1. Introduction

Artificial intelligence (AI) comprises an extensive field of science including areas such as psychology, computer science, linguistics, and philosophy. It generates benefits to the global economy, especially to economic sectors that provide services to customers, given AI might improve the quality of services and products. Specifically, USD 1 trillion each year might be created by the implementation of AI in the global banking industry [

1,

2]. The allure of AI-based financial institutions is grounded in lower operating costs, better client approximation, higher revenues, and innovation in financial products and services. Nowadays, the customers’ preferences and perceptions have been captured by banking industry, especially most financial operations are digitized using AI algorithms. Therefore, it is imperative to understand the level of customer knowledge about the implementation and functionality of AI technologies. However, despite of the potential interactions between customer perception factors and AI-enabled customer experience, little research has been explored on the role of client perception factors in AI-enabled experiences in the Ecuadorian banking industry.

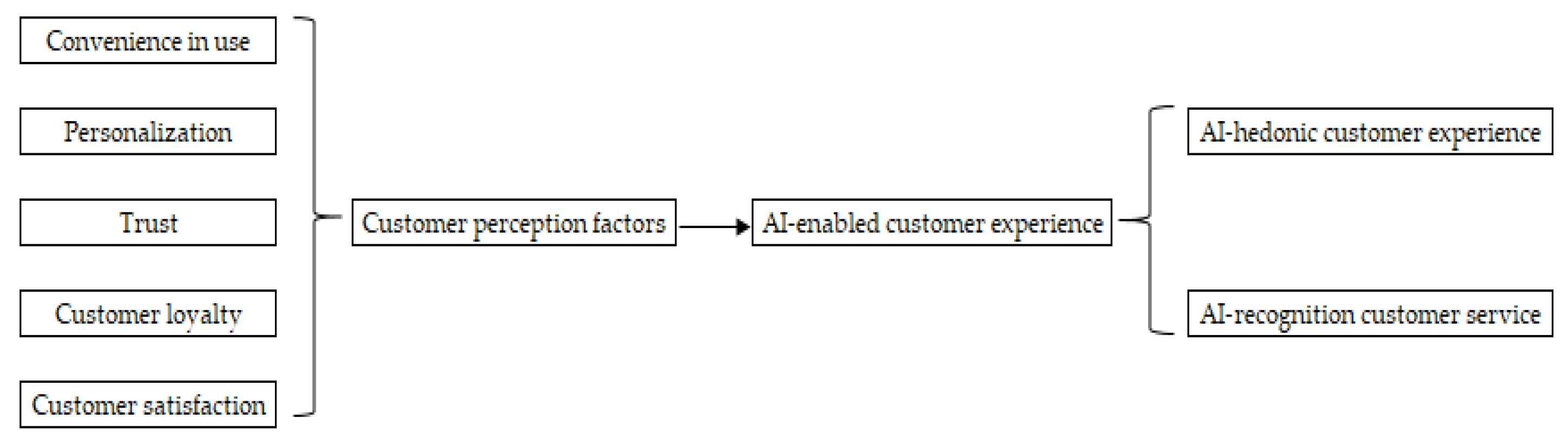

The main objective of this study is to recognize the relationship between customer perception factors and AI-enabled customer experience in the Ecuadorian banking industry using five criteria to measure the customer perception: convenience in use, personalization, trust, customer loyalty, and customer satisfaction, while AI-enabled experience is measured by AI-hedonic customer experience and AI-recognition customer service (more details are given in the next section). The findings revealed that AI-enabled customer experience is affected positively (at least at the 5% level of significance) by all five customer perception factors using individual and joint effects. The findings of this study provide significant insights for bank managers given customer perception and opinion of AI financial services offered by banks positively influence AI-enabled customer experience. This research provides an exhaustive view of the crucial customer perception factors that persuade AI-enabled customer experience.

This manuscript will instruct the banking and finance industry's representatives and managers to design and implement a strategic plan using AI technology in their financial products and services. Moreover, it provides practical evidence of the customer-preferred factors when they use virtual/mobile financial apps and access digital services in the banking environment. Customer perception factors include thoughts and impressions about the financial entity. This information is collected, processed, and analyzed to comprehend the needs, demands, and purchase performance of customers to create a long-term bank-client connection grounded in the knowledge of clients. Satisfied customers will continue doing business with a specific bank, which is transformed into lower costs for the bank, creation of value, incorporation of new and creative AI strategies in all processes, and sustainable competitive advantage. Banks offer undifferentiated financial products and services, and thus, factors involved in client perception convert the dominant competitive preference between parties, motivating positively the development and incorporation of digital banking products and services with AI. Moreover, customers might be recognized the fundamental aim of a firm, and thus, the objective for a firm is to maintain and improve the business relationship with customers building a strong long-term link between financial entities and customers. Therefore, entities might reduce the breach between expectations and real financial products and services.

The rest of the paper is organized as follows.

Section 2 displays a literature review and hypotheses development.

Section 3 illustrates the empirical design.

Section 4 presents the empirical findings.

Section 5 establishes the discussion part.

Section 6 exhibits conclusions and recommendations.

2. Literature Review and Hypotheses Development

2.1. AI in the Banking Environment

AI is defined as “the theory and development of computer systems able to perform tasks normally requiring human intelligence, such as visual perception, speech recognition, decision-making, and translation between languages” [

3]. AI combines algorithms that imitate the processes of human intelligence with machines that tend to emulate human behavior and cognitive functions. AI has been incorporated into several corporate processes because the volume of data far exceeds the capacity of people to acquit, interpret, and make decisions using voluminous databases. Therefore, AI involves the analysis of data and the solution for a certain task or problem in the shortest possible time.

