Submitted:

31 July 2023

Posted:

02 August 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Data and Methods

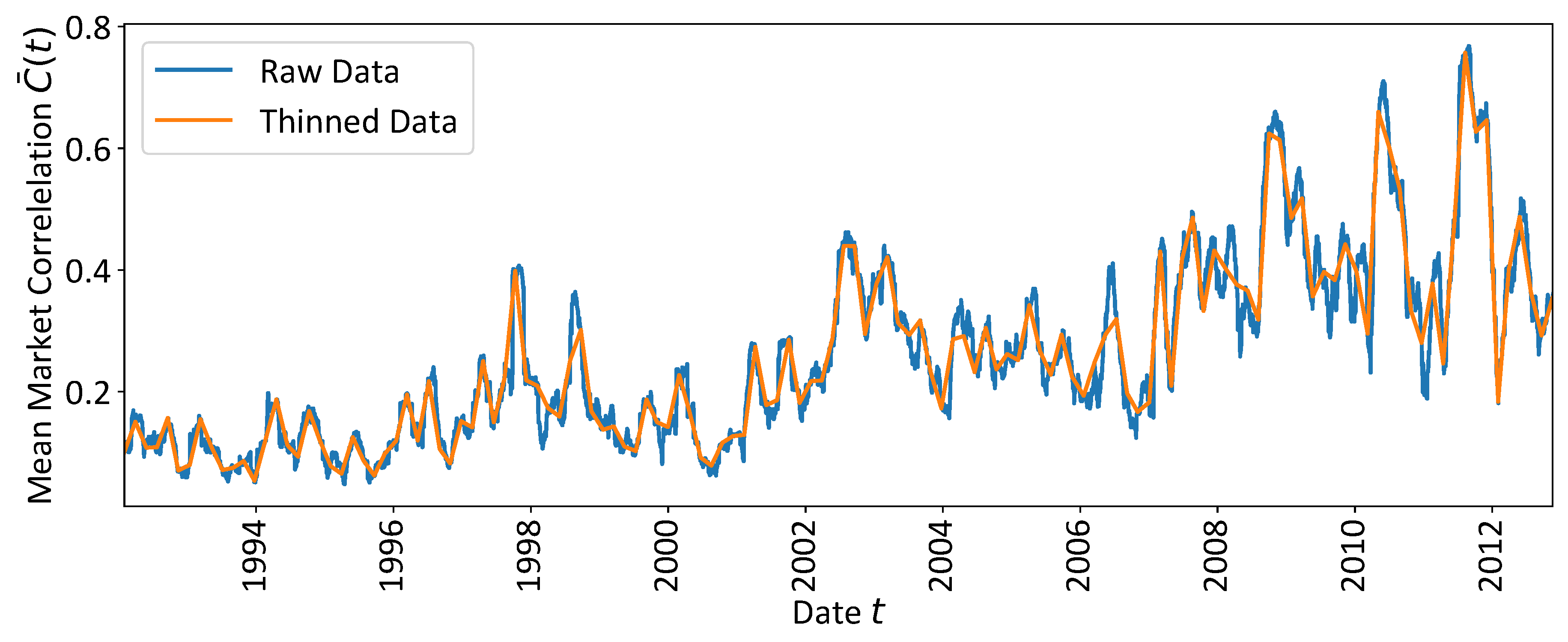

2.1. Data Preparation

2.2. Change Point Identification

3. Results

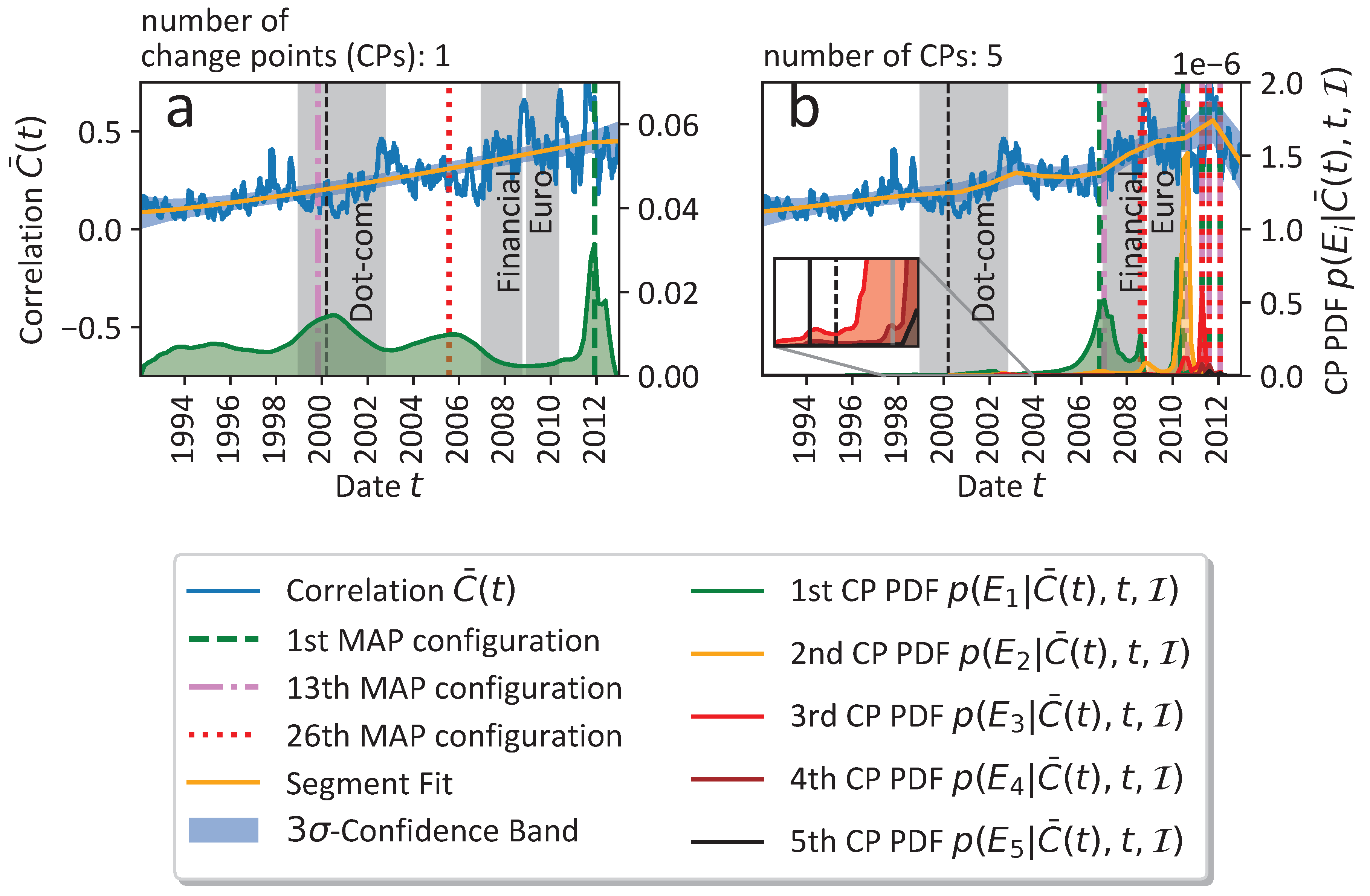

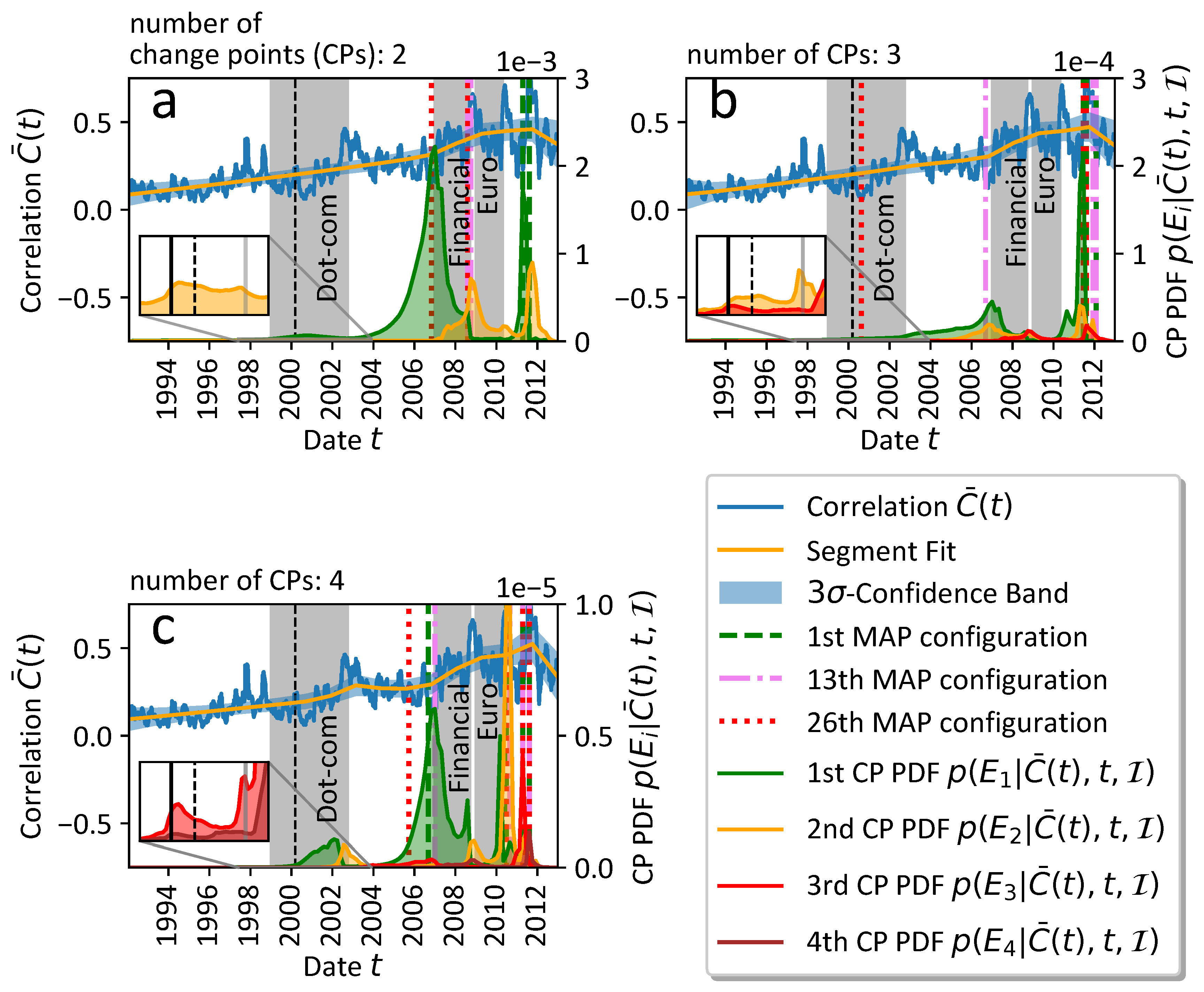

3.1. Change Point Analysis

3.1.1. Dot-Com Bubble

3.1.2. Financial Crisis

3.1.3. Euro Crisis

3.1.4. Remarks and Intermediate Conclusion

| Event Date | Event Description | Source | CP PDF Peak Dates | ||

|---|---|---|---|---|---|

| Figure 2(a) | (b) | (c) | |||

| 1994 | Over the year bond prices fell continuously in consequence of partially unexpected and repeated raise of federal funds rates by the FED. In consequence bonds lost about $1.5 trillion in market value globally. | [21] | 2 February 1995 to 26 July 1995; 31 March 1995 to 21 September 1995 |

2 February 1995; 31 March 1995 to 21 September 1995 |

26 July 1995 to 16 November 1995; 2 February 1995; 26 July 1995 to 16 November 1995 |

| December 1994 | Due to devaluation of the peso by the Mexican government and thus anticipating further devaluations, investors rapidly withdrew capital from Mexican investments. In January 1995 the U.S. government coordinates a $40 billion bailout. | [22] | 2 February 1995 to 26 July 1995; 31 March 1995 to 21 September 1995 |

