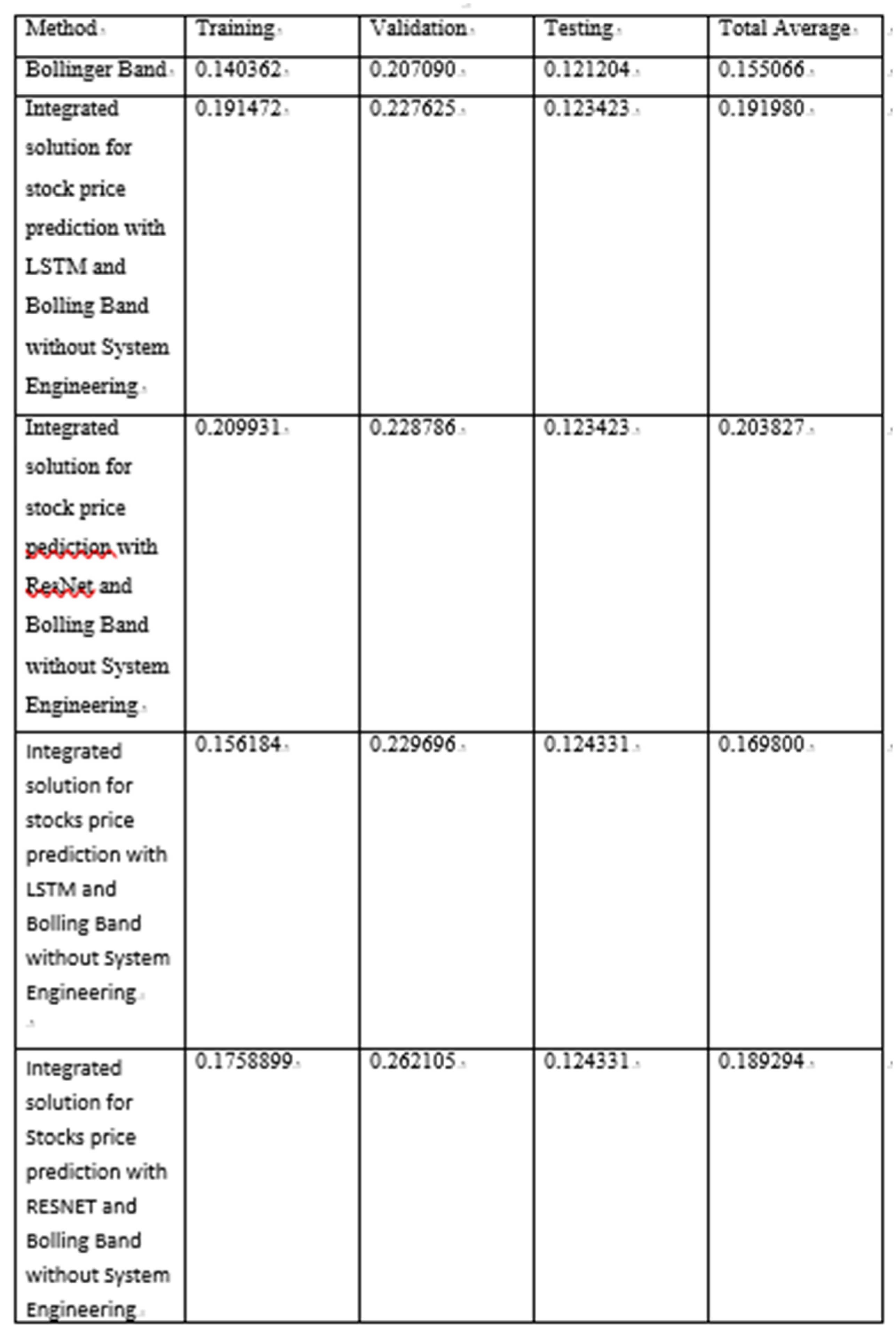

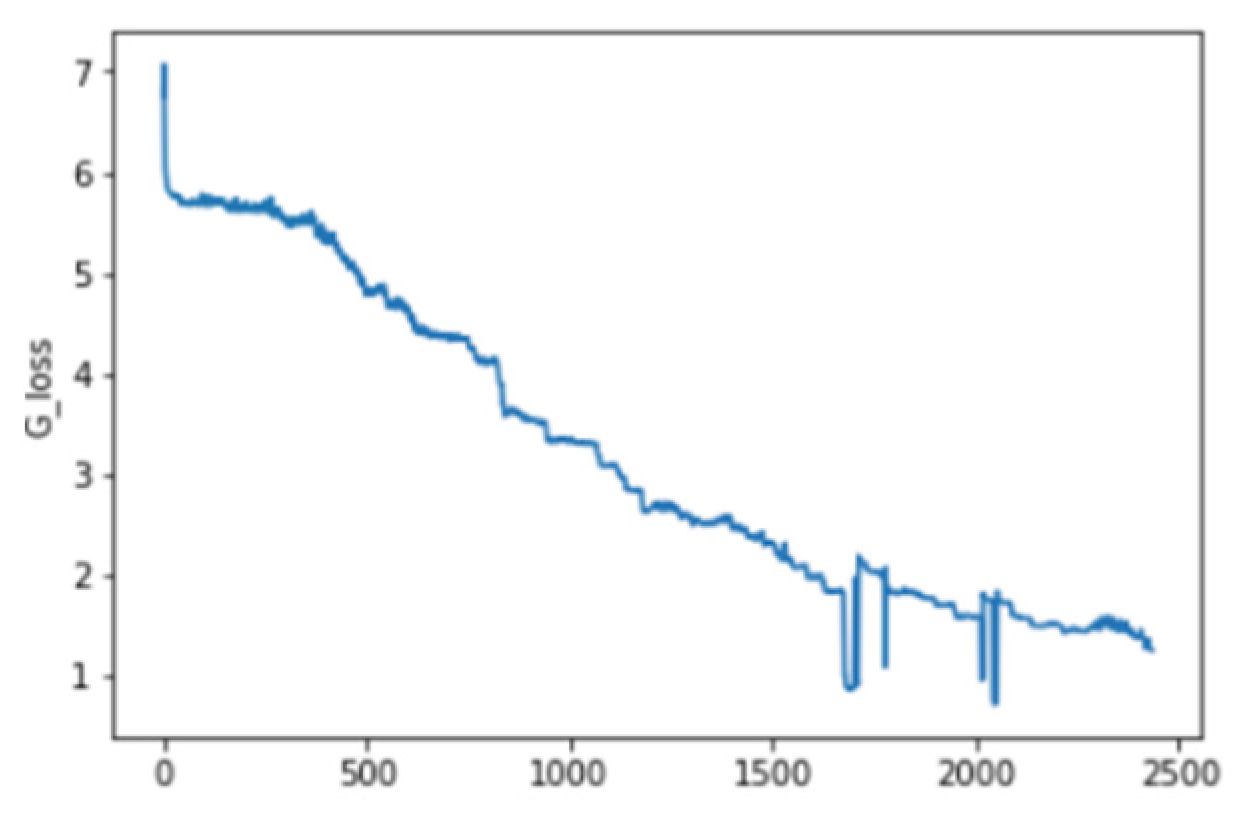

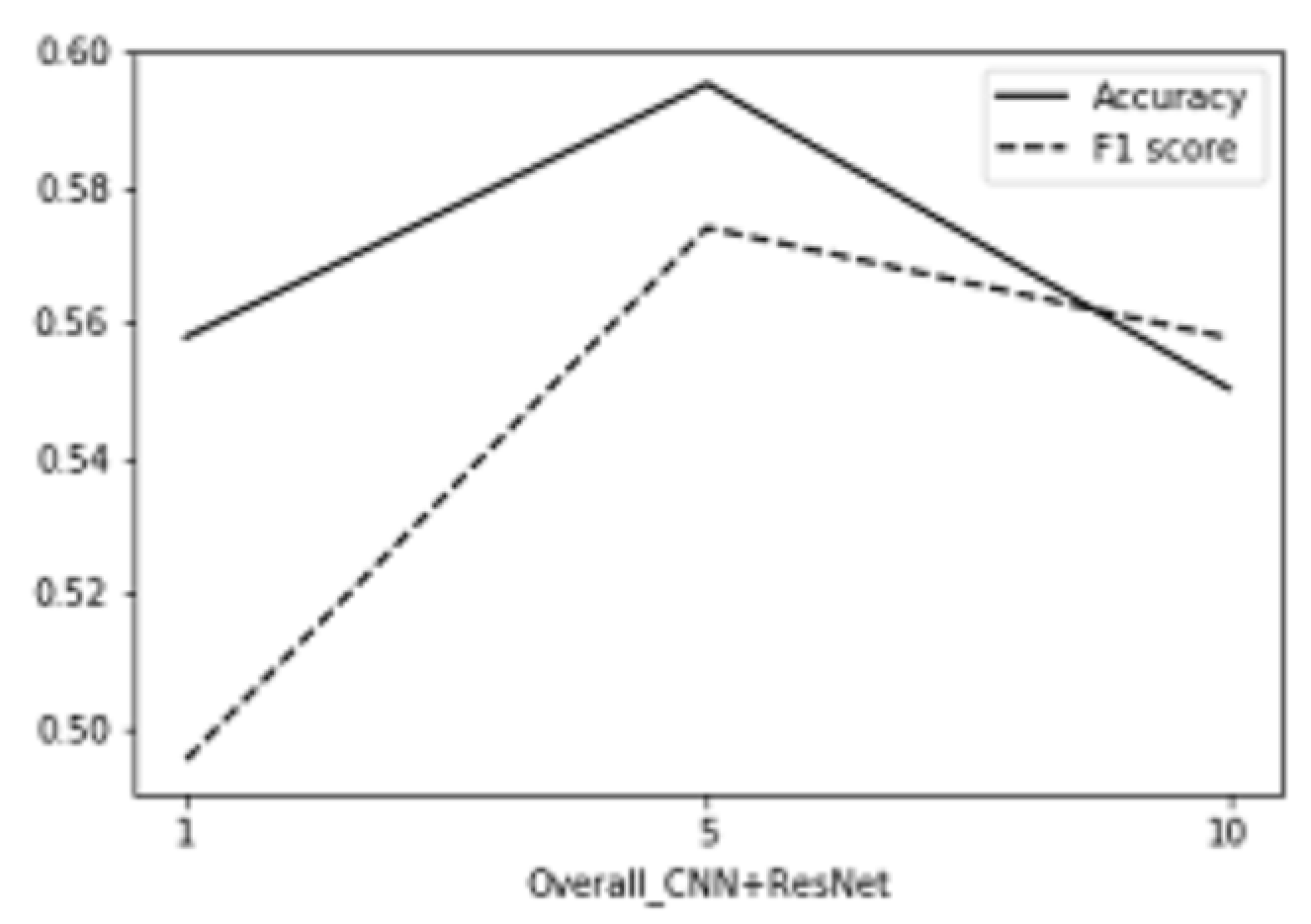

Figure Overall CNN+RESNET training results

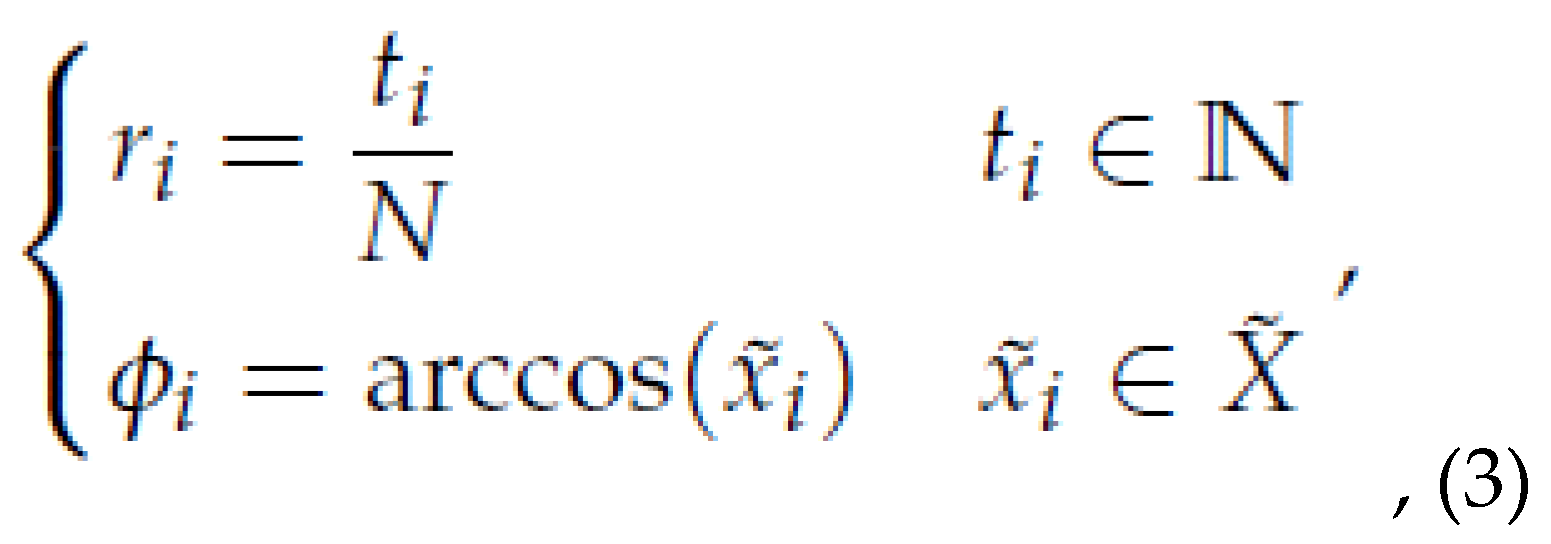

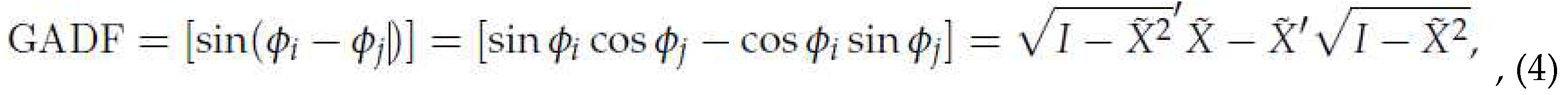

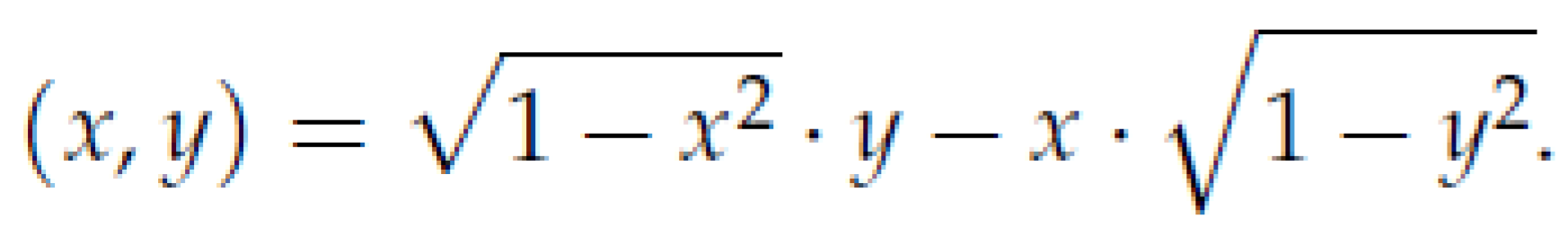

8. Imaging time series by GADF

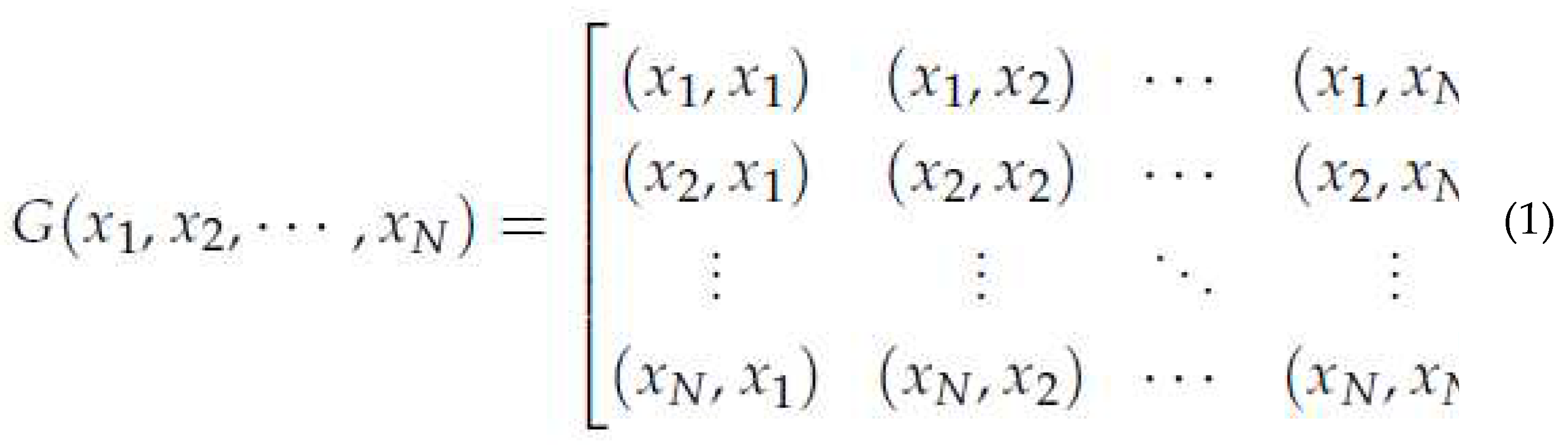

In linear algebra, the Gramian matrix, or Gram matrix, of a set of vectors x1, _ _ _ , xN in an

inner product space is the Hermitian matrix of inner products, whose entries are given by

Gij = (xi, xj) (i, j 2 N),

where (xi, xj) is the inner product of xi and xj.

1

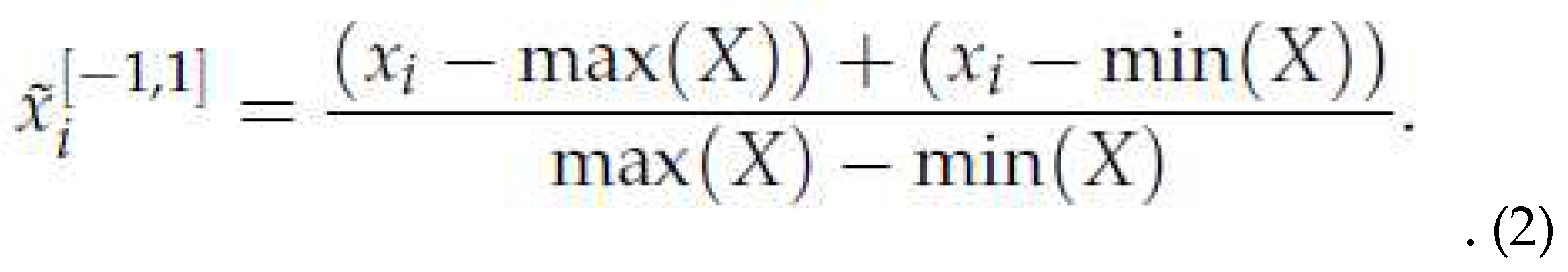

Given a time series data X, we rescale the time series data X so that all the values in X will

fall in the interval [1, 1],