One of the economic sectors that have beneficiated from the implementation of AI is the financial and banking industry. The fundamental impact of AI in the banking industry allows the increase of operational efficiency, optimization of resources, and growth of the firm's profitability through the application of methodologies based on the combination between information and technology. Specifically, the financial and banking sectors have been impacted by AI in the following aspects [

2,

4,

5]:

Credit evaluation (credit score), risk management, cost saving, and automation: AI designs faster and more accurate evaluation of potential clients with the use of fewer resources, allowing a non-subjective identification of high-risk clients through the application of personalized learning models. Therefore, the credit financial planning of each bank/institution is more precise using models with the interaction of multiple variables, which are adjusted in real-time. Moreover, the operating cost of banks decreases because of the reduction in personnel and paper costs involved in the credit score evaluation. Finally, the banking industry employs digital machines in different functional areas given the daily business volume in banks, which reduces the work stress and mathematical error in financial operations.

Prevention of credit card fraud and money laundering: Given the increase in electronic commerce and online transactions, AI algorithms analyze the customer behavior, location of the user, and purchasing habits, to establish mechanisms and schemes of security in all purchases. Moreover, through the recognition of patterns, financial crimes can be prevented by the identification of suspicious financial activities and unusual movements of money.

Identification of investment opportunities: AI provides monitoring advantages to design intelligent investment systems to control structured information (databases) and unstructured information (text format). Therefore, investors might build and manage solid portfolios with fewer resources, time, and effort.

Banking and personalized attention (customer-centric): New products and services are offered through intelligence messaging robots, which provide immediate solutions and offer personalized financial advice, achieving faster decisions and transactions. Chatbot technology and virtual/mobile financial apps are the most useful AI tools in the banking industry, which interact with clients using preprogrammed queries that solve instant problems with effective communication.

However, the financial and banking sectors needs to consider the AI enabled systems biases [

6] and minimize their effects. For example, to avoid that minority groups are discriminated when using credit score AI models [

7]. Even when technology is neutral, the human influence, the datasets or the evaluation methods can cause biases in AI systems. Many efforts are being deployed to reduce this effect such as a carefully selection and governance of the data used in the AI models, or diverse teams to reduce personal biases. Moreover, to maintain the principles of ethical AI (e.g. safety, explainabilitiy, security, fairness, human agency oversigh, and privacy) governments are already taking an action. For instance, the European Commission as well as Australia have created legal frameworks on AI ethics to guide organizations to develop and use AI in a responsible manner. These legal frameworks will help organizations to implement concrete actions in their daily operations and address more ethical and responsible AI solutions.

2.2. AI-Enabled Customer Experience

Customer experience involved in the banking environment is related to the acceptance and adoption of digital banking services. Customers' predilections change between generations. Nowadays, customers demand fast replies with custom-made attention and content. Therefore, AI algorithms can generate useful customer information for banks, and they can analyze and predict customers' likes, dislikes, and behavior, generating a better experience for customers since they meet their expectations [

8]. AI can examine the customers' sentiments and offer a real forecast of customers' emotions and feelings by the scrutiny of customers’ surveys, emails, and social media interactions. Therefore, AI-enabled customer experiences in the banking industry involve interactions with the brand, overall experience, data, and behavioral predictions of customers [

9].

Previous studies identified at least four elements that integrate customer experiences, such as (i) cognitive sense (e.g. functionality, speed, and availability of service), (ii) emotional experience (e.g. positive or negative feelings generated by the service), (iii) physical and sensorial contact (e.g. lighting, layout, signage, technology-related features, clear design, and friendly-user interface) and (iv) social factors (e.g. customer’s wider social network, customer’s social and mental identity) [

10,

11,

12]. AI technologies also include machine learning and natural-language understanding and processing, which provide qualified feedback on customer sentiments, and retailers might improve the customers' experience by promoting the firm's competitive advantages [

13]. AI technologies boost customer experiences by consuming data such as profiles, preferences, and past experiences of customers, to improve the customer-manager communicational relationship and anticipate future consumption tendencies. Therefore, the interaction and integration of AI-enabled experience might increase the quality of the customer experience. AI-enabled customer experience includes hedonic and recognition customer experience and service.

2.2.1. AI-Hedonic Customer Experience

It signifies that clients may be prepared to prioritize hedonic utility with the customer's strong self-relevant values. Hedonic consumption focuses on the most relevant aspects related to the acquisition experience, which are based on the subjectivity of the individual (e.g. sensations, memory, emotions, and fantasy). Therefore, consumption with hedonic characteristics has a diminutive weight of rationality, because benefits are not linked to the function, they are connected with the satisfaction of emotions and ideas. Hedonic customer experience provides raw material to build, maintain, and motivate dialogues and relationships between customers and brands/products. Hedonic consumption experiences (e.g. beverages, perfumes, trips) facilitate the relationship and decision-making process given the customer does not require rigorous or moderate rational analysis of purchase, he/she recures to their memory of personal feelings of previous experiences. In this context, AI might model the perception of individuals when they purchase products or services because they provide a review or feedback of their consumption experience using the most remarkable aspects [

9,

14,

15].

2.2.2. AI-Recognition Customer Service

Customer recognition shows respect and gratitude to individuals or other businesses who buy products or services of a firm. It is a powerful tactic in business strategy that will help to maintain a loyal and engaged customer base. The recognition aspect mentions qualities such as safety, importance, relation, being welcome, and a sense of beauty [

14,

16]. Nowadays, products and services include innovation factors, which are transformed into competitive advantages in the marketplace. These information technology advances, which also include AI, are linked to customer recognition because brands track customers´ purchase history, which identifies repeated and new customers according to their preferences and consumption. Therefore, the trend of customer identification intensifies the contest between brands, and firms show innovation in the design of products and services [

17].