2 February 1995; 31 March 1995 to 21 September 1995 |

26 July 1995 to 16 November 1995; 2 February 1995; 26 July 1995 to 16 November 1995 |

| 1997 - 1998 | Asian financial crisis in East and Southeast Asia. Multiple origins are discussed. However, long-lasting global contagion stayed away and the markets recovered fast in 1998-1999. | [13] | 14 May 1999 | 10 October 1997; 18 March 1999 |

10 October 1997; 18 March 1999; 14 May 1999 |

| 1998 - 1999 | Russian financial crisis in which the rubel was devalued. As a result many neighbouring countries experienced also severe crises. | [14] | 14 May 1999 | 18 March 1999 to 13 July 1999 |

18 March 1999; 14 May 1999 |

| 1 January 1999 | The modest onset of the dotcom-bubble 1998 turns into a rapid rally of the NASDAQ Composite Index. In the literature the long pre-bubble period begins commonly in 1995. | [23,24] | 14 May 1999 | 18 March 1999 to 12 July 1999 |

18 March 1999 |

| 14 May 1999 | Stock market drop due to sharp rise of consumer prices to 1.75% in the U.S. | [12] | 14 May 1999 | 14 May 1999 to 12 July 1999 |

14 May 1999 |

| 10 March 2000 | Based on the NASDAQ Composite Index the Dot-com bubble reaches its all-time high. | [23,24] | 16 October 2000 | 22 June 2000; 9 April 2001 |

kink at 22 June 2000; 9 April 2001 |