After the time series being rescaled, we get a rescaled time series data ˜X. Then we do

the coordinate transformation. Change the time series data from Cartesian coordinate to

polar coordinate. In the Cartesian coordinate, the time series data Xi is represented by

time stamp and data value, that is (ti, ˜ xi). But in the polar coordinate, the time series data

is represented by radius and angle, that is (ri, ϕi). We use the equations below to do the

transformation,

where ti is the time stamp and N is a constant factor to regularize the span of the polar

coordinate system. In this research, we let N = 64, which will be the height and width of

the time series image.

The map of equation (3) has two important proterties. First, it is bijective. A time series

has one and only one transformation result by this method because cos ϕ is monotonic when

ϕ 2 [0, p]. Second, the image preserves the absolute temporal relations. By doing coordinate

transformation for the rescaled time series data, we can get the Gramian angular difference

field (GADF) as follows,

After getting the GADF, we define a new definition of the inner product as follows,

At last, the GADF are can be regarded as the Gramian metrix because every entry in

the Gramian angular fields is the inner product. The Gramian metrix is different from

the traditional Gramian metrix in linear algebra for their definitions of inner product are

different.

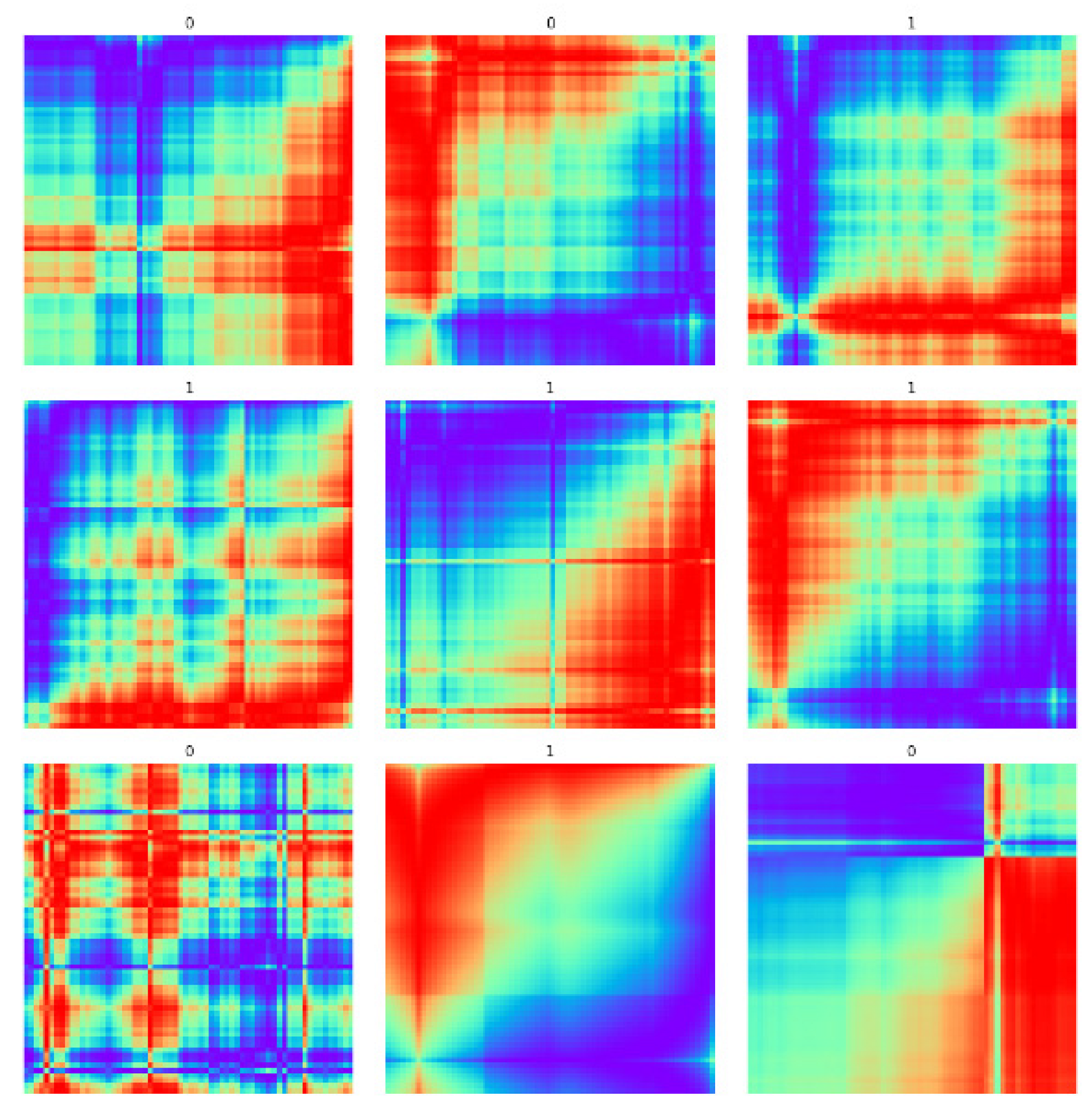

Finally, with the different colors standing for different values of the entries in the Gramian angular fields, we can obtain the time series images.