2.3. Customer Perception Factors and AI-Enabled Customer Experience

2.3.1. Convenience in Use

Convenience is defined as the aptitude to achieve a goal in the limited time with the minimum resources. Customers show engagement in products and services when they perceive convenience in the use of the purchased good or service. Moreover, a convenient service or product is considered a solution to a need, which saves time and effort with the satisfaction of clients, who also are interested in a continuous relationship with the seller. Specifically, the convenience in the use of AI-enabled services will be categorized in three dimensions [

18,

19]: (i) availability of services, which includes 24/7 support and facility to contact the service/self-service, (ii) assistance and admission to real-time information, and (iii) proactive discussions between AI-powered bots and clients providing related information and assistance to the customer. All these AI-enabled aspects might improve time resolution, customer satisfaction, and engagement with the brand experience.

Convenience in use increases trust in the product, service, brand, and firm. Therefore, the perception of convenience in use influences positively the perception of customers when they assess the service utility, which also scores high given the reduced gap between product expectation and real product. Convenience in use reduces the customers' sacrifice [

20] because AI-enabled services can be used anytime and anywhere by customers. Therefore, the first set of hypotheses is:

H1: Convenience in use will have a positive effect on the AI-enabled customer experience.

H1a: Convenience in use will have a positive effect on the AI-hedonic customer experience.

H1b: Convenience in use will have a positive effect on the AI-recognition customer experience.

2.3.2. Personalization

It is defined as the quality of personalized information which covers needs and preferences of a single customer producing a positive experience in individual consumption [

21]. Personalization is possible because of the existence of AI techniques such as visual analytics, data mining, automation, machine learning, and robotics, which provide patterns of customer consumption data. Therefore, personalization is associated with AI-enabled services given the optimization of resources through algorithms and prediction models to make decisions. Specifically, personalization of online services can be measured by [

22] on (i) the user interface, which is the flexibility and functionality of screen design and overall presentation, (ii) content, which remarks the personalization of individual user's profile using its information, preferences, and characteristics to send specific product or services offerings with prices, and (iii) interaction process, which includes AI interactions to approach users. Personalization by AI generates adapted content through data analysis from real-time user decisions. Access to the right user's data might not affect the customer's privacy since algorithms are programmed from interface data. However, data protection regulation represents a challenge to AI, firms, users, and Governments.

Previous studies suggested that a high level of personalization of AI-enabled services is associated with (i) an increase in the brand's competence [

23], (ii) an increase in customers’ perception of firm quality [

24], (iii) a decrease of sensitiveness of customers sacrifice, and (iv) increase of positive firms’ attributions which reinforce the guarantee of clients over the brand and firm [

25]. Therefore, our second set of hypotheses is:

H2: Personalization will have a positive effect on the AI-enabled customer experience.

H2a: Personalization will have a positive effect on the AI-hedonic customer experience.

H2b: Personalization will have a positive effect on the AI-recognition customer experience.

2.3.3. Trust

Trust involves benevolence and credibility of the firm, its products, and its products and services [

26]. It is grounded on the benefits and the customer´s observation that the words and promises of a product or service provided by a firm can be reliable. Based on trust, customers share their personal information because they associated this process with confidentiality, which grows and develops the customer-firm relationship [

27]. In the e-commerce sector, trust includes brand belief and the firm's technology. Especially, firms need to consider the sensibility of the treatment of customer data in digital experiences. Previous studies showed that AI involves trust because it ensures product or service acceptance, increases productivity by continuous progress, rises innovation in a firm, and develops technology [

28]. Moreover, the novel dimensions of trust in AI-enabled customer service includes technology and its comprehension, brand, and purpose (confidence in intentions) [

29,

30]. Therefore, trust in AI is grounded in the transparency of functional logic, algorithm, and code (syntaxis).

Trust also includes the communication process of innovative technologies in the firms' processes. This communication needs to be proactive to influence positively social acceptance of new technologies. The long-term relationship between the brand and customers depends on customers' experience and trust, which shows a positive relationship in the current and subsequent experiences [

10,

31]. Therefore, our third set of hypotheses is:

H3: Trust will have a positive effect on the AI-enabled customer experience.

H3a: Trust will have a positive effect on the AI-hedonic customer experience.

H3b: Trust will have a positive effect on the AI-recognition customer experience.

2.3.4. Customer Loyalty

Loyalty involves the steps of buying recurrently products and services and recommending them to others, which helps to grow business with word-of-mouth and referral marketing. It includes the occurrence and emotions of buying from a specific retailer and the previous experiences and attitudes of this process [

32]. Specifically, AI-enabled customer experience is linked with customer loyalty given it prevents fraud by technology automatization and cyber security, determines customer requirements and behavior for better targeting, and discovers and manages industry data with machine learning applications, provoking the increase of firms’ competitive advantage [

33]. Previous studies showed that customer loyalty might be empowered by AI techniques because of perceived value, cognitive trust, affective trust, and satisfaction of clients grounded on the service quality in the information systems which enhance the AI-enabled customer experience [

34,

35,

36]. Therefore, our fourth set of hypotheses is:

H4: Customer loyalty will have a positive effect on the AI-enabled customer experience.

H4a: Customer loyalty will have a positive effect on the AI-hedonic customer experience.

H4b: Customer loyalty will have a positive effect on the AI-recognition customer experience.

2.3.5. Customer Satisfaction

Customer satisfaction is calculated by the difference between performance/realization/inequity and expectation/confirmation of the product or service [

37]. It evaluates the behavior of clients after the purchase and quantifies the satisfaction level of the customer, which involves the service environment [

38]. Firms that introduce AI in their processes might deliver the proactive and personalized services that customers want. For instance, applications and new interfaces are adopted by banking institutions to provide customer service, both include social and easy payment systems that integrate technology with legacy systems grounded on governance structure mechanisms. Therefore, there is a virtuous circle using AI-enabled customer experience given it can increase the significant value for the business by better service. Customer engagement might be exploited using AI techniques, which increases upsells and cross-sells opportunities with the reduction of cost-to-serve. Prior studies showed a positive relationship between customer satisfaction and AI-enabled customer experience, which also impacts positively the firm performance [

39,

40]. Therefore, our fifth set of hypotheses is:

H5: Customer satisfaction will have a positive effect on the AI-enabled customer experience.