| 11 September 2001 | In course of a terror attack three airplanes crash into the twin towers of the U.S. World Trade Center and the Pentagon coordinated by the militant Islamist extremist network al-Qaeda. | [11] | 24 May to 23 July 2002 |

4 October 2001; 24 May 2002; 23 July 2002 |

4 October 2001; 30 January 2002; 24 May 2002; 23 July 2002; 18 September 2002 |

| 1 October 2002 | Based on the NASDAQ Composite Index the Dot-com bubble reaches a new trough after the bubble burst in course of a more general stock downturn since 11 September 2011. | [23,24] | 28 July 2005 to 18 November 2005 |

28 October 2003 to 24 December 2003 |

28 October 2003 to 24 December 2003 |

| 2002/2003 | The Venezuelan General Strike massively hinders oil exports among others to the USA. | [25,26] | 28 July 2005 to 18 November 2005 |

28 October 2003 to 24 December 2003 |

28 October 2003 to 24 December 2003 |

| 2003 | Approximate beginning of the boom-phase of the U.S. housing bubble. | [27] | 28 July 2005 to 18 November 2005 |

28 October 2003 to 24 December 2003 |

28 October 2003 to 24 December 2003 |

| 2003 - 2016 | Begin of rising oil prices from under $25/bbl to above $30/bbl. The peak of $147.30/bbl is reached in July 2008, before they return temporarily to $35/bbl in 2009. | [26,28] | 28 July 2005 to 18 November 2005 |