Time series image

The time series images have the size 64×64×3. We want to use the time series image, that

is, the SSE Composite Index daily close of the past 64 days to predict the trend of the daily

close of the few days in the future. We label the image of 1 if the average daily closed up of

5 days in the future against the past 5 days, and 0 otherwise. At last, we have 3314 images

with label 0 and 3718 images with label 1 in train and validation data set, and 44 images

with label 0 and 51 images with label 1 in test data set.

GADF images with labels

3. Research methods and procedures

The research process is developed by using PyTorch, and the experimental steps are described as follows:

1. Making a crawler program to collect TSMC stock history information and store it in the database. Use the data on the number of transactions and closing prices of TSMC from 2009 to 2020 published on the Taiwan Stock Exchange (TWSE) (quoted).

2. Normalize the required data.

3. Divide the data into a training set and a test set, and use the cycle Generative Adversarial Network to learn the relationship between volume and price to build a model and adjust the parameter settings for training.

4. Use the trained model to predict the test set data, put the price-volume relationship into the residual neural network and the long short-term memory model (LSTM), and compare the accuracy of the two models in predicting stock prices.

5. Perform short-term stock price forecasts, and evaluate the performance of the forecast results by using dynamic simulation system.

6. Integrate prediction results with technical analysis tools, namely Bollinger Bands, determine trading signals, and verify effects.

3.1. Data set

1. Source: Taiwan Stock Exchange

2. Stock information: TSMC (2330.TW)

3. Data interval: 2010/01/04 to 2020/12/31, a total of ten years of trading day data.

4. Historical data: closing price and trading volume on each trading day.

5. Training data: the first 90% of the total data is used as the training set, and 10% of the total data is used as the validation set.

6. Test data: the last 10% of the total data

3.2. Data pre-processing

The value range of the trading volume is different from the value of the stock value range. If it is directly normalized by the general method, the difference between the two values will be too large, which will affect the operation of the CycleGAN. In order to reduce this effect, this study converts the data into changes, then takes the log value to reduce the gap, and finally uses the Min-Max normalization method to make the data range between 0 and 1.

The Min-Max normalization formula is:

is the normalized value.

is the value to be normalized.

is the minimum value in the data.

is the maximum value in the data.

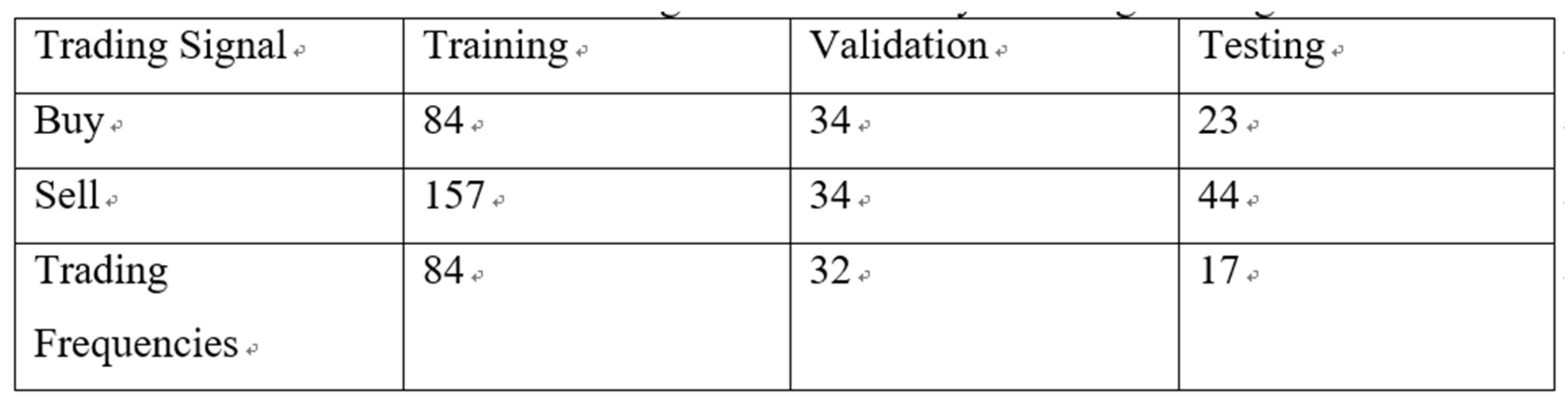

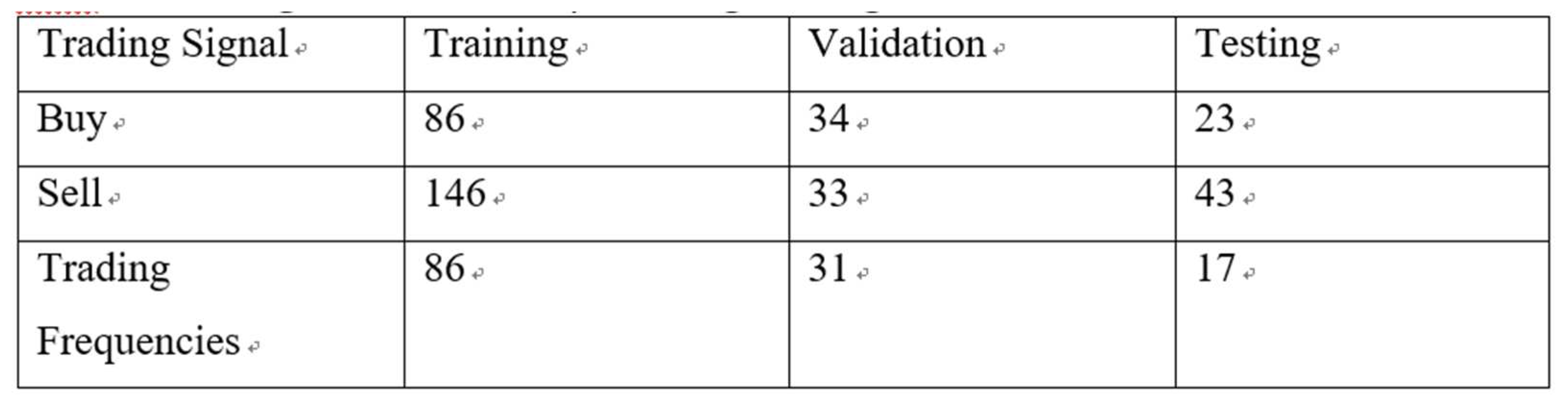

1. Training/validation/test data cutting

In order to avoid the problem of over fitting in the model, the data set is cut into three parts, and the whole time series data is divided into 90% of the training set and 10% of the validation set, and finally 10% of the training set is used as the test data.

3.3. Deep learning neural network architecture

(1) Cycle Generative Adversarial Network Design

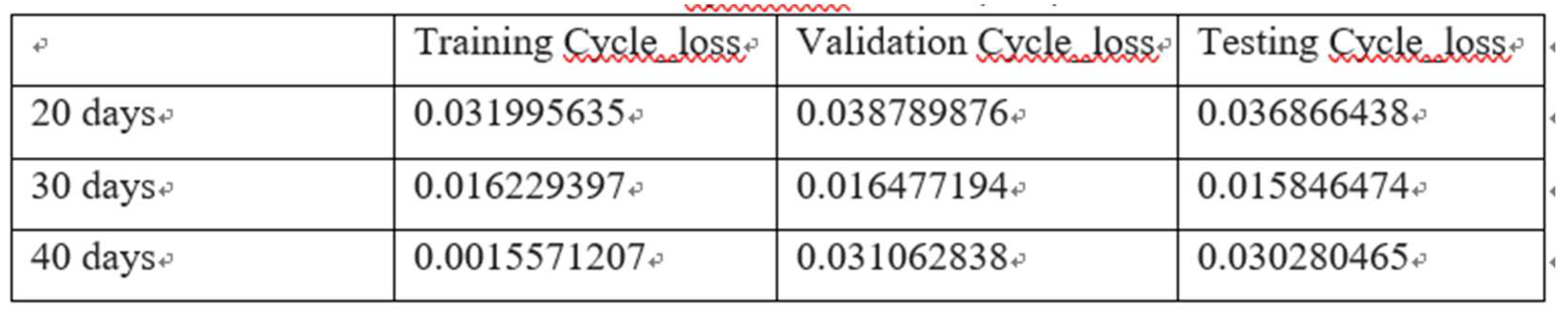

Previous studies have pointed out that there is a joint effect between volume and price, and any model calculation results that use only one of these data will be incorrect. In order to learn the relationship between volume and price, this study uses a CycleGAN to learn; the core mechanism ─ ─ Cycle loss, its loss function is:

For each image from the domain, transform

the joint effect of the domain learning volume and price, that is, return to

the original image through the loop mechanism, the method is:

.