H5a: Customer satisfaction will have a positive effect on the AI-hedonic customer experience.

H5b: Customer satisfaction will have a positive effect on the AI-recognition customer experience.

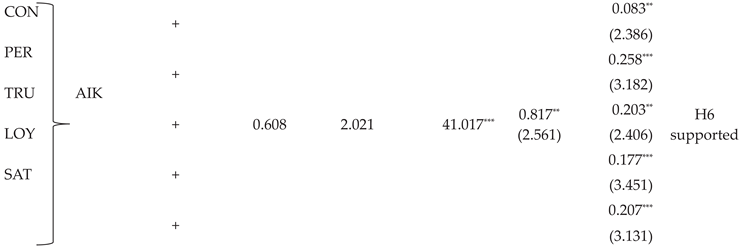

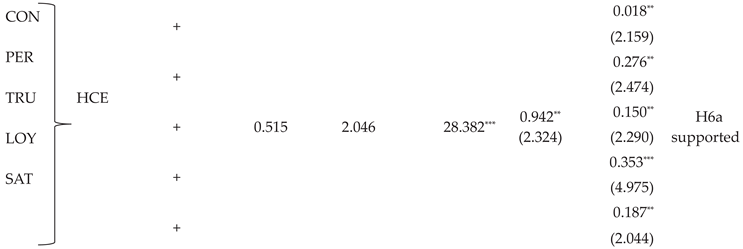

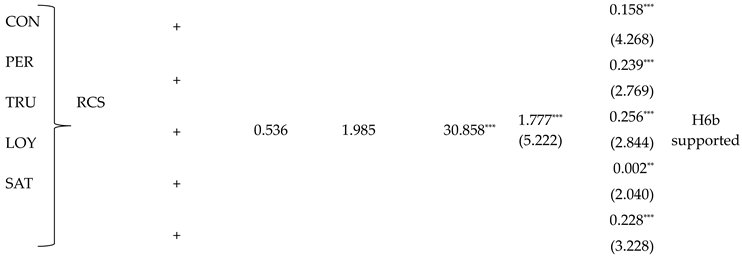

To sum up, AI-enabled customer experience will be influenced by convenience in use, personalization, trust, customer loyalty, and customer satisfaction, given customers develop an impression about a product or service through advertisements, promotions, reviews, social media feedback, etc. All these appreciations might be entitled by the introduction of AI mechanisms in all firm's processes given it increases the quality of service using customers' perceptions, likes, and expectations. Moreover, AI might translate the customers' feelings about products, services, and brands into their purchase intention and their willingness to pay. This valuable information allows managers to recognize the firm's opportunities and challenges to improve all processes in a firm with competitive financial ratios. Therefore, our sixth set of hypotheses refers to the multiple effects of all determinants on AI-enabled customer experience:

H6: Customer perception factors will have a positive effect on the AI-enabled customer experience.

H6a: Customer perception factors will have a positive effect on the AI-hedonic customer experience.

H6b: Customer perception factors will have a positive effect on the AI-recognition customer experience.

3. Research Model

The research model shows the relationship between customer perception factors and the AI-enabled customer experience, including hedonic and recognition divisions in the Ecuadorian baking industry (

Figure 1).

3.1. Measurement of Constructs

The effect of customer perception factors on the AI-enabled customer experience in the Ecuadorian baking industry was collected by an online survey. The study contains five constructs for customer perception (convenience in use, personalization, trust, customer loyalty, and customer satisfaction), and two constructs for AI-enabled customer experience (AI-hedonic customer experience and AI-recognition customer experience). The study employed multiple items to measure all constructs using five-point Likert scale for each item, displaying 1 and 5 for strongly disagree and strongly agree, respectively.

Table 1 presents the list of items for each construct.

4. Empirical Results

Google Forms and IBM SPSS Statistics 26 were the tools to collect and process all the responses from questionary, respectively. A total of 248 questionnaires were recorded. The final sample consists in 226 records, given the duplicated observations and invalid responses.

4.1. Demographic Analysis

Table 2 summarized the socio-demographic characteristics of the sample. It is important to mention that 65.4 percent of respondents specified that they have known the AI definition while 34.6 percent had never heard of the AI concept. Moreover, 43.8% of the total respondents believe that their bank uses AI in the design of financial products and services while the remaining percentage (56.2%) is not completely sure of the banking AI uses.

4.2. Descriptive Statistics and Exploratory Factor Analysis

The study employed principal component analysis with 0.5 as factor loading value. Oblimin was selected as rotation method. The omitted and removed items were CON1, CON2, CON3, PER3, PER4, TRU1, TRU2, TRU3, SAT1, SAT2, HCE1, HCE3, HCE5, and RCS4. These variables indicated segregated validity and lower internal consistency. The 60% of items were conserved in the analysis (initial number of items: 35 and final number of items: 21).

Table 3 shows the descriptive statistics and Exploratory Factor Analysis (EFA). The Kaiser-Meyer-Olkim (KMO) and the significance of Bartlett´s sphericity test was 0.894 and 0.000 (p<0.05), respectively.

The compound score of PER was 4.272, which was the maximum value of client perception factors, ranging from 3.520 to 4.042. This result shows that the main component for Ecuadorian customers is the personalization provided by the banking industry. Personalization is presented in virtual/mobile banking apps according to the user's consumption preferences, which also meets the user's expectations.