28 October 2003 to 24 December 2003 |

28 October 2003 to 24 December 2003 |

| Q4 2006 to Q1 2007 | Period of most intense burst of the U.S. housing bubble with new lowest price in 2011. | [15] | 2 November 2006 to 3 January 2007 |

31 October 2006; 2 January 2007 |

2 November 2006 to 3 January 2007 |

| 9 August 2007 | Commonly listed onset of the global financial crisis. On this day the interest rates for inter-bank financial loans rose sharply. | [16,17] | 22 August 2007 | 22 August 2007 | 22 August 2007 |

| 2008 | Year of the financial crisis and great recession. The year is characterised by manifold bailouts for banks and stock market crashes. | [29] | overall high CP PDFs in 2008 | overall high CP PDFs in 2008 | overall high CP PDFs in 2008 |

| January to March 2008 | The housing prices continue to collapse. The government passes a tax rebate bill on 13 February 2008 and the FED starts bail out programs in the beginning of March. | [30,31] | 4 August 2008 | 4 August 2008 | 4 August 2008 |

| 30 July 2008 | U.S. governments passes bailout laws for Fanny Mae and Freddie Mac. | [32] | Kink at 4 August 2008 |

4 August 2008 | 4 August 2008 |

| 7 September 2008 | U.S. government’s take over of Fanny Mae Association and Freddie Mac Corporation. | [33] | 1 October 2008 to 26 November 2008 |

1 October 2008 | 1 October 2008 to 26 November 2008 |

| 15 September 2008 | Lehman Brothers bankruptcy. | [18] | 1 October 2008 | 1 October 2008 | 1 October 2008 |

| 29 September 2008 | Stock market collapsed when the bailout bill was rejected by the U.S. House of Representatives. | [19] | 1 October 2008 | 30 September 2008 | 1 October 2008 |

| 24 October 2008 | Many world stock indices lost around 10%. | [34] | 26 November 2008 | 26 November 2008 | 26 November 2008 |

| 1 December 2008 | When the National Bureau of Economic Research officially declared that the U.S. was in a recession since December 2007, the S&P500 lost 8.93% and the financial stocks of the index even 17% based on these news. | [35] | high CP PDF after 26 November 2008 |

high CP PDF after 26 November 2008 |

high CP PDF after 26 November 2008 |

| January 2009 | The first ten European banks ask for bailout programs. | [36] | high CP PDF after 26 November 2008 |

high CP PDF after 26 November 2008 |

high CP PDF after 26 November 2008 |

| Early 2010 to mid 2012 | The Arab Spring. Great anti-government protests in large parts of the Middle East and North Africa. The oil prices rise above $100/bbl. | [28,37,38] | 5 May 2010 to 1 July 2010 |

5 May 2010 to 1 July 2010 |

5 May 2010 to 1 July 2010 |

| 27 April 2010 | Greece’s sovereign debt rating was downgraded by Standard& Poor’s. | [20] | 5 May 2010 to 1 July 2010 |

5 May 2010 to 1 July 2010 |

5 May 2010 to 1 July 2010 |

| 6 May 2010 | So-called flash crash led to a 9% drop in the Dow Jones Index caused due to high frequency trading. | [39] | 5 May 2010 to 1 July 2010 |

5 May 2010 to 1 July 2010 |

5 May 2010 to 1 July 2010 |

| 8 May 2010 | Passing drastic bailout plans for Greece in Brussels. A €110 billion package is approved. | [40,41] | 5 May 2010 to 1 July 2010 |

5 May 2010 to 1 July 2010; 28 August 2010 |

5 May 2010 to 1 July 2010; 1 July to 28 August 2010 |

| 17 May 2010 | The Euro currency falls into first four-years low. | [42] | 5 May 2010 to 1 July 2010 |

5 May 2010 to 1 July 2010; 28 August 2010 |

5 May 2010 to 1 July 2010; 1 July to 28 August 2010 |

| Q1/2 2010 | Several downgradings of debt ratings/bonds of European countries, i.e. Portugal, Spain, Greece. | [43] | 5 May 2010 to 1 July 2010 |

5 May 2010 to 1 July 2010; 28 August 2010 |

5 May 2010 to 1 July 2010; 1 July to 28 August 2010; 3 September 2010 |

| 4 June 2010 | The Euro currency falls into second four-years low. Major American markets fall more than 3%. | [44] | 5 May 2010 to 1 July 2010 |

5 May 2010 to 1 July 2010; 28 August 2010 |

5 May 2010 to 1 July 2010; 1 July to 28 August 2010 |

| November 2010 | Bailout request by Ireland. In the end of November Ireland receives €85 billion. | [45,46] | 15 April 2011 | 15 April 2011 | 15 April 2011 |

| 7 April 2011 | In the evening of 6 April 2011 Portugal’s government announces that it is the third after Greece’s and Ireland’s governments that will ask for a bailout package. On 17 May 2011 a bailout package of around €78 billion is formally adopted. | [47] | 15 April 2011 to 14 June 2011 |