Another core mechanism of the cyclic Generative Adversarial Networks is to combat loss, and its loss function is:

Among them, G try to make the generated image G(x) looks like a picture from the Y field, and try to distinguish Dy between the converted sample G(x) and the sample of the real Y field.

The goals of this network are:

This research treats price as the field and transaction volume as the field as the input to the cyclically generated confrontation network.

FC is the abbreviation of Fully Connective layer, in which stock price and transaction volume are matrix remodeling, making them the simulation data of a two-dimensional matrix, which is used as the input value of the generation model and the discriminant model.

Since the CycleGAN was originally used for mutual conversion in the image field, the data is first converted into two-dimensional data of the simulate image, through the Convolutional Neural Network (CNN) that has a good effect on the image, the architecture combined with the residual neural network is used as a generative model to produce works that are sufficient to deceive the discriminant model. The discriminant model also uses a convolutional neural network as a framework to determine whether the two-dimensional data is training data or fake works generated by the generative model.

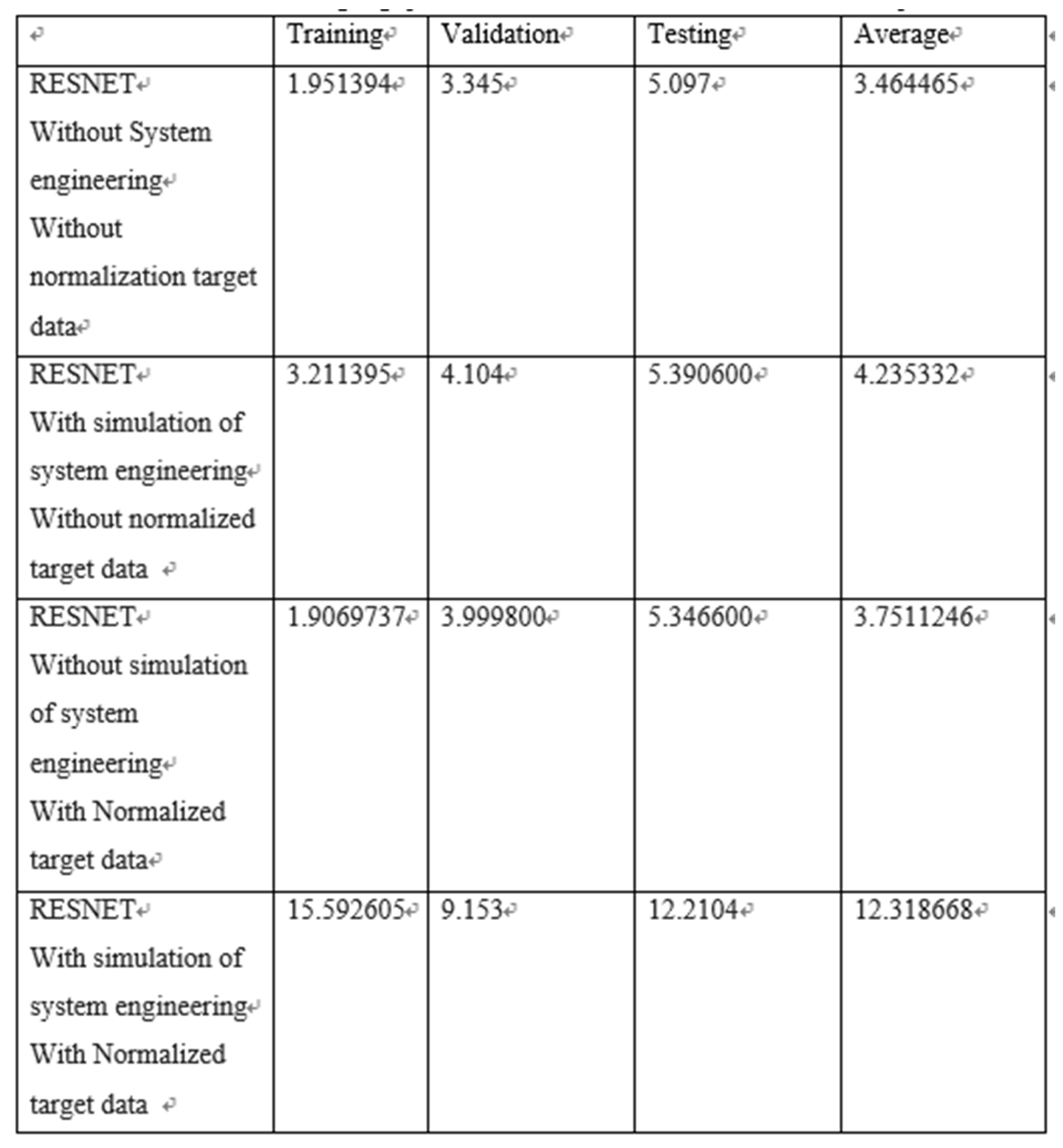

1. Construct the residual neural network model: extract the features through the convolutional neural network to connect with the residual neural network, where 5 days of restoring stock prices and volume are used, and the residual neural network is designed to be 48 layers.