The TRU composite score is 4.042, showing a high level of a customer bank trust. This finding is supported by the customer perception of confidence, interest, and certitude in the technical features shown in the virtual/mobile bank app. The respondents exhibited a concise sensibility for satisfaction, SAT component, (µ=3.846), showing that the staff of the bank demonstrates kindness (µ=3.815) and knowledge (µ=3.815) by the individualized and personalized (µ=3.908) customer´s attention. The composite score for CON was 3.669, suggesting that customers are concerned about the loss of privacy (µ=3.546) and control (µ=3.792) when they use their virtual/mobile bank app. The conglomerate score for LOY was 3.520. However, the loyalty component is the unique factor that preserves all items given their internal consistency and validity. These results reveal that customers believe an emotional link with their bank (µ=3.308), they also are identified (µ=3.492) and mention attributes (µ=3.646) of their financial institution, they will not change their bank (µ=3.500), and finally, they are considered as loyal bank customers (µ=3.654).

The factors of AI-enabled customer experience evidenced high composite scores, such as 3.577 for HCE and 4.138 for RCS. These findings suggest that customers perceive the virtual/mobile bank app as entertained (µ=3.262), comfortable in the use (µ=3.892), respectful for clients (µ=4.208), welcoming in the first step of use (µ=4.085), well aesthetic designed (µ=4.185). Therefore, customers considered the virtual/mobile bank app as the most important tool for all financial services (µ=4.077).

4.3. Reliability Analysis

Table 4 shows the descriptive statistics and correlations matrix of all constructs. The suggested score for Cronbach’s alpha is 0.6 [

54]. Its level in the study was between 0.630 and 0.897. The suggested level for composite reliability is 0.7. Its value in the study ranged from 0.740 to 0.899. The recommended value for average variance extracted (AVE) is 0.5. Its level fluctuated from 0.519 to 0.817.

Table 4 exhibits tolerable discriminant validity for all constructs given there were no multicollinearity problems and the AVE’s square root for each construct was larger than the correlation coefficients between variables [

55].

4.4. Regression Analysis

Table 5 presents the results of individual linear regressions to test the effect of customer perception factors on AI-enabled customer experience in the Ecuadorian banking industry. The adjusted R-square ranged from 0.212 (H1a result) to 0.608 (H6 result). All hypotheses of the study are proved. Fundamentally, H6 is supported, suggesting that AI-enabled customer experience is positively affected by customer perception factors (β=0.083, 0.258, 0.203, 0.177, and 0.207; p<0.05, p<0.01, p<0.05, p<0.01, and p<0.01, respectively). These results show that the customers evaluate the convenience in use, personalization, trust, loyalty, and satisfaction in the design and use of virtual/mobile bank apps, which grounds a long-term business and financial relationship between clients and banks [

31]. The integration of AI in the products and services offered by banks improves the customer experience given the influence of innovation and digital technologies in the service process [

41]. AI-enabled customer experience might be enhanced when customers perceive a secure and reliable environment, which also includes additional support provided by the financial institution. Moreover, AI-enabled customer experience involves human emotions and a feeling of acknowledgment, which are the main components of the hedonic and recognition customer experience. Therefore, customers have a positive attitude toward AI given their aptitude and skills to comprehend and use AI-based financial products and services [

2,

33,

41].

All customer perception factors influenced individually (at least at the 5% level) to AI-enabled, hedonic, and recognition customer experience. Therefore, all hypotheses from H1 to H5b are supported given the significant individual coefficients. Particularly, convenience in use impacted on AI-enabled experience by the facility to conduct a self-service navigation in a virtual/mobile bank app, which is also complemented by the assistance offered to the customers through bank staff and AI-powered bots. The findings of this study are aligned with previous research because the use of powerful AI mechanisms increases the service utility since users have access to real-time information and support, which also improves time problem resolution and increases brand engagement [

18,

20]. Moreover, personalization as a customer perception factor is associated with AI-enabled customer experience given financial products and services are designed using real-time personal and behavioral user information to meet the preferences and consumption decisions of bank clients [

22,

24].

Running individual regressions, trust, customer loyalty, and customer satisfaction; each of them exhibited a significant positive relationship (at the 1% level) with AI, HCE, and RCS components. Bank clients mentioned that their entities own attractive and modern amenities, which include high level of technology, innovation, and security, concluding that customers are influenced of and identified with attitude and performance of their financial institutions (Siau and Wang, 2018). The results of this study are associated with preceding literature. Authors mentioned that AI-enabled customer experience and service might be influenced by personalization, technology, transparency, cognitive trust, affective trust, confidence, purpose, satisfaction, and service quality in the information systems [

29,

30,

34,

35,

36]. All these characteristics create a competitive advantage in institutions and create loyal customers given their continuous AI service satisfaction provoked by anticipated customers' perceptions and expectations.

5. Discussion

Banking industry has evolved from banking to Banking 4.0, moving from traditional and historical banking to the inclusion of advanced AI technologies in all financial operations. The fascination of AI in the banking industry comprises lower operating costs and acceleration in its inclusion in banking services. For instance, financial industries designed and incorporated AI in their virtual/mobile apps to provide clients with options to make transactions, check their balances, and access financial suggestions. Therefore, customer perception of the virtual/mobile app in financial institutions suggests that factors such as convenience in use, personalization, trust, customer loyalty, and customer satisfaction are key builder of the AI-enabled customer experience of the institution because clients score a financial product or service in terms of their expectations, needs, and facilities. The results of this study showed that the strength of customer perception factors was associated with improved AI-enabled customer experience in a bank, which includes financial technologies with AI algorithms in their products and services [

2].

AI helps banks to personalize products and services, which also engage customers given the deep analysis of the client's preferences databases with high-speed data processing. Mathematic al complex algorithms are employed in the design and implementation of digital financial services, showing efficiency and rapidity compared to the traditional banking methods. Therefore, the application of AI technologies helped banks to (i) prevent fraud, (ii) increase their reliability and accuracy, (iii) show a direct impact on their financial operations, (iv) accelerate automation, blockchain, and Fintech, (v) data analysis, (vi) asset management and risk management, and (vii) customer service.