15 April 2011 to 14 June 2011 |

15 May 2011 to 14 June 2011 |

| 13 June 2011 | Greece’s credit rankings become worst in the world. | [48] | 13 June 2011 | 13 June 2011 | 13 June 2011 |

| August 2011 | Under the Securities Markets Programme the ECB restarts to purchase a significant amount of eurozone sovereign bonds. Spanish and Italian yields breach 6%. | [49,50] | 6 October 2011 | 9/10 August 2011 | 10 August 2011 |

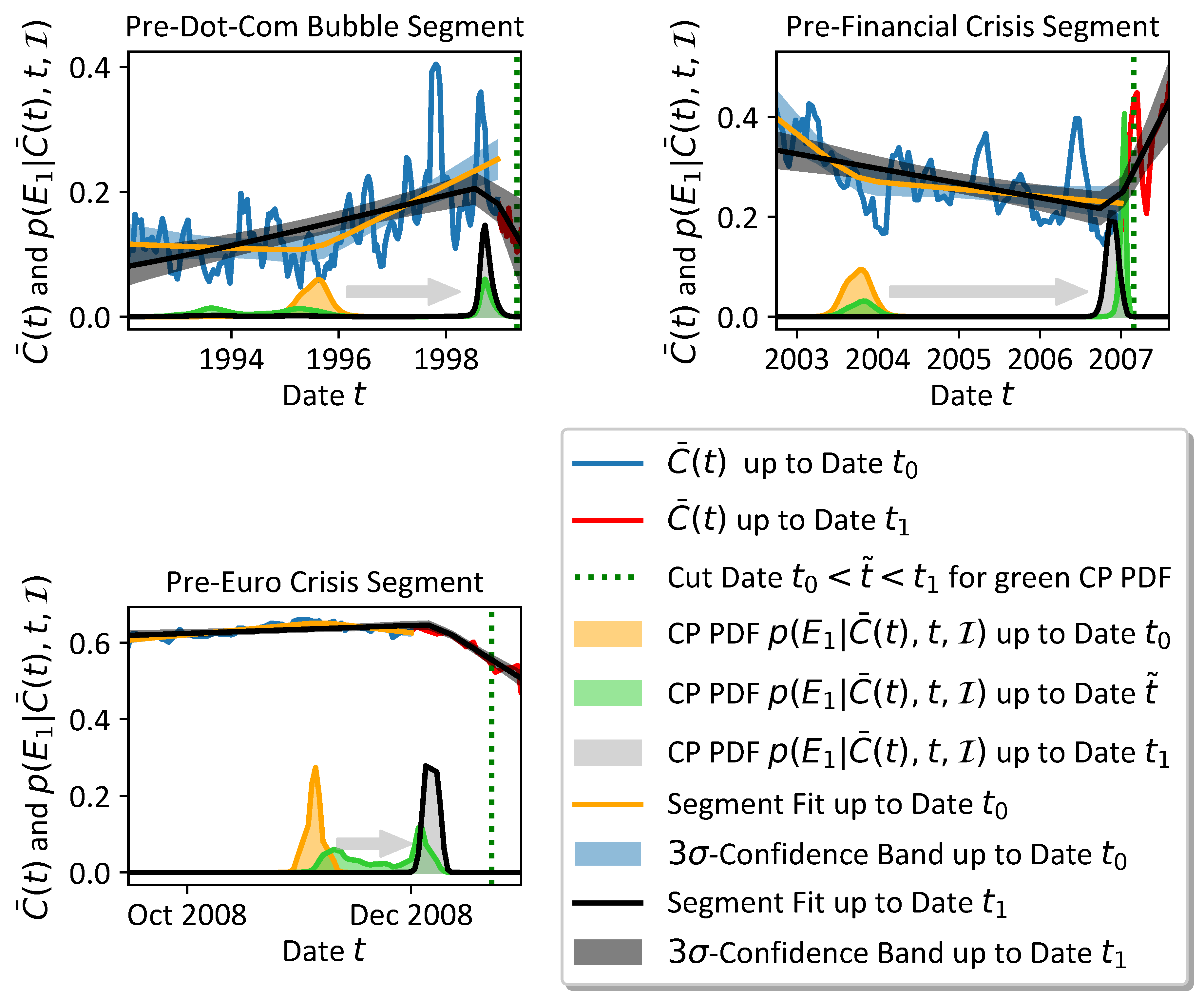

3.2. On-line Change Point Evolution in Pre-Crisis-Segments

3.2.1. Dot-Com Bubble

3.2.2. Financial Crisis

3.2.3. Euro Crisis

4. Discussion and Conclusion

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| CB | Credibility Band |

| CP | Change Point |

| ECB | European Central Bank |

| FED | U.S. Federal Reserve System |

| NASDAQ | National Association of Securities Dealers Automated Quotations |

| U.S. | United States |

| USA | United States of America |

| probability density function | |

| Q1, Q2, ... | quarter 1, quarter 2, ... |

| S&P | Standard and Poor’s |

Appendix A. Detailed Data Preparation

Appendix B. Advanced Change Point Analysis

References

- Stepanov, Y.; Rinn, P.; Guhr, T.; Peinke, J.; Schäfer, R. Stability and hierarchy of quasi-stationary states: financial markets as an example. Journal of Statistical Mechanics: Theory and Experiment 2015, 2015, P08011. [Google Scholar] [CrossRef]