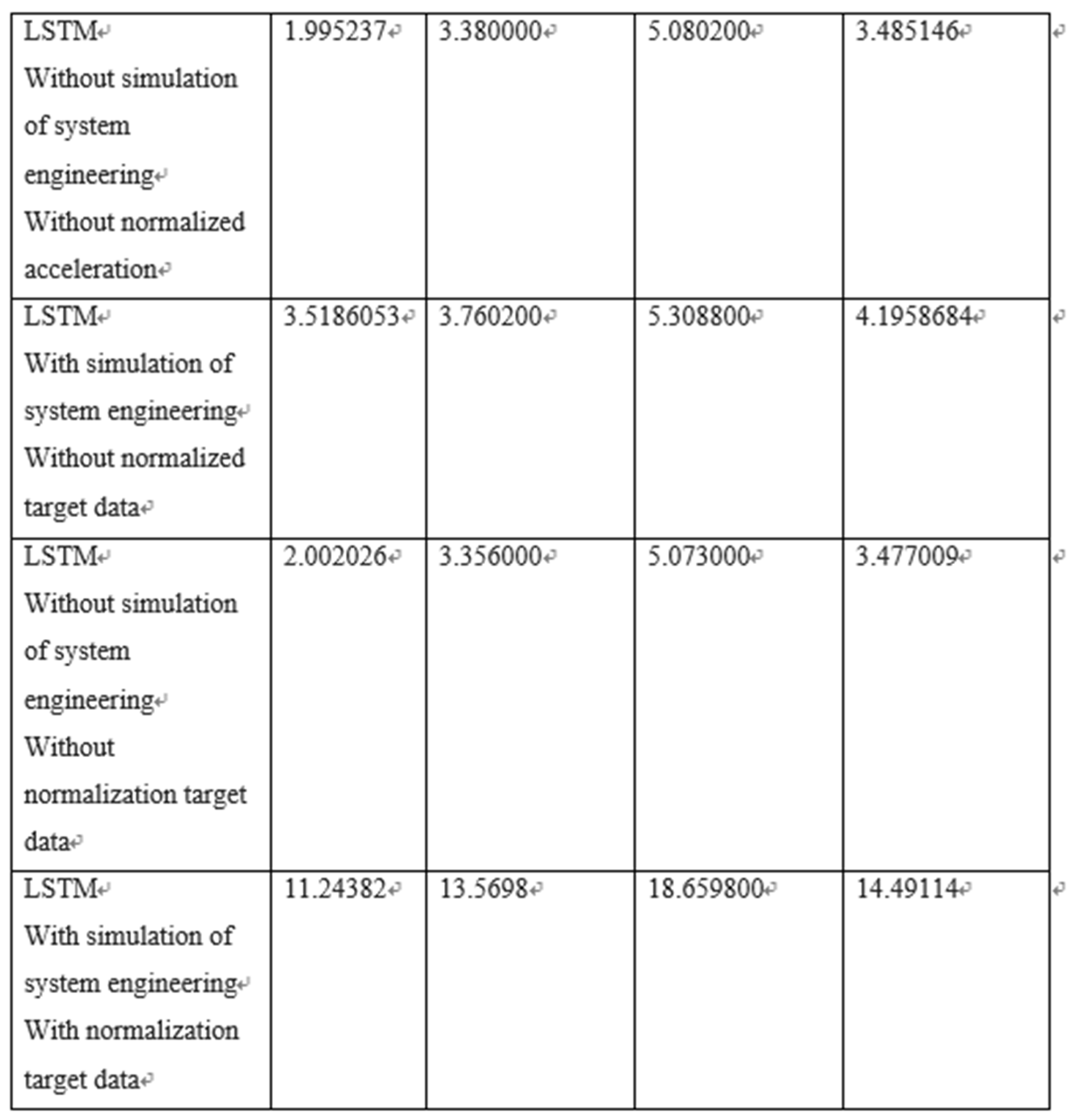

2. Construct a Long Short Term Memory mode(LSTM): Use the LSTM model to restore time series data of quantity and price. Here, 5 days of restoring stock price and volume are used, and the number of layers of the long- and short-term memory model is designed to be 4 layers.

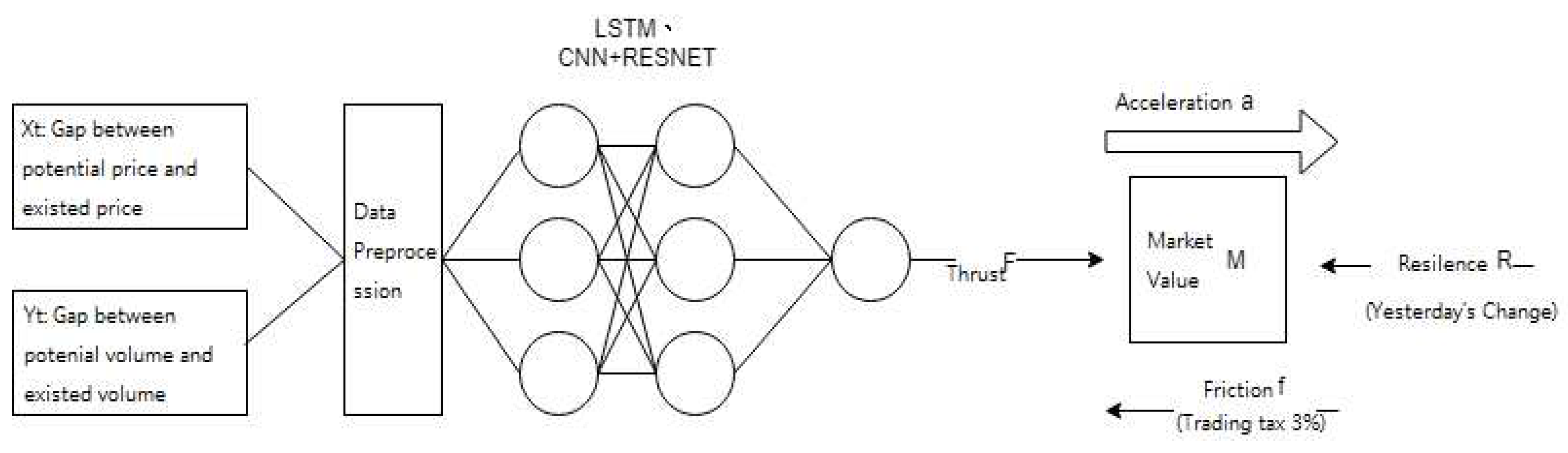

(2) System engineering behavior and stock price prediction

In order to simulate the volatility of the stock market caused by the different potential volume-price relationship in the stock market, this study incorporates a system engineering framework (

Figure 3) assumes that the Cycle Generative Adversarial Network generated fake works

、

by the potential future trend of volume and price; changes in the relationship between price and volume, acting as potential energy conversion kinetic energy, form the power of stock price changes and drive the stock market. among them,

1. Thrust (F): Xt is derived from fake works , the potential price is subtracted from the current price; Yt is obtained by subtracting G(x) from the potential quantity with the current quantity. By inputting Xt and Yt to the neural network to simulate the thrust of the potential energy rotation energy.

2. Market value (M): market value (stock price * number of issued). In the stock market, the growth rate of stock prices is related to market value and capital inflows. The same capital flows into different market capitalizations will have different stock price growth rates. Market value is regarded as an object and driven by thrust. This simulates that when the same thrust promotes different market values, the magnitude of stock price changes will also show different statement.

3. Friction (f): Friction is transaction tax, which is transaction volume * stock price * 0.3‰. In dynamic systems, friction is related to thrust. In the practice of stock market trading, it can be regarded as transaction tax. The source of stock price changes is a bargaining chip, but when it flows into the stock market, taxes will be deducted, creating resistance to stock transactions, so the transaction tax is used as a friction.

4. Resilience (R): According to the previous day’s rise and fall, the corresponding value will be given. The resilience of is related to the stored potential energy. The rise and fall of stocks have a continuous impact and will affect the future stock price the most. Assuming that a sharp rise in stock prices will result in more potential energy reserves, it will be less likely to continue to rise in the future, and vice versa.

5. Acceleration (a): The acceleration a is obtained from the distance formula, assuming that the initial velocity is 0, and k is the stock price at the time point (in days) to be predicted. The formula is as follows:

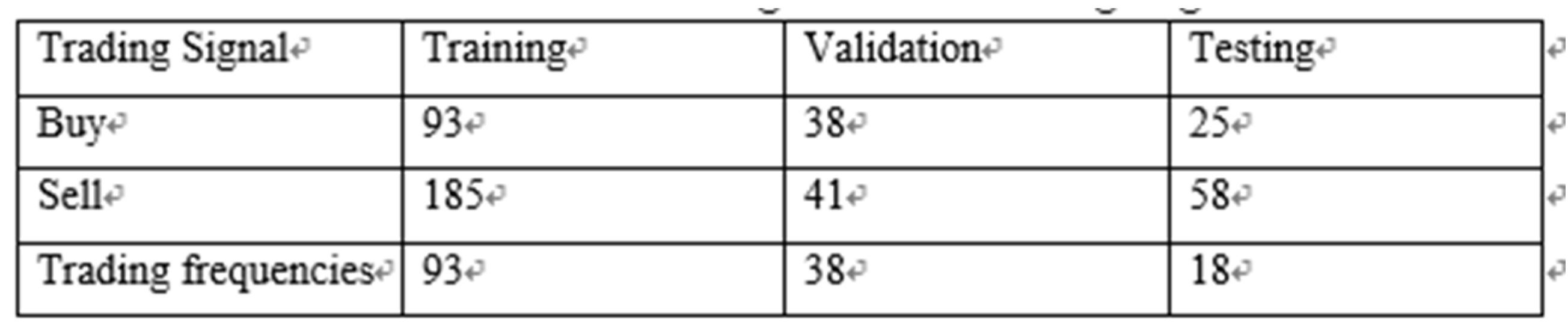

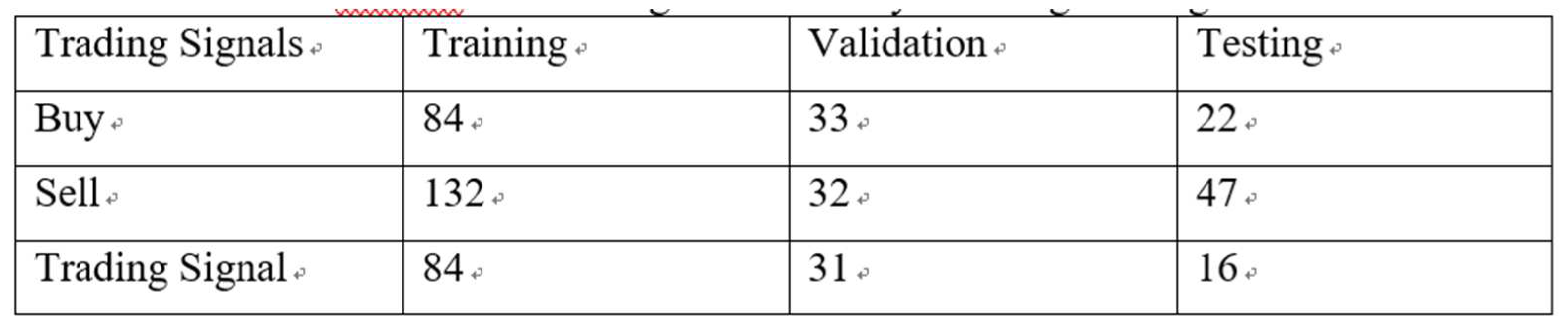

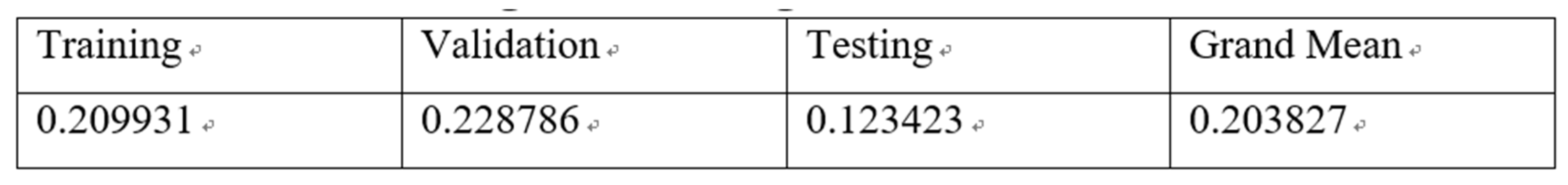

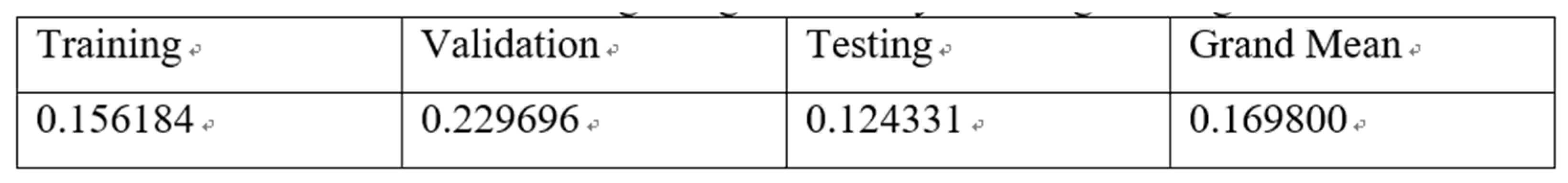

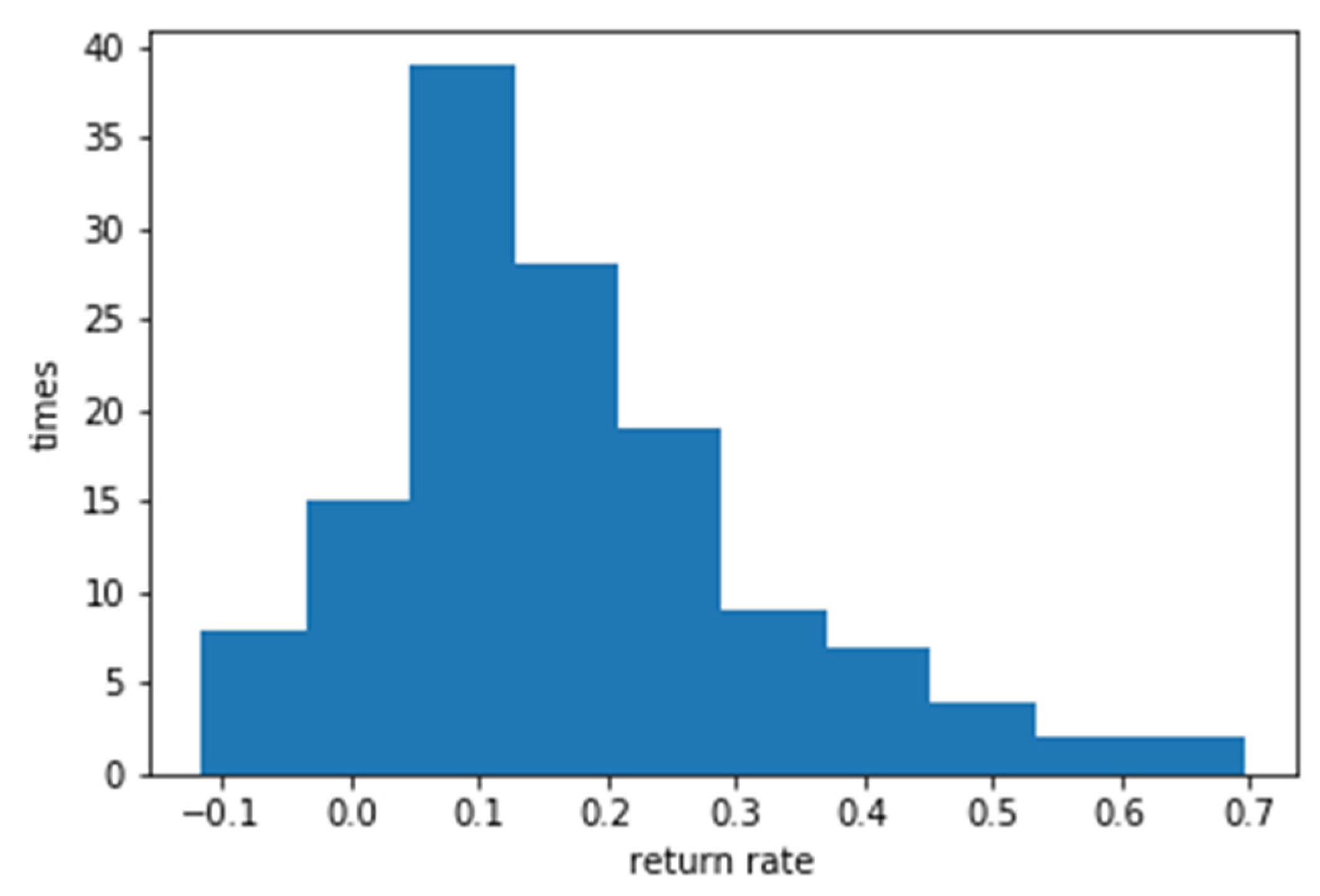

3.4. Bollinger Band Design

By using its extended indicator %b as a trading signal, it is used to obtain the strength of the stock price in the near future. We can know whether the stock price is currently at a relatively recent high/low point through this indicator and make trading decisions.