This study involved the Ecuadorian banking sector, which is composed of 24 private banks. The financial services activities represented 3.6% of the Ecuadorian Real Gross Domestic Product (GDP). The results revealed that five customer perception factors (convenience in use, personalization, trust, customer loyalty, and customer satisfaction) affect positively and significantly (at least at the 5% level) AI-enabled customer experience, hedonic customer experience, and recognition of customer service. The findings are consistent with [

2,

35,

41,

56], which revealed that AI-based financial services depend on the digital facilities provided by financial institutions and the customer impression of tangible and intangible banking services with AI. Therefore, the six sets of hypotheses were corroborated in our study given the integration of AI in financial services might cause a shift in how customers perceive their experiences.

AI-enabled customer experience is built by an integrated understanding of the customer perspective implementing innovative technologies and strategies. This process generates a customer-centric view of AI showing how the AI capabilities are experienced by customers. Therefore, customers might rise their service quality standards of products and services, which also increase the market competitivity, generating a permanent growth in the expectations and demands of clients, which is improved by the implementation of AI mechanisms.

Finally, the method chosen to collect the data needed in this study, online surveys, can generate some bias in the results. The specific characteristics of the target population such as the age, gender, education, among others can be under or overrepresented. This can happen even when the sampling plan is well designed, as this method depends on the willingness and interest of the participants to respond to the survey. An especial concern is the underrepresentation of population groups who lack the means to respond to online surveys, for example internet connection or familiarity with the topic. To overcome this last problem, the questions in the survey used in this study have been formulated in a simple manner to avoid misunderstandings. Moreover, no similar studies have been developed for the Ecuadorian case, so contrasting results is not possible, but the findings of this study show consistency with prior literature in other countries, which can be used to validate the obtained results.

6. Conclusion

We analyze the factors of customer perception that influence on AI-enabled customer experience in the Ecuadorian banking environment. Using 226 records from a self-designed online questionnaire, the results revealed that AI-enabled customer experience, AI-hedonic customer experience, and AI-recognition customer service are affected positively by customer perception factors (individual and joint effect, e.g. convenience in use, personalization, trust, customer loyalty, and customer satisfaction) at least at the 5% level of significance. The positive relationship between customer perception factors and AI-enabled customer experience is supported by preceding studies‘ results in Asian countries [

2], European cities [

41], India [

42], the United Kingdom, Canada, Nigeria, and Vietnam [

5]. Furthermore, customer perception factors might be improved by AI techniques because most financial services incorporate AI algorithms, and identifies the type of customer by recollecting, processing, and analyzing the customer behavior purchases.

Convenience in use, personalization, trust, customer loyalty, and customer satisfaction are the palpable and immaterial factors that compound customer perception, while AI-enabled customer experience is formed by AI-hedonic customer experience and AI-recognition customer service. All factors empowered the AI services provided by financial institutions. Banks offer undifferentiated products and services, and thus, customer perception factors are the unique differentiated elements between entities, growing a major competitive advantage, which also motivates positively the development of digital banking products and services.

This paper provides a complete and significant statistical and econometrical model of factors that compose customer perception and it measures its positive influence on AI-enabled customer experience. Second, this manuscript showed theoretical and practical evidence of the relationship between customer perception factors and AI-enabled customer experience in the Ecuadorian banking industry, which has not been deeply analyzed in the Ecuadorian context. Third, this study showed the importance to introduce AI in the design of financial products and services using as fundamental input the customer information about purchases behavior and preferences of consumers.

The main limitation of the study is the inexistence of a customer perception index for the Ecuadorian economic sectors to compare and supplement our findings. Moreover, the study focused principally on virtual/mobile bank apps and digital financial services that incorporate AI in their design and execution. However, AI technologies involve also other financial products and services. The study only emphasized the most demanded AI financial services developed by Ecuadorian banks for their customers, to compare similar banking services between different institutions. Finally, in the Ecuadorian context, most customers (56.2% of respondents) did not differentiate the presence of AI in banking use. Therefore, there is ignorance of AI power to develop a business. For future research, the authors recommend performing a longitudinal analysis using quantitative data to measure the impact of AI-enabled customer experience on the financial performance of Ecuadorian banks.

CRediT authorship contribution statement

The authors contributed extensively to the work presented in this paper. Writing-original draft preparation, A.B.T.-P; writing-review and editing, A.C.-O. and C.W.L All authors have read and agreed to the published version of the manuscript.

Declaration of competing interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Data availability

Data will be made available on request.

Funding

We extend our gratitude and acknowledgment to the Universidad de las Américas, which financially supported this research (2023).

References

- Consultants, M. “Benefits of Artificial Intelligence in the Banking Sector,” Millinium Consulttants: Kuala Lumpur, Malaysia, 2022.

- Noreen, U.; Shafique, A.; Ahmed, Z.; Ashfaq, M. “Banking 4.0: Artificial Intelligence (AI) in Banking Industry & Consumer’s Perspective,” Sustainability, vol. 15, no. 3682, pp. 1–16, 2023. [CrossRef]

- Jarek, K.; Mazurek, G. “Marketing and artificial intelligence,” Cent. Eur. Bus. Rev., vol. 8, no. 2, pp. 46–56, 2019. [CrossRef]

- Mogaji, E.; Balakrishnan, J.; Nwoba, A.; Nguyen, N. “Emerging-market consumers’ interactions with banking chatbots,” Telemat. Informatics, vol. 65, no. 101711, 2021. [CrossRef]

- Mogaji, E.; Nguyen, N. “Managers’ understanding of artificial intelligence in relation to marketing financial services: Insights from a cross-country study,” Int. J. Bank Mark., vol. 40, pp. 1272–1298, 2022. [CrossRef]

- Breeden, J.L.; Leonova, E. “Creating Unbiased Machine Learning Models by Design,” J. Risk Financ. Manag., vol. 14, no. 11, p. 565, 2021. [CrossRef]