- Laloux, L.; Cizeau, P.; Bouchaud, J.P.; Potters, M. Noise Dressing of Financial Correlation Matrices. Phys. Rev. Lett. 1999, 83, 1467–1470. [Google Scholar] [CrossRef]

- Plerou, V.; Gopikrishnan, P.; Rosenow, B.; Nunes Amaral, L.A.; Stanley, H.E. Universal and Nonuniversal Properties of Cross Correlations in Financial Time Series. Phys. Rev. Lett. 1999, 83, 1471–1474. [Google Scholar] [CrossRef]

- Dehning, J.; Zierenberg, J.; Spitzner, F.P.; Wibral, M.; Neto, J.P.; Wilczek, M.; Priesemann, V. Inferring change points in the spread of COVID-19 reveals the effectiveness of interventions. Science 2020, 369, eabb9789. [Google Scholar] [CrossRef] [PubMed]

- Wand, T.; Heßler, M.; Kamps, O. Memory Effects, Multiple Time Scales and Local Stability in Langevin Models of the S&P500 Market Correlation. arXiv 2023. Preprint. [Google Scholar] [CrossRef]

- Heßler, M.; Kamps, O. Bayesian on-line anticipation of critical transitions. New Journal of Physics 2021. [Google Scholar] [CrossRef]

- Heßler, M. antiCPy. https://github.com/MartinHessler/antiCPy, 2021. [CrossRef]

- Heßler, M. antiCPy’s documentation. https://anticpy.readthedocs.io, 2021.

- Dose, V.; Menzel, A. Bayesian analysis of climate change impacts in phenology. Global Change Biology 2004, 10, 259–272. [Google Scholar] [CrossRef]

- Von der Linden, W.; Dose, V.; Von Toussaint, U. Bayesian probability theory: applications in the physical sciences; Cambridge University Press, 2014. [Google Scholar]

- Kean, T.H.; Ben-Veniste, R.; Fielding, F.F.; Gorelick, J.S.; Gorton, S.; Hamilton, L.H.; Kerrey, B.; Lehman, J.F.; Roemer, T.J.; R.Thompson, J. The 9/11 Commission Report. https://www.9-11commission.gov/report/911Report.pdf (Retrieved: 12 May 2023), 2004. U.S. Governmental 9/11 commission. 12 May.

- Inflation fears punish Dow. https://money.cnn.com/1999/05/14/markets/marketopen/ (Retrieved: 12 May 2023), 1999. CNN Money.

- Asian Financial Crisis. July 1997-December 1998. https://www.federalreservehistory.org/essays/asian-financial-crisis (Retrieved: 12 May 2023), 2001. Federal Reserve History.

- Pastor, G.; Damjanovic, T. IMF Working Paper. The Russian Financial Crisis and its Consequences for Central Asia. https://www.imf.org/external/pubs/ft/wp/2001/wp01169.pdf (Retrieved: 12 May 2023), 2001. International Monetary Fund (WP/01/169). 12 May.

- Hovanesian, M.D.; Goldstein, M. The Mortage Mess Spreads. https://web.archive.org/web/20070310164527/http://www.businessweek.com/investor/content/mar2007/pi20070307_505304.htm (Retrieved: 25 July 2023), 2007. BusinessWeek.

- Schäfer, D. Geborgtes Vertrauen auch nach zehn Jahren Dauerfinanzkrise. https://www.diw.de/documents/publikationen/73/diw_01.c.563108.de/17-32-3.pdf (Retrieved: 12 May 2023), 2017. Deutsches Institut für Wirtschaftsforschun e.V.

- Barr, C. Aug. 9, 2007: The Day the Mortgage Crisis Went Global. https://www.wsj.com/articles/aug-9-2007-the-day-the-mortgage-crisis-went-global-1502271004 (Retrieved: 12 May 2023), 2017. The Wall Street Journal.

- Wiggins, R.Z.; Piontek, T.; Metrick, A. The Lehman Brothers Bankruptcy A: Overview. SSRN Electronic Journal 2014. [Google Scholar] [CrossRef]

- Isidore, C. https://money.cnn.com/2008/09/29/news/economy/bailout/ (Retrieved: 12 May 2023), 2008. CNN.

- Wachman, R.; Fletcher, N. Standard & Poor’s downgrade Greek credit rating to junk status. https://www.theguardian.com/business/2010/apr/27/greece-credit-rating-downgraded (Retrieved: 12 May 2023), 2010. The Guardian.

- Ehrbar, A. The great bond massacre (Fortune, 1994). https://web.archive.org/web/20150102150653/http://fortune.com/2013/02/03/the-great-bond-massacre-fortune-1994/ (Retrieved: 12 May 2023), 2013. Fortune.