(a) Bollinger band formula

1. Middle band: simple moving average for N time period

2. Upper band: middle band + standard deviation of K × N time period

3. Lower band: Middle band-standard deviation of K × N time period

(b) Trading decision

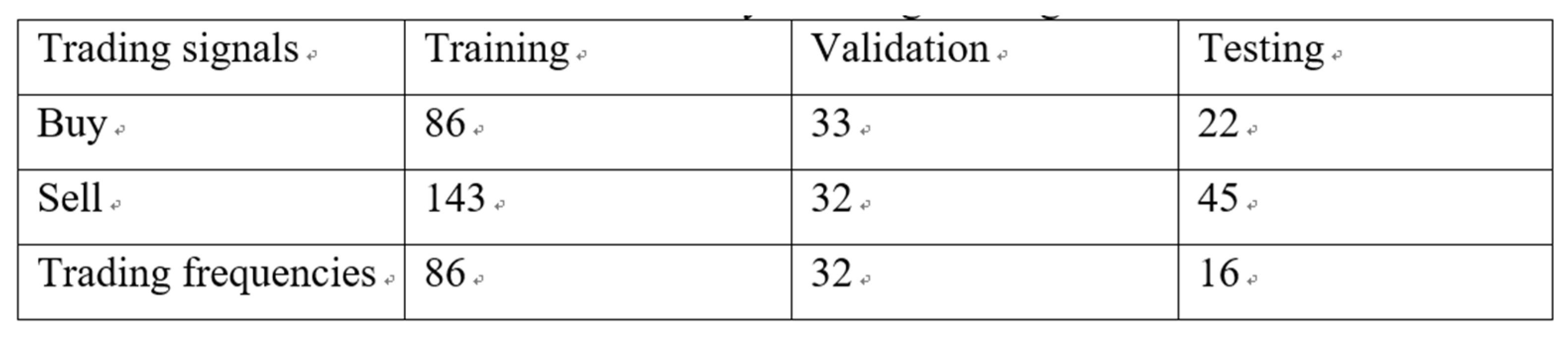

1. Select the closing price of the day.

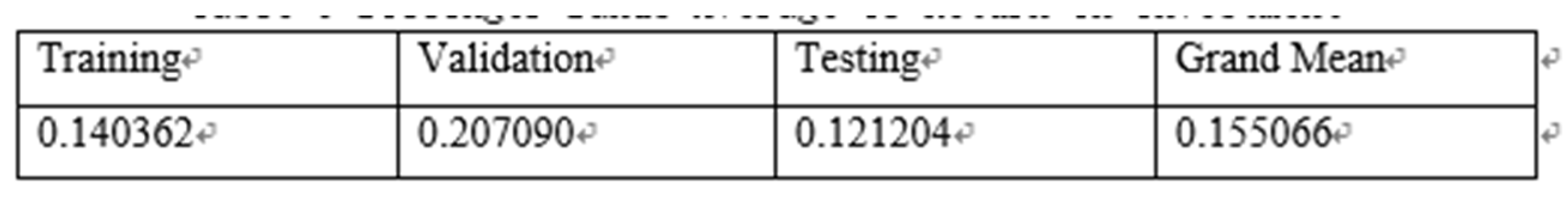

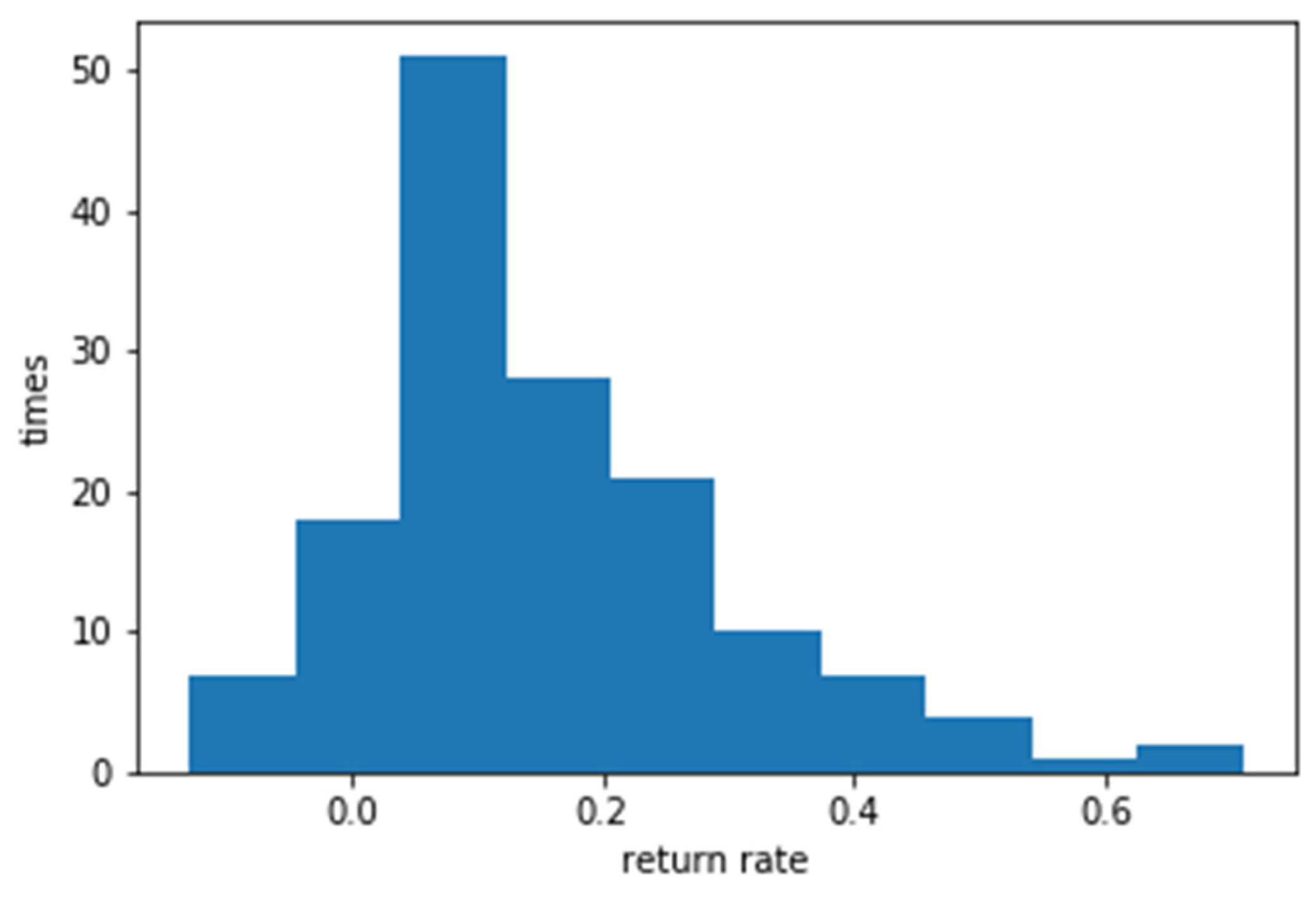

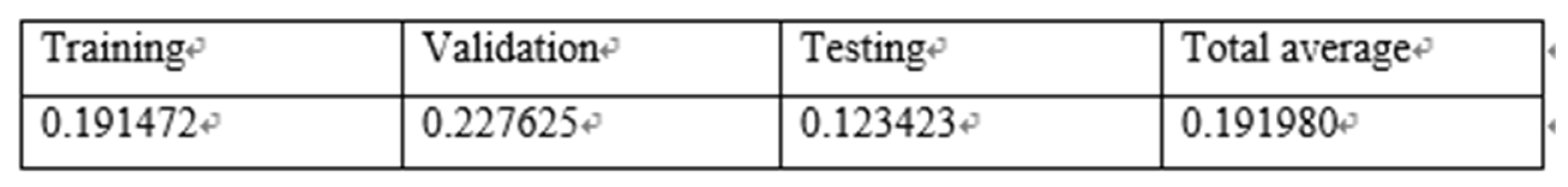

2. The three-band setting parameter K is obtained by experimenting with Bollinger Bands. Experiments 1 and 2 are used to obtain the K which can make it have the best average reporting rate.

3. The three-band setting parameter N is also obtained through experimental Bollinger bands, experiments 5~35, interval 5, and the parameter N that can make it have the best average reporting rate is obtained.

4. When setting %b indicator =>1, the stock should be sold (if it has not been bought before, it will not be sold)

5. The stock should be bought when the %b index<=0.

(c) Integration with stock prices forecasting

Add the forecast of the stock price to the Bollinger Band three band one day later, and know the current strength of the stock price through future information. If the stock price is predicted to be higher, you can know that the current is not relatively high, and you can wait for a period of time before selling, and vice versa. Hope to increase the rate of return on investment through this method.

.

.