- Curto, G.; Jojoa, M.; Comin, F.; Garcia-Zapirain, B. “Are AI systems biased against the poor? A machine learning analysis using Word2Vec and GloVe embeddings,” Nat. Public Heal. Emercency Collect., pp. 1–16, 2022. [CrossRef]

- Lin, R.; Lee, J. “The supports provided by artificial intelligence to continuous usage intention of mobile banking: Evidence from China,” Aslib J. Inf. Manag., vol. ahead-of-p, no. ahead-of-print, 2023. [CrossRef]

- Oh, L.; Teo, H.; Sambamurthy, V. “The effects of retail channel integration through the use of information technologies on firm performance,” J. Oper. Manag., vol. 30, no. 5, pp. 368–381, 2012. [CrossRef]

- Keiningham, T.; Ball, J.; Benoit, S.; Bruce, H.; Buoye, A. “The interplay of customer experience and commitment,” J. Serv. Mark., vol. 31, no. 2, pp. 148–160, 2017. [CrossRef]

- Lam, S. “The effects of store environment on shopping behaviors: A critical review,” Adv. Consum. Res., vol. 28, no. 1, pp. 190–197, 2001.

- Ladhari, R.; Souiden, N.; Dufour, B. “The role of emotions in utilitarian service settings: The effects of emotional satisfaction on product perception and behavioral intentions,” J. Retail. Consum. Serv., vol. 34, pp. 10–18, 2017. [CrossRef]

- Saponaro, M.; Le Gal, D.; Gao, M.; Guisiano, M.; Maniere, I. “Challenges and Opportunities of Artificial Intelligence in the Fashion World,” Int. Conf. Intell. Innov. Comput. Appl. IEEE, pp. 1–5, 2018. [CrossRef]

- Foroudi, P.; Gupta, S.; Sivarajah, U.; Broderick, A. “Investigating the effects of smart technology on customer dynamics and customer experience,” Comput. Human Behav., vol. 80, pp. 271–282, 2018. [CrossRef]

- Verhoef, P.C.; Lemon, K.N.; Parasuraman, A.; Roggeveen, A.; Tsiros, M.; Schlesinger, L.A. “Customer Experience Creation: Determinants, Dynamics and Management Strategies,” J. Retail., vol. 85, no. 1, pp. 31–41, 2009. [CrossRef]

- Rose, S.; Clark, M.; Samouel, P.; Hair, N. “Online Customer Experience in e-Retailing: An empirical model of Antecedents and Outcomes,” J. Retail., vol. 88, no. 2, pp. 308–322, 2012. [CrossRef]

- Li, K. “Product and service innovation with customer recognition,” Decis. Sci., 2021. [CrossRef]

- Roy, S.K.; Balaji, M.S.; Sadeque, S.; Nguyen, B.; Melewar, T.C. “Constituents and consequences of smart customer experience in retailing,” Technol. Forecast. Soc. Change, vol. 124, pp. 257–270, 2018. [CrossRef]

- Van Doorn, J. et al. “Customer engagement behavior: Theoretical foundations and research directions,” J. Serv. Res., vol. 13, no. 3, pp. 253–266, 2010. [CrossRef]

- Kim, Y.; Lee, M.; Park, S. “Shopping value orientation: Conceptualization and measurement,” J. Bus. Res., vol. 67, no. 1, pp. 2884–2890, 2014. [CrossRef]

- Bilgihan, A.; Kandampully, J.; Zhang, T. “Towards a unified customer experience in online shopping environments: Antecedents and outcomes,” Int. J. Qual. Serv. Sci., vol. 8, no. 1, pp. 102–119, 2016. [CrossRef]

- Zanker, M.; Rook, L.; Jannach, D. “Measuring the impact of online personalisation: Past, present and future,” Int. J. Hum. Comput. Stud., vol. 131, pp. 160–168, 2019. [CrossRef]

- Komiak, S.; Banbasat, I. “The Effects of Personalization and Familiarity on Trust and Adoption of Recommendation Agents,” MIS Q., vol. 30, no. 4, pp. 941–960, 2006. [CrossRef]

- Aguirre, E.; Mahr, D.; Grewal, D.; Ruyter, K.; Wetzels, M. “Unraveling the Personalization Paradox: The Effect of Information Collection and Trust-Building Strategies on Online Advertisement Effectiveness,” J. Retail., vol. 91, no. 1, pp. 34–49, 2015. [CrossRef]

- Shen, A.; Ball, A. “Is personalization of services always a good thing? Exploring the role of technology-mediated personalization (TMP) in service relationships,” J. Serv. Mark., vol. 23, no. 2, pp. 80–92, 2009. [CrossRef]

- Ngo, A.; Duong, H.; Nguyen, T.; Nguyen, L. “The effects of ownership structure on dividend policy: Evidence from seasoned equity offerings (SEOs),” Glob. Financ. J., 2018.

- Ponder, N.; Holloway, B.B.; Hansen, J.D. “The mediating effects of customers’ intimacy perceptions on the trust-commitment relationship,” J. Serv. Mark., vol. 30, no. 1, pp. 75–87, 2016.

- Siau, K.; Wang, W. “Building trust in artificial intelligence, machine learning, and robotics,” Cut. Bus. Tecnhology J., vol. 31, no. 2, pp. 47–53, 2018.

- Lee, J.; See, K. “Trust in automation: Designing for appropriate reliance,” Hum. Factors, vol. 46, no. 1, pp. 50–80, 2004.

- Henseler, J.; Ringle, C.; Sarstedt, M. “A new criterion for assessing discriminant validity in variance-based structural equation modeling,” J. Acad. Mark. Sci., vol. 43, pp. 115–135, 2015. [CrossRef]

- Hengstler, M.; Enkel, E.; Duelli, S. “Applied artificial intelligence and trust—The case of autonomous vehicles and medical assistance devices,” Technol. Forecast. Soc. Change, vol. 105, pp. 105–120, 2016. [CrossRef]

- Khadka, K.; Maharjan, S. “Value, satisfaction and customer loyalty,” Mark. Entrep. SMEs, vol. 12, no. 18, pp. 467–480, 2017.