- Boughton, J.M. 10 Tequila Hangover: The Mexican Peso Crisis and Its Aftermath. https://www.elibrary.imf.org/display/book/9781616350840/ch010.xml (Retrieved: 12 May 2023), 2010-2021. International Monetary Fund.

- Hayes, A. Dotcom Bubble. https://www.investopedia.com/terms/d/dotcom-bubble.asp (Retrieved: 12 May 2023), 2019.

- ECONStats. Equity Index Data. NASDAQ Composite Index. http://www.econstats.com/eqty/eq_d_mi_7.htm (Retrieved: 10 May 2023), 2013.

- Venezuelan general strike extended. http://news.bbc.co.uk/2/hi/americas/1918189.stm (Retrieved: 12 May 2023), 2002. BBC News.

- Stevenson, E. 2003-2008 Oil Price Shock: Changing Effects of Oil Shocks on the Economy. https://core.ac.uk/download/pdf/228665034.pdf (Retrieved: 12 May 2023), 2018. LeHigh University.

- Griffin, J.M.; Kruger, S.; Maturana, G. What drove the 2003–2006 house price boom and subsequent collapse? Disentangling competing explanations. Journal of Financial Economics 2021, 141, 1007–1035. [Google Scholar] [CrossRef]

- U.S. Conventional Gas and Crude Oil, Prices WTI - Cushing Oklahoma. https://fred.stlouisfed.org/series/GASREGCOVM#0 (Retrieved: 12 May 2023), 2023. FRED Economic Data. St. Louis FED.

- Loser, C.M. Global financial turmoil and emerging market economies: Major contagion and a shocking loss of wealth? Global Journal of Emerging Market Economies 2009, 1, 137–158. [Google Scholar] [CrossRef]

- (signator), G.W.B., 2008. Economic Stimulus Act.

- Amadeo, K.; Rasure, E. 2008 Financial Crisis Timeline. https://www.thebalancemoney.com/2008-financial-crisis-timeline-3305540 (Retrieved: 12 May 2023), 2022. The Balance.

- (signator), G.W.B., 2008. Housing and Economic Recovery Act.

- Layton, D.H. https://furmancenter.org/thestoop/entry/when-will-government-control-of-freddie-mac-and-fannie-mae-end (Retrieved: 25 July 2023), 2022. New York University Furman Center.

- Bajaj, V.; Grynbaum, M.M. U.S. Stocks Slide After Rout Overseas. https://www.nytimes.com/2008/10/25/business/25markets.html (Retrieved: 25 July 2023), 2008. New York Times.

- Grynbaum, M.M. Cheer Fades as Stocks Plunge 9%. https://www.nytimes.com/2008/12/02/business/02markets.html (Retrieved: 25 July 2023), 2008. New York Times.

- Banks ask for crisis funds for eastern Europe. https://www.ft.com/content/9830fa0c-e809-11dd-b2a5-0000779fd2ac#axzz2u0Q66WnT (Retrieved: 12 May 2023), 2009. Financial Times.

- Arab Spring.pro-democracy protests. https://www.britannica.com/event/Arab-Spring (Retrieved: 12 May 2023), 2023. Encyclopaedia Britannica.

- Assis, C.; Lesova, P. Oil futures extend gains amid unrest. https://web.archive.org/web/20160421110646/http://www.marketwatch.com/story/oil-futures-extend-gains-amid-unrest-2011-02-23 (Retrieved: 12 May 2023), 2011. MarketWatch.

- Treanor, J. The 2010 “flash crash”: how it unfolded. https://www.theguardian.com/business/2015/apr/22/2010-flash-crash-new-york-stock-exchange-unfolded (Retrieved: 12 May 2023), 2015. The Guardian.

- IMF Survey: Europe and IMF Agree €110 Billion Financing Plan With Greece. https://www.imf.org/en/News/Articles/2015/09/28/04/53/socar050210a (Retrieved: 12 May 2023), 2022. IMF Survey online.

- Frayer, L. Europe Tries to Calm Fears Over Greek Debt Crisis. https://web.archive.org/web/20100509111531/http://www.aolnews.com/world/article/european-leaders-try-to-calm-fears-over-greek-debt-crisis-and-protect-euro/19469674 (Retrieved: 25 July 2023), 2010. AOL Inc.

- Kollewe, J.; Wearden, G. Euro falls to four-year low against dollar as its reserve status dips. https://www.theguardian.com/world/2010/may/17/euro-four-year-low-dollar (Retrieved: 12 May 2023), 2010. The Guardian.

- Sutton, C. S&P slashes Spain’s debt rating. https://money.cnn.com/2010/04/28/news/international/Spain_ratings_slashed/index.htm (Retrieved: 12 May 2023), 2010. CNN Money.

- Twin, A. Dow drops 324 points as euro sinks. https://money.cnn.com/2010/06/04/markets/markets_newyork/index.htm (Retrieved: 12 May 2023), 2010. CNN Money.

- Neuger, J.G.; Brennan, J. Ireland Weighs Aid as EU Spars Over Debt-Crisis Remedy. bloomberg.com/news/articles/2010-11-16/ireland-discusses-financial-bailout-as-eu-struggles-to-defuse-debt-crisis (Retrieved: 25 July 2023), 2010. Bloomberg.

- McDonald, H.; Treanor, J. Ireland asks for €90bn EU bailout. https://www.theguardian.com/business/2010/nov/21/ireland-asks-70bn-eu-bailout (Retrieved: 12 May 2023), 2010. The Guardian.

- Financial assistance to Portugal. https://economy-finance.ec.europa.eu/eu-financial-assistance/euro-area-countries/financial-assistance-portugal_en#programme-for-portugal (Retrieved: 12 May 2023), 2023. European Commission.

- George Georgiopoulos, W.B. Greece falls to S&P’s lowest rated, default warned, 2011. Reuters.

- Trichet, J.C. Statement by the President of the ECB. https://www.ecb.europa.eu/press/pr/date/2011/html/pr110807.en.html (Retrieved: 25 July 2023), 2011.

- Minder, R. Spanish and Italian Bond Yields Drop on E.C.B. Buying. https://www.nytimes.com/2011/08/10/business/global/spanish-and-italian-bond-yields-drop-on-ecb-buying.html (Retrieved: 12 May 2023), 2011. New York Times.

- Daily Treasury Par Yield Curve Rates. https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value=all&data=yieldAll&page=4 (Retrieved: 12 May 2023), 2023. U.S. Department of the Treasury.

- U.S. Imports from Venezuela of Crude Oil and Petroleum Products. https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MTTIMUSVE1&f=M (Retrieved: 12 May 2023), 2008. U.S. Energy Information Administration.

- The Great Recession and Its Aftermath. https://www.federalreservehistory.org/essays/great-recession-and-its-aftermath (Retrieved: 12 May 2023), 2013. Federal Reserce History.

- Daily Treasury Par Yield Curve Rates. https://fred.stlouisfed.org/series/GDPC1 (Retrieved: 12 May 2023), 2023. FRED Economic Data. St. Louis FED.

- Sibun, J. Financial crisis: US stock markets suffer worst week on record. https://www.telegraph.co.uk/finance/financialcrisis/3174151/Financial-crisis-US-stock-markets-suffer-worst-week-on-record.html (Retrieved: 12 May 2023), 2008. The Telegraph.

- Rahman, R.; Wirayani, P. Trading halted for first time since 2008 over pandemic. https://www.thejakartapost.com/news/2020/03/13/covid-19-indonesia-idx-trading-halted-first-time-2008.html (Retrieved: 12 May 2023), 2020. The Jakarta Post.

- Kollewe, J. Iceland markets plummet. https://www.theguardian.com/business/2008/oct/14/iceland-marketturmoil (Retrieved: 12 May 2023), 2008. The Guardian.

- Fund, I.M. World Economic Outlook. https://www.imf.org/en/Publications/WEO/Issues/2016/12/31/Rapidly-Weakening-Prospects-Call-for-New-Policy-Stimulus (Retrieved: 5 July 2023), 2008.

- Zheng, Z.; Podobnik, B.; Feng, L.; Li, B. Changes in Cross-Correlations as an Indicator for Systemic Risk. Scientific Reports 2012, 2. [Google Scholar] [CrossRef]

- Heckens, A.J.; Krause, S.M.; Guhr, T. Uncovering the dynamics of correlation structures relative to the collective market motion. Journal of Statistical Mechanics: Theory and Experiment 2020, 2020, 103402. [Google Scholar]

- Heckens, A.J.; Guhr, T. A new attempt to identify long-term precursors for endogenous financial crises in the market correlation structures. Journal of Statistical Mechanics: Theory and Experiment 2022, 2022, 043401. [Google Scholar] [CrossRef]

- Akaike, H. Information Theory and an Extension of the Maximum Likelihood Principle. In Selected Papers of Hirotugu Akaike; Springer New York: New York, NY, 1998; Parzen, E., Tanabe, K., Kitagawa, G., Eds.; Springer New York: New York, NY, 1998; pp. 199–213. [Google Scholar] [CrossRef]

- Aroussi, R. yfinance 0.1.70, 2022.

- Wand, T. S&P500 Mean Correlation Time Series (1992-2012), 2023. [CrossRef]

- Rinn, P.; Stepanov, Y.; Peinke, J.; Guhr, T.; Schäfer, R. Dynamics of quasi-stationary systems: Finance as an example. EPL (Europhysics Letters) 2015, 110, 68003. [Google Scholar] [CrossRef]

- Schäfer, R.; Guhr, T. Local normalization. Uncovering correlations in non-stationary financial time series. Physica A 2010, 389, 3856–3865. [Google Scholar] [CrossRef]

- Münnix, M.C.; Shimada, T.; Schäfer, R.; Leyvraz, F.; Seligman, T.H.; Guhr, T.; Stanley, H.E. Identifying States of a Financial Market. Scientific Reports 2012, 2. [Google Scholar] [CrossRef] [PubMed]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).