- Puntoni, S.; Walker, R.; Giesler, M.; Botti, S. “Consumers and artificial intelligence: An experiential perspective,” J. Mark., vol. 85, no. 1, pp. 131–151, 2021. [CrossRef]

- Chen, Y.; Prentice, C.; Weaven, S.; Hisao, A. “The influence of customer trust and artificial intelligence on customer engagement and loyalty - The case of the home-sharing industry,” Front. Phychology, vol. 13, pp. 1–15, 2022. [CrossRef]

- Chen, Q.; Lu, Y.; Gong, Y.; Xiong, J. “Can AI chatbots help retain customers? Impact of AI service quality on customer loyalty,” Internet Res., vol. ahead-of-p, no. ahead-of-print, 2023. [CrossRef]

- Yau, K.; Saad, N.; Chong, Y. “Artificial Intelligence Marketing (AIM) for Enhancing Customer Relationships,” Appl. Sci., vol. 11, no. 8562, pp. 1–17, 2021. [CrossRef]

- Xu, Y.; Goedegebuure, R.; Van der Heijden, B. “Customer perception, customer satisfaction, and customer loyalty within Chinese securities business,” J. Relatsh. Mark., vol. 5, no. 4, pp. 79–104, 2007.

- Krystallis, A.; Chrysochou, P. “The effects of service brand dimensions on brand loyalty,” J. Retail. Consum. Serv., vol. 21, pp. 139–147, 2014.

- Javed, F.; Cheema, S. “Customer satisfaction and customer perceived value and its impact on customer loyalty: The mediational role of customer relationship management,” J. Internet Bank. Commer., vol. 8, no. 6, pp. 1–14, 2017.

- Sayani, H. “Customer satisfaction and loyalty in the United Arab Emirates banking industry,” Int. J. Bank Mark., vol. 33, pp. 351–375, 2015.

- Ameen, N.; Tarhini, A.; Reppel, A.; Anand, A. “Customer experience in the age of artificial intelligence,” Comput. Human Behav., vol. 114, no. 106548, pp. 1–14, 2021. [CrossRef]

- Cheriyan, A.; Kumar, R.; Joseph, A.; Raju, S. “Consumer acceptance towards AI-enabled chatbots: Case of travel and tourism industries,” J. Posit. Sch. Psychol., vol. 6, no. 3, pp. 3880–3889, 2022.

- Colwell, S.; Aung, M.; Kanetkar, V.; Holden, A. “Toward a measure of service convenience: multiple-item scale development and empirical test,” J. Serv. Mark., vol. 22, no. 2, pp. 160–169, 2008. [CrossRef]

- Saniuk, S.; Grabowska, S.; Gajdzik, B. “Personalization of Products in the Industry 4.0 Concept and Its Impact on Achieving a Higher Level of Sustainable Consumption,” Energies, vol. 13, no. 5895, 2020. [CrossRef]

- Zhen, J.; Zhao, L.; Yan, J. “Why would people purchase personalized products online? An exploratory study,” J. Inf. Technol. Manag., vol. 28, no. 4, pp. 18–30, 2017.

- Spence, A. “Competitive and optimal responses to signals: An analysis of efficiency and distribution,” J. Econ. Theory, vol. 7, no. 3, pp. 296–332, 1974.

- Van Esterik-Plasmeijer, P.; Van Raaij, W. “Banking system trust, bank trust, and bank loyalty,” Int. J. Bank Mark., vol. 35, no. 1, pp. 97–111, 2017. [CrossRef]

- Anderson, R.; Srinivasan, S. “E-satisfaction and e-loyalty: A contingency framework,” Psychol. Mark., vol. 20, pp. 123–138, 2003.

- Ishaq, M. “Perceived value, service quality, corporate image and customer loyalty: Empirical assessment from Pakistan,” Serbian J. Manag., vol. 7, no. 1, pp. 25–36, 2012.

- Sarigiannidis, L.; Maditinos, D. “Customer satisfaction, loyalty and financial performance: A holistic approach of the Greek banking sector,” Int. J. Bank Mark., vol. 31, no. 4, pp. 259–288, 2013.

- Teeroovengadum, V. “Service quality dimensions as predictors of customer satisfaction and loyalty in the banking industry: Moderating effects of gender,” Eur. Bus. Rev., vol. 34, no. 1, pp. 1–19, 2022. [CrossRef]

- Longoni, C.; Cian, L. “Artificial intelligence in utilitarian vs. hedonic contexts: The ‘world-of-machine’ effect,” J. Mark., vol. 86, no. 1, pp. 91–108, 2020. [CrossRef]

- Sujata, J.; Aniket, D.; Mahasingh, M. “Artificial intelligence tools for enhancing customer experience,” Int. J. Recent Technol. Eng., vol. 8, no. 2S3, pp. 700–706, 2019. [CrossRef]

- Hair, J.; Black, W.; Babin, B.; Anderson, R.; Analysis, M.D.; Prentice-Hall, S., 2010.

- Chin, W. “The partial least squares approach to structural equation modeling in: G. A. Marcoulides,” in Modern Methods for Business Research, London: Lawrence Erlbaum Associates, 1998, pp. 295–336.

- Juwaheer, T.D.; Pudaruth, S.; Ramdin, P. “Factors influencing the adoption of internet banking: a case study of commercial banks in Mauritius,” World J. Sci. Technol. Sustain. Dev., vol. 9, no. 3, pp. 204–234, 2012. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

AIK

AIK HCE

HCE RCS

RCS AIK

AIK HCE

HCE RCS

RCS AIK

AIK HCE

HCE RCS

RCS AIK

AIK HCE

HCE RCS

RCS AIK

AIK HCE

HCE RCS

RCS